Attached files

| file | filename |

|---|---|

| S-1/A - AMENDMENT NO.2 TO THE FORM S-1 - Ecovyst Inc. | d382954ds1a.htm |

| EX-23.4 - EX-23.4 - Ecovyst Inc. | d382954dex234.htm |

| EX-23.3 - EX-23.3 - Ecovyst Inc. | d382954dex233.htm |

| EX-23.2 - EX-23.2 - Ecovyst Inc. | d382954dex232.htm |

| EX-23.1 - EX-23.1 - Ecovyst Inc. | d382954dex231.htm |

| EX-16.1 - EX-16.1 - Ecovyst Inc. | d382954dex161.htm |

| EX-10.19 - EX-10.19 - Ecovyst Inc. | d382954dex1019.htm |

| EX-10.13 - EX-10.13 - Ecovyst Inc. | d382954dex1013.htm |

| EX-10.12 - EX-10.12 - Ecovyst Inc. | d382954dex1012.htm |

| EX-10.11 - EX-10.11 - Ecovyst Inc. | d382954dex1011.htm |

Exhibit 10.10

PARTNERSHIP AGREEMENT

By and Between

SHELL POLYMERS AND CATALYSTS ENTERPRISES INC.

and

PQ CORPORATION

LIST OF EXHIBITS

| Designation |

Title | |

| Exhibit 1 | Plant Purchase Agreement | |

| Exhibit 2 | Land Lease | |

| Exhibit 3 | Bill of Sale | |

| Exhibit 4 | PQ Services Agreement | |

| Exhibit 5 | PQ Produced Materials Supply Agreement | |

| Exhibit 6 | Partnership Manufacturing Agreement | |

| Exhibit 7 | Shell Sales Agreement | |

| Exhibit 8 | PQ Sales Agreement | |

| Exhibit 9 | SPACE Services Agreement | |

| Exhibit 10 | PQ Technology License Agreement | |

| Exhibit 11 | SPACE Technology License Agreement | |

| Exhibit 12 | Research and Development Agreement | |

| Exhibit 13 | Confidential Disclosure Agreement | |

| Exhibit 14 | Shell Oil Company Services Agreement | |

PARTNERSHIP AGREEMENT

THIS AGREEMENT is entered into as of February 1, 1988, by and between Shell Polymers and Catalysts Enterprises Inc., a Delaware corporation (“SPACE”), and PQ Corporation, a Pennsylvania corporation (“PQ”). Each of SPACE and PQ is sometimes referred to herein as “Partner”, and collectively they are sometimes referred to as “Partners.”

WITNESSETH:

WHEREAS, PQ and SPACE have entered into a Letter of Intent dated July 22, 1987, for the development of a partnership for Zeolite and Zeolite-containing Catalyst development, production and marketing in certain areas; and

WHEREAS, PQ and SPACE desire to enter into an equally-owned partnership for the purpose of accomplishing the desired development, production and marketing of Zeolite and Zeolite-containing Catalyst in certain areas and for any other lawful purpose related thereto; and

WHEREAS, PQ and SPACE desire to enter into this Partnership Agreement for the conduct of the business of such partnership;

NOW THEREFORE, for and in consideration of the mutual covenants, and subject to the terms and conditions contained herein, between the parties to this Agreement, the Partners hereby form and create a general partnership (the “Partnership”) under and pursuant to the Kansas Uniform Partnership Act, as amended or its successor, (K.S.A. 56-301 et seq.), for the purposes and upon the terms, provisions and conditions as hereinafter set forth:

Article I

Definitions

Unless indicated otherwise, the following terms used herein shall have the meanings set out below. References to Exhibits are to the Exhibits attached to and forming a part of this Agreement.

1.1 “SPACE” shall mean SHELL POLYMERS AND CATALYSTS ENTERPRISES INC., a Delaware Corporation, a wholly owned subsidiary of Shell Oil Company.

1.1.1 “Affiliate”, with respect to SPACE shall mean Shell Oil Company or any company (including a corporation, partnership, joint venture or other association) other than SPACE, PARTNERSHIP and PARTNERSHIP Affiliates, which is now or subsequently becomes directly or indirectly affiliated with Shell.

For the purpose of this definition, a particular company is:

(a) directly affiliated with Shell if Shell holds fifty percent (50%) or more of the shares carrying the right to vote at a general meeting, or its equivalent, of the particular company, and

(b) indirectly affiliated with Shell if a series of companies can be specified beginning with Shell and ending with the particular company, so related that each company of the series, except Shell, is directly affiliated with one or more companies in the series.

1.2 “PQ” shall mean PQ CORPORATION, Pennsylvania corporation.

1.2.1 “Affiliate”, with respect to PQ, shall mean any company (including a corporation, partnership, joint venture or other association) other than PQ, PARTNERSHIP and PARTNERSHIP Affiliates, which is now or subsequently becomes directly or indirectly affiliated with PQ.

For the purpose of this definition, a particular company is:

(a) directly affiliated with PQ if PQ holds fifty percent (50%) or more of the shares carrying the right to vote at a general meeting, or its equivalent, of the particular company, and

(b) indirectly affiliated with PQ if a series of companies can be specified beginning with PQ and ending with the particular company, so related that each company of the series, except PQ, is directly affiliated with one or more companies in the series.

1.3 “Shell Oil Company” or “Shell” shall mean Shell Oil Company, a Delaware Corporation whose principal office is at 900 Louisiana Street, Houston, Texas 77002, including its divisions, Shell Chemical Company and Shell Development Company.

1.4 “Profited Cost” shall mean, for a product produced in a plant:

(a) all direct costs for raw materials, additives, utilities, packaging materials and other materials physically utilized for manufacture of that product;

(b) all direct costs for operations, laboratory, and maintenance labor and materials necessary to the manufacture of the product, quality assurance for the process and product, and the maintenance of the plant at levels consistent with long-term manufacture of the product at the quality level which meets customer requirements. These costs shall include, but not exceed, the cost of operating and maintaining the plant in a safe manner, and meeting all state and federal regulation for worker health and safety and environmental protection, and the cost of any additional processing of the Zeolite and/or the Zeolite-containing Catalyst by any third party;

(c) indirect costs of management, supervision, engineering and R&D support to manufacturing, and on-site management at levels which are agreed to annually by the Management Committee in accordance with the Services Agreement; and

(d) return on investment (ROI) for the fixed assets employed at the plant to produce a product. The method of calculation of the ROI is contained in Appendix A.

Costs which cannot be reasonably attributed to the production of the product in that plant will not be included in Profited Costs.

1.5 “Zeolite” shall mean zeolite(s) including precursors thereto but shall not include zeolite-containing catalysts or zeolites purposefully mixed with other material such as, for example, but not limited to alumina, silica and mullite, or zeolites having catalytically active metals or metal ions incorporated therein or thereon.

1.6 Zeolite-containing Catalysts shall mean catalysts which incorporate Zeolites as a component of their structure.

1.7 “Agreement Date” shall mean the date of execution of this Agreement, if signed by both parties on the same day, or the later of the dates of execution if signed by the parties on different dates.

1.8 “Capital Account” shall mean an account kept on the books of the Partnership. There shall be credited to the Capital Account of each Partner the cash contribution or the fair market value amount of contribution in kind (determined as hereinafter provided) of its capital contributions, and its share of profits of the partnership, and there shall be charged against each Partner’s Capital Account the amount of all distributions made by the Partnership to such Partner and its share of any losses of the Partnership. The Capital Accounts of the Partners will be determined and maintained through the full term of the Partnership in accordance with the capital accounting rules of Treas. Reg. §1.704-1(b)(2)(iv), or any successor regulation. The Partner’s Capital Account will further be adjusted in accordance with Treas. Reg. §1.704-1(b)(2)-(4)(g), or any successor regulation, for allocation to them of depreciation, depletion, amortization, and gain or loss as computed for book purposes, with respect to such property.

