Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - Bankrate, Inc. | rate-20170807xex99_1.htm |

| 8-K - 8-K - Bankrate, Inc. | rate-20170807x8k.htm |

August 7, 2017 Q2 2017 Earnings Presentation  http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png2 Q2 2017 Earnings Presentation This document is not intended as a full business or financial review and should be viewed in the context of all of the information made available by us in our filings with the Securities and Exchange Commission (“SEC”). To the extent there is any discrepancy between this document and the content of our SEC filings, the SEC filings are the authoritative sources of information. Cautionary Statement Regarding Forward-Looking Information Certain matters included in this document may be “forward-looking statements” which involve risks and uncertainties. Those statements include statements regarding the intent, belief or current expectations of the Company and members of our management team. Such forward-looking statements include, without limitation, statements made with respect to future revenue, revenue growth, market acceptance of our products, our strategy and profitability. Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known or unknown factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors currently known to management that could cause actual results to differ materially from those in forward-looking statements include the following: the failure to obtain Bankrate stockholder approval of the proposed merger with Red Ventures or the failure of any of the other conditions to the completion of the merger to be satisfied; the possibility that the proposed merger with Red Ventures may not be completed within the expected time frame or at all; the effect of the announcement and pendency of the merger with Red Ventures on our ability to retain and hire key personnel and maintain relationships with our customers, providers, advertisers, partners and others with whom we do business, or on our operating results and businesses generally; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed merger with Red Ventures; the willingness or interest of credit card issuers, banks, lenders, brokers, senior care providers and other advertisers in the business verticals in which we operate to advertise on our websites or mobile applications, or purchase our leads, clicks, calls and referrals; changes in application approval rates by our credit card issuer customers; increased competition and its effect on our website traffic, click-through rates, advertising rates, margins, and market share; our dependence on internet search engines to attract a significant portion of the visitors to our websites and our ability to diversify the sources from which we obtain visitor traffic to our websites and mobile applications, including without limitation through use of social media channels; changes in the way that search engines display paid and organic search results and the impact of those changes on the number of consumers that visit our online network; the cost of driving consumers to our online network, including without limitation our ability to generate traffic profitably through online and offline marketing channels and branding efforts; our dependence on traffic from our partners to produce a significant portion of the Company’s revenue and our ability to establish and maintain distribution arrangements; the willingness of consumers to accept the Internet and our online network as a medium for obtaining information on financial products or senior care; shift of visitors from desktop to mobile and mobile app environments; the rate of conversion of consumers’ visits to our websites or mobile applications into senior care referrals and the rate at which those referrals result in move-ins with our senior care customers; the number of consumers seeking information about the financial and senior care products we have on our websites or mobile applications; our ability to successfully execute on our strategies, and the effectiveness of our strategies and investments in our business, including without limitation whether they result in increased revenue or profitability; risks relating to the defense or litigation of lawsuits; the timing and outcome of, including potential expense associated with, and the potential impact on our business and stock price of any announcements regarding, the United States Department of Justice (“DOJ”) investigation; the costs of indemnification obligations to current and former directors, officers and employees; any delay or failure to collect the deferred portion of the purchase price due to us in connection with the sale of the Company’s Insurance business in December 2015; our ability to anticipate and manage cybersecurity risk and data security risk and to mitigate or resolve issues that may arise; the effects of any security breach, data breach or cyberattack on our systems, websites or mobile applications, or on our reputation, and the impact of any notification costs or other liability arising from any security breach, data breach or cyberattack on our business; technological changes and our ability to adapt to new or evolving technologies that affect our business environment or operations; the material weakness in our internal controls over financial reporting and our ability to rectify this issue completely and promptly; our ability to otherwise maintain effective disclosure controls and procedures and internal control over financial reporting; our ability to manage traffic on our websites or mobile applications, and service interruptions; our indebtedness and the effect such indebtedness may have on our business; our need and our ability to obtain additional debt or equity financing or to refinance our existing debt; our ability to integrate the operations and realize the expected benefits of businesses that we have acquired and businesses that we may acquire in the future; the effect of unexpected liabilities we assume (whether intentional or not) from our acquisitions; our ability to attract and retain executive officers and personnel; any failure or refusal by our insurance providers to provide coverage under our insurance policies; our ability to protect our intellectual property; the effects of potential liability for content on our websites or mobile applications; the effect of our operations in the United Kingdom and possible expansion to other international markets in which we may have limited experience, and our ability to successfully execute on our business strategies in international markets; risks associated with the wind down of our operations in China; the strength of the U.S. economy in general and the financial services and senior care industries in particular; changes in monetary and fiscal policies of the U.S. government and interest rate volatility; review of our business and operations by regulatory or other governmental authorities; changes in laws and regulations or interpretations of laws and regulations, other changes in the legal and regulatory environment, and the impact of such changes on the operation of our business; any impairment to our goodwill and/or intangible assets; changes in accounting principles, policies, practices or guidelines; and our ability to manage the risks involved in the foregoing. For more information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the Securities and Exchange Commission, including without limitation the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, as updated in our Quarterly Reports on Form 10-Q. These documents are or will be available on the SEC’s website at www.sec.gov. Any factor described above or in our SEC reports could, by itself or together with one or more other factors, adversely affect our financial results and condition. We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. Non-GAAP Measures To supplement Bankrate’s financial statements presented in accordance with generally accepted accounting principles (“GAAP”), Bankrate uses non-GAAP measures of certain components of financial performance, including EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted EPS, which are adjusted from results based on GAAP to exclude certain expenses, gains and losses. These non-GAAP measures are provided to enhance investors’ overall understanding of Bankrate’s current financial performance and its prospects for the future. Specifically, Bankrate believes the non-GAAP results provide useful information to both management and investors by excluding certain expenses, gains and losses that may not be indicative of its core operating results. In addition, because Bankrate has historically reported certain non-GAAP results to investors, Bankrate believes the inclusion of non-GAAP measures provides consistency in its financial reporting. These measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. The non-GAAP measures included in this document have been reconciled to the nearest GAAP measure in the financial tables found in the “Supplemental Information” section of this document. Management defines “Adjusted EBITDA” as income from continuing operations before depreciation and amortization; interest; income taxes; changes in fair value of contingent acquisition consideration; stock-based compensation and other items such as loss on extinguishment of debt, legal settlements, acquisition, disposition and related expenses; restructuring charges; any impairment charges; NextAdvisor contingent deferred compensation for the acquisition; costs related to the Restatement, the Internal Review, the SEC and DOJ investigations and related litigation and indemnification obligations; purchase accounting adjustments; and our operations in China as we are winding down and ceasing those operations. The Company’s presentation of Adjusted EBITDA, a non-GAAP measure, may not be comparable to similarly titled measures used by other companies.

