Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Zendesk, Inc. | zen_8kxq2x2017.htm |

| EX-99.3 - EXHIBIT 99.3 - Zendesk, Inc. | q22017tweetpanelsfinal.htm |

| EX-99.1 - EXHIBIT 99.1 - Zendesk, Inc. | zen_8-kxq2x2017xex991x7.htm |

Shareholder Letter

Second Quarter 2017

August 03, 2017

Zendesk Guide, launched Q2 2017

Exhibit 99.2

Zendesk Shareholder Letter Q2 2017 - 2

Mikkel

Svane

CEO

Elena

Gomez

CFO

Marc

Cabi

Strategy & IR

Introduction

Zendesk heads into the second half of 2017 in a strong position

to deliver on both its strategic goals and growth targets for

the year after steady progress in the first half of the year. We

advanced across all of our growth drivers during the quarter,

while laying the foundation for greater go-to-market impact in

the second half of the year.

In our efforts to further expand our markets, we made

additional inroads with larger organizations by both closing a

greater number of bigger deals during the quarter and growing

our pipeline. We recently expanded our investments interna-

tionally with major events in Brazil, Japan, and Australia and the

announcement of plans for an additional Amazon Web Services

(AWS) data center in Australia. Meanwhile, we made advance-

ments toward selling solutions, reflecting our evolution to a

multi-product company.

We continued our multi-product momentum with strong early

adoption of Zendesk Guide, our self-service knowledge base

product, and general availability this month of Zendesk

Message (for popular messaging platforms like Facebook

Messenger) as part of a new Enterprise version of Zendesk

Chat. We enabled our customers to further innovate in

self-service with the broader release of Answer Bot, our

machine learning-based feature in Guide that enables organi-

zations to deliver automated answers to customers.

$101.3M

Q2 2017 revenue

36%

Y/Y revenue growth

107,400

Paid customer accounts

Zendesk Shareholder Letter Q2 2017 - 3

Second quarter 2017 financial summary

(in thousands, except per share data)

Three Months Ended June 30,

GAAP Results 2017 2016

Revenue $ 101,273 $ 74,200

Gross profit 70,610 51,264

Gross margin 69.7% 69.1%

Operating loss $ (30,504) $ (26,296)

Operating margin -30.1% -35.4%

Net loss $ (29,306) $ (26,254)

Net loss per share (0.29) (0.28)

Non-GAAP Results

Non-GAAP gross profit $ 74,266 $ 54,387

Non-GAAP gross margin 73.3% 73.3%

Non-GAAP operating loss $ (6,187) $ (5,632)

Non-GAAP operating margin -6.1% -7.6%

Non-GAAP net loss $ (4,989) $ (5,590)

Non-GAAP net loss per share (0.05) (0.06)

In the second quarter we delivered $101.3

million in revenue, which represents 36% revenue

growth when compared to the second quarter of

2016. Additionally, we ended the second quarter

with 107,400 paid customer accounts and saw

improvements in both the percentange of MRR

from customers with 100 or more agents and

dollar-based net expansion rate metrics.

Zendesk Shareholder Letter Q2 2017 - 4

Tom

Keiser

Chief Operating Officer

Chief Operating Officer appointment

We are pleased to announce the appointment of Tom Keiser as Chief Operating Officer.

In his new role, Tom will work with our CEO and the executive team to align, communicate, and drive

Zendesk’s organizational priorities. He will ensure these priorities are executed across the organization,

confirm that measurement and success criteria are clearly defined and implemented, and support our

efforts to meet near- and long-term growth and profitability targets.

Over the past 15 months as Zendesk’s Chief Information Officer (CIO), Tom has run Technology

Operations, Security and Compliance, Enterprise Data and Analytics, and IT. He has been instrumental

in bringing structure, discipline, and accountability into our most significant operational issues.

Tom’s career spans 20 years of leading global technology initiatives. He is the former CIO and Executive

Vice President of Global Product Operations at The Gap, Inc. He brings a wealth of experience in enter-

prise technology, sales, and operations and is a proven leader with dedication, vision, and insight.

Zendesk Shareholder Letter Q2 2017 - 5

Go-to-market activities

As we look to the second half of the year, we believe that we have overcome

most of the ripple effects of last year’s reorganization of our U.S. sales and

marketing departments. While the impacts of turnover in our sales force

lingered longer than we expected, we believe that later this year we will reap

the rewards of our work to bolster our go-to-market capabilities. We are now

in a stronger position to both land business with larger organizations and

expand the products used by our existing customers.

Sales hiring

Last year we reorganized our U.S. sales and marketing efforts around a more

territory-based approach to help us more efficiently win new business and

expand within our existing customer base. As discussed in previous quarters,

this change created more employee turnover than expected in that group

in the third and fourth quarters of 2016. We spent much of the fourth quar-

ter of last year and the first quarter of 2017 re-hiring for those lost positions

and filling open territories to bring our sales capacity to levels that support

our growth ambitions. We expect to see sales force productivity continue to

increase during the second half of the year as our most recent hires continue

to ramp.

In addition to closing the headcount gap in sales, we hired more sales

professionals outside San Francisco in key regions throughout the United

States. By putting strategic account executives closer to their customers,

we believe we can foster better relationships in markets that are currently

less penetrated. We also believe these strategic relationships will continue

to help generate more wins in the enterprise space. Additionally, we are

encouraged by the expanding population of household names in

our pipeline.

Zendesk Shareholder Letter Q2 2017 - 6

Selling solutions

At Zendesk’s Analyst and Investor Day in May, we previewed our plans to

move toward selling solutions. This shift reflects our evolution from a single

product to a multi-product company with sophisticated multichannel

solutions that bring together siloed departments with shared context and

intelligence about the customer journey.

