Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE - CPI AEROSTRUCTURES INC | ex99-1.htm |

| 8-K - CURRENT REPORT - CPI AEROSTRUCTURES INC | cvu-8k_080817.htm |

Exhibit 99.2

NYSE MKT: CVU 2Q 2017 Results Presentation A Premier Supplier of Aircraft Structures and Systems Speakers: Douglas McCrosson, President & Chief Executive Officer Vincent Palazzolo, Chief Financial Officer August 8, 2017

Disclosure Statement Forward - Looking Statements This presentation contains forward - looking statements that involve risks and uncertainties . All statements, other than statements of historical fact, included in this presentation, including without limitation, statements regarding projections, future financing needs, and statements regarding future plans and objectives of the Company, are forward - looking statements . Words such as "believes," "expects," "anticipates," "intends," "plans," "estimates" and similar expressions are intended to identify forward - looking statements . These forward - looking statements are based upon the current expectations of management and certain assumptions that are subject to risks and uncertainties . Accordingly, there can be no assurance that such risks and uncertainties will not affect the accuracy of the forward - looking statements contained herein or that our actual results will not differ materially from the results anticipated in such forward - looking statements . Such factors include, but are not limited to, the following : the cyclicality of the aerospace market, the level of U . S . defense spending, production rates for commercial and military aircraft programs, competitive pricing pressures, start - up costs for new programs, technology and product development risks and uncertainties, product performance, increasing consolidation of customers and suppliers in the aerospace industry and costs resulting from changes to and compliance with applicable regulatory requirements . The information contained in this presentation is qualified in its entirety by cautionary statements and risk factors disclosed in the Company's Securities and Exchange Commission filings, including its Annual Report on Form 10 - K filed on March 8 , 2017 , available at http : //www . sec . gov , and quarterly report on Form 10 - Q for the three months ended March 31 , 2017 , filed on May 10 , 2017 . We caution readers not to place undue reliance on any forward - looking statements, which speak only as of the date hereof and for which the Company assumes no obligation to update or revise the forward - looking statements herein . CPI AERO is a registered trademark of CPI Aerostructures, Inc . All other trademarks referenced herein are the property of their respective owners . 2

3 Recent Highlights Douglas McCrosso n President & Chief Executive Officer

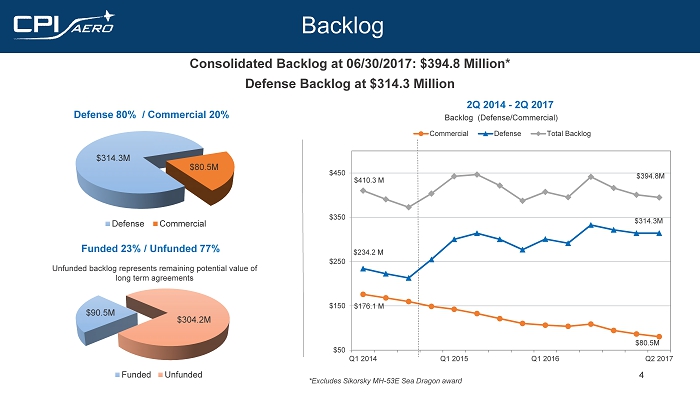

Backlog 4 Consolidated Backlog at 06/30/2017: $394.8 Million* Defense Backlog at $314.3 Million $314.3M $80.5M Defense Commercial Defense 80% / Commercial 20% 2Q 2014 - 2Q 2017 $90.5M $304.2M Funded Unfunded Unfunded backlog represents remaining potential value of long term agreements Funded 23% / Unfunded 77% $80.5M $314.3M $394.8M $50 $150 $250 $350 $450 Q1 2014 Q1 2015 Q1 2016 Q2 2017 Backlog (Defense/Commercial) Commercial Defense Total Backlog $410.3 M $234.2 M $176.1 M *Excludes Sikorsky MH - 53E Sea Dragon award

Driven By Renewed Strength in Defense Business 5 Recent wins account for $ 233 million in backlog as of June 30, 2017 Offers revenue visibility into 2022 and beyond E - 2D Advanced Hawkeye/ C - 2A Greyhound U.S Government F - 16 Falcon Northrop Grumman T - 38C Talon Trainer Lockheed Martin F - 35A Northrop Grumman Japan E - 2D Hawkeye Raytheon Next Generation Jammer Pod $86.1M $53.5M $49M $10.6M $25 - 30M $50+M Announced November 2014 Contract Period 2013 – 2021 Announced November 2014 Contract Period 2014 – 2020 Announced February 2015 Contract Period 2015 – 2021 Announced July 2015 Contract Period 2015 – 2021 Announced January 2016 Contract Period 2016 – 2019 Announced July/Sept 2016 Contract Period 2016 – 2022+ Sikorsky CH - 148 Cyclone Bell Helicopter/ Textron AH - 1Z Viper Sikorsky MH - 53E Sea Dragon UTC Aerospace TacSAR Sikorsky Black Hawk $ 5.0M $14.8M $21M Announced October 2016 Contract Period 2016 – 2018 Announced January 2017 Contract Period 2017 – 2020 Announced May 2017 Contract Period 2015 – 2022 Announced June 2017 Contract Period 2017 Announced July 2017 Contract Period 2018 – 2022

