Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - QUANTENNA COMMUNICATIONS INC | exhibit992quantennaq2fy2.htm |

| EX-99.1 - EXHIBIT 99.1 - QUANTENNA COMMUNICATIONS INC | q22017-exhibit991newsrelea.htm |

| 8-K - 8-K - QUANTENNA COMMUNICATIONS INC | qtnaq220178k.htm |

Wi-Fi Perfected™

Second Quarter 2017 Earnings Presentation

August 7, 2017

Semiconductors Cloud Analytics

Proprietary

Software

Safe Harbor and Non-GAAP Financial Measures

2

This presentation contains “forward-looking” statements that are based on our beliefs and assumptions and on information

currently available to us. Forward-looking statements include information concerning our possible or assumed future results

of operations, business strategies, product development plans, competitive position, potential growth opportunities, use of

proceeds and the effects of competition. Forward-looking statements include all statements that are not historical facts and

can be identified by terms such as “anticipate,” “believe,” “could,” “seek,” “estimate,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual

results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. These risks, uncertainties and other factors include, but are not

limited to, the risk factors listed in our 10-K dated March 2, 2017. Forward-looking statements represent our beliefs and

assumptions only as of the date of this presentation. Except as required by law, we assume no obligation to update these

forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in

the forward-looking statements, even if new information becomes available in the future.

This presentation includes certain non-GAAP financial measures as defined by the SEC rules. We have provided a

reconciliation of those measures to the most directly comparable GAAP measures, which is available in the appendix to this

presentation.

