Attached files

| file | filename |

|---|---|

| 8-K - 8-K - E.W. SCRIPPS Co | a8-kfortermloanbpresentati.htm |

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

LENDER PRESENTATION

AUGUST 8, 2017

Exhibit 99.1

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

1

This presentation contains forward-looking statements that involve a number of risks and

uncertainties. For this purpose, any statements contained herein that are not statements of

historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, the

words “believes,” “anticipates,” “plans,” “expects,” “intends,” and similar expressions are intended

to identify forward-looking statements. Important factors that could cause actual results to differ

materially from those indicated by such forward-looking statements are set forth in The E.W.

Scripps Company’s annual report on Form 10-K for the year ended Dec. 31, 2016, and on Form

10-Q for the quarter ended Jun. 30, 2017 as filed with the Securities and Exchange Commission.

We undertake no obligation to publicly update any forward-looking statements to reflect events or

circumstances after the date the statement is made.

SAFE HARBOR / DISCLOSURES

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

2

•On August 1st, 2017, The E.W. Scripps Company (“Scripps”, “SSP”, or the “Company”) announced that it

had reached an agreement to acquire Bounce Media, LLC and Katz Broadcasting Holdings, LLC (together

“Katz”) for $292 million1

• Provides Scripps with four fast-growing, target-audience broadcast networks, delivered through

multicast – over-the-air on digital subchannels of existing television stations

• Scripps will add Katz’s talented management team and benefit from a proven strategy to develop and

launch target-audience broadcast networks

• Scripps intends to finance the acquisition through the issuance of a new $250 million 7-year Senior

Secured Term Loan B (“Term Loan B”) and cash on hand

• Pro forma 6/30/17 L8QA Net Secured and Net Leverage remain conservative at 0.9x and 3.4x,

respectively

• Term Loan B to fund concurrent with the acquisition closing (expected early-October)

1 Net of Scripps current equity ownership of 5% in Katz Broadcasting Holdings, LLC. Scripps will receive Katz cash on hand at closing of ~$10 million as of June 30, 2017

SCRIPPS ACQUIRES FAST-GROWING,

TARGET-AUDIENCE BROADCAST NETWORKS

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

ACQUISITION OVERVIEW

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

• National reach through leading fast-growing, target-audience broadcast networks

• Over-the-air ecosystem is evolving and growing. 22% of adults 18 to 34 watch TV OTA

• Over-the-air is integrating with over-the-top services in a one remote world

• Significant financial returns expected. The four networks are projected to generate about $180 million

in revenue and about $30 million in segment profit in 2018

4

Jonathan Katz, a former Turner programming executive, formed Bounce in

2011 to launch the first African-American multicast network, leveraging

broadcast stations’ subchannels for distribution. He has since launched three

additional fast-growing, target-audience broadcast networks.

