Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | fbiz2q17ceoletter8-k.htm |

Exhibit 99.1

As we enter the second half of 2017, we remain focused on moving First Business’s credit quality metrics toward our historical levels, building on the operating efficiency gains we've made to date, and laying the groundwork to generate sustainable and high-quality revenue growth.

Our efforts are designed to position First Business with the strongest possible foundation for future growth, with specific performance and efficiency initiatives in place across every aspect of our operation. These include the rebuild of our Small Business Administration (“SBA”) lending platform, the recently completed consolidation of our bank charter structure, our pending core system conversion, ongoing and opportunistic talent acquisition, and focused fee income expansion. We have made meaningful progress to date, all while operating profitably, as we aim to expand our niche business banking franchise.

SECOND QUARTER RESULTS

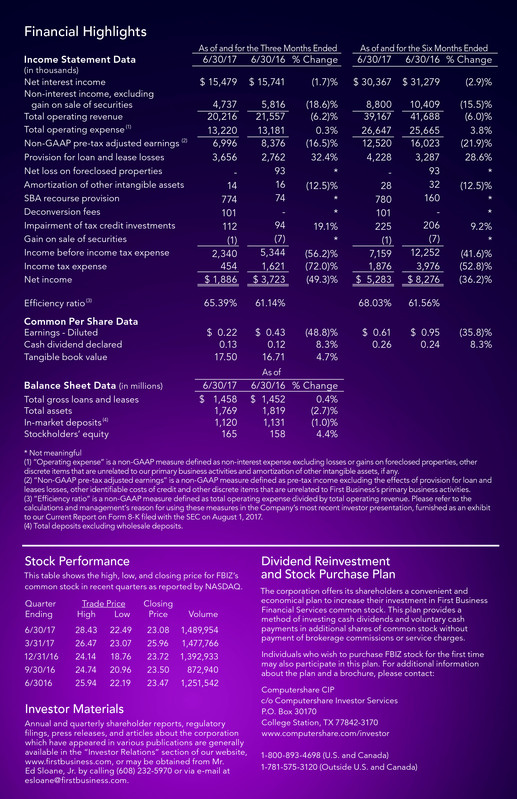

Our financial results for the second quarter of 2017 reflect recent credit challenges, as well as ongoing investments in our franchise. We produced $1.9 million in net income, earning $0.22 per share of profit and delivering 0.42% return on average assets (“ROAA”) and 4.50% return on average equity (“ROAE”). To be sure, we will not be satisfied until we return to levels of profitability that generate ROAA and ROAE of 1% and 12%, respectively, along with above-market levels of revenue growth.

Returning credit quality metrics to our historical levels remains a top priority for our organization. Following the addition of three specific credits to non-performing status in this year’s first quarter, non-performing loans stabilized at 2.55% of total loans as of June 30, 2017, an elevated level compared to 1.56% at June 30, 2016 and our five-year average of 1.39% from 2012 through 2016. The one remaining energy credit of material size in our portfolio experienced a $3.4 million charge-off during the second quarter of 2017, for which a previously recorded specific reserve offset the majority of the provision impact, raising our ratio of year-to-date annualized net charge-offs to average loans to 0.47% for the period. The remaining outstanding loan balances associated with energy sector borrowers now total $2.9 million, which represents just 0.20% of our total gross loan and lease portfolio. Also in the second quarter, deterioration of a $2.8 million asset-based lending (“ABL”) relationship partially offset the decline in non-performing loans associated with the energy sector charge-off. This is not unusual for our ABL line of business, but because of the underwriting and rigorous monitoring, and because these credits are primarily secured by accounts receivable and inventory, we expect full payoffs from the collateral liquidation and a resolution by year-end.

Even as we work through these credit issues, our company's unique business model delivered a solid performance across several other important measures in the second quarter.

Our net interest margin expanded meaningfully, to 3.64% for the three months ended June 30, 2017, compared to 3.51% in the first quarter of 2017 and 3.59% in the second quarter of 2016. Margin improvement reflected our successful efforts to manage deposit rates and utilize an efficient mix of wholesale funding sources, as well as federal funds target rate increases since December 2016. Elevated loan prepayment fees in our ABL business also boosted our margin. The level of loan prepayment fees varies from quarter-to-quarter; nevertheless, it is an important component of our business model and will continue to be an expected source of variability in our quarterly margin results beyond our target baseline of 3.50%.

