Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Cornerstone Building Brands, Inc. | q32017exhibit991.htm |

| 8-K - 8-K - Cornerstone Building Brands, Inc. | ncs201709068-k.htm |

Our Mission & Vision

Q3 2017 Supplemental

Presentation

September 6, 2017

Our Mission & Vision

Forward-looking Statements

2

Certain statements and information in this presentation may constitute forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. The words “believe,” “anticipate,” “plan,” “intend,” “foresee,” “guidance,” “potential,” “expect,”

“should,” “will” “continue,” “could,” “estimate,” “forecast,” “goal,” “may,” “objective,” “predict,” “projection,” or similar expressions are

intended to identify forward-looking statements (including those contained in certain visual depictions) in this presentation. These

forward-looking statements reflect the Company's current expectations and/or beliefs concerning future events. The Company believes

the information, estimates, forecasts and assumptions on which these statements are based are current, reasonable and complete. Our

expectations with respect to the fourth quarter of fiscal 2017 and the full year fiscal 2017 that are contained in this presentation are

forward looking statements based on management’s best estimates, as of the date of this presentation. These estimates are unaudited,

and reflect management’s current views with respect to future results. However, the forward-looking statements in this presentation are

subject to a number of risks and uncertainties that may cause the Company's actual performance to differ materially from that projected

in such statements. Among the factors that could cause actual results to differ materially include, but are not limited to, industry

cyclicality and seasonality and adverse weather conditions; challenging economic conditions affecting the nonresidential construction

industry; volatility in the U.S. economy and abroad, generally, and in the credit markets; substantial indebtedness and our ability to incur

substantially more indebtedness; our ability to generate significant cash flow required to service or refinance our existing debt, including

the 8.25% senior notes due 2023, and obtain future financing; our ability to comply with the financial tests and covenants in our existing

and future debt obligations; operational limitations or restrictions in connection with our debt; increases in interest rates; recognition of

asset impairment charges; commodity price increases and/or limited availability of raw materials, including steel; interruptions in our

supply chain; our ability to make strategic acquisitions accretive to earnings; retention and replacement of key personnel; our ability to

carry out our restructuring plans and to fully realize the expected cost savings; enforcement and obsolescence of intellectual property

rights; fluctuations in customer demand; costs related to environmental clean-ups and liabilities; competitive activity and pricing pressure;

increases in energy prices; volatility of the Company's stock price; dilutive effect on the Company's common stockholders of potential

future sales of the Company's common stock held by our sponsor; substantial governance and other rights held by our sponsor; breaches

of our information system security measures and damage to our major information management systems; hazards that may cause

personal injury or property damage, thereby subjecting us to liabilities and possible losses, which may not be covered by insurance;

changes in laws or regulations, including the Dodd–Frank Act; the timing and amount of our stock repurchases; and costs and other

effects of legal and administrative proceedings, settlements, investigations, claims and other matters. See also the “Risk Factors” in the

Company's Annual Report on Form 10-K for the fiscal year ended October 30, 2016, and other risks described in documents subsequently

filed by the Company from time to time with the SEC, which identify other important factors, though not necessarily all such factors, that

could cause future outcomes to differ materially from those set forth in the forward-looking statements. The Company expressly disclaims

any obligation to release publicly any updates or revisions to these forward-looking statements, whether as a result of new information,

future events, or otherwise.

Our Mission & Vision

3Q 2017 Financial Overview (Page 1 of 2)

3

Sales were $469.4 million, an increase of $7.0 million or 1.5% from $462.4 million in

the prior year’s third quarter

• Revenues for the quarter benefited from commercial pricing discipline in the pass-through of

higher costs in a rising steel price environment

• The comparability of year-over-year activity levels and operating metrics are impacted by the

abnormal prior year’s seasonal pattern which effectively pulled activity out of the fourth

quarter and into the third quarter of 2016

Gross profit margins for the period were 24.5%, compared to 27.7% in the prior year’s

period

• Sequentially, margins improved by 50 basis points, aided by improved pass-through of higher

material costs and seasonally higher capacity utilization

• Compared to the year ago period, margins declined by 320 basis points, resulting from a less

favorable steel market environment and lower year-over-year capacity utilization, partially

mitigated by continued manufacturing cost and efficiency initiatives

ESG&A Costs decreased to $76.3 million (16.3% of sales) from $80.4 million (17.2% of

sales) aided by the ongoing cost reduction programs and lower incentive

compensation costs

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 17

Our Mission & Vision

4

3Q 2017 Financial Overview (Page 2 of 2)

