Attached files

| file | filename |

|---|---|

| EX-32.2 - Verb Technology Company, Inc. | ex32-2.htm |

| EX-32.1 - Verb Technology Company, Inc. | ex32-1.htm |

| EX-31.2 - Verb Technology Company, Inc. | ex31-2.htm |

| EX-31.1 - Verb Technology Company, Inc. | ex31-1.htm |

| 10-Q - Verb Technology Company, Inc. | form10-q.htm |

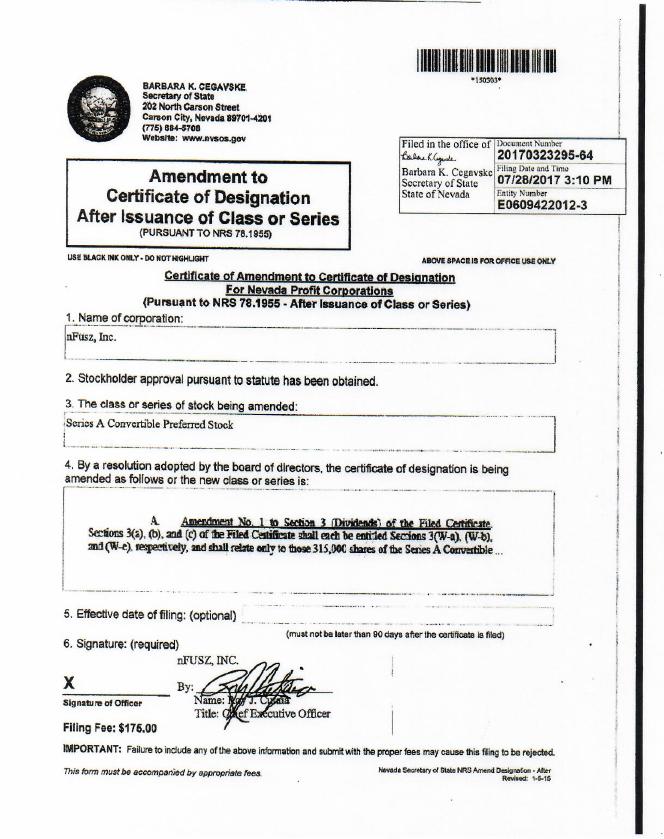

Continued AMENDED TERMS OF SERIES A CONVERTIBLE PREFERRED STOCK

Preferred Stock that are issued on or around February 13, 2017.

B. Additional Sections to Section 3 (Dividends) of the Filed Certificate. Sections 3(X-a), (X-b), and (X-c), respectively, and shall relate only to those 52,500 shares of the Series A Convertible Preferred Stock that were issued on or around July 7, 2017.

(X-a) From and after July 7, 2017 (the “Initial Issuance Date”), each holder of a Preferred Share (each, a “Holder” and collectively, the “Holders”) shall be entitled to receive dividends (the “Dividends”), which Dividends shall be paid by the Company out of funds legally available therefor, payable, subject to the conditions and other terms hereof, in shares of Common Stock or cash on the Stated Value (as defined below) of such Preferred Share at the Dividend Rate (as defined below), which shall be cumulative and shall continue to accrue whether or not declared and whether or not in any fiscal year there shall be net profits or surplus available for the payment of dividends in such fiscal year. Dividends on the Preferred Shares shall commence accumulating on the Initial Issuance Date and shall be computed on the basis of a 365-day year and actual days elapsed. Dividends shall be payable on the following dates (each, a “Dividend Date”): (1) the first (1st) Dividend Date being October 5, 2017; and (ii) and each subsequent Dividend Date shall be solely in connection with and concurrently with Installment Redemption Payments. Notwithstanding anything to the contrary contained herein, unless otherwise agreed to by the Company and the Holders, the Company shall pay Cash Dividends (as defined below) to the Holders on the first (1st) Dividend Date.

