Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 09/11/2017 - KITE REALTY GROUP TRUST | form8k_09112017.htm |

2

SHARE PRICE

(AS OF 9/6/17) $20.45

EQUITY MARKET

CAPITALIZATION

(AS OF 9/6/17)

$1.8 BN

ENTERPRISE

VALUE

(AS OF 9/6/17)

$3.4 BN

DIVIDEND YIELD1 5.9%

MOODY’S/S&P

RATINGS Baa3/BBB-

PORTFOLIO SUMMARY

Number of Properties 118

Number of States 20

Total GLA (SF) 23.2mm

Total Retail Operating Portfolio Leased 94.5%

Retail Operating Shop Portfolio Leased 89.2%

Annualized Base Rent (ABR) Per SF, Including 3-R Properties2 $16.20

Average Center Size (SF) ~200,000

PORTFOLIO DEMOGRAPHICS3

Average Household Income 3 Mile: $86,100 5 Mile: $85,500

Population 3 Mile: 67,300 5 Mile: 165,700

COMPANY

SNAPSHOT

Necessity-Driven

Open-Air

Shopping

Centers

September 2017

INVESTOR UPDATE

20162015201420132012

$1.71

$1.92

$2.02

$1.99

$2.06

~5%

CAGR

FFO PER SHARE, AS ADJUSTED

Note: Unless otherwise indicated, the source of all data contained herein is publicly available information that has been filed with the Securities & Exchanges Commission as of Q2 ‘17.

(1) Source: SNL; Dividend yield calculated as most recent quarterly dividend, annualized and expressed as a percentage of the security price.

(2) 3-R Properties are assets that are in the process of being developed, repositioned, or repurposed, as described in our Quarterly Financial Supplement.

(3) Demographic data source: STI: Popstats based on estimated 2016 data from the U.S. Census Bureau.

3

~$40mm in annual free cash flow1

$83mm limited debt maturities through 2020

5% floating rate debt exposure

3.6x debt service coverage

76% of ABR from top 50 MSAs and destination locations

93% of tenants are internet resistant/omni-channel

66% of grocery-anchored assets

Focusing on experiential tenants, consisting of food,

fitness, entertainment, and service

3.6% historical same-property NOI growth over the last four years

$9.2mm of additional cash NOI from in-process 3-R and transitional projects

Enhancing assets via the 3-Rs:

Redevelop, Reposition, Repurpose

Top-tier operating metrics

INVESTMENT

GRADE

BALANCE

SHEET

HIGH-QUALITY

PORTFOLIO

OPERATIONS

AND GROWTH

OPPORTUNITIES

BUILDING VALUE AND CRITICAL MASS IN AND AROUND REGIONAL FOOTPRINT

(1) After common dividends, capital expenditures, tenant improvements, and leasing commissions.

CORE

STRATEGY

Gearing Up

Shareholder Value

the Kite Way

September 2017

INVESTOR UPDATE

4

DIVIDEND VS. 2017E FFO1

PRICE VS. 2017E FFO1

KIMAKRRPAIFRTDDRROICUERPTWRIKRGREGBRXCDR

66%PEER GROUPMEDIAN

59.1%

FRTAKRREGUEROICRPAIWRIKIMKRGRPTCDRBRXDDR

13.5xPEER GROUPMEDIAN

9.8x

CONSERVATIVE FFO

PAYOUT RATIO

SUPPORTS FUTURE

DIVIDEND INCREASES

DISCOUNTED MULTIPLE

PROVIDES ATTRACTIVE

INVESTMENT

OPPORTUNITY

59.1%

DIVIDEND VS. 2017E FFO1

9.8x

PRICE VS. 2017E FFO1

(1) 2017E FFO per share refers to consensus estimates for companies as of August 2017 per FactSet, which may not reflect the Company’s or the peer companies’ estimates. FFO Payout Ratio calculated as dividends by 2017E FFO, on a per share basis.

September 2017

INVESTOR UPDATETOTAL RETURN KRG Provides Attractive Investment Opportunity

5

3.6%

SPNOI GROWTH AS

REPORTED OVER

LAST 4 YEARS

QUARTERLY AVERAGE SPNOI GROWTH FROM Q2'13-Q2'171

ROIC AKR KRG REG RPAI WRI BRX FRT DDR RPT KIM CDR

5.1%

4.1%

3.4%

3.6%

4.1%

3.4% 3.3%

3.1% 3.1%

2.7% 2.7%

2.5%

2.2%

1.2%

3.1%PEER AVERAGE

KRG SPNOI ADJ. FOR BAD DEBT EXPENSEKRG SPNOI AS REPORTEDKRG SPNOI EXCLUDING 3-R IMPACT

(1) Figures exclude redevelopments, when information is available, averaged on a quarterly basis from supplemental data for Q2’13-Q2’17. Our computation of NOI and Same Property NOI may not be comparable to the methodology used by other REITs.

Excludes companies that have not been public for the four-year time period.

September 2017

INVESTOR UPDATE

OPERATIONAL

EXCELLENCE

Kite’s Consistent, Strong Operational

Performance Is at the Top End of Its Peer Group

September 2017

INVESTOR UPDATE

HIGH-QUALITY

PORTFOLIO

Necessity-Driven and

Experiential-Based

Open-Air

Shopping Centers

7

NORTHEAST

11.4%

OF ABR

SOUTHEAST

18.4%

OF ABR

FLORIDA

24.3%

OF ABR

MID-CENTRAL

16.8%

OF ABR

WEST

12.1%

OF ABR

MIDWEST

17.0%

OF ABR

76% OF ABR DERIVED FROM TOP 50 MSAs AND DESTINATION LOCATIONS1

(1) Destination locations (i.e., areas with high-disposable income) include Beechwood Promenade in Athens, GA, Eddy Street Commons in South Bend, IN, Gainesville Plaza in Gainesville, FL, as well as Kings Lake Square, Pine Ridge Crossing, Riverchase Plaza, Shops at Eagle Creek, Tamiami

Crossing, Tarpon Bay Plaza, and Courthouse Shadows, all located in Naples, FL.

