Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Lincolnway Energy, LLC | form8k.htm |

The Energy Forum Lincolnway Energy NEVADA, IOWA Exhibit 99.1 Volume XIlI, Issue II August 2017 INSIDE THIS EDITION PURESTREAM™ DRYER PROJECT PureStream™ Dryer Project 1-2 By Eric Hakmiller, President and CEO Forward Looking Statements 1 Financial Review 2-3 LWE - Going to the Hogs 3 New Employee 4 UNIT TRADING January 2017: 9 Units @ $650/Unit February 2017: No Sales March 2017: 16 Units @ $700/Unit 75 Units @ $725/Unit April 2017: 25 Units @ $700/Unit 25 Units @ $750/Unit May 2017: 25 Units @ $675/Unit June 2017: No Sales I have always enjoyed making alcohol. Theprocess is elegant, the people in the industryare honest folks and telling people I meet that“alcohol has been good to me” is guaranteedto get a double take out of most casualstrangers. The truth of the mater is we domake alcohol but the money in this businessis made on the margin and for us that is ofenthe value of our co-products be it DDGS orcorn oil. Co-products have been a tough way to makea living as of late as the Chinese and othershave pulled out of the DDGS markets with adisastrous impact on prices. DDGS values havebeen awful for most of the year, running at 75 - 85% that of corn, a level we have not seensince the early days of the industry. While theindustry has suffered, Lincolnway has carriedmore than our share of the pain as we havesupplied upwards of 40% of our material tothe Chinese market in recent years. As I have mentoned at various annualmeetngs, we have been on a technologypath over the last several years we callPureStream™. Fortunately, this technologywill supply some relief to this problem. On ahigh value co-product like corn oil, it is easy to create more value in that the more you pullout of the corn the more money you make.Our extracton rates today are some of thehighest in the industry and prices for oil arestrong. On a lower value commodity like DDGS, it ismuch more difficult. To build value here, theprocess has to be redesigned to produce aproduct that fits the needs of a higher valuedemand. A producer needs to be able todifferentate itself from the market. For us theanswer to that is our new line of PureStream™Proteins. PureStream™ Protein is a higher proteinanimal feed with an amino acid profile wehave designed for the swine and poultryindustries. Our PureStream™ Proteins willbe a 42% protein feed with an even mix ofessental and non-essental amino acids.As monogastric animals, pigs and chickensneed not only a higher protein diet than canbe provided by a standard DDGS but alsospecific amino acids in that protein in orderto grow faster and have beter quality meat.This is especially crucial in the early phase oftheir diet where faster growth leads to betergrowth later and lower mortality rates. contnued on page 2 FORWARD LOOKING STATEMENTS Some of the informaton in this newsleter may contain forward looking statements that express LincolnwayEnergy’s current beliefs, projectons and predictons about future results or events, such as statements with respectto financial results and conditon; future trends in the industry or in business, revenues or income; litgaton orregulatory maters; business and operatng plans and strategies; compettve positon; and opportunites that may beavailable to Lincolnway Energy. Forward looking statements are necessarily subjectve in nature and are made basedon numerous and varied estmates, projectons, beliefs, strategies and assumptons, and are subject to numerous 59511 W. Lincoln HighwayNevada, Iowa 50201 Office: 515-232-1010Fax: 515-663-9335 risks and uncertaintes. Forward looking statements are not guarantees of future results, performance or businessor operatng conditons, and no one should place undue reliance on any forward looking statements because actualresults, performance or conditons could be materially different. Lincolnway Energy undertakes no obligaton to reviseor update any forward looking statements. The forward looking statements contained in this newsleter are includedin the safe harbor protecton provided by Secton 27A of the Securites Act of 1933, as amended and Secton 21E of www.lincolnwayenergy.com the Securites Exchange Act of 1934, as amended. 1

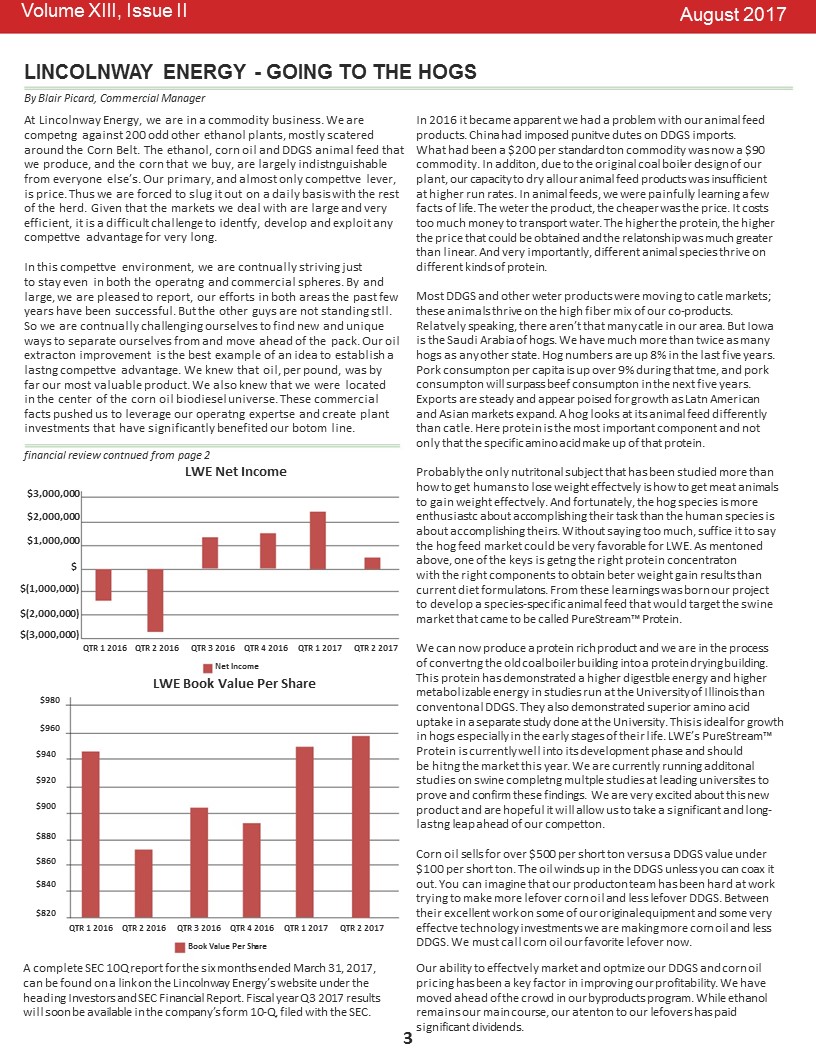

