Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BlueLinx Holdings Inc. | q22017earnings8k.htm |

| EX-99.1 - EXHIBIT 99.1 - BlueLinx Holdings Inc. | q22017earningsexhibit991.htm |

2

This presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. All of these forward-looking statements are based on estimates and assumptions made

by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking

statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental

and technological factors outside of our control, that may cause our business, strategy or actual results to

differ materially from the forward-looking statements. These risks and uncertainties may include, among other

things: changes in the prices, supply, and/or demand for products which we distribute; general economic and

business conditions in the United States; the activities of competitors; changes in significant operating

expenses; changes in the availability of capital and interest rates; adverse weather patterns or conditions; acts

of cyber intrusion; and other factors described in the “Risk Factors” section in the Company’s Annual Report

on Form 10-K for the year ended December 31, 2016, and in its periodic reports filed with the Securities and

Exchange Commission from time to time. Unless otherwise indicated, all forward-looking statements are as of

the date they are made, and we undertake no obligation to update these forward-looking statements, whether

as a result of new information, the occurrence of future events, or otherwise.

Some of the forward-looking statements discuss the company’s plans, strategies, expectations and intentions.

They use words such as “expects”, “may”, “will”, “believes”, “should”, “approximately”, “anticipates”,

“estimates”, “outlook”, and “plans”, and other variations of these and similar words, and one or more of which

may be used in a positive or negative context.

Immaterial Rounding Differences - Immaterial rounding adjustments and differences may exist between

slides, press releases, and previously issued presentations.

Forward-Looking Statements

3

BlueLinx reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”). The

Company also believes that presentation of certain non-GAAP measures may be useful to investors. Any non-GAAP measures used

herein are reconciled in the financial tables accompanying this news release. The Company cautions that non-GAAP measures should be

considered in addition to, but not as a substitute for, the Company’s reported GAAP results.

We define Adjusted EBITDA as an amount equal to net income (loss) plus interest expense and all interest expense related items, income

taxes, depreciation and amortization, and further adjusted to exclude certain non-cash items and other adjustments to Consolidated Net

Income (Loss). Further, we also exclude, as an additional measure, the effects of the operational efficiency initiatives, to determine same-

center Adjusted EBITDA, which is useful for period over period comparability.

We present Adjusted EBITDA (and the exclusion of the effects of the operational efficiency initiatives) because it is a primary measure

used by management to evaluate operating performance and, we believe, helps to enhance investors’ overall understanding of the

financial performance and cash flows of our business. However, Adjusted EBITDA is not a presentation made in accordance with GAAP,

and is not intended to present a superior measure of the financial condition from those determined under GAAP. Adjusted EBITDA, as

used herein, is not necessarily comparable to other similarly titled captions of other companies due to differences in methods of

calculation. We believe Adjusted EBITDA is helpful in highlighting operating trends. We also believe that Adjusted EBITDA is frequently

used by securities analysts, investors and other interested parties in their evaluation of companies, many of which present an Adjusted

EBITDA measure when reporting their results. We compensate for the limitations of using non-GAAP financial measures by using them to

supplement GAAP results to provide a more complete understanding of the factors and trends affecting the business than using GAAP

results alone.

The non-GAAP metrics of adjusted same-center net sales and adjusted same-center gross profit excludes the effects of both closed

facilities and the SKU rationalization initiative to arrive at these adjusted non-GAAP metrics. This calculation is not a presentation made in

accordance with GAAP, and is not intended to present a superior measure of the financial condition from those determined under GAAP.

Adjusted same-center net sales and adjusted same-center gross profit, as used herein, are not necessarily comparable to other similarly

titled captions of other companies due to differences in methods of calculation.

We believe adjusted same-center net sales and adjusted same-center gross profit are helpful in presenting comparability across periods

without the effect of our operational efficiency initiatives. We also believe that these non-GAAP metrics are used by securities analysts,

investors, and other interested parties in their evaluation of our company, to illustrate the effects of these initiatives. We compensate for

the limitations of using non-GAAP financial measures by using them to supplement GAAP results to provide a more complete

understanding of the factors and trends affecting the business than using GAAP results alone.