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png2 Q2 2017 Earnings Presentation This document is not intended as a full business or financial review and should be viewed in the context of all of the information made available by us in our filings with the Securities and Exchange Commission (“SEC”). To the extent there is any discrepancy between this document and the content of our SEC filings, the SEC filings are the authoritative sources of information. Cautionary Statement Regarding Forward-Looking Information Certain matters included in this document may be “forward-looking statements” which involve risks and uncertainties. Those statements include statements regarding the intent, belief or current expectations of the Company and members of our management team. Such forward-looking statements include, without limitation, statements made with respect to future revenue, revenue growth, market acceptance of our products, our strategy and profitability. Investors and prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those contemplated by such forward-looking statements. We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known or unknown factors, and it is impossible for us to anticipate all factors that could affect our actual results. Important factors currently known to management that could cause actual results to differ materially from those in forward-looking statements include the following: the failure to obtain Bankrate stockholder approval of the proposed merger with Red Ventures or the failure of any of the other conditions to the completion of the merger to be satisfied; the possibility that the proposed merger with Red Ventures may not be completed within the expected time frame or at all; the effect of the announcement and pendency of the merger with Red Ventures on our ability to retain and hire key personnel and maintain relationships with our customers, providers, advertisers, partners and others with whom we do business, or on our operating results and businesses generally; risks associated with the disruption of management’s attention from ongoing business operations due to the proposed merger with Red Ventures; the willingness or interest of credit card issuers, banks, lenders, brokers, senior care providers and other advertisers in the business verticals in which we operate to advertise on our websites or mobile applications, or purchase our leads, clicks, calls and referrals; changes in application approval rates by our credit card issuer customers; increased competition and its effect on our website traffic, click-through rates, advertising rates, margins, and market share; our dependence on internet search engines to attract a significant portion of the visitors to our websites and our ability to diversify the sources from which we obtain visitor traffic to our websites and mobile applications, including without limitation through use of social media channels; changes in the way that search engines display paid and organic search results and the impact of those changes on the number of consumers that visit our online network; the cost of driving consumers to our online network, including without limitation our ability to generate traffic profitably through online and offline marketing channels and branding efforts; our dependence on traffic from our partners to produce a significant portion of the Company’s revenue and our ability to establish and maintain distribution arrangements; the willingness of consumers to accept the Internet and our online network as a medium for obtaining information on financial products or senior care; shift of visitors from desktop to mobile and mobile app environments; the rate of conversion of consumers’ visits to our websites or mobile applications into senior care referrals and the rate at which those referrals result in move-ins with our senior care customers; the number of consumers seeking information about the financial and senior care products we have on our websites or mobile applications; our ability to successfully execute on our strategies, and the effectiveness of our strategies and investments in our business, including without limitation whether they result in increased revenue or profitability; risks relating to the defense or litigation of lawsuits; the timing and outcome of, including potential expense associated with, and the potential impact on our business and stock price of any announcements regarding, the United States Department of Justice (“DOJ”) investigation; the costs of indemnification obligations to current and former directors, officers and employees; any delay or failure to collect the deferred portion of the purchase price due to us in connection with the sale of the Company’s Insurance business in December 2015; our ability to anticipate and manage cybersecurity risk and data security risk and to mitigate or resolve issues that may arise; the effects of any security breach, data breach or cyberattack on our systems, websites or mobile applications, or on our reputation, and the impact of any notification costs or other liability arising from any security breach, data breach or cyberattack on our business; technological changes and our ability to adapt to new or evolving technologies that affect our business environment or operations; the material weakness in our internal controls over financial reporting and our ability to rectify this issue completely and promptly; our ability to otherwise maintain effective disclosure controls and procedures and internal control over financial reporting; our ability to manage traffic on our websites or mobile applications, and service interruptions; our indebtedness and the effect such indebtedness may have on our business; our need and our ability to obtain additional debt or equity financing or to refinance our existing debt; our ability to integrate the operations and realize the expected benefits of businesses that we have acquired and businesses that we may acquire in the future; the effect of unexpected liabilities we assume (whether intentional or not) from our acquisitions; our ability to attract and retain executive officers and personnel; any failure or refusal by our insurance providers to provide coverage under our insurance policies; our ability to protect our intellectual property; the effects of potential liability for content on our websites or mobile applications; the effect of our operations in the United Kingdom and possible expansion to other international markets in which we may have limited experience, and our ability to successfully execute on our business strategies in international markets; risks associated with the wind down of our operations in China; the strength of the U.S. economy in general and the financial services and senior care industries in particular; changes in monetary and fiscal policies of the U.S. government and interest rate volatility; review of our business and operations by regulatory or other governmental authorities; changes in laws and regulations or interpretations of laws and regulations, other changes in the legal and regulatory environment, and the impact of such changes on the operation of our business; any impairment to our goodwill and/or intangible assets; changes in accounting principles, policies, practices or guidelines; and our ability to manage the risks involved in the foregoing. For more information about factors that could cause actual results to differ materially from our expectations, refer to our reports filed with the Securities and Exchange Commission, including without limitation the discussion under “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, as updated in our Quarterly Reports on Form 10-Q. These documents are or will be available on the SEC’s website at www.sec.gov. Any factor described above or in our SEC reports could, by itself or together with one or more other factors, adversely affect our financial results and condition. We caution you that the foregoing list of important factors may not contain all of the material factors that are important to you. We undertake no obligation to publicly update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. Non-GAAP Measures To supplement Bankrate’s financial statements presented in accordance with generally accepted accounting principles (“GAAP”), Bankrate uses non-GAAP measures of certain components of financial performance, including EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted EPS, which are adjusted from results based on GAAP to exclude certain expenses, gains and losses. These non-GAAP measures are provided to enhance investors’ overall understanding of Bankrate’s current financial performance and its prospects for the future. Specifically, Bankrate believes the non-GAAP results provide useful information to both management and investors by excluding certain expenses, gains and losses that may not be indicative of its core operating results. In addition, because Bankrate has historically reported certain non-GAAP results to investors, Bankrate believes the inclusion of non-GAAP measures provides consistency in its financial reporting. These measures should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. The non-GAAP measures included in this document have been reconciled to the nearest GAAP measure in the financial tables found in the “Supplemental Information” section of this document. Management defines “Adjusted EBITDA” as income from continuing operations before depreciation and amortization; interest; income taxes; changes in fair value of contingent acquisition consideration; stock-based compensation and other items such as loss on extinguishment of debt, legal settlements, acquisition, disposition and related expenses; restructuring charges; any impairment charges; NextAdvisor contingent deferred compensation for the acquisition; costs related to the Restatement, the Internal Review, the SEC and DOJ investigations and related litigation and indemnification obligations; purchase accounting adjustments; and our operations in China as we are winding down and ceasing those operations. The Company’s presentation of Adjusted EBITDA, a non-GAAP measure, may not be comparable to similarly titled measures used by other companies.

