Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 EARNINGS RELEASE - Novelis Inc. | novelisq1fy18results.htm |

| 8-K - 8-K EARNINGS - Novelis Inc. | nvl-form8xkq1fy18.htm |

© 2017 Novelis

NOVELIS Q1 FISCAL 2018

EARNINGS CONFERENCE CALL

August 7, 2017

Steve Fisher

President and Chief Executive Officer

Devinder Ahuja

Senior Vice President and Chief Financial Officer

Exhibit 99.2

© 2017 Novelis

SAFE HARBOR STATEMENT

Forward-looking statements

Statements made in this presentation which describe Novelis' intentions, expectations, beliefs or predictions may be forward-

looking statements within the meaning of securities laws. Forward-looking statements include statements preceded by, followed

by, or including the words "believes," "expects," "anticipates," "plans," "estimates," "projects," "forecasts," or similar

expressions. Examples of forward-looking statements in this presentation including statements concerning our expectation that

trucks, SUVs and EVs will continue to grow faster than the overall market. Novelis cautions that, by their nature, forward-looking

statements involve risk and uncertainty and that Novelis' actual results could differ materially from those expressed or implied in

such statements. We do not intend, and we disclaim, any obligation to update any forward-looking statements, whether as a result

of new information, future events or otherwise. Factors that could cause actual results or outcomes to differ from the results

expressed or implied by forward-looking statements include, among other things: changes in the prices and availability of aluminum

(or premiums associated with such prices) or other materials and raw materials we use; the capacity and effectiveness of our

hedging activities; relationships with, and financial and operating conditions of, our customers, suppliers and other stakeholders;

fluctuations in the supply of, and prices for, energy in the areas in which we maintain production facilities; our ability to access

financing for future capital requirements; changes in the relative values of various currencies and the effectiveness of our currency

hedging activities; factors affecting our operations, such as litigation, environmental remediation and clean-up costs, labor relations

and negotiations, breakdown of equipment and other events; the impact of restructuring efforts in the future; economic, regulatory

and political factors within the countries in which we operate or sell our products, including changes in duties or tariffs; competition

from other aluminum rolled products producers as well as from substitute materials such as steel, glass, plastic and composite

materials; changes in general economic conditions including deterioration in the global economy, particularly sectors in which our

customers operate; cyclical demand and pricing within the principal markets for our products as well as seasonality in certain of our

customers’ industries; changes in government regulations, particularly those affecting taxes, environmental, health or safety

compliance; changes in interest rates that have the effect of increasing the amounts we pay under our credit facilities and other

financing agreements; the effect of taxes and changes in tax rates; and our level of indebtedness and our ability to generate cash.

The above list of factors is not exhaustive. Other important risk factors included under the caption "Risk Factors" in our Annual

Report on Form 10-K for the fiscal year ended March 31, 2017 are specifically incorporated by reference into this presentation.

2

© 2017 Novelis

FIRST QUARTER FY18 HIGHLIGHTS

Record Q1 shipments, continued auto growth and

operational efficiencies driving strong performance

Total shipments up 4%

Global auto shipments up 16%; global can shipments up 2%

Adjusted EBITDA/ton up 4% to $368

3

On track to achieve record Adjusted EBITDA in FY18

TTM Adjusted EBITDA ($M)

Adjusted EBITDA and Adjusted EBITDA/ton exclude metal price lag in all periods

750

800

850

900

950

1,000

1,050

1,100

1,150

Quarterly Adjusted EBITDA/ton ($)

200

225

250

275

300

325

350

375

© 2017 Novelis

GLOBAL CAN SHEET MARKET

4

Source: Novelis internal research

North America

2017 Demand: 1.8 MT

CAGR 2017-21: +0-1%

South America

2017 Demand: 0.4MT

CAGR 2017-21: +3%

MEAI

2017 Demand: 0.4MT

CAGR 2017-21: +5%

Europe

2017 Demand: 1.1 MT

CAGR 2017-21: +3-4%

China

2017 Demand: 0.7 MT

CAGR 2017-21: +5%

Demand for 5.4 million tonne global aluminum can sheet market remains unchanged,

expected to grow low single digits through 2021

Novelis Q1 EBITDA results reflect majority of new can pricing with secured longer term