All Networks Reach Close to 100 Million Households

Acquisition Overview

WHAT SCRIPPS IS ACQUIRING AND WHY

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

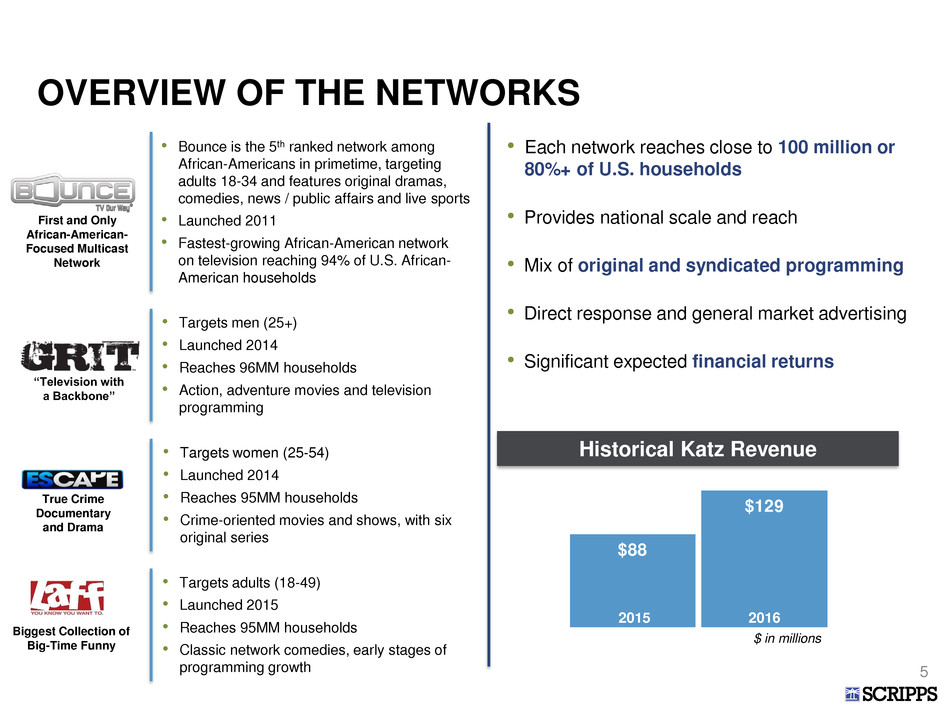

$88

$129

5

$ in millions

2015 2016

Historical Katz Revenue

OVERVIEW OF THE NETWORKS

• Bounce is the 5th ranked network among

African-Americans in primetime, targeting

adults 18-34 and features original dramas,

comedies, news / public affairs and live sports

• Launched 2011

• Fastest-growing African-American network

on television reaching 94% of U.S. African-

American households

• Targets adults (18-49)

• Launched 2015

• Reaches 95MM households

• Classic network comedies, early stages of

programming growth

Biggest Collection of

Big-Time Funny

True Crime

Documentary

and Drama

• Targets women (25-54)

• Launched 2014

• Reaches 95MM households

• Crime-oriented movies and shows, with six

original series

• Targets men (25+)

• Launched 2014

• Reaches 96MM households

• Action, adventure movies and television

programming

“Television with

a Backbone”

First and Only

African-American-

Focused Multicast

Network

• Each network reaches close to 100 million or

80%+ of U.S. households

• Provides national scale and reach

• Mix of original and syndicated programming

• Direct response and general market advertising

• Significant expected financial returns

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

Essentially 100% Advertising Revenue Model

6

CONTENT DISTRIBUTION AND MONETIZATION

How is Revenue Generated?

Antennas transmit

multiple channels that

can be distributed

multiple ways

Channel

7.2

Channel

7.1

Channel

7.3

Channel

7.4

• Generates revenue through ad sales

• Pays a carriage fee to local affiliates

Delivery Over New Channels

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

E.W. SCRIPPS COMPANY OVERVIEW

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

8

• Scripps is a leading media enterprise with

interests in television and radio

broadcasting as well as local and national

digital media brands

• The three reporting segments are

Television, Radio and Digital

• Presence in 24 television markets and

reaching nearly one in five U.S. television

households

• Operating a collection of local and national

digital brands including:

