Attached files

| file | filename |

|---|---|

| EX-99.1 - Q2 2017 EARNINGS RELEASE - CINCINNATI BELL INC | earningsreleaseq22017.htm |

| 8-K - CINCINNATI BELL INC. 8-K - CINCINNATI BELL INC | a8-kearningsreleaseshellq2.htm |

Cincinnati Bell

Second Quarter 2017 Results

August 4, 2017

Safe Harbor

This presentation may contain “forward-looking” statements, as defined in federal securities laws including the Private Securities Litigation Reform Act of 1995, which are based on our current

expectations, estimates, forecasts and projections. Statements that are not historical facts, including statements about the beliefs, expectations and future plans and strategies of the Company, are

forward-looking statements. Actual results may differ materially from those expressed in any forward-looking statements. The following important factors, among other things, could cause or

contribute to actual results being materially and adversely different from those described or implied by such forward-looking statements including, but not limited to: those discussed in this

presentation; we operate in highly competitive industries, and customers may not continue to purchase products or services, which would result in reduced revenue and loss of market share; we

may be unable to grow our revenues and cash flows despite the initiatives we have implemented; failure to anticipate the need for and introduce new products and services or to compete with new

technologies may compromise our success in the telecommunications industry; our access lines, which generate a significant portion of our cash flows and profits, are decreasing in number and if we

continue to experience access line losses similar to the past several years, our revenues, earnings and cash flows from operations may be adversely impacted; our failure to meet performance

standards under our agreements could result in customers terminating their relationships with us or customers being entitled to receive financial compensation, which would lead to reduced

revenues and/or increased costs; we generate a substantial portion of our revenue by serving a limited geographic area; a large customer accounts for a significant portion of our revenues and

accounts receivable and the loss or significant reduction in business from this customer would cause operating revenues to decline and could negatively impact profitability and cash flows;

maintaining our telecommunications networks requires significant capital expenditures, and our inability or failure to maintain our telecommunications networks could have a material impact on our

market share and ability to generate revenue; increases in broadband usage may cause network capacity limitations, resulting in service disruptions or reduced capacity for customers; we may be

liable for material that content providers distribute on our networks; cyber attacks or other breaches of network or other information technology security could have an adverse effect on our

business; natural disasters, terrorists acts or acts of war could cause damage to our infrastructure and result in significant disruptions to our operations; the regulation of our businesses by federal

and state authorities may, among other things, place us at a competitive disadvantage, restrict our ability to price our products and services and threaten our operating licenses; we depend on a

number of third party providers, and the loss of, or problems with, one or more of these providers may impede our growth or cause us to lose customers; a failure of back-office information

technology systems could adversely affect our results of operations and financial condition; if we fail to extend or renegotiate our collective bargaining agreements with our labor union when they

expire or if our unionized employees were to engage in a strike or other work stoppage, our business and operating results could be materially harmed; the loss of any of the senior management

team or attrition among key sales associates could adversely affect our business, financial condition, results of operations and cash flows; our debt could limit our ability to fund operations, raise

additional capital, and fulfill our obligations, which, in turn, would have a material adverse effect on our businesses and prospects generally; our indebtedness imposes significant restrictions on us;

we depend on our loans and credit facilities to provide for our short-term financing requirements in excess of amounts generated by operations, and the availability of those funds may be reduced or

limited; the servicing of our indebtedness is dependent on our ability to generate cash, which could be impacted by many factors beyond our control; we depend on the receipt of dividends or other

intercompany transfers from our subsidiaries and investments; the trading price of our common shares may be volatile, and the value of an investment in our common shares may decline; the

uncertain economic environment, including uncertainty in the U.S. and world securities markets, could impact our business and financial condition; our future cash flows could be adversely affected

if it is unable to fully realize our deferred tax assets; adverse changes in the value of assets or obligations associated with our employee benefit plans could negatively impact shareowners’ deficit and

liquidity; third parties may claim that we are infringing upon their intellectual property, and we could suffer significant litigation or licensing expenses or be prevented from selling products; third

parties may infringe upon our intellectual property, and we may expend significant resources enforcing our rights or suffer competitive injury; we could be subject to a significant amount of litigation,

which could require us to pay significant damages or settlements; we could incur significant costs resulting from complying with, or potential violations of, environmental, health and human safety

laws; the timing and likelihood of completion of our proposed mergers with Hawaiian Telcom and OnX, including the timing, receipt and terms and conditions of any required governmental and

regulatory approvals for the proposed transactions that could reduce anticipated benefits or cause the parties to abandon the transactions; the possibility that Hawaiian Telcom’s stockholders may

not approve the proposed merger; the possibility that competing offers or acquisition proposals for Hawaiian Telcom will be made; the occurrence of any event, change or other circumstance that

could give rise to the termination of the proposed transactions; the possibility that the expected synergies and value creation from the proposed transactions will not be realized or will not be

realized within the expected time period; the risk that the businesses of the Company and Hawaiian Telcom and OnX will not be integrated successfully; disruption from the proposed transactions

making it more difficult to maintain business and operational relationships; the risk that unexpected costs will be incurred; and the possibility that the proposed transactions do not close, including

due to the failure to satisfy the closing conditions and the other risks and uncertainties detailed in our filings, including our Form 10-K, with the SEC as well as Hawaiian Telcom’s filings, including its

Form 10-K, with the SEC.

