Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Majesco | v474794_8k.htm |

Exhibit 99.1

Management Presentation NYSE : MJCO September 2017

2 © 2017 Majesco. All rights reserved Cautionary Language Concerning Forward Looking Statements This presentation contains forward - looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act . These forward - looking statements are made on the basis of the current beliefs, expectations and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty . These forward - looking statements should, therefore, be considered in light of various important factors, including those set forth in Majesco’s reports that it files from time to time with the Securities and Exchange Commission (SEC) and which you should review, including those statements under “Item 1 A – Risk Factors” in Majesco’s Annual Report on Form 10 - K for the fiscal year ended March 31 , 2017 filed with the SEC on June 16 , 2017 . Important factors that could cause actual results to differ materially from those described in forward - looking statements contained in this press release include, but are not limited to : integration risks ; changes in economic conditions, political conditions, trade protection measures, licensing requirements and tax matters ; technology development risks ; intellectual property rights risks ; competition risks ; additional scrutiny and increased expenses as a result of being a public company ; the financial condition, financing requirements, prospects and cash flow of Majesco ; loss of strategic relationships ; changes in laws or regulations affecting the insurance industry in particular ; restrictions on immigration ; the ability and cost of retaining and recruiting key personnel ; the ability to attract new clients and retain them and the risk of loss of large customers ; continued compliance with evolving laws ; customer data and cybersecurity risk ; and Majesco’s ability to raise capital to fund future growth . These forward - looking statements should not be relied upon as predictions of future events and Majesco cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur . If such forward - looking statements prove to be inaccurate, the inaccuracy may be material . You should not regard these statements as a representation or warranty by Majesco or any other person that we will achieve our objectives and plans in any specified timeframe, or at all . You are cautioned not to place undue reliance on these forward - looking statements, which speak only as of the date of this presentation . Majesco disclaims any obligation to publicly update or release any revisions to these forward - looking statements, whether as a result of new information, future events or otherwise, after the date of this press release or to reflect the occurrence of unanticipated events, except as required by law

• Majesco Overview • Insurance Industry & Trends • Financials • Cloud Insurer Model • IBM Partnership • Growth and Margin Drivers Agenda

4 © 2017 Majesco. All rights reserved Majesco’s Vision: Insurance Industry Cloud Solution Leader Market Shift: Large Transformation to Rapid Innovation 248 %• InsurTech funding increased Q2 2017 to $985M* • $4.35B since 2015 • Rapid innovation for customer experience, new products & business models on increase Core Solutions Market Leader Top 5 • Core Systems for P&C and L&A IBM Platform Partner $35M • 10 year subscription deal Momentum in Cloud Business 17 %• Cloud Growth in FY 2017 • 30 + Cloud Customers *Source: Willis Towers Watson

5 © 2017 Majesco. All rights reserved Majesco’s Strong Footprint in Insurance Technology $122m FY 2017 Revenue 30+ Cloud Customers and 17% growth in cloud business in FY 2017 150+ Customers in 7 countries 5 Acquisitions Since 2008 # 1 in Billing * Product in the Market Covers P&C and L&A sectors $ 200m invested in IP (Product R&D and acquisitions) * Source : Celent - 2015 Stand - Alone P&C Billing Solutions

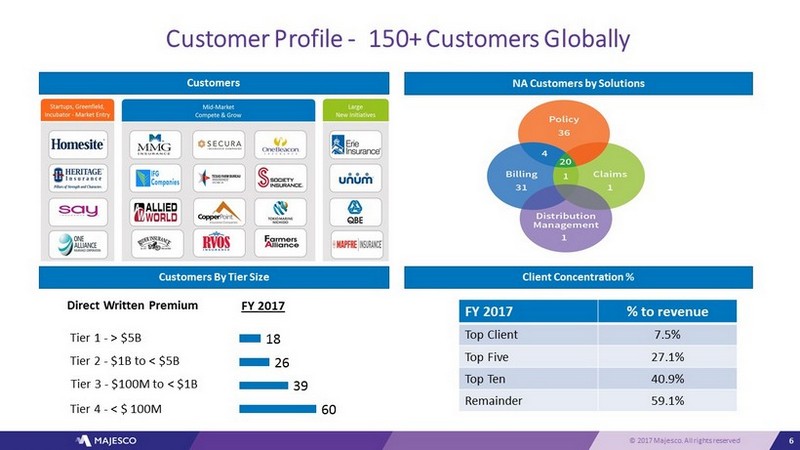

6 © 2017 Majesco. All rights reserved Customer Profile - 150+ Customers Globally Customers By Tier Size Customers 60 39 26 18 Tier 1 - > $5B Tier 2 - $1B to < $5B Tier 3 - $100M to < $1B Tier 4 - < $ 100M FY 2017 Direct Written Premium NA Customers by Solutions Client Concentration % FY 2017 % to revenue Top Client 7.5% Top Five 27.1% Top Ten 40.9% Remainder 59.1%

