Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - FIVE PRIME THERAPEUTICS, INC. | fprx-ex322_8.htm |

| EX-32.1 - EX-32.1 - FIVE PRIME THERAPEUTICS, INC. | fprx-ex321_10.htm |

| EX-31.2 - EX-31.2 - FIVE PRIME THERAPEUTICS, INC. | fprx-ex312_6.htm |

| EX-31.1 - EX-31.1 - FIVE PRIME THERAPEUTICS, INC. | fprx-ex311_7.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

|

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the quarterly period ended June 30, 2017

or

|

☐ |

TRANSITION REPORTS PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from to

Commission File Number: 001-36070

Five Prime Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

26-0038620 |

|

(State or other jurisdiction of incorporation or organization) |

|

(IRS Employer Identification No.) |

Two Corporate Drive

South San Francisco, California 94080

(415) 365-5600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

|

Large accelerated filer |

|

☒ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☐ |

|

|

|

|

|

|||

|

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2) Yes ☐ No ☒

As of August 1, 2017, the number of outstanding shares of the registrant’s common stock was 28,902,102.

|

PART I. |

|

|

4 |

|||

|

|

|

Item 1. |

|

|

4 |

|

|

|

|

|

|

Condensed Balance Sheets as of June 30, 2017 and December 31, 2016 |

|

4 |

|

|

|

|

|

Condensed Statements of Operations for the Three and Six Months Ended June 30, 2017 and 2016 |

|

5 |

|

|

|

|

|

Condensed Statements of Comprehensive Loss for the Three and Six Months Ended June 30, 2017 and 2016 |

|

6 |

|

|

|

|

|

Condensed Statements of Cash Flows for the Six Months Ended June 30, 2017 and 2016 |

|

7 |

|

|

|

|

|

|

|

8 |

|

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

14 |

|

|

|

Item 3. |

|

|

|

24 |

|

|

|

Item 4. |

|

|

|

24 |

|

PART II. |

|

|

|

25 |

||

|

|

|

Item 1. |

|

|

|

25 |

|

|

|

Item 1A. |

|

|

|

25 |

|

|

|

Item 6. |

|

|

|

48 |

|

|

|

|

|

|

|

49 |

|

|

|

|

|

|

|

50 |

In this report, unless otherwise stated or the context otherwise indicates, references to “Five Prime,” “the company,” “we,” “us,” “our” and similar references refer to Five Prime Therapeutics, Inc. The Five Prime logo and RIPPS® are our registered trademarks. This report also contains registered marks, trademarks and trade names of other companies. All other trademarks, registered marks and trade names appearing in this report are the property of their respective holders.

2

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This Quarterly Report on Form 10-Q contains forward-looking statements. In some cases you can identify these statements by forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect,” or similar expressions, or the negative or plural of these words or expressions. These forward-looking statements include statements concerning the following:

|

|

• |

our estimates regarding our expenses, revenues, anticipated capital requirements and our needs for additional financing; |

|

|

• |

our receipt of future milestone payments and/or royalties, and the timing of such payments; |

|

|

• |

our or our partners’ ability to timely advance drug candidates into and through clinical data readouts and successful completion of clinical trials; |

|

|

• |

the timing of the initiation, progress and results of preclinical studies and research and development programs; |

|

|

• |

our expectations regarding the potential safety, efficacy or clinical utility of our product candidates; |

|

|

• |

the implementation, timing and likelihood of success of our plans to develop companion diagnostics for our product candidates; |

|

|

• |

our ability to establish and maintain collaborations and necessary licenses; |

|

|

• |

the implementation of our business model and strategic plans for our business, product candidates and technology; |

|

|

• |

the scope of protection we establish and maintain for intellectual property rights covering our product candidates and technology; |

|

|

• |

the size of patient populations targeted by products we or our partners develop and market adoption of such products by physicians and patients; |

|

|

• |

the timing or likelihood of regulatory filings and approvals; |

|

|

• |

the ability to negotiate adequate reimbursement and pricing for our drug candidates by third parties and government authorities; |

|

|

• |

developments relating to our competitors and our industry; and |

|

|

• |

our expectations regarding licensing, acquisitions and strategic operations. |

These statements are only current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking statements. We discuss many of these risks in this report in greater detail under the heading “Risk Factors” and elsewhere in this report. You should not rely upon forward-looking statements as predictions of future events.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by law, we are under no duty to update or revise any of the forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this report.

We obtained the industry, market and competitive position data in this quarterly report from our own internal estimates and research as well as from industry and general publications and research surveys and studies conducted by third parties. While we believe that each of these studies and publications is reliable, we have not independently verified market and industry data from third-party sources. While we believe our internal company research is reliable and the market definitions we use are appropriate, neither such research nor these definitions have been verified by any independent source.

3

FIVE PRIME THERAPEUTICS, INC.

(In thousands)

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2017 |

|

|

2016 |

|

||

|

Assets |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

59,709 |

|

|

$ |

7,653 |

|

|

Marketable securities |

|

291,009 |

|

|

|

414,095 |

|

|

Receivables from collaborative partners |

|

3,832 |

|

|

|

3,959 |

|

|

Income tax receivable |

|

— |

|

|

|

4,670 |

|

|

Prepaid and other current assets |

|

8,754 |

|

|

|

9,748 |

|

|

Total current assets |

|

363,304 |

|

|

|

440,125 |

|

|

Restricted cash |

|

1,543 |

|

|

|

1,543 |

|

|

Property and equipment, net |

|

15,227 |

|

|

|

6,207 |

|

|

Other long-term assets |

|

37 |

|

|

|

406 |

|

|

Total assets |

$ |

380,111 |

|

|

$ |

448,281 |

|

|

Liabilities and stockholders' equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

1,321 |

|

|

$ |

334 |

|

|

Accrued personnel-related expenses |

|

5,377 |

|

|

|

7,957 |

|

|

Other accrued liabilities |

|

15,113 |

|

|

|

15,435 |

|

|

Deferred revenue, current portion |

|

13,325 |

|

|

|

14,150 |

|

|

Deferred rent, current portion |

|

433 |

|

|

|

865 |

|

|

Total current liabilities |

|

35,569 |

|

|

|

38,741 |

|

|

Deferred revenue, long-term portion |

|

12,033 |

|

|

|

17,856 |

|

|

Deferred rent, long-term portion |

|

1,812 |

|

|

|

— |

|

|

Other long-term liabilities |

|

7,423 |

|

|

|

109 |

|

|

Commitments |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized, 28,804,182 issued and 27,985,692 outstanding at June 30, 2017. 28,550,006 issued and 27,509,077 outstanding at December 31, 2016 |

|

28 |

|

|

|

27 |

|

|

Additional paid-in capital |

|

406,664 |

|

|

|

396,635 |

|

|

Accumulated other comprehensive loss |

|

(304 |

) |

|

|

(39 |

) |

|

Accumulated deficit |

|

(83,114 |

) |

|

|

(5,048 |

) |

|

Total stockholders' equity |

|

323,274 |

|

|

|

391,575 |

|

|

Total liabilities and stockholders' equity |

$ |

380,111 |

|

|

$ |

448,281 |

|

The accompanying notes are an integral part of these unaudited condensed financial statements.

