Attached files

| file | filename |

|---|---|

| EX-99.1 - PRESS RELEASE OF GRANITE POINT MORTGAGE TRUST INC., DATED AUGUST 7, 2017. - Granite Point Mortgage Trust Inc. | gpmtq217financialresults.htm |

| 8-K - 8-K Q2-2017 EARNINGS RELEASE - Granite Point Mortgage Trust Inc. | a8-kgranitepointq2x2017ear.htm |

2Q 2017 Investor Presentation

Safe Harbor Statement

This presentation contains, in addition to historical information, certain forward-looking statements that are based on our current assumptions,

expectations and projections about future performance and events. In particular, statements regarding future economic performance, finances, and

expectations and objectives of management constitute forward-looking statements. Forward-looking statements are not historical in nature and can

be identified by words such as "believes," "expects," "may," "will," "should," "seeks," "approximately," "intends," "plans," "estimates," "anticipates,"

“targets,” “goals,” “future,” “likely” and other expressions that are predictions of or indicate future events and trends and that do not relate to

historical matters.

Although the forward-looking statements contained in this presentation are based upon information available at the time the statements are made

and reflect the best judgment of our senior management, forward-looking statements inherently involve known and unknown risks, uncertainties and

other factors, which may cause the actual results, performance or achievements to differ materially from anticipated future results. Important factors

that could cause actual results to differ materially from expectations include, among others: (i) the state of the U.S. economy generally or in specific

geographic regions; (ii) the state of the commercial real estate market and the availability and cost of our target assets; (iii) defaults by borrowers in

paying debt service on outstanding items and borrowers’ abilities to manage and stabilize properties; (iv) actions and initiatives of the U.S.

Government and changes to U.S. Government policies; (v) our ability to obtain financing arrangement on favorable terms if at all; (vi) general volatility

of the securities markets in which we invest; (vii) changes in interest rates and the market value of our investments; (viii) rates of default or decreased

recovery rates on our target investments; (ix) the degree to which our hedging strategies may or may not protect us from interest rate volatility; (x)

changes in governmental regulations, tax law and rates, and similar matters; and (xi) our ability to qualify as a REIT for U.S. federal income tax

purposes. These forward-looking statements apply only as of the date of this press release. We are under no duty to update any of these forward-

looking statements after the date of this presentation to conform these statements to actual results or revised expectations. You should, therefore,

not rely on these forward-looking statements as predictions of future events.

For historical information relating to TH Commercial Holdings LLC, you should consider the information contained in Two Harbors Investment Corp.’s

filings with the U.S. Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 31,

2016 and Quarterly Report on Form 10-Q for the period ended March 31, 2017, particularly in the sections entitled "Management’s Discussion and

Analysis of Financial Condition and Results of Operations” and “Risk Factors," as well as Two Harbors’ subsequent filings with the SEC. Other unknown

or unpredictable factors also could have material adverse effects on our future results, performance or achievements.

This presentation also contains estimates and other statistical data made by independent parties and by us relating to market size and growth and

other data about our industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such

estimates. In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we

operate are necessarily subject to a high degree of uncertainty and risk.

2

Second Quarter 2017 Highlights(1)

3

SUMMARY

• Completed initial public offering (“IPO”) on June 28, 2017, raising net proceeds of $181.9 million, resulting in an equity

base of $832.4 million.

• Acquired a portfolio of commercial real estate debt investments with an aggregate carrying value of approximately $1.8

billion from Two Harbors Investment Corp. (NYSE: TWO) in exchange for approximately 33.1 million shares of Granite Point

common stock, concurrent with the closing of the IPO.

• Reported book value of $19.25 per common share at June 30, 2017.

• Originated 6 senior floating rate commercial real estate loans representing aggregate loan amounts, including future

fundings, of approximately $272.1 million during the quarter ended June 30, 2017.

• Funded $238.7 million of principal balance of loans during the quarter ended June 30, 2017.