1.9 “Force Majeure” shall mean acts of God, wars, strikes, lockouts, or other industrial disturbances, riots, epidemics, landslides, lightning, earthquakes, fires, storms, floods, washouts, civil disturbances, explosions, breakage or accident to machinery, pipelines or processing plant, government regulations, curtailment of or other inability to obtain equipment, supplies or materials, temporary failure of gas supply, and any other cause whether of the kind herein enumerated or otherwise not within the control of the party claiming suspension, all of which by the exercise of due diligence such party is unable to prevent; but provided, however, that the above requirement that any Force Majeure shall be remedied with the exercise of due diligence shall not require the settlement of strikes or lockouts by acceding to the demands of the opposing party when such course is inadvisable in the discretion of the party having the difficulty.

1.10 “Management Representative(s)” shall mean those individuals appointed by each Partner to make certain decisions as more fully described in Article IX hereof.

1.11 “Operator” shall mean PQ as an independent contractor, or such other independent contractor as may be appointed by the Partnership, in respect to its employment by the Partnership as overseer of the Zeolite/Catalyst Plant and supervisor of its production.

1.12 “Operator’s Personnel” shall mean the personnel who are employees of the Operator, and not employees of the Partnership.

1.13 “Ownership Percentage” shall mean with respect to each Partner, a fifty percent (50%) interest held in the Partnership.

1.14 “Management Committee” shall mean the committee provided for in Article IX.

1.15 “Partnership Interest” shall mean the complete interest, rights, privileges of a Partner, subject however to all duties, obligations, covenants, representations and liabilities provided for in this Agreement.

1.16 “Principal Office” of the Partnership shall be Valley Forge, Pennsylvania or as otherwise agreed to in writing by the Partners.

1.17 “Agreement” or “Partnership Agreement” shall mean this agreement including all exhibits and appendices attached hereto and all other agreements between the parties referenced herein and pertaining to the subject matter herein.

1.18 “Plant Purchase Agreement” shall mean that agreement between PQ and the Partnership whereby the Partnership purchases the Speciality Zeolite/Catalyst Plant located at PQ’s Kansas City Plant location from PQ.

1.19 “Land Lease” shall mean that real estate lease under which PQ leases to the Partnership the land on which the Zeolite/Catalyst Plant sits.

1.20 “PQ Services Agreement” shall mean that agreement between PQ and the Partnership under which PQ operates and manages the day to day operations of the Zeolite/Catalyst Plant and provides services for a fee.

1.21 “PQ Produced Materials Supply Agreement” shall mean that agreement between PQ and the Partnership under which PQ sells to the Partnership products produced by PQ.

1.22 “Partnership Manufacturing Agreement” shall mean that agreement between PQ and the Partnership under which the Partnership agrees to produce specified products for PQ for a Profited Cost utilizing production capacity not being currently used for Partnership purposes. Raw materials will be supplied by PQ.

1.23 “Shell Sales Agreement” or “Shell Marketing Agreement” shall mean that agreement between Shell and the Partnership under which Shell agrees, for a fee, to market, or to have marketed, Zeolite-containing Catalysts produced by the Partnership.

1.24 “PQ Sales Agreement” or “PQ Marketing Agreement” shall mean that agreement between PQ and the Partnership under which PQ agrees, for a fee, to market Zeolites produced by the Partnership.

1.25 “SPACE Services Agreement” shall mean that agreement between SPACE and the Partnership under which SPACE, or an affiliate of SPACE, for a fee, will supply services to the Partnership.

1.26 “PQ Technology License Agreement” shall mean that agreement between PQ and the Partnership under which certain PQ technology and know-how is non-exclusively licensed to the Partnership for use by the Partnership.

1.27 “SPACE Technology License Agreement” shall mean that agreement between SPACE and the Partnership under which certain SPACE technology and know-how is non-exclusively licensed to the Partnership for use by the Partnership.

1.28 “Research and Development Agreement” or “Development Agreement” shall mean that agreement between PQ and Shell Oil Company under which the parties agree to cooperate in Zeolite and Zeolite-containing Catalyst research and development efforts in Designated Use Areas.

1.29 “Confidential Disclosure Agreement” shall mean that agreement between Shell Oil Company and PQ covering the terms and conditions under which the parties will exchange technical and commercial information in areas which are not Designated Use Areas.

1.30 “Shell Oil Company Services Agreement” shall mean that agreement between Shell Oil Company and the Partnership under which Shell Oil Company or an affiliate of Shell Oil Company, will provide, for a fee, services to the Partnership.

1.31 “Kansas City Plant” shall mean that series of manufacturing facilities owned and operated by PQ at Kansas City, Kansas, designed for the production of Zeolite, Zeolite-containing Catalysts, and other silica based products.

1.32 “Specialty Zeolite/Catalyst Plant” or “Zeolite/Catalyst Plant” shall mean that part of the Kansas City Plant which is to be sold to the Partnership by PQ in accordance with the Plant Purchase Agreement.

1.33 “Designated Use Area” or “DUA” shall mean an application area for any Zeolite or Zeolite-containing Catalyst which has been designated herein by the parties hereto, or is later designated by the Partners pursuant to Section 5.1 of this Agreement. DUA does not mean a specific zeolite or zeolite-containing catalyst, but encompasses the process which uses any zeolite or zeolite-containing catalyst in an application area.

1.34 “C5/C6 Isomerization DUA” shall mean a process in which the primary intent is the isomerization of normal C5 and C6 paraffins to branched C5 and C6 paraffins.

1.35 “Hydrocracking DUA” shall mean a process in which the primary intent is the hydroconversion of distillate feedstocks from crude oil (atmospheric or vacuum fractionation), or distillate feedstocks produced from crude oil fractions in other conversion processes, to liquid products with a significantly lower average molecular weight.

1.36 “Catalytic Dewaxing DUA” shall mean a process in which the primary intent is the improvement of low temperature flow properties of distillate fuels and lubricating oil stocks by the hydroconversion of high melting point hydrocarbons contained therein through means of molecularly shape-selective catalytic hydrocracking; a process which results in reduction of the molecular weight of the high melting point hydrocarbons and permits their separation from the stock by distillation.

1.37 “Distillate Deep Hydrogenation DUA” shall mean a process in which the primary intent is the reduction of the contents of aromatic hydrocarbons and/or functionalized aromatic compounds in a hydrocarbon stock to levels that permit its use in higher value applications, for which its original contents of these species would have made it unsuitable or less suitable. It is intended that the aromatics content reduction be achieved with minimal molecular weight reduction of the hydrocarbon stock.

1.38 “Scope of Business” as used herein shall consist of:

(a) the development, manufacture and marketing of Zeolites and/or Zeolite-containing Catalysts for use within the DUAs or within the areas of Accepted Business Opportunities, all within the United States, its possessions and Territories, except as otherwise agreed;

(b) the operation of the Zeolite/Catalyst Plant; and

(c) toll manufacturing.

1.39 “SPACE Zeolite-containing Catalyst Business” as used herein shall mean the current SPACE hydrocracking, C5/C6 isomerization, distillate deep hydrogenation and catalytic dewaxing zeolite catalyst business, with the exclusion of the current supply contract for catalytic dewaxing catalyst between Shell Oil Company and Engelhard.

1.40 “PQ Zeolite Business” as used herein shall mean all current PQ zeolite business which utilizes the Speciality Zeolite/Catalyst Plant for manufacture, excluding Proprietary Zeolites or Proprietary Zeolite-containing Catalysts.

1.41 “Accepted Business Opportunity” or “ABO” shall mean a business opportunity related to zeolites and/or zeolite-containing catalysts which has been agreed to by the Partners.

1.42 “Powder Plant” shall mean that portion of the PQ Kansas City Plant in which PQ currently produces Zeolite A and Zeolite NaY and converts NaY to Ammonia Y Zeolite. The Powder Plant will continue to be owned by PQ. It is anticipated that at times PQ may utilize the Powder Plant for the benefit of the Partnership to process Zeolites at a market price or, in the event that a market price cannot be readily established, at a Profited Cost.

1.43 “Proprietary Zeolites” or “Proprietary Zeolite-containing Catalysts” shall mean zeolites or zeolite-containing catalysts produced by PQ for a third party based on technical information received from the third party under confidentiality.

