Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Hi-Crush Inc. | exhibit991-earningsrelease.htm |

| 8-K - 8-K - Hi-Crush Inc. | q22017-earningsrelease8xk.htm |

INVESTOR PRESENTATION

AUGUST 2017

Forward Looking Statements

Some of the information included herein may contain forward-looking statements within the meaning of the federal securities

laws. Forward-looking statements give our current expectations and may contain projections of results of operations or of

financial condition, or forecasts of future events. Words such as ―may,‖ ―assume,‖ ―forecast,‖ ―position,‖ ―predict,‖ ―strategy,‖

―expect,‖ ―intend,‖ ―plan,‖ ―estimate,‖ ―anticipate,‖ ―could,‖ ―believe,‖ ―project,‖ ―budget,‖ ―potential,‖ or ―continue,‖ and similar

expressions are used to identify forward-looking statements. They can be affected by assumptions used or by known or

unknown risks or uncertainties. Consequently, no expected results of operations or financial condition or other forward-looking

statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors

and other cautionary statements in Hi-Crush Partners LP’s (―Hi-Crush‖) reports filed with the Securities and Exchange

Commission (―SEC‖), including those described under Item 1A, ―Risk Factors‖ of Hi-Crush’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2016. Actual results may vary materially. You are cautioned not to place undue reliance on any

forward-looking statements. You should also understand that it is not possible to predict or identify all such factors and should

not consider the risk factors in our reports filed with the SEC or the following list to be a complete statement of all potential risks

and uncertainties. Factors that could cause our actual results to differ materially from the results contemplated by such forward-

looking statements include: whether we are able to complete the Blair acquisition, the volume of frac sand we are able to sell;

the price at which we are able to sell frac sand; the outcome of any litigation, claims or assessments, including unasserted

claims; changes in the price and availability of natural gas or electricity; changes in prevailing economic conditions; and difficulty

collecting receivables. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary

statements. Hi-Crush’s forward-looking statements speak only as of the date made and Hi-Crush undertakes no obligation to

update or revise its forward-looking statements, whether as a result of new information, future events or otherwise.

2

Strategic Update

Kermit Facility

Initial wet plant production

Photo dated July 17, 2017

Continued Execution & Strategically Positioned

4

Asset Base

Well-Aligned

with

Demands

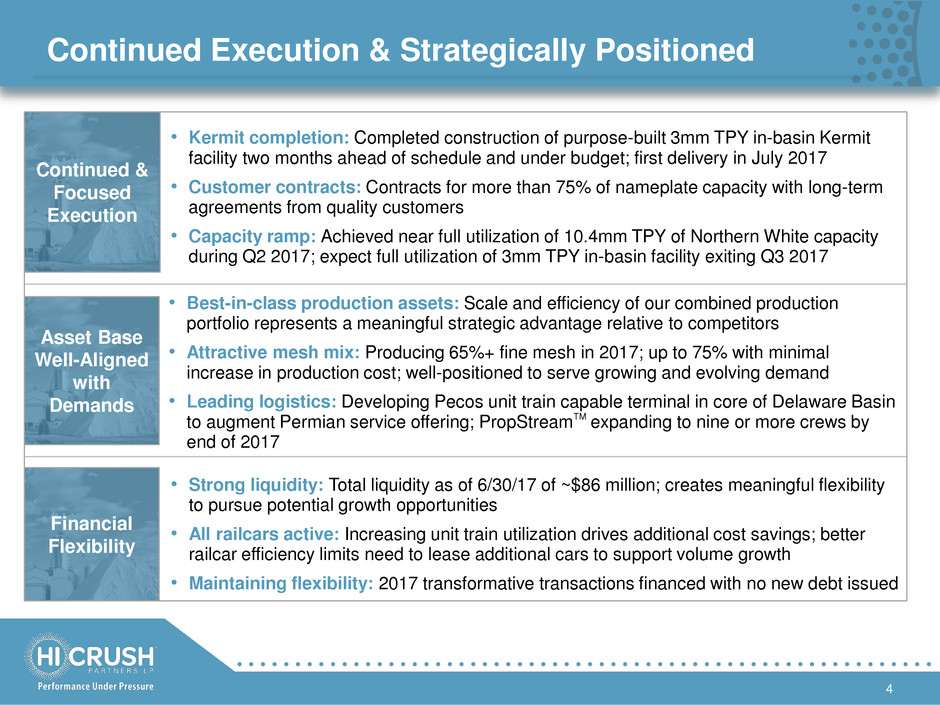

• Kermit completion: Completed construction of purpose-built 3mm TPY in-basin Kermit

facility two months ahead of schedule and under budget; first delivery in July 2017

• Customer contracts: Contracts for more than 75% of nameplate capacity with long-term

agreements from quality customers

• Capacity ramp: Achieved near full utilization of 10.4mm TPY of Northern White capacity

during Q2 2017; expect full utilization of 3mm TPY in-basin facility exiting Q3 2017

Continued &

Focused

Execution

• Best-in-class production assets: Scale and efficiency of our combined production

portfolio represents a meaningful strategic advantage relative to competitors

• Attractive mesh mix: Producing 65%+ fine mesh in 2017; up to 75% with minimal

increase in production cost; well-positioned to serve growing and evolving demand

• Leading logistics: Developing Pecos unit train capable terminal in core of Delaware Basin

to augment Permian service offering; PropStreamTM expanding to nine or more crews by

end of 2017

Financial

Flexibility

• Strong liquidity: Total liquidity as of 6/30/17 of ~$86 million; creates meaningful flexibility

to pursue potential growth opportunities

• All railcars active: Increasing unit train utilization drives additional cost savings; better

railcar efficiency limits need to lease additional cars to support volume growth

• Maintaining flexibility: 2017 transformative transactions financed with no new debt issued

Hi-Crush’s Production Portfolio

5

1) Reserve life estimates based on reserve reports prepared by JT Boyd.