Operating income was $34.1 million, down from $43.5 million

Adjusted Operating Income(1) was $36.5 million, down from $45.1 million

Net income applicable to common shares was $18.1 million, or $0.25 per diluted

common share this quarter compared to $23.6 million, or $0.32 per diluted

common share in the third quarter of fiscal 2016. On an adjusted basis(1), diluted

earnings were $0.27 per share this quarter compared to $0.33 in the prior year

period

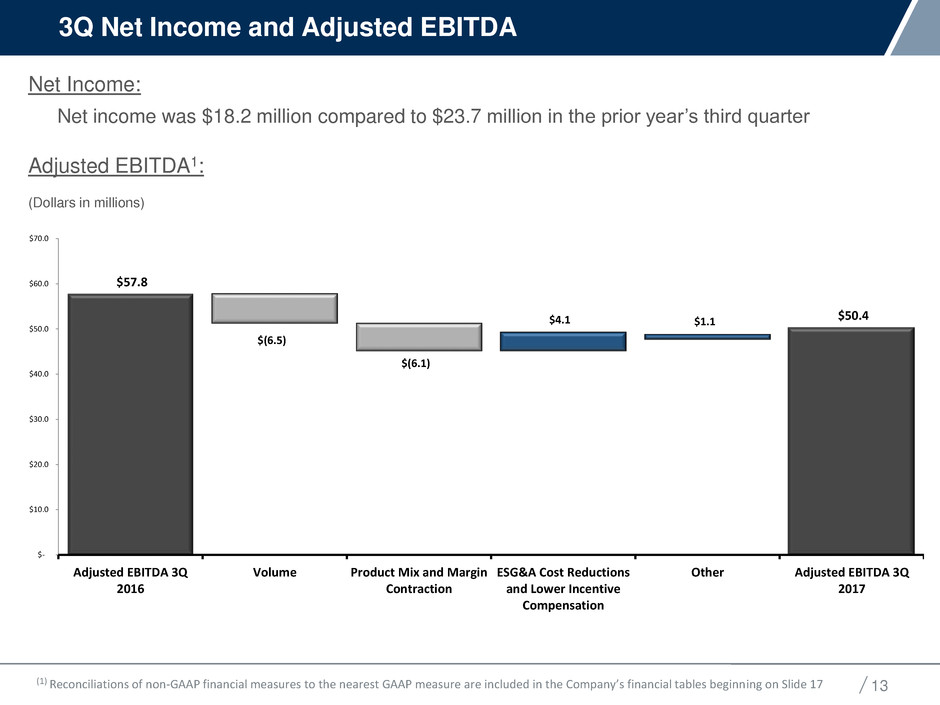

Adjusted EBITDA (1) was $50.4 million compared to $57.8 million in the prior year

period

Consolidated backlog grew 4.2% year-over-year to $580.7 million

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 17

Our Mission & Vision

5

Commercial

• Backlog in the Buildings segment at the end of the quarter increased 5.6% to

$376.8 million, resulting in the highest July backlog since 2009

• The Buildings and Components legacy distribution channels continue to

expand their product offerings, leveraging products from the other business

lines and recognizing the following revenue growth

• IMP intersegment sales increased 109% year-over-year

• Door intersegment sales increased 20% year-over-year

Steel Costs

• Steel costs continue to be elevated by trade cases and the current regulatory

environment

• Slower activity negatively impacted the flow through of higher priced inventory

layers and is reflected in the revised guidance for the fourth quarter of fiscal

2017

3Q 2017 Operational Overview

Our Mission & Vision

3Q 2017 Segment Overview (1)

6

Engineered Building Systems

• Revenue growth of 6.0% to $191.9 million, primarily as a result of improved pricing

