Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - WILLIAM LYON HOMES | d428786dex991.htm |

| 8-K - FORM 8-K - WILLIAM LYON HOMES | d428786d8k.htm |

2017 Q2 Earnings Call August 7, 2017, 9:00 am PT Exhibit 99.2

Forward Looking Statements and Non-GAAP Information Certain statements contained in the Company’s press release for the three and six months ended June 30, 2017 and the accompanying comments during our conference call that are not historical information may constitute “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995, including, but not limited to, forward-looking statements related to: anticipated new home deliveries, revenue and pre-tax income, gross margin performance, backlog conversion rates, operating and financial results for the third quarter of 2017 and full year 2017, community count growth and project performance, market and industry trends, the continued housing market recovery, average sale price of homes to be closed in various periods, SG&A percentage, leverage ratios and reduction strategies and land acquisition spending. The forward-looking statements involve risks and uncertainties and actual results may differ materially from those projected or implied. The Company makes no commitment, and disclaims any duty, to update or revise any forward-looking statements to reflect future events or changes in these expectations. Further, certain forward-looking statements are based on assumptions of future events which may not prove to be accurate. Factors that may impact such forward-looking statements include, among others: the availability of labor and homebuilding materials and increased construction cycle times; the availability and timing of mortgage financing; adverse weather conditions; our financial leverage and level of indebtedness and any inability to comply with financial and other covenants under our debt instruments; continued volatility and worsening in general economic conditions either internationally, nationally or in regions in which we operate; increased outside broker costs; changes in governmental laws and regulations and increased costs, fees and delays associated therewith; potential changes to the tax code; worsening in markets for residential housing; the impact of construction defect, product liability and home warranty claims, including the adequacy of self-insurance accruals, and the applicability and sufficiency of our insurance coverage; decline in real estate values resulting in impairment of our real estate assets; volatility in the banking industry, credit and capital markets; terrorism or other hostilities involving the United States; building moratorium or "slow-growth" or "no-growth" initiatives that could be implemented in states in which we operate; changes in mortgage and other interest rates; conditions in the capital, credit and financial markets, including mortgage lending standards and the availability of mortgage financing; changes in generally accepted accounting principles or interpretations of those principles; competition for home sales from other sellers of new and resale homes; cancellations and our ability to realize our backlog; the occurrence of events such as landslides, soil subsidence and earthquakes that are uninsurable, not economically insurable or not subject to effective indemnification agreements; limitations on our ability to utilize our tax attributes; whether an ownership change occurred that could, under certain circumstances, have resulted in the limitation of our ability to offset prior years' taxable income with net operating losses; the timing of receipt of regulatory approvals and the opening of projects; the availability and cost of land for future development; and additional factors discussed under the sections captioned "Risk Factors" included in our annual and quarterly reports filed with the Securities and Exchange Commission. The foregoing list is not exhaustive. New risk factors may emerge from time to time and it is not possible for management to predict all such risk factors or to assess the impact of such risk factors on our business. This presentation contains certain supplemental financial measures that are not calculated pursuant to U.S. GAAP. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of non-GAAP measures to GAAP measures is contained in the Appendix to this presentation. A copy of the press release reporting the Company’s financial results for the three and six months ended June 30, 2017 is available on the Company's website at www.lyonhomes.com.

Management Presenters William H. Lyon Chairman of the Board and Executive Chairman Matthew R. Zaist President and Chief Executive Officer Colin T. Severn Senior Vice President and Chief Financial Officer

