Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - EXPRESS, INC. | exhibit991-q22017earningsr.htm |

| 8-K - 8-K - EXPRESS, INC. | a8-kq22017earningsreleasec.htm |

Q2 2017

Earnings Call

Cautionary Statement Regarding

Forward-Looking Statements

Forward Looking Statements:

Certain statements are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include any statement that does not directly relate to any historical or current fact

and include, but are not limited to, (1) guidance and expectations for the third quarter and full year 2017, including statements

regarding expected comparable sales, interest expense, effective tax rates, net income, adjusted net income, diluted earnings per

share, adjusted diluted earnings per share, and capital expenditures, as well as statements regarding expectations for improving

sales and margin performance, and cash flow generation, (2) statements regarding expected store openings, store closures, and

gross square footage, and (3) statements regarding the Company's future plans and initiatives, including, but not limited to, results

expected from such initiatives. Forward looking statements are based on our current expectations and assumptions, which may not

prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances

that are difficult to predict, and significant contingencies, many of which are beyond the Company's control. Many factors could

cause actual results to differ materially and adversely from these forward-looking statements. Among these factors are (1) changes

in consumer spending and general economic conditions; (2) our ability to identify and respond to new and changing fashion trends,

customer preferences, and other related factors; (3) fluctuations in our sales, results of operations, and cash levels on a seasonal

basis and due to a variety of other factors, including, our product offerings relative to customer demand, the mix of merchandise we

sell, promotions, and inventory levels; (4) competition from other retailers; (5) customer traffic at malls, shopping centers, and at our

stores and online; (6) our dependence on a strong brand image; (7) our ability to develop and maintain a relevant and reliable omni-

channel experience for our customers; (8) the failure or breach of information systems upon which we rely; (9) our ability to protect

customer data from fraud and theft; (10) our dependence upon third parties to manufacture all of our merchandise; (11) changes in

the cost of raw materials, labor, and freight; (12) supply chain or other business disruption; (13) our dependence upon key executive

management; (14) our ability to achieve our strategic objectives, including improving profitability through a balanced approach to

growth, increasing brand awareness and elevating our customer experience, transforming and leveraging information technology

systems, and investing in the growth and development of our people; (15) our substantial lease obligations; (16) our reliance on third

parties to provide us with certain key services for our business; (17) claims made against us resulting in litigation or changes in laws

and regulations applicable to our business; (18) our inability to protect our trademarks or other intellectual property rights which may

preclude the use of our trademarks or other intellectual property around the world; (19) restrictions imposed on us under the terms of

our asset-based loan facility; (20) impairment charges on long-lived assets; and (21) changes in tax requirements, results of tax

audits, and other factors that may cause fluctuations in our effective tax rate. Additional information concerning these and other

factors can be found in Express, Inc.'s filings with the Securities and Exchange Commission. We undertake no obligation to publicly

update or revise any forward looking statement as a result of new information, future events, or otherwise, except as required by law.