• In the 4Q 2017, revenue will benefit from the full pass through of higher materials

costs

• At the end of the quarter, on a dollar for dollar basis, incremental material costs were being

passed through with an incremental margin

Metal Components

• Revenue growth of 3.4% to $297.0 million primarily resulting from continued growth in

insulated metal panels (“IMP”) and overhead doors through internal distribution channels

• Legacy components successfully passed through increased material costs which was offset

by lower year-over-year volumes

• Q3 of 2016 reflected an abnormal seasonal pattern for the business and volumes

were pulled forward from the Q4 of 2016 to avoid cost increases

• Lower capacity utilization negatively impacted margins in the segment partially offset by cost

and efficiency improvements

Metal Coil Coating

• Revenues declined 2.1% to $70.6 million as a result of lower volumes for both internal and

third-party customers

• Margins were compressed due to lower utilization combined with an unfavorable product

sales mix which reduced operating efficiencies

(1) Segment revenue includes intersegment sales

Our Mission & Vision

Steel Price Movements 2015 – 2017

7 Source: CRU Group

The graph above shows the monthly CRU Index data for the North American Steel Price Index. The

CRU North American Steel Price Index has been published by the CRU Group since 1994 and the

Company believes this index appropriately depicts the volatility it has experienced in steel prices. The

index is based on a CRU survey of industry participants of purchases for forward delivery, according to

mill lead time, which will vary. For example, the January index would likely approximate the Company’s

March steel purchase deliveries based on current lead-times and be representative of the steel costs

that would be recognized in April. The volatility in this steel price index is comparable to the volatility the

Company experiences in its average cost of steel.

173.9

135.3

113.3

173.8

145.0

180.6

167.2

172.3

100

110

120

130

140

150

160

170

180

190

Nov-14 Feb-15 May-15 Aug-15 Nov-15 Feb-16 May-16 Aug-16 Nov-16 Feb-17 May-17 Aug-17

Steel Price (CRU North American Index)

CRUFY 2015 FY 2016 YTD 2017

Our Mission & Vision

3Q 2017 Financial Summary

8 (1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 17

(Dollars in millions, except per share amounts)

July 30,

2017

July 31,

2016 % Chg.

July 30,

2017

July 31,

2016 % Chg.

Sales 469.4$ 462.4$ 1.5% 1,281.6$ 1,204.6$ 6.4%

Gross Profit 115.0$ 128.0$ -10.2% 299.8$ 307.0$ -2.4%

Gross Profit Margin 24.5% 27.7% -11.6% 23.4% 25.5% -8.2%

Income from Operations 34.1$ 43.5$ -21.7% 76.5$ 69.4$ 10.2%

Net Income 18.2$ 23.7$ -23.2% 37.2$ 32.0$ 16.3%

Diluted EPS 0.25$ 0.32$ -21.9% 0.52$ 0.43$ 20.9%

Adjusted Operating Income

1

36.5$ 45.1$ -19.1% 72.6$ 73.2$ -0.8%

Adjusted EBITDA

1

50.4$ 57.8$ -12.8% 113.5$ 112.4$ 1.0%

Adjusted Diluted EPS

1

0.27$ 0.33$ -18.2% 0.48$ 0.44$ 9.1%

Fiscal Three Months Ended Nine Months Ended

Our Mission & Vision

9

3Q 2017 Revenues and Volumes – by Segment

3Q-'17 3Q-'16 % Chg.

% Vol.

Chg.

1

3Q-'17 3Q-'16 % Chg.

% Vol.

Chg.

1

3Q-'17 3Q-'16 % Chg.

% Vol.

Chg.

1

Third-Party 28.7$ 30.7$ -6.4% -10.2% Third-Party 258.5$ 256.2$ 0.9% -6.9% Third-Party 182.2$ 175.5$ 3.8% -3.8%

Internal 41.8 41.4 1.1% -11.0% Internal 38.5 31.1 23.8% -6.6% Internal 9.7 5.5 75.4% 45.1%

Total Sales 70.6$ 72.1$ -2.1% -10.6% Total Sales 297.0$ 287.3$ 3.4% -6.9% Total Sales 191.9$ 181.0$ 6.0% -1.2%