September 2017

INVESTOR UPDATE

GEOGRAPHIC

DIVERSITY Well-Positioned Real Estate Footprint

118

PROPERTIES ACROSS

THE COUNTRY

IN 6 REGIONS

8

CITY CENTER MSA: New York City, NY LANDSTOWN COMMONS MSA: Virginia Beach, VA

CENTENNIAL CENTER MSA: Las Vegas, NV PORTOFINO SHOPPING CENTER MSA: Houston, TX

OWNED

GLA 365,905 SF

ABR

PER SF $27.19

OWNED

GLA 398,349 SF

ABR

PER SF $19.17

OWNED

GLA 334,205 SF

ABR

PER SF $24.85

OWNED

GLA 386,414 SF

ABR

PER SF $19.73

September 2017

INVESTOR UPDATE

HIGH-QUALITY

PROPERTIES

Top 12 Centers Comprise 28%

of Total Core Portfolio ABR

9

PARKSIDE TOWN COMMONS MSA: Raleigh, NC DELRAY MARKETPLACE MSA: Miami, FL

THE LANDING AT TRADITION MSA: Port St. Lucie, FL CENTENNIAL GATEWAY MSA: Las Vegas, NV

OWNED

GLA 347,071 SF

ABR

PER SF $19.87

OWNED

GLA 260,138 SF

ABR

PER SF $26.00

OWNED

GLA 360,974 SF

ABR

PER SF $15.72

OWNED

GLA 193,033 SF

ABR

PER SF $24.14

September 2017

INVESTOR UPDATE

HIGH-QUALITY

PROPERTIES

Top 12 Centers Comprise 28%

of Total Core Portfolio ABR

10

DRAPER PEAKS MSA: Salt Lake City, UT PLAZA AT CEDAR HILL MSA: Dallas, TX

EASTERN BELTWAY MSA: Las Vegas, NV SUNLAND TOWNE CENTER MSA: El Paso, TX

OWNED

GLA 227,494 SF

ABR

PER SF $19.63

OWNED

GLA 302,458 SF

ABR

PER SF $13.25

OWNED

GLA 162,444 SF

ABR

PER SF $24.06

OWNED

GLA 306,437 SF

ABR

PER SF $11.98

September 2017

INVESTOR UPDATE

HIGH-QUALITY

PROPERTIES

Top 12 Centers Comprise 28%

of Total Core Portfolio ABR

11

Top 10 Tenants by ABR Credit Rating # Stores % ABR

1 The TJX Companies, Inc. A+ 22 2.5%

2 Publix Supermarkets, Inc. A 13 2.3%

3 Petsmart, Inc. B+ 19 2.2%

4 Bed Bath & Beyond, Inc. BBB+ 19 2.2%

5 Ross Stores, Inc. A- 18 2.1%

6 Lowe's Companies, Inc. A- 5 1.9%

7 Office Depot B 15 1.6%

8 Dick's Sporting Goods, Inc. NR 8 1.5%

9 Ascena Retail Group BB- 34 1.5%

10 Michaels Stores, Inc. BB- 14 1.5%

TOTAL 167 19.3%

INVESTMENT GRADE-RATED TOP TENANTS

2017 LEASE ACTIVITY EXAMPLES

September 2017

INVESTOR UPDATE

DIVERSE

TENANT BASE

Strong Mix of High-Quality Tenants

Across Our Diversified Portfolio

12

Asset Classification Key

Power Center (No Grocer): 3 + anchors over 20K SF

Grocer: No more than 2 anchors over 20K SF in addition to grocer

Power Center (w/Grocer): 3 + anchors over 20K SF in addition to grocer

(1) Grocer includes traditional grocers, specialty grocers, and big box retailers that have a grocer component.

GROCER

28%

NON-GROCER

STRIP

4%

LIFESTYLE

CENTER

3%

COMMERCIAL

3%

UNANCHORED

STRIP

1%

POWER/

COMMUNITY

CENTER

(W/ GROCER)

38%

POWER

CENTER

(NO GROCER)

23%

66% OF ABR

GENERATED FROM

ASSETS ANCHORED

WITH A GROCER1

LIVINGSTON SHOPPING CENTER

COBBLESTONE PLAZA

KINGS LAKE SQUARE

EDDY STREET COMMONS

AT NOTRE DAME

DIVERSE

TENANT BASE

Necessity-Focused

Retail Portfolio

September 2017

INVESTOR UPDATE

13

INTERNET-RESISTANT 52.3%

Services, Entertainment 21.3%

Grocer, Specialty Stores 15.0%

Restaurants 16.0%

MULTI-CHANNEL 40.4%

Soft Goods 14.5%

Home Improvement Goods 11.8%

Discount Retailers 10.6%

Sporting Goods 3.5%

INTERNET RISK 7.3%

Electronic / Books 4.9%

Office Supplies 2.4%

WELL-POSITIONED TO MANAGE EVOLVING CONSUMER

PREFERENCES WITH EXPERIENTIAL TENANTS

TENANT TYPE

COMPOSITION

BY ABR

MULTI-

CHANNEL

40.4%

INTERNET-

RESISTANT

52.3%

INTERNET

RISK

7.3%

Kite’s tenant base is 81% non-apparel and

93% internet-resistant / multi-channel.1

(1) Apparel tenants comprise 64.1% of soft goods and 88.0% of discount retailers.

September 2017

INVESTOR UPDATE

DIVERSE

TENANT BASE

Internet-Resistant Retail Base

14

RECENT TENANT OPENINGS

FOOD / FITNESS /

ENTERTAINMENT /

SERVICE

DISCOUNT RETAILERS /

SOFT GOODS / SPORTING

GOODS / SPECIALTY

91% OF TOTAL

SQUARE FEET

OPENED

DIVERSE

TENANT BASE

Enhancing Kite’s

Portfolio

with Strong

Retail Tenants

September 2017

INVESTOR UPDATE

15

MINIMAL IMPACT REALIZED IN 2017: <1% OF ABR1

TENANT

# OF KRG

LOCATIONS AT

3/31/2017

# OF KRG

LOCATIONS AT

8/31/2017

REMAINING ABR

EXPOSURE AT 8/31/17

Gander Mountain 1 0 None

HH Gregg 1 0 None

JCPenney 3 3 0.14%

Kmart / Sears 1 / 2 1 / 2 0.32% / 0.20%

Macy’s 1 1 0.11%

Marsh Supermarkets 1 0 None

Payless 9 8 0.23%

Rue 21 8 2 0.05%

No exposure to the following retailers that have filed bankruptcy or have

announced store closings:

Abercrombie & Fitch, American Apparel, Banana Republic, BCBG, bebe, Dillard’s,

Eastern Outfitters, Guess, True Religion, Wet Seal

(1) Includes ABR from operating and redevelopment properties from KRG Q2’17 financial supplemental.