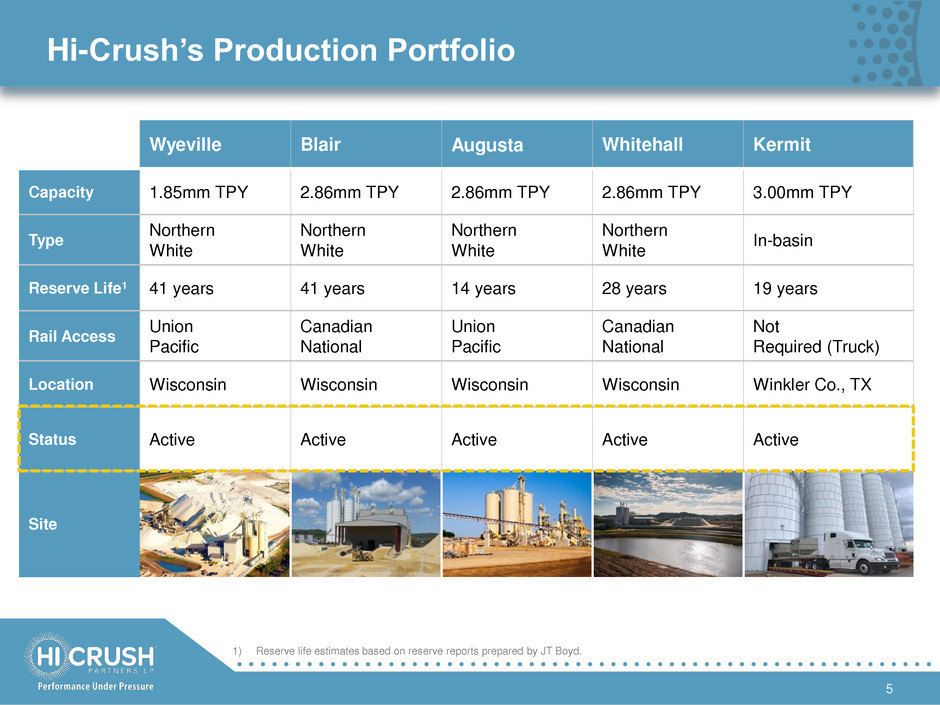

Wyeville Blair Augusta Whitehall Kermit

Capacity 1.85mm TPY 2.86mm TPY 2.86mm TPY 2.86mm TPY 3.00mm TPY

Type

Northern

White

Northern

White

Northern

White

Northern

White

In-basin

Reserve Life1 41 years 41 years 14 years 28 years 19 years

Rail Access

Union

Pacific

Canadian

National

Union

Pacific

Canadian

National

Not

Required (Truck)

Location Wisconsin Wisconsin Wisconsin Wisconsin Winkler Co., TX

Status Active Active Active Active Active

Site

Not

Owned

Not

Owned

Under

Construction

Under

Construction

Fully

Utilized

(Startup

July)

Fully

Utilized

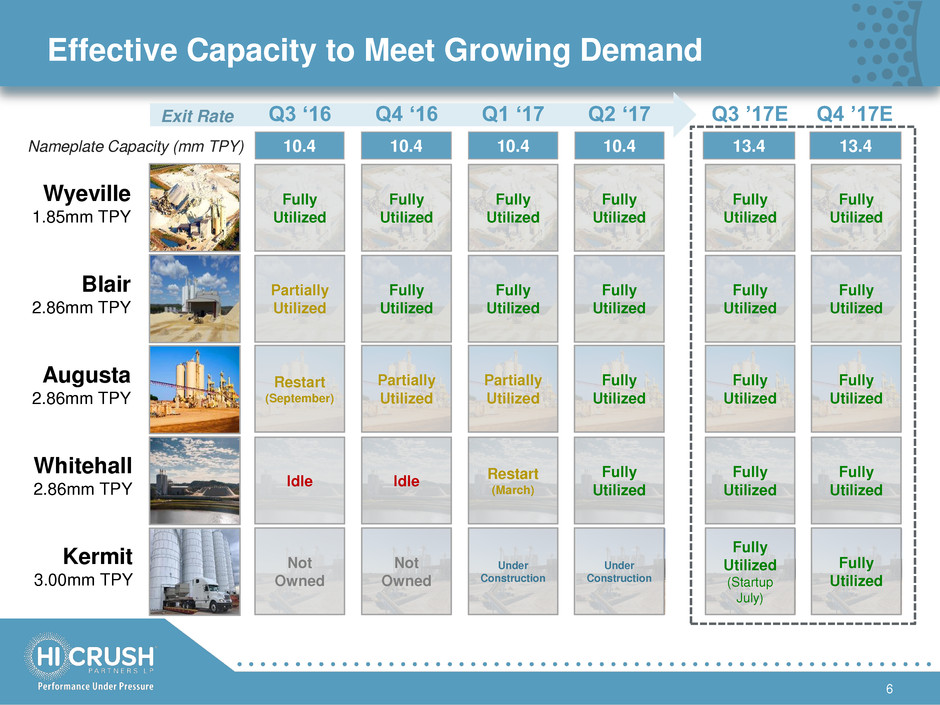

Effective Capacity to Meet Growing Demand

Q3 ‘16

10.4

Fully

Utilized

Partially

Utilized

Restart

(September)

Idle

Q4 ‘16

10.4

Fully

Utilized

Fully

Utilized

Partially

Utilized

Idle

Q1 ‘17

10.4

Fully

Utilized

Fully

Utilized

Partially

Utilized

Restart

(March)

Q2 ‘17

10.4

Fully

Utilized

Fully

Utilized

Fully

Utilized

Fully

Utilized

Q3 ’17E

13.4

Fully

Utilized

Fully

Utilized

Fully

Utilized

Fully

Utilized

Q4 ’17E

13.4

Fully

Utilized

Fully

Utilized

Fully

Utilized

Fully

Utilized

Blair

2.86mm TPY

Wyeville

1.85mm TPY

Augusta

2.86mm TPY

Whitehall

2.86mm TPY

Kermit

3.00mm TPY

Nameplate Capacity (mm TPY)

