Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - PARKER HANNIFIN CORP | exhibit9914qfy17.htm |

| 8-K - 8-K - PARKER HANNIFIN CORP | coverform8-k4qfy17.htm |

4th Quarter & Fiscal Year 2017

Earnings Release

Parker Hannifin Corporation

August 3, 2017

Exhibit 99.2

Forward-Looking Statements and

Non-GAAP Financial Measures

Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in

the future to unforeseen uncertainties and risks. These statements may be identified from use of forward-looking terminology such as “anticipates,” “believes,” “may,” “should,” “could,”

“potential,” “continues,” “plans,” “forecasts,” “estimates,” “projects,” “predicts,” “would,” “intends,” “anticipates,” “expects,” “targets,” “is likely,” “will,” or the negative of these terms and

similar expressions, and include all statements regarding future performance, earnings projections, events or developments. It is possible that the future performance and earnings

projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and

aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating

margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. A change in the economic conditions in

individual markets may have a particularly volatile effect on segment performance.

Among other factors which may affect future performance and earnings projections are: economic conditions within the company’s key markets, and the company’s ability to maintain

and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current

economic environment, and growth, innovation and global diversification initiatives. A change in the economic conditions in individual markets may have a particularly volatile effect on

segment performance. Among other factors which may affect future performance of the company are, as applicable: changes in business relationships with and purchases by or from

major customers, suppliers or distributors, including delays or cancellations in shipments; disputes regarding contract terms or significant changes in financial condition, changes in

contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding

timing, successful completion or integration of acquisitions and similar transactions, including the integration of CLARCOR; the ability to successfully divest businesses planned for

divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the

ability to complete such activities and realize the anticipated cost savings from such activities; ability to implement successfully capital allocation initiatives, including timing, price and

execution of share repurchases; availability, limitations or cost increases of raw materials, component products and/or commodities that cannot be recovered in product pricing; ability to

manage costs related to insurance and employee retirement and health care benefits; compliance costs associated with environmental laws and regulations; potential labor disruptions;

threats associated with and efforts to combat terrorism and cyber-security risks; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the

outcome of any appeals; competitive market conditions and resulting effects on sales and pricing; and global economic factors, including manufacturing activity, air travel trends,

currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these

statements as of the date of this disclosure, and undertakes no obligation to update them unless otherwise required by law.

This presentation reconciles (a) sales amounts reported in accordance with U.S. GAAP to sales amounts adjusted to remove the effects of acquisitions and the effects of currency

exchange rates, (b) cash flow from operating activities and cash flow from operating activities as a percent of sales in accordance with U.S. GAAP to cash flow from operating activities

and cash flow from operating activities as a percent of sales without the effect of discretionary pension plan contributions, (c) segment operating income and operating margins reported

in accordance with U.S. GAAP to segment operating income and operating margins without the effect of business realignment charges, CLARCOR acquisition expenses and

CLARCOR costs to achieve, (d) Below the Line Items reported in accordance with U.S. GAAP to Below the Line Items without the effect of CLARCOR acquisition expenses, and (e)

actual and forecast earnings per diluted share reported in accordance with U.S. GAAP to actual and forecast earnings per diluted share without the effect of business realignment

charges, CLARCOR acquisition expenses and CLARCOR costs to achieve. The effects of acquisitions, currency exchange rates, discretionary pension plan contributions, business

realignment charges, CLARCOR acquisition expenses and CLARCOR costs to achieve are removed to allow investors and the company to meaningfully evaluate changes in sales, and

cash flow from operating activities as a percent of sales, segment operating income, operating margins, Below the Line Items and earnings per diluted share on a comparable basis

from period to period. Full year adjusted guidance removes business realignment charges and CLARCOR acquisition expenses.

Please visit www.PHstock.com for more information

2

Agenda

3

• Chairman & CEO Comments

• Results & Outlook

• Questions & Answers

Chairman and CEO Comments

4th Quarter FY2017 Results

Fourth Quarter Sales Increased 18% to $3.5B

Organic Sales +6%, Acquisitions +13%, Total Parker Orders +8%

Earnings per Share +21% to a record $2.15; or +29% to $2.45 Adjusted

Segment Operating Margins of 15.3%; 16.8% Adjusted, up 120 bps.

