Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - GENERAL CABLE CORP /DE/ | bgc-20170630_exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - GENERAL CABLE CORP /DE/ | bgc-20170630_exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - GENERAL CABLE CORP /DE/ | bgc-20170630_exhibit311.htm |

| EX-12.1 - EXHIBIT 12.1 - GENERAL CABLE CORP /DE/ | bgc-20170630_exhibit121.htm |

| 10-Q - 10-Q - GENERAL CABLE CORP /DE/ | bgc-20170630.htm |

Exhibit 10.2

CERTAIN PORTIONS OF THE SCHEDULES TO THIS EXHIBIT HAVE BEEN OMITTED PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT. THE OMITTED PORTIONS ARE MARKED AS “[XXX]” ALONG WITH A FOOTNOTE INDICATING THAT THE INFORMATION HAS BEEN OMITTED PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT. AN UNREDACTED COPY OF THIS EXHIBIT HAS BEEN FILED SEPARATELY WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION PURSUANT TO A REQUEST FOR CONFIDENTIAL TREATMENT

SECOND AMENDED AND RESTATED CREDIT AGREEMENT

dated as of

May 22, 2017

among

GENERAL CABLE INDUSTRIES, INC., as U.S. Borrower,

GENERAL CABLE COMPANY LTD., as Canadian Borrower,

SILEC CABLE SAS, as French Borrower

NORDDEUTSCHE SEEKABELWERKE GMBH, as German Borrower

GRUPO GENERAL CABLE SISTEMAS, S.L.,

as Spanish Borrower,

GENERAL CABLE CORPORATION

The Other Loan Parties Party Hereto

The Lenders Party Hereto

JPMORGAN CHASE BANK, N.A.,

as Administrative Agent

and

J.P. MORGAN EUROPE LIMITED,

as European Administrative Agent

___________________________

JPMORGAN CHASE BANK, N.A., WELLS FARGO BANK, N.A.,

PNC BANK, N.A., FIFTH THIRD BANK, N.A.

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK and

BANK OF AMERICA, N.A.

as Joint Bookrunners and Joint Lead Arrangers

TABLE OF CONTENTS | ||||

Page | ||||

ARTICLE I Definitions | 1 | |||

Section 1.01 | Defined Terms | 1 | ||

Section 1.02 | Classification of Loans and Borrowings | 78 | ||

Section 1.03 | Terms Generally | 78 | ||

Section 1.04 | Accounting Terms; GAAP | 79 | ||

Section 1.05 | Currency Translations | 79 | ||

Section 1.06 | Permitted Liens | 80 | ||

Section 1.07 | Certain French Matters | 80 | ||

Section 1.08 | Certain Spanish Matters | 80 | ||

Section 1.09 | Certain German Matters | 80 | ||

ARTICLE II The Credits | 80 | |||

Section 2.01 | Revolving Commitments | 80 | ||

Section 2.02 | Loans and Borrowings | 82 | ||

Section 2.03 | Requests for Revolving Borrowings | 83 | ||

Section 2.04 | Protective Advances | 84 | ||

Section 2.05 | Swingline Loans and Overadvances | 86 | ||

Section 2.06 | Letters of Credit | 91 | ||

Section 2.07 | Funding of Borrowings | 100 | ||

Section 2.08 | Interest Elections | 101 | ||

Section 2.09 | Termination and Reduction of Revolving Commitments; Increase in Revolving Commitments | 103 | ||

Section 2.10 | Repayment of Loans; Evidence of Debt | 105 | ||

Section 2.11 | Prepayment of Loans | 107 | ||

Section 2.12 | Fees | 110 | ||

Section 2.13 | Interest | 111 | ||

Section 2.14 | Alternate Rate of Interest | 114 | ||

Section 2.15 | Increased Costs | 116 | ||

Section 2.16 | Break Funding Payments | 117 | ||

Section 2.17 | Taxes | 118 | ||

Section 2.18 | Payments Generally; Allocation of Proceeds; Sharing of Set-offs | 123 | ||

Section 2.19 | Mitigation Obligations; Replacement of Lenders | 126 | ||

Section 2.20 | Defaulting Lenders | 127 | ||

Section 2.21 | Returned Payments | 129 | ||

Section 2.22 | Banking Services and Swap Agreements | 129 | ||

Section 2.23 | Excess Resulting From Exchange Rate Change | 130 | ||

ARTICLE III Representations and Warranties | 131 | |||

Section 3.01 | Organization; Powers | 131 | ||

Section 3.02 | Authorization; Enforceability and Immunity | 131 | ||

i

Section 3.03 | Governmental Approvals; No Conflicts | 132 | ||

Section 3.04 | Financial Condition; No Material Adverse Change | 132 | ||

Section 3.05 | Properties | 132 | ||

Section 3.06 | Litigation and Environmental Matters | 133 | ||

Section 3.07 | Compliance with Laws and Agreements | 133 | ||

Section 3.08 | Investment Company Status | 133 | ||

Section 3.09 | Taxes | 134 | ||

Section 3.10 | Pension Plans | 134 | ||

Section 3.11 | Disclosure | 136 | ||

Section 3.12 | Material Agreements | 136 | ||

Section 3.13 | Solvency | 136 | ||

Section 3.14 | Insurance | 137 | ||

Section 3.15 | Capitalization and Subsidiaries | 137 | ||

Section 3.16 | Security Interest in Collateral | 138 | ||

Section 3.17 | Employment Matters | 138 | ||

Section 3.18 | Common Enterprise | 138 | ||

Section 3.19 | Margin Stock | 139 | ||

Section 3.20 | OFAC and Patriot Act | 139 | ||

Section 3.21 | Certain Inventory Matters | 139 | ||

Section 3.22 | Centre of Main Interests | 139 | ||

Section 3.23 | Sanctions Laws and Regulations | 139 | ||

Section 3.24 | EEA Financial Institutions | 140 | ||

ARTICLE IV Conditions | 140 | |||

Section 4.01 | Effective Date | 140 | ||

Section 4.02 | Each Credit Event | 145 | ||

ARTICLE V Affirmative Covenants | 145 | |||

Section 5.01 | Financial Statements; Borrowing Base and Other Information | 145 | ||

Section 5.02 | Notices of Material Events | 150 | ||

Section 5.03 | Existence; Conduct of Business | 150 | ||

Section 5.04 | Payment of Obligations | 151 | ||

Section 5.05 | Maintenance of Properties | 151 | ||

Section 5.06 | Books and Records; Inspection Rights | 151 | ||

Section 5.07 | Compliance with Laws | 151 | ||

Section 5.08 | Use of Proceeds | 154 | ||

Section 5.09 | Insurance | 154 | ||

Section 5.10 | Casualty and Condemnation | 154 | ||

Section 5.11 | Appraisals | 155 | ||

Section 5.12 | Field Examinations | 155 | ||

Section 5.13 | Depository Banks | 155 | ||

Section 5.14 | Additional Collateral; Further Assurances | 156 | ||

Section 5.15 | Transfer of Accounts of European Loan Parties; Notification of Account Debtors | 161 | ||

Section 5.16 | European Loan Party Cash Management | 162 | ||

ii

Section 5.17 | Financial Assistance | 162 | ||

Section 5.18 | Spanish “Pagarés” (Promissory Notes) | 163 | ||

Section 5.19 | Post-Closing Matters | 163 | ||

ARTICLE VI Negative Covenants | 163 | |||

Section 6.01 | Indebtedness | 163 | ||

Section 6.02 | Liens | 167 | ||

Section 6.03 | Fundamental Changes | 170 | ||

Section 6.04 | Investments, Loans, Advances, Guarantees and Acquisitions | 171 | ||

Section 6.05 | Asset Sales | 174 | ||

Section 6.06 | Sale and Leaseback Transactions | 175 | ||

Section 6.07 | Swap Agreements | 175 | ||

Section 6.08 | Restricted Payments; Certain Payments of Indebtedness | 175 | ||

Section 6.09 | Transactions with Affiliates | 177 | ||

Section 6.10 | Restrictive Agreements | 177 | ||

Section 6.11 | Amendment of Material Documents | 178 | ||

Section 6.12 | Fixed Charge Coverage Ratio | 178 | ||

Section 6.13 | Spanish “Pagarés” (Promissory Notes) | 178 | ||

Section 6.14 | Sanctions Laws and Regulations | 178 | ||

ARTICLE VII Events of Default | 179 | |||

ARTICLE VIII The Administrative Agent and Other Agents | 184 | |||

ARTICLE IX Miscellaneous | 190 | |||

Section 9.01 | Notices | 190 | ||

Section 9.02 | Waivers; Amendments | 193 | ||

Section 9.03 | Expenses; Indemnity; Damage Waiver | 196 | ||

Section 9.04 | Successors and Assigns | 199 | ||

Section 9.05 | Survival | 203 | ||

Section 9.06 | Counterparts; Integration; Effectiveness | 204 | ||

Section 9.07 | Severability | 204 | ||

Section 9.08 | Right of Setoff | 204 | ||

Section 9.09 | Governing Law; Jurisdiction; Consent to Service of Process | 205 | ||