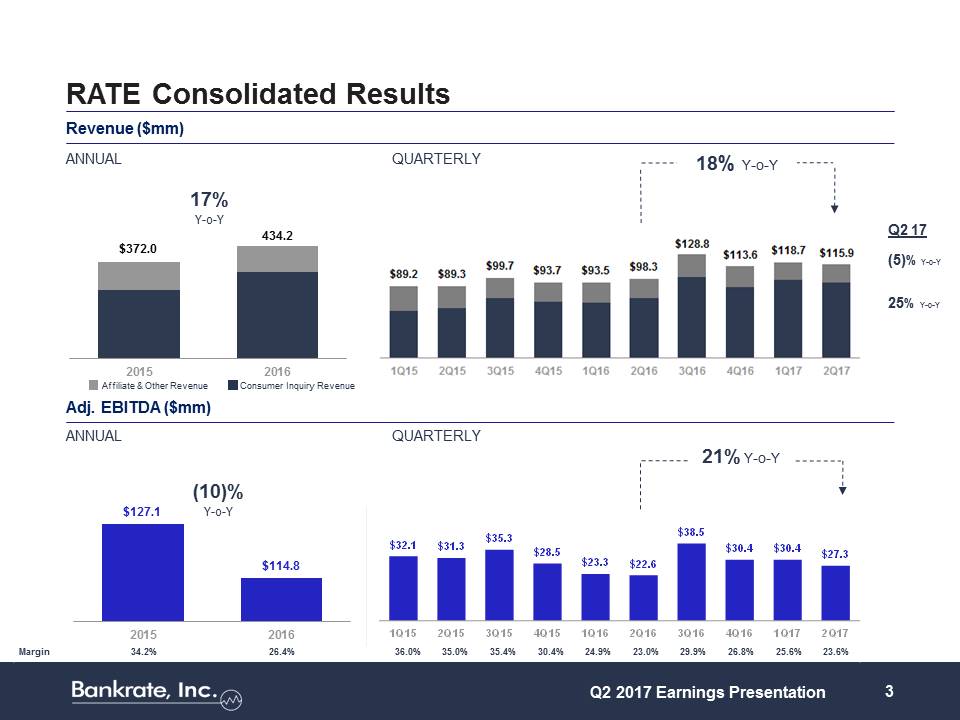

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$32.1$31.3$35.3$28.5$23.3$22.6$38.5$30.4$30.4$27.31Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$372.0 434.2 20152016$127.1 $114.8 201520163 RATE Consolidated Results Q2 2017 Earnings Presentation Revenue ($mm) ANNUAL QUARTERLY 17% Y-o-Y Adj. EBITDA ($mm) (10)% Y-o-Y 18% Y-o-Y 21% Y-o-Y Consumer Inquiry Revenue Affiliate & Other Revenue Q2 17 (5)% Y-o-Y 25% Y-o-Y ANNUAL QUARTERLY Margin 34.2% 26.4% 36.0% 35.0% 35.4% 30.4% 24.9% 23.0% 29.9% 26.8% 25.6% 23.6%

