Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF MNP LLP - TGS International Ltd. | tgs_ex232.htm |

| EX-10.1 - MARKETING AND SALE AGENCY AGREEMENT - TGS International Ltd. | tgs_ex101.htm |

| EX-5.1 - LEGAL OPINION OF W.L MACDONALD LAW CORPORATION - TGS International Ltd. | tgs_ex51.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

Amendment No. 2

Registration Statement under the Securities Act of 1933

| TGS INTERNATIONAL LTD. |

| (Exact name of registrant as specified in its charter) |

| NEVADA |

| 3060 |

| N/A |

| (State or other jurisdiction of |

| (Primary Standard Industrial |

| (I.R.S. Employer |

| incorporation or organization) |

| Classification Code Number) |

| Identification Number) |

Unit 3, 6420 – 4 Street NE

Calgary, Alberta,

Canada T2K 5M8

Telephone: (403) 616 - 9226

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

GKL Registered Agents of NV, Inc.

3064 Silver Sage Drive, Suite 150

Carson City, NV 89701

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Approximate Date of Commencement of Proposed Sale to the Public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Prospectus number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| ||||

| Large accelerated filer | o | Accelerated filer | o | |

| Non-accelerated filer | o | (Do not check if a smaller reporting company) | Smaller reporting company | x |

|

| Emerging growth company | x | ||

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o | ||||

| Title of Each Class of Securities to be Registered |

| Amount to be Registered (1) |

|

| Proposed Maximum Offering Price per Security (2) ($) |

|

| Proposed Maximum Aggregate Offering Price ($) |

|

| Amount of Registration Fee ($) |

| ||||

| Shares of Common Stock, par value $0.0001 |

|

| 4,030,000 |

|

| $ | 0.05 |

|

| $ | 201,500 |

|

| $ | 23.35 |

|

_________________

(1) Represents shares of our common stock previously acquired by and issued to the Selling Shareholders in private transactions directly with us or with one of our affiliates. All of these shares are offered by the Selling Shareholders.

(2) This calculation is made solely for the purposes of determining the registration fee pursuant to the provisions of Rule 457(c) under the Securities Act of 1933.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

| 2 |

PROSPECTUS

Subject to Completion

_______________, 2017

TGS INTERNATIONAL LTD.

A NEVADA CORPORATION

4,030,000 SHARES OF COMMON STOCK

The prospectus relates to the resale to the public by certain selling shareholders of TGS International Ltd. of up to 4,030,000shares of our common stock with a par value of $0.0001.

The selling shareholders will be offering their shares of common stock at a fixed price of $0.05 per share until our common stock is quoted on the OTCQB tier of the OTC Markets electronic quotation system, and thereafter at prevailing market prices or privately negotiated prices. However, our stock may not become quoted on OTCQB. There has been no market for our securities and a public market may not develop, or, if any market does develop, it may not be sustained. Our common stock is not traded on any exchange or on the over-the-counter market. After the effective date of the registration statement relating to this prospectus, we hope to have a market maker file an application with the Financial Industry Regulatory Authority ("FINRA"), for our common stock to be eligible for trading on the OTCQB. We do not yet have a market maker who has agreed to file such application.

We will not receive any proceeds from the resale of shares of our common stock by the selling shareholders. We will pay for expenses of this offering.

The selling security holders and any broker-dealers acting in connection with the sale of the common stock offered under this Prospectus will be deemed to be underwriters within the meaning of section 2(a)(11) of the Securities Act, and any commissions received by them and any profit realized by them on the resale of shares as principals will be deemed underwriting compensation under the Securities Act. Because the selling security holders will be deemed to be “underwriters” within the meaning of section 2(a)(11) of the Securities Act, the selling security holders will be subject to the prospectus delivery requirements of the Securities Act.

OUR BUSINESS IS SUBJECT TO MANY RISKS AND AN INVESTMENT IN OUR COMMON STOCK WILL ALSO INVOLVE A HIGH DEGREE OF RISK. YOU SHOULD INVEST IN OUR COMMON STOCK ONLY IF YOU CAN AFFORD TO LOSE YOUR ENTIRE INVESTMENT. YOU SHOULD CAREFULLY CONSIDER THE VARIOUS RISK FACTORS DESCRIBED BEGINNING ON PAGE 9 OF THIS PROSPECTUS BEFORE INVESTING IN OUR COMMON STOCK.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offence.

The information in this prospectus is not complete and may be changed. The selling shareholders may not sell or offer these securities until this registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is __________________, 2017

| 3 |

| 4 |

| Table of Contents |

PROSPECTUS SUMMARY

This Prospectus, and any supplement to this Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”, “forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary statements in the “Risk Factors” section beginning on page 9 of this Prospectus and the “Management's Discussion and Analysis of Financial Position and Results of Operations” section elsewhere in this Prospectus.

Prospectus Summary

Prospective investors are urged to read this prospectus in its entirety.

Please read this prospectus carefully. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information provided by the prospectus is accurate as of any date other than the date on the front of this prospectus.

Corporate Background:

We are a development stage corporation engaged in the sale and installation of polyvinyl chloride (PVC) wall and ceiling panels in addition to renovation business in North America. We were incorporated in Nevada on December 1, 2016 and entered the development stage on December 21, 2016, upon our acquisition of our wholly owned subsidiary, TGS Building Products Ltd.

Our offices are currently located at Unit 3, 6420 – 4 Street NE, Calgary, Alberta, Canada T2K 5M8. Our phone number is (403) 616 - 9226. Our fiscal year end is February 28, 2017.

Our auditors have issued an audit opinion which includes a statement describing their doubts about whether we will continue as a going concern.

The Offering:

| Securities Being Offered | Up to 4,030,000shares of common stock |

|

| |

| Offering Price | The selling shareholders will sell our shares at fixed price of $0.05 per share until our common stock is quoted on the OTCQB, and thereafter at prevailing market prices or privately negotiated prices. However, our stock may not become quoted on OTCQB. We determined this offering price based upon the price of the last, sale of our common stock to investors. |

|

| |

| Terms of the Offering | The selling shareholders will determine when and how they will sell the common stock offered in this prospectus |

|

| |

| Termination of the Offering | The offering will conclude when all of the 4,030,000shares of common stock have been sold, the shares no longer need to be registered to be sold or we decide to terminate the registration of the shares. |

|

| |

| Securities Issued and to be Issued | 13,530,000 shares of our common stock are issued and outstanding as of the date of this prospectus. All of the common stock to be sold under this prospectus will be sold by existing shareholders. |

|

| |

| Use of Proceeds | We will not receive any proceeds from the sale of the common stock by the selling shareholders. |

| 5 |

| Table of Contents |

Financial Summary Information

All references to currency in this Prospectus are to U.S. Dollars, unless otherwise noted.

