Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLUMBIA PROPERTY TRUST, INC. | cxp8-k201709presentation.htm |

1

09. 2017

INVESTOR

PRESENTATION

2

FORWARD-LOOKING STATEMENTS

Certain statements contained in this presentation other than historical facts may be considered forward-looking statements. Such statements include,

in particular, statements about our plans, strategies, and prospects, and are subject to certain risks and uncertainties, including known and unknown

risks, which could cause actual results to differ materially from those projected or anticipated. Therefore, such statements are not intended to be a

guarantee of our performance in future periods. Such forward-looking statements can generally be identified by our use of forward-looking

terminology such as "may," "will," "expect," "intend," "anticipate," "estimate," "believe," "continue," or other similar words. These forward-looking

statements include information about possible or assumed future results of the business and our financial condition, liquidity, results of operations,

future plans and objectives. They also include, among other things, statement regarding subjects that are forward-looking by their nature, such as

our business and financial strategy, our 2017 guidance (including projecting net operating income, cash rents and contractual growth), our ability to

obtain future financing, future acquisitions and dispositions of operating assets, future repurchases of common stock, and market and industry trends.

Readers are cautioned not to place undue reliance on these forward-looking statements. We make no representations or warranties (express or

implied) about the accuracy of any such forward-looking statements contained in this presentation, and we do not intend to publicly update or revise

any forward-looking statements, whether as a result of new information, future events, or otherwise.

Any such forward-looking statements are subject to risks, uncertainties, and other factors and are based on a number of assumptions involving

judgments with respect to, among other things, future economic, competitive, and market conditions, all of which are difficult or impossible to predict

accurately. To the extent that our assumptions differ from actual conditions, our ability to accurately anticipate results expressed in such forward-

looking statements, including our ability to generate positive cash flow from operations, make distributions to stockholders, and maintain the value of

our real estate properties, may be significantly hindered. See Item 1A in the Company's most recently filed Annual Report on Form 10-K for the year

ended December 31, 2016, for a discussion of some of the risks and uncertainties that could cause actual results to differ materially from those

presented in our forward-looking statements. The risk factors described in our Annual Report are not the only ones we face but do represent those

risks and uncertainties that we believe are material to us. Additional risks and uncertainties not currently known to us or that we currently deem

immaterial may also harm our business. For additional information, please reference the supplemental report furnished by the Company as Exhibit

99.2 to the Company Form 8-K furnished with the Securities and Exchange Commission on July 27, 2017.

The names, logos and related product and service names, design marks, and slogans are the trademarks or service marks of their respective

companies. When evaluating the Company’s performance and capital resources, management considers the financial impact of investments held

directly and through unconsolidated joint ventures. This presentation includes financial and operational information for our wholly-owned investments

and our proportional interest in unconsolidated investments. We do not control the Market Square Joint Venture and recognize that proportional

financial data may not accurately depict all of the legal and economic implications of our interest in this joint venture. Unless otherwise noted, all data

herein is as of June 30, 2017, and pro forma for the planned return of 263 Shuman Boulevard to the lender.

3

COLUMBIA PROPERTY TRUST

Shares trading 15-25% below estimated net asset value3

Highest dividend yield among gateway office peers

ENTICING VALUE

PROPOSITION

Experienced senior management team averages over 25 years

of real estate experience

Regional leadership platforms in NY, SF and DC

EXPERIENCED

LEADERSHIP

Investment-grade rating (Baa2 Stable / BBB Stable)

Broad access to capital

STRONG & FLEXIBLE

BALANCE SHEET

Desirable properties in amenity-rich CBD locations

~80% of portfolio in NY, SF, & DC1

CHOICE GATEWAY

PORTFOLIO

1Based on gross real estate assets; represents 100% of properties owned through unconsolidated joint ventures.

2From runoff of large lease abatements, signed but not yet commenced leases, and escalators on existing leases.

3Based on consensus analyst estimates as of 9.6.2017.

Below-market lease rates at many properties have contributed

to strong cash leasing spreads – a trend we expect to continue

Additional $50+ million of contractual annual cash NOI2

ATTRACTIVE

EMBEDDED GROWTH

4

DESIRABLE BUILDINGS IN PRIME GATEWAY LOCATIONS

PORTFOL

IO

333 Market St.

San Francisco

University Circle

East Palo Alto, CA

Pasadena Corporate

Park, Los Angeles

650 California St.

San Francisco

221 Main St.

San Francisco

229 W. 43rd St.

New York

116 Huntington Ave.

Boston

Market Square

Washington, D.C.

80 M St.

Washington, D.C.