6 Financial Highlights Vincent Palazzolo Chief Financial Officer

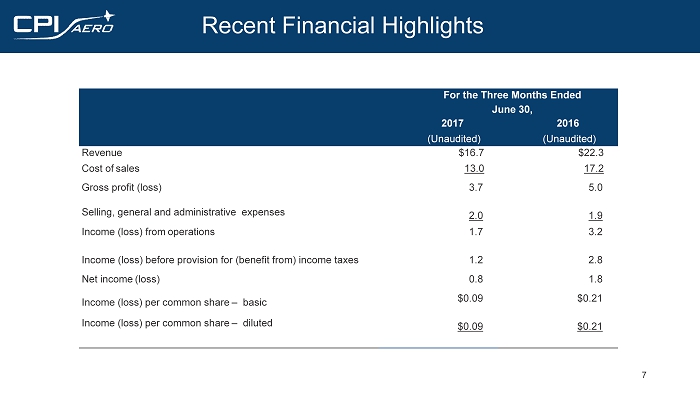

Recent Financial Highlights 7 For the Three Months Ended June 30 , 201 7 201 6 (Unaudited) (Unaudited) Revenue $16.7 $22.3 Cost of sales 13.0 17.2 Gross profit (loss) 3.7 5.0 Selling, general and administrative expenses 2.0 1.9 Income (loss) from operations 1.7 3.2 Income (loss) before provision for (benefit from) income taxes 1.2 2.8 Net income (loss) 0.8 1.8 Income (loss) per common share – basic $0.09 $0.21 Income (loss) per common share – diluted $0.09 $0.21

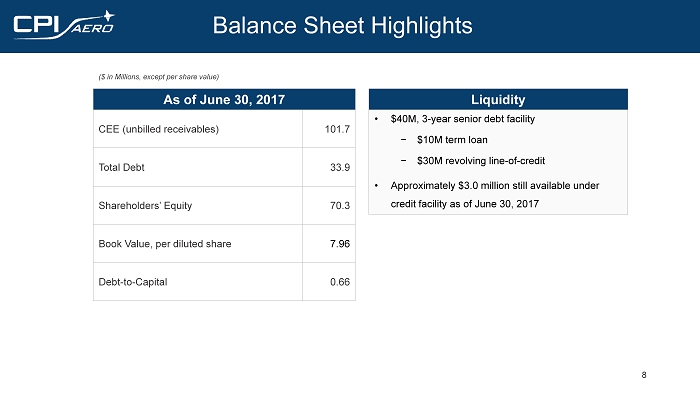

Balance Sheet Highlights 8 As of June 30, 2017 CEE (unbilled receivables) 101.7 Total Debt 33.9 Shareholders’ Equity 70.3 Book Value, per diluted share 7.96 Debt - to - Capital 0.66 ($ in Millions, except per share value) Liquidity • $40M, 3 - year senior debt facility − $10M term loan − $30M revolving line - of - credit • Approximately $3.0 million still available under credit facility as of June 30, 2017

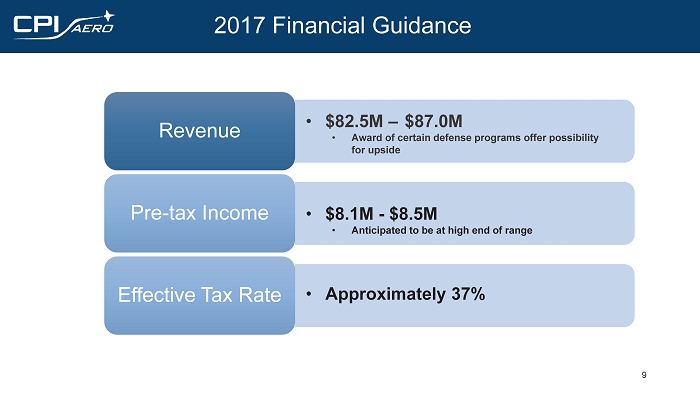

2017 Financial Guidance 9 Revenue Pre - tax Income Effective Tax Rate • $82.5M – $87.0M • Award of certain defense programs offer possibility for upside • $8.1M - $8.5M • Anticipated to be at high end of range • Approximately 37 %

