Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

Of the Securities Exchange Act of 1934

August 18, 2017

Date of report (date of earliest event reported)

BORQS TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

British Virgin Islands |

001- 37593 |

N/A | ||

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) | (I.R.S.

Employer Identification Number) |

Tower A, Building B23, Universal Business Park No. 10 Jiuxiangqiao Road Chaoyang District, Beijing, 100015 China |

| (Address of Principal Executive Offices) |

(86) 10-5975-6336

(Registrant’s telephone number, including area code)

Pacific Special Acquisition Corp.

855 Pudong South Road

The World Plaza, 27th Floor

Pudong, Shanghai

China

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

| 2 |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K (“Report”) contains forward-looking statements in the sections captioned “Description of Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Plan of Operations” and elsewhere. Any and all statements contained in this Report that are not statements of historical fact may be deemed forward-looking statements. Terms such as “may,” “might,” “would,” “should,” “could,” “project,” “estimate,” “pro-forma,” “predict,” “potential,” “strategy,” “anticipate,” “attempt,” “develop,” “plan,” “help,” “believe,” “continue,” “intend,” “expect,” “future,” and terms of similar import (including the negative of any of these terms) may identify forward-looking statements. However, not all forward-looking statements may contain one or more of these identifying terms. Forward-looking statements in this Report may include, without limitation, statements regarding the plans and objectives of management for future operations, projections of income or loss, earnings or loss per share, capital expenditures, dividends, capital structure or other financial items, our future financial performance, including any such statement contained in a discussion and analysis of financial condition by management or in the results of operations included pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”), and the assumptions underlying or relating to any such statement.

The forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon our current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which we have no control over. Actual results and the timing of certain events and circumstances may differ materially from those described by the forward-looking statements as a result of these risks and uncertainties. Factors that may influence or contribute to the accuracy of the forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation:

| ● | Market acceptance of our products and services; |

| ● | Competition from existing products or new products that may emerge; |

| ● | The implementation of our business model and strategic plans for our business and our products; |

| ● | Estimates of our future revenue, expenses, capital requirements and our need for financing; |

| ● | Our financial performance; |

| ● | Current and future government regulations; |

| ● | Developments relating to our competitors; and |

| ● | Other risks and uncertainties, including those listed under the section titled “Risk Factors.” |

Readers are cautioned not to place undue reliance on forward-looking statements because of the risks and uncertainties related to them and to the risk factors. We disclaim any obligation to update the forward-looking statements contained in this Report to reflect any new information or future events or circumstances or otherwise, except as required by law. Readers should read this Report in conjunction with the discussion under the caption “Risk Factors,” our financial statements and the related notes thereto in this Report, and other documents which we may file from time to time with the SEC.

| 3 |

Borqs Technologies, Inc., a British Virgin Islands corporation (“Company” or “Borqs”), formerly known as Pacific Special Acquisition Corp., was incorporated in the British Virgin Islands as a company with limited liability on July 1, 2015 for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, or contractual control arrangement with, purchasing all or substantially all of the assets of, or engaging in any other similar business combination with one or more businesses or entities.

On August 18, 2017 (“Closing Date”), the Company consummated the transactions contemplated by that certain Merger Agreement dated December 27, 2016, as amended on May 10, 2017 and June 29, 2017 (“Merger Agreement”), by and among Pacific Special Acquisition Corp. (“Pacific”), PAAC Merger Subsidiary Limited, an exempted company incorporated under the laws of the Cayman Islands with limited liability and a wholly-owned subsidiary of the Company (“Merger Sub”), Borqs International Holding Corp, an exempted company incorporated under the laws of the Cayman Islands with limited liability (“Borqs International”), Pacific’s sponsor, Zhengqi International Holding Limited, in its capacity thereunder as the Purchaser Representative (the “Purchaser Representative”), the representative Zhengdong Zou (the “Sellers’ Representative”) for each of Borqs International’s shareholders immediately prior to the closing (collectively, the “Sellers”), and for certain limited purposes thereof, Zhengqi International Holding Limited (the “Sponsor”). Pursuant to the Merger Agreement, Merger Sub merged with and into Borqs International, with Borqs International continuing as the surviving company and a wholly-owned subsidiary of the Company, and the Company issued a total of 25,913,964 ordinary shares of the Company, with 942,467 of such shares set aside in escrow for indemnity obligations of the Sellers and 2,352,285 of such shares set aside in escrow subject to certain earn-out provisions in the Merger Agreement (and, to the extent not earned, being retained by the Sponsor and another investor that participated in the backstop arrangement) (such transaction, the “Business Combination”). As a result of the Business Combination, the Sellers became the controlling shareholders of the Company and Borqs International became a wholly-owned subsidiary of the Company.

As a result of the Business Combination, the Company will continue the business operations of Borqs International as a publicly traded company under the name “Borqs Technologies, Inc.”

In accordance with “reverse merger” or “reverse acquisition” accounting treatment, our historical financial statements as of period ends, and for periods ended, prior to the Business Combination will be replaced with the historical financial statements of Borqs International in all future filings with the SEC.

As used in this Report, unless otherwise stated or the context clearly indicates otherwise, the terms “Company,” “Registrant,” “we,” “us” and “our” refer to Borqs Technologies, Inc., giving effect to the Business Combination.

This Report contains summaries of the material terms of various agreements executed in connection with the Business Combination described herein. The summaries of these agreements are subject to, and are qualified in their entirety by reference to, these agreements, which are filed as exhibits hereto and incorporated herein by reference.

Prior to the Business Combination, we were a “shell company” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended (“Exchange Act”). As a result of the Business Combination, we have ceased to be a “shell company.” The information contained in this Report constitutes the information necessary to satisfy the conditions contained in Rule 144(i)(2) under the Securities Act of 1933, as amended (“Securities Act”).

| 4 |

| Item 1.01. | Entry into a Material Definitive Agreement. |

The information contained in Item 2.01 below relating to the various agreements described therein is incorporated herein by reference.

| Item 2.01. | Completion of Acquisition of Disposition of Assets. |

THE MERGER AND RELATED TRANSACTIONS

The Merger

On December 27, 2016, the Company entered into the Merger Agreement with Borqs International, Merger Sub, the Purchaser Representative, the Sellers’ Representative and, for certain limited purposes thereof, the Sponsor, as amended on May 10, 2017 and June 29, 2017, pursuant to which the Company would acquire Borqs International and its subsidiaries, including its variable interest entity Beijing Big Cloud Network Technology Co., Ltd. and its subsidiaries, by acquiring from the Sellers all outstanding equity interests of Borqs International. The acquisition was executed through a reverse merger by which Merger Sub merged with and into Borqs International with Borqs International being the surviving entity (the “Merger”). The Business Combination closed on August 18, 2017 (the “Closing”).

As a result of the Business Combination, we acquired the business of Borqs International and its subsidiaries, which is to provide software and products for IoT providing customizable, differentiated and scalable Android-based smart connected devices and cloud service solutions. As a result, we have ceased to be a shell company.

As consideration for the Merger, the Company issued to the Sellers a total of 25,913,964 ordinary shares of the Company (“Merger Consideration Shares”) , based on a final agreed upon Adjusted Merger Consideration of $269,505,229, with a portion of such shares held in escrow as described below. Additionally, the holders of Borqs International issued and outstanding warrants received replacement warrants to acquire an aggregate of 417,166 Company ordinary shares (“Replacement Warrants”), and the holders of Borqs International issued and outstanding options had their options assumed by the Company and now hold options to acquire a total of 3,628,196 Company ordinary shares upon exercise of those options (“Assumed Options”). The number of shares and exercise price of the Replacement Warrants and the Assumed Options were equitably adjusted to reflect the terms of the Merger Agreement. The Replacement Warrants were in the form of Borq International’s existing warrants rather than the form the Company’s public warrants.