Metal Coil Coating Metal Components Engineered Building Systems

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

$80.0

3Q-'17 3Q-'16

Metal Coil Coating

Third-Party Internal

$-

$50.0

$100.0

$150.0

$200.0

$250.0

$300.0

$350.0

3Q-'17 3Q-'16

Metal Components

Third-Party Internal

$-

$50.0

$100.0

$150.0

$200.0

$250.0

3Q-'17 3Q-'16

Engineered Building Systems

Third-Party Internal

Metal Coil

Coating

6%

Metal

Components

55%

Consolidated 3rd Party Revenue

3Q 2017

Metal Coil

Coating

7%

Metal

Components

55%

Consolidated 3rd Party Revenue

3Q 2016

($ in millions)

Engineered Building

Systems

39%

Engineered Building

Systems

38%

(1) Calculated as the year-over-year change in the tonnage volumes shipped

Our Mission & Vision

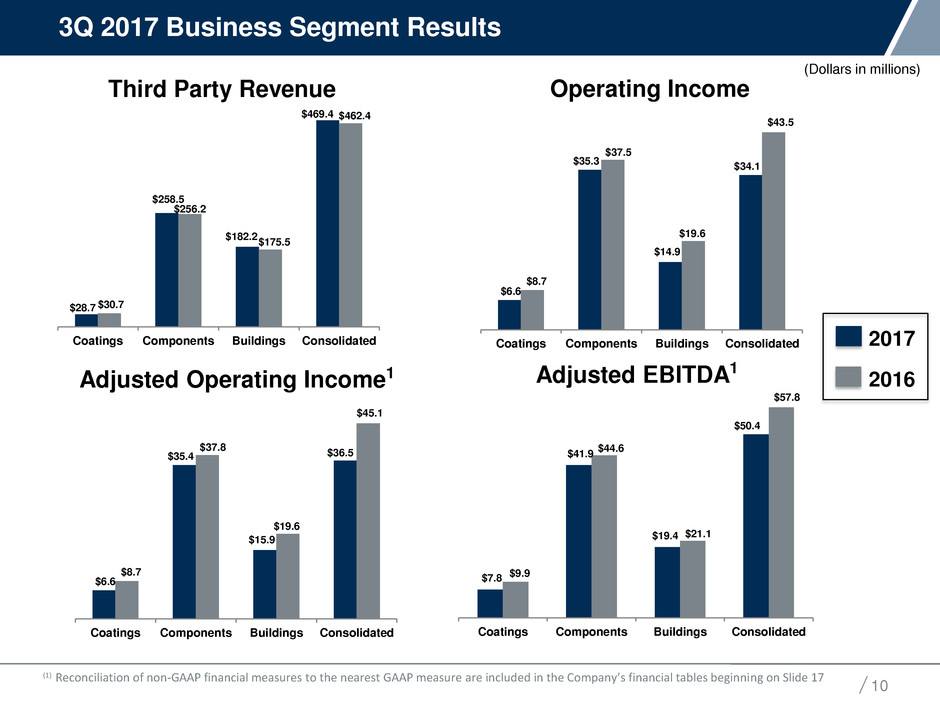

3Q 2017 Business Segment Results

10

(Dollars in millions)

$28.7

$258.5

$182.2

$469.4

$30.7

$256.2

$175.5

$462.4

Coatings Components Buildings Consolidated

(1) Reconciliation of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 17

Third Party Revenue

$6.6

$35.3

$14.9

$34.1

$8.7

$37.5

$19.6

$43.5

Coatings Components Buildings Consolidated

Operating Income

Adjusted Operating Income1

$7.8

$41.9

$19.4

$50.4

$9.9

$44.6

$21.1

$57.8

Coatings Components Buildings Consolidated

2017

2016

Adjusted EBITDA1

$6.6

$35.4

$15.9

$36.5

$8.7

$37.8

$19.6

$45.1

Coatings Components Buildings Consolidated

Our Mission & Vision

Gross Margin Reconciliation

11

Gross Margin 3Q 2016 27.7%

Net impact of rising steel input costs and pricing discipline (2.95%)

Plant utilization, net of process efficiency improvements (0.85%)

Favorable product and segment mix, net 0.75%

Other (0.15%)