Volume XIlI, Issue II PureStream™ Dryer Project contnued from page 1 We have targeted these species in our development because Iowais experiencing rapid growth in these types of animals. There are 20million pigs raised in Iowa at any given tme and 60 million layersgrown here each year. Catle is the traditonal market for DDGS butthere are not any large catle yards near our facility, meaning we needto ship past our compettors to hit these markets. We will be able tosupply the monogastric market via truck from the facility, which willcut down on our needs of rail cars and decrease our dependency onChina. PureStream™ Proteins are showing remarkable results in feed trialswe are conductng on these animals. We have been running trials atthe University of Illinois and Iowa State. We are seeing higher energyand amino acid uptake and solid growth rates in both chickens andpigs. This will allow us to sell our material into higher value markets ata premium to current values. The final piece to the puzzle was finding a dryer that we could bothafford and could give us a superior finished product. High proteinmaterial will not work in our current dryer, as the material is stcky(think peanut buter) and would just make a mess. Afer an exhaustvesearch we found it in REI’s Compression Drying System. This processuses two augers to compress the material and wring the water outof the feed. This allows the material to dry without ever getng over190 ° F. The unusual feature of this dryer system is that they take a very longfootprint but as we are going to install them in the old coal boiler FINANCIAL REVIEW August 2017 building that actually works to our benefit. The PureStream™ Proteinwill enter the dryer units on the north side of the coal building andbe dry by the tme it hits the south end. We will lif them into theold coal silos for storage before they are loaded out. If you drive bythe plant and see cranes working on our site, they are readying thebuilding for these dryers. Finding a process that could fit on our coalbuilding footprint and reutlize the silo provided a significant savings tothe install cost of the entre project. So, there we go. We have a large growing market at our doorstep inthe swine and layer markets. We have an opportunity to get a highervalue feed stream into the market. We have found efficient technologyto install a dryer that will fit in the unusual footprint of the old coalboiler. All the pieces are fitng together. At the current constructonschedule, we ought to have this material to market by the end of theyear. It’s all going to come down to executon of the plan. It is excitngtmes here at Lincolnway. We are seeing results of the PureStream™process in ethanol producton and oil yields. We cannot wait to seewhat it can do with the rest of our protein. As always, I want to thank you for your support in getng the companyto where it is today. If there is any queston you have on PureStream™or any other aspect of the facility please feel free to give me a call. Iwill do my best to answer your queston given the many restrictonsthe federal government puts me under to do so. I look forward toseeing you at our fall picnic. By Kris Strum, Director of Finance Lincolnway Energy, LLC reported net income of $2.7 million for the sixmonths ended March 31, 2017, a 166% increase from the previousyear. Revenues increased $9 million over the previous year. Ethanolsales increased $9.1 million, or 25%, due to higher ethanol prices anda 13.3% increase in sales volume due to beter producton rates withthe optmizaton of the producton process. An increase in corn oil revenue offset by a decrease in DDGS revenue 2018. This new drying and cooling system will aid in our developmentof a new high-quality species-specific animal feed. Working capital was approximately $5.4 million and our book valueper share was $956 at the end of the 2nd quarter for fiscal year 2017. Comparison of the Six Months Ended March 31, 2017 and 2016 resulted in a 1.8% increase in co-product sales. Corn oil revenue Statements of Operatons Data: 2017 2016 increased $1.3 million, or 88.7%, afer the implementaton of severalprocess improvements. Corn oil producton at LWE contnues to hitrecord high levels while market prices also increased due to increaseddemand from the biodiesel industry. DDGS revenue decreased $1.2million due to the reducton in market prices resultng from lower corn Revenues Cost of Goods SoldGross Profit General and Admin. Expenses $ 55,878,701 $ 46,864,241 