Of the Merger Consideration Shares, a total of 25,913,964 ordinary shares were issued to the Sellers at closing, with 942,467 of such shares deposited into escrow for indemnification obligations (“Indemnity Shares”), 2,352,285 of such shares deposited in escrow subject to the Company meeting certain earn-out requirements (“Earnout Shares” and together with the Indemnity Shares, the “Escrow Shares”) in the event certain net income earnout conditions are met during the period July 1, 2017 to June 30, 2018 (“Earnout Period”) and 1,178,084 of such shares were issued to a financial advisor engaged by Borqs International in connection with the Business Combination.

In connection with the Business Combination, the Company sold 1,038,251 of its ordinary shares in a private placement to the Sponsor and EarlyBirdCapital, Inc., the underwriter in the Company’s initial public offering (together, “Backstop Commitment Investors”), for an aggregate consideration of approximately $10.8 million (“Backstop Guarantee Shares”). Additionally, in connection with the closing of the Business Combination, the Company issued 628,187 ordinary shares to the holders of its outstanding public and private rights. The Earnout Shares were issued in the name of the Backstop Commitment Investors and to the extent that the earnout conditions are not met, the Earnout Shares will be released to the Backstop Commitment Investors. To the extent that the earnout conditions are met, the Earnout Shares will be disbursed to the Company and the Company will cancel the shares and issue replacement shares to the Sellers (with 4% of such shares being withheld and deposited into escrow as additional Indemnity Shares).

| 5 |

The Business Combination will be treated as a “reverse acquisition” of the Company for financial accounting purposes, Borqs International will be considered the acquirer for accounting purposes, and the historical financial statements of the Company before the Business Combination will be replaced with the historical financial statements of Borqs International and its consolidated entities before the Business Combination in all future filings with the SEC.

The issuance of Company ordinary shares to the Sellers, the issuance of the Backstop Guarantee Shares to the Backstop Commitment Investors and the issuance of the Replacement Warrants to Borqs International warrant holders in connection with the Business Combination have not been registered under the Securities Act, in reliance upon the exemption from registration provided by Section 4(a)(2), which exempts transactions by an issuer not involving any public offering, and Regulation D and/or Regulation S promulgated by the SEC under that section. These shares may not be offered or sold in the United States absent registration or an applicable exemption from registration.

The foregoing description of the Merger Agreement does not purport to be complete. For further information, please refer to the copy of the Merger Agreement that is filed as Exhibit 2.1 to this Report. There are representations and warranties contained in the Merger Agreement that were made by the parties to each other as of specific dates. The assertions embodied in these representations and warranties were made solely for purposes of the Merger Agreement and may be subject to important qualifications and limitations agreed to by the parties in connection with negotiating their terms. Moreover, some representations and warranties may not be accurate or complete as of any specified date because they are subject to a contractual standard of materiality that is different from certain standards generally applicable to shareholders or were used for the purpose of allocating risk between the parties rather than establishing matters as facts. For these reasons, investors should not rely on the representations and warranties in the Merger Agreement as statements of factual information.

Registration Rights Agreement

As of the Closing and in connection with the Business Combination, we entered into a Registration Rights Agreement with the Sellers, the holders of Borqs warrants and the Purchaser Representative (“Registration Rights Agreement”). Under the Registration Rights Agreement, the Sellers and Borqs International warrant holders (“Warrant Holders” and together with the Sellers, the “Selling Shareholders”) will have registration rights that obligate us to register for resale under the Securities Act all or any portion of their Merger Consideration Shares and shares issuable upon exercise of the Replacement Warrants (together with any securities issued as a dividend or distribution with respect thereto or in exchange therefor, “Registrable Securities”), except that Registrable Securities that are subject to transfer restrictions in the Lock-Up Agreement or Escrow Shares held in the Escrow Account may not be requested to be registered before the end of the applicable transfer restrictions. Holders of a majority-in-interest of any class of Registrable Securities are entitled under the Registration Rights Agreement to make a written demand for registration under the Securities Act of all or part of the their Registrable Securities, and other holders of the Registrable Securities are entitled to join in such demand registration. Subject to exceptions, if the Company proposes to file a registration statement under the Securities Act, we are required to give notice of the proposed filing to the holders of the Registrable Securities and offer them an opportunity to register the resale of such number of Registrable Securities as they may request in writing, subject to customary cut-backs. In addition, subject to some exceptions, holders of Registrable Securities will be entitled under the Registration Rights Agreement to request in writing that we register the resale of any or all of such Registrable Securities on Form S-3 and any similar short-form registration that may be available at such time.

Under the Registration Rights Agreement, we agreed to indemnify the holders of Registrable Securities and certain persons or entities related to them, such as their officers, directors, employees, agents and representatives, against any losses or damages resulting from any untrue statement or omission of a material fact in any registration statement or prospectus pursuant to which they sell Registrable Securities, unless such liability arose from their misstatement or omission; the holders of Registrable Securities, including Registrable Securities in any registration statement or prospectus, agreed to indemnify the Company and certain persons or entities related to it, such as its officers and directors and underwriters, against all losses caused by their misstatements or omissions in those documents.

| 6 |

The foregoing description of the Registration Rights Agreement does not purport to be complete. For further information, please refer to the copy of the Registration Rights Agreement that is filed as Exhibit 10.1 to this Report.

Lock-Up Agreement

At the Closing and in connection with the Business Combination, the Selling Shareholders entered into a Lock-Up Agreement with the Company and the Purchaser Representative (“Lock-Up Agreement”). Under the Lock-Up Agreement, each Seller agreed that, during the period from the Closing until the earlier of (x) the first anniversary of the Closing, (y) the date on which the Company consummates a liquidation, merger, share exchange or other similar transaction with an unaffiliated third party that results in all of the Company’s shareholders having the right to exchange their equity holdings in the Company for cash, securities or other property and, (z) only with respect to 50% of each type of Restricted Securities held by each holder, the date on which the closing sale price of Company ordinary shares equals or exceeds $12.50 per share (as adjusted for share splits, share dividends, reorganizations and recapitalizations) for any 20 trading days within any 30 trading day period commencing after the Closing Date, it will not (i) lend, offer, pledge, hypothecate, encumber, donate, assign, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any Restricted Securities, (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Restricted Securities, or (iii) publicly announce any intention to effect any transaction specified in clause (i) or (ii). Each holder also agreed that the Escrow Shares will continue to be subject to such transfer restrictions until they are released from the Escrow Account. However, each holder is permitted to transfer its Restricted Securities (other than the Escrow Shares while they are held in the Escrow Account) by gift, will or intestate succession upon such holder’s death, pursuant to a court order or settlement agreement related to the distribution of assets in connection with the dissolution of marriage or civil union or to certain permitted transferees, provided in each such case that the transferee thereof agrees to be bound by the restrictions set forth in the Lock-up Agreement. Additionally, each holder will be allowed to pledge its Restricted Securities (other than the Escrow Shares while they are held in the Escrow Account) to an unaffiliated third party as a guarantee to secure borrowings made by such third party to the Company or any of its subsidiaries. In the event that any holder that enters into a Lock-Up Agreement is released from its obligations thereunder with respect to all or any portion of its Restricted Securities, each other holder subject to a Lock-Up Agreement will similarly be released in a proportional manner.

The foregoing description of the Lock-Up Agreement does not purport to be complete. For further information, please refer to the copy of the Lock-Up Agreement that is filed as Exhibit 10.2 to this Report.