These forward-looking statements are based on information, plans and estimates as of the date hereof and there may be other factors that may cause our actual results to differ materially from

these forward-looking statements. We assume no obligation to update the information contained in this presentation except as required by applicable law.

2

Non-GAAP Financial Measures

This presentation contains information about adjusted earnings before interest, taxes, depreciation and

amortization (Adjusted EBITDA), Adjusted EBITDA margin, net debt and free cash flow. These are non-GAAP

financial measures used by Cincinnati Bell management when evaluating results of operations and cash flow.

Management believes these measures also provide users of the financial statements with additional and useful

comparisons of current results of operations and cash flows with past and future periods. Non-GAAP financial

measures should not be construed as being more important than comparable GAAP measures. Detailed

reconciliations of Adjusted EBITDA, net debt and free cash flow (including the Company’s definition of these

terms) to comparable GAAP financial measures can be found in the earnings release on our website at

www.cincinnatibell.com within the Investor Relations section.

3

Call Participants

Page 4

Leigh Fox

President and CEO, Cincinnati Bell

Andy Kaiser

CFO, Cincinnati Bell

4

Page 5

Second Quarter 2017 Highlights

Strategic Revenue

with breakdown

for 2 segments

Adj EBITDA with

breakdown for 2

segments

5

Strategic Revenue

$171M

+9% y/y

Fioptics

Revenue of

$77M

+24% y/y

556,700

addresses

+16% y/y

Cloud Services

Revenue of

$12M

+7% y/y

Adjusted EBITDA

($ in millions)

$192 $201

$110 $96

-$3 -$3

2Q16 2Q17

Entertainment & Communications IT & Hardware Eliminations

Total Revenue

($ in millions)

$74 $72

$7 $10

-$4 -$6

Entertainment & Communications IT & Hardware Corporate

2Q17 2Q16

$76

$299 $294 $77

Key Financial Metrics

• 2016 Revenue: $2,193M(3)

• 2016 EBITDA: $471M(4)

• Margin: 21%

• Hawaii’s fiber-centric technology

leader providing voice, video,

broadband, data center and cloud

solutions

Source: Company Filings

6

Transaction

Size

Business

Description

Key

Financial

Statistics

• Provides technology services and

solutions to enterprise customers

in the U.S., Canada and the U.K.

“New Cincinnati Bell”

• Two distinct but complementary

$1B+ business: a fiber network

and cloud integrator, with clear

pathway for growth

• 2016 Revenue: $393M

• 2016 EBITDA: $116M(1)

• Margin: 30%

• FYE 4/30/17 Revenue: $614M

• FYE 4/30/17 EBITDA: $29M(2)

• Margin: 5%

1. CY2016 EBITDA of HCOM represents net income plus interest expense (net of interest income and other), income taxes, depreciation and amortization, gain on sale of property, non-cash stock and other performance-based

compensation, System Metrics earn-out, pension settlement loss, severance costs and is adjusted for certain non-recurring items.

2. FYE 4/30/2017 EBITDA of OnX represents as net income before income taxes plus share-based compensation, depreciation and amortization, finance costs,

foreign exchange loss, net restructuring and other charges and management fee.

3. Calculated as CY2016 revenue of CBB of $1,186M plus CY2016 revenue of HCOM plus FYE2017 revenue of OnX.

4. Calculated as CY2016 EBITDA of CBB of $305M plus CY2016 EBITDA of HCOM plus FYE2017 EBITDA of OnX plus run-rate synergies of $21M.

Expected Close

Expected

Cost Synergies*

~50% ~50% Network IT Services

(Pro Forma Revenue Mix)

• H2 2018 • Q4 2017

• Network: ~$11M annually • IT Services: ~$10M annually • Combined: ~$21M annually

Page 6

• $650M including existing net debt

• 60% cash and 40% stock

• $201M in cash

*To be realized within two years post-close, and excluding potential revenue synergies from cross-selling opportunities

