Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - Orion Group Holdings Inc | orn063017-321.htm |

| EX-31.2 - EXHIBIT 31.2 - Orion Group Holdings Inc | orn063017-312.htm |

| EX-31.1 - EXHIBIT 31.1 - Orion Group Holdings Inc | orn063017-311.htm |

| 10-Q - 10-Q - Orion Group Holdings Inc | orn06301710q.htm |

EXECUTION VERSION

DMSLIBRARY01\30849741.v4

SECOND AMENDMENT TO CREDIT AGREEMENT

THIS SECOND AMENDMENT TO CREDIT AGREEMENT (this “Amendment”),

is made and entered into as of July 28, 2017, by and among ORION GROUP HOLDINGS,

INC., a Delaware corporation (formerly known as Orion Marine Group, Inc.) (the “Borrower”),

certain Subsidiaries of the Borrower designated as “Guarantors” on the signature pages hereof

(together with the Borrower, the “Credit Parties”), the Lenders (as defined below) party hereto

constituting the Required Lenders (as defined in the Credit Agreement as defined below), and

REGIONS BANK, as administrative agent and collateral agent for the Lenders (in such

capacity, the “Agent”).

W I T N E S S E T H:

WHEREAS, the Borrower, the Guarantors, certain banks and other financial institutions

from time to time party thereto (the “Lenders”) and the Agent are parties to a certain Credit

Agreement, dated as of August 5, 2015 (as amended by that certain First Amendment to Credit

Agreement, dated as of April 27, 2016, and as further amended, restated, supplemented,

increased, extended or otherwise modified from time to time, the “Credit Agreement”;

capitalized terms used herein and not otherwise defined shall have the meanings assigned to such

terms in the Credit Agreement), pursuant to which the Lenders have made loans and certain other

financial accommodations available to the Borrower; and

WHEREAS, the Borrower has requested that the Required Lenders and the Agent amend

certain provisions of the Credit Agreement, and, in each case, subject to the terms and conditions

hereof, the Required Lenders and the Agent are willing to do so.

NOW, THEREFORE, for good and valuable consideration, the sufficiency and receipt

of which are acknowledged, the Borrower, the Guarantors, the Required Lenders and the Agent

agree as follows:

1. Amendments.

(a) Section 8.1 of the Credit Agreement is amended by amending and

restating clause (j) thereof in its entirety as follows (with all changes indicated textually

with italics):

(j) unsecured Indebtedness of the Credit Parties in an aggregate

amount not to exceed at any time $15,000,000; and

(b) Section 8.8 of the Credit Agreement is amended by amending and

restating clause (a) thereof in its entirety as follows (with all changes indicated textually

with italics):

(a) Consolidated Leverage Ratio. Permit the Consolidated Leverage

Ratio as of the end of any Fiscal Quarter of the Borrower (i) occurring during the

period from the Closing Date through and including December 31, 2015, to

2

exceed 3.25 to 1.00 and (ii) thereafter, to exceed the correlative ratio set forth

below:

Fiscal Quarter Ending Consolidated Leverage Ratio

March 31, 2016 4.00 to 1.00

June 30, 2016 3.75 to 1.00

September 30, 2016 3.25 to 1.00

December 31, 2016 3.00 to 1.00

March 31, 2017 2.75 to 1.00

June 30, 2017 2.75 to 1.00

September 30, 2017 2.75 to 1.00

December 31, 2017 and each Fiscal

Quarter thereafter

2.50 to 1.00

(c) Exhibit 7.1(c) to the Credit Agreement is amended and restated in its

entirety as set forth on Annex A attached hereto.

2. Conditions Precedent. Completion of the following to the satisfaction of the

Agent and the Required Lenders shall constitute express conditions precedent to the

effectiveness of the amendments set forth in this Amendment (and the date on which all of the

foregoing shall have occurred as determined by the Agent being called herein the “Second

Amendment Effective Date”):

(a) Executed Credit Documents. Delivery of duly executed counterparts of this

Amendment in form and substance satisfactory to the Agent and the Required Lenders; and

(b) Fees and Expenses. The Agent shall have confirmation that all fees and expenses

required to be paid on or before the Second Amendment Effective Date have been paid,

including the fees and expenses of King & Spalding LLP.

