Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - CANTALOUPE, INC. | usat-20170630ex3228421e1.htm |

| EX-32.1 - EX-32.1 - CANTALOUPE, INC. | usat-20170630ex3213f0fed.htm |

| EX-31.2 - EX-31.2 - CANTALOUPE, INC. | usat-20170630ex312f5e388.htm |

| EX-31.1 - EX-31.1 - CANTALOUPE, INC. | usat-20170630ex311961c96.htm |

| EX-23.1 - EX-23.1 - CANTALOUPE, INC. | usat-20170630ex2319dbad6.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10‑K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2017

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE EXCHANGE ACT OF 1934

For the transition period from ____________________ to _____________________

Commission file number 001-33365

USA Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

Pennsylvania |

|

23‑2679963 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

100 Deerfield Lane, Suite 300, Malvern, Pennsylvania |

|

19355 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(610) 989‑0340

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name Of Each Exchange On Which Registered |

|

Common Stock, no par value |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files) Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10‑K or any amendment to this Form 10‑K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act.

|

Large accelerated filer ☐ |

|

Accelerated filer ☒ |

|

Non-accelerated filer ☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company ☐ |

|

Emerging growth company ☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting common equity securities held by non-affiliates of the Registrant was $167,436,169 as of the last business day of the most recently completed second fiscal quarter, December 31, 2016, based upon the closing price of the Registrant’s Common Stock on that date.

As of August 7, 2017, there were 50,017,368 outstanding shares of Common Stock, no par value.

TABLE OF CONTENTS

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Form 10‑K contains certain forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding, among other things, the anticipated financial and operating results of the Company. For this purpose, forward-looking statements are any statements contained herein that are not statements of historical fact and include, but are not limited to, those preceded by or that include the words, “estimate,” “could,” “should,” “would,” “likely,” “may,” “will,” “plan,” “intend,” “believes,” “expects,” “anticipates,” “projected,” or similar expressions. Those statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from those contemplated by the statements. The forward-looking information is based on various factors and was derived using numerous assumptions.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Actual results or business conditions may differ materially from those projected or suggested in forward-looking statements as a result of various factors including, but not limited to, those described in the “Risk Factors” section of this Form 10‑K. We cannot assure you that we have identified all the factors that create uncertainties. Moreover, new risks emerge from time to time and it is not possible for our management to predict all risks, nor can we assess the impact of all risks on our business or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking statements. Readers should not place undue reliance on forward-looking statements.

Any forward-looking statement made by us in this Form 10‑K speaks only as of the date of this Form 10‑K. Unless required by law, we undertake no obligation to publicly revise any forward-looking statement to reflect circumstances or events after the date of this Form 10‑K or to reflect the occurrence of unanticipated events.

3

USA TECHNOLOGIES, INC.

OVERVIEW

USA Technologies, Inc. (the “Company”, “We”, “USAT”, or “Our”) was incorporated in the Commonwealth of Pennsylvania in January 1992. We are a provider of technology-enabled solutions and value-added services that facilitate electronic payment transactions primarily within the unattended Point of Sale (“POS”) market. We are a leading provider in the small ticket, beverage and food vending industry and are expanding our solutions and services to other unattended market segments, such as amusement, commercial laundry, kiosk and others. Since our founding, we have designed and marketed systems and solutions that facilitate electronic payment options, as well as telemetry and machine-to-machine (“M2M”) services, which include the ability to remotely monitor, control, and report on the results of distributed assets containing our electronic payment solutions. Historically, these distributed assets have relied on cash for payment in the form of coins or bills, whereas, our systems allow them to accept cashless payments such as through the use of credit or debit cards or other emerging contactless forms, such as mobile payment.

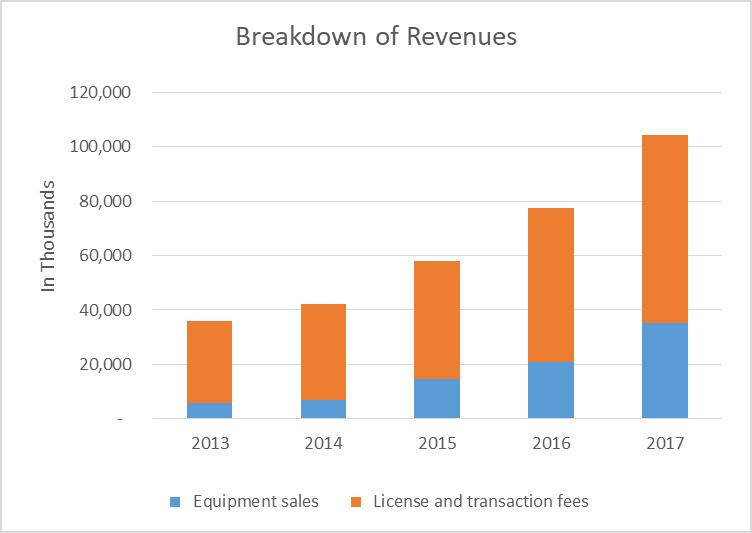

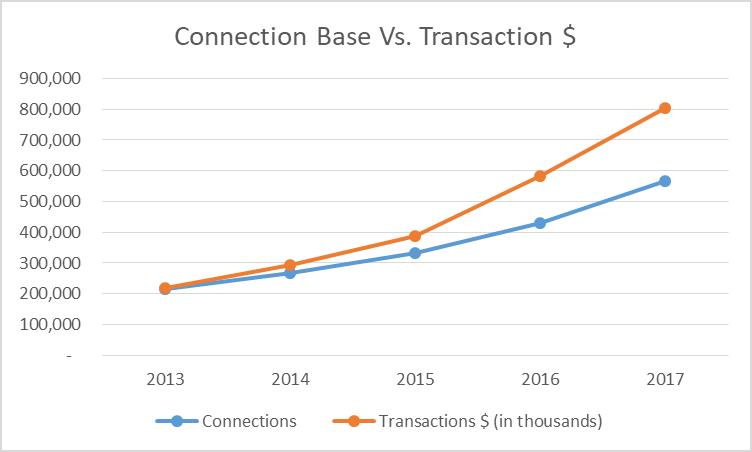

We derive the majority of our revenues from license and transaction fees resulting from connections to, as well as services provided by, our ePort Connect service. Connections to our service stem from the sale or lease of our POS electronic payment devices or certified payment software or the servicing of similar third-party installed POS terminals. The majority of ePort Connect customers pay a monthly fee plus a blended transaction rate on the transaction dollar volume processed by the Company. Connections to the ePort Connect service, therefore, are the most significant driver of the Company’s revenues, particularly revenues from license and transaction fees.

As of June 30, 2017, the Company had approximately 568,000 connections to its ePort Connect service, compared to approximately 429,000 connections as of June 30, 2016, representing a 32.4% increase. During the fiscal year ended June 30, 2017, the Company processed approximately 414.9 million cashless transactions totaling approximately $803.0 million in transaction dollars, representing a 31.4% increase in transaction volume and a 37.4% increase in dollars processed from the 315.8 million cashless transactions totaling approximately $584.4 million during the previous fiscal year ended June 30, 2016.