DIVERSE

TENANT BASE

Minimal Exposure

to Announced

Store Closures

September 2017

INVESTOR UPDATE

September 2017 Investor Update

GROWTH

OPPORTUNITIES

Increasing Value Through

Efficient Operations and

the 3-R Platform

17

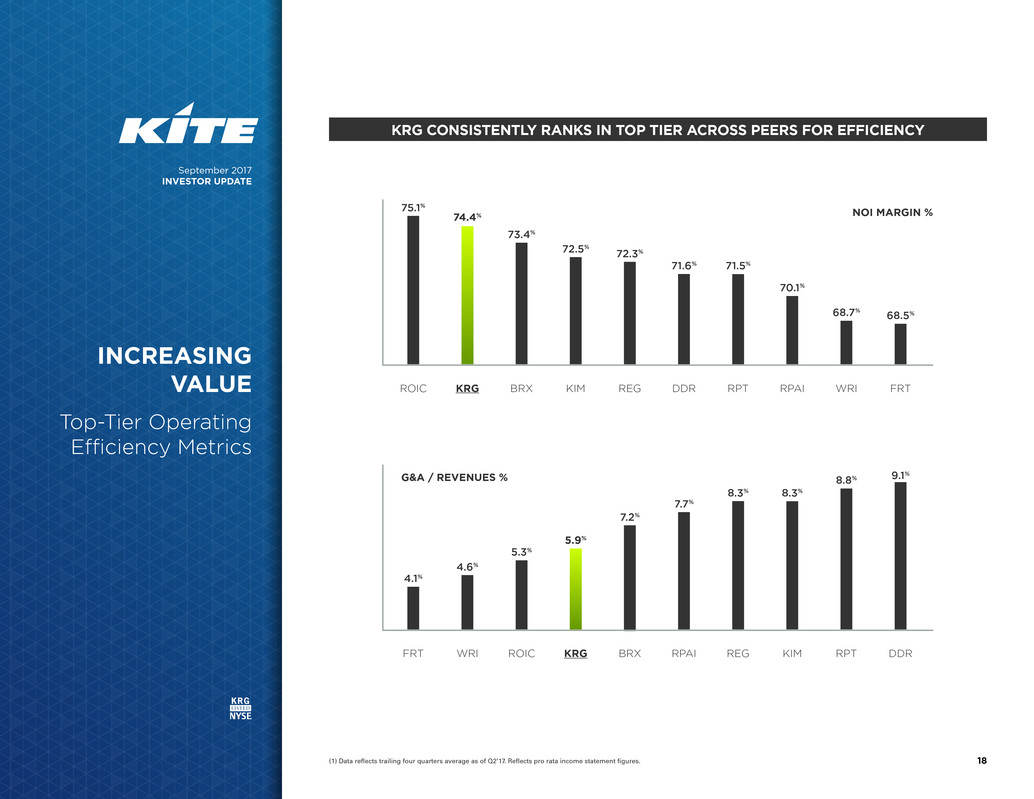

• Attractive NOI Margin: 74.4%, trailing twelve months

• Efficient G&A / Revenues: 5.9%, trailing twelve months

• Opportunity Areas: Operating expense savings, overage rent,

and ancillary income

• New and renewal cash rent spreads of 18.6% and 7.1%,

respectively, in 2016

• Embedded average contractual rent bumps of ~1.5%

• Fixed CAM recovery initiative, ~20% of operating portfolio currently

with goal to increase to ~50%

• $9.2mm of additional cash NOI from $68.5mm-$74.0mm

in-process 3-R and transitional projects

• Seven future 3-R opportunities with a total cost of $65-$85mm

• Potential future acquisitions assuming a more favorable

cost of capital

• Anchor lease-up from 97% to 98.5%, or ~153,000 SF

• Small shops leased at 89.2% with additional upside to 90% +

OPERATING

PROPERTIES

CONTRACTUAL

RENT STEPS /

FIXED CAM

RECOVERY

3-R INITIATIVE /

DEVELOPMENT /

ACQUISITIONS

OCCUPANCY

GROWTH

INCREASING

VALUE

Embedded

NOI Growth

Opportunities

in Portfolio

September 2017

INVESTOR UPDATE

18

KRG CONSISTENTLY RANKS IN TOP TIER ACROSS PEERS FOR EFFICIENCY

ROIC

75.1%

KRG

74.4%

BRX

73.4%

KIM

72.5%

RPAI

70.1%

WRI

68.7% 68.5%

FRT

NOI MARGIN %

REG

72.3%

DDR

71.6%

RPT

71.5%

FRT

4.1%

WRI

4.6%

ROIC

5.3%

KRG

5.9%

KIM

8.3%

RPT

8.8% 9.1

%

DDR

G&A / REVENUES %

BRX

7.2%

RPAI

7.7%

REG

8.3%

(1) Data reflects trailing four quarters average as of Q2’17. Reflects pro rata income statement figures.

INCREASING

VALUE

Top-Tier Operating

Efficiency Metrics

September 2017

INVESTOR UPDATE

19

(1) KRG Supplementals Q4’10 through Q2’17.

Q2'172016201520142013201220112010

92.2%

93.3%

94.2%

95.3%

94.8%

95.4% 95.4%

94.5%

2.

5

%

GR

O

WT

H

SINCE

2010 Q2'172016201520142013201220112010

$12.80

$13.26

$12.95

$13.18

$15.15 $15.22

$15.78

$16.20

26.