ACTIVIT Y POST QUARTER-END

• Generated a pipeline of senior floating rate commercial real estate loans representing aggregate loan amounts, including

any future fundings, of approximately $320 million, which have either closed or are in the closing process, subject to

fallout, as of July 31, 2017.

• Increased the maximum borrowing capacity under the Wells Fargo credit facility by approximately $97 million, for a total

maximum borrowing capacity of approximately $473 million.

(1) Except as otherwise indicated in this presentation, reported data is as of or for the period ended June 30, 2017.

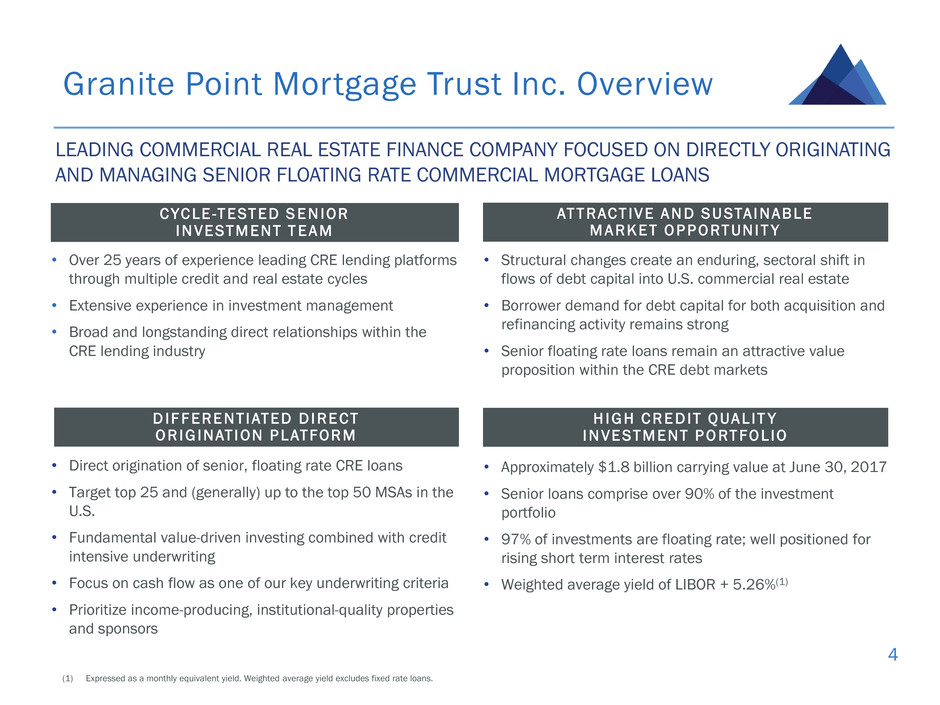

Granite Point Mortgage Trust Inc. Overview

4

C YC LE -T EST ED S E N IO R

I N V E STM E NT T E A M

AT T RAC T I VE A N D S U STA I NAB LE

M A R KE T O P P O RTUNI T Y

H I G H C R E D IT Q UA L IT Y

I N V E STM E NT P O RT FO L IO

D I F F ER E NT IATE D D I R E C T

O R I G INAT I O N P L ATFO R M

LEADING COMMERCIAL REAL ESTATE FINANCE COMPANY FOCUSED ON DIRECTLY ORIGINATING

AND MANAGING SENIOR FLOATING RATE COMMERCIAL MORTGAGE LOANS

• Over 25 years of experience leading CRE lending platforms

through multiple credit and real estate cycles

• Extensive experience in investment management

• Broad and longstanding direct relationships within the

CRE lending industry

• Structural changes create an enduring, sectoral shift in

flows of debt capital into U.S. commercial real estate

• Borrower demand for debt capital for both acquisition and

refinancing activity remains strong

• Senior floating rate loans remain an attractive value

proposition within the CRE debt markets

• Approximately $1.8 billion carrying value at June 30, 2017

• Senior loans comprise over 90% of the investment

portfolio

• 97% of investments are floating rate; well positioned for

rising short term interest rates

• Weighted average yield of LIBOR + 5.26%(1)

• Direct origination of senior, floating rate CRE loans

• Target top 25 and (generally) up to the top 50 MSAs in the

U.S.

