Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGNC Investment Corp. | agnc8-k91217.htm |

© 2017 AGNC Investment Corp. All Rights Reserved.

Barclays Global Financial

Services Conference

September 12, 2017

Exhibit 99.1

Safe harbor statement under the private securities litigation reform act of

1995

2

Safe Harbor Statement

This presentation contains statements that, to the extent they are not

recitations of historical fact, constitute "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of 1995 (the

“Reform Act”). All such forward-looking statements are intended to be

subject to the safe harbor protection provided by the Reform Act. Actual

outcomes and results could differ materially from such forecasts due to the

impact of many factors beyond the control of AGNC Investment Corp.

(“AGNC” or the “Company”). All forward-looking statements included in this

presentation are made only as of the date of this presentation and are

subject to change without notice. Certain important factors that could cause

actual results to differ materially from those contained in the forward-

looking statements are included in our periodic reports filed with the

Securities and Exchange Commission (“SEC”). Copies are available on the

SEC’s website at www.sec.gov. AGNC disclaims any obligation to update such

forward-looking statements unless required by law.

The following slides contain summaries of certain financial and statistical

information about AGNC. They should be read in conjunction with our

periodic reports that are filed from time to time with the SEC. Historical

results discussed in this presentation are not indicative of future results.

AGNC is an internally-managed mortgage real estate investment trust (“REIT”)

As a REIT, AGNC is generally not subject to U.S. federal or state corporate taxes

to the extent that AGNC makes distributions of annual taxable net income to its

stockholders on a timely basis

Structure

AGNC Investment Corp. is an internally-managed real estate investment trust

that invests predominantly in Agency residential mortgage-backed securities

3

AGNC At a Glance

1. As of August 31, 2017.

Note: Information as of June 30, 2017 unless otherwise noted.

May 2008IPO Date

Bethesda, MDHeadquarters

Nasdaq: AGNCExchange

57# Employees

$64 BillionTotal Portfolio

10%1Dividend Yield

AGNC invests primarily in Agency residential mortgage-backed securities (“MBS”)

for which the principal and interest payments are guaranteed by a U.S.

Government-sponsored entity (“GSE”), such as Fannie Mae and Freddie Mac, or a

U.S. Government agency, such as Ginnie Mae

AGNC may also invest in other types of mortgage and mortgage-related

securities, such as credit risk transfer (“CRT”) securities and non-Agency

residential and commercial MBS

Investment Focus

Affiliates

AGNC manages MTGE Investment Corp.

(Nasdaq: MTGE), a hybrid mortgage REIT

with a $7 billion portfolio consisting of

Agency, non-Agency and other real

estate-related assets

AGNC’s funding profile is greatly

enhanced by Bethesda Securities, a

wholly-owned broker-dealer

subsidiary with direct access to the

Fixed Income Clearing Corporation

Analyst Coverage1

$7.7 Billion1Market Cap

4

AGNC: Well-Positioned for the Current Environment

The investment environment for levered Agency MBS investors such as AGNC has

improved materially due to the confluence of several positive market dynamics:

Favorable projected Agency MBS returns driven by anticipated Fed tapering of MBS purchases

Supportive funding backdrop, which is further enhanced for AGNC by its captive broker-dealer

Low interest rate volatility environment

AGNC specifically offers investors a unique residential mortgage investment vehicle

with multiple value-enhancing attributes:

A track record of substantial outperformance since inception in 2008

One of the lowest operating cost structures of any residential mortgage REIT, with a gross

operating expense ratio of approximately 90 bps of stockholders’ equity, or approximately 70 bps

of stockholders’ equity, net of MTGE management fee income1,14

Disciplined risk management

An internalized management structure that aligns management and stockholder interests over

the long-term

Considerable scale with ample stockholder liquidity

Together, the favorable investment environment and AGNC’s

unique attributes provide a compelling value proposition for investors

Note: For additional detail, refer to endnotes in the Appendix.