1.44 “Plant Investment” shall be defined as the total plant and equipment investment of the Partnership. At the date of formation of the Partnership this investment is nine million, nine hundred thousand dollars ($9,900,000). This number will be increased by Partnership investments in additional plant and equipment including associated engineering and installation costs, and decreased as plant and equipment is retired, written-off, or otherwise removed from the assets of the Partnership. However, Plant Investment will not be reduced for depreciation taken on such assets or increased for interest costs of the Partnership after investments are deemed ready for service.

1.45 “Bill of Sale” shall mean the agreement between PQ and the Partnership which identifies the various assets being sold to the Partnership.

Article II

Organization

2.1 Name. The activities and business of the Partnership shall be conducted under the name “Zeolyst Enterprises” in Kansas City, Kansas, and subject to all applicable laws. The business of the Partnership may be conducted in any other state or any foreign jurisdiction under any other name or names deemed appropriate or necessary by the Partnership Committee.

2.2 Purpose. The purpose of the Partnership shall be to develop Zeolites and Zeolite-containing Catalysts for use in DUAs and ABOs; to cause the Zeolite/Catalyst Plant to be operated for manufacture of Zeolites and Zeolite-containing Catalysts; to sell Zeolites and Zeolite-containing Catalysts produced therein and elsewhere for use in DUAs and ABOs within the United States, its possessions and Territories; to execute, enter into and perform the agreements and documents referenced herein; and to engage in any lawful act necessary or incidental to and in furtherance of these purposes.

2.3 Effectiveness. This Agreement shall not become effective or binding upon the Partners until such time as the Exhibits, Agreements and undertakings described in Articles III, IV and VI shall be prepared and executed and/or consummated as the case may be.

2.4 Powers. In furtherance of the purpose set out in Article 2.2 hereof, the Partnership, shall:

(a) Exercise all the powers and privileges granted by this Agreement and by any law, together with any powers incidental thereto;

(b) Receive by contribution, purchase, lease or otherwise acquire, employ, use and otherwise deal in and with real or personal property, or any interest therein, wherever situated; and to sell, convey, lease, exchange, transfer or otherwise dispose of, or mortgage or pledge, all or any of its property and assets, or any interest therein, wherever situated;

(c) Retain an Operator for the Zeolite/Catalyst Plant and appoint or retain such managers, representatives and agents as deemed appropriate and pay or otherwise provide for them suitable compensation;

(d) Participate with others, to the extent permitted by law, (i) in any corporation, partnership, limited partnership, joint venture, or other organization of any kind, or (ii) in any transaction, undertaking or arrangement which the Partnership by itself would have the power to conduct, whether or not such participation involves sharing or delegation of control of such activity with or to others;

(e) Enter into all of the agreements referred to herein and attached as exhibits hereto and any other agreements, contracts or documents referenced herein or as may be added by amendment from time to time and to make other contracts, including contracts of guaranty and suretyship, incur liabilities, borrow money, issue its notes, bonds and other obligations, and secure any of its obligations by mortgage, pledge or other encumbrance of all or part of its property, franchises and income;

(f) Lend money for Partnership purposes, invest and reinvest its funds, open and maintain accounts with banks and other financial institutions and conduct financial business therewith and take, hold and deal with real and personal property as security for the payment of funds so loaned or invested;

(g) Sue and be sued in all courts and judicial, administrative, arbitrative or other proceedings, in its Partnership name; and

(h) Establish and maintain a risk management program for (i) all assets and properties of the Partnership, (ii) all potential legal liabilities arising out of Partnership activities, and (iii) any other possible exposures of the Partnership.

2.5 Partners’ Meetings. Unless waived by the mutual written consent of both Partners, the Partners shall meet as provided in this Section.

(a) Meetings shall be held annually in the first calendar quarter and on such other dates that may be deemed by either Partner to be necessary or appropriate.

(b) Either Partner may request a meeting by giving notice to the other Partner specifying a date, time, and place at least seven (7) days in advance of the date of the meeting, provided that if the Partner receiving notice objects to the date, time or place, the Partners shall agree within fourteen (14) days of the notice of objection to meet within thirty (30) days of the date of the originally scheduled meeting. Notice may be waived in writing or by attendance at any meeting. An agenda need not be provided with the notice.

(c) Meetings may be held by conference telephone and action may be taken by written consent signed by a duly authorized representative of each Partner.

(d) At their meetings the Partners shall, among other things, review the activities of the Partnership and the Management Committee, review the annual business plan described in Article 9.1(e) hereof, consider other matters referred to them by the Management Committee and perform any other acts and exercise any rights afforded by law.

2.6 Partnership Property. All real or personal property (tangible or intangible) of whatever type or description (including all improvements placed or located thereon) acquired by the Partnership shall be owned by the Partnership, such ownership being subject to the other terms and provisions of this Agreement.

2.7 Term. The Partnership shall be formed as of the latter of the Agreement Date or the effective date determined by Article 2.3 hereof, and shall continue until terminated pursuant to the terms and conditions of this Agreement or by law. A notice shall be provided to all parties of the date of the Partnership formation. Any reference herein or in any Exhibit hereto to the formation of the Partnership or the date of formation of the Partnership shall be deemed a reference to the latter of the Agreement Date or the effective date determined by Article 2.3 hereof. For accounting purposes the books of the Partnership shall be opened February 1, 1988, and all costs incurred thereafter which are for the benefit of the Partnership will be charged to the Partnership if consistent with this Agreement.

Article III

Partners’ Contributions

3.1 Cash Contributions. Each Partner shall contribute cash to the Partnership in the following amounts:

(a) Each Partner shall make an initial cash contribution of $3,000,000 within five business days of the formation of the Partnership. This initial cash contribution shall be paid in immediately available funds into a bank account of the Partnership designated by the Management Committee for such purpose. The Partnership intends to borrow $4MM as a non-recourse loan, otherwise the Partners will provide the additional funding. The initial contributions by the Partners and the $4MM loan are intended to be sufficient to purchase the Zeolite Catalyst Plant, and pay Partnership start-up expenses. In addition a line of credit up to $2MM will be established to provide initial working capital.

(b) Upon notification from the Management Committee, each Partner shall make cash contributions in an amount equal to its Ownership Percentage multiplied by any amount required to enable the Partnership to meet any obligation(s) imposed by law which the Partnership is otherwise unable to meet from its own or borrowed funds.

(c) Upon notification from the Management Committee, each Partner shall make cash contributions in an amount equal to its Ownership Percentage multiplied by an amount required to enable the Partnership to meet any cash requirements other than those set forth in Article 3.1(a) and (b) hereof which the Partnership is otherwise unable to meet from its own or borrowed funds.

3.2 Cash Calls. It is intended and anticipated that after the initial start-up of the Partnership, the Partnership will generate sufficient funds to meet its obligations. However, notification from the Management Committee to the Partners of cash contributions under Article 3.1 (b) and (c) above shall set forth (a) the total amount of cash required from both Partners; (b) the amount of cash required from the Partner to whom the cash call is addressed, which amount shall be proportional to its Ownership Percentage or as otherwise provided herein; and (c) the due date of the cash call and the method and place of payments which shall be as specified by the terms of this Agreement or as specified by the Management Committee.

3.3 Failure to Make Contributions. If either Partner fails to make when due any of its contributions under Article 3.1, the noncontributing Partner and the other Partner shall be immediately given written notice of such fact by the Management Committee or any officer of the Partnership. Such other Partner shall have the right, but not the obligation,

to make such contribution on behalf of such noncontributing Partner. If such contribution is made by the other Partner, then its Capital Account shall be accordingly increased by the amount of the contribution. If such contribution is made from the funds of the Partnership or borrowed by the Partnership, then the noncontributing Partner’s Capital Account shall be reduced by the amount of such contribution as appropriate. The noncontributing Partner shall pay interest in the amount of such contribution it fails to make from the original due date of the contribution until the date of payment to the Partnership or reimbursement to the other Partner, as the case may be. Such interest shall be paid (i) to the other Partner at a rate equal to the rate being charged by Chase Manhattan Bank, New York, New York, as announced publicly at the opening of business on such date for ninety (90) day loans to the best commercial credit risks plus five percent (5%) per annum (not to exceed the maximum rate permitted by law); and/or (ii) to the Partnership at a rate equal to the higher of the rate specified in clause (i) above or the rate actually charged to the Partnership if the Partnership borrowed the funds for such contribution from a commercial bank or lender. When such repayment or reimbursement is made, as the case may be, the Capital Accounts shall be adjusted accordingly as if the noncontributing partner had made the contribution when due. Until such

repayment or reimbursement is made in full, all distributions hereunder (including distributions upon dissolution) which the noncontributing Partner would otherwise be entitled to receive, shall be retained by the Partnership or paid directly to the other Partner, as the case may be, and credited against the amount of such repayment or reimbursement obligation until paid in full.