Full Year Fiscal 2017 Results

Recordable Accident Reduction of 22%

Sales Increased 6% to $12.0B, Organic Sales +2%,

Earnings per Share +23% to $7.25, or +26% to $8.11 Adjusted

Segment Operating Margins of 14.9%; or 15.8% Adjusted, up 100 bps.

Cash Flow 12.7% of Sales (excluding discretionary pension contribution)

Free Cash Flow Conversion was 134%

Fiscal 2018 Guidance

Sales Growth forecast in the Range of 11.4% to 15.0%

FY18 EPS Guidance Midpoint of $8.23 As Reported; $8.80 Adjusted

Realignment Expenses of $58M, Clarcor Costs to Achieve of $52M

4

Diluted Earnings Per Share

4th Quarter & Fiscal Year 2017

5

¹Adjusted for Business Realignment Charges, CLARCOR Acquisition Expenses

²Adjusted for Business Realignment Charges

6

Influences on Adjusted Earnings Per Share

4th Quarter FY2017 vs. 4th Quarter FY2016

¹Adjusted for Business Realignment Charges, CLARCOR Acquisition Expenses

²Adjusted for Business Realignment Charges

Influences on Adjusted Earnings Per Share

FY2017 vs. FY2016

7

¹Adjusted for Business Realignment Charges, CLARCOR Acquisition-Expenses

²Adjusted for Business Realignment Charges

³Primarily driven by $36M Stock Option Expense Tax Credit

Sales & Segment Operating Margin

Total Parker

8

*Acquisitions include: Jäger (closed 7/1/16), Helac (closed 2/1/17), CLARCOR (closed 2/28/17)

FY2017

%

Change FY2016

12,029$ 5.9 % 11,361$

558 4.9 %

(84) (0.7)%

11,556$ 1.7 %

FY2017

% of

Sales FY2016 % of Sales

1,790$ 14.9 % 1,576$ 13.9 %

56 107

58

1,904$ 15.8 % 1,682$ 14.8 %

Full Year$ in millions 4th Quarter

FY2017

%

Change FY2016

Sales

As Reported 3,496$ 18.2 % 2,957$

Acquisitions* 382 12.9 %

Currency (21) (0.7)%

Organic Sales 3,135$ 6.0 %

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 535$ 15.3 % 437$ 14.8 %

Business Realignment 21 25

CLARCOR Acquisition Expense 32

Adjusted 588$ 16.8 % 462$ 15.6 %

Sales & Segment Operating Margin

Diversified Industrial North America

9

*Acquisitions include: Jäger (closed 7/1/16), Helac (closed 2/1/17), CLARCOR (closed 2/28/17)

Full Year

FY2017

%

Change FY2016

5,367$ 8.3 % 4,955$

436 8.8 %

(17) (0.3)%

4,947$ (0.2)%

FY2017

% of

Sales FY2016 % of Sales

874$ 16.3 % 790$ 15.9 %

20 42

58

952$ 17.7 % 832$ 16.8 %

$ in millions 4th Quarter

FY2017

%

Change FY2016

Sales

As Reported 1,665$ 32.2 % 1,260$

Acquisitions* 316 25.1 %

Currency (4) (0.3)%

Organic Sales 1,353$ 7.4 %

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 262$ 15.7 % 221$ 17.5 %

Business Realignment 10 5

CLARCOR Acquisition Expense 32

Adjusted 304$ 18.2 % 226$ 18.0 %

Sales & Segment Operating Margin

Diversified Industrial International

10

*Acquisitions include: Jäger (closed 7/1/16), Helac (closed 2/1/17), CLARCOR (closed 2/28/17)

