Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SYNOVUS FINANCIAL CORP | d452456d8k.htm |

September 11, 2017 Barclays Global Financial Services Conference Kevin Blair, Chief Financial Officer, Synovus Financial Corp. Exhibit 99.1

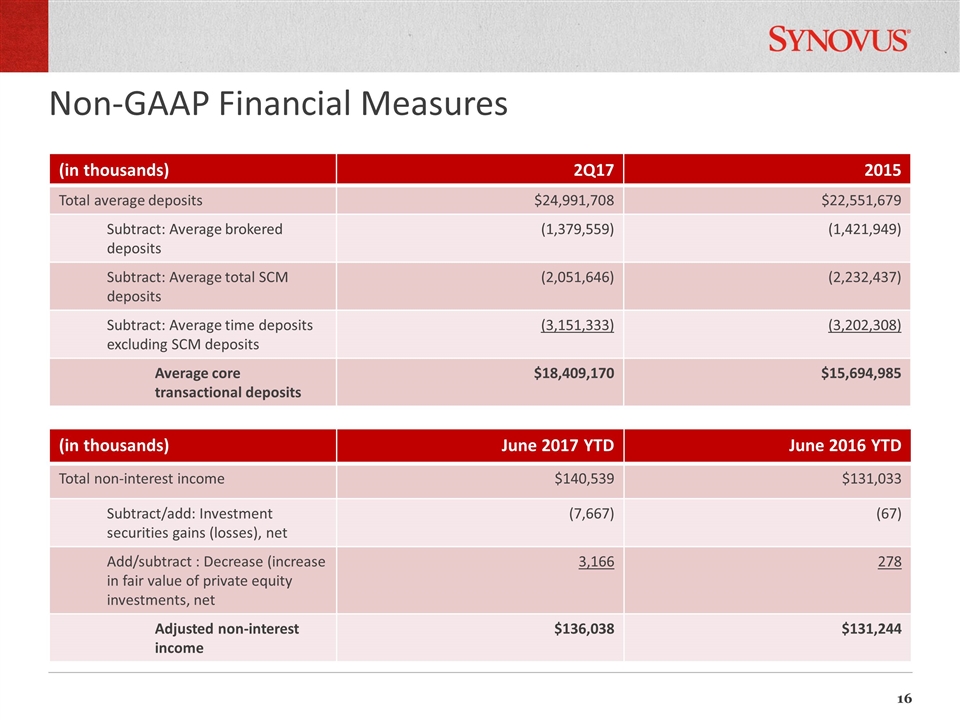

Forward-looking statements and use of non-GAAP financial measures Forward Looking Statements This slide presentation and certain of our other filings with the Securities and Exchange Commission contain statements that constitute “forward-looking statements” within the meaning of, and subject to the protections of, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are forward-looking statements. You can identify these forward-looking statements through Synovus’ use of words such as “believes,” “anticipates,” “expects,” “may,” “will,” “assumes,” “should,” “predicts,” “could,” “should,” “would,” “intends,” “targets,” “estimates,” “projects,” “plans,” “potential” and other similar words and expressions of the future or otherwise regarding the outlook for Synovus’ future business and financial performance and/or the performance of the banking industry and economy in general. These forward-looking statements include, among others, statements on (1) future loan growth; (2) future deposit growth and loan to deposit ratios; (3) future net interest income and net interest margin; (4) future adjusted non-interest income; (5) future non-interest expense levels and efficiency ratios; (6) future credit trends and key metrics; (7) future effective tax rates; (8) our strategy and initiatives for future growth, capital management and our brand initiative; (9) the impact of certain transactions on our earnings and capital ratios, our expectations on opportunities to deploy additional capital as a result of such transactions and our expectations regarding the closing or benefits of such transactions, and (10) our assumptions underlying these expectations. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve known and unknown risks and uncertainties which may cause the actual results, performance or achievements of Synovus to be materially different from the future results, performance or achievements expressed or implied by such forward- looking statements. Forward-looking statements are based on the information known to, and current beliefs and expectations of, Synovus’ management and are subject to significant risks and uncertainties. Actual results may differ materially from those contemplated by such forward-looking statements. A number of factors could cause actual results to differ materially from those contemplated by the forward-looking statements in this presentation. Many of these factors are beyond Synovus’ ability to control or predict. These forward-looking statements are based upon information presently known to Synovus’ management and are inherently subjective, uncertain and subject to change due to any number of risks and uncertainties, including, without limitation, the risks and other factors set forth in Synovus’ filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended December 31, 2016 under the captions “Cautionary Notice Regarding Forward-Looking Statements” and “Risk Factors” and in Synovus’ quarterly reports on Form 10-Q and current reports on Form 8-K. We believe these forward-looking statements are reasonable; however, undue reliance should not be placed on any forward-looking statements, which are based on current expectations and speak only as of the date that they are made. We do not assume any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as otherwise may be required by law. Use of Non-GAAP Financial Measures This slide presentation contains certain non-GAAP financial measures determined by methods other than in accordance with generally accepted accounting principles. Such non- GAAP financial measures include the following: average core transaction deposits and adjusted non-interest income. The most comparable GAAP measures to these measures are total average deposits and total non-interest income. Management uses these non-GAAP financial measures to assess the performance of Synovus’ business and the strength of its capital position. Management believes that these non-GAAP financial measures provide meaningful additional information about Synovus to assist management, investors, and bank regulators in evaluating Synovus’ operating results, financial strength, the performance of its business and the strength of its capital position. However, these non-GAAP financial measures have inherent limitations as analytical tools and should not be considered in isolation or as a substitute for analyses of operating results or capital position as reported under GAAP. The non-GAAP financial measures should be considered as additional views of the way our financial measures are affected by significant items and other factors, and since they are not required to be uniformly applied, they may not be comparable to other similarly titled measures at other companies. Average core transaction deposits is a measure used by management to evaluate organic growth of deposits and the quality of deposits as a funding source. Adjusted non-interest income is a measure used by management to evaluate non-interest income exclusive of net investment securities gains/losses and changes in fair value of private equity investments, net. The computations of the non- GAAP financial measures used in this slide presentation are set forth in the Appendix to this slide presentation.

