Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hostess Brands, Inc. | twnkform8-kbarclaysseptemb.htm |

®

1

®

HOSTESS BRANDS

Barclays Global Consumer Staples Conference

September 2017

®

DISCLAIMER

Forward Looking Statements

This investor presentation contains statements reflecting our views about our future performance that constitute “forward-looking statements” that involve substantial risks and uncertainties. Forward-looking

statements are generally identified through the inclusion of words such as “believes,” “expects,” “intends,” “estimates,” “projects,” “anticipates,” “will,” “plan,” “may,” “should,” or similar language. Statements

addressing our future operating performance and statements addressing events and developments that we expect or anticipate will occur are also considered as forward-looking statements. All forward looking

statements included herein are made only as of the date hereof. Hostess Brands undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events, or

otherwise.

These statements inherently involve risks and uncertainties that could cause actual results to differ materially from those anticipated in such forward-looking statements. These risks and uncertainties include, but are

not limited to, maintaining, extending and expanding our reputation and brand image; protecting our intellectual property rights; leveraging our brand value to compete against lower-priced alternative brands; correctly

predicting, identifying and interpreting changes in consumer preferences and demand and offering new products to meet those changes; operating in a highly competitive industry; our continued ability to produce and

successfully market products with extended shelf life; our ability to drive revenue growth in our key products or add products that are faster-growing and more profitable; volatility in commodity, energy, and other

input prices; our dependence on our major customers; our geographic focus could make us particularly vulnerable to economic and other events and trends in North America; increased costs in order to comply with

governmental regulation; general political, social and economic conditions; a portion of our workforce belongs to unions and strikes or work stoppages could cause our business to suffer; product liability claims,

product recalls, or regulatory enforcement actions; unanticipated business disruptions; dependence on third parties for significant services; our insurance may not provide adequate levels of coverage against claims;

failures, unavailability, or disruptions of our information technology systems; our ability to achieve expected synergies and benefits and performance from our strategic acquisitions; dependence on key personnel or a

highly skilled and diverse workforce; and our ability to finance our indebtedness on terms favorable to us; and other risks as set forth under the caption “Risk Factors” from time to time in our Securities and Exchange

Commission filings.

Industry and Market Data

In this Investor Presentation, Hostess Brands relies on and refers to information and statistics regarding market shares in the sectors in which it competes and other industry data. Hostess Brands obtained this

information and statistics from third-party sources, including reports by market research firms, such as Nielsen. Hostess Brands has supplemented this information where necessary with information from discussions

with Hostess customers and its own internal estimates, taking into account publicly available information about other industry participants and Hostess Brands’ management’s best view as to information that is not

publicly available. Hostess Brands has transitioned to a new Nielsen database for Market Share and Industry Data. All prior periods have been restated utilizing the updated database.

Pro Forma Combined Financial Information

Hostess Brands, Inc. acquired a controlling interest in Hostess Brands on November 4, 2016 (the ”Business Combination”). Unless otherwise noted, financial information for 2016 and LTM ended June 30, 2017 is

presented on a pro forma combined basis given effect to the Business Combination as if it occurred on January 1, 2016.

Use of Non-GAAP Financial Measures

This Investor Presentation includes non-GAAP financial measures, including earnings before interest, taxes, depreciation, amortization and other adjustments to eliminate the impact of certain items that we do not

consider indicative of our ongoing performance (“Adjusted EBITDA”), Adjusted EBITDA Margin, Adjusted Gross Profit, Adjusted Gross Profit Margin, Free Cash Flow and Free Cash Flow Conversion. Adjusted

EBITDA and Adjusted Gross Profit exclude certain items. Adjusted EBITDA Margin represents Adjusted EBITDA divided by net revenues. Adjusted Gross Profit Margin represents Adjusted Gross Profit divided by net

revenues, Free Cash Flow is defined as Adjusted EBITDA minus capital expenditures, and Free Cash Flow conversion is defined as Free Cash Flow divided by Adjusted EBITDA. You can find the reconciliation of

these measures to the nearest comparable GAAP measures in the Appendix. Hostess Brands believes that these non-GAAP financial measures provide useful information to management and investors regarding

certain financial and business trends relating to Hostess Brands’ financial condition and results of operations. Hostess Brands’ management uses these non-GAAP measures to compare Hostess Brands’

performance to that of prior periods for trend analyses, for purposes of determining management incentive compensation, and for budgeting and planning purposes. These measures are used in monthly financial

reports prepared for management and Hostess Brands’ board of directors. Hostess Brands believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating

ongoing operating results and trends. Management of Hostess Brands does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP.

