Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GOLUB CAPITAL BDC, Inc. | gbdc6302017investorpresent.htm |

GOLUB CAPITAL BDC, INC.

INVESTOR

PRESENTATION

QUARTER ENDED JUNE 30, 2017

Disclaimer

2

Some of the statements in this presentation constitute forward-looking statements,

which relate to future events or our future performance or financial condition. The

forward-looking statements contained in this presentation involve risks and

uncertainties, including statements as to: our future operating results; our business

prospects and the prospects of our portfolio companies; the effect of investments

that we expect to make and the competition for those investments; our contractual

arrangements and relationships with third parties; actual and potential conflicts of

interest with GC Advisors LLC ("GC Advisors"), our investment adviser, and other

affiliates of Golub Capital LLC (collectively, "Golub Capital"); the dependence of our

future success on the general economy and its effect on the industries in which we

invest; the ability of our portfolio companies to achieve their objectives; the use of

borrowed money to finance a portion of our investments; the adequacy of our

financing sources and working capital; the timing of cash flows, if any, from the

operations of our portfolio companies; general economic and political trends and

other external factors; the ability of GC Advisors to locate suitable investments for

us and to monitor and administer our investments; the ability of GC Advisors or its

affiliates to attract and retain highly talented professionals; our ability to qualify and

maintain our qualification as a regulated investment company and as a business

development company; general price and volume fluctuations in the stock markets;

the impact on our business of the Dodd-Frank Wall Street Reform and Consumer

Protection Act and the rules and regulations issued thereunder and any actions

toward repeal thereof; and the effect of changes to tax legislation and our tax

position.

Such forward-looking statements may include statements preceded

by, followed by or that otherwise include the words “may,” “might,” “will,” “intend,”

“should,” “could,” “can,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “predict,”

“potential,” “plan” or similar words.

We have based the forward-looking statements included in this presentation on

information available to us on the date of this presentation. Actual results could

differ materially from those anticipated in our forward-looking statements and future

results could differ materially from historical performance. You are advised to

consult any additional disclosures that we may make directly to you or through

reports that we have filed or in the future may file with the Securities and Exchange

Commission (“SEC”), including annual reports on Form 10-K, quarterly reports on

Form 10-Q, current reports on Form 8-K and registration statements on Form N-2.

This presentation contains statistics and other data that have been obtained from or

compiled from information made available by third-party service providers. We have

not independently verified such statistics or data.

In evaluating prior performance information in this presentation, you should

remember that past performance is not a guarantee, prediction or projection of

future results, and there can be no assurance that we will achieve similar results in

the future.

1. As a supplement to U.S. generally accepted accounting principles (“GAAP”) financial measures, the Company has provided this non-GAAP financial measure. The Company believes that this non-GAAP financial

measure is useful as it excludes the accrual of the capital gain incentive fee which is not contractually payable under the terms of the Company’s investment advisory agreement with GC Advisors ( the “Investment

Advisory Agreement”). The capital gain incentive fee payable as calculated under the Investment Advisory Agreement for the period ended June 30, 2017 is $0. However, in accordance with GAAP, the Company is

required to include aggregate unrealized appreciation on investments in the calculation and accrue a capital gain incentive fee on a quarterly basis as if such unrealized capital appreciation were realized, even though

such unrealized capital appreciation is not permitted to be considered in calculating the fee actually payable under the Investment Advisory Agreement. Although this non-GAAP financial measure is intended to

enhance investors’ understanding of the Company’s business and performance, this non-GAAP financial measure should not be considered an alternative to GAAP. Refer to slide 4 for a reconciliation to the nearest

GAAP measure, net investment income per share.

Summary of Quarterly Results

3

Third Fiscal Quarter 2017 Highlights

− Net increase in net assets resulting from operations (i.e. net income) for the quarter ended June 30, 2017 was $20.1 million, or $0.35 per

share, as compared to $20.7 million, or $0.38 per share, for the quarter ended March 31, 2017.

− Net investment income for the quarter ended June 30, 2017 was $17.8 million, or $0.31 per share, as compared to $16.5 million, or $0.30

per share, for the quarter ended March 31, 2017. Excluding a $0.6 million accrual for the capital gain incentive fee under GAAP, net

investment income for the quarter ended June 30, 2017 was $18.4 million, or $0.321 per share, as compared to $17.4 million, or $0.321 per

share, when excluding a $0.9 million accrual for the capital gain incentive fee under GAAP for the quarter ended March 31, 2017.

− Net realized and unrealized gain on investments and secured borrowings of $2.3 million, or $0.04 per share, for the quarter ended June

30, 2017 was the result of a $3.2 million net realized loss and $5.5 million of net unrealized appreciation. This compares to a net realized

and unrealized gain on investments and secured borrowings of $4.2 million, or $0.08 per share, for the quarter ended March 31, 2017.

