Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Allegiant Travel CO | algt20170829_8k.htm |

1 1

Sunseeker

Resorts

by Allegiant

2 2

This presentation as well as oral statements made by officers or directors of

Allegiant Travel Company, its advisors and affiliates (collectively or separately,

the "Company“) will contain forward-looking statements that are only

predictions and involve risks and uncertainties. Forward-looking statements

may include, among others, references to future performance and any

comments about our strategic plans. There are many risk factors that could

prevent us from achieving our goals and cause the underlying assumptions of

these forward-looking statements, and our actual results, to differ materially

from those expressed in, or implied by, our forward-looking statements. These

risk factors and others are more fully discussed in our filings with the Securities

and Exchange Commission. Any forward-looking statements are based on

information available to us today and we undertake no obligation to update

publicly any forward-looking statements, whether as a result of future events,

new information or otherwise. The Company cautions users of this presentation

not to place undue reliance on forward-looking statements, which may be

based on assumptions and anticipated events that do not materialize.

3 3

Introduction

Why a resort?

Why Port Charlotte?

The resort plan

Future opportunities

4 4

Why a Resort?

Create and establish leisure brand

Part of the customer experience not the transaction

Integrate more of the travel experience

Build more touch points for interaction with customer

Participate in beyond airline revenue

5 5

Charlotte County Stats

Charlotte County

• 3rd fastest growth rate in the state(1)

• 8th fastest growth nationwide(1)

Port Charlotte - 3rd best vacation home

market(2)

Constructed large parcel

Ability to build resort community Population Growth

% 2017-2022

Allegiant Airport

(14.2) to (1.2)

(1.2) to 0.6

0.6 to 3.0

3.0 to 6.0

6.0 to 20.0

Y

N

(1) – YOY 2016 - based On Southwest Florida Census: (published 3/17)

(2) – http://realtormag.realtor.org/daily-news/2017/07/11/2017

6 6

Allegiant PGD Destination Customer

19% YOY itinerary

increase - 560K pax

Avg. itineraries/year per

passenger up 5.1% since

2014

4.6% of customers flown

to PGD 8+ times

6th longest avg. stay

Allegiant destinations

Data represents TTM

through Jul-17

7 7

Geocode Data

Map reflective of location of passenger

at flight check-in(1)

Customers traveling from Sarasota to

Naples

Data - August 2017

PGD

(1) - Data based on users of the Allegiant App for check-in

8 8

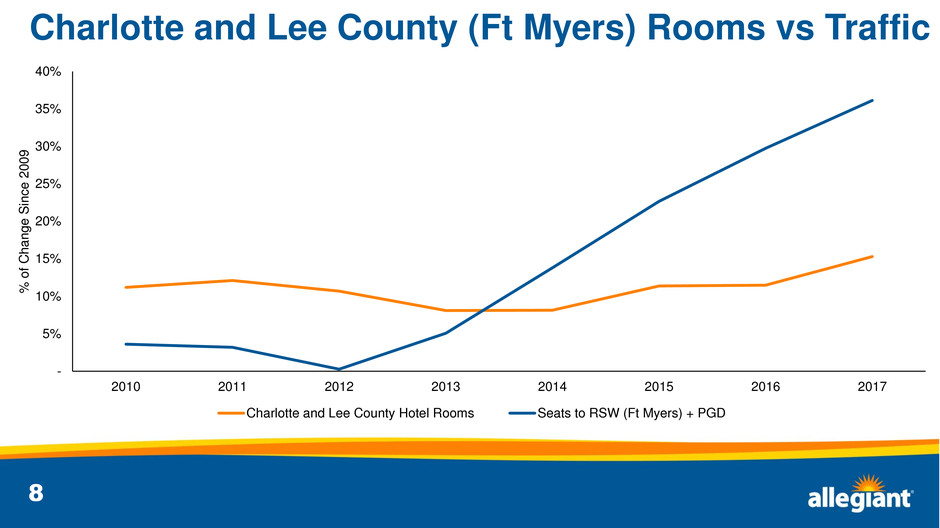

Charlotte and Lee County (Ft Myers) Rooms vs Traffic

-

5%

10%

15%

20%

25%

30%

35%

40%

2010 2011 2012 2013 2014 2015 2016 2017

% o

f Ch

a

n

g

e

S

in

c

e

2

0

0

9

Charlotte and Lee County Hotel Rooms Seats to RSW (Ft Myers) + PGD

9 9

Sunseeker Resorts Property Map

Site on US-41 Tamiami

• Daily traffic approx. 30,000(1)

• Future traffic expected to reach 41,000+ by 2035(1)

Site to include (current plan):

• Hotel Tower – 75 rooms - provisions for future

expansion

• 7-8 Condo Towers – 700+ units

• Marina

• 10+ Restaurant/Bar Concepts/Retail

• Largest resort pool in N. America; 10th largest

world(2)

Newest/largest condo resort on FL coast

(1) - FDOT 2016

(2) - https://en.wikipedia.org/wiki/List_of_largest_swimming_pools

10 10

Port Charlotte Project Plan

Construct approximately 22 acre master planned resort

• Phased build - 7-8 condo towers/pool – HOA owners

• Sunseeker/Allegiant property

75 room hotel Convention/meeting area

10+ retail/eating sites Shopping/Doctor support

• Sunseeker will manage construction and resort after completion

Condos – no construction before sale – projected 30% down payment on sale

Long term – resort will provide recurring revenue model

• Possible over 1000 hotel rooms available in hotel pool, including participating condos

