Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ORACLE CORP | d449795d8k.htm |

Investor Presentation September 2017 Exhibit 99.1

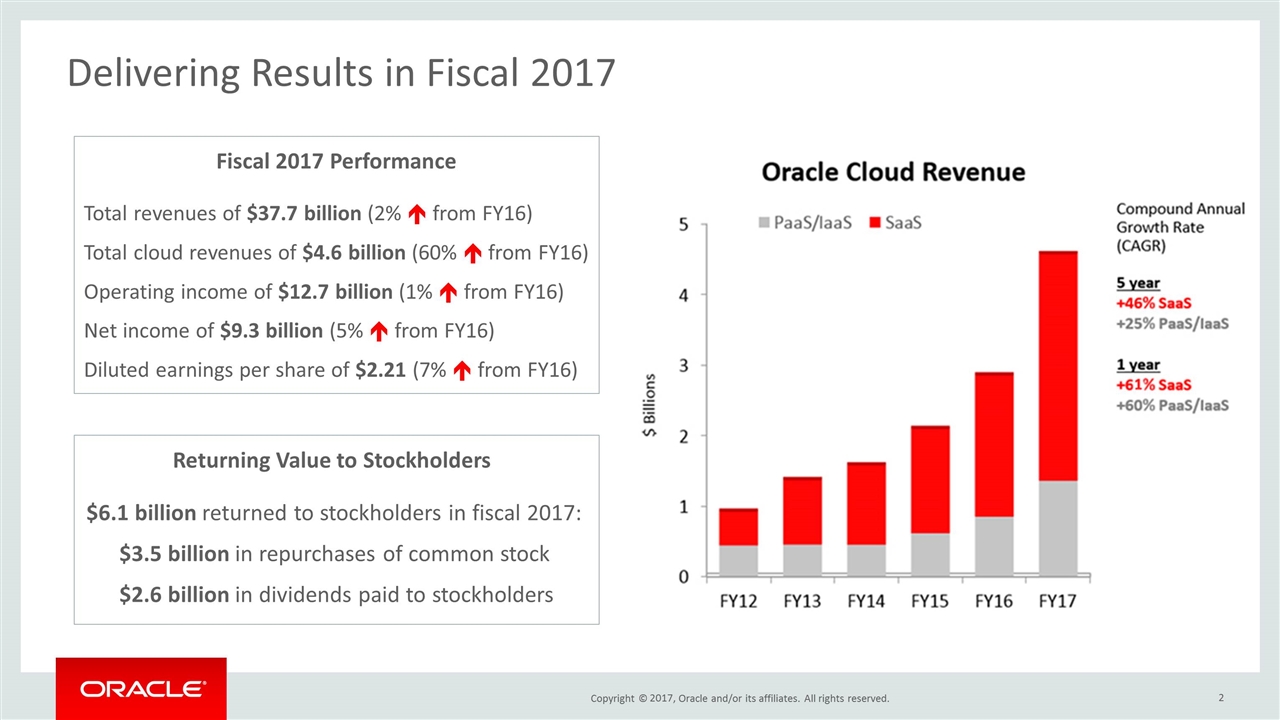

Delivering Results in Fiscal 2017 2017, Fiscal 2017 Performance Total revenues of $37.7 billion (2% é from FY16) Total cloud revenues of $4.6 billion (60% é from FY16) Operating income of $12.7 billion (1% é from FY16) Net income of $9.3 billion (5% é from FY16) Diluted earnings per share of $2.21 (7% é from FY16) Returning Value to Stockholders $6.1 billion returned to stockholders in fiscal 2017: $3.5 billion in repurchases of common stock $2.6 billion in dividends paid to stockholders