One & Three Glenlake

Atlanta

Lindbergh Center

Atlanta

Cranberry Woods

Pittsburgh, PA

222 E. 41st St.

New York

95 Columbus

Jersey City, NJ

114 Fifth Ave.

New York

315 Park Ave. S.

New York

95% LEASED

5

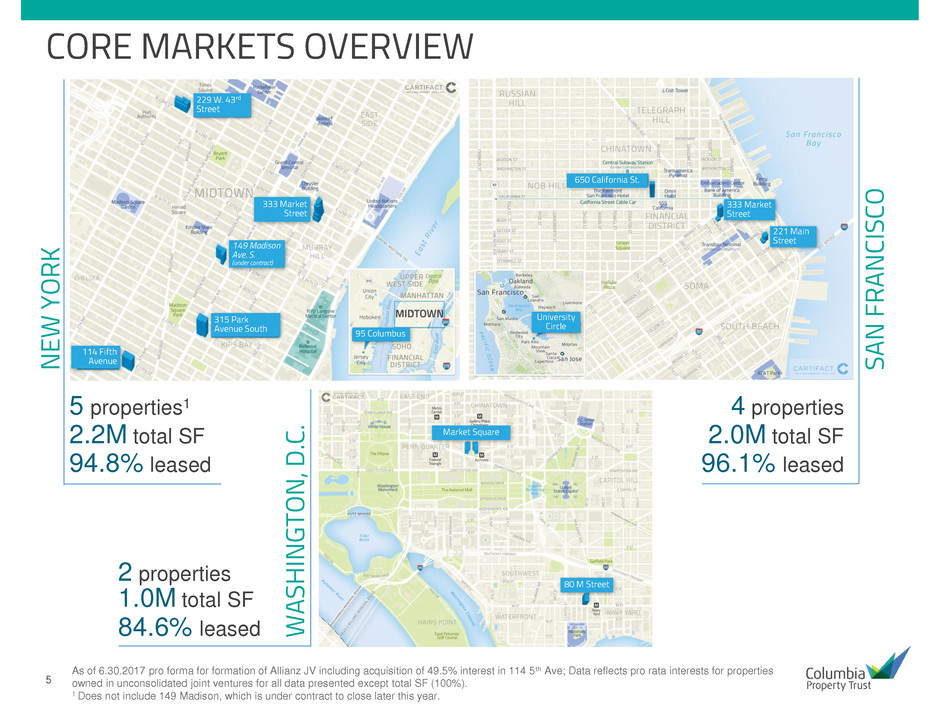

CORE MARKETS OVERVIEW

As of 6.30.2017 pro forma for formation of Allianz JV including acquisition of 49.5% interest in 114 5th Ave; Data reflects pro rata interests for properties

owned in unconsolidated joint ventures for all data presented except total SF (100%).

1 Does not include 149 Madison, which is under contract to close later this year.

5 properties1

2.2M total SF

94.8% leased

4 properties

2.0M total SF

96.1% leased

2 properties

1.0M total SF

84.6% leased

NE

W

YOR

K

SA

N

FR

ANCISC

O

W

AS

HINGTON,

D.C

.

95 Columbus

Market Square

80 M Street

University

Circle

333 Market

Street

650 California St.

221 Main

Street149 Madison

Ave. S.

(under contract)

333 Market

Street

114 Fifth

Avenue

315 Park

Avenue South

229 W. 43rd

Street

6

RECENT LEASING ACHIEVEMENTS

1.6M

30-year, 390,000 SF lease

with NYU Langone for all

of 222 E. 41st

195,000 SF of leases signed YTD

at 650 California, returning the

building to 91% leased despite

50,000 SF April move-out

Expanded and extended

Snapchat for a total 121,000 SF

at 229 W. 43rd

Returned 80 M Street to

94% leased (from 66%)

with 150,000 SF total leasing,

including WeWork lease

One Glenlake Parkway now

100% leased (from 71%)

with 138,000 SF leasing,

including Cotiviti lease

Brought University Circle to 100%

leased with expansion of Amazon

Web Services; eliminated only

substantial near-term roll with 119K

SF renewal of DLA Piper

51%

SF of leases signed on

same-store portfolio

2016-2017 YTD

average cash leasing

spreads during that

period, excluding NYU

7

ADDITIONAL GROWTH FROM VACANCY &

NEAR-TERM LEASE ROLLOVER

PROPERTY VACANCY 2017-2018 ROLL TOTAL HIGHLIGHTS

315 PARK AVE. S.

New York 137,000 0 137,000

• Significant lobby & storefront

renovations to position property as

best-in-class in submarket

• Roll-up opportunity on recently

vacated Credit Suisse SF

MARKET SQUARE(1)

Washington, D.C. 82,000 10,000 92,000

• Renovated to maintain

competitiveness

• Targeting government affairs

offices with spec suites, plus larger

prospects

221 MAIN ST.

San Francisco 18,000 54,000 72,000

• Coveted South of Market address,

with recent upgrades and amenities

that rival new construction

• Significant roll-up opportunity on

expiring leases

116 HUNTINGTON

AVE.