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$32.1$31.3$35.3$28.5$23.3$22.6$38.5$30.4$30.4$27.31Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$372.0 434.2 20152016$127.1 $114.8 201520163 RATE Consolidated Results Q2 2017 Earnings Presentation Revenue ($mm) ANNUAL QUARTERLY 17% Y-o-Y Adj. EBITDA ($mm) (10)% Y-o-Y 18% Y-o-Y 21% Y-o-Y Consumer Inquiry Revenue Affiliate & Other Revenue Q2 17 (5)% Y-o-Y 25% Y-o-Y ANNUAL QUARTERLY Margin 34.2% 26.4% 36.0% 35.0% 35.4% 30.4% 24.9% 23.0% 29.9% 26.8% 25.6% 23.6%

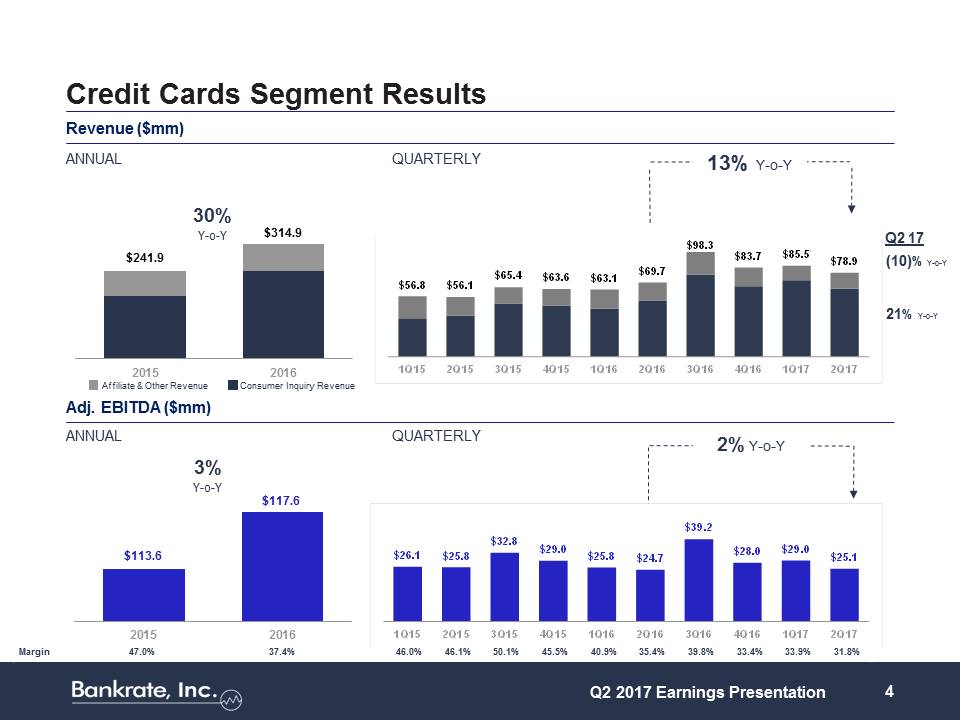

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$113.6 $117.6 20152016$241.9 $314.9 201520164 Credit Cards Segment Results Revenue ($mm) Adj. EBITDA ($mm) 30% Y-o-Y 3% Y-o-Y 13% Y-o-Y 2% Y-o-Y Q2 17 (10)% Y-o-Y 21% Y-o-Y ANNUAL QUARTERLY ANNUAL QUARTERLY Consumer Inquiry Revenue Affiliate & Other Revenue Margin 47.0% 37.4% 46.0% 46.1% 50.1% 45.5% 40.9% 35.4% 39.8% 33.4% 33.9% 31.8% $56.8$56.1$65.4$63.6$63.1$69.7$98.3$83.7$85.5$78.91Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$26.1$25.8$32.8$29.0$25.8$24.7$39.2$28.0$29.0$25.11Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17Q2 2017 Earnings Presentation

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$113.6 $117.6 20152016$241.9 $314.9 201520164 Credit Cards Segment Results Revenue ($mm) Adj. EBITDA ($mm) 30% Y-o-Y 3% Y-o-Y 13% Y-o-Y 2% Y-o-Y Q2 17 (10)% Y-o-Y 21% Y-o-Y ANNUAL QUARTERLY ANNUAL QUARTERLY Consumer Inquiry Revenue Affiliate & Other Revenue Margin 47.0% 37.4% 46.0% 46.1% 50.1% 45.5% 40.9% 35.4% 39.8% 33.4% 33.9% 31.8% $56.8$56.1$65.4$63.6$63.1$69.7$98.3$83.7$85.5$78.91Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$26.1$25.8$32.8$29.0$25.8$24.7$39.2$28.0$29.0$25.11Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17Q2 2017 Earnings Presentation