The above charts show the increases over the last five fiscal years in the number of connections, revenues and the dollar value of transactions handled by us. The vertical bars depict total revenues, segmented by license and transaction fees and equipment revenues. The solid lines depict the number of connections to our ePort Connect service and the dollar value of transactions handled by us, as of the end of each of the last five fiscal years.

Our solutions and services have been designed to simplify the transition to cashless for traditionally cash-only based businesses. As such, they are turn-key and include our comprehensive ePort Connect service and POS electronic payment devices or certified payment software, which are able to process traditional magnetic stripe credit and debit cards, contactless credit and debit cards and mobile payments. Standard services through ePort Connect are maintained on our proprietary operating systems and include merchant account setup on behalf of the customer, automatic processing and

4

settlement, sales reporting and 24x7 customer support. Other value-added services that customers can choose from include things such as cashless deployment planning, cashless performance review and loyalty products and services. Our solutions also provide flexibility to execute a variety of payment applications on a single system, transaction security, connectivity options, compliance with certification standards, and centralized, accurate, real-time sales and inventory data to manage distributed assets (wireless telemetry and M2M). The ePort® Interactive, which was unveiled in April 2016, is a cloud-based interactive media and content delivery management system and enables delivery of nutritional information, remote refunds, loyalty programs, and multimedia-marketing campaigns for the unattended and self-serve retail markets.

Our customers range from global food service organizations to small businesses that operate primarily in the self-serve, small ticket retail markets including beverage and food vending, amusement and arcade machines, smartphones via our ePort Online solution, commercial laundry, tolls, and various other self-serve kiosk applications as well as equipment developers or manufacturers who incorporate our ePort Connect service into their product offerings.

We believe that we have a history of being a market leader in cashless payments with a recognized brand name, a value-added proposition for our customers and a reputation of innovation in our product and services. We believe that these attributes position us to capitalize on industry trends.

In January 2016, the Company acquired the cloud-based content delivery platform, device platform and products, customer base, and intellectual property of VendScreen, Inc. of Portland, Oregon. In addition to new technology and services, the acquisition has added a West Coast operational footprint for the Company, providing greater efficiencies in operational performance, expanded customer services, sales and technical support to the Company’s customer base. As a result of the acquisition, the Company has added to its product line an interactive media, content delivery system, including a vending application that provides enhanced vendor management system (VMS) integration and consumer product information, including nutritional data. The technology is NFC enabled and compatible with mobile wallets including Apple Pay and Android Pay, and supports instant refunds, couponing, advertising and real-time consumer feedback to the owner and operator.

THE INDUSTRY

We operate primarily in the small ticket electronic payments industry and, more specifically, the unattended POS market. We also have the ability to accept cashless payment “on the go” through mobile-based payment services, which are generally higher ticket transactions. Our solutions and services facilitate electronic payments in industries that have traditionally relied on cash transactions. We believe the following industry trends are driving growth in demand for electronic payment systems in general and more specifically within the markets we serve:

|

· |

Ongoing shift toward electronic payment transactions and away from cash and checks; |

|

· |

Increasing demand for electronic transaction functionality from both consumers and merchant/operators; and |

|

· |

Improving POS technology and NFC equipped mobile phone payment technology. |

Shift toward electronic payment transactions and away from cash and checks

There has been an ongoing shift away from paper-based methods of payment, including cash and checks, towards electronic-based methods of payment. According to The Nilson Report, December 2016, paper-based methods of payment continued to decline in 2015, representing 26.14% of transaction dollars measured compared to 28.07% in 2014. The four card-based systems—credit, debit, prepaid, and electronic benefits transfer—generated $5.665 trillion in the United States in 2015, 59.32% of transaction dollars measured. The Nilson Report projects that, by 2019, spending at merchants in the U.S. from the four card-based systems will grow to 67.03% of total transaction dollars measured.

5

Increase in Consumer and Merchant/Operator Demand for Electronic Payments

Increase in Consumer Demand. The unattended, vending and kiosk POS market has historically been dominated by cash purchases. However, oftentimes, cash purchases at unattended POS locations represent a cumbersome transaction for the consumer because they do not have the correct monetary value (paper or coin), or the consumer does not have the ability to convert their bills into coins. We believe electronic payment system providers such as the Company that can meet consumers’ demand within the unattended market will be able to offer retailers, card associations, card issuers and payment processors and business owners an expanding value proposition at the POS. Based upon our survey of selected vending machines connected to our service over a recent twelve month period, we estimate that average annual cashless sales per machine increased by approximately 44% from those of a prior twelve month period, and cashless sales as a percentage of total machine sales (cashless and cash) increased by 15% from those of such prior twelve month period. In addition, average consumer purchases during the recent twelve month period in which the consumer utilized a credit or debit card were approximately 35% higher than purchases where the consumer utilized cash.

Increase in Merchant/Operator Demand. We believe that, increasingly, merchants and operators of unattended payment locations (e.g., vending machines, laundry, tabletop games, etc.) are utilizing electronic payment alternatives as a means to improve business results. The Company works with its customers to help them drive increased revenue of their distributed assets through this expanded market opportunity. In addition, electronic payment systems can provide merchants and operators real-time sales and inventory data utilized for back-office reporting and forecasting, like the Company’s solutions and services, helping them to manage their business more efficiently.

Increase in Demand for Networked Assets. M2M (machine-to-machine) technology includes capturing value from wireless modules and electronic devices to improve business productivity and customer service. The term M2M describes any kind of 2‑way communication system between geographically distributed devices through a centrally managed software application without human intervention and as such, the Company’s integrated POS and ePort Connect remote data management capabilities fall into this category of solution. In addition, networked assets can provide valuable information regarding consumers’ purchasing patterns and payment preferences, allowing operators to more effectively tailor their offerings to consumers. Gartner, Inc. forecasted that 6.4 billion connected things would be in use worldwide in 2016, with 5.5 million new things getting connected every day, and will reach 20.8 billion by 2020. The Company believes that its expertise in integrating cashless payments, its scalable network data capacity, its proven ability to handle high transaction volume, and its high quality and reliable data management capabilities make it well suited for the growing opportunities in the M2M market.

POS Technology and NFC Equipped Mobile Phone Payment Improvements

Consumer Interest in Mobile Payment. NFC, or Near Field Communication, is a short range wireless connectivity technology that uses electromagnetic radio fields to enable communication between devices when there is a physical touch, or when they are within close proximity to one another. We believe that POS contactless terminals that are enabled to accept NFC payments and digital wallet applications, such as Google Wallet, Chase Pay, Apple Pay, the recently introduced Android Pay, and others, stand to benefit from these evolving trends in mobile payment. Digital wallet is essentially a digital service, accessed via the web or a mobile phone application that serves as a substitute for the traditional credit or debit card. Providers can also market directly to targeted consumers with coupons and loyalty programs.

As approximately 475,000 of the Company’s connections are contactless enabled to accept NFC payments (in addition to magnetic stripe cards) as of June 30, 2017, we believe that we are well-positioned to benefit from this emerging space.

OUR TECHNOLOGY-BASED SOLUTION

Our solutions have been designed to be turn-key and include the ePort Connect service, POS electronic payment devices, certified payment software able to process traditional magnetic stripe credit and debit cards, contactless credit and debit cards, and NFC equipped mobile phones that allow consumers to make payments with their cell phones. We believe that our ability to bundle our products and services, as well as the ability to tailor and customize them to individual customer needs, makes it easy and efficient for our customers to adopt and deploy our technology, and results in a service unmatched in the small-ticket, unattended retail market today.

