Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VALLEY NATIONAL BANCORP | vly8-k20170911investorpres.htm |

© 2017 Valley National Bank®. Member FDIC. Equal Opportunity Lender. All Rights Reserved.

2Q 2017 Investor Presentation

EXHIBIT 99.1

Forward Looking Statements

The foregoing contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical

facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products,

acquisitions, relationships, opportunities, taxation, technology, market conditions and economic expectations. These statements may be identified by such forward-

looking terminology as “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,” “typically,” “usually,” “anticipate,” or similar statements

or variations of such terms. Such forward-looking statements involve certain risks and uncertainties. Actual results may differ materially from such forward-looking

statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to:

failure to obtain shareholder or regulatory approval for the merger of USAmeriBancorp, Inc. ("USAB") with Valley or to satisfy other conditions to the merger on the

proposed terms and within the proposed timeframe; delays in closing the merger; the inability to realize expected cost savings and synergies from the merger of

USAB with Valley in the amounts or in the timeframe anticipated; changes in the estimate of non-recurring charges; the diversion of management’s time on issues

relating to the merger; costs or difficulties relating to integration matters might be greater than expected; material adverse changes in Valley’s or USAB’s operations

or earnings; an increase or decrease in the stock price of Valley during the 30 day pricing period prior to the closing of the merger which could cause an adjustment

to the exchange ratio or give either Valley or USAB the right to terminate the merger agreement under certain circumstances; the inability to retain USAB’s

customers and employees; weakness or a decline in the economy, mainly in New Jersey, New York, Florida and Alabama, as well as an unexpected decline in

commercial real estate values within our market areas; less than expected cost reductions and revenue enhancement from Valley's cost reduction plans including its

earnings enhancement program called "LIFT"; damage verdicts or settlements or restrictions related to existing or potential litigations arising from claims of breach

of fiduciary responsibility, negligence, fraud, contractual claims, environmental laws, patent or trade mark infringement, employment related claims, and other

matters; the loss of or decrease in lower-cost funding sources within our deposit base may adversely impact our net interest income and net income; cyber attacks,

computer viruses or other malware that may breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy

data, disable or degrade service, or sabotage our systems; results of examinations by the OCC, the FRB, the CFPB and other regulatory authorities, including the

possibility that any such regulatory authority may, among other things, require us to increase our allowance for credit losses, write-down assets, require us to

reimburse customers, change the way we do business, or limit or eliminate certain other banking activities; changes in accounting policies or accounting standards,

including the new authoritative accounting guidance (known as the current expected credit loss (CECL) model) which may increase the required level of our

allowance for credit losses after adoption on January 1, 2020; higher or lower than expected income tax expense or tax rates, including increases or decreases

resulting from changes in tax laws, regulations and case law; our inability to pay dividends at current levels, or at all, because of inadequate future earnings,

regulatory restrictions or limitations, and changes in our capital requirements; higher than expected loan losses within one or more segments of our loan portfolio;

unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by severe weather or

other external events; unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments,

changes in regulatory lending guidance or other factors; and the failure of other financial institutions with whom we have trading, clearing, counterparty and other

financial relationship. A detailed discussion of factors that could affect our results is included in our SEC filings, including the “Risk Factors” section of our Annual

Report on Form 10-K for the year ended December 31, 2016 and Quarterly Report on form 10-Q for the period ended June 30, 2017. We undertake no duty to

update any forward-looking statement to conform the statement to actual results or changes in our expectations. Although we believe that the expectations

reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements.

2

3

Additional Information and Where to Find It

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. In

connection with the proposed merger, Valley intends to file a joint proxy statement/prospectus with the Securities and Exchange Commission. INVESTORS

AND SECURITY HOLDERS ARE ADVISED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN

IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the registration statement (when available) and other documents

filed by Valley with the Commission at the Commission’s web site at www.sec.gov. These documents may be accessed and downloaded for free at Valley’s

web site at http://www.valleynationalbank.com/filings.html or by directing a request to Dianne M. Grenz, Executive Vice President, Valley National Bancorp,

at 1455 Valley Road, Wayne, New Jersey 07470, telephone (973) 305-3380.