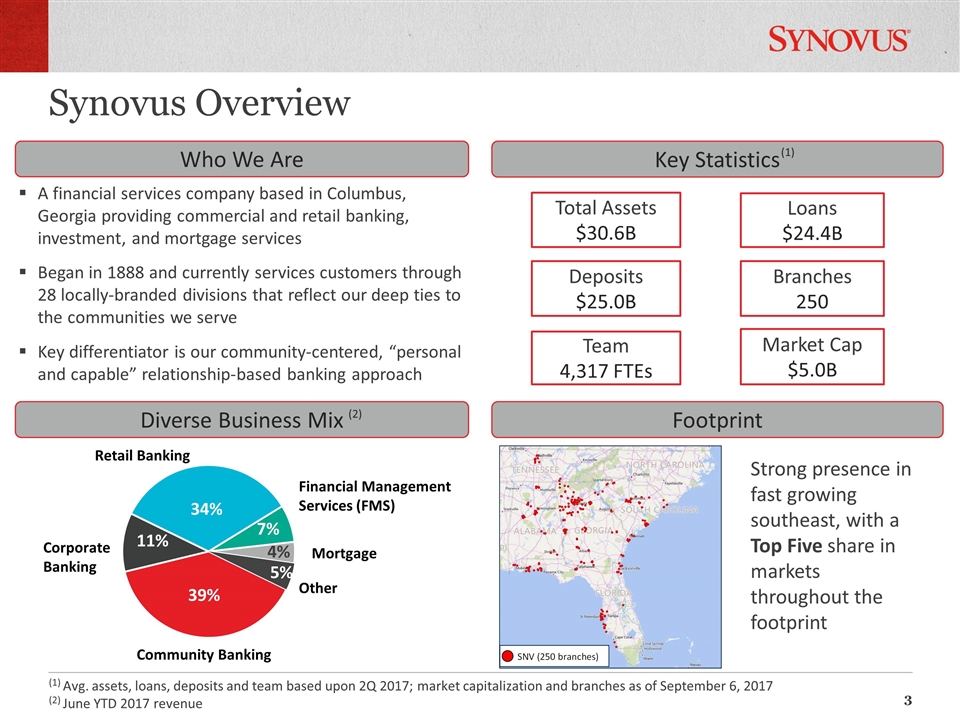

Synovus Overview A financial services company based in Columbus, Georgia providing commercial and retail banking, investment, and mortgage services Began in 1888 and currently services customers through 28 locally-branded divisions that reflect our deep ties to the communities we serve Key differentiator is our community-centered, “personal and capable” relationship-based banking approach (1) Avg. assets, loans, deposits and team based upon 2Q 2017; market capitalization and branches as of September 6, 2017 (2) June YTD 2017 revenue Total Assets $30.6B Loans $24.4B Deposits $25.0B Branches 250 Team 4,317 FTEs Market Cap $5.0B * Key Statistics Who We Are Strong presence in fast growing southeast, with a Top Five share in markets throughout the footprint Footprint Diverse Business Mix (1) (2)

Recent Recognition 2017 American Banker/ Reputation Institute named Synovus “Most Reputable Bank.” Synovus ranked second in 2016. Synovus won 28 Greenwich Excellence Awards for Small Business Banking and Middle Market Banking in 2016. Only one bank won more awards than Synovus. Synovus named “Best Regional Bank, Southeast” in the November 2016 issue of MONEY Magazine. Financial Services Roundtable named Synovus a 2017 Corporate Social Responsibility Leadership Award winner. Family Asset Management (FAM) ranked in the top 50 of Bloomberg Markets Magazine’s list four consecutive years. One of Consumer Reports’ “Best Banks for You” in the January 2016 issue. Georgia Trend named Synovus one of 17 “Best Places to Work In Georgia” in the magazine’s 2016 ranking of the state’s top employers.

