Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Hamilton Beach Brands Holding Co | d374435dex231.htm |

| EX-21.1 - EX-21.1 - Hamilton Beach Brands Holding Co | d374435dex211.htm |

| EX-8.1 - EX-8.1 - Hamilton Beach Brands Holding Co | d374435dex81.htm |

Table of Contents

As filed with the Securities and Exchange Commission on August 21, 2017

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Hamilton Beach Brands Holding Company

(Exact name of registrant as specified in its charter)

| Delaware | 3634 | 31-1236686 | ||

| (State of Incorporation) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

Hamilton Beach Brands Holding Company

4421 Waterfront Dr.

Glen Allen, VA 23060

(804) 273-9777

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dana B. Sykes

Vice President, General Counsel and Secretary

4421 Waterfront Dr.

Glen Allen, VA 23060

(804) 273-9777

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Thomas Murphy, Esq.

Eric Orsic, Esq.

McDermott Will & Emery LLP

444 West Lake Street, Suite 4000

Chicago, IL 60606-0029

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Table of Contents

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | ☐ | |||

| Emerging growth company | ☒ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be |

Proposed Maximum Offering Price Per Unit |

Proposed Aggregate |

Amount of Registration Fee | ||||

| Class A common stock, par value $0.01 per share |

6,836,716 shares | Not Applicable(2) | $31,480,500 | $3,648.59 | ||||

| Class B common stock, par value $0.01 per share |

6,836,716 shares | Not Applicable(2) | $31,480,500 | $3,648.59 | ||||

| Class A common stock, par value $0.01 per share |

6,836,716 shares(4) | (4) | (4) | (4) | ||||

|

| ||||||||

|

| ||||||||

| (1) | This prospectus relates to shares of Class A common stock, par value $0.01 per share, and Class B common stock, par value $0.01 per share, of Hamilton Beach Brands Holding Company (“Hamilton Beach Holding”) which will be distributed pursuant to a spin-off transaction to the holders of Class A common stock, par value $1.00 per share, and Class B common stock, par value $1.00 per share, of NACCO Industries, Inc. (“NACCO”). The amount of Hamilton Beach Holding Class A common stock (“Hamilton Beach Holding Class A Common”) and Hamilton Beach Holding Class B common stock (“Hamilton Beach Holding Class B Common”) to be registered represents the maximum number of shares of Hamilton Beach Holding Class A Common and Hamilton Beach Holding Class B Common, respectively, that will be distributed to the holders of NACCO Class A common stock (“NACCO Class A Common”) and NACCO Class B common stock (“NACCO Class B Common”) upon consummation of the spin-off. One share of Hamilton Beach Holding Class A Common and one share of Hamilton Beach Holding Class B Common will be distributed for each share of NACCO Class A Common outstanding on the record date of the spin-off and one share of Hamilton Beach Holding Class A Common and one share of Hamilton Beach Holding Class B Common will be distributed for each share of NACCO Class B Common outstanding on the record date of the spin-off. Because it is not possible to accurately state the number of shares of NACCO Class A Common and NACCO Class B Common that will be outstanding as of the record date of the spin-off, this calculation is based on the shares of NACCO Class A Common and the shares of NACCO Class B Common outstanding as of August 11, 2017. |

| (2) | Not included pursuant to Rule 457(o) under the Securities Act. |

| (3) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(f)(2) of the Securities Act. The book value of securities as of the latest practicable date prior to the filing of the registration statement is $62,961,000. |

| (4) | Represents the maximum number of shares of Hamilton Beach Holding Class A Common issuable upon conversion of shares of Hamilton Beach Holding Class B Common issued upon the distribution of the Hamilton Beach Holding Class B Common described in this Registration Statement. Such shares of Hamilton Beach Holding Class A Common, if issued, will be issued for no additional consideration and, therefore, pursuant to Rule 457(i), no registration fee is required. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not distribute these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell securities, and it is not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 21, 2017

PRELIMINARY PROSPECTUS

[ ] Shares of Class A Common Stock

[ ] Shares of Class B Common Stock

HAMILTON BEACH BRANDS HOLDING COMPANY

To the Stockholders of NACCO Industries, Inc.:

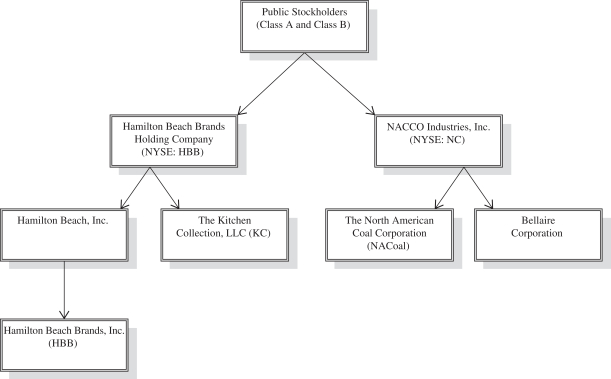

We are pleased to inform you that the board of directors of NACCO Industries, Inc. (“NACCO”) has approved the spin-off of Hamilton Beach Brands Holding Company (“Hamilton Beach Holding”) to NACCO stockholders. Hamilton Beach Holding is a holding company for two separate businesses: consumer, commercial and specialty small appliances (Hamilton Beach Brands, Inc.) and specialty retail (The Kitchen Collection, LLC). Hamilton Beach Brands, Inc. (“HBB”) is a leading designer, marketer, and distributor of branded small electric household and specialty housewares appliances as well as commercial products for restaurants, bars, and hotels. HBB markets such products under numerous brand names, including the Hamilton Beach®, Proctor Silex® and Weston® brands, among others. The Kitchen Collection, LLC (“KC”) is a national specialty retailer of kitchenware in outlet and traditional malls throughout the United States. Immediately following the spin-off, Hamilton Beach Holding will be an independent public company.

To effect the spin-off, NACCO will make a distribution of all of the outstanding shares of Hamilton Beach Holding common stock to holders of NACCO common stock as of 5:00 p.m., Eastern Time, on [ ], 2017, the record date for the spin-off. NACCO will distribute one share of Hamilton Beach Holding Class A common stock, referred to as Hamilton Beach Holding Class A Common, or our Class A Common, and one share of Hamilton Beach Holding Class B common stock, referred to as Hamilton Beach Holding Class B Common or our Class B Common, for each share of NACCO common stock, whether NACCO Class A common stock, referred to as NACCO Class A Common, or NACCO Class B common stock, referred to as NACCO Class B Common. The spin-off is expected to occur after the close of trading on the New York Stock Exchange (the “NYSE”) on [ ], 2017. Hamilton Beach Holding intends to apply to list the Hamilton Beach Holding Class A Common on the NYSE under the symbol “HBB.” The Hamilton Beach Holding Class B Common will not be listed on the NYSE or any other stock exchange and is subject to substantial restrictions on transfer. Each share of Hamilton Beach Holding Class A Common is entitled to one vote per share on matters submitted to a vote of the Hamilton Beach Holding common stockholders. Each share of Hamilton Beach Holding Class B Common is entitled to ten votes per share on matters submitted to a vote of the Hamilton Beach Holding common stockholders, is subject to transfer restrictions and is convertible into one share of Hamilton Beach Holding Class A Common at any time without cost at the option of the holder.

After the spin-off, NACCO will continue to own and operate its other principal business, which is mining and value-added mining services (The North American Coal Corporation).

No vote of NACCO stockholders is required in connection with this spin-off. NACCO stockholders will not be required to pay any consideration for the shares of Hamilton Beach Holding common stock they receive in the spin-off, and they will not be required to surrender or exchange shares of their NACCO common stock or take any other action in connection with the spin-off. We expect that, for U.S. federal income tax purposes, the spin-off will be tax-free to you, except with respect to cash received in lieu of fractional shares of Hamilton Beach Holding common stock.

