Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - Jerash Holdings (US), Inc. | v474624_ex23-1.htm |

As filed with the Securities and Exchange Commission on September 7, 2017

Registration No. 333-218991

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 2

To

Form S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Jerash Holdings (US), Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2300 | 81-4701719 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Jerash Holdings (US), Inc.

Al-Tajamouat Industrial Estate

Sahab - P.O. Box 22

Amman, 11636, Jordan

(962) 6402-0640

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Choi Lin Hung

President

Al-Tajamouat Industrial Estate

Sahab - P.O. Box 22

Amman, 11636, Jordan

(962) 6402-0640

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

James M. Jenkins, Esq.

Alexander R. McClean, Esq.

Harter Secrest & Emery LLP

1600 Bausch & Lomb Place

Rochester, New York 14604

(585) 232-6500

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x |

| (Do not check if a smaller reporting company) |

Emerging Growth Company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. x

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share(2) | Proposed Maximum Aggregate Offering Price(2) | Amount of Registration Fee(2) | ||||||||||||

| Common Stock, par value $0.001 per share | 1,541,750 | $ | 6.00 | $ | 9,250,500 | $ | 1,072.13 | |||||||||

| Common Stock Underlying Warrants | 69,000 | $ | 6.00 | $ | 414,000 | $ | 47.98 | |||||||||

| Total | 1,610,750 | $ | 6.00 | $ | 9,644,500 | $ | 1,120.12 | (3) | ||||||||

| (1) | In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act. |

| (2) | Estimated solely for purposes of calculating the amount of the registration fee in accordance with Rule 457(a) of the Securities Act of 1933. |

| (3) | The Company previously paid this amount. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Dated September 7, 2017

PROSPECTUS (Subject to Completion)

JERASH HOLDINGS (US), Inc.

1,541,750 Shares of Common Stock and

up to 69,000 Shares of Common Stock Underlying Warrants

This prospectus relates to the offering and resale by the selling stockholders identified herein of up to (i) 690,000 shares of common stock, par value $0.001 per share of Jerash Holdings (US), Inc., and (ii) 69,000 shares of common stock that are issuable upon the exercise of the warrants, issued in connection with a private placement offering that we closed on May 15, 2017 (the “Private Placement”), and (iii) 851,750 shares of our common stock. The warrants are exercisable at an exercise price of $6.25 per full share until May 15, 2022 with respect to 49,000 underlying shares and until August 18, 2022 with respect to 20,000 underlying shares.

We will not receive any proceeds from the sale of the common stock or warrants covered by this prospectus. However, we will receive proceeds from the exercise of the warrants if the warrants are exercised for cash. We intend to use those proceeds, if any, for general corporate purposes. We have agreed to bear the expenses relating to the registration of the securities of the selling stockholders.

The selling stockholders may sell any, all or none of the securities offered by this prospectus and we do not know when or in what quantity the selling stockholders may sell their shares of common stock hereunder following the effective date of this registration statement.

Our common stock is presently not traded on any market or securities exchange. After the effective date of the registration statement, we intend to seek a market maker to file an application with the Financial Industry Regulatory Authority, or FINRA, to have our common stock quoted on the OTCQB Market. There can be no assurance that a market maker will agree to file the necessary documents with FINRA, nor can there be any assurance that such an application for quotation will be approved.

The selling stockholders may sell the shares of our common stock at prices ranging from $5.00 to $6.00 per share until such time as our shares are quoted on the OTCQB Market, at which time they may be sold at prevailing market prices or in privately negotiated transactions. The selling stockholders have not engaged any underwriter in connection with the sale of our securities. The selling stockholders may offer and sell our securities in a variety of transactions as described under “Plan of Distribution” beginning on page 48, including transactions on any market on which our common stock is quoted, in privately negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to such market prices or at negotiated prices.

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, or “JOBS Act,” and, as such, have elected to comply with reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus dated , 2017

| 1 |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus and any prospectus supplement prepared by or on behalf of us or to which we have referred you. We have not authorized anyone to provide you with information that is different. If anyone provides you with different or inconsistent information, you should not rely upon it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information in this prospectus is complete and accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since these dates.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Jerash,” the “Company,” “we,” “us,” “our” and similar references refer to Jerash Holdings (US), Inc., which is the parent holding company of our operating subsidiaries, Jerash Garments and Fashions Manufacturing Company Limited (“Jerash Garments”), which is an entity formed under the laws of the Hashemite Kingdom of Jordan (“Jordan”), and Treasure Success International Limited (“Treasure Success”), which is an entity formed under the laws of Hong Kong.

| 2 |

The following summary highlights information contained elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our securities. Before you decide to invest in our securities, you should read and carefully consider the following summary together with the entire prospectus, including our consolidated financial statements and the related notes thereto appearing elsewhere in this prospectus and the matters discussed in the sections in this prospectus entitled “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Some of the statements in this prospectus constitute forward-looking statements that involve risks and uncertainties. See the section in this prospectus entitled “Special Note Regarding Forward-Looking Statements.” Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus.

Our Company

Through our operating subsidiaries, we are principally engaged in the manufacturing and exporting of customized, ready-made outerwear from knitted fabric from our production facilities in Jordan. Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Jerash,” the “Company,” “we,” “us,” “our” and similar references refer to Jerash Holdings (US), Inc. after giving effect to the Merger (as defined below), with Jerash Holdings (US), Inc. as the parent holding company of our operating subsidiaries, Jerash Garments, including its wholly owned subsidiaries, and Treasure Success.

We are an approved manufacturer by many well-known brands and retailers, such as Walmart, Costco, Sears, Hanes, Columbia, Land’s End, VF Corporation (which owns brands such as The North Face, Nautica, Timberland, Wrangler, Lee, Jansport, etc.), and Philip-Van Heusen (which owns brands such as Calvin Klein, Tommy Hilfiger, IZOD, Speedo, etc.). Our production facilities are made up of three factory units and two warehouses and employ approximately 2,500 people. Our employees include local Jordanian workers as well as import workers from Bangladesh, Sri Lanka, India, Myanmar and Nepal. The total annual capacity at our facilities is approximately 6.5 million pieces.

Our Strategy

We are focused on growing our operations by expanding existing production facilities and establishing beneficial relationships with neighboring factories; diversifying our range of products to include additional pieces such as trousers and urban styling outerwear and different types of natural and synthetic materials; and expanding our workforce with import workers in Jordan from other countries. We also seek to diversify our sales geographically by exploring acquisition opportunities to further diversify our product range and export locations. We continue to focus on increasing customer diversification by introducing new customers as a result of our increased product and geographical offerings described above.