6

Exit Rate

Leveraging Our Competitive Advantages

7

Factor Our Position The Hi-Crush Advantage

Size and

Scale

Five facilities, 13.4mm

tons of annual capacity

Premier supplier with operational flexibility and

ability to meet dynamic customer needs

Supply

Diversity

Leading supplier of

Northern White and in-

basin frac sand

In Q3 2017, expect to operate 13.4mm TPY of low-

cost, high-quality frac sand production with diversity

of grades and sand types

Best-in-Class

Assets

Market-leading cost

structure

Best-in-class cost structure provides competitive,

financial and operational advantages from mine to

well site

Distribution

Network

Two class-1 rail origins;

strategic and expanding

owned terminal network

Direct access to UP and CN railroads combined

with PropStream last-mile solution extends

competitive advantages to the well site

Customer

Relationships

Strong, long-term

relationships

Increasing profitable market share through close

partnerships with key customers who are

consolidating their supply sources

Balance

Sheet

Ample liquidity and

significant capital flexibility

Maintain conservative position; strong ability to

pursue potential attractive growth opportunities

Focused

Strategy

Clear strategy to win long-

term

Positioned to profitably capture long-term market

share and meet industry’s evolving demands

Facility Status

• Completed construction and commenced operations in July

2017; under budget and two months ahead of schedule

• Expect to ramp utilization during Q3 2017; estimate

operating full capacity throughout Q4 2017

• First-mover for in-basin facility development provides clear

competitive advantage

• Completed all hiring

Facility Overview

• Purpose-built 3mm TPY production facility, 55+mm tons of

high-quality fine mesh reserves

• Located within 75 mile radius of significant Delaware and

Midland Basin activity

• Production costs expected to be in-line with all Hi-Crush

facilities; no royalty burden, no overburden

• Opportunity to leverage PropStream capabilities and

mitigate logistical bottlenecks

Kermit Facility Completed Ahead of Schedule

8

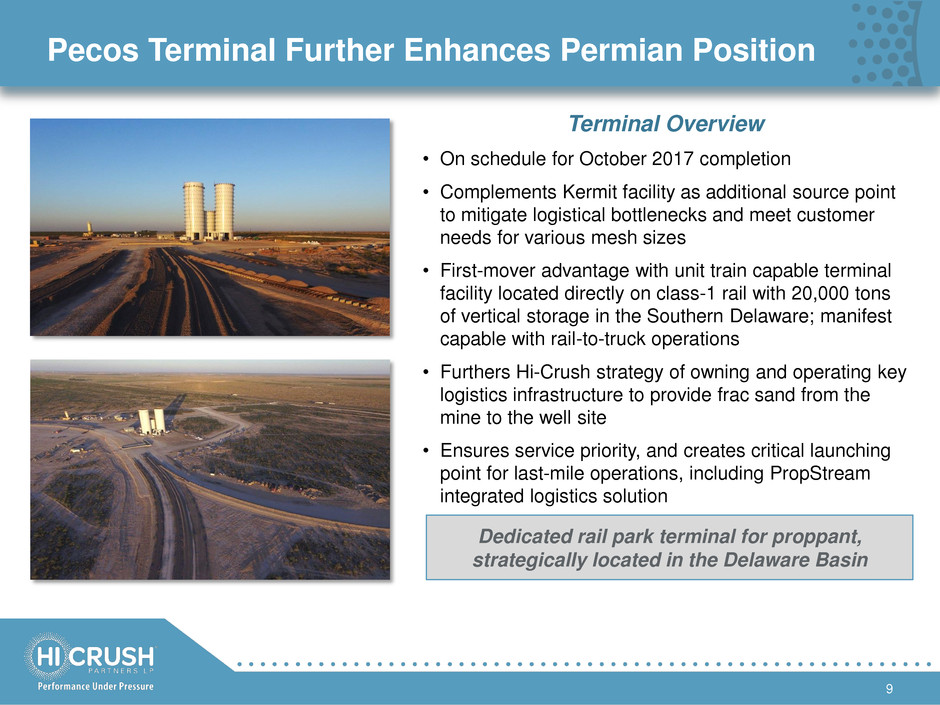

Pecos Terminal Further Enhances Permian Position

9

Terminal Overview

• On schedule for October 2017 completion

• Complements Kermit facility as additional source point

to mitigate logistical bottlenecks and meet customer

needs for various mesh sizes

• First-mover advantage with unit train capable terminal

facility located directly on class-1 rail with 20,000 tons

of vertical storage in the Southern Delaware; manifest

capable with rail-to-truck operations

• Furthers Hi-Crush strategy of owning and operating key

logistics infrastructure to provide frac sand from the

mine to the well site

• Ensures service priority, and creates critical launching

point for last-mile operations, including PropStream

integrated logistics solution

Dedicated rail park terminal for proppant,

strategically located in the Delaware Basin

10

PropStream: Success in the Market

• Strong adoption rate from current and

new customers since roll-out

• No lost-time incidents; greater than 98%

uptime performance

• Q2 2017 utilization of 91%; increased

from Q1 2017 utilization of 79%

• Currently operating four crews in the

Permian and one crew in the Northeast;