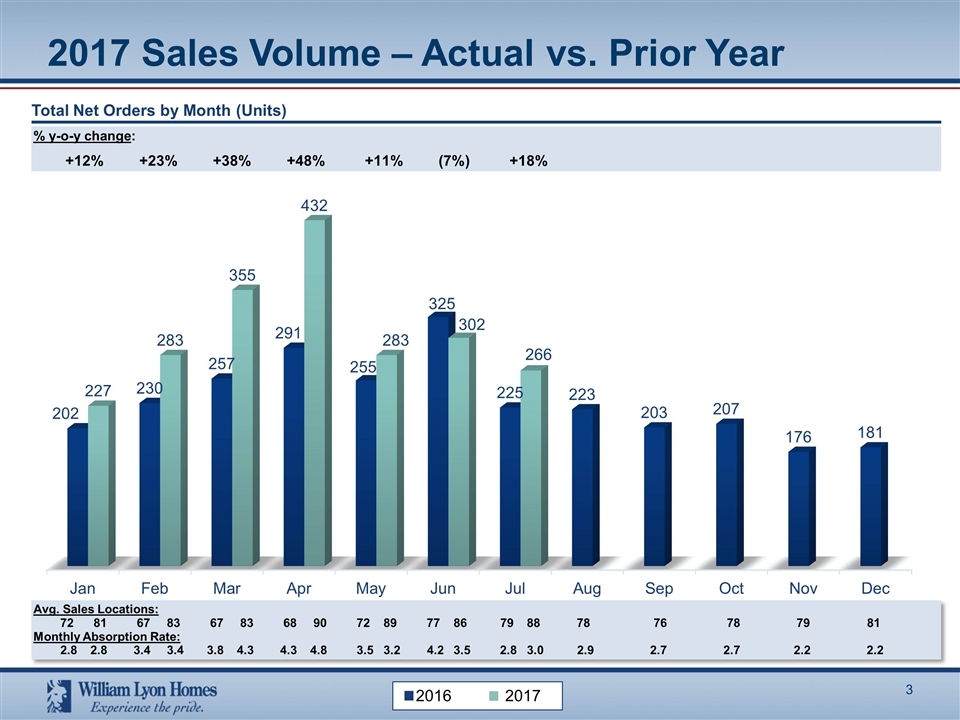

2017 Sales Volume – Actual vs. Prior Year Total Net Orders by Month (Units) % y-o-y change: +12% +23% +38% +48% +11% (7%) +18% 2016 2017 Avg. Sales Locations: 72 81 67 83 67 83 68 90 72 89 77 86 79 88 78 76 78 79 81 Monthly Absorption Rate: 2.8 2.8 3.4 3.4 3.8 4.3 4.3 4.8 3.5 3.2 4.2 3.5 2.8 3.0 2.9 2.7 2.7 2.2 2.2

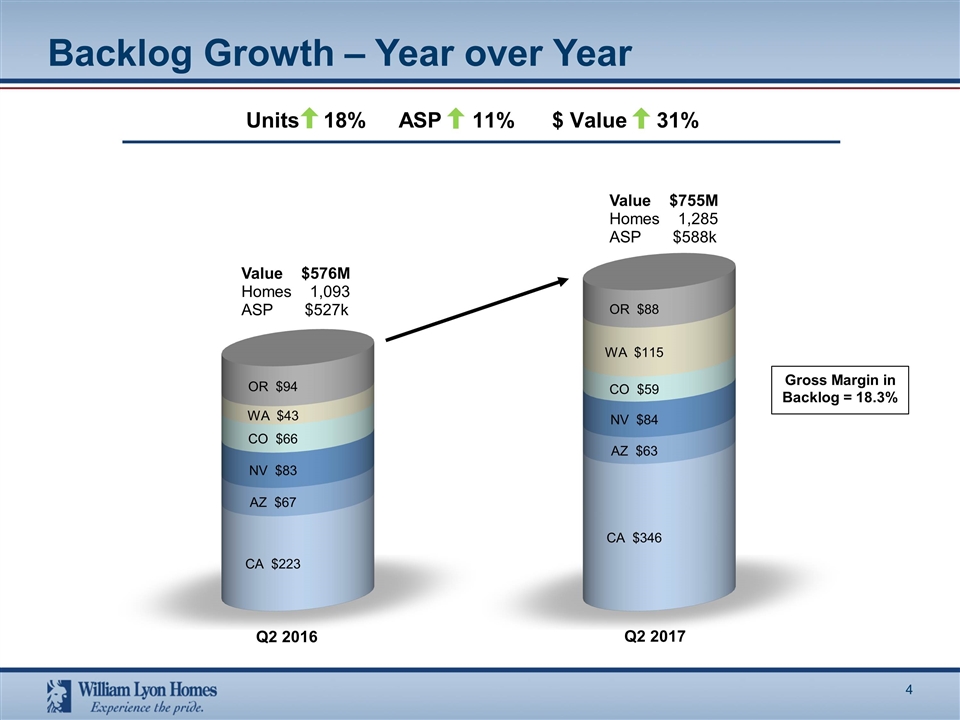

Backlog Growth – Year over Year Value $576M Homes 1,093 ASP $527k Q2 2016 Q2 2017 Value $755M Homes 1,285 ASP $588k Units 18%ASP 11%$ Value 31% Gross Margin in Backlog = 18.3%