• Midroll – creates original podcasts and

operates a podcast network

• Newsy – millennial-focused digital video

news service

• Cracked – multi-platform humor and

satire brand

# of Television Stations

33

# of Radio Stations 34 (28 FM / 6 AM)

PF L8QA Q2 2017

Total Revenue

$1,018 million

PF L8QA Q2 2017

Adjusted EBITDA

$165 million

Key Stats

SCRIPPS OVERVIEW

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

9

Wichita, KS

Radio

4 FM, 1 AM

Springfield, MO

Radio 4 FM, 1 AM

Knoxville, TN

Radio

4 FM

Scripps Washington

News Bureau &

Political Sales Office

Green Bay-Appleton, WI

WGBA, WACY

Indianapolis

WRTV

Baltimore

WMAR

Cleveland

WEWS

Cincinnati

WCPO

West Palm Beach

WPTV

Kansas City, MO

KSHB, KMCI

Tulsa, OK

KJRH

Radio

4 FM, 1 AM

Phoenix

KNXV

Buffalo

WKBW

Boise, ID

KIVI

Radio, 4 FM

Las Vegas

KTNV

Tucson

KGUN

KWBA

Radio 3 FM, 1 AM

Omaha, NE

KMTV

Radio

4 FM, 1 AM

Milwaukee

WTMJ

Radio

1 FM 1 AM

Nashville

WTVF

Twin Falls, ID

KSAW-LD

Lansing, MI

WSYM

Ft. Myers – Naples

WFTX

Denver

KMGH, KZCO, KZFC

Bakersfield

KERO

KZKC

San Diego

KGTV

KZSD

Colorado Springs, CO

KZCS Detroit

WXYZ, WMYD

Tampa

WFTS

COAST-TO-COAST PORTFOLIO OF TELEVISION,

RADIO & DIGITAL BRANDS

KATZ

Top 50 Nielsen DMA

TV Markets

Other

TV Markets

Radio Markets Digital Brands Katz

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

REBUILDING SCRIPPS FOR GROWTH

10

2008

Complete

separation of

Scripps

Networks

Interactive

2010

Divest

“Peanuts”

and

licensing

2012

Launch original

programming

unit, two

access shows

2014

Buy Newsy

Buy Granite

Stations

2009

Reset

expenses

2011

Combine digital

operations;

announce

investment and

salesforce overbuild

Acquire four

McGraw Hill

TV Stations

2013

Launch D.C.

National

Investigative Unit

2015

Spin/combine

newspapers with

Journal

Merge Journal TV

and radio

operations into

Scripps

Buy Midroll

2016

Buy

Cracked; Stitcher

National brands

move to 45% of

Digital revenue

ECONOMIC

CRISIS

2017

National

brands move

to ~55%

of Digital

revenue

Acquire Katz

Broadcasting

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

11

• Scripps owns or operates 33 television

stations in 24 markets across the U.S.

• The Company reaches nearly one in five

U.S. television households

• Affiliations with all of the “Big Four”

networks

• Second largest ABC affiliate group by

audience reach

• L8QA Q2 2017 Revenue mix consists

of 70% advertising, 28% retransmission

revenues and 2% of other revenue

• Scripps partners with or produces three

original shows that run across its footprint.

A fourth show, starring Kellie Picker and

Ben Aaron, will begin airing in September.

Three of the four shows are available

nationally

TELEVISION SEGMENT OVERVIEW

15

5

2

2

4

5

Television Station Affiliation Mix

Other

Historical Television Revenue

1 Based on adjusted combined historical results as if the acquisition of Journal Communications had occurred 1/1/2015

$ in millions

$654

$802

$752

2015

1

2016

L8QA Q2

2017

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

12 Source: Company filings, company websites for non-public companies and BIA Investing in Television Market Report, 2017 1st Edition

Note: Pro forma for all announced and closed transactions

1 Prior to any potential divestitures

BROADCAST PEER LANDSCAPE

Sinclair /

Tribune

Univision

Nexstar

Media

Group

TEGNA Hearst

EW

Scripps

Raycom Entravision Cox Meredith Gray Graham

72%¹

44%

39%

32%

19% 18%

16% 14%

11% 11% 11%

7%

U.S. Household Reach

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

$36 $36

$54 $53 $53

$61

$66 $66

Gross Retransmission Revenue

$213M

Network and MVPD Renewals

L8QA Q2 2017

gross retrans

revenue

$ in millions

4 stations

1 station

10 stations

5 stations

2 stations

1 station

19% of subs

5% of subs

36% of subs

40% of subs

(Including more than

2 million Comcast

households)