Risks Associated with Our Business

Before you invest in our securities, you should carefully consider all the information in this prospectus, including the following risks and uncertainties that may materially affect our business, financial condition, results of operations and prospects, as described more fully in the section entitled “Risk Factors:”

| · | We may require additional financing to fund our operations and capital expenditures; if we are unable to obtain such additional financing our business operations may be harmed; |

| · | Future sales and issuances of our capital stock or rights to purchase capital stock could result in substantial dilution to our stockholders; |

| · | We rely on one key customer for substantially all of our revenue; |

| · | We are dependent on a single produce segment comprised of a limited number of products; |

| · | Our customers are in the clothing retail industry, which is subject to substantial cyclical variations; |

| · | We face intense competition in the worldwide apparel manufacturing industry; |

| · | Becoming subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the “Exchange Act” and the requirements of the Sarbanes-Oxley Act of 2002, may strain our resources, increase our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner; we estimate that we may incur approximately $735,000 in costs during the fiscal years ending March 31, 2018 and 2019 in connection with becoming a public company; and |

| · | There is no current trading market for our securities, and if a trading market does not develop, you may be unable to resell your securities. |

| 3 |

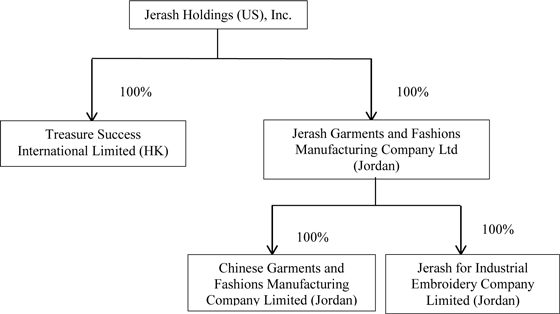

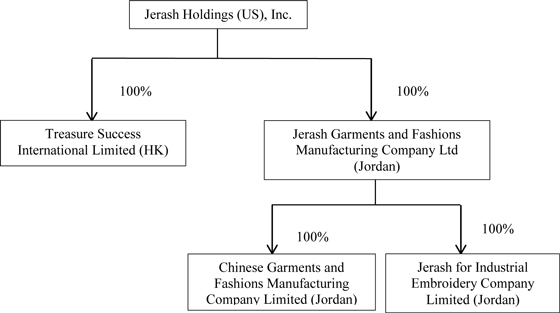

Organizational Structure

We have the following wholly-owned subsidiaries: (i) Jerash Garments, an entity formed under the laws of Jordan, (ii) Treasure Success, an entity formed under the laws of Hong Kong, (iii) Chinese Garments and Fashions Manufacturing Company Limited, an entity formed under the laws of Jordan and a wholly owned subsidiary of Jerash Garments (“Chinese Garments”), and (iv) Jerash for Industrial Embroidery Company Limited, an entity formed under the laws of Jordan and a wholly owned subsidiary of Jerash Garments (“Jerash Embroidery”).

This table reflects our organizational structure:

Jerash Garments was established in Jordan in November 2000 and operates out of our factory unit in Al Tajamouat Industrial City, a Qualifying Industrial Zone in Amman, Jordan. Jerash Garments’ principal activities are to house management offices and to operate production lines and sewing, ironing, packing and quality control units, as well as house our trims and finished products warehouses.

Chinese Garments was established in Jordan in June 2013 and operates out of our factory unit in Al Tajamouat Industrial City, a Qualifying Industrial Zone in Amman, Jordan. Chinese Garments’ principal activities are to house administration, human resources, finance and management offices and to operate additional production lines and sewing, ironing, and packing units, as well as house our trims warehouse.

Jerash Embroidery was established in Jordan in March 2013 and operates out of our factory unit in Al Tajamouat Industrial City, a Qualifying Industrial Zone in Amman, Jordan. Jerash Embroidery’s principal activities are to perform the cutting and embroidery for our products.

Treasure Success was established in Hong Kong in July 2016 and operates in Hong Kong. Treasure Success’s primary activities are to employ sales and merchandising staff and supporting personnel in Hong Kong to support the business of Jerash Garments and its subsidiaries.

Our Corporate Information

Jerash Holdings (US), Inc. is a holding company organized in Delaware in January 2016 with nominal or no assets or operations. On May 11, 2017, we implemented two transactions, the first being an equity contribution whereby the shareholders of Global Trend Investments Limited, a limited company incorporated in the British Virgin Islands (“Global Trend”), contributed 100% of the outstanding capital stock of Global Trend to Jerash Holdings (US), Inc. in exchange for an aggregate of 8,787,500 shares of common stock of Jerash Holdings (US), Inc., with Global Trend becoming the wholly-owned subsidiary of Jerash Holdings (US), Inc. In the second transaction, Global Trend merged with and into Jerash Holdings (US), Inc., with Jerash Holdings (US), Inc. being the surviving entity, as a result of which Jerash Holdings (US), Inc. became the direct parent of Global Trend’s wholly-owned operating subsidiaries, Jerash Garments, including its wholly owned subsidiaries, and Treasure Success. The transactions described above are collectively referred to in this prospectus as the “Merger”.

| 4 |

Our principal executive offices are located at Al-Tajamouat Industrial Estate, Sahab - P.O. Box 22, Amman, 11636, Jordan, and our telephone number is (962) 6402-0640. Our website address is www.jerashgarments.com. Our website and the information contained on, or that can be accessed through, our website will not be deemed to be incorporated by reference in, and are not considered part of, this prospectus or the registration statement of which it forms a part. You should not rely on any information on our website in making your decision to purchase our common stock.

Accounting Treatment of Merger

For accounting purposes, Global Trend is recognized as the accounting acquirer, and Jerash Holdings (US), Inc. is the legal acquirer or accounting acquiree. As such, following the Merger, the historical financial statements of Global Trend are treated as the historical financial statements of the combined company. Accordingly, the financial results presented in this prospectus reflect the operations of Global Trend, its subsidiaries and its affiliate, which includes as a variable interest entity Victory Apparel (Jordan) Manufacturing Company Limited, an entity formed under the laws of Jordan (“Victory Apparel”). Victory Apparel was incorporated in Jordan in 2005 and it is a wholly owned subsidiary of Wealth Choice Limited ("WCL"), a BVI corporation and the former sole shareholder of Global Trend. WCL acquired Global Trend and Jerash Garments from two third party individuals on March 21, 2012. On March 31, 2006, Victory Apparel purchased all of the property and equipment of Jerash Garments at an industrial building in Al Tajamouat Industrial City purchased by Jerash Garments on July 31, 2000. The land and building was not registered in Victory Apparel’s name, and Jerash Garments continued to hold the land and building in its name in trust for Victory Apparel. The declaration of trust was never registered with the Land Registry of Jordan, and on June 30, 2016, Victory Apparel and Jerash Garments dissolved the sale agreement, resulting in the property and equipment being owned free and clear by Jerash Garments. Victory Apparel does not currently have any material assets or operations of its own, and Mr. Choi Lin Hung and Mr. Lee Kian Tjiauw, our significant stockholders who together indirectly own 100% of Victory Apparel through WCL, intend to dissolve the entity. See the section titled “Related Party Transactions”.

| 5 |

Implications of Being an Emerging Growth Company

We qualify as an emerging growth company as that term is used in the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. These provisions include:

| · | A requirement to have only two years of audited financial statements and only two years of related MD&A; |

| · | Exemption from the auditor attestation requirement in the assessment of the emerging growth company’s internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002; and |

| · | Reduced disclosure about the emerging growth company’s executive compensation arrangements. |

We have already taken advantage of these reduced reporting burdens in this prospectus, which are also available to us as a smaller reporting company as defined under Rule 12b-2 of the Exchange Act.

