Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PINNACLE WEST CAPITAL CORP | pnw201706308kexhibit991.htm |

| 8-K - 8-K - PINNACLE WEST CAPITAL CORP | a8-kfor63017earnings.htm |

Second Quarter 2017

SECOND QUARTER 2017 RESULTS

August 3, 2017

Second Quarter 20172

FORWARD LOOKING STATEMENTS AND

NON-GAAP FINANCIAL MEASURES

This presentation contains forward-looking statements based on current expectations, including statements regarding our earnings guidance and financial outlook and

goals. These forward-looking statements are often identified by words such as “estimate,” “predict,” “may,” “believe,” “plan,” “expect,” “require,” “intend,” “assume,”

“project” and similar words. Because actual results may differ materially from expectations, we caution you not to place undue reliance on these statements. A number

of factors could cause future results to differ materially from historical results, or from outcomes currently expected or sought by Pinnacle West or APS. These factors

include, but are not limited to: our ability to manage capital expenditures and operations and maintenance costs while maintaining high reliability and customer service

levels; variations in demand for electricity, including those due to weather seasonality, the general economy, customer and sales growth (or decline), and the effects of

energy conservation measures and distributed generation; power plant and transmission system performance and outages; competition in retail and wholesale power

markets; regulatory and judicial decisions, developments and proceedings; new legislation, ballet initiatives and regulation, including those relating to environmental

requirements, regulatory policy, nuclear plant operations and potential deregulation of retail electric markets; fuel and water supply availability; our ability to achieve

timely and adequate rate recovery of our costs, including returns on and of debt and equity capital investments; our ability to meet renewable energy and energy

efficiency mandates and recover related costs; risks inherent in the operation of nuclear facilities, including spent fuel disposal uncertainty; current and future

economic conditions in Arizona, including in real estate markets; the development of new technologies which may affect electric sales or delivery; the cost of debt and

equity capital and the ability to access capital markets when required; environmental, economic and other concerns surrounding coal-fired generation, including

regulation of greenhouse gas emissions; volatile fuel and purchased power costs; the investment performance of the assets of our nuclear decommissioning trust,

pension, and other postretirement benefit plans and the resulting impact on future funding requirements; the liquidity of wholesale power markets and the use of

derivative contracts in our business; potential shortfalls in insurance coverage; new accounting requirements or new interpretations of existing requirements;

generation, transmission and distribution facility and system conditions and operating costs; the ability to meet the anticipated future need for additional generation

and associated transmission facilities in our region; the willingness or ability of our counterparties, power plant participants and power plant land owners to meet

contractual or other obligations or extend the rights for continued power plant operations; and restrictions on dividends or other provisions in our credit agreements

and ACC orders. These and other factors are discussed in Risk Factors described in Part I, Item 1A of the Pinnacle West/APS Annual Report on Form 10-K for the fiscal

year ended December 31, 2016 and in Part II, Item 1A of the Pinnacle West/APS Quarterly Report on Form 10-Q for the quarter ended June 30, 2017, which you

should review carefully before placing any reliance on our financial statements, disclosures or earnings outlook. Neither Pinnacle West nor APS assumes any obligation

to update these statements, even if our internal estimates change, except as required by law.

In this presentation, references to net income and earnings per share (EPS) refer to amounts attributable to common shareholders.

We present “gross margin” per diluted share of common stock. Gross margin refers to operating revenues less fuel and purchased power expenses. Gross margin is a

“non-GAAP financial measure,” as defined in accordance with SEC rules. The appendix contains a reconciliation of this non-GAAP financial measure to the referenced

revenue and expense line items on our Consolidated Statements of Income, which are the most directly comparable financial measures calculated and presented in

accordance with generally accepted accounting principles in the United States of America (GAAP). We view gross margin as an important performance measure of the

core profitability of our operations.

We refer to “on-going earnings” in this presentation, which is also a non-GAAP financial measure. We also provide a reconciliation to show the impacts associated with

certain regulatory adjustments. We believe on-going earnings and these adjustments included in the reconciliation provide investors with a useful indicator of our

results that is comparable among periods because it excludes the effects of unusual items that may occur on an irregular basis.

Investors should note that these non-GAAP financial measures may involve judgments by management, including whether an item is classified as an unusual item.

These measures are key components of our internal financial reporting and are used by our management in analyzing the operations of our business. We believe that

investors benefit from having access to the same financial measures that management uses.