4

Condensed Statements of Operations

(In thousands, except per share amounts)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Collaboration revenue |

$ |

7,822 |

|

|

$ |

9,229 |

|

|

$ |

17,957 |

|

|

$ |

15,749 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

41,744 |

|

|

|

22,177 |

|

|

|

75,504 |

|

|

|

41,033 |

|

|

General and administrative |

|

9,363 |

|

|

|

8,106 |

|

|

|

19,849 |

|

|

|

16,163 |

|

|

Total operating expenses |

|

51,107 |

|

|

|

30,283 |

|

|

|

95,353 |

|

|

|

57,196 |

|

|

Loss from operations |

|

(43,285 |

) |

|

|

(21,054 |

) |

|

|

(77,396 |

) |

|

|

(41,447 |

) |

|

Interest and other income, net |

|

702 |

|

|

|

646 |

|

|

|

1,370 |

|

|

|

1,182 |

|

|

Loss before income tax |

|

(42,583 |

) |

|

|

(20,408 |

) |

|

|

(76,026 |

) |

|

|

(40,265 |

) |

|

Income tax (provision) benefit |

|

(1,703 |

) |

|

|

7,271 |

|

|

|

(1,703 |

) |

|

|

14,088 |

|

|

Net loss |

$ |

(44,286 |

) |

|

$ |

(13,137 |

) |

|

$ |

(77,729 |

) |

|

$ |

(26,177 |

) |

|

Basic and diluted net loss per common share |

$ |

(1.58 |

) |

|

$ |

(0.49 |

) |

|

$ |

(2.79 |

) |

|

$ |

(0.98 |

) |

|

Weighted-average shares used to compute basic and diluted net loss per common share |

|

27,946 |

|

|

|

26,924 |

|

|

|

27,813 |

|

|

|

26,619 |

|

The accompanying notes are an integral part of these unaudited condensed financial statements.

5

Condensed Statements of Comprehensive Loss

(In thousands)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Net loss |

$ |

(44,286 |

) |

|

$ |

(13,137 |

) |

|

$ |

(77,729 |

) |

|

$ |

(26,177 |

) |

|

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unrealized gain (loss) on marketable securities, net of tax |

|

(60 |

) |

|

|

109 |

|

|

|

(265 |

) |

|

|

293 |

|

|

Comprehensive loss |

$ |

(44,346 |

) |

|

$ |

(13,028 |

) |

|

$ |

(77,994 |

) |

|

$ |

(25,884 |

) |

The accompanying notes are an integral part of these unaudited condensed financial statements.

6

Condensed Statements of Cash Flows

(In thousands)

|

|

Six Months Ended |

|

|||||

|

|

June 30, |

|

|||||

|

|

2017 |

|

|

2016 |

|

||

|

Operating activities |

|

|

|

|

|

|

|

|

Net loss |

$ |

(77,729 |

) |

|

$ |

(26,177 |

) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

1,112 |

|

|

|

782 |

|

|

Stock-based compensation expense |

|

19,648 |

|

|

|

14,527 |

|

|

Excess tax benefits from employee equity incentive plans |

|

— |

|

|

|

(2,533 |

) |

|

Deferred income taxes |

|

— |

|

|

|

3,451 |

|

|

Amortization of premiums and discounts on marketable securities |

|

1,223 |

|

|

|

2,346 |

|

|

Loss (gain) on disposal of property and equipment |

|

2 |

|

|

|

(9 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Receivables from collaborative partners |

|

127 |

|

|

|

655 |

|

|

Income tax receivable |

|

4,670 |

|

|

|

(1,504 |

) |

|

Prepaid, other current assets, and other long-term assets |

|

1,363 |

|

|

|

770 |

|

|

Accounts payable |

|

987 |

|

|

|

(1,240 |

) |

|

Accrued personnel-related expenses |

|

(2,580 |

) |

|

|

(2,863 |

) |

|

Deferred revenue |

|

(6,648 |

) |

|

|

(8,618 |

) |

|

Deferred rent |

|

1,185 |

|

|

|

(383 |

) |

|

Income tax payable |

|

— |

|

|

|

(30,580 |

) |

|

Other accrued liabilities and other long-term liabilities |

|

(377 |

) |

|

|

2,210 |

|

|

Net cash used in operating activities |

|

(57,017 |

) |

|

|

(49,166 |

) |

|

Investing activities |

|

|

|

|

|

|

|

|

Purchases of marketable securities |

|

(220,652 |

) |

|

|

(339,880 |

) |

|

Maturities of marketable securities |

|

342,250 |

|

|

|

274,250 |

|

|

Purchases of property and equipment |

|

(2,581 |

) |

|

|

(1,868 |

) |

|

Proceeds from disposal of property and equipment |

|

12 |

|

|

|

— |

|

|

Net cash provided by (used in) investing activities |

|

119,029 |

|

|

|

(67,498 |

) |

|

Financing activities |

|

|

|

|

|

|

|

|

Proceeds from issuance of common stock under equity incentive plans |

|

2,230 |

|

|

|

5,916 |

|

|

Repurchase of shares to satisfy tax withholding obligations |

|

(12,186 |

) |

|

|

(3,602 |

) |

|

Excess tax benefits from employee equity incentive plans |

|

— |

|

|

|

2,533 |

|

|

Net cash (used in) provided by financing activities |

|

(9,956 |

) |

|

|

4,847 |

|

|

Net increase (decrease) in cash and cash equivalents |

|

52,056 |

|

|

|

(111,817 |

) |

|

Cash and cash equivalents at beginning of period |

|

7,653 |

|

|

|

149,971 |

|

|

Cash and cash equivalents at end of period |

$ |

59,709 |

|

|

$ |

38,154 |

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information |

|

|

|

|

|

|

|

|

Cash paid for income taxes |

$ |

— |

|

|

$ |

14,701 |

|

|

|

|

|

|

|

|

|

|

|

Non-cash investing activities |

|

|

|

|

|

|

|

|

Unpaid property and equipment purchases included in accrued liabilities |

$ |

403 |

|

|

$ |

— |

|

|

Tenant improvements provided by the landlord |

$ |

8,291 |

|

|

$ |

— |

|

The accompanying notes are an integral part of these unaudited condensed financial statements.

