Attached files

| file | filename |

|---|---|

| 8-K - 8-K - WYNN RESORTS LTD | wrl_91117x8kxwmlbonds.htm |

1

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the

contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability

whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

This announcement is for informational purposes only and is not an offer to sell or the solicitation of an offer to buy securities in

the United States or in any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

Neither this announcement nor anything herein forms the basis for any contract or commitment whatsoever. Neither this

announcement nor any copy hereof may be taken into or distributed in the United States. The securities referred to herein have

not been and will not be registered under the United States Securities Act of 1933, as amended, and may not be offered or sold in

the United States absent registration or an applicable exemption from registration. No public offer of securities is to be made by

the Company in the United States.

(Incorporated in the Cayman Islands with limited liability)

(Stock Code: 1128 and Debt Stock Code: 5983)

PROPOSED ISSUANCE OF SENIOR NOTES AND

CONCURRENT TENDER OFFER FOR REPURCHASE

OF THE 2021 NOTES

THE PROPOSED NOTES ISSUE

The Company is pleased to announce that it proposes to conduct an offering of the Notes to

Professional Investors.

Completion of the proposed offering of the Notes is subject to market conditions and investor interest.

Deutsche Bank AG, Singapore Branch, has been appointed as the Sole Global Coordinator and Left

Lead Bookrunner, BNP Paribas Securities Corp., BOCI Asia Limited, DBS Bank Ltd., Industrial and

Commercial Bank of China (Macau) Limited, Merrill Lynch, Pierce, Fenner & Smith Incorporated,

Scotia Capital (USA) Inc., SMBC Nikko Securities America, Inc. and United Overseas Bank

Limited have been appointed as Joint Bookrunners and Banco Nacional Ultramarino, S.A., Bank of

Communications Co. Ltd. Macau Branch and J.P. Morgan Securities LLC have been appointed as Co-

Managers. Pricing of the Notes will be determined through a book building exercise to be conducted

by the Sole Global Coordinator and the Joint Bookrunners. The Notes, if issued, will be repayable at

maturity, unless earlier redeemed or repurchased pursuant to their terms.

The aggregate principal amount, terms and conditions of the Notes have not been determined as

at the date of this announcement. Upon finalization of the terms of the Notes, it is expected that

the Initial Purchasers and the Company will enter into the Purchase Agreement. The Company

will make a further announcement in respect of the proposed offering of the Notes if a binding

agreement is signed.

* For identification purposes only.

EXHIBIT 99.1

2

The Notes have not been and will not be registered under the Securities Act or the securities law of

any other jurisdiction, and may be offered and sold only to qualified institutional buyers in reliance

on Rule 144A under the Securities Act, non-U.S. persons (as defined in Regulation S under the

Securities Act) outside the United States in reliance on Regulation S under the Securities Act and

professional investors as defined in Part 1 of Schedule 1 to the SFO (including those prescribed by

rules made under Section 397 of the SFO), and in accordance with any other applicable laws. None

of the Notes will be offered or sold to the public in Hong Kong and none of the Notes will be placed

to any Connected Person of the Company.

REASONS FOR THE PROPOSED ISSUE

If the Notes are issued, the Company intends to use the net proceeds from the proposed offering,

together with other sources of funds available to us and/or cash on hand, as applicable, to

repurchase and redeem in full the 2021 Notes.

LISTING

The Company has sought a listing of the Notes on the Stock Exchange and has received an

eligibility letter from the Stock Exchange for the listing of the Notes. Admission of the Notes to the

Stock Exchange is not to be taken as an indication of the merits of the Company or the Notes.

GENERAL

As no binding agreement in relation to the proposed offering of Notes has been entered into as

at the date of this announcement, the proposed offering of Notes may or may not materialize.

Investors and shareholders of the Company are urged to exercise caution when dealing in the

securities of the Company.