Section 9.10 | WAIVER OF JURY TRIAL | 206 | ||

Section 9.11 | Headings | 207 | ||

Section 9.12 | Confidentiality | 207 | ||

Section 9.13 | Several Obligations; Nonreliance; Violation of Law | 208 | ||

Section 9.14 | USA PATRIOT Act | 208 | ||

Section 9.15 | Disclosure | 209 | ||

Section 9.16 | Appointment for Perfection | 209 | ||

Section 9.17 | Interest Rate Limitation | 209 | ||

Section 9.18 | Judgment Currency | 209 | ||

Section 9.19 | Anti-Money Laundering Legislation | 210 | ||

iii

Section 9.20 | Lender Loss Sharing Agreement | 210 | ||

Section 9.21 | Waiver of Immunity | 213 | ||

Section 9.22 | Parallel Debt | 213 | ||

Section 9.23 | Process Agent | 215 | ||

Section 9.24 | Acknowledgement and Consent to Bail-In of EEA Financial Institutions | 215 | ||

Section 9.25 | No Fiduciary Duty | 215 | ||

Section 9.26 | Existing Credit Agreement | 216 | ||

Section 9.27 | Marketing Consent | 217 | ||

ARTICLE X Loan Guaranty | 217 | |||

Section 10.01 | Guaranty | 217 | ||

Section 10.02 | Guaranty of Payment | 219 | ||

Section 10.03 | No Discharge or Diminishment of Loan Guaranty | 219 | ||

Section 10.04 | Defenses Waived | 220 | ||

Section 10.05 | Rights of Subrogation | 220 | ||

Section 10.06 | Reinstatement; Stay of Acceleration | 220 | ||

Section 10.07 | Information | 221 | ||

Section 10.08 | Termination | 221 | ||

Section 10.09 | Taxes | 221 | ||

Section 10.10 | Maximum Liability | 221 | ||

Section 10.11 | Contribution | 221 | ||

Section 10.12 | Liability Cumulative | 222 | ||

Section 10.13 | French Guarantee Limitations | 223 | ||

Section 10.14 | German Guarantee Limitations | 223 | ||

Section 10.15 | Spanish Guarantee Limitations | 228 | ||

Section 10.16 | Keepwell | 229 | ||

ARTICLE XI The Borrower Representative | 229 | |||

Section 11.01 | Appointment; Nature of Relationship | 229 | ||

Section 11.02 | Powers | 230 | ||

Section 11.03 | Employment of Agents | 230 | ||

Section 11.04 | Notices | 230 | ||

Section 11.05 | Successor Borrower Representative | 230 | ||

Section 11.06 | Execution of Loan Documents; Borrowing Base Certificate | 230 | ||

Section 11.07 | Reporting | 231 | ||

iv

SCHEDULES: | |

Revolving Commitment Schedule | |

Schedule 1.01A - Eligible Real Property | |

Schedule 1.01B - Certain Account Debtors | |

Schedule 1.01C - Existing Banking Services Obligations | |

Schedule 1.01D - Existing Swap Agreement Obligations | |

Schedule 1.01E - Excluded Deposit Account | |

Schedule 3.05 - Properties | |

Schedule 3.06 - Disclosed Matters | |

Schedule 3.10 - Canadian Pension Plan and Benefit Plans | |

Schedule 3.14 - Insurance | |

Schedule 3.15 - Capitalization and Subsidiaries | |

Schedule 5.19 - Post-Closing Matters | |

Schedule 6.01 - Existing Indebtedness | |

Schedule 6.02 - Existing Liens | |

Schedule 6.04 - Existing Investments | |

Schedule 6.10 - Existing Restrictions | |

EXHIBITS: | |

Exhibit A - Form of Assignment and Assumption | |

Exhibit B-1 - Form of Notice of Banking Services Obligation | |

Exhibit B-2 - Form of Notice of Swap Agreement Obligation | |

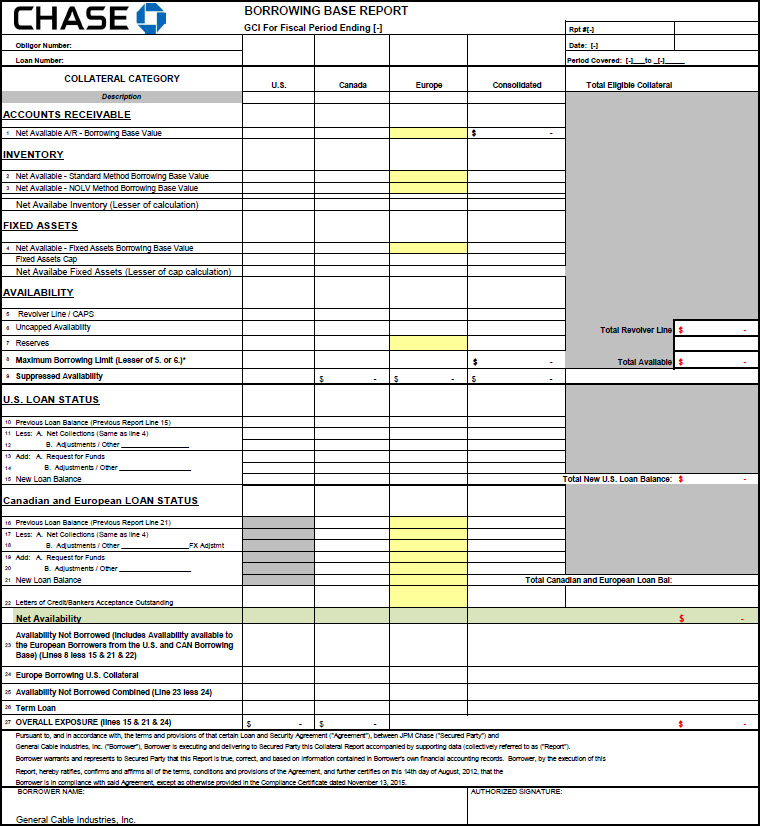

Exhibit C - Form of Borrowing Base Certificate | |

Exhibit D - Form of Compliance Certificate | |

Exhibit E-1 - U.S. Guarantor Joinder Agreement | |

Exhibit E-2 - Canadian Guarantor Joinder Agreement | |

Exhibit E-3 - French Guarantor Joinder Agreement | |

Exhibit E-4 - German Guarantor Joinder Agreement | |

Exhibit E-5 - Spanish Guarantor Joinder Agreement | |

Exhibit F-1 - Form of U.S. Tax Certificate (for Non-U.S. | |

Lenders or non-U.S. Participants That Are Not Partnerships for U.S. Federal Income Tax Purposes) | |

Exhibit F-2 - Form of U.S. Tax Certificate (for Non-U.S. Lenders or non-U.S. Participants | |

That are Partnerships for U.S. Federal Income Tax Purposes) | |

v

SECOND AMENDED AND RESTATED CREDIT AGREEMENT dated as of May 22, 2017 (as it may be amended or modified from time to time, this “Agreement”) among GENERAL CABLE INDUSTRIES, INC., a Delaware corporation (the “U.S. Borrower”), GENERAL CABLE COMPANY LTD., a company organized under the laws of Nova Scotia (the “Canadian Borrower”), SILEC CABLE SAS, a French société par actions simplifiée (the “French Borrower”), NORDDEUTSCHE SEEKABELWERKE GMBH, a limited liability company (Gesellschaft mit beschränkter Haftung) existing under the laws of Germany (the “German Borrower”), GRUPO GENERAL CABLE SISTEMAS, S.L., a public limited liability company (formerly Grupo General Cable Sistemas, S.A.) organized under the laws of Spain ( the “Spanish Borrower”), GENERAL CABLE CORPORATION, a Delaware corporation (“Holdings”), the other Loan Parties party hereto, the Lenders party hereto, JPMORGAN CHASE BANK, N.A., as Administrative Agent, and J.P. MORGAN EUROPE LIMITED, as European Administrative Agent.

The parties hereto agree as follows:

ARTICLE I

DEFINITIONS

DEFINITIONS

Section 1.01 Defined Terms. As used in this Agreement, the following terms have the meanings specified below:

“ABR”, when used in reference to any Loan or Borrowing denominated in Dollars, refers to whether such Loan, or the Loans comprising such Borrowing, bear interest at a rate determined by reference to the Alternate Base Rate.

“Account” means, individually and collectively, any “Account” referred to in any Security Agreement.

“Account Debtor” means any Person obligated on an Account.

“Additional European Borrower” means any Person that becomes a party to this Agreement as a European Borrower in connection with a Permitted Reorganization.