200

320

440

560

680

800

40

60

80

100

120

140

H

igh Yield and CR

TIn

ve

st

m

en

t

G

ra

de

Investment Grade High Yield (RHS) CRT (RHS)

(20)

0

20

40

60

(20)

0

20

40

60

30 Year Current Coupon MBS OAS

5

Attractiveness of Agency MBS

Spreads on Agency MBS and other fixed income assets have diverged over the last year

as the market has focused on Fed tapering of its MBS and Treasury purchases

Spreads in most credit-centric sectors are currently near post-crisis tights, while Agency MBS spreads

have widened to levels last seen before QE3 was priced into the market

The stability of MBS valuations in the face of relatively hawkish communication from the Fed seems to

support AGNC’s view that the market has already largely priced in the anticipated reduction in the Fed’s

reinvestment activity

Wider MBS spreads create attractive investment opportunities and can be accretive to

AGNC’s long-term franchise value

Note: For additional detail, refer to endnotes in the Appendix.

Agency MBS OAS vs. Other Fixed Income Spreads (Dec 2009 – Aug 2017)

30 Year Current Coupon MBS OAS2 Investment Grade, High Yield and CRT Spreads3

QE3

MBS spreads have

returned to pre-QE3

levels…

QE3 …while other fixed

income spreads have

tightened

bps bps bps bps

(10 bps)

(5 bps)

-

5 bps

10 bps

15 bps

20 bps

1Q

14

2Q

14

3Q

14

4Q

14

1Q

15

2Q

15

3Q

15

4Q

15

1Q

16

2Q

16

3Q

16

4Q

16

1Q

17

2Q

17

AGNC’s direct access to the FICC through its captive broker-dealer, Bethesda Securities,

further enhances AGNC’s funding profile

Access to wholesale repo rates provides a funding benefit of approximately 10 – 15 bps in comparison

to retail rates available through bilateral repo counterparties

Bethesda Securities significantly expands and diversifies AGNC’s funding base, with approximately $10

billion of Agency repo as of June 30, 2017

Attractive pricing and haircut levels available through AGNC’s broker-dealer provide the opportunity for

AGNC to operate at higher leverage under appropriate market conditions

Approximately 20 – 40% of AGNC’s total Agency repo financing is expected to be funded through

Bethesda Securities over the long-term

6

Advantageous Funding Dynamics for AGNC

The funding backdrop for Agency MBS

has improved materially over the last

several years as money market reform has

driven a significant flow of capital from

prime to government funds

Agency MBS funding costs have decreased

substantially relative to LIBOR as a result

The Agency repo market is now supported by

a broader mix of counterparties and

substantially less exposure to the largest

global banks

Note: For additional detail, refer to endnotes in the Appendix.

AGNC Repo Cost Spread to LIBOR4

AGNC’s weighted average repo

cost relative to 3-month LIBOR

has improved by approximately

15 bps from the historical average

Average

7

Opportunistic Risk Management Activity

AGNC has opportunistically reduced its exposure to rising interest rates given the year-

to-date decline in rates, weaker global economic growth and a more hawkish Fed

As a result of these risk management actions, AGNC’s projected tangible net book value decline in a

+100 bps interest rate shock scenario has been reduced by approximately 40% from December 31, 2016

to June 30, 2017

Reduced interest rate volatility and the relatively flat curve have allowed AGNC to

mitigate interest rate risk without a significant impact on current earnings

As of June 30, 2017, AGNC’s hedge portfolio totaled approximately $56 billion and

covered 98% of funding liabilities (Agency repo, other debt and net TBA position)

AGNC’s hedge portfolio includes interest rate swaps, payer swaptions and U.S. Treasury securities and

futures

AGNC Interest Rate Sensitivity610 Year U.S. Treasury Rate5

Note: For additional detail, refer to endnotes in the Appendix.