Non-Competition and Non-Solicitation Agreement

At the Closing and in connection with the Business Combination, specified Sellers actively involved with Borqs International management (each, a “Subject Party”) entered into Non-Competition and Non-Solicitation Agreements (each, a “Non-Competition Agreement”), in favor of the Company, Borqs International and their respective successors and subsidiaries (referred to as the “Covered Parties”), and to which the Purchaser Representative is also a party thereunder, relating to the business of providing software and solutions for connected devices in the Internet of Things industry, and mobile communication services as a Mobile Virtual Network Operator (“Business”) as conducted by Borqs and to be conducted by us after the Closing. Under the Non-Competition Agreement, for a period from the Closing until the later of (i) the four-year anniversary of the Closing or (ii) the date on which the Subject Party is no longer a director, officer, manager, employee or independent contractor of any Covered Party (“Restricted Period”), the Subject Party and its controlled affiliates will not, without the Company’s prior written consent, anywhere in the Peoples’ Republic of China or in any other markets in which the Covered Parties are engaged, or are actively contemplating to become engaged, in the Business as of the Closing Date or during the Restricted Period, directly or indirectly engage in the Business (other than through a Covered Party) or own, manage, finance or control, or participate in the ownership, management, financing or control of, or become engaged or serve as an officer, director, member, partner, employee, agent, consultant, advisor or representative of, a business or entity (other than a Covered Party) that engages in the Business (“Competitor”). However, the Subject Party and its affiliates will be permitted under the Non-Competition Agreement to own passive investments of no more than 2% of any class of outstanding equity interests in a Competitor that is publicly traded, so long as the Subject Party and its affiliates and immediate family members are not involved in the management or control of such Competitor. Under the Non-Competition Agreements, the Subject Party and its controlled affiliates will also be subject to certain non-solicitation and non-interference obligations during the Restricted Period with respect to the Covered Parties’ respective (i) employees, consultants and independent contractors, (ii) customers and (iii) vendors, suppliers, distributors, agents or other service providers. The Subject Party will also be subject to non-disparagement provisions regarding the Covered Parties and confidentiality obligations with respect to the confidential information of the Covered Parties.

| 7 |

The foregoing description of the Non-Competition Agreement does not purport to be complete. For further information, please refer to the copy of the form of Non-Competition Agreement that is filed as Exhibit 10.3 to this Report.

Escrow Agreement

At the Closing, the Company, the Purchaser Representative and the Seller Representative (on behalf of the Sellers) entered into an Escrow Agreement with Continental Stock Transfer & Trust Company (“Escrow Agent”) pursuant to which the Escrow Agent will hold the Escrow Shares in escrow accounts, to be held and disbursed as agreed to in the Merger Agreement. The Purchaser Representative will have the sole right to act on our behalf under the Escrow Agreement.

The foregoing description of the Escrow Agreement does not purport to be complete. For further information, please refer to the copy of the Escrow Agreement that is filed as Exhibit 10.4 to this Report.

Letter of Transmittal

At the Closing and in connection with the Business Combination, the Sellers and the holders of a Borqs International warrant provided Borqs International and Pacific with a completed and duly executed Letter of Transmittal (“Letter of Transmittal”), with respect to their Borqs International shares and warrants. In the Letter of Transmittal, each such holder made customary representations and warranties, acknowledged its obligations with respect to the indemnification obligations and escrow provisions under the Merger Agreement, appointed the Seller Representative to act on its behalf in accordance with the terms of the Merger Agreement, provided a general release to Borqs International and its affiliates and certain related persons with respect to claims relating to the holder’s capacity as a holder of Borqs International shares, warrants or options, and agreed to be bound by confidentiality obligations to Borqs International for two years after the Closing.

The foregoing description of the Letter of Transmittal does not purport to be complete. For further information, please refer to the copy of the Letter of Transmittal that is filed as Exhibit 10.5 to this Report.

Backstop and Subscription Agreement

On May 11, 2017, in connection with the execution of an amendment to the Merger Agreement on May 10, 2017, the Company and the Sponsor entered into a Backstop and Subscription Agreement (“Backstop and Subscription Agreement”), pursuant to which the Sponsor agreed to purchase up to $24.0 million of our ordinary shares through (i) open market or privately negotiated transactions with third parties (with the Sponsor not obligated to pay a price of greater than $10.40 per share), (ii) a private placement at a price of $10.40 per share with consummation to occur concurrently with that of the Business Combination or (iii) a combination thereof, in order to ensure that there is at least $24.0 million in funds left in the Company’s trust account after redemptions in connection with the Merger and the proceeds from any third party equity financing conducted by the Company prior to the closing of the Merger (“Backstop Commitment”), although the Sponsor was entitled, at its sole election, to purchase additional ordinary shares in excess of such $24.0 million closing proceeds requirement, up to a total of $24.0 million purchased in total in connection with the Backstop and Subscription Agreement. On August 16, 2017, $750,000 of the Sponsor’s obligations to purchase shares in the private placement from the Company under the Backstop and Subscription Agreement were assigned to EarlyBirdCapital. As consideration for the Backstop Commitment, the Sponsor and EarlyBirdCapital received the Backstop Guarantee Shares. At the Closing, the Company, the Sponsor, EarlyBirdCapital and certain other investors thereto amended and restated the registration rights agreement, dated as of October 14, 2015, with respect to the Backstop Guarantee Shares and the shares purchased by the Sponsor and EarlyBirdCapital in connection with the Backstop and Subscription Agreement.

The foregoing description of the Backstop and Subscription Agreement does not purport to be complete. For further information, please refer to the copy of the Backstop and Subscription Agreement that is filed as Exhibit 10.6 to this Report and the Partial Assignment and Amendment of Backstop and Subscription Agreement, dated August 18, 2017, by and between the Sponsor, EarlyBirdCapital, Pacific and Borqs International that is filed as Exhibit 10.12 to this Report.

| 8 |

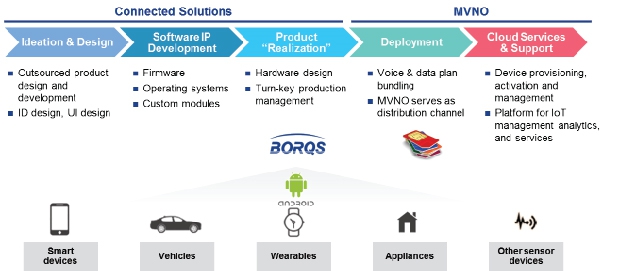

The business of Borqs Technologies, Inc. is to provide customizable, differentiated and scalable Android-based smart connected devices and cloud service solutions through its two business units (“BUs”), Connected Solutions and MVNO. The Connected Solutions BU develops wireless mobile connected devices and cloud solutions. The MVNO BU operates a mobile virtual network in China that provides a full range of 2G/3G/4G mobile communication services at the consumer level.

Overview

Borqs Technologies, Inc. is a global leader in software, development services and products providing customizable, differentiated and scalable Android-based smart connected devices and cloud service solutions. Borqs is a leading provider of commercial grade Android platform software for mobile chipset manufacturers, mobile device OEMs and mobile operators, as well as complete product solutions of mobile connected devices for enterprise and consumer applications. In recent years, Borqs has been awarded significant business contracts from Intel and Qualcomm, leading global chipset manufacturers.

Borqs has two BUs, Connected Solutions and MVNO. The Connected Solutions BU develops wireless mobile connected devices and cloud solutions. Connected Solutions BU revenue is recognized as software revenue and hardware revenue. The MVNO BU operates a mobile virtual network in China that provides a full range of 2G/3G/4G mobile communication services at the consumer level.

The Connected Solutions BU works closely with chipset partners to develop new connected devices. Borqs developed the reference Android software platform and hardware platform for Intel and Qualcomm phones and tablets. In February 2016, Qualcomm announced its planned business expansion for its next generation Qualcomm® Snapdragon™ Wear platform with the addition of new ecosystem partners, including Borqs. The platform is targeted for next generation connected and tethered wearables, such as smartwatches, kid and elderly watches, smart bands, smart eyewear and smart headsets. The availability of the state-of-the-art chipset functionalities from partners, combined with full service industrial design, hardware and software engineering and manufacturing management, opens exciting new possibilities for device manufacturers to accelerate the design, development and deployment of innovative connected devices.