7 © 2017 Majesco. All rights reserved Experienced Management Team Ketan Mehta Chief Executive Officer & Co - Founder Integrated four acquisitions and executed insurance focus strategy Edward Ossie Chief Operating Officer Former President of Innovation Group and Director of Corum Technologies Farid Kazani Chief Financial Officer & Treasurer Deep experience in strategic technology mergers and acquisitions. William Freitag Executive Vice President - Strategic Accounts and Key Initiatives Founder of Agile Technologies, insurance focused consulting company Ganesh Pai Executive Vice President – Consulting Services Has a 26 year track record of business growth and success with prior leadership experience at Genpact and Mphasis Chad Hersh Executive Vice President - L&A Business Ex - Managing Director, Novarica’s Insurance Practice and Ex - Senior Analyst, Celent. Manish Shah Executive Vice President – Products Former CEO of Cover - All Technologies with over 17 years of insurance technology experience Prateek Kumar Executive Vice President – Sales 14 years of experience in insurance technology Tilakraj Panjabi Executive Vice President - P&C Delivery Over 26 years of experience in IT industry and majority of his experience is in insurance and retail banking domains Denise Garth Senior Vice President – Strategic Marketing & Innovation Insurance Company and ACORD executive; Head of Innovation and Ex - Partner, Strategy Meets Action.

8 © 2017 Majesco. All rights reserved Market Trends in the Insurance Industry Higher customer expectations set by other industries with digital first models like Amazon, Netflix Carriers seeking growth strategies through innovation in distribution, products and markets Changing insurance industry boundaries - InsurTech impact Greenfield initiatives by new and established carriers – a rising trend High focus on customer engagement and experience Compelling changes in Insurance Industry favors adoption of cloud model

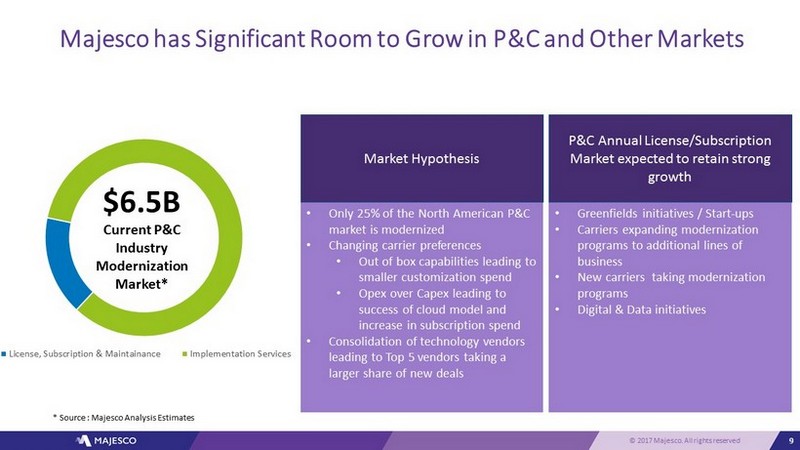

9 © 2017 Majesco. All rights reserved • Only 25% of the North American P&C market is modernized • Changing carrier preferences • Out of box capabilities leading to smaller customization spend • Opex over Capex leading to success of cloud model and increase in subscription spend • Consolidation of technology vendors leading to Top 5 vendors taking a larger share of new deals Market Hypothesis Majesco has Significant Room to Grow in P&C and Other Markets • Greenfields initiatives / Start - ups • Carriers expanding modernization programs to additional lines of business • New carriers taking modernization programs • Digital & Data initiatives P&C Annual License/Subscription Market expected to retain strong growth License, Subscription & Maintainance Implementation Services $6.5B Current P&C Industry Modernization Market* * Source : Majesco Analysis Estimates

10 © 2017 Majesco. All rights reserved FY 2017 Financials - Revenue Profile and Improved Profitability