− Net asset value per share rose to $16.01 at June 30, 2017 from $15.88 at March 31, 2017 due to accretion from completing a common

stock offering on June 12, 2017 at a premium to net asset value per share and earnings in excess of our quarterly distribution.

− New middle-market investment commitments totaled $241.9 million for the quarter ended June 30, 2017. Approximately 11% of the new

investment commitments were senior secured loans, 88% were one stop loans, and 1% were investments in equity securities. Overall, total

investments in portfolio companies at fair value increased by approximately 3.9%, or $67.8 million during the quarter ended June 30,

2017.

1. As a supplement to GAAP financial measures, the Company has provided this non-GAAP financial measure. The Company believes that this non-GAAP financial measure is useful as it excludes the accrual of the capital

gain incentive fee which is not contractually payable under the terms of the Investment Advisory Agreement. The capital gain incentive fee payable as calculated under the Investment Advisory Agreement for the period

ended June 30, 2017 is $0. However, in accordance with GAAP, the Company is required to include aggregate unrealized appreciation on investments in the calculation and accrue a capital gain incentive fee on a

quarterly basis as if such unrealized capital appreciation were realized, even though such unrealized capital appreciation is not permitted to be considered in calculating the fee actually payable under the Investment

Advisory Agreement. Although this non-GAAP financial measure is intended to enhance investors’ understanding of the Company’s business and performance, this non-GAAP financial measure should not be

considered an alternative to GAAP.

2. Excludes SLF.

3. Includes a special distribution of $0.25 per share.

Financial Highlights

4

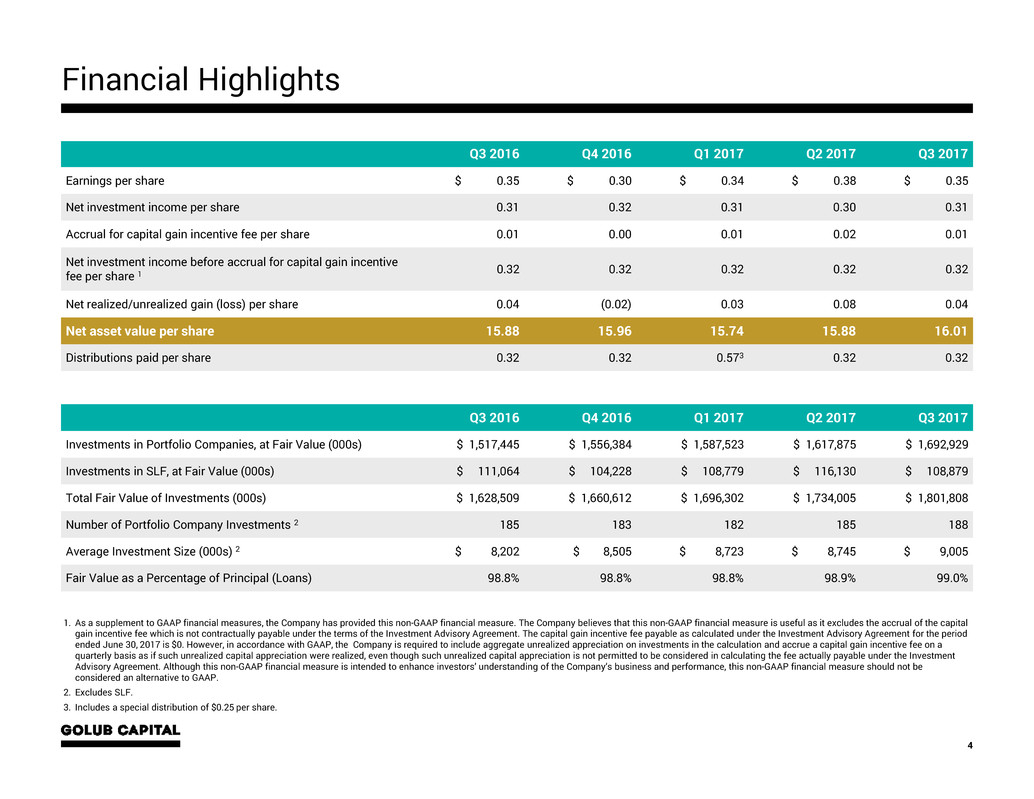

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Earnings per share $ 0.35 $ 0.30 $ 0.34 $ 0.38 $ 0.35

Net investment income per share 0.31 0.32 0.31 0.30 0.31

Accrual for capital gain incentive fee per share 0.01 0.00 0.01 0.02 0.01

Net investment income before accrual for capital gain incentive

fee per share 1 0.32 0.32 0.32 0.32 0.32

Net realized/unrealized gain (loss) per share 0.04 (0.02) 0.03 0.08 0.04

Net asset value per share 15.88 15.96 15.74 15.88 16.01

Distributions paid per share 0.32 0.32 0.573 0.32 0.32

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Investments in Portfolio Companies, at Fair Value (000s) $ 1,517,445 $ 1,556,384 $ 1,587,523 $ 1,617,875 $ 1,692,929