The following table sets forth selected financial information, which should be read in conjunction with the information set forth in the "Management’s Discussion and Analysis of Financial Position and Results of Operations" section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

Income Statement Data

|

|

| Three Months May 31, 2017 (TGS International Ltd.) (consolidated) |

|

| D ecember 1, 2016 (inception) to February 28, 2017 (TGS International Ltd.) (consolidated) |

| ||

| Revenues |

| $ | 7,817 |

|

| $ | 6,239 |

|

| Gross Profit |

| $ | 3,065 |

|

| $ | 1,004 |

|

| Operating Expenses |

| $ | (15,714 | ) |

| $ | (15,330 | ) |

| Net Income ( Loss) |

| $ | (12,649 | ) |

| $ | (14,327 | ) |

| Basic and diluted Loss Per Share |

|

| (0.001 | ) |

|

| (0.001 | ) |

Balance Sheet Data

|

|

| As at May 31, 2017 (TGS International Ltd.) (consolidated) |

|

| As at February 28, 2017 (TGS International Ltd.) (consolidated) |

| ||

| Working Capital (Deficit) |

| $ | (2,863 | ) |

| $ | (9,950 | ) |

| Total Assets |

| $ | 27,595 |

|

| $ | 39,823 |

|

| Total Liabilities |

| $ | 20,540 |

|

| $ | 19,955 |

|

Emerging Growth Company

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups (JOBS) Act. We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the JOBS Act.

We are also smaller reporting company as defined by Rule 12b-2 of the Securities Exchange Act of 1934.

The JOBS Act is intended to reduce the regulatory burden on emerging growth companies. We meet the definition of an emerging growth company and so long as we qualify as an “emerging growth company,” we will, among other things:

| 6 |

| Table of Contents |

The recently enacted JOBS Act is intended to reduce the regulatory burden on emerging growth companies. We meet the definition of an emerging growth company and so long as we qualify as an “emerging growth company,” we will, among other things:

- be temporarily exempted from the internal control audit requirements Section 404(b) of the Sarbanes-Oxley Act (although we are permanently relieved of this requirement for as long as we remain a smaller reporting company);

- be temporarily exempted from various existing and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for-performance”, and “CEO pay ratio”;

- be temporarily exempted from any rules that might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental auditor discussion and analysis reporting;

- be temporarily exempted from having to solicit advisory say-on-pay, say-on-frequency and say-on-golden-parachute shareholder votes on executive compensation under Section 14A of the Securities Exchange Act of 1934, as amended;

- be permitted to comply with the SEC’s detailed executive compensation disclosure requirements on the same basis as a smaller reporting company (we also qualify for these reduced requirements by virtue of being a smaller reporting company). These disclosure requirements require two years, rather than three, of executive compensation information for executive officers, and require compensation data only for the principal executive officer and two other most highly paid executive officers, rather than for the principal executive officer, principal financial officer and the three other most highly paid executive officers applicable to other registrants; and

We shall continue to be deemed an emerging growth company until the earliest of:

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b -2 of title 17, Code of Federal Regulations, or any successor thereto.

RISK FACTORS

Before making an investment decision, prospective investors should carefully consider, along with other matters referred to in this prospectus, the following risk factors, which have set forth all of the material risks inherent in and affecting our business and this offering. Please consider the following risk factors before deciding to invest in our common stock:

Risks Associated with Our Business

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern.

We incurred cumulative net losses of $26,976 during the period from December 1, 2016 (inception) to May 31, 2017 and had cash (and cash equivalents) of $5,367 as at May 31, 2017. We are in the development stage and have yet to attain profitable operations and in their report on our financial statements for the fiscal year ended February 28, 2017, our independent auditors included an explanatory paragraph regarding the substantial doubt about our ability to continue as a going concern. Our financial statements contain additional note disclosures describing the circumstances that led to this disclosure by our independent auditors.

| 7 |

| Table of Contents |

Because our officers and directors have no experience in managing a public company our business may be at a competitive disadvantage.

Our President, Chief Executive Officer and director, Chung Szeto, and our Secretary, Treasurer, Chief Financial Officer and Director, Sau Chun Yu, lack public company experience and do not possess a sophisticated knowledge of the requirements of United States securities laws, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. Neither Mr. Szeto nor Ms. Yu has ever had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our management may not be able to implement programs and policies in an effective and timely manner which adequately responds to our legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

If we are unable to obtain financing in the amounts and on terms and dates acceptable to us, we may not be able to expand or continue our operations and developments and so may be forced to scale back or cease operations or discontinue our business and you could lose your entire investment.

We require approximately $125,000 to carry out our planned business activities over the next 12 months and had approximately $5,367 in cash and cash equivalents on hand as of May 31, 2017. We do not currently have any arrangements for additional financing. We will have to raise additional funds for the development of our business and the marketing of our products. Such additional funds may be raised through the sale of additional stock, stockholder and director advances and/or commercial borrowing. There can be no assurance that a financing will continue to be available if necessary to meet these continuing development costs or, if the financing is available, that it will be on terms acceptable to us. The issuance of additional equity securities by us will result in a significant dilution in the equity interests of our stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments. If we are unable to obtain financing in the amounts and on terms deemed acceptable to us, we may not be able to expand or continue our operations and developments and so may be forced to scale back or cease operations or discontinue our business and you could lose your entire investment.

We may not be able to compete effectively against other companies that have existed for a longer period and have greater financial resources.

We compete in a market that is highly competitive and expect competition to intensify in the future. We will seek to compete with a variety of developing and established companies, including those specialized exclusively in the sale of PVC panels, as well as those engaged in the sale of broader portfolios of hardware and building materials. Many of our prospective competitors have significantly greater financial, technical, and marketing resources than our company, and many have established consumer brands, preferential supplier relationship, and developed retail distribution networks, both traditional and online.

We may not be able to compete successfully against these competitors. If we are unable to effectively compete in our chosen markets, our results would be negatively affected, we may be unable to implement our business plan, and our business may ultimately fail.

Our products or our company may be subject to product liability claims which may be detrimental to our reputation and financial condition.