The Product. The Company offers its customers several different devices or software to connect their distributed assets. These range from our QuickConnect™ Web service, more fully described below under the section “OUR PRODUCTS”,

6

and encrypted magnetic stripe card readers to our ePort® hardware that can be attached to the door of a stand-alone terminal.

The Network. Our network is designed to transmit payment information from our customers’ terminals for processing and sales and diagnostic data for storage and reporting to our customers. Also, the network, through server-based software applications, provides remote management information, and enables control of the networked device’s functionality. Through our network we have the ability to upload software and update devices remotely enabling us to manage the devices easily and efficiently (e.g., change protocol functionality, provide software upgrades, and change terminal display messages).

The Connectivity Mediums. The client devices (described above) are interconnected for the transfer of our customers’ data through our ePort Connect network that provides multiple connectivity options such as phone line, ethernet, and wireless. Increased wireless connectivity options, coverage and reliability have allowed us to service a greater number of geographically dispersed customer locations. Additionally, we make it easy for our customers to deploy wireless solutions by acting as a single point of contact. We have contracted with Verizon Wireless in order to supply our customers with wireless network coverage.

Data Security. We are listed on the VISA Global Registry of Service Providers, meaning that VISA has reviewed and accepted the Report on Compliance (RoC) from our authorized Payment Card Industry (“PCI”) assessor as a PCI DSS Service Provider. Our entry on this registry is renewed annually, and our current entry is valid through January 31, 2018. The VISA listing can be found online at http://www.visa.com/splisting/searchGrsp.do.

OUR SERVICES

For the fiscal year ended June 30, 2017, license and transaction fees generated by our ePort Connect service represented 66.4% of the Company’s revenues. Our ePort Connect solution provides customers with all of the following services, under one cohesive service umbrella:

|

· |

Diverse POS options. Ability to connect to a broad product line of cashless acceptance devices or software. |

|

· |

Card Processing Services. Through our existing relationships with card processors and card associations, we provide merchant account and terminal ID set up, pre-negotiated discounted fees on small ticket purchases, and direct electronic funds transfers (EFTs) to our customers’ bank accounts for all settled card transactions as well as ensure compliance with current processing guidelines. |

|

· |

Wireless Connectivity. We manage wireless account activations, distributions, and relationships with wireless providers for our customers, if needed. |

|

· |

Customer/Consumer Services. We support our installed base by providing 24‑hour help desk support, repairs, and replacement of impaired system solutions. In addition, all inbound billing inquiries are handled through a 24‑hour help desk, thereby eliminating the need for our customers to deal with consumer billing inquiries and potential chargebacks. |

|

· |

Online Sales Reporting. Via the USALive online reporting system, we provide customers with a host of sales and operational data, including information regarding their credit and cash transactions, user configuration, reporting by machine and region, by date range and transaction type, data reports for operations and finance, graphical reporting of sales, and condition monitoring for equipment service, as well as activation of new devices and redeployments. |

|

· |

M2M Telemetry and DEX data transfer. DEX, an acronym for digital exchange, is the Vending Industry’s standard way to communicate information such as sales, cash in bill validators, coins in coin boxes, sales of units by selection, pricing, door openings, and much more. The Company is able to remotely transfer and push DEX data to customers’ route management systems through its DEX partner program. The Company operates within the VDI (Vending Data Interchange) standards established by NAMA (National Automatic Merchandising Association) and sends DEX files compatible with most major remote management software systems. |

7

|

· |

Over-the-Air Update Capabilities. Automatic over-the-air updates to software, settings, and features from our network to our ePort card reader keep our customers’ hardware up-to-date and enable customers to benefit from any advancement made after their hardware or software purchase. |

|

· |

Value-added Services. Access to additional services such as MORE, our loyalty program, two-tier pricing, special promotions such as our nationwide Apple Pay mobile payment for vending customers, as well as a menu of hardware purchasing options including our JumpStart and QuickStart programs. |

|

· |

Deployment Planning. Access to services to help operators successfully deploy cashless payment systems and integrated solutions that is based on our extensive market and customer experience data. |

|

· |

Premium Services. USAT offers Premium Services to support our customers that fully leverages the Company’s industry expertise and access to data. These services include planning, project management, installation support, marketing and performance evaluation. |

We enter into an ePort Connect Services Agreement, our processing and licensing agreement, with our customers pursuant to which we act as a provider of cashless financial services for the customer’s distributed assets, and the customer agrees to pay us an activation fee, monthly service fees, and transaction processing fees either pursuant to this agreement or another related agreement, such as a purchase order. Our agreements are generally cancelable by the customer upon thirty to sixty days’ notice to us. It typically takes thirty to sixty days for a new connection to begin contributing to the Company’s license and transaction fee revenues.

The Company counts its ePort connections upon shipment of an active terminal to a customer under contract, at which time activation on its network is performed by the Company, and the terminal is capable of conducting business via the Company’s network and related services. An ePort connection does not necessarily mean that the unit is actually installed by the customer on a machine, or that the unit has begun processing transactions, or that the Company has begun receiving monthly service fees in connection with the unit. Rather, at the time of shipment of the ePort, the customer becomes obligated to pay the one-time activation fee (if applicable), and is obligated to pay monthly service fees and lease payments (if applicable) in accordance with the terms of the customer’s contract with the Company.

OUR PRODUCTS

ePort is the Company’s core device, which is currently being utilized in self-service, unattended markets such as vending, amusement and arcade, and various other kiosk applications. Our ePort product facilitates cashless payments by capturing payment information and transmitting it to our network for authorization with the payment system (e.g., credit card processors). Additional capabilities of our ePort consist of control/access management by authorized users, collection of audit information (e.g., date and time of sale and sales amount), diagnostic information of the host equipment, and transmission of this data back to our network for web-based reporting, or to a compatible remote management system. Our ePort products are available in several distinctive modular configurations, and as hardware, software or as an API Web service, offering our customers flexibility to install a POS solution that best fits their needs and consumer demands.

|

· |

ePort Edge™ is a one-piece design and is intended for those customers who require a magnetic swipe-only cashless system with basic features at a lower price point. |

|

· |

ePort G‑8 is a two-piece design that supports traditional magnetic stripe credit/debit cards and contactless cards. The ePort G8 telemeter is also available as a stand-alone DEX telemetry solution. |

|

· |

ePort G‑9 has been designed to offer all the features of the G‑8 plus additional new features that support expanded acceptance options, consumer engagement offerings and advanced diagnostics. |

|

· |

ePort G10-S is a 4G LTE cashless payment device that enables faster processing and enhanced functionality for payment and consumer engagement applications that require higher speeds and large data loads. |

|

· |

ePort Interactive is a cloud-based interactive media and content delivery management system, enabling delivery of nutritional information, remote refunds, loyalty programs, and multimedia-marketing for the unattended and self-serve retail markets. |

8

|

· |

QuickConnect is a Web service that allows a client application to securely interface with the Company’s ePort Connect service. QuickConnect essentially replaces ePort SDK (software development kit), which captured our ePort technology in software form for PC-based devices such as kiosks. |