As customer journeys become more complex, customer support software

must be built for the needs of customers and businesses alike. Zendesk

helps businesses transform their customer experiences and deliver effortless

engagement through the varied communication channels and service styles

preferred by their customers. With solutions built to improve every point of

interaction across a complex journey, Zendesk brings together currently

siloed departments—such as support, marketing, and sales—and adds

context and intelligence to help businesses deliver on the promise of great

service in a personalized style, whether that’s self-service, a quick call, live

chat, messaging, or a simple email.

platformfuture

2017+

2014

solutions

products

Zendesk Shareholder Letter Q2 2017 - 7

Products

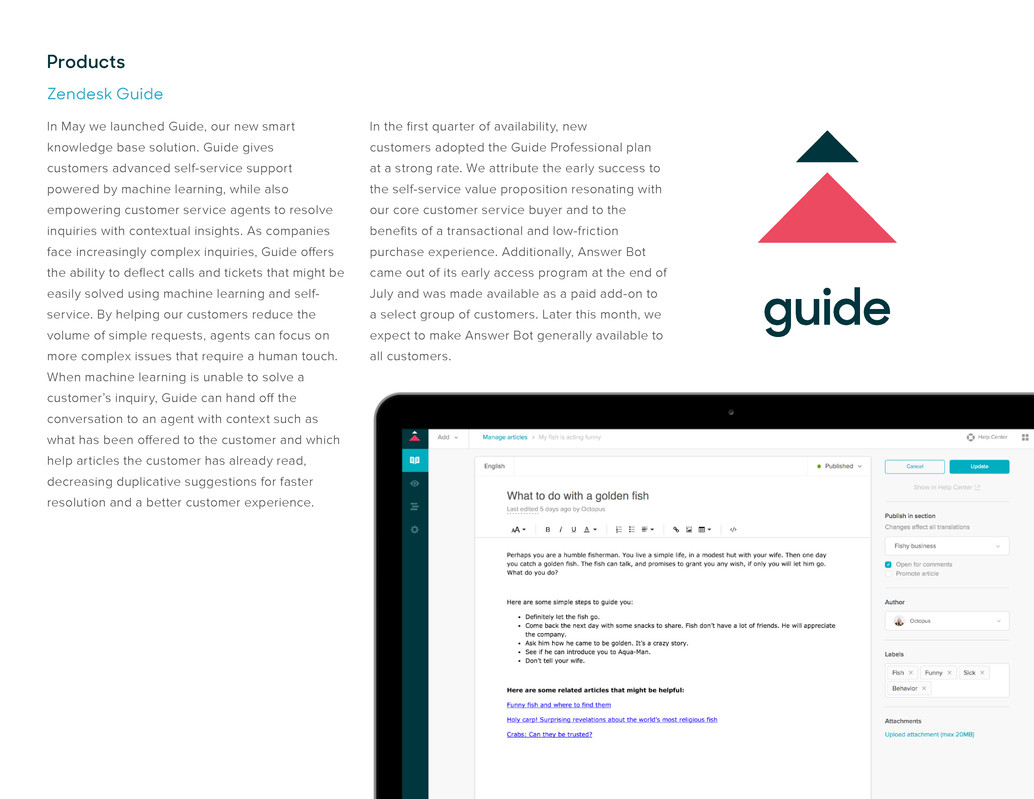

Zendesk Guide

In May we launched Guide, our new smart

knowledge base solution. Guide gives

customers advanced self-service support

powered by machine learning, while also

empowering customer service agents to resolve

inquiries with contextual insights. As companies

face increasingly complex inquiries, Guide offers

the ability to deflect calls and tickets that might be

easily solved using machine learning and self-

service. By helping our customers reduce the

volume of simple requests, agents can focus on

more complex issues that require a human touch.

When machine learning is unable to solve a

customer’s inquiry, Guide can hand off the

conversation to an agent with context such as

what has been offered to the customer and which

help articles the customer has already read,

decreasing duplicative suggestions for faster

resolution and a better customer experience.

In the first quarter of availability, new

customers adopted the Guide Professional plan

at a strong rate. We attribute the early success to

the self-service value proposition resonating with

our core customer service buyer and to the

benefits of a transactional and low-friction

purchase experience. Additionally, Answer Bot

came out of its early access program at the end of

July and was made available as a paid add-on to

a select group of customers. Later this month, we

expect to make Answer Bot generally available to

all customers.

Zendesk Shareholder Letter Q2 2017 - 8

Outbound by Zendesk

In May we announced the acquisition of

Outbound. With this small acquisition, we

expanded the product scope and market

opportunity of the Zendesk Connect product,

ultimately accelerating our time to meaningful

revenue. Outbound by Zendesk enables

businesses to automate and deliver relevant

messages across web, email, and mobile

channels and to better measure their effectiveness.

Since closing the acquisition, we have continued

to market and sell Outbound, while we work to

combine the Connect and Outbound products

into a single solution. As we discussed last

quarter, we do not expect the acquisition to have

a material impact on our 2017 revenue. However,

customer interest in Outbound has increased

significantly since the acquisition, and our focus

in the third quarter will be ramping up additional

sales specialists and working on integration with

Zendesk Support.

Zendesk Chat + Message

At the beginning of August, we launched Chat

Enterprise, designed to help businesses deliver

an effortless customer experience by providing

the tools necessary to offer real-time support

on websites, in mobile apps, and through messag-

ing channels. Chat Enterprise goes above and

beyond our previous Chat offerings to serve

larger use cases with features like skills-based

routing and roles and permissions to ensure

that customers can mitigate risk and scale

strategically. The Chat workflow and management

features have enabled our largest customers to

deploy live chat across multiple countries,

languages, and brands.

Additionally, we announced general availability for

Zendesk Message as part of the Chat Enterprise

offering. By combining Chat and Message, Chat

agents can continue to focus on their live chat

responsibilities, while extending that real-time

expertise to serve inbound queries from linked

messaging channels such as Facebook Messen-

ger, Twitter Direct Message, and LINE. We have

built our Message offering to integrate with more

messaging platforms in the future.

Zendesk Shareholder Letter Q2 2017 - 9

Embeddables

Our Web Widget and Mobile SDKs allow our customers to leverage data across Support,

Chat, and Guide and to put it all into one cohesive experience. At the end of the second

quarter, we had more than 19,000 monthly active Web Widgets, which customers can use

to start a chat, access the help center, or email for support, all without interrupting their

online experience. Over 60% of those active Web Widget customers were using it across

more than one product.

Additionally, mobile adoption continues to rise, with a 25% quarter-over-quarter increase in

the number of tickets created using our Support SDK.

As we move closer to a true multichannel solutions offering, our Embeddables will help us

collect information tied to interactions and events across the entire customer journey. With

the ability to aggregate information across every interaction, every channel, and every

customer-facing department, we will help businesses create a valuable and shared context

that improves current engagements and optimizes future ones.

Web Widget on mobile with contact options

Zendesk Shareholder Letter Q2 2017 - 10

International presence

In the second quarter, we continued with expansion activities in several regions to support our

global business, grow our customer base in key geographies, and serve our customers around

the world.

We recently announced growth plans for our Dublin office to support our business in EMEA, where

we have approximately 40,000 paid customer accounts as of the end of the second quarter. We

signed a lease for a larger office near our current Dublin location and plan to move in 2018. Along

with our current 200 employees, our expanded EMEA headquarters in Dublin provides us the space

to add 300 employees in the future.