(Estimated change in portfolio value as a % of tangible net book value in a

+100 bps interest rate shock scenario)

(15.3%) (15.1%)

(9.2%)

(20%)

(15%)

(10%)

(5%)

0%

Dec 31, 2016 Mar 31, 2017 Jun 30, 2017

1.3%

1.5%

1.7%

1.9%

2.1%

2.3%

2.5%

2.7%

Jan-15 Jul-15 Jan-16 Jul-16 Jan-17 Jul-17

2015 Range

~80 bps

2016 Range

~120 bps

2017 YTD Range

~50 bps

Asset Yield 3.0%

Less: Cost of Funds (1.8%)

Net Interest Rate Spread 1.2%

Times: Leverage 8x - 9x

Leveraged Net Interest Rate Spread 10% - 11%

Plus: Asset Yield 3.0%

Gross Levered ROE 13% - 14%

Less: Net Operating Expenses as % of Equity (0.7%)

Net Levered ROE 12% - 13%

As a result of current market conditions and AGNC’s unique attributes, AGNC

projects favorable returns from its investments in Agency MBS

8

Putting it All Together: Business Economics

Hypothetical Business Economics

for 30-Year 3.5% MBS Investments7 The AGNC Advantage

Note: For additional detail, refer to endnotes in the Appendix.

Opportunity for Outperformance

1

Agency MBS option-adjusted spreads are near multiyear wides as market participants

have priced in the end of Fed MBS purchases

AGNC’s current portfolio is seasoned and heavily prepay-protected

The potential for opportunistic growth of AGNC’s CRT and non-Agency portfolio

provides investment flexibility as market conditions shift

Assets

AGNC’s broker-dealer provides a 10 – 15 bps financing cost benefit, expands AGNC’s

funding base and facilitates higher leverage levels through lower collateral haircuts

Agency repo costs relative to LIBOR have decreased substantially and remain on the

low end of the post-crisis range

Funding and Leverage

AGNC operates with one of the lowest cost structures of any residential mortgage

REIT, which is critical in a sustained lower interest rate environment1,14

Operating Efficiency

Recent low interest rate volatility has provided an opportunity to increase AGNC’s

hedge position in a cost-effective manner, with minimal impact on projected earnings

Risk Management and Hedging

The AGNC Value Proposition

Note: For additional detail, refer to endnotes in the Appendix. 9

Industry-Leading

Performance

Highly Efficient

Operating Cost

Structure

Disciplined Risk

Management

Stockholder

Focus

Liquidity and

Scale

Since its 2008 IPO, AGNC has delivered industry-

leading performance as measured by

total stock return8,15 and total economic return9,15

18%

Annualized

Stock

Return8

14%

Annualized

Economic

Return9

0.90%

Gross

Operating

Expense

Ratio1

Monthly

Dividend Payment &

Net Book Value Disclosure

$7.7 Billion

Market Capitalization as

of August 31, 2017

Limited

Duration

Gap10

40

Funding

Counterparties

AGNC has one of the lowest operating cost

structures as a percentage of stockholders’ equity

among residential mortgage REITs1,14

AGNC utilizes a comprehensive risk management

framework that is predicated on careful asset

selection, disciplined hedging and

diversified funding

AGNC has consistently been recognized as an

industry leader for its financial disclosure,

transparency and shareholder-focused approach to

capital management

AGNC is the largest internally-managed residential

mortgage REIT by stockholders’ equity and

one of only three residential mortgage REITs

with a market cap over $5 billion14

0.70%

Net

Operating

Expense

Ratio1

(100%)

(50%)