3. Representations and Warranties. As of the Second Amendment Effective Date,

after giving effect to this Amendment, the representations and warranties contained in the Credit

Agreement and in the other Credit Documents are true and correct in all material respects (or,

with respect to any such representation or warranty that is modified by materiality or Material

Adverse Effect, are true and correct in all respects) on and as of the Second Amendment

Effective Date, except to the extent such representations and warranties specifically relate to an

earlier date, in which case such representations and warranties shall have been true and correct in

all material respects on and as of such earlier date, and no event has occurred and is continuing

3

or would result from the consummation of this Amendment and the transactions contemplated

hereby that would constitute an Event of Default or a Default.

4. Reaffirmation of Credit Party Obligations. Each Credit Party hereby ratifies

the Credit Agreement, as amended hereby, and each other Credit Document to which it is a party

and acknowledges and reaffirms (a) that it is bound by all terms of the Credit Agreement, as

amended hereby, and such other Credit Documents applicable to it and (b) that it is responsible

for the observance and full performance of its respective Obligations.

5. Release of Claims and Covenant Not to Sue.

(a) On the Second Amendment Effective Date, in consideration of the Required

Lenders’ and the Agent’s agreements contained in this Amendment, and for other good and

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each

Credit Party, on behalf of itself and its successors and assigns, and its present and former

members, managers, shareholders, affiliates, subsidiaries, divisions, predecessors, directors,

officers, attorneys, employees, agents, legal representatives, and other representatives (each

Credit Party and all such other Persons being hereinafter referred to collectively as the

“Releasing Parties” and individually as a “Releasing Party”), hereby absolutely, unconditionally,

and irrevocably releases, remises, and forever discharges Agent, each Lender, and each of their

respective successors and assigns, and their respective present and former shareholders,

members, managers, affiliates, subsidiaries, divisions, predecessors, directors, officers, attorneys,

employees, agents, legal representatives, and other representatives (Agent, Lenders, and all such

other Persons being hereinafter referred to collectively as the “Releasees” and individually as a

“Releasee”), of and from any and all demands, actions, causes of action, suits, damages, and any

and all other claims, counterclaims, defenses, rights of set-off, demands, and liabilities

whatsoever (individually, a “Claim” and collectively, “Claims”) of every kind and nature, known

or unknown, suspected or unsuspected, at law or in equity, which any Releasing Party or any of

its successors, assigns, or other legal representatives may now or hereafter own, hold, have, or

claim to have against the Releasees or any of them for, upon, or by reason of any circumstance,

action, cause, or thing whatsoever which arises at any time on or prior to the date of this

Amendment for or on account of, in relation to, or in any way in connection with this

Amendment, the Credit Agreement, any of the other Credit Documents, or any of the

transactions hereunder or thereunder.

(b) Each Credit Party understands, acknowledges, and agrees that the release set forth

above may be pleaded as a full and complete defense to any Claim and may be used as a basis

for an injunction against any action, suit, or other proceeding which may be instituted,

prosecuted, or attempted in breach of the provisions of such release.

(c) Each Credit Party agrees that no fact, event, circumstance, evidence, or

transaction which could now be asserted or which may hereafter be discovered will affect in any

manner the final, absolute, and unconditional nature of the release set forth above.

(d) On and after the Second Amendment Effective Date, each Credit Party hereby

absolutely, unconditionally and irrevocably covenants and agrees with and in favor of each

Releasee that it will not sue (at law, in equity, in any regulatory proceeding, or otherwise) any

4

Releasee on the basis of any Claim released, remised, and discharged by any Credit Party

pursuant to clause (a) of this Section. If any Credit Party violates the foregoing covenant, the

Borrower, for itself and its successors and assigns, and its present and former members,

managers, shareholders, affiliates, subsidiaries, divisions, predecessors, directors, officers,

attorneys, employees, agents, legal representatives, and other representatives, agrees to pay, in

addition to such other damages as any Releasee may sustain as a result of such violation, all

attorneys’ fees and costs incurred by any Releasee as a result of such violation.