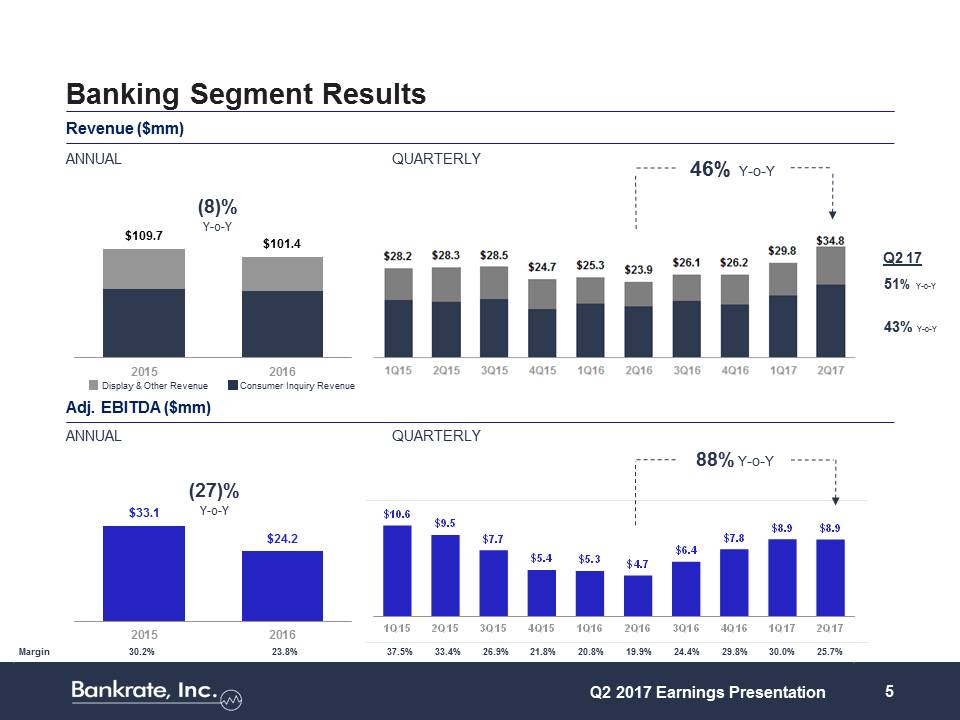

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$10.6$9.5$7.7$5.4$5.3$4.7$6.4$7.8$8.9$8.91Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$33.1 $24.2 20152016$109.7 $101.4 201520165 Banking Segment Results Revenue ($mm) Adj. EBITDA ($mm) (8)% Y-o-Y (27)% Y-o-Y 88% Y-o-Y 46% Y-o-Y ANNUAL QUARTERLY ANNUAL QUARTERLY Consumer Inquiry Revenue Display & Other Revenue Margin 30.2% 23.8% 37.5% 33.4% 26.9% 21.8% 20.8% 19.9% 24.4% 29.8% 30.0% 25.7% Q2 17 51% Y-o-Y 43% Y-o-Y Q2 2017 Earnings Presentation

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$10.6$9.5$7.7$5.4$5.3$4.7$6.4$7.8$8.9$8.91Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$33.1 $24.2 20152016$109.7 $101.4 201520165 Banking Segment Results Revenue ($mm) Adj. EBITDA ($mm) (8)% Y-o-Y (27)% Y-o-Y 88% Y-o-Y 46% Y-o-Y ANNUAL QUARTERLY ANNUAL QUARTERLY Consumer Inquiry Revenue Display & Other Revenue Margin 30.2% 23.8% 37.5% 33.4% 26.9% 21.8% 20.8% 19.9% 24.4% 29.8% 30.0% 25.7% Q2 17 51% Y-o-Y 43% Y-o-Y Q2 2017 Earnings Presentation