(X-b) Dividends shall be payable on each Dividend Date, to the Holders of record of the Preferred Shares on the applicable Dividend Date, in shares of Common Stock (the “Dividend Shares”) so long as there has been no Equity Conditions Failure and so long as the delivery of Dividend Shares would not violate the provisions of Section 4; provided, however, that the Company may, at its option, pay Dividends on any Dividend Date in cash (the “Cash Dividends”) or in a combination of Cash Dividends and, so long as there has been no Equity Conditions Failure, Dividend Shares. The Company shall deliver a written notice (each, a “Dividend Election Notice”) to each Holder two (2) Trading Days prior to each Dividend Date (the date such notice is delivered to all of the Holders, the “Dividend Notice Date”), which notice (1) notifies the then-record Holders that the Company has elected to pay the accrued Dividends as Cash Dividends, Dividend Shares, or as a combination of Dividend Shares and Cash Dividends and, in any event, specifies the amount of the to-be-paid Dividends, if any, as Cash Dividends and the amount of the to-be-paid Dividends, if any, as Dividend Shares and (2) certifies that there has been no Equity Conditions Failure as of such time, if the Company has elected to pay any portion of the to-be-paid Dividends as Dividend Shares. Notwithstanding anything herein to the contrary, if no Equity Conditions Failure has occurred as of the Dividend Notice Date but an Equity Conditions Failure occurs at any time prior to the date on which a to-be-paid Dividend Shares are to be issued, (A) the Company shall provide each Holder with a subsequent notice to that effect and (B) unless such Holder waives the Equity Conditions Failure, such to-be-paid Dividends shall be paid as Cash Dividends. Dividends that are to be paid to each Holder in Dividend Shares shall be paid in a number of fully paid and non-assessable shares (rounded to the nearest whole share, with 0.50 or more of a share being rounded up to the nearest whole share and 0.49 or less of a share being rounded down to the nearest whole share) of Common Stock equal to the quotient of (1) the amount of Dividends payable to such Holder on such Dividend Date less any Cash Dividends paid and (2) the lesser of (i) the Redemption Price in effect on the applicable Dividend Date, and (ii) the VWAP on the Trading Day immediately preceding the Dividend Date.

(X-c) When any Dividend Shares are to be paid to any Holder, the Company shall (i) (A) provided that (x) the Company’s transfer agent (the “Transfer Agent”) is participating in the Depository Trust Company (“DTC”) Fast Automated Securities Transfer Program and (y) either a Registration Statement for the resale by the applicable Holder of the Dividend Shares or such Dividend Shares to be so issued are otherwise eligible for resale pursuant to Rule 144 (as defined in the Securities Purchase Agreement), credit such aggregate number of Dividend Shares to which such Holder shall be entitled to such Holder’s or its designee’s balance account with DTC through its Deposit and Withdrawal at Custodian system, or (B) if either of the immediately preceding clauses (x) or (y) is not satisfied, issue and deliver on the applicable Dividend Date, to the address set forth in the register maintained by the Company for such purpose pursuant to the Securities Purchase Agreement or to such address as specified by such Holder in writing to the Company at least two (2) Business Days prior to the applicable Dividend Date, a certificate, registered in the name of such Holder or its designee, for the number of Dividend Shares to which such Holder shall be entitled and (ii) with respect to each such payment of a Dividend, pay to such Holder, in cash by wire transfer of immediately available funds, the amount of any Cash Dividend. The Company shall pay any and all taxes that may be payable with respect to the issuance and delivery of Dividend Shares.

C. Additional Sections to Section 3 (Dividends) of the Filed Certificate. Sections 3(Y-a), (Y-b), and (Y-c), respectively, and shall relate only to the first 131,250 shares of the Series A Convertible Preferred Stock that are sold and issued subsequently to the date of this Amendment No 1.

(Y-a) From and after July 28, 2017 (the “Initial Issuance Date”), each holder of a Preferred Share (each, a “Holder” and collectively, the “Holders”) shall be entitled to receive dividends (the “Dividends”), which Dividends shall be paid by the Company out of funds legally available therefor, payable, subject to the conditions and other terms hereof, in shares of Common Stock or cash on the Stated Value (as defined below) of such Preferred Share at the Dividend Rate (as defined below), which shall be cumulative and shall continue to accrue whether or not declared and whether or not in any fiscal year there shall be net profits or surplus available for the payment of dividends in such fiscal year. Dividends on the Preferred Shares shall commence accumulating on the Initial Issuance Date and shall be computed on the basis of a 365-day year and actual days elapsed. Dividends shall be payable on the following dates (each, a “Dividend Date”): (1) the first (1st) Dividend Date being October 5, 2017; and (ii) and each subsequent Dividend Date shall be solely in connection with and concurrently with Installment Redemption Payments. Notwithstanding anything to the contrary contained herein, unless otherwise agreed to by the Company and the Holders, the Company shall pay Cash Dividends (as defined below) to the Holders on the first (1st) Dividend Date.