Full Year

FY2017

%

Change FY2016

4,378$ 5.6 % 4,145$

121 2.9 %

(66) (1.6)%

4,323$ 4.3 %

FY2017

% of

Sales FY2016 % of Sales

579$ 13.2 % 448$ 10.8 %

33 61

612$ 14.0 % 509$ 12.3 %

$ in millions 4th Quarter

FY2017

%

Change FY2016

Sales

As Reported 1,228$ 12.2 % 1,095$

Acquisitions* 66 6.0 %

Currency (17) (1.5)%

Organic Sales 1,179$ 7.7 %

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 161$ 13.2 % 119$ 10.8 %

Business Realignment 11 19

Adjusted 172$ 14.0 % 137$ 12.6 %

Sales & Segment Operating Margin

Aerospace Systems

11

$ in millions 4th Quarter

FY2017

%

Change FY2016

Sales

As Reported 603$ 0.1 % 602$

Acquisitions - - %

Currency (0) (0.0)%

Organic Sales 603$ 0.1 %

FY2017

% of

Sales FY2016

% of

Sales

Segment Operating Margin

As Reported 112$ 18.5 % 98$ 16.2 %

Business Realignment (0) 1

Adjusted 112$ 18.5 % 99$ 16.4 %

FY2017

%

Change FY2016

2,285$ 1.1 % 2,260$

- - %

(1) (0.0)%

2,285$ 1.1 %

FY2017

% of

Sales FY2016 % of Sales

337$ 14.8 % 338$ 14.9 %

3 4

340$ 14.9 % 341$ 15.1 %

Full Year

12

FY17 Q4 Highlights – Legacy Parker¹

As Reported FY16 Q4 FY17 Q4

Total

Parker

Total

Parker

Clarcor

Legacy

Parker

Net Sales $2,957 $3,496 $351 $3,145

Operating Income $437 $535 ($3) $538

Operating Margin 14.8% 15.3% 17.1%

Adjusted² FY16 Q4 FY17 Q4

Total

Parker

Total

Parker

Clarcor

Legacy

Parker

Net Sales $2,957 $3,496 $351 $3,145

Operating Income $462 $588 $30 $558

Operating Margin 15.6% 16.8% 17.7%

¹Legacy Parker excludes impact from Clarcor

²Adjusted for business realignment charges and Clarcor acquisition expenses

13

FY17 Highlights – Legacy Parker¹

As Reported FY16 FY17

Total

Parker

Total

Parker

Clarcor

Legacy