Other forms of our ePort technology include:

|

· |

eSuds, our solution developed for the commercial laundry industry that enables laundry operators to provide customers cashless transactions via the use of their credit cards, debit cards and other payment mediums such as student IDs. Effective with the April 2013 mutually exclusive agreement with Setomatic Systems, we are no longer selling the entire eSuds solution to new customers, but we continue to provide processing services for laundry machines equipped with cashless hardware supplied by Setomatic Systems. |

|

· |

ePort Online, enables customers to use USALive to securely process cards typically held on file for the purpose of online billing and recurring charges. ePort Online helps USAT’s customers reduce paper invoicing and collections. |

SPECIFIC MARKETS WE SERVE

Our current customers are primarily in the self-serve, small ticket retail markets including beverage and food vending and kiosk, commercial laundry, car wash, tolls, amusement and gaming, and office coffee. We estimate that there are approximately 13 million to 15 million potential connections in this self-serve, small ticket retail market. The 568,000 connections to our service as of June 30, 2017 constitute only 4% of these potential connections. While these industry sectors represent only a small fraction of our total market potential, as described below, these are the areas where we have gained the most traction to date. In addition to being our current primary markets, we believe these sectors serve as a proof-of-concept for other unattended POS industry applications.

Vending. According to Vending Times’ 2014 Census of the Industry, annual U.S. sales in the vending industry sector were estimated to be approximately $43 billion in 2013 transacted by approximately 4.5 million machines. The Company believes these machines represent a significant market opportunity for electronic payment conversion when compared to the Company’s existing ePort Connect service base and the overall low rate of industry adoption to date. For example, in another study conducted by Automatic Merchandiser (State of the Vending Industry, June 2015) that included a representative 5.1 million machines, cashless adoption was estimated at only 11% in 2014, up from 7% in 2012. With the continued shift to electronic payments and the advancement in mobile and POS technology, we believe that the traditional beverage and food vending industry will continue to look to cashless payments and telemetry systems to improve their business results.

Kiosk. According to IHL Group’s September 2013 Market Study on Self-Service Kiosks, approximately $822 billion was transacted through self-service kiosks in 2012, which represents an increase of 5.9% from 2011. We believe that kiosks are becoming increasingly popular as credit, debit or contactless payment options enable kiosks to sell an increased variety of items. In addition, the study points to the increasing trend toward self-sufficiency, where time is the most important commodity of the consumer. As merchants continue to seek new ways to reach their customers through kiosk applications, we believe the need for a reliable cashless payment provider experienced with machine integration, PCI compliance and cashless payment services designed specifically for the unattended market will be of increasing value in this market. Our existing kiosk customers integrate with our cashless payment services via our QuickConnect Web service using one of our encrypted readers or ePort POS technologies.

Laundry. Our primary targets in laundry consist of the coin-operated commercial laundry and multi-housing laundry markets. According to the Coin Laundry Association, the U.S. commercial laundry industry was comprised of about 35,000 coin laundries in the U.S. in 2015 that our partner, Setomatic Systems, estimated translates to roughly 2.5 million commercial washers and dryers. The Coin Laundry Association estimated gross annual revenue in the laundromat market at nearly $5 billion annually.

9

OUR COMPETITIVE STRENGTHS

We believe that we benefit from a number of advantages gained through our nearly twenty-five year history in our industry. They include:

|

1. |

One-Stop Shop, End-to-End Solution. We believe that our ability to offer our customers one point of contact through a bundled cashless payment solution makes it easy and efficient for our customers to adopt and deploy our electronic payment solutions and results in a service that is unmatched in the small ticket, self-service retail market today. To our knowledge, other cashless payment solutions available in the market today require the operator to set up their own accounts for cashless processing and manage multiple service providers (i.e., hardware terminal manufacturer, wireless network provider, and/or credit card processor). We interface directly with our card processor and wireless service provider, and, with our hardware solutions, are able to offer a bundled solution to our customers. |

|

2. |

Trusted Brand Name. We believe that the ePort has a strong national reputation for quality, reliability, and innovation. We believe that card associations, payment processors, and merchants/operators trust our system solutions and services to handle financial transactions in a secure operating environment. Our trusted brand name is best exemplified by our high level of customer retention, numerous exclusive three-year agreements with customers for use of our ePort Connect service. We have agreements with partners like Visa, MasterCard, Chase Paymentech and Verizon Wireless as well as several one-way exclusive relationships which we have solidified with leading organizations within the unattended POS industry, including Setomatic Systems, AMI Entertainment Network, Inc., Innovative Foto, and Air-Serv. |

|

3. |

Market Leadership. We believe we have one of the largest installed bases of Unattended POS electronic payment systems in the unattended small ticket retail market for food and beverage and we are continuing to expand to other adjacent markets such as laundry, amusement, and gaming and kiosks. As of June 30, 2017, we had approximately 568,000 connections to our network. Our installed base supports our sales and marketing initiatives by enhancing our ability to establish or expand our market position. In addition, this data in combination with our industry experts and analysis enables us to offer Premium Services to our customers to help them deploy and better leverage our technology in their locations. We believe our installed base also provides multiple opportunities for referrals for new business, either from the merchant or operator of the deployed asset or through one of our several strategic partnerships. |

|

4. |

Attractive Value Proposition for Our Customers. We believe that our solutions provide our customers an attractive value proposition. Our solutions and services make possible increased purchases by consumers who in the past were limited to the physical cash on hand while making a purchase at an unattended terminal, thereby increasing the universe of potential customers and the size of the purchases of those customers. In addition, value-added offerings and services such as Two-Tier Pricing, which allows the operator to charge different amounts for the same product depending upon whether the consumer chooses to pay by cash or credit/debit, and M2M telemetry provide operators with the ability to pursue additional opportunities to reduce costs and improve operating efficiencies. Lastly, new consumer engagement services further extend the potential for customers to build new revenue opportunities, customer loyalty and brand distinction. One of such services is provided through the ePort Interactive platform, our cloud-based interactive media and content delivery management system, which enables delivery of nutritional information, remote refunds, loyalty programs, and multimedia-marketing campaigns for the unattended and self-serve retail markets. |

|

5. |

Increasing Scale and Financial Stability. Due to the continued growth in connections to the Company’s ePort Connect service, during the 2017 fiscal year, 66.4% of the Company’s revenues were from licensing and processing fees which are recurring in nature. We believe that this growing scale provides us improved financial stability and the footprint to market and distribute our products and services more effectively and in more markets than most of our competitors. |

|

6. |

Customer-Focused Research and Development. Our research and development initiatives focus primarily on adding features and functionality to our electronic payment solutions based on customer input and emerging market trends. As of June 30, 2017, we had 73 patents (US and International) in force, and 3 United States and 10 international patent applications pending. We have generated considerable intellectual property and know-how associated with creating a seamless, end-to-end experience for our customers. |

10

OUR GROWTH OPPORTUNITY

Our primary objective is to continue to enhance our position as a leading provider of technology that enables electronic payment transactions and value-added services primarily at small-ticket, self-service retail locations such as vending, kiosks, commercial laundry, and other similar markets. We plan to execute our growth strategy organically and through strategic acquisitions. The Company believes its service-approach business model can create a high-margin stream of recurring revenues that could create a foundation for long-term value and continued growth. Key elements of our strategy are to:

Drive Growth in Connections

Leverage Existing Customers/Partners. We have a solid base of key customers across multiple markets, particularly in vending, that have currently deployed our solutions and services to just a small portion of their deployed base. Approximately 93% of our new connections during the fourth fiscal quarter ended June 30, 2017 were from existing customers. We estimate that our current customers represent approximately 2.0 million potential connections. Based on the 568,000 connections to our service as of June 30, 2017, there remain approximately 1.4 million potential connections from our current customers that could be connected to our service. As a result, they are a key component of our plan to drive future sales. We have worked to build these relationships, drive future deployments, and develop customized network interfaces. Our customers have seen the benefits of our products and services first-hand and we believe they represent the largest opportunity to scale connections to our service.