Because NACCO owns all of the outstanding shares of Hamilton Beach Holding’s common stock, there currently is no public trading market for Hamilton Beach Holding common stock. We anticipate that a limited market, commonly known as a “when-issued” trading market, for Hamilton Beach Holding’s Class A Common will develop on or shortly before the record date for the spin-off and will continue up to and including the spin-off date. We expect the “regular-way” trading of Hamilton Beach Holding’s Class A Common will begin on the first trading day following the spin-off date.

Hamilton Beach Holding qualifies as an “emerging growth company” as defined in the Jumpstart our Business Startups Act of 2012, or the JOBS Act, and, therefore will be subject to reduced reporting requirements.

In reviewing this prospectus, you should carefully consider the matters described in “Risk Factors” beginning on page 18 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined whether this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities.

The date of this prospectus is [ ], 2017.

Table of Contents

| 1 | ||||

| 8 | ||||

| 16 | ||||

| 18 | ||||

| 35 | ||||

| 37 | ||||

| 45 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| Selected Historical Financial Data of Hamilton Beach Brands Holding Company |

52 | |||

| Management’s Discussion And Analysis of Financial Condition and Results of Operations |

53 | |||

| 84 | ||||

| 90 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

91 | |||

| 98 | ||||

| 109 | ||||

| 137 | ||||

| 140 | ||||

| Description of Capital Stock of Hamilton Beach Holding After the Spin-Off |

143 | |||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| 148 | ||||

| F-1 |

This prospectus is being furnished solely to provide information to NACCO stockholders who will receive shares of Hamilton Beach Holding common stock in the spin-off. It is not and is not to be construed as an inducement or encouragement to buy or sell any securities of NACCO or Hamilton Beach Holding. This prospectus describes Hamilton Beach Holding’s business, its relationship with NACCO and how the spin-off affects NACCO and its stockholders, and provides other information to assist you in evaluating the benefits and risks of holding or disposing of the common stock that you will receive in the spin-off.

You should not assume that the information contained in this prospectus is accurate as of any date other than the date set forth on the cover. Changes to the information contained in this prospectus may occur after that date, and we undertake no obligation to update the information, except in the normal course of our public disclosure obligations.

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE SPIN-OFF

The following questions and answers briefly address some commonly asked questions about the spin-off. They may not include all the information that is important to you. We encourage you to read carefully this entire prospectus, including the annexes and the other documents to which we have referred you. We have included page references in certain parts of this section to direct you to a more detailed discussion of each topic presented in this section. Unless the context indicates otherwise, “Hamilton Beach Holding,” “we,” “us” and “our” refer to Hamilton Beach Brands Holding Company and its subsidiaries before the spin-off and after the spin-off, as applicable. “NACCO” refers to NACCO Industries, Inc., unless the context clearly indicates otherwise, not its subsidiaries.

What will NACCO stockholders receive in the spin-off?

To effect the spin-off, NACCO will make a distribution of all of the outstanding shares of Hamilton Beach Holding common stock to NACCO common stockholders as of the record date, which will be [ ], 2017. For each share of NACCO Class A Common held on the record date, NACCO will distribute one share of Hamilton Beach Holding Class A Common and one share of Hamilton Beach Holding Class B Common. Similarly, for each share of NACCO Class B Common held on the record date, NACCO will distribute one share of Hamilton Beach Holding Class A Common and one share of Hamilton Beach Holding Class B Common.

No fractional shares of our Class A Common or our Class B Common will be distributed in the spin-off. Instead, as soon as practicable after the spin-off, the transfer agent will convert the fractional shares of our Class B Common into an equal number of fractional shares of our Class A Common, aggregate all fractional shares of our Class A Common into whole shares of our Class A Common, sell these shares of our Class A Common in the open market at prevailing market prices and distribute the applicable portion of the aggregate net cash proceeds of these sales to each holder who otherwise would have been entitled to receive a fractional share in the spin-off. You will not be entitled to any interest on the amount of the cash payment made in lieu of fractional shares.

NACCO stockholders will not be required to pay for shares of our common stock received in the spin-off, or to surrender or exchange shares of NACCO common stock or take any other action to be entitled to receive our common stock in the distribution. The distribution of our common stock will not cancel or affect the number of outstanding shares of NACCO common stock. Accordingly, NACCO stockholders should retain any NACCO stock certificates they hold as of the spin-off.

Immediately after the spin-off, holders of NACCO common stock as of the record date will hold all of the outstanding shares of our Class A Common and our Class B Common. Based on the number of shares of NACCO common stock outstanding on June 1, 2017, NACCO expects to distribute approximately 6.8 million shares of our Class A Common and approximately 6.8 million shares of our Class B Common to NACCO stockholders in the spin-off (page 38).

Why is NACCO spinning off Hamilton Beach Holding?

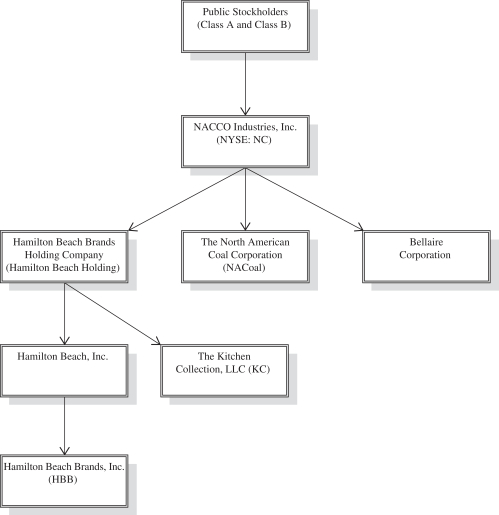

NACCO is an operating holding company with the following principal businesses: mining and value-added mining services (The North American Coal Corporation or “NACoal”), consumer, commercial and specialty small appliances (Hamilton Beach Brands, Inc. or “HBB”) and specialty retail (The Kitchen Collection, LLC or “KC”). NACCO’s board of directors, which is referred to as the NACCO board, determined that separating its consumer, commercial and specialty small appliances and specialty retail businesses from NACCO’s mining and value-added mining services business through the spin-off of Hamilton Beach Holding is in the best interests of NACCO and its stockholders and has concluded that the separation will provide both NACCO and Hamilton Beach Holding with a number of significant opportunities and benefits, including:

| • | Create Opportunities for Growth. Create greater flexibility for Hamilton Beach Holding (i) to pursue strategic growth opportunities, such as acquisitions and joint ventures, in the housewares industry because |

1

Table of Contents

| it will have the ability, subject to certain restrictions relating to the requirements for a tax-free distribution, to offer its stock as consideration in connection with potential future acquisitions or other growth opportunities and (ii) to use its stock to raise funds for acquisitions or other growth opportunities. |

| • | Access to Capital and Capital Structure. Provide Hamilton Beach Holding with direct access to equity capital markets and greater access to debt capital markets to fund its growth strategies and to establish a capital structure and dividend policy reflecting our business needs and financial position. |

| • | Implement CEO Succession. Provide Hamilton Beach Holding and NACCO with the ability to immediately implement CEO succession for their respective companies. After the spin-off, Hamilton Beach Holding will be a focused company led by a seasoned and highly qualified CEO and executive team. NACCO’s current Chairman, President and Chief Executive Officer, who is also the current Chairman of HBB, Alfred M. Rankin, Jr., will be able to dramatically reduce his role at Hamilton Beach Holding by becoming Executive Chairman. If HBB were to remain a part of NACCO, designating a successor to Mr. Rankin as CEO of the combined company would be difficult because of the vastly different industries with respect to which the successor would be responsible. |

| • | Recruiting, Motivating and Retaining Employees. Strengthen the alignment of senior management incentives with the needs and performance of Hamilton Beach Holding through the use of equity compensation arrangements that will also improve our ability to motivate and retain current personnel and attract, retain and motivate additional qualified personnel. |

| • | Management Focus. Reinforce NACCO management’s focus on operating the NACoal business since a majority of NACCO’s executive officers will remain with NACCO after the spin-off and no longer be required to oversee the HBB and KC businesses. Reinforce Hamilton Beach Holding management’s focus on serving each of Hamilton Beach Holding’s market segments and customer needs, and on responding flexibly to changing market conditions and growth markets. |