Boston

63,000 0 63,000

• Renovated to reposition as

boutique office

• Renewal successes, plus strong

interest in availability

149 MADISON AVE.

New York 127,000 0 127,000

• Acquisition under contract will be

vacant beginning 1Q18

• Full renovation plans underway,

with initial occupancy expected

in 2019

1Reflects 51% of the SF for the Market Square Joint Venture.

8

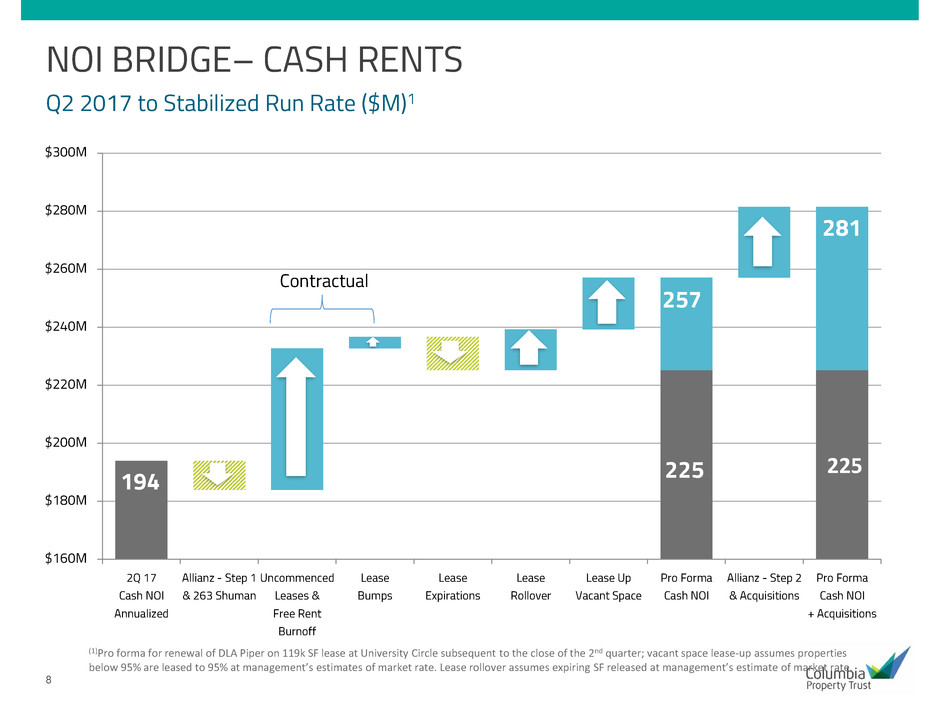

194

225

$160M

$180M

$200M

$220M

$240M

$260M

$280M

$300M

2Q 17

Cash NOI

Annualized

Allianz - Step 1

& 263 Shuman

Uncommenced

Leases &

Free Rent

Burnoff

Lease

Bumps

Lease

Expirations

Lease

Rollover

Lease Up

Vacant Space

Pro Forma

Cash NOI

Allianz - Step 2

& Acquisitions

Pro Forma

Cash NOI

+ Acquisitions

225

281

257

Contractual

NOI BRIDGE– CASH RENTS

Q2 2017 to Stabilized Run Rate ($M)1

(1)Pro forma for renewal of DLA Piper on 119k SF lease at University Circle subsequent to the close of the 2nd quarter; vacant space lease-up assumes properties

below 95% are leased to 95% at management’s estimates of market rate. Lease rollover assumes expiring SF released at management’s estimate of market rate.

9

69

68 68 68 68 67 67

80

$55M

$60M

$65M

$70M

$75M

$80M

$85M

$90M

2Q 17 Normalized

(2)

3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 (3) 4Q 18 (3)

Leases uncommenced or in abatement at 7/1/17 (contractual)

In place - net of expirations (contractual)

$4-7M of

additional

growth potential

from speculative

leasing of vacant

space and lease

rollover(4)

80

75

717069

EMBEDDED CONTRACTUAL GROWTH WITH LIMITED

NEAR-TERM ROLLOVER

Tenant Revenue – Quarterly Cash Rents(1)

(1) Tenant revenue (base rent + expense reimbursements) based on our portfolio as of 9.6.2017 assuming exit of 263 Shuman and no further acquisitions or

dispositions

(2) 2Q 17 Normalized = 2Q Actual (cash) - 22.5% of University Circle - 22.5% of 333 Market Street - 263 Shuman + 49.5% 114 5th Avenue.