6

%

GR

O

WT

H

SINCE

2010

Q2'172016201520142013201220112010

78.1%

79.5%

82.5%

85.5% 85.7

%

87.6%

88.9% 89.2

%

14.

2

%

GR

O

WT

H

SINCE

2010 Q2'172016201520142013201220112010

85.7%

87.3%

82.5%

85.9%

89.6%

87.3%

89.2%

93.1%

8.

6

%

GR

O

WT

H

SINCE

2010

RETAIL PORTFOLIO LEASE % ABR PER SQUARE FOOT

SMALL SHOP LEASE % RETAIL RECOVERY RATIO

September 2017

INVESTOR UPDATE

INCREASING

VALUE

Proven Ability to Create

Positive Operating Results1

20

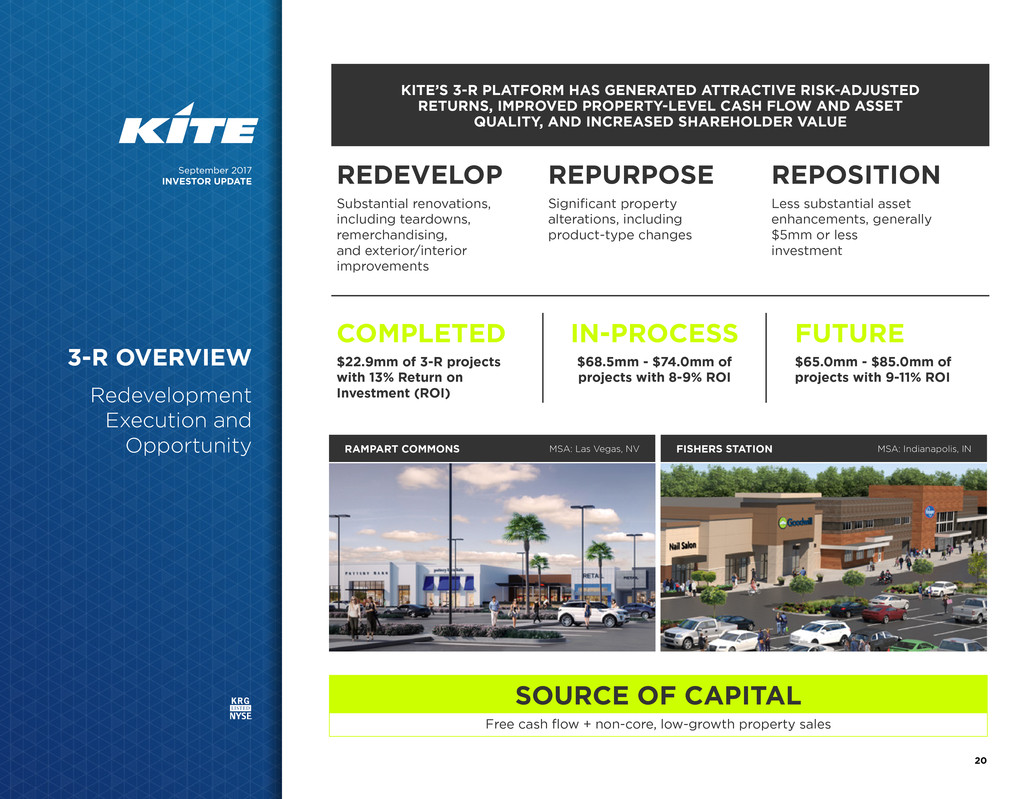

REDEVELOP REPURPOSE REPOSITION

Substantial renovations,

including teardowns,

remerchandising,

and exterior/interior

improvements

Significant property

alterations, including

product-type changes

Less substantial asset

enhancements, generally

$5mm or less

investment

COMPLETED IN-PROCESS FUTURE

$22.9mm of 3-R projects

with 13% Return on

Investment (ROI)

$68.5mm - $74.0mm of

projects with 8-9% ROI

$65.0mm - $85.0mm of

projects with 9-11% ROI

SOURCE OF CAPITAL

Free cash flow + non-core, low-growth property sales

KITE’S 3-R PLATFORM HAS GENERATED ATTRACTIVE RISK-ADJUSTED

RETURNS, IMPROVED PROPERTY-LEVEL CASH FLOW AND ASSET

QUALITY, AND INCREASED SHAREHOLDER VALUE

RAMPART COMMONS MSA: Las Vegas, NV FISHERS STATION MSA: Indianapolis, IN

3-R OVERVIEW

Redevelopment

Execution and

Opportunity

September 2017

INVESTOR UPDATE

September 2017 Investor Update

INVESTMENT GRADE

BALANCE SHEET

Well-Positioned

for the Future

22(1) KRG Supplementals Q4’11 through Q2’17.

Q2'17201620152014201320122011

9.7x

8.6x

7.4x

6.5x

7.0x 7.0x

6.8x

2.9x

LOWERED

Q2'17201620152014201320122011

1.6x 1.6x

2.0x

3.2x

3.4x

3.3x

3.6x

2.0x

INCREASED

Q2'17201620152014201320122011

42%

28%

30%

23%

12%

7%

5%

3,700

bps

DECREASED

NET DEBT / EBITDA DEBT SERVICE COVERAGE FLOATING RATE EXPOSURE

September 2017

INVESTOR UPDATE

STRONG

BALANCE SHEET

Significantly Improved Metrics1

23

6.0

YEARS

WEIGHTED AVERAGE

DEBT MATURITY

WEIGHTED AVERAGE DEBT MATURITIES AND WEIGHTED AVERAGE INTEREST RATE1

DDR ROIC BRX RPAI REG RPT KRG WRI KIM

4.0%

6.0 YEARS

WEIGHTED AVERAGE DEBT MATURITY (YEARS)

WEIGHTED AVERAGE INTEREST RATE (%)

(1) Peer data sourced from publicly available Q2’17 information.

Note: Only inclusive or peers who provided both weighted average debt maturity and weighted average interest rates.