“Additional European Borrower Borrowing Base” means, at any time, the difference of

(a) 85% of any Additional European Borrower’s Eligible Accounts at such time, plus

(b) the lesser of (i) 70% of any Additional European Borrower’s Eligible Inventory, valued at the lower of average cost or market value and (ii) the product of 85% multiplied by Net Orderly Liquidation Value percentage identified in the most recent inventory appraisal ordered by the Administrative Agent multiplied by any Additional European Borrower’s Eligible Inventory, valued at the lower of average cost or market value, plus

(c) any Additional European Borrower PP&E Component, less

1

(d) any applicable Reserve then in effect to the extent applicable to the Additional European Borrower or such Eligible Accounts, Eligible Inventory, Eligible Real Estate or Eligible Equipment.

The Administrative Agent may, in its Permitted Discretion, establish lower advance rates for any category of collateral of any Additional European Borrower, or any portion thereof. Prior to inclusion of any assets of an Additional European Borrower in the determination of the Borrowing Base, due diligence (including, without limitation, legal due diligence, field exams, and appraisals) in respect of such assets satisfactory to the Administrative Agent, in its Permitted Discretion, shall be completed. No assets (other than Eligible Accounts) of any Additional European Borrower shall be included in the Additional European Borrowing Base without the consent of the Administrative Agent and each Joint Lead Arranger.

“Additional European Borrower Borrowing Base Availability” means, at any time, an amount equal to (a) the Additional European Borrower Borrowing Base plus (b) the Canadian Tranche C Borrowing Base Availability plus (c) the U.S. Borrowing Base Availability minus (d) the Additional European Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

“Additional European Borrower PP&E Component” means, at the time of any determination, an amount equal to the lesser of:

(a)an amount equal to the PP&E Amortization Factor multiplied by (i) (A) 75% of the fair market value of any Additional European Borrower’s Eligible Real Property plus (B) 85% of the Net Orderly Liquidation Value of any Eligible European Borrower’s Eligible Equipment minus (ii) Reserves established by the Administrative Agent, or

(b)$150,000,000 minus the Canadian PP&E Component minus the German Equipment Component minus the U.S. PP&E Component minus Reserves established by the Administrative Agent.

“Additional European Borrower Revolving Exposure” means, with respect to any Additional European Borrower, the sum of (a) the outstanding principal amount of Tranche C Revolving Loans to the Additional European Borrower at such time, plus (b) the aggregate principal amount of the Tranche C Swingline Loans to the Additional European Borrower at such time, plus (c) the European LC Exposure issued for the account of the Additional European Borrower at such time, plus (d) the aggregate principal amount of Tranche C Overadvances outstanding to the Additional European Borrower.

“Additional European Guarantee” means, individually and/or collectively as the context may require, any guarantee that is entered into by an Additional European Borrower or any other Additional European Loan Party pursuant to the terms of this Agreement or any other Loan Document, including Section 5.14(a) and (d), in form and substance reasonably satisfactory to the Administrative Agent, as each of the foregoing may be amended, restated or otherwise modified from time to time.

2

“Additional European Guarantor” means an Additional European Borrower and each Person that is a party to this Agreement as an Additional European Guarantor, or that becomes a party to this Agreement as an Additional European Guarantor pursuant to an Additional European Guarantor Joinder Agreement pursuant to Section 5.14(a) and/or (d).

“Additional European Guarantor Joinder Agreement” has the meaning assigned to such term in Section 5.14(a).

“Additional European Loan Parties” means, individually and/or collectively as the context may require, any Additional European Borrower and any Additional European Guarantors, and their respective successors and assigns.

“Additional European Security Agreement” means, individually and collectively as the context may require, each pledge agreement, security agreement, guarantee or other agreement that is entered into by any Additional European Loan Party or any Person who is the holder of Equity Interests in any Additional European Loan Party in favor of any Agent or any other Secured Party, securing or guaranteeing any of the Secured Obligations, in each case in form and substance satisfactory to the Administrative Agent and entered into pursuant to the terms of this Agreement or any other Loan Document (including Section 5.14), as the same may be amended, restated or otherwise modified from time to time.

“Adjusted LIBO Rate” means, with respect to any LIBOR Borrowing for any Interest Period or for any ABR Borrowing, an interest rate per annum (rounded upwards, if necessary, to the next 1/16 of 1%) equal to (a) the LIBO Rate for such Interest Period multiplied by (if applicable) (b) the Statutory Reserve Rate.

“Adjustment Date” means the date that is three Business Days after the date on which financial statements and the accompanying Compliance Certificate are delivered within the time periods specified in Section 5.01.

“Administrative Agent” means JPMorgan Chase Bank, N.A. (including its branches), in its capacity as administrative agent for the Lenders hereunder, and its successors and permitted assigns in such capacity.

“Administrative Questionnaire” means an Administrative Questionnaire in a form supplied by the Administrative Agent.

“Affiliate” means, with respect to a specified Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified.

“Agents” means, individually and collectively as the context may require, the Administrative Agent (including in its capacities as Hypothecary Representative) and the European Administrative Agent.

“Agents’ Liens” means the Liens granted in favor of any Agent to secure any of the Secured Obligations.

3

“Aggregate Borrowing Base” means, with respect to all the Borrowers, at any time, an amount equal to the sum of (a) the U.S. Borrowing Base, plus (b) the lesser of (i) the Canadian Borrowing Base and (ii) the aggregate Tranche B Commitments, plus (c) the lesser of (i) the sum of (A) the French Borrowing Base plus (B) the German Borrowing Base plus (C) the Spanish Borrowing Base plus (D) any Additional European Borrower Borrowing Base plus (E) the greater of (I) zero and (II) the difference of the Canadian Borrowing Base minus the aggregate Tranche B Commitments and (ii) the aggregate Tranche C Commitments.

“Aggregate Credit Exposure” means, at any time, the aggregate Credit Exposure of all the Lenders.

“Aggregate European Borrowing Base” means (a) the French Borrowing Base plus (b) the German Borrowing Base plus (c) the Spanish Borrowing Base plus (d) any Additional European Borrower Borrowing Base.

“Aggregate Revolving Exposure” means, at any time, the aggregate Revolving Exposure of all the Lenders.

“Agreement” has the meaning assigned to such term in the preamble.

“Allocable Amount” has the meaning assigned to such term in Section 10.11(b).

“ALTA” means the American Land Title Association.

“Alternate Base Rate” means, for any day, a rate per annum equal to the greatest of (a) the Prime Rate in effect on such day, (b) the NYFRB Rate in effect on such day plus ½ of 1% and (c) the Adjusted LIBO Rate for a one month Interest Period on such day (or if such day is not a Business Day, the immediately preceding Business Day) plus 1%, provided that, for the purpose of this definition, the Adjusted LIBO Rate for any day shall be based on the LIBO Screen Rate (or if the LIBO Screen Rate is not available for such one month Interest Period, the Interpolated Rate) at approximately 11:00 a.m. London time on such day, subject to the interest rate floors set forth therein. Any change in the Alternate Base Rate due to a change in the Prime Rate, the NYFRB Rate or the Adjusted LIBO Rate shall be effective from and including the effective date of such change in the Prime Rate, the NYFRB Rate or the Adjusted LIBO Rate, respectively. If the Alternate Base Rate is being used as an alternate rate of interest pursuant to Section 2.14 hereof, then the Alternate Base Rate shall be the greater of clause (a) and (b) above and shall be determined without reference to clause (c) above.

“Alternate Rate” means, for any day and for any currency, the sum of (a) a rate per annum selected by the Administrative Agent, in its reasonable discretion based on market conditions in consultation with the Borrower Representative (or the applicable Borrower), reflecting the cost to the Lenders of obtaining funds, plus (b) the Applicable Rate for LIBOR Loans or EURIBOR Loans, as applicable. When used in reference to any Loan or Borrowing, “Alternate Rate” refers to whether such Loan, or the Loans comprising such Borrowing are bearing interest at a rate determined by reference to the Alternate Rate.

“AML Legislation” has the meaning assigned to such term in Section 9.19.

4

“Annex” has the meaning assigned to such term in Section 3.20.

“Anti-Corruption Laws” means all laws, rules, and regulations of any jurisdiction applicable to any Borrower and its Affiliates concerning or relating to bribery or corruption.

“Applicable Limit” has the meaning assigned to such term in Section 2.01.

“Applicable Pension Laws” means the Pension Benefits Act (Ontario) or the similar pension standards statute of Canada or other applicable Canadian jurisdictions, and the ITA, and the regulations of each, as amended from time to time (or any successor statute).