0%

50%

100%

150%

200%

250%

300%

350%

400%

May-08 May-09 May-10 May-11 May-12 May-13 May-14 May-15 May-16 May-17

AGNC

Peer Group

Large Resi mREIT Group

Resi mREIT Universe

S&P 500

27%

21% 21%

15%

11%

0%

5%

10%

15%

20%

25%

30%

AGNC Large Resi

mREIT

Group

Peer

Group

Resi

mREIT

Universe

S&P 500

10

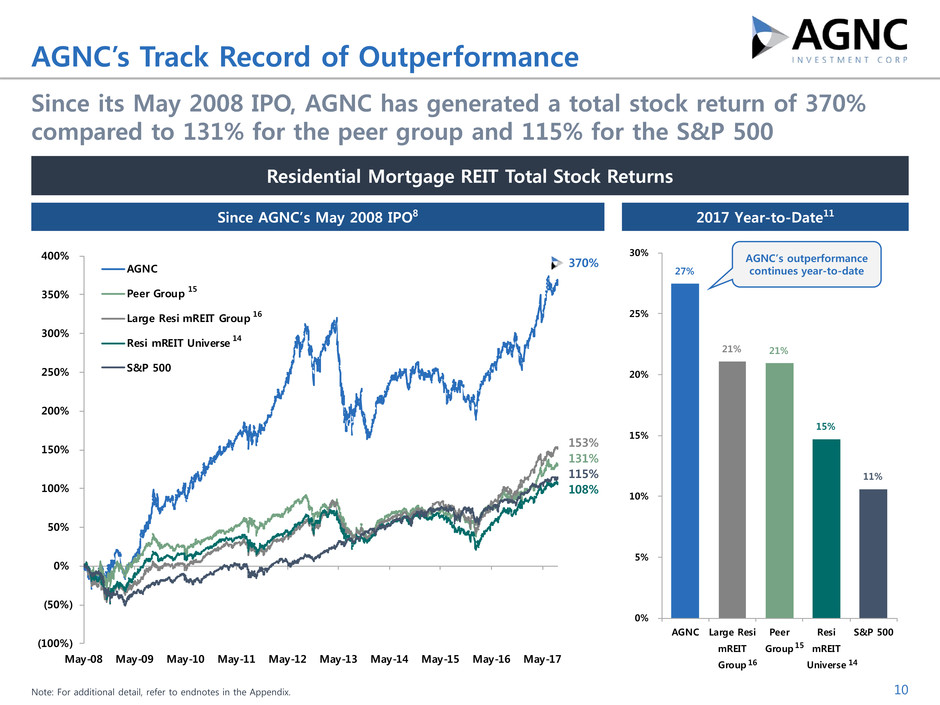

AGNC’s Track Record of Outperformance

Since its May 2008 IPO, AGNC has generated a total stock return of 370%

compared to 131% for the peer group and 115% for the S&P 500

Residential Mortgage REIT Total Stock Returns

Since AGNC’s May 2008 IPO8 2017 Year-to-Date11

370%

153%

131%

115%

108%

AGNC’s outperformance

continues year-to-date

15

16

14

15

16 14

Note: For additional detail, refer to endnotes in the Appendix.

524

315

170 155 146

90

70

319 306

262

175

90

70

REIT

A

REIT

B

REIT

C

REIT

D

REIT

E

AGNC

Gross

AGNC

Net

Mid / Small

Resi mREIT

Group

Resi

mREIT

Universe

Large

Resi mREIT

Group

AGNC

Peer

Group

AGNC

Gross

AGNC

Net

Note: For additional detail, refer to endnotes in the Appendix. 11

In today’s environment, cost structure is a critical consideration in evaluating any and all

investment vehicles

Projected operating expenses, net of MTGE management fee income, are expected to be

approximately 70 bps of stockholders’ equity, or less than 10 bps of total assets1

On a per-asset basis, AGNC’s net operating cost is in-line with low-cost bond ETFs, which are passive,

unlevered and unhedged and do not have access to the broker-dealer financing that AGNC enjoys

As depicted below, AGNC’s operating cost is significantly lower than those of comparable

residential mortgage REITs

Industry-Leading Operating Cost Structure

Residential Mortgage REIT Operating Cost Structure Comparison1

(Operating expenses as a percentage of stockholders’ equity, in basis points)