Investments in SLF, at Fair Value (000s) $ 111,064 $ 104,228 $ 108,779 $ 116,130 $ 108,879

Total Fair Value of Investments (000s) $ 1,628,509 $ 1,660,612 $ 1,696,302 $ 1,734,005 $ 1,801,808

Number of Portfolio Company Investments 2 185 183 182 185 188

Average Investment Size (000s) 2 $ 8,202 $ 8,505 $ 8,723 $ 8,745 $ 9,005

Fair Value as a Percentage of Principal (Loans) 98.8% 98.8% 98.8% 98.9% 99.0%

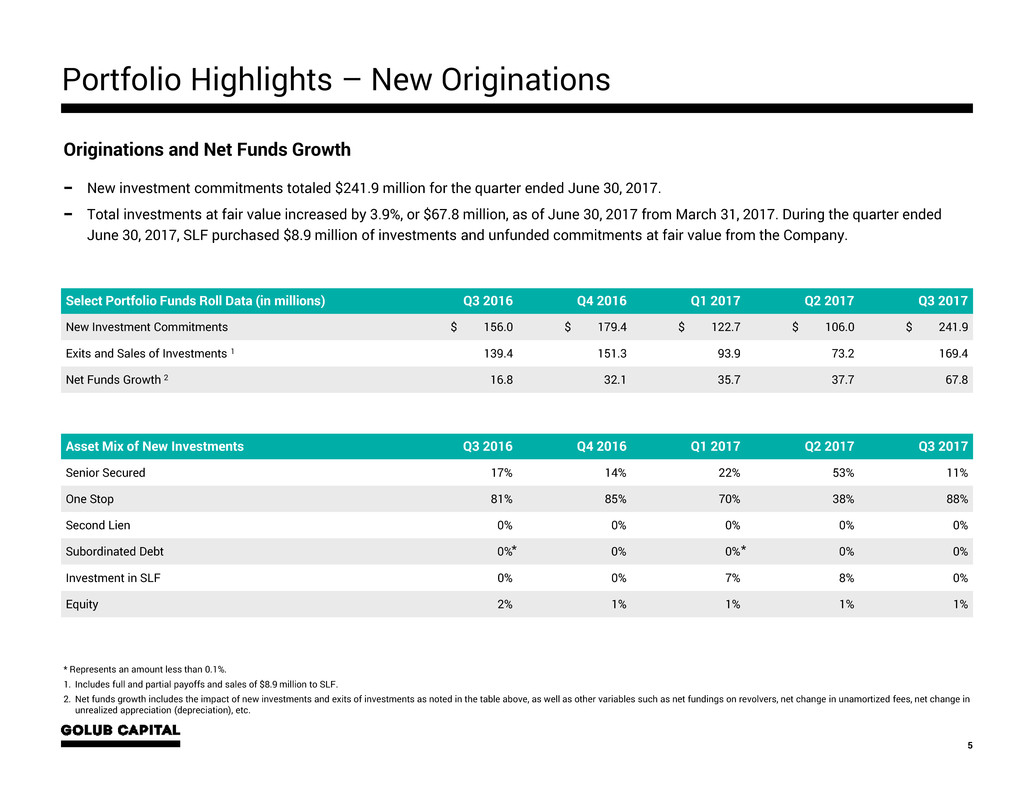

Asset Mix of New Investments Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Senior Secured 17% 14% 22% 53% 11%

One Stop 81% 85% 70% 38% 88%

Second Lien 0% 0% 0% 0% 0%

Subordinated Debt 0% 0% 0% 0% 0%

Investment in SLF 0% 0% 7% 8% 0%

Equity 2% 1% 1% 1% 1%

Select Portfolio Funds Roll Data (in millions) Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

New Investment Commitments $ 156.0 $ 179.4 $ 122.7 $ 106.0 $ 241.9

Exits and Sales of Investments 1 139.4 151.3 93.9 73.2 169.4

Net Funds Growth 2 16.8 32.1 35.7 37.7 67.8

* Represents an amount less than 0.1%.

1. Includes full and partial payoffs and sales of $8.9 million to SLF.

2. Net funds growth includes the impact of new investments and exits of investments as noted in the table above, as well as other variables such as net fundings on revolvers, net change in unamortized fees, net change in

unrealized appreciation (depreciation), etc.

Portfolio Highlights – New Originations

5

Originations and Net Funds Growth

− New investment commitments totaled $241.9 million for the quarter ended June 30, 2017.

− Total investments at fair value increased by 3.9%, or $67.8 million, as of June 30, 2017 from March 31, 2017. During the quarter ended

June 30, 2017, SLF purchased $8.9 million of investments and unfunded commitments at fair value from the Company.