We could remain an emerging growth company for up to five years, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

| 6 |

The Offering

| Securities offered by the selling stockholders | Up to (i) 690,000 shares of our common stock and (ii) 69,000 shares of common stock that are issuable upon the exercise of the warrants, issued in connection with the Private Placement, and (iii) 851,750 shares of our common stock. The warrants are exercisable at an exercise price of $6.25 per full share until May 15, 2022 with respect to 49,000 underlying shares and August 18, 2022 with respect to 20,000 underlying shares. | |

| Offering price | $5.00-$6.00 per share of common stock until such time as our shares are quoted on the OTCQB Market, at which time they may be sold at prevailing market prices or in privately negotiated transactions. | |

| Common stock outstanding prior to this offering (1) | 9,870,000 shares | |

| Common stock to be outstanding following this offering (2) | 9,939,000 shares (assuming the warrants are exercised in full) | |

| Use of proceeds | We will not receive any proceeds from the sale of the common stock or warrants offered by the selling stockholders under this prospectus. However, we will receive proceeds from the exercise of the warrants if the warrants are exercised for cash. We intend to use those proceeds, if any, for general corporate purposes. See “Use of Proceeds.” | |

| Risk factors | You should read the section of this prospectus entitled “Risk Factors” for a discussion of factors to carefully consider before deciding to invest in shares of our common stock. |

| (1) | The number of shares of our common stock outstanding prior to this offering is based on 9,870,000 shares outstanding as of September 7, 2017, and excludes the following: |

| · | 74,000 shares of common stock issuable upon exercise of outstanding warrants at an exercise price of $6.25 |

| · | 50,000 shares of common stock issuable upon exercise of outstanding warrants at an exercise price of $5.00 |

| · | Common stock underlying warrants to purchase 48,600 units, with each unit consisting of one share of our common stock and one warrant (with each such warrant being immediately exercisable for one-tenth (1/10th) of one share of common stock at an exercise price of $6.25 per share for a period of five years from the issuance date), at an exercise price of $5.50 per unit |

| (2) | The number of shares of our common stock outstanding following this offering is based on 9,870,000 shares outstanding as of September 7, 2017, and excludes the following: |

| · | 5,000 shares of common stock issuable upon exercise of outstanding warrants at an exercise price of $6.25 |

| · | 50,000 shares of common stock issuable upon exercise of outstanding warrants at an exercise price of $5.00 |

| · | Common stock underlying warrants to purchase 48,600 units, with each unit consisting of one share of our common stock and one warrant (with each such warrant being immediately exercisable for one-tenth (1/10th ) of one share of common stock at an exercise price of $6.25 per share for a period of five years from the issuance date), at an exercise price of $5.50 per unit |

| 7 |

An investment in the securities offered hereby is speculative in nature, involves a high degree of risk, and should not be made by an investor who cannot bear the economic risk of its investment for an indefinite period of time and who cannot afford the loss of its entire investment. Each prospective investor should carefully consider the following risk factors, as well as other information contained elsewhere in this prospectus, before making an investment. If any of the following issues actually materializes, our operating results, financial condition and liquidity could be adversely affected, and you could lose part or all of your investment. The risks below are not the only ones we face. Additional risks presently unknown to us, and risks that are known to us that we currently consider immaterial, could also adversely affect our operating results, financial condition and liquidity.

Risks Related to Our Business and our Industry

We may require additional financing to fund our operations and capital expenditures.

On December 14, 2016, we paid a dividend in an amount equal to $5,307,500 to our shareholders. As of June 30, 2017, we had cash and cash equivalents of approximately $1.5 million and restricted cash of approximately $0.5 million. There can be no assurances that our available cash, together with resources from our operations, will be sufficient to fund our operations and capital expenditures. In addition, our cash position may decline in the future, and we may not be successful in maintaining an adequate level of cash resources. Treasure Success has been in discussions to enter into a secured credit facility with HSBC for up to a minimum of $20,000,000 (the “ Secured Credit Facility ”) to finance the working capital needs of the Company. Pursuant to a letter agreement dated May 29, 2017, Treasure Success entered into an $8,000,000 import credit facility with Hong Kong Shanghai Banking Corporation (“HSBC”). In addition, pursuant to an offer letter dated June 5, 2017, HSBC offered to provide Treasure Success with a $12,000,000 factoring facility, subject to the completion of final documentation. In addition, we may be required to seek additional debt or equity financing in order to support our growing operations. We may not be able to obtain additional financing on satisfactory terms, or at all, and any new equity financing could have a substantial dilutive effect on our existing stockholders. If we cannot obtain additional financing, we may not be able to achieve our desired sales growth, and our results of operations would be negatively affected.

Defaults under the Secured Credit Facility could result in a foreclosure on our assets by our lender which may result in a loss of your investment.

Pursuant to a letter agreement dated May 29, 2017, Treasure Success entered into an $8,000,000 import credit facility with HSBC. In addition, pursuant to an offer letter dated June 5, 2017, HSBC offered to provide Treasure Success with a $12,000,000 factoring facility, subject to the completion of final documentation. These facilities will be guaranteed by us and Jerash Garments, as well as by our significant stockholders Mr. Choi Lin Hung and Mr. Ng Tsze Lun, whose interests may differ from the other stockholders of the Company as a result of their personal guarantees. These facilities will be collateralized by a blanket security interest and include various financial and other covenants. If in the future we default under our facilities, our lender could, among other things, declare our debt to be immediately due and payable. If this were to occur, we would be unable to repay our bank debt in full unless we could sell sufficient assets or obtain new financing through a replacement credit facility or equity transaction. If a new credit facility could be obtained, it is likely that it would have higher interest rates and impose significant additional restrictions and requirements on us. New securities issuances would dilute your stock ownership. There is no assurance that we would be able to obtain a waiver or amendment from our lender or obtain replacement debt financing or issue sufficient equity securities to refinance these facilities. If we are unable to pay off the facility, our lender could foreclose on our assets, which may result in a loss of your investment.