Large Resi mREITs ($3 Billion+ in Stockholders’ Equity) Resi mREIT Group Averages

1 1 1 1

16 1614 15

AGNC’s gross cost structure

is approximately one-half and

one-third of the peer group

and the large resi mREIT

group averages, respectively

(Illustrative Purposes Only)

Hypothetical

Externally-

Managed REIT

AGNC

(Hypothetical)

Business Economics (Hypothetical):

Asset Yield 2.6% 2.6%

Less: Cost of Funds (1.4) (1.4)

Net Interest Rate Spread 1.2% 1.2%

Times: Leverage 7.7x 7.7x

Leveraged Net Interest Rate Spread 9.2% 9.2%

Plus: Asset Yield 2.6 2.6

Gross Levered ROE 11.8% 11.8%

Less: Net Operating Expenses as % of Equity (1.8) (0.7)

Net Levered ROE 10.0% 11.1%

(Illustrative Purposes Only)

AGNC

(Hypothetical)

Base Assumptions

Beginning Equity Capital $8.0 Billion

Net Operating Expense Ratio 70 bps

Hypothetical $1 Billion Capital Raise

Pro Forma Equity Capital $9.0 Billion

Incremental Management Fees None

Pro Forma Net Operating Expense Ratio 62 bps

Net Operating Expense Ratio Reduction 11%

12

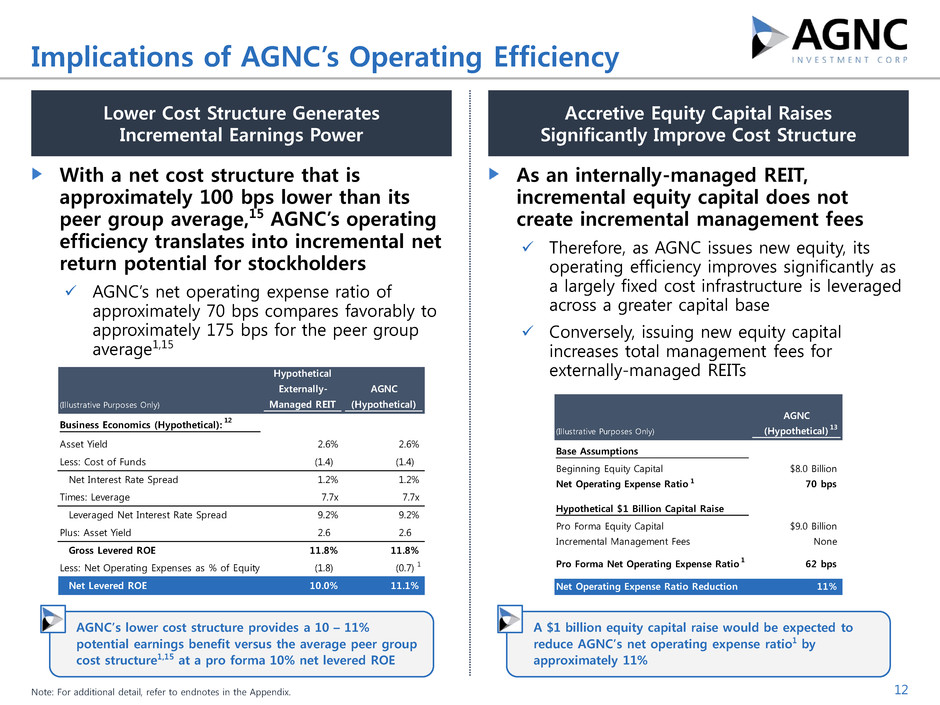

Implications of AGNC’s Operating Efficiency

With a net cost structure that is

approximately 100 bps lower than its

peer group average,15 AGNC’s operating

efficiency translates into incremental net

return potential for stockholders

AGNC’s net operating expense ratio of

approximately 70 bps compares favorably to

approximately 175 bps for the peer group

average1,15

12

Note: For additional detail, refer to endnotes in the Appendix.