“Applicable Percentage” means, with respect to any Lender:

(a)with respect to payments, computations and other matters relating to the U.S. Commitment or U.S. Revolving Loans, U.S. LC Exposure, U.S. Swingline Loans, U.S. Overadvances or U.S. Protective Advances, a percentage equal to a fraction, the numerator of which is (i) the U.S. Commitment of such U.S. Revolving Lender and the denominator of which is (ii) the aggregate U.S. Commitments of all the U.S. Revolving Lenders (or, if the U.S. Commitments have terminated or expired, the Applicable Percentage shall be determined based upon such U.S. Revolving Lender’s share of the aggregate U.S. Revolving Exposure) at that time;

(b)with respect to payments, computations and other matters relating to the Tranche B Commitment or Tranche B Revolving Loans, Canadian LC Exposure, Tranche B Swingline Loans, Tranche B Overadvances or Tranche B Protective Advances, a percentage equal to a fraction, the numerator of which is (i) the Tranche B Commitment of such Tranche B Revolving Lender and the denominator of which is (ii) the aggregate Tranche B Commitments of all the Tranche B Revolving Lenders (or, if the Tranche B Commitments have terminated or expired, the Applicable Percentage shall be determined based upon such Tranche B Revolving Lender’s share of the aggregate Tranche B Revolving Exposure) at that time;

(c)with respect to payments, computations and other matters relating to the Tranche C Commitment or Tranche C Revolving Loans, European LC Exposure, Tranche C Swingline Loans, Tranche C Overadvances or Tranche C Protective Advances, a percentage equal to a fraction, the numerator of which is (i) the Tranche C Commitment of such Tranche C Revolving Lender and the denominator of which is (ii) the aggregate Tranche C Commitments of all the Tranche C Revolving Lenders (or, if the Tranche C Commitments have terminated or expired, the Applicable Percentage shall be determined based upon such Tranche C Revolving Lender’s share of the aggregate Tranche C Revolving Exposure) at that time;

(d)with respect to payments, computations and other matters relating to the Revolving Commitments or Loans, LC Exposure, Swingline Loans, Overadvances or Protective Advances generally, a percentage equal to a fraction, the numerator of which is (i) the sum of the U.S. Commitment, Tranche B Commitment, and Tranche C Commitment of such Revolving Lender and the denominator of which is (ii) the aggregate Revolving Commitments of all the Revolving Lenders (or, if any (or all) of the U.S. Commitment, Tranche B Commitment, or Tranche C Commitment have

5

terminated or expired, the Applicable Percentage with respect to such terminated or expired Facility (or Facilities) shall be determined based upon such Revolving Lender’s share of the U.S. Revolving Exposure, Tranche B Revolving Exposure, Tranche C Revolving Exposure, or Aggregate Revolving Exposure, as applicable) at that time;

(e)with respect to payments, computations and other matters relating to any other combination of Revolving Commitments or Loans, LC Exposure, Swingline Loans or Overadvances, a percentage equal to a fraction, the numerator of which is (i) the sum of the applicable Revolving Commitments of such Revolving Lenders and the denominator of which is (ii) the aggregate of the applicable Commitments of all the applicable Revolving Lenders (or, if any (or all) of the U.S. Commitment, Tranche B Commitment, or Tranche C Commitment have terminated or expired, the Applicable Percentage with respect to such terminated or expired Facility (or Facilities) shall be determined based upon such Revolving Lender’s share of the U.S. Revolving Exposure, Tranche B Revolving Exposure, Tranche C Revolving Exposure, or Aggregate Revolving Exposure, as applicable) at that time;

provided, that in accordance with Section 2.20, so long as (i) any Lender shall be a Defaulting Lender or (ii) any Tranche C Revolving Lender ceases to be a French Qualifying Lender, such Defaulting Lender’s Revolving Commitment, or such Tranche C Revolving Lender’s Tranche C Commitment, shall be disregarded in the calculations above.

“Applicable Rate” means, for any day, with respect to any Loan, or with respect to the participation fees payable hereunder, as the case may be, the applicable rate per annum set forth below under the caption “ABR Spread”, “Canadian Prime Spread”, “EURIBOR Spread”, “LIBOR Spread”, “Overnight LIBO Rate Spread”, or “CDOR Spread”, as the case may be, based upon the daily average Availability during the most recently completed fiscal quarter of Holdings (the “Average Availability”):

Average Availability | ABR Spread and Canadian Prime Spread | EURIBOR Spread, LIBOR Spread, Overnight LIBO Rate Spread and CDOR Spread |

Category 1 > 66% of the Revolving Commitments | 0.50% | 1.50% |

Category 2 < 66% but > 33% of the Revolving Commitments | 0.75% | 1.75% |

Category 3 < 33% of the Revolving Commitments | 1.00% | 2.00% |

6

For purposes of the foregoing, the Applicable Rate shall be determined as of the end of the first month of each fiscal quarter of Holdings based upon the Borrowing Base Certificate that is mostly recently delivered from time to time pursuant to Section 5.01(f), with any changes to the Applicable Rate resulting from changes in the Average Availability to be effective during the succeeding period of three fiscal months; provided that the Average Availability shall be deemed to be in Category 3 (a) at any time that any Event of Default has occurred and is continuing (other than an Event of Default arising from the failure to deliver any Borrowing Base Certificate) or (b) if the Borrowers fail to deliver any Borrowing Base Certificate that is required to be delivered pursuant to Section 5.01(f), during the period from the expiration of the time for delivery thereof until five days after each such Borrowing Base Certificate is so delivered; provided further that if any Borrowing Base Certificate is at any time restated or otherwise revised or if the information set forth in any Borrowing Base Certificate otherwise proves to be false or incorrect such that the Applicable Rate would have been higher than was otherwise in effect during any period, without constituting a waiver of any Default or Event of Default arising as a result thereof, interest due under this Agreement shall be immediately recalculated at such higher rate for any such applicable periods and shall be due and payable on demand.

“Approved Fund” has the meaning assigned to such term in Section 9.04.

“Assignment and Assumption” means an assignment and assumption entered into by a Lender and an assignee (with the consent of any party whose consent is required by Section 9.04), and accepted by the Administrative Agent, in the form of Exhibit A or any other form approved by the Administrative Agent.

“Availability” means, at any time, an amount equal to (a) the lesser of (i) the aggregate Revolving Commitments and (ii) the Aggregate Borrowing Base minus (b) the Aggregate Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

“Availability Period” means the period from and including the Effective Date to but excluding the earlier of the Maturity Date and the date of termination of the Revolving Commitments.

“Available Revolving Commitment” means, at any time, the aggregate Revolving Commitments minus the Aggregate Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

“Available Tranche B Commitment” means, at any time, the aggregate Tranche B Commitments minus the Tranche B Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

“Available Tranche C Commitment” means, at any time, the aggregate Tranche C Commitments minus the Tranche C Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

7

“Available U.S. Commitment” means, at any time, the aggregate U.S. Commitments minus the U.S. Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

“Average Availability” has the meaning assigned to such term in the definition of “Applicable Rate”.

“Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an EEA Financial Institution.

“Bail-In Legislation” means, with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule.

“Bank of America” means, as long as it or any of its Affiliates remain a Lender, Bank of America, N.A., together with its branches, affiliates and subsidiaries, including, without limitation, Bank of America, N.A. (acting through its Canada branch) and Bank of America Merrill Lynch International Limited.

“Banking Services” means each and any of the following bank services provided to any Loan Party by any Lender or any of its Affiliates: (a) credit cards for commercial customers (including, without limitation, “commercial credit cards” and purchasing cards), (b) stored value cards, (c) merchant processing services, (d) treasury management services (including, without limitation, controlled disbursement, automated clearinghouse transactions, return items, any direct debit scheme or arrangement, overdrafts and interstate depository network services), (e) overdraft lines of credit for investment and deposit accounts, (f) ePayables and (g) supply chain finance services including, without limitation, trade payable services and supplier accounts receivable and drafts/bills of exchange purchases.

“Banking Services Obligations” of the Loan Parties means any and all obligations of the Loan Parties, whether absolute or contingent and howsoever and whensoever created, arising, evidenced or acquired (including all renewals, extensions and modifications thereof and substitutions therefor) in connection with Banking Services.

“Banking Services Reserves” means all Reserves which the Administrative Agent from time to time establishes in its Permitted Discretion for Banking Services then provided or outstanding.

“Bankruptcy Event” means, with respect to any Person, such Person files a petition or application seeking relief under any Insolvency Law or becomes the subject of a bankruptcy or insolvency proceeding, or has had an interim receiver, receiver, receiver and manager, liquidator, sequestrator, conservator, trustee, administrator, custodian, assignee for the benefit of creditors or similar Person charged with reorganization or liquidation of its business, appointed for it, or, in the good faith determination of the Administrative Agent, has taken any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any such proceeding or appointment, provided that a Bankruptcy Event shall not result solely by virtue of the acquisition of any ownership interest in such Person by a Governmental Authority or instrumentality thereof, provided, further, that such acquisition does not result in or provide

8

such Person with immunity from the jurisdiction of courts within Canada, the United States or any other jurisdiction of incorporation or organization of such Person, or from the enforcement of judgments or writs of attachment on its assets or permit such Person (or such Governmental Authority or instrumentality), to reject, repudiate, disavow or disaffirm any contracts or agreements made by such Person.