Second Quarter 2017 Highlights

Combinations with Hawaiian Telcom and OnX

Page 7

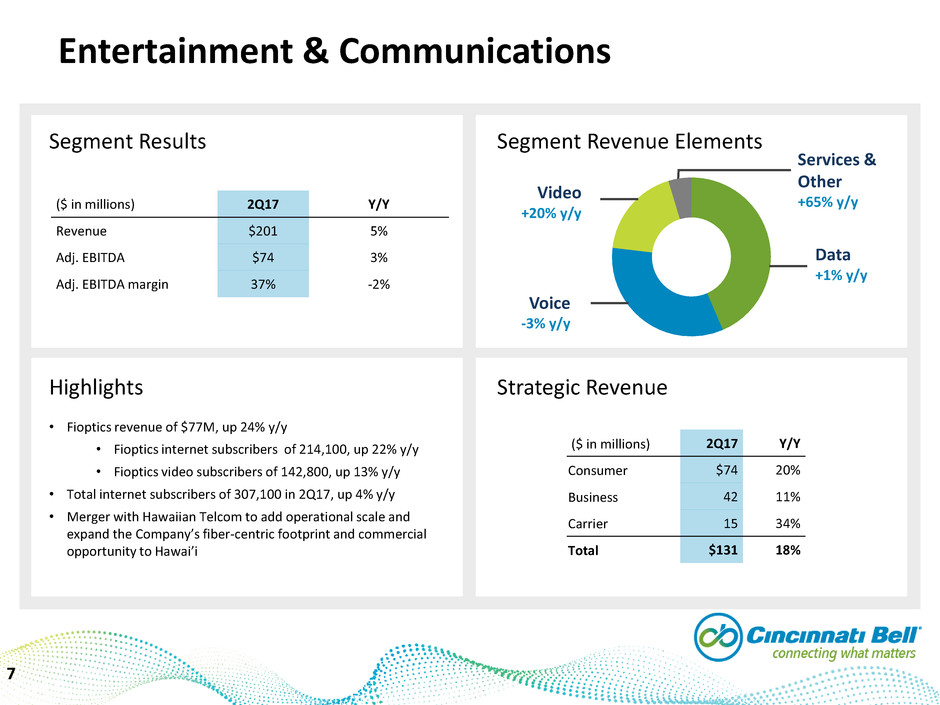

Entertainment & Communications

7

Strategic Revenue

with breakdown

for 2 segments

Segment Revenue Elements

Segment Results

Strategic Revenue

Highlights

• Fioptics revenue of $77M, up 24% y/y

• Fioptics internet subscribers of 214,100, up 22% y/y

• Fioptics video subscribers of 142,800, up 13% y/y

• Total internet subscribers of 307,100 in 2Q17, up 4% y/y

• Merger with Hawaiian Telcom to add operational scale and

expand the Company’s fiber-centric footprint and commercial

opportunity to Hawai’i

($ in millions) 2Q17 Y/Y

Consumer $74 20%

Business 42 11%

Carrier 15 34%

Total $131 18%

($ in millions) 2Q17 Y/Y

Revenue $201 5%

Adj. EBITDA $74 3%

Adj. EBITDA margin 37% -2%

Data

+1% y/y

Voice

-3% y/y

Services &

Other

+65% y/y

Video

+20% y/y

Page 8

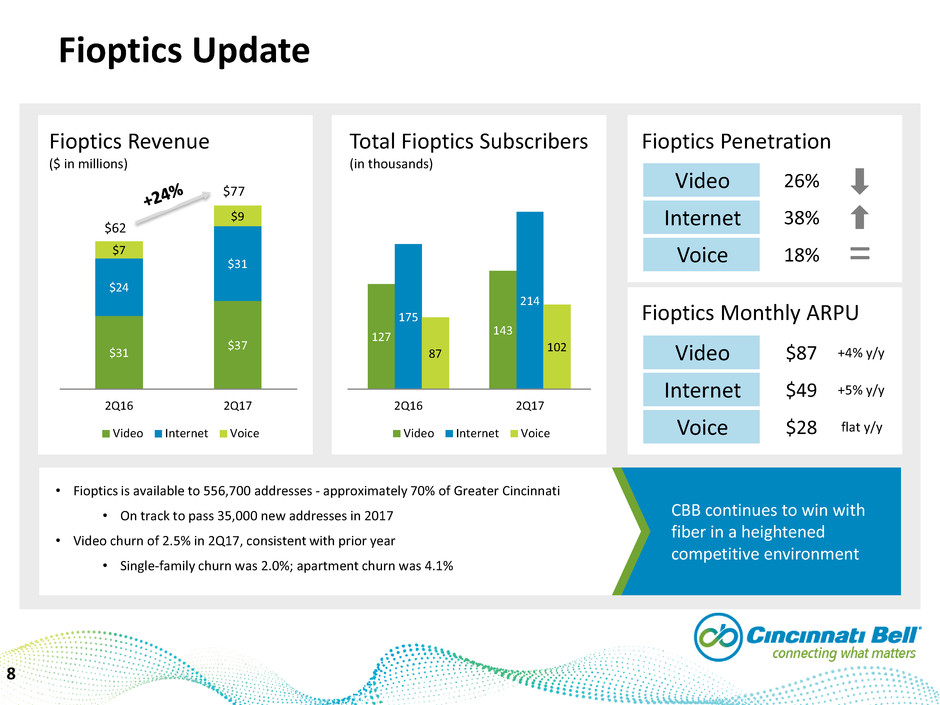

Fioptics Update

8

Fioptics Revenue

($ in millions)