Quantenna at a Glance

3

Strong Revenue Growth Profile

$40

$67

$84

$129

$85

2013 2014 2015 2016 2017 YTD

$MM

100 million+

chips shipped

60+

products with

Quantenna inside

50+

service providers

40+

OEMs / ODMs

350+

employees

11+

years of history

48%

CAGR

$50

Q3 guide

midpoint

Quantenna Takes Wi-Fi to Unparalleled Performance

4

Basic Features

of Standards

Basic Functionality

and Interoperability

Optional Features of

Standards

Better Performance

Innovative Implementation

High Performance

Value-Add Proprietary Software & Algorithmic Features

• Advanced MIMO

• Advanced MU-MIMO

• Transmit

Beamforming

Technology

• 2.4GHz + 5GHz

Integrated Dual-

Band Chipset

• Complete Host

Offload

• Full Access Point in

a Single Chipset

• IQStream Traffic Management

Classify and prioritize traffic

• SuperDFS Dynamic Channel

Selection

• MAUI Analytics

Embedded cloud-based Wi-Fi

analytics platform

• SONiQ Smart Managed Wi-Fi

Solution

Manages multiple access points

and repeaters

Supports third-party silicon

4x4 MIMO

8x8 + 4x4 MIMO

Performance

Wi-Fi Perfected™

2Gbps 10 Gbps5Gbps

Wave 2 / Wave 3

8x8 MIMO

Dual-Band Predictive Software

Advanced Routing

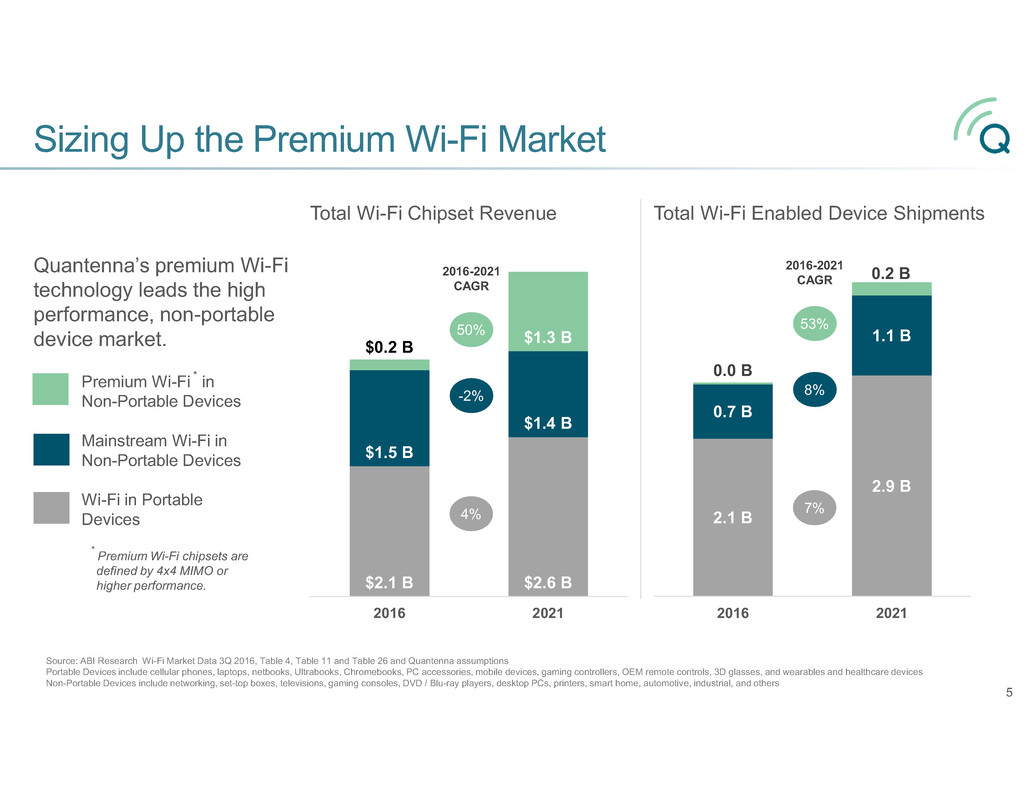

Sizing Up the Premium Wi-Fi Market

5

Total Wi-Fi Chipset Revenue

$2.1 B $2.6 B

$1.5 B

$1.4 B

$0.2 B $1.3 B

2016 2021

Source: ABI Research Wi-Fi Market Data 3Q 2016, Table 4, Table 11 and Table 26 and Quantenna assumptions

Portable Devices include cellular phones, laptops, netbooks, Ultrabooks, Chromebooks, PC accessories, mobile devices, gaming controllers, OEM remote controls, 3D glasses, and wearables and healthcare devices

Non-Portable Devices include networking, set-top boxes, televisions, gaming consoles, DVD / Blu-ray players, desktop PCs, printers, smart home, automotive, industrial, and others

2.1 B

2.9 B

0.7 B

1.1 B

0.0 B

0.2 B

2016 2021

Total Wi-Fi Enabled Device Shipments

53%

2016-2021

CAGR

8%

7%

50%

2016-2021

CAGR

-2%

4%

Premium Wi-Fi * in

Non-Portable Devices

Mainstream Wi-Fi in

Non-Portable Devices

Wi-Fi in Portable

Devices

* Premium Wi-Fi chipsets are

defined by 4x4 MIMO or

higher performance.

Quantenna’s premium Wi-Fi

technology leads the high

performance, non-portable

device market.

Q2 2017 Financial Highlights

Record quarterly revenue of $47.1 million

• 43% Y/Y growth vs Q2 2016

• 24% Q/Q growth vs Q1 2017

Strong gross margin of 50.6%

• Above 48.5% to 50.5% guidance range

• Up 140bps Q/Q vs Q1 2017

Operating cash flow positive

• Cash from ops $7.4 million or $0.19/share

Record Earnings Performance

• $2.7 million net income

– Net income more than doubled Q/Q

• $0.07 in EPS

– Up materially Q/Q vs $0.03 in Q1 2017

0

25

50

75

100

125

150

175

Q2 2016 Q2 2017 TTM

Q2 2016

TTM

Q2 2017

50%

YoY

Strong Revenue Growth Profile

$MM

43%

YoY

6

*Gross margin, income and EPS figures are fully diluted based on non-GAAP reporting which excludes stock-based compensation. TTM means trailing twelve months.