“Board” means the Board of Governors of the Federal Reserve System of the United States of America.

“Borrower” or “Borrowers” means, individually and/or collectively, as the context may require, the European Borrowers, the U.S. Borrower, and the Canadian Borrower.

“Borrower Representative” has the meaning assigned to such term in Section 11.01.

“Borrowing” means (a) Revolving Loans of the same Facility, Type and currency, made, converted or continued on the same date and, in the case of LIBOR Loans, EURIBOR Loans and CDOR Loans, as to which a single Interest Period is in effect, (b) a Swingline Loan, (c) a Protective Advance and (d) an Overadvance.

“Borrowing Base” means, individually and/or collectively (without duplication) as the context may require, the Aggregate Borrowing Base, the U.S. Borrowing Base, the Canadian Borrowing Base, each European Borrowing Base, and the Aggregate European Borrowing Base. In the Administrative Agent’s sole discretion, additional Inventory, Equipment or real estate (which otherwise meet applicable eligibility criteria) may be added to the Borrowing Base during the first twelve months after the Effective Date with only an appraisal of such additional assets, and thereafter, a full reappraisal of Inventory, Equipment and real property shall be required to include such assets in the Borrowing Base.

“Borrowing Base Certificate” means, individually and/or collectively, as the context may require, a certificate (or certificates), setting forth calculation of the Canadian Borrowing Base, the U.S. Borrowing Base, each European Borrowing Base, the Aggregate European Borrowing Base, and the Aggregate Borrowing Base, signed and certified as accurate and complete by a Financial Officer of the Borrower Representative (provided that, with respect to assets of an individual Borrower that are included in the applicable Borrowing Base, such certificate may be signed and certified as accurate and complete by a Financial Officer of such Borrower), in substantially the form of Exhibit C or another form which is mutually acceptable to the Administrative Agent and the Borrower Representative.

“Borrowing Request” means a request by the Borrower Representative (or the applicable Borrower) for a Revolving Borrowing in accordance with Section 2.03.

“Business Day” means any day that is not a Saturday, Sunday or other day on which commercial banks in New York City are authorized or required by law to remain closed; provided that, (a) when used in connection with any LIBOR Loan, any EURIBOR Loan, any Tranche C Swingline Loan, or any European Letter of Credit the term “Business Day” shall also exclude any day on which banks are not open for general business in London, (b) when used in connection with any Tranche B Loan, any Canadian Letter of Credit or any U.S. Letter of Credit denominated in Canadian Dollars, the term “Business Day” shall also exclude any day in which commercial banks in Toronto, Canada are authorized or required by law to remain closed, and (c) when used in connection with any Tranche C Loan or any European Letter of

9

Credit denominated in Sterling, the term “Business Day” shall also exclude any day on which commercial banks in London, England are authorized or required by law to remain closed.

“CAM” has the meaning assigned to such term in Section 9.20(a)(i).

“CAM Exchange” has the meaning assigned to such term in Section 9.20(a)(ii).

“CAM Exchange Date” has the meaning assigned to such term in Section 9.20(a)(iii).

“CAM Percentage” has the meaning assigned to such term in Section 9.20(a)(iv).

“Canada” means the country of Canada.

“Canadian Benefit Plan” means any plan, fund, program, or policy, whether oral or written, formal or informal, funded or unfunded, insured or uninsured, providing employee benefits, including medical, hospital care, dental, sickness, accident, disability, life insurance, pension, retirement or savings benefits, under which any Canadian Loan Party or any Subsidiary of any Canadian Loan Party has any liability with respect to any employee or former employee, but excluding any Canadian Pension Plans.

“Canadian Borrower” has the meaning assigned to such term in the preamble.

“Canadian Borrowing Base” means, at any time, the sum of

(a)85% of the Canadian Loan Parties’ Eligible Accounts at such time, plus

(b)the lesser of (i) 70% of the Canadian Loan Parties’ Eligible Inventory, valued at the lower of average cost or market value and (ii) the product of 85% multiplied by the Net Orderly Liquidation Value percentage identified in the most recent inventory appraisal ordered by the Administrative Agent multiplied by the Canadian Loan Parties’ Eligible Inventory valued at the lower of average cost or market value, plus

(c)the Canadian PP&E Component, less

(d)any applicable Reserve then in effect to the extent applicable to the Canadian Borrower or such Eligible Accounts, Eligible Inventory, Eligible Real Estate or Eligible Equipment.

“Canadian Collection Deposit Account” means a “Collection Deposit Account” as defined in the Canadian Security Agreement.

“Canadian Dollars” and “Cdn.$” means dollars in the lawful currency of Canada.

10

“Canadian Funding Office” means the office of JPMorgan Chase Bank, N.A., Toronto Branch specified in Section 9.01 or such other office as may be specified from time to time by the Administrative Agent by written notice to the Canadian Borrower and the Tranche B Revolving Lenders.

“Canadian Guarantee” means, individually and/or collectively as the context may require, any guarantee that is entered into by the Canadian Borrower or any other Canadian Loan Party pursuant to the terms of this Agreement or any other Loan Document, including Section 5.14(a) and (c), in form and substance reasonably satisfactory to the Administrative Agent, as each of the foregoing may be amended, restated or otherwise modified from time to time.

“Canadian Guaranteed Obligations” has the meaning assigned to such term in Section 10.01(b).

“Canadian Guarantor” means the Canadian Borrower and each Person that is a party to this Agreement as a Canadian Guarantor, or that becomes a party to this Agreement as a Canadian Guarantor pursuant to a Canadian Guarantor Joinder Agreement pursuant to Section 5.14(a) and/or (c).

“Canadian Guarantor Joinder Agreement” has the meaning assigned to such term in Section 5.14(a).

“Canadian Intercompany Financing Agreements” means (a) the Capital Support Agreement dated as of December 27, 2012, between the U.S. Borrower and GCC Holdings, as it may be amended, supplemented, restated, replaced or otherwise modified from time to time, (b) the Guarantee, dated as of December 27, 2012, made by the U.S. Borrower in favor of GCC Nova Scotia, as it may be amended, supplemented, restated, replaced or otherwise modified from time to time, (c) the Secured Promissory Note issued by GCC Nova Scotia to the U.S. Borrower on December 27, 2012, as it may be amended, supplemented, restated, replaced or otherwise modified from time to time, in a principal amount not to exceed $100,000,000 and (d) the Subscription Agreement, dated as of December 27, 2012 between GCC Holdings and GCC Nova Scotia, as it may be amended, supplemented, restated, replaced or otherwise modified from time to time.

“Canadian Issuing Banks” means, individually and/or collectively as the context may require, in the case of each Canadian Letter of Credit, JPMorgan Chase Bank, N.A., Toronto Branch, PNC Bank Canada Branch, Fifth Third Bank, operating through its Canadian Branch, Bank of America, N.A. (acting through its Canada Branch), and any other Lender from time to time designated by the Borrower Representative as a Canadian Issuing Bank, with the consent of such Lender and the Administrative Agent, each in its capacity as the issuer of Canadian Letters of Credit hereunder, and their respective successors and assigns in such capacity as provided in Section 2.06(j). Any Canadian Issuing Bank may, in its sole discretion, arrange for one or more Canadian Letters of Credit to be issued by its Affiliates, in which case the term “Canadian Issuing Bank” shall include any such Affiliate with respect to Canadian Letters of Credit issued by such Affiliate (it being agreed that such Issuing Bank shall, or shall cause such Affiliate to, comply with the requirements of Section 2.06 with respect to such Canadian Letters of Credit). At any time there is more than one Canadian Issuing Bank, all singular references to the Canadian Issuing Bank shall mean any Canadian Issuing Bank, either Canadian Issuing

11

Bank, each Canadian Issuing Bank, the Canadian Issuing Bank that has issued the applicable Letter of Credit, or both (or all) Canadian Issuing Banks, as the context may require.

“Canadian Issuing Bank Sublimit” means, as of the Effective Date, (i) $7,966,000, in the case of JPMorgan Chase Bank, N.A., Toronto Branch, (ii) $6,388,000, in the case of PNC Bank Canada Branch, (iii) $6,388,000, in the case of Fifth Third Bank, operating through its Canadian Branch, (iv) $4,258,000, in the case of Bank of America, N.A. (acting through its Canada Branch), and (v) such amount as shall be designated to the Administrative Agent and the Borrower Representative in writing by a Canadian Issuing Bank; provided that any Canadian Issuing Bank shall be permitted at any time to increase or reduce its Canadian Issuing Bank Sublimit upon providing five (5) days’ prior written notice thereof to the Administrative Agent and the Borrower Representative (so long as the aggregate Canadian Issuing Bank Sublimits of all Canadian Issuing Banks does not exceed the Tranche B Commitment).