Total Fioptics Subscribers

(in thousands)

Fioptics Penetration

Video

Internet

Voice

26%

38%

18%

Fioptics Monthly ARPU

Video

Internet

Voice

$87

$49

$28

+4% y/y

+5% y/y

flat y/y

$31

$37

$24

$31

$7

$9

2Q16 2Q17

Video Internet Voice

$62

$77

127

143

175

214

87 102

2Q16 2Q17

Video Internet Voice

CBB continues to win with

fiber in a heightened

competitive environment

• Fioptics is available to 556,700 addresses - approximately 70% of Greater Cincinnati

• On track to pass 35,000 new addresses in 2017

• Video churn of 2.5% in 2Q17, consistent with prior year

• Single-family churn was 2.0%; apartment churn was 4.1%

=

$32 $26

$61 $74

2Q16 2Q17

Legacy Strategic Integration

Page 9

Entertainment & Communications

9

Consumer Market

$14 $14

$12

$10

$5

2Q16 2Q17

Legacy Strategic One-time Fiber Build Project

Business Market

Carrier Market

$94

• Fioptics revenue growth

continues to more than offset

legacy declines

• Ongoing transition of customers

from copper network to strategic

fiber-based products continues

• Positive contribution from one-time

fiber build project completed in 2Q17

• On-going FCC switched access rate

reductions

• National carriers increased focus on

reducing costs

1. Entertainment & Communications Consumer Integration revenue totaled $1M 2Q16

2. Entertainment & Communications Business Integration revenue was less than $1M in 2Q16 and 2Q17

$34 $30

$38 $42

2Q16 2Q17

Legacy Strategic Integration

$72 $72

(1) (2)

($ in millions)

=

$29

$26

$100

Page 10

IT Services & Hardware

10

Strategic Revenue

with breakdown

for 2 segments

Adj EBITDA with

breakdown for 2

segments

Segment Results

Strategic Revenue

($ in millions) 2Q17 Y/Y

Professional Services $18 -20%

Management and Monitoring 5 -35%

Unified Communications 7 1%

Cloud Services 12 7%

Total $42 -13%

Highlights

• Cloud Services revenue of $12 million, up 7% y/y

• Revenue decreased due to a decline in Telecom & IT hardware

sales and increased insourcing of IT services in the Company’s

market

• Positive contribution from the SunTel Services acquisition,

expanding CBTS' presence into the Michigan market

• Acquisition of OnX Enterprise Solutions to expand the Company’s

product offering, and provide greater geographic and customer

diversification

($ in millions) 2Q17 Y/Y

Revenue $96 -13%

Adj. EBITDA $7 -35%

Adj. EBITDA margin 7% -25%

Segment Revenue Elements

Professional Services

-14% y/y

Management &

Monitoring

-35% y/y

Unified Communications

+9% y/y

Cloud Services

+7% y/y

Telecom & IT

Hardware

-17% y/y

Page 11

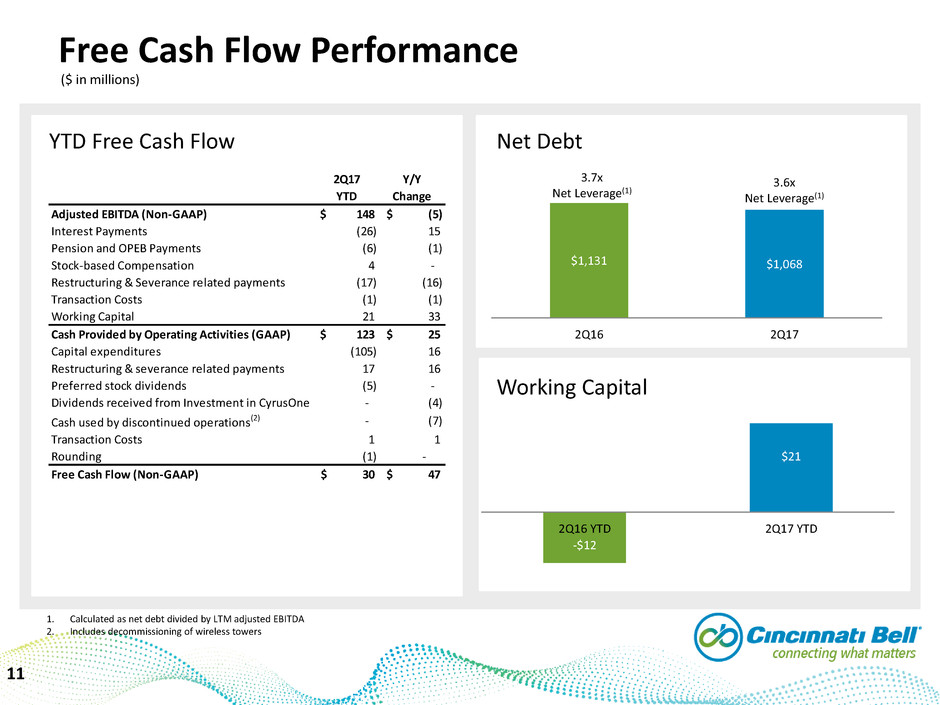

Free Cash Flow Performance

11

YTD Free Cash Flow

Net Debt

Working Capital

1. Calculated as net debt divided by LTM adjusted EBITDA

2. Includes decommissioning of wireless towers

$1,131 $1,068

2Q16 2Q17

($ in millions)