Lower Cost Structure Generates

Incremental Earnings Power

Accretive Equity Capital Raises

Significantly Improve Cost Structure

As an internally-managed REIT,

incremental equity capital does not

create incremental management fees

Therefore, as AGNC issues new equity, its

operating efficiency improves significantly as

a largely fixed cost infrastructure is leveraged

across a greater capital base

Conversely, issuing new equity capital

increases total management fees for

externally-managed REITs

AGNC’s lower cost structure provides a 10 – 11%

potential earnings benefit versus the average peer group

cost structure1,15 at a pro forma 10% net levered ROE

A $1 billion equity capital raise would be expected to

reduce AGNC’s net operating expense ratio1 by

approximately 11%

13

1

1

1

Appendix

(1.0%)

(0.5%)

0.0%

0.5%

- 50 bps No Change + 50 bps

1. Interest rate and MBS spread sensitivity are derived from models that are dependent on inputs and assumptions provided by third parties as well as by AGNC’s investment team and, accordingly,

actual results could differ materially from these estimates.

2. Estimated dollar change in value expressed as a percentage of the total market value of “at risk” assets.

3. Reflects estimated change in portfolio market value (vertical axis) for each interest rate scenario (horizontal axis) as reported by AGNC and its peer group. The peer group is unweighted and

includes ARR, CMO, CYS and NLY (ANH does not provide this information for ±50 bps interest rate shifts as of June 30, 2017). 14

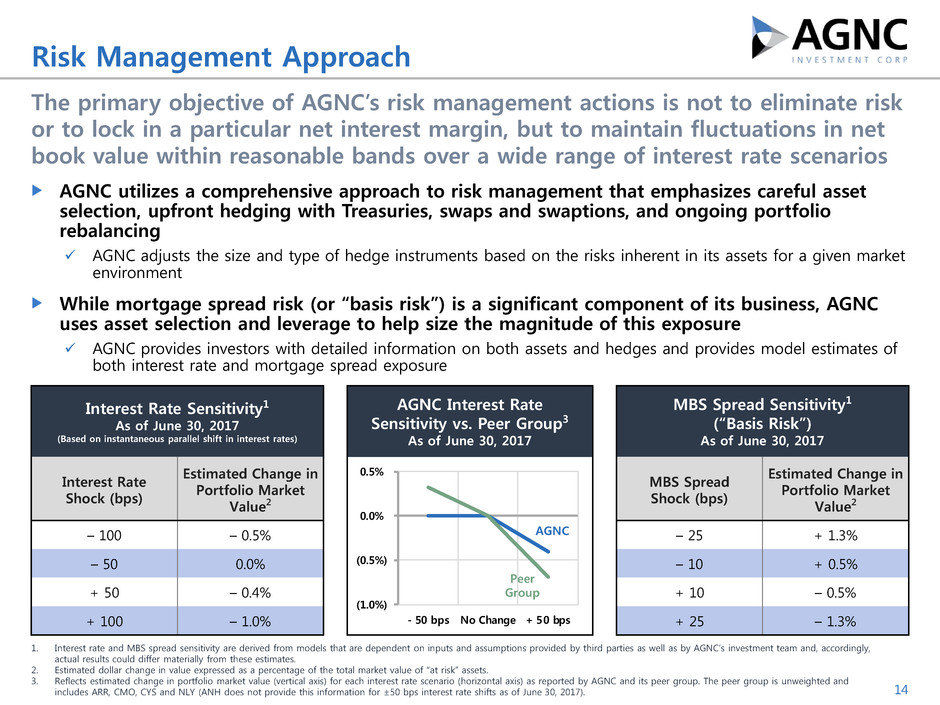

AGNC utilizes a comprehensive approach to risk management that emphasizes careful asset