four crews active at the end of Q2 2017,

up from two crews at the end of Q1 2017

‒ Deploying fifth Permian crew and hiring

sixth Permian crew in Q3 2017

• Expect nine or more PropStream crews to

be operating by the end of 2017

Performance and Strategy

Outlook

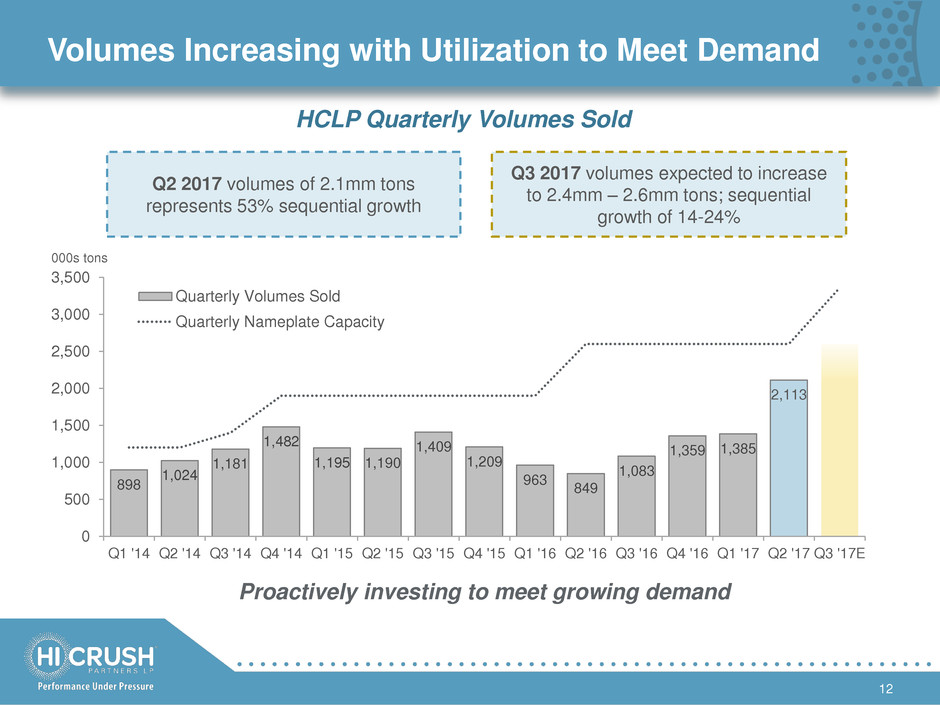

Volumes Increasing with Utilization to Meet Demand

12

898

1,024

1,181

1,482

1,195 1,190

1,409

1,209

963

849

1,083

1,359 1,385

2,113

0

500

1,000

1,500

2,000

2,500

3,000

3,500

Q1 '14 Q2 '14 Q3 '14 Q4 '14 Q1 '15 Q2 '15 Q3 '15 Q4 '15 Q1 '16 Q2 '16 Q3 '16 Q4 '16 Q1 '17 Q2 '17 Q3 '17E

000s tons

Quarterly Volumes Sold

Quarterly Nameplate Capacity

Q3 2017 volumes expected to increase

to 2.4mm – 2.6mm tons; sequential

growth of 14-24%

Q2 2017 volumes of 2.1mm tons

represents 53% sequential growth

HCLP Quarterly Volumes Sold

Proactively investing to meet growing demand

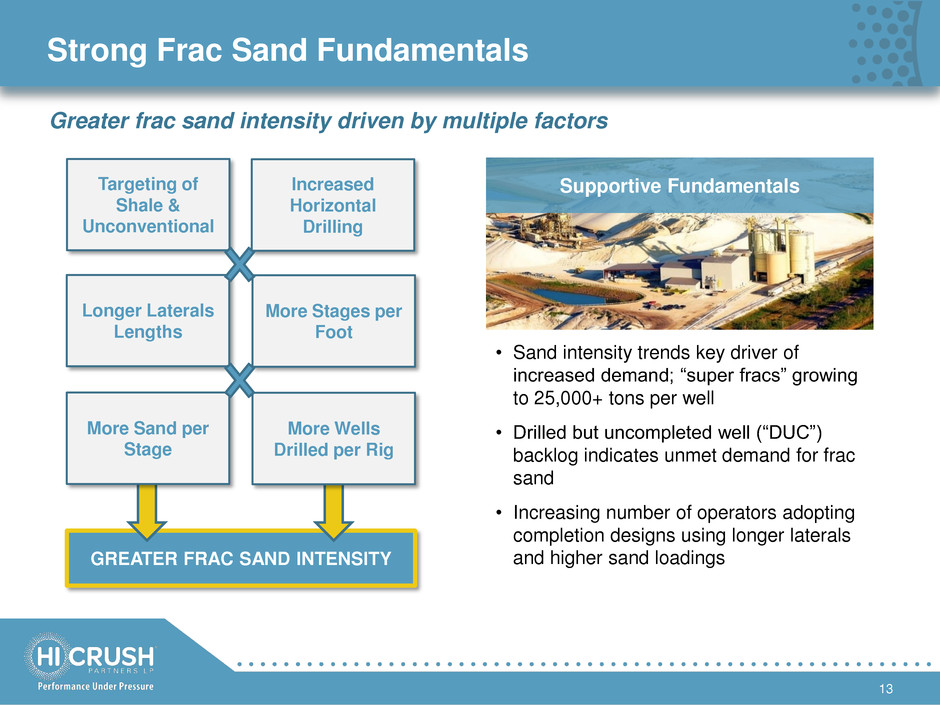

Strong Frac Sand Fundamentals

13

Supportive Fundamentals

GREATER FRAC SAND INTENSITY

Targeting of

Shale &

Unconventional

Increased

Horizontal

Drilling

Longer Laterals

Lengths

More Stages per

Foot

More Sand per

Stage

More Wells

Drilled per Rig

Greater frac sand intensity driven by multiple factors

• Sand intensity trends key driver of

increased demand; ―super fracs‖ growing

to 25,000+ tons per well

• Drilled but uncompleted well (―DUC‖)

backlog indicates unmet demand for frac

sand

• Increasing number of operators adopting

completion designs using longer laterals

and higher sand loadings

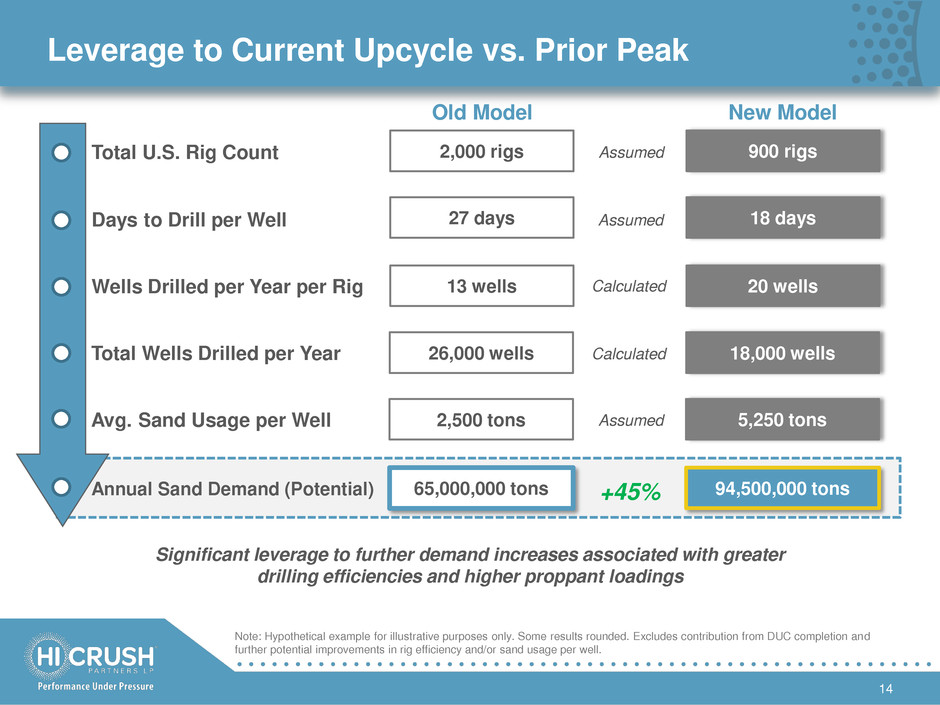

Leverage to Current Upcycle vs. Prior Peak

14

2,000 rigs

27 days

13 wells

26,000 wells

2,500 tons

65,000,000 tons

Total U.S. Rig Count

Days to Drill per Well

Wells Drilled per Year per Rig

Total Wells Drilled per Year

Avg. Sand Usage per Well

Annual Sand Demand (Potential)

Old Model

Note: Hypothetical example for illustrative purposes only. Some results rounded. Excludes contribution from DUC completion and

further potential improvements in rig efficiency and/or sand usage per well.

