Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUDSON TECHNOLOGIES INC /NY | v472770_8k.htm |

Exhibit 99.1

0 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm Hudson Technologies and Airgas - Refrigerants, Inc. A Strategic Combination NASDAQ : HDSN Investor Presentation: August 2017

1 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm Statements contained herein which are not historical facts constitute forward - looking statements. These include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future including, without limitation, expectations of Hudson Technologies, Inc. (the “Company”) with respect to the benefits, costs and other anticipated financial impacts of the proposed ARI transaction; future financial and operating results of the Company ; the Company’s plans, objectives, expectations and intentions with respect to future operations and services; approval of the proposed transaction by governmen tal regulatory authorities; the availability of financing; the satisfaction of the closing conditions to the proposed transaction ; a nd the timing of the completion of the proposed transaction. Such forward - looking statements involve a number of known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward - looking statements. Such factors include, but are not limited to, changes in the laws and regulations affecting the industry, changes in the demand and price for refrigerants (including unfavorable market conditions adversely affecting the demand for, and the price of, refrigerants), the Company's ability to source refrigerants, regulatory and economic factors, seasonality, competition, litig ati on, the nature of supplier or customer arrangements that become available to the Company in the future, adverse weather conditions, possible technological obsolescence of existing products and services, possible reduction in the carrying value o f l ong - lived assets, estimates of the useful life of its assets, potential environmental liability, customer concentration, the abil ity to obtain financing, any delays or interruptions in bringing products and services to market, the timely availability of any req uis ite permits and authorizations from governmental entities and third parties as well as factors relating to doing business outside th e United States, including changes in the laws, regulations, policies, and political, financial and economic conditions, includ ing inflation, interest and currency exchange rates, of countries in which the Company may seek to conduct business, the Company’ s ability to successfully integrate any assets it acquires from third parties into its operations, and other risks detailed in the Company's 10 - K for the year ended December 31, 2016 and other subsequent filings with the Securities and Exchange Commission. Examples of such risks and uncertainties specific to the proposed ARI transaction include, but are not limited to : t he possibility that the proposed transaction is delayed or does not close, including due to the failure to receive required regu lat ory approvals or the failure of other closing conditions; the possibility that the expected benefits will not be realized, or wil l n ot be realized within the expected time period; and the ability to complete the contemplated debt financings. The words "believe", "expect", "anticipate", "may", "plan", "should" and similar expressions identify forward - looking statements. Readers are caution ed not to place undue reliance on these forward - looking statements, which speak only as of the date the statement was made. Safe Harbor Statement