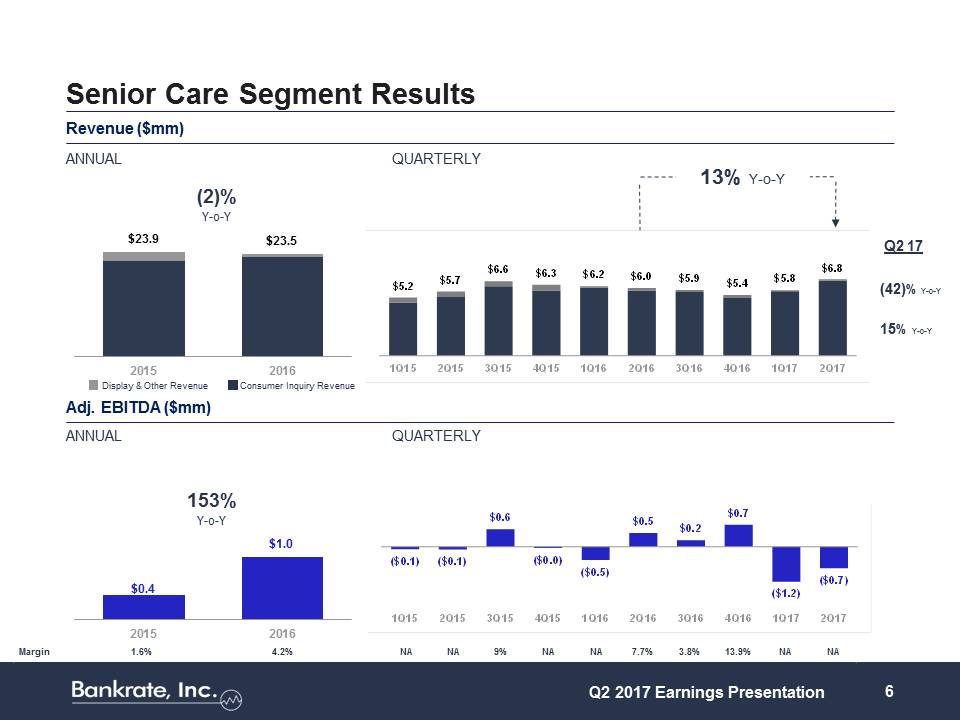

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$23.9 $23.5 20152016$0.4 $1.0 201520166 Senior Care Segment Results Revenue ($mm) Adj. EBITDA ($mm) Q2 17 (2)% Y-o-Y (42)% Y-o-Y 15% Y-o-Y 13% Y-o-Y ANNUAL QUARTERLY ANNUAL QUARTERLY Consumer Inquiry Revenue Display & Other Revenue 153% Y-o-Y Margin 1.6% 4.2% NA NA 9% NA NA 7.7% 3.8% 13.9% NA NA ($0.1)($0.1)$0.6($0.0)($0.5)$0.5$0.2$0.7($1.2)($0.7)1Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$5.2$5.7$6.6$6.3$6.2$6.0$5.9$5.4$5.8$6.81Q1

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png$23.9 $23.5 20152016$0.4 $1.0 201520166 Senior Care Segment Results Revenue ($mm) Adj. EBITDA ($mm) Q2 17 (2)% Y-o-Y (42)% Y-o-Y 15% Y-o-Y 13% Y-o-Y ANNUAL QUARTERLY ANNUAL QUARTERLY Consumer Inquiry Revenue Display & Other Revenue 153% Y-o-Y Margin 1.6% 4.2% NA NA 9% NA NA 7.7% 3.8% 13.9% NA NA ($0.1)($0.1)$0.6($0.0)($0.5)$0.5$0.2$0.7($1.2)($0.7)1Q152Q153Q154Q151Q162Q163Q164Q161Q172Q17$5.2$5.7$6.6$6.3$6.2$6.0$5.9$5.4$5.8$6.81Q1

52Q153Q154Q151Q162Q163Q164Q161Q172Q17Q2 2017 Earnings Presentation http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.pngSupplemental Information 7

52Q153Q154Q151Q162Q163Q164Q161Q172Q17Q2 2017 Earnings Presentation http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.pngSupplemental Information 7

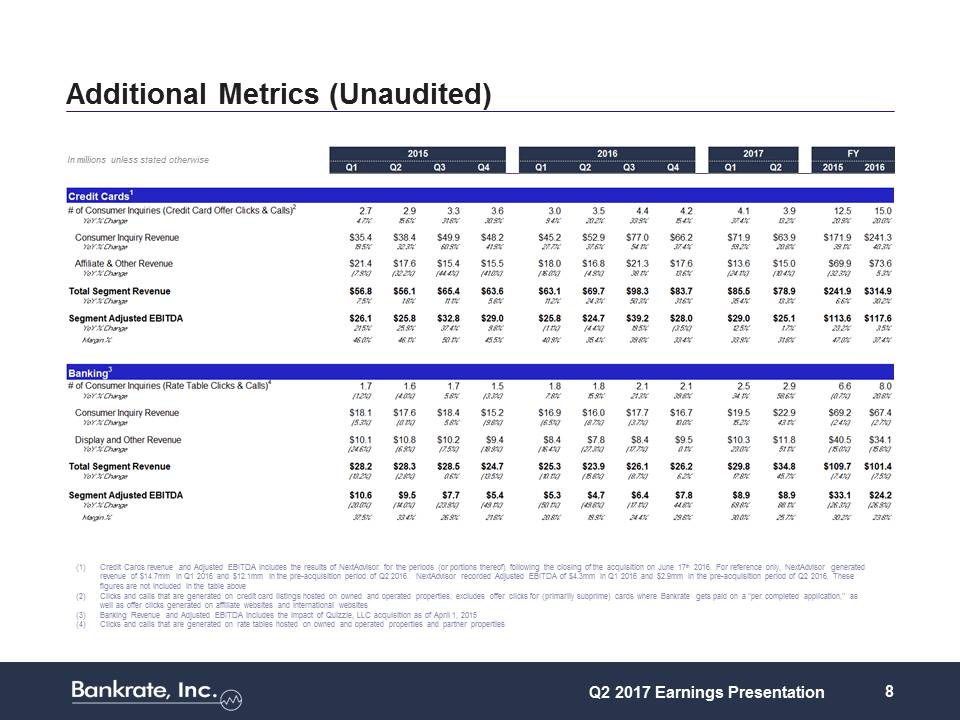

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png8 Additional Metrics (Unaudited) (1)Credit Cards revenue and Adjusted EBITDA includes the results of NextAdvisor for the periods (or portions thereof) following the closing of the acquisition on June 17th 2016. For reference only, NextAdvisor generated revenue of $14.7mm in Q1 2016 and $12.1mm in the pre-acquisition period of Q2 2016. NextAdvisor recorded Adjusted EBITDA of $4.3mm in Q1 2016 and $2.9mm in the pre-acquisition period of Q2 2016. These figures are not included in the table above (2)Clicks and calls that are generated on credit card listings hosted on owned and operated properties; excludes offer clicks for (primarily subprime) cards where Bankrate gets paid on a "per completed application," as well as offer clicks generated on affiliate websites and international websites (3)Banking Revenue and Adjusted EBITDA includes the impact of Quizzle, LLC acquisition as of April 1, 2015 (4)Clicks and calls that are generated on rate tables hosted on owned and operated properties and partner properties In millions unless stated otherwise Q2 2017 Earnings Presentation