Other companies may calculate Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Profit, Adjusted Gross Profit Margin, Free Cash Flow, Free Cash Flow Conversion and other non-GAAP measures

differently, and therefore Hostess Brands’ Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Gross Profit, Adjusted Gross Profit Margin, Free Cash Flow , Free Cash Flow Conversion and other non-GAAP

measures may not be directly comparable to similarly titled measures of other companies.

Totals in this Investor Presentation may not add up due to rounding.

2

®

DEAN METROPOULOS

Executive Chairman

Founder and Executive Chairman of Metropoulos & Co.

More than 30 years of successful experience revamping iconic brands

throughout the consumer space

Strong track record of growing revenues, reducing costs and

enhancing capital efficiency of portfolio companies

3

®

BILL TOLER

President & CEO

Former CEO and President of AdvancePierre Foods

Former President of Pinnacle Foods

30+ years of executive experience in the packaged food and consumer sectors

Proven track record of brand growth, strategic planning, operations management,

and profit growth

4

®

5

AGENDA

COMPANY OVERVIEW

BRAND & CHANNEL POSITIONING

GROWTH DRIVERS

FINANCIAL OVERVIEW

APPENDIX

2

1

4

3

®

COMPANY

OVERVIEW

1

6

®

7

Kansas City, MO

Product Portfolio

with Numerous

Iconic Brands

#2 Market

Position

in $6.55bn Sweet

Baked Goods

Category

Modern and

Efficient National

Manufacturing System

Direct to

Warehouse

Distribution Model

Driving Industry

Leading Profitability

Proven

Platform

with Multiple Avenues

of Growth

KEY HIGHLIGHTS

LTM Net Sales(1):

$763m

LTM Adj. EBITDA(2):

$226m

% Adj. EBITDA

margin(2): 30%

Source: Nielsen U.S. total universe, 52 weeks ending 8/12/17.

(1) Financial results for 2016 and LTM ended 6/30/17 are presented on a pro forma combined basis. See “Pro Forma Combined Financial Information” on page 2.

(2) See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP measures on page 2 and reconciliations to the comparable

GAAP measures.

