Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JetPay Corp | v473489_8k.htm |

©Copyright JetPay Corporation 2017 Payments | Payroll | Partners Annual Shareholder Meeting August 15 th , 2017 Exhibit 99.1

©Copyright JetPay Corporation 2017

©Copyright JetPay Corporation 2017 www.jetpay.com 3 Diane (Vogt) Faro Chief Executive Officer Agenda - August 15 th , 2017 » Preliminary » Introductions » Call to Order • Presentation of Due Notice • Determination of Quorum » Vote to Approve the Proposed Election of One Director to the Board of Directors for a Three - Year Term. The Board has Nominated for Election Diane (Vogt) Faro » Vote to Approve and Adopt the First Amendment to the JetPay Corporation Amended and Restated 2013 Stock Incentive Plan to Make Available an Additional 1,000,000 Shares of JetPay Common Stock for the Grant of Awards Under the Plan » Formal Adjournment » Presentation by Management » Questions and Answers Available with Management Subsequent to Presentation 2017 ANNUAL SHAREHOLDER MEETING

©Copyright JetPay Corporation 2017 www.jetpay.com 4 OPTIMISTIC ABOUT FUTURE GROWTH “Our foundation is solid and our vision is clear. We have the leadership, technology and focus to deliver innovative solutions to both our current and future customers.” Building C apabilities W ith P eople, S ystems and P roducts » In 2016 and the first quarter of 2017, JetPay made significant investments in management, technology and products to drive new growth across all business segments. » These strategic investments included revamping the JetPay operating team, bringing in significant sales and marketing talent, and better focusing on our strengths - allowing JetPay to address the changing business landscape faced by our customers with agility and flexibility. » Revenues grew 30.3 % in 2016 to $56.3 million, reflecting a strong performance in our HR & Payroll and Payment Services segments. » We delivered record results in the last twelve months and the momentum continues. We remain creative and innovative in our approach, allowing us to be competitive in the marketplace. Diane (Vogt) Faro Chief Executive Officer

©Copyright JetPay Corporation 2017 www.jetpay.com 5 Complexity Simplified Responsive P latforms End - to - End platforms that m ove s money and manage s information . Cloud - based S olutions G iving businesses the ability to take payments and pay people from anywhere with our Magic Gateway, Workforce Today and the JetWay Dashboard. Collaborative Partnerships Bringing together integrated business products that will deliver management solutions and value - added services like gift and loyalty programs, merchant discount programs, terminals and POS. A Vision for Simplified Business Solutions » Managing the complexity within our business segments remains our primary focus. » We are e xpanding capabilities through collaboration, relationships and new technology – our Magic Gateway with e - bill and communications functionality , Workforce Today offering a suite of human capital management services and the JetWay Portal providing an integrated portal for boarding and residual payments. » Our vision of simplifying the complexities that come with managing businesses drives our decisions every day . » W e will continue to build trusted business relationships by delivering technology and automation support that our current and future customers require. A BREAKTHROUGH YEAR FOR JETPAY

©Copyright JetPay Corporation 2017 www.jetpay.com 6 . . Complexity Simplified » JetWay – A portal that bring products and services to our partners to engage cross - sell with Payments, Gift, Loyalty and HR & Payroll Services. » Developer APIs – Offering controlled but easy integrations for ISV Partners and brings technical expertise to deliver custom development for high - volume business solutions. » Payment Facilitation – Simplifying pricing complexity for integration partners and direct merchants. » Transparent Pricing – Pass - through pricing for merchants and partners that understand card fees, risk management and secured technology. » M omentum – The last twelve months has sparked an excitement amongst our teams to continue to find ways to retain, deepen and grow relationships. A BREAKTHROUGH YEAR FOR JETPAY “The momentum of the last fifteen months has sparked an excitement amongst our teams. Continuing to find ways to retain, deepen and grow relationships is the focus for everyone.” Diane (Vogt) Faro Chief Executive Officer

©Copyright JetPay Corporation 2017 www.jetpay.com 7 BUILDING A STRONG FOUNDATION Invested in the Future of Integrated S olutions » Understanding our strengths in 2016 has allowed us to focus on simplifying the complexities across all business segments in 2017. » We are blending the best of our technology and service cultures to become the premier customer - focused company in our industry. » We are unique in our flexibility, ability and willingness to customize services to meet the needs of our customers . » The demands for mobile technology and cloud - based solutions continues to change. We are meeting the needs of our customers with products and processes – Poynt Smart Terminals, Magic Mobile Applications and Virtual Terminal » As a sales, customer and revenue driven company, our goal is to make doing business with us less complex and as frictionless as possible – The JetWay Portal, Magic Gateway and Cash Discount programs “We are customer focused in sales, relationship management and customer service. We understand that continuous education and coaching at every level will empower our employees to become decision makers.” Peter B. Davidson Vice Chairman & Corporate Secretary