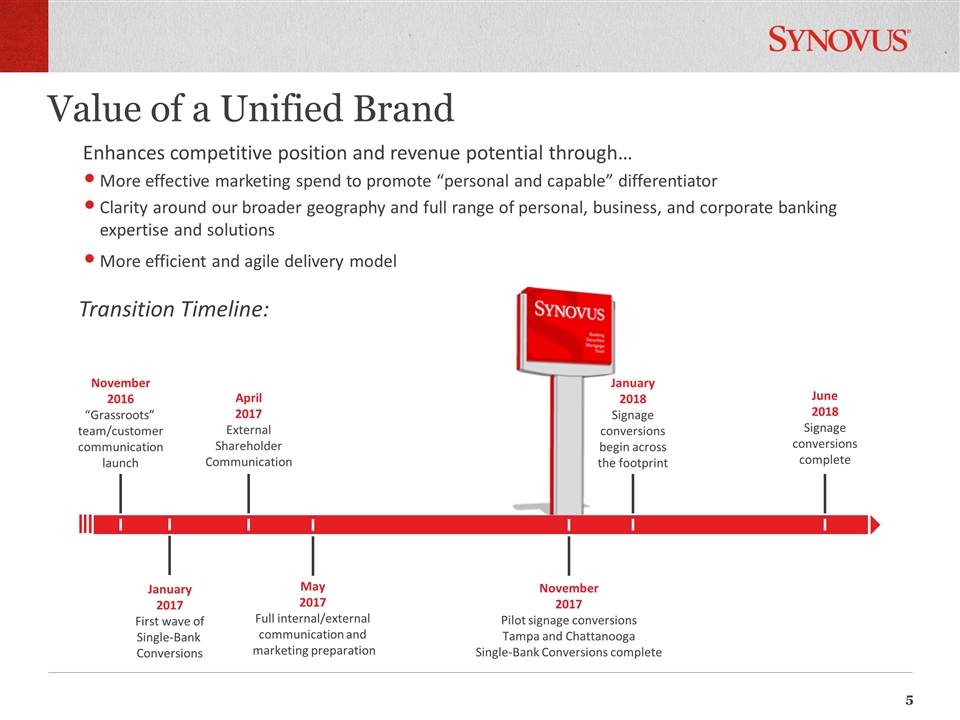

Transition Timeline: November 2016 “Grassroots” team/customer communication launch April 2017 External Shareholder Communication May 2017 Full internal/external communication and marketing preparation November 2017 Pilot signage conversions Tampa and Chattanooga Single-Bank Conversions complete January 2018 Signage conversions begin across the footprint June 2018 Signage conversions complete Enhances competitive position and revenue potential through… More effective marketing spend to promote “personal and capable” differentiator Clarity around our broader geography and full range of personal, business, and corporate banking expertise and solutions More efficient and agile delivery model Value of a Unified Brand January 2017 First wave of Single-Bank Conversions

