Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Cadence Bancorporation | cade-8k_20170930.htm |

ANALYST PRESENTATION February 7, 2017 Paul B. Murphy, Jr. Chairman and CEO Hurricane Harvey - Impact and Response Conference Call August 31, 2017 Exhibit 99.1

Disclaimers This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect our current views with respect to, among other things, future events and our results of operations, financial condition and financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Such factors include, without limitation, the “Risk Factors” referenced in our Registration Statement on Form S-1 filed with the Securities and Exchange Commission (SEC), other risks and uncertainties listed from time to time in our reports and documents filed with the SEC, including our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q, and the following factors: business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic market areas; economic, market, operational, liquidity, credit and interest rate risks associated with our business; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; the laws and regulations applicable to our business; our ability to achieve organic loan and deposit growth and the composition of such growth; increased competition in the financial services industry, nationally, regionally or locally; our ability to maintain our historical earnings trends; our ability to raise additional capital to implement our business plan; material weaknesses in our internal control over financial reporting; systems failures or interruptions involving our information technology and telecommunications systems or third-party servicers; the composition of our management team and our ability to attract and retain key personnel; the fiscal position of the U.S. federal government and the soundness of other financial institutions; the composition of our loan portfolio, including the identify of our borrowers and the concentration of loans in energy-related industries and in our specialized industries; the portion of our loan portfolio that is comprised of participations and shared national credits; and the amount of nonperforming and classified assets we hold. Cadence can give no assurance that any goal or plan or expectation set forth in forward-looking statements can be achieved and readers are cautioned not to place undue reliance on such statements. The forward-looking statements are made as of the date of this communication, and Cadence does not intend, and assumes no obligation, to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. Certain of the financial measures and ratios we present are supplemental measures that are not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (GAAP). We refer to these financial measures and ratios as “non-GAAP financial measures.” We consider the use of select non-GAAP financial measures and ratios to be useful for financial and operational decision making and useful in evaluating period-to-period comparisons. These non-GAAP financial measures should not be considered a substitute for financial information presented in accordance with GAAP and you should not rely on non-GAAP financial measures alone as measures of our performance. More information regarding non-GAAP financial measures, including a reconciliation of non-GAAP financial measures to the comparable GAAP financial measures, is included in our earnings release and in the appendix to this presentation.

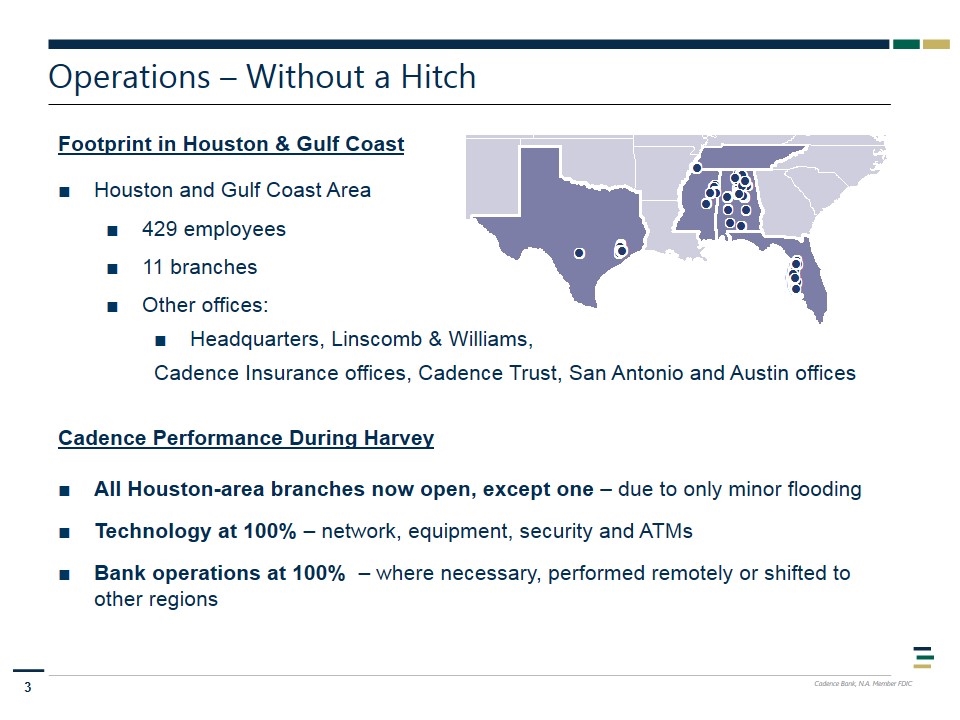

Operations – Without a Hitch Footprint in Houston & Gulf Coast Houston and Gulf Coast Area 429 employees 11 branches Other offices: Headquarters, Linscomb & Williams, Cadence Insurance offices, Cadence Trust, San Antonio and Austin offices Cadence Performance During Harvey All Houston-area branches now open, except one – due to only minor flooding Technology at 100% – network, equipment, security and ATMs Bank operations at 100% – where necessary, performed remotely or shifted to other regions