6. Effect of Amendment. Except as set forth expressly herein, all terms of the

Credit Agreement, as amended hereby, and the other Credit Documents shall be and remain in

full force and effect and shall constitute the legal, valid, binding and enforceable obligations of

the Borrower to the Lenders and the Agent. The execution, delivery and effectiveness of this

Amendment shall not, except as expressly provided herein, operate as a waiver of any right,

power or remedy of the Lenders under the Credit Agreement or the other Credit Documents, nor

constitute a waiver of any provision of the Credit Agreement or the other Credit Documents.

This Amendment shall constitute a Credit Document for all purposes of the Credit Agreement.

7. Governing Law. This Amendment shall be governed by, and construed in

accordance with, the internal laws of the State of New York.

8. No Novation. This Amendment is not intended by the parties to be, and shall not

be construed to be, a novation of the Credit Agreement or an accord and satisfaction in regard

thereto.

9. Counterparts. This Amendment may be executed by one or more of the parties

hereto in any number of separate counterparts, each of which shall be deemed an original and all

of which, taken together, shall be deemed to constitute one and the same instrument. Delivery of

an executed counterpart of this Amendment by facsimile transmission or by electronic mail in

pdf form shall be as effective as delivery of a manually executed counterpart hereof.

10. Binding Nature. This Amendment shall be binding upon and inure to the benefit

of the parties hereto, their respective successors, successors-in-titles, and assigns.

11. Entire Understanding. This Amendment sets forth the entire understanding of

the parties with respect to the matters set forth herein, and shall supersede any prior negotiations

or agreements, whether written or oral, with respect thereto.

[Signature Pages To Follow]

ANNEX A

Exhibit 7.1(c) to Credit Agreement

[Attached]

30857720.v2

Exhibit 7.1(c)

[Form of] Compliance Certificate

Financial Statement Date: __________, 20___

To: Regions Bank, as Administrative Agent

Re: Credit Agreement dated as of August 5, 2015 (as amended, restated, supplemented, increased,

extended, supplemented or otherwise modified from time to time, the “Credit Agreement”)

among Orion Marine Group, Inc., a Delaware corporation (the “Borrower”), certain Subsidiaries

of the Borrower from time to time party thereto, as Guarantors, the Lenders from time to time

party thereto and Regions Bank, as Administrative Agent and Collateral Agent. Capitalized

terms used but not otherwise defined herein have the meanings provided in the Credit Agreement.

Ladies and Gentlemen:

The undersigned hereby certifies as of the date hereof that [he/she] is the ____________ of the Borrower,

and that, in [his/her] capacity as such, [he/she] is authorized to execute and deliver this certificate

(including the schedules attached hereto and made a party hereof, this “Compliance Certificate”) to the

Administrative Agent on behalf of the Borrower, and that:

[Use following paragraph 1 for Fiscal Year-end financial statements:]

[1. Attached hereto as Schedule 1 are the year-end audited consolidated financial statements required

by Section 7.1(b) of the Credit Agreement for the Fiscal Year of the Borrower ended as of the above date,

together with the report and opinion of an independent certified public accountant of recognized national

standing required by such section. Such financial statements fairly present, in all material respects, the

consolidated financial position of the Borrower and its Subsidiaries as at the date indicated and the results

of their operations and their cash flows for the period indicated.]

[Use following paragraph 1 for Fiscal Quarter-end financial statements:]

[1. Attached hereto as Schedule 1 are the unaudited consolidated financial statements required by

Section 7.1(a) of the Credit Agreement for the Fiscal Quarter of the Borrower ended as of the above date.

Such financial statements fairly present, in all material respects, the financial condition of consolidated

financial position of the Borrower and its Subsidiaries as at the date indicated and the results of their

operations and their cash flows for the period indicated, subject to changes resulting from audit and

normal year end adjustments.]

2. The undersigned has reviewed and is familiar with the terms of the Credit Agreement and has

made, or has caused to be made, a detailed review of the transactions and financial condition of the

Borrower and its Subsidiaries during the accounting period covered by the attached financial statements.

3. A review of the activities of the Borrower and its Subsidiaries during such fiscal period has been

made under the supervision of the undersigned with a view to determining whether a Default or Event of

Default exists, and

[select one:]

[to the knowledge of the undersigned during such fiscal period, no Default or Event of Default exists as of

the date hereof.]