4.0%

WEIGHTED AVERAGE

INTEREST RATE

September 2017

INVESTOR UPDATE

STRONG

BALANCE SHEET

Efficient Debt Structure Relative to Peers

24(1) Chart excludes annual principal payments and net premiums on fixed rate

ONLY

$83mm

THROUGH 2020

SCHEDULE OF DEBT MATURITIES ($ IN MILLIONS)1

2017 2018 2019 2020 2021 2022 2023 20252024 2027+2026

MORTGAGE DEBT LINE OF CREDIT TERM LOAN PRIVATE PLACEMENT SENIOR UNSECURED NOTES

38 45

80 75

11

300

169

215 215

95

33

200

200

Only $83mm of debt

maturing through 2020

September 2017

INVESTOR UPDATE

STRONG

BALANCE SHEET

Well-staggered Debt Maturity Profile

25

FORWARD-LOOKING STATEMENTS

This supplemental information package, together with other statements and information publicly disseminated by us, contains certain forward-

looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

Such statements are based on assumptions and expectations that may not be realized and are inherently subject to risks, uncertainties and

other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual

results, performance, transactions or achievements, financial or otherwise, may differ materially from the results, performance, transactions or

achievements, financial or otherwise, expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might

cause such differences, some of which could be material, include but are not limited to:

• national and local economic, business, real estate and other market conditions, particularly in light of low growth in the U.S. economy

as well as economic uncertainty caused by fluctuations in the prices of oil and other energy sources;

• financing risks, including the availability of, and costs associated with, sources of liquidity;

• our ability to refinance, or extend the maturity dates of, our indebtedness;

• the level and volatility of interest rates;

• the financial stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies;

• the competitive environment in which the Company operates;

• acquisition, disposition, development and joint venture risks;

• property ownership and management risks;

• our ability to maintain our status as a real estate investment trust for federal income tax purposes;

• potential environmental and other liabilities;

• impairment in the value of real estate property the Company owns;

• the impact of online retail and the perception that such retail has on the value of shopping center assets;

• risks related to the geographical concentration of our properties in Florida, Indiana and Texas;

• insurance costs and coverage;

• risks associated with cybersecurity attacks and the loss of confidential information and other business disruptions;

• other factors affecting the real estate industry generally; and

• other risks identified in reports the Company files with the Securities and Exchange Commission (“the SEC”) or in other documents that

it publicly disseminates, including, in particular, the section titled “Risk Factors” in our Annual Report on Form

• 10-K for the fiscal year ended December 31, 2016, and in our quarterly reports on Form 10-Q.

The Company undertakes no obligation to publicly update or revise these forward-looking statements, whether as a result of new information,

future events or otherwise.

September 2017

INVESTOR UPDATEDISCLAIMER

26

FREE CASH FLOW

Free Cash Flow is reflected on an annual basis and is defined as Funds From Operations (FFO) as adjusted, less capital expenditures, capitalized

internal costs, tenant improvements, plus non-cash items, and after dividends paid.

FUNDS FROM OPERATIONS

Funds from Operations (FFO) is a widely used performance measure for real estate companies and is provided here as a supplemental measure

of operating performance. The Company calculates FFO, a non-GAAP financial measure, in accordance with the best practices described in the

April 2002 National Policy Bulletin of the National Association of Real Estate Investment Trusts (“NAREIT”). The NAREIT white paper defines FFO

as net income (determined in accordance with GAAP), excluding gains (or losses) from sales and impairments of depreciated property, plus de-

preciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures.

Considering the nature of our business as a real estate owner and operator, the Company believes that FFO is helpful to investors in measuring

our operational performance because it excludes various items included in net income that do not relate to or are not indicative of our operat-

ing performance, such as gains or losses from sales of depreciated property and depreciation and amortization, which can make periodic and

peer analyses of operating performance more difficult. For informational purposes, the Company has also provided FFO adjusted for transaction

costs and a severance charge in 2016. The Company believes this supplemental information provides a meaningful measure of our operating

performance. The Company believes our presentation of FFO, as adjusted, provides investors with another financial measure that may facilitate

comparison of operating performance between periods and among our peer companies. FFO should not be considered as an alternative to net

income (determined in accordance with GAAP) as an indicator of our financial performance, is not an alternative to cash flow from operating

activities (determined in accordance with GAAP) as a measure of our liquidity, and is not indicative of funds available to satisfy our cash needs,

including our ability to make distributions. Our computation of FFO may not be comparable to FFO reported by other REITs that do not define

the term in accordance with the current NAREIT definition or that interpret the current NAREIT definition differently than we do. A reconciliation

of net income (computed in accordance with GAAP) to FFO is included elsewhere in this Financial Supplement.

ADJUSTED FUNDS FROM OPERATIONS

Adjusted Funds From Operations (“AFFO”) is a non-GAAP financial measure of operating performance used by many companies in the REIT

industry. AFFO modifies FFO, as adjusted for certain cash and non-cash transactions not included in FFO, as adjusted. AFFO should not be con-

sidered an alternative to net income as an indication of the company’s performance or as an alternative to cash flow as a measure of liquidity

or ability to make distributions. Management considers AFFO a useful supplemental measure of the company’s performance. The Company’s

computation of AFFO may differ from the methodology for calculating AFFO used by other REITs, and therefore, may not be comparable to such

other REITs. A reconciliation of net income (computed in accordance with GAAP) to AFFO is included elsewhere in this Financial Supplement.

NET OPERATING INCOME AND SAME PROPERTY NET OPERATING INCOME

The Company uses property net operating income (“NOI”), a non-GAAP financial measure, to evaluate the performance of our properties. The

Company defines NOI as income from our real estate, including lease termination fees received from tenants, less our property operating ex-

penses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions and corporate level expenses. The Compa-

ny believes that NOI is helpful to investors as a measure of our operating performance because it excludes various items included in net income

that do not relate to or are not indicative of our operating performance, such as depreciation and amortization, interest expense, and impair-

ment, if any.

September 2017

INVESTOR UPDATENON-GAAP FINANCIAL MEASURES

27

NET OPERATING INCOME AND SAME PROPERTY NET OPERATING INCOME (CONT.)