Participants in the Solicitation

This communication is not a solicitation of a proxy from any security holder of Valley or USAB. However, Valley, USAB, their respective directors and

executive officers and other persons may be deemed to be participants in the solicitation of proxies from USAB’s shareholders in respect of the proposed

transaction. Information regarding the directors and executive officers of Valley may be found in its definitive proxy statement relating to its 2017 Annual

Meeting of Shareholders, which was filed with the Commission on March 17, 2017 and can be obtained free of charge from Valley’s website. Other

information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will

be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available.

Valley National Bancorp

2Q 2017 Earnings Highlights

4

Net Income

Q2 2017: $50.1 MM

Q2 2016: $39.0 MM

Diluted Earnings Per Share

Q2 2017: $0.18

Q2 2016: $0.15

Net Interest Margin

Q2 2017: 3.20%

Q2 2016: 3.14%

Return on Avg Assets

Q2 2017: 0.86%

Q2 2016: 0.72%

Operating Efficiency Ratio1

Q2 2017: 57.5%

Q2 2016: 63.8%

Valley National Bancorp

• 2Q 2017 Highlights

– Continued Earnings Improvement

• Project LIFT Results

– Earnings Enhancement Program

• Announced Merger

– USAmeriBancorp, Inc.

Key Metrics

1Refer to the appendix regarding the calculation for certain non-GAAP financial measures 5

6

Financial Highlights

Margin Improvement 2Q 2017 Highlights

3.14

3.20

3.10

3.15

3.20

Q2 2016 Q2 2017

Year over Year Loan Growth1 New Loan Originations2

• Yield on interest earning assets up 6 bps

compared to the same period one year ago

• New volume loan yield up 55 bps to

approximately 4.03% compared to the same

quarter one year ago

• Deposits contracted 2.3% year-to-date and

funding costs have modestly increased

4%

15% 15%

7%

Commercial &

Industrial

CRE Construction Total Loans

+6 bps

1,296

1,076

1,464

979 929

3.48% 3.40% 3.51%

3.75%

4.03%

0

500

1,000

1,500

2,000

2,500

2.00%

2.50%

3.00%

3.50%

4.00%

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Loan Volume Loan Yield (LHS)

1Loan growth is the change from June 30, 2016 to June 30, 2017, excludes loans held for sale

2Includes participations and sold loans

m

illio

n

s

Operating Efficiency

Efficiency Ratio 2Q 2017 Highlights

• Operating Efficiency Ratio

– Improved to 57.5% for the quarter

compared to 63.8% in the same

quarter one year ago1

• Net Interest Income

– Increased $17.5 million year over

year

• Non-Interest Income

– Increased $0.4 million year over year

• Non-Interest Expense

– Declined $0.6 million year over year

1Refer to the appendix regarding the calculation for certain non-GAAP financial measures 7

63.8

57.5

-0.3

-6.0

50

52

54

56

58

60

62

64

66

2Q 2016 Cost Saves Revnue

Enhancements

2Q 2017

Percent

Credit Quality

2Q 2017 Highlights

• Past Due & Non Accrual Loans

– Decreased 14 basis points linked

quarter to 0.47% of total loans

• Non-Performing Assets

– Remained steady at 0.23% of total

assets

• Provision vs. Net Charge-offs

– $3.6 million Provision for Credit

Losses compared to $2.7 million in

Net charge-offs

• Taxi Medallion Portfolio

– Similar to Peers, NYC medallions are

valued under $400k

YTD 2017 Net Charge-Offs1

0

.0

0

%

0

.0

4

%

0

.0

0

%

0

.0

1

%

0

.0

5

%

0

.0

3

%

0

.5

1

%

0

.0

3

%

1

.1

3

%

0

.4

5

%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

CRE C&I 1-4 Family Consumer Total Loans

VLY $10B - $50B Peers

1.22%

0.23%

2013 2014 2015 2016 2017

Non-Performing Assets to Total Assets

1Peer group includes commercial and savings banks between $10 billion and $50 billion in assets at December 31, 2016. Figures are YTD 2017 as of July 24, 2017 from SNL 8