©Copyright JetPay Corporation 2017 www.jetpay.com 8 BUILDING A STRONG FOUNDATION Payment Sales and Partnerships » JetPay made a strategic decision to become vertically focused in defined markets and align sales and relationship management teams accordingly. » We don’t need to be the biggest, but we do want to be the best at adding value to our customers and partners. We are focused on cross - selling and have implemented direct marketing campaigns to our HR & Payroll customers selling payment processing. » By migrating all of our customers and prospects to a single customer relationship management platform, we have put significant emphasis on partnerships and connectivity. Partner Services Referral Partners CPAs, A ccountants and B rokers ISOs and Agent Partners When Agents are Looking for Ways to Differentiate . ISVs and Developers Integrations with Guided Connectivity . e - Commerce Partners Online, Mobile and Digital Payments Financial Institutions Agent or Referral Institutions Government and Utilities Specialized Vertical M arkets “JetPay is growing substantially because we pro vide incredible value and support to our customers and partners’ growth. Their success and growth is driving our own.” Vinny Breault President – Payment Services

©Copyright JetPay Corporation 2017 www.jetpay.com 9 BUILDING A STRONG FOUNDATION Michael Pires President HR & Payroll Services “ At JetPay, we are family, and we all have a single mission, and that is to provide the best customer service possible. We will continue to attract people who want to be part of that kind of company.” An Evolution In Managing People » Human Capital Management (HCM) goes beyond payroll, helping companies handle everything HR related, from hire to retire. » HCM is designed to make complex HR matters simple with single database technology that is agile and easily meet the needs of each customer. » We combine world - class technology with “white glove” service, assigning Account Managers and Processors to each of our clients. » A significant portion of our business comes from referral sources, and under a new sales strategy we have more than doubled our HR & Payroll sales force allowing us to cast a larger net in the mid - market segment. » We remain focused and committed to serving the needs of our small business clients and expanding relationships.

©Copyright JetPay Corporation 2017 www.jetpay.com 10 2016 - 2017 FINANCIAL OVERVIEW Gregory M. Krzemien Chief Financial Officer “Our 2016 financial performance speaks for itself with 42% growth in our Payment segment and strong organic growth of 6% in our HR & Payroll segment.” » We experienced 30% revenue growth in both 2015 and 2016 with revenues of over $56 million in 2016. » Revenues increased 53.8% to $18.8 million in Q2 of 2017 and 58.1% to $37.7 million for the first half of 2017. Organic growth was 20.1% and 17.1% in Q2 and the first half of 2017, respectively, with solid growth in both our Payment Services and HR & Payroll Segments. » Revenues within our Payment Services Segment increased 69.7%, to $15.0 million in Q2 of 2017 and 81.2% to $29.3 million for the first half of 2017. Organic growth in this segment was 23.5% and 20.8% for Q2 and the first half of 2017, respectively. “Our future is exciting. We believe we can continue to achieve double - digit revenue growth over the next several quarters.” Gregory M. Krzemien Chief Financial Officer » Revenues within our HR & Payroll Segment increased 12.5%, to $3.8 million in Q2 of 2017 and 10.0% to $8.4 million for the first half of 2017. This organic growth included accelerated growth in our Workforce Today® product, highly desired by medium to large employers.

©Copyright JetPay Corporation 2017 www.jetpay.com 11 2016 - 2017 FINANCIAL OVERVIEW Gregory M. Krzemien Chief Financial Officer “Our 2016 financial performance speaks for itself with 42% growth in our Payment segment and strong organic growth of 6% in our HR & Payroll segment.” » Consolidated gross profit increased 46.6% to $5.7 million, or 30.5% of revenues in Q2 of 2017, up from $3.9 million for the same period in 2016, and up 48.3% to $12.1 million, or 32.0% of revenues, in the first half of 2017. » We achieved these results through our strategic combinations with ACI Merchant Systems and CollectorSolutions, Inc. and through the introduction of new products and services such as Workforce Today ® and our Cash Discount product. » Adjusted EBITDA was $3.8 million in 2016 and $2.8 million, or 7.4% of revenue, in the first half of 2017. » The ratio of our total debt, which consists of total debt of $16.3 million, to debt and total equity capitalization, was 20.6% at June 30, 2017, a substantial improvement from 24.6% at December 31, 2016. » As of June 30, 2017, the Company had positive working capital of $1.0 million .

