Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - DuPont de Nemours, Inc. | d442661dex991.htm |

| EX-3.1 - EX-3.1 - DuPont de Nemours, Inc. | d442661dex31.htm |

| 8-K - FORM 8-K - DuPont de Nemours, Inc. | d442661d8k.htm |

DowDuPont Announces Results of Portfolio Review September 12, 2017 Exhibit 99.2

Cautionary Statement About Forward-Looking Statements This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. On December 11, 2015, The Dow Chemical Company (“Dow”) and E. I. du Pont de Nemours and Company (“DuPont”) announced entry into an Agreement and Plan of Merger, as amended on March 31, 2017, (the “Merger Agreement”) under which the companies would combine in an all-stock merger of equals transaction (the “Merger Transaction”). Effective August 31, 2017, the Merger Transaction was completed and each of Dow and DuPont became subsidiaries of DowDuPont Inc (“DowDuPont”). For more information, please see each of DowDuPont’s, Dow’s and DuPont’s latest annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K, as the case may be, and the joint proxy statement/prospectus included in the registration statement on Form S-4 filed by DowDuPont with the SEC on March 1, 2016 (File No. 333-209869), as last amended on June 7, 2016, and declared effective by the SEC on June 9, 2016 (the “Registration Statement”) in connection with the Merger Transaction. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, including the intended separation of DowDuPont’s agriculture, materials science and specialty products businesses in one or more tax efficient transactions on anticipated terms (the “Intended Business Separations”). Forward-looking statements are not guarantees of future performance and are based on certain assumptions and expectations of future events which may not be realized. Forward-looking statements also involve risks and uncertainties, many of which are beyond the company’s control. Some of the important factors that could cause DowDuPont’s, Dow’s or DuPont’s actual results to differ materially from those projected in any such forward-looking statements include, but are not limited to: (i) successful integration of the respective agriculture, materials science and specialty products businesses of Dow and DuPont, including anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, productivity actions, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined operations; (ii) impact of the divestitures required as a condition to consummation of the Merger Transaction as well as other conditional commitments; (iii) achievement of the anticipated synergies by DowDuPont’s agriculture, materials science and specialty products businesses; (iv) risks associated with the Intended Business Separations, including those that may result from the comprehensive portfolio review undertaken by the DowDuPont board, changes and timing, including a number of conditions which could delay, prevent or otherwise adversely affect the proposed transactions, including possible issues or delays in obtaining required regulatory approvals or clearances related to the Intended Business Separations, disruptions in the financial markets or other potential barriers; (v) the risk that disruptions from the Intended Business Separations will harm DowDuPont’s business (either directly or as conducted by and through Dow or DuPont), including current plans and operations; (vi) the ability to retain and hire key personnel; (vii) potential adverse reactions or changes to business relationships resulting from the completion of the merger or the Intended Business Separations; (viii) uncertainty as to the long-term value of DowDuPont common stock; (ix) continued availability of capital and financing and rating agency actions; (x) legislative, regulatory and economic developments; (xi) potential business uncertainty, including changes to existing business relationships, during the pendency of the Intended Business Separations that could affect the company’s financial performance and (xii) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors. These risks, as well as other risks associated with the merger and the Intended Business Separations, are more fully discussed in (1) the Registration Statement and (2) the current, periodic and annual reports filed with the SEC by DowDuPont and to the extent incorporated by reference into the Registration Statement, by Dow and DuPont. While the list of factors presented here is, and the list of factors presented in the Registration Statement are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on DowDuPont’s, Dow’s or DuPont’s consolidated financial condition, results of operations, credit rating or liquidity. None of DowDuPont, Dow or DuPont assumes any obligation to publicly provide revisions or updates to any forward-looking statements regarding the proposed transaction and intended business separations, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. ©2017 DowDuPont. All rights reserved.