3.7x

Net Leverage(1)

3.6x

Net Leverage(1)

2Q17 Y/Y

YTD Change

Adjusted EBITDA (Non-GAAP) $ 148 $ (5)

Interest Payments (26) 15

Pension and OPEB Payments (6) (1)

Stock-based Compensation 4 -

Restructuring & Severance related payments (17) (16)

Transaction Costs (1) (1)

Working Capital 21 33

Cash Provided by Operating Activities (GAAP) $ 123 $ 25

Capital expenditures (105) 16

Restructuring & severance related payments 17 16

Preferred stock dividends (5) -

Dividends received from Investment in CyrusOne - (4)

Cash used by discontinued operations(2) - (7)

Transaction Costs 1 1

Rounding (1) -

Free Cash Flow (N n-GAAP) $ 30 $ 47

-$12

$21

2Q16 YTD 2Q17 YTD

Page 12

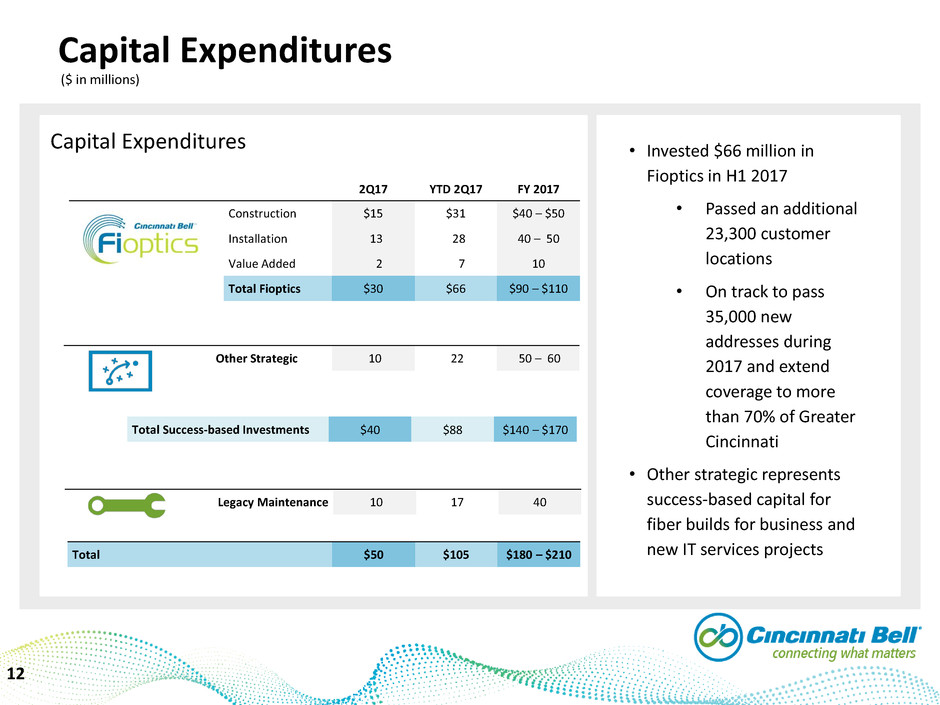

Capital Expenditures

12

Capital Expenditures

Total $50 $105 $180 – $210

• Invested $66 million in

Fioptics in H1 2017

• Passed an additional

23,300 customer

locations

• On track to pass

35,000 new

addresses during

2017 and extend

coverage to more

than 70% of Greater

Cincinnati

• Other strategic represents

success-based capital for

fiber builds for business and

new IT services projects

2Q17 YTD 2Q17 FY 2017

Construction $15 $31 $40 – $50

Installation 13 28 40 – 50

Value Added 2 7 10

Total Fioptics $30 $66 $90 – $110

Other Strategic 10 22 50 – 60

Total Success-based Investments $40 $88 $140 – $170

Legacy Maintenance 10 17 40

($ in millions)