Valley National Bancorp

2020 Vision

9

Strategic Focus to Achieve 2020 Vision

10

66.0%

61.1% 59.5%

< 55%

2015 2016 2017 YTD Long-Term Goal

Efficiency Ratio2

13%

14%

13%

15% - 20%

2015 2016 2017 YTD Long-Term Goal

Non-Int Income / Net Interest Income

plus Total Non-Int Income 13%

7%

6%

8% - 10%

2015 2016 2017

Annualized

Long-Term Goal

Loan Growth Exclusive of Whole Bank

Acquisitions1

1For 2015 and 2016, loan growth is the change in average loans for the year ended for the period indicated compared to the average loans for the prior year

ended; for 2017, loan growth is the change in average loans for the six months ended compared to the average loans for 2016 year ended

2Refer to the appendix regarding the calculation for certain non-GAAP financial measures

Enhance Non-Interest Revenue Growth

Improve Operating Efficiency

Improve

Earnings

Performance

Improve Operating Efficiency

Enhance Non-Interest Revenue

Residential Mortgage

11

Deliver Sustained Performance in Challenging Interest Rate Environments

Creating a Sustainable Gain on Sale Model

Refinance

91%

Purchase

9%

2011 - 2016 Originations

Refinance

38%

Purchase

62%

Q2 2017 Originations

• Valley Trust

• Hallmark Capital Management

• Commercial Purpose Premium Finance

Other

Initiatives

Expand Customer Base

• NJ / NY Market Strategy

– Increase Market Share via

Expansion of Current

Products

• C&I Lending

• Residential Mortgage

Purchase Product

• Florida Market Strategy

– Organic Growth

Opportunities

• 3.0% Real GPD Growth in

2016 (1.8x Greater NYC1)

– Opportunistic Acquisitions

• Gain Scale in Key Geographic

Markets

12

Leveraging Current Infrastructure Across All Three States to Drive Growth

NJ/NY

87%

FL

13%

Loans

NJ/NY

85%

FL

15%

Deposits

1Greater NYC represents NY-NJ-PA MSA, Source U.S. Bureau of Economic Analysis

Improve Operating Efficiency

13

6

7

%

6

6

%

6

7

%

6

4

%

6

5

%

6

4

%

6

0

%

5

6

%

6

2

%

5

7

%

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 2018 2018 2018 2019 2019

Branch Rationalization

$19.5MM

Operating Efficiency Ratio1

Project LIFT

1Refer to the appendix regarding the calculation for certain non-GAAP financial measures

Compensation

69%

IT Contracts

20%

Occupancy

4%

Other

7%

Project LIFT: Impact

14 1Recurring annual pre-tax savings after 2Q 2019, net of severance, consulting fees and implementation expenses

$22MM

Recurring Annual

Pre-Tax Impact1

$19MM

Expense

Reduction

Fee Income

75%

$3MM

Revenue

Enhancement

$475

$480

$488

$491 +$4

($17)

($19)

450

460

470

480

490

500

2016 2017 2018 2019

Non-Interest Expense Projections

Consensus Lift Impact

m

ill

ion

s

Actual

Interest Income

25%

Overview of USAmeriBancorp, Inc.

15

Company Overview Financial Highlights ($ in Millions)

Management Team

USAB Deposit Franchise3

• Founded in 2007

• Headquartered in

Clearwater, FL

• Acquired Alexander

City, AL-based

Aliant Financial

Corporation in 2011

Market Market No. of Deposits

MSA Rank Share (%) Branches ($mm)

Tampa-St. Petersburg-Clearwater, FL 8 3.4% 14 $2,114

Montgomery, AL 7 5.7 6 441

Birmingham-Hoover, AL 14 0.9 5 321

Alexander City, AL 1 52.7 3 289

Auburn-Opelika, AL 13 1.9 1 47

Total: 29 $3,211

Name Title

Joseph V. Chillura President & CEO

Alfred T. Rogers, Jr. Executive VP and Chief Lending Officer

Amanda J. Stevens Executive VP & CFO

Loans2 Deposits2

Non-Interest

Demand

25%

Savings, MMA

& O her

Checking

46%

Retail Time

6%

Jumbo Time

23%

Construction

12%

Residential

R.E.