* *

6

Portfolio Highlights – Portfolio Diversity as of June 30, 2017

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

$1,800

$2,000

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

$1,629 $1,661

Historical Investment Portfolio ($mm)

76%

11%

78%

10%

79%

10%

77%

11%

79%

11%

Equity

Inv. in SLF

One Stop

Senior

Secured

Investment Portfolio $1,693mm1 // 188 Investments1 – Average Size $9.0mm

Sub. Debt 2

Second Lien

2%

2%

1% 1%

1%

4%

4%

4%

4%

3%

7%

6%

6% 7%

6%

1. Excludes investment in SLF.

2. The subordinated debt investments held in all periods presented represent an amount less than 1.0%

$1,696

$1,734

$1,802

21%

16%

8%

8%

7%

5%

4%

4% %

4%

3%

6%

14%

Healthcare, Education and Childcare

Diversified/Conglomerate Service

Retail Stores

Beverage, Food and Tobacco

Electronics

Diversified/Conglomerate Manufacturing

Leisure, Amusement, Motion Pictures, Entertainment

Personal, Food and Miscellaneous Services

Personal and Non Durable Consumer Products (Mfg. Only)

Aerospace and Defense

Senior Loan Fund

Other

7

Portfolio Highlights – Portfolio Diversity as of June 30, 2017

Industry Diversity of InvestmentsDiversity by Investment Size

1. The percentage of fixed rate loans and floating rate loans is calculated using total debt investments at fair value and excludes equity investments.

Top 25

Investments

36%Remaining

163 Investments

58%

SLF

6%

Interest Rate on Loans1

Top 10

Investments

18%

Fixed - 0.4%

99.6%

Floating

Portfolio Rotation –

Debt Investments

Q3

2016

Q4

2016

Q1

2017

Q2

2017

Q3

2017

Weighted average interest rate

of new investments 1,2 7.2% 7.6% 6.9% 6.4% 7.3%

Weighted average interest rate

on investments

that were sold or paid-off 2,3

6.8% 6.8% 6.9% 6.5% 7.9%

Weighted average spread over

LIBOR of new floating rate

investments 2

6.2% 6.6% 5.9% 5.4% 6.0%

Weighted average interest rate

of new fixed rate investments 10.6% 10.8% N/A N/A 7.5%

Weighted average fees

on new investments 2.1% 2.1% 1.6% 1.2% 1.6%

Portfolio Highlights – Spread Analysis

8

8.2%

8.5%

8.1% 8.2%

8.7%

7.6% 7.8% 7.7% 7.7%

7.9%

3.3% 3.4% 3.4% 3.5%

3.7%

4.9% 5.1% 4.7% 4.7%

5.0%

0.7% 0.9%

1.0% 1.1%

1.3%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

7.0%

8.0%

9.0%

10.0%

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Investment income yield

Income yield

Weighted average cost of debt

Weighted average net investment spread

3-Month London Interbank Offered Rate ("LIBOR")

5

7

6

4

1. Weighted average interest rate on new investments is based on the contractual interest rate at the time of funding. For variable rate loans that have a LIBOR or Prime rate option, the contractual rate is calculated using

current LIBOR at the time of funding, the spread over LIBOR and the impact of any LIBOR floor. For variable rate loans that only have a Prime rate option, the contractual rate is calculated using current Prime at the time

of funding, the spread over Prime and the impact of any Prime floor. For fixed rate loans, the contract rate is the stated fixed rate.

2. Excludes activity on the subordinated note investment in SLF.

3. Excludes exits on investments on non-accrual status.

4. Investment income yield is calculated as (a) the actual amount earned on earning investments, including the subordinated note investment in SLF, including interest and fee income and amortization of capitalized fees

and discounts, divided by (b) the daily average of total earning investments at fair value. On December 30, 2016, the subordinated notes previously issued by SLF were redeemed in full and terminated.

5. Income yield is calculated as (a) the actual amount earned on earning investments, including the subordinated note investment in SLF, including interest and fee income but excluding amortization of capitalized fees

and discounts, divided by (b) the daily average of total earning investments at fair value. On December 30, 2016, the subordinated notes previously issued by SLF were redeemed in full and terminated.

6. The weighted average cost of debt is calculated as (a) the actual amount incurred on debt obligations divided by (b) the daily average of total debt obligations.

7. The weighted average net investment spread is calculated as (a) the investment income yield less (b) the weighted average cost of debt.

1. Please see Internal Performance Ratings definitions on the following page.

Portfolio Highlights – Credit Quality

9

Credit Quality – Investment Portfolio

− Fundamental credit quality at June 30, 2017 remains strong with non-accrual investments as a percentage of total investments at cost

and fair value of 0.6% and 0.2%, respectively.

− During the quarter ended June 30, 2017, one additional portfolio company investment was classified as non-accrual.