900 rigs

18 days

20 wells

18,000 wells

5,250 tons

94,500,000 tons

New Model

+45%

Calculated

Calculated

Assumed

Assumed

Assumed

Significant leverage to further demand increases associated with greater

drilling efficiencies and higher proppant loadings

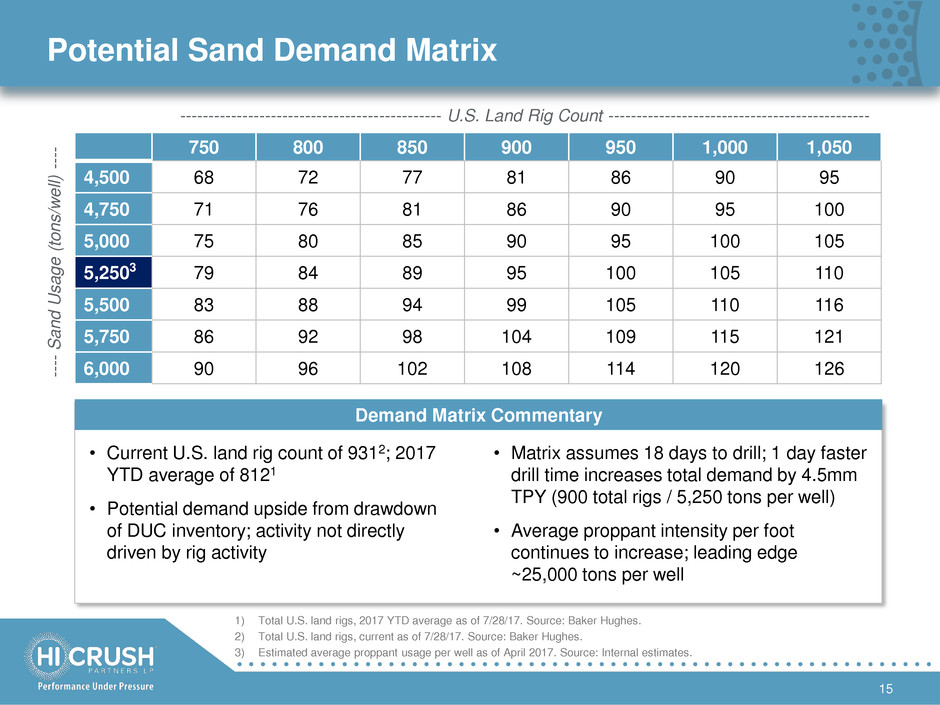

Potential Sand Demand Matrix

15

1) Total U.S. land rigs, 2017 YTD average as of 7/28/17. Source: Baker Hughes.

2) Total U.S. land rigs, current as of 7/28/17. Source: Baker Hughes.

3) Estimated average proppant usage per well as of April 2017. Source: Internal estimates.

750 800 850 900 950 1,000 1,050

4,500 68 72 77 81 86 90 95

4,750 71 76 81 86 90 95 100

5,000 75 80 85 90 95 100 105

5,2503 79 84 89 95 100 105 110

5,500 83 88 94 99 105 110 116

5,750 86 92 98 104 109 115 121

6,000 90 96 102 108 114 120 126

---------------------------------------------- U.S. Land Rig Count ----------------------------------------------

--

--

Sand

Usage

(tons/

w

ell)

-

--

-

• Current U.S. land rig count of 9312; 2017

YTD average of 8121

• Potential demand upside from drawdown

of DUC inventory; activity not directly

driven by rig activity

Demand Matrix Commentary

• Matrix assumes 18 days to drill; 1 day faster

drill time increases total demand by 4.5mm

TPY (900 total rigs / 5,250 tons per well)