14%

Commercial

R.E.

54%

Commercial &

Industrial

18%

Consumer &

Other

2%

1Refer to the appendix regarding the calculation for certain non-GAAP financial measures; 2As of June 30, 2017; 3Per SNL Financial, as of June 30, 2016

2016Y 2017Q2

Net Interest Income $126.0 $35.5

Non Interest Income 14.3 5.2

Provision 6.0 (0.0)

Non Interest Expenses 75.9 21.2

Net Income 43.4 12.7

ROAA (%) 1.12% 1.19%

ROACE (%) 14.37 15.19

Net Interest Margin (%) 3.53 3.60

Efficiency Ratio (%) 54.1 52.2

Total Assets $4,153.3 $4,382.9

Gross Loans 3,373.6 3,585.7

Total Deposits 3,478.0 3,530.0

Total Equity 319.7 345.2

TCE / TA (%) (1) 7.2% 7.4%

Loans/ Deposits (%) 97 102

Leverage Ratio (%) 8.0 8.1

Tier 1 Ratio (%) 9.0 9.1

Total Capital Ratio (%) 11.7 12.1

Pr

of

ita

bi

lit

y

Ba

la

nc

e

Sh

ee

t

Ca

pi

ta

l

Ra

tio

s

In

co

m

e

St

at

em

en

t

Pro-Forma Impact Financial Summary

16

Note: Pro-forma impacts presented inclusive of preferred stock capital raise of approximately $75 million; actual preferred stock capital raise was $100 million

Note: Assumes pricing based on VLY closing price of $12.40 as of 7/25/2017

1Estimated financial impact is presented solely for illustrative purposes using mean analyst estimates. Includes purchase accounting marks and cost savings,

as well as approximately $75 million preferred stock capital raise 2See Non-GAAP disclosures in appendix

Key Transaction Impacts to VLY (1)

2018E EPS Accretion ~3%

2019E EPS Accretion ~6%

Initial Tangible Book Value Dilution 5.5%

Tangible Book Value Earnback Period 4.7 years

As of June 30, 2017 Proforma (1)

VLY USAB

As of and for the year ended

December 31, 2017

Balance Sheet (S in Millions)