− Over 85.0% of the investments in our portfolio continue to have an Internal Performance Rating1 of 4 or higher as of June 30, 2017.

Non-Accrual – Debt Investments Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017

Non-accrual investments at amortized cost (000s) $ 5,278 $ 5,278 $ 5,278 $ 5,278 $ 10,221

Non-accrual investments / Total investments at amortized cost 0.3% 0.3% 0.3% 0.3% 0.6%

Non-accrual investments at fair value (000s) $ 1,326 $ 1,326 $ 1,101 $ 1,110 $ 3,407

Non-accrual investments / Total investments at fair value 0.1% 0.1% 0.1% 0.1% 0.2%

Rating Definition

5 Borrower is performing above expectations and the trends and risk factors are generally favorable

4 Borrower is generally performing as expected and the risk factors are neutral to favorable

3 Borrower may be out of compliance with debt covenants; however, loan payments are generally not past due

2 Borrower is performing materially below expectations and the loan’s risk has increased materially since origination

1 Borrower is performing substantially below expectations and the loan’s risk has substantially increased since origination

December 31, 2016 March 31, 2017 June 30, 2017

Internal

Performance Rating

Investments at

Fair Value

(000s)

% of

Total

Portfolio

Investments at

Fair Value

(000s)

% of

Total

Portfolio

Investments at

Fair Value

(000s)

% of

Total

Portfolio

5 $ 75,633 4.5% $ 218,405 12.6% $ 212,063 11.8%

4 $ 1,406,965 82.9% $ 1,298,557 74.9% $ 1,377,526 76.5%

3 $ 196,001 11.6% $ 212,322 12.2% $ 209,231 11.6%

2 $ 17,772 1.0% $ 4,781 0.3% $ 240 0.0%

1 $ (69) 0.0% $ (60) 0.0% $ 2,748 0.1%

Total $ 1,696,302 100.0% $ 1,734,005 100.0% $ 1,801,808 100.0%

Portfolio Highlights – Portfolio Ratings

10

Portfolio Risk Ratings

Internal Performance Ratings Definition

* Represents an amount less than 0.1%.

*

1. The negative fair value is the result of an unfunded commitment being valued below par.

1

*

*1

Quarterly Statements of Financial Condition

11

1. On September 13, 2011, we received exemptive relief from the SEC to permit us to exclude the debt of our small business investment company (“SBIC”) subsidiaries from our 200% asset coverage test. As such, asset

coverage and regulatory leverage exclude the Small Business Administration (“SBA”) debentures of our SBICs.

As of

(Dollar amounts in 000s,

except per share data)

June 30, 2016

(unaudited)

September 30, 2016

(audited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

June 30, 2017

(unaudited)

Assets

Investments, at fair value $ 1,628,509 $ 1,660,612 $ 1,696,302 $ 1,734,005 $ 1,801,808

Cash and cash equivalents 3,167 10,947 5,709 4,614 12,827

Restricted cash and cash equivalents 58,727 78,593 66,016 39,330 33,042

Other assets 6,293 6,357 6,059 6,278 7,362

Total Assets $ 1,696,696 $ 1,756,509 $ 1,774,086 $ 1,784,227 $ 1,855,039

Liabilities

Debt $ 862,050 $ 864,700 $ 889,500 $ 863,650 $ 883,400

Unamortized debt issuance costs (6,051) (5,627) (5,257) (4,921) (4,284)

Secured borrowings, at fair value 326 475 462 448 406

Interest payable 5,300 3,229 5,937 3,637 6,274

Management and incentive fee payable 11,335 12,763 11,812 12,328 13,404

Other liabilities 3,755 2,144 2,062 2,204 7,620

Total Liabilities 876,715 877,684 904,516 877,346 906,820

Total Net Assets 819,981 878,825 869,570 906,881 948,219

Total Liabilities and Net Assets $ 1,696,696 $ 1,756,509 $ 1,774,086 $ 1,784,227 $ 1,855,039

Net Asset Value per Share $ 15.88 $ 15.96 $ 15.74 $ 15.88 $ 16.01

GAAP leverage 1.06x 0.99x 1.03x 0.96x 0.94x

Regulatory leverage 1 0.74x 0.67x 0.70x 0.64x 0.63x

Asset coverage 1 234.5% 248.8% 242.6% 255.3% 258.4%

Quarterly Operating Results

12

For the three months ended

(Dollar amounts in 000s,

except share and per share data)

June 30, 2016

(unaudited)

September 30, 2016

(unaudited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

June 30, 2017

(unaudited)