The Borqs platform is built on the Android platform developed by Google and first released to the public in 2008. Borqs was among the first to obtain the Android source code, and in 2008 Borqs built an innovative technology platform used in the first deployment of Android-based mobile devices to support the TD-SCDMA network of China Mobile Communications Corporation (“China Mobile”).

Borqs provides Connected Solutions customers with customized, integrated, commercial grade Android platform software and service solutions to address vertical market segment needs through the targeted BorqsWare software platform solutions. The BorqsWare software platform consists of BorqsWare Client Software and BorqsWare Server Software. The BorqsWare Client Software platform consists of three major components: the latest commercial grade Android software that works with particular mobile chipsets, functionality enhancements of the open source Android software and mobile operator required services. Based on the BorqsWare Client Software platform, customers may require Borqs to provide further customization based on their specific market needs. The BorqsWare Client Software platform has been used in Android phones, tablets, watches and various Internet-of-things (“IoT”) devices. The BorqsWare Server Software platform consists of back-end server software that allows customers to develop their own mobile end-to-end services for their devices. The BorqsWare Server Software provides software necessary for upgrades, charging and various APIs that enhance the customers’ services. Based on BorqsWare Server Software service platform, customers may require us to provide further customization based on their specific needs.

The MVNO BU provides a full range 2G/3G/4G voice and data services for general consumer usage and IoT devices, as well as traditional telecom services such as voice conferencing. The MVNO BU also acts as a sales and promotion channel for the products developed by the Connected Solutions BU. Borqs believes that a key component of the sales of connected devices going forward is the bundling of those devices with a voice/data plan through its MVNO BU. The MVNO BU launched operations in the fourth quarter of 2014. The MVNO BU provides services throughout China. Borqs had more than two million registered subscribers at the end of 2015 and approximately 4.5 million at the end of 2016.

| 9 |

The MVNO BU is the principal in providing the bundled voice and data services to Chinese consumers, thus revenue is recognized on a gross basis. As sales of bundled services are mostly pre-paid by the consumers, cash received in advance of voice and data consumption are recognized as deferred revenue. Revenue is recognized when the services are actually used. Pre-paid bundled services do not expire. Sales of the bundles are mostly made through agents and franchisees. Bundled services sold to agents are discounted and not refundable to Borqs; and such discounts are recorded as reductions of revenue. We enter into profit sharing arrangements with franchisees under which bundled services may be returned if not sold to the consumers. The franchisees receive certain percentages of profits made by Borqs on the sales of the bundled services as they are used by the consumers. We account for profit sharing with franchisees as selling expenses in the consolidated statements of operations. Pursuant to the Company’s policy, the amount of discounts that may be provided by the franchisees to consumers is capped at 5%, based on which, we recognized the maximum amount of discounts that may be provided by the franchisees as reductions of revenue.

The Connected Solutions BU has a global customer base covering the core parts of the Android platform value chain, including mobile chipset manufacturers, mobile device OEMs and mobile operators. This BU represented 73.4% and 70.9% of Borqs’ net revenues in 2015 and 2016, respectively, while the MVNO BU represented 26.6% and 29.1% of net revenues for the same periods. In 2015 and 2016, Borqs generated 61.7% and 65.7%, respectively, of its net revenues from customers headquartered outside of China and 38.3% and 34.3%, respectively, of its net revenues from customers headquartered within China. As of July 2017, Borqs has collaborated with six mobile chipset manufacturers and 29 mobile device OEMs to commercially launch Android based connected devices in 11 countries, and sales of connected devices with the BorqsWare software platform solutions are embedded in more than 10 million units worldwide.

Borqs has dedicated significant resources to research and development, and has research and development centers in Beijing, China and Bangalore, India. As of December 31, 2016, 403 of its 565 full-time employees and contractors were technical professionals dedicated to platform research and development and product specific customization. Technical professionals have diverse backgrounds and experience gained through employment with leading mobile chipset designers and manufacturers, mobile device OEMs, internet content providers and other software and hardware enterprises.

Borqs has achieved significant growth since inception in 2007. Net revenues increased from $47.5 million in 2014 to $75.1 million and $120.6 million in 2015 and 2016, respectively. Borqs recorded a net loss of $8.2 million in 2014 and a net income of $0.8 million and $2.6 million in 2015 and 2016, respectively.

Corporate Information and History

We incorporated in the British Virgin Islands on July 1, 2015. We were formed for the purpose of acquiring, engaging in a share exchange, share reconstruction and amalgamation, purchasing all or substantially all of the assets of, entering into contractual arrangements, or engaging in any other similar business combination with one or more businesses or entities. Since incorporation and prior to the Business Combination, we were a “shell company” as defined in Rule 12b-2 under the Exchange Act. As a result of the Business Combination, we acquired the business of Borqs International and have ceased to be a shell company.

As of August 18, 2017, our authorized and issued capital stock consisted of 30,804,635 ordinary shares, 5,750,000 public warrants, 497,671 private warrants, and 4,415,923 assumed warrants. Our ordinary shares and warrants began trading on the Nasdaq Capital Market (“Nasdaq”) under the symbols “BRQS” and “BRQSW,” respectively, on or around August 21, 2017.

Our principal executive offices are located at Tower A, Building B23, Universal Business Park No. 10 Jiuxiangqiao Road, Chaoyang District, Beijing, 100015 China. Our telephone number is +86 10-5975-6336. Our website address is www.borqs.com. The information contained on our website is not incorporated by reference into this Report.

| 10 |

Borqs International Holding Corp was incorporated in the Cayman Islands on July 27, 2007 and after the Business Combination is a direct, wholly-owned subsidiary of the Company. As of the date of this Report, the Company conducts its business principally through BORQS Beijing Ltd. (“Borqs Beijing”), which is a wholly-owned Chinese subsidiary. In addition, Borqs conducts part of its operations through its other subsidiaries in China, India, Hong Kong and South Korea.

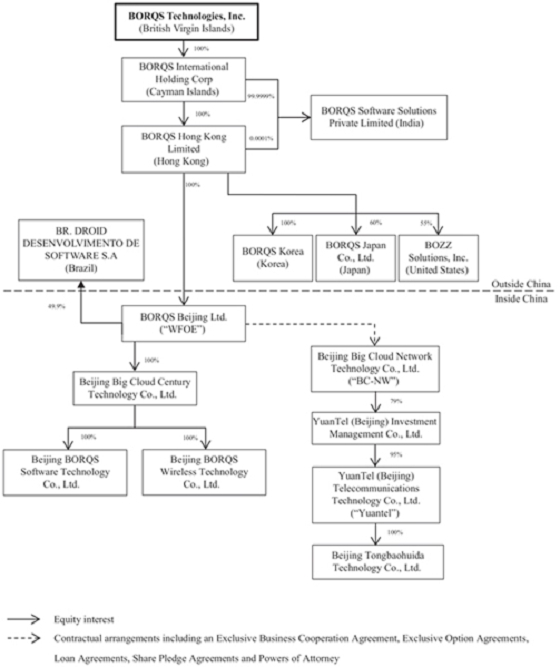

The following diagram illustrates our current corporate structure and the place of formation, ownership interest and affiliation of each of our subsidiaries and consolidated affiliated entities as of the date of this Report.