| 2 |

(Y-b) Dividends shall be payable on each Dividend Date, to the Holders of record of the Preferred Shares on the applicable Dividend Date, in shares of Common Stock (the “Dividend Shares”) so long as there has been no Equity Conditions Failure and so long as the delivery of Dividend Shares would not violate the provisions of Section 4; provided, however, that the Company may, at its option, pay Dividends on any Dividend Date in cash (the “Cash Dividends”) or in a combination of Cash Dividends and, so long as there has been no Equity Conditions Failure, Dividend Shares. The Company shall deliver a written notice (each, a “Dividend Election Notice”) to each Holder two (2) Trading Days prior to each Dividend Date (the date such notice is delivered to all of the Holders, the “Dividend Notice Date”), which notice (1) notifies the then-record Holders that the Company has elected to pay the accrued Dividends as Cash Dividends, Dividend Shares, or as a combination of Dividend Shares and Cash Dividends and, in any event, specifies the amount of the to-be-paid Dividends, if any, as Cash Dividends and the amount of the to-be-paid Dividends, if any, as Dividend Shares and (2) certifies that there has been no Equity Conditions Failure as of such time, if the Company has elected to pay any portion of the to-be-paid Dividends as Dividend Shares. Notwithstanding anything herein to the contrary, if no Equity Conditions Failure has occurred as of the Dividend Notice Date but an Equity Conditions Failure occurs at any time prior to the date on which a to-be-paid Dividend Shares are to be issued, (A) the Company shall provide each Holder with a subsequent notice to that effect and (B) unless such Holder waives the Equity Conditions Failure, such to-be-paid Dividends shall be paid as Cash Dividends. Dividends that are to be paid to each Holder in Dividend Shares shall be paid in a number of fully paid and non-assessable shares (rounded to the nearest whole share, with 0.50 or more of a share being rounded up to the nearest whole share and 0.49 or less of a share being rounded down to the nearest whole share) of Common Stock equal to the quotient of (1) the amount of Dividends payable to such Holder on such Dividend Date less any Cash Dividends paid and (2) the lesser of (i) the Redemption Price in effect on the applicable Dividend Date, and (ii) the VWAP on the Trading Day immediately preceding the Dividend Date.

(Y-c) When any Dividend Shares are to be paid to any Holder, the Company shall (i) (A) provided that (x) the Company’s transfer agent (the “Transfer Agent”) is participating in the Depository Trust Company (“DTC”) Fast Automated Securities Transfer Program and (y) either a Registration Statement for the resale by the applicable Holder of the Dividend Shares or such Dividend Shares to be so issued are otherwise eligible for resale pursuant to Rule 144 (as defined in the Securities Purchase Agreement), credit such aggregate number of Dividend Shares to which such Holder shall be entitled to such Holder’s or its designee’s balance account with DTC through its Deposit and Withdrawal at Custodian system, or (B) if either of the immediately preceding clauses (x) or (y) is not satisfied, issue and deliver on the applicable Dividend Date, to the address set forth in the register maintained by the Company for such purpose pursuant to the Securities Purchase Agreement or to such address as specified by such Holder in writing to the Company at least two (2) Business Days prior to the applicable Dividend Date, a certificate, registered in the name of such Holder or its designee, for the number of Dividend Shares to which such Holder shall be entitled and (ii) with respect to each such payment of a Dividend, pay to such Holder, in cash by wire transfer of immediately available funds, the amount of any Cash Dividend. The Company shall pay any and all taxes that may be payable with respect to the issuance and delivery of Dividend Shares.

| 3 |

D. Amendment No. 1 to Section 5 (Mandatory Installment Redemptions; Triggering Events) of the Filed Certificate. Section 5(b) of the Filed Certificate shall be entitled Section 5(W-b) and shall relate only to those 315,000 shares of the Series A Convertible Preferred Stock that are issued on or around February 13, 2017.

E. Additional Section to Section 5 (Mandatory Installment Redemptions; Triggering Events) of the Filed Certificate. Section 5(X-b) shall relate only to those 52,500 shares of the Series A Convertible Preferred Stock that were issued on or around July 7, 2017.

X-(b) Mandatory Installment Redemption.