We rely on one key customer for substantially all of our revenue. We cannot assure that this customer or any other customer will continue to buy our products in the same volumes or on the same terms.

Our sales to VF Corporation, directly and indirectly, accounted for approximately 85% of our total sales in the fiscal year ended March 31, 2016, which we refer to as “fiscal 2016”, approximately 79% of our total sales in the fiscal year ended March 31, 2017, which we refer to as “fiscal 2017,” and 82% and 84% of our total sales during the first quarter of the year ended March 31, 2018, which we referred to as “fiscal 2018,” and fiscal 2017, respectively.

We are not party to any long-term contracts with VF Corporation or our other customers, and our sales arrangements with our customers do not have minimum purchase requirements. As is common in our industry, VF Corporation and our other customers place purchase orders to us after we complete detailed sample development and approval processes that we and our customers agree to the purchase and manufacture of the garments in question. It is through the sample development and approval processes that we and VF Corporation agree to the purchase and manufacture of the garments in question. From April 1, 2017 to July 26, 2017, VF Corporation issued approximately 2,200 purchase orders to us in amounts ranging from approximately $10 to $570,000. We are not substantially dependent on any particular order from VF Corporation.

We cannot assure that our end customers will continue to buy our products at all or in the same volumes or on the same terms as they have in the past. Failures of VF Corporation to continue to buy our products in the same volumes and on the same terms as in the past may significantly reduce our sales and our earnings. In addition, we cannot assure that we will be able to attract new customers.

A material decrease in the quantity of sales made to our principal customers, a material adverse change in the terms of such sales or a material adverse change in the financial condition of our principal customers could significantly reduce our sales and our earnings.

We cannot assure you that VF Corporation will continue to purchase our merchandise at the same rate as they have historically purchased, or at all in the future, or that we will be able to attract new customers. In addition, because of our reliance on them as our key customer and their bargaining power with us, VF Corporation has the ability to exert significant control over our business decisions, including prices.

| 8 |

We have historically depended on Ford Glory for substantially all of our sales.

Until August 2016, substantially all of our sales were through Ford Glory International Limited (“ Ford Glory ”), which Ford Glory then sold to the end-customers. Ford Glory is 49% owned by Mr. Choi Lin Hung, our director and a significant stockholder, through his wholly-owned entity Merlotte Enterprise Limited (“ Merlotte ”). Pursuant to the terms of a sale and purchase agreement dated July 13, 2016 between Lee Kian Tjiauw, a significant stockholder of ours, and Victory City Investments Limited (“Victory City”), which at that time was the ultimate 51% shareholder of our predecessor entity, Global Trend (the “Sale and Purchase Agreement”), Victory City sold its 51% interest in RS International Holdings Limited, an investment holding company to Mr. Lee. Pursuant to the Sale and Purchase Agreement, and effective since August 1, 2016, all rights, interests and benefits of any contracts entered into with or sale/purchase orders made by any subsidiary of Victory City International Holdings Limited, the parent of Victory City, on or prior to August 1, 2016 in respect of the sale and purchase of garment products manufactured or to be manufactured by the Company or one of our subsidiaries, together with the costs and obligations relating to those contracts, were transferred to the relevant subsidiary. Thereafter, we began conducting business directly with the end-customers and no longer through our affiliate, Ford Glory. Following August 1, 2016, there was a transition period for orders placed directly with Ford Glory. For the fiscal year ended March 31, 2017 and for the first quarter of fiscal 2018, approximately 37.6% and 0%, respectively, of our net sales were made to Ford Glory, which Ford Glory then sold to the end-customers, and approximately 52.6% and 87.9% of our net sales for the fiscal year ended March 31, 2017 and for the first quarter of fiscal 2018, respectively, were made directly to end-customers with the support of Ford Glory. For sales orders received before customers successfully changed their vendor registrations to issue orders directly to the Company, the Company actually fulfilled the order for customers, including inventory purchases and manufacturing. As customers have almost entirely started to issue sales orders directly to the Company, support from Ford Glory will continue to fade in the coming quarters. We no longer rely on Ford Glory to receive sales order for us, and we intend in the future to continue to sell all of our products directly to the end-customers for our products, and our merchandising personnel now receive orders directly from the end-customers through our wholly-owned subsidiaries, Treasure Success and Jerash Garments. While we intend in the future to continue to sell our products directly to the end-customers, there can be no guaranty that we will effectively make such a transition or that the end-customers will continue to purchaser merchandise from us at the same rate as they have historically purchased from Ford Glory or at all. In addition, if Ford Glory withdrew their support from our business, the associated loss of sales would significantly decrease our revenues and adversely affect our results of operations to the point that we might be forced to cease operations. See “Related Party Transactions.”

Because we depend on related parties as suppliers, we may not be able to always obtain materials when we need them and we may lose sales and customers.

For the fiscal year ended March 31, 2017 and for the first quarter of fiscal 2018, we purchased approximately 13% and 5%, and 0% and 0%, respectively, of our raw materials from two related major suppliers, Value Plus (Macao Commercial Offshore) Limited (“Value Plus”) and Ford Glory. For the fiscal year ended March 31, 2016 and for the first quarter of fiscal 2017, we purchased approximately 77% and 23%, and 83% and 14%, respectively, of our raw materials from these two related major suppliers, respectively. Value Plus and Ford Glory are each 49% owned by Mr. Choi Lin Hung, our director and a significant stockholder through his wholly-owned entity Merlotte. Historically, we have purchased these raw materials directly from our related party suppliers, which our related party suppliers purchase from the approved suppliers for our end customers. We have not entered into any contracts with our related party suppliers. While we intend in the future to continue to purchase raw materials directly from the approved suppliers for our products, there can be no guaranty that we will effectively make such a transition. Shortages or disruptions in the supply of materials from our related party suppliers, or our inability to procure materials from alternate sources at acceptable prices in a timely manner, could lead us to miss deadlines for orders and lose sales and customers.

The requirements of being a public company, including compliance with the reporting requirements of the Exchange Act and the requirements of the Sarbanes-Oxley Act, may strain our resources, increase our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner.