[or:]

[the following is a list of each Default or Event of Default, the nature and extent thereof and proposed

actions with respect thereto:]

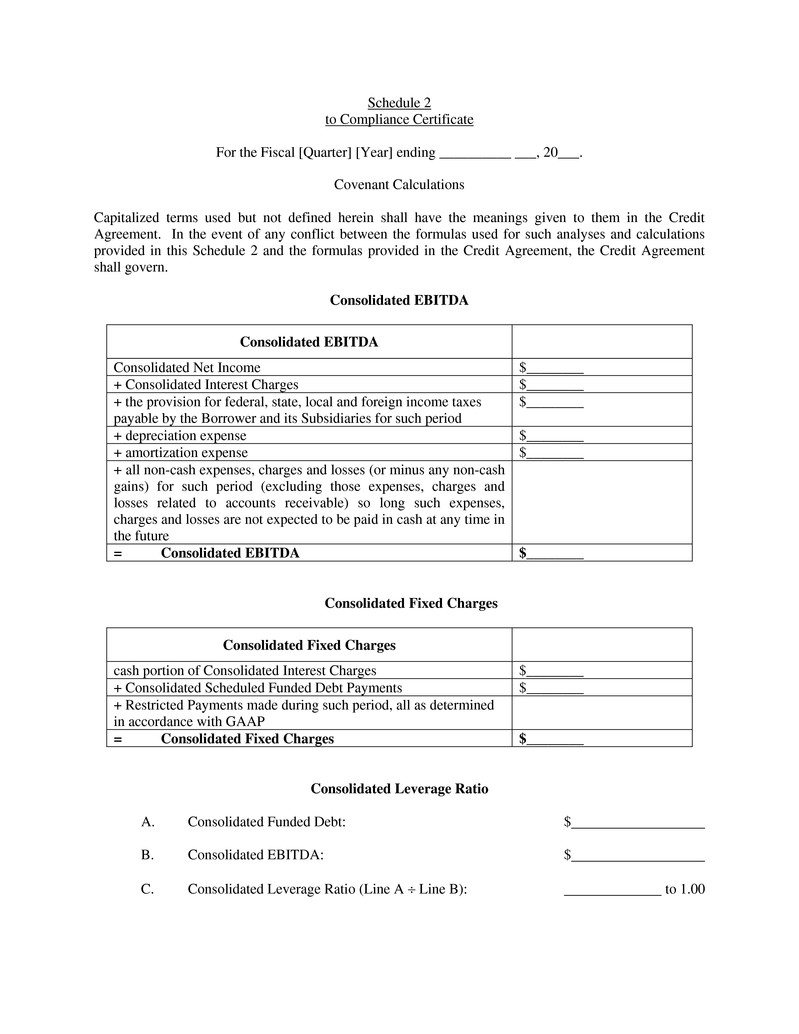

4. The financial covenant analyses and calculations for the periods identified therein of the

Consolidated Fixed Charges, Consolidated Leverage Ratio (used in the determination of the Applicable

Margin), Consolidated Fixed Charge Coverage Ratio, and Consolidated Capital Expenditures are set forth

on Schedule 2 attached hereto. In the event of any conflict between the formulas used for such analyses

and calculations provided in the attached Schedule 2 and the formulas provided in the Credit Agreement,

the Credit Agreement shall govern.

5. Set forth on Schedule 3 is a summary of all material changes in GAAP and in the consistent

application thereof, unless such change and the effects thereof have been described in a previous

Compliance Certificate, the effect on the financial covenants resulting therefrom, and a reconciliation

between calculation of the financial covenants before and after giving effect to such changes.

[Signature on Following Page]

IN WITNESS WHEREOF, the undersigned has executed this Compliance Certificate as of

__________, 20___.

ORION MARINE GROUP, INC.

By:

Name:

Title:

Schedule 1

to Compliance Certificate

For the Fiscal [Quarter] [Year] ending __________ ___, 20___.

Financial Statements

(see attached)

Schedule 2

to Compliance Certificate

For the Fiscal [Quarter] [Year] ending __________ ___, 20___.

Covenant Calculations

Capitalized terms used but not defined herein shall have the meanings given to them in the Credit

Agreement. In the event of any conflict between the formulas used for such analyses and calculations

provided in this Schedule 2 and the formulas provided in the Credit Agreement, the Credit Agreement

shall govern.