Page 13

2017 Outlook

13

Reaffirms 2017 Guidance

Revenue $1.2B

Adjusted EBITDA $295M*

• Reaffirms 2017 financial guidance, provided on

February 15, 2017

• This guidance does not include any contribution

from pending mergers

* Plus or minus 2 percent

Selected 2017 Free Cash Flow Items

Capital Expenditures $180 - $210M

Interest payments ~$70M

Pension and OPEB payments ~ $14M

10%

20%

30%

40%

50%

60%

Year 1 Year 2 Year 3 Year 4

Fiber to the Home

Penetration

FHSI Penetration Rates

Video Penetration

Page 14

Summary

Refining Cincinnati Bell’s strategy

Entertainment &

Communications

IT Services & Hardware

1

Focus on investing

where we are

winning

• Fioptics revenue

growth of 24% y/y in

2Q17

• Cloud Services revenue

growth of 7% y/y in 2Q17

3 How we win • Continued investment in fiber

• Additional IT services

customers provides cloud

growth potential through

scale and distribution

4

Significant market

opportunity

• Growth driven by IoT

and 5G infrastructure

spend

• 89% of organizations are

willing to pay a premium for

cloud implementation and

management services

14

2 Why we win

• The more fiber, the

greater the market

penetration

• IT services business,

combined with our network

provides a platform for

cloud migration services

Page 15

Q&A

Page 16

Appendix

Page 17

17

Consolidated Results

($ in millions, except per share amounts)

2017 2016

Revenue 294.0$ 299.2$

Costs and expenses

Cost of services and products 165.4 170.8

Selling, general and administrative 55.4 56.2

Depreciation and amortization 47.0 44.8

Restructuring and severance related charges 3.6 —

Other 1.7 —

Operating income 20.9 27.4

Interest expense 18.1 19.9

Loss on extinguishment of debt, net — 5.2

Gain on sale of Investment in CyrusOne — (118.6)

Other income, net (0.6) (1.1)

Income before income taxes 3.4 122.0

Income tax expense 1.3 44.4

Net income 2.1 77.6

Preferred stock dividends 2.6 2.6

Net (loss) income applicable to common shareowners (0.5)$ 75.0$

Basic net (loss) earnings per common share (0.01)$ 1.79$

Dilu ed net (loss) earnings per common share (0.01)$ 1.78$

Weighted average common shares outstanding (in millions)

– Basic 42.2 42.0

– Diluted 42.2 42.1

June 30,

Three Months Ended

Page 18

18

Consolidated Results

($ in millions, except per share amounts)

2017 2016

Revenue 572.2$ 588.1$

Costs and expenses

Cost of services and products 320.2 333.5

Selling, general and administrative 112.1 109.4

Depreciation and amortization 92.8 88.2

Restructuring and severance related charges 29.2 —

Other 2.3 —

Operating income 15.6 57.0

Interest expense 36.1 40.2

Loss on extinguishment of debt, net — 2.8

Gain on sale of Investment in CyrusOne (117.7) (118.6)

Other income, net (1.0) (1.1)

Income before income taxes 98.2 133.7

Income tax expense 35.7 49.1

Net income 62.5 84.6

Preferred stock dividends 5.2 5.2

Net income applicable to common shareowners 57.3$ 79.4$

Basic net earnings per common share 1.36$ 1.89$

Diluted net earnings per common share 1.35$ 1.89$

Weighted average common shares outstanding (in millions)

– Basic 42.1 42.0

– Diluted 42.3 42.1

Six Months Ended

June 30,

Page 19

19

Strategic Legacy Integration

Data

Fioptics Internet

DSL (1) (> 10 meg)

Ethernet

Private Line

MPLS (2)

SONET (3)

Dedicated Internet Access

Wavelength

Audio Conferencing

DSL (< 10 meg)

DS0 (5), DS1, DS3

TDM (6)

Voice Fioptics Voice

VoIP (4)

Traditional Voice

Long Distance

Switched Access

Digital Trunking

Video Fioptics Video

Services and Other Wiring Projects Advertising Directory

Assistance

Maintenance

Information Services

Wireless Handsets and

Accessories

(1) Digital Subscriber Line

(2) Multi-Protocol Label Switching

(3) Synchronous Optical Network

(4) Voice of Internet Protocol

(5) Digital Signal

(6) Time Division Multiplexing

Revenue Classifications – Entertainment and Communications

Page 20

20

Strategic Integration

Professional Services

Consulting

Staff Augmentation

Installation

Unified Communications Voice Monitoring

Managed IP Telephony Solutions

Maintenance

Cloud Services Virtual Data Centers

Storage

Backup

Monitoring and Management Network Monitoring/Management

Security

Telecom & IT Hardware Hardware

Software Licenses

Revenue Classifications – IT Services and Hardware

Page 21

21

Revenue – Strategic, Legacy and Integration

($ in millions)

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data 66.2$ $ —

Voice 21.5 —

Video 37.2 —

Services and other 6.4 —

Professional services — 18.4

Management and monitoring — 5.1

Unified communications — 7.4

Cloud services — 11.6

Total Strategic 131.3 42.5 173.8 (2.3) 171.5

Legacy

Data 21.5$ $ —

Voice 45.6 —

Services and other 2.6 —

Total Legacy 69.7 - 69.7 (0.3) 69.4

Integration

Services and other 0.4$ $ —

Professional services — 5.1

Unified communications — 3.6

Telecom and IT hardware — 44.8

Total Integration 0.4 53.5 53.9 (0.8) 53.1

201.4$ 96.0$ 297.4$ (3.4)$ 294.0$

Eliminations (0.5) (2.9) (3.4)