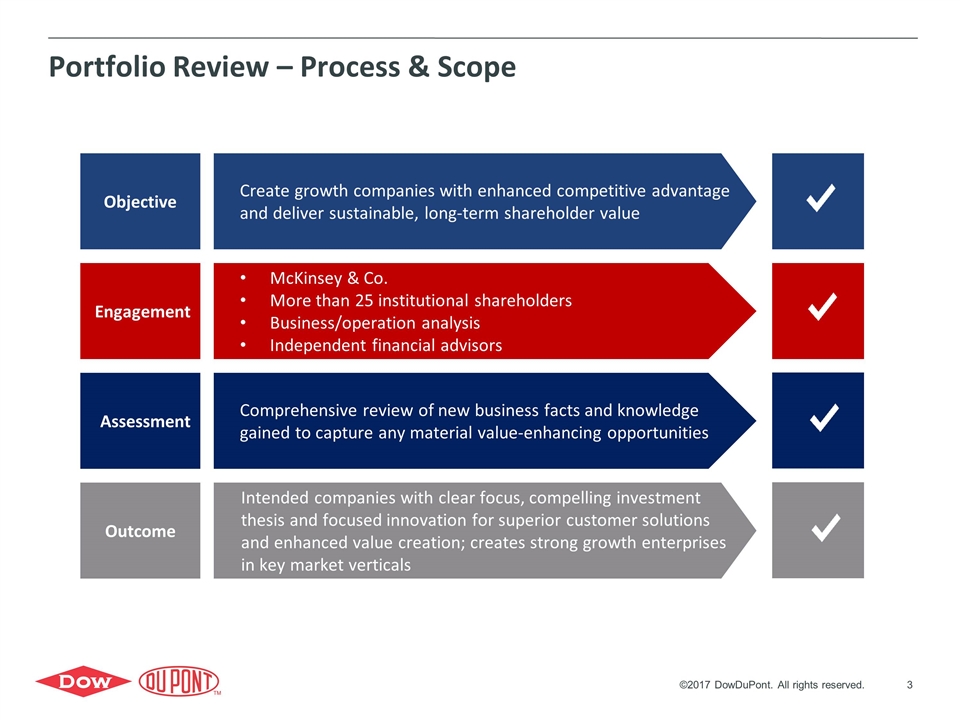

Portfolio Review – Process & Scope ©2017 DowDuPont. All rights reserved. Create growth companies with enhanced competitive advantage and deliver sustainable, long-term shareholder value Comprehensive review of new business facts and knowledge gained to capture any material value-enhancing opportunities McKinsey & Co. More than 25 institutional shareholders Business/operation analysis Independent financial advisors Intended companies with clear focus, compelling investment thesis and focused innovation for superior customer solutions and enhanced value creation; creates strong growth enterprises in key market verticals Objective Assessment Engagement Outcome

Portfolio Shifts Enhance Competitive Advantages, Value Creation and Growth of Intended Companies Dow’s Automotive Systems’ adhesives and fluids platforms Dow Building Solutions Dow Water and Process Dow Pharma and Food Dow Microbial Control DuPont Performance Polymers Certain portions of heritage Dow Corning Materials Science Division Specialty Products Division Specialty Products Division Customer-driven innovation leader Delivering differentiated value through science and specialty market insights Distinct market verticals: food & safety, electronics, construction, transportation, health & wellness Driven by Strong Industrial Logic >$8B of sales and ~$2.4B of Op. EBITDA move to SpecCo* ©2017 DowDuPont. All rights reserved. Materials Science Division One of the strongest & deepest toolkits Aligned with three high-growth market verticals: packaging, infrastructure and consumer care Robust technology & asset integration, scale and competitive capabilities *Amounts are on a 2017 forecast basis. Operating EBITDA is defined as income from continuing operations, net of tax excluding depreciation and amortization, interest income, interest expense and amortization of debt discount, taxes, and significant items.