HOSTESS BRANDS AT A GLANCE

Iconic American brand delivering new and classic

sweet treats to our customers for generations

ICONIC BRAND

Delivering New and Classic Sweet Treats

8

75+

YEARS OLD

50+

YEARS OLD

<50

YEARS OLD

BRANDS SINCE

RELAUNCH

EMOTIONAL BRAND CONNECTION

Consumers share a special emotional relationship with the

98 year old Hostess, a brand that defines the rapidly growing

“Indulgent Snacking” trend

98

Year history

90%+

Brand awareness

Source: Harmon Atchison, Awareness, Use and Status Perception Study, 12/8/14

9

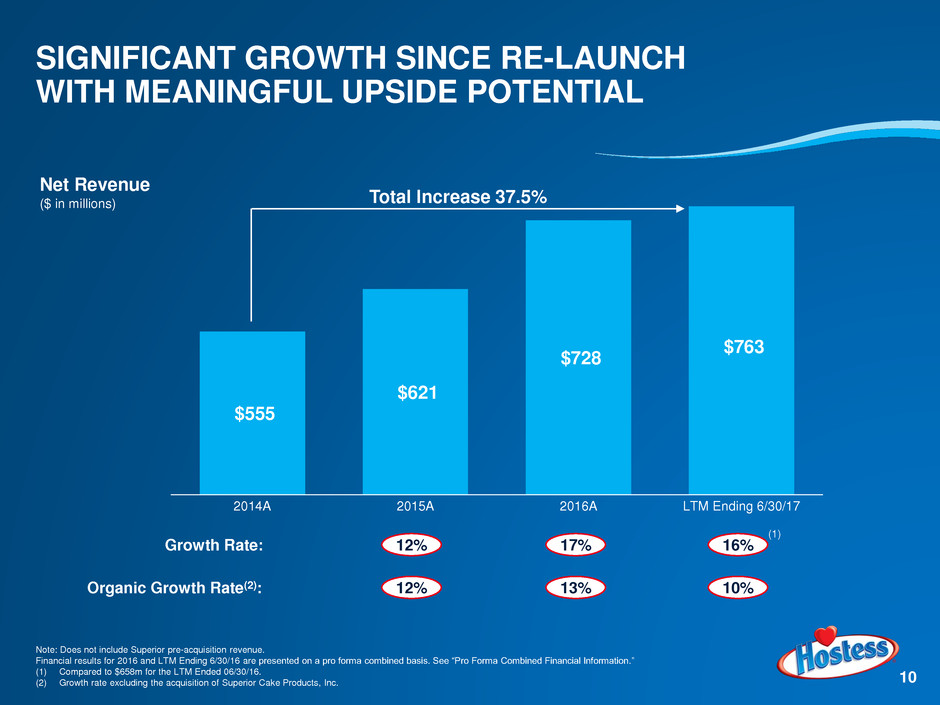

SIGNIFICANT GROWTH SINCE RE-LAUNCH

WITH MEANINGFUL UPSIDE POTENTIAL

Net Revenue

($ in millions)

$555

$621

$728

$763

2014A 2015A 2016A LTM Ending 6/30/17

Total Increase 37.5%

17%12%

Note: Does not include Superior pre-acquisition revenue.

Financial results for 2016 and LTM Ending 6/30/16 are presented on a pro forma combined basis. See “Pro Forma Combined Financial Information.”

(1) Compared to $658m for the LTM Ended 06/30/16.

(2) Growth rate excluding the acquisition of Superior Cake Products, Inc. 10

®

Growth Rate: 16%

Organic Growth Rate(2): 13%12% 10%

(1)

Created a Compelling Growth Story

Powerful

Hostess Brand

Aggressive

Capital

Investment

Competitively

Advantaged

Business Model

Compelling

Growth Story=

11

®

SINCE THE RELAUNCH, HOSTESS HAS…

®

12

Dean

Metropoulos

Executive

Chairman

Bill Toler

President

& CEO

Tom

Peterson

EVP & CFO

Michael

Cramer

EVP & Chief

Administrative

Officer

Andrew

Jacobs

EVP & Chief

Commercial

Officer

Burke

Raine

SVP &

CMO

Jolyn

Sebree

SVP,

General

Counsel &

Corporate

Secretary

Darryl

Riley

SVP,

Quality/

Food Safety

& R&D

EXPERIENCED SENIOR LEADERSHIP

®

13

BRAND &

CHANNEL

POSITIONING

2

®

Donuts

~$1.5B

Snack Cakes

~$1.7B

Pies, Bars

& Other

~$450M

Blondies,

Brownies

~$300M

Breakfast pastries,

Danish ~$1.3B

Muffins

~$500M

SBG

Cookies

~$800M

Danish, Honey

Buns, Sweet Rolls

Mini and

Jumbo

Muffins

Donettes

Twinkies®, Zingers®,

CupCakes, Ding

Dongs®, Ho Hos®

Fruit Pie

STRONG MARKET POSITION IN KEY SEGMENTS

14

In $6.55bn Sweet Baked Goods Category,

14% Increase Since Re-launch

Donuts

Regular Donuts,

Donut Sticks

~$500M

Bars & Other

Bars & Crisps

~$150MM

SBG Cookies

SBG Cookies

~$800MM

Total ~$1.5B

Source: Nielsen U.S. total universe, 52 weeks ending 8/12/17.

Note: Hostess data does not include Superior. The Company has transitioned to a new Nielsen database for Market Share and Industry Data, al l prior periods

have been restated utilizing the updated database.

Sweet Baked Goods category includes items determined to be ‘Commercial Sweet Baked Goods’ (items wrapped for individual sale) ; All Fresh Bakery products

are excluded from the scope; Sunbelt Granola Bars are the only Granola Bars included – because they are a part of McKee’s total SBG business and targeted for

sale with SBG items. Only SBG Cookies or non-traditional aisle-cookies are included (e.g., Nutty Fudge Bars, Oatmeal Cream Sandwiches, Whoopie Pies).