Gross Margin 3Q 2017 24.5%

For the quarter, gross profit was $115.0 million compared to $128.0 million in the

third quarter of fiscal 2016

The favorable product and segment mix was predominately in IMP sales and the

relative weighting of the three business segments

Note: Basis point attributions in the above tables are approximate

Our Mission & Vision

Key Cost Initiatives

12

($ in millions)

Original

Target 1

2016 Cost

Savings

Realized

Expected

2017 Cost

Savings

Manufacturing Consolidation $15.0 - $20.0 $6.0 $6.5

ESG&A Restructuring $15.0 - $20.0 $6.0 $3.5

Total $30.0 - $40.0 $12.0 $10.0

The Manufacturing cost initiative includes the continuing rationalization of

manufacturing facilities and relocation of equipment and machinery

The ESG&A initiative includes the elimination of certain fixed and indirect

costs through restructuring and consolidation

Both initiatives remain on target to achieve the expected 2017 cost savings

During the fourth quarter of 2017, management accelerated parts of the cost

reduction initiatives originally planned for 2018. Approximately $7 million to $9

million will be realized in 2018 as a result of these fourth quarter actions,

predominantly in the ESG&A cost area

(1) Key initiatives are anticipated to generate the target amount of savings by fiscal year-end 2018

Our Mission & Vision

13

Net Income:

Net income was $18.2 million compared to $23.7 million in the prior year’s third quarter

Adjusted EBITDA1:

(Dollars in millions)

3Q Net Income and Adjusted EBITDA

(1) Reconciliations of non-GAAP financial measures to the nearest GAAP measure are included in the Company’s financial tables beginning on Slide 17

$57.8

$50.4

$(6.1)

$4.1

$(6.5)

$1.1

$-

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

$70.0

Adjusted EBITDA 3Q

2016

Volume Product Mix and Margin

Contraction

ESG&A Cost Reductions

and Lower Incentive

Compensation

Other Adjusted EBITDA 3Q

2017

Our Mission & Vision

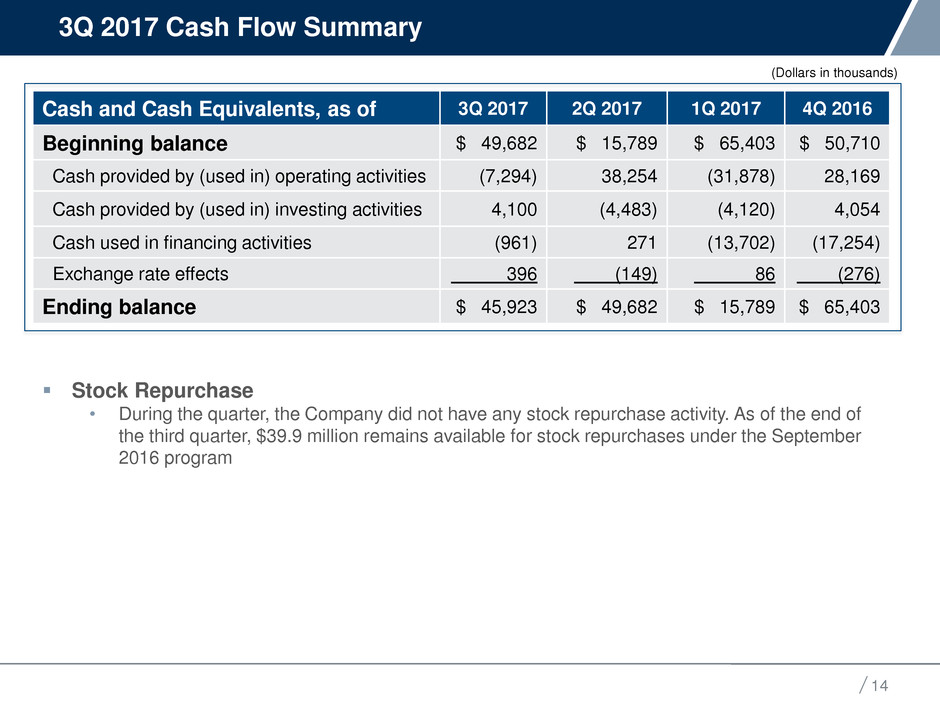

3Q 2017 Cash Flow Summary

14

Cash and Cash Equivalents, as of 3Q 2017 2Q 2017 1Q 2017 4Q 2016

Beginning balance $ 49,682 $ 15,789 $ 65,403 $ 50,710

Cash provided by (used in) operating activities (7,294) 38,254 (31,878) 28,169

Cash provided by (used in) investing activities 4,100 (4,483) (4,120) 4,054

Cash used in financing activities (961) 271 (13,702) (17,254)