• Revenues from restaurants, retail, marina rentals, parking, rent from vendors

No reinvestment in condos – HOA fees expected to cover future internal/external

maintenance

No operating expenses on common areas (pool, etc.) – HOA Fees

11 11

Resort Operation Plan

Allegiant will own and operate the following:

• Hotel

• All restaurants and bars

• Retail, grocery, and other commercial spaces leased to third party operators

Resident/HOA will own:

• Condo units

• Pool and related grounds

Property – master planned:

• Include tower HOAs with master association

• Sunseeker will manage all rooms contributed to rental pool

• No third party rental channels will be permitted (Airbnb, VRBO, etc.)

Condos sold fully furnished - ensure consistency - provide feel of hotel room

12 12

Current Status - Plan

Assembled Land – own 22+/- acres – water front property

Land zoned for commercial/residential use – up to 9 stories

City/County supportive

Utilizing John R’s contacts/experience

• Started design - See pictures – Steelman Partners – world class

• Begun adding staff – brand manager – very experienced

• Construction – Project manager on board

Finish negotiations with County/City on final details

Start sales process – next 90 days

Start construction first half of 2018

13 13

14 14

State of Market - Sales

Condo Market – west coast of Florida

• 1,000+ active listings Sarasota to Naples - $600K-$6M(1)

• 89% built before 2011

• 62% on the market for 6 months or more

• 1,000+ sold in past year - $600K-$6M(1)

Have solicited interest in condo units – used Allegiant Air database

• 4,000+ expressions of interest (as of 8/17/17)

100+ - pay over $1M

400+ - pay $750K to $1M

Remainder – up to $750K

• Convert the expressions of interest to:

Registrations of interest

Sale - non-refundable 30% deposit sought by year end

Using Allegiant Air database – save up to 20% distribution costs

Strategic goal – continue to build customer data base!

(1) - real estate data source: Zillow.com

15 15

16 16

Resort Project Timeline

Approval process (1Q-2Q18)

Ground breaking (2Q-3Q18)

Move-in ready date (4Q19-1Q20)

Hotel opening (4Q19-1Q20)

17 17

Brand Strategy

Allegiant has the rights to the following Sunseeker brands:

• Resorts

• Hotels

• Residences

• Management

Plan to trademark food and beverage concepts

Resort adds additional brands to Allegiant portfolio

Opportunities for future franchising/licensing with both Sunseeker

and food and beverage brands

18 18

Sunseeker Synergies

Allegiant Mastercard/Loyalty Program

• Exposure

• Sign-ups

• Redemption on all elements of project

Selling hotel rooms

• Use Allegiant Air data base – 7M+

• 120 US Cities – strong presence in Florida origination cities – e.g. upper Midwest

• Enhanced package with Air/car/events

Airline synergies

• Sunseeker - capacity to host large groups - sell to group/charter flights

• Potential load factor impact - Sunseeker - more customers to Charlotte County

• Potential new air package products leveraging frequency data - Florida pass

Future areas – airline hotel sales have not kept up with passenger growth

19 19

Management Contracts

Successful implementation will allow for hotel management contracts

There are 500+ managed hotels in Florida outside of Orlando

Target $150K-$1M per year management contracts – 20-200 room

hotels

Need to be in Allegiant Air’s eco-sphere – no sales of independent

hotel rooms

Targeting 50-75 hotel management contracts in coming years

Focus on Florida before looking beyond

20 20

Benefits of Allegiant as a Management Company

Airline

Closed distribution

Branded credit card acceptance/point redemption

Software solutions

Brand exposure in source markets and inflight

Branded restaurants

• Registered/trademarked brands

• Provide brand, concept, design/build oversight, menus, etc.

21 21

22 22

Appendix

23 23

Resort Revenue Sources

Sale of condo units

Hotel rooms

Management fee from renting out owners’ condos as whole units or subdivided suites

and rooms

Restaurant/bar revenue

Banquet revenue

Commercial space rental

• Grocery, hair salons, medical, etc.

Marina slip rentals

Bikes, paddle boards, wave runners, boat/fishing excursions, etc.

Car rentals

Rent/sell parking spots to condo owners

HOA dues

24 24

Focus on airline operations

Current management will maintain airline focus

Allegiant brand critical to success of Sunseeker Resort

Will add world class hotel management team

Improve airline performance - focus of Exec Mgmt and teams

Substantial operational performance improvement - July and

August

Completion 99.6% first 26 days of Aug - A14 8pts better than

2016

25 25

Drastic reduction in June / July / August

Cancellations

Category Aug

2017

Aug

2016

% Change July

2017

July

2016

% Change June

2017

June

2016

% Change

Scheduled

Departures

6,146 5,917 4% 9,157 8,664 6% 9,128 8,181 12%

Actual

Departures

6,121 5,769 6% 8,989 8,328 8% 8,865 7,905 12%

Cancellations 25 148 (83%) 168 336 (50%) 265 276 (3%)

August is through the 26th of 2017 and 27th of 2016