We also are continuing to see good momentum in both Asian and Latin American markets. In June

we held our largest 2017 event to date: Zendesk Presents São Paulo, with more than 1,300

attendees. We also held one of our largest gatherings of regional reseller and implementation

partners at a summit before the event.

Our growing team in Japan is seeking broader opportunities and expanding the customer base. As

of the end of the second quarter, we have more than 1,200 paid customer accounts in Japan,

representing 60% growth year over year. That momentum was reflected in a mid-June Tokyo event—

our biggest to date in Japan—with more than 140 attendees.

In Australia, the recent Zendesk Presents Sydney event drew 160 attendees, making it the largest

Zendesk event in the Asia-Pacific region this year. In association with that event, we announced

plans to launch a new data center pod in Sydney this month in a secure AWS environment. Approxi-

mately 1,000 customers from Australia and New Zealand will move to the new data center beginning

in the third quarter.

Zendesk Shareholder Letter Q2 2017 - 11

Industry recognition

As we expand our global footprint, Zendesk has earned an increased

amount of attention from industry analysts. The opinions of these analysts

are increasingly important for us as we attract customers in larger, enter-

prise organizations. Zendesk believes that it continues to perform well in two

industry analyses that we feel are most valued by the business and IT

leaders who are focused on developing and implementing customer engage-

ment strategies. For the second consecutive year, Zendesk is a Leader in

Gartner’s Magic Quadrant for the CRM Customer Engagement Center, which

was published in May 2017. In addition, Zendesk is a Strong Performer in The

Forrester Wave™: Customer Service Solutions For Midsize Teams, Q2 2017.

A notable customer success story from the second quarter of 2017 is an

industry analyst ROI award for our customer AdRoll, the retargeting and pros-

pecting platform for more than 35,000 advertisers worldwide. AdRoll unified

13 siloed support channels into a centralized engagement center on Zendesk

for customer-facing support and account management. AdRoll

was selected from more than 176 nominations as a winner of the Nucleus

Research 2017 ROI Awards. The company’s selection was based on AdRoll’s

implementation of Zendesk and the 812% ROI that the company realized with

the project. The AdRoll story is a good example of how Zendesk often lands

in one part of a customer’s business and expands with them over time.

Gartner does not endorse any vendor, product or service

depicted in its research publications, and does not advise

technology users to select only those vendors with the high-

est ratings or other designation. Gartner research publications

consist of the opinions of Gartner’s research organization and

should not be construed as statements of fact. Gartner disclaims

all warranties, expressed or implied, with respect to this research,

including any warranties of merchantability or fitness for a

particular purpose.

Zendesk Shareholder Letter Q2 2017 - 12

Key accomplishments

Timeline not to scale

1600 1800

Google

Play

Channel

Framework

80K

Satisfaction

Prediction

70K

Inaugural

Analyst

Day

SMS Rebrand

1400

Office 365Pathfinder

Gartner MQ

Leader

Forrester

Wave

Strong

Performer

Jan

2016

Jan

2017

July

2017

India

Office

Opening

TokyoSao Paulo

São Paulo

Sydney

Answer

Bot

Enterprise

90K

Manila

Office

Opening

100K

AWS

Connect

Integration

SDK

Fabric

Montpellier

Office

Opening

Singapore

Office

Opening

+

+

ZENDESK PRESENTS

Lorem ipsum

Zendesk Shareholder Letter Q2 2017 - 13

Customers

Some of the customers to join us or expand with us recently include:

Harry’s - a popular men’s shaving supply company

MeUndies - underwear for men and women

Mixpanel - product analytics for mobile, web, and beyond

OVH - a French cloud computing company that offers virtual private servers

Peloton - a popular exercise bike with streaming indoor cycling classes

PlanGrid - a leader in construction productivity software

Rapha - creator of cycling clothing and accessories

ROBLOX - a user-generated online gaming platform

Zendesk Shareholder Letter Q2 2017 - 14

25%

27%

31%

32%

33% 33% 33%

34% 34%

35%

Operating metrics

As a proxy of our success with larger opportuni-

ties, we measure our number of contracts signed

with an annual value of $50,000 or greater. In

the second quarter, we closed over 45% more of

these contracts versus a year ago, with the

average contract size remaining roughly equal to

the second quarter of 2016. Another metric we

use to gauge our penetration within larger orga-

nizations is the percentage of recurring revenue

generated by customers with 100 or more agents,

which grew to 35% at the end of the second quar-

ter of 2017, compared to 34% at the end of the first

quarter of 2017 and 33% at the end of the second

quarter of 2016. While we expect this metric

to grow gradually, we see this second quarter

increase as a sign of growing enterprise momen-

tum as we enter into the second half of the year,

which correlates with returns from our expanding

investment in strategic account executives.

Our dollar-based net expansion rate also

increased by one percentage point to end the

second quarter at 116%, compared to 115% at the

end of the first quarter of 2017 and 118% at the

end of the second quarter of 2016. Consistent

with expectations in prior quarters, we expect our

dollar-based net expansion rate to remain in the

110-120% range over the next several quarters.

% of total quarter-ending Support MRR

from paid customer accounts with 100+ Support agents

Q1’15 Q2’15 Q3’15 Q4’15 Q1’16 Q2’16 Q3’16 Q4’16 Q1’17 Q2’17

35%100+ agents

Q2 2017

Zendesk Shareholder Letter Q2 2017 - 15

Corporate social responsibility

Our corporate social responsibility programs this year have

drawn some of our greatest employee and community engage-

ment. Employee involvement is strong across our offices, and

for the first half of 2017, both our San Francisco and Dublin

offices doubled volunteer hours as compared to the same

period in 2016. Zendesk employees completed approximately

4,600 volunteer hours globally, and the Zendesk Neighbor

Foundation donated more than $800,000 to 40 organizations

during the first half of 2017.

Zendesk values diversity among its employees and a culture in

which everyone feels welcome and can excel and grow in their

work and career. We recently hired a senior manager of

diversity and inclusion to help us further advance our efforts

worldwide. The new leader already has helped train employees

on unconscious bias and developed internal groups for our

LGBTQ employees and persons of color. We also expanded on

our tradition of participating in Pride festivities with nearly all of

our global offices taking part in local events.

San Francisco Pride Parade, June 2017

Zendesk Shareholder Letter Q2 2017 - 16

Financial measures and cash flow

We surpassed $100 million in quarterly revenue for the first time in our

history, closing out the second quarter with $101.3 million in revenue, up

36% over the second quarter of 2016. From a gross margin perspective, we

embarked on an expanded investment cycle in infrastructure to support

our continued growth, ensure our scalability, and support our growing

complexity of infrastructure requirements as part of our multi-product efforts.