Non-GAAP Financial Measures

4

Key Emphasis for BlueLinx

• Focus on sales excellence

• Emphasize local customer

interaction to grow market share

• Focus on margin enhancement

opportunities

• Initiatives to delever the

Company

• Real estate optimization

5

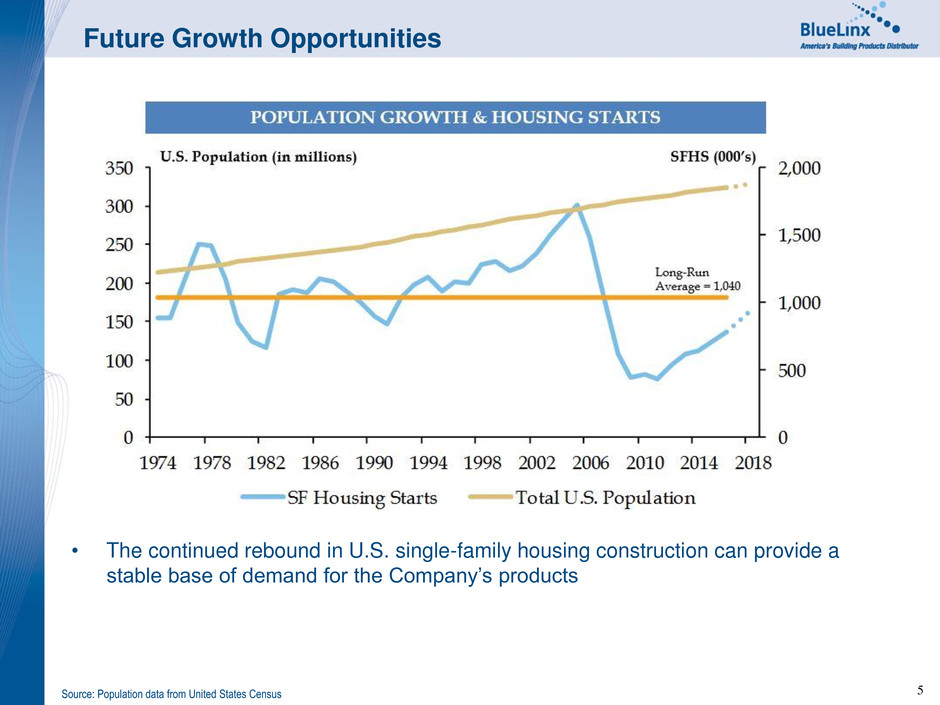

Future Growth Opportunities

• The continued rebound in U.S. single-family housing construction can provide a

stable base of demand for the Company’s products

Source: Population data from United States Census

6

7

Executive Summary – Second Quarter 2017 Highlights

• Net Sales of $474.0 million

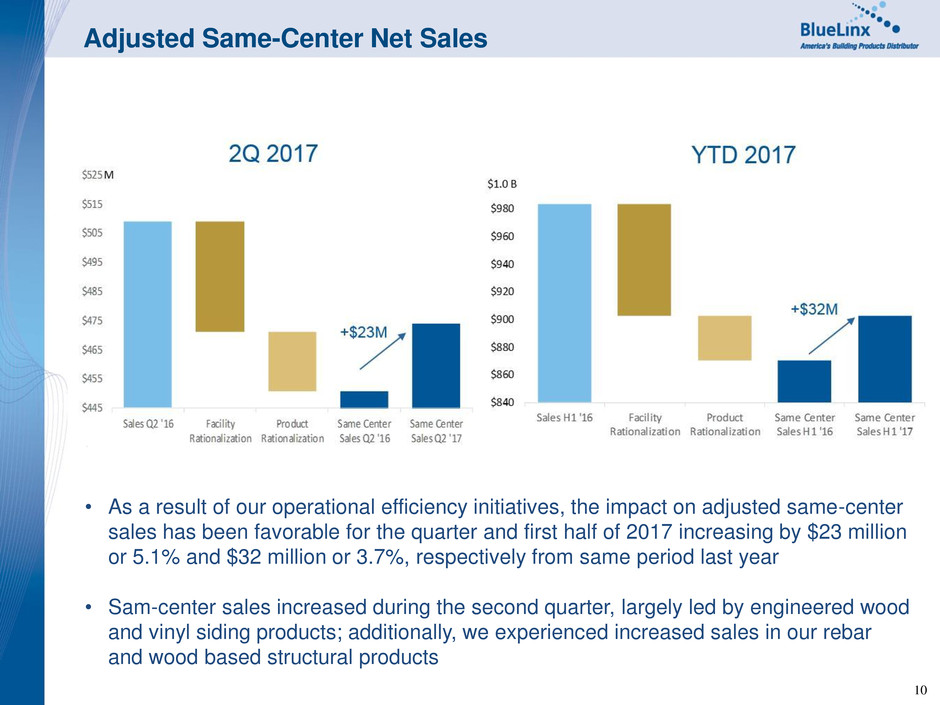

• Adjusted same-center net sales increased $23.2 million or 5.1% from

Q2 2016

• Gross Profit of $60.5 million, up $3.2 million from Q2 2016