51,550,023 49,453,901 4,328,678 (2,589,660) 1,583,011 1,475,654 prices and decreased export demand, principally from China. Operatng Income (loss) 2,745,667 (4,065,314) Cost of goods sold for the six months increased by 4.2%, or $2.1 million.The increase was primarily due to increases in corn costs, and repairsand maintenance, offset by a decrease in depreciaton. Corn costsincreased by $1.5 million, or 4.3%, from higher producton. Repairs andmaintenance increased approximately $.8 million, or 94.9%. A larger Other Income (loss) (28,391) (24,760) Net Income $ 2,717,276 $ (4,090,074) Balance Sheet Data: March 31, 2017 September 30, 2016 focus has also been made on preventatve maintenance to reducedowntme and maintaining higher producton rates. Depreciatontotaled approximately $1.6 million, a decrease of $1.5 million. Thedecrease in depreciaton resulted from the fact that the plant hascompleted 10 years of operaton and a majority of the original assets Working Capital Net Property Plant and EquipmentTotal Assets Long-Term Obligatons $ 5,376,874 $ 5,265,892 38,099,084 34,929,124 48,104,077 46,085,438 4,092,776 3,542,593 are now fully depreciated. Member’s Equity 40,211,066 37,493,790 In March 2017, LWE began a capital project for the installaton of agrains drying and cooling system. Payments of $2.4 million were madeon the project during the six months ended March 31, 2017. Theproject is estmated to be completed in the first quarter of fiscal year Book Value Per Member Unit $ 956 $ 892 2

Volume XIlI, Issue II August 2017 LINCOLNWAY ENERGY - GOING TO THE HOGS By Blair Picard, Commercial Manager At Lincolnway Energy, we are in a commodity business. We arecompetng against 200 odd other ethanol plants, mostly scateredaround the Corn Belt. The ethanol, corn oil and DDGS animal feed thatwe produce, and the corn that we buy, are largely indistnguishablefrom everyone else’s. Our primary, and almost only compettve lever,is price. Thus we are forced to slug it out on a daily basis with the restof the herd. Given that the markets we deal with are large and veryefficient, it is a difficult challenge to identfy, develop and exploit anycompettve advantage for very long. In this compettve environment, we are contnually striving justto stay even in both the operatng and commercial spheres. By andlarge, we are pleased to report, our efforts in both areas the past fewyears have been successful. But the other guys are not standing stll.So we are contnually challenging ourselves to find new and uniqueways to separate ourselves from and move ahead of the pack. Our oilextracton improvement is the best example of an idea to establish alastng compettve advantage. We knew that oil, per pound, was byfar our most valuable product. We also knew that we were locatedin the center of the corn oil biodiesel universe. These commercialfacts pushed us to leverage our operatng expertse and create plantinvestments that have significantly benefited our botom line. financial review contnued from page 2 LWE Net Income $3,000,000 $2,000,000 $1,000,000 $ $(1,000,000) $(2,000,000) $(3,000,000) QTR 1 2016 QTR 2 2016 QTR 3 2016 QTR 4 2016 QTR 1 2017 QTR 2 2017 Net Income LWE Book Value Per Share $980 $960 $940 $920 $900 $880 $860 $840 $820 QTR 1 2016 QTR 2 2016 QTR 3 2016 QTR 4 2016 QTR 1 2017 QTR 2 2017 Book Value Per Share A complete SEC 10Q report for the six months ended March 31, 2017,can be found on a link on the Lincolnway Energy’s website under theheading Investors and SEC Financial Report. Fiscal year Q3 2017 resultswill soon be available in the company’s form 10-Q, filed with the SEC. In 2016 it became apparent we had a problem with our animal feedproducts. China had imposed punitve dutes on DDGS imports.What had been a $200 per standard ton commodity was now a $90commodity. In additon, due to the original coal boiler design of ourplant, our capacity to dry all our animal feed products was insufficientat higher run rates. In animal feeds, we were painfully learning a fewfacts of life. The weter the product, the cheaper was the price. It coststoo much money to transport water. The higher the protein, the higherthe price that could be obtained and the relatonship was much greaterthan linear. And very importantly, different animal species thrive ondifferent kinds of protein. Most DDGS and other weter products were moving to catle markets;these animals