(i) On January 8, 2018, the Company shall redeem the Fifty-two Thousand Five Hundred Dollars ($52,500) of Preferred Shares and any accrued but unpaid Dividends thereon on such date (the “Installment Redemption Payment”). The Installment Redemption Payment shall be made, at the Company’s option (subject to the Company’s compliance with the Equity Conditions (i.e., there is no Equity Conditions Failure)) in (i) cash at a price equal to the product of (A) the applicable Installment Redemption Payment multiplied by (B) the Redemption Premium or (ii) in shares of Common Stock (the “Installment Redemption Shares”) at a price equal to the product of (A) the applicable Installment Redemption Payment multiplied by (B) the Redemption Premium divided by the lesser of (x) the Redemption Price (subject to adjustment for any share dividend, share split, share combination, reclassification or similar transaction that proportionately decreases or increases the Common Stock) or (y) the VWAP during the period commencing five (5) Trading Days prior to the Installment Redemption Payment (the “Installment Redemption Price”). In the event that the Company elects to not pay the Installment Redemption Payment in cash and the Equity Conditions are not met (i.e., there is an Equity Conditions Failure), then each Holder shall be entitled to the redemption of the applicable Installment Redemption Payment at a price equal to the Triggering Event Redemption Price until such time that the Equity Conditions Failure is cured. For the avoidance of doubt, if Holder defers the receipt of Installment Redemption Shares due to the limitations set forth in Section 4, Holder shall remain entitled to such shares as originally calculated, i.e., any weekly VWAP increase subsequent to the Installment Redemption Payment shall not decrease the amount of shares due to the Holder. However, if Holder defers the receipt of Installment Redemption Shares due to the limitations set forth in Section 4 and any VWAP for the Installment Redemption Shares the VWAP during any Subsequent Installment Redemption Paymentdue to the limitations set forth in Section 4, then such portion shall be subject to the pricing period of the Subsequent Installment Redemption Payment.

| 4 |

In the event that the Installment Redemption Price from the immediately prior Installment Redemption Payment, if any, is greater than the VWAP for the Installment Redemption Payment, then the Company shall make one make-whole payment to such Holder in additional shares of Common Stock (“Installment Redemption Price Make-Whole Shares”) to compensate the Holder for the loss of value for the immediately previous Installment Redemption Payment. The number of Installment Redemption Price Make-Whole Shares shall be determined by the quotient of (A) the Installment Redemption Payment (including the Redemption Premium) divided by (B) the VWAP calculated during the Make-Whole VWAP Period (the “Make-Whole VWAP Price”); and then subtracting from such result the number of shares of Common Stock issued in connection with the Installment Redemption Payment. Such Installment Redemption Price Make-Whole Shares shall be delivered to Holder by no later than the next Installment Redemption Payment or, if such Installment Redemption Price Make-Whole Shares relates to the final Installment Redemption Payment, then Installment Redemption Price Make-Whole Shares shall be delivered to Holder by no later than three Trading Days following the last Trading Day of the relevant Make-Whole VWAP Period. For the avoidance of doubt, the Make-Whole VWAP Period for the final Installment Redemption Payment shall be the

The Company’s obligations to deliver the Installment Redemption Price Make-Whole Shares shall continue even though a Triggering Event has occurred (for the avoidance of doubt, in such event the Redemption Price that is utilized shall be the Triggering Event Redemption Price in lieu of the Installment Redemption Price). For the avoidance of doubt, if Holder defers the receipt of Installment Redemption Price Make-Whole Shares due to the limitations set forth in Section 4, Holder shall remain entitled to the amount of the Installment Redemption Price Make-Whole Shares as originally calculated, i.e., any weekly VWAP increase subsequent to the Make-Whole VWAP Period shall not decrease the amount of Installment Redemption Price Make-Whole Shares due to the Holder. However, if Holder defers the receipt of Installment Redemption Price Make-Whole Shares due to the limitations set forth in Section 4 and any VWAP for the the VWAP during any Subsequent Make-Whole Perioddue to the limitations set forth in Section 4, then such portion shall be subject to the pricing period of the Subsequent Make-Whole VWAP Period. Further, the Holder may demand the receipt of any portion of the Installment Redemption Price Make-Whole Shares prior to the receipt of the next Installment Redemption Payment. In such event, the Company shall deliver a separate Redemption Notice to the Holder with respect to the next Installment Redemption Payment.

| 5 |

(ii) On the Business Day immediately prior to each Installment Redemption Payment, the Company shall deliver to each Holder a written notice of each Installment Redemption Payment by facsimile or electronic mail in the form attached to the Filed Certificate as Exhibit II, which shall (A) certify that there has been no Equity Conditions Failure and (B) state the aggregate amount of the Preferred Shares which is being redeemed in such Installment Redemption Payment from such Holder and all of the other Holders of the Preferred Shares pursuant to this Section 5(b). Redemptions made pursuant to this Section 5(b) shall be made in accordance with Section 5(d).