Expand Distribution and Sales Reach. We are intently focused on driving profitable growth through efficient sales channels. Our sales resources and new distribution relationships have led to approximately 1,650 new ePort Connect customers as well as increased penetration in markets such as amusement and arcade, and commercial laundry in fiscal year 2017.

Further Penetrate Attractive Adjacent Markets. We plan to continue to introduce our turn-key solutions and services to various adjacent markets such as the broad-based kiosk market and other similar markets by leveraging our expertise in cashless payment integration combined with the capacity and uniqueness of our ePort Connect solution.

Capitalize on Opportunities in International Markets. We are currently focused on the U.S. and Canadian markets for our ePort devices and related ePort Connect service but may seek to establish a presence in electronic payment markets in Europe, Asia, and Latin America. In order to do so, however, we would have to invest in additional sales and marketing and research and development resources targeted towards these regions. At this time, the Company believes the most efficient route to these markets will be achieved by optimizing and coordinating opportunities with its global partners and customers. Our energy management devices have been shipped to customers located in North America, Europe, and Asia.

Expanding the Value of our Service

Capitalize on the emerging NFC and growing mobile payments trends. With approximately 83% of our connected base contactless enabled to accept NFC payments (including mobile wallets), the Company believes that continued increases in consumer preferences towards contactless payments, including mobile wallets like Apple Pay and Android Pay, represent a significant opportunity for the Company to further drive adoption. According to a market research study conducted in June 2015, almost one in six US consumers (15%) had used a mobile wallet in the past six months, up from 9% in the same period in 2013, and an additional 22% are likely to adopt mobile wallet functionality in the coming six months (The Future of the Mobile Wallet - Chadwick Martin Bailey). As consumers continue to adopt these new methods of cashless payments, it is our belief that adoption will continue to accelerate at a rapid pace and result in more rapid adoption of cashless solutions like the Company’s ePort in the markets that we serve.

Continuous Innovation. We are continuously enhancing our solutions and services in order to satisfy our customers and the end-consumers relying on our products at the POS locations. Our product innovation team is always working to enhance the design, size, and speed of data transmission, as well as security and compatibility with other electronic payment solution providers’ technologies. We believe our continued innovation will lead to further adoption of USAT’s solutions and services in the unattended POS payments market.

Comprehensive Service and Support. In addition to its industry-leading ePort cashless payments system, the Company seeks to provide its customers with a comprehensive, value-added ePort Connect service that is designed to encourage

11

optimal ROI through business planning and performance optimization; business metrics through the Company’s KnowledgeBase of data; a loyalty and rewards program for consumer engagement; marketing strategy and executional support; sales data and machine alerts; DEX data transmission; and the ability to extend cashless payments capabilities and the full suite of services across multiple aspects of an operator’s business including micro-markets contract food industry, online payments and mobile payments.

Leverage Intellectual Property. Through June 30, 2017, we have 73 U.S. and foreign patents in force that contain various claims, including claims relating to payment processing, networking and energy management devices. In addition, we own numerous trademarks, copyrights, and trade secrets. We will continue to explore ways to leverage this intellectual property in order to add value for our customers, attain an increased share of the market, and generate licensing revenues.

SALES AND MARKETING

The Company’s sales strategy includes both direct sales and channel development, depending on the particular dynamics of each of our markets. Our marketing strategy is diversified and includes media relations, direct mail, conferences, and client referrals. As of June 30, 2017, the Company was marketing and selling its products through its full and part-time sales staff consisting of 18 people.

Direct Sales

Our direct sales efforts are currently primarily focused on the beverage and food vending industry, although we continue to further develop our presence in our ancillary market segments.

Indirect Sales/ Distribution

As part of our strategy to expand our sales reach while optimizing resources, we also have agreements with select resellers in the car wash, amusement and arcade, and vending markets. We also have a strategic marketing relationship in the commercial laundry market that makes the Company the exclusive service provider to Setomatic Systems’ POS offering, SpyderWash. We have also entered into agreements with resellers and distributors in connection with our energy management products.

Marketing

Our marketing strategy includes advertising and outreach initiatives designed to build brand awareness, make clear USAT’s competitive strengths, and prove the value of our services to our target markets-both for existing and prospective customers. Activities include creating company and product presence on the web including www.usatech.com and www.energymisers.com, digital advertising, SEO (Search Engine Optimization), and social media; the use of direct mail and email campaigns; educational and instructional online training sessions; advertising in vertically-oriented trade publications; participating in industry tradeshows and events; and working closely with customers and key strategic partners on co-marketing opportunities and new, innovative solutions that drive customer and consumer adoption of our services.

IMPORTANT RELATIONSHIPS

Verizon Wireless

In April 2011, we signed an agreement with Verizon for access to their digital wireless wide area network for the transport of data, including credit card transactions and inventory management data. The initial term of the agreement was three years, which was extended until April 2016. At the end of the term, the agreement automatically renews for successive one month periods unless terminated by either party upon thirty days’ notice.

On September 21, 2011, the Company and Verizon entered into a Joint Marketing Addendum (the “Verizon Agreement”) which amended the agreement described above. Pursuant to the Verizon Agreement, the Company and Verizon would work together to help identify business opportunities for the Company’s products and services. Verizon may introduce the Company to existing or potential Verizon customers that Verizon believes are potential purchasers of the Company’s products or services, and may attend sales calls with the Company made to these customers. The Company and Verizon would collaborate on marketing and communications materials that would be used by each of them to educate and inform

12

customers regarding their joint marketing work. Verizon has the right to list the Company’s products and services in its Data Solutions Guide for use by its sales and marketing employees and in its external website. The Verizon Marketing Agreement is terminable by either party upon 45 days’ notice.

VISA

As of November 14, 2014, we entered into a three-year agreement with Visa U.S.A. Inc. (“Visa”), pursuant to which Visa has agreed to continue to make available to the Company certain promotional interchange reimbursement fees for small ticket debit and credit card transactions. As previously reported, following implementation of the Durbin Amendment, Visa had significantly increased its interchange fees for small ticket regulated debit card transactions effective October 1, 2011. The promotional interchange reimbursement fees provided by the aforementioned agreement will continue until October 31, 2017.