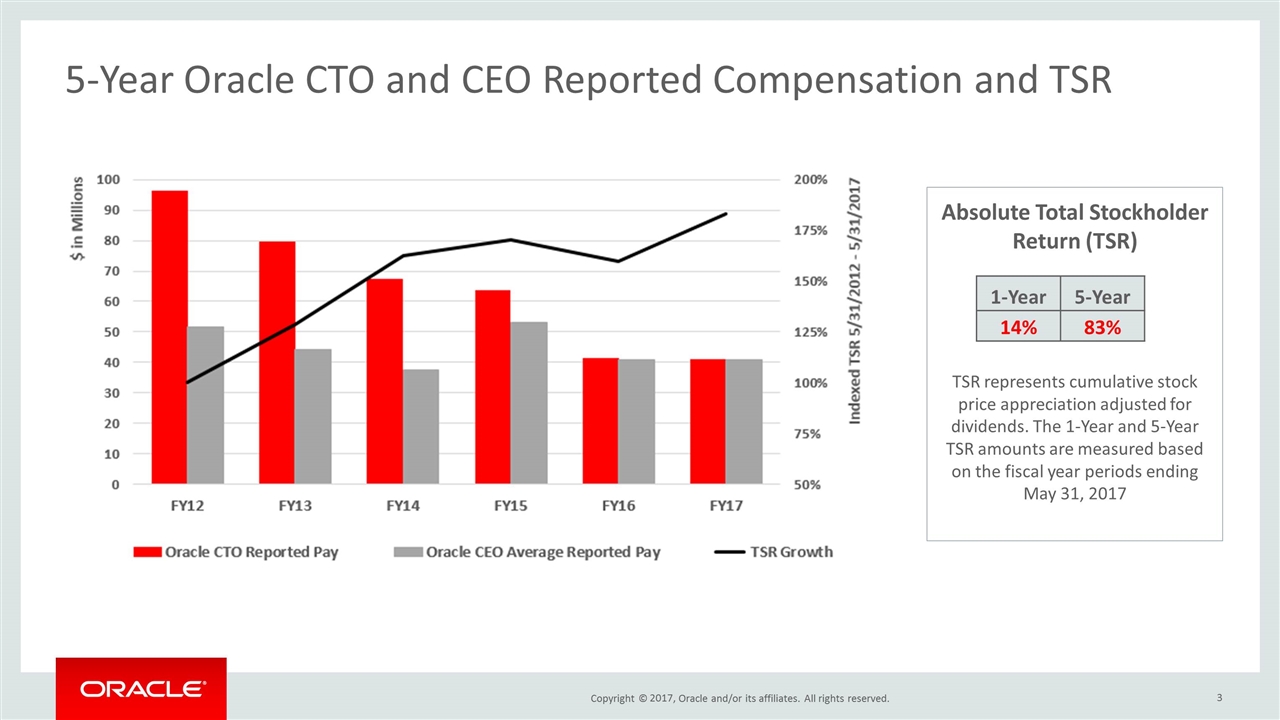

5-Year Oracle CTO and CEO Reported Compensation and TSR 2017, Absolute Total Stockholder Return (TSR) TSR represents cumulative stock price appreciation adjusted for dividends. The 1-Year and 5-Year TSR amounts are measured based on the fiscal year periods ending May 31, 2017 1-Year 5-Year 14% 83%