“Canadian LC Collateral Account” has the meaning assigned to such term in Section 2.06(k).

“Canadian LC Exposure” means, at any time, the sum of the Dollar Amount of the Commercial LC Exposure and the Standby LC Exposure in respect of Canadian Letters of Credit. The Canadian LC Exposure of any Tranche B Revolving Lender at any time shall be its Applicable Percentage of the total Canadian LC Exposure at such time.

“Canadian Letter of Credit” means any Letter of Credit or similar instrument (including a bank guarantee) acceptable to the applicable Canadian Issuing Bank issued hereunder for the purpose of providing credit support for the Canadian Borrower.

“Canadian Loan Parties” means, individually and/or collectively as the context may require, the Canadian Borrower and the Canadian Guarantors, and their respective successors and assigns.

“Canadian Multiemployer Plan” means a Canadian Pension Plan that is contributed to by a Canadian Loan Party for its employees or former employees pursuant to a collective agreement or participation agreement but which is not maintained or administered by the Canadian Loan Party.

“Canadian Obligations” means, with respect to the Canadian Loan Parties, all unpaid principal of and accrued and unpaid interest on the Tranche B Loans made to the Canadian Borrower, all Canadian LC Exposure, all accrued and unpaid fees and all expenses, reimbursements, indemnities and other obligations of the Canadian Loan Parties to any Lender, the Administrative Agent, any Canadian Issuing Bank, any indemnified party arising under the Loan Documents, or any other Secured Party, including those arising pursuant to Section 10.01(b) or arising under any other Canadian Guarantee (in each case including interest and other obligations accruing or incurred during the pendency of any bankruptcy, insolvency, receivership or other similar proceeding or which would have accrued but for such bankruptcy, insolvency or similar proceeding, regardless of whether allowed or allowable in such proceeding).

12

“Canadian Pension Plans” means each pension plan required to be registered under Canadian federal or provincial law that is maintained or contributed to by a Canadian Loan Party or any Subsidiary of any Canadian Loan Party for its employees or former employees, but does not include the Canada Pension Plan or the Quebec Pension Plan as administered by the Government of Canada or the Province of Quebec, respectively.

“Canadian PP&E Component” means, at the time of any determination, an amount equal to the lesser of:

(a)an amount equal to the PP&E Amortization Factor multiplied by (i) an amount equal to (A) 75% of the fair market value of the Canadian Loan Parties’ Eligible Real Property plus (B) 85% of the Net Orderly Liquidation Value of the Canadian Loan Parties’ Eligible Equipment minus (ii) Reserves established by the Administrative Agent, or

(b)$150,000,000 minus the U.S. PP&E Component minus the German Equipment Component minus any Additional European Borrower PP&E Component minus Reserves established by the Administrative Agent.

“Canadian Prime Rate” means, for any period, the rate per annum determined by the Administrative Agent to be the higher of (i) the rate equal to the PRIMCAN Index rate that appears on the Bloomberg screen at 10:15 a.m. Toronto time on such day (or, in the event that the PRIMCAN Index is not published by Bloomberg, any other information services that publishes such index from time to time, as selected by the Administrative Agent in its reasonable discretion) and (ii) the average rate for 30 day Canadian Dollar bankers’ acceptances that appears on the Reuters Screen CDOR Page (or, in the event such rate does not appear on such page or screen, on any successor or substitute page or screen that displays such rate, or on the appropriate page of such other information service that publishes such rate from time to time, as selected by the Administrative Agent in its reasonable discretion) at 10:15 a.m. Toronto time on such day, plus 1.00% per annum; provided, that if any the above rates shall be less than zero, such rate shall be deemed to be zero for purposes of this Agreement. Any change in the Canadian Prime Rate due to a change in the PRIMCAN Index or the CDOR Rate shall be effective from and including the effective date of such change in the PRIMCAN Index or CDOR Rate, respectively.

“Canadian Prime Rate Loan” means a Loan denominated in Canadian Dollars the rate of interest applicable to which is based upon the Canadian Prime Rate.

“Canadian Priority Payable Reserve” means reserves for amounts secured by any Liens, choate or inchoate, or interests similar thereto under applicable law, which rank or are capable of ranking in priority to or pari passu with the Administrative Agent’s or any other Secured Parties’ Liens and/or for amounts which may represent costs relating to the enforcement of the Administrative Agent’s or any Secured Parties’ Liens including, without limitation or duplication, in the Permitted Discretion of the Administrative Agent, any such amounts due and not paid for or in respect of wages, vacation pay, amounts due and not paid under any legislation relating to workers’ compensation or to employment insurance, all amounts deducted or withheld and not paid and remitted when due with respect to goods and services taxes, sales taxes, harmonized taxes, excise taxes, value-added taxes, employee income taxes, amounts currently or past due and not paid for realty, municipal or similar taxes (to the extent impacting personal or moveable property), Quebec corporate taxes, overdue rents, the Wage Earner

13

Protection Program Act Reserve, and all amounts currently or past due and not contributed, remitted or paid to or under any Canadian Pension Plan or Applicable Pension Laws or under the Canada Pension Plan, and any solvency deficiency, unfunded liability or wind-up deficiency under or in respect of any Canadian Pension Plan.

“Canadian Reaffirmation Agreement” means the Canadian Reaffirmation Agreement, dated as of the date hereof, among the Canadian Loan Parties party thereto and the Administrative Agent.

“Canadian Secured Obligations” means all Canadian Obligations, together with all (a) Banking Services Obligations of the Canadian Loan Parties owing to one or more Revolving Lenders or their respective Affiliates, provided that (i) (A) such Banking Services Obligation is listed on Schedule 1.01C as of the Effective Date, (B) within one week of the time that any agreement relating to such Banking Services Obligation is executed (or in the case of Banking Services Obligations existing on the date that a Person becomes a Revolving Lender (or an Affiliate of a Revolving Lender) after the Effective Date, within one week after such date), the Revolving Lender or Affiliate of a Revolving Lender party thereto shall have delivered written notice (executed by such Revolving Lender or Affiliate and the Borrower Representative) to the Administrative Agent in the form of Exhibit B-1 or any other form approved by the Administrative Agent that such a transaction has been entered into and that it constitutes a Canadian Secured Obligation entitled to the benefits of the applicable Collateral Documents or (C) JPMCB or an Affiliate is a party thereto and (ii) the applicable Revolving Lender has not, at the time such transaction relating to such Banking Services Obligation is executed, received notice of any continuing Event of Default; and (b) Swap Agreement Obligations of the Canadian Loan Parties owing to one or more Revolving Lenders or their respective Affiliates, provided that (i) (A) such Swap Agreement Obligation is listed on Schedule 1.01D as of the Effective Date, (B) within one week of the time that any transaction relating to such Swap Agreement Obligation is executed (or in the case of Swap Agreement Obligations existing on the date that a Person becomes a Revolving Lender (or an Affiliate of a Revolving Lender) after the Effective Date, within one week after such date), the Revolving Lender or Affiliate of a Revolving Lender party thereto shall have delivered written notice (executed by such Revolving Lender or Affiliate and the Borrower Representative) to the Administrative Agent in the form of Exhibit B-2 or any other form approved by the Administrative Agent that such a transaction has been entered into and that it constitutes a Canadian Secured Obligation entitled to the benefits of the applicable Collateral Documents or (C) JPMCB or an Affiliate is a party thereto and (ii) the applicable Revolving Lender has not, at the time such transaction relating to such Swap Agreement Obligation is executed, received notice of any continuing Event of Default; provided, however, that the definition of “Canadian Secured Obligations” shall not create any guarantee by any Canadian Guarantor of (or grant of security interest by any Canadian Guarantor to support, as applicable) any Excluded Swap Obligations of such Canadian Guarantor for purposes of determining any obligations of any Canadian Guarantor.

“Canadian Security Agreement” means, individually and/or collectively as the context may require, (a) the Canadian Pledge and Security Agreement, dated as of July 21, 2011, of the Canadian Loan Parties in favor of the Administrative Agent, as amended by the Canadian Reaffirmation and Amendment Agreement, dated as of September 6, 2013, made by the Canadian Borrower in favor of the Administrative Agent, (b) the Quebec Security Documents, dated as of July 21, 2011, between the Canadian Loan Parties party thereto and the Administrative Agent and (c) any other pledge or security agreement (including the Quebec

14

Security Documents) that is entered into by any Canadian Loan Party or any Person who is the holder of Equity Interests in any Canadian Loan Party pursuant to the terms of this Agreement or any other Loan Document, including Section 5.14(a) and (c), as each of the foregoing may be amended, restated or otherwise modified from time to time.

“Canadian Subsidiary” means each Subsidiary of Holdings that is organized under the laws of Canada, or any province or territory of Canada.