MasterCard

On January 12, 2015, we entered into a three-year MasterCard Acceptance Agreement (“MasterCard Agreement”) with MasterCard International Incorporated ("MasterCard"), pursuant to which MasterCard has agreed to make available to us reduced interchange rates for small ticket debit card transactions in certain merchant category codes. As previously reported, MasterCard had significantly increased its interchange rates for small ticket regulated debit card transactions effective October 1, 2011, and as a result, the Company ceased accepting MasterCard debit card products in mid-November 2011. Pursuant to the MasterCard Agreement, however, the Company is currently accepting MasterCard debit card products for small ticket debit card transactions in the unattended beverage and food vending merchant category code. The Company and MasterCard entered into a first amendment on April 27, 2015, pursuant to which the conditions under, or the transactions to, which the MasterCard custom pricing would be available, was amended. The reduced interchange rates became effective on April 20, 2015.

Chase Paymentech

We entered into a five-year Third Party Payment Processor Agreement, dated April 24, 2015 with Paymentech, LLC, through its member, JPMorgan Chase Bank, N.A. (“Chase Paymentech”), pursuant to which Chase Paymentech will act as the provider of credit and debit card transaction processing services (including authorization, conveyance and settlement of transactions) to the Company and its customers. The Agreement provides that Chase Paymentech will act as the exclusive provider of transaction processing services to the Company and its customers for at least 250 million transactions per year. The Agreement provides that Chase Paymentech may modify the pricing for its services upon 30‑days’ notice, and in connection with certain such increases, the Company has the right to terminate the Agreement upon 120‑days’ notice.

Compass/Foodbuy

On June 30, 2009, we entered into a Master Purchase Agreement (“MPA”) with Foodbuy, LLC (“Foodbuy”), the procurement company for Compass Group USA, Inc. (“Compass”) and other customers. The MPA provides, among other things that, for a period of thirty-six months, Foodbuy, on behalf of Compass, shall utilize USAT as the sole credit or debit card vending system hardware and related software and connect services provider for not less than seventy-five percent of the vending machines of Compass utilizing cashless payments solutions. The MPA also provides that, for a period of thirty-six months from the effective date of the agreement, USAT shall be a preferred supplier and provider to Foodbuy and its customers, including Compass, of USAT’s products and services. The MPA automatically renews for successive one-year periods unless terminated by either party upon sixty days’ notice prior to the end of any such one year renewal period. In addition, on July 1, 2009, USAT and Compass, in conjunction with the MPA described above, also entered into a three-year ePort Connect Services Agreement pursuant to which USAT will provide Compass with all card processing, data, network, communications and financial services, and DEX telemetry data services required in connection with all Compass vending machines utilizing ePorts. The agreement automatically renews for successive one-year periods unless terminated by either party upon sixty days’ notice prior to the end of any such one-year renewal period. During the fiscal year ended June 30, 2017, Compass represented approximately 25% of our total revenues.

13

AMI Entertainment

On August 22, 2011, we entered into an exclusive three-year agreement with AMI Entertainment (“AMI”) as their exclusive processor of credit and debit cards and other electronic payments in connection with equipment operated on AMI’s network in the U.S. and Canada. The agreement is subject to renewal for one-year periods thereafter, subject to notice of non-renewal by either party. AMI manufactures various types of amusement, entertainment and music equipment for sale to third party users.

Setomatic Systems

In April 2013, we entered into a three-year exclusive agreement with Setomatic Systems (“Setomatic”), a privately owned and operated developer and manufacturer of both open and closed loop card payment systems, drop coin meters and electronic timers for the commercial laundry industry. Under the terms of the agreement, the Company, through our ePort Connect® service, will act as the exclusive service provider for all credit/debit card processing for all new customers of Setomatic’s SpyderWash, a credit/debit card acceptance product. Similarly, the Company will market its ePort Connect service in the United States laundry market exclusively through Setomatic. The agreement is subject to renewal for one-year periods after the initial three-year term, subject to notice of non-renewal by either party.

QUICK START PROGRAM

In order to reduce customers’ upfront capital costs associated with the ePort hardware, the Company makes available to its customers the Quick Start program, pursuant to which the customer would enter into a five-year non-cancelable lease with either the Company or a third-party leasing company for the devices. At the end of the lease period, the customer would have the option to purchase the device for a nominal fee.

From its introduction in September 2014 and through approximately mid-March 2015, the Company entered into these leases directly with its customers. In the third and fourth quarter of fiscal year 2015, however, the Company signed vendor agreements with two leasing companies, whereby our customers could enter into leases directly with the leasing companies.

There has been a shift by our customers from acquiring our product via JumpStart, which accounted for 9% of our gross connections in fiscal year 2016, and for 7% of our gross connections in fiscal year 2017, to QuickStart or a straight purchase, which accounted for approximately 93% of gross connections in fiscal year 2017. The shift to a straight purchase, along with our ability to increase cash collections under QuickStart sales by utilizing leasing companies, improves cash provided by operating activities.

Due to the success of the QuickStart program as measured by customer utilization of the program and the positive impact on the Company’s cash flows from operating activities when a leasing company is utilized, the Company intends to expand this program by entering into additional vendor agreements with leasing companies and/or expanding its relationship with the two incumbent leasing companies.

JUMP START PROGRAM

Pursuant to the JumpStart Program, customers acquire the ePort cashless device at no upfront cost by paying a higher monthly service fee, avoiding the need to make a major upfront capital investment. The Company would continue to own the ePort device utilized by its customer. At the time of the shipment of the ePort device, the customer is obligated to pay to the Company a one-time activation fee, and is later obligated to pay monthly ePort Connect service fees in accordance with the terms of the customer’s contract with the Company, in addition to transaction processing fees generated from the device. In fiscal year 2017, the Company added approximately 7% of its gross connections through JumpStart.

MANUFACTURING

The Company utilizes independent third party companies for the manufacturing of its products. Our internal manufacturing process mainly consists of quality assurance of materials and testing of finished goods received from our contract manufacturers. We have not entered into a long-term contract with our contract manufacturers, nor have we agreed to

14

commit to purchase certain quantities of materials or finished goods from our manufacturers beyond those submitted under routine purchase orders, typically covering short-term forecasts.

COMPETITION

We are a leading provider of cashless payments systems for the small-ticket, unattended market and believe we have the largest installed base of unattended POS electronic payment systems in the beverage and food vending industry. Factors that we consider to be our competitive advantages are described above under “OUR COMPETITIVE STRENGTHS.” Our competitors are increasingly and actively marketing products and services that compete with our products and services in the vending space including manufacturers who may include in their new vending machines their own (or another third party’s) cashless payment systems and services. These major competitors include Crane Payment Innovations and Cantaloupe Systems, Inc. While we believe our products and services are superior to our competitors’, many of our competitors are much larger enterprises and have substantially greater revenues. In addition to these competitors, there are also numerous credit card processors that offer card processing services to traditional retail establishments that could decide to offer similar services to the industries that we serve.

In the cashless laundry market, our joint solution with Setomatic Systems competes with hardware manufacturers, who provide joint solutions to their customers in partnership with payment processors, and with at least one competitor who provides an integrated hardware and payment processing solution.