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png8 Additional Metrics (Unaudited) (1)Credit Cards revenue and Adjusted EBITDA includes the results of NextAdvisor for the periods (or portions thereof) following the closing of the acquisition on June 17th 2016. For reference only, NextAdvisor generated revenue of $14.7mm in Q1 2016 and $12.1mm in the pre-acquisition period of Q2 2016. NextAdvisor recorded Adjusted EBITDA of $4.3mm in Q1 2016 and $2.9mm in the pre-acquisition period of Q2 2016. These figures are not included in the table above (2)Clicks and calls that are generated on credit card listings hosted on owned and operated properties; excludes offer clicks for (primarily subprime) cards where Bankrate gets paid on a "per completed application," as well as offer clicks generated on affiliate websites and international websites (3)Banking Revenue and Adjusted EBITDA includes the impact of Quizzle, LLC acquisition as of April 1, 2015 (4)Clicks and calls that are generated on rate tables hosted on owned and operated properties and partner properties In millions unless stated otherwise Q2 2017 Earnings Presentation

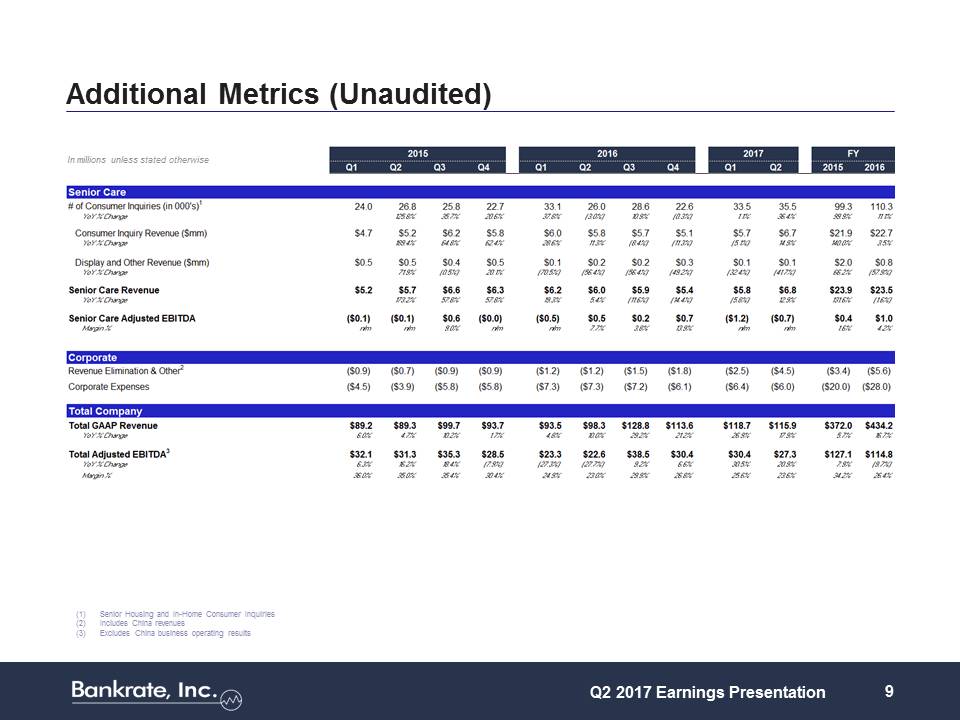

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png9 Additional Metrics (Unaudited) (1)Senior Housing and In-Home Consumer Inquiries (2)Includes China revenues (3)Excludes China business operating results In millions unless stated otherwise Q2 2017 Earnings Presentation

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png9 Additional Metrics (Unaudited) (1)Senior Housing and In-Home Consumer Inquiries (2)Includes China revenues (3)Excludes China business operating results In millions unless stated otherwise Q2 2017 Earnings Presentation