Corporate Organizational Chart

| 11 |

Borqs Wholly-Owned Subsidiaries and Consolidated Affiliated Entities

| ● | Borqs Beijing, a wholly foreign owned enterprise established under the laws of the PRC in 2007, which is Borqs’ primary operating entity and 100% owned by BORQS Hong Kong Limited; |

| ● | BORQS Hong Kong Limited, or Borqs Hong Kong, a limited company established under the laws of Hong Kong in 2007, which engages in the software and services business and is 100% owned by us; |

| ● | BORQS Software Solutions Private Limited, or Borqs Software Solutions, a private limited company established under the laws of India in 2009, which engages in the R&D of software and is 99.99% owned by us and 0.01% owned by Borqs Hong Kong; |

| ● | BORQS Korea, or Borqs Korea, a company established under the laws of South Korea in 2012, which engages in the R&D of software and is 100% owned by Borqs Hong Kong; |

| ● | Beijing BORQS Software Technology Co, Ltd., or Borqs Software, a company established under the laws of the PRC in 2008, which engages in government subsidized software development and engineering projects as well as other software and services business and is 100% owned by Beijing Big Cloud Century Technology Limited, or Big Cloud, which is 100% owned by Borqs Beijing; and |

| ● | YuanTel (Beijing) Telecommunications Technology Co., Ltd., or YuanTel Telecom, a company established under the laws of the PRC in 2004, which mainly engages in MVNO services and is 95% owned by YuanTel (Beijing) Investment Management Co., Ltd., which is 79% owned by Beijing Big Cloud Network Technology Co. Ltd., which is 100% beneficially owned and controlled by Borqs Beijing through contractual control arrangements. |

Our Business

Immediately following the Business Combination, the business of Borqs Technologies, Inc. is to provide customizable, differentiated and scalable Android-based smart connected devices and cloud service solutions through its two BUs, Connected Solutions and MVNO. The Connected Solutions BU develops wireless mobile connected devices and cloud solutions. The MVNO BU operates a mobile virtual network in China that provides a full range of 2G/3G/4G mobile communication services at the consumer level.

Industry Background

Overview

Android is an open source operating system for mobile devices such as smartphones and tablet computers, and was first released to the public by Google in late 2008. Participants in the Android ecosystem, including mobile device OEMs, mobile chipset manufacturers, mobile network operators, Android platform software companies and third party developers, can work together on this open source platform to provide customized end-to-end solutions, services and applications for connected devices. Android has become the world’s top-selling smartphone platform.

Android source code is available under free and open software licenses, but has limited commercial viability in several respects, including the fact that it:

| ● | lacks software needed to integrate with a particular chipset; | |

| ● | does not support many advanced radio network features; | |

| ● | lacks user interface and features differentiation for different mobile device OEMs; | |

| ● | lacks software for mobile operator services; and | |

| ● | lacks software for various vertical applications. |

| 12 |

Worldwide Connected Devices vs IoT Market

Connected devices include regular phones, tablets, wearables and machine-to-machine (M2M) devices. Each connected device has a uniquely identifiable endpoint that communicates using IP connectivity — be it “locally” using Wifi/Bluetooth or “remotely” using 2G/3G/4G/5G technologies. Connected devices facilitate ubiquitous connectivity for businesses, governments and consumers, leveraging built-in management, monitoring and analytics capabilities. We define IoT to include all connected devices other than phones and tablets, so devices such as wearables and M2M devices are in the category of IoT.

In its report on IoT platforms, IHS Technology describes IoT devices as having four major components: the managed device itself; managed connectivity through operators and MVNOs; the IoT end-to-end software platform and particular IoT software applications. For instance, to provide a fleet management IoT solution, a managed device (e.g., a fleet device in a vehicle) is needed, along with a phone number (usually stored in a SIM card) providing connectivity (managed through operators or MVNOs), an end-to-end software platform to manage the devices with software upgrade, charging and control capabilities and a fleet software application that runs on both the fleet device and the backend cloud server (IoT particular application).

Deloitte has identified IoT as one of four key technology trends, and the consensus of different industry forecasts is that the IoT market is growing rapidly. IHS Technology estimates that there were about 15 billion IoT devices in use in 2015, and that number will grow to about 30 billion IoT devices in 2020. In its June 2016 mobility report, Ericsson forecasts that the number of IoT devices in use is expected to increase at a compounded annual growth rate (CAGR) of 23 percent from 2015 to 2021, driven by new use cases. In total, Ericsson estimates around 28 billion connected devices will ship by 2021, of which close to 16 billion will be related to IoT. There were around 400 million IoT devices with cellular subscriptions at the end of 2015. Cellular IoT is expected to have the highest growth among the all categories of connected devices, reaching 1.5 billion in 2021.

Smartphones and Tablets Operating System Market Share

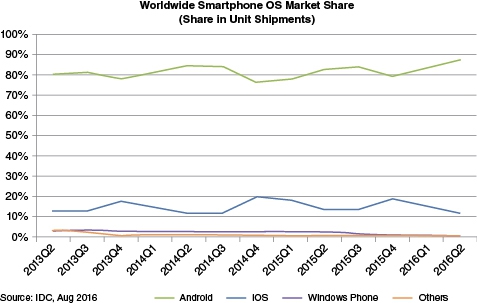

Android and iOS remain the dominant operating systems for smartphones and tablets. IDC reported that in the second quarter of 2016, Android and iOS market shares for smartphones were 87.6% and 11.7%, respectively. Strata reported that in the third quarter of 2016, the market share of iOS tablets was about 21.5% and the remainder is dominated by Android tablets.

IoT Operating System Market Share

The current IoT operating system market is fragmented. Android, Android-based operating systems, Windows and proprietary operating systems compete in the market along with other small players. The success of an IoT operating system depends on many factors, including the ability to build a full ecosystem of products and services that utilize the IoT operating system.

Android. Google first announced Android in November 2007 and first released it to the public in late 2008. Developers use the open source Android platform to provide customized solutions, services and applications for mobile devices. In addition, Android has built a strong developer community through the Android Market, which features over 2.2M applications that have over ten billion downloads collectively. This developer community is expected to continue to support the growth and development of Android. In addition, Google has launched the specific version of Android for wearables, called Android Wear.

Android-Based. Android-based operating systems are based on Android but with significant changes in the underlying software. This includes Google’s Brillo/Weave operating system. Brillo has the advantages of being open source and can leverage the Android ecosystem; it is suitable for connected devices that have small memory footprint and a small or no display. Brillo’s communications protocol is called Weave.

Linux-Based Open Source. The Linux community has developed a number of open source IoT operating systems, e.g. RIOT and Zephyr. One advantage of these operating systems is that they are open source and a number of developers can explore and enhance the software. However, these operating systems lack industry standardization and support that large companies like Google or Microsoft can provide.

| 13 |

Linux-Based Proprietary. Historically, various companies have developed real-time operating systems that can be used in real-time applications, such as VxWorks and Nucleus. These operating systems are proprietary and not open source. They have mostly been used in the industrial, medical, and aerospace fields. The disadvantage of these operating systems is that they lack industry momentum and support from large companies such as Google or Microsoft, and they lack service APIs to create versatile applications.

Windows. Microsoft’s latest embedded operating system is known as Windows 10 for IoT. Under this umbrella, three subset operating systems are available. Windows 10 for IoT Mobile supports the ARM architecture; Windows 10 for IoT Core supports Raspberry Pi and Intel Atom; and Windows 10 for IoT Enterprise is essentially the full-blown Windows 10 Enterprise operating system. Because Windows 10 for IoT is so new, it lags behind many others in terms of user base and experienced developers.

ARM. ARM is developing its own open source embedded operating system, called mbed OS. Since it is being developed by ARM, that is the only supported architecture. That said, mbed OS is expected to make a splash in the smart-home and wearable-device IoT segments. Mbed OS differs from many other embedded operating systems because it is single-threaded, rather than multi-threaded. ARM says it feels this is necessary for it to be able to run on the smallest and lowest-power devices out there. If physical size and battery life are critical, mbed OS can be a choice.

