Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Hamilton Lane INC | earningsrelease8-kq12018.htm |

Exhibit 99.1

HAMILTON LANE INCORPORATED REPORTS FIRST QUARTER FISCAL 2018 RESULTS

BALA CYNWYD, PENN. – August 8, 2017 – Leading private markets asset management firm Hamilton Lane Incorporated (NASDAQ: HLNE) today reported its results for the first quarter of fiscal year 2018, the period ended June 30, 2017.

Hamilton Lane CEO Mario Giannini commented: “Our business continues to be well-positioned to serve our clients’ growing needs within the private markets, as evidenced by year-over-year growth in each of our core offerings. Our ability to add new clients, grow existing client relationships and expand our product platform led to meaningful growth in both management and advisory fees during the quarter.

Throughout our first several months as a public company, we also continued to execute on opportunities to better serve our clients and to reach new clients, through continued global expansion and strategic initiatives in growing areas within the private markets. As we look forward, we believe that the strength in our core business together with the strategic enhancements we have made position the business nicely for continued growth.”

Hamilton Lane issued a full detailed presentation of its first quarter fiscal 2018 results, which can be viewed at http://ir.hamiltonlane.com.

Dividend

Hamilton Lane has declared a quarterly dividend of $0.175 per share of Class A common stock to record holders at the close of business on September 15, 2017. This dividend will be paid on October 2, 2017.

Conference Call

Hamilton Lane will discuss first quarter fiscal 2018 results in a webcast and conference call today, Tuesday, August 8, 2017, at 11:00 a.m. Eastern Time. The call will be broadcast live via a webcast, which may be accessed on Hamilton Lane’s Investor Relations website. The call may also be accessed by dialing 1-833-231-8267 inside the U.S., or 1-647-689-4112 for international callers. The conference ID is 56087236.

A replay of the webcast will be available on Hamilton Lane’s Investor Relations website approximately two hours after the live broadcast for a period of one year, and can be accessed in the same manner as the live webcast at the Hamilton Lane Investor Relations website.

About Hamilton Lane

Hamilton Lane (NASDAQ: HLNE) is a leading alternative investment management firm providing innovative private markets solutions to sophisticated investors around the world. Dedicated to private markets investing for 26 years, the firm currently employs more than 290 professionals operating in offices throughout the U.S., Europe, Asia-Pacific, Latin America and the Middle East. With nearly $360 billion in total assets under management and supervision as of June 30, 2017, Hamilton Lane offers a full range of investment products and services that enable clients to participate in the private markets asset class on a global and customized basis. For more information, please visit www.hamiltonlane.com or follow Hamilton Lane on Twitter: @hamilton_lane.

Forward-Looking Statements

Some of the statements in this release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe” and similar expressions are used to identify these forward-looking statements. Forward-looking statements discuss

management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to our ability to manage growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment guidelines set by our clients; our ability to consummate planned acquisitions and successfully integrate the acquired business with ours; the time, expense and effort associated with being a newly public company; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2017 and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this release are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law.