CONCURRENT TENDER OFFER FOR REPURCHASE OF THE 2021

NOTES

BACKGROUND

In October 2013, the Company issued an aggregate principal amount of US$600,000,000 5.250%

senior notes due 2021 (CUSIP: 98313R AA4 and G98149 AA8; ISIN: US98313RAA41 and

USG98149AA89). In March 2014, the Company issued an additional aggregate principal amount of

US$750,000,000 5.250% senior notes due 2021. The 2021 Notes will mature on 21 October 2021

unless previously redeemed or purchased and cancelled pursuant to the terms thereof. Reference

is made to the announcements of the Company dated 16 October 2013 and 21 March 2014 in

relation to the issuance of the 2021 Notes by the Company. As at the date of this announcement, the

aggregate outstanding principal amount of the 2021 Notes is US$1,350,000,000. The 2021 Notes

are listed on the Stock Exchange (stock code: 05983).

3

TENDER OFFER FOR REPURCHASE OF THE 2021 NOTES

The Tender Offer is being made pursuant to an Offer to Purchase and the related Notice of

Guaranteed Delivery, dated 11 September 2017. Subject to the terms and conditions in the Offer

to Purchase, the amount payable per principal amount of the Notes validly tendered and not

subsequently validly withdrawn at or prior to the Expiration Time will be US$1,028.75 for each

US$1,000 in principal amount of the Notes. In addition, holders whose 2021 Notes are accepted

for purchase pursuant to the Tender Offer will also receive accrued and unpaid interest on such

Notes from and including the immediately preceding interest payment date for such Notes up to,

but excluding, the Settlement Date. No tenders of the Notes will be valid if submitted after the

Expiration Time.

The purpose of the Tender Offer is to acquire all of the outstanding 2021 Notes prior to maturity.

The Company intends to deliver a notice of redemption in order to redeem any 2021 Notes

outstanding following the consummation of the Tender Offer that are not purchased pursuant to the

Tender Offer on the date that is 30 days after the Settlement Date (or if such date is not a business

day, on the next succeeding business day) at a cash redemption price per US$1,000 principal

amount of 2021 Notes equal to US$1,026.25, plus accrued and unpaid interest to, but excluding, the

redemption date, in accordance with the 2021 Notes Indenture, pursuant to which the 2021 Notes

were issued. Following delivery of such notice, the Company intends to satisfy and discharge the

2021 Notes Indenture in accordance with its terms.

The Tender Offer will commence on 11 September 2017 and will expire at 5:00 p.m. (New York

City time) on 19 September 2017, unless extended, withdrawn, terminated or amended at the sole

discretion of the Company as provided in the Offer to Purchase, in which case an announcement

to that effect will be made by the Information Agent and Tender Agent or the Dealer Manager on

behalf of the Company. The Company may, in its sole discretion, waive, amend, extend, terminate

or withdraw the Tender Offer at any time.

2021 Notes repurchased by the Company pursuant to the Tender Offer will be cancelled. 2021

Notes which are validly submitted and accepted for tender pursuant to the Tender Offer will remain

outstanding. Any 2021 Notes that remain outstanding after the Tender Offer will continue to be the

obligations of the Company. Holders of those outstanding 2021 Notes will continue to have all the

rights associated with those 2021 Notes.

The Company will from time to time issue announcements in respect of the progress of the Tender

Offer as and when necessary pursuant to the Listing Rules and other relevant rules and regulations.

The Settlement Date for the Tender Offer is currently expected to be not later than 20 September

2017 subject to the right of the Company to extend, amend or terminate the Tender Offer.

The Tender Offer will be funded with the proceeds from the proposed issue of Notes and other

sources of funds available to us and/or cash on hand, as applicable.

The Company’s obligation to accept for purchase, and to pay for, 2021 Notes validly tendered and

not validly withdrawn pursuant to the Tender Offer is conditioned upon certain conditions having

occurred or having been waived by the Company, including the completion of the issuance of the

Notes.

4

For a detailed statement of the terms and conditions of the Tender Offer, holders of the Notes

should refer to the Tender Offer Documents. The Tender Offer Documents will be distributed to

holders of the 2021 Notes by the Information Agent and Tender Agent. In connection with the

Tender Offer, the Company has appointed Deutsche Bank AG, Singapore Branch as the Dealer

Manager and D.F. King & Co., Inc. as the Information Agent and Tender Agent. Requests for

copies of the Offer to Purchase and its related documents may be directed to the Information Agent

and Tender Agent by telephone at +(212) 269 5552, by facsimile at +(212) 709 3328 or by email

to: wynnmacau@dfking.com. Questions regarding the Tender Offer should be directed to Deutsche

Bank AG, Singapore Branch at One Raffles Quay, South Tower Level 17, Singapore 048583

(attention: Liability Management Group, +65 6423 5934), c/o Deutsche Bank Securities Inc. at 60

Wall Street, 2nd Floor New York, New York 10005 (attention: Liability Management Group, (855)

287-1922 (Call U.S. Toll-Free), (212) 250-7527 (Call Collect)).