• Average proppant intensity per foot

continues to increase; leading edge

~25,000 tons per well

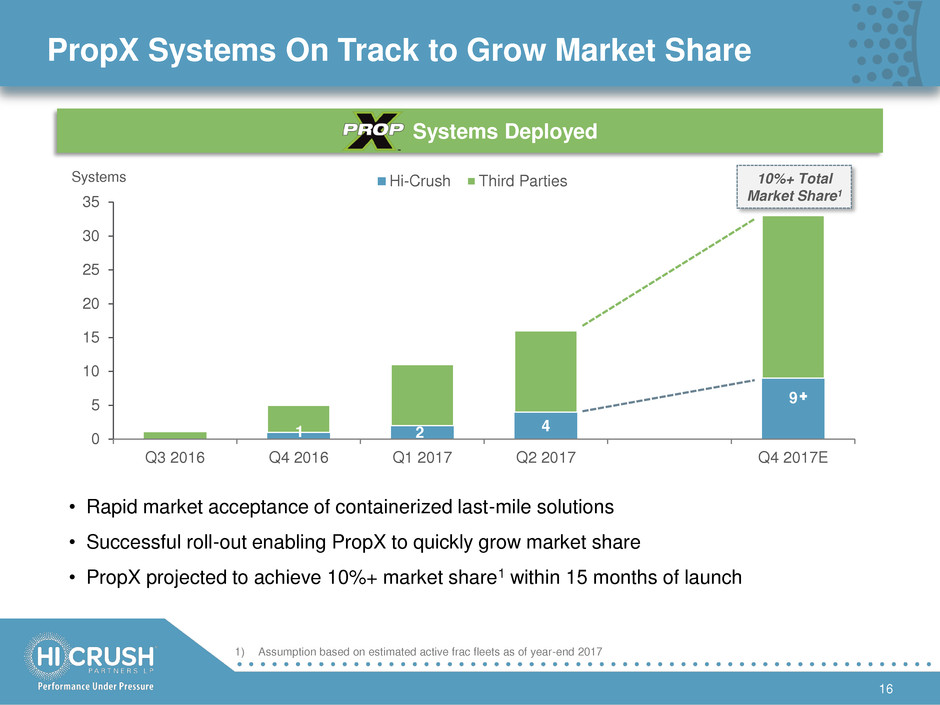

PropX Systems On Track to Grow Market Share

16

• Rapid market acceptance of containerized last-mile solutions

• Successful roll-out enabling PropX to quickly grow market share

• PropX projected to achieve 10%+ market share1 within 15 months of launch

Systems Deployed

1 2 4

9

0

5

10

15

20

25

30

35

Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q4 2017E

Systems Hi-Crush Third Parties 10%+ Total

Market Share1

1) Assumption based on estimated active frac fleets as of year-end 2017

Business Update

325

500

2014 2018E

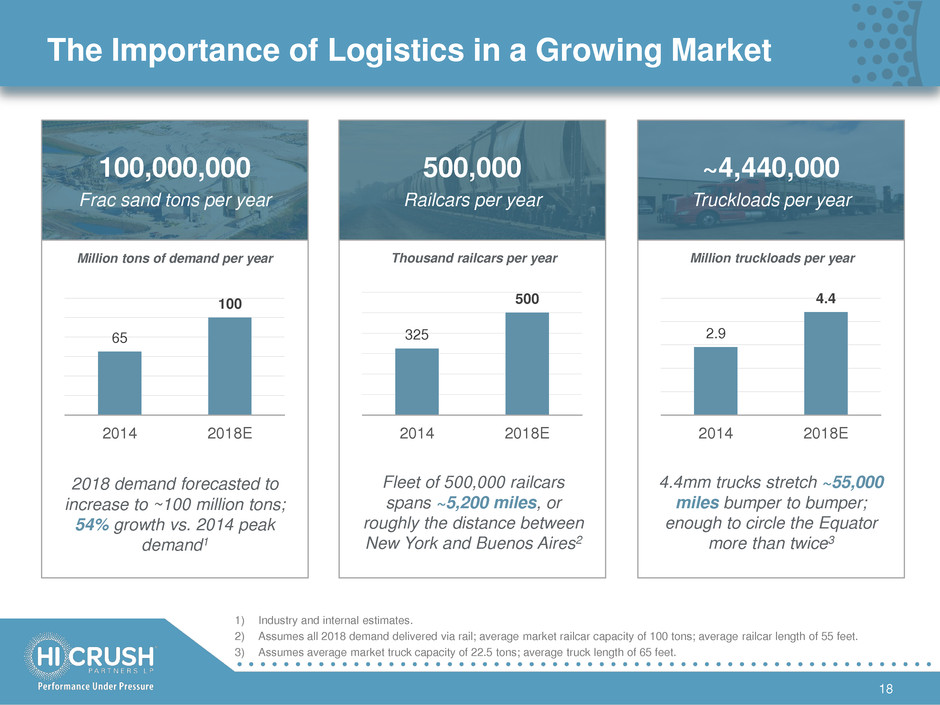

The Importance of Logistics in a Growing Market

18

100,000,000

Frac sand tons per year

~4,440,000

Truckloads per year

500,000

Railcars per year

65

100

2014 2018E

2.9

4.4

2014 2018E

Million tons of demand per year Million truckloads per year Thousand railcars per year

2018 demand forecasted to

increase to ~100 million tons;

54% growth vs. 2014 peak

demand1

4.4mm trucks stretch ~55,000

miles bumper to bumper;

enough to circle the Equator

more than twice3

Fleet of 500,000 railcars

spans ~5,200 miles, or

roughly the distance between

New York and Buenos Aires2

1) Industry and internal estimates.

2) Assumes all 2018 demand delivered via rail; average market railcar capacity of 100 tons; average railcar length of 55 feet.

3) Assumes average market truck capacity of 22.5 tons; average truck length of 65 feet.

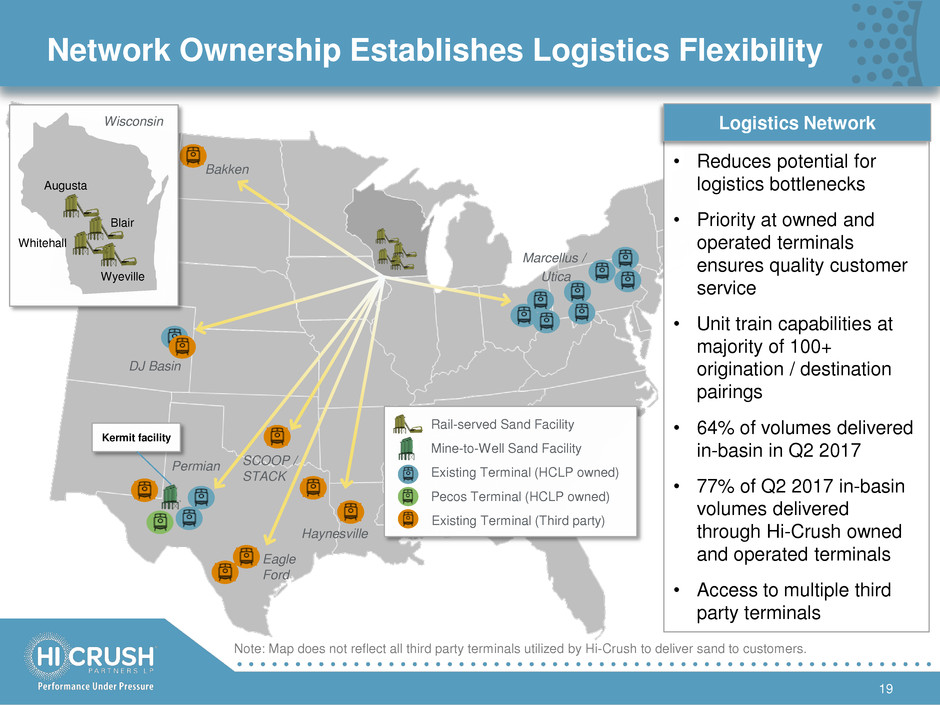

Network Ownership Establishes Logistics Flexibility

19

Note: Map does not reflect all third party terminals utilized by Hi-Crush to deliver sand to customers.