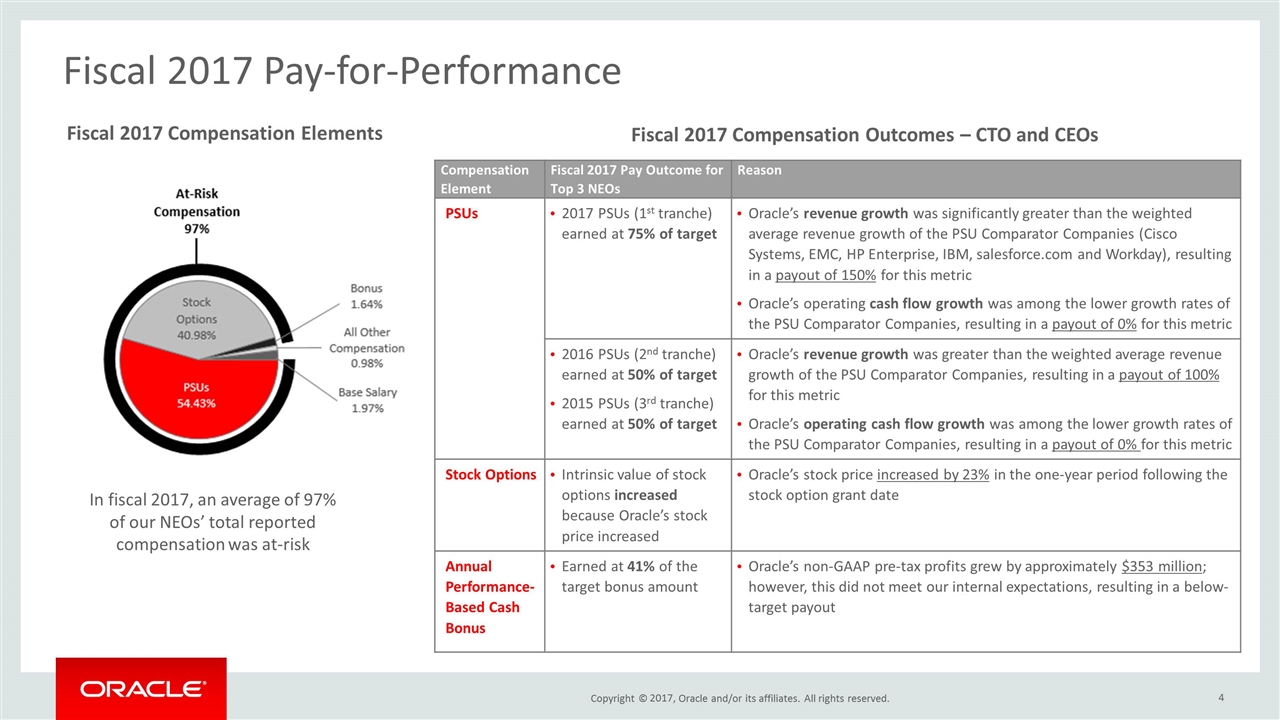

Fiscal 2017 Pay-for-Performance In fiscal 2017, an average of 97% of our NEOs’ total reported compensation was at-risk 2017, Compensation Element Fiscal 2017 Pay Outcome for Top 3 NEOs Reason PSUs 2017 PSUs (1st tranche) earned at 75% of target Oracle’s revenue growth was significantly greater than the weighted average revenue growth of the PSU Comparator Companies (Cisco Systems, EMC, HP Enterprise, IBM, salesforce.com and Workday), resulting in a payout of 150% for this metric Oracle’s operating cash flow growth was among the lower growth rates of the PSU Comparator Companies, resulting in a payout of 0% for this metric 2016 PSUs (2nd tranche) earned at 50% of target 2015 PSUs (3rd tranche) earned at 50% of target Oracle’s revenue growth was greater than the weighted average revenue growth of the PSU Comparator Companies, resulting in a payout of 100% for this metric Oracle’s operating cash flow growth was among the lower growth rates of the PSU Comparator Companies, resulting in a payout of 0% for this metric Stock Options Intrinsic value of stock options increased because Oracle’s stock price increased Oracle’s stock price increased by 23% in the one-year period following the stock option grant date Annual Performance-Based Cash Bonus Earned at 41% of the target bonus amount Oracle’s non-GAAP pre-tax profits grew by approximately $353 million; however, this did not meet our internal expectations, resulting in a below-target payout Fiscal 2017 Compensation Elements Fiscal 2017 Compensation Outcomes – CTO and CEOs