None of the Company, its Directors, Deutsche Bank AG, Singapore Branch or D.F. King or

Deutsche Bank Trust Company Americas as trustee of the 2021 Notes, makes any recommendation

as to whether the holders of the Notes should tender their 2021 Notes in response to the Tender

Offer.

Before making a decision in respect of the Tender Offer, holders of the 2021 Notes should carefully

consider all information as disclosed in the Offer to Purchase and the related Notice of Guarantee

Delivery. Noteholders are recommended to seek their own financial and legal advice, including with

regard to any tax consequences, from their stockbroker, bank manager, solicitor, tax adviser or other

independent financial or legal adviser.

The Tender Offer is not being made to, and any offers to tender 2021 Notes pursuant to the Tender

Offer will not be accepted from, or on behalf of, holders of the Notes in any jurisdiction in which

the making of such Tender Offer would not be in compliance with the laws or regulations of such

jurisdiction.

DEFINITIONS

In this announcement, unless otherwise indicated in the context, the following expressions have the

meanings set out below:

“2021 Notes” : the 5.250% senior notes due 2021 issued by the Company

(CUSIP: 98313R AA4 and G98149 AA8; ISIN:

US98313RAA41 and USG98149AA89)

“Company” : Wynn Macau, Limited, a company incorporated in the

Cayman Islands on September 4, 2009 as an exempted

company with limited liability

“Connected Person” : has the meaning ascribed to it under the Listing Rules

“Dealer Manager” : Deutsche Bank AG, Singapore Branch

“Expiration Time” : 5:00 p.m., New York City time, on 19 September 2017

(subject to the right of the Company, in its sole discretion, to

extend or amend such date)