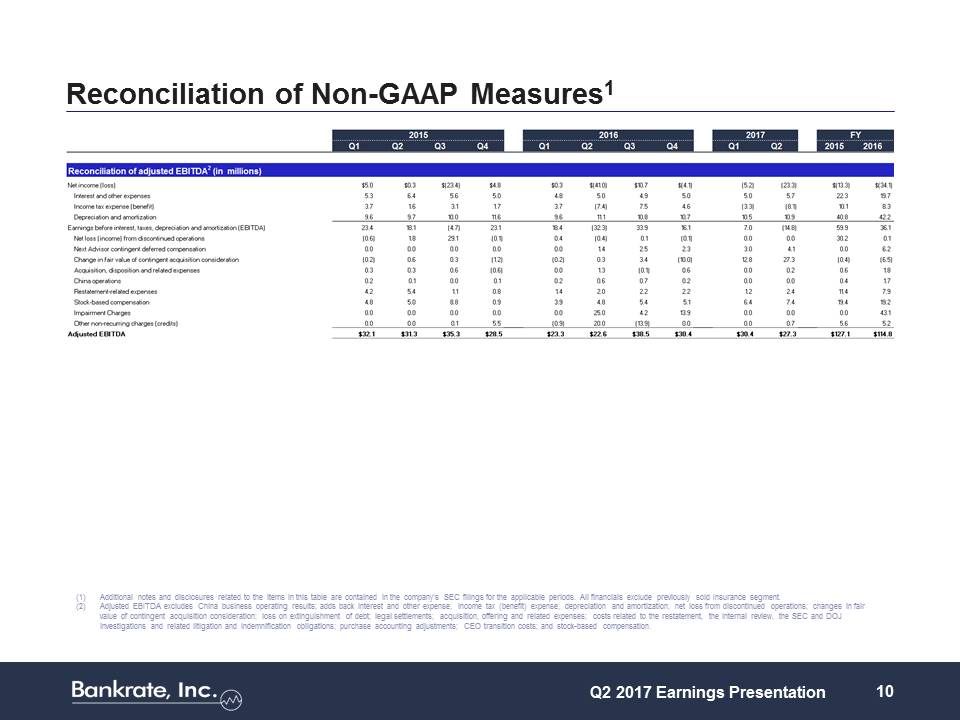

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png10 Reconciliation of Non-GAAP Measures1 (1)Additional notes and disclosures related to the items in this table are contained in the company’s SEC filings for the applicable periods. All financials exclude previously sold Insurance segment. (2)Adjusted EBITDA excludes China business operating results; adds back interest and other expense; income tax (benefit) expense; depreciation and amortization; net loss from discontinued operations; changes in fair value of contingent acquisition consideration; loss on extinguishment of debt; legal settlements; acquisition, offering and related expenses; costs related to the restatement, the internal review, the SEC and DOJ investigations and related litigation and indemnification obligations; purchase accounting adjustments; CEO transition costs; and stock-based compensation. Q2 2017 Earnings Presentation

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png10 Reconciliation of Non-GAAP Measures1 (1)Additional notes and disclosures related to the items in this table are contained in the company’s SEC filings for the applicable periods. All financials exclude previously sold Insurance segment. (2)Adjusted EBITDA excludes China business operating results; adds back interest and other expense; income tax (benefit) expense; depreciation and amortization; net loss from discontinued operations; changes in fair value of contingent acquisition consideration; loss on extinguishment of debt; legal settlements; acquisition, offering and related expenses; costs related to the restatement, the internal review, the SEC and DOJ investigations and related litigation and indemnification obligations; purchase accounting adjustments; CEO transition costs; and stock-based compensation. Q2 2017 Earnings Presentation

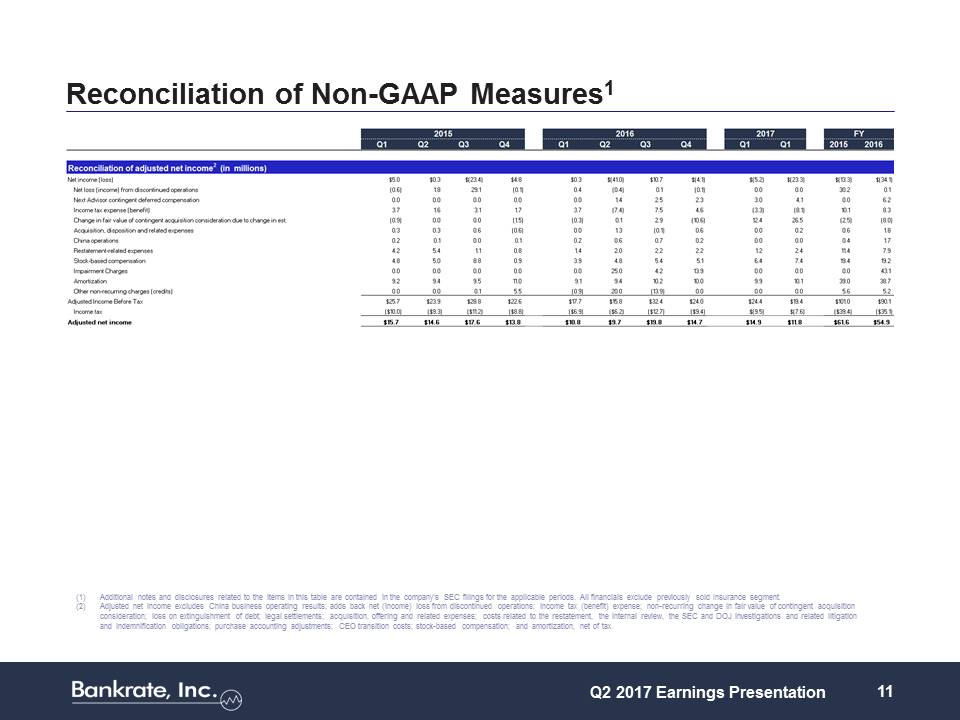

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png11 Reconciliation of Non-GAAP Measures1 (1)Additional notes and disclosures related to the items in this table are contained in the company’s SEC filings for the applicable periods. All financials exclude previously sold Insurance segment. (2)Adjusted net income excludes China business operating results; adds back net (income) loss from discontinued operations; income tax (benefit) expense; non-recurring change in fair value of contingent acquisition consideration; loss on extinguishment of debt; legal settlements; acquisition, offering and related expenses; costs related to the restatement, the internal review, the SEC and DOJ investigations and related litigation and indemnification obligations; purchase accounting adjustments; CEO transition costs; stock-based compensation; and amortization, net of tax. Q2 2017 Earnings Presentation

http://www.bankrate.com/coinfo/branding/logos/BankrateInc_Logo_White.png11 Reconciliation of Non-GAAP Measures1 (1)Additional notes and disclosures related to the items in this table are contained in the company’s SEC filings for the applicable periods. All financials exclude previously sold Insurance segment. (2)Adjusted net income excludes China business operating results; adds back net (income) loss from discontinued operations; income tax (benefit) expense; non-recurring change in fair value of contingent acquisition consideration; loss on extinguishment of debt; legal settlements; acquisition, offering and related expenses; costs related to the restatement, the internal review, the SEC and DOJ investigations and related litigation and indemnification obligations; purchase accounting adjustments; CEO transition costs; stock-based compensation; and amortization, net of tax. Q2 2017 Earnings Presentation