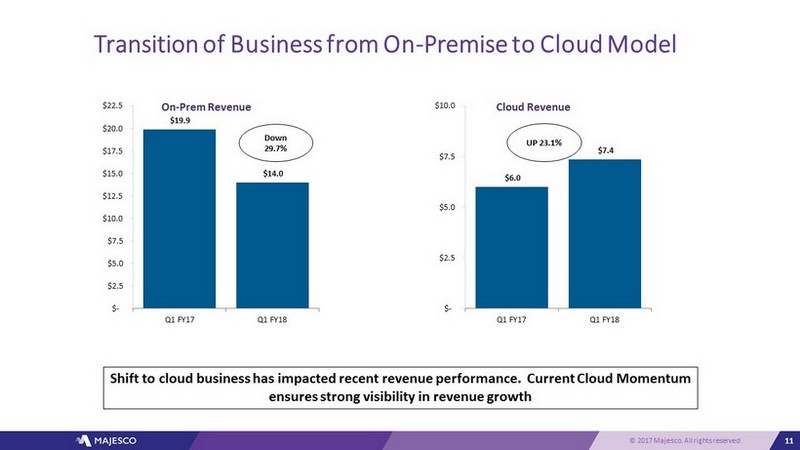

11 © 2017 Majesco. All rights reserved Transition of Business from On - Premise to Cloud Model $6.0 $7.4 $- $2.5 $5.0 $7.5 $10.0 Q1 FY17 Q1 FY18 Cloud Revenue UP 23.1% $19.9 $14.0 $- $2.5 $5.0 $7.5 $10.0 $12.5 $15.0 $17.5 $20.0 $22.5 Q1 FY17 Q1 FY18 On - Prem Revenue Down 29.7% Shift to cloud business has impacted recent revenue performance. Current Cloud Momentum ensures strong visibility in revenue growth

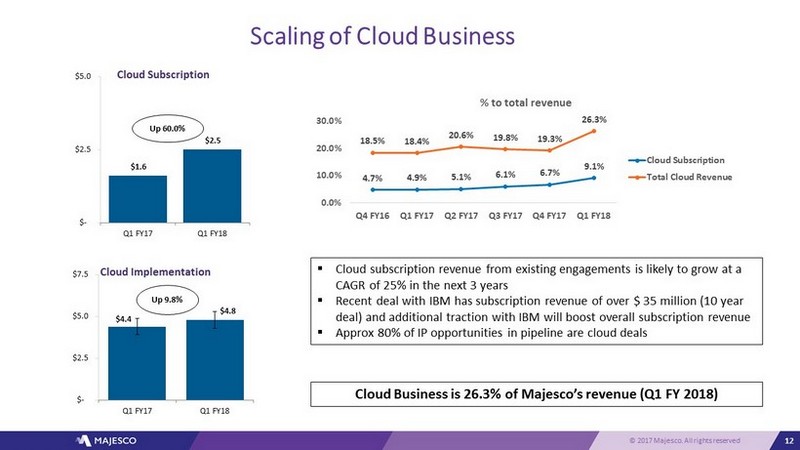

12 © 2017 Majesco. All rights reserved Scaling of Cloud Business $4.4 $4.8 $- $2.5 $5.0 $7.5 Q1 FY17 Q1 FY18 Cloud Implementation Up 9.8% $1.6 $2.5 $- $2.5 $5.0 Q1 FY17 Q1 FY18 Cloud Subscription Up 60.0% ▪ Cloud subscription revenue from existing engagements is likely to grow at a CAGR of 25% in the next 3 years ▪ Recent deal with IBM has subscription revenue of over $ 35 million (10 year deal) and additional traction with IBM will boost overall subscription revenue ▪ Approx 80% of IP opportunities in pipeline are cloud deals 4.7% 4.9% 5.1% 6.1% 6.7% 9.1% 18.5% 18.4% 20.6% 19.8% 19.3% 26.3% 0.0% 10.0% 20.0% 30.0% Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 Q1 FY18 % to total revenue Cloud Subscription Total Cloud Revenue Cloud Business is 26.3% of Majesco’s revenue (Q1 FY 2018)

13 © 2017 Majesco. All rights reserved Majesco CloudInsurer – Business Insurance Platform on Cloud 1 . Agents Customer Employees Greenfield Start - up Digital Insurance Platform Aggregators & Compare Times Alternate Channels Market Facing Incubate Transform Market Information L&A Individual P&C Personal P&C Commercial P&C Specialty Third Party Data Services Third Party Reports Third Party Components Content Providers Group, EB, & Worksite Operations – Managed by Majesco Help Desk Hosting Updates Operations SaaS Policy Billing Claims Distribution Analytics Majesco CloudInsurer 31 Clients in the cloud 10+ Years experience in cloud hosting Cloud business - 80 % current pipeline

14 © 2017 Majesco. All rights reserved Majesco' s Cloud Platform Value Proposition These Benefits are Driving Insurer’s Interest in Cloud Model Speed Rapid rollout On - Prem: 2 - 4X (or more) Slower Rollout Lower TCO “Pay - as - you - Go” Pricing On - Prem : Upfront Large and Risky License and Implementation Costs Upgrades Regular and Seamless Upgrades On - Prem : Customer responsibility with often high cost Scalability Upscaling and Downscaling On - Prem : Upfront hardware costs with limited flexibility to upscale Security Preventive Security and Data Protection On - Prem : Onus on Customer Support Support, Maintenance and Monitoring On - Prem : Limited and fixed support time with limited staff scalability