©Copyright JetPay Corporation 2017 www.jetpay.com 12 2016 – 2017 FINANCIAL OVERVIEW $- $5.0 $10.0 $15.0 $20.0 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Payment $7.3 $8.8 $11.8 $12.7 $14.3 $15.0 Payroll $4.3 $3.4 $3.4 $4.5 $4.6 $3.8 Quarterly Revenue (in millions)

©Copyright JetPay Corporation 2017 www.jetpay.com 13 2016 - 2017 FINANCIAL OVERVIEW 20.0% 22.5% 25.0% 27.5% 30.0% $- $10 $20 $30 $40 $50 $60 $70 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Debt to Capitalization Ratio ($ in millions) Debt Capital Ratio

©Copyright JetPay Corporation 2017 www.jetpay.com 14 2016 - 2017 FINANCIAL OVERVIEW $- $500 $1,000 $1,500 $2,000 Mar-16 Jun-16 Sep-16 Dec-16 Mar-17 Jun-17 Quarterly EBITDA & Adjusted EBITDA (in thousands) EBITDA Adjusted EBITDA EBITDA for the quarter ended June 30, 2016 was $(6.0) million and $(75) for the quarter ended June 30, 2017.

©Copyright JetPay Corporation 2017 www.jetpay.com 15 2016 - 2017 FINANCIAL OVERVIEW EBITDA and Adjusted EBITDA Reconciliation Year Ended Six Months Ended December 31, 2016 June 30, 2017 Operating (loss) income $ (8,088) $ (719) Change in fair value of contingent consideration liability (103) (183) Amortization of intangibles 3,244 1,749 Depreciation 721 479 EBITDA $ (4,226) $ 1,326 Professional fees for non - repetitive matters 1,339 216 Legal settlement costs 6,192 747 Non - cash stock - based compensation 446 384 Non - cash loss on disposal of fixed asset 32 110 Adjusted EBITDA $ 3,783 $ 2,783 Non - GAAP Financial Measures These comments include a discussion of non - GAAP financial measures, EBITDA and adjusted EBITDA, as defined in Regulation G of the Securities and Exchange Act of 1934 , as amended . We report our financial results in compliance with GAAP, but believe that also discussing non - GAAP measures provides investors with financial information that we use in the management of our business . We define EBITDA as operating income (loss), before interest, taxes, depreciation, amortization of intangibles, and non - cash changes in the fair value of contingent consideration liability . We define adjusted EBITDA as EBITDA, as defined above, plus certain non - recurring items, including certain legal and professional costs for non - repetitive matters, legal settlement costs, non - cash stock option costs, and non - cash losses on the disposal of fixed assets . These measures may not be comparable to similarly titled measures reported by other companies . Management uses EBITDA and adjusted EBITDA as indicators of the Company’s operating performance and ability to fund acquisitions, capital expenditures and other investments and, in the absence of refinancing options, to repay debt obligations . Management believes EBITDA and adjusted EBITDA are helpful to investors in evaluating the Company’s operating performance because non - cash costs and other items that management believes are not indicative of its results of operations are excluded . EBITDA and adjusted EBITDA are supplemental non - GAAP measures, which have limitations when used as an analytical tool . Non - GAAP financial measures should not be considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP such as net income or income from operations . NonGAAP financial measures do not reflect a comprehensive system of accounting, may differ from GAAP measures with the same names, and may differ from non - GAAP financial measures with the same or similar names that are used by other companies . For a description of our use of EBITDA and adjusted EBITDA and a reconciliation of EBITDA and adjusted EBITDA to operating income (loss), see the section of this Annual Report titled “EBITDA and Adjusted EBITDA Reconciliation . ”

©Copyright JetPay Corporation 2017 www.jetpay.com 16 BUILDING A STRONG FOUNDATION Simplify and Streamline » We are aligning internal processes and technological approach with every product to ensure we are improving efficiencies, automating processes and growing business for our merchants and partners. » From operations to technology, we’ve adopted best practices with a keen focus on stability and scalability. Michael Collester Chief Operating Officer “We have identified our strengths, and we are moving forward in both operations and technology with strong teams to support all business lines.” JetWay A Portal and Marketplace that will manage boarding, transactions and reporting within a single dashboard.