• Fundamental value-driven investing combined with credit

intensive underwriting

• Focus on cash flow as one of our key underwriting criteria

• Prioritize income-producing, institutional-quality properties

and sponsors

(1) Expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans.

Market Environment

5 (1) Source: Trepp LLC and Federal Reserve Bank, dated as of 12/31/2016.

(2) Source: Real Capital Analytics. Data from 12/31/2001 to 12/31/2016.

(3) Source: Real Capital Analytics. Data from 1/1/1983 through 12/31/2016.

(4) Source: Census Bureau and BEA. Data from 1/1/1993 to 12/31/2016.

DEMAND FOR COMMERCIAL REAL ESTATE LOANS REMAINS H IGH…

$-

$100

$200

$300

$400

$500

$600

$

in

b

ill

io

ns

Sale transaction volume rebounded strongly post the

global economic crisis(2)

U.S. Foreign

…AND MARKET FUNDAMENTALS REMAIN STRONG.

5.0%

7.0%

9.0%

11.0%

13.0%

15.0%

-10.0%

-5.0%

0.0%

5.0%

10.0%

15.0%

1Q

92

1Q

94

1Q

96

1Q

98

1Q

00

1Q

02

1Q

04

1Q

06

1Q

08

1Q

10

1Q

12

1Q

14

1Q

16

V

ac

an

cy

(%

)

N

O

I G

ro

w

th

(%

)

Occupancies and rents continue to improve across most

markets and property types(3)

NOI Growth Vacancy

0.80%

0.95%

1.10%

1.25%

1.40%

1.55%

1.70%

1.85%

2.00%

2.15%

2.30%

19

93

19

94

19

95

19

96

19

97

19

98

19

99

20

00

20

01

20

02

20

03

20

04

20

05

20

06

20

07

20

08

20

09

20

10

20

11

20

12

20

13

20

14

20

15

20

16

Historically low level of new construction over past

several years has constrained supply of properties(4)

Pct. GDP Average (1993-2009) Average (2010-2016)

$-

$50

$100

$150

$200

$250

$300

$350

$400

$450

2017 2018 2019 2020 2021

$

in

b

ill

io

ns

Over $1.5 trillion of loans maturing

over the next 5 years(1)

Banks CMBS Life Cos Other

Investment Strategy and Target Assets

6

INVESTMENT STRATEGY TARGET INVESTMENTS

• Focus on generating stable and attractive cash flows

while preserving capital base

– Primarily directly originated investments funding property

acquisition, refinancing, recapitalization, restructuring and

repositioning purposes with high credit-quality owners

– Asset-by-asset portfolio construction focused on property and local

market fundamentals and relative value across property types and

markets, as well as within the capital structure

• Actively participate in primary and secondary markets(1)

Primary target investments

• Senior floating rate commercial real estate loans

• Transitional loans on a variety of property types located in

primary and secondary markets in the U.S.

• Generally sized between $25 million and $150 million

• Stabilized loan-to-values (“LTVs”) generally ranging from

55% to 70%

• Loan yields generally ranging from LIBOR + 4.00% to

5.50%

Secondary target investments

• Subordinated interests (or B-notes), mezzanine loans,

debt-like preferred equity and real estate-related

securities

37%

63%

Primary Markets Secondary Markets

(1) Primary markets are defined as the top 5 MSAs. Secondary markets are defined as MSAs 6 and above.

(2) Stabilized LTV considers the "as stabilized" value (as determined in conformance with USPAP) of the underlying property or properties, as set forth in the original appraisal. "As stabilized" value may be

based on certain assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or

increased tenant occupancies.

Floating

96.9%

Fixed

3.1%

Investment Portfolio Overview

7

PROPERTY TYPE GEOGRAPHY

COUPON STRUCTURE INVESTMENT TYPE

Note: Portfolio data as of June 30, 2017.