3.4 Services Not Contributions. Services, if any, rendered to the Partnership by either of the Partners, shall not constitute contributions to either of their Capital Accounts and, unless otherwise agreed in writing, shall not be reimbursable by the Partnership in any manner, provided, however, this provision shall not in any way affect the rights and obligations of the Partners or the Partnership under any other agreements to which any one or more of them is a party including the Services Agreement.

3.5 Noncash Contributions. Nothing in this Agreement shall preclude the Partnership from accepting from a Partner, in lieu of cash, any rights or other real, personal or intangible property at a value established by the Management Committee.

Article IV

Plant Facilities

4.1 Plant Purchase. The Partnership shall purchase from PQ the Zeolite/Catalyst Plant at Kansas City, Kansas for the sum of nine million, nine hundred thousand dollars ($9,900,000) in substantial accordance with the terms and conditions contained in the Plant Purchase Agreement attached hereto as Exhibit 1. Such purchase shall include the assets set forth in the Bill of Sale attached hereto as Exhibit 3.

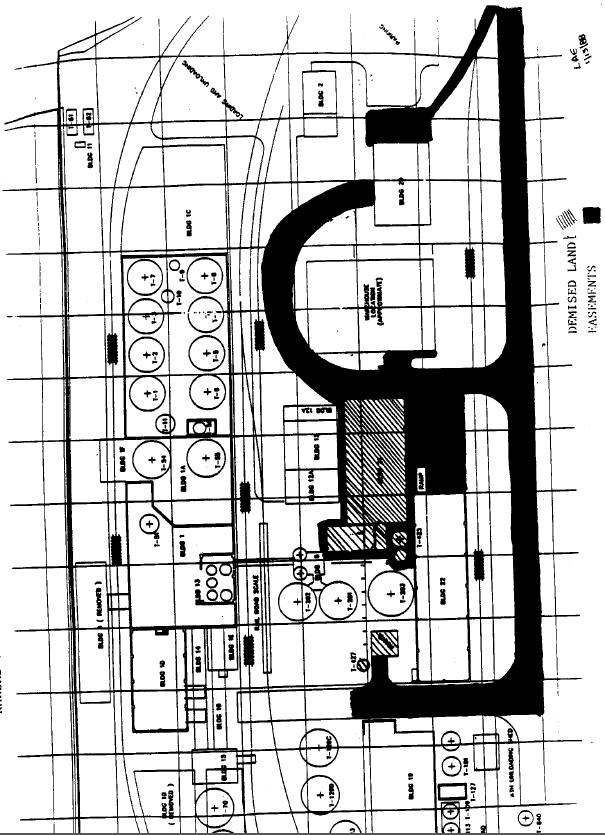

4.2 Land Lease. The Partnership shall lease from PQ all the land necessary upon which is situated the Specialty Zeolite/Catalyst Plant. Such land is situated at PQ’s Kansas City Plant. The precise description of such leased land and the duration, terms and conditions of such lease are more particularly set forth in the Land Lease attached hereto as Exhibit 2 and incorporated by reference.

Article V

Partnership Zeolite Business

5.0 Partnership Business and Definitions. The business of the Partnership shall be the management and operation of the marketing and manufacturing activities necessary to exploit the potential of the DUAs and ABOs making up the Scope of Business. As provided in this Article V the Scope of Business may change with time but will initially include specifically the SPACE Zeolite-containing Catalyst Business and the PQ Zeolite Business. The Partnership may pursue all activities directly or indirectly, through joint ventures, partnerships or other associations, that the Management Committee deems are in the best interests of the Partnership and necessary to accomplish their established business objectives.

For the purposes of this Article V the following definitions shall apply:

(a) “Other SPACE Business Opportunities” shall include all opportunities for the manufacture and sale of zeolite-containing catalysts outside of “SPACE Zeolite-containing Catalyst Business”, with the exclusion of the current supply contract for catalytic dewaxing catalyst between Shell Oil Company and Engelhard.

(b) “Other PQ Business Opportunities” shall include all opportunities for the manufacture and sale of zeolites with the exclusion of:

(1) PQ Zeolite Business

(2) zeolites for detergents unless hydrothermal stablization is required for their manufacture

(3) zeolites which require atmospheric synthesis and which have anticipated annual sales by PQ in excess of 200,000 lb/yr, and for which hydrothermal stabilization would not be used in their manufacture by PQ or the Partnership.

(c) “zeolite” shall mean any synthetic molecular sieve, consisting of an infinitely extending, three-dimensional network of AlO4 and SiO4 tetrahedra linked by the sharing of oxygen atoms, including synthetic molecular sieves in which the Al and Si have been replaced with other atoms, including but not limited to Fe or Ga.

5.1 Designated Use Areas

(a) Initial Designation

The initial DUAs are to be C5/C6 Isomerization, Hydrocracking, Catalytic Dewaxing and Distillate Deep Hydrogenation (as defined in Paragraphs 1.34 through 1.37).

(b) Addition Designation Procedure

(i) Shell and PQ are expected to exchange Confidential Know-how under the Confidential Disclosure Agreement (Exhibit 13) for the purposes of developing and evaluating additional DUAs.

(ii) Addition of a DUA may be proposed by either General Manager or by any member of the Management Committee. In the event implementation of the DUA would fall within the authority level of the General Managers, they may approve the incorporation of the DUA, subject only to veto by the Management Committee. Approval of a DUA by either General Manager or the Management Committee shall not be unreasonably withheld.

(iii) In the event implementation of a DUA falls outside the authority level of the General Managers, the Management Committee approval will be requested at their next quarterly meeting, or any other properly called meeting.

(iv) Should the DUA be rejected by the Management Committee, either Partner will be free to proceed separately in the proposed area, provided however this does not authorize either Partner to violate the Confidential Disclosure Agreement (Exhibit 13).

(c) DUA Termination

In the event a DUA is no longer considered to be desirable by the Partners, that DUA may be terminated by a unanimous vote of the Management Committee. Continuing supply/purchase obligations and licensing requirements will be negotiated as part of the termination.

(d) DUA Notification

Upon approval or termination of a DUA, Partnership shall provide SPACE and PQ with written notification of such approval or termination which reference the technology licensing agreements and

the research agreement as appropriate. Upon receipt of such notification from Partnership, SPACE shall notify Shell of the approval of an additional DUA or the termination of an existing DUA and request that Shell amend the Research and Development Agreement (Exhibit 12) accordingly. The additional or terminated DUA will be automatically incorporated into or removed from, respectively, the Technology Licensing Agreements (Exhibits 10 and 11).

(e) DUA Uses

DUAs are used to define the Scope of Business. In addition, DUAs will be used by SPACE and PQ for business planning (allocation of resources, etc.), technology licensing purposes, and Zeolite/Catalyst Plant access priority determination.

5.2. “Accepted Business Opportunities”

(a) Offering to Partnership

(i) SPACE will offer to Partnership all “Other SPACE Business Opportunities.”

(ii) PQ shall offer to Partnership all “Other PQ Business Opportunities”.

(b) Procedures

(i) Shell and PQ will exchange Confidential Know-how under the Confidential Disclosure Agreement (Exhibit 13) for the purposes of developing and evaluating additional ABOs.

(ii) Other SPACE and/or PQ Business Opportunities offered to the Partnership shall be proposed or terminated, approved, and/or vetoed using the same procedures as for DUAs in Paragraph 5.1(b) and 5.1(c).

(c) ABO Notification

Upon approval or termination of an ABO, Partnership shall provide SPACE and PQ with written notification of such approval or termination which references the technology licensing agreements and

the research agreement as appropriate. The additional or terminated ABO will be automatically incorporated into or removed from, respectively, the Technology Licensing Agreements (Exhibit 10 and 11). If the Partners agree that an ABO should be incorporated into the Research and Development Agreement, SPACE shall, upon receipt of such notification from Partnership, notify Shell of the approval of an ABO and request that Shell amend the Research and Development Agreement (Exhibit 12).