Investor Contact

Demetrius Sidberry

dsidberry@hamiltonlane.com

+1 610 617 6768

Media Contact

Kate McGann

kmcgann@hamiltonlane.com

+1 610 617 5841

Fiscal Year 2018 First Quarter Results

Earnings Presentation - August 8, 2017

Page 2

Today’s Speakers

Mario Giannini

Chief Executive Officer

Randy Stilman

Chief Financial Officer

Demetrius Sidberry

Head of Investor Relations

Erik Hirsch

Vice Chairman

Page 3

Period Highlights

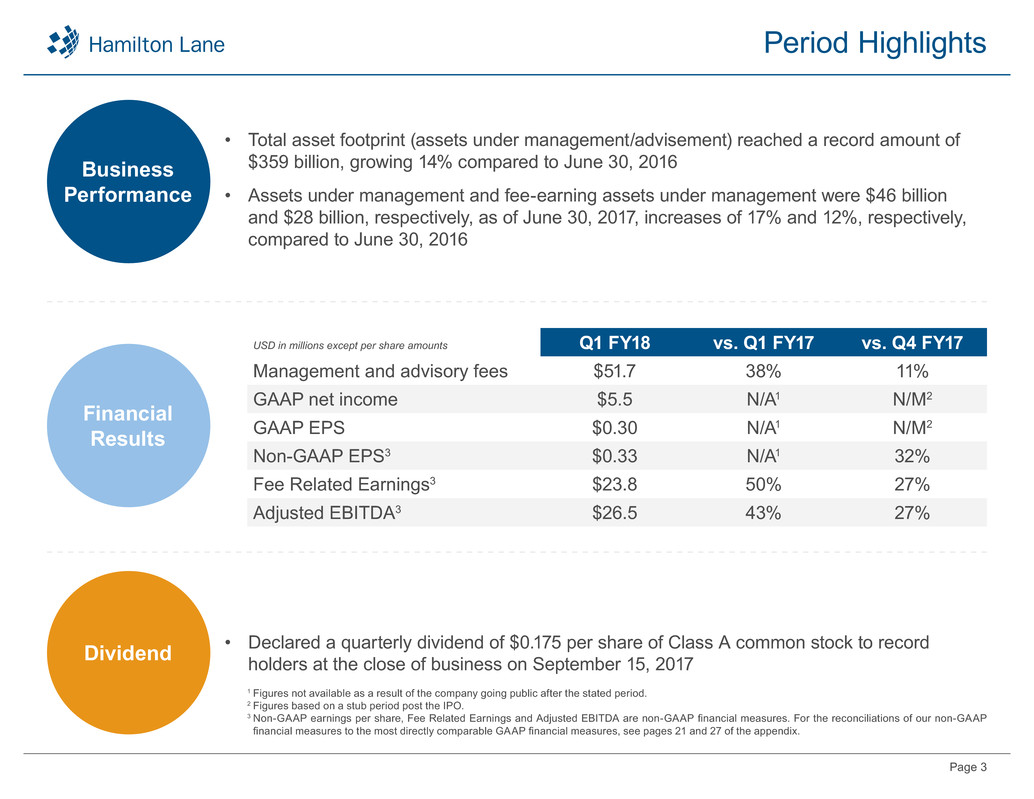

• Total asset footprint (assets under management/advisement) reached a record amount of

$359 billion, growing 14% compared to June 30, 2016

• Assets under management and fee-earning assets under management were $46 billion

and $28 billion, respectively, as of June 30, 2017, increases of 17% and 12%, respectively,

compared to June 30, 2016

• Declared a quarterly dividend of $0.175 per share of Class A common stock to record

holders at the close of business on September 15, 2017

Business

Performance

Financial

Results

Dividend

USD in millions except per share amounts Q1 FY18 vs. Q1 FY17 vs. Q4 FY17

Management and advisory fees $51.7 38% 11%

GAAP net income $5.5 N/A1 N/M2

GAAP EPS $0.30 N/A1 N/M2

Non-GAAP EPS3 $0.33 N/A1 32%

Fee Related Earnings3 $23.8 50% 27%

Adjusted EBITDA3 $26.5 43% 27%

1 Figures not available as a result of the company going public after the stated period.

2 Figures based on a stub period post the IPO.

3 Non-GAAP earnings per share, Fee Related Earnings and Adjusted EBITDA are non-GAAP financial measures. For the reconciliations of our non-GAAP

financial measures to the most directly comparable GAAP financial measures, see pages 21 and 27 of the appendix.

Page 4

• Founded in 1991, we are one of the largest allocators of capital to private markets worldwide with nearly $360B of

AUM / AUA

• Over 290 professionals dedicated to the private markets (substantially all are stockholders)

• 14 offices in key markets globally

• ~350 sophisticated clients globally (in 35 countries)

• Significant proprietary databases and suite of analytical tools

• $49B of discretionary commitments since 2000

Leading, Global Private Markets Solutions Provider

We operate at the epicenter of a large, fast-growing and highly desirable asset class, helping a wide

array of investors around the world navigate, access and succeed in the private markets

~$46B

of AUM1

~$314B

of AUA1

Buyout Growth Equity R

eal E

state

In

fr

as

tr

u

ct

ur

e

Cr

ed

it

V enture Capital Co-Investment Seco

nda

ry

N

at

. R

es

ou

rc

es

C

o

-Investm

ents

Se

co

nd

ar

y

Tr

an

sa

ct

io

n

s

Prim

ary Funds

Private Markets Funds

Private Companies

Investors/Limited

Partners (LPs)