volume at sustained market share

Committed to our Can sheet customers and market

Aluminum beverage can sheet demand

Asia excl. China

2017 Demand: 1.0 MT

CAGR 2017-21: +3%

© 2017 Novelis

GLOBAL AUTOMOTIVE SHEET MARKET

5

Novelis is the preferred choice for automotive aluminum sheet solutions

Ducker Worldwide and IHS project increased penetration of aluminum sheet, mainly

through hang-on parts, leading to higher demand

Aluminum penetration is higher in Trucks, SUVs, and EVs globally

China automotive FRP market is growing at the highest CAGR supported by

government policies and EV market development

Trucks, SUVs and EVs will continue to grow faster than the overall market

NORTH AMERICA

2017 Demand: 0.7 MT

CAGR 2017-21: +13-15%

EUROPE

2017 Demand: 0.5 MT

CAGR 2017-21: +10-12%

ASIA

2017 Demand: 0.1 MT

CAGR 2017-21: +35-40%

Automotive Aluminum Sheet Demand

Source: Novelis internal research, IHS Material Forecast, Ducker Worldwide

© 2017 Novelis

FINANCIAL HIGHLIGHTS

© 2017 Novelis

Q1 FISCAL 2018 FINANCIAL HIGHLIGHTS

Net income of $101 million up from $24 million in prior year

Excluding tax-effected special items*, net income up 212% from $33

million to $103 million

$19 million lower interest expense mainly a result of FY17

refinancing actions

Adjusted EBITDA up 8% from $268 million to $289 million

Sales up 16% to $2.7 billion

Total FRP Shipments up 4% to 785 kilotonnes

Automotive shipments up 16% YoY

Strong liquidity position at $1.2 billion

7

Q1FY18 vs Q1FY17

*Tax-effected special items may include restructuring & impairment, metal price lag, gain/loss on assets held for sale, loss on extinguishment of debt, loss on sale of business

Adjusted EBITDA excludes metal price lag in all periods

© 2017 Novelis

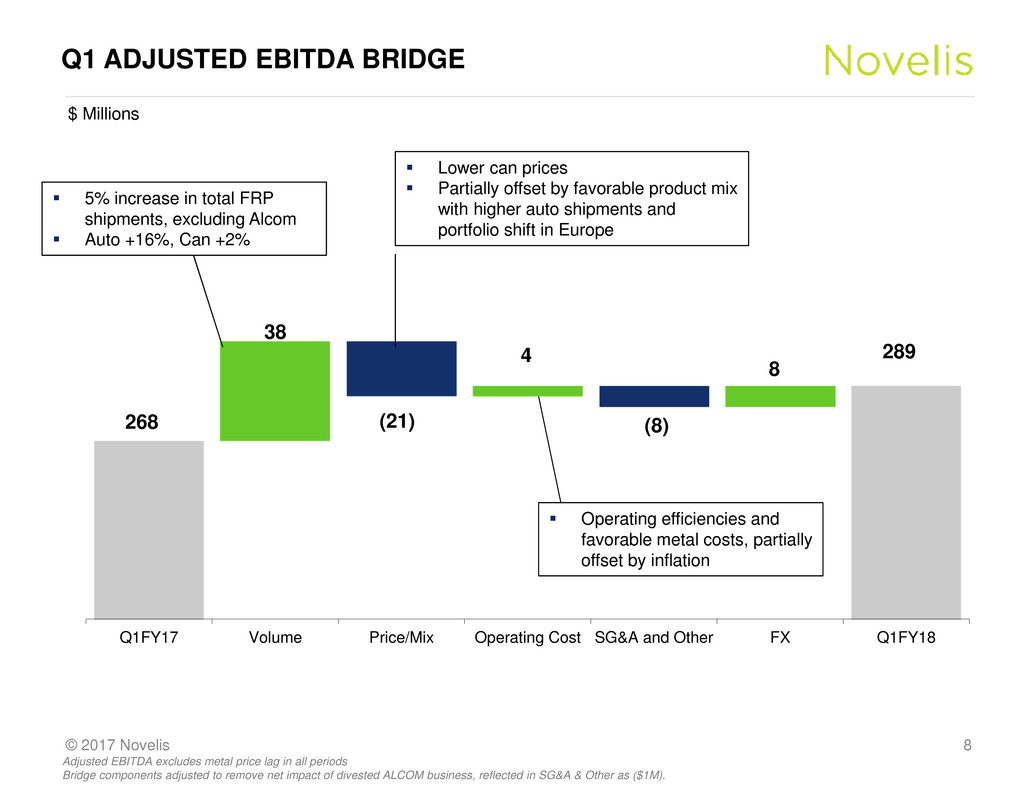

Q1 ADJUSTED EBITDA BRIDGE

8

$ Millions

268

38

(21)

4

(8)

8

289

Q1FY17 Volume Price/Mix Operating Cost SG&A and Other FX Q1FY18

Adjusted EBITDA excludes metal price lag in all periods

Bridge components adjusted to remove net impact of divested ALCOM business, reflected in SG&A & Other as ($1M).