Following this offering, we will need to comply with new laws, regulations, requirements and certain corporate governance provisions under the Exchange Act and the Sarbanes-Oxley Act. Complying with these statutes, regulations and requirements will occupy a significant amount of time of our board of directors and management, and will significantly increase our costs and expenses and will make some activities more time-consuming and costly. In connection with becoming a reporting company, we will need to:

| · | institute a more comprehensive compliance function; |

| · | prepare and distribute periodic and current reports under the federal securities laws; |

| · | establish new internal policies, such as those related to insider trading; and |

| · | involve and retain to a greater degree outside counsel and accountants. |

Our ongoing compliance efforts will increase general and administrative expenses and may divert management’s time and attention from the development of our business, which may adversely affect our financial condition and results of operations. We estimate that we may incur approximately $735,000 in costs during the fiscal years ending March 31, 2018 and 2019 in connection with becoming a public company.

We may have conflicts of interest and have engaged in transactions with affiliates and have entered into agreements or arrangements that were not negotiated at arms’ length.

We have engaged, and may in the future engage, in transactions with affiliates and other related parties. These transactions may not have been on terms as favorable to us as could have been obtained from non-affiliated persons. While an effort has been made and will continue to be made to obtain services from affiliated persons and other related parties at rates and on terms as favorable as would be charged by others, there will always be an inherent conflict of interest between our interests and those of our affiliates and related parties. Through his wholly-owned entity Merlotte, Mr. Choi Lin Hung, our director and a significant stockholder, has an indirect ownership interest in certain of the companies, including Ford Glory and Value Plus, with which we have, or in the future may have, such agreements or arrangements. In addition, we have entered into agreements with Victory Apparel, which is wholly-owned by Mr. Choi Lin Hung and Mr. Lee Kian Tjiauw, a significant stockholder. See “Related Party Transactions.” Our majority stockholders may economically benefit from the use of these companies.

| 9 |

Any adverse change in our relationship with VF Corporation and its The North Face brand, or with their strategies and/or reputation, would have a material adverse effect on our results of operations.

Substantially all of our products are sold under The North Face brand that is owned by VF Corporation. Any adverse change in our relationship with VF Corporation would have a material adverse effect on our results of operations. In addition, our sales of those products could be materially and adversely affected if either VF Corporation’s or The North Face brand’s images, reputations or popularity were to be negatively impacted.

If we lose our larger brand and retail nominations or end customers, or the customers fail to purchase at anticipated levels, our sales and operating results will be adversely affected.

Our results of operations depend to a significant extent upon the commercial success of our larger brand nominations and end customers. If we lose our significant brand nominations, or our end customers fail to purchase our products at anticipated levels, or our relationship with these customers or the brands and retailers they serve diminishes, it may have an adverse effect on our results because we may lose a primary source of revenue if these customers choose not to purchase our products; we may lose the nomination of the retailer or brand; we may not be able to recoup development and inventory costs associated with these customers; and we may not be able to collect our receivables from them.

If the market share of our customers declines, our sales and earnings may decline.

Our sales can be adversely affected in the event that our direct and indirect end customers do not successfully compete in the markets in which they operate. In the event that the sales of one of our major end customers decline for any reason, irrespective of whether it is related to us or to our products, our sales to such customer may also decline, which could reduce our overall sales and our earnings.

We are dependent on a single product segment comprised of a limited number of products.

Presently, our product offering is limited primarily to outerwear from knitted fabric. A shift in demand from such products may result in reductions in the growth of new business for our products, as well as reductions in existing business. If such a trend were to occur, we may be forced to expand or transition our product offerings to other segments of the clothing retail industry. There can be no assurance that we would be able to successfully make such an expansion or transition, or that our sales and margins would not decline in the event we made such an expansion or transition.

Our direct and indirect end customers are in the clothing retail industry, which is subject to substantial cyclical variations which could have a material adverse effect on our results of operations.

Our direct and indirect end customers are in the clothing retail industry, which is subject to substantial cyclical variations and is affected strongly by any downturn or slowdown in the general economy. Factors that may influence our operating results from quarter to quarter include:

| ● | the volume and timing of customer orders received during the quarter; |

| ● | the timing and magnitude of our customers’ marketing campaigns; |

| ● | the loss or addition of a major customer or of a major retailer nomination; |

| ● | the availability and pricing of materials for our products; |

| ● | the increased expenses incurred in connection with the introduction of new products; |

| ● | currency fluctuations; |

| ● | political factors that may affect the expected flow of commerce; and |

| ● | delays caused by third parties. |

In addition, uncertainty over future economic prospects could have a material adverse effect on our results of operations. Many factors affect the level of consumer spending in the industry, including, among others:

| ● | general business conditions; |

| ● | interest rates; |

| ● | the availability of consumer credit; |

| ● | taxation; and |

| ● | consumer confidence in future economic conditions. |

Consumer purchases of discretionary items, including our products, may decline during recessionary periods and also may decline at other times when disposable income is lower. Consequently, our customers may have larger inventories of our products than expected, and they may reduce the size of their orders, change the payment terms, limit their purchases to a lower price range and try to change their purchase terms.

| 10 |

The clothing retail industry is subject to changes in fashion preferences. If our customers misjudge a fashion trend or the price which consumers are willing to pay for our products, our revenues could be adversely affected.

The clothing retail industry is subject to changes in fashion preferences. We design and manufacture products based on our end customers’ judgment as to what products will appeal to consumers and what price consumers would be willing to pay for our products. Our end customers may not be successful in accurately anticipating consumer preferences and the prices that consumers would be willing to pay for our products. Our end customers may reduce the volume of their purchases from us and/or the prices at which we sell our products will decline if our end customers are not successful, in either case resulting in reduced revenues.

If we experience product quality or late delivery problems, or if we experience financial problems, our business will be negatively affected.

We may from time to time experience difficulties in making timely delivery of products of acceptable quality. Such difficulties may result in cancellation of orders, customer refusals to accept deliveries or reductions in purchase prices, any of which could have a material adverse effect on our financial condition and results of operations. There can be no assurance that we will not experience difficulties with the manufacture of our products. In addition, we may have difficulty sourcing the raw materials for the products we manufacture from third parties at a similar cost or at all.

We face intense competition in the worldwide apparel manufacturing industry.

We compete directly with a number of manufacturers of sport and outerwear from knitted fabric, some have a lower cost-base than us, longer operating histories, larger customer bases, greater geographical proximity to customers and greater financial and marketing resources than we do. Increased competition, direct or indirect, could reduce our revenues and profitability through pricing pressure, loss of market share and other factors. We cannot assure that we will be able to compete successfully against existing or new competitors, as the market for our products evolves and the level of competition increases. We believe that our business will depend upon our ability to provide apparel products, which are of good quality and meet our customers’ pricing and delivery requirements, as well as our ability to maintain relationships with our major customers. There can be no assurance that we will be successful in this regard.

In addition, our customers operate in an intensely competitive retail environment. In the event that any of our customers’ sales decline for any reason, whether or not related to us or to our products, our sales to such customers could be materially reduced.