Second Quarter 20173

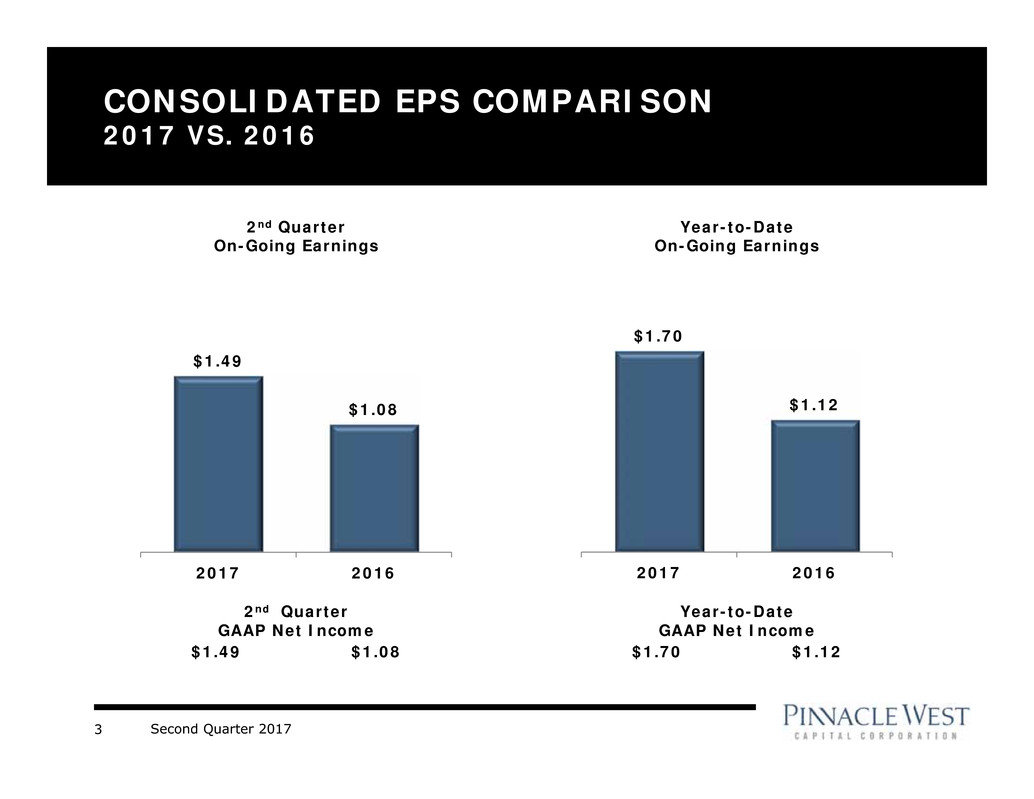

CONSOLIDATED EPS COMPARISON

2017 VS. 2016

$1.49

$1.08

2017 2016

2nd Quarter

GAAP Net Income

$1.49 $1.08

2nd Quarter

On-Going Earnings

$1.70

$1.12

2017 2016

Year-to-Date

GAAP Net Income

$1.70 $1.12

Year-to-Date

On-Going Earnings

Second Quarter 20174

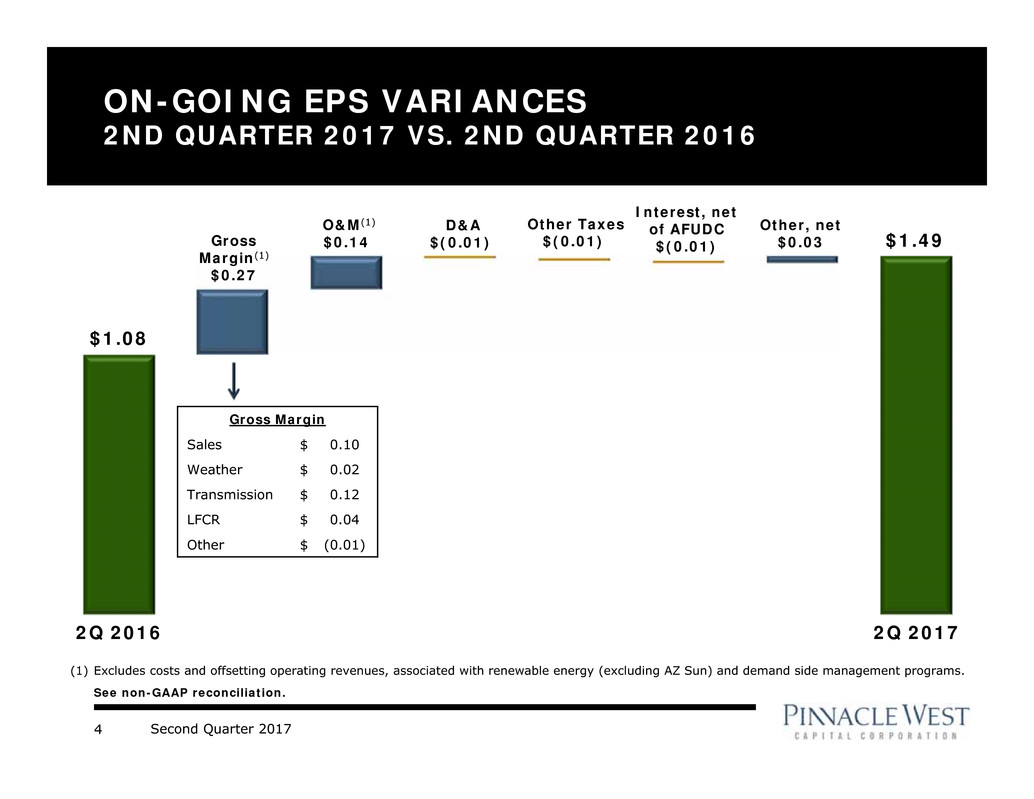

Gross

Margin(1)

$0.27

ON-GOING EPS VARIANCES

2ND QUARTER 2017 VS. 2ND QUARTER 2016

Other, net

$0.03

Interest, net

of AFUDC

$(0.01)

O&M(1)

$0.14

2Q 2016 2Q 2017

$1.08

$1.49

D&A

$(0.01)

(1) Excludes costs and offsetting operating revenues, associated with renewable energy (excluding AZ Sun) and demand side management programs.

See non-GAAP reconciliation.

Other Taxes

$(0.01)

Gross Margin

Sales $ 0.10

Weather $ 0.02

Transmission $ 0.12

LFCR $ 0.04

Other $ (0.01)

Second Quarter 20175

0

10,000

20,000

30,000

40,000

'07 '08 '09 '10 '11 '12 '13 '14 '15 '16 '17

Single Family Multifamily

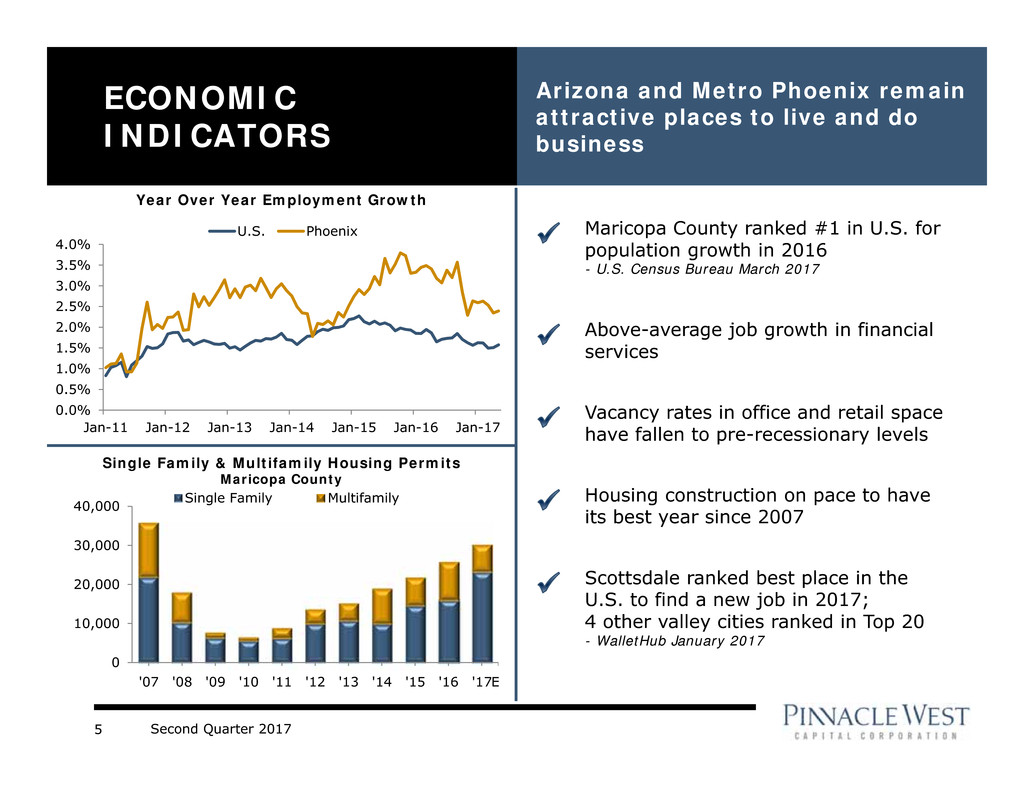

ECONOMIC

INDICATORS

Arizona and Metro Phoenix remain

attractive places to live and do

business

Single Family & Multifamily Housing Permits

Maricopa County

Above-average job growth in financial

services

Maricopa County ranked #1 in U.S. for

population growth in 2016

- U.S. Census Bureau March 2017

E

Scottsdale ranked best place in the

U.S. to find a new job in 2017;

4 other valley cities ranked in Top 20

- WalletHub January 2017

Housing construction on pace to have

its best year since 2007

Vacancy rates in office and retail space

have fallen to pre-recessionary levels

Year Over Year Employment Growth

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

U.S. Phoenix

Second Quarter 2017

APPENDIX

Second Quarter 20177

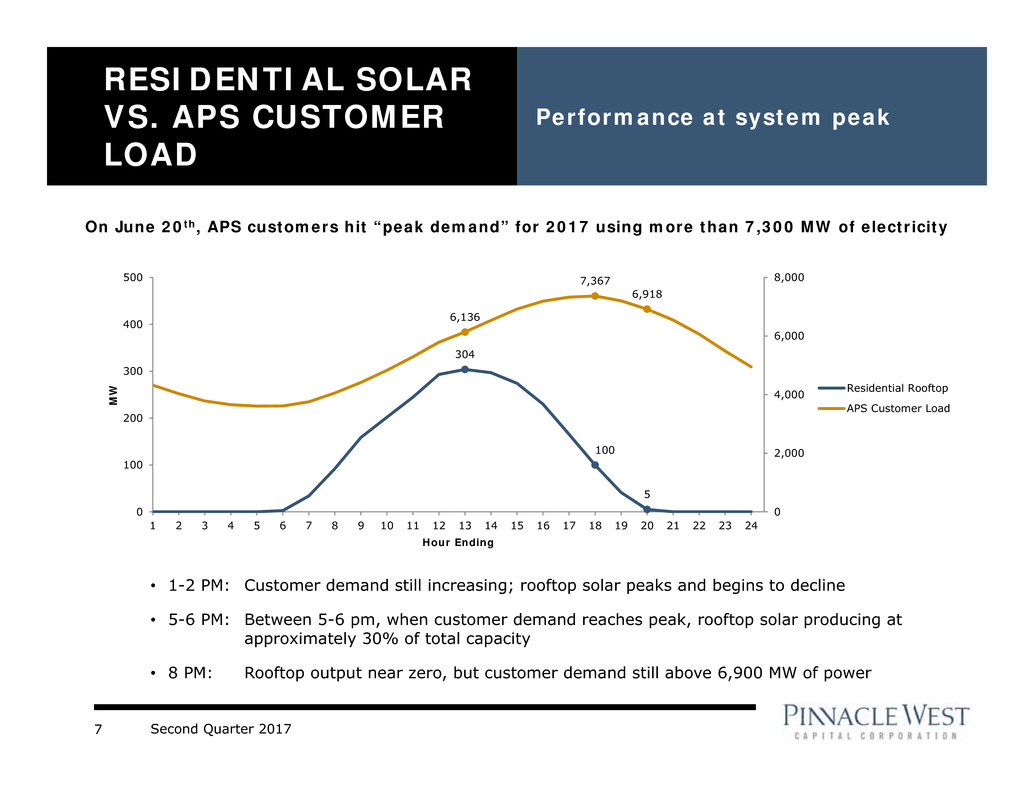

RESIDENTIAL SOLAR

VS. APS CUSTOMER

LOAD

Performance at system peak

On June 20th, APS customers hit “peak demand” for 2017 using more than 7,300 MW of electricity