Although we are a distributor and not a manufacturer of products, and therefore not directly responsible for potential flaws or defects in any of the goods which we intend to sell, we may become implicated in product liability claims as a result of alleged or actual harm related to the use of our products by end users. Whether we are directly implicated as a named defendant in such a civil claim, or indirectly implicated by association as a product distributor, we may suffer reputational and economic harm to the extent that the safety or quality of our products is called into question. Additionally, if we are directly named as a defendant in such a civil claim, we expect to incur significant legal expense and, if we our held responsible for injury arising from any of our products, significant additional financial liability. Although we intend to carry product liability insurance to safeguard against potential claims, any such claims could irreparably harm our reputation, our financial condition, and ultimately cause our business to fail.

| 8 |

| Table of Contents |

We depend on third parties for our product supply and therefore, if they fail to perform, we may not be able to effectively operate our business.

To generate significant customer traffic, volume of purchases and repeat purchases that we believe are crucial to obtaining sufficient revenues, we must develop and maintain customer trust in the quality of goods which we deliver, in the timeliness of our delivery and installation services, among other factors. If for any reason any of our suppliers fails to perform, we may not be able to service our customers (buyers) effectively and thereby may lose customers or damage our reputation. Furthermore, if we do not secure sufficient number of suppliers to supply our products, then we may not have a successful product offering and may not attract customers. In addition, the success of our business requires that we establish relationships with professionals in strategic regions around the world who can, through their expertise, source and nurture relationships to develop our business. If we are unable to establish such relationships, we may be unable to procure goods or on terms acceptable to us, and our business may fail.

Compliance with rules and requirements applicable to public companies will cause us to incur increased costs, which may negatively affect our results of operations.

We are subject to a numbers of laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act and related regulations implemented by the SEC. Unlike private companies, we must invest significant resources to comply with current and future securities laws, regulations and standards. This investment will result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities in favor of compliance related activities. In that regard, we estimate that, based on our anticipated public reporting obligations, we must dedicate approximately $40,000 per year in respect of legal, auditing, accounting and filing costs. Furthermore, the laws, regulations and standards that are applicable to our Company are subject to change, which could result in continuing uncertainty regarding compliance matters, and higher compliance and disclosure costs. If we are unable to benefit from our status as a reporting company by establishing a public market for our securities in order to attract investment, the ongoing costs of our public reporting obligations will have a material adverse effect on our financial condition and results of operations.

Because our principal assets and our sole director and officer are located outside of the United States, it may be difficult for you to enforce your rights based on U.S. Federal Securities Laws against us or our sole officer and director, or to enforce U.S. Court Judgments against us or our sole officer and director in Canada.

Our sole officer and directors resides in Canada. In addition, although we are a Nevada corporation, our primary assets, which include cash, trade receivables, and any inventory we may acquire, will be located outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the U.S. Federal securities laws against us in the courts of either the U.S. or in Canada and, even if civil judgments are obtained in U.S. courts, to enforce such judgments against our sole officer and director in courts of Canada. Further, it is unclear whether extradition treaties now in effect between the United States and Canada would permit effective enforcement against us or our sole officer and director of criminal penalties, under the U.S. Federal securities laws or otherwise.

Our officers are engaged as consultants instead of employees of our company.

Having our officers engaged as consultants instead of employees poses the risk to our company that, perhaps, our consultant may not always be available. If one of our consultants has other clients, we may be at a lower priority until we are fit into their schedule. Additionally, most business decisions that need additional consultation are top priority and have an upcoming and hard-set deadline.

Further, when we engage consultants rather than employees, we do not have the advantages of an employee, such as consistency, dependability, and availability. If we need our employee to work on a project, all we have to do is assign it and wait for it to be completed. As the business owner, we won’t be lowly prioritized as we would with a consultant. Contrary to a consultant, an employee will maintain focus on our objective, rather than furthering his/her career by taking on additional clients. Many consultants will leave clients behind once they secure higher-paying clients.

Unlike employees, whom we can closely supervise and monitor, independent contractors enjoy certain autonomy to decide how best to do the task for which we hired them. We may be liable for injuries a consultant suffers on the job. Employees who are injured on the job are usually covered by workers' compensation insurance. In exchange for the benefits they receive for their injuries, these employees give up the right to sue their employer for damages. Consultants are not covered by workers’ compensation, which means that if they are injured on the job, they might be able to sue us and recover damages.

| 9 |

| Table of Contents |

We expect to be directly affected by fluctuations in the general economy.

Demand for goods is affected by the general global economic conditions. When economic conditions are favorable,, commercial and residential construction increase. Under such circumstances, purchases of building and renovation materials, such as PVC panels, generally increase. When economic conditions are less favorable, sales of building and renovation materials are generally lower. In addition, we may experience more competitive pricing pressure during economic downturns. Therefore, any significant economic downturn or any future changes in consumer spending habits could have a material adverse effect on our financial condition and results of operations.

We expect our products to be subject to changes in customer taste.

The markets for our products are subject to changing customer tastes and the need to create and market new products. Demand for construction finishing materials, such as wall and ceiling paneling, is influenced by the popularity of certain aesthetics, cultural and demographic trends, marketing and advertising expenditures and general economic conditions. Because these factors can change rapidly, customer demand also can shift quickly. Some goods appeal to customers for only a limited time. The success of new product introductions depends on various factors, including product selection and quality, sales and marketing efforts, timely production and delivery and customer acceptance. We may not always be able to respond quickly and effectively to changes in customer taste and demand due to the amount of time and financial resources that may be required to bring new products to market. The inability to respond quickly to market changes could have a material adverse effect on our financial condition and results of operations.

If we are unable to successfully manage growth, our operations could be adversely affected, and our business may fail.

Our progress is expected to require the full utilization of our management, financial and other resources. Our ability to manage growth effectively will depend on our ability to improve and expand operations, including our financial and management information systems, and to recruit, train and manage sales personnel. There can be no assurance that management will be able to manage growth effectively.

Because we do not have sufficient insurance to cover our business losses, we might have uninsured losses, increasing the possibility that you may lose your investment.

We may incur uninsured liabilities and losses as a result of the conduct of our business. We do not currently maintain any comprehensive liability or property insurance. Even if we obtain such insurance in the future, we may not carry sufficient insurance coverage to satisfy potential claims. We do not carry any business interruption insurance.

We may have liabilities to affiliated or unaffiliated third parties incurred in the regular course of our business.

We regularly do business with third party vendors, customers, suppliers and other third parties and thus we are always subject to the risk of litigation from customers, employees, suppliers or other third parties because of the nature of our business. Litigation could cause us to incur substantial expenses and, negative outcomes of any such litigation could add to our operating costs which would reduce the available cash from which we could fund our ongoing business operations.

| 10 |

| Table of Contents |

The loss of the services of our executive officers would disrupt our operations and interfere with our ability to compete.

