Attached files

| file | filename |

|---|---|

| 8-K - 8-K - CUMULUS MEDIA INC | cmls20170630investorpresen.htm |

August 14, 2017

CUMULUS MEDIA INC.

2017 Second Quarter

Earnings Call Presentation

Safe Harbor Statement

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this presentation may constitute “forward-looking” statements within the meaning of the Private Securities Litigation Reform

Act of 1995 and other federal securities laws. Such statements are statements other than historical fact and relate to our intent, belief or current

expectations, primarily with respect to our future operating, financial and strategic performance. Any such forward-looking statements are not

guarantees of future performance and involve risks and uncertainties. Actual results may differ from those contained in or implied by the forward-

looking statements as a result of various factors including, but not limited to, risks and uncertainties relating to the need for additional funds to

service our debt and to execute our business strategy; our ability to access borrowings under our revolving credit facility; our ability from time to

time to renew one or more of our broadcast licenses; changes in interest rates; changes in the fair value of our investments; the timing of, and our

ability to complete, any acquisitions or dispositions pending from time to time; costs and synergies resulting from the integration of any completed

acquisitions; our ability to effectively manage costs; our ability to effectively drive and manage growth; the popularity of radio as a broadcasting and

advertising medium; changing consumer tastes; the impact of general economic conditions in the United States or in specific markets in which we

currently do business; industry conditions, including existing competition and future competitive technologies and cancellation, disruptions or

postponements of advertising schedules in response to national or world events; our ability to generate revenues from new sources, including local

commerce and technology-based initiatives; the impact of regulatory rules or proceedings that may affect our business or any acquisitions; our

ability to continue regain compliance with the listing standards for our Class A common stock to continue to be listed for trading on the NASDAQ

stock market; the write-off of a material portion of the fair value of our FCC broadcast licenses and goodwill from time to time; or other risk factors

described from time to time in our filings with the Securities and Exchange Commission, including our Form 10-K for the year ended December 31,

2016 (the “2016 Form 10-K”) and any subsequent filings. Many of these risks and uncertainties are beyond our control, and the unexpected

occurrence or failure to occur of any such events or matters could significantly alter the actual results of our operations or financial condition.

Cumulus Media Inc. assumes no responsibility to update any forward-looking statement as a result of new information, future events or otherwise.

CUMULUS MEDIA INC.

2017 Second Quarter

Earnings Call Presentation

• Second quarter results provide further

evidence of financial inflection point

• Net revenue increased year-over-year by

1.2%, despite tough market

• Adjusted EBITDA grew 6.7%, for the first

time in over three years(1)