(3) Pro forma for renewal of DLA Piper on 119k SF lease at University Circle subsequent to the close of the 2nd quarter.

(4) Timing of speculative leasing uncertain; low end of range assumes 25% renewal probability at market rate (based on managements estimates) on leases expiring

between 7/1/17 - 12/31/18 and lease up of properties below 90% to 90%. High end of range assumes 75% renewal probability at market on leases expiring between

7/1/17 - 12/31/18 and lease up of properties below 95% to 95%.

1st full quarter of NYU

rent; Affirm free rent

ends (650 Cal)

NYU free rent ends

(222 E 41st); WeWork

free rent ends (650 Cal)

10

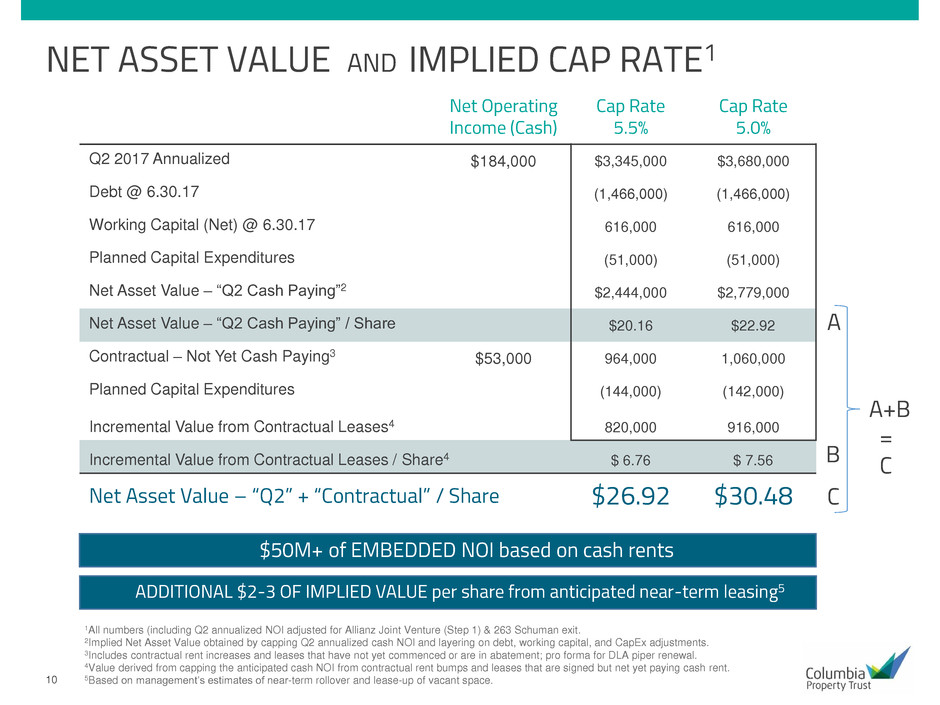

NET ASSET VALUE AND IMPLIED CAP RATE1

1All numbers (including Q2 annualized NOI adjusted for Allianz Joint Venture (Step 1) & 263 Schuman exit.

2Implied Net Asset Value obtained by capping Q2 annualized cash NOI and layering on debt, working capital, and CapEx adjustments.

3Includes contractual rent increases and leases that have not yet commenced or are in abatement; pro forma for DLA piper renewal.

4Value derived from capping the anticipated cash NOI from contractual rent bumps and leases that are signed but net yet paying cash rent.

5Based on management’s estimates of near-term rollover and lease-up of vacant space.

Net Operating

Income (Cash)

Cap Rate

5.5%

Cap Rate

5.0%

Q2 2017 Annualized $184,000 $3,345,000 $3,680,000

Debt @ 6.30.17 (1,466,000) (1,466,000)

Working Capital (Net) @ 6.30.17 616,000 616,000

Planned Capital Expenditures (51,000) (51,000)

Net Asset Value – “Q2 Cash Paying”2 $2,444,000 $2,779,000

Net Asset Value – “Q2 Cash Paying” / Share $20.16 $22.92

Contractual – Not Yet Cash Paying3 $53,000 964,000 1,060,000

Planned Capital Expenditures (144,000) (142,000)

Incremental Value from Contractual Leases4 820,000 916,000

Incremental Value from Contractual Leases / Share4 $ 6.76 $ 7.56

Net Asset Value – “Q2” + “Contractual” / Share $26.92 $30.48

$50M+ of EMBEDDED NOI based on cash rents

A

B

C

ADDITIONAL $2-3 OF IMPLIED VALUE per share from anticipated near-term leasing5

A+B

=

C

11

HIGHEST YIELD & PROJECTED EARNINGS GROWTH

AMONG GATEWAY PEERS

As of 9.6.2017; analyst estimates sourced from S&P Global Market Intelligence.