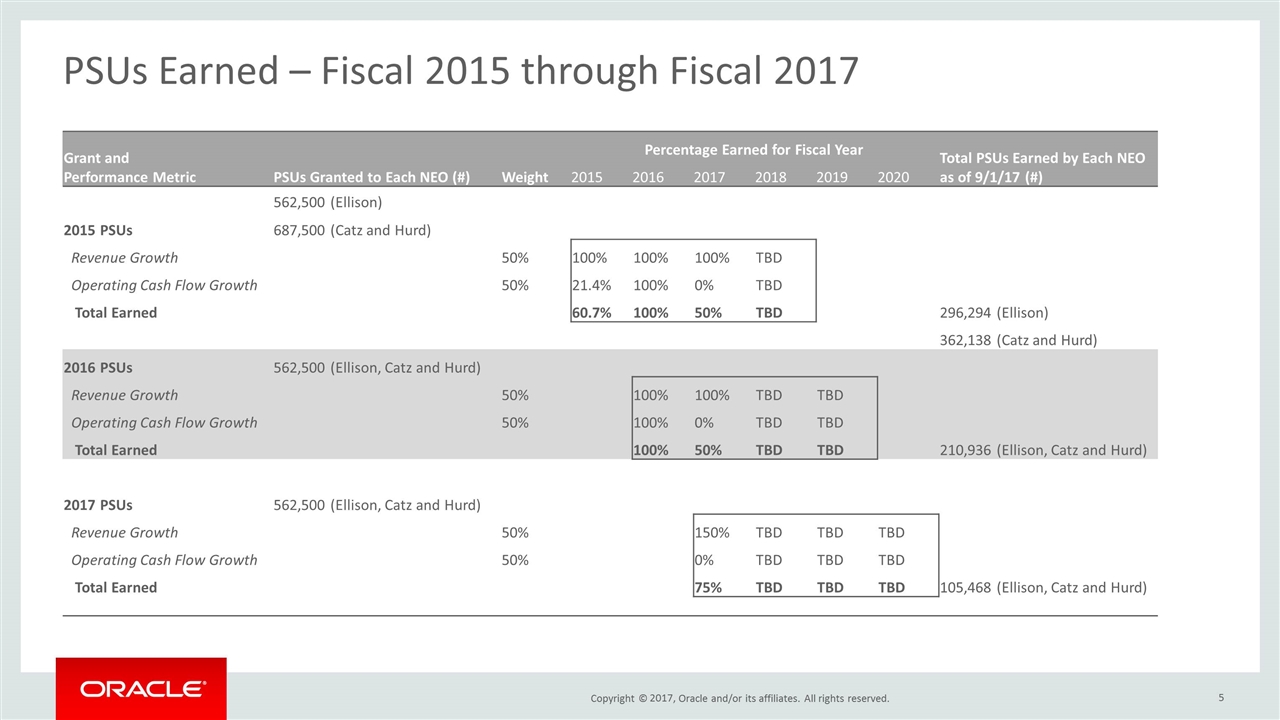

PSUs Earned – Fiscal 2015 through Fiscal 2017 5 2017, Grant and Performance Metric PSUs Granted to Each NEO (#) Weight Percentage Earned for Fiscal Year Total PSUs Earned by Each NEO as of 9/1/17 (#) 2015 2016 2017 2018 2019 2020 562,500 (Ellison) 2015 PSUs 687,500 (Catz and Hurd) Revenue Growth 50% 100% 100% 100% TBD Operating Cash Flow Growth 50% 21.4% 100% 0% TBD Total Earned 60.7% 100% 50% TBD 296,294 (Ellison) 362,138 (Catz and Hurd) 2016 PSUs 562,500 (Ellison, Catz and Hurd) Revenue Growth 50% 100% 100% TBD TBD Operating Cash Flow Growth 50% 100% 0% TBD TBD Total Earned 100% 50% TBD TBD 210,936 (Ellison, Catz and Hurd) 2017 PSUs 562,500 (Ellison, Catz and Hurd) Revenue Growth 50% 150% TBD TBD TBD Operating Cash Flow Growth 50% 0% TBD TBD TBD Total Earned 75% TBD TBD TBD 105,468 (Ellison, Catz and Hurd)