24%

11%

Sub-category where

Hostess does not

currently participate

32%

8%

8%

8%

= Hostess Share of

Retail Sales

Significant Untapped

Market Potential

®

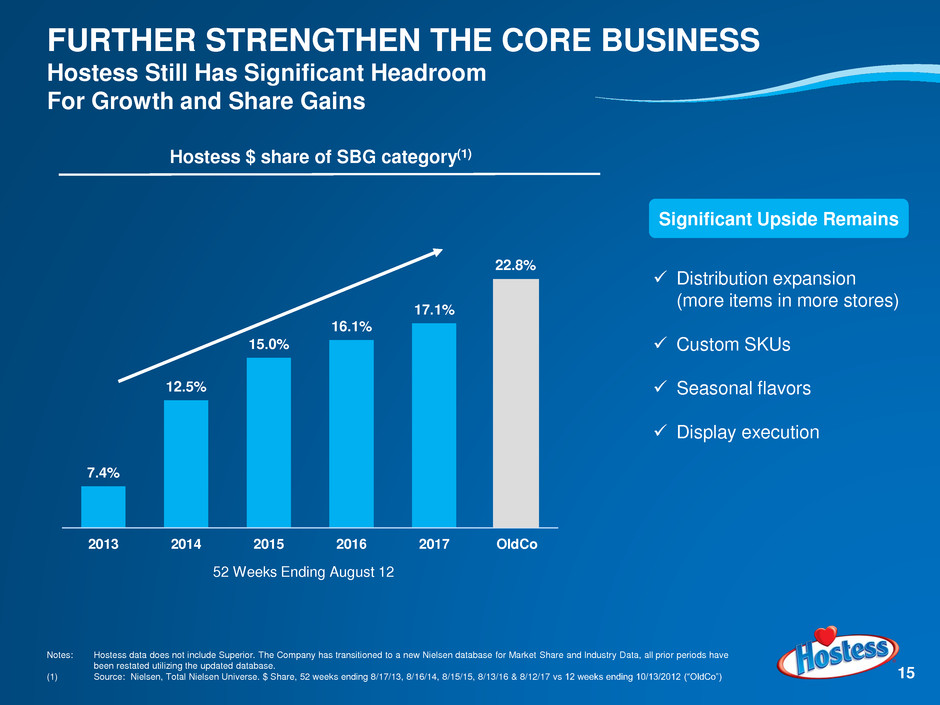

7.4%

12.5%

15.0%

16.1%

17.1%

22.8%

2013 2014 2015 2016 2017 OldCo

52 Weeks Ending August 12

FURTHER STRENGTHEN THE CORE BUSINESS

Hostess Still Has Significant Headroom

For Growth and Share Gains

15

Notes: Hostess data does not include Superior. The Company has transitioned to a new Nielsen database for Market Share and Industry Data, all prior periods have

been restated utilizing the updated database.

(1) Source: Nielsen, Total Nielsen Universe. $ Share, 52 weeks ending 8/17/13, 8/16/14, 8/15/15, 8/13/16 & 8/12/17 vs 12 weeks ending 10/13/2012 (“OldCo”)

Hostess $ share of SBG category(1)

Distribution expansion

(more items in more stores)

Custom SKUs

Seasonal flavors

Display execution

Significant Upside Remains

®

CONTINUED CORE BRAND GROWTH

16

Top Six Hostess Brands Posted Consumption Growth YTD

Source: Nielsen Total Universe, Year To Date data through week ending 8/12/17.

4%

12%

10%

3%

30%

4%

5%

Hostess Zingers

Hostess Twinkies

Hostess Ho Hos

Hostess Donette

Hostess Ding Dongs

Hostess Cupcakes

Hostess

Hostess Brands $ % Change - First Half 2017

®

1Q17 2Q17

Permanent Items since 2015 Seasonal & LTO Programs 2017 Innovation

2016 Innovation Discontinued Items

SOLID FIRST HALF POS PERFORMANCE

17

$280

$290

Total Nielsen POS

($ in millions)

Source: Total Nielsen Universe, Hostess Q1 dollars through 04/01/17, Q2 dollar through 07/01/17.

Growth vs. PY 8% 3%

®

16.6%

16.8%

16.9% 16.9%

17.1%

17.3%

17.6% 17.7%

01/28/17 02/25/17 03/25/17 04/22/17 05/20/17 06/17/17 07/15/17 08/12/17

13 Weeks Ending

CATEGORY IS STRENGTHENING

18

Source: Nielsen Total Universe, Sweet Baked Goods, Dollar Volume & % Chg through 8/12/17

(1) Represents Total Nielsen Universe Sweet Baked Goods for January through May 2017 and June through August 2017

$ Share Change

vs. PY

Hostess SBG Share (%)

Total Nielsen

SBG Category

$ % Chg (1)