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

ESRT KRC DEI PGRE BXP HPP SLG VNO CXP

DIVIDEND YIELD vs. GATEWAY OFFICE PEERS

-10.0%

0.0%

10.0%

20.0%

30.0%

40.0%

50.0%

VNO DEI ESRT BXP SLG KRC HPP PGRE CXP

PROJECTED 2018 AFFO/SHARE GROWTH (CONSENSUS ESTIMATES)

12

$25

$166

$300

$150

$350 $350

0

100

200

300

400

500

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

STABLE & FLEXIBLE BALANCE SHEET

INVESTMENT GRADE

BALANCE SHEET

25% / 75%

Secured Unsecured

25%

Net Debt to

Real-Estate

Assets1

Baa2

Stable /

Ratings

BBB

Stable

5.2x

Net Debt to

EBITDA

DEBT

OUT

STANDIN

G ($M

)

Mortgage Debt

Bonds

Term Loans

WELL-LADDERED MATURITES2

2.12%

3.07%3 5.07%

4.15% 3.65%

5.80%

Market Square4

One Glenlake

$500M undrawn line of credit

Unencumbered asset pool of

$3.3 billion (81% of total

portfolio)

$507M cash balance

$700M of investment

grade bonds issued in

2015-16

LIQUIDITY

1Based on gross real estate assets as of 6.30.2017.

2Pro forma for the exit of 263 Shuman and repayment of 650 California.

3Includes effective rate on variable rate loan swapped to fixed. Pro forma for modification in July 2017 that reduced LIBOR spread by 45 bps.

4Reflects 51% of the mortgage note secured by the Market Square Buildings, which Columbia owns through an unconsolidated joint venture.

13

DIVERSIFIED BASE OF HIGH QUALITY TENANTS

STRONG INDUSTRY DIVERSIFICATION1

Data as of 6.30.17, pro forma for the formation of the Allianz Joint Venture.

1Reflects ALR at CXP’s pro rata share for properties owned through unconsolidated joint ventures.

2Credit rating may reflect the credit rating of the partner or a guarantor. Only the Standard & Poor’s credit rating has been provided.

3Rating represents Yahoo!; in discussions with Verizon (A-) regarding parent guarantee following recent merger.

TOP TENANTS1,2

19%

14%

9%

7%6%

6%

6%

6%

3%

3%

21%

Services - Business Services

Depository Institutions

Transportation & Utilities - Communication

Services - Legal Services

Services - Health Services

Nondepository Institutions

Transportation & Utilities - Electric, Gas, And Sanitary Services

Services - Engineering & Management Services

Security And Commodity Brokers

Real Estate

Other

Tenant

Credit

Rating

% of

ALR

AT&T Corporation/AT&T Services BBB+ 6.8%

Wells Fargo Bank N.A. AA- 6.3%

Pershing LLC A 5.6%

Westinghouse Electric Company Not Rated 4.9%

NYU AA- 4.6%

Verizon / Yahoo!3 BB+ 4.5%

Newell Brands, Inc. BBB- 2.9%

DocuSign, Inc. Not Rated 2.7%

WeWork Companies Not Rated 2.3%

DLA Piper US, LLP Not Rated 2.0%

Amazon Web Services, Inc. AA- 2.0%

14

STRATEGIC JOINT VENTURE

with Allianz Real Estate

HIGHLIGHTS

Ability to increase scale in top markets on a

leverage-neutral basis

Attractive cost of capital

Initial gross asset value of $1.26B

Plans to acquire additional assets in select gateway

markets

Allianz to increase to 45% interest in University

Circle and 333 Market Street within next 12 months

Joint Venture Ownership Interest

Property

CXP Allianz

49.5%* 49.5%* 114 Fifth Avenue, New York

77.5% 22.5% University Circle, San Francisco

77.5% 22.5% 333 Market Street, San Francisco

*L&L Holding Co. LLC holds a 1% ownership interest in 114 Fifth Avenue.

15

COLUMBIA PROPERTY TRUST – SENIOR TEAM

KEVIN HOOVER

SVP – Portfolio

Management

NELSON MILLS

President and CEO

JIM FLEMING

Executive VP

and CFO

WENDY GILL

SVP - Corporate

Operations and Chief

Accounting Officer

DAVID DOWDNEY

SVP – Western

Region

ADAM POPPER

SVP – Eastern

Region

MARK WITSCHORIK

VP – Eastern Region,

Washington D.C.