7

Notes to Condensed Financial Statements

June 30, 2017

|

1. |

Description of Business |

Five Prime Therapeutics, Inc. (we, us, our, or the Company) is a clinical-stage biotechnology company focused on discovering and developing innovative protein therapeutics. We were incorporated in December 2001 in Delaware. Our operations are based in South San Francisco, California and we operate in one segment.

Unaudited Interim Financial Information

The accompanying financial information as of June 30, 2017 is unaudited. The condensed financial statements included in this report reflect all adjustments (consisting only of normal recurring adjustments) that our management considers necessary for the fair statement of the results of operations for the interim periods covered and of the financial condition of the Company at the date of the interim balance sheet. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles, or GAAP, for interim financial information. Accordingly, they do not include all of the information and notes required by GAAP for complete financial statements. The results for interim periods are not necessarily indicative of the results for the entire year or any other interim period. The accompanying condensed financial statements and related financial information should be read in conjunction with the audited financial statements and the related notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016 filed with the U.S. Securities and Exchange Commission.

|

2. |

Summary of Significant Accounting Policies |

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions about future events that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ materially from those estimates.

Fair Value of Financial Instruments

We determine the fair value of financial and nonfinancial assets and liabilities using the fair value hierarchy, which describes three levels of inputs that may be used to measure fair value, as follows:

Level 1—Quoted prices in active markets for identical assets or liabilities;

Level 2—Observable inputs other than Level 1 prices such as quoted prices for similar assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; and

Level 3—Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

We determine the fair value of Level 1 assets using quoted prices in active markets for identical assets. We review trading activity and pricing for Level 2 investments as of each measurement date. Level 2 inputs, which are obtained from various third-party data providers, represent quoted prices for similar assets in active markets and were derived from observable market data, or, if not directly observable, were derived from or corroborated by other observable market data. There were no transfers between Level 1 and Level 2 securities in the periods presented.

In certain cases where there is limited activity or less transparency around inputs to valuation, we classify securities as Level 3 within the valuation hierarchy. We do not have any assets or liabilities measured using Level 3 inputs as of June 30, 2017.

8

The following table summarizes our financial instruments that were measured at fair value on a recurring basis by level of input within the fair value hierarchy defined above (in thousands):

|

|

June 30, 2017 |

|

|||||||||||||

|

|

|

|

|

|

Basis of Fair Value |

|

|||||||||

|

|

|

|

|

|

Measurements |

|

|||||||||

|

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

$ |

44,600 |

|

|

$ |

44,600 |

|

|

$ |

— |

|

|

$ |

— |

|

|

U.S. Treasury securities |

|

291,009 |

|

|

|

291,009 |

|

|

|

— |

|

|

|

— |

|

|

Certificate of deposit |

|

1,543 |

|

|

|

— |

|

|

|

1,543 |

|

|

|

— |

|

|

Total cash equivalents and marketable securities |

$ |

337,152 |

|

|

$ |

335,609 |

|

|

$ |

1,543 |

|

|

$ |

— |

|

|

|

December 31, 2016 |

|

|||||||||||||

|

|

|

|

|

|

Basis of Fair Value |

|

|||||||||

|

|

|

|

|

|

Measurements |

|

|||||||||

|

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Money market funds |

$ |

432 |

|

|

$ |

432 |

|

|

$ |

— |

|

|

$ |

— |

|

|

U.S. Treasury securities |

|

414,095 |

|

|

|

414,095 |

|

|

|

— |

|

|

|

— |

|

|

Certificate of deposit |

|

1,543 |

|

|

|

— |

|

|

|

1,543 |

|

|

|

— |

|

|

Total cash equivalents and marketable securities |

$ |

416,070 |

|

|

$ |

414,527 |

|

|

$ |

1,543 |

|

|

$ |

— |

|

Net Loss Per Share of Common Stock

We compute basic net loss per common share by dividing net loss attributable to common stockholders by the weighted-average number of shares of common stock outstanding during the period.

We excluded the following securities from the calculation of diluted net loss per share as the effect would have been antidilutive (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Options to purchase common stock |

|

3,879 |

|

|

|

2,561 |

|

|

|

3,796 |

|

|

|

2,739 |

|

|

Restricted stock awards (RSAs) |

|

834 |

|

|

|

1,319 |

|

|

|

940 |

|

|

|

1,412 |

|

|

|

|

4,713 |

|

|

|

3,880 |

|

|

|

4,736 |

|

|

|

4,151 |

|

9

Accounting Pronouncements Adopted in 2017

In March 2016, the Financial Accounting Standards Board, or FASB, issued Accounting Standards Update, or ASU, 2016-09, Improvements to Employee Share-Based Payment Accounting, to simplify certain aspects of the accounting for share-based payment transactions to employees. The new standard requires excess tax benefits and tax deficiencies to be recorded as a component of the provision for income taxes in a company’s statements of income when stock awards vest or are settled. In addition, it eliminates the requirement to reclassify cash flows related to excess tax benefits from operating activities to financing activities on the consolidated statements of cash flows. The standard also provides an accounting policy election to account for forfeitures as they occur, allowing a company to withhold more of an employee’s vesting shares for tax withholding purposes without triggering liability accounting, and clarifies that all cash payments made to tax authorities on an employee’s behalf for withheld shares should be presented as a financing activity on a company’s cash flows statement. We adopted ASU 2016-09 as of January 1, 2017. Starting in the first quarter of 2017, we reflected excess tax benefits or deficiencies from share-based award activity in the consolidated statements of income as a component of the provision for income taxes, whereas we previously recognized them in equity. We have not adjusted prior periods. In addition, we adopted the aspects of the standard affecting the cash flow presentation prospectively. We will include the cash flow related to excess tax benefits within the operating activities. The presentation requirements for cash flows related to employee taxes paid for withheld shares has no impact on our consolidated statements of cash flows since such cash flows have historically been presented as a financing activity. Finally, we elected to account for forfeitures as they occur, rather than estimate expected forfeitures, on a modified retrospective basis. Our adoption of ASU 2016-09 resulted in a $337,000 decrease to retained earnings as of January 1, 2017 to record the additional stock compensation expense due to the elimination of the estimated forfeiture rate and a $3.1 million increase to deferred tax assets which is fully offset by a valuation allowance because we determined that it is more likely than not that the deferred tax asset will not be fully realized.