-1.8% -0.2%

+1.3% +1.3% +1.4% +1.1% +1.0% +0.9% +0.7% +0.3%

®

BROAD CHANNEL OPPORTUNITY

19

Small Format Total US Mass Total Food

16.3%

16.1%

16.9%

52WE

8/15/15

52WE

8/13/16

52WE

8/12/17

18.7%

21.1%

22.3%

52WE

8/15/15

52WE

8/13/16

52WE

8/12/17

Source: Hostess Market Dollar Share, 52 weeks ending 8/15/15, 8/13/16 and 8/12/17. (Oldco) shares,Total Nielsen Universe 12 weeks ending 10/13/12

Total US Mass revised from previously published documents to include additional retailers

Club includes only Sam’s and BJ’s.

The Company has transitioned to a new Nielsen database for Market Share and Industry Data, all prior periods have been restated utilizing the updated database.

19.1%OldCo: 20.3%30.1%

$2.7B Category $1.3B Category $2.3B Category

11.6%

11.9%

12.8%

52WE

8/15/15

52WE

8/13/16

52WE

8/12/17

®

20

GROWTH

DRIVERS

3

®

FUTURE OPPORTUNITIES

21

Rebuild Core

Business

Innovation &

Renovation

White Space M&A

®

REBUILD CORE PRODUCTS

22

More Items in

More Stores

Continue to Build

Distribution

10%+ TDP Growth

Drive Penetration

in Channels

Unlocked by

Warehouse Model

®

2017 INNOVATION

23

Cinnamon Sugar

Crunch Donettes

White Fudge

Peanut Butter Apple Streusel Cupcake Expansion

Twinkies

®

2017 RENOVATION

24

The Chocodile Pies

BrowniesSuzy Q’s

®

WHITESPACE – KEY FOCUS AREAS

25

In-Store Bakery Foodservice International

1 2 3

®

WHITESPACE OPPORTUNITY

In-Store Bakery (Sweets) is an $8.0 Billion Category

26

Source: Nielsen Perishable Group, In Store Bakery, Total US, 52 weeks ending 7/1/17.

Note: Total In-Store Bakery is $11.3B Category (including Bread and Rolls)

ISB –

$ Share

Breakfast

Bakery

28%

Desserts

and Sweet

Snacks

72% Introduced Hostess Bake

Shop™

Providing “Made With” for

Retailer Own Labels

Launching Incremental

Innovation in New Forms

Club Tub Donettes

Big Twinkie Cake

®

M&A STRATEGY

27

Leverage Hostess Brand and/or warehouse model

Expand baking capabilities, including further into ISB, or move into

attractive adjacent categories

Facilitate building Hostess’ scale as broader snacking platform

Provide cash flow and EPS accretion

We are focused on potential targets that:

®

28

FINANCIAL

OVERVIEW

4

®

TOM PETERSON

EVP & CFO

Served as Hostess Corporate Controller since relaunch

Promoted to CFO in March 2016

Formerly a Managing Director at FTI Consulting and on the restructuring

team of Legacy Hostess

20+ years of accounting and finance expertise

29

®

$555

$621

2014A 2015A 2016A LTM Ended

6/30/17

SIGNIFICANT GROWTH SINCE RE-LAUNCH WITH

MEANINGFUL UPSIDE POTENTIAL

30

Net Revenue(1)(2)

($ in millions)

Adjusted EBITDA(1)(2)(3)

($ in millions)

$145

$178

$226

2014A 2015A 2016A LTM Ended

6/30/17

% Adj. EBITDA

Margin(3)

26% 29% 30%

$215

12%

Total Increase 37.5%

$728

All growth rates are based on the comparable period in the prior year

(1) Does not include Superior pre-acquisition results.

(2) Financial results for 2016 and LTM Ended 6/30/17 are presented on a pro forma combined basis. See “Pro Forma Combined Financial Information.”

(3) See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP measures and reconciliations to the comparable GAAP

measures.

(4) Growth rate excluding the acquisition of Superior Cake Products, Inc.

30%

$763

Growth Rate 16%17%

12%Organic Growth Rate(4) 10%13%

Total Increase 55.9%

®

MOMENTUM CONTINUES IN 1H 2017…

31

Net Revenue

($ in millions)

Adjusted Gross Profit(1)

($ in millions)

% Adj. Gross

Profit Margin(1)

Adjusted EBITDA(1)

($ in millions)

% Adj. EBITDA

Margin(1)

30%

(1) See “Use of Non-GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP measures and reconciliations to the comparable GAAP

measures.