5% increase in total FRP

shipments, excluding Alcom

Auto +16%, Can +2%

Lower can prices

Partially offset by favorable product mix

with higher auto shipments and

portfolio shift in Europe

Operating efficiencies and

favorable metal costs, partially

offset by inflation

© 2017 Novelis

FREE CASH FLOW

9

Q1 FY18 Q1 FY17

Adjusted EBITDA 289 268

Capital expenditures (39) (44)

Interest paid (81) (133)

Taxes paid (27) (28)

Working capital & other (219) (209)

Free cash flow (77) (146)

Free cash flow improved year over year driven by higher

Adjusted EBITDA and refinancing driven interest savings

Q1 working capital outflow due to seasonally higher inventory,

rising aluminum prices, timing of customer payments

Expect record FY18 free cash flow

$ Millions

Adjusted EBITDA excludes metal price lag in all periods

© 2017 Novelis

SUMMARY & OUTLOOK

Demonstrating continued strong operating & financial

performance

Well poised for record Adjusted EBITDA and free cash flow for

the full year FY18

FY18 Adjusted EBITDA $1,100-$1,150 million

FY18 free cash flow $400-$450 million

Positive outlook for automotive aluminum sheet demand

Strong financial position allows us to evaluate potential growth

opportunities to meet customer needs

10

© 2017 Novelis

THANK YOU

QUESTIONS?

THANK YOU AND QUESTIONS

© 2017 Novelis

APPENDIX

© 2017 Novelis

INCOME STATEMENT RECONCILIATION TO ADJUSTED EBITDA

13

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Net income (loss) attributable to our common shareholder 24 (89) 63 47 45 101

- Noncontrolling interests - - 1 - 1 -

- Interest, net 80 79 65 59 283 62

- Income tax provision 36 27 47 41 151 43

- Depreciation and amortization 89 90 88 93 360 90

EBITDA 229 107 264 240 840 296

- Unrealized loss (gain) on derivatives 7 (4) (21) 13 (5) (16)

- Realized gain on derivative instruments not included in segment

income (1) - (1) (3) (5) (1)

- Proportional consolidation 8 8 4 8 28 8

- Loss on extinguishment of debt - 112 - 22 134 -

- Restructuring and impairment, net 2 1 1 6 10 1

- Loss on sale of business - 27 - - 27 -

- Loss (gain) on sale of fixed assets 4 2 (2) 2 6 1

- Gain on assets held for sale, net (1) (1) - - (2) -

- Metal price lag (A) 13 14 4 - 31 1

- Others costs (income), net 7 4 6 4 21 (1)

Adjusted EBITDA 268 270 255 292 1,085 289

(A) Effective in the first quarter of fiscal 2018, management removed the impact of metal price lag from Adjusted EBITDA (Segment Income) in order to

provide more transparency and visibility for our stakeholders on the underlying performance of the business. On certain sales contracts, we experience

timing differences on the pass through of changing aluminum prices from our suppliers to our customers. Additional timing differences occur in the flow of

metal costs through moving average inventory cost values and cost of goods sold. This timing difference is referred to as metal price lag. The company will

continue to report metal price lag as a separate line item in Reconciliation from Net Income (loss) attributable to our common shareholder to Adjusted

EBITDA. Segment information for all prior periods presented has been updated to reflect this change.

© 2017 Novelis

FREE CASH FLOW AND LIQUIDITY

14

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Cash (used in) provided by operating activities (107) 80 178 424 575 (45)

Cash used in investing activities (39) (48) (35) (90) (212) (31)

Less: outflows (proceeds) from sales of assets - 12 (12) (2) (2) (1)

Free cash flow (146) 44 131 332 361 (77)

Capital expenditures 44 46 48 86 224 39

(in $ m) Q1 Q2 Q3 Q4 FY17 Q1FY18

Cash and cash equivalents 457 473 505 594 594 565

Availability under committed credit facilities 633 573 534 701 701 671

Liquidity 1,090 1,046 1,039 1,295 1,295 1,236