• Adjusted same-center gross profit increased $3.4 million

• Gross Margin of 12.8%, best second quarter since 2008

• Specialty product margin of 15.3% and Structural product margin of

8.7%

• Net Income of $3.2 million, best second quarter since 2008

• Adjusted EBITDA of $12.8 million, best second quarter since 2008

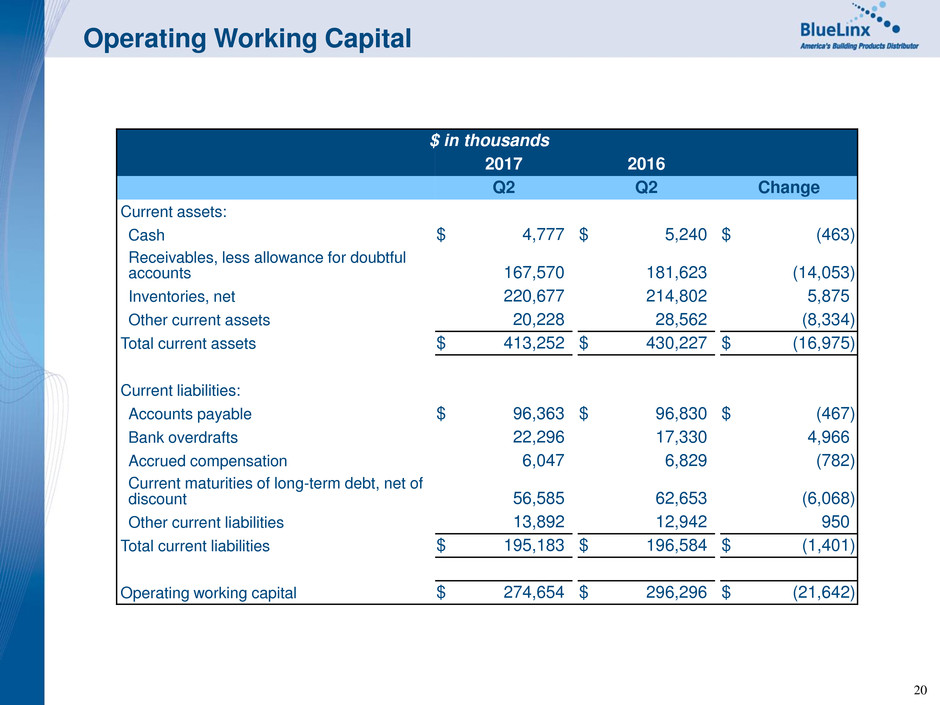

• Operating Working Capital improved by $21.6 million from Q2 2016

• Excess Availability of $74.2 million, an increase of $8.9 million from Q2 2016

• Debt principal reduction of $76.4 million from Q2 2016

8

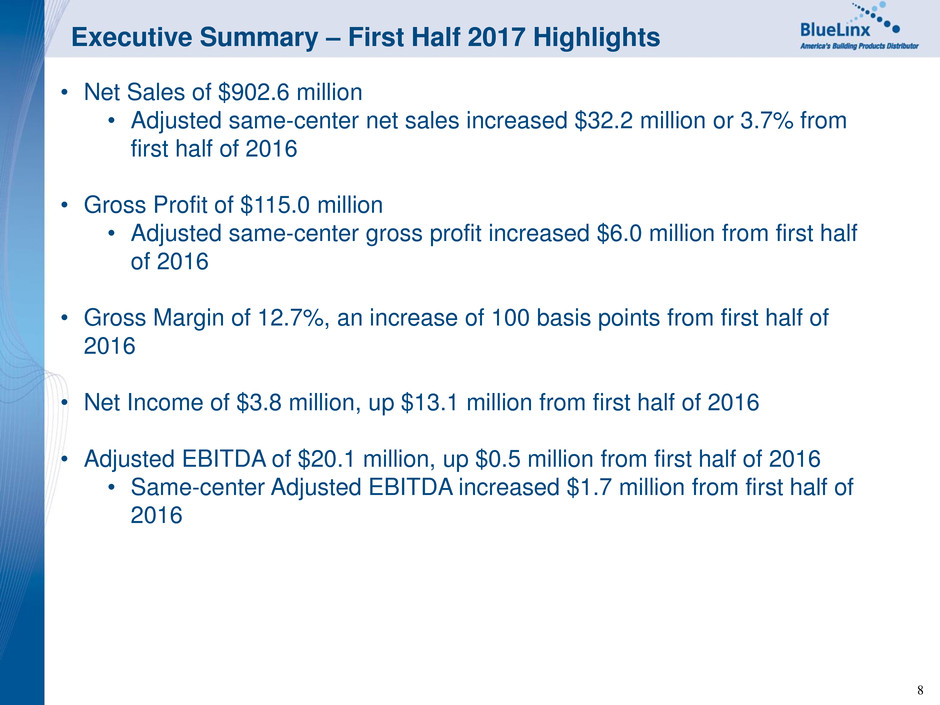

Executive Summary – First Half 2017 Highlights

• Net Sales of $902.6 million

• Adjusted same-center net sales increased $32.2 million or 3.7% from