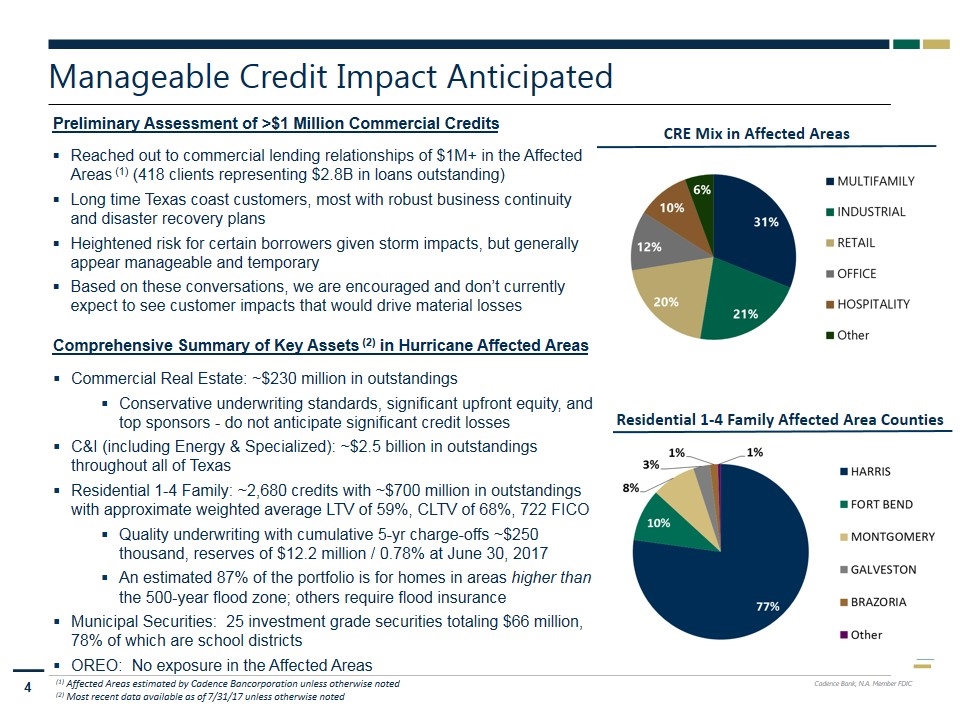

Manageable Credit Impact Anticipated Preliminary Assessment of >$1 Million Commercial Credits Reached out to commercial lending relationships of $1M+ in the Affected Areas (1) (418 clients representing $2.8B in loans outstanding) Long time Texas coast customers, most with robust business continuity and disaster recovery plans Heightened risk for certain borrowers given storm impacts, but generally appear manageable and temporary Based on these conversations, we are encouraged and don’t currently expect to see customer impacts that would drive material losses Comprehensive Summary of Key Assets (2) in Hurricane Affected Areas Commercial Real Estate: ~$230 million in outstandings Conservative underwriting standards, significant upfront equity, and top sponsors - do not anticipate significant credit losses C&I (including Energy & Specialized): ~$2.5 billion in outstandings throughout all of Texas Residential 1-4 Family: ~2,680 credits with ~$700 million in outstandings with approximate weighted average LTV of 59%, CLTV of 68%, 722 FICO Quality underwriting with cumulative 5-yr charge-offs ~$250 thousand, reserves of $12.2 million / 0.78% at June 30, 2017 An estimated 87% of the portfolio is for homes in areas higher than the 500-year flood zone; others require flood insurance Municipal Securities: 25 investment grade securities totaling $66 million, 78% of which are school districts OREO: No exposure in the Affected Areas CRE Mix in Affected Areas Residential 1-4 Family Affected Area Counties (1) Affected Areas estimated by Cadence Bancorporation unless otherwise noted (2) Most recent data available as of 7/31/17 unless otherwise noted

Customer and Community Relief Efforts – Houston Strong Cadence will be a source of strength for its customers, employees and community in the recovery from Harvey. Assistance efforts continue to be developed, and currently include the following (1). Special financing for those impacted Quick decisions on vehicle and home improvement loans with special financing Small business special financing with expedited decision making Waiver of CD withdrawal penalties Restructure of payments on loans as needed Specific impacted employee assistance Commitment of resources and community service from company and employee base throughout recovery efforts (1) Timing and terms of programs may vary. Refer to www.cadencebank.com for ongoing updates.