selection, upfront hedging with Treasuries, swaps and swaptions, and ongoing portfolio

rebalancing

AGNC adjusts the size and type of hedge instruments based on the risks inherent in its assets for a given market

environment

While mortgage spread risk (or “basis risk”) is a significant component of its business, AGNC

uses asset selection and leverage to help size the magnitude of this exposure

AGNC provides investors with detailed information on both assets and hedges and provides model estimates of

both interest rate and mortgage spread exposure

Risk Management Approach

The primary objective of AGNC’s risk management actions is not to eliminate risk

or to lock in a particular net interest margin, but to maintain fluctuations in net

book value within reasonable bands over a wide range of interest rate scenarios

MBS Spread Sensitivity1

(“Basis Risk”)

As of June 30, 2017

MBS Spread

Shock (bps)

Estimated Change in

Portfolio Market

Value2

– 25 + 1.3%

– 10 + 0.5%

+ 10 – 0.5%

+ 25 – 1.3%

Interest Rate Sensitivity1

As of June 30, 2017

(Based on instantaneous parallel shift in interest rates)

Interest Rate

Shock (bps)

Estimated Change in

Portfolio Market

Value2

– 100 – 0.5%

– 50 0.0%

+ 50 – 0.4%

+ 100 – 1.0%

AGNC Interest Rate

Sensitivity vs. Peer Group3

As of June 30, 2017

AGNC

Peer

Group

$13.6

$7.7

$5.1

$3.6

$3.6 $3.5

$1.9

$1.3

$1.3 $1.2

$1.1 $0.9 $0.9 $0.7 $0.6 $0.5 $0.4 $0.4 $0.4 $0.2 $0.2 $0.2 $0.1

$71

$-

$20

$40

$60

$80

$100

$-

$3.0

$6.0

$9.0

$12.0

$15.0

NLY AGNC NRZ CIM TWO MFA IVR CYS RWT PMT ARR CMO MTGE NYMT ANH MITT WMC ORC DX AJX CHMI EARN OAKS

A

verage D

aily Trading V

olum

e ($ M

illions)

M

ar

ke

t

Ca

pi

ta

liz

at

io

n

($

B

ill

io

ns

)

Market Cap (Left Axis) ADTV (Right Axis)

1. The residential mortgage REIT universe includes all REITs shown above.

2. Market capitalizations as of August 31, 2017.

3. Average daily trading volume from September 1, 2016 through August 31, 2017. Daily trading volume reflects total trading volume (in number of shares) multiplied by the average of the stock’s

closing price on such trading day and the prior trading day.

4. Median includes all REITs shown above except AGNC.

Source: SNL Financial. 15

AGNC’s Liquidity and Scale

As the second largest residential mortgage REIT by stockholders’ equity,1

AGNC offers favorable liquidity and scale benefits

Residential Mortgage REIT Market Capitalizations2 and Average Daily Trading Volumes3

$7.7 Billion

$0.9 BillionMedian4

Market Cap ADTV

$71 Million

$7 Million

9x 11x

16

Endnotes

1) Mortgage REIT cost structures are based on operating expenses and average stockholders’ equity (excluding noncontrolling interests, as applicable) over the trailing twelve month period ended June

30, 2017 as publicly reported by such REITs. Operating costs include expenses for compensation and benefits, management fees and G&A and may include one-time or nonrecurring expenses.

Operating costs exclude direct costs associated with operating activities, such as loan acquisition costs, securitization costs, servicing expenses, etc. to the extent publicly disclosed by such REITs.

AGNC’s ratio is based on average stockholders’ equity from June 30, 2016 through June 30, 2017 and excludes nonrecurring transaction-related charges (including retention or stay bonuses), one-time

or transitionary expenses, and non-cash expenses, such as non-cash amortization charges, associated with the internalization transaction. AGNC’s gross ratio excludes the net economic benefit

associated with MTGE management fee income and incremental G&A expenses associated with AGNC’s management of MTGE that are reimbursed by MTGE; AGNC’s net ratio includes the net

economic benefit associated with MTGE management fee income but excludes incremental G&A expenses associated with AGNC’s management of MTGE that are reimbursed by MTGE. Source:

Company SEC filings and SNL Financial.