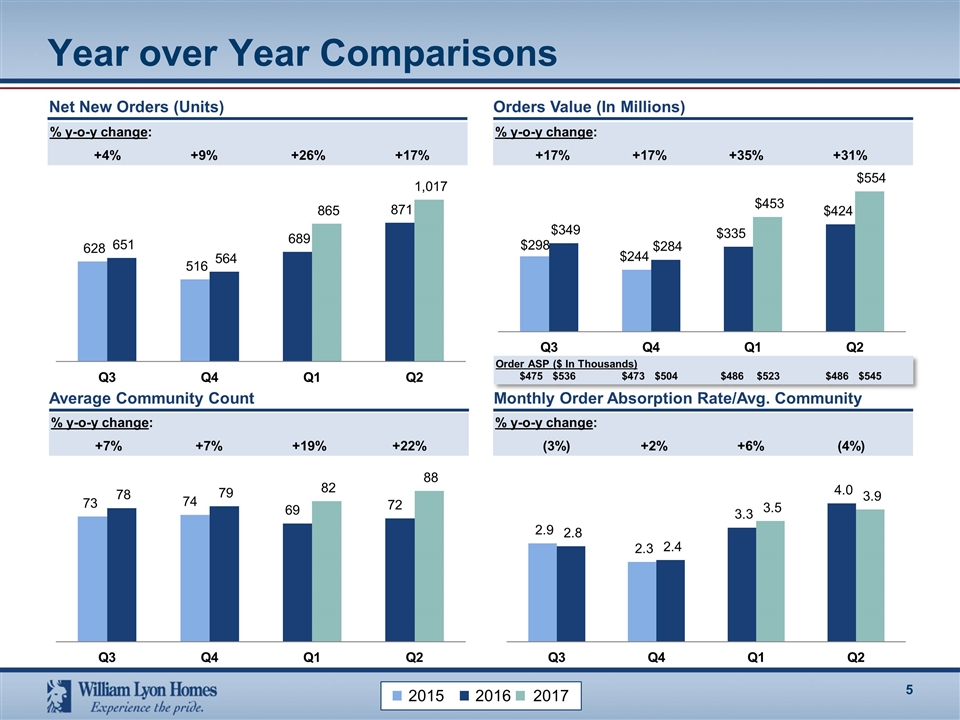

Year over Year Comparisons % y-o-y change: +4% +9% +26% +17% % y-o-y change: +7% +7% +19% +22% % y-o-y change: (3%) +2% +6% (4%) Net New Orders (Units) Orders Value (In Millions) Average Community Count Monthly Order Absorption Rate/Avg. Community % y-o-y change: +17% +17% +35% +31% Order ASP ($ In Thousands) $475 $536 $473 $504 $486 $523 $486 $545 2015 2016 2017

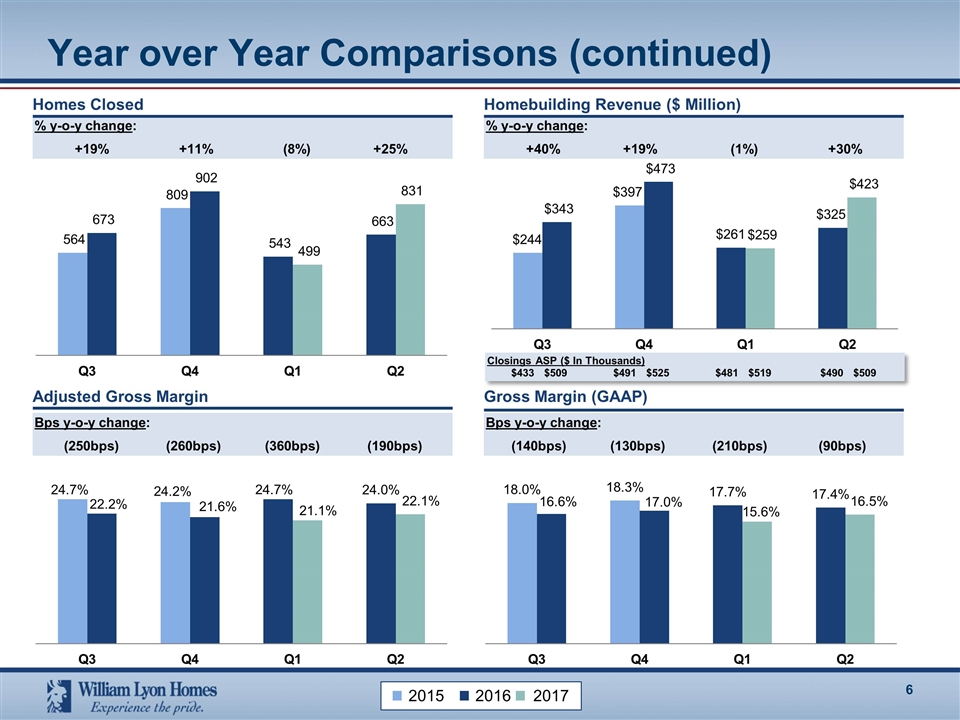

% y-o-y change: +40% +19% (1%) +30% Year over Year Comparisons (continued) % y-o-y change: +19% +11% (8%) +25% Homes Closed Homebuilding Revenue ($ Million) Bps y-o-y change: (250bps) (260bps) (360bps) (190bps) Bps y-o-y change: (140bps) (130bps) (210bps) (90bps) Adjusted Gross Margin Gross Margin (GAAP) Closings ASP ($ In Thousands) $433 $509 $491 $525 $481 $519 $490 $509 2015 2016 2017