10 Looking Ahead Douglas McCrosso n President & Chief Executive Officer

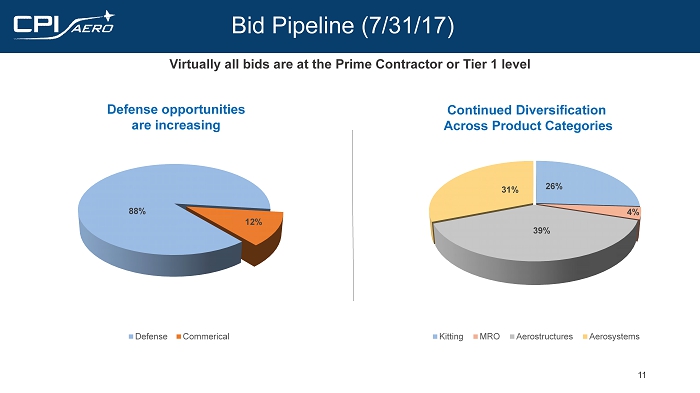

Bid Pipeline (7/31/17 ) 11 Virtually all bids are at the Prime Contractor or Tier 1 level Defense opportunities are increasing Continued Diversification Across Product Categories 88% 12% Defense Commerical 26% 4% 39% 31% Kitting MRO Aerostructures Aerosystems

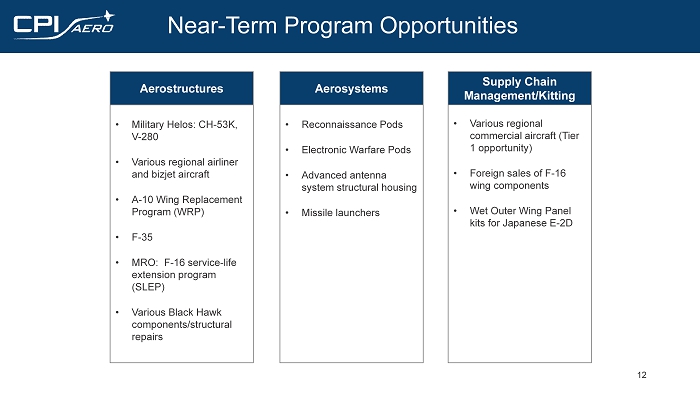

Near - Term Program Opportunities 12 Aerostructures • Military Helos : CH - 53K, V - 280 • Various regional airliner and bizjet aircraft • A - 10 Wing Replacement Program ( WRP ) • F - 35 • MRO: F - 16 service - life extension program (SLEP) • Various Black Hawk components/structural repairs Aerosystems • Reconnaissance Pods • Electronic Warfare Pods • Advanced antenna system structural housing • Missile launchers Supply Chain Management/Kitting • Various regional commercial aircraft (Tier 1 opportunity) • Foreign sales of F - 16 wing components • Wet Outer Wing Panel kits for Japanese E - 2D

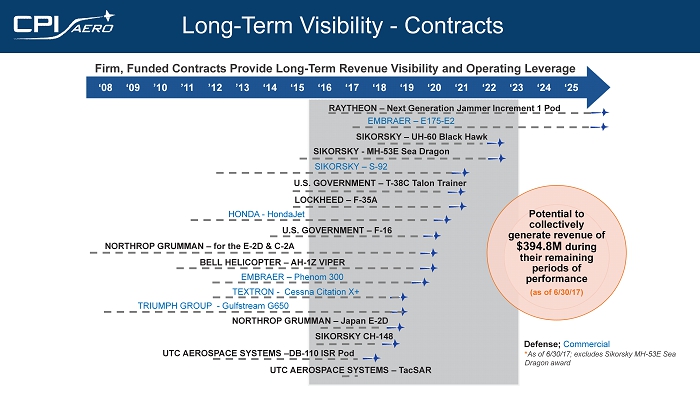

Long - Term Visibility - Contracts ‘08 ‘09 ’10 ’11 ’12 ’13 ‘14 ‘15 ‘16 ‘17 ‘18 ‘19 ‘20 ‘21 ‘22 ‘23 ‘24 ‘25 Firm, Funded Contracts Provide Long - Term Revenue Visibility and Operating Leverage EMBRAER – E175 - E2 RAYTHEON – Next Generation Jammer Increment 1 Pod SIKORSKY – UH - 60 Black Hawk SIKORSKY - MH - 53E Sea Dragon SIKORSKY – S - 92 U.S. GOVERNMENT – T - 38C Talon Trainer LOCKHEED – F - 35A HONDA - HondaJet NORTHROP GRUMMAN – for the E - 2D & C - 2A U.S. GOVERNMENT – F - 16 BELL HELICOPTER – AH - 1Z VIPER TEXTRON - Cessna Citation X+ EMBRAER – Phenom 300 TRIUMPH GROUP - Gulfstream G650 NORTHROP GRUMMAN – Japan E - 2D SIKORSKY CH - 148 UTC AEROSPACE SYSTEMS – DB - 110 ISR Pod UTC AEROSPACE SYSTEMS – TacSAR Potential to collectively generate revenue of $394.8M during their remaining periods of performance (as of 6/30/17) * As of 6/30/17; excludes Sikorsky MH - 53E Sea Dragon award Defense ; Commercial

14 Q&A Session

15 Thank You CPI Aerostructures Vincent Palazzolo, Chief Financial Officer (631) 586 - 5200 www.cpiaero.com Investor Relations Sanjay M. Hurry LHA (212) 838 - 3777 cpiaero@lhai.com