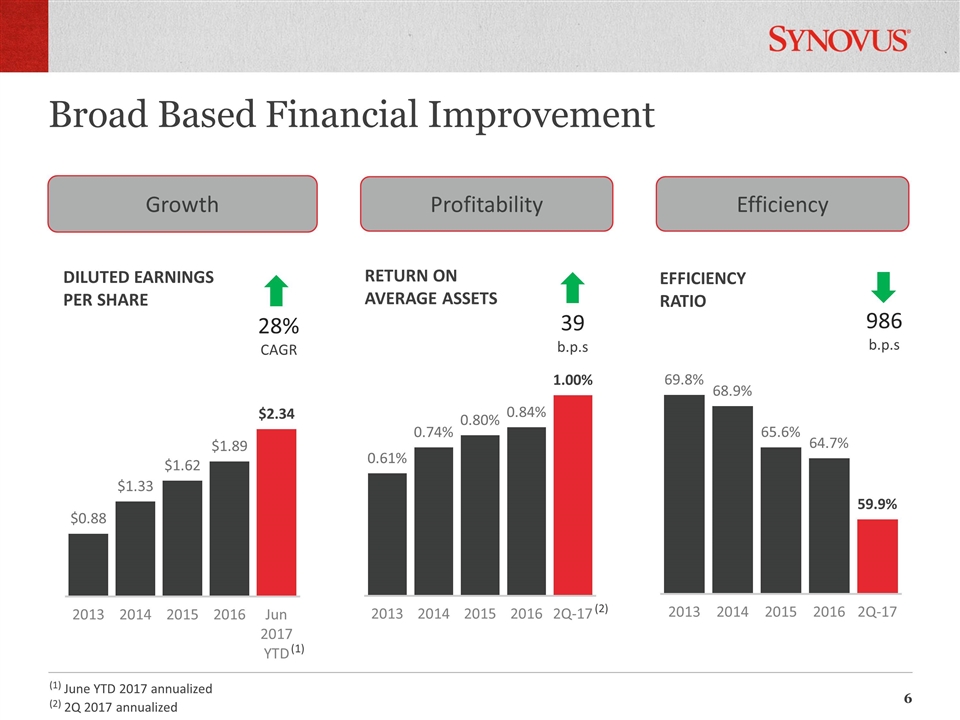

Broad Based Financial Improvement (1) (1) June YTD 2017 annualized Growth Profitability Efficiency 28% CAGR 39 b.p.s 986 b.p.s (2) (2) 2Q 2017 annualized

Strategic Pillars Delivering Sustainable Growth Enhancing Returns and Optimizing Balance Sheet Driving Efficiencies While Investing Strategically Maintaining Strong Credit, Capital and Liquidity

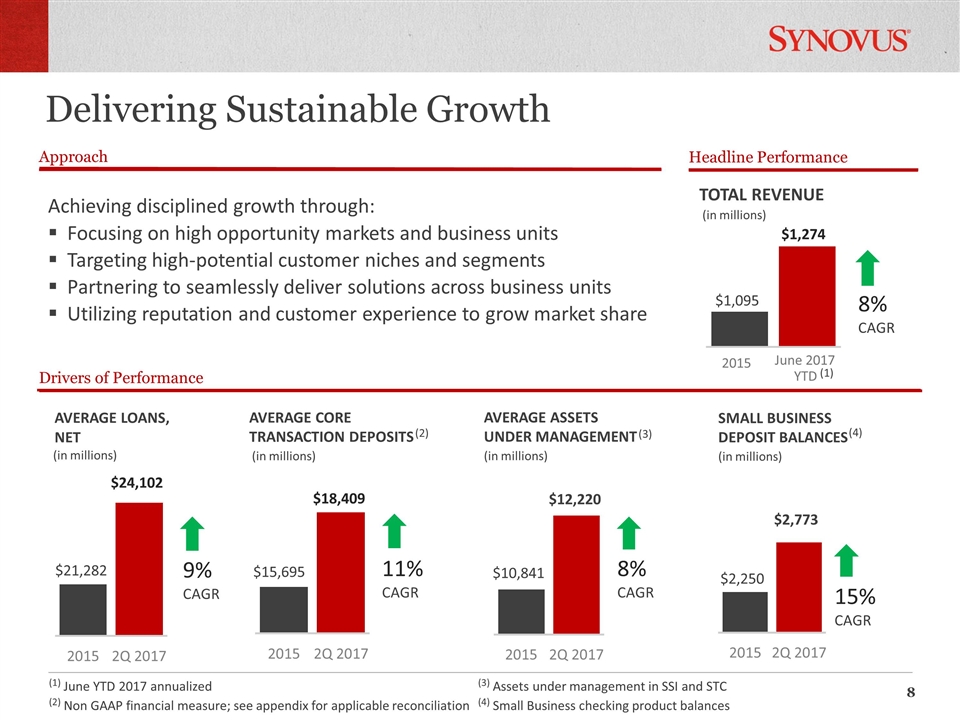

Drivers of Performance June 2017 YTD Approach Delivering Sustainable Growth Headline Performance Achieving disciplined growth through: Focusing on high opportunity markets and business units Targeting high-potential customer niches and segments Partnering to seamlessly deliver solutions across business units Utilizing reputation and customer experience to grow market share (1) (1) June YTD 2017 annualized Average Core Transaction Deposits Average Assets Under management Small business deposit Balances (in millions) (in millions) (in millions) (in millions) (in millions) (4) (2) (2) Non GAAP financial measure; see appendix for applicable reconciliation (4) Small Business checking product balances (3) (3) Assets under management in SSI and STC 8% CAGR 9% CAGR 11% CAGR 8% CAGR 15% CAGR 2015 $24,102 $21,282 $15,695 $18,409 $10,841 $12,220 $2,250 $2,773 $1,095 $1,274