2

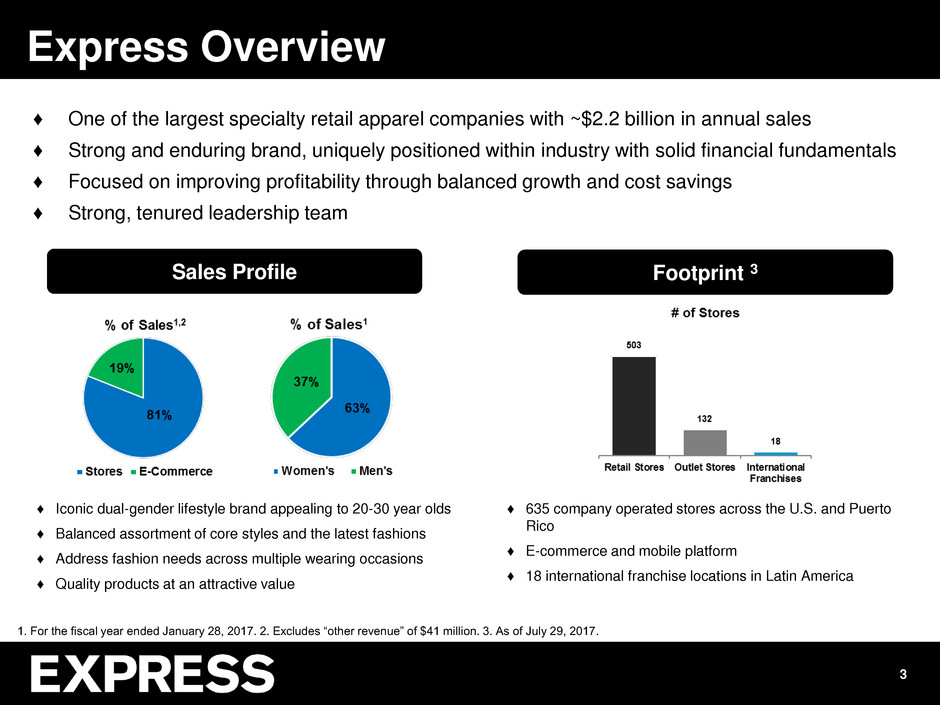

♦ One of the largest specialty retail apparel companies with ~$2.2 billion in annual sales

♦ Strong and enduring brand, uniquely positioned within industry with solid financial fundamentals

♦ Focused on improving profitability through balanced growth and cost savings

♦ Strong, tenured leadership team

Sales Profile Footprint 3

♦ Iconic dual-gender lifestyle brand appealing to 20-30 year olds

♦ Balanced assortment of core styles and the latest fashions

♦ Address fashion needs across multiple wearing occasions

♦ Quality products at an attractive value

♦ 635 company operated stores across the U.S. and Puerto

Rico

♦ E-commerce and mobile platform

♦ 18 international franchise locations in Latin America

3

Express Overview

1. For the fiscal year ended January 28, 2017. 2. Excludes “other revenue” of $41 million. 3. As of July 29, 2017.

4

Key Q2 Achievements

♦ Achieved top end of guidance for comparable sales and adjusted diluted EPS

♦ E-commerce sales growth was very strong, increasing 28% over last year and accounting

for 19% of sales, up from 14% in the prior year period

♦ Sequential improvement in store comps as our initiatives gained further traction

♦ Completed relaunch of Express NEXT customer loyalty program, with significant year-over-

year growth in sign-ups for NEXT and the Express NEXT credit card

♦ Successful “ship from store” omni-channel launch, validating our future ability to leverage

store inventories to maximize sales, drive inventory productivity, and reduce markdowns

♦ Closed 40 retail stores, 19 of which were converted to outlets, and opened 4 new outlet

stores, as part of continued focus on store footprint optimization

♦ Increased marketing effectiveness with new brand platform, including August denim

campaign and increased customer touchpoints

♦ Remain on track to deliver $20 million in cost savings in 2017 and a total of $44 to $54

million dollars over the 2016 to 2019 period

♦ We are focused on generating long-term value for our stockholders through the following

strategic objectives:

1. Improving profitability through a balanced approach to growth

2. Increasing brand awareness and elevating our customer experience

3. Transforming and leveraging information technology systems

4. Investing in the growth and development of our people

5

Strategic Objectives

6

Improving Profitability

1. Increasing the productivity of our existing stores

Telling more defined fashion stories

Ensuring offerings are clear and cohesive across lifestyles

2. Optimizing our retail store footprint and opening new outlet stores

Investing in stores that achieve a strong return on investment

Continuing conversion of select mall stores to outlets

3. Growing our e-commerce and omni-channel capabilities

Expanding product assortment, further enhancing mobile experience, launching “ship

from store,” and piloting “buy online, pick up in store”

4. Significant cost savings initiatives

Aggressively managing costs across all areas of the business

Taking a more conservative approach to capital spending

Q2 2017

Results

8

Q2 2017 Financial Performance

$ in millions

Net Sales Diluted EPS*

Net sales -5%

Comparable sales -4%

E-commerce sales +28%

*Q2 2017 diluted EPS is adjusted to exclude $0.16

per share impact related to the exit of Canada;

Q2 2017 GAAP diluted EPS is ($0.15)

• Comparable sales and adjusted diluted EPS at the top end of our guidance

• E-commerce sales increased 28%, accounting for 19% of net sales vs. 14% last year

• SG&A declined by 1%, despite increases in depreciation expense and other wage inflationary costs

Key Highlights

Note: Adjusted diluted EPS is a non-GAAP financial measure. Refer to pages 17-19 for information about non-GAAP financial measures and reconciliations of GAAP to

non-GAAP financial measures.