MICHAEL SCHMIDT

VP – Western Region

AMY TABB

VP – Portfolio

Operations

KELLY LIM

VP – Eastern Region,

New York

LINDA BOLAN

VP – National

Property Management

and Sustainability

DOUG MCDONALD

VP – Finance

16

LOOKING AHEAD

OPPORTUNITIES FOR INVESTMENT

Acquisitions in target markets

Individual assets

Portfolio acquisitions

Share repurchases

Reposition and lease 149 Madison

ADDITIONAL SOURCES OF CAPITAL

Allianz increased interest in

University Circle & 333 Market

(see page 14)

Recycle assets

$507M

Cash on hand1

$500M

Available line of

credit balance

1As of 6.30.2017.

17

APPENDIX

FOR MORE INFORMATION

Columbia Property Trust

INVESTOR RELATIONS

404.465.2227

ir@columbia.reit

www.columbia.reit

18

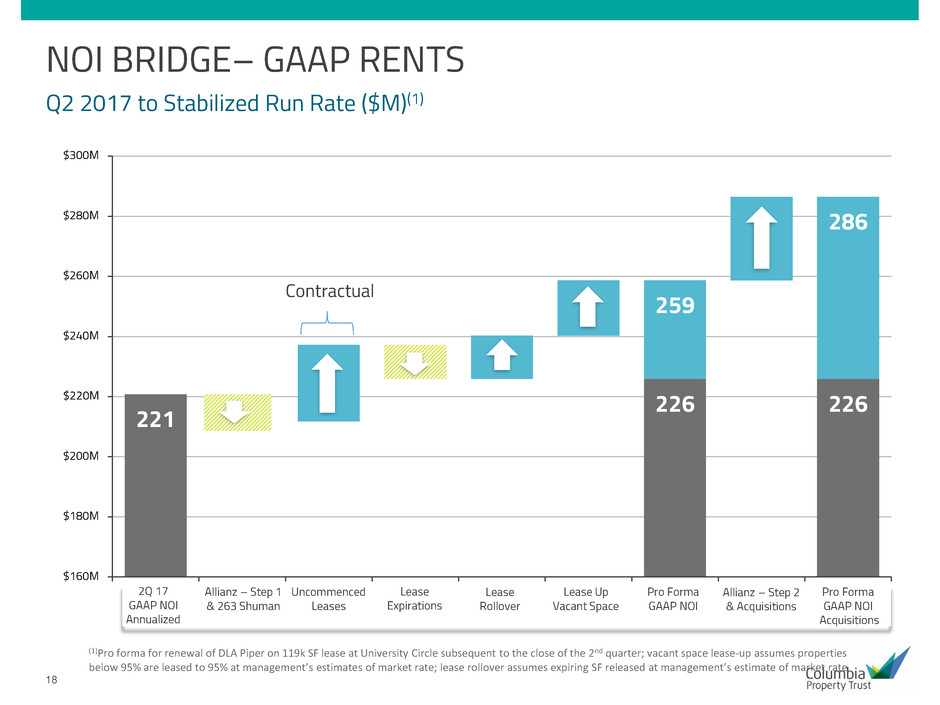

221 226226

259

286

$160M

$180M

$200M

$220M

$240M

$260M

$280M

$300M

2Q 17

GAAP NOI…

Allianz - Step 1

& 263 Shuman

Uncommenced Leases Lease

Expirations

Lease

Rollover

Lease Up

Vacant Space

Pro Forma

GAAP NOI

Allianz - Step 2

& Acquisitions

Pro Forma

GAAP NOI…

NOI BRIDGE– GAAP RENTS

2Q 17

GAAP NOI

Annualized

Allianz – Step 1

& 263 Shuman

Uncommenced

Leases

Lease

Expirations

Lease

Rollover

Lease Up

Vacant Space

Pro Forma

GAAP NOI

Allianz – Step 2

& Acquisitions

Pro Forma

GAAP NOI

Acquisitions

Contractual

Q2 2017 to Stabilized Run Rate ($M)(1)

(1)Pro forma for renewal of DLA Piper on 119k SF lease at University Circle subsequent to the close of the 2nd quarter; vacant space lease-up assumes properties

below 95% are leased to 95% at management’s estimates of market rate; lease rollover assumes expiring SF released at management’s estimate of market rate

19

EMBEDDED CONTRACTUAL GROWTH WITH LIMITED

NEAR-TERM ROLLOVER

78

77 77 77 76 76 75

83

$55M

$60M

$65M

$70M

$75M

$80M

$85M

$90M

2Q 17 Normalized

(2)

3Q 17 4Q 17 1Q 18 2Q 18 3Q 18 (3) 4Q 18 (3)

Leases uncommenced at 7/1/17 (contractual)

In place (contractual)

83838282

80

90.3

$4-7M of

Additional

growth potential

from speculative

leasing of vacant

space and lease

rollover(4)

Tenant Revenue – Quarterly GAAP Rents(1)

(1) Tenant revenue (base rent + expense reimbursements) based on our portfolio as of 9.6.2017 assuming exit of 263 Shuman and no further acquisitions or

dispositions

(2) 2Q 17 Normalized = 2Q Actual (GAAP) - 22.5% of University Circle - 22.5% of 333 Market Street - 263 Shuman + 49.5% 114 5th Avenue.