Exchange rate effects 396 (149) 86 (276)

Ending balance $ 45,923 $ 49,682 $ 15,789 $ 65,403

Stock Repurchase

• During the quarter, the Company did not have any stock repurchase activity. As of the end of

the third quarter, $39.9 million remains available for stock repurchases under the September

2016 program

(Dollars in thousands)

Our Mission & Vision

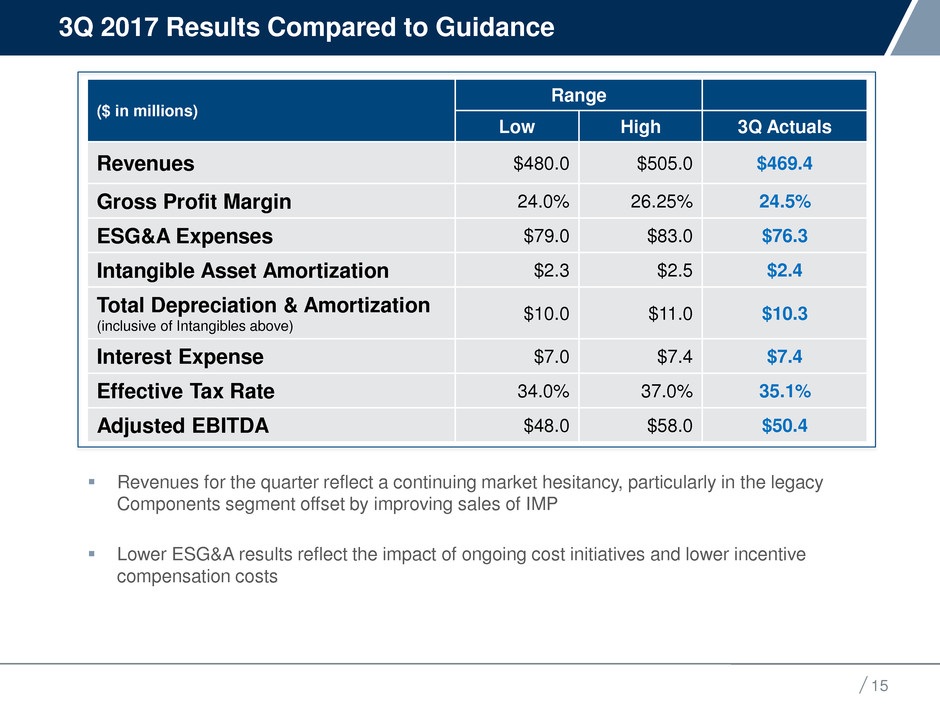

3Q 2017 Results Compared to Guidance

15

($ in millions)

Range

Low High 3Q Actuals

Revenues $480.0 $505.0 $469.4

Gross Profit Margin 24.0% 26.25% 24.5%

ESG&A Expenses $79.0 $83.0 $76.3

Intangible Asset Amortization $2.3 $2.5 $2.4

Total Depreciation & Amortization

(inclusive of Intangibles above)

$10.0 $11.0 $10.3

Interest Expense $7.0 $7.4 $7.4

Effective Tax Rate 34.0% 37.0% 35.1%

Adjusted EBITDA $48.0 $58.0 $50.4

Revenues for the quarter reflect a continuing market hesitancy, particularly in the legacy

Components segment offset by improving sales of IMP

Lower ESG&A results reflect the impact of ongoing cost initiatives and lower incentive

compensation costs

Our Mission & Vision

4Q and FY 2017 Guidance (1)

16

($ in million)

4Q Range

Low High

Revenues $470.0 $500.0

Gross Profit Margin 24.3% 26.3%

ESG&A Expenses $77.0 $80.0

Intangible Asset Amortization $2.3 $2.5

Total Depreciation & Amortization

(inclusive of Intangible Asset Amortization above)