We have experienced material weaknesses in our internal control over financial reporting. If we fail to establish and maintain a system of disclosure controls and procedures and an effective system of internal control over financial reporting, we may not be able to accurately and timely disclose information about us and our financial results or prevent fraud. Any inability to accurately and timely disclose information and financial results could harm our business and reputation and cause the value of our securities to decline.

A system of disclosure controls and procedures is necessary to ensure that information about us and our financial results is recorded, processed, summarized and reported, in an accurate and timely fashion. Effective internal control over financial reporting is necessary for us to provide reliable financial reports and prevent fraud. If we cannot disclose required information or provide reliable financial reports, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. Our independent registered public accounting firm has identified that we have a material weakness because we lack sufficient personnel with an appropriate level of knowledge of U.S. GAAP and SEC financial reporting. Although we have taken certain steps to address this deficiency, we continue to have a material weakness and continue to determine how best to change our current system and implement a more effective system. There can be no assurance that implementation of any changes will be completed in a timely manner or that they will be adequate once implemented.

Our results of operations are subject to fluctuations in currency exchange rates.

Exchange rate fluctuations between the U.S. dollar and the Jordanian dinar or Hong Kong dollar and inflation in Jordan may negatively affect our earnings. A substantial majority of our revenues and a substantial portion of our expenses are denominated in U.S. dollars. However, a significant portion of the expenses associated with our Jordanian or Hong Kong operations, including personnel and facilities-related expenses, are incurred in Jordanian dinar or Hong Kong dollars, respectively. Consequently, inflation in Jordan or Hong Kong will have the effect of increasing the dollar cost of our operations in Jordan and Hong Kong, respectively, unless it is offset on a timely basis by a devaluation of the Jordanian dinar or Hong Kong dollar, as applicable, relative to the U.S. dollar. We cannot predict any future trends in the rate of inflation in Jordan or Hong Kong or the rate of devaluation of the Jordanian dinar or Hong Kong dollar, as applicable, against the U.S. dollar. In addition, we are exposed to the risk of fluctuation in the value of the Jordanian dinar and Hong Kong dollar vis-a-vis the U.S. dollar. Although the exchange rate between the Jordanian dinar and Hong Kong dollar against the U.S. dollar has been effectively pegged, there can be no assurance that the Jordanian dinar and Hong Kong dollar will remain pegged to the U.S. dollar. Any significant appreciation of the Jordanian dinar or Hong Kong dollar against the U.S. dollar would cause an increase in our Jordanian dinar or Hong Kong dollar expenses, as applicable, as recorded in our U.S. dollar denominated financial reports, even though the expenses denominated in Jordanian dinar or Hong Kong dollars, as applicable, will remain unchanged. In addition, exchange rate fluctuations in currency exchange rates in countries other than Jordan where we operate and do business may also negatively affect our earnings.

| 11 |

We are subject to the risks of doing business abroad.

All of our products are manufactured outside the United States, at our subsidiaries’ production facilities in Jordan. Foreign manufacturing is subject to a number of risks, including work stoppages, transportation delays and interruptions, political instability, foreign currency fluctuations, economic disruptions, expropriation, nationalization, the imposition of tariffs and import and export controls, changes in governmental policies (including U.S. policy toward these countries) and other factors which could have an adverse effect on our business. In addition, we may be subject to risks associated with the availability of and time required for the transportation of products from foreign countries. The occurrence of certain of these factors may delay or prevent the delivery of goods ordered by customers, and such delay or inability to meet delivery requirements would have a severe adverse impact on our results of operations and could have an adverse effect on our relationships with our customers.

Our ability to benefit from the lower labor costs in Jordan will depend on the political, social and economic stability of Jordan and in the Middle East in general. We cannot assure that the political, economic or social situation in Jordan or in the Middle East in general will not have a material adverse effect on our operations, especially in light of the potential for hostilities in the Middle East. The success of the production facilities also will depend on the quality of the workmanship of laborers and our ability to maintain good relations with such laborers in these countries. We cannot guarantee that our operations in Jordan or any new locations outside of Jordan will be cost-efficient or successful.

Our business could suffer if we violate labor laws or fail to conform to generally accepted labor standards or the ethical standards of our end customers.

We are subject to labor laws issued by the Jordanian Ministry of Labor for our facilities in Jordan. In addition, many of our end customers require their manufacturing suppliers to meet their standards for working conditions and other matters. If we violate applicable labor laws or generally accepted labor standards or the ethical standards of our end customers by, for example, using forced or indentured labor or child labor, failing to pay compensation in accordance with local law, failing to operate our factories in compliance with local safety regulations, or diverging from other labor practices generally accepted as ethical, we could suffer a loss of sales or customers. In addition, such actions could result in negative publicity and may damage our reputation and discourage retail customers and consumers from buying our products.

Our products may not comply with various industry and governmental regulations and our customers may incur losses in their products or operations as a consequence of our non-compliance.

Our products are produced under strict supervision and controls to ensure that all materials and manufacturing processes comply with the industry and governmental regulations governing the markets in which these products are sold. However, if these controls fail to detect or prevent non-compliant materials from entering the manufacturing process, our products could cause damages to our customers’ products or processes and could also result in fines being incurred. The possible damages, replacement costs and fines could significantly exceed the value of our products and these risks may not be covered by our insurance policies.

We depend on our suppliers for machinery and maintenance of machinery. We may experience delays or additional costs satisfying our production requirements due to our reliance on these suppliers.

We purchase machinery and equipment used in our manufacturing process from third party suppliers. If our suppliers are not able to provide us with maintenance, additional machinery or equipment as needed, we might not be able to maintain or increase our production to meet any demand for our products.

We are a holding company and rely on dividends, distributions and other payments, advances and transfers of funds from our subsidiaries to meet our obligations.

We are a holding company that does not conduct any business operations of our own. As a result, we are largely dependent upon cash dividends and distributions and other transfers from our operating subsidiaries to meet our obligations. The deterioration of income from, or other available assets of, our operating subsidiaries for any reason could limit or impair their ability to pay dividends or other distributions to us, which in turn could adversely affect our financial condition and results of operations.

Periods of sustained economic adversity and uncertainty could negatively affect our business, results of operations and financial condition.

Disruptions in the financial markets, such as what occurred in the global markets in 2008, may adversely impact the availability and cost of credit for our customers and prospective customers, which could result in the delay or cancellation of customer purchases. In addition, disruptions in the financial markets may have an adverse impact on regional and world economies and credit markets, which could negatively impact the availability and cost of capital for us and our customers. These conditions may reduce the willingness or ability of our customers and prospective customers to commit funds to purchase our services or products, or their ability to pay for our services after purchase. These conditions could result in bankruptcy or insolvency for some customers, which would impact our revenue and cash collections. These conditions could also result in pricing pressure and less favorable financial terms to us and our ability to access capital to fund our operations.

| 12 |

Risks Related to Operations in Jordan

We are affected by conditions to, and possible reduction of, free trade agreements.