(3) Pro forma for renewal of DLA Piper on 119k SF lease at University Circle subsequent to the close of the 2nd quarter.

(4) Timing of speculative leasing uncertain; low end of range assumes 25% renewal probability at market rate (based on managements estimates) on leases expiring

between 7/1/17 - 12/31/18 and lease up of properties below 90% to 90%. High end of range assumes 75% renewal probability at market on leases expiring between

7/1/17 - 12/31/18 and lease up of properties below 95% to 95%.

20

OPPORTUNITIES FOR INTRINSIC RATE GROWTH

2% 2% 4%

8%

19%

7%

10%

5%

14%

29%

0.0%

10.0%

20.0%

30.0%

32%

19%

79%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2015 2016 2017 YTD

Lease Rollover to Achieve Higher Rents

Note: Pro forma for renewal of DLA Piper on 119k SF at University Circle subsequent to the close of the 2nd quarter.

1Cash leasing spreads on same-store properties excluding 30-year NYU lease at 222 E. 41st Street.

DRAMATIC CASH LEASING

SPREADS1

LEASE EXPIRATIONS BY YEAR (% OF ALR)

21

EMBEDDED GROWTH FROM SIGNED LEASES1

TENANT PROPERTY MARKET

SF

(000s)

CURRENTLY IN

ABATEMENT

NOT YET

COMMENCED

NYU Langone Medical Center 222 E. 41st Street NY 390 ✔

WeWork 80 M Street DC 69 ✔

WeWork 650 California Street SF 61 ✔

Bustle 315 Park Avenue South NY 34 ✔

Other Abated Leases 150 ✔

DLA Piper (renewal)2 University Circle SF 92 ✔

Affirm 650 California Street SF 81 ✔

Cotiviti One Glenlake ATL 66 ✔

Snap 229 West 43rd Street NY 26 ✔

Other Leases Not Yet Commenced 96 ✔

Total Embedded NOI – Cash Rents3 $35.2M $18.0M

1SF and NOI for joint ventures are reflected at CXP’s ownership interest

2DLA Piper has given notice that they will exercise their renewal option; new lease at higher rate not yet commenced

3Non-GAAP financial measure. See Appendix.

22

149 MADISON

HIGHLIGHTS

14’+ slab-to-slab ceiling heights throughout

Oversized windows

Highly-desirable boutique-sized floorplates (10,400 SF)

Potential for rooftop deck with city skyline views

Submarket: Midtown South

Year Built: 1916

Total Rentable SF: 127,000

Columbia is under contract to acquire 149 Madison Avenue

later this year, expanding our presence in New York.

149 Madison is a 12-story building located in the heart of the

NoMAD district of Midtown South, on the southeast corner of 32nd

Street and Madison Avenue. One of New York’s most vibrant

neighborhoods, the Midtown South submarket has become one of

the most attractive and dynamic locations in Manhattan.

Columbia plans to invest significant capital to perform a

comprehensive renovation of the property, including updating and

upgrading its infrastructure, interior and exterior finishes, and

common areas throughout to give it a modern boutique office feel.

23

LEASING SUCCESS CASE STUDIES

650 CALIFORNIA

SAN FRANCISCO

222 E. 41ST STREET

NEW YORK

Primary tenant Jones Day informed us of

plans to vacate upon lease expiration in

Oct. 2016 (353K SF)

Began exploring multi-tenant strategies

as well as potential full-building users in

2015

Signed 30-Year, 390K SF lease with NYU

221K SF of rollover from 2016-April 2017:

Low retention rate by design to bring

building up to market rate

Upgraded lobby and amenities and

embarked on selective spec suite program

Returned building to 91% leased with 218K

SF of leasing in last 12 months, including

195K YTD 2017

24

LEASING SUCCESS CASE STUDIES

150k SF Oracle downsize created 29%

vacancy

Upgraded common areas and amenities to

best-in-submarket

Returned property to 100% leased with

138,000 SF leasing since Nov. 2016,

including 66K SF Cotiviti lease

Rebranded property to attract more

creative tenant base and compete with

new construction in submarket

Signed150,000 SF of leases to return

building to 94% leased

ONE GLENLAKE

ATLANTA

80 M STREET

WASHINGTON, D.C.