We depend upon the continued contributions of our executive officers. Our executive officers handle all of the responsibilities in the area of corporate administration and business development. We do not carry key person life insurance on any of their lives and the loss of services of any of these individuals could disrupt our operations and interfere with our ability to compete with others.

Risks Associated with Our Common Stock

There is no active trading market for our common stock and if a market for our common stock does not develop, our investors will be unable to sell their shares.

There has been no public market for our securities and there can be no assurance that an active trading market for the securities offered herein will develop or be sustained after this Offering. After the effective date of the registration statement of which this prospectus is a part, we intend to identify a market maker to file an application with the Financial Industry Regulatory Authority (“FINRA”) to have our common stock quoted on the OTCQB tier of the OTC Markets electronic quotation system. We must satisfy certain criteria in order for our application to be accepted. We do not currently have a market maker willing to participate in this application process, and even if we identify a market maker, there can be no assurance as to whether we will meet the requisite criteria or that our application will be accepted. Our common stock may never be quoted on the OTCQB or a public market for our common stock may not materialize if it becomes quoted.

If our securities are not eligible for initial or continued quotation on the OTCQB or if a public trading market does not develop, purchasers of the common stock in this Offering may have difficulty selling or be unable to sell their securities should they desire to do so, rendering their shares effectively worthless and resulting in a complete loss of their investment.

If we do not file a Registration Statement on Form 8-A to become a mandatory reporting company under Section 12(g) of the Securities Exchange Act of 1934, we will continue as a reporting company and will not be subject to the proxy statement requirements, and our officers, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity, all of which could reduce the value of your investment and the amount of publicly available information about us.

As a result of this offering as required under Section 15(d) of the Securities Exchange Act of 1934, we will file periodic reports with the Securities and Exchange Commission through August , 2018, including a Form 10-K for the year ended February 28, 2017, assuming this registration statement is declared effective before that date. At or prior to February 28, 2017, we intend voluntarily to file a registration statement on Form 8-A which will subject us to all of the reporting requirements of the 1934 Act. This will require us to file quarterly and annual reports with the SEC and will also subject us to the proxy rules of the SEC. In addition, our officers, directors and 10% stockholders will be required to submit reports to the SEC on their stock ownership and stock trading activity. We are not required under Section 12(g) or otherwise to become a mandatory 1934 Act filer unless we have more than 2,000 shareholders (of which 500 may be unaccredited) and total assets of more than $10 million on February 28, 2018 If we do not file a registration statement on Form 8-A at or prior to February 28, 2018, we will continue as a reporting company and will not be subject to the proxy statement requirements of the 1934 Act, and our officers, directors and 10% stockholders will not be required to submit reports to the SEC on their stock ownership and stock trading activity.

We will be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. We anticipate that our common stock will be a “penny stock”, and we will become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers. For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our common shares and may affect the ability of purchasers to sell any of our common shares in the secondary market.

For any transaction (other than an exempt transaction) involving a penny stock, the rules require delivery, prior to such transaction, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made regarding sales commissions payable to both the broker-dealer and the registered representative, and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

We do not anticipate that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock is exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

Financial Industry Regulatory Authority (FINRA) sales practice requirements may also limit your ability to buy and sell our stock, which could depress our share price.

FINRA rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares, depressing our share price.

| 11 |

| Table of Contents |

State securities laws may limit secondary trading, which may restrict the states in which you can sell the shares offered by this prospectus.

If you purchase shares of our common stock sold pursuant to this Offering, you may not be able to resell the shares in a certain state unless and until the shares of our common stock are qualified for secondary trading under the applicable securities laws of such state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in such state. There can be no assurance that we will be successful in registering or qualifying our common stock for secondary trading, or identifying an available exemption for secondary trading in our common stock in every state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, our common stock in any particular state, the shares of common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the market for the common stock will be limited which could drive down the market price of our common stock and reduce the liquidity of the shares of our common stock and a stockholder’s ability to resell shares of our common stock at all or at current market prices, which could increase a stockholder’s risk of losing some or all of their investment.

If quoted, the price of our common stock may be volatile, which may substantially increase the risk that you may not be able to sell your shares at or above the price that you may pay for the shares.

Even if our shares are quoted for trading on the OTCQB following this Offering and a public market develops for our common stock, the market price of our common stock may be volatile. It may fluctuate significantly in response to the following factors:

|

| · | variations in quarterly operating results; |

|

| · | our announcements of significant contracts and achievement of milestones; |

|

| · | our relationships with other companies or capital commitments; |

|

| · | additions or departures of key personnel; |

|

| · | sales of common stock or termination of stock transfer restrictions; |

|

| · | changes in financial estimates by securities analysts, if any; and |

|

| · | fluctuations in stock market price and volume. |

Your inability to sell your shares during a decline in the price of our stock may increase losses that you may suffer as a result of your investment.

We arbitrarily determined the price of the shares of our common stock to be sold pursuant to this prospectus, and such price does not reflect the actual market price for the securities. Consequently, there is an increased risk that you may not be able to re-sell our common stock at the price you bought it for.

The Selling shareholders may sell their shares at the fixed price of $0.05 per share until our common stock is quoted on the OTCQB tier of the OTC Markets electronic quotation system, and thereafter at prevailing market prices or privately negotiated prices. However, our stock may not become quoted on the OTCQB. The initial offering price of $0.05 per share of the common stock offered pursuant to this prospectus was determined by us arbitrarily. The price is not based on our financial condition or prospects, on the market prices of securities of comparable publicly traded companies, on financial and operating information of companies engaged in similar activities to ours, or on general conditions of the securities market. The price may not be indicative of the market price, if any, for our common stock in the trading market after this Offering. If the market price for our stock drops below the price which you paid, you may not be able to re-sell out common stock at the price you bought it for.

| 12 |

| Table of Contents |

Because we do not intend to pay any dividends on our common stock; holders of our common stock must rely on stock appreciation for any return on their investment.

We have not declared or paid any dividends on our common stock since our inception, and we do not anticipate paying any such dividends for the foreseeable future. Accordingly, holders of our common stock will have to rely on capital appreciation, if any, to earn a return on their investment in our common stock.

We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any December 31.

Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company”, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

USE OF PROCEEDS

We will not receive any proceeds from the resale of the securities offered through this Prospectus by the selling security holders. The selling security holders will receive all proceeds from this offering.