first half of 2016

• Gross Profit of $115.0 million

• Adjusted same-center gross profit increased $6.0 million from first half

of 2016

• Gross Margin of 12.7%, an increase of 100 basis points from first half of

2016

• Net Income of $3.8 million, up $13.1 million from first half of 2016

• Adjusted EBITDA of $20.1 million, up $0.5 million from first half of 2016

• Same-center Adjusted EBITDA increased $1.7 million from first half of

2016

9

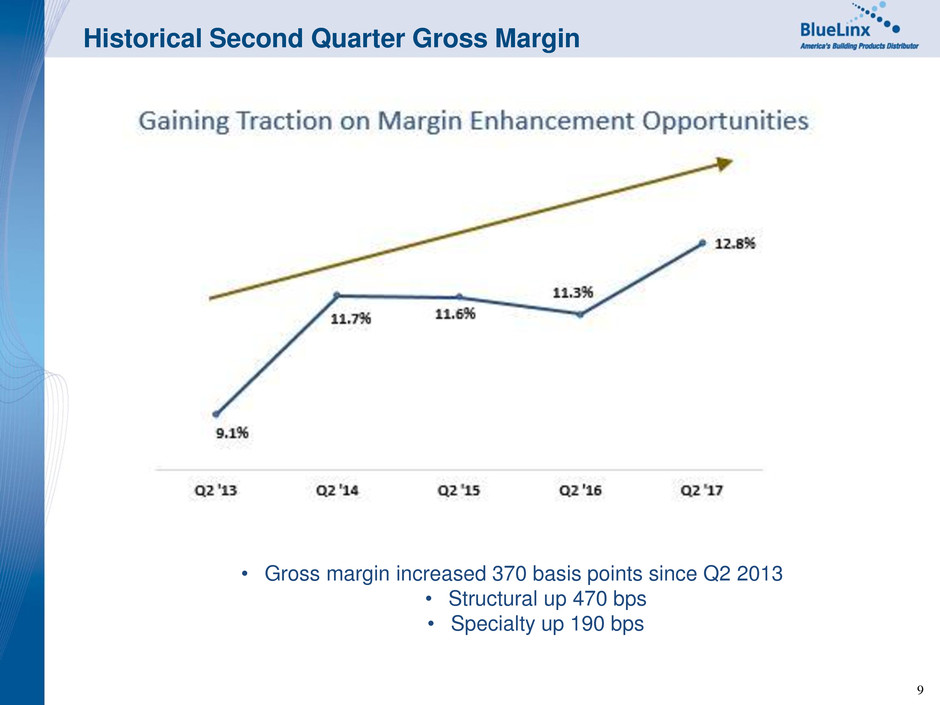

Historical Second Quarter Gross Margin

• Gross margin increased 370 basis points since Q2 2013

• Structural up 470 bps

• Specialty up 190 bps

10

Adjusted Same-Center Net Sales

• As a result of our operational efficiency initiatives, the impact on adjusted same-center