Consolidated EBITDA

Consolidated EBITDA

Consolidated Net Income $________

+ Consolidated Interest Charges $________

+ the provision for federal, state, local and foreign income taxes

payable by the Borrower and its Subsidiaries for such period

$________

+ depreciation expense $________

+ amortization expense $________

+ all non-cash expenses, charges and losses (or minus any non-cash

gains) for such period (excluding those expenses, charges and

losses related to accounts receivable) so long such expenses,

charges and losses are not expected to be paid in cash at any time in

the future

= Consolidated EBITDA $________

Consolidated Fixed Charges

Consolidated Fixed Charges

cash portion of Consolidated Interest Charges $________

+ Consolidated Scheduled Funded Debt Payments $________

+ Restricted Payments made during such period, all as determined

in accordance with GAAP

= Consolidated Fixed Charges $________

Consolidated Leverage Ratio

A. Consolidated Funded Debt: $

B. Consolidated EBITDA: $

C. Consolidated Leverage Ratio (Line A Line B): to 1.00

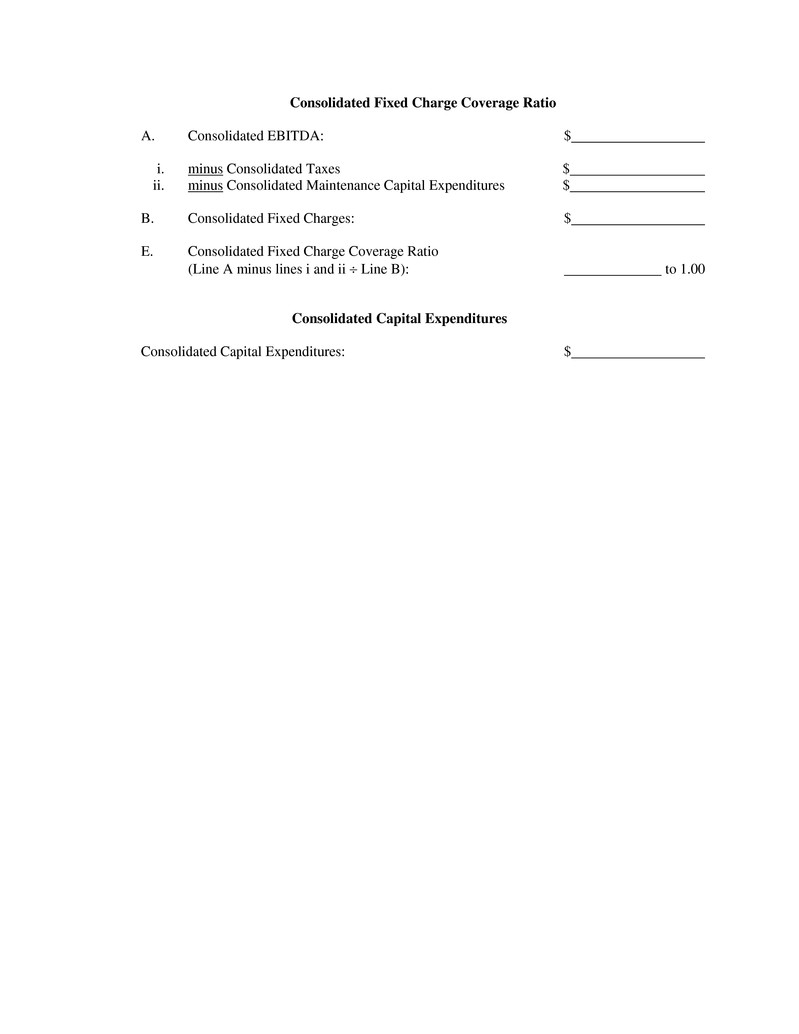

Consolidated Fixed Charge Coverage Ratio

A. Consolidated EBITDA: $

i. minus Consolidated Taxes $

ii. minus Consolidated Maintenance Capital Expenditures $

B. Consolidated Fixed Charges: $

E. Consolidated Fixed Charge Coverage Ratio

(Line A minus lines i and ii Line B): to 1.00

Consolidated Capital Expenditures

Consolidated Capital Expenditures: $

Schedule 3

to Compliance Certificate

For the Fiscal [Quarter] [Year] ending __________ ___, 20___.

Changes in GAAP

(see attached)