1 As of 6/30/2017

Page 5

Deep Bench of Talent and Award-Winning Culture

Executive Management (7)

Investment

Team

(95)

Business

Development

(20)

Product

Management

(20)

Finance

(20)

IT

(20)

Legal &

Compliance

(20)

HR / Admin

(15)

Client

Services

(80)

Key Stats

• Over 290 employees globally

• ~70% of the team is less than 40 years of age

• Women compose ~40% of the employee base and ~30% of

all senior roles

Beyond the Business

• HL in Action – Volunteerism and Matching Gifts Program

• HL Wellness Committee

• Hamilton Lane matching gifts program

• HL Women’s Exchange

• HL Diversity & Inclusion Council

Awards

Widespread employee ownership

Source: Company data. Employee figures as of 6/30/2017

Page 6

Customized

Separate Accounts

Tailored solutions through

managed investment

accounts

Specialized Funds

Primaries, secondaries,

direct/co-investments, fund-

of-funds and white-label

products

Advisory Services

Partnering with large

institutions with in-house

resources to assist across

the complex landscape

Reporting,

Monitoring,

Data and Analytics

Customized, technology-

driven reporting, monitoring

& analytics services

Distribution

Management

Active portfolio

management of private

markets distributions

Our value proposition

What We Do for Our Clients

Key Business Highlights

Page 8

Key Topics

1

Opportunity Pipeline

2

Asset Growth

3

Geographic Expansion

4

Strategic Development

Page 9

Opportunity Pipeline1

Customized Separate

Accounts

Specialized

Funds

Advisory

Services

Diverse mix of existing and

prospective clients seeking to

further or establish relationship

with Hamilton Lane

Select funds in market:

• Co-Investment Fund

• Strategic Opportunities Fund

• Private Equity Fund of Funds

Typically larger clients with

wide-ranging mandates;

opportunity set continues to

be robust

Page 10

Growing Asset Footprint & Influence

$36 $51

$77 $79 $95 $81

$129 $147 $147

$189 $205

$292

$314

$6

$7

$11 $13

$16 $19

$22

$24 $30

$32

$35

$40

$46

$0

$50

$100

$150

$200

$250

$300

$350

$400

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 6/30/17

Total AUA Total AUM

Total Assets Under Management/Advisement ($B)1

1 Data as of calendar year end 12/31 unless noted otherwise. Numbers may not tie due to rounding.

CAGR

: 21%

$359B

AUM & AUA

2

Q-o-Q Growth

AUA: 4%

AUM: 10%

Page 11

Fee-Earning AUM Driving Revenues

...and annual fee rates are stable

2

Drivers of Growth:

* Customized Separate Accounts:

• New client wins

• Client re-ups

Specialized Funds:

* Final Closes:

• Secondary Fund IV

• Strategic Opportunities 2017

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Jun-16 Jun-17

Customized Separate Accounts Specialized Funds

CAGR: 1

4%

Total Fee-Earning Assets Under Management ($B)1

$0

$5

$10

$15

$20

$25

$30

$35

$40

$11

$5

$16

$14

$5

$19

$16

$6

$22

$17

$7

$24

$18

$9

$27

$18

$9

$28

$17

$7

$25

12%

Y-o-Y Growth

0.58% 0.55% 0.56% 0.57% 0.65%20.51%

1 Data as of fiscal year end 3/31; unless otherwise noted

2 Reflects retroactive fees of $5.8M

Total Management Fee Revenues as a % of Average FEAUM

Page 12

Geographic Expansion3

Australia

Sydney

Munich

Germany Oregon

Portland

International United States

Page 13

On June 20, 2017, Hamilton Lane announced the acquisition of Real Asset Portfolio

Management LLC (“RAPM”)

Strategic Development - RAPM

Overview

• RAPM is an investment advisory firm focused exclusively on real assets

• Established in 2011 and headquartered in Portland, OR, RAPM manages and advises on approximately $4 billion

of real asset investments for institutional clients

• RAPM serves as a fiduciary to clients on investments related to fund manager selection, co-investment and

secondary transactions

• Services include portfolio construction, investment due diligence and other services