(1) Expressed as a monthly equivalent yield. Weighted average yield excludes fixed rate loans.

(2) Stabilized LTV considers the "as stabilized" value (as determined in conformance with USPAP) of the underlying property or properties, as set forth in the original appraisal. "As stabilized" value may be based on certain

assumptions, such as future construction completion, projected re-tenanting, payment of tenant improvement or leasing commissions allowances or free or abated rent periods, or increased tenant occupancies.

(3) Weighted average of original maturity of each investment in the portfolio.

(4) Includes mixed-use properties.

KEY PORTFOLIO STATISTICS

Number of

Investments

47

Average Size ~$39m

Weighted

Avg. Yield

L + 5.26%(1)

Weighted Avg.

Stabilized LTV

63.9%(2)

Weighted Avg.

Original Maturity

3.7 years(3)

Office

53.1%

Multifamily

14.8%

Retail(4)

13.7%

Hotel

10.4%

Industrial

8.0%

First Mortgage

91.1%

Mezzanine

5.0%

B-Notes

0.8%

Northeast

36.9%

West

21.7%

Southwest

18.9%

Southeast

17.8%

Midwest

4.7%

CMBS

3.1%

Financing Facilities Update

8

$ in millions Amount Outstanding Unused Capacity Total Capacity(1)

J.P. Morgan $211.7 $288.3 $500.0

Morgan Stanley(2) $229.9 $270.1 $500.0

Goldman Sachs $15.8 $234.2 $250.0

Citi - $250.0 $250.0

Wells Fargo(3)(4) $90.0 $286.5 $376.5

Note: Data as of June 30, 2017.

(1) Excludes short-term bridge financing facility with UBS.

(2) Includes an option to be exercised at the company’s discretion to increase the maximum facility amount to $600 million, subject to certain customary conditions contained in the agreement.

(3) The facility finances a fixed pool of assets.

(4) Post quarter-end, increased the maximum borrowing capacity under the Wells Fargo credit facility by approximately $97 million, for a total maximum borrowing capacity of approximately $473 million.

Appendix

9

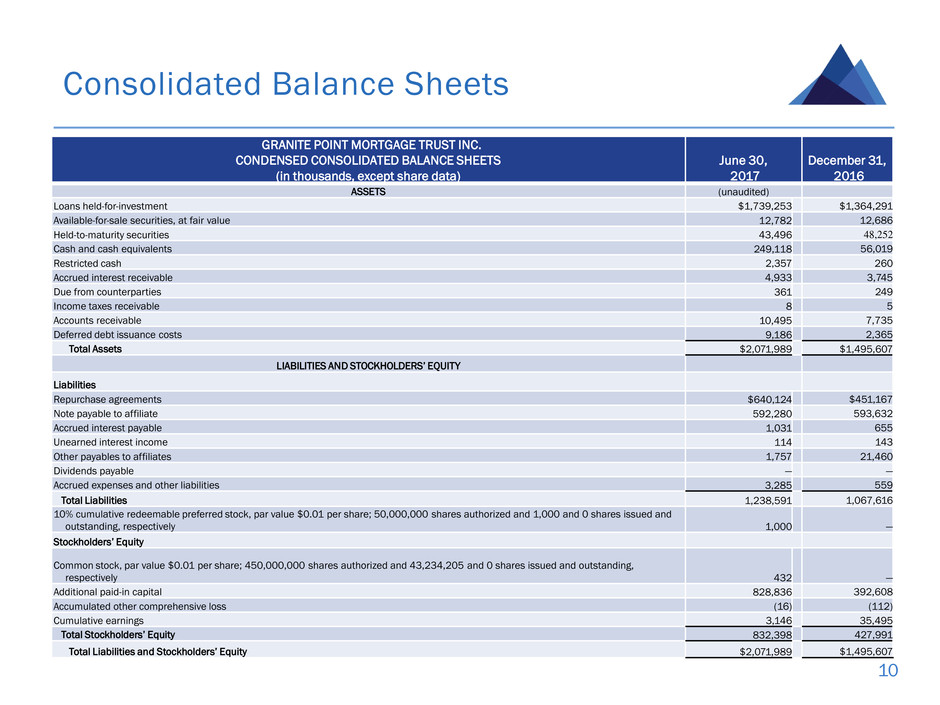

Consolidated Balance Sheets

10

(4)