thrive on the high fiber mix of our co-products.Relatvely speaking, there aren’t that many catle in our area. But Iowais the Saudi Arabia of hogs. We have much more than twice as manyhogs as any other state. Hog numbers are up 8% in the last five years.Pork consumpton per capita is up over 9% during that tme, and porkconsumpton will surpass beef consumpton in the next five years.Exports are steady and appear poised for growth as Latn Americanand Asian markets expand. A hog looks at its animal feed differentlythan catle. Here protein is the most important component and notonly that the specific amino acid make up of that protein. Probably the only nutritonal subject that has been studied more thanhow to get humans to lose weight effectvely is how to get meat animalsto gain weight effectvely. And fortunately, the hog species is moreenthusiastc about accomplishing their task than the human species isabout accomplishing theirs. Without saying too much, suffice it to saythe hog feed market could be very favorable for LWE. As mentonedabove, one of the keys is getng the right protein concentratonwith the right components to obtain beter weight gain results thancurrent diet formulatons. From these learnings was born our projectto develop a species-specific animal feed that would target the swinemarket that came to be called PureStream™ Protein. We can now produce a protein rich product and we are in the processof convertng the old coal boiler building into a protein drying building.This protein has demonstrated a higher digestble energy and highermetabolizable energy in studies run at the University of Illinois thanconventonal DDGS. They also demonstrated superior amino aciduptake in a separate study done at the University. This is ideal for growthin hogs especially in the early stages of their life. LWE’s PureStream™Protein is currently well into its development phase and shouldbe hitng the market this year. We are currently running additonalstudies on swine completng multple studies at leading universites toprove and confirm these findings. We are very excited about this newproduct and are hopeful it will allow us to take a significant and long-lastng leap ahead of our competton. Corn oil sells for over $500 per short ton versus a DDGS value under$100 per short ton. The oil winds up in the DDGS unless you can coax itout. You can imagine that our producton team has been hard at worktrying to make more lefover corn oil and less lefover DDGS. Betweentheir excellent work on some of our original equipment and some veryeffectve technology investments we are making more corn oil and lessDDGS. We must call corn oil our favorite lefover now. Our ability to effectvely market and optmize our DDGS and corn oilpricing has been a key factor in improving our profitability. We havemoved ahead of the crowd in our byproducts program. While ethanolremains our main course, our atenton to our lefovers has paidsignificant dividends. 3

NEW EMPLOYEE - BLAKE GOOD Hello. I am Blake Good, the new Environmental, Health and Safety Manager at Lincolnway Energy. I am veryexcited to be part of this team and look forward to a bright future at Lincolnway Energy. I was born and went to college in Ames, but grew up in the Quad City area. Most of my family currently livesin the Des Moines area, and we love it here. I have three kids with one on the way. Outside of work, my kidsconsume the majority of my tme. I do a lot of baseball and sofball coaching for my two oldest. I also dobaseball and sofball hitng instructon for young kids. I have a degree in Industrial Engineering and Business Management from ISU and have my MBA through theUniversity of Texas. I have been working in manufacturing for over 15 years in leadership roles focused onsafety, HR, and operatons. Most of my tme was spent in the food packaging industry, where I worked in plantsall over the country. Glad to be grounded and home in Iowa, though! I am very excited to be a part of this great company. Lincolnway Energy, LLC 59511 W. Lincoln HighwayNevada, Iowa 50201 Volume XIlI, Issue II August 2017 COME JOIN US ON THE WEB! If you haven’t already, please give us your e-mail address. This way you can receive the full color newsleter via e-mail and we can save on postage. E-mail your request to us at info@lincolnwayenergy.com. Find us on Linked https://www.linkedin.com/company/lincolnway-energy 4