(d) ABO Uses

ABOs are used to define the Scope of Business. In addition, ABOs will be used by SPACE and PQ for business planning (allocation of resources, etc.), technology licensing purposes, and Zeolite/Catalyst Plant access priority determination.

5.3 Zeolite/Catalyst Plant Access Priority. The parties envision four types of commercial transactions might be carried out by the Partnership. The access to the Zeolite/Catalyst Plant’s capacity will be in the following priority order subject to the notice requirements contained in the PQ Services Agreement, the PQ Manufacturing Agreement and Management Committee directives.

(a) Zeolite-containing Catalyst for use in a DUA will have first priority for use of the Zeolite/Catalyst Plant. In the event that additional processing outside the Zeolite/Catalyst Plant is required to produce a Zeolite-containing Catalyst, the processor will be selected by mutual agreement of the General Managers subject only to veto by the Management Committee.

(b) In the event the Partnership can produce Zeolites and other Zeolite-containing products in excess of Partnership requirements for Zeolite-containing Catalyst within all the DUA’s, the Partnership will produce and sell such Zeolite-containing products to third parties for use in the DUA’s. If the Management Committee elects to produce and sell such products, their production will receive second priority.

(c) Proprietary Zeolite and Proprietary Zeolite-containing Catalyst production for PQ will have the next priority.

PQ will pay the Partnership a Profited Cost when producing these products in accordance with all the terms and conditions contained in the Partnership Manufacturing Agreement (Exhibit 6).

(d) In the event the Partnership can produce Zeolites and Zeolite-containing products for use in ABOs in excess of Partnership requirements under (a) and (b), and PQ requirements under (c), the Partnership will manufacture these products as the next priority for utilizing the Plant.

(e) In the event plant capacity exists in excess of that required for (a) through (d), the Management Committee may approve utilization of the plant for other purposes.

5.4 Partnership Product Marketing.

(a) Zeolite-containing Catalysts will be marketed for the Partnership by Shell Oil Company or a Shell Oil Company Associate as defined in the Shell Sales Agreement (Exhibit 7).

(b) Zeolites and other Zeolite-containing products will be marketed for the Partnership by PQ under the PQ Sales Agreement (Exhibit 8).

(c) Zeolites and Zeolite-containing products produced by the Partnership for sale outside the DUA’s or ABO’s shall be marketed by the Partner or other party designated by the Management Committee, with preference given to the Partners.

5.5 Special Allocation of Income and Losses Between Partners.

(a) Both Partners will contribute equally to the Partnership Capital Account. However the end use and production technology contributions of the Partners through the technology licenses for Partnership products, discussed in 5.1 and 5.2, will have different proportional values. In recognition of these different values, SPACE and PQ will share in the Partnership annual cash income before tax (CIBT), as referenced by Article 8 of the PQ and SPACE Technology License Agreements, on the following basis:

(1) CIBT between 0 and 20% of Plant Investment will be divided on a 50/50 basis to each Partner.

(2) The first $4,000,000 of CIBT above 20% of Plant Investment will be divided 70% to SPACE, 30% to PQ.

(3) All CIBT above the sum of (1) and (2) will be divided 65% to SPACE, 35% to PQ.

(4) Credit for depreciation of Partnership Assets shall be shared equally by the Partners, unless otherwise agreed.

(5) If the Partnership generates a net loss before taxes, such losses shall be charged equally to the Partners.

(b) Monthly Estimates of Profit/Loss. At the end of each calendar month, the Partnership shall calculate an estimate of the current year-to-date profit allocation and report such to each Partner by the end of the seventh (7th) working day of the following month.

5.6 PQ Produced Materials. The Partnership will purchase from PQ its zeolites and other materials produced by PQ. Such materials purchased from PQ by the Partnership shall be priced at market value, wherever such a value can be determined or reasonably inferred, with a Profited Cost adjustment (ROI component of Profited Cost = 20% of Plant Investment) when Market Value cannot be established. For example, NH4Y value could be based on NaY market value adjusted for ion exchange in the Power Plant at a Profited Cost. All terms and conditions for such purchases shall be set out in the PQ Produced Material Supply Agreement (Exhibit 5). Such materials will include, but are not limited to sodium and ammonium Y zeolite. If the market price for similar quantity and quality is lower than the calculated Profited Cost, PQ may elect to sell produced materials at the market price, or if PQ does not so elect, the Partnership may purchase these materials from a third party at the market price.

5.7 The parties understand that SPACE Affiliates are not required to purchase for their own use any Partnership product from the Partnership unless they so contract otherwise.

5.8 Neither SPACE nor PQ will compete directly or indirectly with the Partnership without the express written approval of the Management Committee.

5.9 PQ and Shell Oil Company are expected to share technology in the DUA’s and, when specified, ABO’s under the Development Agreement (Exhibit 12), and potential DUA’s and other business opportunities under the Confidential Disclosure Agreement (Exhibit 13).

A. Present Technology

(a) PQ is expected to disclose to Shell Oil Company and SPACE those aspects of its current Zeolite production and modification technology which could be utilized by the Partnership to produce and market improved Zeolites and Zeolite-containing Catalysts for the current Partnership businesses.

(b) Shell Oil Company is expected to disclose to PQ those aspects of current Zeolite and Zeolite-containing Catalyst manufacture and performance which could be utilized by the Partnership to enable the Partnership to produce and market improved Zeolites and Zeolite-containing Catalysts for the current Partnership businesses.

B. Future Technology and Development

(a) Technology developed by SPACE, or its Affiliates and available to SPACE, or PQ, independent of Partnership activity which has applicability to improve performance of the Partnership will be offered exclusively to the Partnership under a first right of refusal for use in the current Partnership businesses pursuant to the terms of confidentiality in the Confidential Disclosure Agreement (Exhibit 13) and this Agreement.

(b) Technology developed or funded by Partnership shall be offered to both parties hereto for use outside the current Partnership business opportunities in accordance with the Technology Licensing Agreements (Exhibits 10 and 11).

5.10 It is anticipated by the Partners that Shell Oil Company and PQ in response to DUA and, when specified, ABO market needs will use the information described in 5.9 above to attempt to develop improved Zeolites and Zeolite-containing Catalysts offering superior performance in accordance with the Development Agreement (Exhibit 12).

Article VI

Operation and Management

6.1 Operating License Agreements. The Partners shall license to the Partnership, upon Partnership formation, certain technology as follows:

(a) PQ will provide the Partnership with rights to all PQ technology sufficient for the Partnership to operate the Zeolite/Catalyst Plant and to produce Zeolites and Zeolite-containing Catalysts for the Partnership businesses and to market them in accordance with the terms and conditions of the PQ Technology License Agreement attached hereto as Exhibit 10.

(b) SPACE will provide the Partnership with rights to all SPACE technology sufficient for the Partnership to operate the Zeolite/Catalyst Plant and to produce and market Zeolites and Zeolite-containing Catalysts for the Partnership businesses in accordance with the terms and conditions of the SPACE Technology License Agreement attached hereto as Exhibit 11.

6.2 Operating Agreement. The Partnership shall retain and designate PQ in the capacity of an independent contractor, to operate and maintain the Zeolite/Catalyst Plant and where appropriate to carry out the operational purposes as stated in Article II above in accordance with the terms more particularly described in the PQ Services Agreement attached hereto as Exhibit 3.

6.3 Service and Utility Agreements.

(a) The Partnership shall enter into a SPACE Services Agreement with SPACE, in its capacity other than as a Partner, in the form attached hereto as Exhibit 9.

(b) The Partnership shall enter into the PQ Services Agreement with PQ, in its capacity other than as a Partner, in the form attached hereto as Exhibit 4.

(c) The Partnership shall enter into the Shell Services Agreement with Shell, in the form attached hereto as Exhibit 14.