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

June 30,

2017

December 31,

2016

ASSETS (unaudited)

Loans held-for-investment $1,739,253 $1,364,291

Available-for-sale securities, at fair value 12,782 12,686

Held-to-maturity securities 43,496 48,252

Cash and cash equivalents 249,118 56,019

Restricted cash 2,357 260

Accrued interest receivable 4,933 3,745

Due from counterparties 361 249

Income taxes receivable 8 5

Accounts receivable 10,495 7,735

Deferred debt issuance costs 9,186 2,365

Total Assets $2,071,989 $1,495,607

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities

Repurchase agreements $640,124 $451,167

Note payable to affiliate 592,280 593,632

Accrued interest payable 1,031 655

Unearned interest income 114 143

Other payables to affiliates 1,757 21,460

Dividends payable — —

Accrued expenses and other liabilities 3,285 559

Total Liabilities 1,238,591 1,067,616

10% cumulative redeemable preferred stock, par value $0.01 per share; 50,000,000 shares authorized and 1,000 and 0 shares issued and

outstanding, respectively 1,000

—

Stockholders’ Equity

Common stock, par value $0.01 per share; 450,000,000 shares authorized and 43,234,205 and 0 shares issued and outstanding,

respectively 432

—

Additional paid-in capital 828,836 392,608

Accumulated other comprehensive loss (16) (112)

Cumulative earnings 3,146 35,495

Total Stockholders’ Equity 832,398 427,991

Total Liabilities and Stockholders’ Equity $2,071,989 $1,495,607

Consolidated Statements of Comprehensive Income

11

(4)

GRANITE POINT MORTGAGE TRUST INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands, except share data)

Three Months Ended

June 30,

Six Months Ended

June 30,

2017 2016 2017 2016

Interest income: (unaudited) (unaudited)

Loans held-for-investment $24,290 $12,238 $47,558 $22,129

Available-for-sale securities 256 248 502 516

Held-to-maturity securities 920 1,062 1,852 2,243

Cash and cash equivalents 4 2 6 3

Total interest income 26,100 13,550 49,918 24,891

Interest expense 7,773 2,576 13,879 4,028

Net interest income 18,327 10,974 36,039 20,863

Other income:

Ancillary fee income — 21 — 26

Total other income — 21 — 26

Expenses:

Management fees 1,925 1,640 3,587 3,409

Servicing expenses 307 122 629 227

General and administrative expenses 1,900 1,396 4,173 3,483

Total expenses 4,132 3,158 8,389 7,119

Income before income taxes 14,195 7,837 27,650 13,770

Benefit from income taxes (2) (1) (1) (7)

Net income $14,197 $7,838 $27,651 $13,777

Basic and diluted earnings per weighted average common share (1) $— $— $— $—

Dividends declared per common share $— $— $— $—

Basic and diluted weighted average number of shares of common stock outstanding 43,234,205 — 43,234,205 —

Comprehensive income:

Net income $14,197 $7,838 $27,651 $13,777

Other comprehensive income (loss), net of tax:

Unrealized gain (loss) on available-for-sale securities 16 63 96 (192)

Other comprehensive income (loss) 16 63 96 (192)

Comprehensive income $14,213 $7,901 $27,747 $13,585

(1) The Company has calculated earnings per share only for the period common stock was outstanding, referred to as the post-formation period. The Company has defined the post-formation period to be the

period from the date the Company commenced operations as a publicly traded company on June 28, 2017 through June 30, 2017, or three days of activity. Earnings per share is calculated by dividing the

net income for the post-formation period by the weighted average number of shares outstanding during the post-formation period.