DETERMINATION OF OFFERING PRICE

The selling security holders will offer their shares at fixed price of $0.05 per share until our common stock is quoted on the OTCQB tier of OTC Markets electronic quotation system (“OTCQB”), and thereafter at prevailing market prices or privately negotiated prices. However, our stock may not become quoted on OTCQB. The initial offering price of $0.05 per share was determined by our Board of Directors, who considered several factors in arriving at the $0.05 per share figure, including the following:

|

| · | our most recent private placements of 4,030,000 shares of our common stock at a price of CDN$0.01per share on January 28, 2017; |

|

| · | our lack of operating history; |

|

| · | our capital structure; and |

|

| · | the background of our management. |

As a result, the $0.05 per share initial offering price of our common stock does not necessarily bear any relationship to established valuation criteria and may not be indicative of prices that may prevail at any time. The price is not based on past earnings, nor is it indicative of the current market value of our assets. No valuation or appraisal has been prepared for our business. You cannot be sure that a public market for any of our securities will develop.

| 13 |

| Table of Contents |

All of the 4,030,000shares of our common stock to be sold by the selling security holders are currently issued and outstanding, and will therefore not cause dilution to any of our existing stockholders.

SELLING SECURITY HOLDERS

As of August 18 , 2017 our company has 200,000,000 common shares and 100,000,000 preferred shares authorized, each with a par value of $0.0001 per share, with 13,530,000 common shares and no preferred shares outstanding.

The 23 selling security holders are offering for sale 4,030,000shares of our issued and outstanding common stock which they obtained through the following private transactions:

|

| · | On January 28, 2017, we issued 4,030,000 common shares at the price of $0.0076 (CDN$0.01) per share or $30,733 (CDN$40,300) in the aggregate. These shares were issued to twenty- three (23) non-U.S. persons (as that term is defined in Regulation S of the Securities Act of 1933, as amended) in an offshore transaction relying on Regulation S of the Securities Act of 1933, as amended). All of these shares are being registered in this Prospectus on behalf of the selling security holders. |

The following table provides information as of August 18 , 2017 regarding the beneficial ownership of our common stock by each of the selling security holders, including:

|

| · | the number of shares owned by each prior to this offering; |

|

| · | the number of shares being offered by each; |

|

| · | the number of shares that will be owned by each upon completion of the offering, assuming that all the shares being offered are sold; |

|

| · | the percentage of shares owned by each; and |

|

| · | the identity of the beneficial holder of any entity that owns the shares being offered. |

| Name of Selling |

| Shares Owned |

|

| Percent(2) |

|

| Maximum |

|

| Beneficial |

| Percentage |

| |||||

| Yu Shui Hung Flat D, 9/F, The Blue Yard, 1 Tak Uk ST. Tsuen Wan, Hong Kong |

|

| 575,000 |

|

|

| 4.249 |

|

|

| 575,000 |

|

| Nil |

|

|

| 0 | % |

| Ma Yuk Sau Room 1816, Lung Fai House, Lower Wong Tai Sin, Kowloon, Hong Kong |

|

| 535,000 |

|

|

| 3.954 |

|

|

| 535,000 |

|

| Nil |

|

|

| 0 | % |

| Szeto So Chu Room 1816, Lung Fai House, Lower Wong Tai Sin, Kowloon, Hong Kong |

|

| 470,000 |

|

|

| 3.473 |

|

|

| 470,000 |

|

| Nil |

|

|

| 0 | % |

| Leung Lai Nor Shirley Room H, 25/F, Blk 1, Saddle Ridge Garden, Kam Ying Road, Ma On Shan, Hong Kong |

|

| 420,000 |

|

|

| 3.104 |

|

|

| 420,000 |

|

| Nil |

|

|

| 0 | % |

| Lam Tsui Ling Rm 1629, Kwong Ping House, Kwong Fuk Estate, Tai Po, Hong Kong |

|

| 500,000 |

|

|

| 3.695 |

|

|

| 500,000 |

|

| Nil |

|

|

| 0 | % |

| Ng Yut Kuen Rm 1502, Wah Shui House, Tin Wah estate, Tin Shui Wai, Hong Kong |

|

| 520,000 |

|

|

| 3.843 |

|

|

| 520,000 |

|

| Nil |

|

|

| 0 | % |

| Leong Kai Chung Rm 1502, Wah Shui House, Tin Wah Estate, Tin Shui Wai, Hong Kong |

|

| 430,000 |

|

|

| 3.178 |

|

|

| 430,000 |

|

| Nil |

|

|

| 0 | % |

| 14 |

| Table of Contents |

| Name of Selling Security holder |

| Shares Owned Prior to this Offering(1) |

| Percent(2) |

| Maximum Numbers of Shares Being Offered |

| Beneficial Ownership After Offering |

| Percentage Owned upon Completion of the Offering |

| |||||||

| Mario Todd Unit E, 23/F, Tower 11, Metro City, Phase 2, Tseung Kwan, Hong Kong |