Explosive IP Traffic Growth Stresses Wi-Fi Bottleneck

Cloud data rapidly evolving

towards 100G switch fabric

Infrastructure upgrades

such as fiber, G.fast and

DOCSIS 3.1 are

distributing up to 10G

to the home

Current

Wi-Fi

speed up

to 1G is

gating

factor

7 EB

48 EB49 EB

103 EB

40 EB

127 EB

2016 2021

Worldwide IP Traffic in Exabytes per Month

26%

2016-2021

CAGR

16%

46%

Wi-Fi

(fixed & mob)

Wireline

(incl. VoD)

Mobile

(carrier)

Source: Cisco Visual Networking Index: Forecast and Methodology, 2016-2021; updated June 6, 2017

Wi-Fi will deliver 48% of WW IP traffic growth from 2016-2021

7

Wi-Fi Offload a Requirement for MVNO Profitability

-$10

$0

$10

$20

$30

$40

$50

60% 70% 80% 90%

Revenue MVNO Costs EBITDA

Wi-Fi data offload penetration rate

Cable MSOs are building out new

mobile phone service

• MVNO strategy leases expensive mobile

airtime with other carriers in a “virtual”

arrangement to complete network

• Creates a “sticky” bundling strategy to

retain subs over long-term, further

expanding EBITDA

Wi-Fi offload is critical to success

• Without Wi-Fi data offload, the MSO

would lose money

• The last portion of offload unleashes

incremental leverage to subscriber

EBITDA

• In this example, every 1% of Wi-Fi data

offload translates to 2.7% of EBITDA

expansion per subscriber

Wi-Fi Integral to Cable MSO Mobile Strategy

Source: New Street Research, LLP, “Xfinity Mobile is More Disruptive Than You Think”, April 17, 2017