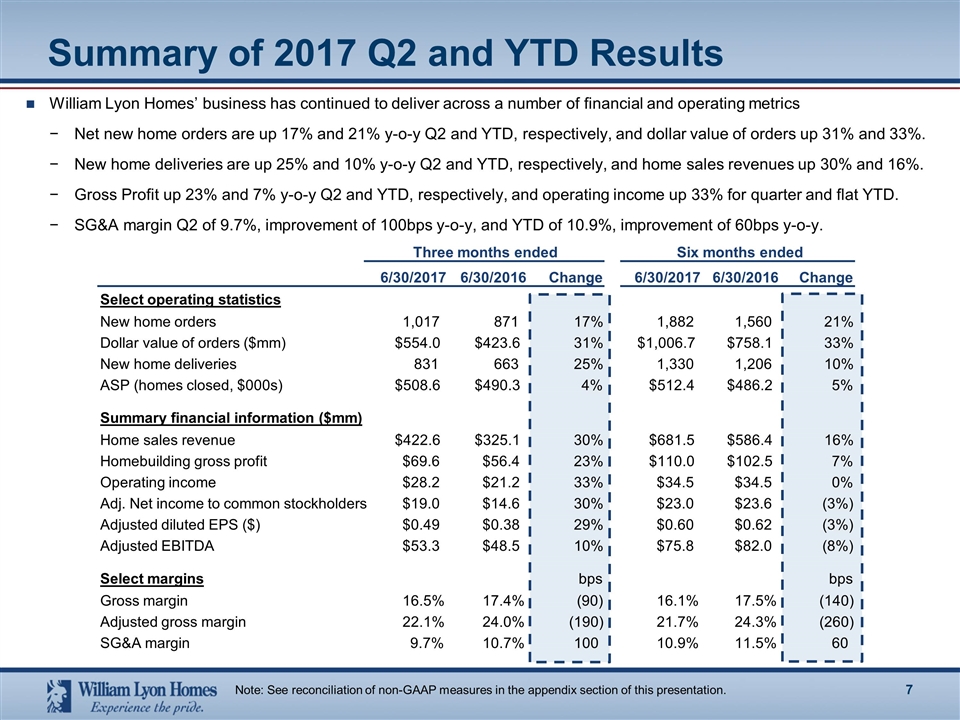

William Lyon Homes’ business has continued to deliver across a number of financial and operating metrics Net new home orders are up 17% and 21% y-o-y Q2 and YTD, respectively, and dollar value of orders up 31% and 33%. New home deliveries are up 25% and 10% y-o-y Q2 and YTD, respectively, and home sales revenues up 30% and 16%. Gross Profit up 23% and 7% y-o-y Q2 and YTD, respectively, and operating income up 33% for quarter and flat YTD. SG&A margin Q2 of 9.7%, improvement of 100bps y-o-y, and YTD of 10.9%, improvement of 60bps y-o-y. Note: See reconciliation of non-GAAP measures in the appendix section of this presentation. Summary of 2017 Q2 and YTD Results 6/30/2017 6/30/2016 Change 6/30/2017 6/30/2016 Change Select operating statistics New home orders 1,017 871 17% 1,882 1,560 21% Dollar value of orders ($mm) $554.0 $423.6 31% $1,006.7 $758.1 33% New home deliveries 831 663 25% 1,330 1,206 10% ASP (homes closed, $000s) $508.6 $490.3 4% $512.4 $486.2 5% Summary financial information ($mm) Home sales revenue $422.6 $325.1 30% $681.5 $586.4 16% Homebuilding gross profit $69.6 $56.4 23% $110.0 $102.5 7% Operating income $28.2 $21.2 33% $34.5 $34.5 0% Adj. Net income to common stockholders $19.0 $14.6 30% $23.0 $23.6 (3%) Adjusted diluted EPS ($) $0.49 $0.38 29% $0.60 $0.62 (3%) Adjusted EBITDA $53.3 $48.5 10% $75.8 $82.0 (8%) Select margins bps bps Gross margin 16.5% 17.4% (90) 16.1% 17.5% (140) Adjusted gross margin 22.1% 24.0% (190) 21.7% 24.3% (260) SG&A margin 9.7% 10.7% 100 10.9% 11.5% 60 Three months ended Six months ended