$10.0 $11.0

Interest Expense $7.1 $7.5

Effective Tax Rate 34.0% 37.0%

Adjusted EBITDA $48.0 $62.0

Guidance for ESG&A excludes the amortization of intangible assets, which is shown as a separate line item above

Total Depreciation & Amortization includes the intangible amortization and is reported on the Company’s Statements

of Operations within Cost of Goods Sold, ESG&A Expense and Intangible Asset Amortization

Weighted average diluted common shares is expected to be 71.2 million for 4Q 2017

Total capital expenditures for fiscal 2017 are expected to be in the range of $25.0 million to $30.0 million

Full year 2017 revenues are expected to be in the range of $1.75 - $1.82 billion and Adjusted EBITDA is expected to

be in the range of $162 - $176 million. The revised fourth quarter EBITDA range includes an estimated impact of $3

to $8 million related to the disruptions from Hurricane Harvey and the potential impact on customer job sites and

their readiness for product delivery

(1) See “Forward Looking Statements” on Slide 2

Our Mission & Vision

Reconciliation of Net Income (Loss) and Adjusted Net Income (Loss) per

Diluted Common Share

17

(Dollars in thousands, except per share amounts)

July 30, July 31, July 30, July 31,

2017 2016 2017 2016

Net income per diluted common share, GAAP basis 0.25$ 0.32$ 0.52$ 0.43$

Restructuring and impairment charges 0.01 0.01 0.05 0.05

Strategic development and acquisition related costs 0.02 0.01 0.02 0.03

(Gain) on insurance recovery 0.00 - (0.14) -

Unreimbursed business interruption costs 0.00 - 0.01 -

Other losses (gains), net - (0.00) 0.00 (0.05)

Tax effect of applicable non-GAAP adjustments

(1)

(0.01) (0.01) 0.02 (0.02)

Adjusted net income per diluted common share

(2)

0.27$ 0.33$ 0.48$ 0.44$

July 30, July 31, July 30, July 31,

2017 2016 2017 2016

Net income applicable to common shares, GAAP basis 18,119$ 23,550$ 36,994$ 31,761$

Restructuring and impairment charges 1,009 778 3,587 3,437

Strategic development and acquisition related costs 1,297 819 1,778 2,080

(Gain) on insurance recovery (148) - (9,749) -

Unreimbursed business interruption costs 235 - 426 -

Other losses (gains), net - (52) 137 (3,568)

Tax effect of applicable non-GAAP adjustments

(1)

(933) (603) 1,490 (1,487)

Adjusted net income applicable to common shares

(2)

19,579$ 24,492$ 34,663$ 32,223$

#DIV/0! #DIV/0!

#DIV/0! #DIV/0!

(1) The Company calculated the tax effect of non-GAAP adjustments by applying the applicable statutory tax rate for the period to each applicable non-GAAP item.

(2) The Company discloses a tabular comparison of Adjusted net income per diluted common share and Adjusted net income applicable to common shares, which are non-GAAP measures,

because they are referred to in the text of our press releases and are instrumental in comparing the results from period to period. Adjusted net income per diluted common share

and Adjusted net income applicable to common shares should not be considered in isolation or as a substitute for net income per diluted common share and net income applicable to common

shares as reported on the face of our consolidated statements of operations.

Fiscal Three Months Ended Fiscal Nine Months Ended

Fiscal Three Months Ended Fiscal Nine Months Ended

Our Mission & Vision

Reconciliation of 3Q 2017 Operating Income(Loss) to Adjusted

Operating Income (Loss) by Segment

18

(Dollars in thousands)

Trailing 12

Months

Engineered

Building

Systems

Metal

Components

Metal Coil

Coating Corporate Consolidated

Consolidated

Operating income (loss), GAAP basis 14,948$ 35,289$ 6,562$ (22,702)$ 34,097$ 115,847$

Restructuring and impairment charges 941 68 - - 1,009 4,403

Strategic development and acquisition related costs - - - 1,297 1,297 2,368

Loss on sale of assets and asset recovery - - - - - 199

(Gain) on insurance recovery - (148) - - (148) (9,749)

Unreimbursed business interruption costs - 235 - - 235 426

Adjusted operating income (loss)

(1)