Parker

Net Sales $11,361 $12,029 $487 $11,542

Operating Income $1,576 $1,790 ($16) $1,806

Operating Margin 13.9% 14.9% 15.7%

Adjusted² FY16 FY17

Total

Parker

Total

Parker

Clarcor

Legacy

Parker

Net Sales $11,361 $12,029 $487 $11,542

Operating Income $1,682 $1,904 $42 $1,862

Operating Margin 14.8% 15.8% 16.1%

¹Legacy Parker excludes impact from Clarcor

²Adjusted for business realignment charges and Clarcor acquisition expenses

Jun 2017 Mar 2017 Jun 2016 Mar 2016

Total Parker 8 %+ 8 %+ 1 %- 6 %-

Diversified Industrial North America 10 %+ 9 %+ 10 %- 9 %-

Diversified Industrial International 10 %+ 13 %+ 3 %+ 6 %-

Aerospace Systems 1 %+ 0% 14 %+ 1 %+

Order Rates

14

Excludes Acquisitions, Divestitures & Currency

3-month year-over-year comparisons of total dollars, except Aerospace Systems

Aerospace Systems is calculated using a 12-month rolling average

Cash Flow from Operating Activities

15

*Adjusted for Discretionary Pension Plan Contribution

Dollars in millions

As Reported Cash Flow From Operating Activities

Discretionary Pension Plan Contribution

Adjusted Cash Flow From Operating Activities

Full Year

FY 2017 % of Sales FY 2016 % of Sales

1,302$ 10.8% 1,211 10.7%

220 200

1,522$ 12.7% 1,411 12.4%

*

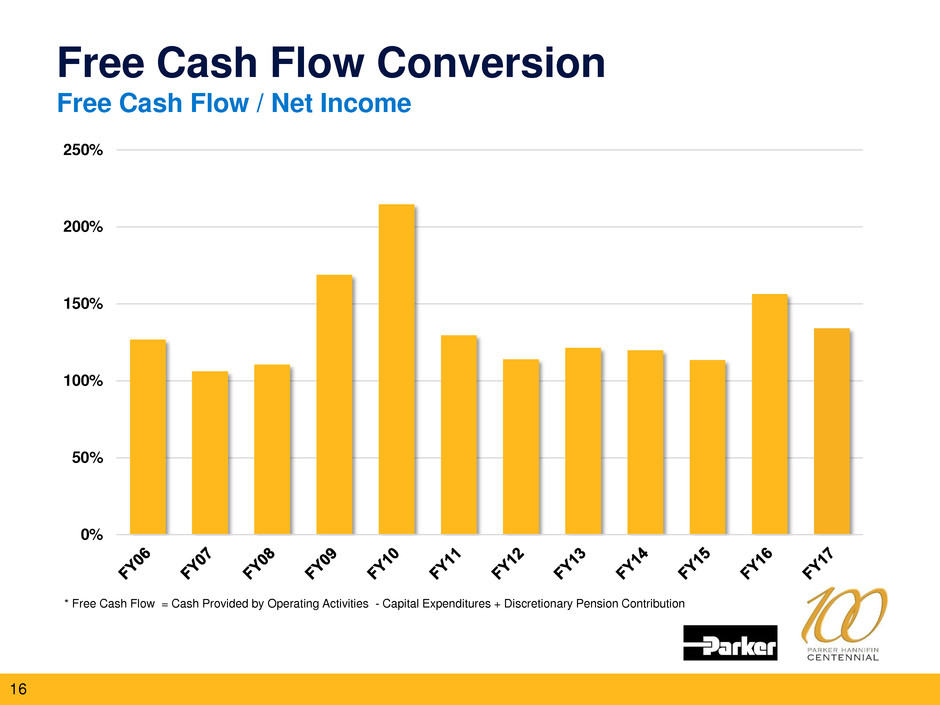

Free Cash Flow Conversion

Free Cash Flow / Net Income

16

* Free Cash Flow = Cash Provided by Operating Activities - Capital Expenditures + Discretionary Pension Contribution

0%

50%

100%

150%

200%

250%

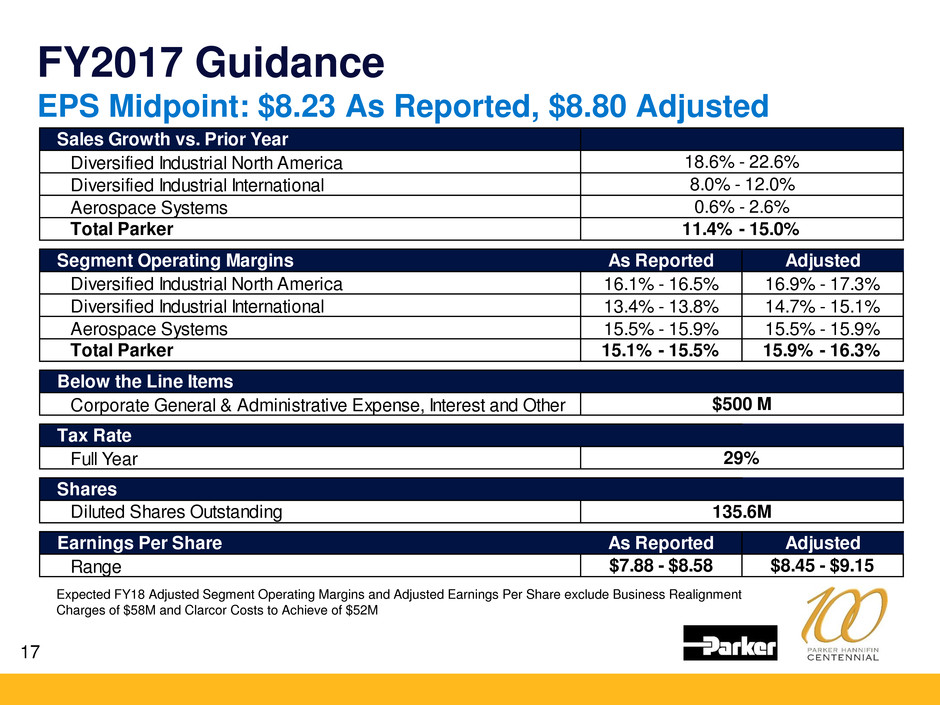

FY2017 Guidance

EPS Midpoint: $8.23 As Reported, $8.80 Adjusted

17

Expected FY18 Adjusted Segment Operating Margins and Adjusted Earnings Per Share exclude Business Realignment