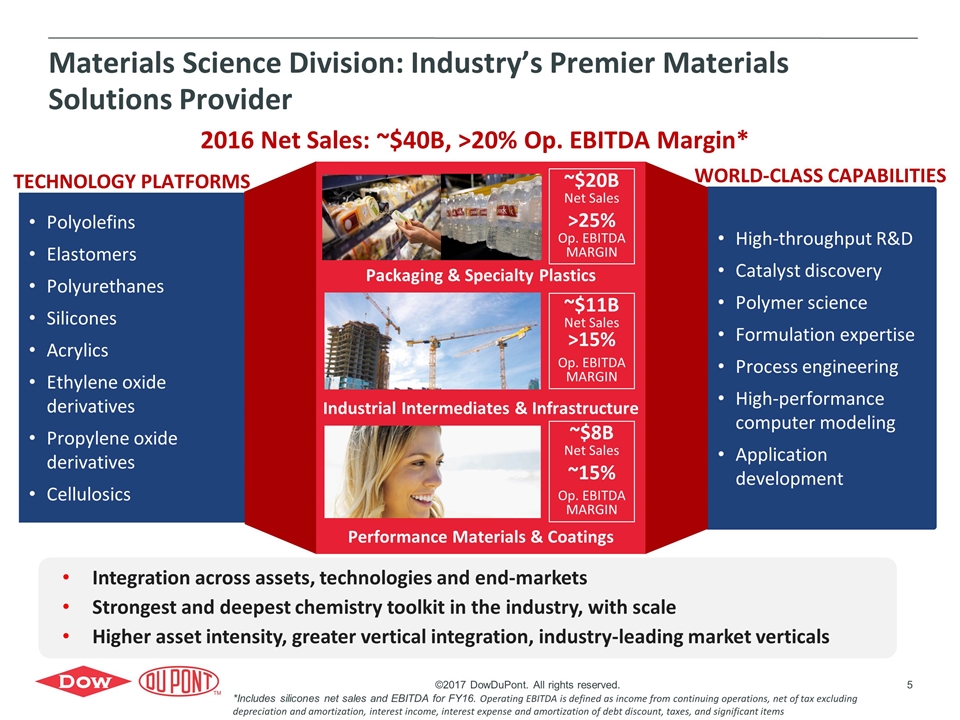

Materials Science Division: Industry’s Premier Materials Solutions Provider ©2017 DowDuPont. All rights reserved. Polyolefins Elastomers Polyurethanes Silicones Acrylics Ethylene oxide derivatives Propylene oxide derivatives Cellulosics High-throughput R&D Catalyst discovery Polymer science Formulation expertise Process engineering High-performance computer modeling Application development Industrial Intermediates & Infrastructure Performance Materials & Coatings Packaging & Specialty Plastics 2016 Net Sales: ~$40B, >20% Op. EBITDA Margin* Integration across assets, technologies and end-markets Strongest and deepest chemistry toolkit in the industry, with scale Higher asset intensity, greater vertical integration, industry-leading market verticals TECHNOLOGY PLATFORMS WORLD-CLASS CAPABILITIES ~$20B Net Sales >25% Op. EBITDA MARGIN ~$11B Net Sales >15% Op. EBITDA MARGIN ~$8B Net Sales ~15% Op. EBITDA MARGIN *Includes silicones net sales and EBITDA for FY16. Operating EBITDA is defined as income from continuing operations, net of tax excluding depreciation and amortization, interest income, interest expense and amortization of debt discount, taxes, and significant items

Specialty Products: Powerful Combination of Highly Differentiated, Innovation-Driven Segments *Note: Net sales include FMC H&N acquisition; expected to be completed in Nov 2017 Operating EBITDA is defined as income from continuing operations, net of tax excluding depreciation and amortization, interest income, interest expense and amortization of debt discount, taxes, and significant items. World’s largest supplier with the broadest set of materials and technologies to solve complex problems for the semiconductor, circuit board, photovoltaic, display and digital printing industries. Global leader in branded products including fibers and foams, aramid papers, non-wovens, membranes and protective garments serving the construction, oil & gas, energy, worker safety and transportation markets. Industry leader providing high-performance engineering resins, adhesives, lubricants and parts to engineers and designers in the transportation, electronics and medical markets. Industry leader in bio-based ingredients and a biosciences pioneer serving the food, nutrition, pharma, home and personal care, bio fuels and animal nutrition markets with healthier and more sustainable offerings. ~30% 2016 Op. EBITDA MARGIN >20% 2016 Op. EBITDA MARGIN >20% 2016 Op. EBITDA MARGIN >20% 2016 Op. EBITDA MARGIN 2016 Net Sales*: ~$21 billion, ~25% Op. EBITDA Margin* Market Insights & Customer Intimacy Technology & Innovation Edge Differentiation & Market Leadership Transportation & Advanced Polymers Safety & Construction Electronics & Imaging Nutrition & Biosciences ©2017 DowDuPont. All rights reserved. ~$5B ~$5B ~$5B ~$6B