Investment Income

Interest income $ 30,867 $ 32,615 $ 32,697 $ 30,954 $ 33,249

Dividend income 1,179 1,274 898 2,425 1,169

Fee income 60 614 254 178 990

Total Investment Income 32,106 34,503 33,849 33,557 35,408

Expenses

Interest and other debt financing expenses 7,019 7,141 7,606 7,674 8,099

Base management fee 5,567 5,734 5,837 5,848 6,059

Incentive fee 2,311 3,004 2,091 2,110 2,073

Other operating expenses 1,324 1,396 1,352 1,371 1,369

Total Expenses 16,221 17,275 16,886 17,003 17,600

Excise tax - - 10 7 -

Net Investment Income after excise tax 15,885 17,228 16,953 16,547 17,808

Net Gain (Loss) on Investments and Secured Borrowings

Net realized gain (loss) on investments (5,416) 6,514 907 686 (3,209)

Net unrealized appreciation (depreciation) on investments and

secured borrowings 7,820 (7,643) 1,124 3,507 5,512

Net gain (loss) on investments and secured borrowings 2,404 (1,129) 2,031 4,193 2,303

Net Increase in Net Assets Resulting from Operations $ 18,289 $ 16,099 $ 18,984 $ 20,740 $ 20,111

Per Share

Earnings Per Share $ 0.35 $ 0.30 $ 0.34 $ 0.38 $ 0.35

Net Investment Income Per Share $ 0.31 $ 0.32 $ 0.31 $ 0.30 $ 0.31

Distributions Paid $ 0.32 $ 0.32 $ 0.571 $ 0.32 $ 0.32

Weighted average common shares outstanding 51,513,685 53,567,275 55,064,870 55,395,179 57,719,505

Common shares outstanding at end of period 51,623,325 55,059,067 55,237,037 57,103,423 59,235,174

1. Includes a special distribution of $0.25 per share.

Financial Performance Highlights

13

9.0%

7.5%

8.6%

9.6%

8.8%

6%

8%

10%

12%

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

Net Income

$14.66

$14.80

$15.12 $15.21

$15.23

$15.41 $15.44

$15.55 $15.55 $15.61

$15.74 $15.80

$15.89 $15.85 $15.88

$15.96 $15.99

$16.13

$16.26

$14.66

$14.80

$15.12 $15.21

$15.23

$15.41 $15.44

$15.55 $15.55 $15.61

$15.74 $15.80

$15.89 $15.85 $15.88

$15.96

$15.74

$15.88

$16.01

$14.00

$14.25

$14.50

$14.75

$15.00

$15.25

$15.50

$15.75

$16.00

$16.25

$16.50

Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14 Q3'14 Q4'14 Q1'15 Q2'15 Q3'15 Q4'15 Q1'16 Q2'16 Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

Quarterly Distributions Annualized Return on Average Equity1

GBDC Quarterly NAV per Common Share Since FY 2013 Q1

1. The net income annualized return on average equity is calculated as (a) the net increase in assets resulting from operations for the period presented divided by (b) the daily average of total net assets and does not represent a return to any

investor in the Company.

2. As a supplement to GAAP financial measures, the Company has provided this non-GAAP financial measure. The Company believes that this non-GAAP financial measure is useful as it highlights the changes in NAV per common share for

each quarter excluding the impact of a special distribution that was paid on December 29, 2016 and shows the pro forma change to the Company’s NAV after payment of recurring distributions.

$0.32 $0.32 $0.32

$0.32

$0.32

$0.25

$0.00

$0.10

$0.20

$0.30

$0.40

$0.50

$0.60

Q3'16 Q4'16 Q1'17 Q2'17 Q3'17

Regular Distribution Special Distribution

$0.57

8.7%

Net Asset Value per Common Share Net Asset Value per Common Share If No Special Distribution Were Paid2

5 qtr.

wtd. avg.:

Portfolio Highlights – Senior Loan Fund LLC

14

− The annualized quarterly return for the quarter ended June 30, 2017 was 3.4%. The quarterly return was negatively impacted

primarily as a result of a mark-to-market unrealized loss on one middle-market non-accrual loan.

− Total investments at fair value for the quarter ended June 30, 2017 were $322.3 million, a decrease of 8.1%, or $28.4 million, from March

31, 2017. SLF purchased $8.9 million of investments and unfunded commitments from GBDC at fair value which was offset by $35.5

million of payoffs and sales.

− Subject to leverage and borrowing base restrictions, as of June 30, 2017, SLF had approximately $95.1 million of remaining

commitments and $2.1 million of availability on its revolving credit facility.

1. The Company’s annualized total return is calculated by dividing total income (loss) earned on the Company’s investments in SLF by the combined daily average of its investments in (1) the principal of the SLF

subordinated notes, if any, and (2) the net asset value of the SLF LLC equity interests. Annualized total return excludes the impact of management fees and incentive fees that may be charged by GC Advisors based on

the Company’s investments in SLF and the income from such investments.