(d) The Partnership may also enter into such other material processing, utility, supply, waste disposal, service or other agreements with its Partners or third parties as are necessary or desirable for the operation and/or management of the Zeolite/Catalyst Plant and the other purposes of the Partnership. The Management Committee may designate any of such agreements which it

believes would be more efficiently or economically entered into by the Operator for the benefit of the Partnership and so delegate to the Operator the right to enter into such agreements. All such agreements entered into by the Operator in behalf of the Partnership under the above described delegation shall be approved as to form and substance, by the Management Committee prior to execution.

6.4 PQ Produced Material Supply. The Partnership shall enter into the PQ Produced Materials Supply Agreement with PQ, a copy of which is attached hereto as Exhibit 5 for the supply of zeolites and other materials produced by PQ necessary to produce Zeolite-containing Catalysts.

6.5 Marketing Agreements.

(a) Shell Zeolite Catalyst Marketing Agreement. The Partnership shall contract with Shell, for Shell or a third party agreeable to the Management Committee, to market Zeolite-containing Catalysts produced by the Partnership, in accordance with the terms of the Shell Sales Agreement (Exhibit 7).

(b) The Partnership shall contract with PQ and PQ shall market, or contract with a third party agreed to by the Management Committee to market Zeolites produced by the Partnership in accordance with the terms of the PQ Sales Agreement attached hereto as Exhibit 8.

6.6 Partnership Manufacturing Agreement. The Partnership shall permit PQ to use the Zeolite/Catalyst Plant to manufacture Proprietary Zeolites and Proprietary Zeolite-containing Catalysts, and any other such zeolites or zeolite-containing products as shall be agreed by the management committee in accordance with the Partnership Manufacturing Agreement attached hereto as Exhibit 6. The Zeolite/Catalyst Plant is to be used for the production of Zeolites for PQ only at such times as the Management Committee shall agree, which consent shall not be unreasonably withheld.

6.7 Fees Paid to a Partner. If a Partner (or its Affiliate) is retained or contracts with the Partnership to perform a service or other function for the Partnership at a fee or charge related to such Partner’s cost in performing such service or function, the compensation and benefits to such Partner’s personnel participating in performing such service or function shall not be greater than the compensation and benefits normally paid by such Partner for such services or functions performed by employees with the same or similar experience of those performing such service or function for the Partnership.

6.8 Miscellaneous. Unless there is an agreement otherwise the Parties intend that services to the Partnership by the Partners or their Affiliates, if any, will be provided at cost. The Partnership may contract for services from third parties when such can be justified by lower costs or when the Partners or their Affiliates are unwilling or unable to provide such services. The use of any service is a decision of the Partnership.

Article VII

Representations and Warranties

7.1 General Representations and Warranties. Each of SPACE and PQ represents and warrants to the other that:

(a) It has the necessary authority, to make and perform this Agreement and has duly approved and authorized the delivering and performing of this Agreement.

(b) It shall execute and deliver, or cause to be executed and delivered, all instruments and documents necessary or desirable to effectuate the purposes and intent of this Agreement.

(c) It assures the other that, by this Agreement and performance hereunder, all of the ownership interests to be conveyed by the terms of this Agreement shall be effectively conveyed.

(d) It assures the other that there are no known material encumbrances, burdens, debts, liabilities, claims, damages, causes of action or contingencies of any type or nature appurtenant to or associated with the technology or the ownership interests in the technology to be conveyed by the terms of this Agreement or arising in connection with any action or activity prior to the Agreement Date, that could cause material liability for the other party hereto, except as disclosed in Exhibit 7.1.

7.2 Limitation of Warranties. Except as otherwise provided herein, or otherwise agreed, SPACE and PQ, respectively, make no warranties to the other of any kind covering likelihood of successful completion, accuracy of cost estimates or schedules, ability of their respective technology to perform satisfactorily in its intended use or the fitness thereof for any intended purpose.

7.3 General Partnership Intended. SPACE and PQ each acknowledge that the partnership interests in the Partnership are meant and intended to be general partnership interests with the rights of management and control thereof under applicable law, and SPACE and PQ are each acquiring such partnership interests to evidence ownership and management of the Partnership. SPACE and PQ shall not take any action with respect to ownership or disposition of such partnership interests except in accordance with all applicable statutes, rules and regulations.

Article VIII

Confidentiality Obligations

8.1 Technical Information. Notwithstanding any provision hereof to the contrary, neither the existence of this Agreement nor the provisions hereof shall be construed or abrogate either Partner from its obligations of confidentiality and nonuse with respect to Confidential Technical Information as provided in the various license agreements and the Confidentiality Agreements between the Partners and the Partnership. Further, all rights to technical information, inventions and patents under or with respect to this Partnership shall be considered for all purposes as being developed under the various research agreements between the Partners and their Affiliates and the Partnership and shall be subject to the provisions thereof.

8.2 Business Information. Except for such data and information as the Management Committee may designate in writing as being non-confidential, all information relating to the business activities contemplated herein received by any Partner or its Affiliate from another Partner or its Affiliate shall be treated in a confidential manner which shall require the recipient of such information to treat it with the same degree of confidentiality it affords its own information of a similar type. Subject to the preceding sentence, should such information become public information or otherwise generally available to the public through no act or fault of the recipient, the recipient shall neither confirm nor deny the source or authenticity of such information. The obligations of this Article 8.2 shall be binding upon the recipient of such business information for a period of ten years after receipt of such information and this obligation shall survive any termination or assignment of this Agreement.

Article IX

Management Committee

9.1 Responsibilities and Authority. Each Partner shall have an equal voice in the management of the Partnership and shall act (except where provided herein to the contrary) through the Management Committee. The Management Committee shall establish general policies and procedures for the Partnership and shall direct and make provision for the implementation of those policies and procedures in the conduct of the day-to-day operations of the Partnership’s business. In furtherance and not by way of limitation with respect to the foregoing, except as provided in Article 9.2 (a), the Management Committee shall perform the following specific duties.

(a) Subject to the provisions of Article 9.7, appoint and discharge officers of the Partnership.

(b) Adopt, and may revise from time to time in whole or in part, appropriate delegations of authority for officers, agents, and any other representatives.

(c) Review the performance of the officers of the Partnership.

(d) Adopt, and may revise from time to time in whole or in part, and shall monitor compliance with (i) guidelines under which funds of the Partnership may be committed, (ii) resolutions dealing with banking matters and (iii) any other necessary financial business of the Partnership.

(e) Adopt and review and revise, from time to time, but at least annually, a business plan, which may include objectives, strategies, programs, operating and capital budgets and shall provide the framework for the management of the business and affairs of the Partnership and the implementation of this Agreement and make provision for the implementation of said business plan. For annual planning purposes, such plan shall also include forecasts of technical support activities and technical manpower requirements to be provided by each Partner as well as services to be provided by each Partner.

(f) Make distributions, subject to the provisions of Article XIII hereof.

(g) Exercise all rights, privileges, and options, if and to the extent provided, under insurance policies purchased and maintained by the Partnership pursuant to Article 21.1; and have the authority to settle or compromise any claim against the Partnership not covered by insurance.

(h) Except as provided herein to the contrary, the Management Committee shall have the authority to bind the Partnership in the conduct of the Partnership’s business and affairs.

(i) Review all legal actions against the Partnership, retain counsel and otherwise arrange for the defense thereof and approve settlement of any such actions by payment not in excess of $25,000 by the Partnership.

(j) Establish one or more committees, for such purposes and with such duties as the Management Committee shall designate and appoint the members of each such committee from among the members of the Management Committee and/or the officers of the Partnership and/or such other persons whose services on such committee shall be considered to be beneficial to the Partnership; provided that if any members of the Management Committee shall be appointed to such a committee they shall be appointed in equal numbers from the members of the Management appointed by each Partner.

(k) File for all necessary governmental permits and approvals and commence and arrange for participation in any administrative proceeding, hearing or action appropriate to conduct of the usual business of the Partnership.

(1) Do, or cause to be done, any and all things and acts and execute, or cause to be executed, any and all documents, contracts, evidences of indebtedness, security agreements, financing statement or other instruments, or purchase performance bonds, necessary or appropriate to the conduct of the usual business of the Partnership in the ordinary course and to effectuate fully the purpose of the Partnership as expressed in this Agreement.

(m) Resolve any disputes which may arise under any agreement executed between the Partnership and a Partner not acting in its capacity as a Partner.