304

100

5

6,136

7,367

6,918

0

2,000

4,000

6,000

8,000

0

100

200

300

400

500

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24

M

W

Hour Ending

Residential Rooftop

APS Customer Load

• 1-2 PM: Customer demand still increasing; rooftop solar peaks and begins to decline

• 5-6 PM: Between 5-6 pm, when customer demand reaches peak, rooftop solar producing at

approximately 30% of total capacity

• 8 PM: Rooftop output near zero, but customer demand still above 6,900 MW of power

Second Quarter 20178

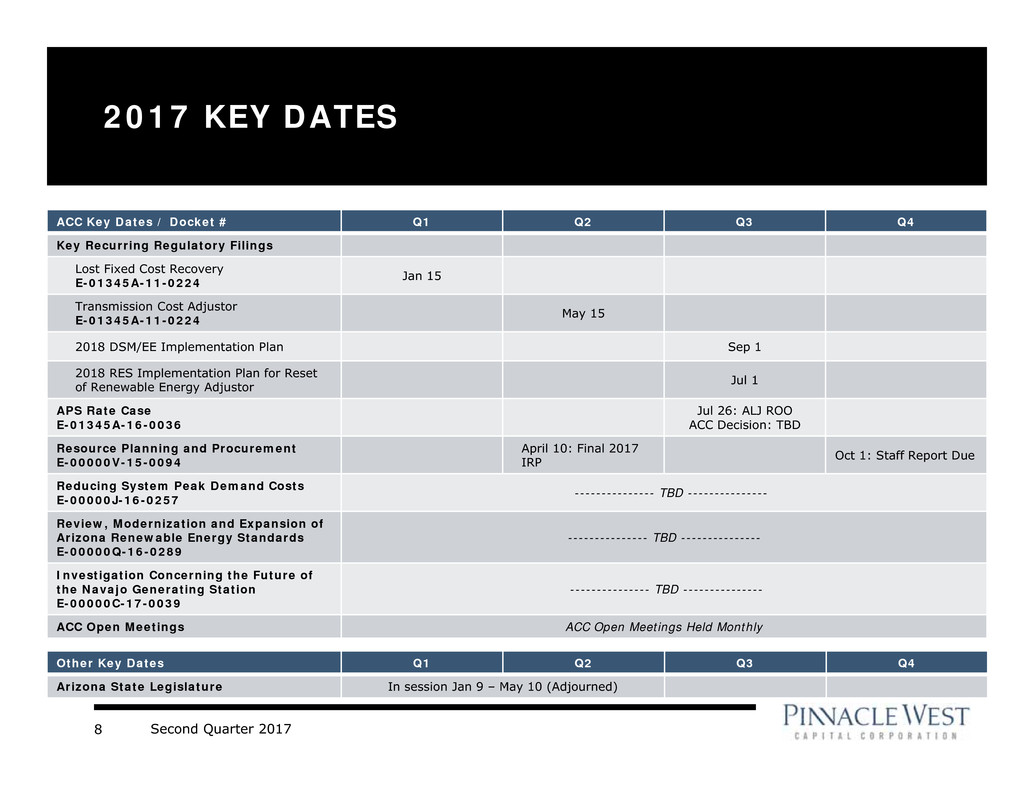

2017 KEY DATES

ACC Key Dates / Docket # Q1 Q2 Q3 Q4

Key Recurring Regulatory Filings

Lost Fixed Cost Recovery

E-01345A-11-0224 Jan 15

Transmission Cost Adjustor

E-01345A-11-0224 May 15

2018 DSM/EE Implementation Plan Sep 1

2018 RES Implementation Plan for Reset

of Renewable Energy Adjustor Jul 1

APS Rate Case

E-01345A-16-0036

Jul 26: ALJ ROO

ACC Decision: TBD

Resource Planning and Procurement

E-00000V-15-0094

April 10: Final 2017

IRP Oct 1: Staff Report Due

Reducing System Peak Demand Costs

E-00000J-16-0257 --------------- TBD ---------------

Review, Modernization and Expansion of

Arizona Renewable Energy Standards

E-00000Q-16-0289

--------------- TBD ---------------

Investigation Concerning the Future of

the Navajo Generating Station

E-00000C-17-0039

--------------- TBD ---------------

ACC Open Meetings ACC Open Meetings Held Monthly

Other Key Dates Q1 Q2 Q3 Q4

Arizona State Legislature In session Jan 9 – May 10 (Adjourned)

Second Quarter 20179

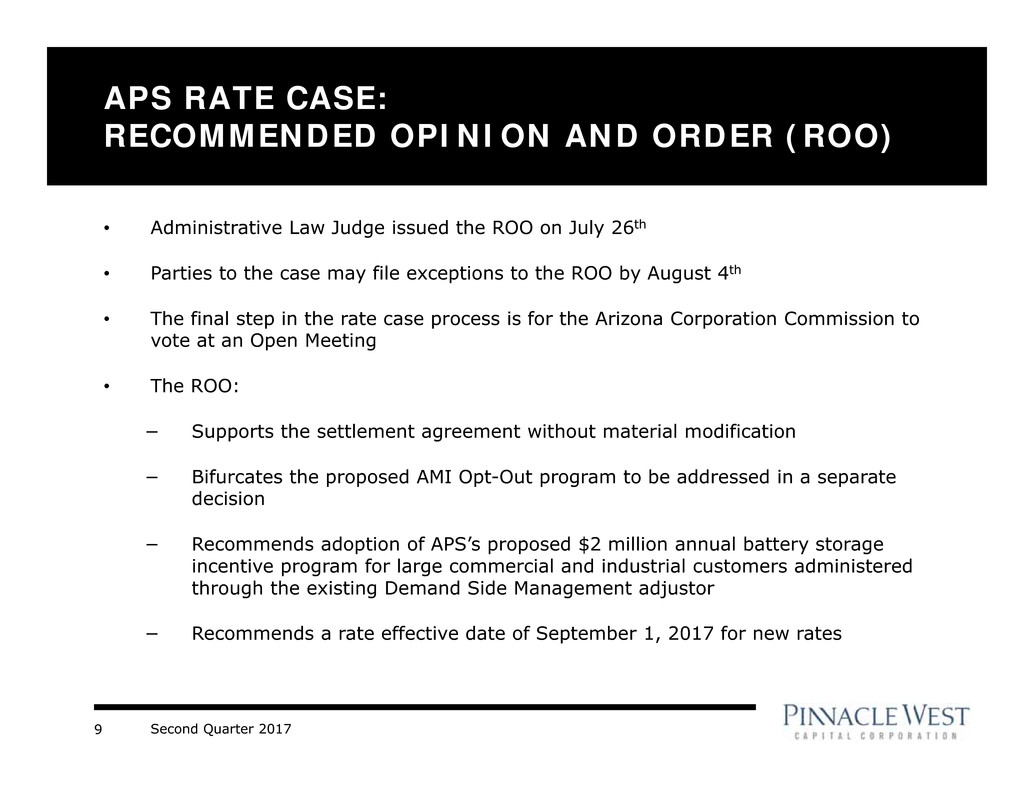

APS RATE CASE:

RECOMMENDED OPINION AND ORDER (ROO)

• Administrative Law Judge issued the ROO on July 26th

• Parties to the case may file exceptions to the ROO by August 4th

• The final step in the rate case process is for the Arizona Corporation Commission to

vote at an Open Meeting

• The ROO:

− Supports the settlement agreement without material modification

− Bifurcates the proposed AMI Opt-Out program to be addressed in a separate

decision

− Recommends adoption of APS’s proposed $2 million annual battery storage

incentive program for large commercial and industrial customers administered

through the existing Demand Side Management adjustor

− Recommends a rate effective date of September 1, 2017 for new rates

Second Quarter 201710

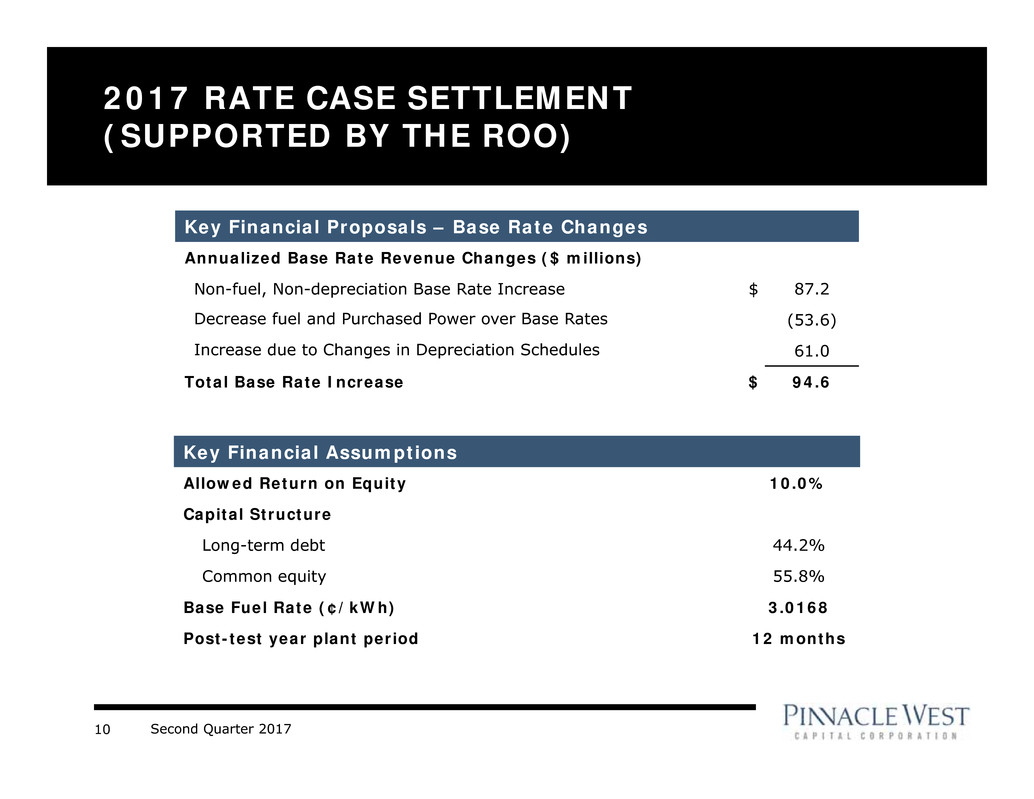

2017 RATE CASE SETTLEMENT

(SUPPORTED BY THE ROO)

Key Financial Proposals – Base Rate Changes

Annualized Base Rate Revenue Changes ($ millions)

Non-fuel, Non-depreciation Base Rate Increase $ 87.2

Decrease fuel and Purchased Power over Base Rates (53.6)

Increase due to Changes in Depreciation Schedules 61.0

Total Base Rate Increase $ 94.6

Key Financial Assumptions

Allowed Return on Equity 10.0%

Capital Structure

Long-term debt 44.2%

Common equity 55.8%

Base Fuel Rate (¢/kWh) 3.0168

Post-test year plant period 12 months

Second Quarter 201711

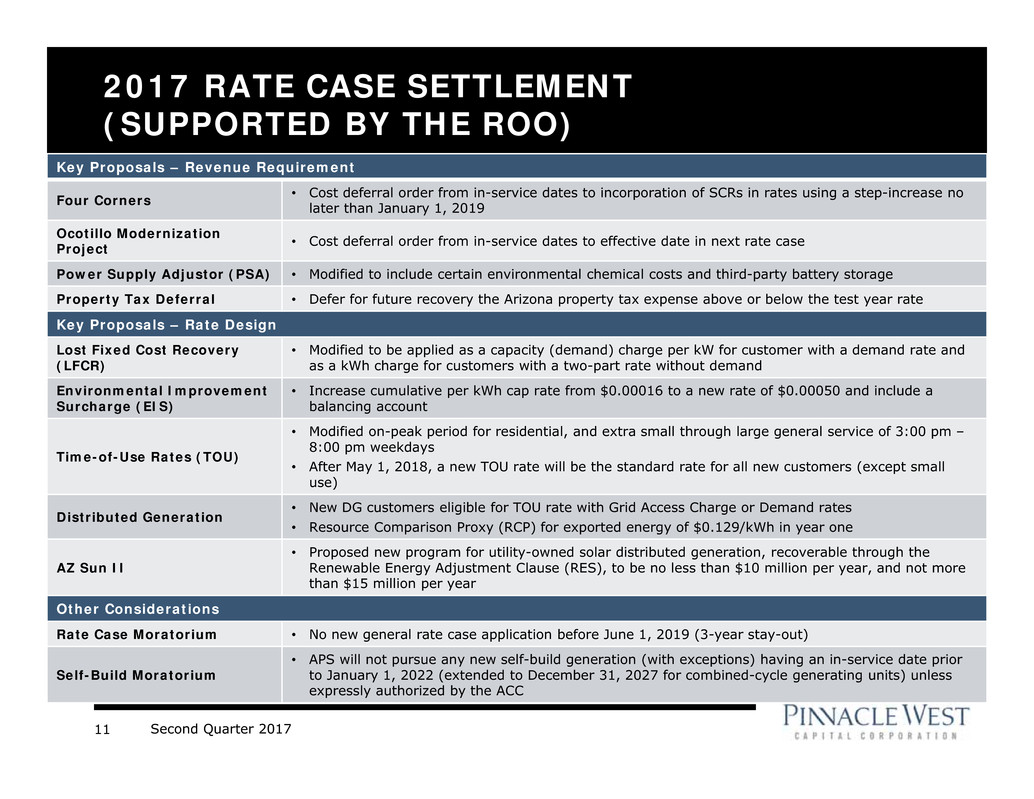

2017 RATE CASE SETTLEMENT

(SUPPORTED BY THE ROO)

Key Proposals – Revenue Requirement

Four Corners • Cost deferral order from in-service dates to incorporation of SCRs in rates using a step-increase no later than January 1, 2019

Ocotillo Modernization

Project • Cost deferral order from in-service dates to effective date in next rate case

Power Supply Adjustor (PSA) • Modified to include certain environmental chemical costs and third-party battery storage

Property Tax Deferral • Defer for future recovery the Arizona property tax expense above or below the test year rate

Key Proposals – Rate Design

Lost Fixed Cost Recovery

(LFCR)

• Modified to be applied as a capacity (demand) charge per kW for customer with a demand rate and

as a kWh charge for customers with a two-part rate without demand

Environmental Improvement

Surcharge (EIS)

• Increase cumulative per kWh cap rate from $0.00016 to a new rate of $0.00050 and include a

balancing account

Time-of-Use Rates (TOU)

• Modified on-peak period for residential, and extra small through large general service of 3:00 pm –

8:00 pm weekdays

• After May 1, 2018, a new TOU rate will be the standard rate for all new customers (except small

use)

Distributed Generation

• New DG customers eligible for TOU rate with Grid Access Charge or Demand rates

• Resource Comparison Proxy (RCP) for exported energy of $0.129/kWh in year one

AZ Sun II

• Proposed new program for utility-owned solar distributed generation, recoverable through the

Renewable Energy Adjustment Clause (RES), to be no less than $10 million per year, and not more

than $15 million per year

Other Considerations

Rate Case Moratorium • No new general rate case application before June 1, 2019 (3-year stay-out)

Self-Build Moratorium

• APS will not pursue any new self-build generation (with exceptions) having an in-service date prior

to January 1, 2022 (extended to December 31, 2027 for combined-cycle generating units) unless

expressly authorized by the ACC

Second Quarter 201712

2017 ON-GOING EARNINGS KEY DRIVERS

• EPS guidance issuance pending timing of APS rate case decision

• Retail customer growth about 1.5-2.5%

• Weather-normalized retail electricity sales volume growth about 0.0-1.0% after

customer conservation and energy efficiency and distributed renewable generation

• Annual transmission rate increase

• Operations and maintenance - Planned outages (e.g. Four Corners SCRs)