(Dollar amounts in 000s) As of

Balance Sheet

June 30, 2016

(unaudited)

September 30, 2016

(audited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

June 30, 2017

(unaudited)

Total investments, at fair value $ 350,565 $ 323,510 $ 333,275 $ 350,652 $ 322,261

Cash and other assets 7,178 9,276 11,735 7,307 8,951

Total assets $ 357,743 $ 332,786 $ 345,010 $ 357,959 $ 331,212

Senior credit facility $ 231,550 $ 214,050 $ 220,600 $ 224,750 $ 204,900

Unamortized debt issuance costs (1,336) (949) (563) (184) (110)

Other liabilities 599 567 654 673 1,989

Total liabilities 230,813 213,668 220,691 225,239 206,779

Subordinated debt and members’ equity 126,930 119,118 124,319 132,720 124,433

Total liabilities and members’ equity $ 357,743 $ 332,786 $ 345,010 $ 357,959 $ 331,212

Senior leverage 1.82x 1.80x 1.77x 1.69x 1.65x

(Dollar amounts in 000s) For the three months ended

GBDC Return on Investments in SLF

June 30, 2016

(unaudited)

September 30, 2016

(unaudited)

December 31, 2016

(unaudited)

March 31, 2017

(unaudited)

June 30, 2017

(unaudited)

Total income (loss) $ 3,685 $ 852 $ 1,887 $ 2,987 $ 990

Annualized total return 1 12.6% 3.0% 7.1% 10.8% 3.4%

Liquidity and Investment Capacity

15

Cash and Cash Equivalents

− Unrestricted cash and cash equivalents totaled $12.8 million as of June 30, 2017.

− Restricted cash and cash equivalents totaled $33.0 million as of June 30, 2017. Restricted cash is held in our securitization vehicles,

SBIC subsidiaries and our revolving credit facility subsidiary and is reserved for quarterly interest payments and is also available for new

investments that qualify for acquisition by these entities.

Debt Facilities - Availability

− Revolving Credit Facility – As of June 30, 2017, subject to leverage and borrowing base restrictions, we had approximately $80.6 million

of remaining commitments and $35.9 million of availability on our $225.0 million revolving credit facility with Wells Fargo.

− SBIC Debentures – As of June 30, 2017, through our SBIC licensees, we had $62.0 million of unfunded debenture commitments, of which

$34.0 million was available to be drawn, subject to customary SBA regulatory requirements.

− GC Advisors Revolving Credit Facility – As of June 30, 2017, we had $20.0 million of remaining commitments and availability on our $20.0

million unsecured revolving credit facility with GC Advisors.

Common Stock Issuances

− Stock Offering - On June 6, 2017, we entered into an agreement to sell 1.75 million shares of our common stock pursuant to an

underwritten, public offering at a price to us of $18.71 per share, raising $32.7 million in proceeds net of offering costs but before

expenses. The price was 1.18x our most recently reported NAV per share at the time of the share issuance. On July 5, 2017, we sold an

additional 220,221 shares of our common stock pursuant to the underwriter’s partial exercise of the option to purchase additional shares

of our common stock.

Debt Facilities

16

Tranche Rating (M/S)

Par Amount

($mm) Interest Rate Stated Maturity Reinvestment Period

Class A-1 Notes Aaa/AAA $191.0 3 Month LIBOR + 1.75% April 25, 2026 April 28, 2018

Class A-2 Notes Aaa/AAA $20.0 3 Month LIBOR + 1.95% April 25, 2026 April 28, 2018

Class B Notes Aa2/AA $35.0 3 Month LIBOR + 2.50% April 25, 2026 April 28, 2018

Total Notes Issued 2 $246.0

Tranche Rating (M/S)

Par Amount

($mm) Interest Rate Stated Maturity Reinvestment Period

Class A-Refi Notes Aaa/AAA $205.0 3 Month LIBOR + 1.90% July 20, 2023 July 20, 2018

Total Notes Issued 1 $205.0

Issuer

Amount

Outstanding

($mm)

Maximum

Commitment

($mm) Interest Rate Stated Maturity Reinvestment Period

Wells Fargo Revolving Credit Facility 3 $144.4 $225.0 1 Month LIBOR + 2.25% September 28, 2020 September 27, 2017

SBIC IV $150.0 $150.0 3.5% 4 10-year maturity after drawn N/A

SBIC V $133.0 $150.0 3.5% 4 10-year maturity after drawn N/A

SBIC VI $5.0 $50.0 2.0% 4 10-year maturity after drawn N/A

GC Advisors Revolving Credit Facility $0.0 $20.0 Applicable Federal Rate June 22, 2019 N/A

2010 Debt Securitization

2014 Debt Securitization

1. The Class B-Refi and Subordinated Notes issued in the 2010 Debt Securitization, as amended in October 2016, totaling $10.0 million and $135.0 million, respectively, were retained by us.

2. The Class C Notes and LLC Equity Interests issued in the 2014 Debt Securitization, totaling $37.5 million and $119.1 million, respectively, were retained by us.