Apple iOS. While Apple has yet to play a significant role in today’s IoT market, it is expected to do so soon. Up to this point, Apple has adopted variants of its iOS platform and created IoT devices such as Apple TV, CarPlay and the Apple Watch. Moving forward, Apple is expected to continue its use of iOS and to modify OS X so that it runs leaner and more efficiently on IoT endpoints.

The table below shows historical and current market shares of mobile operating systems for smartphone based on unit shipments. Android dominates the market shares, followed by Apple iOS. While the IoT OS ecosystem is fragmented, we anticipate that Android and Android-based IoT OS will follow the trend of smartphones to dominate the IoT OS.

| 14 |

Android Platform and Software Market

Market Development. Prior to the introduction of Android, the market for mobile chipset and mobile device software was primarily served by the in-house research and development teams of mobile chipset manufacturers and mobile device OEMs, who developed and configured proprietary software, such as the BlackBerry and Windows Mobile operating systems, for each mobile device. However, Android’s open source nature has enabled participants in the Android ecosystem to exert greater influence over the design of mobile devices and related software and features, as well as mobile services. This has led to a rapid proliferation and upgrading of products, and introduced a greater degree of complexity for participants in the Android ecosystem because Android requires configuration and customization of both Android platform software and other essential software in order to become commercially viable. For example:

| ● | mobile chipset manufacturers need to develop chipsets with the latest commercial grade Android software that supports specific radio networks, enhances compute and connectivity performance, optimizes power management and supports network specific features; |

| ● | connected devices OEMs may need to manufacture devices that contain the latest commercial grade Android software that supports mobile device- and network-specific features, enhances Android compute and connectivity performance, enhances the user interface and incorporates operator software packages; and |

| ● | mobile operators may need to provide services to their customers, such as subscriber data synchronization, file backup and restore, software upgrades, mobile markets, content push and others. |

The key drivers for growth in the Android platform and software market include:

| ● | continued widespread acceptance and deployment of the Android platform; |

| ● | continued rollout of high speed mobile networks, which are expected to promote growth in the smartphone market and contribute to the growth of mobile operating system platforms; |

| ● | continued growth in smartphone shipments; |

| ● | introduction of new and targeted mobile services; |

| ● | increasing variety and availability of mobile chipsets and mobile devices; and |

| ● | mobile operators seeking to create unique and differentiated services for their subscribers. |

Market Segmentation. Segmentation in the connected device market includes connected chipset manufacturers, connected device and mobile operators.

Connected Chipset Manufacturers. The connected chipset industry has undergone consolidation in the past several years. Currently, Intel, MediaTek, Spreadtrum and Qualcomm are the four leading mobile chipset vendors. Intel and Qualcomm are known for their innovation and capability. MediaTek and Spreadtrum are known for being low cost. These companies have acquired a number of their competitors. Qualcomm has announced the acquisition of NXP in October 2016. NXP said it was the fifth-largest non-memory semiconductor supplier in 2016, and the leading semiconductor supplier for the secure identification, automotive and digital networking industries. The market for connected chipsets is expected to experience significant growth in conjunction with the increasing popularity of connected devices.

Connected Device. The market for traditional connected devices, such as smartphones and tablets, are expected to continue to grow. Ericsson forecasted that the worldwide mobile subscriptions would increase from 3.2 billion in 2015 to 6.3 billion in 2016. The growth was due to the fact that many consumers in developing markets first experience the internet on a smartphone, usually due to limited access to fixed broadband. The growth will primarily come from markets such as India, Middle East and Africa.

| 15 |

With the popularity of IoT devices, connected devices are expected to post another wave of significant growth. Ericsson forecasted that around 29 billion connected devices by 2022, of which around 18 billion will be IoT devices. Cisco estimated that the number of connected devices per person, which was 1.84 devices per person in 2010, will grow to 6.58 devices per person by 2020. The table below shows the historical and projected growth of IoT devices.

Mobile Operators. For the past two decades, mobile operators have experienced a significant growth in subscribers due to the popularity of mobile phones. With the launch of 3G and 4G services, the growth of data traffic has increased significantly as the cost per bit declined. Ericsson’s report states the monthly traffic per smartphone grew from 1GB/month in 2014 to 1.4GB/month in 2015, and forecasted a CAGR of 35% over the period 2015-2021. Cellular networks have also evolved to support the growth of data traffic and IoT traffic. The state-of-the-art 4G network can support more than 1Gbps downlink traffic and 500Mbps uplink traffic. By 5G, the network architecture can support up to 10Gbps and 100 times more number of connected devices. Ericsson estimated that 70% of wide-area IoT devices will use cellular technology in 2022. In 2018, the number of IoT devices is expected to exceed the number of mobile phones.

MVNO. A mobile virtual network operator (“MVNO”) is a wireless communications services provider that does not own the wireless network infrastructure over which it provides services to its customers. An MVNO enters into a business agreement with a mobile network operator to obtain bulk access to network services at wholesale rates, then sets retail prices independently. An MVNO may use its own customer service, billing support systems, marketing, and sales personnel, or may employ the services of a mobile virtual network enabler. GSMA Intelligence estimated that between June 2010 and June 2015, the number of MVNOs worldwide increased by 70%, to 1,017 in June 2015. The report noted that the 10 countries with the largest number of MVNOs in June 2015 were Germany with 129, the U.S. with 108, the UK 76, the Netherlands 56, France 49, Australia 43, Denmark 43, Spain 35, Poland 27, and Belgium with 26. In Europe, about 30% to 40% of the mobile users are MVNO subscribers. In the U.S., it is about 10% to 15%. China launched MVNO in late 2014. Statista estimated that there were 30 million MVNO subscribers in China in 2015 and will grow to 90 million by 2020.

Necessity for Third Party Providers. Although the in-house research and development teams of mobile chipset manufacturers and connected device OEMs have dominated the Android platform and software market, participants in the Android ecosystem are increasingly turning to third party solutions providers to address their needs. Several factors have contributed to this shift, including the increasing need of mobile chipset manufacturers and mobile device OEMs to deal with a wider range of specific software requirements and limited capabilities of in-house research and development teams with respect to product development and implementation. Third party providers often (i) have the domain expertise and resources to develop enhanced Android platform software and service solutions that address the specific performance, feature and functionality requirements of various mobile chipset manufacturers, mobile device OEMs and mobile operators, (ii) generate deep expertise from developing and customizing software products for multiple customers and (iii) are able to keep pace with the near-constant introduction of new mobile chipsets, mobile devices, OS and apps. Therefore, third party providers are expected to continue to play a key role in providing comprehensive software and service solutions for participants in the Android ecosystem.

| 16 |

Solution Offering — End to End Business Model

The Borqs Connected Solutions BU can help customers to design, develop and “realize” the commercialization of their connected devices. The MVNO BU can help customers to deploy their devices in China with 2G/3G/4G cellular connectivity with flexible voice/data plan.

Ideation & Design — Based on customer requirements on the type of connected device the customer want to have, we can help customers design the product ID and user interface. We have the design engineering to provide 2D/3D rendering. The Company can provide physical mockup with different color, material and finishes, so the customer can hold and “feel” the mockup before finalizing the product ID.

Software IP Development — IoT devices are often highly customized and require special software to display the data (e.g. circular watch display and user interface), to reduce the power consumption (e.g., a small battery in a wearable device), to perform specific functions (e.g., push-to-talk) and to connect to the network (e.g., 3G/4G connection). The Company has developed a large number of software libraries that can be reused for various connected devices.

Product “Realization” — Some customers have limited hardware design capabilities. The Company has a strong hardware research and development team to help customers to design the hardware, including the PCBA design and mechanical design. The Company can also provide turn-key services to help customer to handle the manufacturing logistics (including supply chain and EMS management) in order to manufacture the product. The Company has the experiences and resources to manage the factory supply chain, quality control and other manufacturing logistics.