13

RETRANS HAS STRONG POTENTIAL IN

UPCOMING RENEWALS

1 station

2020+ 2018 2017 2016 2019

Q1 2016

3 million TWC

subs renewed

Q4 2016

3 million

subs renewed

Q4 ’16 Q3 ’16 Q2 ’16 Q1 ’16 Q4 ’15 Q3 ’15 Q2 ’17 Q1 ’17

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

$82 $83

$144

$75

$101

2016

saw the second-highest-grossing election season ever

• Local broadcast TV spending for all candidates,

excluding presidential, was up 5% from 2012

• Candidates, the national parties and outside groups

spent more than $1.2 billion on local broadcast TV

ads in 11 battleground states

• Local broadcast TV spending on U.S. Senate races

was $679 million, 18% higher than 2012

2018

is expected to see broadcast TV play a leading role in

U.S. elections

• Control of the U.S. Senate will again be up for

grabs, with Democrats having to defend 23 of 33

seats

• Scripps markets will host 10 U.S. Senate races

• 36 states will have governors’ races, of which

Scripps markets will host 16 races

$ in millions

2008 2010 2012 2014 2016

Adj. Combined Scripps Political Revenue

Scripps 2018 Political Footprint

WISCONSIN

CALIFORNIA

NEVADA

ARIZONA

TENNESEE

IND.

OHIO MARYLAND

FLORIDA

COLORADO

KANSAS

NEBRASKA

IOWA

OKLAHOMA

MICHIGAN

NEW YORK

IDAHO

MISSOURI

U.S. Senate race

Governor’s race

Both Senate and Governor’s races

14

BROADCAST TELEVISION IS POSITIONED

TO PLAY A KEY ROLE IN 2018 ELECTIONS

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

• Scripps owns 34 radio stations in eight

markets

• The Company operates 28 FM stations

and 6 AM stations

• In five markets, Scripps operates both

television and radio stations

• Multiple properties in the same market

help to better serve advertisers, viewers

and listeners as well as to leverage

expenses and enhance operating results

• The Milwaukee station currently maintains

exclusive radio broadcast rights for the

Green Bay Packers and Milwaukee

Brewers and offers the broadcast of their

games to other radio stations

RADIO SEGMENT OVERVIEW

Strategy

Historical Radio Revenue

• Focus on providing targeted and

relevant local programming

responsive to the interest of the

communities we serve

• Create unique and differentiated

brand positions at each station

1 Based on adjusted combined historical results as if the acquisition of Journal

Communications had occurred 1/1/2015

$74 $71

15

$ in millions

2016 2015

1

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

16

• Scripps’ digital segment provides locally

branded news content and information

across 27 television and radio markets on

multiple digital platforms

• Local brands consist of the local TV and

radio station websites as well as the related

smartphone and tablet apps

• Video views were up over 25% from

Q1’17 to Q2’17

• National brands include:

• Newsy competes on multiple platforms:

desktop, mobile, and OTT services including

Hulu, Roku, Amazon Fire TV, Apple TV, Sling

TV and Comcast’s Watchable

• Midroll is the nation’s leading podcast

company

DIGITAL SEGMENT OVERVIEW

Q2 2017 Digital Highlights

Historical Digital Revenue

1 Based on adjusted combined historical results as if the acquisition of Journal Communications had occurred 1/1/2015

(Acquired July 2015) (Acquired January 2014) (Acquired April 2016) $41

$62

$ in millions

2015

1

2016

• Newsy OTT video views increased 25%

from Q1’17, to more than 130 million

• 90% of Newsy revenue from OTT

• Midroll had 1 billion downloads in Q2’17

• Midroll added 50 new shows to its

advertising and distribution network,

bringing the total number of shows close to

300

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

LOCAL

NATIONAL

2017E revenue split

17

SCRIPPS IS BUILDING STRONG LOCAL

AND NATIONAL DIGITAL BRANDS

• By millennials for millennials

• Terrific content for an OTT news audience

• Purchased: January 2014, $35 million

• Nearly 60 million (and growing) Americans

listen to podcasts

• Multiple revenue streams

• Purchased: July 2015, $50 million1

• Strong brand loyalty

• Satire and humor video lends itself to OTT

• Purchased: April 2016, $39 million

1 Excludes $10 million earnout provision

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

KEY CREDIT HIGHLIGHTS

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

19

National portfolio of television, radio and digital

brands provides diversified revenue sources

Leading television stations positioned in large,

NFL-sized markets

Continued growth of retransmission revenue

One of the strongest TV footprints for political

advertising

National digital brands are rapidly gaining scale

and attracting large audiences

Seasoned management team with extensive

broadcast industry experience

Strong balance sheet and robust free cash flow

generation

SCRIPPS CREDIT HIGHLIGHTS

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

20

Scripps Markets Revenue by Segment

PF L8QA Q2 2017 Total Revenue: $1,018 million

SCRIPPS IS DIVERSIFIED ACROSS REVENUE

STREAMS AND MARKETS

TV Only

19 Markets

TV/Radio

Overlap

5 Markets

Radio Only

3 Markets

27 Television and Radio Markets

TV: Local

32%

TV: National

14%

TV: Political

5%

TV: Other

1%

TV:

Retransmission

21%

Katz

13%

Radio

7%

Digital

6%

Other

1%

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

21

(Pro Forma

L8QA 6/30/17)

Closing Period 6/30/2017 6/30/2017 3/31/2017 3/31/2017 3/31/2017

Market Cap $1,648 $3,172 $1,090 $4,569 $3,218

Note: Market data as of 8/1/17; Net leverage stats for public peers based on 2015A / 2016A Adj. EBITDA and book value of debt

and adjusted for all announced and closed transactions; Scripps based on pro forma L8QA 6/30/17 EBITDA and pro forma net debt as of 6/30/17

3.4x

4.1x

5.3x

5.4x 5.5x

Attractive Net Leverage Profile vs. Peers

Peer Average:5.1x

INDUSTRY-LEADING BALANCE SHEET

$ in millions

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

22

Management Overview

• The current leadership team has led the Company’s transformation from 13 newspapers and 10 TV

stations to 33 TV stations, 34 radio stations and valuable local and national digital businesses over

the last five years

• Disciplined capital allocation strategy

Sector/Relevant

Experience

Richard Boehne Board Chairman 35

Adam Symson President, Chief Executive Officer (Effective Aug. 8, 2017) 24

Brian Lawlor Senior Vice President, Broadcast 28

Timo hy Wesolowski Senior Vice President, Chief Financial Officer 30

Douglas Lyons Vice President, Controller, Treasurer 32

William Appleton Senior Vice President, General Counsel 28

Lisa Knutson Senior Vice President, Chief Administrative Officer 26

EXPERIENCED MANAGEMENT TEAM

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

FINANCIAL OVERVIEW

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

$88

$177

$139

107

196

153

5

10

12

$112

$206

$165

13%

19%

16%

777

943 890

88

129 128 $865

$1,072

$1,018

Note: 2015 financials based on adjusted combined historical results as if the acquisition of Journal Communications had occurred 1/1/2015

1 Unlevered free cash flow is calculated based on Adjusted EBITDA less Capital Expenditures

Revenue Adjusted EBITDA & Margin

2015 2016

L8QA Q2

2017

Capital Expenditures Unlevered Free Cash Flow

1

$ in millions $ in millions

$ in millions $ in millions

24

PRO FORMA FINANCIAL PERFORMANCE

Katz Scripps

2015 2016

L8QA Q2

2017

23

28 25

1

1

1

$24

$29

$26

2015 2016

L8QA Q2

2017

Katz Scripps

2015 2016

L8QA Q2

2017

Katz Scripps Margin

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

25

STRONG BALANCE SHEET AND

CASH FLOW GENERATION

Capitalization LTM Q2’17 Free Cash Flow Bridge

• Cash Balance1: $105 million

• Total Debt1: $661 million

• Net Leverage1: 3.4x

• Liquidity2: $230 million

1 Pro forma for the acquisitions and new $250 million Term Loan B

2 Liquidity defined as revolver availability, plus cash, less outstanding LCs

As Reported

$186 ($23)

$163 ($12) ($2)

$149

Adj.