As we previously stated, we anticipate our step-up investment in

infrastructure will continue throughout 2017 as we continue our transition

from co-located data centers into cloud infrastructure hosted from multiple

providers. As a result of these investments, our GAAP gross margin declined

quarter over quarter to 69.7% in the second quarter of 2017, from 69.8% in

the first quarter of 2017. GAAP gross margin increased year over year from

69.1% in the second quarter of 2016. Non-GAAP gross margin declined

quarter over quarter to 73.3%, from 73.6% in the first quarter of 2017, and

remained flat year over year when compared to 73.3% in the second quarter

of 2016.

GAAP operating loss for the second quarter of 2017 was $30.5 million

compared to GAAP operating loss for the first quarter of 2017 of $27.2 million.

GAAP operating loss for the second quarter of 2016 was $26.3 million. Non-

GAAP operating loss for the second quarter of 2017 was $6.2 million and

compares to non-GAAP operating loss for the first quarter of 2017 of $5.2

million. Non-GAAP operating loss for the second quarter of 2016 was

$5.6 million.

In the second quarter of 2017, GAAP operating margin was -30.1% versus

-29.2% in the first quarter of 2017 and -35.4% in the second quarter of 2016.

Non-GAAP operating margin declined quarter over quarter to -6.1% in the

second quarter of 2017 from -5.6% in the first quarter of 2017. Non-GAAP

operating margin was -7.6% in the second quarter of 2016.

GAAP net loss for the second quarter of 2017 was $29.3 million or $0.29 per

share, compared to GAAP net loss of $27.0 million or $0.28 per share in the

first quarter of 2017. GAAP net loss was $26.3 million or $0.28 per share for

the second quarter of 2016. Non-GAAP net loss for the second quarter of

2017 was $5.0 million or $0.05 per share, compared to non-GAAP net loss

of $5.1 million or $0.05 per share for the first quarter of 2017. Non-GAAP

net loss was $5.6 million or $0.06 per share for the second quarter of 2016.

Weighted average shares used to compute both GAAP and non-GAAP net

loss per share for the second quarter of 2017 was 99.5 million.

Non-GAAP results for the second quarter of 2017 exclude $22.4 million in

share-based compensation and related expenses (including $0.9 million

of employer tax related to employee stock transactions and $0.4 million of

amortization of share-based compensation capitalized in internal-use

software), $1.0 million of amortization of purchased intangibles, and $0.9

million in acquisition-related expenses. Non-GAAP results for the first

quarter of 2017 exclude $21.0 million in share-based compensation and

related expenses (including $1.4 million of employer tax related to employee

stock transactions and $0.4 million of amortization of share-based compen-

sation capitalized in internal-use software), and $0.9 million of amortization

of purchased intangibles. Non-GAAP results for the second quarter of 2016

exclude $19.7 million in share-based compensation and related expenses

(including $0.7 million of employer tax related to employee stock transactions

and $0.4 million of amortization of share-based compensation capitalized in

internal-use software), and $1.0 million of amortization of purchased intangibles.

During the second quarter of 2017, net cash from operating activities was

$10.1 million, and free cash flow was $4.1 million. We ended the second

quarter of 2017 with $102.8 million of cash and equivalents, and we had an

additional $137.5 million of short-term marketable securities and $68.5 million

in long-term marketable securities.

Zendesk Shareholder Letter Q2 2017 - 17

Guidance

For the third quarter of 2017, we expect revenue to range between $108.0

and $110.0 million. We expect our GAAP operating loss for the third quarter

of 2017 to range between $31.0 and $32.0 million. We expect our non-GAAP

operating loss for the third quarter of 2017 to range between $6.0 and

$7.0 million, which we estimate to exclude share-based compensation and

related expenses of approximately $23.4 million, amortization of purchased

intangibles of approximately $1.0 million and acquisition-related expenses of

$0.6 million.

For the full year of 2017, we expect revenue to range between $420.0 and

$425.0 million, compared to our previous full-year guidance range of $417.0

to $425.0 million. This range represents revenue growth between 35% and

36% year over year. We expect our GAAP operating loss to range between

$115.0 and $119.0 million. We expect our non-GAAP operating loss to range

between $16.0 and $20.0 million, which we estimate to exclude share-

based compensation and related expenses of approximately $93.3 million,

amortization of purchased intangibles of approximately $3.7 million and

acquisition-related expenses of $2.0 million. Our updated full-year guidance

reflects our confidence in being able to maintain a high growth rate in 2017.

We continue to expect net cash from operating activities and free cash flow

to be positive for the full year 2017. This target regarding free cash flow

includes cash used for purchases of property and equipment and

internal-use software development costs. We have not reconciled free cash

flow guidance to net cash from operating activities for this future period

because we do not provide guidance on the reconciling items between

net cash from operating activities and free cash flow, as a result of the

uncertainty regarding, and the potential variability of, these items. The

actual amount of such reconciling items will have a significant impact on

our free cash flow and, accordingly, a reconciliation of net cash from

operating activities to free cash flow for the period is not available without

unreasonable effort.

Finally, we estimate we will have approximately 100.7 million weighted

average shares outstanding for the third quarter of 2017 and 100.0 million

weighted average shares outstanding for the full year of 2017, each based

only on current shares outstanding and anticipated activity associated with

equity incentive plans.

Zendesk Shareholder Letter Q2 2017 - 18

Condensed consolidated

statements of operations

(In thousands, except per

share data; unaudited)

Three Months Ended

June 30,

Six Months Ended

June 30,

2017 2016 2017 2016

Revenue $101,273 $74,200 $194,280 $142,659

Cost of revenue 30,663 22,936 58,770 44,452

Gross profit 70,610 51,264 135,510 98,207

Operating expenses:

Research and development 28,698 22,134 55,154 43,731

Sales and marketing 52,628 39,350 99,929 75,522

General and administrative 19,788 16,076 38,105 31,937

Total operating expenses 101,114 77,560 193,188 151,190

Operating loss (30,504) (26,296) (57,678) (52,983)

Other income, net 508 134 726 64

Loss before provision for (benefit from) income taxes (29,996) (26,162) (56,952) (52,919)

Provision for (benefit from) income taxes (690) 92 (652) 506

Net loss $(29,306) $(26,254) $(56,300) $(53,425)

Net loss per share, basic and diluted $(0.29) $(0.28) $(0.57) $(0.58)