Driven by new product initiatives and white space opportunities,

including ISB, Food Service and International channels

$353

$388

1H FY16 1H FY17

10%

$156

$168

1H FY16 1H FY17

7%

$107

$118

1H FY16 1H FY17

10%

30%43%44%

®

2016 INNOVATION SUCCESS TO LAP

32

1Q17 2Q17 3Q17 4Q17

Note: M&M’s is a registered trademarks of Mars, Incorporated. Ghostbusters is a registered trademark of Columbia Pictures Industries, Inc.

Twinkies Innovation

Brownie Innovation

Return of Suzy Q

• Strong Results

and Share Gains

• Lap Gets Easier

• Return to Drivers

of Growth:

• Distribution

• Innovation

• Whitespace

Brownie

Innovation

Return of

Suzy Q

Lapping from 2Q16 Lapping from 3Q16

®

STRONG CASH FLOW ENABLES MULTIPLE

VALUE CREATION OPPORTUNITIES

33

Notes: FCF defined as Adj. EBITDA-Capex and FCF conversion defined as Adj. EBITDA-Capex / Adj. EBITDA are non-GAAP financial measures. See “Use of Non-

GAAP Financial Measures” and the Appendix for an explanation of all non-GAAP measures and reconciliations to the comparable GAAP financial measures.

Financial results for 2016 are presented on a pro forma combined basis. See “Pro Forma Combined Financial Information.”

Anticipate 2017 net increase in cash of $95M to $105M after giving consideration to

capital expenditures, required debt payments and partnership tax distributions

Expect net leverage of approximately 3.65x to 3.75x at year end

Potential uses of cash include acquisitions, optional debt reductions and opportunistically

simplifying equity structure

$94

$153

$180

$195 - $205

2014A 2015A 2016A 2017 Estimated

FREE CASH FLOW

($ in millions)

FCF Conversion: 84%86%65% 83% - 87%

®

CONCLUDING REMARKS

Differentiated Business Model

Drives Continued Growth

34

Hostess is Well Positioned for Future Growth…

Warehouse

Distribution Unique

in SBG Category

Supports Strength of

Innovation Pipeline

and Speed-To-Market

Compelling Opportunity for

Continued Market Share

and Volume Gains Across

Distribution Channels

®

35

APPENDIX

®

36Footnotes on next page

$ in millions

Pro Forma

Combined,

Twelve Months

ended

30-Jun-17

Six Months

Ended

30-Jun-17

(Successor)

Pro Forma

Six Months

Ended

30-Jun-16

Successor

4-Nov-16 to

31-Dec-16

Predecessor

1-Jan-16 to

3-Nov-16

Pro Forma

Combined,

Year Ended

31-Dec-16

Year

Ended

31-Dec-15

Year

Ended

31-Dec-14

Net income (loss) $100.7 $52.4 $34.2 ($8.5) $60.4 $82.4 $88.8 $81.5

Plus non-GAAP adjustments:

Income tax provision 40.5 21.3 13.6 (7.8) 0.4 32.9 – –

Interest expense, net 44.8 19.9 26.5 6.6 60.4 51.4 50.0 37.4

(Gain) loss on debt extinguishment(1) (0.8) – – (0.8) – (0.8) 25.9 –

Depreciation and amortization 37.1 18.9 18.2 5.8 10.3 36.5 9.8 7.1

Executive chairman agreement termination and

execution(2)

– – – 26.7 – – – –

Share/Unit-based compensation(3) 4.4 4.4 – – 3.9 – 1.4 0.4

Other (income) expense(4) (3.1) 1.0 6.5 0.8 1.6 2.4 (8.7) 0.6

Business combination transaction costs(5) – – 0.6 – 31.8 0.6 – –

Impairment of property and equipment(6) – – 7.3 – 7.3 7.3 2.7 13.2

Loss on sale/abandonment of property and

equipment and bakery shutdown costs(7)

2.6 – – – 2.6 2.6 4.2 5.2

Inventory fair value adjustment(8) – – – 8.9 – – – –

Special employee incentive compensation(9) – – – – 4.7 – 3.9 –

Adjusted EBITDA $226.2 $117.7 $106.8 $31.9 $183.4 $215.3 $177.9 $145.3

Net Revenue $762.7 $387.7 $352.6 $112.0 $615.6 $727.6 $620.8 $554.7

Adjusted EBITDA Margin (Adj. EBITDA divided by

Net Rev.)