| 550,000 |

| 4.065 |

| 550,000 |

| Nil |

| 0 | % | |||||||

| Jean Nlandu 264 Riverstone Pl SE, Calgary, AB, T2C 3W8 |

| 2,300 |

| 0.016 | (3) |

| 2,300 |

| Nil |

| 0 | % | ||||||

| Nadine Mujinga Bawala 264 Riverstone Pl SE, Calgary, AB, T2C 3W8 |

| 1,700 |

| 0.012 | (3) |

| 1,700 |

| Nil |

| 0 | % | ||||||

| Chang Fei Zhou 56 Auburn Meadows Gardens SE, Calgary, AB, Canada T3M 2H7 |

| 2,000 |

| 0.014 | (3) |

| 2,000 |

| Nil |

| 0 | % | ||||||

| Jacob Unger 100 Huntwick Way NE, Calgary, AB, Canada T2K 4H3 |

| 1,800 |

| 0.013 | (3) |

| 1,800 |

| Nil |

| 0 | % | ||||||

| Joseph Au 308 78 Ave NE, Calgary, AB, Canada T2K 0R6 |

| 2,000 |

| 0.014 | (3) |

| 2,000 |

| Nil |

| 0 | % | ||||||

| Jun Chen Unit 320, 1920 14 Ave NE, Calgary, AB, Canada T2E 8V4 |

| 2,000 |

| 0.014 | (3) |

| 2,000 |

| Nil |

| 0 | % | ||||||

| James Hau Fat Au 308 78 Ave NE, Calgary, AB, Canada T2K 0R6 |

| 1,800 |

| 0.013 | (3) |

| 1,800 |

| Nil |

| 0 | % | ||||||

| Grace Pui Yin Au 308 78 Ave NE, Calgary, AB, Canada T2K 0R6 |

| 2,200 |

| 0.016 | (3) |

| 2,200 |

| Nil |

| 0 | % | ||||||

| Sun Qi 223 Pump Hill View SW, Calgary, AB, Canada T2V 4R7 |

| 1,700 |

| 0.012 | (3) |

| 1,700 |

| Nil |

| 0 | % | ||||||

| Guangcheng Zheng 7727 Hunterview Drive NW, Calgary, AB, Canada T2K 4P8 |

| 2,300 |

| 0.016 | (3) |

| 2,300 |

| Nil |

| 0 | % | ||||||

| Jiang Ying Tan 7727 Hunterview Drive NW, Calgary, AB, Canada T2K 4P8 |

| 1,700 |

| 0.012 | (3) |

| 1,700 |

| Nil |

| 0 | % | ||||||

| So Ngo Szeto 3 - 6420 41 Street NE, Calgary, AB, Canada T2K 5M8 |

| 2,000 |

| 0.014 | (3) |

| 2,000 |

| Nil |

| 0 | % | ||||||

| Phanh Boi Lu 48 Evansdale Common NW, Calgary, AB, Canada T3P 0E1 |

| 2,200 |

| 0.016 | (3) |

| 2,200 |

| Nil |

| 0 | % | ||||||

| Yiu To Li 48 Evansdale Common NW, Calgary, AB, Canada T3P 0E1 |

| 1,800 |

| 0.013 | (3) |

| 1,800 |

| Nil |

| 0 | % | ||||||

| Ye Xu 28 Beddington Gdns NE, Calgary, AB, Canada T3K 4N9 |

| 2,500 |

| 0.018 | (3) |

| 2,500 |

| Nil |

| 0 | % | ||||||

| 15 |

| Table of Contents |

| Name of Selling |

| Shares Owned |

|

| Percent(2) |

|

| Maximum |

|

| Beneficial |

|

| Percentage |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||

| TOTAL |

|

| 4,030,000 |

|

|

| / |

|

|

| 4,030,000 |

|

|

|

|

|

|

| ||

| (1) | The number and percentage of shares beneficially owned is determined to the best of our knowledge in accordance with the Rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the selling security holder has sole or shared voting or investment power and also any shares which the selling security holder has the right to acquire within 60 days of the date of this Prospectus. |

| (2) | The percentages are based on 13,530,000 shares of our common stock issued and outstanding and as at August 18 , 2017. |

| (3) | Less than 1%. |

Except as otherwise noted in the above list, the named party beneficially owns and has sole voting and investment power over all the shares or rights to the shares. The numbers in this table assume that none of the selling security holders will sell shares not being offered in this Prospectus or will purchase additional shares, and assumes that all the shares being registered will be sold.

Other than as described above, none of the selling security holders or their beneficial owners has had a material relationship with us other than as a security holder at any time within the past three years, or has ever been one of our officers or directors or an officer or director of our affiliates.

None of the selling security holders are broker-dealers or affiliates of a broker-dealer.

No public market currently exists for shares of our common stock. We intend to engage a market maker to apply to have our common stock quoted on the OTCQB electronic quotation system. In order for our common stock to be quoted on the OTCQB, a market maker must file an application on our behalf to make a market for our common stock. This process takes at least 60 days and can take longer than a year. We have not yet engaged a market maker to make an application on our behalf. If we are unable to obtain a market maker for our securities, we will be unable to develop a trading market for our common stock. There is no assurance that our common stock will become quoted on the OTCQB or that any public market for our common stock will develop. The selling security holders may sell some or all of their shares of our common stock in one or more transactions, including block transactions:

|

| · | on such public markets as the securities may be trading; |

|

| · | in privately negotiated transactions; or |

|

| · | in any combination of these methods of distribution. |

The selling security holders may offer our common stock to the public: at a fixed for of $0.05 per share for the duration of the offering.

We are bearing all costs relating to the registration of our common stock. The selling security holders, however, will pay any commissions or other fees payable to brokers or dealers in connection with any sale of the shares of our common stock.

| 16 |

| Table of Contents |

The selling security holders must comply with the requirements of the Securities Act and the Exchange Act in the offer and sale of our common stock. In particular, during such times as the selling security holders may be deemed to be engaged in a distribution of any securities, and therefore be considered to be an underwriter, they must comply with applicable laws and may, among other things:

|

| · | furnish each broker or dealer through which our common stock may be offered such copies of this Prospectus, as amended from time to time, as may be required by such broker or dealer; |

|

| · | not engage in any stabilization activities in connection with our securities; and |

|

| · | not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities other than as permitted under the Exchange Act. |

The selling security holders and any broker-dealers acting in connection with the sale of the common stock offered under this Prospectus will be deemed to be underwriters within the meaning of section 2(a)(11) of the Securities Act, and any commissions received by them and any profit realized by them on the resale of shares as principals will be deemed underwriting compensation under the Securities Act. Neither we nor the selling security holders can presently estimate the amount of such compensation. We know of no existing arrangements between the selling security holders and any other security holder, broker, dealer, underwriter or agent relating to the sale or distribution of our common stock. Because the selling security holders will be deemed to be “underwriters” within the meaning of section 2(a)(11) of the Securities Act, the selling security holders will be subject to the prospectus delivery requirements of the Securities Act. Each selling security holder has advised us that they have not yet entered into any agreements, understandings, or arrangements with any underwriters or broker-dealers regarding the sale of their shares. We may indemnify any underwriter against specific civil liabilities, including liabilities under the Securities Act.

Regulation M

During such time as the selling security holders may be engaged in a distribution of any of the securities being registered by this Prospectus, the selling security holders are required to comply with Regulation M under the Exchange Act. In general, Regulation M precludes any selling security holder, any affiliated purchaser and any broker-dealer or other person who participates in a distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase, any security that is the subject of the distribution until the entire distribution is complete.

Regulation M defines a “distribution” as an offering of securities that is distinguished from ordinary trading activities by the magnitude of the offering and the presence of special selling efforts and selling methods. Regulation M also defines a “distribution participant” as an underwriter, prospective underwriter, broker, dealer, or other person who has agreed to participate or who is participating in a distribution.