Weighted-average shares used to compute net loss per share, basic

and diluted 99,506 92,174 98,545 91,351

Zendesk Shareholder Letter Q2 2017 - 19

Condensed consolidated

balance sheets

(In thousands, except par

value; unaudited)

June 30, 2017 December 31, 2016

Assets

Current assets:

Cash and cash equivalents $102,775 $93,677

Marketable securities 137,489 131,190

Accounts receivable, net of allowance for doubtful

accounts of $919 and $1,269 as of June 30, 2017

and December 31, 2016, respectively

41,311 37,343

Prepaid expenses and other current assets 21,141 17,608

Total current assets 302,716 279,818

Marketable securities, noncurrent 68,502 75,168

Property and equipment, net 61,753 62,731

Goodwill and intangible assets, net 68,762 53,296

Other assets 7,909 4,272

Total assets $509,642 $475,285

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable $8,161 $4,555

Accrued liabilities 19,935 19,106

Accrued compensation and related benefits 21,982 20,281

Deferred revenue 141,345 123,276

Total current liabilities 191,423 167,218

Deferred revenue, noncurrent 1,773 1,257

Other liabilities 8,477 7,382

Total liabilities 201,673 175,857

Stockholders’ equity:

Preferred stock, par value $0.01 per share — —

Common stock, par value $0.01 per share 1,007 971

Additional paid-in capital 686,336 624,026

Accumulated other comprehensive loss (2,474) (5,197)

Accumulated deficit (376,248) (319,720)

Treasury stock, at cost (652) (652)

Total stockholders’ equity 307,969 299,428

Total liabilities and stockholders’ equity $509,642 $475,285

Condensed consolidated

statements of cash flows

(In thousands; unaudited)

Three Months Ended

June 30,

2017 2016

Cash flows from operating activities

Net loss $(29,306) $(26,254)

Adjustments to reconcile net loss to net cash provided by (used in) operating activities:

Depreciation and amortization 8,209 6,621

Share-based compensation 21,074 18,646

Other (338) 196

Changes in operating assets and liabilities:

Accounts receivable (2,303) (4,325)

Prepaid expenses and other current assets (2,502) (8,722)

Other assets and liabilities (3,262) 3

Accounts payable 1,851 1,272

Accrued liabilities 1,664 (504)

Accrued compensation and related benefits 3,990 3,164

Deferred revenue 10,999 9,874

Net cash provided by (used in) operating activities 10,076 (29)

Cash flows from investing activities

Purchases of property and equipment (4,485) (5,161)

Internal-use software development costs (1,463) (1,422)

Purchases of marketable securities (41,567) (115,376)

Proceeds from maturities of marketable securities 30,032 6,425

Proceeds from sales of marketable securities 12,141 6,027

Cash paid for the acquisition of Outbound, net of cash acquired (16,470) —

Net cash used in investing activities (21,812) (109,507)

Cash flows from financing activities

Proceeds from exercise of employee stock options 3,486 7,472

Proceeds from employee stock purchase plan 3,295 2,528

Taxes paid related to net share settlement of equity awards (1,609) (156)

Principal payment on debt — (323)

Net cash provided by financing activities 5,172 9,521

Effect of exchange rate changes on cash and cash equivalents 81 260

Net decrease in cash and cash equivalents (6,483) (99,755)

Cash and cash equivalents at beginning of period 109,258 217,791

Cash and cash equivalents at end of period $102,775 $118,036

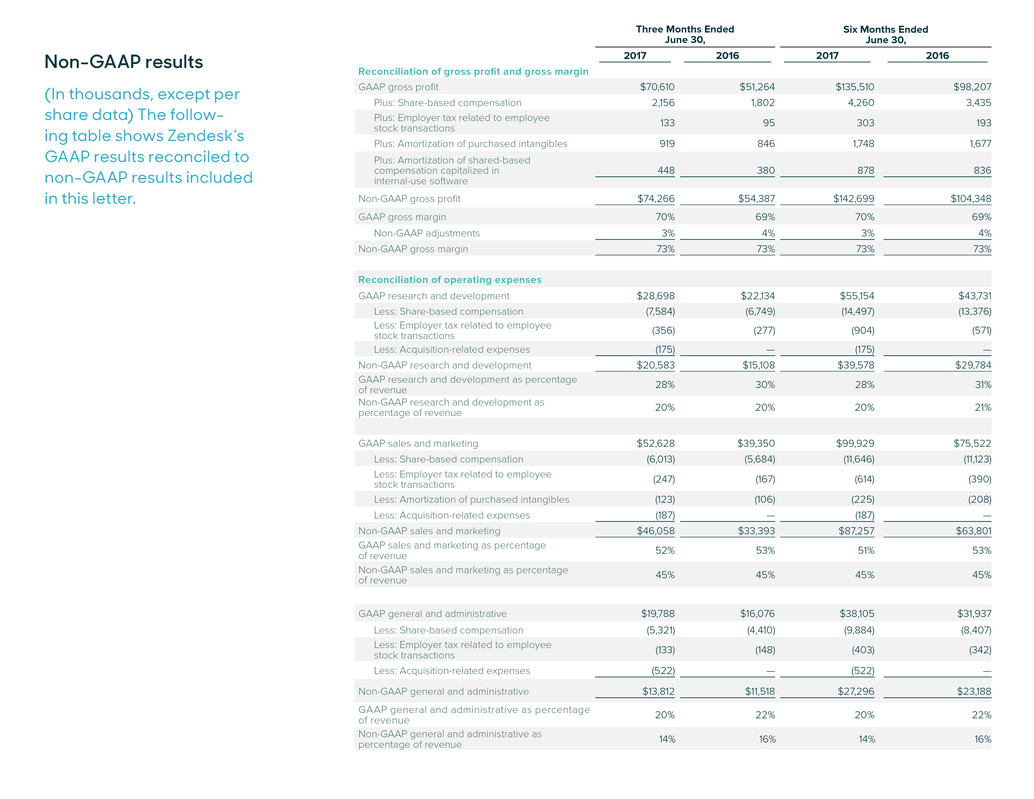

Non-GAAP results

(In thousands, except per

share data) The follow-

ing table shows Zendesk’s

GAAP results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

June 30,

Six Months Ended

June 30,

2017 2016 2017 2016

Reconciliation of gross profit and gross margin

GAAP gross profit $70,610 $51,264 $135,510 $98,207

Plus: Share-based compensation 2,156 1,802 4,260 3,435

Plus: Employer tax related to employee

stock transactions 133 95 303 193

Plus: Amortization of purchased intangibles 919 846 1,748 1,677

Plus: Amortization of shared-based

compensation capitalized in

internal-use software

448 380 878 836

Non-GAAP gross profit $74,266 $54,387 $142,699 $104,348

GAAP gross margin 70% 69% 70% 69%

Non-GAAP adjustments 3% 4% 3% 4%

Non-GAAP gross margin 73% 73% 73% 73%

Reconciliation of operating expenses

GAAP research and development $28,698 $22,134 $55,154 $43,731

Less: Share-based compensation (7,584) (6,749) (14,497) (13,376)