(iii) Pursuant to the limitations set forth in Section 4, each Holder may defer all or any portion of any Installment Redemption Payment (including without limitation, any Installment Redemption Price Make-Whole Shares) and have it be paid simultaneously with any future Installment Redemption Payment(s) or on any other date. For the avoidance of doubt, if a Holder defers all or any portion of any Installment Redemption Payment (including without limitation, any Installment Redemption Price Make-Whole Shares) due to the limitations set forth in Section 4, such deferral alone shall not be deemed a Triggering Event.

F. Additional Section to Section 5 (Mandatory Installment Redemptions; Triggering Events) of the Filed Certificate. Section 5(Y-b) shall relate only to first 131,250 shares of the Series A Convertible Preferred Stock that are sold and issued subsequently to the date of this Amendment No. 1.

| 6 |

Y-(b) Mandatory Installment Redemption.

(i) Beginning on the earlier of the effectiveness of a Registration Statement and January 28, 2018, and so long as any Preferred Shares are outstanding, with respect to any Holder, the Company shall redeem Twenty-six Thousand Two Hundred Fifty Dollars ($26,250) of the outstanding amount of Preferred Shares and any accrued but unpaid Dividends thereon on the first (1st) Business Day of each week (each, an “Installment Redemption Payment”) for five (5) consecutive weeks. Each Installment Redemption Payment shall be made, at the Company’s option (subject to the Company’s compliance with the Equity Conditions (i.e., there is no Equity Conditions Failure)) in (i) cash at a price equal to the product of (A) the applicable Installment Redemption Payment multiplied by (B) the Redemption Premium or (ii) in shares of Common Stock (the “Installment Redemption Shares”) at a price equal to the product of (A) the applicable Installment Redemption Payment multiplied by (B) the Redemption Premium divided by the lesser of (x) the Redemption Price (subject to adjustment for any share dividend, share split, share combination, reclassification or similar transaction that proportionately decreases or increases the Common Stock) or (y) the VWAP during the period commencing five (5) Trading Days prior to the Installment Redemption Payment (the “Installment Redemption Price”). Notwithstanding the foregoing, the Holder shall have the option to demand payment of one (1) Installment Redemption Payment in shares of Common Stock at price equal to the Installment Redemption Price, in lieu of the receipt of cash; provided, that the Holder shall give the Company at least one (1) week’s notice prior to the applicable Installment Redemption Payment. In the event that the Company elects to not pay an Installment Redemption Payment in cash and the Equity Conditions are not met (i.e., there is an Equity Conditions Failure), then each Holder shall be entitled to the redemption of the applicable Installment Redemption Payment at a price equal to the Triggering Event Redemption Price until such time that the Equity Conditions Failure is cured. For the avoidance of doubt, if Holder defers the receipt of Installment Redemption Shares due to the limitations set forth in Section 4, Holder shall remain entitled to such shares as originally calculated, i.e., any weekly VWAP increase subsequent to the original Installment Redemption Payment shall not decrease the amount of shares due to the Holder. However, if Holder defers the receipt of Installment Redemption Shares due to the limitations set forth in Section 4 and any VWAP for the Installment Redemption Shares the VWAP during any Subsequent Installment Redemption Paymentdue to the limitations set forth in Section 4, then such portion shall be subject to the pricing period of the Subsequent Installment Redemption Payment.

| 7 |

In the event that the Installment Redemption Price from the immediately prior Installment Redemption Payment is greater than the VWAP for the Installment Redemption Payment, then the Company shall make one make-whole payment to such Holder in additional shares of Common Stock (“Installment Redemption Price Make-Whole Shares”) to compensate the Holder for the loss of value for the immediately previous Installment Redemption Payment. The number of Installment Redemption Price Make-Whole Shares shall be determined by the quotient of (A) the Installment Redemption Payment (including the Redemption Premium) divided by (B) the VWAP calculated during the Make-Whole VWAP Period (the “Make-Whole VWAP Price”); and then subtracting from such result the number of shares of Common Stock issued in connection with the Installment Redemption Payment. Such Installment Redemption Price Make-Whole Shares shall be delivered to Holder by no later than the next Installment Redemption Payment or, if such Installment Redemption Price Make-Whole Shares relates to the final Installment Redemption Payment, then Installment Redemption Price Make-Whole Shares shall be delivered to Holder by no later than three Trading Days following the last Trading Day of the relevant Make-Whole VWAP Period. For the avoidance of doubt, the Make-Whole VWAP Period for the final Installment Redemption Payment shall be the