Another of our highest priorities is diversifying First Business’s income stream, with non-interest income as a percentage of total revenues serving as one measure of our progress. During the second quarter, we approached our 25% target with non-interest income totaling $4.7 million, or 23.4% of total revenue, up from 21.4% in the linked first quarter of 2017. Growth was mainly related to expansion of SBA loan sale gains and loan fees, demonstrating important progress toward our goal. Gains on the sale of SBA loans of $535,000 grew by $175,000, or 49%, compared to the linked quarter as we steadily expanded scalable, sustainable production. Loan fees earned from client relationships and loan prepayments rose more than 47% from the linked quarter, to $675,000. In addition, our trust and investment services business again delivered superior performance, with trust assets under management and administration reaching a record $1.338 billion, driving a record $1.6 million in quarterly non-interest income.

Strong revenue compared to the linked quarter contributed to important efficiency gains during the second quarter. We believe the optimal level of operating efficiency for First Business’s niche business model is between 58% and 62% and this quarter’s 546 basis point improvement in the efficiency ratio, down to 65.39%, was an encouraging sign of progress toward that target.

Consolidation of our three bank charters into one charter in June 2017 was another notable milestone on our path toward continued efficiency improvements. In addition, as previously disclosed, at the end of 2017 we will upgrade and integrate our core systems with a single provider, presenting opportunity for both cost savings and streamlined operations in 2018 and beyond.

LOOKING FORWARD: GROWING PRODUCTION

Our team is executing when quality opportunities arise. Our robust first quarter loan growth demonstrated this quick and effective execution: balances grew $30.3 million, or 8.4% annualized, marking First Business’s strongest first quarter expansion since 2008. Expeditious production late in the first quarter drew from our second quarter pipeline. This, in combination with the large energy sector charge-off, as well as multiple large ABL payoffs due to the sale of the client companies, drove second quarter loan balances down modestly from the end of the first quarter. It is a trend we intend to reverse, with prudence.

Today, our challenge is to grow our loan portfolio with profitable relationships that support our 3.50% net interest margin target, amidst competitive pressure and soft commercial loan demand. We are thrilled with our recent hiring of several outstanding producers, whom we expect will contribute meaningfully to our growth efforts in the coming quarters. This summer we welcome our new Northeast Wisconsin Market President who brings more than 25 years of commercial banking and entrepreneurial experience in the Green Bay area. He’s joined by a proven SBA lender in the Milwaukee market, and commercial banking VPs in the Northeast and Kansas City markets. We know it takes talent and "feet-on-the-street" to win clients in the business banking arena, and we are excited about the boost this new group of business development officers will give us.

Likewise, we aim to replicate our Madison trust and private wealth management team's success as we expand the offerings across our other markets. In July, we hired a private wealth management VP in our Milwaukee market, complementing key wealth management hires in our Northeast and Milwaukee markets in the second half of 2016. Today we are actively recruiting for a producer in our Kansas City market as well. As these producers join our entrepreneurial team, internal support for their efforts and client relationships has never been stronger. Across the franchise, we’ve paired talent and resources in a manner we believe to be truly best-in-class.

Specifically, we are pleased to announce that the build-out of our back office SBA support team is now complete and on par with our exceptional commercial banking, specialty lending and wealth management businesses. The operations, compliance and credit functions we have established are the “three-legged stool” we believe is necessary to successfully scale a profitable SBA lending platform. With the rebuild complete, we are now adding producers in order to achieve the appropriate mix of producers and internal support staff to drive an optimal level of efficiency in our model.

FOCUSED ON EXECUTION

While we have made progress, significant and sustainable improvement in credit quality will remain our highest priority until we again achieve below-market loss rates, as we have previously. As noted before, we will not be satisfied until First Business returns to levels of profitability that generate 1% ROAA, 12% ROAE and above-market revenue growth in a steady and sustainable manner. We are focused and confident in our ability to execute, and we fully intend for our stock price and valuation to once again reflect the value we see in our niche business banking franchise. This quarter, we were pleased to return a $0.13 per share dividend to our shareholders, representing a yield of 2.25% at June 30, 2017. This compares very favorably to the 1.45% average dividend yield for commercial banks with assets of $1 billion to $3 billion.

We thank you for your commitment to First Business, and we look forward to sharing our progress in the second half of 2017.

Sincerely,

Corey Chambas, President and CEO

This letter includes “forward-looking statements” related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company’s future plans, objectives, goals or expectations. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company’s future results, please see the Company’s most recent annual report on Form 10-K, quarterly reports on Form 10-Q and other filings with the Securities and Exchange Commission.