TRADEMARKS, PROPRIETARY INFORMATION, AND PATENTS

The Company owns US federal registrations for the following trademarks and service marks: Blue Light Sequence®, Business Express®, CM2iQ®, Creating Value Through Innovation®, EnergyMiser®, ePort®, ePort Connect®, ePort Edge®, ePort GO®, ePort Mobile®, eSuds®, Intelligent Vending®, Public PC®, SnackMiser®, TransAct®, USA Technologies® USALive®, VendingMiser®, PC EXPRESS®, VENDSCREEN® and VM2iQ®. The Company owns pending applications for US federal registration of the following trademarks and service marks: Horizontal Blue Light Sequence™, and MORE.

Much of the technology developed or to be developed by the Company is subject to trade secret protection. To reduce the risk of loss of trade secret protection through disclosure, the Company has entered into confidentiality agreements with its key employees. There can be no assurance that the Company will be successful in maintaining such trade secret protection, that they will be recognized as trade secrets by a court of law, or that others will not capitalize on certain aspects of the Company’s technology.

Through June 30, 2017, 96 patents have been granted to the Company, including 81 United States patents and 15 foreign patents, and 3 United States and 10 international patent applications are pending. Of the 96 patents, 73 are still in force. Our patents expire between 2017 and 2035.

RESEARCH AND DEVELOPMENT

Research and development expenses, which are included in selling, general and administrative expense in the Consolidated Statements of Operations, were approximately $1.4 million, $1.4 million and $1.5 million for the years ended June 30, 2017, 2016 and 2015, respectively.

EMPLOYEES

As of June 30, 2017, the Company had 91 full-time employees and 10 part-time employees.

15

Risks Relating to Our Business

We have a history of losses since inception and if we continue to incur losses, the price of our shares can be expected to fall.

We experienced losses from inception through June 30, 2012, with net income for the years ended June 30, 2013 and June 30, 2014. However, we experienced losses for the fiscal years 2015, 2016, and 2017, and continued profitability is not assured. From our inception through June 30, 2017, our cumulative losses from operations are approximately $183 million. Until the Company’s products and services can generate sufficient annual revenues, the Company will be required to use its cash and cash equivalents on hand, its line of credit, and may raise capital to meet its cash flow requirements including the issuance of common stock or debt financing. For the years ended June 30, 2017 and 2016, we incurred a net loss of $1.9 million and $6.8 million, respectively. If we continue to incur losses in the future, the price of our common stock can be expected to fall.

The occurrence of material unanticipated expenses may require us to divert our cash resources from achieving our business plan, adversely affecting our financial performance and resulting in the decline of our stock price.

In the event we incur any material unanticipated expenses, we may be required to divert our cash resources from our operating activities in order to fund any such expenses. Any such occurrence may cause our anticipated connections, revenues, gross profits, and other financial metrics for the 2017 fiscal year and beyond to be materially adversely affected. In such event, the price of our common stock could be expected to fall.

The inability of our customers to utilize third party leasing companies under our QuickStart program would materially adversely affect our cash generated from operating activities and/or attaining our business plan.

The use of third party leasing companies by our customers under our QuickStart program positively affects our net cash provided by operating activities because we receive the purchase price from the leasing company at the time of the sale. There can be no assurance that we will be able to obtain such third party leasing companies. To the extent that third party leasing companies would not be available, we would lease the equipment directly to our customers. In such event, our net cash from operating activities would be adversely affected and we may be required to incur additional equity or debt financing to fund operations. In the alternative, we would not be able to attain our business plan, including anticipated connections and revenues.

We may require additional financing or find it necessary to raise capital to sustain our operations and without it we may not be able to achieve our business plan.

At June 30, 2017, we had net working capital of $5.8 million. We had net cash (used in) provided by operating activities of $(6.8) million, $6.5 million, and $(1.7) million for the fiscal years ended June 30, 2017, 2016, and 2015, respectively. Although we believe that we have adequate existing resources to provide for our funding requirements over the next 12 months, there can be no assurances that we will be able to continue to generate sufficient funds thereafter. Unless we maintain or grow our current level of operations, we may need additional funds to continue these operations. We may also need additional capital to update our technology or respond to unusual or unanticipated non-operational events. Should the financing that we require to sustain our working capital needs be unavailable or prohibitively expensive when we require it, the consequences could have a material adverse effect on our business, operating results, financial condition and prospects.

Our future operating results may fluctuate.

Our future operating results will depend significantly on our ability to continue to drive revenues from license and transaction fees and our ability to develop and commercialize new products and services. Our operating results may fluctuate based upon many factors, including:

|

· |

fluctuations in revenue generated by our business; |

|

· |

fluctuations in operating expenses; |

16

|

· |

our ability to establish or maintain effective relationships with significant partners and suppliers on acceptable terms; |

|

· |

the amount of debit or credit card interchange rates that are charged by Visa and MasterCard; |

|

· |

the fees that we charge our customers for processing services; |

|

· |

the successful operation of our network; |

|

· |

the commercial success of our customers, which could be affected by such factors as general economic conditions; |

|

· |

the level of product and price competition; |

|

· |

the timing and cost of, and our ability to develop and successfully commercialize, new or enhanced products and services; |

|

· |

activities of, and acquisitions or announcements by, competitors; |

|

· |

the impact from any impairment of inventory, goodwill, fixed assets or intangibles; |

|

· |

the impact of any changes of valuation allowance on deferred tax assets; |

|

· |

the ability to increase the number of customer connections to our network; |

|

· |

marketing programs which delay realization by us of monthly service fees on our new connections; |

|

· |

the material breach of security of any of the Company’s systems or third party systems utilized by the Company; and |

|

· |

the anticipation of and response to technological changes. |

Our products may fail to gain substantial increased market acceptance. As a result, we may not generate sufficient revenues or profit margins to achieve our financial objectives or growth plans.

There can be no assurances that demand for our products will be sufficient to enable us to generate sufficient revenue or become profitable on a sustainable basis. Likewise, no assurance can be given that we will be able to have a sufficient number of ePorts® connected to our network or sell or lease equipment utilizing our network to enough locations to achieve significant revenues. Alternatively, the locations which utilize the network may not be successful locations and our revenues would be adversely affected. We may lose locations utilizing our products to competitors, or may not be able to install our products at competitors’ locations, or may not obtain future locations which would be obtained by our competitors. In addition, there can be no assurance that our products could evolve or be improved to meet the future needs of the marketplace. In any such event, we may not be able to achieve our growth plans, including anticipated connections and revenue growth.

We may be required to incur further debt to meet future capital requirements of our business. Should we be required to incur additional debt, the restrictions imposed by the terms of such debt could adversely affect our financial condition and our ability to respond to changes in our business.

If we incur additional debt, we may be subject to the following risks:

|

· |

our vulnerability to adverse economic conditions and competitive pressures may be heightened; |

|

· |

our flexibility in planning for, or reacting to, changes in our business and industry may be limited; |

|

· |

our debt covenants may affect our flexibility in planning for, and reacting to, changes in the economy and in our industry; |

|

· |

a high level of debt may place us at a competitive disadvantage compared to our competitors that are less leveraged and therefore, may be able to take advantage of opportunities that our indebtedness would prevent us from pursuing; |

|

· |

the covenants contained in the agreements governing our outstanding indebtedness may limit our ability to borrow additional funds, dispose of assets and make certain investments; |

|

· |

a significant portion of our cash flows could be used to service our indebtedness; |

|

· |

we may be sensitive to fluctuations in interest rates if any of our debt obligations are subject to variable interest rates; and |

|

· |

our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions, general corporate purposes or other purposes may be impaired. |

17

We cannot assure you that our leverage and such restrictions will not materially and adversely affect our ability to finance our future operations or capital needs or to engage in other business activities. In addition, we cannot assure you that additional financing will be available when required or, if available, will be on terms satisfactory to us.