Total Revenue 200.9$ 93.1$ 294.0$

2Q17

Page 22

22

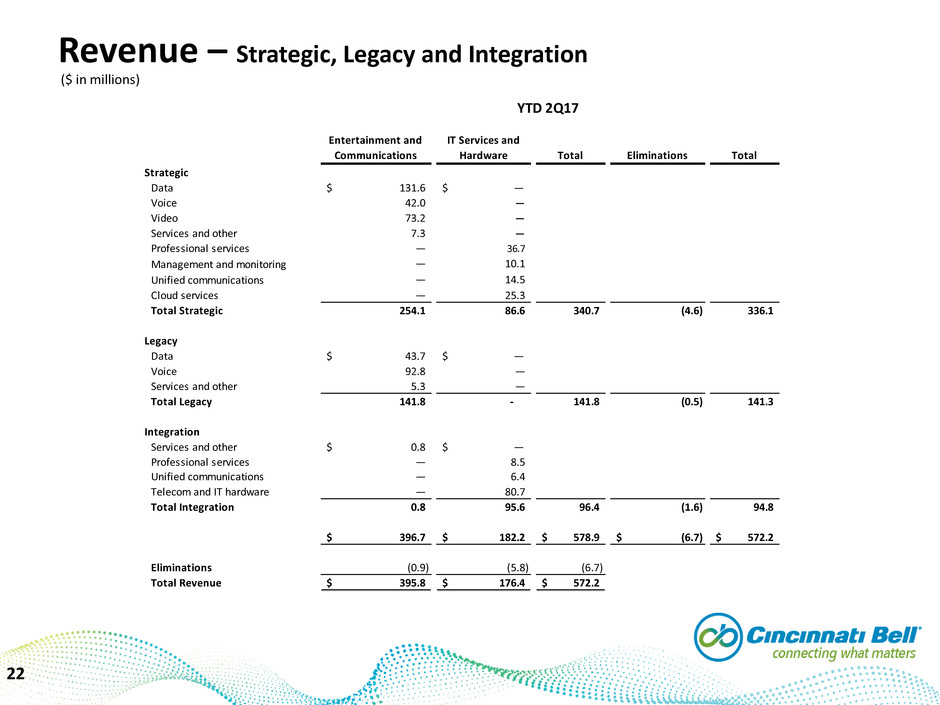

Revenue – Strategic, Legacy and Integration

($ in millions)

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data 131.6$ $ —

Voice 42.0 —

Video 73.2 —

Services and other 7.3 —

Professional services — 36.7

Management and monitoring — 10.1

Unified communications — 14.5

Cloud services — 25.3

Total Strategic 254.1 86.6 340.7 (4.6) 336.1

Legacy

Data 43.7$ $ —

Voice 92.8 —

Services and other 5.3 —

Total Legacy 141.8 - 141.8 (0.5) 141.3

Integration

Services and other 0.8$ $ —

Professional services — 8.5

Unified communications — 6.4

Telecom and IT hardware — 80.7

Total Integration 0.8 95.6 96.4 (1.6) 94.8

396.7$ 182.2$ 578.9$ (6.7)$ 572.2$

Eliminations (0.9) (5.8) (6.7)