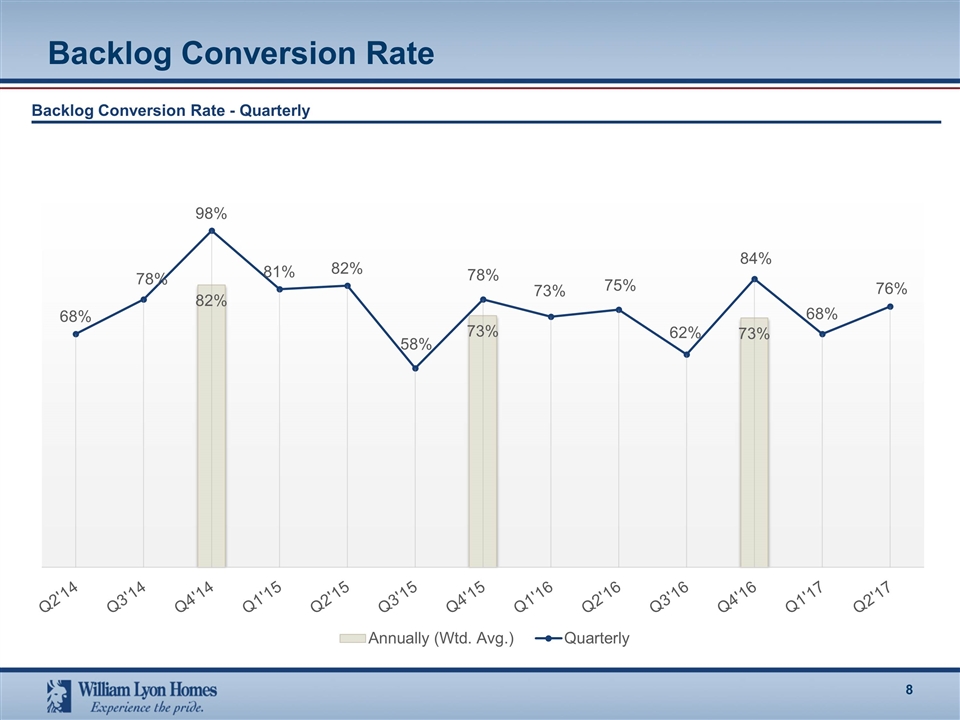

Backlog Conversion Rate Backlog Conversion Rate - Quarterly

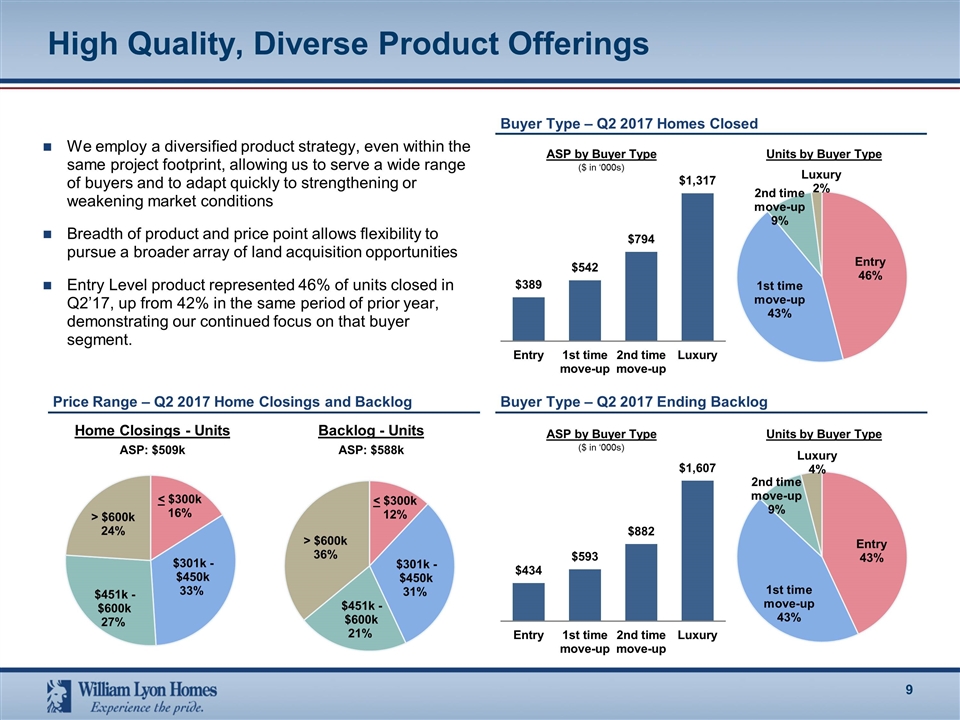

We employ a diversified product strategy, even within the same project footprint, allowing us to serve a wide range of buyers and to adapt quickly to strengthening or weakening market conditions Breadth of product and price point allows flexibility to pursue a broader array of land acquisition opportunities Entry Level product represented 46% of units closed in Q2’17, up from 42% in the same period of prior year, demonstrating our continued focus on that buyer segment. ASP by Buyer Type ($ in ‘000s) Units by Buyer Type High Quality, Diverse Product Offerings Buyer Type – Q2 2017 Homes Closed Price Range – Q2 2017 Home Closings and Backlog Home Closings - Units Backlog - Units ASP: $509k ASP: $588k Buyer Type – Q2 2017 Ending Backlog ASP by Buyer Type ($ in ‘000s) Units by Buyer Type 1st time move-up43% 2nd time move-up9% Luxury 2% Luxury 4% 2nd time move-up9% 1st time move-up43% $301k - $450k 31% $301k - $450k 33% $451k - $600k 21% < $300k 12% < $300k 16% $451k - $600k 27% > $600k 24% > $600k 36%