• Share gains achieved in every major ad

channel, including Westwood One

• Company currently pacing approximately flat

for Q3, excluding political

Key

Highlights

(1) Adjusted EBITDA still positive even when adjusting

for items affecting comparability in Q2 2016

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

• PPM ratings share growth continued,

marking seven straight quarters of

outperformance

• PPM ratings share growth converted

into revenue share growth in Q2

• Following two quarters of growth, 4-

Book ratings share declined in Spring

2017, driven entirely by six of 27

markets

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

• Be a LEADer has generated nearly

500 new advertisers and millions of

incremental revenue

• Positive sentiment facilitating

recruitment of high-quality talent

• Survey statistics remain compelling –

92% are proud to work at Cumulus

and 91% believe Cumulus is

changing for the better

• Turnover statistics continue to beat

internal goals

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

• Reduced expenses year-over-year

while still funding critical series of

investments

• For the full year, expect contractual

escalators will be meaningfully

mitigated

• Upcoming systems overhaul and

establishment of formal revenue

management function will provide

future opportunity

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

1. Talent

2. Training & Tools

3. Sales Analytics

4. Platform Growth

Products & Tactics

5. Digital

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

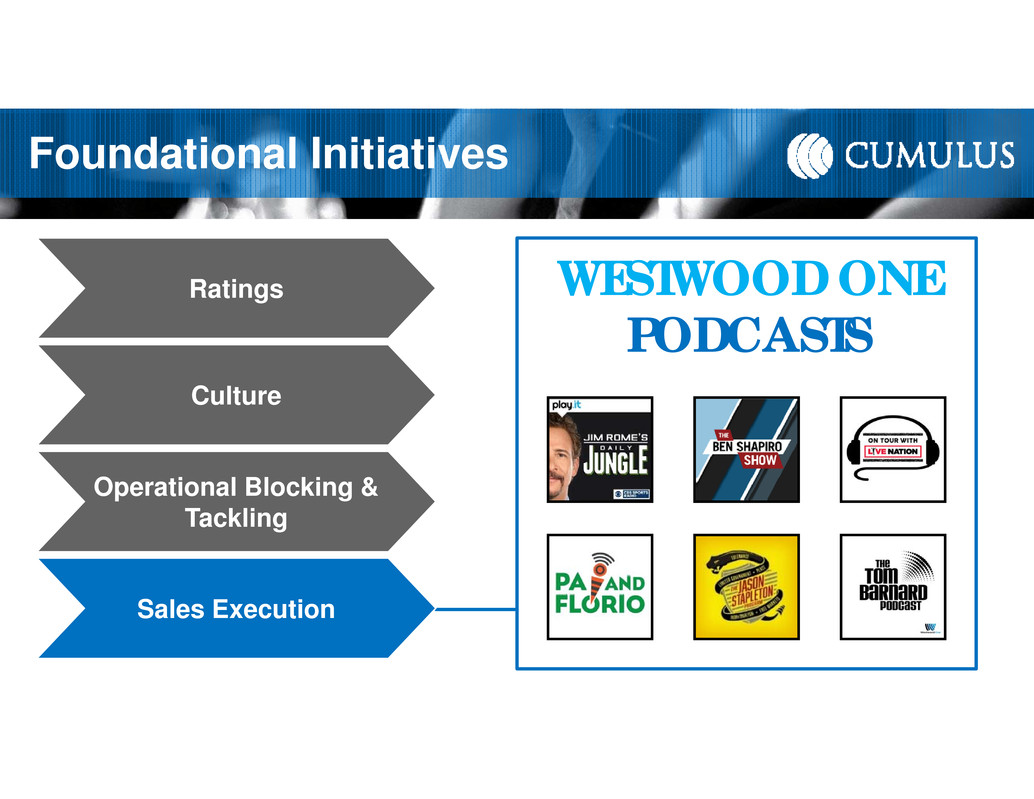

Foundational Initiatives

Ratings

Culture

Operational Blocking &

Tackling

Sales Execution

WESTWOOD ONE

PODCASTS

• Revenue growth of 6.1% year-over-year

• Adjusted EBITDA growth of 31.0% year-

over-year

• Benefit of a single leader driving strategy

and execution across the platform

• More mature go-to-market strategy and new

business development effort

• Fine-tuned stable of content partnerships

focused on our key strengths

Key

Highlights

• Over-levered capital structure must be addressed to achieve the full

potential of our assets

• Exploring all available options with a focus on maintaining the

momentum of the turnaround effort

Continued focus on our debt level...

Second Quarter 2017

Financial Results

See Press Release and 10-Q for More Detail

www.cumulus.com/investors

APPENDIX:

Financial Summary &

Reconciliation to Non-GAAP Term

Non-GAAP Financial Measure

Definition of Adjusted EBITDA

Adjusted EBITDA is the financial metric utilized by management to analyze the cash flow generated by our business. This measure isolates the

amount of income generated by our core operations before the incurrence of corporate expenses. Management also uses this measure to

determine the contribution of our core operations to the funding of our corporate resources utilized to manage our operations and our non-operating

expenses including debt service. In addition, Adjusted EBITDA is a key metric for purposes of calculating and determining our compliance with

certain covenants contained in our credit facility. We define Adjusted EBITDA as net income (loss) before any non-operating expenses, including

depreciation and amortization, stock-based compensation expense, gain or loss on sale of assets or stations (if any), gain or loss on derivative

instruments (if any), impairment of assets (if any), acquisition-related and restructuring costs (if any) and franchise and state taxes. In deriving this

measure, management excludes depreciation, amortization, and stock-based compensation expense, as these do not represent cash payments for

activities directly related to our core operations. Management excludes any gain or loss on the exchange or sale of any assets or stations and any

gain or loss on derivative instruments as they do not represent cash transactions nor are they associated with core operations. Expenses relating

to acquisitions and restructuring costs are also excluded from the calculation of Adjusted EBITDA as they are not directly related to our core

operations. Management excludes any non-cash costs associated with impairment of assets as they do not require a cash outlay. Management

believes that Adjusted EBITDA, although not a measure that is calculated in accordance with GAAP, nevertheless is commonly employed by the

investment community as a measure for determining the market value of media companies. Management has also observed that Adjusted EBITDA

is routinely employed to evaluate and negotiate the potential purchase price for media companies and is a key metric for purposes of calculating

and determining compliance with certain covenants in our credit facility. Given the relevance to our overall value, management believes that

investors consider the metric to be extremely useful.

Adjusted EBITDA should not be considered in isolation or as a substitute for net income, operating income, cash flows from operating activities or

any other measure for determining the Company’s operating performance or liquidity that is calculated in accordance with GAAP. In addition,

Adjusted EBITDA may be defined or calculated differently by other companies and comparability may be limited.

2nd Quarter 2017 Adjusted EBITDA

Reconciliation Table

The following table reconciles net income (loss), the most directly comparable financial measure calculated and presented in accordance with

GAAP, to Adjusted EBITDA for the three months ended June 31, 2017 (dollars in thousands):

Three Months Ended June 30, 2017

Radio Station

Group Westwood One

Corporate

and Other Consolidated

GAAP net income (loss) $ 46,803 $ 10,976 $ (52,107) $ 5,672

Income tax expense — — 7,234 7,234

Non-operating (income) expense, including net

interest expense (1) 133

34,288 34,420

Local marketing agreement fees 2,713 — — 2,713

Depreciation and amortization 10,251 5,449 420 16,120

Stock-based compensation expense — — 530 530

Loss on sale of assets or stations 104 — — 104

Acquisition-related and restructuring costs — 384 83 467

Franchise and state taxes — — 140 140

Adjusted EBITDA $ 59,870 $ 16,942 $ (9,412) $ 67,400

2nd Quarter 2016 Adjusted EBITDA

Reconciliation Table

The following table reconciles net income (loss), the most directly comparable financial measure calculated and presented in accordance with

GAAP, to Adjusted EBITDA for the three months ended June 31, 2016 (dollars in thousands):

Three Months Ended June 30, 2016

Radio Station

Group Westwood One

Corporate

and Other Consolidated

GAAP net income (loss) $ 46,405 $ 887 $ (46,226) $ 1,066

Income tax expense — — 1,249 1,249

Non-operating expense, including net interest

expense 17 63

34,270 34,350

Local marketing agreement fees 2,482 — — 2,482

Depreciation and amortization 13,538 8,894 537 22,969

Stock-based compensation expense — — 790 790

Gain on sale of assets or stations (3,121) — (25) (3,146)

Impairment of intangible assets — 1,816 — 1,816

Acquisition-related and restructuring costs — 1,268 153 1,421

Franchise and state taxes — — 183 183

Adjusted EBITDA $ 59,321 $ 12,928 $ (9,069) $ 63,180