Regulation M prohibits, with certain exceptions, participants in a distribution from bidding for or purchasing, for an account in which the participant has a beneficial interest, any of the securities that are the subject of the distribution. Regulation M also governs bids and purchases made in order to stabilize the price of a security in connection with a distribution of the security. We have informed the selling security holders that the anti-manipulation provisions of Regulation M may apply to the sales of their shares offered by this Prospectus, and we have also advised the selling security holders of the requirements for delivery of this Prospectus in connection with any sales of the shares offered by this Prospectus.

With regard to short sales, the selling security holders cannot cover their short sales with securities from this offering. In addition, if a short sale is deemed to be a stabilizing activity, then the selling security holders will not be permitted to engage in such an activity. All of these limitations may affect the marketability of our common stock.

| 17 |

| Table of Contents |

Penny Stock Rules

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC which:

|

| · | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

|

| · | contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to violations of such duties or other requirements of federal securities laws; |

|

| · | contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask prices; |

|

| · | contains the toll-free telephone number for inquiries on disciplinary actions; |

|

| · | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

|

| · | contains such other information, and is in such form (including language, type size, and format) as the SEC shall require by rule or regulation. |

Prior to effecting any transaction in a penny stock, a broker-dealer must also provide a customer with:

|

| · | the bid and ask prices for the penny stock; |

|

| · | the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; |

|

| · | the amount and a description of any compensation that the broker-dealer and its associated salesperson will receive in connection with the transaction; and |

|

| · | a monthly account statement indicating the market value of each penny stock held in the customer's account. |

In addition, the penny stock rules require that prior to effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser's written acknowledgment of the receipt of a risk disclosure statement, (ii) a written agreement to transactions involving penny stocks, and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our securities, and therefore our stockholders may have difficulty selling their shares.

Blue Sky Restrictions on Resale

When a selling security holder wants to sell shares of our common stock under this Prospectus in the United States, the selling security holder will need to comply with state securities laws, also known as “blue sky laws,” with regard to secondary sales. All states offer a variety of exemptions from registration of secondary sales. Many states, for example, have an exemption for secondary trading of securities registered under section 12(g) of the Exchange Act or for securities of issuers that publish continuous disclosure of financial and non-financial information in a recognized securities manual, such as Standard & Poor’s. The broker for a selling security holder will be able to advise the stockholder as to which states have an exemption for secondary sales of our common stock.

| 18 |

| Table of Contents |

Any person who purchases shares of our common stock from a selling security holder pursuant to this Prospectus, and who subsequently wants to resell such shares will also have to comply with blue sky laws regarding secondary sales.

When this Registration Statement becomes effective, and a selling security holder indicates in which state(s) he desires to sell his shares, we will be able to identify whether he will need to register or may rely on an exemption from registration.

DESCRIPTION OF SECURITIES TO BE REGISTERED

General

Our authorized capital stock consists of 200,000,000 shares of common stock with a par value of $0.0001 per share and 100,000,000 preferred shares with a par value of $0.0001 per share.

Common Stock

As at the date of this registration statement there were 13,530,000 issued and outstanding shares of our common stock that are held by 27 holders of record.

Holders of our common stock are entitled to one vote for each share on all matters submitted to a stockholder vote. Holders of common stock do not have cumulative voting rights. Therefore, holders of a majority of the shares of common stock voting for the election of directors can elect all of the directors. Holders of our common stock representing a majority of the voting power of our capital stock issued, outstanding and entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our articles of incorporation.

Holders of common stock are entitled to share in all dividends that the board of directors, in its discretion, declares from legally available funds. In the event of liquidation, dissolution or winding up, each outstanding share entitles its holder to participate pro rata in all assets that remain after payment of liabilities and after providing for each class of stock, if any, having preference over the common stock. Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Preferred Stock

As of the date of this registration statement there were no shares of our preferred stock outstanding.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. As a result, we do not anticipate paying any cash dividends in the foreseeable future.

Share Purchase Warrants and Options

As of the date of this Prospectus, there are no warrants to purchase shares of our common stock and no options to purchase shares of our common stock outstanding.

| 19 |

| Table of Contents |

Convertible Securities

We have not issued any securities convertible into shares of our common stock or granted any rights convertible or exchangeable into shares of our common stock.

INTERESTS OF NAMED EXPERTS AND COUNSEL

No expert or counsel named in this Prospectus as having prepared or certified any part thereof or having given an opinion upon the validity of the securities being registered or upon other legal matters in connection with the registration or offering of our common stock was employed on a contingency basis or had or is to receive, in connection with the offering, a substantial interest, directly or indirectly, in us. Additionally, no such expert or counsel was connected with us as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Experts

The audited consolidated financial statement of TGS International Ltd. for the period from December 1, 2016 (inception) to February 28, 2017 has been included in this Prospectus in reliance upon MNP LLP, an independent registered public accounting firm, as experts in accounting and auditing.

W.L. Macdonald Law Corporation of the law firm Macdonald Tuskey, of 409 – 221 W. Esplanade, North Vancouver, British Columbia, Canada V7M 3J3, has rendered a legal opinion regarding the validity of the shares of common stock offered by the Selling Shareholders. The opinion is filed as exhibit 5.1 to this registration statement.

Forward-Looking Statements

This Prospectus contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “will”, “may”, “anticipates”, “believes”, “should”, “intends”, “estimates” and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our intellectual property; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified personnel; and other risks detailed from time to time in our filings with the SEC, or otherwise.

OUR COMPANY AND OUR BUSINESS

TGS International Ltd. (“TGS International”) was established on December 1, 2016 in Nevada, USA. On December 21, 2016, TGS International acquired TGS Building Products Ltd. of Alberta (“TGS Alberta”) as its wholly subsidiary. TGS Alberta was established in March, 2016 in Alberta, Canada with focus in the sale and installation of PVC wall and ceiling panels in addition to renovation business in North America. TGS Alberta has worked closely with a PVC products manufacturer in China to bring the Company’s newly-formulated PVC products into Canada. TGS International and TGS Alberta are collectively referred to in the registration statement as “we”, “us”, “our”, “TGS” or “the Company”.

Our executive offices are located at Unit 3, 6420 – 4 Street NE2806, 505 - 6th Street SW, Calgary, Alberta, Canada T2K 5M8. Our telephone number is (403) 616 - 9226.