Deployment — A number of connected devices require cellular 2G/3G/4G connectivity to connect to the network to access the backend cloud services. If a customer intends to deploy their connected devices in China, the customer can acquire SIM cards with flexible voice/data plans from our MVNO to have the cellular connectivity.

Cloud Services and Support — The MVNO can help customers to provision and manage their subscribers database, handle the payment and re-charging and as well as provide data analytics of the subscribers for their usage traffic models.

Competitive Strengths

We believe the following factors differentiate us from our competitors and contribute to our success:

Strategic relationships with leading chipset vendors.

The Company works closely with the world’s two leading chipset vendors, Intel and Qualcomm, in their software development, including software for their latest state-of-the-art chipsets. The Company develops connected device products and solutions based on these chipsets. Due to these strategic relationships, it is able to come up with a competitive product portfolio. The Company leverages the large global sales teams of both Intel and Qualcomm.

| 17 |

Strong software capabilities across core parts of the Android platform value chain, driving a full suite of BorqsWare software and services platform solutions and a significant time to market advantage for customers.

The Company was among the first to obtain the Android source code in early 2008 and has since been focused on building the Company’s innovative technology platform to serve customers across the core parts of the Android platform value chain. For example, the Company believes it was the first company to develop commercial grade software to support video telephony for Android, which was not supported by open source Android. In addition, in connection with collaboration with China Mobile, the Company developed the base chipset software for the first deployment of Android-based mobile devices to support China Mobile’s TD-SCDMA network. Recently, the Company partnered with Qualcomm and launched the world’s first 4G watch. The Company has the Google GMS license that can be used for the Android phones and tablets for its customers.

Global customer base and extensive industry relationships.

The Company had more than 50 customers as of December 31, 2016, including some of the world’s leading companies in the mobile industry. Its diversified customer base includes mobile chipset manufacturers, mobile device OEMs and mobile operators. The Company has collaborated with more than six mobile chipset manufacturers (Intel, Qualcomm, Marvell, etc.) and 29 connected device OEMs (LGE, Micromax, Acer, Motorola, Vizio, etc.) to commercially launch Android-based devices in 11 countries, and more than 10 million mobile devices sold worldwide have BorqsWare software platform solutions embedded. Our products have been deployed by more than 10 service providers (AT&T, China Mobile, Claro, Orange, Reliance Jio, Sprint, Verizon, etc.) on four continents.

MVNO subscribers and sales channel.

According to the MVNO Cooperative Office of the Regulatory Affairs Department of China Unicom (the incumbent mobile operator), we had 4.56 million registered subscribers as of December 31, 2016, making it the second largest MVNO in China. The Company’s MVNO BU provides a positive cash flow. The Company believes that a key success factor of IoT business is to bundle IoT devices with a SIM card for voice/data communications. It plans to launch connected devices together with SIM cards (and voice/data plans) in 2017, converting one-time device sales revenues into recurring monthly voice/data revenues.

Significant resources dedicated to research and development.

The Company dedicated significant financial and human resources to research and development needed to build a full suite of connected device software and service platform solutions to address customers’ evolving needs across the core parts of the Android platform value chain. Research and development expenses represented 57.7% and 37.2% of operating expenses in 2014 and 2015. The decrease in research and development expenses as a percentage of operating expenses was due to the capitalization of $3.3 million in project-based software development costs in the year 2015. In 2016, research and development expenses represented 30.1% of operating expenses, while $4.9 million of project-based software development costs were capitalized.

To date, the Company has been granted 130 patents in China and six patents in the United States, and it has 18 pending patent applications in China and three pending patent applications in the United States. The Company also has 91 software copyrights and 47 trademarks registered and 17 pending trademarks in China. In addition, the Company has registered its domain name with various domain name registration services.

The Company believes that it has one of the most experienced research and development teams in the Android platform software ecosystem. As of December 31, 2016, the Company had 565 full-time employees and contractors, of which 71 were technical professionals dedicated to platform research and development and project-specific customization. Of these, 60% have more than five years of experience in software or hardware engineering and development and 100% hold a bachelor’s degree or higher. The Company’s research and development team members have diverse backgrounds and experience gained through employment with leading mobile chipset designers and manufacturers, mobile device OEMs, Internet content providers and other software and hardware enterprises.

| 18 |

Strong and experienced management team.

The Company is led by a strong management team with rich operational experience and strong execution capabilities. Several senior executives have technical and engineering backgrounds and extensive experience as senior managers of leading mobile technology companies. The Company’s Chairman of the Board and Chief Executive Officer, Pat Chan, is the former senior vice president and general manager of UTStarcom, a telecommunications and telecommunications equipment company listed on Nasdaq, where he was responsible for the infrastructure business, including mobile networks, broadband and IPTV. Mr. Chan is an established entrepreneur and has received many awards, including the “High-Caliber Talent from Overseas Award” from the PRC government, and “2012 Beijing Entrepreneur of the Year” in 2012 from Silicon Dragon.

The Connected Solutions BU is headed by Hareesh Ramanna and Simon Sun. Mr. Ramanna has over 20 years of experience in mobile industry. Prior to joining us, he served as senior director and head of mobile devices software in Global Software Group, Motorola India Electronic. Mr. Simon Sun was the CEO of Nollec, a phone design house in China. The MVNO BU is headed by Gene Wuu. Previously Mr. Wuu was the SVP and GM of UTStarcom and has also worked as an executive in Telcordia Technologies (formerly Bellcore). The international business team is headed by George Thangadurai. Mr. Thangadurai worked for Intel for more than two decades in various technical and senior management roles including GM of Strategy & Product Planning for the Mobile PC business and GM of the Client Services business. The Company’s Chief Financial Officer has over 30 years of experience in US-China cross border investments and business operations, and has been instrumentally involved with M&A, spin-off, IPO and capital market transactions totaling over US$200 million. Our corporate affairs and China sales is headed by Bob Li, who has over 20 years research and development and management experience in the wireless communications, semiconductor and mobile Internet industries.

Growth Strategies

Our strategic goal is to lead and expand the market for smart connected devices, and grow our MVNO market share in China. We plan to achieve its goal through the following key strategies:

Maintain and grow market share and maintain technology leadership.

The Company intends to leverage its core technology to maintain its position as a leading independent provider of commercial grade Android platform software for mobile chipset manufacturers, mobile device OEMs and mobile operators, and further grow market share by expanding its BorqsWare software and service platform solutions. The Company also intends to hire additional experienced engineers in China and India and further invest in research and development efforts to strengthen its core technology expertise and capabilities to maintain technology leadership. With respect to the BorqsWare Client software platform solutions, the Company intends to leverage its core technology and strength in research and development to maintain its technology leadership position in the industry. With respect to BorqsWare Server software platform, we believe that mobile operators and MVNO intend to capture additional revenue from their networks by providing various services to their customers rather than just providing bandwidth. The Company intends to continue to develop and promote its BorqsWare Server platform solutions, which include end-to-end Android platform software for both mobile devices and servers and services to operate, manage, maintain and promote end-to-end services for customers. In addition, the Company intends to focus additional research and development resources in areas including enhancing Android platform security, virtualization, such as running multiple operating systems on the same hardware, and end-to-end Android platform software and service solutions for adaptation to mobile operator legacy systems.

| 19 |

Deepen relationships with existing customers.

The Company believes that its relationships with existing customers are strong and intends to strengthen those relationships to create more opportunities for its business. Through collaborations with customers from the early stages of a product launch, the Company believes that it can gain unique insight into its customers’ long-term goals. The Company further believes that its customers are looking for more integrated Android platform solutions across the Android platform value chain. With respect to BorqsWare Client software platform solutions, we work closely with various mobile chipset manufacturers to develop the corresponding software platform solutions for their new chipsets. When the chipsets are ready for commercial launch, we also work with connected device OEMs and mobile operators to develop operator service packages and network specific features for these chipsets based on the BorqsWare Client software platform solutions. With respect to the BorqsWare Server platform solutions, for example, we plan to launch our wearable watch server solution in 2017.