Charges of $58M and Clarcor Costs to Achieve of $52M

Sales Growth vs. Prior Year

Diversified Industrial North America

Diversified Industrial International

Aerospace Systems

Total Parker

Segment Operating Margins As Reported Adjusted

Diversified Industrial North America 16.1% - 16.5% 16.9% - 17.3%

Diversified Industrial International 13.4% - 13.8% 14.7% - 15.1%

Aerospace Systems 15.5% - 15.9% 15.5% - 15.9%

Total Parker 15.1% - 15.5% 15.9% - 16.3%

Below the Line Items

Corporate General & Administrative Expense, Interest and Other

Tax Rate

Full Year

Shares

Diluted Shares Outstanding

Earnings Per Share As Reported Adjusted

Range $7.88 - $8.58 $8.45 - $9.15

135.6M

29%

$500 M

18.6% - 22.6%

8.0% - 12.0%

0.6% - 2.6%

11.4% - 15.0%

18

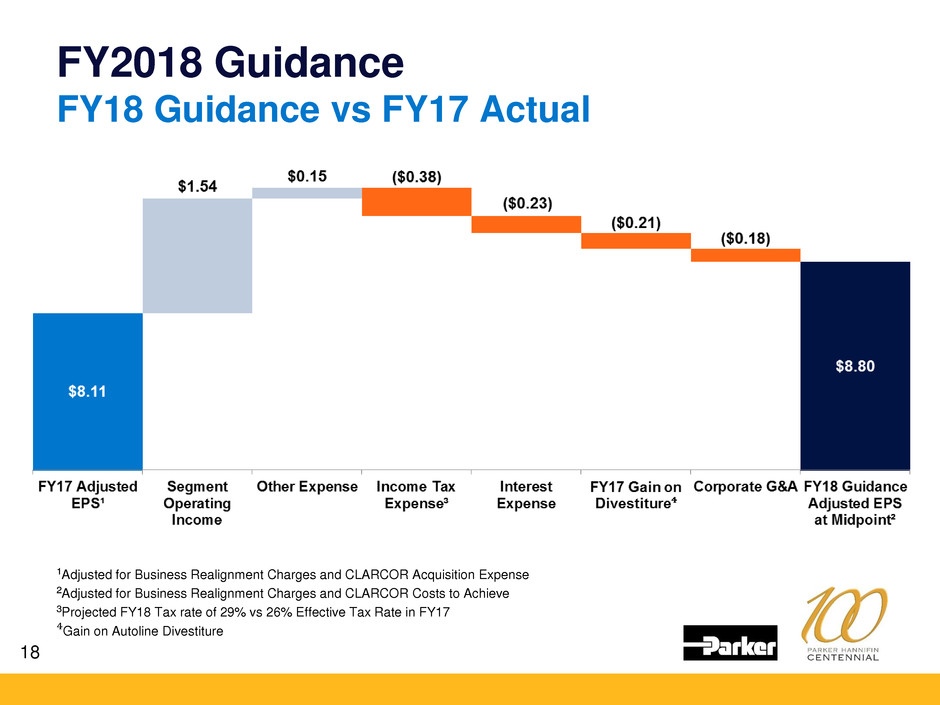

FY2018 Guidance

FY18 Guidance vs FY17 Actual

¹Adjusted for Business Realignment Charges and CLARCOR Acquisition Expense

²Adjusted for Business Realignment Charges and CLARCOR Costs to Achieve

³Projected FY18 Tax rate of 29% vs 26% Effective Tax Rate in FY17

⁴Gain on Autoline Divestiture

19

Appendix

• CLARCOR Impact on Financial Results

• Consolidated Statement of Income

• Adjusted Amounts Reconciliation

• Reconciliation of EPS

• Business Segment Information

• Reconciliation of Total Segment Operating Margin to Adjusted Total

Segment Operating Margin

• Consolidated Balance Sheet

• Consolidated Statement of Cash Flows

• Reconciliation of Cash Flow from Operations to Adjusted Cash

Flow from Operations

• Reconciliation of EPS

• Supplemental Sales Information – Global Technology Platforms

CLARCOR Impact on Financial Results

21

CLARCOR EPS Impact – FY2017

Q3 Actual Q4 Actual FY17

Sales $136 $351 $487

Operating Income (As Reported) $(13) $(2) $(15)