Strategic Rationale

• Adds to Hamilton Lane’s ability to address increasing client demand for extensive real assets capabilities, a

growing vertical within alternatives

• Expands Hamilton Lane’s real assets team by adding a highly regarded team in the real assets space that is a

strong cultural fit

• Adds to Hamilton Lane’s blue chip client roster

• Allows RAPM to leverage Hamilton Lane’s back-office capabilities and sales efforts

4

Financial Highlights

Page 15

Revenues continue to be driven primarily by management and advisory fees

Consolidated Revenues

• Represented an average of 93% of total revenues over the

past five fiscal years

• Y-o-Y growth of 38%; Q-o-Q growth of 11%

• Growth across all management and advisory fee offerings

• 83% Y-o-Y growth in specialized funds management fees

driven by $0.5B raised in Secondary Fund IV during the

three months ended June 30, 2017; final close resulted in

retroactive fees of $5.8M during the quarter

• Incentive fees derived from a highly diversified pool of

assets and funds

• Off balance sheet allocated carried interest of $266M as of

6/30/17 diversified across +3,000 assets and

~40 funds

• Total revenues increased by 33%, driven by growth across

core offerings

0

50

100

150

200

FY13 FY17Q1 FY17 Q1 FY18

$113

$173

Management and Advisory Fees

Incentive Fees

Total Revenues

$38 $52

Y-o-Y Growth: 38% CAGR: 11%

0

50

100

150

200

FY13 FY17Q1 FY17 Q1 FY18

$6 $7$2 $1

Y-o-Y Growth: (49%) CAGR: 4%

0

50

100

150

200

FY13 FY17Q1 FY17 Q1 FY18

$119

$180

$40 $53

Y-o-Y Growth: 33% CAGR: 11%

Long-Term GrowthQuarter

Long-Term GrowthQuarter

Long-Term GrowthQuarter

U

S

D

in

M

ill

io

ns

U

S

D

in

M

ill

io

ns

U

S

D

in

M

ill

io

ns

Page 16

Profitability stable and growing

Consolidated Earnings

• Y-o-Y growth of 43%; Q-o-Q growth of 27%

• Incremental margin gained during the quarter due to

retro fees

• $5M in net income attributable to HLI for the quarter

• No comparable measure in prior period as that was

before the Company’s IPO

• Y-o-Y growth of 50%; Q-o-Q growth of 27%

• Long-term double digit growth in Fee Related Earnings

1 Adjusted EBITDA and Fee Related Earnings are non-GAAP financial measures. For a reconciliation from GAAP financial measures to non-GAAP financial measures, see page 27 in Appendix

Adjusted EBITDA1

Fee Related Earnings1

U

S

D

in

M

ill

io

ns

Long-Term GrowthQuarter

U

S

D

in

M

ill

io

ns

FY13 FY17Q1 FY17 Q1 FY18

$55

$83

$19 $26

Y-o-Y Growth: 43% CAGR: 11%

Net Income Attributable to HLI

U

S

D

in

M

ill

io

ns

Long-Term GrowthQuarter

FY13 FY17Q1 FY17 Q1 FY18

N/A N/A$5 $1

Long-Term GrowthQuarter

FY13 FY17Q1 FY17 Q1 FY18

$47

$72

$16

$24

Y-o-Y Growth: 50% CAGR: 11%

Page 17

Strong balance sheet with investments in our own products and a modest amount

of leverage...

Other Key Items

• Vast majority of our investments are those made

alongside our clients

• For 6/30/17, the total investment balance consisted of

~$107M in equity method investments in our funds and

~$17M in technology related investments

• Senior secured term loan payable of $85.5M as of 6/30/17

$0

$30

$60

$90

$120

$150

Mar-13 Mar-14 Mar-15 Mar-16 Mar-17

$78

$92 $103 $103

$120

Jun-17

$124

Investments

0.0x

1.0x

2.0x

3.0x

4.0x

Jun-17

0.9x

Mar-17

1.0x

Gross Leverage Profile1

U

S

D

in

M

ill

io

ns

X T

T

M

A

dj

us

te

d

E

B

IT

D

A

1 Ratio of senior secured term loan payable to trailing twelve months Adjusted EBITDA. See page 28 for additional detail on calculation of gross leverage ratio.