We benefit from exemptions from customs duties and import quotas due to our location in Al Tajamouat Industrial City, a Qualifying Industrial Zone in Amman, Jordan, and the free trade agreements with the United States. Qualifying Industrial Zones (“QIZ”) are industrial parks that house manufacturing operations in Jordan and Egypt. They are special free trade zones established in collaboration with Israel to take advantage of the free trade agreements between the United States and Israel. Under the trade agreement between Jordan and the U.S., goods produced in QIZ areas can directly access U.S. markets without tariff or quota restrictions if they satisfy certain criteria. If there is a change in such benefits or if any such agreements were terminated, our profitability may be reduced.

It is uncertain what impact Donald Trump’s victory in the U.S. presidential election will have on trade agreements and tariffs and duties in the United States. As a candidate, President Trump espoused antipathy towards existing and proposed trade agreements, called for greater restrictions on free trade generally and significant increases on tariffs on good imported into the United States. It remains unclear what specifically President Trump would or would not do with respect to such trade agreements, tariffs and duties. If President Trump takes action or publicly speaks out about the need to terminate or re-negotiate existing free trade agreements, or in favor of restricting free trade and/or increasing tariffs and duties, such actions may adversely affect our sales and have a material adverse impact on our business, results of operations and cash flows.

Our results of operations would be materially and adversely affected in the event we are unable to operate our principal production facilities in Amman, Jordan.

All of our manufacturing process is performed in a complex of production facilities located in Amman, the capital of Jordan. We have no effective back-up for these operations and, in the event that we are unable to use the production facilities located in Amman, Jordan as a result of damage or for any other reason, our ability to manufacture a major portion of our products and our relationships with customers could be significantly impaired, which would materially and adversely affect our results of operation.

Our operations in Jordan may be adversely affected by social and political uncertainties or change, military activity, health-related risks or acts of terrorism.

From time to time Jordan has experienced instances of civil unrest, terrorism and hostilities among neighboring countries, including Syria and Israel. A peace agreement between Israel and Jordan was signed in 1994. Terrorist attacks, military activity, rioting, or civil or political unrest in the future could influence the Jordanian economy and our operations by disrupting operations and communications and making travel within Jordan more difficult and less desirable. Political or social tensions also could create a greater perception that investments in companies with Jordanian operations involve a high degree of risk, which could adversely affect the market and price for our securities. We do not have insurance for losses and interruptions caused by terrorist attacks, military conflicts and wars, which could subject us to significant financial losses. The realization of any of these risks could cause a material adverse effect on our business, financial condition, results of operations and cash flows.

We may face interruption of production and services due to increased security measures in response to terrorism.

Our business depends on the free flow of products and services through the channels of commerce. In response to terrorists’ activities and threats aimed at the United States, transportation, mail, financial and other services may be slowed or stopped altogether. Extensive delays or stoppages in transportation, mail, financial or other services could have a material adverse effect on our business, results of operations and financial condition. Furthermore, we may experience an increase in operating costs, such as costs for transportation, insurance and security as a result of the activities and potential delays. We may also experience delays in receiving payments from payers that have been affected by the terrorist activities. The United States economy in general may be adversely affected by terrorist activities and any economic downturn could adversely impact our results of operations, impair our ability to raise capital or otherwise adversely affect our ability to grow our business.

We are subject to regulatory and political uncertainties in Jordan.

We conduct substantially all of our business and operations in Jordan. Consequently, government policies and regulations, including tax policies, in Jordan will impact our financial performance and the market price of our common stock.

| 13 |

Jordan is a constitutional monarchy, but the King holds wide executive and legislative powers. The ruling family has taken initiatives that support the economic growth of the country. However, there is no assurance that such initiatives will be successful or will continue. The rate of economic liberalization could change, and specific laws and policies affecting manufacturing companies, foreign investments, currency exchange rates and other matters affecting investments in Jordan could change as well. A significant change in Jordan’s economic policy or any social or political uncertainties could adversely affect business and economic conditions in Jordan generally and our business and prospects.

If we violate applicable anti-corruption laws or our internal policies designed to ensure ethical business practices, we could face financial penalties and/or reputational harm that would negatively impact our financial condition and results of operations.

We are subject to anti-corruption and anti-bribery laws in the United States and Jordan. Jordan’s reputation for potential corruption and the challenges presented by Jordan’s complex business environment, including high levels of bureaucracy, red tape, and vague regulations, may increase our risk of violating applicable anti-corruption laws. We face the risk that we, our employees or any third parties such as our sales agents and distributors that we engage to do work on our behalf may take action determined to be in violation of anti-corruption laws in any jurisdiction in which we conduct business, including the Foreign Corrupt Practices Act of 1977 (“FCPA”). Any violation of the FCPA or any similar anti-corruption law or regulation could result in substantial fines, sanctions, civil and/or criminal penalties and curtailment of operations that might harm our business, financial condition or results of operations.

You may face difficulties in protecting your interests and exercising your rights as a stockholder of ours since we conduct substantially all of our operations in Jordan and all of our officers and directors reside outside of the United States.

All of our officers and directors reside outside the United States. Therefore, investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in any of these jurisdictions based upon U.S. laws, including the federal securities laws or other foreign laws against us, our officers and directors. Furthermore, we conduct substantially all of our operations in Jordan through our operating subsidiaries. Because the majority of our assets are located outside the United States, any judgment obtained in the United States against us or any of our directors and officers may not be collectible within the United States.

Risk Factors Relating to this Offering and Ownership of our Securities

There currently is no trading market for our securities and one may never develop.

There is currently no active trading market or public market for our securities and such a market, public or private, may not develop in the foreseeable future or ever and, if it does, such a market may not be sustained. We intend to seek a market maker to apply for admission to quotation of our common stock on the OTCQB Market. However, there can be no assurance that a market maker will agree to file the necessary documents with the Financial Industry Regulatory Authority, nor can there be any assurance that such an application for quotation will be approved. If for any reason our securities are not approved for quotation on the OTCQB Market or a public trading market does not otherwise develop, purchasers of the securities may have difficulty selling their shares. Accordingly, investors may bear the economic risk of an investment in our securities for an indefinite period of time.

Our majority stockholders will control the Company for the foreseeable future, including the outcome of matters requiring stockholder approval.