The Company also uses same property NOI (“Same Property NOI”), a non-GAAP financial measure, to evaluate the performance of our proper-

ties. Same Property NOI excludes properties that have not been owned for the full period presented. It also excludes net gains from outlot sales,

straight-line rent revenue, bad debt expense and recoveries, lease termination fees, amortization of lease intangibles and significant prior period

expense recoveries and adjustments, if any. The Company believes that Same Property NOI is helpful to investors as a measure of our operating

performance because it includes only the NOI of properties that have been owned for the full period presented, which eliminates disparities in

net income due to the acquisition or disposition of properties during the particular period presented and thus provides a more consistent metric

for the comparison of our properties. The year to date results represent the sum of the individual quarters, as reported.

NOI and Same Property NOI should not, however, be considered as alternatives to net income (calculated in accordance with GAAP) as indica-

tors of our financial performance. Our computation of NOI and Same Property NOI may differ from the methodology used by other REITs, and

therefore may not be comparable to such other REITs.

When evaluating the properties that are included in the same property pool, the Company has established specific criteria for determining the in-

clusion of properties acquired or those recently under development. An acquired property is included in the same property pool when there is a

full quarter of operations in both years subsequent to the acquisition date. Development and redevelopment properties are included in the same

property pool four full quarters after the properties have been transferred to the operating portfolio. A redevelopment property is first excluded

from the same property pool when the execution of a redevelopment plan is likely and the Company begins recapturing space from tenants. For

the quarter ended June 30, 2017, the Company excluded eight redevelopment properties and the recently completed Northdale Promenade from

the same property pool that met these criteria and were owned in both comparable periods.

EARNINGS BEFORE INTEREST EXPENSE, INCOME TAX EXPENSE, DEPRECIATION AND AMORTIZATION (EBITDA)

The Company defines EBITDA, a non-GAAP financial measure, as net income before depreciation and amortization, interest expense and income

tax expense of taxable REIT subsidiary. For informational purposes, the Company has also provided Adjusted EBITDA, which the Company de-

fines as EBITDA less (i) EBITDA from unconsolidated entities, (ii) gains on sales of operating properties or impairment charges, (iii) other income

and expense, (iv) noncontrolling interest EBITDA and (v) other non-recurring activity or items impacting comparability from period to period.

Annualized Adjusted EBITDA is Adjusted EBITDA for the most recent quarter multiplied by four. Net Debt to Adjusted EBITDA is the Company’s

share of net debt divided by Annualized Adjusted EBITDA. EBITDA, Adjusted EBITDA, Annualized Adjusted EBITDA and Net Debt to Adjusted

EBITDA, as calculated by us, are not comparable to EBITDA and EBITDA-related measures reported by other REITs that do not define EBITDA

and EBITDA-related measures exactly as we do. EBITDA, Adjusted EBITDA and Annualized Adjusted EBITDA do not represent cash generated

from operating activities in accordance with GAAP, and should not be considered alternatives to net income as an indicator of performance or as

alternatives to cash flows from operating activities as an indicator of liquidity.

Considering the nature of our business as a real estate owner and operator, the Company believes that EBITDA, Adjusted EBITDA and the ratio

of Net Debt to Adjusted EBITDA are helpful to investors in measuring our operational performance because they exclude various items included

in net income that do not relate to or are not indicative of our operating performance, such as gains or losses from sales of depreciated prop-

erty and depreciation and amortization, which can make periodic and peer analyses of operating performance more difficult. For informational

purposes, the Company has also provided Annualized Adjusted EBITDA, adjusted as described above. The Company believes this supplemental

information provides a meaningful measure of our operating performance. The Company believes presenting EBITDA and the related measures

in this manner allows investors and other interested parties to form a more meaningful assessment of our operating results.

September 2017

INVESTOR UPDATENON-GAAP FINANCIAL MEASURES

28

September 2017

INVESTOR UPDATE

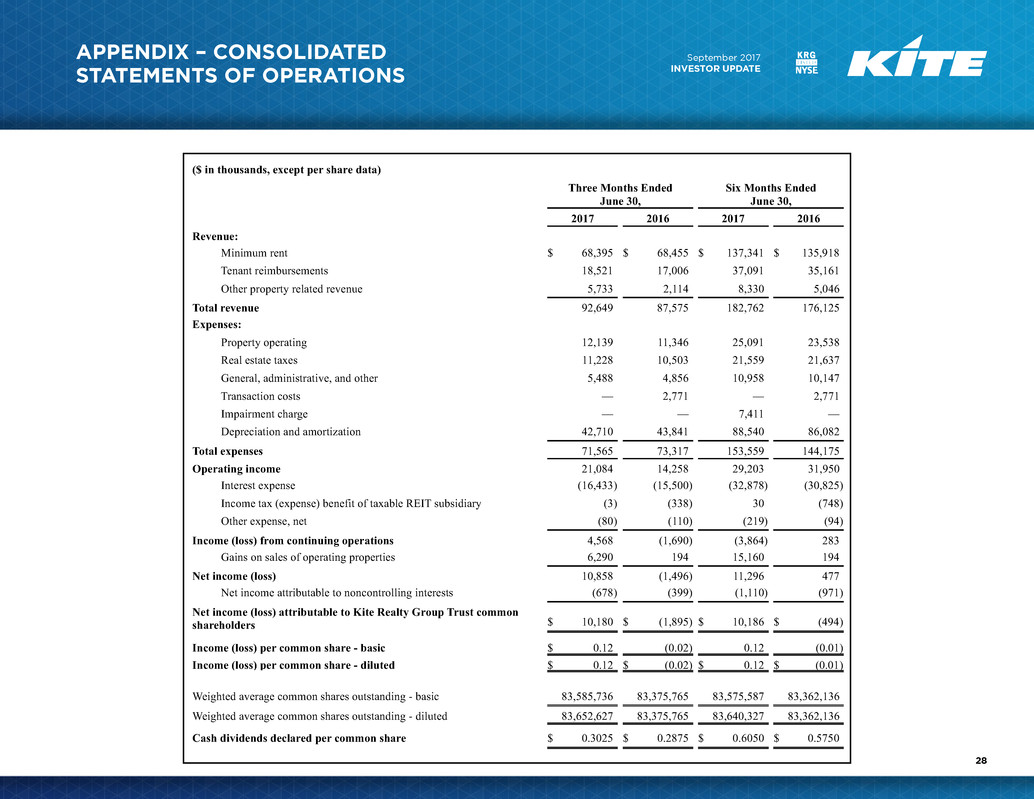

APPENDIX – CONSOLIDATED

STATEMENTS OF OPERATIONS

7

Kite Realty Group Trust

Consolidated Statements of Operations

For the Three and Six Months Ended June 30, 20 1 7 and 20 1 6

(U naudited)