9.2 Restrictions on Authority of Officers and Management Committee.

(a) Except as otherwise mutually agreed or as set forth in Article 9.1 and 9.11 hereof, neither the Management Committee nor any of the individual members of the Management Committee or officers of the Partnership, unless otherwise authorized in writing by the Partners, shall have authority in the name and on behalf of the Partnership to:

(i) Do any act in contravention of this Agreement or execute any agreement between the Partnership and a Partner;

(ii) Possess or use Partnership property or assign any right of the Partnership property for other than a Partnership purpose

(iii) Make, execute, or deliver any general assignment for the benefit of creditors, or any bond, guaranty, indemnity bond or surety bond;

(iv) Assign, transfer, pledge, compromise, or release any claim of the Partnership for amounts equal to or exceeding $25,000, except for full payment, or arbitrate or consent to the arbitration of any of its disputes or controversies;

(v) Make, execute, or deliver any deed, long-term ground lease or contract to sell all or substantially all of the Partnership property or to sell or dispose of any assets of the Partnership which have an original book value in excess of $250,000 other than as provided in Articles IV, V and VI hereof;

(vi) Confess a judgment;

(vii) Make, execute, or deliver on behalf of the Partnership any mortgage, deed of trust, or accommodation paper or accommodation endorsement other than as provided in Article V hereof;

(viii) Delete, waive or otherwise amend or change this Agreement;

(ix) Approve or authorize any capital project or expenditure in excess of $300,000 in the case of the Management Committee or $75,000 in the case of the officers;

(x) Commence any legal action or lawsuit for damages or equitable relief; or

(xi) Create any personal liability for any Partner other than that personal liability to which any Partner may have previously agreed to in writing.

(b) Neither Partner shall represent or act for or purport to represent or act for or otherwise bind the Partnership, its affairs, business or assets, without the prior written approval of the other Partner except to the extent authorized by the provisions of this Agreement, any agreement between the Partners or any agreements between the Partnership and any one of the Partners.

9.3 Standard of Care. Each member of the Management Committee shall act in the same manner as would a reasonable business person in similar circumstances using sound business judgment.

9.4 Membership. The Management Committee shall initially be composed of six (6) members with three (3) members being designated by each Partner. The composition of the Management Committee may be increased at any time by the mutual agreement of the Partners. Each Partner shall designate one of its members on the Management Committee as its Management Representative. The Partners shall notify each other of their designees, which may be changed at any time. The initial members of the Management Committee shall be designated on the Agreement Date.

9.5 Voting Procedures. Each Partner shall have one vote which shall be cast by its designated Management Representative or in his absence by his designee. The Management Committee shall act only on the basis of unanimous vote of both Partner’s Management Representative and/or designees. In the event that the Management Committee, after a meeting duly called and convened, is unable to reach a consensus on a matter (including, but not limited to, matters arising under Article 9.1 (m) hereof) within thirty (30) days, the Secretary of the Management Committee shall notify the Partners, and the Partners shall meet and resolve the matter within fourteen (14) days of the date notice is given.

9.6 Quorum. The quorum for Management Committee meetings shall be two (2) members, with each Partner being represented by not less than (1) member appointed by it. In the event there is no quorum for two (2) consecutive meetings, the Partners shall meet within thirty (30) days.

9.7 Officers. Except as otherwise mutually agreed by the Partners:

(a) The Management Committee shall appoint two General Managers of the Partnership, one from each Partner. For the duration of the first full calendar year of the Partnership, PQ shall designate the Chairman of the Management Committee who will preside at all meetings of the Management Committee. This responsibility shall alternate between SPACE and PQ each succeeding calendar year.

The Partner not designating the Chairman shall designate the Vice Chairman of the Management Committee who in the absence of the Chairman shall act as Chairman of the Management Committee.

(b) Upon the formation of the Partnership the areas of primary responsibility for the two General Managers shall be as set out below. The Management Committee may expand or change such responsibilities as it deems necessary. In all other respects, the two General Managers shall be deemed to have equal and coextensive authority. They shall confer on all items of major importance and business planning.

| (1) | The General Manager designated by PQ shall have the primary responsibility for all plant operations and Zeolite technology and marketing of Zeolites. | |

| (2) | The General Manager designated by SPACE shall have the primary responsibility for all Zeolite-containing Catalyst technology and marketing. | |

(c) The Secretary of the Partnership who shall also be Secretary to the Management Committee shall be appointed by the Management Committee from such persons recommended by SPACE. The Secretary shall attend to the giving of notice of all meetings of the Management Committee, shall keep minutes of all proceedings at meetings of the Management Committee and all meetings of committees thereof. In the absence of the Secretary, such person as shall be designated by the Chairman shall perform his duties.

(d) The Treasurer/Comptroller shall be appointed by the Management Committee from such persons recommended by PQ. The Treasurer/Comptroller shall be the principal accounting officer of the Partnership, be in charge of the accounting books and records of the Partnership, have the care and custody of all the funds of the Partnership and be Chairman of the accounting committee created under Article 9.1(j) hereof. However, at any time either Partner may undertake an audit in accordance with Section 11.7 hereof.

(e) The Management Committee may appoint such other officers as it may from time to time deem advisable. All officers of the Partnership must be employees of a Partner or a wholly owned subsidiary of a Partner. Subject to the restrictions set forth in this Article 9.7, a person may hold more than one office except no one person may hold the office of Secretary if he also holds the office of Chairman or Vice Chairman acting as Chairman of the Management Committee.

(f) Except as provided herein to the contrary all officers appointed by the Management Committee shall hold office at the pleasure of the Management Committee and may be removed at any time either with or without cause, by the Management Committee.

9.8 Meetings.

(a) The Management Committee shall have an initial meeting on the formation date of the Partnership and shall meet thereafter at least once each calendar quarter. The quarterly meetings shall be called by the Chairman or by at least two members and may be at the Kansas City Plant, the respective offices of the Partners or any other mutually acceptable location. Other meetings may be called by the Chairman or by all of the members appointed by one of the Partners and may be held at the Kansas City Plant, the respective offices of the Partners or any other mutually acceptable location. The Secretary shall give written notice of any meetings by letter, telex, cable or telegram to each member at least seven (7) days in advance of the date of the meeting.

(b) Any member may waive notice of any meeting of the Management Committee by written waiver filed with the Secretary either before or after the meeting, and attendance at any meeting shall constitute waiver of notice.

(c) Any member may participate in Management Committee meeting by means of conference telephone, television transmitted image with audio or other similar communications equipment by means of which all persons participating in the meeting can hear each other, and any member so participating shall be deemed to be present at the meeting in person.

(d) The minutes of all Management Committee meetings shall be approved by the Chairman and Vice-Chairman and placed in an official minute book.

9.9 Action Without Meeting. Any action to be taken by the Management Committee may, subject to the restrictions on the Management Committee’s powers contained in Section 9.2, be taken without a meeting if a consent in writing (or separate counterparts thereof), setting forth the action so taken, and the date it shall be effective, shall be signed by both Management Representatives and such consent shall have the same force and effect as an action duly taken by the Management Committee at a meeting. Any such signed consent(s) shall be placed in the official minute book.

9.10 Expenses. Members of the Management Committee and officers of the Partnership shall receive no remuneration from the Partnership in connection with their duties on the Management Committee or as officers of the Partnership, as the case may be, nor shall the Partnership reimburse any expenses of members of the Management Committee or officers of the Partnership incurred in connection with their respective duties on the Partnership Committee or as officers of the Partnership.

9.11 Execution of Partnership Agreements. Notwithstanding any provision hereof to the contrary, all agreements entered into by the Partnership shall be upon prior authorization of the Management Committee and shall be executed on behalf of the Partnership by a General Manager, or other duly authorized representative, except,

(a) Any agreement to be entered into between the Partnership and a Partner or a Partner’s Affiliate shall be executed on behalf of the Partnership by the General Manager or other duly authorized representative of the Partner not a party to the Agreement;

(b) Any agreement between the Partnership and a public utility is authorized and may be executed by a General Manager of the Partnership or such other officers or representative so designated by the Management Committee; and

(c) Any agreement between the Partnership and any third party other than a public utility is authorized and may be executed by a General Manager of the Partnership or such other officer or representative designated by the Management Committee provided such agreement is for a duration of one year or less and involves payments of one party to the other of $50,000 or less.