Accounting Pronouncements Not Yet Adopted

In May 2014, FASB issued ASU 2014-09, Revenue from Contracts with Customers: Topic 606, to supersede nearly all existing revenue recognition guidance under GAAP. The core principle of ASU 2014-09 is to recognize revenues when promised goods or services are transferred to customers in an amount that reflects the consideration that is expected to be received for those goods or services. ASU 2014-09 defines a five-step process to achieve this core principle and, in doing so, it is possible more judgment and estimates may be required within the revenue recognition process than are required under existing GAAP, including identifying performance obligations in a contract, estimating the amount of variable consideration to include in the transaction price and allocating the transaction price to each separate performance obligation. ASU 2014-09 will become effective for us in our first quarter of 2018 using either of two methods: (i) retrospective application of ASU 2014-09 to each prior reporting period presented with the option to elect certain practical expedients as defined within ASU 2014-09; or (ii) modified retrospective application of ASU 2014-09 with the cumulative effect of initially applying ASU 2014-09 recognized at the date of initial application and providing certain additional disclosures as defined per ASU 2014-09. In March, April, May and December 2016, the FASB issued ASU 2016-08, Revenue from Contracts with Customers: Principal versus Agent Considerations, ASU 2016-10, Revenue from Contracts with Customers: Identifying Performance Obligations and Licensing, ASU 2016-12, Revenue from Contracts with Customers: Narrow-Scope Improvements and Practical Expedients to provide supplemental adoption guidance and clarification to ASU 2014-09 and ASU 2016-20, Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers, respectively. The effective date for these new standards is the same as the effective date and transition requirements for ASU 2014-09. We expect to adopt ASU 2014-09 in the first quarter of 2018 using the modified retrospective method.

Our adoption of ASU 2014-09 may have a material effect on our financial statements. To date, we have derived our revenues from license and collaboration agreements. The consideration we are eligible to receive under these agreements includes upfront payments, research and development funding, milestone payments and royalties. Each license and collaboration agreement is unique and will need to be assessed separately under the five-step process set forth in under the new standard. We are currently assessing our active license and collaboration agreements. We expect that our evaluation of the accounting for license and collaboration agreements under the new revenue standard could identify material changes from the current accounting treatment. ASU 2014-09 differs from the current accounting standard in many respects, such as in the accounting for variable consideration, including milestone payments. Under our current accounting policy, we recognize milestone revenue using the milestone method specified in ASC 605-28, which generally results in the recognition of the milestone payment as revenue in the period that the milestone is achieved. However, under the new accounting standard, it is possible to start to recognize milestone revenue before the milestone is achieved, subject to management’s assessment of whether it is probable that a significant reversal in the amount of cumulative revenue recognized will not occur when the uncertainty associated with the variable consideration is subsequently resolved. In addition, the current accounting standards include a presumption that revenue from up-front non-refundable fees would be recognized ratably over the performance period, unless another attribution method was determined to more closely approximate the delivery of the goods or services to the customer. The new accounting standard does not have a presumption that entities would default to a ratable attribution approach and will require entities to determine an appropriate attribution method using either output or input methods. As such, the amount and timing of revenue recognition for our license and collaboration agreements may change under the new revenue standard.

10

In February 2016, FASB issued ASU 2016-02, Leases, which amends existing guidance to require substantially all leases be recognized by lessees on their balance sheet as a right-of-use asset and corresponding lease liability, including leases currently accounted for as operating leases. ASU 2016-02 will become effective for our interim and annual reporting periods during the year ending December 31, 2019 and will apply to all annual and interim reporting periods thereafter. Early adoption is permitted. Under the new standard, we expect to record a right-to-use lease asset and a lease liability on our balance sheet. Under the new standard, we expect to recognize expense on our statement of operations in a manner similar to the current accounting standard.

In May 2017, FASB issued ASU 2017-09, Compensation-Stock Compensation (Topic 718) – Scope of Modification Accounting, which amends the scope of modification accounting for share-based payment arrangements. Specifically, an entity would not apply modification accounting if the fair value, vesting conditions, and classification of the awards are the same immediately before and after the modification. We will adopt the standard effective January 1, 2018. The adoption is not expected to have a material impact on our consolidated financial statements.

|

3. |

Cash Equivalents and Marketable Securities |

The following table summarizes our cash equivalents and marketable securities (in thousands):

|

|

June 30, 2017 |

|

|||||||||||||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

Cost Basis |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Money market funds |

$ |

44,600 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

44,600 |

|

|

U.S. Treasury securities |

|

291,313 |

|

|

|

— |

|

|

|

(304 |

) |

|

|

291,009 |

|

|

|

|

335,913 |

|

|

|

— |

|

|

|

(304 |

) |

|

|

335,609 |

|

|

Less: cash equivalents |

|

(44,600 |

) |

|

|

— |

|

|

|

— |

|

|

|

(44,600 |

) |

|

Total marketable securities |

$ |

291,313 |

|

|

$ |

— |

|

|

$ |

(304 |

) |

|

$ |

291,009 |

|

|

|

December 31, 2016 |

|

|||||||||||||

|

|

Amortized |

|

|

Unrealized |

|

|

Unrealized |

|

|

Estimated |

|

||||

|

|

Cost Basis |

|

|

Gains |

|

|

Losses |

|

|

Fair Value |

|

||||

|

Money market funds |

$ |

432 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

432 |

|

|

U.S. Treasury securities |

|

414,134 |

|

|

|

54 |

|

|

|

(93 |

) |

|

|

414,095 |

|

|

|

|

414,566 |

|

|

|

54 |

|

|

|

(93 |

) |

|

|

414,527 |

|

|

Less: cash equivalents |

|

(432 |

) |

|

|

— |

|

|

|

— |

|

|

|

(432 |

) |

|

Total marketable securities |

$ |

414,134 |

|

|

$ |

54 |

|

|

$ |

(93 |

) |

|

$ |

414,095 |

|

As of June 30, 2017, the amortized cost and estimated fair value of our available-for-sale securities by contractual maturity are shown below (in thousands):

|

|

Amortized |

|

|

Estimated |

|

||

|

|

Cost |

|

|

Fair Value |

|

||

|

Debt securities maturing: |

|

|

|

|

|

|

|

|

In one year or less |

$ |

286,339 |

|

|

$ |

286,042 |

|

|

In one to two years |

|

4,974 |

|

|

|

4,967 |

|

|

Total marketable securities |

$ |

291,313 |

|

|

$ |

291,009 |

|

We determined that the gross unrealized losses on our marketable securities as of June 30, 2017 were temporary in nature. We currently do not intend to sell these securities prior to maturity and do not consider these investments to be other-than-temporarily impaired at June 30, 2017. There were no sales of available-for-sale securities in any of the periods presented.