• Depreciation and amortization - Higher plant balances

• Interest expense increasing

• Higher AFUDC, driven by higher CWIP balances

Second Quarter 201713

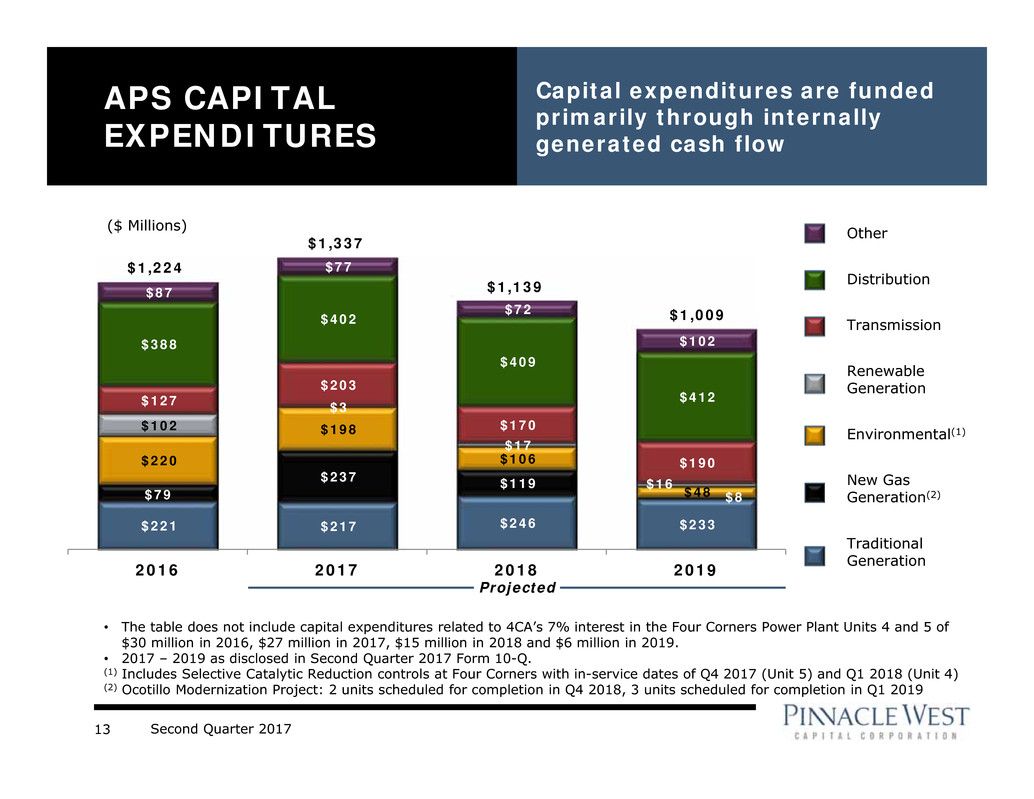

$221 $217 $246 $233

$79

$237 $119

$8

$220

$198

$106

$48

$102

$3

$17

$16

$127

$203

$170

$190

$388

$402

$409

$412

$87

$77

$72

$102

2016 2017 2018 2019

APS CAPITAL

EXPENDITURES

Capital expenditures are funded

primarily through internally

generated cash flow

($ Millions)

$1,224

$1,337

Other

Distribution

Transmission

Renewable

Generation

Environmental(1)

Traditional

Generation

Projected

$1,139

New Gas

Generation(2)

• The table does not include capital expenditures related to 4CA’s 7% interest in the Four Corners Power Plant Units 4 and 5 of

$30 million in 2016, $27 million in 2017, $15 million in 2018 and $6 million in 2019.

• 2017 – 2019 as disclosed in Second Quarter 2017 Form 10-Q.

(1) Includes Selective Catalytic Reduction controls at Four Corners with in-service dates of Q4 2017 (Unit 5) and Q1 2018 (Unit 4)

(2) Ocotillo Modernization Project: 2 units scheduled for completion in Q4 2018, 3 units scheduled for completion in Q1 2019

$1,009

Second Quarter 201714

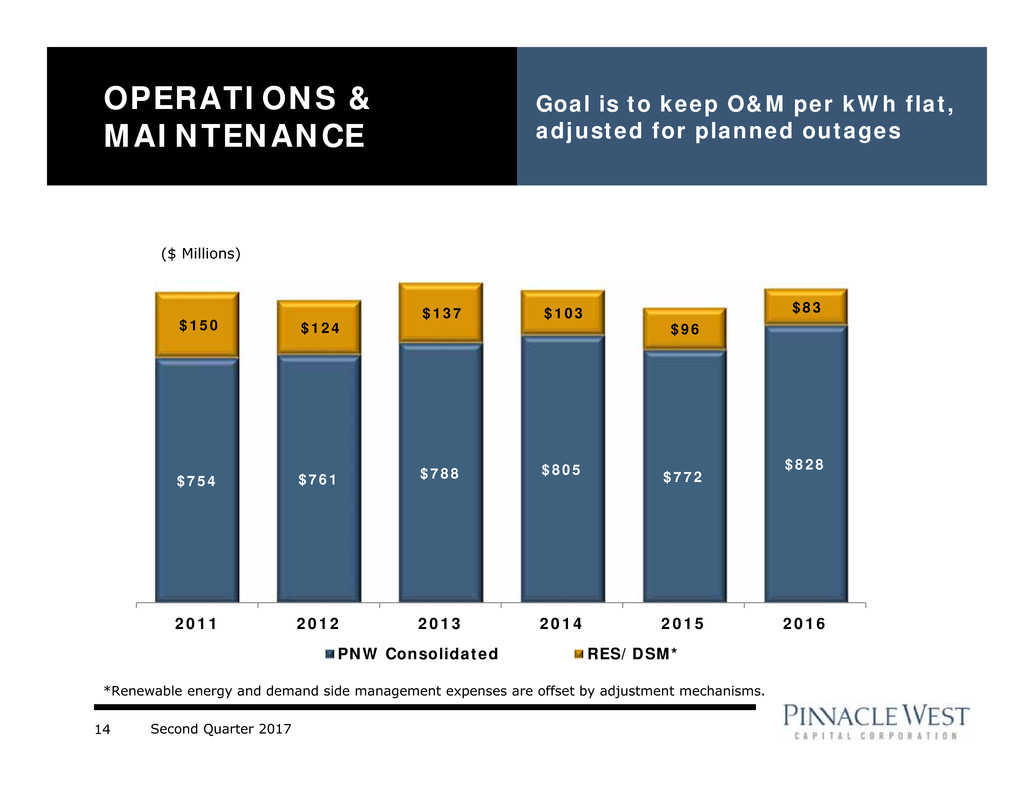

OPERATIONS &

MAINTENANCE

Goal is to keep O&M per kWh flat,

adjusted for planned outages

$754 $761 $788

$805 $772

$828

$150 $124

$137 $103

$96

$83

2011 2012 2013 2014 2015 2016

PNW Consolidated RES/DSM*

*Renewable energy and demand side management expenses are offset by adjustment mechanisms.