29.7% 30.4% 30.3% 28.5% 29.8% 29.6% 28.7% 26.2%

Capital Expenditures $34.5 $15.1 $15.7 $6.5 $28.6 $35.1 $25.1 $51.1

Free Cash Flow $191.7 $102.6 $91.1 $25.4 $154.8 $180.2 $152.8 $94.2

FCF Conversion (Adjusted EBITDA – Capital

Expenditures divided by Adjusted EBITDA)

84.7% 87.2% 85.3% 79.6% 84.4% 83.7% 85.9% 64.9%

Footnotes on following page.

HOSTESS NON-GAAP RECONCILIATIONS

Adjusted EBITDA

®

HOSTESS NON-GAAP RECONCILIATIONS

Adjusted EBITDA

37

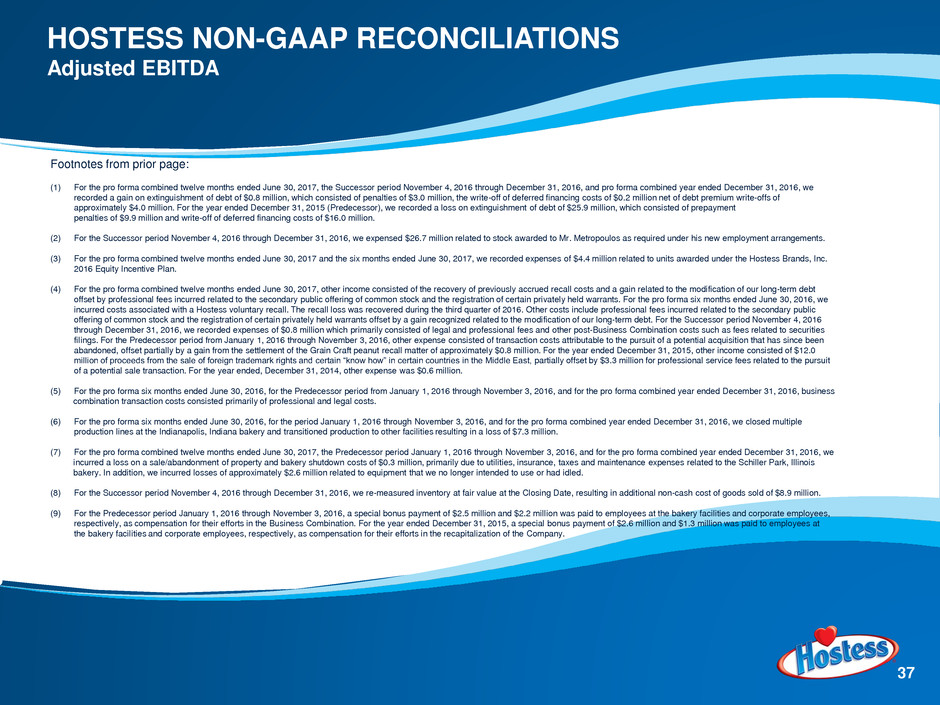

Footnotes from prior page:

(1) For the pro forma combined twelve months ended June 30, 2017, the Successor period November 4, 2016 through December 31, 2016, and pro forma combined year ended December 31, 2016, we

recorded a gain on extinguishment of debt of $0.8 million, which consisted of penalties of $3.0 million, the write-off of deferred financing costs of $0.2 million net of debt premium write-offs of

approximately $4.0 million. For the year ended December 31, 2015 (Predecessor), we recorded a loss on extinguishment of debt of $25.9 million, which consisted of prepayment

penalties of $9.9 million and write-off of deferred financing costs of $16.0 million.

(2) For the Successor period November 4, 2016 through December 31, 2016, we expensed $26.7 million related to stock awarded to Mr. Metropoulos as required under his new employment arrangements.

(3) For the pro forma combined twelve months ended June 30, 2017 and the six months ended June 30, 2017, we recorded expenses of $4.4 million related to units awarded under the Hostess Brands, Inc.