Less: Employer tax related to employee

stock transactions (356) (277) (904) (571)

Less: Acquisition-related expenses (175) — (175) —

Non-GAAP research and development $20,583 $15,108 $39,578 $29,784

GAAP research and development as percentage

of revenue 28% 30% 28% 31%

Non-GAAP research and development as

percentage of revenue 20% 20% 20% 21%

GAAP sales and marketing $52,628 $39,350 $99,929 $75,522

Less: Share-based compensation (6,013) (5,684) (11,646) (11,123)

Less: Employer tax related to employee

stock transactions (247) (167) (614) (390)

Less: Amortization of purchased intangibles (123) (106) (225) (208)

Less: Acquisition-related expenses (187) — (187) —

Non-GAAP sales and marketing $46,058 $33,393 $87,257 $63,801

GAAP sales and marketing as percentage

of revenue 52% 53% 51% 53%

Non-GAAP sales and marketing as percentage

of revenue 45% 45% 45% 45%

GAAP general and administrative $19,788 $16,076 $38,105 $31,937

Less: Share-based compensation (5,321) (4,410) (9,884) (8,407)

Less: Employer tax related to employee

stock transactions (133) (148) (403) (342)

Less: Acquisition-related expenses (522) — (522) —

Non-GAAP general and administrative $13,812 $11,518 $27,296 $23,188

GAAP general and administrative as percentage

of revenue 20% 22% 20% 22%

Non-GAAP general and administrative as

percentage of revenue 14% 16% 14% 16%

Zendesk Shareholder Letter Q2 2017 - 22

(continued...)

Non-GAAP results

(In thousands, except per

share data) The follow-

ing table shows Zendesk’s

GAAP results reconciled to

non-GAAP results included

in this letter.

Three Months Ended

June 30,

Six Months Ended

June 30,

2017 2016 2017 2016

Reconciliation of operating loss and

operating margin

GAAP operating loss $(30,504) $(26,296) $(57,678) $(52,983)

Plus: Share-based compensation 21,074 18,645 40,287 36,341

Plus: Employer tax related to employee stock

transactions 869 687 2,224 1,496

Plus: Amortization of purchased intangibles 1,042 952 1,973 1,885

Plus: Acquisition-related expenses 884 — 884 —

Plus: Amortization of shared-based compensation

capitalized in internal-use software 448 380 878 836

Non-GAAP operating loss $(6,187) $(5,632) $(11,432) $(12,425)

GAAP operating margin (30)% (35)% (30)% (37)%

Non-GAAP adjustments 24% 27% 24% 28%

Non-GAAP operating margin (6)% (8)% (6)% (9)%

Reconciliation of net loss

GAAP net loss $(29,306) $(26,254) $(56,300) $(53,425)

Plus: Share-based compensation 21,074 18,645 40,287 36,341

Plus: Employer tax related to employee

stock transactions 869 687 2,224 1,496

Plus: Amortization of purchased intangibles 1,042 952 1,973 1,885

Plus: Acquisition-related expenses 884 — 884 —

Plus: Amortization of shared-based compensation

capitalized in internal-use software 448 380 878 836

Non-GAAP net loss $(4,989) $(5,590) $(10,054) $12,867)

Reconciliation of net loss per share, basic

and diluted

GAAP net loss per share, basic and diluted $(0.29) $(0.28) $(0.57) $(0.58)

Non-GAAP adjustments to net loss 0.24 0.22 0.47 0.44

Non-GAAP net loss per share, basic and diluted $(0.05) $(0.06) $(0.10) $(0.14)

Weighted-average shares used to compute net loss

per share, basic and diluted 99,506 92,174 98,545 91,351

Computation of free cash flow

Net cash provided by (used in) operating activities $10,076 $(29) $17,225 $4,560

Less: purchases of property and equipment (4,485) (5,161) (9,276) (8,410)

Less: internal-use software development costs (1,463) (1,422) (3,315) (2,773)

Free cash flow $4,128 $(6,612) $4,634 $(6,623)

Zendesk Shareholder Letter Q2 2017 - 23

About Zendesk

Zendesk builds software for better customer relationships. It empowers organizations to

improve customer engagement and better understand their customers. More than 107,000

paid customer accounts in over 160 countries and territories use Zendesk products. Based

in San Francisco, Zendesk has operations in the United States, Europe, Asia, Australia, and

South America. Learn more at www.zendesk.com.

Forward-looking statements

This press release contains forward-looking statements, including, among other things,

statements regarding Zendesk’s future financial performance, its continued investment to

grow its business, and progress towards its long-term financial objectives. The words such as

“may,” “should,” “will,” “believe,” “expect,” “anticipate,” “target,” “project,” and similar phrases

that denote future expectation or intent regarding Zendesk’s financial results, operations, and

other matters are intended to identify forward-looking statements. You should not rely upon

forward-looking statements as predictions of future events.

The outcome of the events described in these forward-looking statements is subject to

known and unknown risks, uncertainties, and other factors that may cause Zendesk’s actual

results, performance, or achievements to differ materially, including (i) adverse changes in

general economic or market conditions; (ii) Zendesk’s ability to adapt its products to chang-

ing market dynamics and customer preferences or achieve increased market acceptance of

its products; (iii) Zendesk’s expectation that the future growth rate of its revenues will decline,

and that, as its costs increase, Zendesk may not be able to generate sufficient revenues to

achieve or sustain profitability; (iv) Zendesk’s limited operating history, which makes it difficult

to evaluate its prospects and future operating results; (v) Zendesk’s ability to effectively

manage its growth and organizational change; (vi) the market in which Zendesk operates is

intensely competitive, and Zendesk may not compete effectively; (vii) the development of

the market for software as a service business software applications; (viii) Zendesk’s ability to

introduce and market new products and to support its products on a shared services plat-

form; (ix) Zendesk’s ability to integrate acquired businesses and technologies successfully or

achieve the expected benefits of such acquisitions; (x) breaches in Zendesk’s security mea-

sures or unauthorized access to its customers’ data; (xi) service interruptions or performance

problems associated with Zendesk’s technology and infrastructure; (xii) real or perceived

errors, failures, or bugs in its products; (xiii) Zendesk’s substantial reliance on its customers

renewing their subscriptions and purchasing additional subscriptions; and (xiv) Zendesk’s

ability to effectively expand its sales capabilities.