($ Millions)

Second Quarter 201715

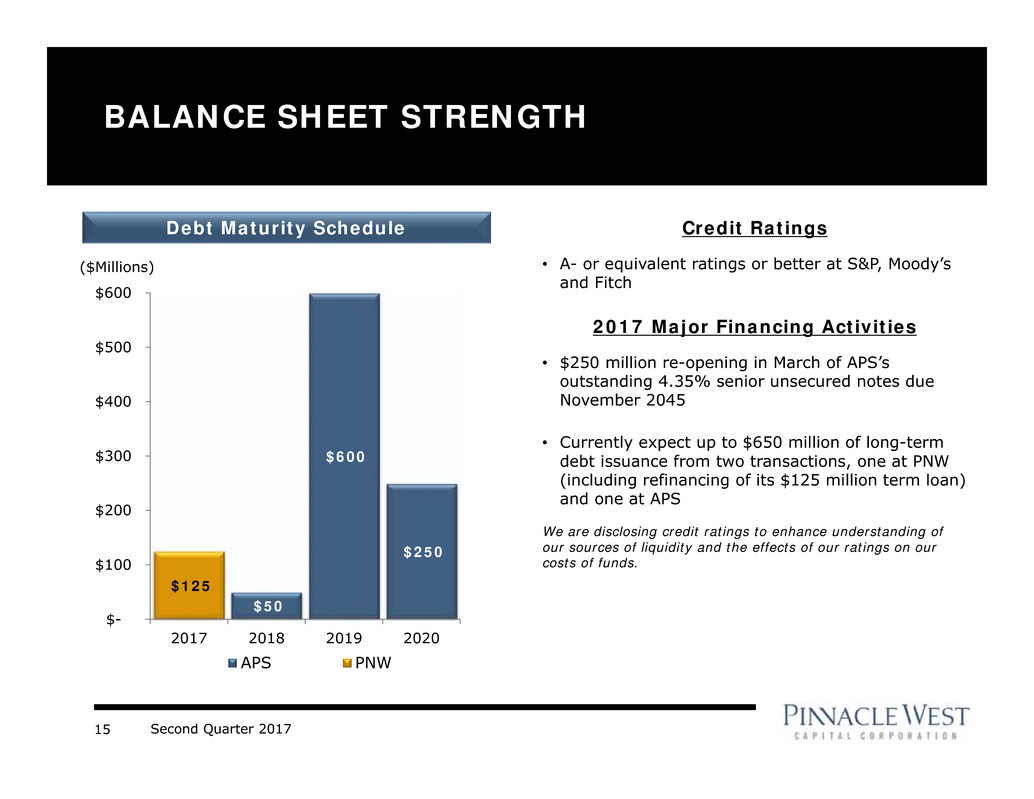

Credit Ratings

• A- or equivalent ratings or better at S&P, Moody’s

and Fitch

2017 Major Financing Activities

• $250 million re-opening in March of APS’s

outstanding 4.35% senior unsecured notes due

November 2045

• Currently expect up to $650 million of long-term

debt issuance from two transactions, one at PNW

(including refinancing of its $125 million term loan)

and one at APS

We are disclosing credit ratings to enhance understanding of

our sources of liquidity and the effects of our ratings on our

costs of funds.

BALANCE SHEET STRENGTH

$50

$600

$250

$125

$-

$100

$200

$300

$400

$500

$600

2017 2018 2019 2020

APS PNW

($Millions)

Debt Maturity Schedule

Second Quarter 201716

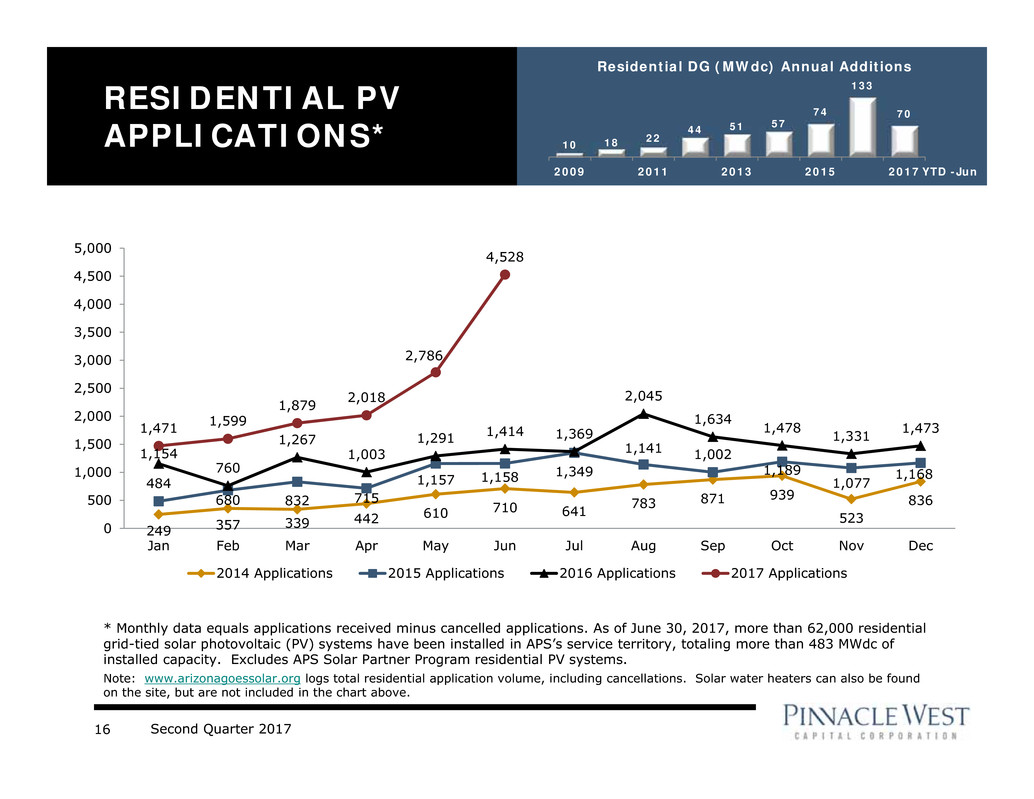

249 357 339

442 610

710 641 783

871 939

523

836

484

680 832 715

1,157 1,158 1,349

1,141 1,002

1,189

1,077

1,168

1,154

760

1,267

1,003

1,291 1,414 1,369

2,045

1,634

1,478 1,331 1,4731,471

1,599

1,879 2,018

2,786

4,528

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2014 Applications 2015 Applications 2016 Applications 2017 Applications

* Monthly data equals applications received minus cancelled applications. As of June 30, 2017, more than 62,000 residential

grid-tied solar photovoltaic (PV) systems have been installed in APS’s service territory, totaling more than 483 MWdc of

installed capacity. Excludes APS Solar Partner Program residential PV systems.

Note: www.arizonagoessolar.org logs total residential application volume, including cancellations. Solar water heaters can also be found

on the site, but are not included in the chart above.

RESIDENTIAL PV

APPLICATIONS* 10 18 22 44 51

57

74

133

70

2009 2011 2013 2015 2017

Residential DG (MWdc) Annual Additions

YTD -Jun

Second Quarter 201717

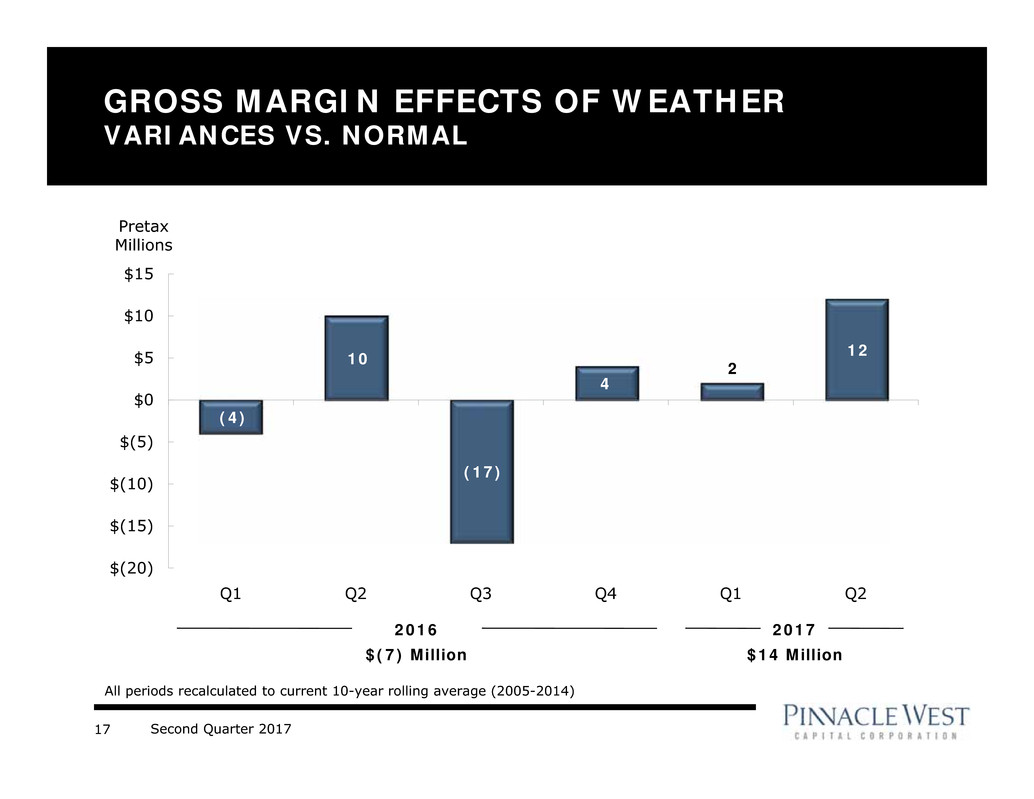

(4)