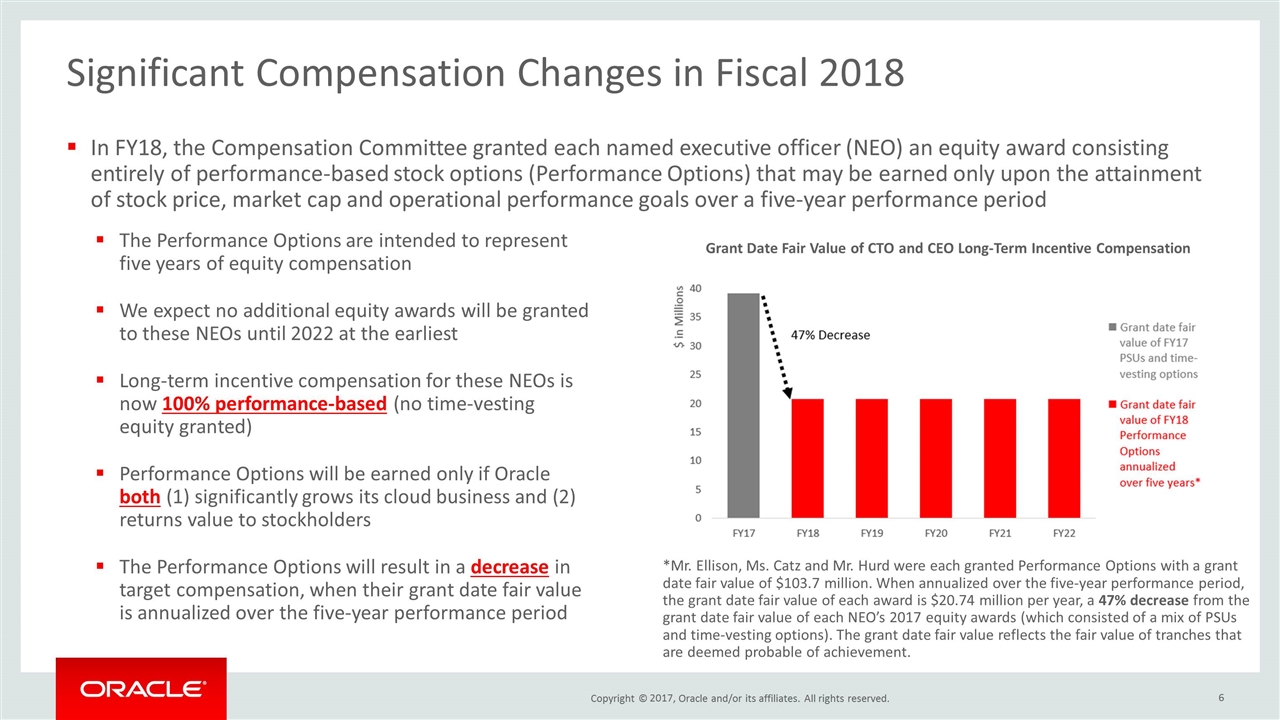

Significant Compensation Changes in Fiscal 2018 In FY18, the Compensation Committee granted each named executive officer (NEO) an equity award consisting entirely of performance-based stock options (Performance Options) that may be earned only upon the attainment of stock price, market cap and operational performance goals over a five-year performance period 2017, The Performance Options are intended to represent five years of equity compensation We expect no additional equity awards will be granted to these NEOs until 2022 at the earliest Long-term incentive compensation for these NEOs is now 100% performance-based (no time-vesting equity granted) Performance Options will be earned only if Oracle both (1) significantly grows its cloud business and (2) returns value to stockholders The Performance Options will result in a decrease in target compensation, when their grant date fair value is annualized over the five-year performance period *Mr. Ellison, Ms. Catz and Mr. Hurd were each granted Performance Options with a grant date fair value of $103.7 million. When annualized over the five-year performance period, the grant date fair value of each award is $20.74 million per year, a 47% decrease from the grant date fair value of each NEO’s 2017 equity awards (which consisted of a mix of PSUs and time-vesting options). The grant date fair value reflects the fair value of tranches that are deemed probable of achievement. Grant Date Fair Value of CTO and CEO Long-Term Incentive Compensation