9

Balance Sheet and Cash Flow

$ in millions

Cash Capital Expenditures

No debt outstanding

Untapped revolver of up to $250M

• Healthy balance sheet with $173 million in cash and no debt

• Conservative approach to capital spending going forward

• 2017 guidance implies continued strong operating and free cash flow generation

$ in millions

Key Highlights

2017 Financial

Guidance

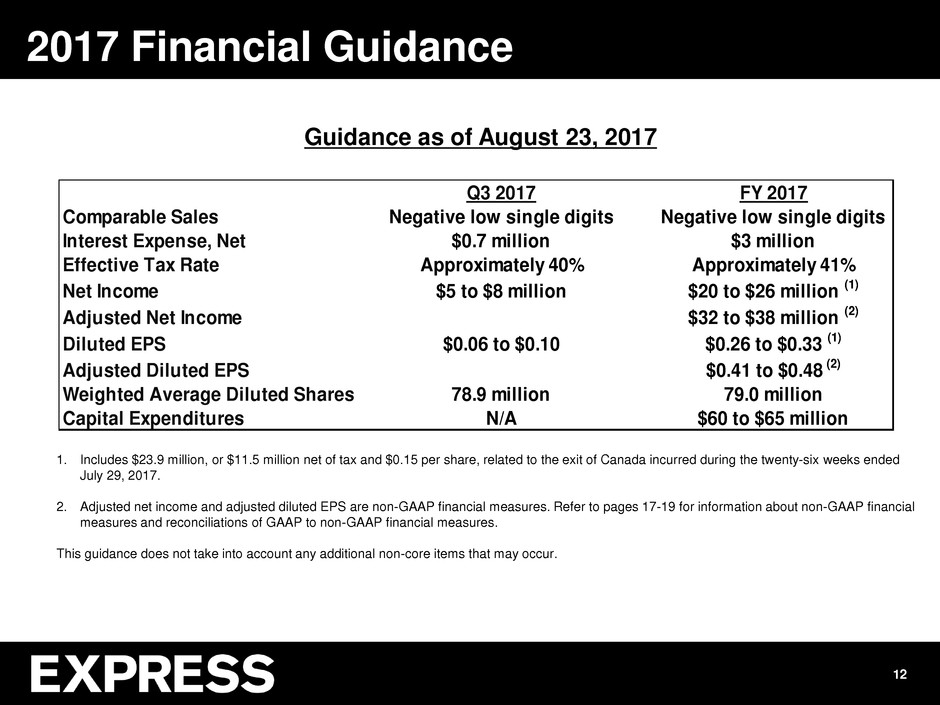

♦ We expect our sales and margin performance to improve during the balance of the year

Traffic in the mall continues to be a headwind and we expect the retail environment to remain

promotional

♦ Our key 2017 initiatives remain consistent with our long-term objectives and include:

Improving the fashion clarity in our stores through reduced choice counts

Improving the effectiveness of our marketing investment with a new brand platform

Introducing compelling new products and improving upon key existing categories

Relaunching our customer loyalty program

Capitalizing on our new IT systems, including implementing additional omni-channel

capabilities

Managing our overall cost structure and optimizing our store footprint

11

2017 Outlook

12

2017 Financial Guidance

Guidance as of August 23, 2017

Q3 2017 FY 2017

Comparable Sales Negative low single digits Negative low single digits

Interest Expense, Net $0.7 million $3 million

Effective Tax Rate Approximately 40% Approximately 41%

Net I come $5 to $8 million $20 to $26 million (1)

Adjusted Net Income $32 to $38 million (2)

Diluted EPS $0.06 to $0.10 $0.26 to $0.33 (1)

Adjusted Diluted EPS $0.41 to $0.48 (2)

78.9 million 79.0 million

Capital Expenditures N/A $60 to $65 million

Weighted Average Diluted Shares

1. Includes $23.9 million, or $11.5 million net of tax and $0.15 per share, related to the exit of Canada incurred during the twenty-six weeks ended

July 29, 2017.

2. Adjusted net income and adjusted diluted EPS are non-GAAP financial measures. Refer to pages 17-19 for information about non-GAAP financial

measures and reconciliations of GAAP to non-GAAP financial measures.

This guidance does not take into account any additional non-core items that may occur.