The NACCO board considered the following factors, among others, in connection with its decision to spin-off Hamilton Beach Holding:

| • | Voting Power/Proportionate Interest. As of June 1, 2017, holders of NACCO Class A Common and NACCO Class B Common have 25.1% and 74.9% of the voting power of NACCO, respectively. NACCO’s Restated Certificate of Incorporation, which is referred to as the NACCO Charter, provides that each class of NACCO common stock has equal rights in connection with stock dividends. When the spin-off, structured as a stock dividend, occurs, the holders of Hamilton Beach Holding Class A Common will have 9.1% of the voting power of Hamilton Beach Holding, while holders of Hamilton Beach Holding Class B Common will have 90.9% of the voting power of Hamilton Beach Holding. The collective voting power in Hamilton Beach Holding of current holders of NACCO Class A Common after the spin-off will be approximately 77%, while the collective voting power in Hamilton Beach Holding of current holders of NACCO Class B Common after the spin-off will be approximately 23%. |

| • | Certain Restrictions Relating to Tax-Free Distributions. The ability of Hamilton Beach Holding to engage in equity transactions could be limited or restricted for a period of time after the spin-off in order to preserve the tax-free nature of the spin-off. See “Risk Factors — We might not be able to engage in desirable strategic transactions and equity issuances for some period of time following the spin-off because of certain restrictions relating to requirements for tax-free distributions.” |

| • | No Existing Public Market. There is no existing public market for our common stock and the combined market values of NACCO common stock and our common stock following the spin-off may be less than the value of NACCO common stock prior to the spin-off. |

| • | Risks Factors. Certain other risks associated with the spin-off and our business after the spin-off, as described in this prospectus under the heading “Risk Factors” beginning on page 18. |

2

Table of Contents

What businesses will NACCO engage in after the spin-off?

NACCO will be principally engaged in the mining and value-added mining services business after the spin-off.

Why does Hamilton Beach Holding have two classes of common stock?

NACCO has two classes of common stock. The spin-off of Hamilton Beach Holding from NACCO is structured to provide the Hamilton Beach Holding stockholders with substantially the same capital structure that currently exists for the NACCO stockholders, with certain changes intended to provide Hamilton Beach Holding, as an independent company, with additional flexibility, including the ability to issue blank check preferred shares and an increased number of authorized shares. In the event blank check preferred stock is issued in the future, the voting rights and other rights of holders of our common stock may be adversely affected. In addition, while the governance-related provisions of Hamilton Beach Holding’s amended and restated certificate of incorporation and amended and restated bylaws, as well as a stockholders’ agreement to which Hamilton Beach Holding will be a party, are substantially the same as NACCO’s governance-related provisions and stockholders’ agreement, there are certain changes from the corresponding NACCO provisions. For example, holders of Hamilton Beach Holding Class B Common are permitted to transfer their shares to certain limited liability companies in addition to certain trusts and corporations. In addition, holders of NACCO Class B Common currently have the ability to transfer their shares to certain relatives and holders of our Class B Common will not have that right. With respect to the distribution of the stock of any subsidiary of Hamilton Beach Holding, Hamilton Beach Holding’s amended and restated certificate of incorporation will permit the Company to elect to distribute to each holder of Hamilton Beach Holding Class A Common shares of the Class A common stock of such subsidiary and to each holder of Hamilton Beach Holding’s Class B Common shares of the Class B common stock of such subsidiary, which is not permitted under the NACCO restated certificate of incorporation. Our amended and restated bylaws, unlike NACCO’s, contain additional procedures for the nomination and election of directors of Hamilton Beach Holding. Unlike NACCO’s, the 80% vote requirement to amend certain provisions of our amended and restated bylaws also applies to amendments to provisions regarding the order of business at meetings of stockholders and nominations and election of directors. The NACCO restated certificate of incorporation requires the affirmative vote of 50% of the outstanding voting stock of NACCO for the removal of directors, but our amended and restated certificate of incorporation provides for the removal of directors with or without cause by an 80% vote of our outstanding stock. Finally, our amended and restated certificate of incorporation contains an 80% vote requirement to amend certain provisions of our amended and restated certificate of incorporation with respect to the election and removal of directors, amendment of bylaws and rights to indemnification, which is not in the NACCO restated certificate of incorporation. Hamilton Beach Holding’s amended and restated certificate of incorporation, amended and restated bylaws and stockholders’ agreement are as described in more detail in “Ancillary Agreements — Stockholders’ Agreement” and “Description of Capital Stock of Hamilton Beach Holding after the Spin-Off.”

Why will I receive Hamilton Beach Holding Class A Common and Hamilton Beach Holding Class B Common if I currently own only NACCO Class A Common or NACCO Class B Common?

The NACCO Charter provides that each share of NACCO Class A Common and NACCO Class B Common is equal in respect of rights to dividends and any other distribution in cash, stock or property. Therefore, pursuant to the terms of the NACCO Charter, NACCO is required to distribute one share of Hamilton Beach Holding Class A Common and one share of Hamilton Beach Holding Class B Common for each share of NACCO common stock, whether NACCO Class A Common or NACCO Class B Common. As a result of this requirement for equal distribution, the proportionate interest that NACCO stockholders will have in Hamilton Beach Holding following the spin-off will differ from the interest those stockholders currently have in NACCO. In particular, the collective voting power in Hamilton Beach Holding of current holders of NACCO Class A Common after the spin-off will be approximately 77% while the collective voting power in Hamilton Beach Holding of current holders of NACCO Class B Common after the spin-off will be approximately 23%. By contrast, the collective voting power in NACCO of the current holders of NACCO Class A Common is approximately 25% while the

3

Table of Contents

collective voting power in NACCO of the current holders of NACCO Class B Common is approximately 75%. By virtue of the spin-off, there will be a greater concentration of voting power in Hamilton Beach Holding among the holders of NACCO Class A Common than such holders have in NACCO and a corresponding reduction in the concentration of voting power in Hamilton Beach Holding among the holders of NACCO Class B Common. See “Risk Factors – The relative voting power of holders of our Class B Common who convert their shares of our Class B Common into shares of our Class A Common will diminish” and “Risk Factors — The relative voting power of the remaining holders of Class B Common will increase as holders of our Class B Common convert their shares of our Class B Common into shares of our Class A Common.”

Who is entitled to receive shares of our common stock in the spin-off?

Holders of NACCO common stock at the close of business on [ ], 2017, the record date for the spin-off, will be entitled to receive shares of our common stock in the spin-off.

When is the spin-off expected to be completed?

The spin-off is expected to be completed during the third quarter of 2017.

What do I need to do to receive my shares of Hamilton Beach Holding common stock?

You do not need to take any action to receive your shares of our common stock. The shares of our common stock will be distributed on the date of the spin-off to holders of NACCO common stock as of the record date for the spin-off in book-entry form in accordance with Section 170 of the General Corporation Law of the State of Delaware (the “DGCL”).

What if I want to receive certificates representing my shares of Hamilton Beach Holding common stock?

While the shares of our common stock will be distributed in book-entry form, you may request to receive certificates representing your shares of our common stock from our transfer agent.

What will govern my rights as a Hamilton Beach Holding stockholder?