sales has been favorable for the quarter and first half of 2017 increasing by $23 million

or 5.1% and $32 million or 3.7%, respectively from same period last year

• Sam-center sales increased during the second quarter, largely led by engineered wood

and vinyl siding products; additionally, we experienced increased sales in our rebar

and wood based structural products

11

Real Estate Valuation

• Property sales in 2016 and YTD 2017 generated gross sales of $68 million

• Our previous valuations are substantiated by sales in the past 18 months

• Collective value of properties sold is consistent with 2015 desktop valuation;

$68 million in property sales had a desktop valuation of $69 million

• Our real estate continues to prove to be a valuable and attractive asset

12

Delevering the Business

• Mortgage and revolving credit facility decreased by $60.9 million and $15.5 million,

respectively from this period last year

13

14

Statements of Operations

$ in thousands except per share amounts

(unaudited)

2017 2016 2017 2016

Q2 Q2 Q2 YTD Q2 YTD

Net sales $ 474,001 $ 509,011 $ 902,609 $ 983,337

Cost of sales 413,455 451,624 787,629 868,354

Gross profit 60,546 57,387 114,980 114,983

Operating expenses (income):

Selling, general, and administrative 49,012 52,678 101,925 107,855

Gains from sales of property — (384 ) (6,700 ) (761 )

Depreciation and amortization 2,253 2,396 4,616 4,871

Total operating expenses 51,265 54,690 99,841 111,965

Operating income 9,281 2,697 15,139 3,018

Non-operating expenses (income):

Interest expense 5,367 6,250 10,610 13,457

Other expense (income), net — 135 (2 ) (237 )

Income (loss) before provision for (benefit from)

income taxes 3,914 (3,688 ) 4,531 (10,202 )

Provision for (benefit from) income taxes 676 (544 ) 709 (913 )

Net income (loss) $ 3,238 $ (3,144 ) $ 3,822 $ (9,289 )

Basic earnings (loss) per share $ 0.36 $ (0.35 ) $ 0.42 $ (1.05 )

Diluted earnings (loss) per share $ 0.35 $ (0.35 ) $ 0.42 $ (1.05 )

15

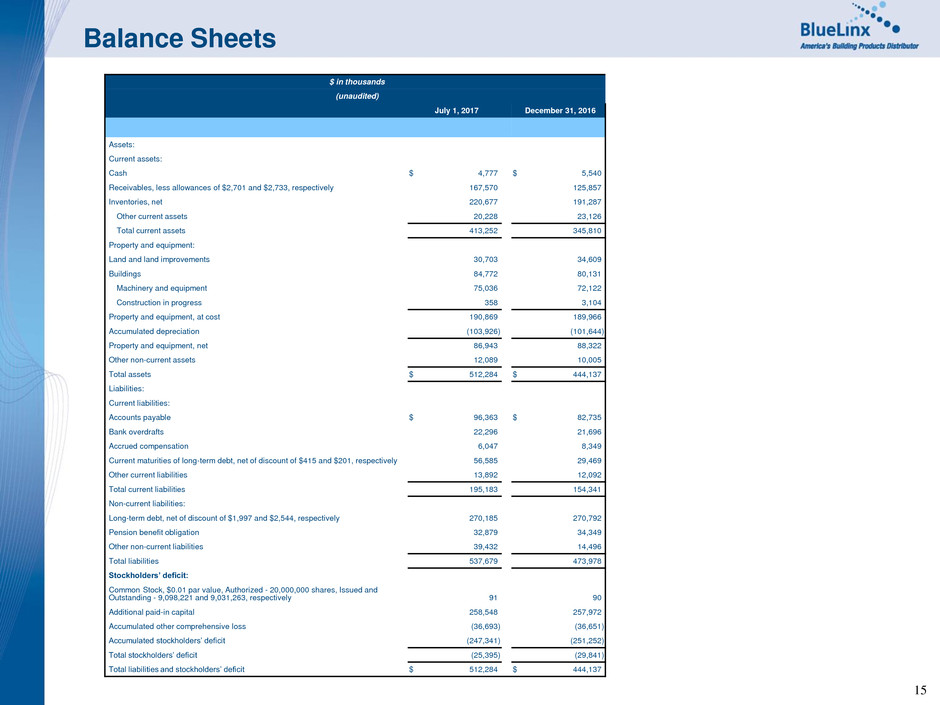

Balance Sheets

$ in thousands

(unaudited)