PRODUCTS

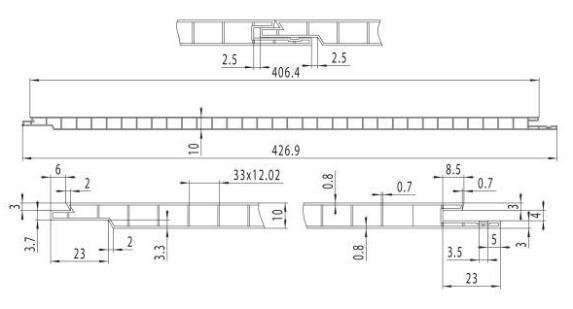

The Company specializes in indoor PVC (polyvinyl chloride) wall and ceiling panels for residential, commercial, and industrial applications. Initially, the Company is focusing in the production and sale of white PVC wall and ceiling panels in standard width of 16 inches to better streamline its operations and to ensure a quality and timely delivery of its products to customers. Coloured and textured panels will be offered as special custom orders on a per project basis.

| 20 |

| Table of Contents |

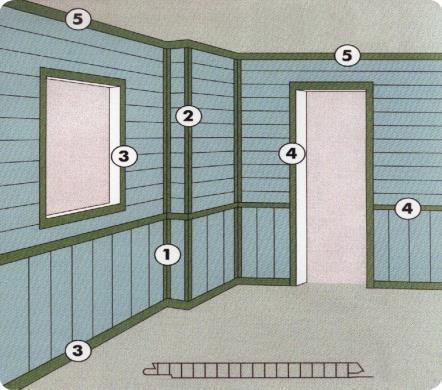

The Company has designed a mold for its PVC panels as shown below. The mold has been manufactured and placed with its manufacturer in China.

(dimensions in mm)

In addition to PVC wall and ceiling panels, the company also offers a selection of PVC floorings as a part of the company’s product line.

PRODUCT SOURCING

TGS purchases its products from a Chinese manufacturer, Jiangyin Weixin Plastic Co. Ltd. of Jiangyin City, Jiangsu Province, China with whom it has established a strong relationship. On June 4, 2017, we entered into a marketing and sale agency agreement with Jiangyin Weixin Plastic Co. Ltd. With this agreement, we will be responsible for the marketing and sale of products in Canada. The agreement is for a term of 2 years with automatic renewal for one year term for subsequent years. There are no royalties payable pursuant to the agreement and no pre-determined wholesale or retail prices. Wholesale product pricing will be determined by the parties on a continual basis, and retail pricing will be at the discretion of TGS. Weixin will manufacture PVC panels to order based on the mold designed by the company, or to such other specifications as may be requested by the company from time to time. The company will strive to maintain a solid rapport with its manufacturer to ensure the company will have a good quality product and enhanced reliability in manufacturing and delivery. TGS also plans to work closely with its manufacturer to diversify its products to present a more complete and varied product line.

BENEFITS OF PVC PANELS

PVC panels boast many advantageous qualities for building applications both traditional and creative. Their usage has gained increasing popularity as they are ideal alternatives for conventional building materials such as drywalls and plywood, particularly in areas exposed to water and moisture.

Easy Installation. PVC panels are quick and easy to install, without the need for complex specialty tools. Their interlocking design is based on a simple tongue-and-groove mechanism, pieced together like a jigsaw puzzle. Fasteners are hidden inside the grooves and finished off with specially designed trimmings to provide a smooth and clean finish. Panels are available in standard width and customizable lengths to accommodate to different project requirements.

Low Maintenance. PVC panels require minimal effort to maintain and cleaning only involves water and a mild soap solution using a sponge or soft bristle brush. On most occasions, wiping will be sufficient.

Waterproof and Mold Proof. One of the most appealing selling points of PVC panels is their water-resistant capability; ideal for use in areas with frequent exposure to water that would otherwise damage alternative wall applications. Because of their ability to repel water, they are also highly resistant to mold and bacteria, making them highly hygienic and suitable for environments with stringent health and safety requirements.

| 21 |

| Table of Contents |

Fire and Chemical Resistant. The chemical makeup of PVC panels provide an inherit resistance to fire and most corrosive chemicals. Not only do they offer a safe environment for application but also longevity not obtainable with conventional building materials.

Lightweight yet Durable. With their hollow design and standard widths, PVC panels are easy to transport and lightweight compared to other materials of similar application. Nonetheless, they are also very durable and robust; materials that can withstand even the toughest and most demanding environments.

Bright and Clean. The smooth, glossy finish of the panels helps reflect light, offering interiors a bright and clean appearance. As long as the panels are installed indoor as directed, they are fade resistant and the surface will remain fresh and clean for a long period of time.

Versatile Application. PVC panels are suitable for virtually all indoor settings and environments whereby walls and ceilings exist. They can be installed as a new walls system or retrofitted to existing surfaces with little complications. The panels can be installed horizontally, vertically, or even diagonally to accommodate to the needs and tastes of individual customers.

Cost and Time Effective. The simplicity of PVC panels calls for straightforward labour. No additional plastering or painting is required. Not only can projects be completed in a fraction amount of time in comparison to drywall, but money is also saved as labour cost is significantly reduced.

Recyclable. PVC panels can be recycled and reshaped into new products.

PVC PANEL APPLICATIONS

Due to the versatility of the products, PVC panels can be utilized in a wide array of different applications within residential, commercial, and industrial settings. They are ideal alternatives to traditional wall systems not only for their functionality but also for their decorative aptitude.

| Residential Use |

| Commercial Use |

| Industrial Use |

| Kitchen |

| Office |

| Agricultural facilities |

| Bathroom |

| Car Washes |

| Meat packaging plants |

| Indoor Pools |

| Laundromats |

| Food processing plants |

| Laundry Room |

| Supermarkets |

| Chemical processing plants |

| Living Room |

| Health care facilities |

| Factories /Warehouses |

| Garage |

| Hospitality facilities |

| Laboratories |

| Basement |

| Gyms/Aquatic centres |

| Marinas/Fisheries |

Installation Overview

Cutting. The panels can be cut vertically or horizontally using simple woodworking tools. They can be cut using a normal fine-toothed wood saw or with a jigsaw.

Fitting to Walls. The panels can be fitted directly to the wall and can be fixed straight over tiles. Only on exceptionally uneven/bad conditioned walls do they need to be fitted to battens. The panels can be glued, screwed, nailed or stapled as desired. Due to the tongue and groove nature of the paneling, they can be fixed through the tongue, such that the fixings are always hidden.

| 22 |

| Table of Contents |

Fitting to Ceilings. Panels can be fitted using adhesive, staples or screws. If suspending from the ceiling, panels can be fitted using a metal hanger bracket or attached to a wooden framework. To cut holes for spotlights, a hole cutting attachment for an electric drill is ideal.

|

|

|

|

INDUSTRY ANALYSIS

Construction Industry