10

(17)

4

2

12

$(20)

$(15)

$(10)

$(5)

$0

$5

$10

$15

Q1 Q2 Q3 Q4 Q1 Q2

GROSS MARGIN EFFECTS OF WEATHER

VARIANCES VS. NORMAL

Pretax

Millions

All periods recalculated to current 10-year rolling average (2005-2014)

2016

$(7) Million

2017

$14 Million

Second Quarter 201718

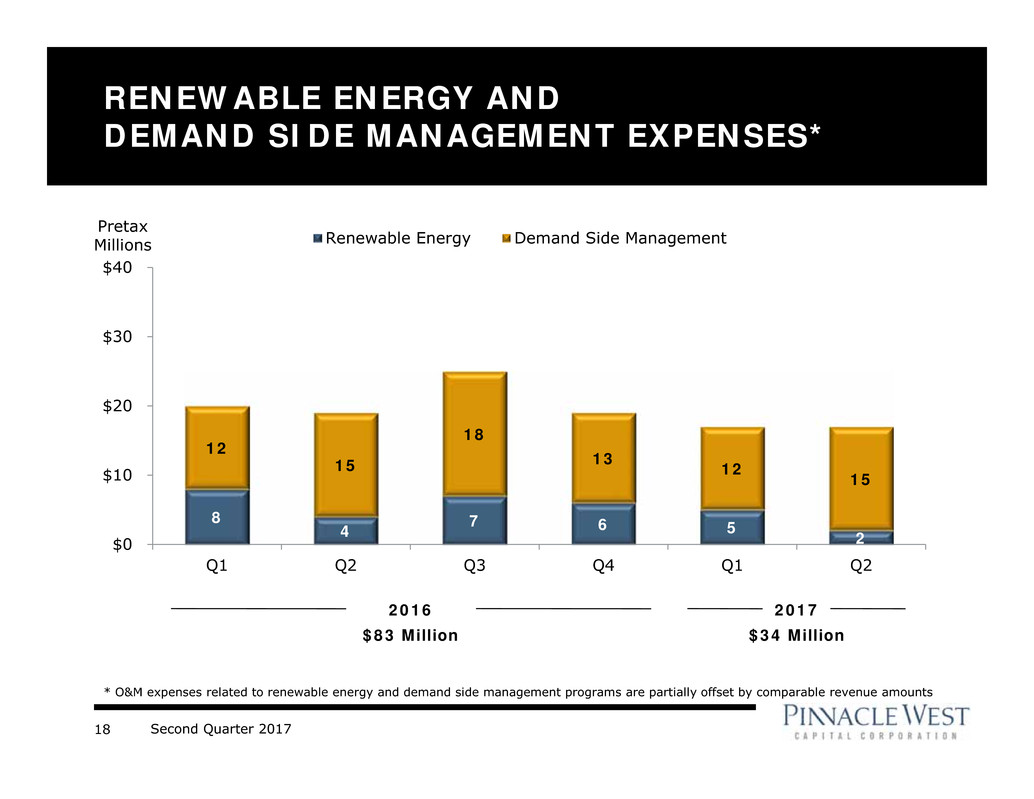

8

4

7 6 5

2

12

15

18

13

12

15

$0

$10

$20

$30

$40

Q1 Q2 Q3 Q4 Q1 Q2

Renewable Energy Demand Side Management

RENEWABLE ENERGY AND

DEMAND SIDE MANAGEMENT EXPENSES*

* O&M expenses related to renewable energy and demand side management programs are partially offset by comparable revenue amounts

Pretax

Millions

2016

$83 Million

2017

$34 Million

Second Quarter 201719

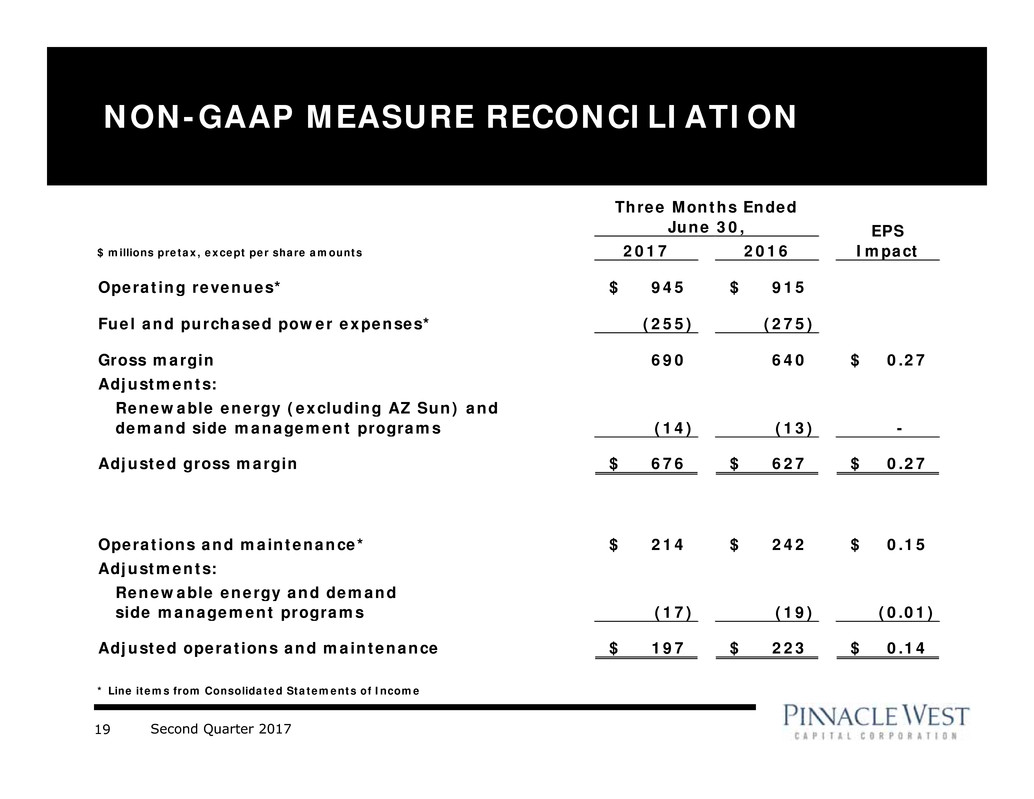

NON-GAAP MEASURE RECONCILIATION

$ millions pretax, except per share amounts 2017 2016

Operating revenues* 945$ 915$

Fuel and purchased power expenses* (255) (275)

Gross margin 690 640 0.27$

Adjustments:

Renewable energy (excluding AZ Sun) and

demand side management programs (14) (13) -

Adjusted gross margin 676$ 627$ 0.27$

Operations and maintenance* 214$ 242$ 0.15$

Adjustments:

Renewable energy and demand

side management programs (17) (19) (0.01)