The Company’s obligations to deliver the Installment Redemption Price Make-Whole Shares shall continue even though a Triggering Event has occurred (for the avoidance of doubt, in such event the Redemption Price that is utilized shall be the Triggering Event Redemption Price in lieu of the Installment Redemption Price). For an example of the issuance of Installment Redemption Price Make-Whole Shares, see Exhibit I attached hereto. For the avoidance of doubt, if Holder defers the receipt of Installment Redemption Price Make-Whole Shares due to the limitations set forth in Section 4, Holder shall remain entitled to the amount of the Installment Redemption Price Make-Whole Shares as originally calculated, i.e., any weekly VWAP increase subsequent to the Make-Whole VWAP Period shall not decrease the amount of Installment Redemption Price Make-Whole Shares due to the Holder. However, if Holder defers the receipt of Installment Redemption Price Make-Whole Shares due to the limitations set forth in Section 4 and any VWAP for the the VWAP during any Subsequent Make-Whole Perioddue to the limitations set forth in Section 4, then such portion shall be subject to the pricing period of the Subsequent Make-Whole VWAP Period. Further, the Holder may demand the receipt of any portion of the Installment Redemption Price Make-Whole Shares prior to the receipt of the next Installment Redemption Payment. In such event, the Company shall deliver a separate Redemption Notice to the Holder with respect to the next Installment Redemption Payment.

(ii) On the Business Day immediately prior to each Installment Redemption Payment, the Company shall deliver to each Holder a written notice of each Installment Redemption Payment by facsimile or electronic mail in the form attached hereto as Exhibit II, which shall (A) certify that there has been no Equity Conditions Failure and (B) state the aggregate amount of the Preferred Shares which is being redeemed in such Installment Redemption Payment from such Holder and all of the other Holders of the Preferred Shares pursuant to this Section 5(b). Redemptions made pursuant to this Section 5(b) shall be made in accordance with Section 5(d).

| 8 |

(iii) Pursuant to the limitations set forth in Section 4, each Holder may defer all or any portion of any Installment Redemption Payment (including without limitation, any Installment Redemption Price Make-Whole Shares) and have it be paid simultaneously with any future Installment Redemption Payment(s) or on any other date. For the avoidance of doubt, if a Holder defers all or any portion of any Installment Redemption Payment (including without limitation, any Installment Redemption Price Make-Whole Shares) due to the limitations set forth in Section 4, such deferral alone shall not be deemed a Triggering Event.

G. Application of Subsections 5(c) and 5(d) of Section 5 (Mandatory Installment Redemptions; Triggering Events) of the Filed Certificate. Subsections 5(c) and 5(d) of Section 5 of the Filed Certificate shall apply both to the 367,500 shares of the Series A Convertible Preferred Stock that are issued and outstanding as of the date of this Amendment No. 1 and to those shares of the Series A Convertible Preferred Stock that are sold and issued subsequently to the date of this Amendment No. 1, in each case without amendment or modification hereby.

H. Application of Subsection 5(qq) of Section 5 (Certain Defined Terms) of the Filed Certificate. “Subscription Date: as defined in Subsection 5(qq) of Section 5 of the Filed Certificate shall mean (i) February 13, 2017 as to the 315,000 shares of the Series A Convertible Preferred Stock that are issued and outstanding as of the date of this Amendment No. 1, (ii) July 7, 2017, as to the 52,500 shares of the Series A Convertible Preferred Stock that are issued and outstanding as of the date of this Amendment No. 1, and (iii) July 28, 2017, as to the first 131,250 shares of Series A Convertible Preferred Stock that are sold and issued subsequently to the date of this Amendment No. 1.

| 9 |

IN WITNESS WHEREOF, the Corporation has caused this Amendment No. 1 to Certificate of Designations of Series A Convertible Preferred Stock of nFüsz, Inc. to be signed by its Chief Executive Officer on this 28th day of July, 2017.

| nFŰSZ, INC. | ||

| By: | ||

| Name: | Rory J. Cutaia | |

| Title: | Chief Executive Officer | |

| 10 |