Operating Income (Adjusted)* $13 $30 $43

Incremental Interest Expense $6 $19 $25

Incremental Pre-tax Income $7 $11 $18

EPS Accretion $.04 $.06 $.10

*Adjustments to Operating Income

Acquisition Related Expenses $26 $32 $58

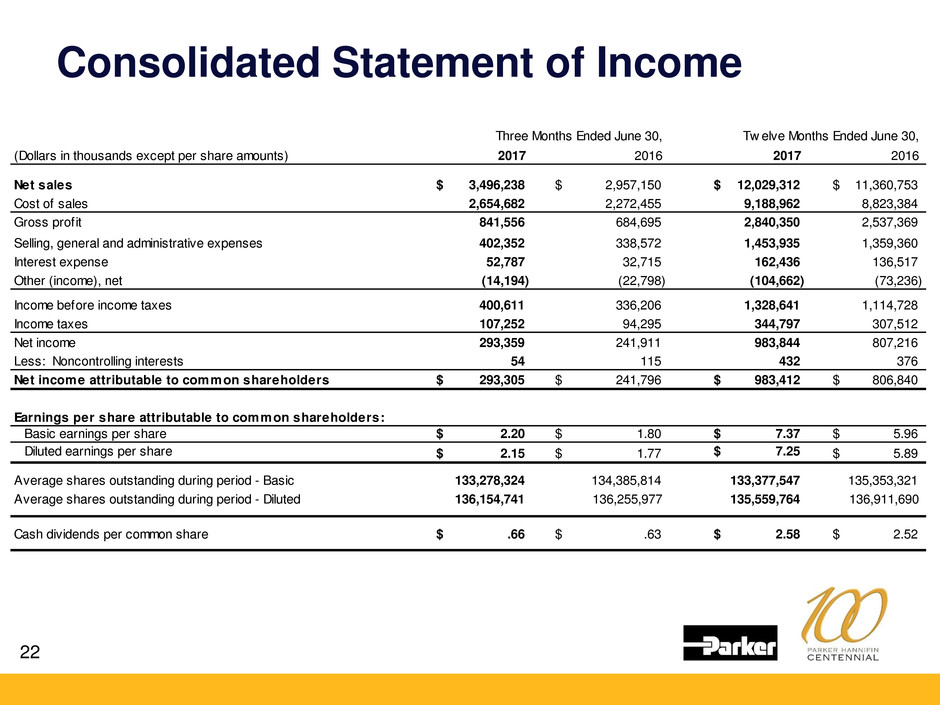

Consolidated Statement of Income

22

Three Months Ended June 30, Tw elve Months Ended June 30,

(Dollars in thousands except per share amounts) 2017 2016 2017 2016

Net sales 3,496,238$ 2,957,150$ 12,029,312$ 11,360,753$

Cost of sales 2,654,682 2,272,455 9,188,962 8,823,384

Gross profit 841,556 684,695 2,840,350 2,537,369

Selling, general and administrative expenses 402,352 338,572 1,453,935 1,359,360

Interest expense 52,787 32,715 162,436 136,517

Other (income), net (14,194) (22,798) (104,662) (73,236)

Income before income taxes 400,611 336,206 1,328,641 1,114,728

Income taxes 107,252 94,295 344,797 307,512

Net income 293,359 241,911 983,844 807,216

Less: Noncontrolling interests 54 115 432 376

Net income attributable to common shareholders 293,305$ 241,796$ 983,412$ 806,840$

Earnings per share attributable to common shareholders:

Basic earnings per share 2.20$ 1.80$ 7.37$ 5.96$

Diluted earnings per share 2.15$ 1.77$ 7.25$ 5.89$

Average shares outstanding during period - Basic 133,278,324 134,385,814 133,377,547 135,353,321

Average shares outstanding during period - Diluted 136,154,741 136,255,977 135,559,764 136,911,690

Cash dividends per common share .66$ .63$ 2.58$ 2.52$

Adjusted Amounts Reconciliation

23

FOURTH QUARTER 2017 U.S. GAAP TO ADJUSTED AMOUNTS RECONCILIATION

INCOME STATEMENT

As Reported Business Acquisition Adjusted

Jun-17 Realignment Expenses Jun-17

Net sales 3,496,238 3,496,238

Cost of sales 2,654,682 10,964 2,643,718

Gross profit 841,556 (10,964) - 852,520

Selling, general and administrative expenses 402,352 9,689 36,303 356,360

Interest expense 52,787 52,787

Other expense (income), net (14,194) 784 (14,978)

Income before income taxes 400,611 (21,437) (36,303) 458,351

Income taxes 107,252 5,788 9,802 122,842

Net income 293,359 (15,649) (26,501) 335,509

Less: Noncontrolling interests 54 - 54

Net income attributable to common shareholders 293,305 (15,649) (26,501) 335,455

EPS attributable to common shareholders:

Diluted earnings per share 2.15 (0.11) (0.19) 2.45

FOURTH QUARTER FY 2017

FOURTH QUARTER FY 2017 U.S. GAAP TO ADJUSTED AMOUNTS RECONCILIATION

SEGMENTS

As Reported Business Acquisition Adjusted

Jun-17 Realignment Expenses Jun-17

Segment Operating Income

Diversified Industrial:

North America 261,509 10,127 32,182 303,818

International 161,499 10,648 172,147

Total Diversified Industrial 423,008 20,775 32,182 475,965

Aerospace Systems 111,732 (122) 111,610

Total segment operating income 534,740 20,653 32,182 587,575

Corporate administration 51,925 - 51,925

Income before interest expense and other 482,815 20,653 32,182 535,650

Interest expense 52,787 52,787

Other expense 29,417 784 4,121 24,512

Income before income taxes 400,611 21,437 36,303 458,351

FOURTH QUARTER FY 2017

Reconciliation of EPS

24

(Unaudited) Three Months Ended June 30, Tw elve Months Ended June 30,

(Amounts in Dollars) 2017 2016 2017 2016

Earnings per diluted share 2.15$ 1.77$ 7.25$ 5.89$

Adjustments:

Business realignment charges 0.11 0.13 0.30 0.57

Acquisition-related expenses 0.19 - 0.56 -

Adjusted earnings per diluted share 2.45$ 1.90$ 8.11$ 6.46$

Business Segment Information

25

Three Months Ended June 30, Tw elve Months Ended June 30,

(Dollars in thousands) 2017 2016 2017 2016

Net sales

Diversif ied Industrial:

North America 1,665,483$ 1,260,203$ 5,366,809$ 4,955,211$

International 1,227,999 1,094,585 4,377,776 4,145,272

Aerospace Systems 602,756 602,362 2,284,727 2,260,270

Total 3,496,238$ 2,957,150$ 12,029,312$ 11,360,753$

Segment operating income

Diversif ied Industrial:

North America 261,509$ 221,158$ 873,552$ 789,667$

International 161,499 118,634 579,207 448,457

Aerospace Systems 111,732 97,526 337,496 337,531

Total segment operating income 534,740 437,318 1,790,255 1,575,655

Corporate general and administrative expenses 51,925 46,620 172,632 173,203

Income before interest and other expense 482,815 390,698 1,617,623 1,402,452

Interest expense 52,787 32,715 162,436 136,517

Other expense 29,417 21,777 126,546 151,207

Income before income taxes 400,611$ 336,206$ 1,328,641$ 1,114,728$

Reconciliation of Total Segment Operating

Margin to Adjusted Total Segment

Operating Margin

26

(Unaudited)

(Dollars in thousands)

Three Months

Ended June 30,

2017

Three Months

Ended June 30,

2016

Operating margin Operating margin

Total segment operating income 534,740$ 15.3% 437,318$ 14.8%

Adjustments:

Business realignment charges 20,653 25,024

Acquisition-related expenses 32,182 -

Adjusted total segment operating income 587,575$ 16.8% 462,342$ 15.6%

Consolidated Balance Sheet

27

June 30, June 30,

(Dollars in thousands) 2017 2016

Assets

Current assets:

Cash and cash equivalents 884,886$ 1,221,653$

Marketable securities and other investments 39,318 882,342

Trade accounts receivable, net 1,930,751 1,593,920

Non-trade and notes receivable 254,987 232,183

Inventories 1,549,494 1,173,329

Prepaid expenses 120,282 104,360

Total current assets 4,779,718 5,207,787

Plant and equipment, net 1,937,292 1,568,100

Deferred income taxes 36,057 605,155

Goodw ill 5,586,878 2,903,037

Intangible assets, net 2,307,484 922,571

Other assets 842,475 827,492

Total assets 15,489,904$ 12,034,142$

Liabilities and equity

Current liabilities:

Notes payable 1,008,465$ 361,787$

Accounts payable 1,300,496 1,034,589

Accrued liabilities 933,762 841,915

Accrued domestic and foreign taxes 153,137 127,597

Total current liabilities 3,395,860 2,365,888

Long-term debt 4,861,895 2,652,457

Pensions and other postretirement benefits 1,406,082 2,076,143

Deferred income taxes 221,790 54,395

Other liabilities 336,931 306,581

Shareholders' equity 5,261,649 4,575,255

Noncontrolling interests 5,697 3,423

Total liabilities and equity 15,489,904$ 12,034,142$

Consolidated Statement of Cash Flows

28

(Unaudited) Tw elve Months Ended June 30,

(Dollars in thousands) 2017 2016

Cash flows from operating activities:

Net income 983,844$ 807,216$

Depreciation and amortization 355,229 306,843

Stock incentive plan compensation 80,339 71,293

(Gain) on sale of business (41,285) (10,666)

Loss on disposal of assets 1,494 414

(Gain) on sale of marketable securities (1,032) (723)

Net change in receivables, inventories, and trade payables 5,741 85,414

Net change in other assets and liabilities (126,943) (6,077)

Other, net 45,084 (42,936)

Net cash provided by operating activities 1,302,471 1,210,778

Cash flows from investing activities:

Acquisitions (net of cash of $157,426 in 2017 and $3,814 in 2016) (4,069,197) (67,552)

Capital expenditures (203,748) (149,407)

Proceeds from sale of plant and equipment 14,648 18,821

Proceeds from sale of business 85,610 24,325

Purchases of marketable securities and other investments (465,666) (1,351,464)

Maturities and sales of marketable securities and other investments 1,279,318 1,300,633

Other, net (6,113) (39,995)

Net cash (used in) investing activities (3,365,148) (264,639)

Cash flows from financing activities:

Net payments for common stock activity (335,876) (587,239)

Net proceeds from debt 2,463,884 85,843

Dividen s (345,380) (341,962)

Net cash provided by (used in) financing activities 1,782,628 (843,358)

Effect of exchange rate changes on cash (56,718) (61,712)

Net (decrease) increase in cash and cash equivalents (336,767) 41,069

Cash and cash equivalents at beginning of period 1,221,653 1,180,584

Cash and cash equivalents at end of period 884,886$ 1,221,653$

Reconciliation of Cash Flow from

Operations to Adjusted Cash Flow from

Operations

29

(Unaudite )

(Dollars in thousands)

Twelve

Months Ended

June 30, 2017

Twelve

Months Ended

June 30, 2016

Percent of sales Percent of sales

As reported cash flow from operations 1,302,471$ 10.8% 1,210,778$ 10.7%

Discretionary pension contribution 220,000 200,000

Adjusted cash flow from operations 1,522,471$ 12.7% 1,410,778$ 12.4%

Reconciliation of Free Cash Flow

Conversion

30

(Unaudited)

(Dollars in thousands)

Twelve

Months Ended

June 30, 2017

Net income 983,844$

Cash flow from operations 1,302,471

Capital expenditures (203,748)

Discretionary pension contribution 220,000

Free cash flow 1,318,723$

Free cash flow conversion (free cash flow/net income) 134%

Reconciliation of EPS

Fiscal Year 2018 Guidance

31

(Unaudited)

(Amounts in dollars)

Fiscal Year

2018

Forecasted earnings per diluted share $7.88 to $8.58

Adjustments:

Business realignment charges .30

Clarcor costs to achieve .27

Adjusted forecasted earnings per diluted share $8.45 to $9.15

Supplemental Sales Information

Global Technology Platforms

32

(Unaudit d)

(Dollars in thousands)

September 30,

2016

December 31,

2016

March 31,

2017

June 30,

2017

September 30,

2016

December 31,

2016

March 31,

2017

June 30,

2017

Net sales

Diversif ied Industrial:

Motion Systems 741,650$ 754,772$ 856,388$ 906,158$ 741,650$ $ 1,496,422 $ 2,352,810 $ 3,258,968

Flow and Process Control 824,314 783,864 905,667 953,529 824,314 1,608,178 2,513,845 3,467,374

Filtration and Engineered Materials 615,930 588,385 780,133 1,033,795 615,930 1,204,315 1,984,448 3,018,243

Aerospace Systems 561,237 543,783 576,951 602,756 561,237 1,105,020 1,681,971 2,284,727

Total 2,743,131$ 2,670,804$ 3,119,139$ 3,496,238$ 2,743,131$ 5,413,935$ 8,533,074$ 12,029,312$

Three Months Ending Fiscal Year-to-Date