9.12 Audits under Agreements with a Partner. Notwithstanding any provision hereof to the contrary, with respect to all agreements between the Partnership and a Partner, the General Manager of the Partner not a party to such an agreement shall have the authority acting alone to cause the Partnership to exercise any and all rights the Partnership might have with respect to audits or financial review under such an agreement and to act on behalf of the Partnership with respect thereto.

9.13 Administration of Agreements with a Partner. Notwithstanding any provision hereof to the contrary, with respect to all agreements between the Partnership and a Partner, the Partner not a party to such an agreement shall select the person responsible for the administration of such agreement by the Partnership provided such person shall be reasonably acceptable to the other Partner.

Article X

Ownership Percentage

10.1 Ownership Percentage. The Partners shall each have fifty percent (50%) ownership in the Partnership.

Article XI

Fiscal Matters

11.1 Fiscal Year. The fiscal year of the Partnership shall be the calendar year. The Partnership’s first fiscal year shall end December 31, 1988.

11.2 Location of Books of Account. The books of account for the Partnership shall be kept and maintained by the Partnership in Valley Forge, Pennsylvania. PQ will be responsible for the maintenance of the Partnership accounting. PQ shall be responsible for maintaining the accounting records associated with the operating and maintenance of the Zeolite/Catalyst Plant.

11.3 Books and Records. The books of account shall be maintained on an accrual basis in accordance with generally accepted accounting principles consistently applied. The books and records shall include the designation and identification of any property in which the Partnership owns a beneficial interest; such records shall also include, but shall not be limited to, the ownership of property (real, personal, and mixed), as well as any property in which the Partnership owns an interest and the title to which has been recorded or is maintained in the name of one of the Partners without designation of the Partnership. Book depreciation with respect to the investment in the Plant facilities shall be based on a useful life of said investment based on good business practice and determined by the Management Committee.

11.4 Summary Billings. Within fifteen (15) business days after the end of each calendar month, each Partner shall issue summary billings to the Partnership at the location set forth in Article 11.2 hereof, covering billable items originating on the books of that Partner during said month. A copy of such summary billing will be directed to the other

Partner’s designee at the discretion of the Management Committee. Summary billings shall be in addition to and include any individual billings sent to the Partnership consistent with the normal billing procedures of the Partners, and shall follow the numerations, terms and reporting requirements set out in the various agreements between the Partnership and the Partners including but not limited to the Agreement identified in the List of Exhibits attached hereto.

11.5 Determination of Net Income or Loss. Within twenty-five (25) days after the end of each calendar month, the Partnership shall determine the Partnership’s net income or loss (revenue less expenses, including book depreciation) and before the last day of such calendar month the Partnership shall cause to be prepared and delivered to each Partner an unaudited profit and loss statement, a balance sheet and a statement of each Partner’s Capital Account as of the end of each calendar month.

11.6 Annual Financial Statements. No later than 90 days following the end of each fiscal year of the Partnership, the Management Committee shall cause to be prepared and delivered to each Partner a profit and loss statement and a statement of changes in financial position for such fiscal year, a balance sheet and a statement of each Partner’s Capital Account as of the end of such fiscal year and such financial statements will be audited and certified.

11.7 Inspection of Facilities and Records; Audits.

(a) Unless otherwise agreed by the Partnership Committee, the Partnership shall retain a mutually acceptable national accounting firm as independent auditors of the Partnership to conduct an examination of the financial statements of the Partnership as of the close of business of each fiscal year of the Partnership and to furnish its opinion on the balance sheet of the Partnership as of such date and the related statement of income and Partners’ Capital Accounts for the fiscal period then ended. If such opinion is qualified, the Management Committee shall promptly meet to take whatever action is necessary or appropriate. A copy of the audited annual financial statements shall be furnished to each Partner within 95 days after the end of each fiscal year.

(b) Additionally each Partner shall have the right at all reasonable times during usual business hours to inspect the facilities of the Partnership except as restricted in Exhibit 6 and to examine the books of account and records of the Partnership. Such right may be exercised through any agent, employee or representative of such Partner designated by it, or by an independent public accountant. The Partner conducting such examination or inspection shall bear all costs and expenses incurred in connection therewith. No exceptions to the books and records of the Partnership shall be taken for any fiscal year unless taken in writing within twenty-four (24) months following the end of such fiscal year. Such audits shall be conducted in such a manner so as to cause minimum inconvenience to the Partnership.

11.8 Banking Matters. Funds of the Partnership shall be deposited in such banks or other depositories as shall be designated by the Management Committee. The Management Committee shall notify the Partners of the particular accounts into which all contributions or payments of the Partners are to be made on or prior to the due date of such contributions or payments. Checks or other orders of withdrawal shall be drawn upon the Partnership and shall be signed by such officers or authorized representatives as are designated by, and pursuant to the procedures and requirements set by, the Management Committee. Prior to the Agreement Date, SPACE or PQ shall have caused to be opened a bank account in the name of the Partnership for the purpose of receiving the initial cash contributions of the Partners.

11.9 Tax Matters.

(a) The Partnership shall file all appropriate federal, state, and local tax returns and make all appropriate elections for such returns. Pursuant to the terms of the services agreement between PQ and the Partnership, PQ shall prepare or have prepared all such necessary tax returns and defend them upon audit and handle other tax matters, except as provided in the Lease Agreement, whether or not such other matters may require preparation of formal tax returns. Federal and state income tax returns and any other tax returns (except ad valorem returns, sales and use tax returns and other related excise tax returns) designated by the Management Committee and so prepared by PQ shall be mailed by PQ to the members of the Management Committee in sufficient time so that each member of the Management Committee will receive a copy of such tax return at least fifteen (15) days prior to the date on which it is due. No later than seven (7) days prior to the date on which the return is due, SPACE shall notify PQ of any objections or questions to the proposed tax return.

Such notification may be oral or written. Thereupon, PQ shall attempt to resolve the differences. If the differences are not resolved by five (5) days prior to the date upon which the return is due, the Management Committee shall meet to resolve the matter. If SPACE fails to notify PQ of any objections by seven (7) days prior to the date on which the return is due, the return may be filed in the form submitted to members of the Management Committee. The Management Committee must approve all proposed Partnership income and franchise tax ruling requests before their submission to the proper authorities.

(b) PQ is designated the tax matters partner (“TMP”) as defined in Section 623l(a) (7) of the Internal Revenue Code. The designation as TMP shall be effective only for operations conducted by the Partners pursuant to this Partnership Agreement. The TMP shall not bind SPACE to any agreement, extend the Statute of Limitations, settle any outstanding audit, litigate any unsettled audit issues, choose a forum for litigation, appeal an adverse lower court decision, file a Request for Administrative Adjustment, make any election with respect to federal, state or local income tax law, or take any other actions affecting tax matters without

obtaining the prior written concurrence of SPACE. The TMP shall inform SPACE, on a timely basis, of any tax matters, including, but not limited to, progress of any Internal Revenue Service audit, receipt of a Revenue Agent’s Report, and notice of an Appeals Conference.

(c) The Management Committee is granted authority and shall make elections under the Internal Revenue Code of 1986 (“Code”), as amended, and the Treasury Regulations thereunder in the first and subsequent years’ federal (and, if applicable, state and local) partnership tax returns with respect to the Partnership’s activities as follows:

(i) The accrual method of accounting shall be adopted and such accounting shall be maintained on a calendar year basis.

(ii) A system of internal accounting controls shall be devised and maintained in conformity with good management practice including the provisions of the Foreign Corrupt Practices Act.

(iii) Operating supplies and parts shall be stated at average cost which represents invoice for production cost for new items.

(iv) Fixed assets, if any, shall be carried at cost.

(v) The Partnership shall, in accounting for tax depreciation or amortization of depreciable or amortizable property, use the depreciation or amortization methods and the depreciable lives which will maximize tax benefits available hereunder while taking maximum advantage of any available tax credits or the Investment Tax incentive programs.

(vi) All other elections shall be determined by the Management Committee.