Fiscal Year 2018 First Quarter Results

Earnings Presentation - August 8, 2017

Appendix

Page 20

Condensed Consolidated Statements of Income (Unaudited)

Three Months Ended,

(Dollars in thousands except share and per share amounts) June 30, 2016 March 31, 2017 June 30, 2017 YoY % Change QoQ % Change

Revenues

Management and advisory fees $37,583 $46,401 $51,684 38% 11%

Incentive fees 1,983 278 1,017 (49)% 266%

Total revenues 39,566 46,679 52,701 33% 13%

Expenses

Compensation and benefits 15,936 18,955 19,962 25% 5%

General, administrative and other 6,770 8,664 8,458 25% (2)%

Total expenses 22,706 27,619 28,420 25% 3%

Other income (expense)

Equity in income of investees 1,966 3,919 5,919 201% 51%

Interest expense (2,902) (5,785) (1,106) (62)% (81)%

Interest income 66 161 316 379% 96%

Other non-operating income (loss) - (149) (106) N/A (29)%

Total other income (expense) (870) (1,854) 5,023 N/A N/A

Income before income taxes 15,990 17,206 29,304 83% 70%

Income tax expense (benefit) (401) 580 3,692 N/A 537%

Net income 16,391 16,626 25,612 56% 54%

Less: Income attributable to non-controlling interests in general partnerships 545 168 898 65% 435%

Less: Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 15,846 15,846 19,250 21% 21%

Net income attributable to Hamilton Lane Incorporated $- $612 $5,464 N/A 793%

Basic earnings per share of Class A common stock1 $0.03 $0.30

Diluted earnings per share of Class A common stock1 $0.03 $0.30

Weighted-average shares of Class A common stock outstanding - basic 17,788,363 17,981,601

Weighted-average shares of Class A common stock outstanding - diluted 18,341,079 18,459,415

1 There were no shares of Class A common stock outstanding prior to March 6, 2017; therefore, no earnings per share information has been presented for any period prior to that date. The earnings per

share for the three months ended March 31, 2017 is for the period from March 6, 2017 through March 31, 2017, the period following our initial public offering.

Page 21

Non-GAAP Financial Measures

Three Months Ended,

(Dollars in thousands except share and per share amounts) June 30, 2016 March 31, 2017 June 30, 2017 YoY % Change QoQ % Change

Adjusted EBITDA

Management and advisory fees $37,583 $46,401 $51,684 38% 11%

Total expenses 22,706 27,619 28,420 25% 3%

Less:

Incentive fee related compensation1 (974) 88 (499) (49)% (667)%

Management fee related expenses 21,732 27,707 27,921 28% 1%

Fee Related Earnings $15,851 $18,694 $23,763 50% 27%

Incentive fees 1,983 278 1,017 (49)% 266%

Incentive fee related compensation1 (974) 88 (499) (49)% (667)%

Interest income 66 161 316 379% 96%

Equity-based compensation 1,094 1,175 1,416 29% 21%

Depreciation and amortization 487 475 437 (10)% (8)%

Adjusted EBITDA $18,507 $20,871 $26,450 43% 27%

Adjusted EBITDA margin 47% 45% 50%

Non-GAAP earnings per share

Net income attributable to Hamilton Lane Incorporated $612 $5,464

Income attributable to non-controlling interests in general partnerships 168 898

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 15,846 19,250

Income tax expense 580 3,692

IPO related expenses2 1,935 -

Write-off of deferred financing costs3 3,359 -

Adjusted pre-tax net income 22,500 29,304

Adjusted income taxes4 (9,054) (11,792)

Adjusted net income $13,446 $17,512

Adjusted shares5 52,779,748 52,898,084

Non-GAAP earnings per share $0.25 $0.33

1 Incentive fee related compensation includes incentive fee compensation expense as well as bonus and other revenue sharing allocated to carried interest classified as base compensation.

2 Represents accrual of one-time payments to induce members of HLA to exchange their HLA units for HLI Class A common stock in the reorganization in connection with the IPO.

3 Represents write-down of unamortized discount and debt issuance costs due to the $160 million paydown of outstanding indebtedness under the Term Loan with proceeds from the IPO.

4 Represents corporate income taxes at assumed effective tax rate of 40.24% applied to adjusted pre-tax net income. The 40.24% is based on a federal tax statutory rate of 35.00% and a combined state

income tax rate net of federal benefits of 5.24%.