15 © 2017 Majesco. All rights reserved Majesco Enables Speed to Value – Customer Case Studies Speed to Implementation Speed – 12 Months Speed – 10 Months Speed – 8 Months Speed – 4 Months Speed to Revenue Value – <$1M/LOB Value – <$1M/LOB Value – <$1M launch Value – <$0.5M/LOB Speed to Market New Model, Commercial Lines Product in 50 States Specialty Lines & Aviation New Startup in Florida, new product or state in 3 - 4 months Commercial Package Quick Go - Live Single Jurisdiction

16 © 2017 Majesco. All rights reserved Majesco – IBM Partnership • End to end insurance capability offered as a Service • Variable and consumption based cost model are available • Majesco is a foundation partner in IBM’s Industry Platform strategy for Insurance • Cognitive Capabilities as a part of the core offering The IBM and Majesco partnership enables insurance companies with multiple options to bring new business models, products, and services to market rapidly Emerging Industry Platforms • IBM Sales Teams have been engaged and have initiated the process of taking the Industry Platform value proposition to their client base • Tier 1 win announcement in June 2017 provides further boost to the partnership

17 © 2017 Majesco. All rights reserved IBM Deal Impact 10+ Leadership in Group Insurance Space Establishes Majesco & IBM in the group and worksite benefits space Cloud Model MJCO Cloud Credentials Partnership Long term partnership with significant revenue commitment Industry Disruption Platform as a Service, redefines group insurance administration

18 © 2017 Majesco. All rights reserved Growth Drivers • Cloud Revenues • Fast growing segment of the industry • Cloud subscription revenue from existing engagements to grow at CAGR of 25% (next 3 years) • 8 0% IP deals in opportunity pipeline are cloud deals • IBM Partnership • Build up of strong pipeline with early win of large Tier 1 customer • Life & Annuities business • L&A vendor space is fragmented. Majesco has an opportunity to become a dominant technology vendor in L&A market place • Increasing spends towards employees leading to more focus on Voluntary Benefits creating significant impact to Group Market • 2 out of top 3 Group carriers in UK and 2 out of top 10 in NA are existing customers • M&A • Track record of 5 acquisition since 2008 and successfully integrating them • Potential acquisitions to add capability to existing platform, expand client base, geographic presence and build management team

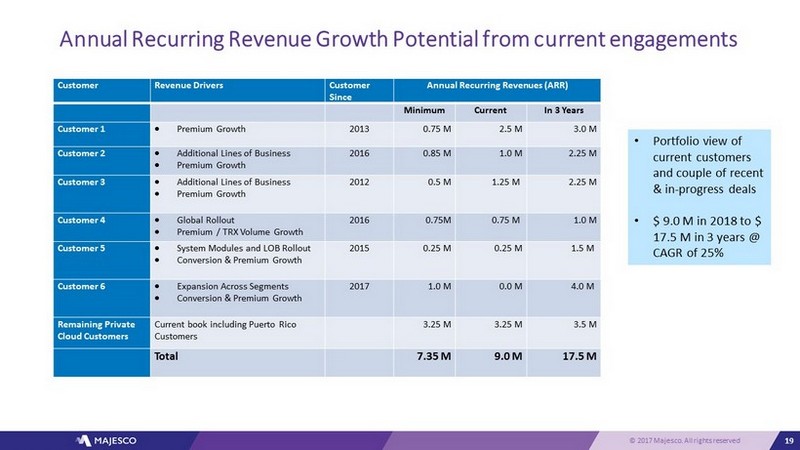

19 © 2017 Majesco. All rights reserved Annual Recurring Revenue Growth Potential from current engagements Customer Revenue Drivers Customer Since Annual Recurring Revenues (ARR) Minimum Current In 3 Years Customer 1 Premium Growth 2013 0.75 M 2.5 M 3.0 M Customer 2 Additional Lines of Business Premium Growth 2016 0.85 M 1.0 M 2.25 M Customer 3 Additional Lines of Business Premium Growth 2012 0.5 M 1.25 M 2.25 M Customer 4 Global Rollout Premium / TRX Volume Growth 2016 0.75M 0.75 M 1.0 M Customer 5 System Modules and LOB Rollout Conversion & Premium Growth 2015 0.25 M 0.25 M 1.5 M Customer 6 Expansion Across Segments Conversion & Premium Growth 2017 1.0 M 0.0 M 4.0 M Remaining Private Cloud Customers Current book including Puerto Rico Customers 3.25 M 3.25 M 3.5 M Total 7 .35 M 9.0 M 17.5 M • Portfolio view of current customers and couple of recent & in - progress deals • $ 9.0 M in 2018 to $ 17.5 M in 3 years @ CAGR of 25%

20 © 2017 Majesco. All rights reserved Margin Drivers • Increasing Cloud & Subscription business as portion of Majesco revenue • Improving Subscription Margins with benefits of scale on cloud platform • Operating Leverage (SG&A and Product Costs)

Thank You www.majesco.com