Expand MVNO market share in China.

The Company is one of the top MVNO businesses in China, as measured in terms of registered subscribers. It intends to expand market share organically or by acquiring smaller MVNOs. The Company intends to bundle its connected products with its SIM cards (with voice/data plans) and focus the bundling in the IoT devices.

Selectively pursue acquisitions, strategic alliances, joint ventures and partnerships.

The Company intends to selectively pursue acquisition opportunities, strategic alliances, joint ventures and partnerships to complement its core technology, further its geographic expansion and otherwise enhance shareholder value. Given the fragmentation in the industry, in which we operate, it is actively looking for attractive acquisition, strategic alliance, joint venture and partnership opportunities to grow its business.

Business Units

The Company has two BUs, the Connected Solutions BU and the MVNO BU. The Connected Solutions BU develops wireless smart connected devices and cloud solutions. The MVNO BU operates a mobile virtual network in China that provides a full range of 2G/3G/4G mobile communication services at the consumer level and some traditional commercial telephony services.

The following table presents the sales and profitability of the Company’s two BUs:

SALES

AND PROFITABILITY OF BUSINESS UNITS

(Dollars in thousands)

| For the year ended December 31, | ||||||||||||||||||||||||

| 2014 | 2015 | 2016 | ||||||||||||||||||||||

| $ | % | $ | % | $ | % | |||||||||||||||||||

| ($ in thousands) | ||||||||||||||||||||||||

| Net Revenues: | ||||||||||||||||||||||||

| Connected solutions | 45,280 | 95 | % | 55,115 | 73 | % | 85,448 | 71 | % | |||||||||||||||

| MVNO and others | 2,208 | 5 | % | 19,957 | 27 | % | 35,138 | 29 | % | |||||||||||||||

| Total net revenues | 47,488 | 75,072 | 120,586 | |||||||||||||||||||||

| Cost of Revenues: | ||||||||||||||||||||||||

| Connected solutions | 33,269 | 93 | % | 38,761 | 67 | % | 63,799 | 68 | % | |||||||||||||||

| MVNO and others | 2,378 | 7 | % | 19,205 | 33 | % | 30,493 | 32 | % | |||||||||||||||

| Total cost of revenues | 35,647 | 57,966 | 94,292 | |||||||||||||||||||||

| Gross Margin: | ||||||||||||||||||||||||

| Connected solutions | 27 | % | 30 | % | 25 | % | ||||||||||||||||||

| MVNO and others | -8 | % | 4 | % | 13 | % | ||||||||||||||||||

| Combined gross margin of the Group | 25 | % | 23 | % | 22 | % | ||||||||||||||||||

The Connected Solutions BU designs chipsets and related software for mobile connected devices. The Company outsources manufacturing of connected devices to third-party factories, buying key components for devices and consigning them to the factories to manufacture and assemble. The Company sells the final connected device products to its customers, which are responsible for marketing and retail distribution.

| 20 |

The MVNO BU serves all the domestic China market. Operating under the brand name Yuantel, it leverages the network coverage China Unicom, which is China’s incumbent mobile operator. Subscribers purchase prepaid services, and are charged by the amount of data consumed, minutes of voice calls made, number of text messages sent, and other value-added services (such as caller ID display) used. As needed, subscribers may refresh the mobile phone SIM card, on a pay-as-you-go basis. Each month, we pay China Unicom for the total amount of traffic (MB of data, minutes of voice call made, etc.) actually consumed by subscribers.

The Company uses MVNO franchisees and agents as distribution channels. Those franchisees sell our prepaid services to their subscribers, on SIM cards. The Company compensates franchisees under a profit-sharing arrangement that is based on gross margin on franchisee sales of our services to subscribers. Agents sell our services on behalf of the Company and pay us a discount price for those services.

Customers

The Company’s primary customers are mobile chipset manufacturers, mobile device OEMs and mobile operators. The following table sets forth the top ten customers by net revenue contribution for 2015 and 2016, in absolute amount and as a percentage of net revenues.

| Top 10 Customers | Year ended December 31, 2015 | |||||||

| $ in thousands | % of revenues | |||||||

| Chipset manufacturer | ||||||||

| Customer A | $ | 7,473 | 10.0 | % | ||||

| Customer B | $ | 6,259 | 8.3 | % | ||||

| Mobile operator | ||||||||

| Customer C | $ | 1,003 | 1.3 | % | ||||

| Mobile device OEM | ||||||||

| Customer D | $ | 19,302 | 25.7 | % | ||||

| Customer E | $ | 4,265 | 5.7 | % | ||||

| Customer F | $ | 3,868 | 5.2 | % | ||||

| Customer G | $ | 3,235 | 4.3 | % | ||||

| Customer H | $ | 2,400 | 3.2 | % | ||||

| Customer I | $ | 1,170 | 1.6 | % | ||||

| Customer J | $ | 894 | 1.2 | % | ||||

| Top 10 Customers | Year ended December 31, 2016 | |||||||

| $ in thousands | % of revenues | |||||||

| Chipset manufacturer | ||||||||

| Customer A | $ | 4,250 | 3.5 | % | ||||

| Customer B | $ | 1,101 | 0.9 | % | ||||

| Mobile device OEM | ||||||||

| Customer P | $ | 19,985 | 16.6 | % | ||||

| Customer D | $ | 17,623 | 14.6 | % | ||||

| Customer K | $ | 11,068 | 9.2 | % | ||||

| Customer L | $ | 9,196 | 7.6 | % | ||||

| Customer F | $ | 4,465 | 3.7 | % | ||||

| Customer M | $ | 4,249 | 3.5 | % | ||||

| Customer O | $ | 2,605 | 2.2 | % | ||||

| Customer N | $ | 2,489 | 2.1 | % | ||||

| 21 |

In 2015, the Company generated 61.7% of its net revenues from customers whose headquarters are located outside of China and 38.3% of net revenues from customers whose headquarters are located within China. In 2016, we generated 65.7% of net revenues from customers whose headquarters are located outside of China and 34.3% of net revenues from customers whose headquarters are located within China. These figures do not take into account the geographic location of end-users of customers’ products that we sell to our customers.

As of the date of this Report, the Company has collaborated with six mobile chipset manufacturers and 29 mobile device OEMs to commercially launch Android-based mobile devices in 11 countries, and sales of mobile devices with BorqsWare software platform embedded have exceeded 10 million units worldwide.

| ● | Case Study. A prominent mobile chipset manufacturer customer decided to enter the wearable market with its newly designed chipset. The Company collaborated with this customer to develop the latest Android software to support its chipset. The Company integrated the BorqsWare software platform into the newly designed chipset that provides enhanced features and user experiences, improved chipset performance and stability, optimized power management and included the mobile operator’s required operator software package. In June of 2016, we announced the launch of one of the world’s first 4G watches for this customer. |

| ● | Case Study. A major TV manufacturer in United States selected the Company to develop its TV Wifi tablet remote. This connected device has been sold in the United States since 2016. The tablet remote uses Qualcomm chipsets with BorqsWare software platform. |

| ● | Case Study. This Company customer supplies restaurant ordering tablets to Applebee’s restaurants in the United States. These Android-based ordering tablets use BorqsWare software running on and Intel and Qualcomm chipsets. |

| ● | Case Study. A major mobile operator in India launched the world first 4G LTE FDD/TDD carrier aggregation Android phone in 2016. We provided this phone, which uses BorqsWare and Qualcomm chipsets. |

Research and Development