5 Assumes the full exchange of HLA Class B and Class C units in HLA for HLI Class A common stock.

See page 27 for additional reconciliation to GAAP financial measures

Page 22

Management and Advisory Fees

Three Months Ended,

(Dollars in thousands) June 30, 2016 March 31, 2017 June 30, 2017 YoY % Change QoQ % Change

Management and advisory fees

Customized separate accounts $17,504 $18,467 $18,784 7% 2%

Specialized funds 13,752 21,268 25,206 83% 19%

Advisory and reporting 5,767 6,118 6,650 15% 9%

Distribution management 560 548 1,044 86% 91%

Total management and advisory fees $37,583 $46,401 $51,684 38% 11%

Specialized

funds

49%

Customized

separate

accounts

36%

Advisory

and reporting

13%

Distribution

management

2%

Three Months Ended June 30, 2017

Page 23

Incentive Fees

(Dollars in thousands)

Three Months Ended,

June 30, 2016 March 31, 2017 June 30, 2017 YoY % Change QoQ % Change

Incentive fees

Secondary Fund II $900 $183 $638 (29)% 249%

Other specialized funds 569 28 (40) (107)% (243)%

Customized separate accounts 514 67 419 (18)% 525%

Incentive fees $1,983 $278 $1,017 (49)% 266%

As of

June 30, 2016 March 31, 2017 June 30, 2017 YoY % Change QoQ % Change

Allocated carried interest

Secondary Fund II $9,004 $8,476 $7,513 (17)% (11)%

Secondary Fund III 21,357 29,844 30,306 42% 2%

Secondary Fund IV 578 3,041 4,730 718% 56%

Co-investment Fund I 1,703 715 1,050 (38)% 47%

Co-investment Fund II 88,804 97,313 106,208 20% 9%

Co-investment Fund III - 14,070 20,031 N/A 42%

Other specialized funds 9,516 14,632 18,614 96% 27%

Customized separate accounts 50,105 68,766 77,922 56% 13%

Total allocated carried interest $181,067 $236,857 $266,374 47% 12%

Page 24

Assets Under Management

Three Months Ended,

(Dollars in millions) June 30, 2016 March 31, 2017 June 30, 2017 YoY % Change QoQ % Change

Assets under management / advisement

Assets under management $39,032 $41,794 $45,788 17% 10%

Assets under advisement 276,682 300,426 313,652 13% 4%

Total assets under management / advisement $315,714 $342,220 $359,440 14% 5%

Fee-earning assets under management

Customized separate accounts

Balance, beginning of period $16,976 $17,737 $18,028 6% 2%

Contributions 921 1,410 997 8% (29)%

Distributions (444) (1,142) (754) 70% (34)%

Foreign exchange, market value and other (87) 23 (85) (2)% (470)%

Balance, end of period $17,366 $18,028 $18,186 5% 1%

Specialized funds

Balance, beginning of period $7,019 $8,487 $8,793 25% 4%

Contributions 392 418 759 94% 82%

Distributions (20) (115) (113) 465% (2)%

Foreign exchange, market value and other 7 3 (2) (129)% (167)%

Balance, end of period $7,398 $8,793 $9,437 28% 7%

Total

Balance, beginning of period $23,995 $26,224 $26,821 12% 2%

Contributions 1,313 1,828 1,756 34% (4)%

Distributions (464) (1,257) (867) 87% (31)%

Foreign exchange, market value and other (80) 26 (87) 9% (435)%

Balance, end of period $24,764 $26,821 $27,623 12% 3%

Page 25

Condensed Consolidated Balance Sheets (Unaudited)

As of,

(Dollars in thousands except share and per share amounts) March 31, 2017 June 30, 2017

Assets

Cash and cash equivalents $32,286 $46,471

Restricted cash 1,849 1,857

Fees receivable 12,113 19,474

Prepaid expenses 2,593 2,719

Due from related parties 3,313 2,951

Furniture, fixtures and equipment, net 4,063 4,014

Investments 120,147 124,027

Deferred income taxes 61,223 59,435

Other assets 3,030 3,595

Total assets $240,617 $264,543

Liabilities and Equity

Accounts payable $1,366 $1,326

Accrued compensation and benefits 3,417 11,543

Deferred incentive fee revenue 45,166 45,166

Senior secured term loan payable

Principal amount 86,100 85,450

Less: unamortized discount and debt issuance costs 1,790 1,705

Senior secured term loan payable, net 84,310 83,745

Accrued members' distributions 2,385 4,598

Accrued dividend payable - 3,167

Payable to related parties pursuant to tax receivable agreement 10,734 10,734

Other liabilities 6,612 6,670

Total liabilities 153,990 166,949

Preferred stock, $0.001 par value, 10,000,000 authorized, none issued - -

Class A common stock, $0.001 par value, 300,000,000 authorized; 19,256,873 and 19,151,033 issued and