8

Monthly per Subscriber Metrics

3%

29%

56%

EBITA%

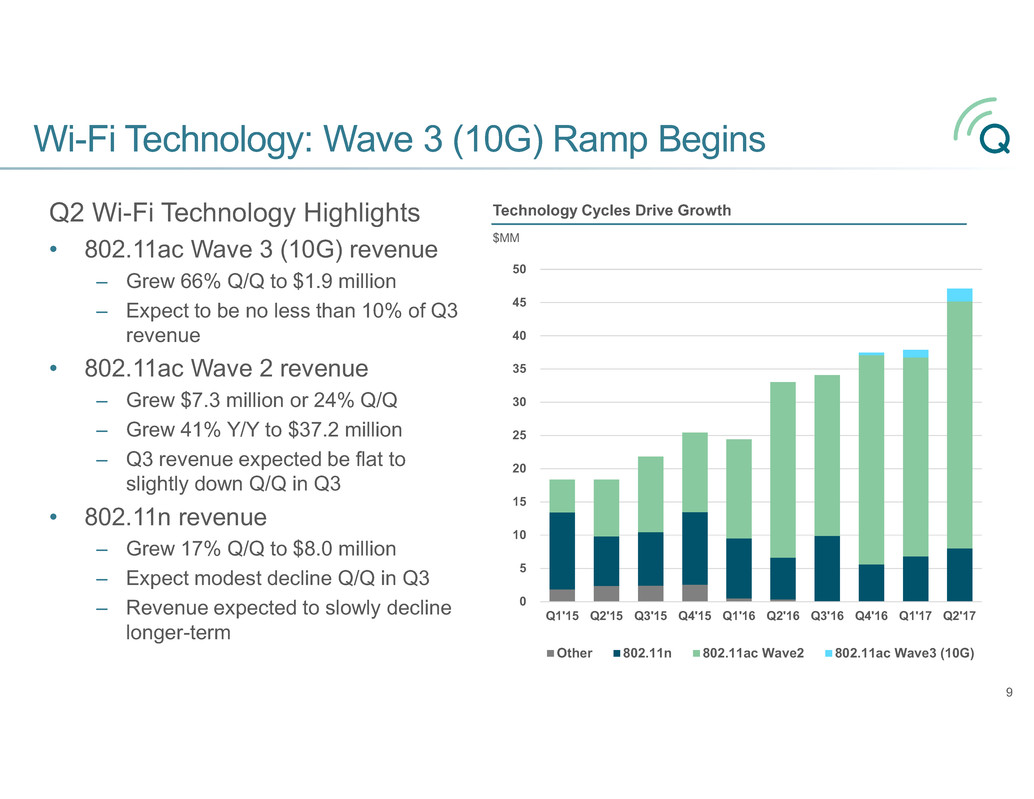

Technology Cycles Drive Growth

$MM

0

5

10

15

20

25

30

35

40

45

50

Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17

Other 802.11n 802.11ac Wave2 802.11ac Wave3 (10G)

Q2 Wi-Fi Technology Highlights

• 802.11ac Wave 3 (10G) revenue

– Grew 66% Q/Q to $1.9 million

– Expect to be no less than 10% of Q3

revenue

• 802.11ac Wave 2 revenue

– Grew $7.3 million or 24% Q/Q

– Grew 41% Y/Y to $37.2 million

– Q3 revenue expected be flat to

slightly down Q/Q in Q3

• 802.11n revenue

– Grew 17% Q/Q to $8.0 million

– Expect modest decline Q/Q in Q3

– Revenue expected to slowly decline

longer-term

Wi-Fi Technology: Wave 3 (10G) Ramp Begins

9

Operating Results & Guidance

2015 2016 Q1 2017 Q2 2017 Q3 2017 Guidance

Revenue $83.8 $129.1 $37.9 $47.1 $49 - $51

Gross Margin 49% 50% 49% 51%

GAAP: 46.9% +/-100bps

non-GAAP: 47.0% +/-100bps

OPEX 55% 48% 45% 44%

GAAP: flat to -4% Q/Q

non-GAAP: flat to -5% Q/Q

EPS $(7.59) $0.04 $0.03 $0.07

GAAP: $0.00 - $0.02

non-GAAP: $0.07 - $0.09

10

*Gross margin, OPEX and EPS figures are based on non-GAAP reporting which excludes stock-based compensation.

Balance Sheet Summary

2015 2016 Q1 2017 Q2 2017

Cash, Cash Equivalents &

Marketable Securities $18.9 $117.0 $114.4 $124.4

Total Assets $46.7 $154.8 $156.1 $174.6

Total Debt $5.8 $5.9 $5.4 $5.0

Total Liabilities $17.6 $26.0 $25.9 $38.0

Total Stockholders’ Equity ($155.7) $128.7 $130.2 $136.6

11

Appendix

12

Non-GAAP to GAAP Operating Margin Reconciliation

13

SBC means stock-based compensation, percentages may not total due to rounding

2015 2016 Q1 2017 Q2 2017

Non-GAAP Gross Margin 49% 50% 49% 51%

SBC: Gross Margin 0% 0% 0% 0%

GAAP Gross Margin 49% 50% 49% 51%

Non-GAAP Operating Margin (6%) 2% 6% 6%

SBC: R&D 0% 1% 3% 3%

SBC: S&M 1% 0% 1% 1%

SBC: G&A 1% 1% 1% 2%

GAAP Operating Margin (7%) (1%) (1%) 1%

Non-GAAP to GAAP Net Margin Reconciliation

14

SBC means stock-based compensation, percentages may not total due to rounding

2015 2016 Q1 2017 Q2 2017

Non-GAAP Net Margin (7%) 1% 6% 6%

SBC: Gross Margin 0% 0% 0% 0%

SBC: R&D 0% 1% 3% 3%

SBC: S&M 1% 0% 1% 1%

SBC: G&A 1% 1% 1% 2%

GAAP Net Margin (8%) (1%) (2%) 0%

Wi-Fi Perfected™

15

Semiconductors Cloud Analytics

Proprietary

Software