Total Assets $23,449 $4,383 $29,046

Gross Loans HFI 17,711 3,586 21,766

Deposits 17,250 3,530 21,286

Tangible Common Equity (2) 1,578 323 1,910

Capital Ratios

TCE/TA (2) 6.9% 7.4% 6.9%

Leverage Ratio 7.7% 8.1% 7.9%

Common Equity Tier I Ratio 9.2% 8.4% 9.0%

Tier I Ratio 9.8% 9.1% 10.0%

Total Risk-based Capital Ratio 12.0% 12.1% 12.2%

Loan Concentration Ratios

C&D / Tier 1 + ALLL 47% 108% 58%

CRE / Total Risk-based Capital 433% 367% 417%

Valley National Bancorp

Appendix

17

Valley National Bancorp

1Data as of September 7, 2017

Since the Bank was founded in 1927, Valley has never produced a losing quarter

• Customer centric culture with experienced commercial lenders

• Superior credit quality

• Measured growth strategies

• Seasoned management team

• Operations in three (3) of the most heavily populated states

• Concentrated in affluent geographic markets

• Balanced institutional and retail stock ownership

• More than 288 institutional holders or 64% of all shares1

• Long-term investment approach

• Focus on cash dividends

• Large insider stock ownership including family members, retired

employees and retired directors

Shareholder

Focus

Demographic

Focus

Core

Focus

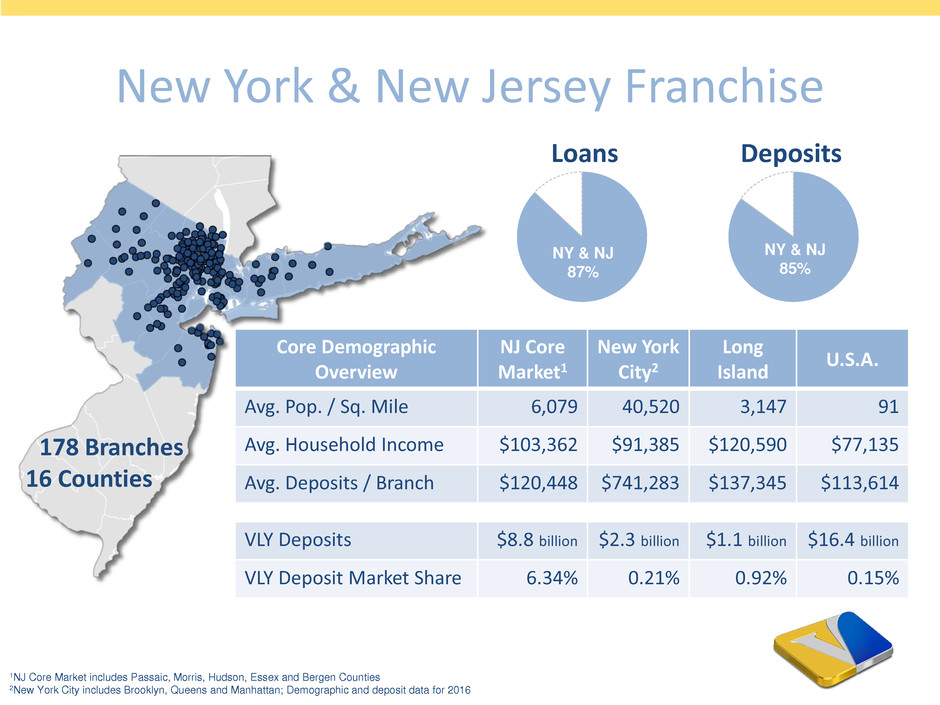

New York & New Jersey Franchise

178 Branches

Loans Deposits

16 Counties

Core Demographic

Overview

NJ Core

Market1

New York

City2

Long

Island

U.S.A.

Avg. Pop. / Sq. Mile 6,079 40,520 3,147 91

Avg. Household Income $103,362 $91,385 $120,590 $77,135

Avg. Deposits / Branch $120,448 $741,283 $137,345 $113,614

VLY Deposits $8.8 billion $2.3 billion $1.1 billion $16.4 billion

VLY Deposit Market Share 6.34% 0.21% 0.92% 0.15%

1NJ Core Market includes Passaic, Morris, Hudson, Essex and Bergen Counties

2New York City includes Brooklyn, Queens and Manhattan; Demographic and deposit data for 2016

NY & NJ

87%

NY & NJ

85%

Florida Franchise

FL

13%

Loans

FL

15%

Deposits

31 Branches

14 Counties

Core Demographic

Overview

Central

Tampa1

Central

Orlando2

Southeast3 Florida

Avg. Pop. / Sq. Mile 2,219 1,101 1,308 379

Avg. Household Income $69,745 $65,894 $72,350 $67,858

Avg. Deposits / Branch $115,137 $93,911 $146,160 $94,918

VLY Deposits $0.1 billion $0.5 billion $1.4 billion $2.5 billion

VLY Deposit Market Share 0.17% 1.10% 0.62% 0.50%

1Central Tampa includes Pinellas & Hillsborough Counties 2Central Orlando includes Orange, Brevard & Indian River Counties 3Southeast includes Palm Beach,

Broward & Miami-Dade Counties; Demographic and deposit data for 2016

Non-GAAP Disclosure Reconciliations

Calculation for operating efficiency ratio

Three Months Ended

($, thousands) June 30, March 31, December 31, September 30, June 30, March 31, December 31, September 30, June 30, March 31, December 31, September 30,

2017 2017 2016 2016 2016 2016 2015 2015 2015 2015 2014 2014

Total non-interest expense 119,239 120,952 124,829 113,268 119,803 118,225 174,893 108,652 107,412 108,118 121,267 91,536