• Reduces potential for

logistics bottlenecks

• Priority at owned and

operated terminals

ensures quality customer

service

• Unit train capabilities at

majority of 100+

origination / destination

pairings

• 64% of volumes delivered

in-basin in Q2 2017

• 77% of Q2 2017 in-basin

volumes delivered

through Hi-Crush owned

and operated terminals

• Access to multiple third

party terminals

Bakken

DJ Basin

Permian SCOOP /

STACK

Eagle

Ford

Marcellus /

Utica

Logistics Network

Kermit facility

Rail-served Sand Facility

Existing Terminal (HCLP owned)

Pecos Terminal (HCLP owned)

Mine-to-Well Sand Facility

Existing Terminal (Third party)

Wisconsin

Augusta

Wyeville

Whitehall

Blair

Haynesville

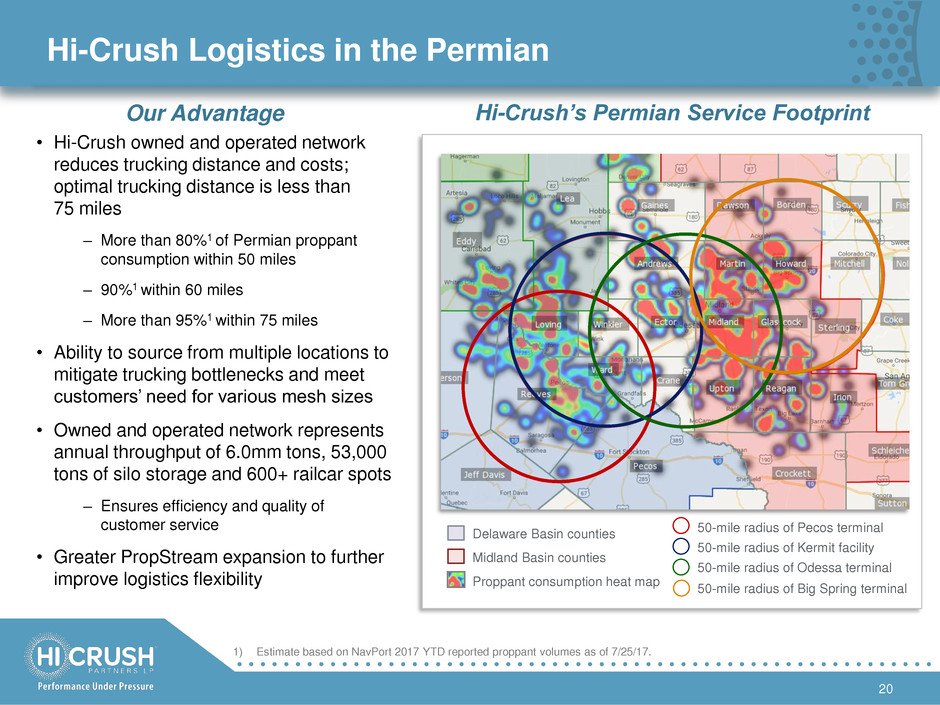

Hi-Crush Logistics in the Permian

20

• Hi-Crush owned and operated network

reduces trucking distance and costs;

optimal trucking distance is less than

75 miles

‒ More than 80%1 of Permian proppant

consumption within 50 miles

‒ 90%1 within 60 miles

‒ More than 95%1 within 75 miles

• Ability to source from multiple locations to

mitigate trucking bottlenecks and meet

customers’ need for various mesh sizes

• Owned and operated network represents

annual throughput of 6.0mm tons, 53,000

tons of silo storage and 600+ railcar spots

‒ Ensures efficiency and quality of

customer service

• Greater PropStream expansion to further

improve logistics flexibility

1) Estimate based on NavPort 2017 YTD reported proppant volumes as of 7/25/17.

50-mile radius of Pecos terminal Delaware Basin counties

Midland Basin counties

Proppant consumption heat map

50-mile radius of Kermit facility

50-mile radius of Odessa terminal

50-mile radius of Big Spring terminal

Our Advantage Hi-Crush’s Permian Service Footprint

PropStream: Simplifying the Supply Chain

21

Differentiated Last-Mile Capabilities

• Fully integrated delivery solution to provide proppant

logistics services

• Fully enclosed system reduces particulate matter

emissions by >90% versus pneumatic equipment,

meeting 2018 OSHA requirements today

• Purpose-built cubic design delivers greater tonnage

per truckload

• Controls sand quality from origin to the blender hopper

• Highly efficient PropBeast™ conveyor systems

generate up to 20% faster delivery into the blender

• Fully mobile system of conveyors, containers and

trucks significantly reduces well site footprint

• Lessens well site trucking congestion; reduces or

eliminates demurrage

Financial Results

Key Financial Metrics

23

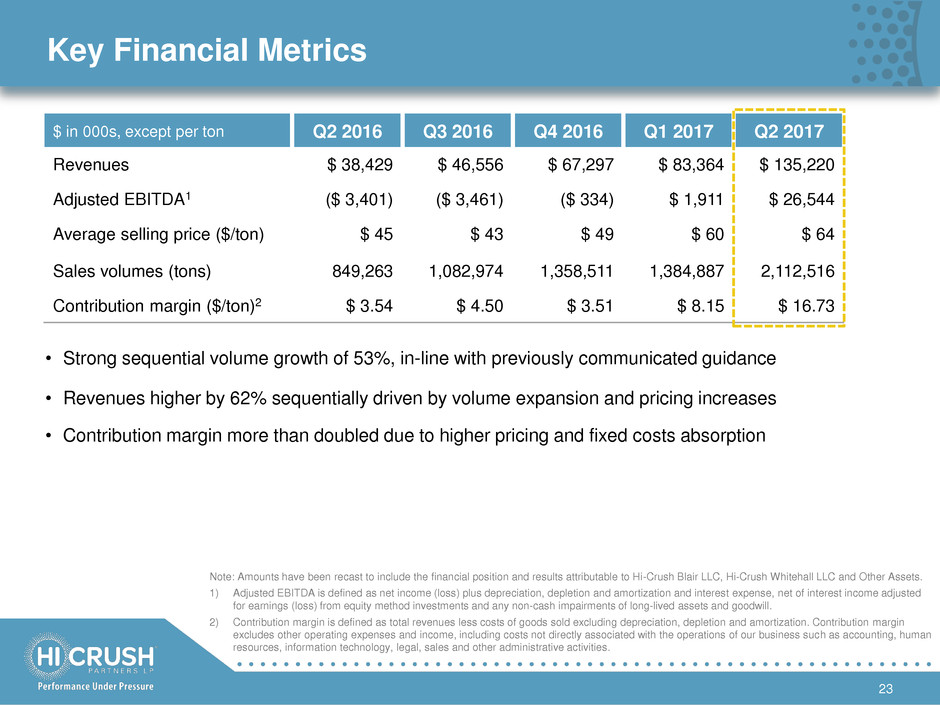

$ in 000s, except per ton Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Revenues $ 38,429 $ 46,556 $ 67,297 $ 83,364 $ 135,220