2016 Equity Incentive Plan.

(4) For the pro forma combined twelve months ended June 30, 2017, other income consisted of the recovery of previously accrued recall costs and a gain related to the modification of our long-term debt

offset by professional fees incurred related to the secondary public offering of common stock and the registration of certain privately held warrants. For the pro forma six months ended June 30, 2016, we

incurred costs associated with a Hostess voluntary recall. The recall loss was recovered during the third quarter of 2016. Other costs include professional fees incurred related to the secondary public

offering of common stock and the registration of certain privately held warrants offset by a gain recognized related to the modification of our long-term debt. For the Successor period November 4, 2016

through December 31, 2016, we recorded expenses of $0.8 million which primarily consisted of legal and professional fees and other post-Business Combination costs such as fees related to securities

filings. For the Predecessor period from January 1, 2016 through November 3, 2016, other expense consisted of transaction costs attributable to the pursuit of a potential acquisition that has since been

abandoned, offset partially by a gain from the settlement of the Grain Craft peanut recall matter of approximately $0.8 million. For the year ended December 31, 2015, other income consisted of $12.0

million of proceeds from the sale of foreign trademark rights and certain “know how” in certain countries in the Middle East, partially offset by $3.3 million for professional service fees related to the pursuit

of a potential sale transaction. For the year ended, December 31, 2014, other expense was $0.6 million.

(5) For the pro forma six months ended June 30, 2016, for the Predecessor period from January 1, 2016 through November 3, 2016, and for the pro forma combined year ended December 31, 2016, business

combination transaction costs consisted primarily of professional and legal costs.

(6) For the pro forma six months ended June 30, 2016, for the period January 1, 2016 through November 3, 2016, and for the pro forma combined year ended December 31, 2016, we closed multiple

production lines at the Indianapolis, Indiana bakery and transitioned production to other facilities resulting in a loss of $7.3 million.

(7) For the pro forma combined twelve months ended June 30, 2017, the Predecessor period January 1, 2016 through November 3, 2016, and for the pro forma combined year ended December 31, 2016, we

incurred a loss on a sale/abandonment of property and bakery shutdown costs of $0.3 million, primarily due to utilities, insurance, taxes and maintenance expenses related to the Schiller Park, Illinois

bakery. In addition, we incurred losses of approximately $2.6 million related to equipment that we no longer intended to use or had idled.

(8) For the Successor period November 4, 2016 through December 31, 2016, we re-measured inventory at fair value at the Closing Date, resulting in additional non-cash cost of goods sold of $8.9 million.

(9) For the Predecessor period January 1, 2016 through November 3, 2016, a special bonus payment of $2.5 million and $2.2 million was paid to employees at the bakery facilities and corporate employees,

respectively, as compensation for their efforts in the Business Combination. For the year ended December 31, 2015, a special bonus payment of $2.6 million and $1.3 million was paid to employees at

the bakery facilities and corporate employees, respectively, as compensation for their efforts in the recapitalization of the Company.

®

38Footnotes on next page

HOSTESS NON-GAAP RECONCILIATIONS

Adjusted Gross Profit

$ in millions

Successor

4-Nov-16 to

31-Dec-16

Predecessor

1-Jan-16 to

3-Nov-16

Pro Forma

Combined,

Year Ended

31-Dec-16

Year Ended

31-Dec-15

Year Ended

31-Dec-14

Net revenue $112.0 $615.6 $727.6 $620.8 $554.7

Cost of goods sold 73.3 346.9 411.6 356.0 320.8

Special employee incentive compensation – 2.2 – 2.6 –

Gross Profit – US GAAP $38.7 $266.5 $316.0 $262.2 $233.9

Add back:

Special employee incentive compensation(1) – $2.2 – $2.6 –

Inventory fair value adjustment(2) $8.9 – – – –

Adjusted Gross Profit $47.6 $268.7 $316.0 $264.9 $233.9

Gross Margin – GAAP 34.6% 43.3% 43.4% 42.2% 42.2%

Adjusted Gross Margin 42.5% 43.7% 43.4% 42.7% 42.2%

(1) For the Predecessor period January 1, 2016 through November 3, 2016, a special bonus payment of $2.2 million was paid to employees at the bakery facilities as compensation for their efforts in the

Business Combination. For the year ended December 31, 2015, a special bonus payment of $2.6 million was paid to employees at the bakery facilities as compensation for their efforts in the

recapitalization of Hostess.

(2) For the Successor period November 4, 2016 through December 31, 2016, the Company re-measured inventory at fair value at the Business Combination date, resulting in additional non-cash cost of

goods sold of $8.9 million.

®

GLOSSARY

39

Term Definition

BFY Better-for-you

ISB In-store bakery

SBG Sweet baked goods

SKU Stock keeping unit