The forward-looking statements contained in this press release are also subject to additional

risks, uncertainties, and factors, including those more fully described in Zendesk’s filings with

the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for

the quarter ended March 31, 2017. Further information on potential risks that could affect actu-

al results will be included in the subsequent periodic and current reports and other filings that

Zendesk makes with the Securities and Exchange Commission from time to time, including its

Quarterly Report on Form 10-Q for the quarter ended June 30, 2017.

Forward-looking statements represent Zendesk’s management’s beliefs and assumptions

only as of the date such statements are made. Zendesk undertakes no obligation to update

any forward-looking statements made in this press release to reflect events or circumstances

after the date of this press release or to reflect new information or the occurrence of unantici-

pated events, except as required by law.

About non-GAAP financial measures

To provide investors and others with additional information regarding Zendesk’s results, the

following non-GAAP financial measures were disclosed: non-GAAP gross profit and gross

margin, non-GAAP operating expenses, non-GAAP operating loss and operating margin,

non-GAAP net loss, non-GAAP net loss per share, basic and diluted, and free cash flow.

Specifically, Zendesk excludes the following from its historical and prospective non-GAAP

financial measures, as applicable:

Share-based Compensation and Amortization of Share-based Compensation Capitalized

in Internal-use Software: Zendesk utilizes share-based compensation to attract and retain

employees. It is principally aimed at aligning their interests with those of its stockholders

and at long-term retention, rather than to address operational performance for any particular

period. As a result, share-based compensation expenses vary for reasons that are generally

unrelated to financial and operational performance in any particular period.

Employer Tax Related to Employee Stock Transactions: Zendesk views the amount of

employer taxes related to its employee stock transactions as an expense that is dependent

on its stock price, employee exercise and other award disposition activity, and other factors

that are beyond Zendesk’s control. As a result, employer taxes related to its employee stock

transactions vary for reasons that are generally unrelated to financial and operational perfor-

mance in any particular period.

Amortization of Purchased Intangibles: Zendesk views amortization of purchased intangible

assets, including the amortization of the cost associated with an acquired entity’s developed

technology, as items arising from pre-acquisition activities determined at the time of an

acquisition. While these intangible assets are evaluated for impairment regularly, amortization

of the cost of purchased intangibles is an expense that is not typically affected by operations

during any particular period.

Acquisition-Related Expenses: Zendesk views acquisition-related expenses, such as

transaction costs, integration costs, restructuring costs, and acquisition-related retention

payments, including amortization of acquisition-related retention payments capitalized in in-

ternal-use software, as events that are not necessarily reflective of operational performance

during a period. In particular, Zendesk believes the consideration of measures that exclude

such expenses can assist in the comparison of operational performance in different periods

which may or may not include such expenses.

Zendesk provides disclosures regarding its free cash flow, which is defined as net cash from

operating activities, less purchases of property and equipment and internal-use software

development costs. Zendesk uses free cash flow, among other measures, to evaluate the

ability of its operations to generate cash that is available for purposes other than capital

expenditures and capitalized software development costs. Zendesk believes that informa-

tion regarding free cash flow provides investors with an important perspective on the cash

available to fund ongoing operations.

Zendesk’s disclosures regarding its expectations for its non-GAAP operating margin include

adjustments to its expectations for its GAAP operating margin that exclude the expected

share-based compensation and related expenses, amortization of purchased intangibles,

and acquisition-related expenses excluded from its expectations for non-GAAP operating

loss as compared to its expectation for GAAP operating loss for the same period.

Zendesk does not provide a reconciliation of its non-GAAP operating margin guidance to

GAAP operating margin for future periods beyond the current fiscal year because Zendesk

does not provide guidance on the reconciling items between GAAP operating margin and

non-GAAP operating margin for such periods, as a result of the uncertainty regarding, and

the potential variability of, these items. The actual amount of such reconciling items will have

a significant impact on Zendesk’s non-GAAP operating margin and, accordingly, a reconcili-

ation of GAAP operating margin to non-GAAP operating margin guidance for such periods is

not available without unreasonable effort.

Zendesk Shareholder Letter Q2 2017 - 24

About operating metrics

Zendesk reviews a number of operating metrics to evaluate its business, measure

performance, identify trends, formulate business plans, and make strategic decisions. These

include the number of paid customer accounts on Zendesk Support, Zendesk Chat, and its

other products, dollar-based net expansion rate, monthly recurring revenue represented by

its churned customers, and the percentage of its monthly recurring revenue from Support

originating from customers with 100 or more agents on Support.

Zendesk defines the number of paid customer accounts at the end of any particular period

as the sum of (i) the number of accounts on Support, exclusive of its legacy Starter plan, free

trials, or other free services, (ii) the number of accounts using Chat, exclusive of free trials

or other free services, and (iii) the number of accounts on all of its other products, exclusive

of free trials and other free services, each as of the end of the period and as identified by

a unique account identifier. Use of Support, Chat, and Zendesk’s other products requires

separate subscriptions and each of these accounts are treated as a separate paid customer

account. Existing customers may also expand their utilization of Zendesk’s products by

adding new accounts and a single consolidated organization or customer may have multiple

accounts across each of Zendesk’s products to service separate subsidiaries, divisions, or

work processes. Each of these accounts is also treated as a separate paid customer account.

Zendesk’s dollar-based net expansion rate provides a measurement of its ability to increase

revenue across its existing customer base through expansion of authorized agents associ-

ated with a paid customer account, upgrades in subscription plans, and the purchase of addi-

tional products as offset by churn, contraction in authorized agents associated with a paid

customer account, and downgrades in subscription plans. Zendesk’s dollar-based net expan-

sion rate is based upon monthly recurring revenue for a set of paid customer accounts on its

products. Monthly recurring revenue for a paid customer account is a legal and contractual

determination made by assessing the contractual terms of each paid customer account, as

of the date of determination, as to the revenue Zendesk expects to generate in the next

monthly period for that paid customer account, assuming no changes to the subscription and

without taking into account any one-time discounts or any platform usage above the sub-

scription base, if any, that may be applicable to such subscription. Monthly recurring revenue

is not determined by reference to historical revenue, deferred revenue, or any other GAAP

financial measure over any period. It is forward-looking and contractually derived as of the

date of determination.