“Canadian Tranche C Borrowing Base Availability” means, at any time, an amount equal to the greater of (a) zero and (b)(i) the Canadian Borrowing Base minus (ii) the Tranche C Canadian Borrowing Base Usage minus (iii) the total Tranche B Revolving Exposure (calculated, with respect to any Defaulting Lender, as if such Defaulting Lender had funded its Applicable Percentage of all outstanding Borrowings).

“Capital Expenditures” means, without duplication, any expenditure or commitment to expend money for any purchase or other acquisition of any asset which would be classified as a fixed or capital asset on a consolidated balance sheet of Holdings and its Subsidiaries prepared in accordance with GAAP.

“Capital Lease Obligations” of any Person means the obligations of such Person to pay rent or other amounts under any lease of (or other arrangement conveying the right to use) real or personal property, or a combination thereof, which obligations are required to be classified and accounted for as capital leases on a balance sheet of such Person under GAAP, and the amount of such obligations shall be the capitalized amount thereof determined in accordance with GAAP.

“Cash Management Period” means (a) each period commencing on any day that (i) an Event of Default, (ii) a Default under clause (a), (b), (h) or (i) of Article VII or (iii) in the sole discretion of the Administrative Agent, any other Default, occurs and is continuing until, during the preceding 45 consecutive days, no Default or Event of Default has existed on any day and (b) each period commencing on any day that Availability is less than the greater of (i) $87,500,000 or (ii) 12.5% of the sum of the total Revolving Commitments at such time, and continuing until, during the preceding 45 consecutive days, no Default or Event of Default has existed on any day and Availability has at all times been greater than the greater of (y) $87,500,000 or (z) 12.5% of the sum of the total Revolving Commitments at such time.

“Cash Pooling Arrangements” means cash pooling arrangements entered into between one or more Subsidiaries of Holdings and the Administrative Agent (or its Affiliates), in form and substance acceptable to the Agents and, with respect to any deposit accounts entered into by any Loan Party pursuant thereto, subject to Deposit Account Control Agreements in favor of the European Administrative Agent.

15

“CDOR” when used in reference to any Loan or Borrowing denominated in Canadian Dollars, refers to whether such Loan, or the Loans comprising such Borrowing, are bearing interest at a rate determined by reference to the CDOR Rate.

“CDOR Rate” means, for the relevant Interest Period, the Canadian dollar offered rate which, in turn means on any day the sum of (a) the annual rate of interest determined with reference to the arithmetic average of the discount rate quotations of all institutions listed in respect of the relevant interest period for Canadian Dollar-denominated bankers’ acceptances displayed and identified as such on the “CDOR Page” (or any display substituted therefor) of Reuters Monitor Money Rates Service Reuters Screen, or, in the event such rate does not appear on such page or screen, on any successor or substitute page or screen that displays such rate, or on the appropriate page of such other information service that publishes such rate from time to time, as selected by the Administrative Agent in its reasonable discretion (the “CDOR Screen Rate”), at or about 10:15 a.m. Toronto local time on the first day of the applicable Interest Period and, if such day is not a business day, then on the immediately preceding business day (as adjusted by the Administrative Agent after 10:15 a.m. Toronto local time to reflect any error in the posted rate of interest or in the posted average annual rate of interest) plus (b) 0.10% per annum; provided that (x) if the CDOR Screen Rate shall be less than zero, such rate shall be deemed to be zero and (y) if the CDOR Screen Rate is not available on the Reuters Screen CDOR Page on any particular day, then the Canadian dollar offered rate component of such rate on that day shall be calculated as the applicable Interpolated Rate as of such time on such day ; or if such day is not a Business Day, then as so determined on the immediately preceding Business Day.

“CDOR Rate Loan” means a Loan denominated in Canadian Dollars made by the Lenders to the Borrower which bears interest at a rate based on the CDOR Rate.

“Change in Control” means (a) the acquisition of ownership, directly or indirectly, beneficially or of record, by any Person or group (within the meaning of the Securities Exchange Act of 1934 and the rules of the Securities and Exchange Commission thereunder as in effect on the date hereof), of Equity Interests representing more than 35% of the aggregate ordinary voting power represented by the issued and outstanding Equity Interests of Holdings; (b) occupation of a majority of the seats (other than vacant seats) on the board of directors of Holdings by Persons who were neither (i) directors of Holdings on the date hereof, (ii) nominated by the board of directors of Holdings, nor (iii) appointed by directors so nominated; (c) prior to the occurrence of the Permitted Reorganization, (i) Holdings at any time ceases to own, free and clear of all Liens or other encumbrances (other than the Agents’ Liens), and control 100% of the issued and outstanding Equity Interests of Intermediate Holdings, (ii) Intermediate Holdings at any time ceases to own, free and clear of all Liens or other encumbrances (other than the Agents’ Liens) and control 100% of the issued and outstanding Equity Interests of the U.S. Borrower, (iii) Holdings at any time ceases to own, free and clear of all Liens or other encumbrances (other than the Agents’ Liens) and control at least 100% (99% solely through one or more Loan Parties) of the issued and outstanding Equity Interests of the Canadian Borrower, (iv) Holdings at any time ceases directly or indirectly to own free and clear of all Liens or other encumbrances (other than the Agents’ Liens) and control 100% of each class of the outstanding Equity Interests of each European Borrower (at least 99% solely through one or more Loan Parties), or (v) Holdings at any time ceases to, directly, or indirectly, own, free and clear of all Liens or other encumbrances (other than the Agents’ Liens) and control 100% of each class of the outstanding Equity Interests of each Loan Guarantor (at

16

least 99% solely through one or more Loan Parties), provided that no transaction permitted by Section 6.03 shall constitute a Change in Control under this clause (c)(v); (d) from and after the occurrence of the Permitted Reorganization, Holdings at any time ceases, directly or indirectly (through one or more other Loan Parties), to own, free and clear of all Liens or other encumbrances (other than Agents’ Liens) 100% of the issued and outstanding Equity Interests of each Loan Party; or (e) at any time a change of control occurs under and as defined in any documentation relating to any Material Indebtedness.

“Change in Law” means (a) the adoption of any law, rule, regulation or treaty (including any rules or regulations issued under or implementing any existing law) after the date of this Agreement, (b) any change in any law, rule, regulation or treaty or in the interpretation, administration, implementation or application thereof by any Governmental Authority after the date of this Agreement or (c) compliance by any Lender or the Issuing Bank (or, for purposes of Section 2.15(b), by any lending office of such Lender or by such Lender’s or the Issuing Bank’s holding company, if any) with any request, rule, guideline or directive (whether or not having the force of law) of any Governmental Authority made or issued after the date of this Agreement; provided that notwithstanding anything herein to the contrary, (i) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules, guidelines or directives thereunder, issued in connection therewith or in implementation thereof, and (ii) all requests, proposed and/or final rules, interpretations, guidelines and directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, shall in each case be deemed to be a “Change in Law”, regardless of the date enacted, adopted, issued or implemented.

“Class”, when used in reference to any Loan or Borrowing, refers to whether such Loan, or the Loans comprising such Borrowing, are Revolving Loans, Swingline Loans, Protective Advances or Overadvances.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collateral” means any and all property owned, leased or operated by a Person covered by the Collateral Documents and any and all other property of any Loan Party, now existing or hereafter acquired, that may at any time be or become subject to a security interest, hypothec or Lien granted by any Loan Party in favor of any Agent to secure any Secured Obligations.

“Collateral Access Agreement” has the meaning assigned to such term in any Security Agreement.

“Collateral Documents” means, individually and/or collectively as the context may require, each Security Agreement, each Mortgage, each Collateral Access Agreement, each Trademark Security Agreement, each Deposit Account Control Agreement, the Quebec Security Documents, the U.S. Reaffirmation Agreement, the Canadian Reaffirmation Agreement, and each other document pursuant to which a Person grants a Lien upon any real or personal property as security for payment of any Secured Obligations.

17

“Collection Deposit Account” means, individually and/or collectively as the context may require, any U.S. Collection Deposit Account, any Canadian Collection Deposit Account, and any European Collection Deposit Account.

“Commercial LC Exposure” means, at any time, the sum of (a) the aggregate undrawn amount of all outstanding Commercial Letters of Credit plus (b) the aggregate amount of all LC Disbursements relating to Commercial Letters of Credit that have not yet been reimbursed by or on behalf of the Borrowers. The Commercial LC Exposure of any Revolving Lender at any time shall be its Applicable Percentage of the aggregate Commercial LC Exposure at such time.

“Commercial Letter of Credit” means any Letter of Credit issued for the purpose of providing the primary payment mechanism in connection with the purchase of any materials, goods or services by a Borrower in the ordinary course of business of such Borrower.

“Commodity Exchange Act” means the Commodity Exchange Act (7 U.S.C. § 1 et seq.), as amended from time to time, and any successor statute.

“Compliance Certificate” means a certificate, signed and certified as accurate and complete by a Financial Officer of the Borrower Representative, in substantially the form of Exhibit D or another form which is mutually acceptable to the Administrative Agent and the Borrower Representative.