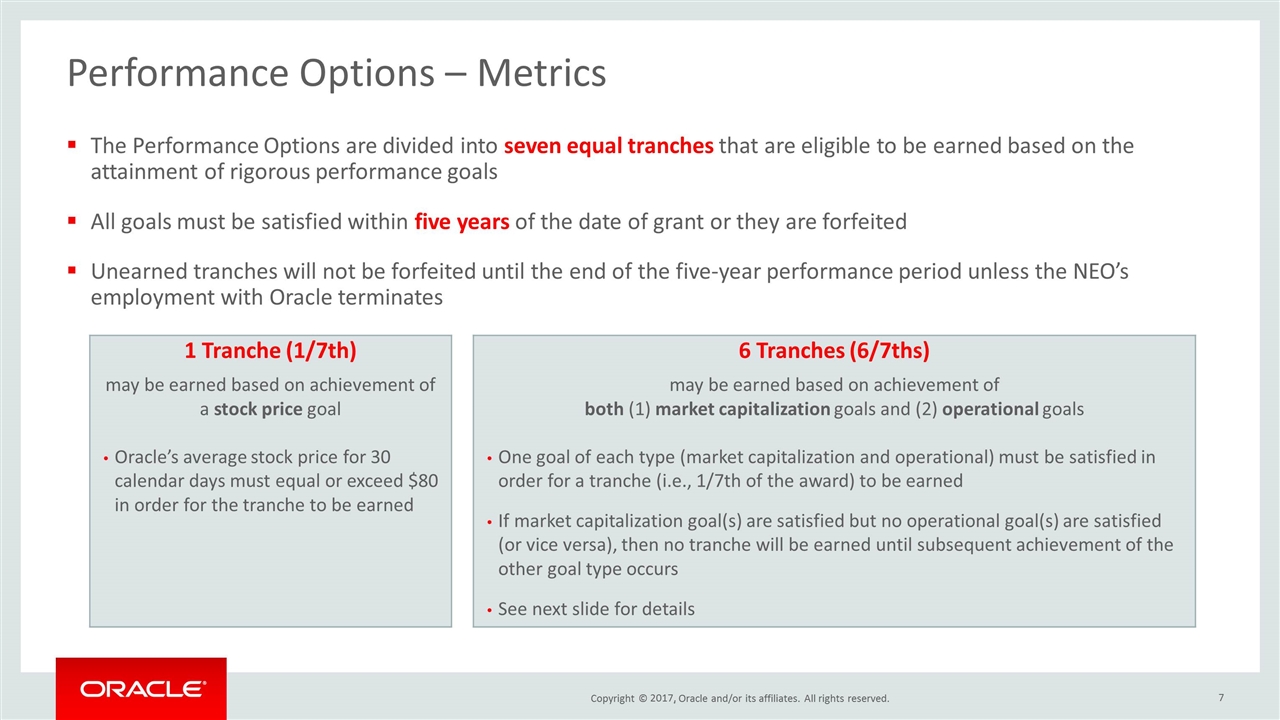

Performance Options – Metrics The Performance Options are divided into seven equal tranches that are eligible to be earned based on the attainment of rigorous performance goals All goals must be satisfied within five years of the date of grant or they are forfeited Unearned tranches will not be forfeited until the end of the five-year performance period unless the NEO’s employment with Oracle terminates 2017, 1 Tranche (1/7th) may be earned based on achievement of a stock price goal Oracle’s average stock price for 30 calendar days must equal or exceed $80 in order for the tranche to be earned 6 Tranches (6/7ths) may be earned based on achievement of both (1) market capitalization goals and (2) operational goals One goal of each type (market capitalization and operational) must be satisfied in order for a tranche (i.e., 1/7th of the award) to be earned If market capitalization goal(s) are satisfied but no operational goal(s) are satisfied (or vice versa), then no tranche will be earned until subsequent achievement of the other goal type occurs See next slide for details

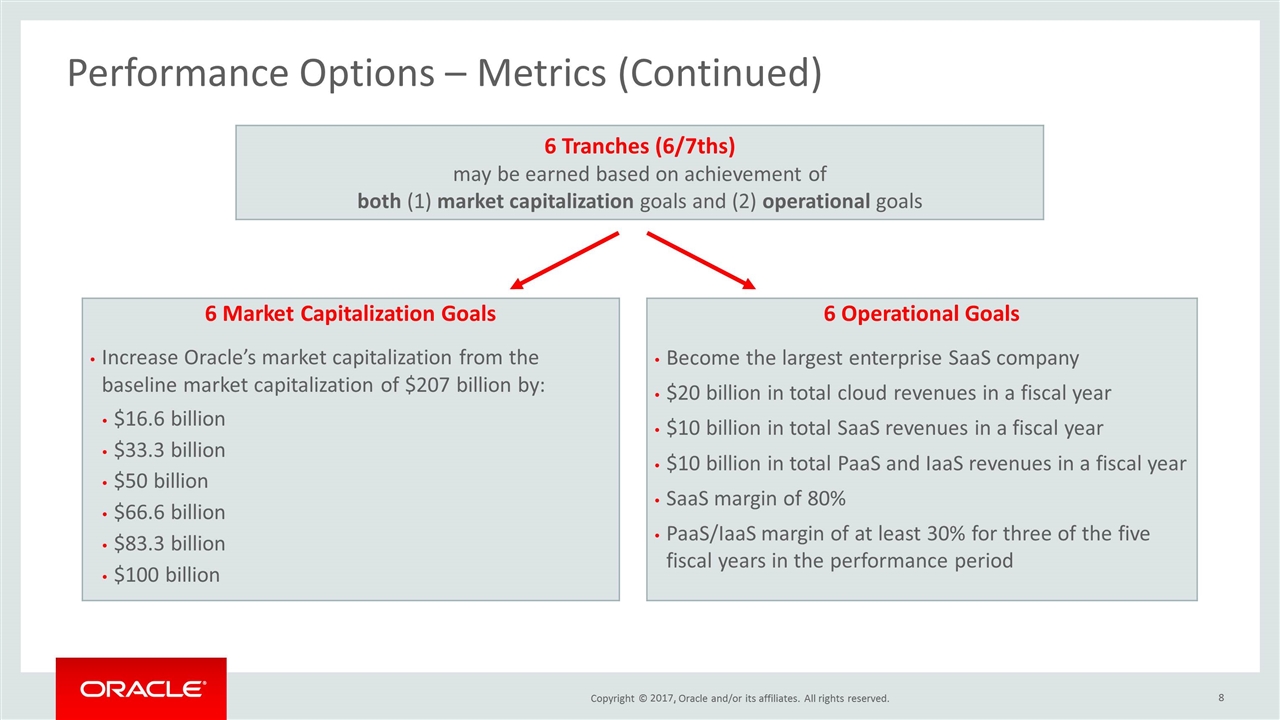

Performance Options – Metrics (Continued) 2017, 6 Tranches (6/7ths) may be earned based on achievement of both (1) market capitalization goals and (2) operational goals 6 Market Capitalization Goals Increase Oracle’s market capitalization from the baseline market capitalization of $207 billion by: $16.6 billion $33.3 billion $50 billion $66.6 billion $83.3 billion $100 billion 6 Operational Goals Become the largest enterprise SaaS company $20 billion in total cloud revenues in a fiscal year $10 billion in total SaaS revenues in a fiscal year $10 billion in total PaaS and IaaS revenues in a fiscal year SaaS margin of 80% PaaS/IaaS margin of at least 30% for three of the five fiscal years in the performance period