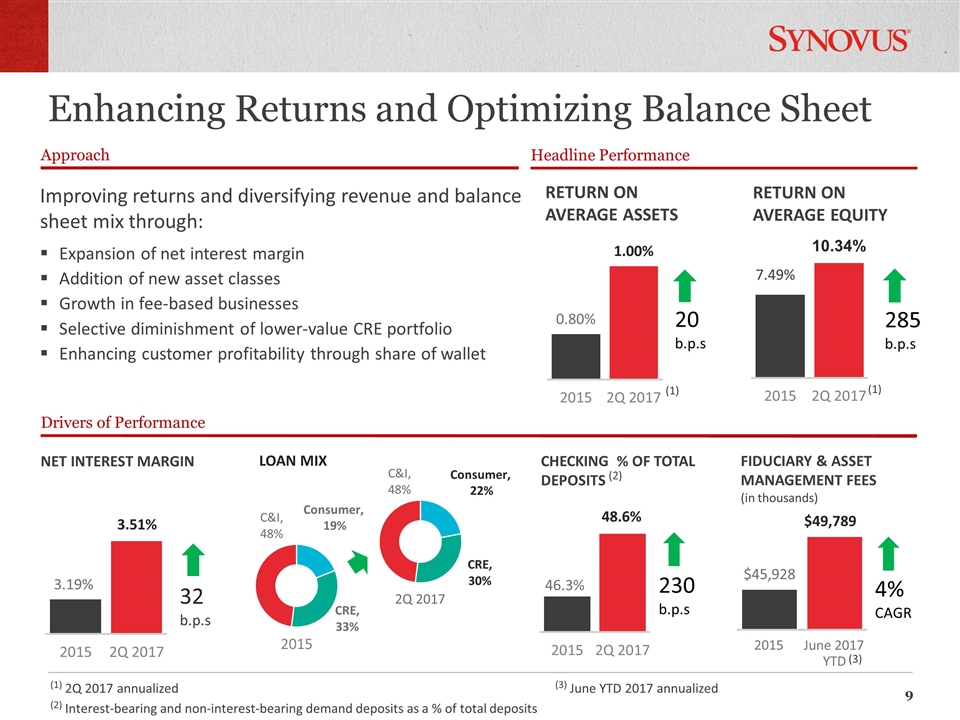

June 2017 YTD Drivers of Performance Approach Enhancing Returns and Optimizing Balance Sheet Headline Performance Improving returns and diversifying revenue and balance sheet mix through: Expansion of net interest margin Addition of new asset classes Growth in fee-based businesses Selective diminishment of lower-value CRE portfolio Enhancing customer profitability through share of wallet (3) (1) 2Q 2017 annualized Loan Mix Checking % of Total Deposits Return on Average Assets Net interest Margin 2015 2Q 2017 Fiduciary & Asset Management Fees Return on Average Equity (2) Interest-bearing and non-interest-bearing demand deposits as a % of total deposits (2) (in thousands) 2015 (3) June YTD 2017 annualized (1) (1) 10.34% 7.49% Consumer, 19% $49,789 $45,928 48.6% 3.19% 3.51% Consumer, 22% 46.3%