25

LEASING SUCCESS CASE STUDIES

229 W. 43RD STREET

NEW YORK

UNIVERSITY CIRCLE

SAN FRANCISCO

Capitalized on two large vacates by

rebranding formerly law-firm-centric property

to attract more diverse tenant base in 2012

Subsequently signed and expanded Amazon

Web Services and other tech tenants,

reaching 100% occupancy while raising in-

place gross rates over 30% (from $68 to $90

PSF)

Eliminated only substantial near-term roll with

119K SF renewal of DLA Piper (mid-2018

expiration).

Expanded and extended Snap on 121K SF

Brings building to 100% leased, with all

near-term roll pre-leased, with positive

leasing spreads

26

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

(in thousands) Three Months

Ended 6/30/17 Annualized

Net Cash Provided by Operating Activities $ 30,224 $ 120,896

Straight line rental income 6,087 24,348

Depreciation of real estate assets (20,423) (81,692)

Amortization of lease-related costs (7,920) (31,680)

Loss from unconsolidated joint venture (1,817) (7,268)

Other non-cash expenses (2,981) (11,924)

Net changes in operating assets & liabilities (2,037) (8,148)

Net Income $ 1,133 $ 4,532

Interest expense (net) 13,785 55,140

Interest income from development authority bonds (1,800) (7,200)

Income tax benefit 7 28

Depreciation of real estate assets 20,423 81,692

Amortization of lease-related costs 8.191 32,764

Adjustments from unconsolidated joint venture 4,233 16,932

EBITDA $ 45,972 $ 183,888

Adjusted EBITDA $ 45,972 $ 183,888

General and administrative 9,201 36,804

Straight line rental income (5,893) (23,572)

Net effect of below market amortization (271) (1,084)

Adjustments from unconsolidated joint venture (512) (2,048)

Net Operating Income (based on cash rents) $ 48,497 $ 193,988

27

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

(continued from prior page)

(in thousands) Three Months

Ended 6/30/17 Annualized

Net Operating Income (based on cash rents) $ 48,497 $ 193,988

Allianz Step 1 & 263 Shuman Disposition (2,500) (10,000)

Uncommenced Leases & Free Rent Burnoff 12,000 48,000

Lease Bumps 1,003 4,012

Lease Expirations (2,750) (11,000)

Lease Rollover 3,500 14,000

Lease Up Vacant Space 4,500 18,000

Net Operating Income (based on cash rents) – “Pro Forma” $ 64,250 $ 257,000

Allianz Step 2 & Acquisitions 6,000 24,000

Net Operating Income (based on cash rents) – “Pro Forma” + “Acquisitions” $ 70,250 $ 281,000

28

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

(in thousands) Three Months

Ended 6/30/17 Annualized

Net Income $ 1,133 $ 4,532

Interest expense (net) 13,785 55,140

Interest income from development authority bonds (1,800) (7,200)

Income tax benefit 7 28

Depreciation of real estate assets 20,423 81,692

Amortization of lease-related costs 8.191 32,764

Adjustments from unconsolidated joint venture 4,233 16,932

EBITDA $ 45,972 $ 183,888

Adjusted EBITDA $ 45,972 $ 183,888

General and administrative 9,201 36,804

Adjustments from unconsolidated joint venture 9 36

Net Operating Income (based on GAAP rents) $ 55,182 $ 220,728

Allianz Step 1 & 263 Shuman Disposition (2,182) (8,728)

Uncommenced Leases 6,500 26,000

Lease Expirations (2,750) (11,000)

Lease Rollover 3,500 14,000

Lease Up Vacant Space 4,500 18,000

Net Operating Income (based on GAAP rents) – “Pro Forma” $ 64,750 $ 259,000

Allianz Step 2 & Acquisitions 6,750 27,000

Net Operating Income (based on GAAP rents) – “Pro Forma” + “Acquisitions” $ 71,500 $ 286,000

29

RECONCILIATIONS: NON-GAAP TO COMPARABLE GAAP

MEASURES

(in thousands) Three Months

Ended 6/30/17

Total Revenues – GAAP $ 74,857

Total Revenues – CXP’s Interest in Unconsolidated Joint Ventures 5,318

Total Revenues $ 80,175

Allianz Step 1 & 263 Shuman Disposition 189

Other Property Income & Lease Termination Income (764)

Lease Expirations – 2Q 17 (900)

Total Revenues – 2Q 17 Normalized (GAAP) $ 78,700

Total Revenues – GAAP $ 74,857

Total Revenues – CXP’s Interest in Unconsolidated Joint Ventures 5,318

Total Revenues $ 80,175

Allianz Step 1 & 263 Shuman Disposition 189

Other Property Income & Lease Termination Income (764)

Lease Expirations – 2Q 17 (900)

Straight-line Rent & Other Adjustments (9,400)

Total Revenues – 2Q 17 Normalized (Cash) $ 69,300