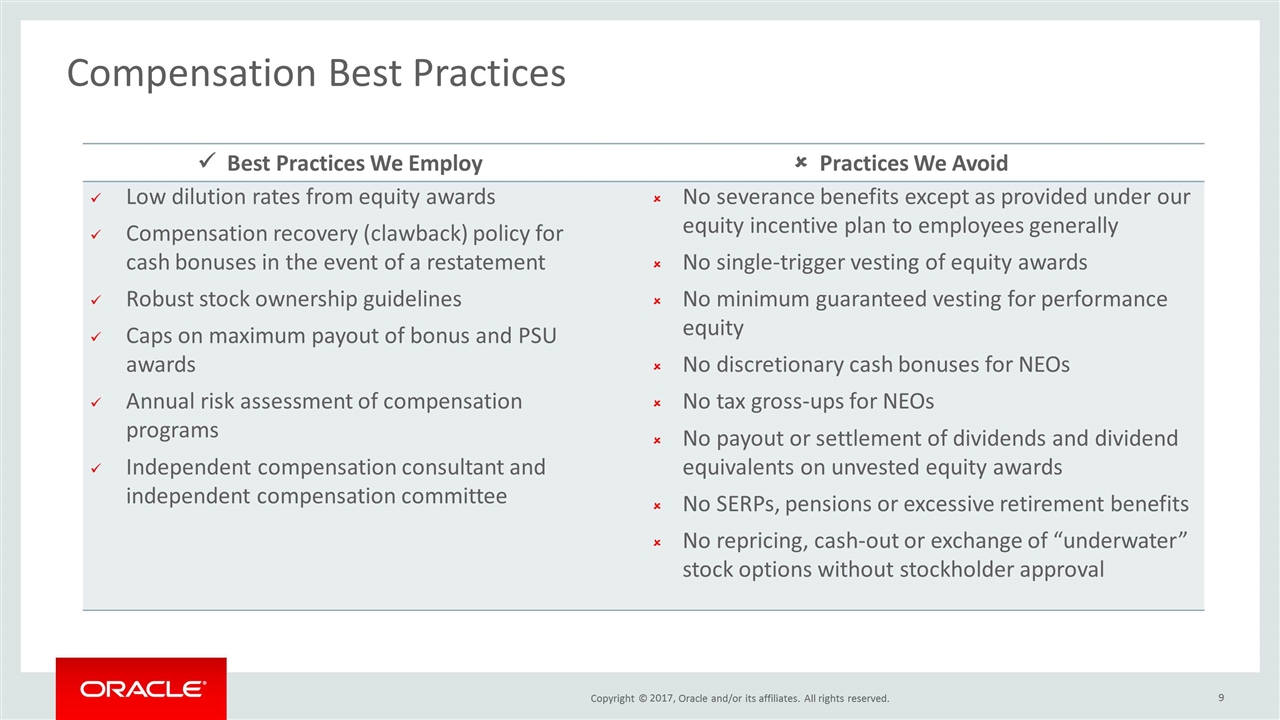

Compensation Best Practices 2017, ü Best Practices We Employ û Practices We Avoid Low dilution rates from equity awards Compensation recovery (clawback) policy for cash bonuses in the event of a restatement Robust stock ownership guidelines Caps on maximum payout of bonus and PSU awards Annual risk assessment of compensation programs Independent compensation consultant and independent compensation committee No severance benefits except as provided under our equity incentive plan to employees generally No single-trigger vesting of equity awards No minimum guaranteed vesting for performance equity No discretionary cash bonuses for NEOs No tax gross-ups for NEOs No payout or settlement of dividends and dividend equivalents on unvested equity awards No SERPs, pensions or excessive retirement benefits No repricing, cash-out or exchange of “underwater” stock options without stockholder approval