Your rights as a Hamilton Beach Holding stockholder will be governed by Delaware law, as well as our amended and restated certificate of incorporation and our amended and restated bylaws. A description of these rights is included in this prospectus under the heading “Description of Capital Stock of Hamilton Beach Holding after the Spin-Off” (page 143). Except as otherwise described in this prospectus, these documents are substantially comparable to NACCO’s constituent documents.

What if I want to convert or sell the shares of Hamilton Beach Holding Class B Common I receive in the spin-off?

Like the NACCO Class B Common, our Class B Common will not be listed on the NYSE or any other stock exchange, and we do not expect any trading market for our Class B Common to exist. In addition, our Class B Common generally will not be transferable except to or among a limited number of permitted transferees pursuant to our amended and restated certificate of incorporation. Violation of these transfer restrictions will cause our Class B Common to convert automatically into Class A Common, as described in more detail in “Description of Capital Stock of Hamilton Beach Holding after the Spin-Off — Common Stock — Restrictions on Transfer of Class B Common; Convertibility of Class B Common into Class A Common” beginning on page 143. However, our Class B Common will be convertible at any time, without cost to you, into our Class A Common on a share-for-share basis. If you want to sell the equity interest represented by your shares of our Class B Common, you may convert those shares into an equal number of shares of our Class A Common at any time, without cost, and then sell your shares of our Class A Common.

4

Table of Contents

You will receive a conversion form when you receive the shares of our Class B Common that you are entitled to receive in the spin-off. The conversion form will include instructions for converting shares of our Class B Common into an equal number of shares of our Class A Common. If you elect to convert your shares of our Class B Common into shares of our Class A Common, you should follow the instructions included with the form, complete, sign and date the form, and return the form, along with your certificate, if any, representing shares of our Class B Common, to our transfer agent. If you deliver a certificate, our transfer agent, as promptly as practicable after receipt of your completed, signed and dated form and certificate, will issue to you a certificate representing shares of our Class A Common equal to the number of shares of our Class B Common that you elected to convert. Any Class A Common issued upon conversion of Class B Common will be issued in the name or names you specified in the form. The conversion will be deemed to have been made immediately prior to the close of business on the date you surrendered your completed, signed and dated form and certificate, if any. After you receive shares of our Class A Common you may sell those shares. After you convert our Class B Common into our Class A Common, such shares may not be converted back into shares of our Class B Common.

Do I have to convert my shares of Class B Common before I sell them?

No. If you do not wish to complete the conversion process before you sell, you may effect a sale of our Class A Common into which your shares of our Class B Common are convertible. If you hold certificated Class B Common simply deliver the certificate or certificates representing such shares of our Class B Common to a broker, properly endorsed, in contemplation of the sale. The broker will then instruct the transfer agent to convert such Class B Common and, if necessary, present a certificate or certificates representing shares of our Class B Common to our transfer agent, who will issue to the purchaser a certificate, if necessary, representing the number of shares of our Class A Common sold in settlement of the transaction.

What are the potential risks, costs, and materially adverse consequences that could arise should NACCO decide not to proceed with the spin-off of Hamilton Beach Brands, Inc. and The Kitchen Collection, LLC?

If the spin-off is not completed for any reason, NACCO and Hamilton Beach Holding will have incurred significant costs related to the spin-off, including fees for attorneys and auditors and printer costs, that will not be recouped. In addition, members of our senior management will have devoted significant time to manage the spin-off process, which may have decreased the time they have had to manage the business of NACCO and Hamilton Beach Holding.

We note that NACCO previously attempted to spin-off the Hamilton Beach business on two separate occasions. In 2006, NACCO intended to execute a spin-off of the Hamilton Beach business as part of a transaction in which NACCO would spin off the Hamilton Beach business and merge it into a third party target company. This spin-off did not occur because the target company was acquired before the spin-off could be completed. In 2007, NACCO intended to execute a spin-off of the Hamilton Beach business as a stand-alone company. NACCO’s board of directors ultimately determined not to proceed due to weak and declining macroeconomic and stock market conditions at the time of the proposed spin-off.

Are there risks associated with the spin-off and our business after the spin-off?

Yes. You should carefully review the risks described in this prospectus under the heading “Risk Factors” beginning on page 18.

5

Table of Contents

Who can answer my questions about the spin-off?

If you have any questions about the spin-off, please contact the following.

NACCO Industries, Inc. 5875 Landerbrook Drive, Suite 220 Cleveland, Ohio 44124-4017 Attn: Investor Relations Telephone: 440-229-5130 Email: ir@naccoind.com

Is stockholder approval needed in connection with the spin-off?

No vote of NACCO stockholders is required or will be sought in connection with the spin-off.

Where will the shares of Hamilton Beach Holding common stock be listed?

We have applied for listing of our shares of Class A Common on the New York Stock Exchange under the symbol “HBB.” Our Class B Common will not be listed on the NYSE or any other stock exchange.

Where can I find more information about Hamilton Beach Holding and NACCO?

You can find more information about NACCO and us from various sources described under “Where You Can Find More Information” beginning on page 148.

What are the U.S. federal income tax consequences of the spin-off to NACCO stockholders?

The spin-off is conditioned upon receipt by NACCO of an opinion of tax counsel to the effect that, for U.S. federal income tax purposes, the spin-off will qualify as tax-free under Section 355 of the Internal Revenue Code (the “Code”), except for cash received in lieu of fractional shares. The opinion of tax counsel to NACCO will be based on, among other things, current law and will rely on certain facts and assumptions, and certain representations and undertakings, provided by NACCO and us regarding the past and future conduct of our respective businesses and other matters, which, if incorrect, could jeopardize the conclusions reached in this opinion.

We expect that the opinion of tax counsel will conclude that for U.S. federal income tax purposes, the spin-off will qualify as tax-free under Section 355 of the Code, such that (1) no gain or loss will be recognized by NACCO or us as a result of the spin-off, and (2) no gain or loss will be recognized by (and no amount will be included in the income of) a NACCO stockholder, upon the receipt of our common stock in the spin-off, except a NACCO stockholder may recognize a gain or loss with respect to any cash received in lieu of a fractional share. A form of the opinion we expect to receive from tax counsel is filed as an exhibit to the registration statement that contains this prospectus.

In connection with the spin-off, we will enter into a tax allocation agreement with NACCO (the “Tax Allocation Agreement”). Under the Tax Allocation Agreement, NACCO has agreed to make a protective election under Section 336(e) of the Code with respect to the spin-off. If, notwithstanding the receipt of an opinion of tax counsel, the spin-off fails to qualify as tax-free under Section 355 of the Code, the Section 336(e) election would generally cause a deemed sale of the assets of Hamilton Beach Holding and its subsidiaries, causing the NACCO group to recognize a gain to the extent the fair market value of the assets exceeded the basis of Hamilton Beach Holding and its subsidiaries in such assets. In such case, to the extent that NACCO is responsible for the resulting transaction taxes, Hamilton Beach Holding generally would be required under the Tax Allocation Agreement to make periodic payments to NACCO equal to the tax savings arising from a “step up” in the tax basis of Hamilton Beach Holding’s assets.

6

Table of Contents

In addition, if the spin-off fails to qualify as tax-free under Section 355 of the Code, NACCO stockholders could be taxed on the full value of the shares of Hamilton Beach Holding’s common stock that they receive, which generally would be treated first as a taxable dividend to the extent of NACCO’s earnings and profits, then as a non-taxable return of capital to the extent of each stockholder’s tax basis in shares of NACCO common stock, and thereafter as a capital gain with respect to any remaining value. The protective Section 336(e) election does not impact this treatment of NACCO stockholders.