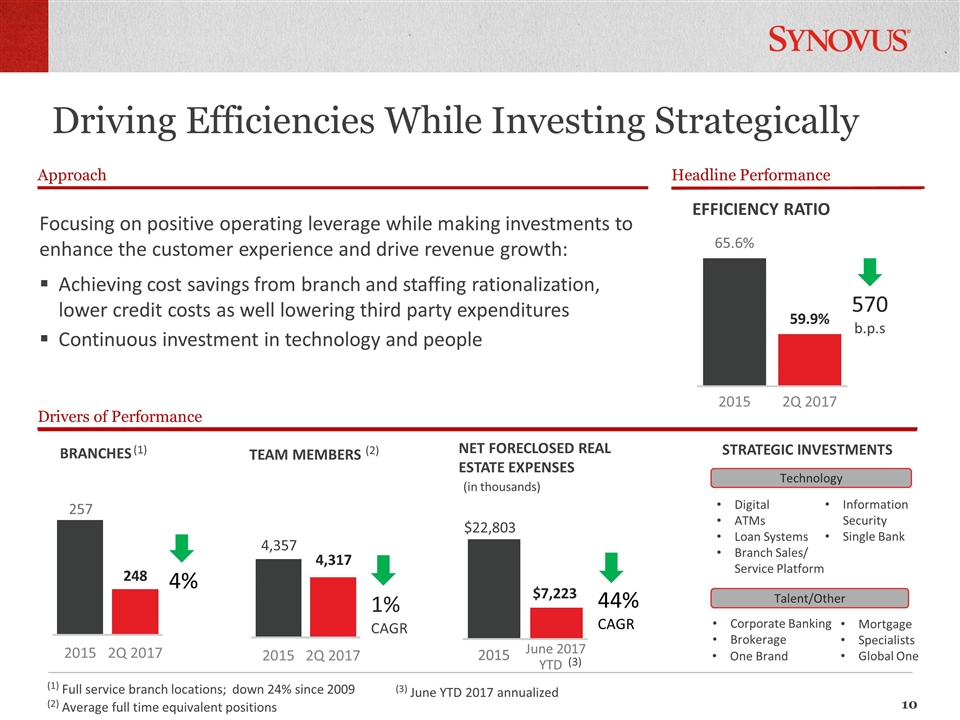

June 2017 YTD Drivers of Performance Approach Driving Efficiencies While Investing Strategically Headline Performance Focusing on positive operating leverage while making investments to enhance the customer experience and drive revenue growth: Achieving cost savings from branch and staffing rationalization, lower credit costs as well lowering third party expenditures Continuous investment in technology and people (3) June YTD 2017 annualized Team Members Net Foreclosed Real Estate Expenses Strategic Investments Digital ATMs Loan Systems Branch Sales/ Service Platform Information Security Single Bank Technology Talent/Other Corporate Banking Brokerage Mortgage Specialists Global One One Brand (3) (1) (1) Full service branch locations; down 24% since 2009 (2) Average full time equivalent positions (2) (in thousands) 4,357 4,317 $22,803 $7,223

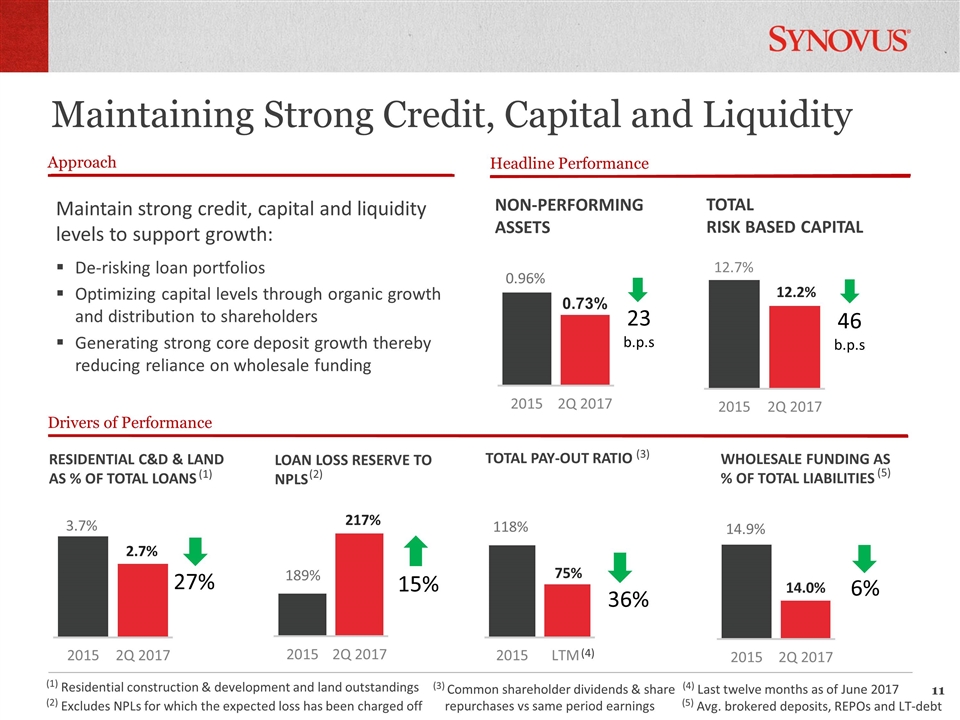

Drivers of Performance Approach Maintaining Strong Credit, Capital and Liquidity Headline Performance Maintain strong credit, capital and liquidity levels to support growth: De-risking loan portfolios Optimizing capital levels through organic growth and distribution to shareholders Generating strong core deposit growth thereby reducing reliance on wholesale funding (1) Residential construction & development and land outstandings Loan Loss Reserve to NPLs Total Pay-out Ratio Non-performing Assets Total Risk Based Capital 12.7% 12.2% Residential C&D & Land As % of Total Loans (2) (2) Excludes NPLs for which the expected loss has been charged off (4) (4) Last twelve months as of June 2017 Wholesale Funding as % of Total Liabilities (1) (3) Common shareholder dividends & share repurchases vs same period earnings (3) (5) (5) Avg. brokered deposits, REPOs and LT-debt 189% 217% 118% 75% 14.9% 14.0% 0.96% 0.73% 3.7%