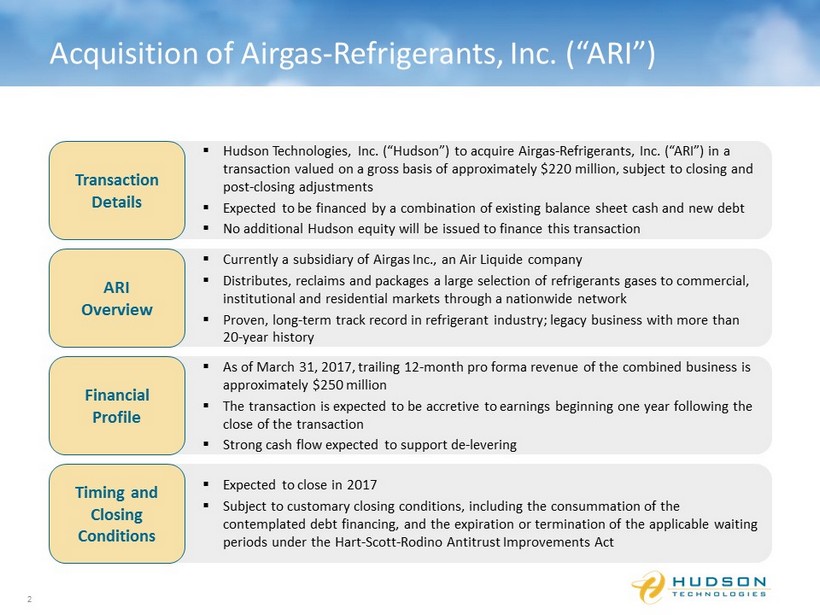

2 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm ▪ Expected to close in 2017 ▪ Subject to customary closing conditions, including the consummation of the contemplated debt financing, and the expiration or termination of the applicable waiting periods under the Hart - Scott - Rodino Antitrust Improvements Act ▪ Hudson Technologies, Inc. (“Hudson”) to acquire Airgas - Refrigerants, Inc. (“ARI”) in a transaction valued on a gross basis of approximately $220 million, subject to closing and post - closing adjustments ▪ Expected to be financed by a combination of existing balance sheet cash and new debt ▪ No additional Hudson equity will be issued to finance this transaction ▪ Currently a subsidiary of Airgas Inc., an Air Liquide company ▪ Distributes , reclaims and packages a large selection of refrigerants gases to commercial, institutional and residential markets through a nationwide network ▪ Proven, long - term track record in refrigerant industry; legacy business with more than 20 - year history ▪ As of March 31, 2017, trailing 12 - month pro forma revenue of the combined business is approximately $250 million ▪ The transaction is expected to be accretive to earnings beginning one year following the close of the transaction ▪ Strong cash flow expected to support de - levering Acquisition of Airgas - Refrigerants, Inc. (“ARI”) Transaction Details ARI Overview Financial Profile Timing and Closing Conditions 2

3 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm Transaction Overview Business Overview ~$250 million • Refrigerants • Reclamation • Remediation Services • Global Energy Services • Refrigerants • Reclamation • Remediation Services • HQ – Pearl River, NY • 4 Reclamation Facilities throughout the U.S. and Puerto Rico • ~140 employees • AHRI certified laboratory • HQ – Lawrenceville, GA; regional sales offices across the U.S. • 1 Reclamation Facility • 30+ facilities and stocking points • ~125 employees • AHRI certified laboratory Airgas - Refrigerants Air Liquide Airgas - Refrigerants LTM Revenue as of 3/31/17 Offerings Size and Scale 3

4 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm Transformational Acquisition ARI’s large customer base for HFCs positions Hudson to better serve an expanded customer base during the future phase down of HFCs. Expanded customer network increases access to refrigerants and strengthens distribution capabilities Anticipated cross - selling of Hudson services to ARI’s existing customer base Increased processing capacity to support the anticipated growth in reclamation volume from the ongoing phase - out of HCFC production and expected future phase - outs Enhanced geographic footprint in the U.S. Strategic purchase of valuable refrigerant inventory will more than double Hudson’s existing inventory balance Combining two businesses with complementary offerings and best - in - class employees in the refrigerant industry 4

5 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm Positioning for the Future Yesterday: CFCs Example: R - 12 Virgin Phase - Out Start: 1995 Virgin Phase - Out Complete*: 1996 Today: HCFCs Example: R - 22 Virgin Phase - Down Start: 2010 Virgin Phase - Down Complete*: 2019 Tomorrow: HFCs Example: R - 410A Virgin Phase - Down Start: Est. 2019 Virgin Phase - Down Complete*: Est. 2035 Future: HFOs Example: 1234 YF (autos) Virgin Phase - Down Start: NA Virgin Phase - Down Complete*: NA Preparing for industry evolution towards next generation gases; infrastructure in place to support future phase - outs When virgin production is eliminated, reclamation becomes the only source of production 5 *Reclaim volume continues thereafter

6 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm Coast - to - Coast National Coverage Corporate Office Reclamation Centers Stock Points Government Fulfillment Center San Juan Hudson’s New Expanded Operations After Deal Closing $250+ million of revenue More than doubles Hudson's existing inventory balance >2 million pounds of additional reclamation processing capacity More than 7,000 customers Greater than 250 employees 1 2 3 4 5 6

7 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm ▪ Strong cash flow expected to support de - levering ▪ No additional Hudson equity will be issued to finance this transaction ▪ Significant allocation of purchase price for inventory levels; less goodwill and intangible assets ▪ Availability of incremental leverage for growth post - transaction ▪ As of March 31, 2017, trailing 12 - month pro forma revenue of the combined business is approximately $250 million ▪ Attractive gross margin profile of over 30%, consistent with Hudson’s performance ▪ Consolidated operating margin of over 20%, consistent with Hudson’s performance ▪ The transaction is expected to be accretive to earnings beginning one year following the close of the transaction ▪ Gross margins for the first 12 months following Close is subject to purchase price accounting Compelling Financials Enhanced Financial Profile EPS Accretive Efficient Balance Sheet 7

8 S: \ H \ Hudson Technologies \ 2017 \ Project CHILLER \ Announcement \ Presentation \ CHILLER - Investor Presentation_v4.pptx 06/28/17 7:32 pm Transformative Combination Diversified Product Portfolio Enhanced EPS Strengthened Management Team; Significant Combined Experience & Expertise Expanded Geographic Footprint Additional Revenue Opportunities Increased Efficiencies Transaction expected to close in 2017 Until the deal closes, Hudson and ARI will continue to operate as two independent companies 8 Airgas - Refrigerants