Even if the spin-off qualifies as tax-free under Section 355 of the Code, the spin-off would become taxable to NACCO under Section 355(e) of the Code if a 50% or greater interest (by vote or value) in NACCO or Hamilton Beach Holding stock were treated as acquired, directly or indirectly, by certain persons as part of a plan or series of related transactions that included the spin-off. For this purpose, it is unclear whether any increase in voting power by holders of our Class B Common Stock by reason of the conversion by other holders of Hamilton Beach Holding Class B Common Stock to Hamilton Beach Holding Class A Common Stock should be considered an acquisition of voting power as part of a plan or series of related transactions. However, even if so treated, any such voting shift would not alone cause an acquisition of 50% or more of the voting power of our Common Stock and, as a result, would not, by itself, cause the spin-off to be taxable to NACCO under Section 355(e) of the Code. However, if the IRS were to determine that other acquisitions of NACCO shares before or after the spin-off, or Hamilton Beach Holding shares after the spin-off, were part of a plan or series of related transactions that included the spin-off for purposes of Section 355(e) of the Code, such determination could result in the recognition of a gain by NACCO under Section 355(e) of the Code. Because of the protective Section 336(e) election, Hamilton Beach Holding and its subsidiaries would be deemed to have sold all of their assets, thereby causing the NACCO group to recognize a gain to the extent the fair market value of the assets exceeded the basis of Hamilton Beach Holding and its subsidiaries in such assets. As described, above, to the extent that NACCO is responsible for the resulting transaction taxes, Hamilton Beach Holding would generally be required under the Tax Allocation Agreement to make certain periodic payments to NACCO.

For further information concerning the U.S. federal income tax consequences of the spin-off, see “Material U.S. Federal Income Tax Consequences” beginning on page 45.

Each NACCO stockholder is urged to consult a tax advisor as to the specific tax consequences of the spin-off to that stockholder, including the effect of any state, local, or non-U.S. tax laws and any changes in applicable tax laws.

How will I determine the tax basis I will have in the shares of Hamilton Beach Holding Class A and Class B common stock I receive in the spin-off?

Generally, for U.S. federal income tax purposes, your aggregate basis in the stock you hold in NACCO and the Hamilton Beach Holding common stock received in the spin-off (including cash received in lieu of fractional shares) will equal the aggregate basis of NACCO common stock held by you immediately before the spin-off. This aggregate basis will be allocated among your NACCO common stock and the Hamilton Beach Holding common stock you receive in the spin-off (including any fractional share interests in Hamilton Beach Holding for which cash is received) in proportion to the relative fair market value of each immediately following the spin-off. See “Material U.S. Federal Income Tax Consequences” beginning on page 45.

You should consult with your tax advisor about how this allocation will work in your situation (including a situation where you have purchased or received NACCO shares at different times or for different amounts) and regarding any particular consequences of the spin-off to you, including the application of state, local and non-U.S. tax laws.

7

Table of Contents

This summary of the information contained in this prospectus may not include all the information that is important to you. To understand fully and for a more complete description of the terms and conditions of the spin-off, you should read this prospectus, including the annexes, in its entirety and the documents to which you are referred. See “Where You Can Find More Information” (page 148). Page references have been included parenthetically to direct you to a more complete discussion of each topic presented in this summary.

Information About Hamilton Beach Holding (page 84)

Hamilton Beach Holding is a Delaware corporation and a wholly owned subsidiary of NACCO. Hamilton Beach Holding is a holding company for two separate businesses: consumer, commercial and specialty small appliances (HBB) and specialty retail (KC). HBB is a leading designer, marketer, and distributor of branded small electric household and specialty housewares appliances as well as commercial products for restaurants, bars and hotels. HBB markets such products under numerous brand names, including the Hamilton Beach®, Proctor Silex®, and Weston® brands, among others. KC is a national specialty retailer of kitchenware in outlet and traditional malls throughout the United States. For more information about our businesses, including our competitive strengths, see “Businesses of Hamilton Beach Holding” beginning on page 84.

Hamilton Beach Brands Holding Company

4421 Waterfront Dr.

Glen Allen, VA 23060

(804) 273-9777

Information about NACCO

NACCO is a holding company that will have one principal business after the spin-off: mining and value-added mining services. NACoal mines coal primarily for use in power generation and provides value-added services for natural resource companies.

NACCO Industries, Inc.

5875 Landerbrook Drive, Suite 220

Cleveland, Ohio 44124

(440) 229-5151

Emerging Growth Company Status

We are an “emerging growth company,” as defined in the JOBS Act. For as long as we are an “emerging growth company,” we may take advantage of certain exemptions that are not otherwise applicable to public companies from various reporting requirements. These include, but are not limited to, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements and exemptions from the requirements of holding advisory “say-on-pay” votes on executive compensation and stockholder advisory votes on golden parachute compensation.

Under the JOBS Act, we will remain an “emerging growth company” until the earliest of:

| • | the last day of the fiscal year during which we have total annual gross revenues that exceed $1,070,000,000; |

| • | the last day of the fiscal year following the fifth anniversary of the completion of the spin-off; |

8

Table of Contents

| • | the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; and |

| • | the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, (the “Exchange Act”) (we will qualify as a large accelerated filer as of the first day of the first fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates and (ii) been public for at least 12 months; the value of our outstanding common equity will be measured each year on the last day of our second fiscal quarter). |

The JOBS Act also provides that an “emerging growth company” can utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933 (the “Securities Act”) for complying with new or revised accounting standards. We have elected not to opt out of such extended transition period which means that when a standard is issued or revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the new or revised standard at the time private companies adopt the new or revised standard. This may make comparison of our financial statements with those of another public company, which is neither an emerging growth company nor an emerging growth company which has opted out of using the extended transition period, difficult or impossible because of the potential differences in accounting standards used.

The Spin-Off (page 37)

On [ ], 2017, the NACCO board of directors and the Hamilton Beach Holding board of directors, which is referred to as our Board, each approved the spin-off of Hamilton Beach Holding, upon the terms and subject to the conditions contained in the separation agreement between NACCO and us, which is referred to as the separation agreement. For a more detailed description of the terms of the separation agreement, see “The Separation Agreement” beginning on page 137.

We encourage you to read the separation agreement, which is filed as an exhibit to the registration statement that contains this prospectus, because it sets forth the terms of the spin-off.

Stock Ownership of Hamilton Beach Holding Directors and Executive Officers (page 91)

The stock ownership of our directors and executive officers immediately after the spin-off is described under the heading “Security Ownership of Certain Beneficial Owners and Management” beginning on page 91.

Ownership of Hamilton Beach Holding after the Spin-Off (page 40)

Immediately after the spin-off, NACCO stockholders as of the record date will hold all of the outstanding shares of our Class A Common and our Class B Common. Based on the number of shares of NACCO common stock outstanding on June 1, 2017, NACCO expects to distribute approximately 6.8 million shares of our Class A Common and approximately 6.8 million shares of our Class B Common in the spin-off.

Operations of Hamilton Beach Holding after the Spin-Off (page 40)

We will continue to conduct business after completion of the spin-off under multiple brands and trade names. Our headquarters will continue to be located in Glen Allen, Virginia.

Management of Hamilton Beach Holding after the Spin-Off (page 40)

After the spin-off, our executive officers will be substantially the same as our executive officers immediately before the spin-off and will remain in office until their respective successors are duly elected or appointed and qualified in accordance with our amended and restated certificate of incorporation and our amended and restated bylaws or as otherwise provided by law.

9

Table of Contents

After the spin-off, we will be led by:

| • | Alfred M. Rankin, Jr. as our Executive Chairman; |

| • | Gregory H. Trepp as our and HBB’s President and Chief Executive Officer; |

| • | Keith B. Burns as HBB’s Vice President, Engineering and Information Technology; |

| • | Gregory E. Salyers as HBB’s Senior Vice President, Global Operations; |

| • | Dana B. Sykes as our and HBB’s Vice President, General Counsel and Secretary; |

| • | James H. Taylor as our and HBB’s Vice President and Chief Financial Officer; |

| • | R. Scott Tidey as HBB’s Senior Vice President, North America Sales and Marketing; and |

| • | Robert O. Strenski as KC’s President. |

See “Management” beginning on page 98 for additional information regarding our management after the spin-off.