Adjusted operations and maintenance 197$ 223$ 0.14$

* Line items from Consolidated Statements of Income

Three Months Ended

June 30, EPS

Impact

Second Quarter 201720

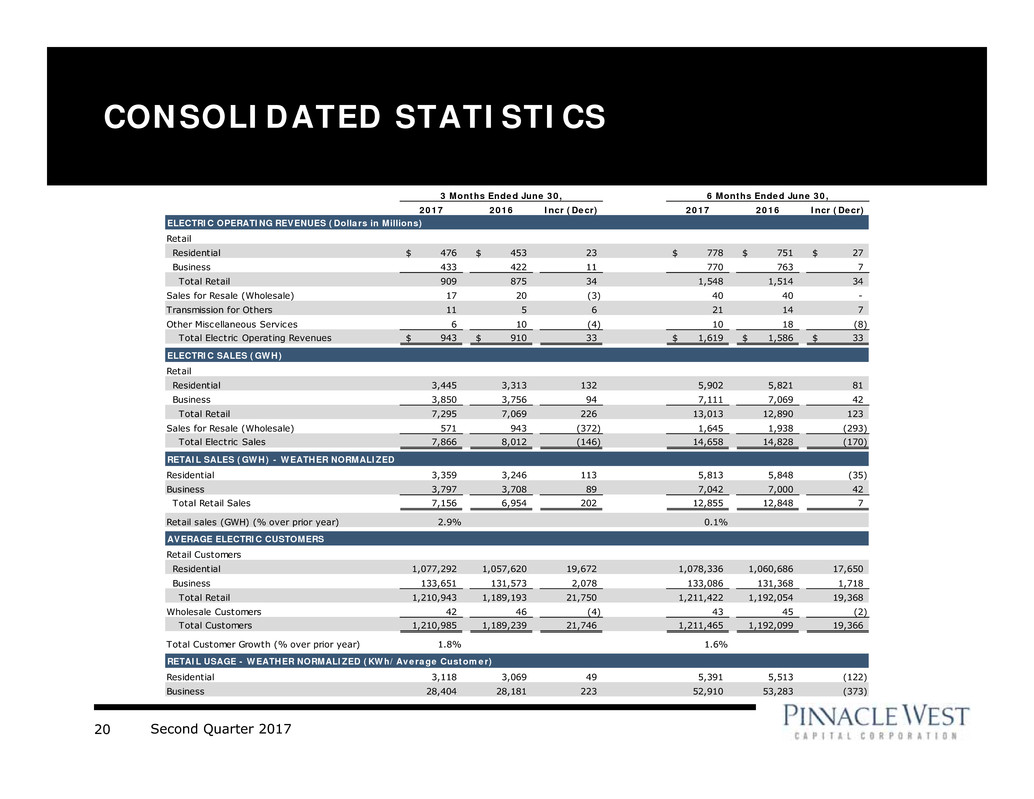

CONSOLIDATED STATISTICS

2017 2016 Incr (Decr) 2017 2016 Incr (Decr)

ELECTRIC OPERATING REVENUES (Dollars in Millions)

Retail

Residential 476$ 453$ 23 778$ 751$ 27$

Business 433 422 11 770 763 7

Total Retail 909 875 34 1,548 1,514 34

Sales for Resale (Wholesale) 17 20 (3) 40 40 -

Transmission for Others 11 5 6 21 14 7

Other Miscellaneous Services 6 10 (4) 10 18 (8)

Total Electric Operating Revenues 943$ 910$ 33 1,619$ 1,586$ 33$

ELECTRIC SALES (GWH)

Retail

Residential 3,445 3,313 132 5,902 5,821 81

Business 3,850 3,756 94 7,111 7,069 42

Total Retail 7,295 7,069 226 13,013 12,890 123

Sales for Resale (Wholesale) 571 943 (372) 1,645 1,938 (293)

Total Electric Sales 7,866 8,012 (146) 14,658 14,828 (170)

RETAIL SALES (GWH) - WEATHER NORMALIZED

Residential 3,359 3,246 113 5,813 5,848 (35)

Business 3,797 3,708 89 7,042 7,000 42

Total Retail Sales 7,156 6,954 202 12,855 12,848 7

Retail sales (GWH) (% over prior year) 2.9% 0.1%

AVERAGE ELECTRIC CUSTOMERS

Retail Customers

Residential 1,077,292 1,057,620 19,672 1,078,336 1,060,686 17,650

Business 133,651 131,573 2,078 133,086 131,368 1,718

Total Retail 1,210,943 1,189,193 21,750 1,211,422 1,192,054 19,368

Wholesale Customers 42 46 (4) 43 45 (2)

Total Customers 1,210,985 1,189,239 21,746 1,211,465 1,192,099 19,366

Total Customer Growth (% over prior year) 1.8% 1.6%

RETAIL USAGE - WEATHER NORMALIZED (KWh/Average Customer)

Residential 3,118 3,069 49 5,391 5,513 (122)

Business 28,404 28,181 223 52,910 53,283 (373)

3 Months Ended June 30, 6 Months Ended June 30,

Second Quarter 201721

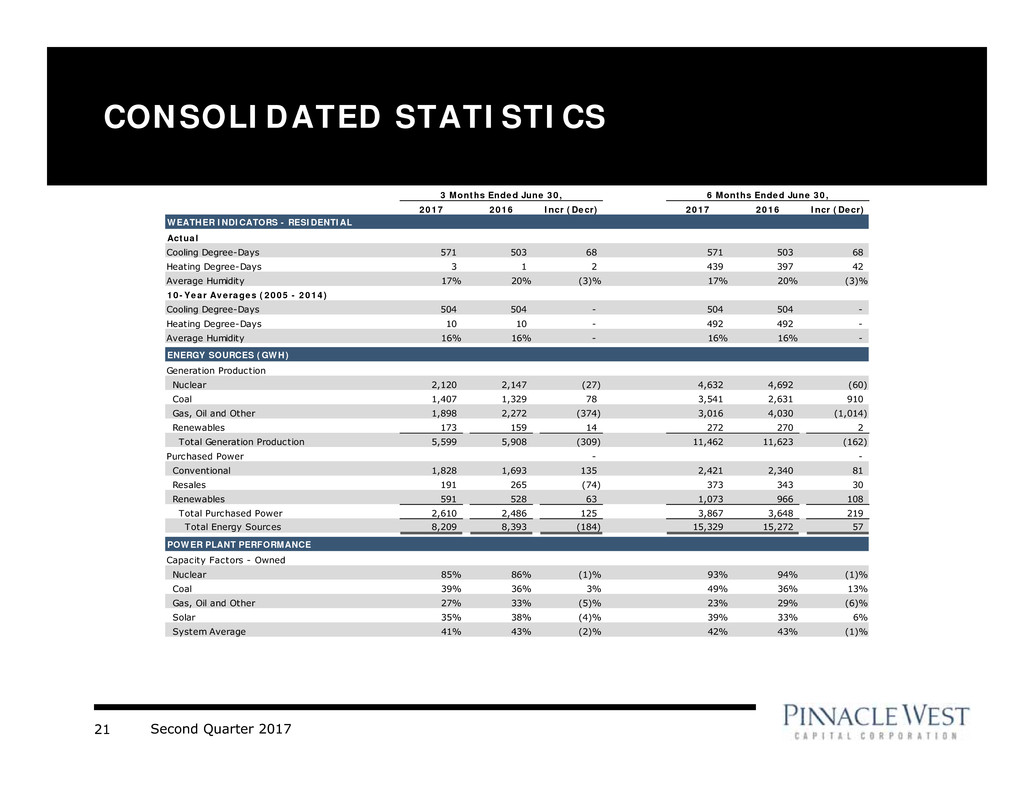

CONSOLIDATED STATISTICS

2017 2016 Incr (Decr) 2017 2016 Incr (Decr)

WEATHER INDICATORS - RESIDENTIAL

Actual

Cooling Degree-Days 571 503 68 571 503 68

Heating Degree-Days 3 1 2 439 397 42

Average Humidity 17% 20% (3)% 17% 20% (3)%

10-Year Averages (2005 - 2014)

Cooling Degree-Days 504 504 - 504 504 -

Heating Degree-Days 10 10 - 492 492 -

Average Humidity 16% 16% - 16% 16% -

ENERGY SOURCES (GWH)

Generation Production

Nuclear 2,120 2,147 (27) 4,632 4,692 (60)

Coal 1,407 1,329 78 3,541 2,631 910

Gas, Oil and Other 1,898 2,272 (374) 3,016 4,030 (1,014)

Renewables 173 159 14 272 270 2

Total Generation Production 5,599 5,908 (309) 11,462 11,623 (162)

Purchased Power - -

Conventional 1,828 1,693 135 2,421 2,340 81

Resales 191 265 (74) 373 343 30

Renewables 591 528 63 1,073 966 108

Total Purchased Power 2,610 2,486 125 3,867 3,648 219

Total Energy Sources 8,209 8,393 (184) 15,329 15,272 57

POWER PLANT PERFORMANCE

Capacity Factors - Owned

Nuclear 85% 86% (1)% 93% 94% (1)%

Coal 39% 36% 3% 49% 36% 13%

Gas, Oil and Other 27% 33% (5)% 23% 29% (6)%

Solar 35% 38% (4)% 39% 33% 6%

System Average 41% 43% (2)% 42% 43% (1)%

3 Months Ended June 30, 6 Months Ended June 30,