Immediately prior to this offering, three of our stockholders beneficially owned approximately 85.29% of our outstanding common stock. Therefore you will not have any ability to exercise control over our company, and such entities and individuals will have the ability, acting together, to elect all of our directors and to substantially influence the outcome of corporate actions requiring stockholder approval, such as: (i) a merger or a sale of the Company, (ii) a sale of all or substantially all of our asset; and (iii) amendments to our corporate documents. This concentration of voting power and control could have a significant effect in delaying, deferring or preventing an action that might otherwise be beneficial to our other stockholders and be disadvantageous to our stockholders with interests different from those entities and individuals.

Your ownership interest may be diluted by exercises of currently outstanding or committed warrants.

We have granted warrants to purchases up to 48,600 units to designees of the placement agent in connection with the Private Placement. Each unit consists of one share of our common stock and one warrant (with each such warrant being immediately exercisable for one-tenth (1/10th) of one share of common stock at an exercise price of $6.25 per share for a period of five years from the issuance date). The placement agent warrants are exercisable beginning on July 15, 2017 and will expire on May 15, 2022. The placement agent’s warrants are exercisable at a price per unit equal to $5.50.

Future sales and issuances of our capital stock or rights to purchase capital stock could result in additional dilution of the percentage ownership of our stockholders and could cause the market price of our securities to decline.

We may issue additional securities in the future. We intend to establish an equity incentive plan (the “Plan”) and reserve a number of shares of common stock equal to ten percent (10%) of the total number of shares of common stock outstanding, for issuance to certain members of management and key employees of the Company pursuant to the Plan.

| 14 |

Future sales and issuances of our capital stock or rights to purchase our capital stock could result in substantial dilution to our existing stockholders. We may sell common stock, convertible securities and other equity securities in one or more transactions at prices and in a manner as we may determine from time to time. If we sell any such securities in subsequent transactions, our stockholders may be materially diluted. New investors in such subsequent transactions could gain rights, preferences and privileges senior to those of holders of our common stock.

We do not expect to pay dividends for the foreseeable future.

We do not expect to pay dividends on our common stock for the foreseeable future. Accordingly, any potential investor who anticipates the need for current dividends from his or her investment should not purchase our common stock.

Our lack of experienced accounting staff may impact our ability to report our future financial results on a timely and accurate basis, and we need to retain the services of additional accountants and consultants with required accounting experience and expertise.

With the exception of our chief financial officer, our accounting and finance staff lacks depth and skill in the application of generally accepted accounting principles with respect to external financial reporting for Exchange Act reporting companies. We also do not have an audit committee or a member of our board of directors who would satisfy the definition of an audit committee financial expert. We intend to engage the services of additional accounting personnel and expert consultants to assist with our financial accounting and reporting requirements to develop our internal control over financial reporting and to produce timely financial reports. Until we do so, we may experience difficulty producing reliable and timely financial statements, which could cause investors to lose confidence in our reported financial information, the market price of our stock to decline significantly, we may be unable to obtain additional financing on acceptable terms, and our business and financial condition could be harmed.

We will not be required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act until the end of the second fiscal year reported on our second annual report on Form 10-K.

We will not be required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act until the end of the second fiscal year reported on our second annual report on Form 10-K. In addition, as a smaller reporting company, we will not be required to obtain an auditor attestation of management’s evaluation of internal controls over financial reporting once such internal controls are in place. As a result, we may fail to identify and remediate a material weakness or deficiency in our internal control over financial reporting, which may cause our financial statements and related disclosure to contain material misstatements and could cause delays in filing required financial statements and related reports. Furthermore, the process of designing and implementing internal controls over financial reporting may divert our internal resources and take a significant amount of time and expenditure to complete. The actual or perceived risk associated with our lack of internal controls could cause investors lose confidence in our reported financial information, which could negatively impact the market for our common stock and cause us to be unable to obtain additional financing on acceptable terms or at all, which could cause harm to our business and financial condition.

The reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors, which may lead to volatility and a decrease in the price of our common stock.

For as long as we continue to be an emerging growth company, we may take advantage of exemptions from reporting requirements that apply to other public companies that are not emerging growth companies. Investors may find our common stock less attractive because we may rely on these exemptions, which include not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. In addition, Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. We have elected to opt out of the extended transition period for complying with the revised accounting standards. This election is irrevocable. If investors find our common stock less attractive as a result of exemptions and reduced disclosure requirements, there may be a less active trading market for our common stock and our stock price may be more volatile or may decrease.

Our common stock may be subject to the “penny stock” rules of the Securities and Exchange Commission, which could make transactions in our common stock more cumbersome and may reduce the value of your investment in our securities.

Rule 15g-9 under the Exchange Act defines a “penny stock” as any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. To the extent a market develops for our common stock, there can be no assurance that our common stock will not be considered a penny stock. In order to approve a person’s account for transactions in penny stocks, the broker or dealer must: (a) obtain financial information and investment experience objectives of the person and (b) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Securities and Exchange Commission (the “SEC”) relating to the penny stock market, which, in highlight form: (a) sets forth the basis on which the broker or dealer made the suitability determination; and (b) confirms that the broker or dealer received a signed, written agreement from the investor prior to the transaction. Generally, brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make it more difficult for investors to dispose of our common stock and could depress the market value of our common stock, to the extent a market develops.

| 15 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including: any projections of earnings, revenues or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements concerning proposed new products, services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words “may,” “will,” “estimate,” “intend,” “continue,” “believe,” “expect,” “plan” or “anticipate” and other similar words. Such forward-looking statements may be contained in the sections “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” among other places in this prospectus.

Although we believe that the expectations reflected in our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties, such as those disclosed in this prospectus. We do not intend, and undertake no obligation, to update any forward-looking statement, except as required by law.

Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, expressly state that the safe harbor for forward looking statements does not apply to companies that issue penny stocks. Accordingly, the safe harbor for forward looking statements under the PSLRA is not currently available to the Company because we may be considered to be an issuer of penny stock.

DETERMINATION OF OFFERING PRICE

Following the effectiveness of the registration statement of which this prospectus forms a part, we intend to apply for quotation of our common stock on the OTCQB Market. Until such time, the selling stockholders will offer shares of our common stock offered by this prospectus at a price between $5.00 to $6.00 per share. After our shares are listed on the OTCQB, the selling stockholders will determine at what price they may sell their shares of common stock through privately negotiated transactions or otherwise at market prices at the time of sale.

We determined the offering price range of $5.00 to $6.00 per share based on the sale price of $5.00 per share and warrant sold in the Private Placement, and our plans to become a publicly traded company and continue executing on our strategic plan to increase sales quarter over quarter. The sale price in the Private Placement was based on a multiple of 4.5 times earnings, which is conservative compares to peer group companies.