July 1, 2017 December 31, 2016

Assets:

Current assets:

Cash $ 4,777 $ 5,540

Receivables, less allowances of $2,701 and $2,733, respectively 167,570 125,857

Inventories, net 220,677 191,287

Other current assets 20,228 23,126

Total current assets 413,252 345,810

Property and equipment:

Land and land improvements 30,703 34,609

Buildings 84,772 80,131

Machinery and equipment 75,036 72,122

Construction in progress 358 3,104

Property and equipment, at cost 190,869 189,966

Accumulated depreciation (103,926 ) (101,644 )

Property and equipment, net 86,943 88,322

Other non-current assets 12,089 10,005

Total assets $ 512,284 $ 444,137

Liabilities:

Current liabilities:

Accounts payable $ 96,363 $ 82,735

Bank overdrafts 22,296 21,696

Accrued compensation 6,047 8,349

Current maturities of long-term debt, net of discount of $415 and $201, respectively 56,585 29,469

Other current liabilities 13,892 12,092

Total current liabilities 195,183 154,341

Non-current liabilities:

Long-term debt, net of discount of $1,997 and $2,544, respectively 270,185 270,792

Pension benefit obligation 32,879 34,349

Other non-current liabilities 39,432 14,496

Total liabilities 537,679 473,978

Stockholders’ deficit:

Common Stock, $0.01 par value, Authorized - 20,000,000 shares, Issued and

Outstanding - 9,098,221 and 9,031,263, respectively 91 90

Additional paid-in capital 258,548 257,972

Accumulated other comprehensive loss (36,693 ) (36,651 )

Accumulated stockholders’ deficit (247,341 ) (251,252 )

Total stockholders’ deficit (25,395 ) (29,841 )

Total liabilities and stockholders’ deficit $ 512,284 $ 444,137

16

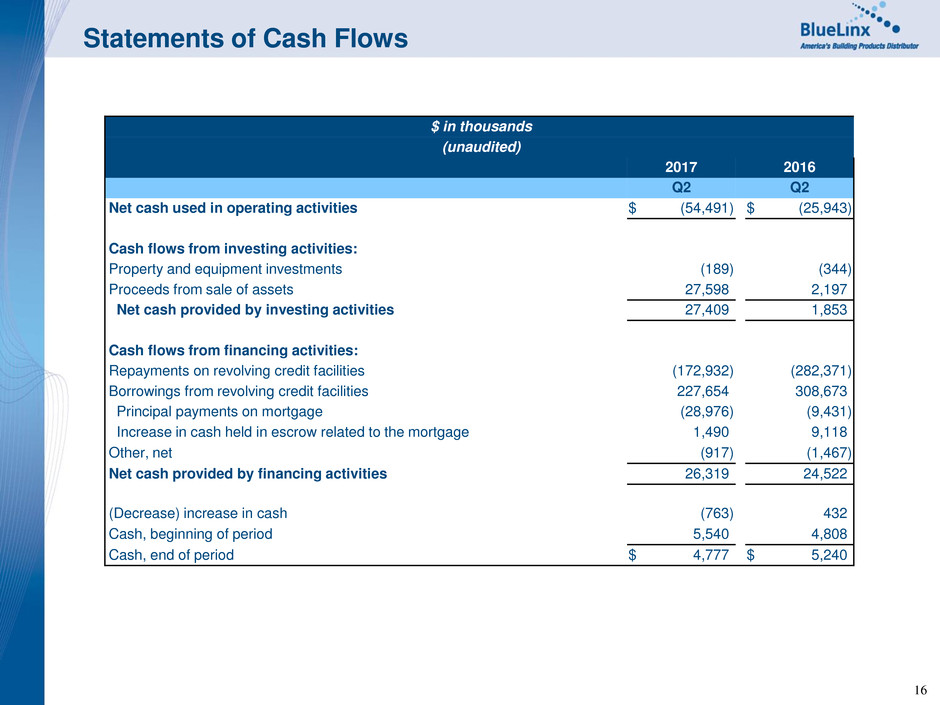

Statements of Cash Flows

$ in thousands

(unaudited)