11

The following table summarizes option activity under our equity incentive plans and related information:

|

|

Options Outstanding |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

Weighted |

|

|

|

|

|

|

|

|

Weighted |

|

|

Average |

|

||

|

|

|

|

|

|

Average |

|

|

Remaining |

|

||

|

|

Number of |

|

|

Exercise Price |

|

|

Contractual |

|

|||

|

|

Shares |

|

|

Per Share |

|

|

Term (years) |

|

|||

|

Balance at December 31, 2016 |

|

3,454,339 |

|

|

$ |

26.80 |

|

|

|

|

|

|

Options granted |

|

699,050 |

|

|

$ |

41.91 |

|

|

|

|

|

|

Options exercised |

|

(115,944 |

) |

|

$ |

12.37 |

|

|

|

|

|

|

Options forfeited |

|

(160,002 |

) |

|

$ |

37.87 |

|

|

|

|

|

|

Options expired |

|

(552 |

) |

|

$ |

43.93 |

|

|

|

|

|

|

Balance at June 30, 2017 |

|

3,876,891 |

|

|

$ |

29.50 |

|

|

|

|

|

|

Options exercisable as of June 30, 2017 |

|

1,748,719 |

|

|

$ |

19.87 |

|

|

|

6.00 |

|

We have granted RSAs to certain of our employees, some of which are subject to performance conditions. RSAs are share awards that entitle the holder to receive freely tradable shares of our common stock upon vesting and are not forfeitable once fully vested. We based the fair value of RSAs on the closing sale price of our common stock on the grant date. For awards subject to performance conditions, we recognize stock-based compensation expense using the accelerated attribution recognition method when it is probable that the performance condition will be achieved.

The following table summarizes RSA activity under our 2013 Omnibus Incentive Plan and related information:

|

|

RSAs Outstanding |

|

||||

|

|

|

|

|

Weighted-Average |

|

|

|

|

Number |

|

Grant-Date |

|

||

|

|

of Shares |

|

Fair Value |

|

||

|

Unvested balance at December 31, 2016 |

|

1,040,929 |

|

$ |

28.84 |

|

|

RSAs granted |

|

452,555 |

|

$ |

43.96 |

|

|

RSAs vested |

|

(602,467 |

) |

$ |

20.24 |

|

|

RSAs forfeited |

|

(72,527 |

) |

$ |

42.50 |

|

|

Unvested balance at June 30, 2017 |

|

818,490 |

|

$ |

42.32 |

|

|

|

|

|

|

|

|

|

As of June 30, 2017, there were 1,564,142 shares of common stock available for future issuance under our 2013 Omnibus Incentive Plan.

Stock-Based Compensation

Total stock-based compensation expense recognized was as follows (in thousands):

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Research and development |

$ |

5,930 |

|

|

$ |

3,868 |

|

|

$ |

11,216 |

|

|

$ |

8,143 |

|

|

General and administrative |

|

3,831 |

|

|

|

3,258 |

|

|

|

8,432 |

|

|

|

6,384 |

|

|

Total |

$ |

9,761 |

|

|

$ |

7,126 |

|

|

$ |

19,648 |

|

|

$ |

14,527 |

|

12

We estimated the fair value of stock options using the Black-Scholes option-pricing model based on the date of grant of such stock option with the following assumptions:

|

|

Three Months Ended |

|

Six Months Ended |

||||

|

|

June 30, |

|

June 30, |

||||

|

|

2017 |

|

2016 |

|

2017 |

|

2016 |

|

Expected term (years) |

5.5-6.3 |

|

5.5-6.3 |

|

5.5-6.3 |

|

5.5-6.3 |

|

Expected volatility |

66% |

|

72% |

|

66-68% |

|

72-74% |

|

Risk-free interest rate |

1.9% |

|

1.4% |

|

1.9-2.1 |

|

1.4-1.5% |

|

Expected dividend yield |

0% |

|

0% |

|

0% |

|

0% |

As of June 30, 2017, we had $46.4 million of total unrecognized compensation expense related to unvested employee and director stock options that we expect to recognize over a weighted-average period of 2.8 years. Additionally, we had $26.2 million of total unrecognized compensation expense related to employee and director RSAs that we expect to recognize over a weighted-average period of 2.2 years.

|

5. |

Income Taxes |

We recorded a provision for income taxes of $1.7 million for the three and six months ended June 30, 2017 based on our ongoing discussions with the Internal Revenue Service as to our tentative net operating loss carryback refund claim filed in March 2017. We realized an income tax benefit of $7.3 million and $14.1 million for the three and six months ended June 30, 2016, respectively. This income tax benefit represented our ability to recover taxes accrued in 2015 based on existing tax law that allowed us to carryback our 2016 tax losses and/or credits to recover prior taxes. The income tax benefit was based on the annual effective tax rate method and considered our forecasted 2016 pre-tax losses reduced by non-deductible stock based compensation expenses and other immaterial non-deductible permanent items. In addition, as a result of the forecasted loss, the income tax benefit was decreased by a valuation allowance recorded against certain deferred tax assets due to the uncertainty surrounding the realization of such assets in the future.

After the carryback of our full year 2016 net operating losses to 2015, we maximized our ability to obtain a refund of prior income taxes paid.

13

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following management’s discussion and analysis of our financial condition and results of operations in conjunction with our unaudited condensed financial statements and notes thereto included in Part I, Item 1 of this Quarterly Report on Form 10-Q and with our audited financial statements and related notes thereto for the year ended December 31, 2016, included in our Annual Report on Form 10-K as filed with the U.S. Securities and Exchange Commission, or the SEC, on February 24, 2017, or our Annual Report.

Overview

We are a clinical-stage biotechnology company focused on discovering and developing innovative protein therapeutics to improve the lives of patients with serious diseases. Each of our product candidates has an innovative mechanism of action and addresses patient populations for which better therapies are still needed. We have an emphasis in immuno-oncology, an area in which we have clinical, preclinical and discovery programs and product and discovery collaborations. In addition, we plan to use companion diagnostics where appropriate to allow us to select patients most likely to benefit from treatment. Our most advanced product candidates are identified below.

|

|

• |

Cabiralizumab (FPA008) is an antibody that inhibits colony stimulating factor-1, or CSF1, receptor, or CSF1R, that we are studying in clinical trials as a monotherapy in tenosynovial giant cell tumor, also known as diffuse pigmented villonodular synovitis, or PVNS, and in multiple cancers in combination with Bristol-Myers Squibb Company’s PD-1 immune checkpoint inhibitor, Opdivo® (nivolumab). In October 2015, we entered into a license and collaboration agreement, or the cabiralizumab collaboration agreement, with Bristol-Myers Squibb Company, or BMS, pursuant to which we granted BMS an exclusive worldwide license for the development and commercialization of cabiralizumab. |

|

|

• |

FPA144 is an antibody that inhibits fibroblast growth factor receptor 2b, or FGFR2b, that we are initially developing in Phase 1 clinical trials to treat patients with gastric (stomach) or gastroesophageal junction, or GEJ, cancer and bladder cancer. |

|

|

• |

FP-1039 is a fusion protein that “traps” and neutralizes cancer-promoting fibroblast growth factors, or FGFs, involved in cancer cell proliferation and new blood vessel formation that is in Phase 1b clinical development to treat patients with malignant pleural mesothelioma. |