5

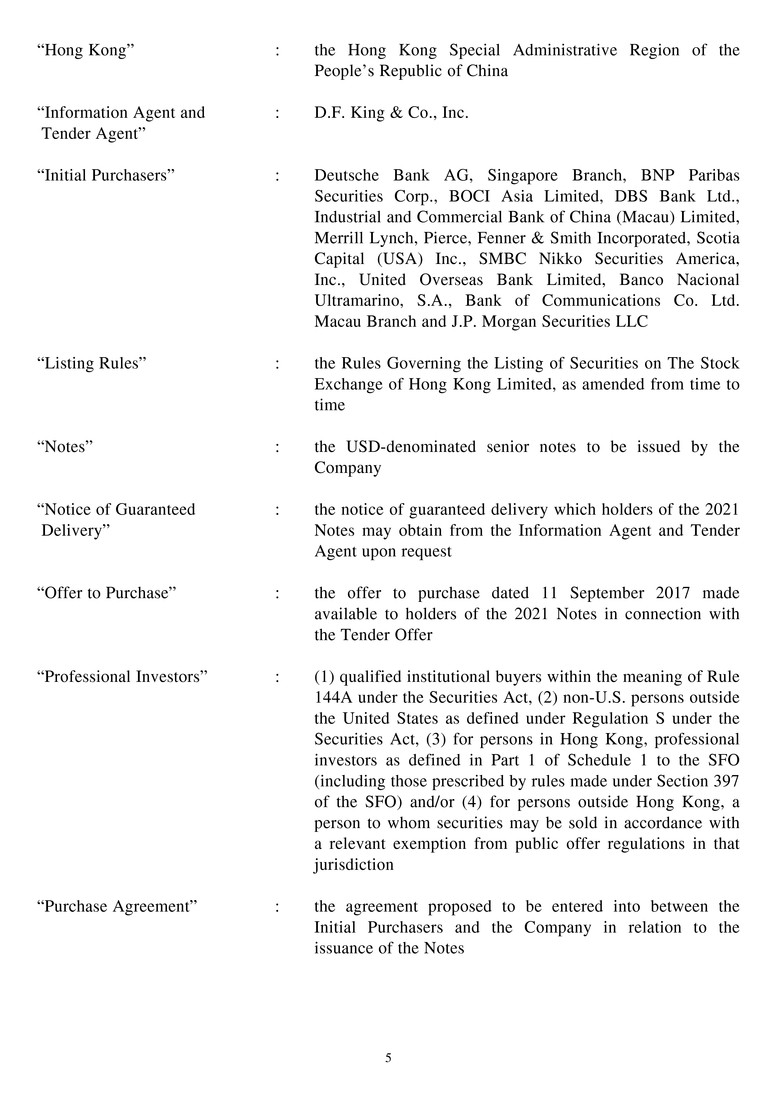

“Hong Kong” : the Hong Kong Special Administrative Region of the

People’s Republic of China

“Information Agent and

Tender Agent”

: D.F. King & Co., Inc.

“Initial Purchasers” : Deutsche Bank AG, Singapore Branch, BNP Paribas

Securities Corp., BOCI Asia Limited, DBS Bank Ltd.,

Industrial and Commercial Bank of China (Macau) Limited,

Merrill Lynch, Pierce, Fenner & Smith Incorporated, Scotia

Capital (USA) Inc., SMBC Nikko Securities America,

Inc., United Overseas Bank Limited, Banco Nacional

Ultramarino, S.A., Bank of Communications Co. Ltd.

Macau Branch and J.P. Morgan Securities LLC

“Listing Rules” : the Rules Governing the Listing of Securities on The Stock

Exchange of Hong Kong Limited, as amended from time to

time

“Notes” : the USD-denominated senior notes to be issued by the

Company

“Notice of Guaranteed

Delivery”

: the notice of guaranteed delivery which holders of the 2021

Notes may obtain from the Information Agent and Tender

Agent upon request

“Offer to Purchase” : the offer to purchase dated 11 September 2017 made

available to holders of the 2021 Notes in connection with

the Tender Offer

“Professional Investors” : (1) qualified institutional buyers within the meaning of Rule

144A under the Securities Act, (2) non-U.S. persons outside

the United States as defined under Regulation S under the

Securities Act, (3) for persons in Hong Kong, professional

investors as defined in Part 1 of Schedule 1 to the SFO

(including those prescribed by rules made under Section 397

of the SFO) and/or (4) for persons outside Hong Kong, a

person to whom securities may be sold in accordance with

a relevant exemption from public offer regulations in that

jurisdiction

“Purchase Agreement” : the agreement proposed to be entered into between the

Initial Purchasers and the Company in relation to the

issuance of the Notes

6

“Securities Act” : the United States Securities Act of 1933, as amended

“Settlement Date” : expected to be not later than 20 September 2017 (subject to

the right of the Company, in its sole discretion, to extend or

amend such date)

“SFO” : the Securities and Futures Ordinance (Chapters 571 of the

Laws of Hong Kong)

“Sole Global Coordinator

and Left Lead

Bookrunner”

: Deutsche Bank AG, Singapore Branch

“Stock Exchange” : The Stock Exchange of Hong Kong Limited

“Tender Offer” : the offer by the Company to purchase for cash any and all

of the outstanding 2021 Notes accepted for purchase by

the Company upon the terms and subject to the conditions

described in the Tender Offer Documents and any

amendments or supplements thereto

“Tender Offer Documents” : the Offer to Purchase and the Notice of Guaranteed Delivery

“United States” : the United States of America

“US$” or “USD” : United States dollars, the lawful currency of the United

States

By Order of the Board

Wynn Macau, Limited

Stephen A. Wynn

Chairman

Hong Kong, 11 September 2017

As at the date of this announcement, the Board comprises Stephen A. Wynn, Ian Michael Coughlan and Linda Chen (as Executive

Directors); Matthew O. Maddox and Kim Sinatra (as Non-Executive Directors); Allan Zeman, Nicholas Sallnow-Smith,

Bruce Rockowitz and Jeffrey Kin-fung Lam (as Independent Non-Executive Directors).