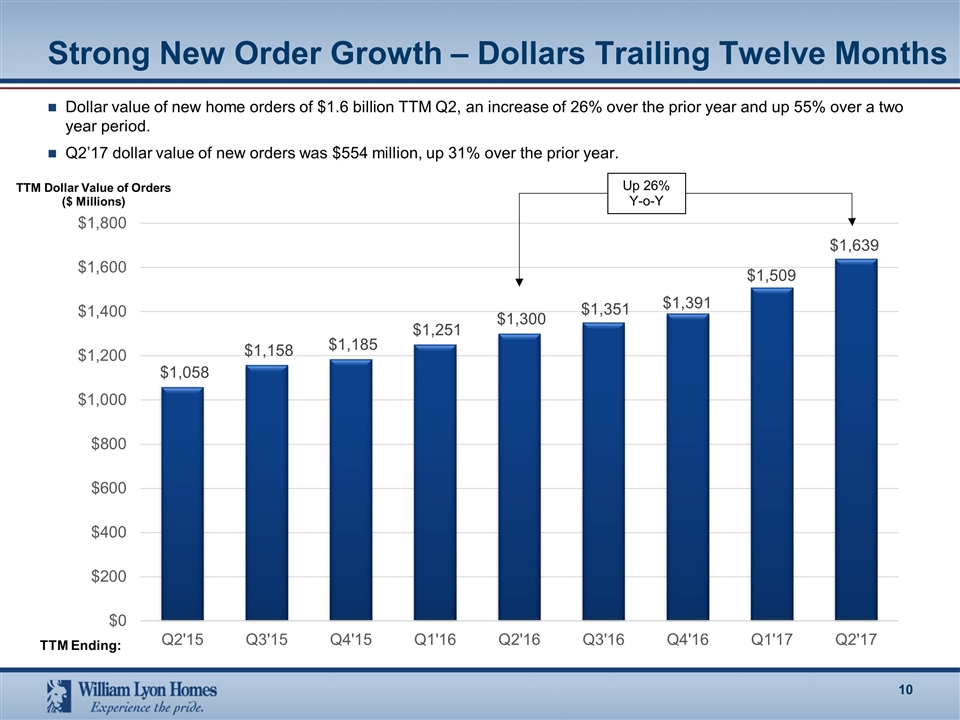

Strong New Order Growth – Dollars Trailing Twelve Months Dollar value of new home orders of $1.6 billion TTM Q2, an increase of 26% over the prior year and up 55% over a two year period. Q2’17 dollar value of new orders was $554 million, up 31% over the prior year. TTM Dollar Value of Orders ($ Millions) TTM Ending: Up 26% Y-o-Y

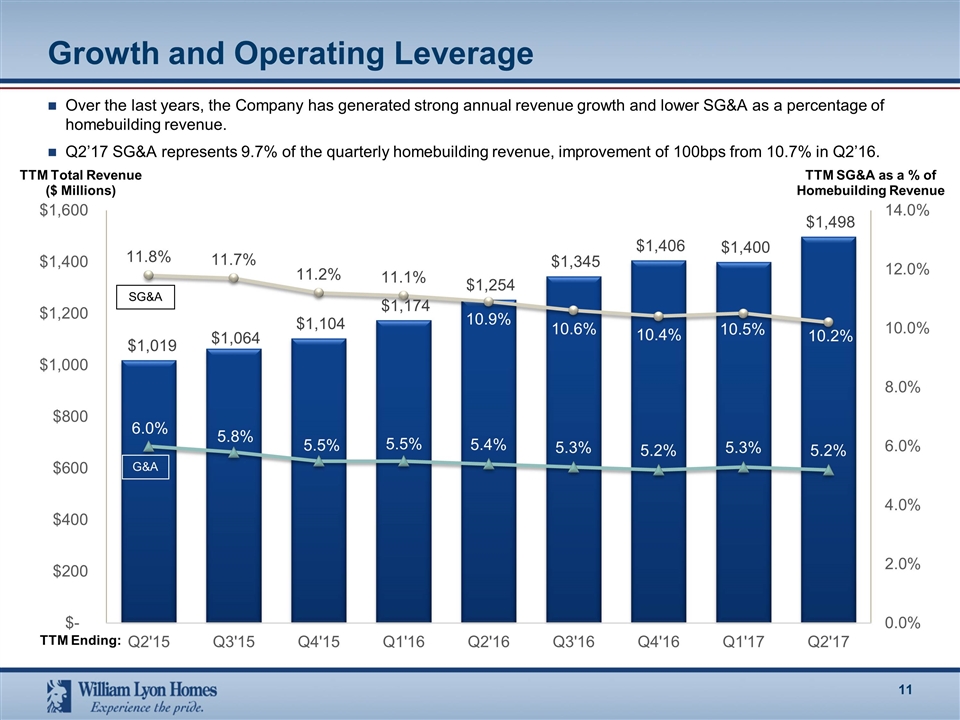

Growth and Operating Leverage Over the last years, the Company has generated strong annual revenue growth and lower SG&A as a percentage of homebuilding revenue. Q2’17 SG&A represents 9.7% of the quarterly homebuilding revenue, improvement of 100bps from 10.7% in Q2’16. TTM Total Revenue ($ Millions) TTM Ending: TTM SG&A as a % of Homebuilding Revenue SG&A G&A