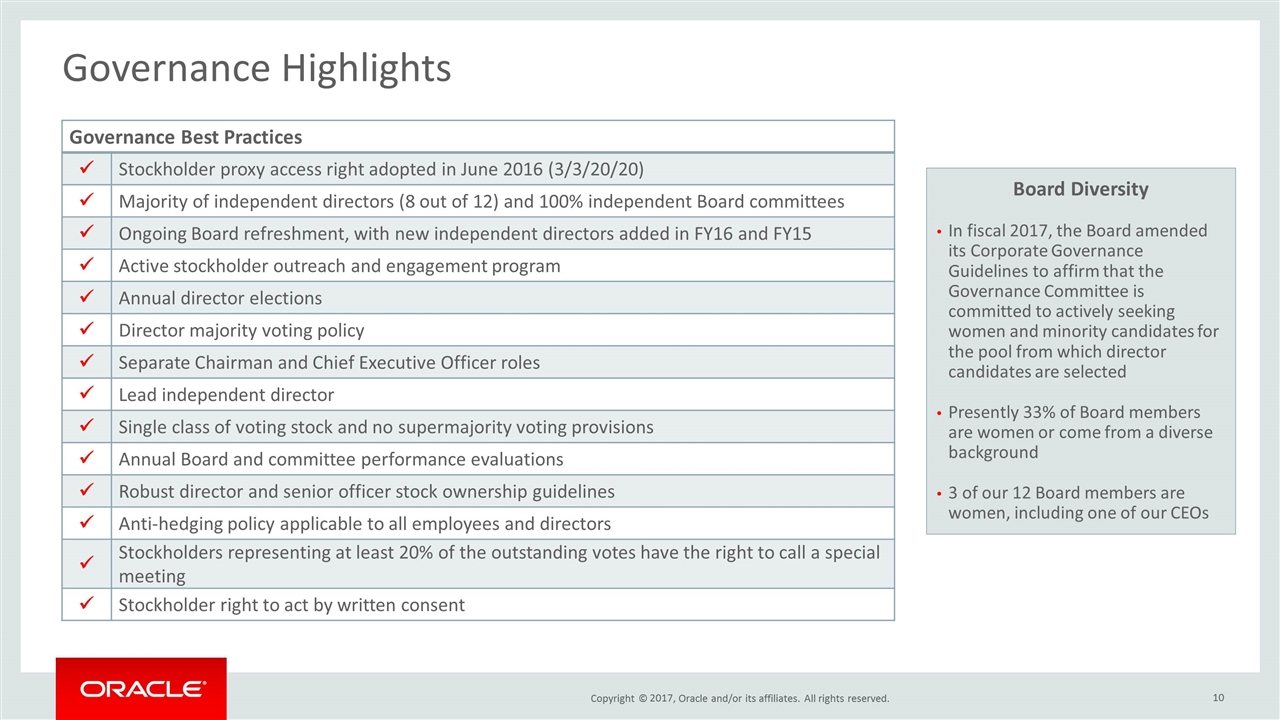

Governance Highlights 2017, Governance Best Practices ü Stockholder proxy access right adopted in June 2016 (3/3/20/20) ü Majority of independent directors (8 out of 12) and 100% independent Board committees ü Ongoing Board refreshment, with new independent directors added in FY16 and FY15 ü Active stockholder outreach and engagement program ü Annual director elections ü Director majority voting policy ü Separate Chairman and Chief Executive Officer roles ü Lead independent director ü Single class of voting stock and no supermajority voting provisions ü Annual Board and committee performance evaluations ü Robust director and senior officer stock ownership guidelines ü Anti-hedging policy applicable to all employees and directors ü Stockholders representing at least 20% of the outstanding votes have the right to call a special meeting ü Stockholder right to act by written consent Board Diversity In fiscal 2017, the Board amended its Corporate Governance Guidelines to affirm that the Governance Committee is committed to actively seeking women and minority candidates for the pool from which director candidates are selected Presently 33% of Board members are women or come from a diverse background 3 of our 12 Board members are women, including one of our CEOs

Safe Harbor Statement: Statements in this presentation relating to Oracle’s future plans, expectations, beliefs, intentions and prospects are “forward-looking statements” and are subject to material risks and uncertainties. A detailed discussion of these factors and other risks that affect our business is contained in our SEC filings, including our most recent reports on Form 10-K and Form 10-Q, particularly under the heading “Risk Factors.” Copies of these filings are available online from the SEC or by contacting Oracle Corporation’s Investor Relations Department at (650) 506-4073 or by clicking on SEC Filings on Oracle’s Investor Relations website at http://www.oracle.com/investor. All information set forth in this presentation is current as of September 5, 2017. Oracle undertakes no duty to update any statement in light of new information or future events. Safe Harbor Statement 2017,