($ in thousands, except per share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

2 0 1 7 2 0 1 6 2 0 1 7 2 0 1 6

Revenue:

Min i m u m re n t $ 68 , 3 9 5 $ 68 , 4 5 5 $ 137,34 1 $ 13 5 , 9 1 8

Ten a n t re i m b u r s e m e n t s 18, 5 2 1 17,00 6 37,09 1 35,1 6 1

Oth e r pr o p e r t y re l a t e d re v e n u e 5,733 2,11 4 8,3 3 0 5,0 4 6

Total revenue 92,6 4 9 87,575 182 ,762 176,1 2 5

E xpenses:

Pro p e r t y op e r a t i n g 12, 1 3 9 11,3 4 6 25,0 9 1 23,5 3 8

Rea l es t a t e ta x e s 11,2 2 8 10,5 0 3 21,5 5 9 21,6 37

Gen e r a l , ad m i n i s t r a t i v e , an d oth e r 5,4 8 8 4,8 5 6 10,9 5 8 10,1 47

Tra n s a c t i o n co s t s — 2,771 — 2,771

Im p a i r m e n t ch a rg e — — 7,411 —

Dep r e c i a t i o n an d am o r t i z a t i o n 42,710 43,8 4 1 88,5 4 0 86,0 8 2

Total expenses 71,56 5 73,3 17 153 , 5 5 9 144 , 175

Operating income 21,0 8 4 14,2 5 8 29,2 0 3 31,9 5 0

Inte r e s t ex p e n s e (16 , 4 3 3 ) (15 , 5 0 0 ) (32 , 878 ) (30 , 8 2 5 )

Inc o m e ta x (e x p e n s e ) be n e f i t of ta x a b l e R E I T su b s i d i a r y (3 ) (33 8 ) 30 (748 )

Oth e r ex p e n s e , ne t (80 ) (11 0 ) (21 9 ) (94 )

I n come (loss) from continuing operations 4,5 6 8 (1,6 9 0 ) (3,8 6 4 ) 283

Gain s on sa l e s of op e r a t i n g pr o p e r t i e s 6,2 9 0 194 15,1 6 0 194

Net income (loss) 10,8 5 8 (1,4 9 6 ) 11,2 9 6 477

Net in c o m e att r i b u t a b l e to no n c o n t r o l l i n g in t e r e s t s (678 ) (39 9 ) (1,11 0 ) (971 )

Net income (loss) attributable to Kite Realty Group Trust common

shareholders $ 10, 1 8 0

$ (1, 8 9 5 ) $ 10 , 1 8 6

$ (49 4 )

I n come (loss) per common share - basic $ 0.1 2 (0.0 2 ) 0.1 2 (0.0 1 )

I n come (loss) per common share - diluted $ 0.1 2 $ (0. 0 2 ) $ 0.1 2 $ (0. 0 1 )

Weig h t e d av e r a g e co m m o n sh a r e s ou t s t a n d i n g - bas i c 83,5 8 5 ,736 83,375,765 83,575,5 87 83,3 6 2 , 1 3 6

Weig h t e d av e r a g e co m m o n sh a r e s ou t s t a n d i n g - dilu t e d 83, 6 5 2 , 6 27 83,375,765 83,6 4 0 , 3 27 83,3 6 2 , 1 3 6

Cash dividends declared per common share $ 0.3 0 2 5 $ 0.2 875 $ 0.6 0 5 0 $ 0.5750

29

(1) “FFO of the Operating Partnership” measures 100% of the operating performance of the Operating Partnership’s real estate properties. “FFO attributable to Kite Realty Group Trust common shareholders” reflects a reduction for the redeemable noncontrolling weighted average diluted interest

in the Operating Partnership.

September 2017

INVESTOR UPDATE

APPENDIX – RECONCILIATION

OF FFO TO NET INCOME

($ in thousands, except per share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

2017 2016 2017 2016

Funds From Operations

Consolidated net income $ 10,858 $ (1,496 ) $ 11,296 $ 477

Less: net income attributable to noncontrolling interests in properties (438 ) (461 ) (870 ) (922 )

Less: gains on sales of operating properties (6,290 ) (194 ) (15,160 ) (194 )

Add: impairment charge — — 7,411 —

Add: depreciation and amortization of consolidated entities, net of noncontrolling interests 42,050

43,545

87,416

85,599

FFO of the Operating Partnership1 46,180 41,394 90,093 84,960

Less: Limited Partners' interests in FFO (1,056 ) (809 ) (2,045 ) (1,790 )

FFO attributable to Kite Realty Group Trust common shareholders1 $ 45,124 $ 40,585 $ 88,048 $ 83,170

FFO, as defined by NAREIT, per share of the Operating Partnership - basic $ 0.54 $ 0.49 $ 1.05 $ 1.00

FFO, as defined by NAREIT, per share of the Operating Partnership - diluted $ 0.54 $ 0.48 $ 1.05 $ 0.99

FFO of the Operating Partnership1 $ 46,180 $ 41,394 $ 90,093 $ 84,960

Add: transaction costs — 2,771 — 2,771

Add: severance charge — — — 500

FFO, as adjusted, of the Operating Partnership $ 46,180 $ 44,165 $ 90,093 $ 88,231

FFO, as adjusted, per share of the Operating Partnership - basic $ 0.54 $ 0.52 $ 1.05 $ 1.03

FFO, as adjusted, per share of the Operating Partnership - diluted $ 0.54 $ 0.52 $ 1.05 $ 1.03

Weighted average common shares outstanding - basic 83,585,736 83,375,765 83,575,587 83,362,136

Weighted average common shares outstanding - diluted 83,652,627 83,475,474 83,640,327 83,460,521