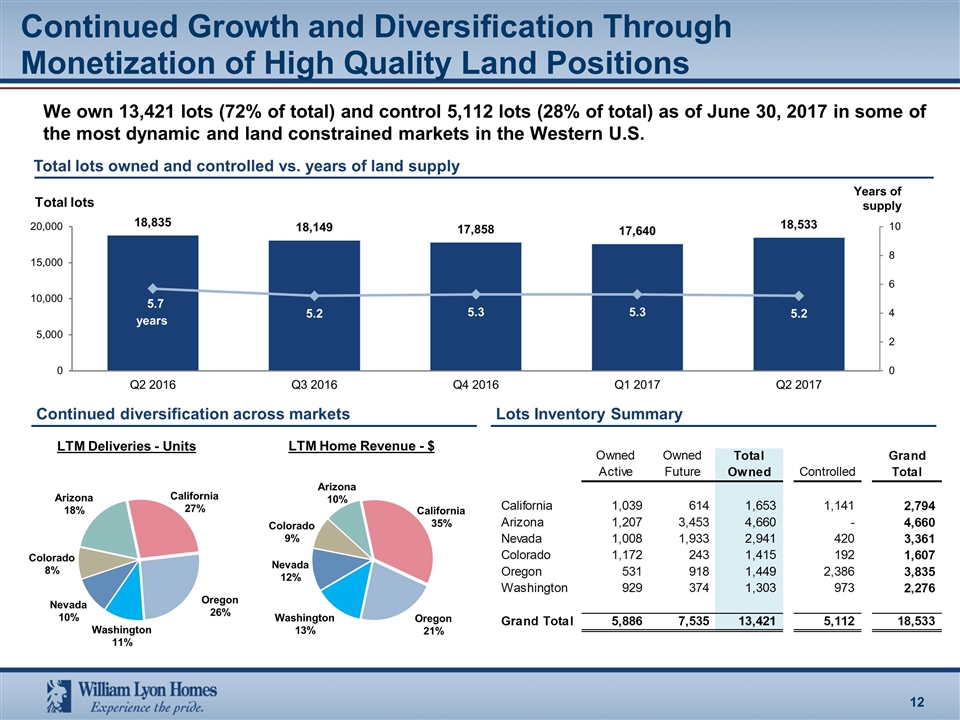

Continued Growth and Diversification Through Monetization of High Quality Land Positions Total lots owned and controlled vs. years of land supply LTM Deliveries - Units Continued diversification across markets Lots Inventory Summary We own 13,421 lots (72% of total) and control 5,112 lots (28% of total) as of June 30, 2017 in some of the most dynamic and land constrained markets in the Western U.S. LTM Home Revenue - $