Hamilton Beach Holding Board after the Spin-Off (page 41)

After the spin-off, our Board will consist of [ ], [ ], [ ] and [ ], who will remain in office until their respective successors are duly elected or appointed and qualified in accordance with our amended and restated certificate of incorporation and our amended and restated bylaws or as otherwise provided by law. Of these individuals, the following served as our directors prior to the spin-off: [ ] and [ ]. Our Board has determined that [ ], [ ] and [ ] satisfy the criteria for director independence as set forth in the NYSE rules.

Committees of the Hamilton Beach Holding Board after the Spin-Off (page 41)

After the spin-off, our Board will have an audit review committee, a compensation committee, and a nominating and corporate governance committee.

Immediately after the spin-off, the members of our audit review committee, compensation committee, and nominating and corporate governance committee will be as follows:

| Board Members |

Audit Review Committee |

Compensation Committee |

Nominating and Corporate Governance Committee |

|||||||||

Interests of NACCO and Hamilton Beach Holding Directors and Executive Officers in the Spin-Off (page 41)

Some NACCO and Hamilton Beach Holding directors and executive officers have interests in the spin-off that are different from, or in addition to, the interests of NACCO stockholders who will receive shares of our common stock in the spin-off. The NACCO board and our Board were aware of these interests and considered them in making their respective decisions to approve the separation agreement and the spin-off. These interests include:

| • | the designation of certain of our directors and officers before the spin-off as our directors or executive officers after the spin-off, including some who will serve as directors or executive officers of both Hamilton Beach Holding and NACCO; |

10

Table of Contents

| • | the rights of Mr. Rankin, our Executive Chairman, and [ ], [ ] and [ ], our directors, as parties to the stockholders’ agreement among Hamilton Beach Holding and certain members of the Rankin and Taplin families with respect to ownership of our common stock, as described in more detail in “Security Ownership of Certain Beneficial Owners and Management” beginning on page 91 and “Ancillary Agreements — Stockholders’ Agreement” beginning on page 142; |

| • | the participation of our executive officers in various incentive compensation plans for 2017 prior to the spin-off, as previously approved by the compensation committee of the NACCO Industries, Inc. board, which is referred to as the NACCO compensation committee; |

| • | the provision of NACCO equity compensation to our directors who were directors of NACCO prior to the spin-off under the NACCO Industries, Inc. Non-Employee Directors’ Equity Compensation Plan, referred to as the NACCO Directors’ Plan, as described in more detail in “Management — Compensation of Directors” beginning on page 105; |

| • | the provision of Hamilton Beach Holding equity to our directors and the participation by our directors in a director equity compensation plan following the spin-off, as described in more detail in “Management — Compensation of Directors” beginning on page 105; |

| • | the participation by our Executive Chairman in a NACCO equity incentive compensation plan before the spin-off, subject to the approval of grants of awards by the NACCO compensation committee, as described in more detail in “Executive Compensation — Long-Term Incentive Compensation — Historically” beginning on page 122; and |

| • | the participation by our executive officers in a Hamilton Beach Holding equity incentive compensation plan after the spin-off, subject to the approval of grants of awards by the Hamilton Beach Holding compensation committee, which is referred to as our compensation committee or the Hamilton Beach Holding compensation committee, as described in more detail in “Executive Compensation — Long-Term Incentive Compensation — Going Forward” beginning on page 126. |

Listing of Hamilton Beach Holding Common Stock (page 51)

We have applied to list our Class A Common on the NYSE under the symbol “HBB.” Our Class B Common will not be listed on the NYSE or any other stock exchange.

Market for Hamilton Beach Holding Common Stock (page 51)

Currently, there is no public market for our Class A Common. We have applied to list our Class A Common on the NYSE. If the NYSE approves the listing, we expect that a “when-issued” trading market for our Class A Common will develop before the record date for the spin-off. “When-issued” trading refers to a transaction made conditionally because the stock has been authorized but is not yet issued or available. Even though when-issued trading may develop, none of these trades will settle before the record date for the spin-off, and if the spin-off does not occur, all when-issued trading will be null and void. On the first trading day after the spin-off, when-issued trading will end and “regular-way” trading will begin. “Regular-way” trading refers to trading after a stock has been issued and typically involves a transaction that settles on the third full business day after the date of a transaction.

Our Class B Common will not be listed on the NYSE or any other stock exchange or otherwise traded and will be subject to substantial restrictions on transfer, the violation of which will cause it to convert automatically into Class A Common as described in more detail in “Description of Capital Stock of Hamilton Beach Holding after the Spin-Off — Common Stock — Restrictions on Transfer of Class B Common; Convertibility of Class B Common into Class A Common” beginning on page 143. Our Class B Common will, however, be convertible at

11

Table of Contents

all times, and without cost to the stockholder, into our Class A Common on a share-for-share basis. Therefore, stockholders desiring to sell the equity interest in us represented by their shares of our Class B Common may convert those shares into an equal number of shares of our Class A Common at any time and then sell the shares of our Class A Common.

Material U.S. Federal Income Tax Consequences (page 45)

The spin-off is conditioned upon receipt by NACCO of an opinion of tax counsel to the effect that, for U.S. federal income tax purposes, the spin-off will qualify as tax-free under Section 355 of the Code, except for cash received in lieu of fractional shares. The opinion of tax counsel to NACCO will be based on, among other things, current law and will rely on certain facts and assumptions, and certain representations and undertakings, provided by NACCO and us regarding the past and future conduct of our respective businesses and other matters, which, if incorrect, could jeopardize the conclusions reached in this opinion.

We expect that the opinion of tax counsel will conclude that for U.S. federal income tax purposes, the spin-off will qualify as tax-free under Section 355 of the Code, such that (1) no gain or loss will be recognized by NACCO or us as a result of the spin-off, and (2) no gain or loss will be recognized by (and no amount will be included in the income of) a NACCO stockholder, upon the receipt of our common stock in the spin-off, except a NACCO stockholder may recognize a gain or loss with respect to any cash received in lieu of a fractional share. A form of the opinion we expect to receive from tax counsel is filed as an exhibit to the registration statement that contains this prospectus.

Under the Tax Allocation Agreement, NACCO has agreed to make a protective election under Section 336(e) of the Code with respect to the spin-off. If, notwithstanding the receipt of an opinion of tax counsel, the spin-off fails to qualify as tax-free under Section 355 of the Code, the Section 336(e) election would generally cause a deemed sale of the assets of Hamilton Beach Holding and its subsidiaries, causing the NACCO group to recognize a gain to the extent the fair market value of the assets exceeded the basis of Hamilton Beach Holding and its subsidiaries in such assets. In such case, to the extent that NACCO is responsible for the resulting transaction taxes, Hamilton Beach Holding generally would be required under the Tax Allocation Agreement to make periodic payments to NACCO equal to the tax savings arising from a “step up” in the tax basis of Hamilton Beach Holding’s assets.

In addition, if the spin-off fails to qualify as tax-free under Section 355 of the Code, NACCO stockholders could be taxed on the full value of the shares of Hamilton Beach Holding’s common stock that they receive, which generally would be treated first as a taxable dividend to the extent of NACCO’s earnings and profits, then as a non-taxable return of capital to the extent of each stockholder’s tax basis in shares of NACCO common stock, and thereafter as a capital gain with respect to any remaining value. The protective Section 336(e) election does not impact this treatment of NACCO stockholders.