2017 2016

Q2 Q2

Net cash used in operating activities $ (54,491 ) $ (25,943 )

Cash flows from investing activities:

Property and equipment investments (189 ) (344 )

Proceeds from sale of assets 27,598 2,197

Net cash provided by investing activities 27,409 1,853

Cash flows from financing activities:

Repayments on revolving credit facilities (172,932 ) (282,371 )

Borrowings from revolving credit facilities 227,654 308,673

Principal payments on mortgage (28,976 ) (9,431 )

Increase in cash held in escrow related to the mortgage 1,490 9,118

Other, net (917 ) (1,467 )

Net cash provided by financing activities 26,319 24,522

(Decrease) increase in cash (763 ) 432

Cash, beginning of period 5,540 4,808

Cash, end of period $ 4,777 $ 5,240

17

Adjusted EBITDA

$ in thousands

2017 2016 2017 2016

Q2 Q2 Q2 YTD Q2 YTD

Net income (loss) $ 3,238 $ (3,144 ) $ 3,822 $ (9,289 )

Adjustments:

Depreciation and amortization 2,253 2,396 4,616 4,871

Interest expense 5,367 6,250 10,610 13,457

Provision for (benefit from) income taxes 676 (544 ) 709 (913 )

Gain from sales of property — (384 ) (6,700 ) (761 )

Share-based compensation expense 695 430 1,459 845

Multi-employer pension withdrawal 1,000 — 5,500 —

Restructuring, severance, and legal, and other (427 ) 7,581 108 8,069

Refinancing-related expenses — 69 — 3,385

Adjusted EBITDA $ 12,802 $ 12,654 $ 20,124 $ 19,664

Adjusted EBITDA $ 12,802 $ 12,654 $ 20,124 $ 19,664

Less: non-GAAP adjustments — 106 — 1,190

Same-center Adjusted EBITDA $ 12,802 $ 12,548 $ 20,124 $ 18,474

18

Comparable Same-Center Schedule

$ in thousands

2017 2016 2017 2016

Q2 Q2 Q2 YTD Q2 YTD

Net sales $ 474,001 $ 509,011 $ 902,609 $ 983,337

Less: non-GAAP adjustments — 58,222 — 112,893

Adjusted same-center net sales $ 474,001 $ 450,789 $ 902,609 $ 870,444

Adjusted year-over-year percentage increase -

sales 5.1 % 3.7 %

Gross profit $ 60,546 $ 57,387 $ 114,980 $ 114,983

Less: non-GAAP adjustments — 224 — 5,959

Adjusted same-center gross profit $ 60,546 $ 57,163 $ 114,980 $ 109,024

19

Debt Principal

$ in thousands

2017 2016

Q2 Q2 Change

Revolving credit facilities - principal $ 231,335 $ 246,858 $ (15,523 )

Mortgage - principal 97,847 158,769 (60,922 )

Total $ 329,182 $ 405,627 $ (76,445 )

20

Operating Working Capital

$ in thousands

2017 2016

Q2 Q2 Change

Current assets:

Cash $ 4,777 $ 5,240 $ (463 )

Receivables, less allowance for doubtful

accounts 167,570 181,623 (14,053 )

Inventories, net 220,677 214,802 5,875

Other current assets 20,228 28,562 (8,334 )

Total current assets $ 413,252 $ 430,227 $ (16,975 )

Current liabilities:

Accounts payable $ 96,363 $ 96,830 $ (467 )

Bank overdrafts 22,296 17,330 4,966

Accrued compensation 6,047 6,829 (782 )

Current maturities of long-term debt, net of

discount 56,585 62,653 (6,068 )

Other current liabilities 13,892 12,942 950

Total current liabilities $ 195,183 $ 196,584 $ (1,401 )

Operating working capital $ 274,654 $ 296,296 $ (21,642 )

21