Appendix

14

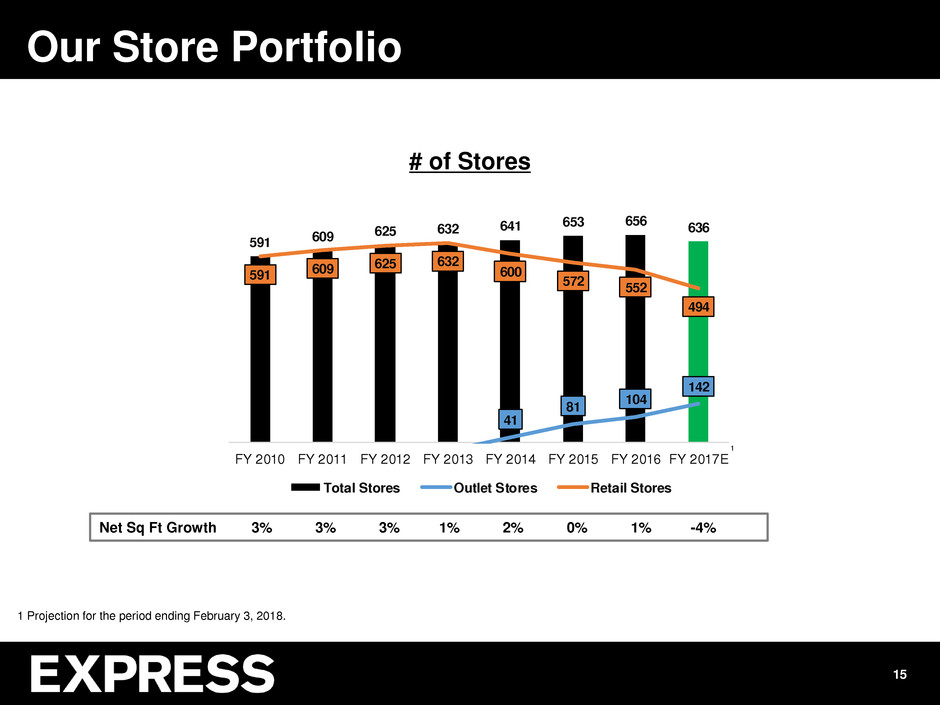

Projected 2017 Real Estate Activity

591 609

625 632 641

653 656 636

41

81

104

142

591 609

625 632

600

572

552

494

FY 2010 FY 2011 FY 2012 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017E

Total Stores Outlet Stores Retail Stores

15

Our Store Portfolio

Net Sq Ft Growth 3% 3% 3% 1% 2% 0% 1% -4%

# of Stores

1 Projection for the period ending February 3, 2018.

1

Non-GAAP

Reconciliations

Cautionary Statement Regarding

Non GAAP Financial Measures

Non-GAAP Financial Measures

This presentation contains references to adjusted net income and adjusted diluted earnings per share, which are non-GAAP

measures. These measures should be considered supplemental to and not a substitute for financial information prepared in

accordance with generally accepted accounting principles (GAAP). The Company provides non-GAAP measures when

management believes they provide additional useful information to assist stockholders in understanding the Company’s

financial results and assessing its prospects for future performance. Management believes adjusted net income and adjusted

diluted earnings per share are important indicators of the Company's business performance because they exclude items that

may not be indicative of, or are unrelated to, the Company's underlying operating results, and provide a better baseline for

analyzing trends in the business. In addition, adjusted diluted earnings per share is used as a performance measure in the

Company's executive compensation program for purposes of determining the number of equity awards that are ultimately

earned. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial

measures with other companies' non-GAAP financial measures having the same or similar names. Please refer to pages 18-

19 in this presentation for reconciliations of these non-GAAP measures to the most directly comparable financial measures

calculated in accordance with GAAP.

17

18

Non-GAAP Reconciliations

Q2 2017 Adjusted Net Income and Adjusted EPS

(a) Includes $16.3 million in restructuring costs and an additional $1.3 million in inventory adjustments related to

the Canadian exit.

(b) Weighted average diluted shares outstanding for purpose of calculating adjusted diluted earnings per share

includes the dilutive effect of share-based awards as determined under the treasury stock method.

Thirteen Weeks Ended July 29, 2017

(in thousan s, except per share

amounts) Net Loss

Diluted

Earnings per

Share

Weighted

Average

Diluted

Shares

Outstanding

Reported GAAP Measure $ (11,802 ) $ (0.15 ) 78,786

Impact of Canadian Exit (a)

17,622 0.22

Income Tax Benefit - Canadian Exit

(5,074 ) (0.06 )

Adjusted Non-GAAP Measure

$ 746 $ 0.01 78,810 (b)

19

Non-GAAP Reconciliations

FY 2017 Adjusted Net Income and Adjusted EPS

This guidance does not take into account any additional non-core items that may occur.