Even if the spin-off qualifies as tax-free under Section 355 of the Code, the spin-off would become taxable to NACCO under Section 355(e) of the Code if a 50% or greater interest (by vote or value) in NACCO or Hamilton Beach Holding stock were treated as acquired, directly or indirectly, by certain persons as part of a plan or series of related transactions that included the spin-off. For this purpose, it is unclear whether any increase in voting power by holders of our Class B Common Stock by reason of the conversion by other holders of Hamilton Beach Holding Class B Common Stock to Hamilton Beach Holding Class A Common Stock should be considered an acquisition of voting power as part of a plan or series of related transactions. However, even if so treated, any such voting shift would not alone cause an acquisition of 50% or more of the voting power of our Common Stock and, as a result, would not, by itself, cause the spin-off to be taxable to NACCO under Section 355(e) of the Code. However, if the IRS were to determine that other acquisitions of NACCO shares before or after the spin-off, or Hamilton Beach Holding shares after the spin-off, were part of a plan or series of

12

Table of Contents

related transactions that included the spin-off for purposes of Section 355(e) of the Code, such determination could result in the recognition of a gain by NACCO under Section 355(e) of the Code. Because of the protective Section 336(e) election, Hamilton Beach Holding and its subsidiaries would be deemed to have sold all of their assets, thereby causing the NACCO group to recognize a gain to the extent the fair market value of the assets exceeded the basis of Hamilton Beach Holding and its subsidiaries in such assets. As described, above, to the extent that NACCO is responsible for the resulting transaction taxes, Hamilton Beach Holding would generally be required under the Tax Allocation Agreement to make certain periodic payments to NACCO.

NACCO has the right to waive, in its sole discretion, the receipt of a tax opinion on or prior to the date of the spin-off that the tax consequences relating to the spin-off are as described above. NACCO does not currently intend to waive this condition to its obligation to complete the spin-off. In the event this condition were to be waived by NACCO and any changes to the tax consequences relating to the spin-off were material, Hamilton Beach Holding would undertake to recirculate this prospectus prior to the commencement of the distribution.

For further information concerning the U.S. federal income tax consequences of the spin-off, see “Material U.S. Federal Income Tax Consequences” beginning on page 45.

You are encouraged to consult with your own tax advisor for a full understanding of the tax consequences of the spin-off to you.

Accounting Treatment (page 44)

The spin-off will be accounted for by NACCO as a spin-off of Hamilton Beach Holding. After the spin-off, Hamilton Beach Holding is expected to be accounted for as a discontinued operation by NACCO. If accounted for as a discontinued operation, the measurement date would be the effective date of the spin-off, which is referred to as the spin-off date. After the spin-off, our assets and liabilities will be accounted for at the historical book values carried by NACCO prior to the spin-off. No gain or loss will be recognized as a result of the spin-off.

Ancillary Agreements (page 140)

In connection with the spin-off, we will also enter into a transition services agreement with NACCO, a transfer restriction agreement with NACCO and certain of our stockholders, the Tax Allocation Agreement and a stockholders’ agreement with certain of our stockholders. This stockholders’ agreement is substantially similar to the stockholders’ agreement that was entered into among certain stockholders of NACCO.

Transition Services Agreement

Under the terms of the transition services agreement, NACCO will provide services to us on a transitional basis, as needed, for varying periods after the spin-off date. The services NACCO will provide include:

| • | legal and consulting support relating to employee benefits and compensation matters; |

| • | general accounting support, including public company support; |

| • | general legal, public company, information technology, insurance and internal audit support (including responding to requests from regulatory and compliance agencies) as needed; and |

| • | tax compliance and consulting support (including completion of federal audits and appeals through the 2015 tax year; 2017 tax sharing computations; 2017 state income tax return filings for certain operating subsidiaries of NACCO after the spin-off and miscellaneous provision and tax return oversight). |

None of the transition services are expected to exceed one year. We may extend the initial transition period for a period of up to three months for any service upon 30 days written notice to NACCO prior to the initial

13

Table of Contents

termination date. We expect to pay NACCO net aggregate fees of approximately $1 million over the initial term of the transition services agreement.

Transfer Restriction Agreement

Hamilton Beach Holding, NACCO, and certain members of the Rankin and Taplin families will enter into a transfer restriction agreement. Absent a ruling from the IRS, an unqualified tax opinion from approved counsel, or approval by Hamilton Beach Holding as the Administrator of the transfer restriction agreement, the agreement prohibits members of NACCO’s extended founding family, for a 2-year period following the spin-off, from (1) acquiring any stock of either NACCO or Hamilton Beach Holding (other than acquisitions of stock pursuant to an equity compensation plan of either NACCO or Hamilton Beach Holding) or (2) transferring directly or indirectly any stock owned by such family members. For the Administrator to approve any proposed transaction, the following requirements must be met:

| 1. | Any dispositions of stock by members of the extended founding family must be made in a manner that for every share of NACCO stock disposed of (whether by sale, gift, or otherwise), two shares of Hamilton Beach Holding stock also are disposed of by a similar transfer (whether by sale, gift, or otherwise)). However, this requirement does not apply to (1) the conversion of Class B Common Stock into Class A Common Stock of either NACCO or Hamilton Beach Holding or (2) swaps between members of the extended founding family of NACCO Class A Common Stock for NACCO Class B Common Stock, or of Hamilton Beach Holding Class A Common Stock for Hamilton Beach Holding Class B Common Stock. |

| 2. | Including the proposed transaction, members of the extended founding family in the aggregate shall not have transferred or acquired more than 35 percent (by value) of the stock of either NACCO or Hamilton Beach Holding. |

| 3. | Including the proposed transaction, members of the extended founding family in the aggregate shall not have transferred or acquired stock representing more than 35 percent of the voting power of NACCO or 5 percent of the voting power of Hamilton Beach Holding. However, certain transfers to direct relatives and certain trusts and controlled entities are not taken into account. |

The transfer restriction agreement further provides that the 5-percent voting limitation on transfers of Hamilton Beach Holding voting power will be converted to a 35-percent limitation if NACCO or Hamilton Beach Holding obtains a private letter ruling from the IRS or an unqualified tax opinion substantially to the effect that the increase in voting power by holders of our Class B Common Stock by reason of the conversion by other holders of Hamilton Beach Holding Class B Common Stock to Hamilton Beach Holding Class A Common Stock will not be taken into account for purposes of Section 355(e) of the Code.

Tax Allocation Agreement

Hamilton Beach Holding and NACCO will enter into the Tax Allocation Agreement prior to the spin-off that will generally govern NACCO’s and Hamilton Beach Holding’s respective rights, responsibilities and obligations after the spin-off with respect to taxes for any tax period ending on or before the date of the spin-off, as well as tax periods beginning before and ending after the date of the spin-off. Generally, Hamilton Beach Holding will be liable for all pre-spin-off U.S. federal income taxes, foreign income taxes and certain non-income taxes attributable to Hamilton Beach Holding’s business. In addition, the Tax Allocation Agreement will address the allocation of liability for taxes that are incurred as a result of restructuring activities undertaken to effectuate the spin-off, if any. The Tax Allocation Agreement will also provide that Hamilton Beach Holding is liable for taxes incurred by NACCO that arise as a result of Hamilton Beach Holding’s taking or failing to take, as the case may be, certain actions that result in the spin-off failing to meet the requirements of a tax-free

14

Table of Contents

distribution under Section 355 of the Code. The Tax Allocation Agreement will also provide that NACCO is liable for taxes incurred by Hamilton Beach Holding as a result of NACCO’s taking or failing to take certain actions that result in the spin-off failing to meet the requirements of a tax-free distribution under Section 355 of the Code.