Our bank borrowing agreement contains restrictions which may limit our flexibility in operating and growing our business.

Our bank borrowing agreement contains covenants regarding our maintenance of a minimum quarterly adjusted EBITDA as defined in our loan agreement and certain numbers of connections. Our loan agreement also includes covenants that limit our ability to engage in specified types of transactions, including among other things:

|

· |

incur additional indebtedness or issue equity; |

|

· |

pay dividends on, repurchase or make distributions in respect of our common stock; |

|

· |

make certain investments (including acquisitions) and distributions; |

|

· |

sell certain assets; |

|

· |

create liens; |

|

· |

consolidate, merge, sell or otherwise dispose of all or substantially all of our assets; |

|

· |

enter into certain transactions with respect to our affiliates; |

|

· |

ability to enter into business combinations; and |

|

· |

certain other financial and non-financial covenants. |

We were in compliance with these covenants as of June 30, 2017. Failure to be in compliance with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all or a portion of our outstanding indebtedness, which would have a material adverse effect on our business, financial condition and results of operations.

The loss of one or more of our key customers could significantly reduce our revenues, results of operations, and net income.

We have derived, and believe we may continue to derive, a significant portion of our revenues from one large customer or a limited number of large customers. Customer concentrations for the years ended June 30, 2017, 2016 and 2015 were as follows:

|

|

|

2017 |

|

2016 |

|

2015 |

|

|

Trade account and finance receivables - one customer |

|

42 |

% |

18 |

% |

35 |

% |

|

License and transaction processing revenues - one customer |

|

20 |

% |

16 |

% |

21 |

% |

|

Equipment sales revenue - one customer |

|

37 |

% |

28 |

% |

17 |

% |

Our customers may buy less of our products or services depending on their own technological developments, end-user demand for our products and internal budget cycles. A major customer in one year may not purchase any of our products or services in another year, which may negatively affect our financial performance. We have offered, and may in the future offer, discounts to our large customers to incentivize them to continue to utilize our products and services. If we are required to sell products to any of our large customers at reduced prices or unfavorable terms, our results of operations and revenue could be materially adversely affected. Further, there is no assurance that our customers will continue to utilize our transaction processing and related services as our customer agreements are generally cancelable by the customer on thirty to sixty days’ notice.

We depend on our key personnel and, if they leave us, our business could be adversely affected.

We are dependent on key management personnel, particularly the Chairman and Chief Executive Officer, Stephen P. Herbert. The loss of services of Mr. Herbert or other officers could dramatically affect our business prospects. Our executive officers and certain of our officers and employees are particularly valuable to us because:

|

· |

they have specialized knowledge about our company and operations; |

|

· |

they have specialized skills that are important to our operations; or |

18

|

· |

they would be particularly difficult to replace. |

We have entered into an employment agreement with Mr. Herbert, which contains confidentiality and non-compete provisions. The agreement provided for an initial term continuing through January 1, 2013, which is automatically renewed for consecutive one year periods unless terminated by either Mr. Herbert or the Company upon at least 90 days’ notice prior to the end of the initial term or any one-year extension thereof.

We also may be unable to retain other existing senior management, sales personnel, and development and engineering personnel critical to our ability to execute our business plan, which could result in harm to key customer relationships, loss of key information, expertise or know-how and unanticipated recruitment and training costs.

Our dependence on proprietary technology and limited ability to protect our intellectual property may adversely affect our ability to compete.

Challenge to our ownership of our intellectual property could materially damage our business prospects. Our technology may infringe upon the proprietary rights of others. Our ability to execute our business plan is dependent, in part, on our ability to obtain patent protection for our proprietary products, maintain trade secret protection and operate without infringing the proprietary rights of others.

Through June 30, 2017, we had 13 pending United States and foreign patent applications, and will consider filing applications for additional patents covering aspects of our future developments, although there can be no assurance that we will do so. In addition, there can be no assurance that we will maintain or prosecute these applications. The United States Government and other countries have granted us 96 patents as of June 30, 2017. There can be no assurance that:

|

· |

any of the remaining patent applications will be granted to us; |

|

· |

we will develop additional products that are patentable or do not infringe the patents of others; |

|

· |

any patents issued to us will provide us with any competitive advantages or adequate protection for our products; |

|

· |

any patents issued to us will not be challenged, invalidated or circumvented by others; or |

|

· |

any of our products would not infringe the patents of others. |

If any of our products or services is found to have infringed any patent, there can be no assurance that we will be able to obtain licenses to continue to manufacture, use, sell, and license such product or service or that we will not have to pay damages and/or be enjoined as a result of such infringement. Even if a patent application is granted for any of our products, there can be no assurance that the patented technology will be a commercial success or result in any profits to us.

If we are unable to adequately protect our proprietary technology or fail to enforce or prosecute our patents against others, third parties may be able to compete more effectively against us, which could result in the loss of customers and our business being adversely affected. Patent and proprietary rights litigation entails substantial legal and other costs, and diverts Company resources as well as the attention of our management. There can be no assurance we will have the necessary financial resources to appropriately defend or prosecute our intellectual property rights in connection with any such litigation.

Competition from others could prevent the Company from increasing revenue and achieving its growth plans.

While we are a leading provider and believe we have the largest installed base of unattended POS electronic payment systems in the small ticket, beverage and food vending industry, our competitors are increasingly and actively marketing products and services that compete with our products and services in this vending space. The competition includes manufacturers who may include in their new vending machines their own (or another third party’s) cashless payment systems and services other than our systems and services. While we believe our products and services are superior to our competitors, many of our competitors are much larger enterprises and have substantially greater revenues. In addition to these competitors, there are also numerous credit card processors that offer card processing services to traditional retail establishments that could decide to offer similar services to the industries that we serve. Competition from other companies, including those that are well established and have substantially greater resources, may reduce our profitability or reduce our business opportunities. Competition may result in lower profit margins on our products or may reduce potential profits or result in a loss of some or all of our customer base. To the extent that our competitors are able to offer more attractive technology, our ability to compete could be adversely affected.

19

The termination of any of our relationships with third parties upon whom we rely for supplies and services that are critical to our products could adversely affect our business and delay achievement of our business plan.

We depend on arrangements with third parties for a variety of component parts used in our products. We have contracted with various suppliers to assist us to develop and manufacture our ePort® products. For other components, we do not have supply contracts with any of our third-party suppliers and we purchase components as needed from time to time. We have contracted with a third-party data system recovery vendor to host our network in a secure, 24/7 environment to ensure the reliability of our network services. We also have contracted with multiple land-based telecommunications providers to ensure the reliability of our land-based network. If these business relationships are terminated, the implementation of our business plan may be delayed until an alternative supplier or service provider can be retained. If we are unable to find another source or one that is comparable, the content and quality of our products could suffer and our business, operating results and financial condition could be harmed.

A disruption in the manufacturing capabilities of our third-party manufacturers, suppliers or distributors would negatively impact our ability to meet customer requirements.