19,265,873 and 19,036,504 outstanding as of June 30, 2017 and March 31, 2017, respectively 19 19

Class B common stock, $0.001 par value, 50,000,000 authorized; 27,935,255 issued and outstanding as of June

30, 2017 and March 31, 2017 28 28

Additional paid-in-capital 61,845 60,220

Accumulated other comprehensive loss (311) (299)

Retained earnings 612 2,909

Less: Treasury stock, at cost, 114,529 shares of class A common stock as of March 31, 2017 (2,151) -

Total Hamilton Lane Incorporated stockholders’ equity 60,042 62,877

Non-controlling interests in general partnerships 9,901 9,705

Non-controlling interests in Hamilton Lane Advisors, L.L.C. 16,684 25,012

Total equity 86,627 97,594

Total liabilities and equity $240,617 $264,543

Page 26

Condensed Consolidated Statements of Cash Flows (Unaudited)

Three Months Ended,

(Dollars in thousands) June 30, 2016 June 30, 2017

Operating activities

Net income $16,391 $25,612

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization 488 437

Change in deferred income taxes (410) 1,903

Amortization of deferred financing costs 214 85

Equity-based compensation 1,094 1,416

Equity in income of investees (1,966) (5,919)

Proceeds received from investments 950 5,176

Changes in operating assets and liabilities 675 347

Other - 129

Net cash provided by operating activities $17,436 $29,186

Investing activities

Purchase of furniture, fixtures and equipment (363) (388)

Distributions received from investments 1,487 3,465

Contributions to investments (8,069) (6,589)

Net cash (used in) investing activities $(6,945) $(3,512)

Financing activities

Repayments of senior secured term loan (650) (650)

Contributions from non-controlling interest in Partnerships 84 40

Distributions to non-controlling interest in Partnerships - (1,134)

Sale of membership interests 2,434 -

Purchase of Class A shares for tax withholdings - (663)

Purchase of membership interests (1,028) -

Proceeds received from option exercises 217 313

Members’ distributions (18,281) (9,387)

Net cash (used in) financing activities $(17,224) $(11,481)

Increase (decrease) in cash, cash equivalents, and restricted cash (6,733) 14,193

Cash, cash equivalents, and restricted cash at beginning of the period 70,382 34,135

Cash, cash equivalents, and restricted cash at end of the period $63,649 $48,328

Page 27

Non-GAAP Reconciliation

Three Months Ended,

(Dollars in thousands) June 30, 2016 March 31, 2017 June 30, 2017

Net income attributable to Hamilton Lane Incorporated $- $612 $5,464

Income attributable to non-controlling interests in general partnerships 545 168 898

Income attributable to non-controlling interests in Hamilton Lane Advisors, L.L.C. 15,846 15,846 19,250

Incentive fees (1,983) (278) (1,017)

Incentive fee related compensation1 974 (88) 499

Interest income (66) (161) (316)

Interest expense 2,902 5,785 1,106

Income tax expense (benefit) (401) 580 3,692

Equity in income of investees (1,966) (3,919) (5,919)

Other non-operating (income) loss - 149 106

Fee Related Earnings $15,851 $18,694 $23,763

Depreciation and amortization 487 475 437

Equity-based compensation 1,094 1,175 1,416

Incentive fees 1,983 278 1,017

Incentive fee related compensation1 (974) 88 (499)

Interest income 66 161 316

Adjusted EBITDA $18,507 $20,871 $26,450

1 Incentive fee related compensation includes incentive fee compensation expense as well as bonus and other revenue sharing allocated to carried interest classified as base compensation.