Stockholders’ Agreement

Our Class B Common is subject to substantial restrictions on transfer as set forth in our amended and restated certificate of incorporation. In addition, we intend to enter into a stockholders’ agreement with certain of our stockholders who are members of the Rankin and Taplin families, the extended founding families of NACoal, predecessor to NACCO. Immediately following the spin-off, [ ]% of our Class B Common will be subject to the stockholders’ agreement. We anticipate that at least 95% of the founding family members’ Class B Common will be subject to the stockholders’ agreement. See “Security Ownership of Certain Beneficial Owners and Management.” The terms of the stockholders’ agreement require signatories to the agreement, prior to any conversion of our Class B Common into our Class A Common by such signatories, to offer such Class B Common to all of the other signatories on a pro rata basis. A signatory may sell or transfer all shares not purchased under the right of first refusal as long as they are converted into our Class A Common prior to such sale or transfer. Under the stockholders’ agreement, we may, but are not obligated to, buy any of the shares of our Class B Common not purchased by signatories following the triggering of the right of first refusal. A substantially similar stockholders’ agreement is in effect among certain stockholders of NACCO. For a description of transfer restrictions on our Class B Common, see “Description of Capital Stock of Hamilton Beach Holding after the Spin-Off — Common Stock — Restrictions on Transfer of Class B Common; Convertibility of Class B Common into Class A Common.”

15

Table of Contents

Market Price Data

There is no established trading market for shares of our Class A Common or our Class B Common. At June 1, 2017, there were 100 shares of our common stock outstanding, all of which immediately prior to the spin-off were owned by NACCO.

In connection with the spin-off, NACCO will distribute approximately 6.8 million shares of our Class A Common and approximately 6.8 million shares of our Class B Common to holders of NACCO Class A Common and NACCO Class B Common as of the record date for the spin-off. We have applied to list our Class A Common on the NYSE under the symbol “HBB.” Our Class B Common will not be listed on the NYSE or any other stock exchange or otherwise traded and will be subject to substantial restrictions on transfer.

Dividends

We paid dividends to NACCO in 2015 and 2016 in the aggregate amount of $57 million. We paid $3 million in dividends to NACCO from January 1, 2017 to June 30, 2017, and expect to declare an additional $30 million to $40 million in dividends to NACCO prior to the spin-off.

Dividend Policy

We currently intend to pay regular quarterly dividends after the spin-off. The declaration of future dividends and the establishment of the per share amount, record dates and payout dates for such future dividends will be at the discretion of our Board and will depend on various factors then existing, including earnings, financial condition, results of operations, capital requirements, level of indebtedness, contractual restrictions with respect to the payment of dividends, restrictions imposed by applicable law, general business conditions and other factors that our Board deems relevant. The HBB and KC credit facilities limit our ability to pay dividends or make distributions in respect of our capital stock in certain circumstances. For a discussion of these restrictions, see the discussion under “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources of HBB — After the Spin-Off” beginning on page 66 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources of KC — After the Spin-Off” beginning on page 77.

16

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA OF HAMILTON BEACH HOLDING

The following table sets forth our selected historical financial data as of and for each of the periods indicated. We derived the summary historical financial data as of and for each of the two years ended December 31, 2016 from our audited consolidated financial statements. We derived the summary historical financial data as of and for the three and six months ended June 30, 2017 and 2016 from our unaudited condensed consolidated financial statements which, in the opinion of our management, include all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of the results of the interim period. This information is only a summary and you should read it in conjunction with the historical consolidated financial statements and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” included in this prospectus.

| Three Months Ended June 30 |

Six Months Ended June 30 |

Year Ended December 31 |

||||||||||||||||||||||

| 2017 | 2016 | 2017 | 2016 | 2016 | 2015 | |||||||||||||||||||

| (In thousands) | ||||||||||||||||||||||||

| Operating Statement Data: |

||||||||||||||||||||||||

| Revenues |

$ | 152,976 | $ | 154,918 | $ | 293,258 | $ | 298,052 | $ | 745,357 | $ | 767,862 | ||||||||||||

| Operating profit (loss) |

$ | 2,164 | $ | 1,684 | $ | (274 | ) | $ | (1,205 | ) | $ | 43,374 | $ | 35,554 | ||||||||||

| Net income (loss) |

$ | 1,239 | $ | 964 | $ | (119 | ) | $ | (1,184 | ) | $ | 26,179 | $ | 19,711 | ||||||||||

| June 30 | December 31 | |||||||||||||||

| 2017 | 2016 | 2016 | 2015 | |||||||||||||

| (In thousands) | ||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||

| Total assets |

$ | 277,182 | $ | 263,221 | $ | 310,833 | $ | 310,128 | ||||||||

| Long-term debt |

$ | 32,000 | $ | 34,156 | $ | 26,000 | $ | 50,000 | ||||||||

| Stockholder equity |

$ | 62,961 | $ | 69,766 | $ | 65,126 | $ | 82,824 | ||||||||

| Six Months Ended June 30 |

Year Ended December 31 |

|||||||||||||||

| 2017 | 2016 | 2016 | 2015 | |||||||||||||

| (In thousands) | ||||||||||||||||

| Cash Flow Data: |

||||||||||||||||

| Provided by (used for) operating activities |

$ | (16,261 | ) | $ | 18,834 | $ | 62,563 | $ | 26,488 | |||||||

| Used for investing activities |

$ | (2,378 | ) | $ | (2,989 | ) | $ | (5,925 | ) | $ | (6,543 | ) | ||||

| Provided by (used for) financing activities |

$ | 12,562 | $ | (28,251 | ) | $ | (61,837 | ) | $ | (10,088 | ) | |||||

| Other Data: |

||||||||||||||||

| Cash dividends paid |

$ | 3,000 | $ | 10,000 | $ | 42,000 | $ | 15,000 | ||||||||

17

Table of Contents

In addition to the other information included in this prospectus, including the matters addressed in “Special Note Regarding Forward-Looking Statements” on page 35, you should carefully consider the matters described below. The risk factors described below include risk factors that will be applicable to our business if the spin-off is consummated, as well as risks related to the spin-off.

Risks Relating to the Spin-Off

If we are unable to list the shares of our Class A Common on the NYSE or Nasdaq the spin-off will not be consummated.

Although we have applied for listing of the shares of our Class A Common on the NYSE, we cannot assure you that we will meet the NYSE’s listing requirements or that our listing application will be approved by the NYSE. If the NYSE does not approve our listing application, we intend to apply to Nasdaq to list our Class A Common. We cannot assure you that we will meet Nasdaq’s listing requirements or that our listing application will be approved by Nasdaq. If our Class A Common cannot be listed on either the NYSE or Nasdaq, the spin-off will not be consummated.

The relative voting power of holders of our Class B Common who convert their shares of our Class B Common into shares of our Class A Common will diminish.

Holders of our Class B Common will have ten votes per share of our Class B Common, while holders of our Class A Common will have one vote per share of our Class A Common. Holders of our Class A Common and holders of our Class B Common generally will vote together as a single class on most matters submitted to a vote of our stockholders. Holders of our Class B Common who convert their shares of our Class B Common into shares of our Class A common will reduce their voting power.

The relative voting power of the remaining holders of Class B Common will increase as holders of our Class B Common convert their shares of our Class B Common into shares of our Class A Common.

After the spin-off, holders of our Class A Common and holders of our Class B Common generally will vote together on most matters submitted to a vote of our stockholders. Consequently, as holders of our Class B Common convert their shares of our Class B Common into shares of our Class A Common, the relative voting power of the remaining holders of our Class B Common will increase. Immediately after the spin-off, the holders of our Class B Common will collectively control approximately 90.9% of the voting power of the outstanding shares of our common stock and the holders of our Class A Common will collectively control approximately 9.1% of the voting power of the outstanding shares of our common stock.

If the spin-off by NACCO of our common stock to NACCO’s stockholders does not qualify as a tax-free transaction, the spin-off will not be consummated or if it is, tax could be imposed on NACCO’s stockholders.