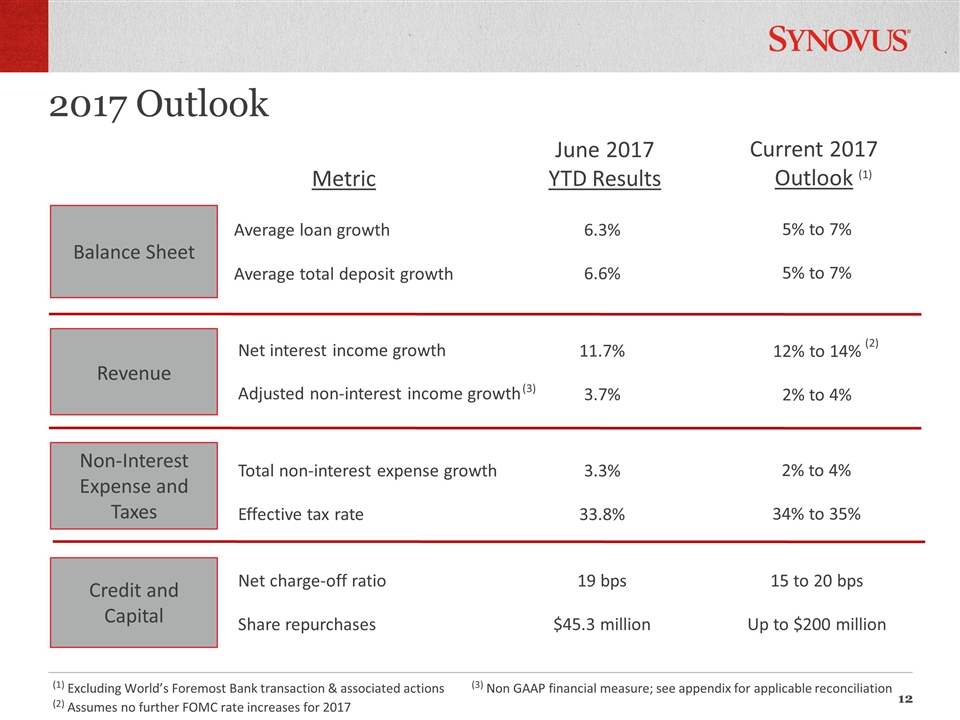

2017 Outlook Balance Sheet Revenue Non-Interest Expense and Taxes Credit and Capital Metric June 2017 YTD Results Average loan growth Average total deposit growth Current 2017 Outlook Net interest income growth Adjusted non-interest income growth Total non-interest expense growth Effective tax rate Net charge-off ratio Share repurchases 6.3% 6.6% 11.7% 3.7% 3.3% 33.8% 19 bps $45.3 million 5% to 7% 5% to 7% 12% to 14% 2% to 4% 15 to 20 bps Up to $200 million 2% to 4% 34% to 35% (2) (3) (2) Assumes no further FOMC rate increases for 2017 (3) Non GAAP financial measure; see appendix for applicable reconciliation (1) Excluding World’s Foremost Bank transaction & associated actions (1)