Zendesk calculates its dollar-based net expansion rate by dividing the retained revenue net

of contraction and churn by Zendesk’s base revenue. Zendesk defines its base revenue

as the aggregate monthly recurring revenue across its products for customers with paid

customer accounts on Support or Chat as of the date one year prior to the date of calcula-

tion. Zendesk defines the retained revenue net of contraction and churn as the aggregate

monthly recurring revenue across its products for the same customer base included in the

measure of base revenue at the end of the annual period being measured. The dollar-based

net expansion rate is also adjusted to eliminate the effect of certain activities that Zendesk

identifies involving the transfer of agents between paid customer accounts, consolidation of

customer accounts, or the split of a single paid customer account into multiple paid customer

accounts. In addition, the dollar-based net expansion rate is adjusted to include paid

customer accounts in the customer base used to determine retained revenue net of con-

traction and churn that share common corporate information with customers in the customer

base that are used to determine the base revenue. Giving effect to this consolidation results

in Zendesk’s dollar-based net expansion rate being calculated across approximately 87,500

customers, as compared to the approximately 107,400 total paid customer accounts as of

June 30, 2017.

To the extent that Zendesk can determine that the underlying customers do not share

common corporate information, Zendesk does not aggregate paid customer accounts

associated with reseller and other similar channel arrangements for the purposes of deter-

mining its dollar-based net expansion rate. While not material, Zendesk believes the failure

to account for these activities would otherwise skew the dollar-based net expansion metrics

associated with customers that maintain multiple paid customer accounts across its products

and paid customer accounts associated with reseller and other similar

channel arrangements.

Zendesk does not currently incorporate operating metrics associated with its analytics

product or its Outbound product into its measurement of dollar-based net expansion rate.

For a more detailed description of how Zendesk calculates its dollar-based net expansion

rate, please refer to Zendesk’s periodic reports filed with the Securities and

Exchange Commission.

Zendesk’s disclosures regarding its expectations for its non-GAAP gross margin include

adjustments to its expectations for its GAAP gross margin that exclude share-based com-

pensation and related expenses in Zendesk’s cost of revenue and amortization of purchased

intangibles related to developed technology. The share-based compensation and related

expenses excluded due to such adjustments are primarily comprised of the share-based

compensation and related expenses for employees associated with Zendesk’s platform

infrastructure and customer experience organization.

Zendesk does not provide a reconciliation of its non-GAAP gross margin guidance to GAAP

gross margin for future periods because Zendesk does not provide guidance on the rec-

onciling items between GAAP gross margin and non-GAAP gross margin, as a result of the

uncertainty regarding, and the potential variability of, these items. The actual amount of such

reconciling items will have a significant impact on Zendesk’s non-GAAP gross margin and,

accordingly, a reconciliation of GAAP gross margin to non-GAAP gross margin guidance for

the period is not available without unreasonable effort.

Zendesk uses non-GAAP financial information to evaluate its ongoing operations and for

internal planning and forecasting purposes. Zendesk’s management does not itself, nor does

it suggest that investors should, consider such non-GAAP financial measures in isolation

from, or as a substitute for, financial information prepared in accordance with GAAP. Zendesk

presents such non-GAAP financial measures in reporting its financial results to provide inves-

tors with an additional tool to evaluate Zendesk’s operating results. Zendesk believes these

non-GAAP financial measures are useful because they allow for greater transparency with

respect to key metrics used by management in its financial and operational decision-making.

This allows investors and others to better understand and evaluate Zendesk’s operating

results and future prospects in the same manner as management.

Zendesk’s management believes it is useful for itself and investors to review, as applicable,

both GAAP information that may include items such as share-based compensation and

related expenses, amortization of purchased intangibles, and transaction costs related to

acquisitions, and the non-GAAP measures that exclude such information in order to assess

the performance of Zendesk’s business and for planning and forecasting in subsequent

periods. When Zendesk uses such a non-GAAP financial measure with respect to historical

periods, it provides a reconciliation of the non-GAAP financial measure to the most closely

comparable GAAP financial measure. When Zendesk uses such a non-GAAP financial mea-

sure in a forward-looking manner for future periods, and a reconciliation is not determinable

Zendesk Shareholder Letter Q2 2017 - 25

About customer metrics June 30, 2016

September

30, 2016

December

31, 2016

March

31, 2017

June

30, 2017

Paid Customer Accounts on Zendesk

Support (approx.)

43,700 47,400 50,800 54,900 57,800

+Paid Customer Accounts on Zendesk

Chat (approx.)

37,800 40,000 41,300 44,000 45,300

+Paid Customer Accounts on Other

Zendesk Products (approx.)

1,300 1,700 2,200 2,900 4,300

=Approximate Number of Paid Customer

Accounts

82,800 89,100 94,300 101,800 107,400

Source: Zendesk, Inc.

Contact:

Investor Contact

Marc Cabi, +1 415-852-3877

ir@zendesk.com

Media Contact

Tian Lee, +1 415-231-0847

press@zendesk.com

Zendesk calculates its monthly recurring revenue represented by its churned customers on

an annualized basis by dividing base revenue associated with paid customer accounts on

Support that churn, either by termination of the subscription or failure to renew, during the

annual period being measured, by Zendesk’s base revenue. Zendesk’s monthly recurring

revenue represented by its churned customers excludes expansion or contraction associ-

ated with paid customer accounts on Support and the effect of upgrades or downgrades in

subscription plan. The monthly recurring revenue represented by its churned customers is

adjusted to exclude paid customer accounts that churned from the customer base used that

share common corporate information with customer accounts that did not churn from the cus-

tomer base during the annual period being measured. While not material, Zendesk believes

the failure to make this adjustment could otherwise skew the monthly recurring revenue

represented by its churned customers as a result of customers that maintain multiple paid

customer accounts on Support.

Zendesk’s percentage of monthly recurring revenue from Support that is generated by cus-

tomers with 100 or more agents on Support is determined by dividing the monthly recurring

revenue from Support for paid customer accounts with 100 or more agents on Support as of

the measurement date by the monthly recurring revenue from Support for all paid customer

accounts on Support as of the measurement date. Zendesk determines the customers with

100 or more agents on Support as of the measurement date based on the number of acti-

vated agents on Support at the measurement date and includes adjustments to aggregate

paid customer accounts that share common corporate information.

Zendesk determines the annualized value of a contract by annualizing the monthly recurring

revenue for such contract.

Zendesk does not currently incorporate operating metrics associated with products other

than Support into its measurement of monthly recurring revenue represented by its churned

customers or the percentage of monthly recurring revenue from Support that is generated by

customers with 100 or more agents on Support.