We have a differentiated target discovery platform and library of more than 5,700 human transmembrane and extracellular soluble proteins that we believe encompasses substantially all of the body’s medically important targets for protein therapeutics. We have identified approximately 700 of these proteins, which we refer to as the immunome, that we believe modulate immune cell interactions and may be important in understanding and treating cancer patients using immuno-oncology therapeutics. Our target discovery platform and capabilities uniquely position us to explore pathways in cancer and inflammation and their intersection in immuno-oncology, an area of oncology with significant therapeutic potential and the focus of our research activities. We are applying all aspects of our biologics discovery platform, including cell-based screening, immunome-by-immunome screening, in vivo screening, receptor-ligand matching technologies and bioinformatics, in our immuno-oncology research program. We have identified several targets that we believe could be useful in immuno-oncology that we are actively validating, and we are also looking for additional targets. We generate and preclinically test therapeutic proteins, including antibodies and ligand traps containing or directed to the targets we identify. We plan to advance selected therapeutic candidates into clinical development, with a goal of filing at least one Investigational New Drug, or IND, application for a new molecule each year beginning in 2017.

We have no products approved for commercial sale and have not generated any revenue from product sales to date. We continue to incur significant research and development and other expenses related to our ongoing operations and we expect that our expenses will increase as we advance our product candidates into later stages of clinical development and increase the number of product candidates in clinical development. We have incurred losses in each period since our inception in 2002, with the exception of the fiscal year ended December 31, 2015, due primarily to the $350.0 million upfront payment we received from BMS from our cabiralizumab collaboration agreement, and the fiscal year ended December 31, 2011, due primarily to the $50.0 million upfront payment we received from GlaxoSmithKline, or GSK, from our license and collaboration agreement for FP-1039. For the six months ended June 30, 2017 and 2016, we reported a net loss of $77.7 million and $26.2 million, respectively.

Our management’s discussion and analysis of our financial condition and results of operations are based upon our unaudited consolidated financial statements included in this Quarterly Report on Form 10-Q, which we prepared in accordance with GAAP for interim periods and with Regulation S-X promulgated under the Securities and Exchange Act of 1934, as amended, or the Exchange Act.

14

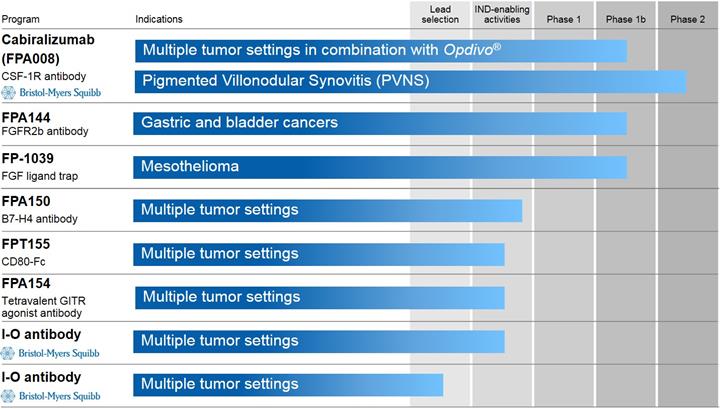

The following table shows the stage of development of our most advanced product candidates:

Cabiralizumab (FPA008)

Cabiralizumab in Immuno-Oncology

We are conducting a Phase 1a/1b clinical trial with BMS to evaluate the safety, tolerability and preliminary efficacy of combining cabiralizumab with Opdivo as a potential treatment for a variety of cancers. We currently expect to enroll approximately 280 patients in the overall trial. In October 2016, we initiated the Phase 1b portion of the trial to evaluate the safety, tolerability and preliminary efficacy of the selected dose of cabiralizumab in combination with Opdivo in the following tumor settings:

|

|

• |

non-small cell lung cancer, or NSCLC (anti PD-1 therapy naïve); |

|

|

• |

anti PD-1 therapy resistant NSCLC (either de novo or acquired resistance); |

|

|

• |

squamous cell carcinoma of the head and neck; |

|

|

• |

pancreatic cancer; |

|

|

• |

renal cancer; |

|

|

• |

ovarian cancer; and |

|

|

• |

glioblastoma multiforme. |

We have completed enrollment in some of the Phase 1b cohorts and expect to complete enrollment in the Phase 1b portion of the trial in the second half of 2017.

We continue to enroll patients in the expansion of the Phase 1a portion of the trial to enable us to study the highest dose of cabiralizumab as monotherapy and as combination therapy with Opdivo. We are conducting these additional Phase 1a activities in parallel with our conduct of the Phase 1b portion of the trial.

We and BMS plan to announce certain initial clinical data for the Phase 1a/1b trial at Society of Immunotherapy of Cancer’s 2017 Annual Meeting.

15

We are conducting a Phase 2 clinical trial of cabiralizumab as a potential treatment for diffuse PVNS. During the Phase 2 expansion portion of the trial, we are evaluating tumor response rate and duration and measures of pain and joint function in PVNS patients.

We completed patient enrollment in the initially-planned 30-patient cohort of the Phase 2 portion of the trial in April 2017. We are in the process of amending the protocol for the Phase 2 portion of this study to enroll additional patients with diffuse PVNS to refine the dosing schedule of and optimize the therapeutic index of cabiralizumab in PVNS. Data from these additional patients are intended to support the design of our planned pivotal trial of cabiralizumab in PVNS.

In June 2017, we presented in a clinical poster presentation at the 2017 American Society of Clinical Oncology, or ASCO, Annual Meeting updated pharmacokinetics, or PK, pharmacodynamics, or PD, and safety data from the 21 patients enrolled and treated with cabiralizumab in our ongoing Phase 1/2 clinical trial following our August 2016 protocol amendment and efficacy data from the 11 patients treated with cabiralizumab prior to the protocol amendment.

Based on the data, we concluded that the PK and PD of cabiralizumab support dosing of up to 4 mg/kg. We did not observe any dose-limiting toxicities at doses up to 4 mg/kg. The most common treatment-related adverse events were periorbital and eyelid edema, rash and pruritis, which are all class effects for compounds targeting the CSF1R pathway.