Total Revenue 395.8$ 176.4$ 572.2$

YTD 2Q17

Page 23

23

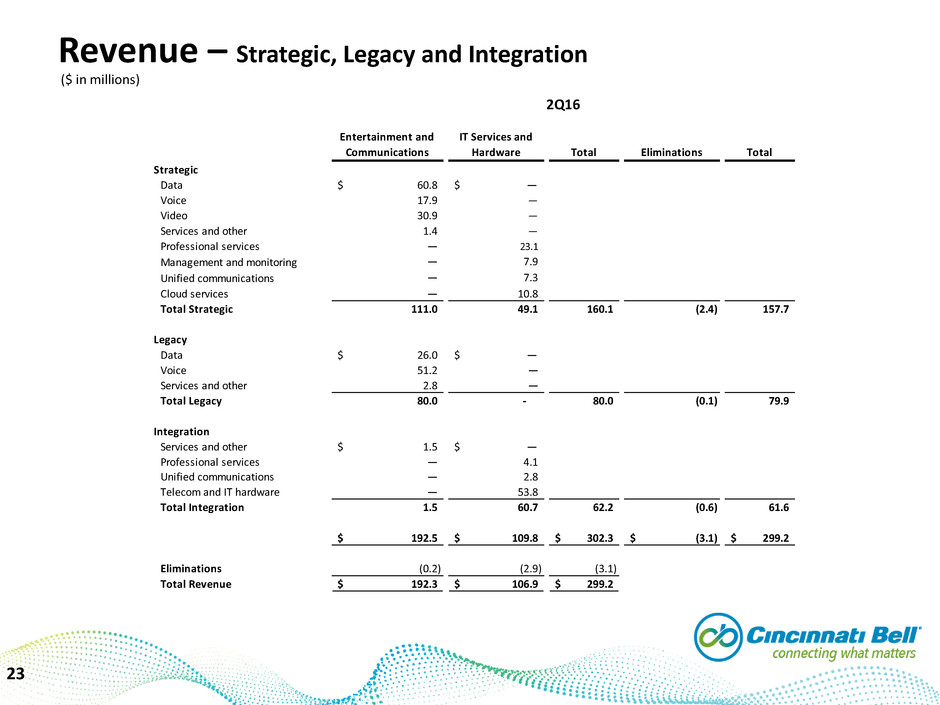

Revenue – Strategic, Legacy and Integration

($ in millions)

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data 60.8$ $ —

Voice 17.9 —

Video 30.9 —

Services and other 1.4 —

Professional services — 23.1

Management and monitoring — 7.9

Unified communications — 7.3

Cloud services — 10.8

Total Strategic 111.0 49.1 160.1 (2.4) 157.7

Legacy

Data 26.0$ $ —

Voice 51.2 —

Services and other 2.8 —

Total Legacy 80.0 - 80.0 (0.1) 79.9

Integration

Services and other 1.5$ $ —

Professional services — 4.1

Unified communications — 2.8

Telecom and IT hardware — 53.8

Total Integration 1.5 60.7 62.2 (0.6) 61.6

192.5$ 109.8$ 302.3$ (3.1)$ 299.2$

Eliminations (0.2) (2.9) (3.1)

Total Revenue 192.3$ 106.9$ 299.2$

2Q16

Page 24

24

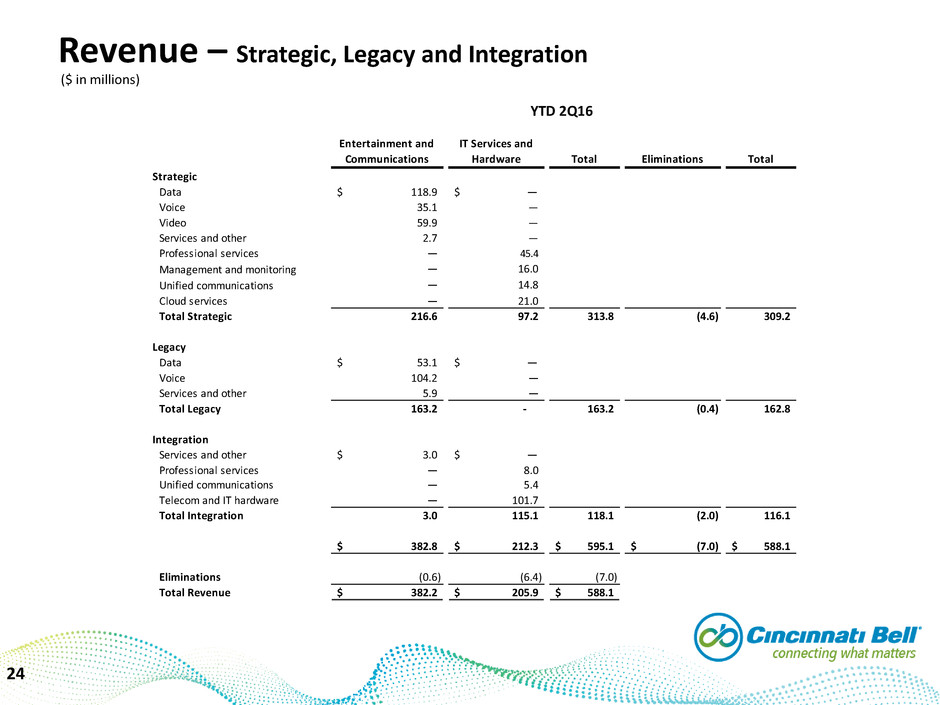

Revenue – Strategic, Legacy and Integration

($ in millions)

Entertainment and

Communications

IT Services and

Hardware Total Eliminations Total

Strategic

Data 118.9$ $ —

Voice 35.1 —

Video 59.9 —

Services and other 2.7 —

Professional services — 45.4

Management and monitoring — 16.0

Unified communications — 14.8

Cloud services — 21.0

Total Strategic 216.6 97.2 313.8 (4.6) 309.2

Legacy

Data 53.1$ $ —

Voice 104.2 —

Services and other 5.9 —

Total Legacy 163.2 - 163.2 (0.4) 162.8

Integration

Services and other 3.0$ $ —

Professional services — 8.0

Unified communications — 5.4

Telecom and IT hardware — 101.7

Total Integration 3.0 115.1 118.1 (2.0) 116.1

382.8$ 212.3$ 595.1$ (7.0)$ 588.1$

Eliminations (0.6) (6.4) (7.0)

Total Revenue 382.2$ 205.9$ 588.1$

YTD 2Q16