15,889$ 35,444$ 6,562$ (21,405)$ 36,490$ 113,494$

Trailing 12

Months

Engineered

Building

Systems

Metal

Components

Metal Coil

Coating Corporate Consolidated Consolidated

Operating income (loss), GAAP basis 19,561$ 37,497$ 8,748$ (22,271)$ 43,535$ 105,887$

Restructuring and impairment charges 106 261 - 411 778 11,048

Strategic development and acquisition related costs - 9 - 810 819 3,222

(Gain) on legal settlements - - - - (3,765)

(Gain) on sale of assets and asset recovery (52) - - - (52) (1,704)

Amortization of short lived acquired intangibles - - - - - 2,343

Adjusted operating income (loss)

(1)

19,615$ 37,767$ 8,748$ (21,050)$ 45,080$ 117,031$

(1) The Company discloses a tabular comparison of Adjusted operating income (loss), which is a non-GAAP measure, because it is instrumental in comparing the results from period

to period. Adjusted operating income (loss) should not be considered in isolation or as a substitute for operating income (loss) as reported on the face of our statements of operations.

Fiscal Three Months Ended July 30, 2017

Fiscal Three Months Ended July 31, 2016

Our Mission & Vision

Reconciliation of 3Q 2017 Net Income (Loss) to Adjusted EBITDA by

Segment

19

(Dollars in thousands)

Trailing 12

Months

Engineered

Building Metal Metal Coil

Systems Components Coating Corporate Consolidated Consolidated

Net income (loss) 17,874$ 35,148$ 6,562$ (41,363)$ 18,221$ 56,235$

Add:

Depreciation and amortization 2,255 6,631 1,214 178 10,278 40,472

Consolidated interest expense, net 5 (15) - 7,363 7,353 29,123

(Benefit) provision for income taxes (1,640) - - 11,485 9,845 32,375

Restructuring and impairment charges 941 68 - - 1,009 4,403

Strategic development and acquisition related costs - - - 1,297 1,297 2,368

Share-based compensation - - - 2,284 2,284 11,327

Loss on sale of assets and asset recovery - - - - - 199

(Gain) on insurance recovery - (148) - - (148) (9,749)

Unreimbursed business interruption costs - 235 - - 235 426

Adjusted EBITDA

(1)

19,435$ 41,919$ 7,776$ (18,756)$ 50,374$ 167,179$

Trailing 12

Months

Engineered

Building Metal Metal Coil

Systems Components Coating Corporate Consolidated Consolidated

Net income (loss) 19,140$ 37,628$ 8,749$ (41,802)$ 23,715$ 50,434$

Add:

Depreciation and amortization 2,438 6,752 1,184 221 10,595 45,461

Consolidated interest expense, net (39) (8) - 7,732 7,685 31,317

(Benefit) provision for income taxes (471) 2 - 12,096 11,627 25,318

Restructuring and impairment charges 106 261 - 411 778 11,048

(Gain) from bargain purchsae - - - - - (1,864)

Strategic development and acquisition related costs - 9 - 810 819 3,222

(Gain) on legal settlements - - - - - (3,765)

Share-based compensation - - - 2,661 2,661 9,388

(Gain) on sale of assets and asset recovery (52) - - - (52) (1,704)

Adjusted EBITDA

(1)

21,122$ 44,644$ 9,933$ (17,871)$ 57,828$ 168,855$

(1) The Company's Credit Agreement defines Adjusted EBITDA. Adjusted EBITDA excludes non-cash charges for goodwill and other asset impairments and stock compensation

as well as certain special charges. As such, the historical information is presented in accordance with such definition. Concurrent with the amendment and restatement of the

Term Loan facility, the Company entered into an Asset-Based Lending facility which has substantially the same definition of Adjusted EBITDA except that the ABL facility caps

certain special charges. The Company is disclosing Adjusted EBITDA, which is a non-GAAP measure, because it is used by management and provided to investors to provide

comparability of underlying operational results.

Fiscal Three Months Ended July 30, 2017

Fiscal Three Months Ended July 31, 2016

Our Mission & Vision

K. DARCEY MATTHEWS

Vice President, Investor Relations

E: darcey.matthews@ncigroup.com

281.897.7785

ncibuildingsystems.com