Weighted average common shares and units outstanding - basic 85,572,566 85,320,923 85,551,356 85,295,968

Weighted average common shares and units outstanding - diluted 85,639,457 85,420,633 85,616,096 85,394,353

FFO, as defined by NAREIT, per diluted share

Consolidated net income $ 0.13 $ (0.02 ) $ 0.13 $ 0.01

Less: net income attributable to noncontrolling interests in properties (0.01 ) (0.01 ) (0.01 ) (0.01 )

Less: gains on sales of operating properties (0.07 ) — (0.17 ) —

Add: impairment charge — — 0.08 —

Add: depreciation and amortization of consolidated entities, net of noncontrolling interests 0.49

0.51

1.02

1.00

FFO, as defined by NAREIT, of the Operating Partnership per diluted share1 $ 0.54 $ 0.48 $ 1.05 $ 1.00

Add: transaction costs — 0.04 — 0.03

Add: severance charge — — — —

FFO, as adjusted, of the Operating Partnership per diluted share $ 0.54 $ 0.52 $ 1.05 $ 1.03

30

(1) Same Property NOI excludes eight properties in redevelopment, the recently completed Northdale Promenade as well as office properties (Thirty South Meridian and Eddy Street Commons).

(2) Excludes leases that are signed but for which tenants have not yet commenced the payment of cash rent. Calculated as a weighted average based on the timing of cash rent commencement and expiration during the period.

(3) Same Property NOI excludes net gains from outlot sales, straight-line rent revenue, bad debt expense and recoveries, lease termination fees, amortization of lease intangibles and significant prior period expense recoveries and adjustments, if any.

(4) See pages 27 and 28 of Q2 2017 supplemental for further detail of the properties included in the 3-R initiative.

(5) Includes non-cash activity across the portfolio as well as net operating income from properties not included in the same property pool.

September 2017

INVESTOR UPDATE

APPENDIX – RECONCILIATION OF

SAME PROPERTY NOI TO NET INCOME

($ in thousands)

Three Months Ended June 30, Six Months Ended June 30,

2017 2016

%

Change 2017 2016

%

Change

Number of properties for the quarter1 102 102

Leased percentage at period end 94.3 % 95.1 % 94.3 % 95.1 %

Economic Occupancy percentage2 93.8 % 92.7 % 93.9 % 93.0 %

Minimum rent $ 58,028 $ 56,358 $ 116,809 $ 113,716

Tenant recoveries 16,233 15,231 33,059 31,640

Other income 168 121 453 264

74,429 71,710 150,321 145,620

Property operating expenses (9,992 ) (9,547 ) (19,747 ) (18,914 )

Real estate taxes (9,945 ) (9,381 ) (19,987 ) (19,509 )

(19,937 ) (18,928 ) (39,734 ) (38,423 )

Same Property NOI3 $ 54,492 $ 52,782 3.2% $ 110,587 $ 107,197 3.2%

Same Property NOI - excluding the impact of the 3-R

initiative4 3.8% 3.9%

Reconciliation of Same Property NOI to Most Directly

Comparable GAAP Measure:

Net operating income - same properties $ 54,492 $ 52,782 $ 110,587 $ 107,197

Net operating income - non-same activity5 15,655 13,287 26,996 24,629

Other expense, net (83 ) (448 ) (189 ) (842 )

General, administrative and other (5,488 ) (4,856 ) (10,958 ) (10,147 )

Transaction costs — (2,771 ) — (2,771 )

Bad Debt Expense – Same Properties (865 ) (343 ) (1,471 ) (876 )

Impairment charge — — (7,411 ) —

Depreciation and amortization expense (42,710 ) (43,841 ) (88,540 ) (86,082 )

Interest expense (16,433 ) (15,500 ) (32,878 ) (30,825 )

Gains on sales of operating properties 6,290 194 15,160 194

Net income attributable to noncontrolling interests (678 ) (399 ) (1,110 ) (971 )

Net income (loss) attributable to common shareholders $ 10,180 $ (1,895 ) $ 10,186 $ (494 )

31

(1) Relates to (a) a reduction reflecting the second quarter GAAP operating income of $0.8 million for properties sold during the second quarter of 2017, which adjustment to EBITDA (an income measure) corresponds with the use of proceeds from such sales to pay down the Credit Facility, as

reflected in the change in net debt (a balance sheet measure) for the period ending June 30, 2017, and (b) a reduction of approximately $2.6 million in other property related revenue to normalize the impact on comparability of a $4.9 million net gain from the sale of an outlot at Cove Center

during the second quarter of 2017 to the Company’s quarterly average of other property related revenue.

(2) Represents Adjusted EBITDA for the three months ended June 30, 2017 (as shown in the table above) multiplied by four.

(3) Partner share of consolidated joint venture debt is calculated based upon the partner’s pro-rata ownership of the joint venture, multiplied by the related secured debt balance. In all cases, this debt is the responsibility of the consolidated joint venture.

September 2017

INVESTOR UPDATE

APPENDIX – RECONCILIATION OF

EBITDA/ADJUSTED EBITDA TO NET INCOME

($ in thousands)

Three Months Ended

June 30, 2017

Consolidated net income $ 10,858

Adjustments to net income

Depreciation and amortization 42,710

Interest expense 16,433

Income tax benefit of taxable REIT subsidiary 3

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) 70,004

Adjustments to EBITDA:

Unconsolidated EBITDA 34

Gain on sale of operating property (6,290 )

Pro-forma adjustments1 (3,369 )

Other income and expense, net 80

Noncontrolling interest (432 )

Adjusted EBITDA 60,027

Annualized Adjusted EBITDA2 $ 240,108

Company share of net debt:

Mortgage and other indebtedness 1,675,064

Less: Partner share of consolidated joint venture debt3 (13,373 )

Less: Cash, cash equivalents, and restricted cash (36,352 )

Less: Net debt premiums and issuance costs, net 1,146

Company Share of Net Debt 1,626,485

Net Debt to Adjusted EBITDA 6.77x

888 577 5600

kiterealty.com

30 S MERIDIAN STREET

SUITE 1100

INDIANAPOLIS, IN 46204