Reconciliation from Net Income

Page 28

Gross Leverage Ratio

Twelve Months Ended,

(Dollars in thousands) March 31, 2017 June 30, 2017

Senior secured term loan payable - principal amount $86,100 $85,450

Adjusted EBITDA 83,031 90,975

Gross leverage ratio 1.0x 0.9x

Page 29

Terms

Adjusted EBITDA is our primary internal measure of profitability. We believe Adjusted EBITDA is useful to investors because it enables them to better evaluate the performance of our core business

across reporting periods. Adjusted EBITDA represents net income excluding (a) interest expense on our Term Loan, (b) income tax expense, (c) depreciation and amortization expense, (d) equity-based

compensation expense, (e) non-operating income (loss) and (f) certain other significant items that we believe are not indicative of our core performance.

Fee Related Earnings (“FRE”) is used to highlight earnings of the company from recurring management fees. FRE represents (a) management and advisory fees less (b) total expenses (excluding

incentive fee related expenses). FRE is presented before income taxes. We believe FRE is useful to investors because it provides additional insight into the operating profitability of our business.

Non-GAAP earnings per share measures the per share earnings of the company excluding expenses related to our IPO and assuming all Class B and Class C units in HLA were exchanged for Class

A common stock in HLI. Non-GAAP earnings per share is calculated as adjusted net income divided by adjusted shares outstanding. We believe Non-GAAP earnings per share is useful to investors

because it enables them to better evaluate per-interest operating performance across reporting periods.

Our assets under management (“AUM”) comprise primarily the assets associated with our customized separate accounts and specialized funds. We classify assets as AUM if we have full discretion

over the investment decisions in an account. We calculate our AUM as the sum of:

(1) the net asset value of our clients’ and funds’ underlying investments;

(2) the unfunded commitments to our clients’ and funds’ underlying investments; and

(3) the amounts authorized for us to invest on behalf of our clients and fund investors but not committed to an underlying investment.

Our assets under advisement (“AUA”) comprise assets from clients for which we do not have full discretion to make investments in their account. We generally earn revenue on a fixed fee basis on

our AUA client accounts for services including asset allocation, strategic planning, development of investment policies and guidelines, screening and recommending investments, legal negotiations,

monitoring and reporting on investments and investment manager review and due diligence. Advisory fees vary by client based on the amount of annual commitments, services provided and other factors.

Since we earn annual fixed fees from the majority of our AUA clients, the growth in AUA from existing accounts does not have a material impact on our revenues. However, we view AUA growth as a

meaningful benefit in terms of the amount of data we are able to collect and the degree of influence we have with fund managers.

Fee-earning assets under management, or fee-earning AUM, is a metric we use to measure the assets from which we earn management fees. Our fee-earning AUM comprise assets in our customized

separate accounts and specialized funds on which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which

includes the majority of our discretionary AUM accounts but also includes certain non-discretionary AUA accounts. Our fee-earning AUM is equal to the amount of capital commitments, net invested

capital and net asset value of our customized separate accounts and specialized funds depending on the fee terms. Substantially all of our customized separate accounts and specialized funds earn fees

based on commitments or net invested capital, which are not impacted by market appreciation or depreciation. Therefore, revenues and fee-earning AUM are not significantly impacted by changes in

market value. Our calculations of fee-earning AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other

asset managers. Our definition of fee-earning AUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage.

Hamilton Lane Incorporated (or “HLI”) was incorporated in the State of Delaware on December 31, 2007. The Company was formed for the purpose of completing an initial public offering (“IPO”) and

related transactions (“Reorganization”) in order to carry on the business of Hamilton Lane Advisors, L.L.C. (“HLA”) as a publicly-traded entity. As of March 6, 2017, HLI became the sole managing

member of HLA.

Page 30

Disclosures

As of August 8, 2017

Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of

1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will,” “expect,” “believe” and similar expressions are used to identify these forward-looking statements. Forward-looking

statements discuss management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking

statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to our ability to manage

growth, fund performance, risk, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to

maintain our fee structure; our ability to attract and retain key employees; our ability to consummate planned acquisitions and successfully integrate the acquired business with ours; our ability to manage

our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to us; our ability to comply with investment guidelines set by our clients; the time, expense and

effort associated with being a newly public company; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed in Part

I, Item 1A of our Annual Report on Form 10K for the fiscal year ended March 31, 2017, and in our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-

looking statements included in this presentation are made only as of the date presented. We undertake no obligation to update or revise any forward-looking statement as a result of new information or

future events, except as otherwise required by law.