We observed clinical benefit in patients with diffuse PVNS in doses up to 4mg/kg. Based on radiographic assessments by RECIST 1.1 of anti-tumor activity of the 11 patients treated with cabiralizumab at the 4mg/kg dose, we observed, as of the March 7, 2017 data cut-off date:

|

|

• |

four confirmed radiographic responses and one unconfirmed radiographic response; and |

|

|

• |

improvements in median Ogilvie-Harris composite score of pain and function in both responders and non-responders. |

FPA144

We are conducting a Phase 1 clinical trial of FPA144 as a potential treatment for gastric and GEJ cancer and bladder cancer. We are currently enrolling patients in the expansion portion of the trial in which we are evaluating the safety, PK, and efficacy of FPA144 in metastatic gastric and GEJ cancer patients, with the aim of exploring the correlation between efficacy and FGFR2b overexpression. We are conducting tumor testing for FGFR2b overexpression centrally using an immunohistochemistry, or IHC, assay to identify gastric and GEJ cancer patients that have tumors that overexpress FGFR2b protein.

We also have opened for enrollment a cohort in this Phase 1 clinical trial to test FPA144 as a treatment for bladder cancer patients whose tumors overexpress the FGFR2b protein.

In June 2017, we presented in a clinical poster presentation at the 2017 ASCO Annual Meeting updated safety and efficacy data from 64 patients from this Phase 1 clinical trial. In the trial, we tested FPA144 in advanced solid tumors up to 15mg/kg, including in patients with gastric or GEJ cancer and one patient with bladder cancer. As of the March 20, 2017 data cut-off date, we did not observe any dose-limiting toxicities or a maximum-tolerated dose. In addition, unlike small molecule FGF receptor kinase inhibitors, which block signaling through a broad number of FGF receptors and can lead to hyperphosphatemia, we did not observe any treatment-related hyperphosphatemia in patients treated with FPA144. All treatment-related adverse events were Grades 1, 2 or 3. All treatment-related ocular adverse events were Grades 1 or 2, and no retinal toxicity was reported.

We observed preliminary anti-tumor activity with FPA144 monotherapy in late-line gastric and GEJ cancer patients who had had a median of three prior therapies and whose tumors overexpress the FGFR2b protein. Based on radiographic assessments by RECIST 1.1 of anti-tumor activity in the 21 patients who had high FGFR2b+ overexpressing gastric or GEJ cancer, we observed, as of the March 20, 2017 data cut-off date:

|

|

• |

four confirmed partial responses (one each at the 3 mg/kg, 6 mg/kg, 10 mg/kg and 15 mg/kg dose levels); one unconfirmed partial response (at the 6 mg/kg dose level); |

|

|

• |

an objective response rate of 19.0%; |

|

|

• |

a median duration of response of 15.4 weeks; and |

|

|

• |

a disease control rate at 6 weeks of 57.1%. |

16

In addition, we observed anti-tumor activity with FPA144 monotherapy in a urothelial bladder cancer patient with FGFR2b overexpression, as determined by an IHC assay, who enrolled in the dose escalation portion of the Phase 1 clinical trial. Based on radiographic assessments by RECIST 1.1 of anti-tumor activity in the urothelial bladder cancer patient, we observed that the patient had a complete response at a dose of 3 mg/kg. To better understand the potential utility of FPA144 for the treatment of urothelial bladder cancer patients that overexpress FGFR2b, we analyzed 387 archival primary urothelial bladder cancer samples with an immunohistochemistry (IHC) assay for FGFR2b overexpression and determined that 11.6% of the primary tumor samples (n=342) overexpressed FGFR2b at a level of at least 1+ in at least 10% of the primary tumor sample and that 14.2% of the metastatic tumor samples (n=30) overexpressed FGFR2b at a level of at least 1+ in at least 10% of the metastatic tumor sample.

We have begun discussions with regulatory authorities regarding our plans to advance FPA144 in combination with standard of care chemotherapy to a global Phase 3 clinical trial in front-line gastric and GEJ cancer patients whose tumors overexpress FGFR2b. We also plan to continue evaluating whether FPA144 may be a potential treatment for bladder cancer and potentially other types of cancer.

Because the observed incidence of gastric and GEJ cancer is higher in Asian populations than in other populations, in July 2017, we initiated dosing in a Phase 1 clinical trial in Japan evaluating FPA144 as a monotherapy to treat patients with gastric or GEJ cancer. This trial is intended to enable the inclusion of Japanese patients in the global Phase 3 clinical trial that we are planning. In addition, we are actively evaluating the initiation of clinical development of FPA144 to potentially treat patients with gastric cancer in China.

In conjunction with developing FPA144 as a therapeutic for gastric and GEJ cancer, we are developing both an IHC assay and a blood-based (liquid biopsy) assay, in collaboration with diagnostic development partners, to use as companion diagnostics to identify gastric and GEJ cancer patients whose tumors overexpress FGFR2b or amplify the FGFR2 gene. Because the IHC-based companion diagnostic will allow us to determine FGFR2b overexpression in tumor tissue samples from gastric and GEJ cancer patients and the blood-based companion diagnostic will allow us to detect FGFR2 gene amplification by circulating tumor DNA, which is DNA shed from tumors that circulates in blood plasma outside of cells, from gastric and GEJ cancer patients, we plan to use both companion diagnostics concurrently to more effectively identify gastric and GEJ cancer patients whose tumors overexpress FGFR2b. We plan to develop both companion diagnostics in parallel with our clinical development of FPA144 and to pursue regulatory approval of each companion diagnostic concurrently with regulatory approval of FPA144.

FP-1039

In March 2011, we licensed to Human Genome Sciences, Inc., or HGS, rights to develop and commercialize FP-1039 in the United States, the European Union and Canada. In August 2012, GSK acquired HGS and HGS is now a wholly-owned subsidiary of GSK. HGS/GSK terminated its license to FP-1039 for convenience effective September 5, 2016.

Prior to GSK’s termination of the FP-1039 license, GSK had initiated a Phase 1b clinical trial of FP-1039 to evaluate the safety, tolerability, dosage, response rate and duration of response of FP-1039 in combination with front-line pemetrexed and cisplatin in malignant pleural mesothelioma, or MPM, patients. In June 2016, GSK completed enrollment of MPM patients at an expansion dose of 15 mg/kg in the Phase 1b clinical trial and GSK is currently dosing and following patients that remain on the study. Pursuant to the terms of the FP-1039 license, we elected to have GSK complete the conduct of the Phase 1b clinical trial of FP-1039 that GSK is currently conducting, at GSK’s expense.

Together with GSK, we plan to present updated response rate, duration of response and progression-free survival data from the Phase 1b clinical trial at the European Society for Medical Oncology’s 2017 Congress.

We will make decisions regarding any future development of FP-1039 in mesothelioma based on overall safety as well as the quantity and durability of responses in the Phase 1b clinical trial and other business considerations, such as drug supply and manufacturing.

Preclinical Programs

We are currently conducting IND-enabling activities in each of our FPA150 (B7H4 antibody), FPA154 (GITR antibody) and FPT155 (CD80 fusion protein) programs. We plan to file IND applications for the FPA150 in the fourth quarter of 2017 and for the FPA154 and FPT155 in 2018.