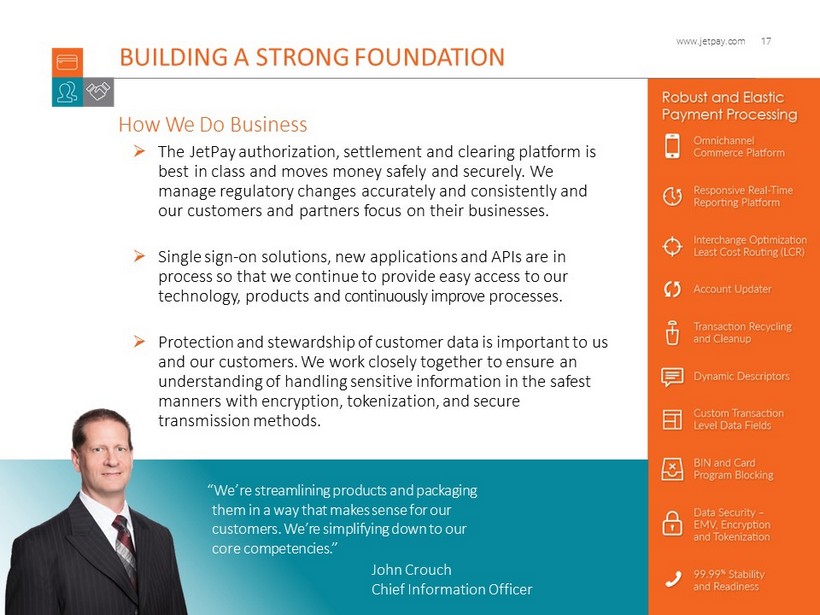

©Copyright JetPay Corporation 2017 www.jetpay.com 17 John Crouch, Chief Information Officer “We’re streamlining products and packaging them in a way that makes sense for our customers. We’re simplifying down to our core competencies.” How We Do Business » The JetPay authorization, settlement and clearing platform is best in class and moves money safely and securely. We manage regulatory changes accurately and consistently and our customers and partners focus on their businesses . » Single sign - on solutions, new applications and APIs are in process so that we continue to provide easy access to our technology, products and continuously improve processes. » Protection and stewardship of customer data is important to us and our customers. We work closely together to ensure an understanding of handling sensitive information in the safest manners with encryption, tokenization, and secure transmission methods. BUILDING A STRONG FOUNDATION John Crouch Chief Information Officer

©Copyright JetPay Corporation 2017 www.jetpay.com 18 THE NEXT WAY TO PAY Our Strategy is Strong » S trategic acquisitions and improved operating technologies have well - positioned us to respond to changing business landscapes. » The consolidation of operations and management improved the economies of scale and has unified our a pproach to solutions and processes. » With divergent technologies, we are expanding into more market channels and unique integrations. We will continue to look around the corner for new opportunities . » JetPay is focused on ways to shorten the activation cycle and respond quickly to new vertical markets. With responsive technology, ef fective innovation and collaboration we will move our business forward. “JetPay is poised to leverage its abilities to see around corners , anticipate what’s next in the market and react quickl y with the right combination of people and technologies in place.” Gene M. Valentino Chief Strategy Officer

©Copyright JetPay Corporation 2017 www.jetpay.com 19 “ Collaborative communication drive our messaging both internally and externally. Building on our strengths will allow us to make complex simple. Customer - Driven Marketing & Communications » We will inspire our employees, customers, future customers and shareholders with a message that focuses on our strengths and making complex simple. » Driving growth, retention and building brand awareness within the industries we serve will be the focus of every message promoting innovated products, packaged services, automated processes and easy access to information to both existing customers and new ones. » Our marketing and communication approach will be focused on both internal and external audiences empowering and engaging our employees, partners and prospects. » Our success will be measured through trusted relationships, increased sales, and a culture of collaboration and empowerment that enriches our brand. BUILDING ON OUR STRENGTHS Michelle Jenkins Chief Marketing Officer

©Copyright JetPay Corporation 2017 www.jetpay.com 20 2017 – Looking Forward P a yme n ts HR & P a y r oll P artne rs Performance Technology that manage s reliability and maintain s s peed and capacity . Progress Continuously looking forward, growing strategic partnership and adding products . Products Packaged products that help businesses manage people and payment services Process Dashboards that automate s processes improv es efficiencies and delivers more service s . People Collaborative r elationships creative solutions to solve complex requirements.

©Copyright JetPay Corporation 2017 www.jetpay.com 21 Payments | Payroll | Partners 2017 Annual Shareholder Meeting For additional information please contact us at: Investorinquiries@jetpay.com