Less: Amortization of tax credit investment 7,732 5,324 13,384 6,450 7,646 7,264 13,081 5,224 4,511 4,496 10,048 4,630

Less: Loss on extinquishment of debt 51,129 10,132

Total non-interest expense, adjusted 111,507 115,628 111,445 106,818 112,157 110,961 110,683 103,428 102,901 103,622 101,087 86,906

Net interest income 168,960 162,529 164,395 154,146 151,455 148,153 148,046 133,960 136,177 132,086 128,646 114,668

Total non-interest income 24,690 25,059 32,660 24,853 24,264 21,448 24,038 20,919 20,200 18,645 29,563 14,781

Total net interest income and non-interest income 193,650 187,588 197,055 178,999 175,719 169,601 172,084 154,879 156,377 150,731 158,209 129,449

Less: Change in FDIC loss-share receivable -452 -229 -419 -313 1 -560 54 -55 595 -3,920 -9,182 -3,823

Total net interest income and non-interest income, adjusted 194,102 187,817 197,474 179,312 175,718 170,161 172,030 154,934 155,782 154,651 167,391 133,272

Efficiency ratio 61.57% 64.48% 63.35% 63.28% 68.18% 69.71% 101.63% 70.15% 68.69% 71.73% 76.65% 70.71%

Efficiency ratio, adjusted 57.45% 61.56% 56.44% 59.57% 63.83% 65.21% 64.34% 66.76% 66.05% 67.00% 60.39% 65.21%

21

Non-GAAP Disclosure Reconciliations

Six Months Ended Years Ended

($, thousands) June 30, December 31, December 31,

2017 2016 2015

Total non-interest expense 240,191 476,125 499,075

Less: Amortization of tax credit investment 13,056 34,744 27,312

Less: Loss on extinguishment of debt 51,129

Total non-interest expense, adjusted 227,135 441,381 420,634

Net interest income 331,489 618,149 550,269

Total non-interest income 49,749 103,225 83,802

Total net interest income and non-interest income 381,238 721,374 634,071

Less: Change in FDIC loss-share receivable -681 -1,291 -3,326

Total net interest income and non-interest income, adjusted 381,919 722,665 637,397

Efficiency ratio 63.00% 66.00% 78.71%

Efficiency ratio, adjusted 59.47% 61.08% 65.99%

22

Calculation for operating efficiency ratio (continued)

23

As of

($, millions)

December 31,

2015

December 31,

2016

June 30,

2017

Total Assets 3,632 4,153 4,383

Less: Goodwill & Other Intangibles 13 13 12

Total Tangible Assets (TA) 3,619 4,141 4,371

Total Common Equity 270 310 335

Less: Goodwill & Other Intangibles 13 13 12

Total Tangible Common Equity (TCE) 257 297 323

TCE / TA (%) 7.1 7.2 7.4

1Pro Forma includes estimated purchase accounting adjustments

Financial measures for USAmeriBank

Non-GAAP Disclosure Reconciliations

24

As of

($, millions) June 30, 2017 December 31, 2017

VLY USAB Pro-Forma1

Total Assets 23,449 4,383 29,046

Less: Goodwill & Other Intangibles 734 12 1,235

Total Tangible Assets (TA) 22,715 4,371 27,811

Total Common Equity 2,312 335 3,145

Less: Goodwill & Other Intangibles 734 12 1,235

Total Tangible Common Equity (TCE) 1,578 323 1,910

TCE / TA (%) 6.9 7.4 6.9

1Pro Forma includes estimated purchase accounting adjustments

Financial measures for Valley National Bank and USAmeriBank

Non-GAAP Disclosure Reconciliations

For More Information

Log onto our web site: www.valleynationalbank.com

E-mail requests to: tzarkadas@valleynationalbank.com

Call Shareholder Relations at: (973) 305-3380

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Tina Zarkadas, Shareholder Relations Specialist

Log onto our website above or www.sec.gov to obtain free copies of documents

filed by Valley with the SEC

25