2) Reflects an unweighted monthly average of daily LIBOR OAS close valuations from the following models: Citi, JP Morgan, Credit Suisse and Barclays. Data is through August 29, 2017.

3) Investment grade reflects a monthly average of daily close valuations of the DJ CDX.NA.IG on the run 5 year CDS spread index. High yield reflects a monthly average of daily close valuations of the DJ

CDX.NA.HY on the run 5 year CDS spread index. CRT reflects a monthly average of new issuance spreads. Data is through August 30, 2017. Source: Bloomberg.

4) Reflects a quarterly average of month-end AGNC repo spreads to month-end 3-month LIBOR.

5) Reflects daily close values of the H15T10Y Index (10 year U.S. Treasury constant maturity) on Bloomberg. Data is through August 31, 2017. Source: Bloomberg.

6) Interest rate sensitivity assumes an instantaneous parallel shift in interest rates and is derived from models that are dependent on inputs and assumptions provided by third parties as well as by

AGNC’s investment team and, accordingly, actual results could differ materially from these estimates. Estimated change as a percentage of tangible net book value incorporates the impact of leverage.

7) These hypothetical examples are for illustrative purposes only and are dependent on a variety of inputs and assumptions, which are assumed to be static. Actual results could differ materially based on

a number of factors, including changes in interest rates, spreads, prepayments, asset values, funding levels, risk positions, hedging costs, expenses and other factors.

8) Stock return is measured from IPO through August 31, 2017. Total stock return over a period includes price appreciation and dividend reinvestment; dividends are assumed to be reinvested at the

closing price of the security on the ex-dividend date. Source: SNL Financial.

9) Economic return is measured from June 30, 2008 through June 30, 2017. Total economic return represents the change in net book value per common share and dividends declared on common stock

during the period over the beginning net book value per common share. Source: Company SEC filings and SNL Financial.

10) The duration of an asset or liability measures how much its price is expected to change if interest rates move in a parallel manner; it is a model estimate of interest rate sensitivity and is measured in

years as of a point in time. Duration gap is a measure of the difference in the interest rate exposure, or estimated price sensitivity, of AGNC’s assets and liabilities (including hedges).

11) Stock return is measured from December 31, 2016 through August 31, 2017. Total stock return over a period includes price appreciation and dividend reinvestment; dividends are assumed to be

reinvested at the closing price of the security on the ex-dividend date. Source: SNL Financial.

12) Hypothetical analysis is for illustrative purposes only and assumes AGNC and the hypothetical externally-managed REIT have identical portfolios, funding and leverage profiles but different operating

cost structures.

13) Hypothetical analysis is for illustrative purposes only and assumes unchanged G&A expenses in the capital raise scenario.

14) The residential mortgage REIT universe is unweighted and includes AJX, ANH, ARR, CHMI, CIM, CMO, CYS, DX, EARN, IVR, MFA, MITT, MTGE, NLY, NRZ, NYMT, OAKS, ORC, PMT, RWT, TWO and WMC.

15) For agency-focused residential mortgage REIT peer comparison purposes, AGNC’s peer group is unweighted and includes ANH, ARR, CMO, CYS and NLY.

16) The large resi mREIT group includes resi mREITs with greater than $3 billion in total stockholders’ equity as of June 30, 2017: CIM, MFA, NLY, NRZ and TWO. The mid / small resi mREIT group includes

resi mREITs with less than $3 billion in total stockholders’ equity as of June 30, 2017: AJX, ANH, ARR, CHMI, CMO, CYS, DX, EARN, IVR, MITT, MTGE, NYMT, OAKS, ORC, PMT, RWT and WMC.