“Consolidated Total Assets” of any Person means, as of any date, the amount that, in accordance with GAAP, would be set forth under the caption “Total Assets” (or any like caption) on a consolidated balance sheet of such Person and its Subsidiaries, as of the end of the most recent fiscal quarter for which internal financial statements are available.

“Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto.

“Controlled Disbursement Account” means any account or accounts of the U.S. Borrower or the Canadian Borrower maintained with the Administrative Agent as a zero balance, cash management account pursuant to and under any agreement between a Borrower and the Administrative Agent, as modified and amended from time to time, which account or accounts are designated as Controlled Disbursement Accounts by the Borrower Representative and the Administrative Agent, and upon such designation, through which all disbursements of such Borrower, any other U.S. Loan Party (in the case of a Controlled Disbursement Account of the U.S. Borrower), any other Canadian Loan Party (in the case of a Controlled Disbursement Account of the Canadian Borrower), and any designated Subsidiary of such U.S. Borrower or Canadian Borrower are made and settled on a daily basis with no uninvested balance remaining overnight.

“Convertible Preferred Stock” shall mean Holdings’ 5.75% Series A Redeemable Convertible Preferred Stock of Holdings, par value $0.01 per share, liquidation preference $50 per share, issued pursuant to the Convertible Preferred Stock Documents.

18

“Convertible Preferred Stock Documents” shall mean the Certificate of Designations relating to the Convertible Preferred Stock, the Convertible Preferred Stock Purchase Agreement and other documents pursuant to which the Convertible Preferred Stock is issued and all other documents executed and delivered with respect to the Convertible Preferred Stock prior to the date of this Agreement.

“Covenant Trigger Period” means each period commencing on any day that Availability is less than the greater of (x) $70,000,000 or (y) 10.0% of the sum of the total Revolving Commitments at such time, and continuing until, during the preceding 30 consecutive days, Availability has at all times been greater than or equal to the greater of (x) $70,000,000 or (y) 10.0% of the sum of the total Revolving Commitments at such time.

“Credit Exposure” means, as to any Lender at any time, the sum of (a) such Lender’s Revolving Exposure, plus (b) an amount equal to its Applicable Percentage, if any, of the aggregate principal amount of U.S. Protective Advances, Tranche B Protective Advances, and Tranche C Protective Advances outstanding.

“Credit Party” means any Agent, any Issuing Bank, any Swingline Lender, or any other Lender.

“Default” means any event or condition which constitutes an Event of Default or which upon notice, lapse of time or both would, unless cured or waived, become an Event of Default.

“Defaulting Lender” means any Lender that (a) has failed, within two Business Days of the date required to be funded or paid, to (i) fund any portion of its Loans, (ii) fund any portion of its participations in Letters of Credit or Swingline Loans or (iii) pay over to any Credit Party any other amount required to be paid by it hereunder, unless, in the case of clause (i) above, such Lender notifies the Administrative Agent in writing that such failure is the result of such Lender’s good faith determination that a condition precedent to funding (specifically identified and including the particular Default, if any) has not been satisfied; (b) has notified any Borrower or any Credit Party in writing, or has made a public statement, to the effect that it does not intend or expect to comply with any of its funding obligations under this Agreement (unless such writing or public statement indicates that such position is based on such Lender’s good faith determination that a condition precedent (specifically identified and including the particular Default, if any) to funding a Loan under this Agreement cannot be satisfied), (c) has failed, within three Business Days after request by a Credit Party, acting in good faith, to provide a certification in writing from an authorized officer of such Lender that it will comply with its obligations to fund prospective Loans and participations in then outstanding Letters of Credit and Swingline Loans under this Agreement; provided that such Lender shall cease to be a Defaulting Lender pursuant to this clause (c) upon such Credit Party’s receipt of such certification in form and substance satisfactory to it and the Administrative Agent, or (d) has become the subject of (i) a Bankruptcy Event or (ii) a Bail-In Action.

“Deposit Account Control Agreement” means, individually and collectively, each “Deposit Account Control Agreement” referred to herein or in any Security Agreement and any similar agreements (and, in the case of any European Loan Party, documentation or requirements) necessary to perfect the security interest of any Agent or effect control over the relevant deposit accounts referred to in such Security Agreement or such similar agreement.

19

“Deposit Account Transition Date” has the meaning assigned to such term in Section 5.13.

“Designated Obligations” has the meaning assigned to such term in Section 9.20(a)(v).

“Disclosed Matters” means the actions, suits and proceedings and the environmental matters disclosed in Schedule 3.06.

“Document” has the meaning assigned to such term in the U.S. Security Agreement.

“Dollar Amount” means (a) with regard to any Obligation or calculation denominated in Dollars, the amount thereof, and (b) with regard to any Obligation or calculation denominated in any other currency, the amount of Dollars which is equivalent to the sum of (i) the amount so expressed in such other currency at the Spot Rate on the relevant date of determination; plus (ii) any amounts owed by the Borrowers pursuant to Section 2.06(f).

“Dollars” or “$” refers to lawful money of the United States of America.

“Domestic Subsidiary” means each Subsidiary of Holdings that is organized under the laws of the United States, any state of the United States or the District of Columbia.

“EBITDA” means, for any period for any Person, Net Income for such period plus (a) without duplication and to the extent deducted in determining Net Income for such period, the sum of (i) Interest Expense for such period, (ii) income tax expense for such period net of tax refunds, (iii) all amounts attributable to depreciation and amortization expense for such period, (iv) any extraordinary charges for such period and (v) any other non-cash charges for such period (but excluding any non-cash charge in respect of an item that was included in Net Income in a prior period and any non-cash charge that relates to the write-down or write-off of inventory), minus (b) without duplication and to the extent included in Net Income, (i) any cash payments made during such period in respect of non-cash charges described in clause (a)(v) taken in a prior period and (ii) any extraordinary gains and any non-cash items of income for such period, all calculated in accordance with GAAP.

“ECP” means an “eligible contract participant” as defined in Section 1(a)(18) of the Commodity Exchange Act or any regulations promulgated thereunder and the applicable rules issued by the Commodity Futures Trading Commission and/or the SEC.

“EEA Financial Institution” means (a) any institution established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any institution established in an EEA Member Country which is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent.

20

“EEA Member Country” means any of the member states of the European Union, Iceland, Liechtenstein, and Norway.

“EEA Resolution Authority” means any public administrative authority or any Person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution.

“Effective Date” means the date on which the conditions specified in Section 4.01 are satisfied (or waived in accordance with Section 9.02).

“Electronic Signature” means an electronic sound, symbol, or process attached to, or associated with, a contract or other record and adopted by a Person with the intent to sign, authenticate or accept such contract or record.

“Electronic System” means any electronic system, including e-mail, e-fax, web portal access for any Borrower, Intralinks®, ClearPar®, Debt Domain, Syndtrak and any other Internet or extranet-based site, whether such electronic system is owned, operated or hosted by the Administrative Agent, European Administrative Agent or any Issuing Bank and any of its respective Related Parties or any other Person, providing for access to data protected by passcodes or other security system.

“Eligible Accounts” means, at any time, the Accounts of a Loan Party which the Administrative Agent determines in its Permitted Discretion are eligible as the basis for the extension of Revolving Loans and Swingline Loans and the issuance of Letters of Credit. Without limiting the Administrative Agent’s discretion provided herein, Eligible Accounts shall not include any Account of a Loan Party:

(a)which is not subject to a first priority perfected security interest granted by (i) the U.S. Loan Parties in favor of the Administrative Agent on behalf of itself and the Secured Parties to secure the Secured Obligations, (ii) the Canadian Loan Parties in favor of the Administrative Agent on behalf of itself and the International Secured Parties to secure the applicable Secured Obligations, or (iii) the European Loan Parties in favor of the European Administrative Agent on behalf of itself and the International Secured Parties to secure the applicable Secured Obligations;

(b)which is subject to any Lien other than (i) the Agents’ Liens or (ii) a Permitted Encumbrance which does not have priority over the Agents’ Liens;

(c)(i) which (A) in the case of Account Debtors other than those listed on Schedule 1.01B, is unpaid more than 120 days (150 days in the case of Accounts of the Spanish Borrower) after the date of the original invoice therefor or (B) in the case of Account Debtors listed on Schedule 1.01B, is unpaid more than 30 days after the original due date therefor (in the case of each of clauses (A) and (B), “Overage”) (when calculating such amount for the same Account Debtor, the Administrative Agent shall include the net amount of such Overage and add back any credits, but only to the extent that such credits do not exceed the total gross receivables from such Account Debtor), or (ii) which has been written off the books of such Loan Party or otherwise designated as uncollectible;

21

(d)which is owing by an Account Debtor for which more than 50% of the Accounts owing from such Account Debtor and its Affiliates are ineligible pursuant to clause (c) above;