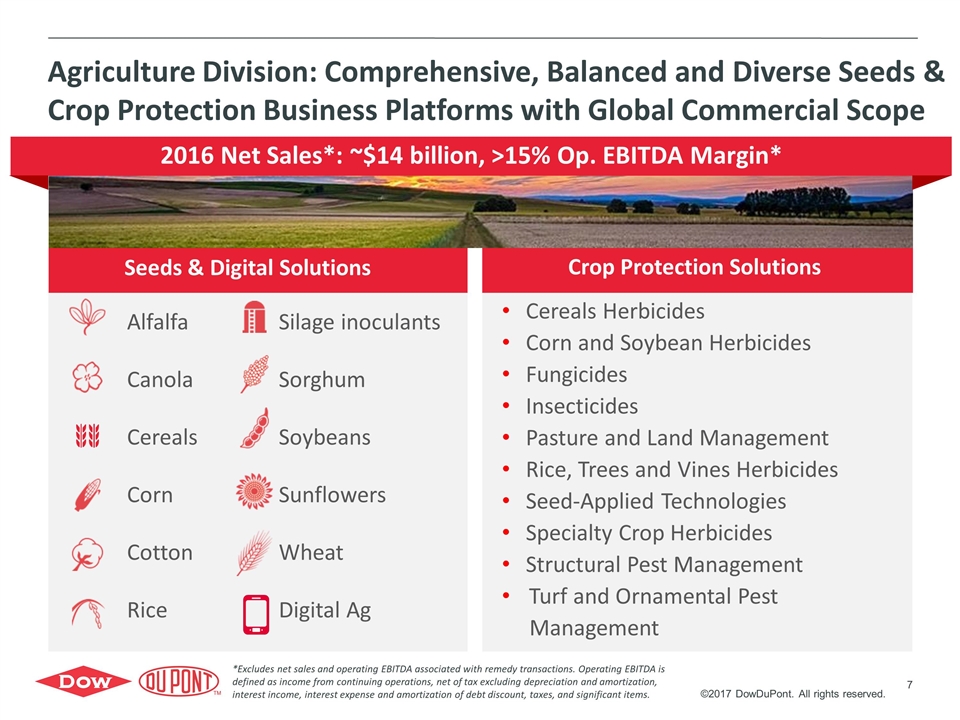

Agriculture Division: Comprehensive, Balanced and Diverse Seeds & Crop Protection Business Platforms with Global Commercial Scope Alfalfa Canola Cereals Corn Cotton Rice Silage inoculants Sorghum Soybeans Sunflowers Wheat Digital Ag Cereals Herbicides Corn and Soybean Herbicides Fungicides Insecticides Pasture and Land Management Rice, Trees and Vines Herbicides Seed-Applied Technologies Specialty Crop Herbicides Structural Pest Management Turf and Ornamental Pest Management ©2017 DowDuPont. All rights reserved. Seeds & Digital Solutions Crop Protection Solutions 2016 Net Sales*: ~$14 billion, >15% Op. EBITDA Margin* *Excludes net sales and operating EBITDA associated with remedy transactions. Operating EBITDA is defined as income from continuing operations, net of tax excluding depreciation and amortization, interest income, interest expense and amortization of debt discount, taxes, and significant items.