Appendix

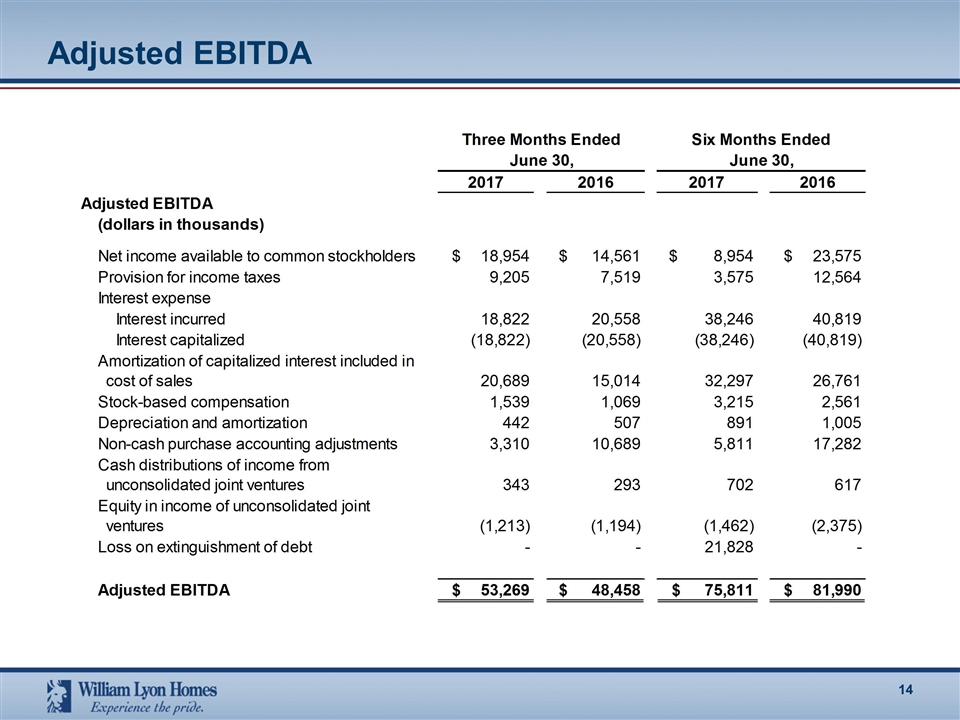

Adjusted EBITDA

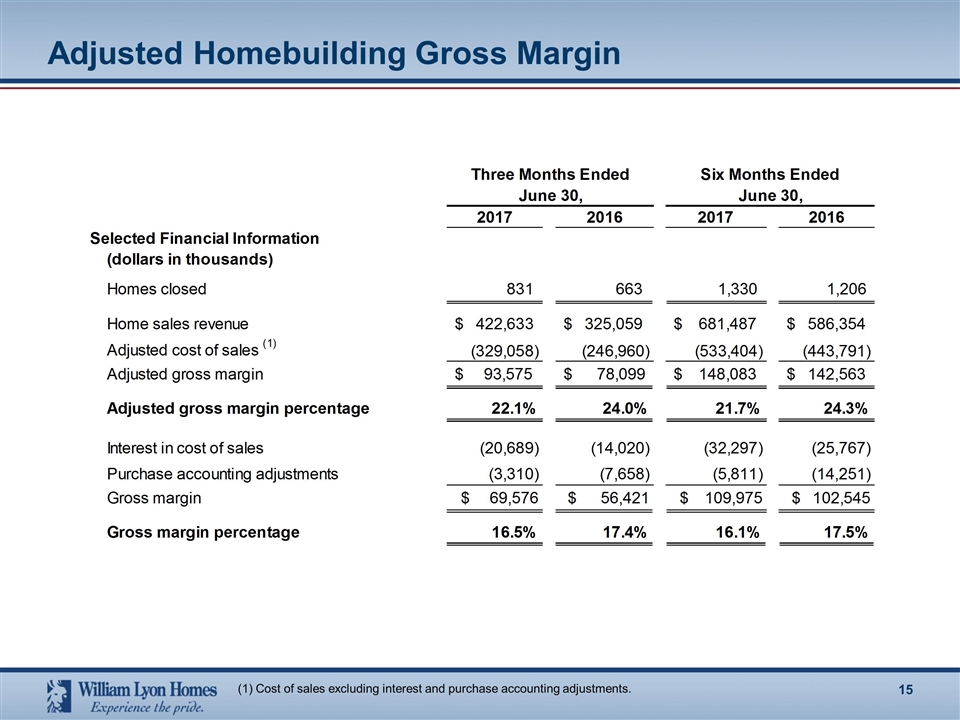

Adjusted Homebuilding Gross Margin (1) Cost of sales excluding interest and purchase accounting adjustments.

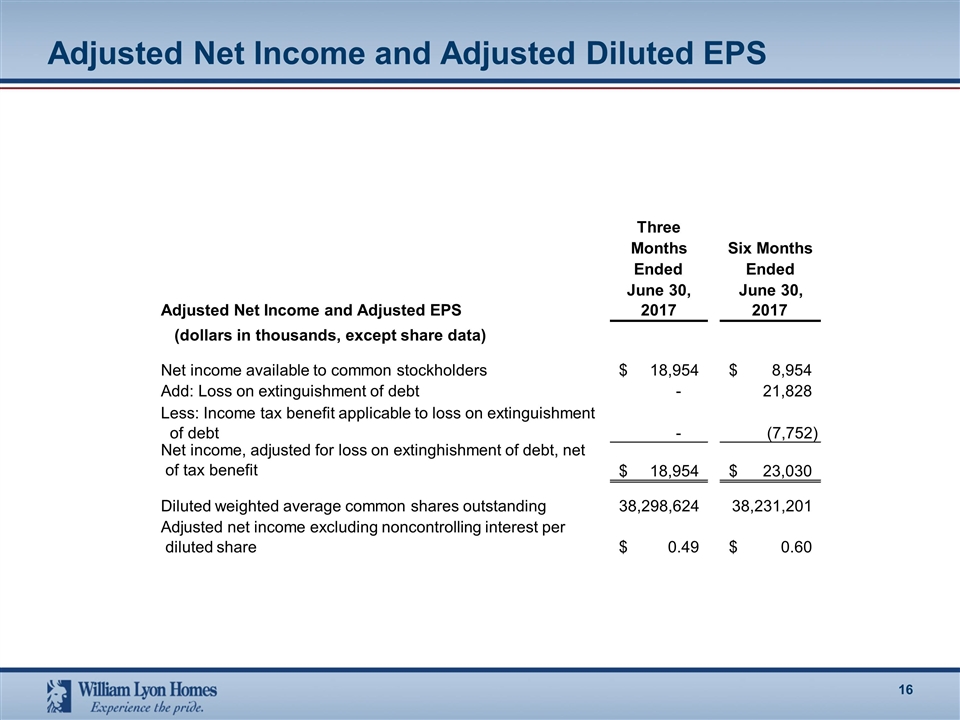

Adjusted Net Income and Adjusted Diluted EPS Three Months Ended June 30, Six Months Ended June 30, Adjusted Net Income and Adjusted EPS 2017 2017 (dollars in thousands, except share data) Net income available to common stockholders 18,954 $ 8,954 $ Add: Loss on extinguishment of debt - 21,828 - (7,752) 18,954 $ 23,030 $ Diluted weighted average common shares outstanding 38,298,624 38,231,201 0.49 $ 0.60 $ Net income, adjusted for loss on extinghishment of debt, net of tax benefit Less: Income tax benefit applicable to loss on extinguishment of debt Adjusted net income excluding noncontrolling interest per diluted share