3. On July 28, 2017, the revolving credit facility with Wells Fargo was amended to, among other things, (a) extend the expiration of the reinvestment period from July 29, 2017 to September 29, 2017 and (b) extend the

stated maturity date to September 28, 2020.

4. The SBA debentures have interest rates that are fixed at various pooling dates and have an average annualized rate of 3.5%.

Debt Facilities

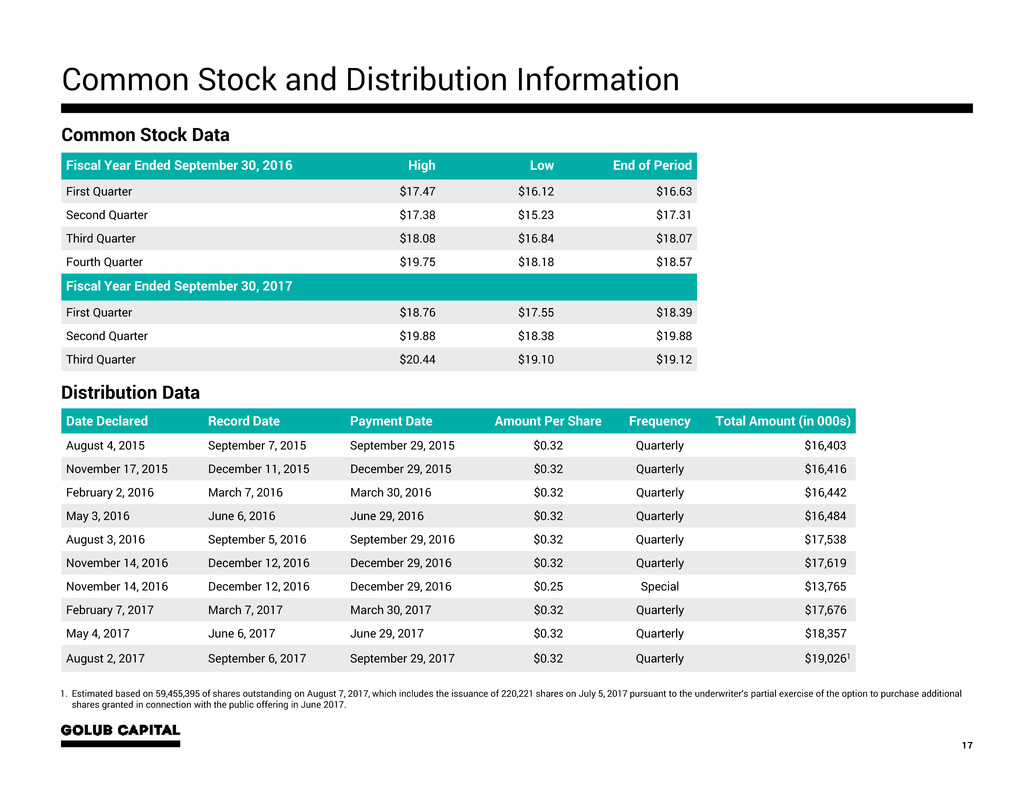

Common Stock and Distribution Information

17

Common Stock Data

Distribution Data

Date Declared Record Date Payment Date Amount Per Share Frequency Total Amount (in 000s)

August 4, 2015 September 7, 2015 September 29, 2015 $0.32 Quarterly $16,403

November 17, 2015 December 11, 2015 December 29, 2015 $0.32 Quarterly $16,416

February 2, 2016 March 7, 2016 March 30, 2016 $0.32 Quarterly $16,442

May 3, 2016 June 6, 2016 June 29, 2016 $0.32 Quarterly $16,484

August 3, 2016 September 5, 2016 September 29, 2016 $0.32 Quarterly $17,538

November 14, 2016 December 12, 2016 December 29, 2016 $0.32 Quarterly $17,619

November 14, 2016 December 12, 2016 December 29, 2016 $0.25 Special $13,765

February 7, 2017 March 7, 2017 March 30, 2017 $0.32 Quarterly $17,676

May 4, 2017 June 6, 2017 June 29, 2017 $0.32 Quarterly $18,3571

August 2, 2017 September 6, 2017 September 29, 2017 $0.32 Quarterly $19,0261

Fiscal Year Ended September 30, 2016 High Low End of Period

First Quarter $17.47 $16.12 $16.63

Second Quarter $17.38 $15.23 $17.31

Third Quarter $18.08 $16.84 $18.07

Fourth Quarter $19.75 $18.18 $18.57

Fiscal Year Ended September 30, 2017

First Quarter $18.76 $17.55 $18.39

Second Quarter $19.88 $18.38 $19.88

Third Quarter $20.44 $19.10 $19.12

1. Estimated based on 59,455,395 of shares outstanding on August 7, 2017, which includes the issuance of 220,221 shares on July 5, 2017 pursuant to the underwriter’s partial exercise of the option to purchase additional

shares granted in connection with the public offering in June 2017.