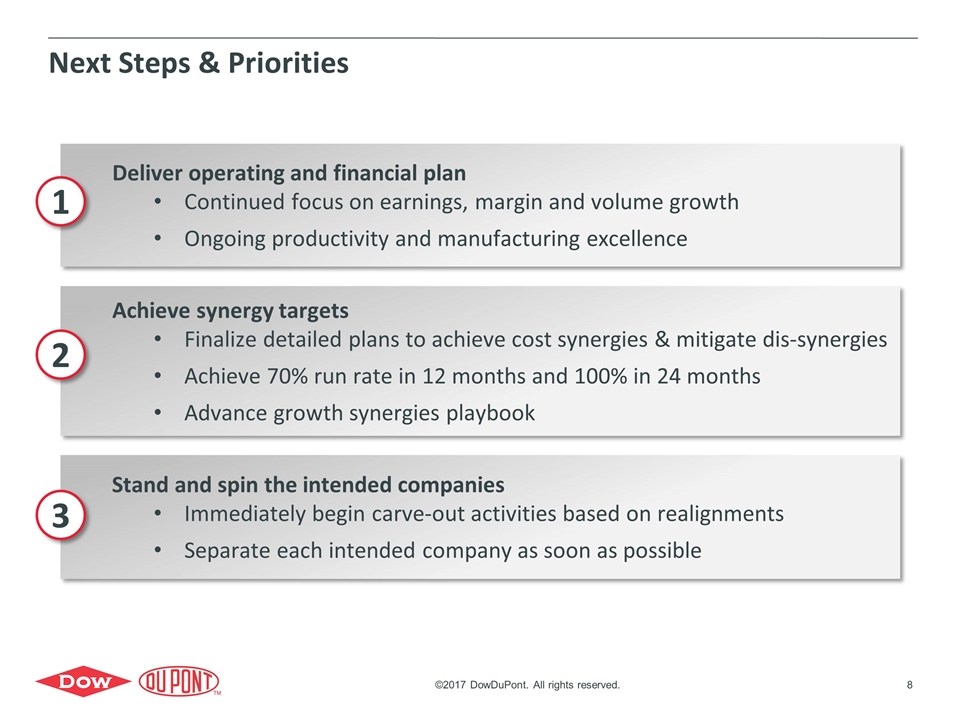

Next Steps & Priorities ©2017 DowDuPont. All rights reserved. Deliver operating and financial plan Continued focus on earnings, margin and volume growth Ongoing productivity and manufacturing excellence Achieve synergy targets Finalize detailed plans to achieve cost synergies & mitigate dis-synergies Achieve 70% run rate in 12 months and 100% in 24 months Advance growth synergies playbook Stand and spin the intended companies Immediately begin carve-out activities based on realignments Separate each intended company as soon as possible 1 2 3

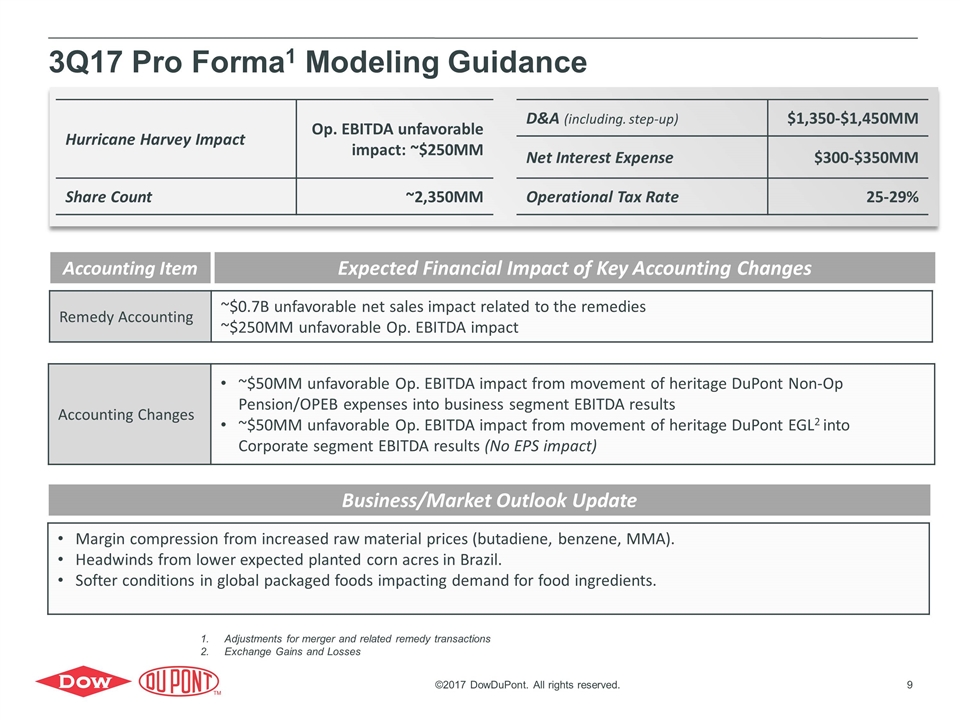

3Q17 Pro Forma1 Modeling Guidance ©2017 DowDuPont. All rights reserved. Accounting Item Expected Financial Impact of Key Accounting Changes Accounting Changes ~$50MM unfavorable Op. EBITDA impact from movement of heritage DuPont Non-Op Pension/OPEB expenses into business segment EBITDA results ~$50MM unfavorable Op. EBITDA impact from movement of heritage DuPont EGL2 into Corporate segment EBITDA results (No EPS impact) Remedy Accounting ~$0.7B unfavorable net sales impact related to the remedies ~$250MM unfavorable Op. EBITDA impact Hurricane Harvey Impact Op. EBITDA unfavorable impact: ~$250MM D&A (including. step-up) $1,350-$1,450MM Net Interest Expense $300-$350MM Share Count ~2,350MM Operational Tax Rate 25-29% Adjustments for merger and related remedy transactions Exchange Gains and Losses Business/Market Outlook Update Margin compression from increased raw material prices (butadiene, benzene, MMA). Headwinds from lower expected planted corn acres in Brazil. Softer conditions in global packaged foods impacting demand for food ingredients.