EBITDA

Capital

Expenditures

Unlevered

Free Cash

Flow

Cash

Interest

Cash

Taxes

Free Cash

Flow

Pro Forma for Katz Acquisition

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

APPENDIX

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

27

SELECTED STATEMENT OF OPERATIONS

($ in Millions) Fiscal Year Ending December 31, L8QA

2015 2016 Q2 2017A

Operating Revenues

Advertising $598 $681 $637

Retransmission 147 221 213

Other 32 42 40

Total Operating Revenues $777 $943 $890

Costs and Expenses

Employee Compensation and benefits $364 $374 $376

Programs and program licenses 133 175 169

Other expenses 170 194 192

Acquisition and related integration costs 38 1 3

Total costs and expenses $704 $743 $739

Depreciation, Amortization, and Losses (Gains):

Depreciation $38 $35 $36

Amortization of intangible assets 20 24 23

Impairment of goodwill and intangibles 25 0 12

Losses (gains), net on disposal of property and equipment 1 1 0

Net Depreciation, Amortization, and Losses (Gains): 83 59 72

Operating (loss) income (11) 141 79

Interest expense (17) (18) (20)

Defined benefit pension plan expense (59) (14) (37)

Miscellaneous, net (0) (3) 1

Income (loss) from operations before income taxes before income taxes ($87) $106 $23

Segment Operating Revenues

Television $654 $802 $752

Radio 74 71 71

Digital 41 62 60

Syndication and other 8 8 7

Total Revenue $777 $943 $890

Katz Contribution 88 129 128

Total Pro Forma Revenue $865 $1,072 $1,018

Note: 2015 financials based on adjusted combined historical results as if the acquisition of Journal Communications had occurred 1/1/2015

R 44

G 66

B 120

R 187

G 8

B 38

R 138

G 205

B 34

R 86

G 151

B 202

R 127

G 127

B 127

“EBITDA" is defined by us as net earnings before income taxes, interest expense and depreciation, amortization and impairment of goodwill and intangibles. "Adjusted EBITDA" is defined by us as EBITDA,

losses(gains), net on disposal of property and equipment, loss (income) from discontinued operations, net of tax, acquisition and related integration costs, amortization of pension actuarial loss, pension curtailment

charges, miscellaneous expense, net, and share based compensation expense. We present EBITDA and Adjusted EBITDA because we believe that EBITDA and Adjusted EBITDA are useful supplemental measures

in evaluating the performance of our business and provide greater transparency into our results of operations. EBITDA and Adjusted EBITDA are used by our management to perform such evaluation. We also believe

that EBITDA and Adjusted EBITDA facilitate company-to-company operating performance comparisons by backing out potential differences caused by variations in capital structures (affecting net interest expense),

taxation and the age and book appreciation of facilities (affecting relative depreciation expense), which may vary for different companies for reasons unrelated to operating performance. We believe that EBITDA and

Adjusted EBITDA are frequently used by investors, securities analysts and other interested parties in their evaluation of companies, many of which present EBITDA and Adjusted EBITDA when reporting their results.

Our presentation of EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures used by other companies. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not

consider them either in isolation or as substitutes for analyzing our results as reported under GAAP. Some of these limitations are:

EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs;

EBITDA and Adjusted EBITDA do not reflect our interest expense, or the cash requirements necessary to service interest or principal payments, on our debt;

EBITDA and Adjusted EBITDA do not reflect our income tax expense or the cash requirements to pay our taxes;

EBITDA and Adjusted EBITDA do not reflect historical cash expenditures or future requirements for capital expenditures or contractual commitments;

Although depreciation and amortization are non-cash charges, the assets being depreciated, depleted and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect

any cash requirements for such replacements; and

Other companies in our industry may calculate EBITDA and Adjusted EBITDA differently so they may not be comparable. 28

ADJUSTED EBITDA RECONCILIATION

($ in Millions) Fiscal Year Ending December 31, L8QA

2015 2016 Q2 2017A

Net Income ($56) $67 $14

Amortization of Pension Losses 5 4 4

Interest Expense 17 18 20

Income Taxes (28) 39 9

Depreciation and Amortization 58 59 59

Restructuring Costs 0 0 0

Acquisition and Related Integration Costs 32 1 1

Unusual and Non-Recurring Non-Cash Charges 70 0 35

Non-Cash Share Based Compensation Charges 8 8 10

Gain (loss) on Fair Value Adjustments to Derivatives 1 0 0

Adjusted EBITDA $107 $196 $153

Katz Contribution 5 10 12

Total Pro Forma Adjusted EBITDA $112 $206 $165