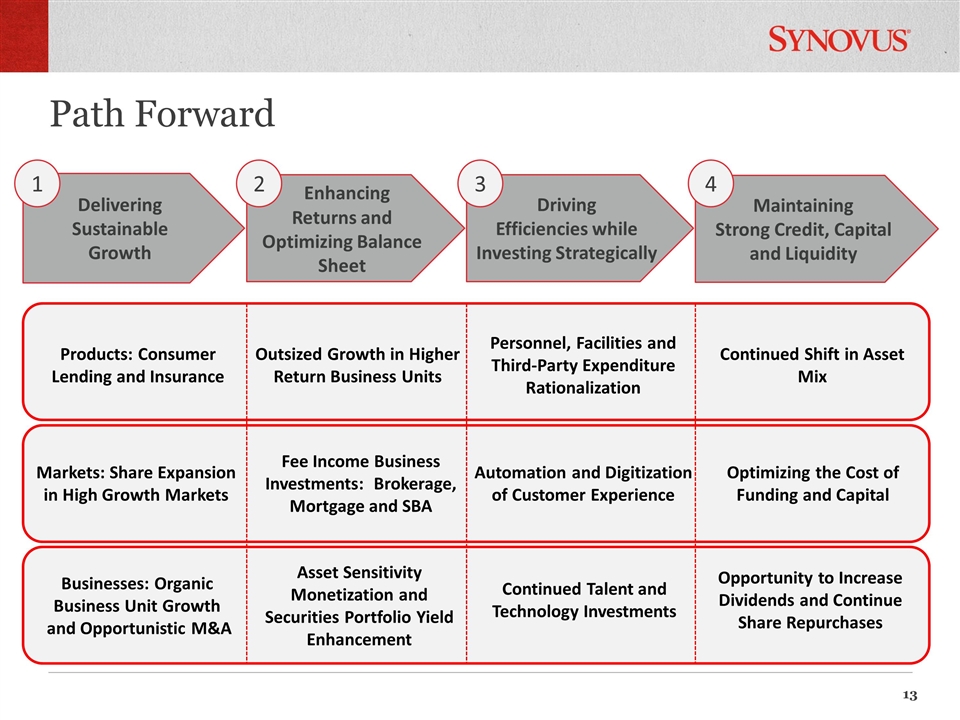

Maintaining Strong Credit, Capital and Liquidity Driving Efficiencies while Investing Strategically Path Forward Enhancing Returns and Optimizing Balance Sheet Delivering Sustainable Growth 1 2 3 4 Products: Consumer Lending and Insurance Markets: Share Expansion in High Growth Markets Businesses: Organic Business Unit Growth and Opportunistic M&A Outsized Growth in Higher Return Business Units Fee Income Business Investments: Brokerage, Mortgage and SBA Asset Sensitivity Monetization and Securities Portfolio Yield Enhancement Personnel, Facilities and Third-Party Expenditure Rationalization Automation and Digitization of Customer Experience Continued Talent and Technology Investments Continued Shift in Asset Mix Optimizing the Cost of Funding and Capital Opportunity to Increase Dividends and Continue Share Repurchases

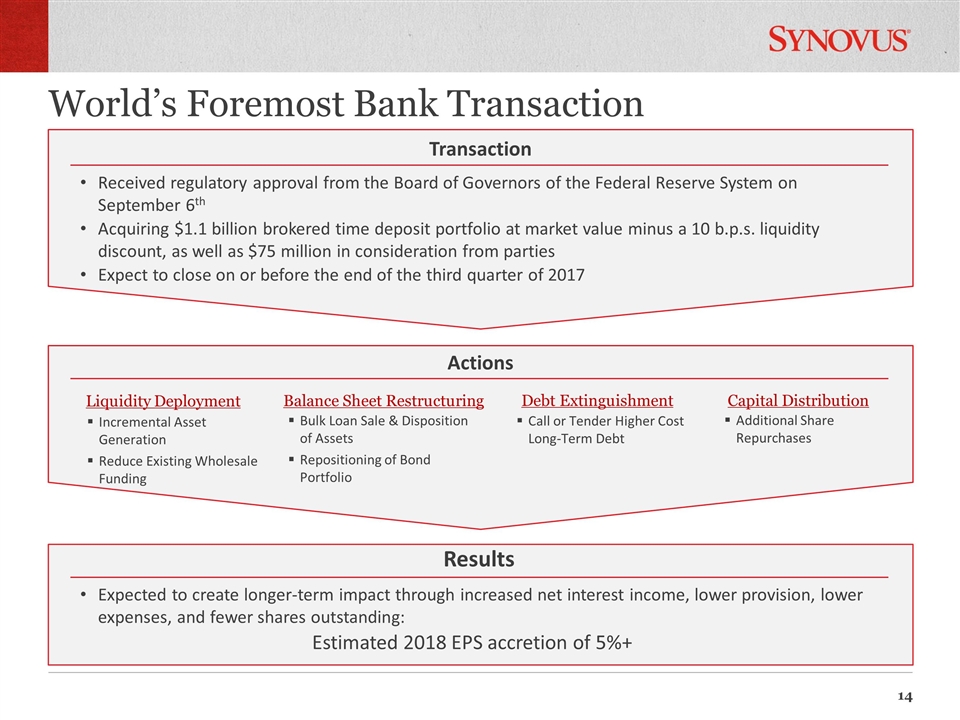

World’s Foremost Bank Transaction Transaction Received regulatory approval from the Board of Governors of the Federal Reserve System on September 6th Acquiring $1.1 billion brokered time deposit portfolio at market value minus a 10 b.p.s. liquidity discount, as well as $75 million in consideration from parties Expect to close on or before the end of the third quarter of 2017 Liquidity Deployment Balance Sheet Restructuring Debt Extinguishment Capital Distribution Incremental Asset Generation Reduce Existing Wholesale Funding Bulk Loan Sale & Disposition of Assets Repositioning of Bond Portfolio Call or Tender Higher Cost Long-Term Debt Additional Share Repurchases Expected to create longer-term impact through increased net interest income, lower provision, lower expenses, and fewer shares outstanding: Estimated 2018 EPS accretion of 5%+ Actions Results

Non-GAAP Financial Measures (in thousands) 2Q17 2015 Total average deposits $24,991,708 $22,551,679 Subtract: Average brokered deposits (1,379,559) (1,421,949) Subtract: Average total SCM deposits (2,051,646) (2,232,437) Subtract: Average time deposits excluding SCM deposits (3,151,333) (3,202,308) Average core transactional deposits $18,409,170 $15,694,985 (in thousands) June 2017 YTD June 2016 YTD Total non-interest income $140,539 $131,033 Subtract/add: Investment securities gains (losses), net (7,667) (67) Add/subtract : Decrease (increase in fair value of private equity investments, net 3,166 278 Adjusted non-interest income $136,038 $131,244