17

Immuno-Oncology Drug Discovery

We are currently focusing our internal research efforts in immuno-oncology. Cancers grow and spread because tumor cells have developed ways to evade elimination by the immune system. For example, cancer cells make proteins that apply the “brakes” to immune cells and prevent the immune cells from killing the tumor cells. One of the most exciting recent discoveries in cancer therapy has been the identification of ways to release these “brakes” and allow the immune cells to once again kill tumor cells. This new approach has the potential to not only reduce tumor growth like traditional therapies, but potentially to eliminate the cancer entirely in some patients. In addition to releasing the “brakes” on immune cells, other recent discoveries in cancer therapy have focused on identifying ways to “press on the gas” to amplify the anti-tumor immune response. This second approach targets stimulatory pathways on immune cells. Agents that agonize stimulatory pathways can help immune cells overcome inhibitory signals in the tumor microenvironment and kill tumor cells.

While checkpoint inhibitor therapies have been validated in the clinic with agents targeting the PD-1/PD-L1 and CTLA-4 pathways to release the “brakes,” a significant proportion of patients do not respond to these treatments. New targets for immuno-oncology are needed to address those patients who do not respond to or cannot tolerate traditional therapies or agents currently in development. We are applying all aspects of our biologics discovery platform to identify protein partners for molecules known to be involved in the anti-tumor immune response. We believe we have identified promising new antibody targets and ligand traps and are actively screening for and validating additional targets.

Financial Overview

Collaboration and License Revenue

We have not generated any revenue from product sales. We have derived our revenue to date from upfront payments, research and development funding and milestone payments under collaboration and license agreements with our collaboration partners and licensees. We currently have an active immuno-oncology research collaboration and cabiralizumab license and collaboration agreement with BMS. We completed the research term of our research collaboration in respiratory diseases with GSK and our fibrosis and CNS research collaboration with UCB Pharma S.A., or UCB, in July 2016 and March 2016, respectively.

Summary Revenue by Collaboration and License Agreements

The following is a comparison of collaboration and license revenue for the three and six months ended June 30, 2017 and 2016:

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

(in millions) |

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

R&D Funding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cabiralizumab Collaboration - BMS |

$ |

3.9 |

|

|

$ |

1.7 |

|

|

$ |

9.6 |

|

|

$ |

2.8 |

|

|

Immuno-oncology Research Collaboration - BMS |

|

0.7 |

|

|

|

0.8 |

|

|

|

1.5 |

|

|

|

1.4 |

|

|

Respiratory Diseases Collaboration - GSK |

|

— |

|

|

|

1.4 |

|

|

|

— |

|

|

|

2.3 |

|

|

Fibrosis and CNS Collaboration - UCB |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.1 |

|

|

Ratable Revenue Recognition |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cabiralizumab Collaboration - BMS |

|

1.5 |

|

|

|

1.5 |

|

|

|

3.0 |

|

|

|

2.9 |

|

|

Immuno-oncology Research Collaboration - BMS |

|

1.1 |

|

|

|

1.1 |

|

|

|

2.2 |

|

|

|

2.2 |

|

|

Respiratory Diseases Collaboration - GSK |

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

|

0.7 |

|

|

Fibrosis and CNS Collaboration - UCB |

|

0.7 |

|

|

|

0.7 |

|

|

|

1.5 |

|

|

|

1.5 |

|

|

Milestone and Contingent Payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Respiratory Diseases Collaboration - GSK |

|

— |

|

|

|

1.5 |

|

|

|

— |

|

|

|

1.5 |

|

|

Fibrosis and CNS Collaboration - UCB |

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

0.2 |

|

|

Other License Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

bluebird bio License Agreement |

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

0.1 |

|

|

Total |

$ |

7.8 |

|

|

$ |

9.2 |

|

|

$ |

18.0 |

|

|

$ |

15.7 |

|

We expect that any revenue we generate will fluctuate from period to period as a result of the timing and amount of milestones and other payments from our existing collaborations and licenses or entry into any new collaborations and license agreements.

18

Research and development expenses consist of costs we incur for our own and for sponsored and collaborative research and development activities. Expenses we incur related to collaborative research and development agreements approximate the revenue we recognize under these agreements. We expense research and development costs as we incur them. Research and development costs consist of salaries and benefits, including associated stock-based compensation, laboratory supplies and facility costs, as well as fees we pay to other entities that conduct certain research and development activities on our behalf. We estimate preclinical study and clinical trial expenses based on the services performed pursuant to contracts with research institutions and contract research organizations, or CROs, and clinical manufacturing organizations, or CMOs, that conduct and manage preclinical studies and clinical trials on our behalf based on actual time and expenses incurred by them. Further, we accrue expenses related to clinical trials based on the level of patient enrollment and activity contemplated by the applicable agreement. We monitor patient enrollment levels and related activity to the extent reasonably possible and adjust estimates accordingly. If we do not identify costs that we have begun to incur or if we underestimate or overestimate the level of services performed or the costs of these services, our actual expenses could differ from our estimates. To date, we have not experienced significant changes in our estimates of preclinical studies and clinical trial accruals.

We expense payments for the acquisition and development of technology as research and development costs if, at the time of payment, the technology: is under development; is not approved by the U.S. Food and Drug Administration or other regulatory agencies for marketing; has not reached technical feasibility; or otherwise has no foreseeable alternative future use.

The following is a comparison of research and development expenses for the three and six months ended June 30, 2017 and 2016:

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

(in millions) |

2017 |

|

|

2016 |

|

|

2017 |

|

|

2016 |

|

||||

|

Development programs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cabiralizumab |

$ |

6.4 |

|

|

$ |

3.9 |

|

|

$ |

16.5 |

|

|

$ |

7.4 |

|

|

FPA144 |

|

6.1 |

|

|

|

5.6 |

|

|

|

13.5 |

|

|

|

9.0 |

|

|

FP-1039 |

|

0.6 |

|

|

|

0.1 |

|

|

|

0.7 |

|

|

|

0.1 |

|

|

Subtotal development programs |

|

13.1 |

|

|

|

9.6 |

|

|

|

30.7 |

|

|

|

16.5 |

|

|

Preclinical programs |

|

19.2 |

|

|

|

4.9 |

|

|

|

26.6 |

|

|

|

7.2 |

|

|

Discovery collaborations |

|

1.1 |

|

|

|

1.7 |

|

|

|

2.5 |

|

|

|

5.7 |

|

|

Early research and discovery |

|

8.3 |

|

|

|

6.0 |

|

|

|

15.7 |

|

|

|

11.6 |

|

|

Total research and development expenses |

$ |

41.7 |

|

|

$ |

22.2 |

|

|

$ |

75.5 |

|

|

$ |

41.0 |

|