Adjusted EBITDA1 ($ 3,401) ($ 3,461) ($ 334) $ 1,911 $ 26,544

Average selling price ($/ton) $ 45 $ 43 $ 49 $ 60 $ 64

Sales volumes (tons) 849,263 1,082,974 1,358,511 1,384,887 2,112,516

Contribution margin ($/ton)2 $ 3.54 $ 4.50 $ 3.51 $ 8.15 $ 16.73

Note: Amounts have been recast to include the financial position and results attributable to Hi-Crush Blair LLC, Hi-Crush Whitehall LLC and Other Assets.

1) Adjusted EBITDA is defined as net income (loss) plus depreciation, depletion and amortization and interest expense, net of interest income adjusted

for earnings (loss) from equity method investments and any non-cash impairments of long-lived assets and goodwill.

2) Contribution margin is defined as total revenues less costs of goods sold excluding depreciation, depletion and amortization. Contribution margin

excludes other operating expenses and income, including costs not directly associated with the operations of our business such as accounting, human

resources, information technology, legal, sales and other administrative activities.

• Strong sequential volume growth of 53%, in-line with previously communicated guidance

• Revenues higher by 62% sequentially driven by volume expansion and pricing increases

• Contribution margin more than doubled due to higher pricing and fixed costs absorption

Improved Liquidity and Financial Flexibility

24

$ in 000s December 31, 2016 June 30, 2017

Cash $ 4,521 $ 27,490

Revolver $ - $ -

Term loan1 189,715 189,265

Other notes payable 6,705 5,223

Total debt $ 196,420 $ 194,488

Net debt $ 191,899 $ 166,998

Revolver availability2 $ 66,368 $ 58,231

Available liquidity3 $ 70,889 $ 85,721

1) Senior secured term loan: $200mm original face value at L+3.75%; rated Caa1 and B by Moody’s and Standard & Poor’s,

respectively; includes accordion feature to increase capacity to $300mm. Presented net of discounts and issuance costs.

2) Revolving credit agreement at 6/30/17: $58.2mm available at L+4.50% ($75mm capacity less $16.8mm of LCs); includes

accordion feature to increase capacity to $125mm.

3) Revolver availability plus cash.

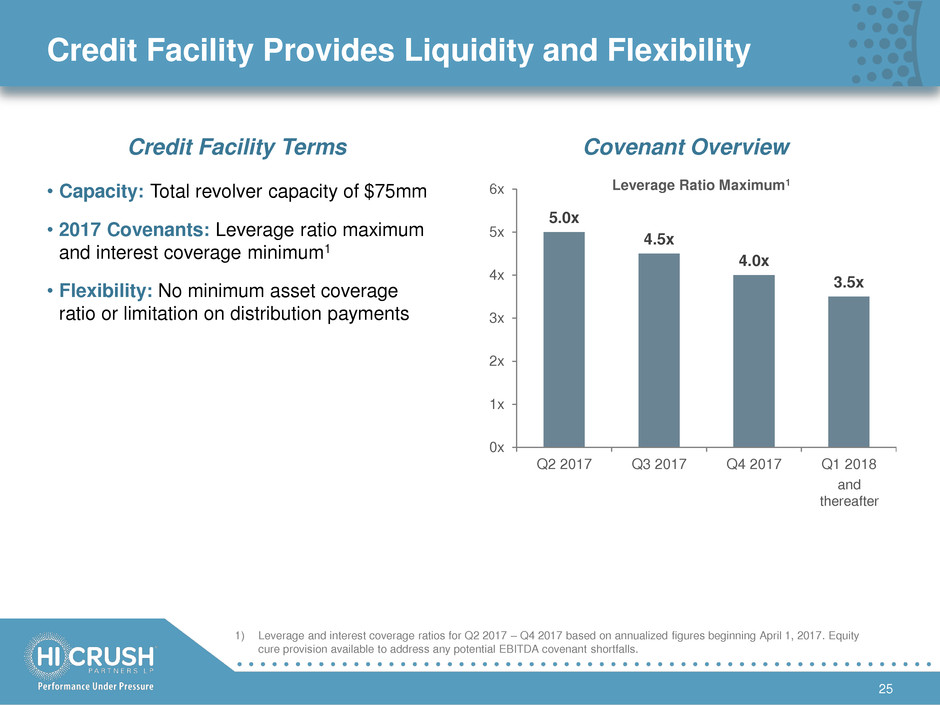

Credit Facility Provides Liquidity and Flexibility

25

1) Leverage and interest coverage ratios for Q2 2017 – Q4 2017 based on annualized figures beginning April 1, 2017. Equity

cure provision available to address any potential EBITDA covenant shortfalls.

• Capacity: Total revolver capacity of $75mm

• 2017 Covenants: Leverage ratio maximum

and interest coverage minimum1

• Flexibility: No minimum asset coverage

ratio or limitation on distribution payments

5.0x

4.5x

4.0x

3.5x

0x

1x

2x

3x

4x

5x

6x

Q2 2017 Q3 2017 Q4 2017 Q1 2018

$mm Leverage Ratio Maximum1

and

thereafter

Credit Facility Terms Covenant Overview

Q2 2017 Summary – Statements of Operations

26

1) Financial information has been recast to include the financial position and results attributable to Hi-Crush Blair LLC.

2) Financial information has been recast to include the financial position and results attributable to Hi-Crush Whitehall LLC,

2.0% equity interest in Hi-Crush Augusta LLC and PDQ Properties LLC (together the "Other Assets").

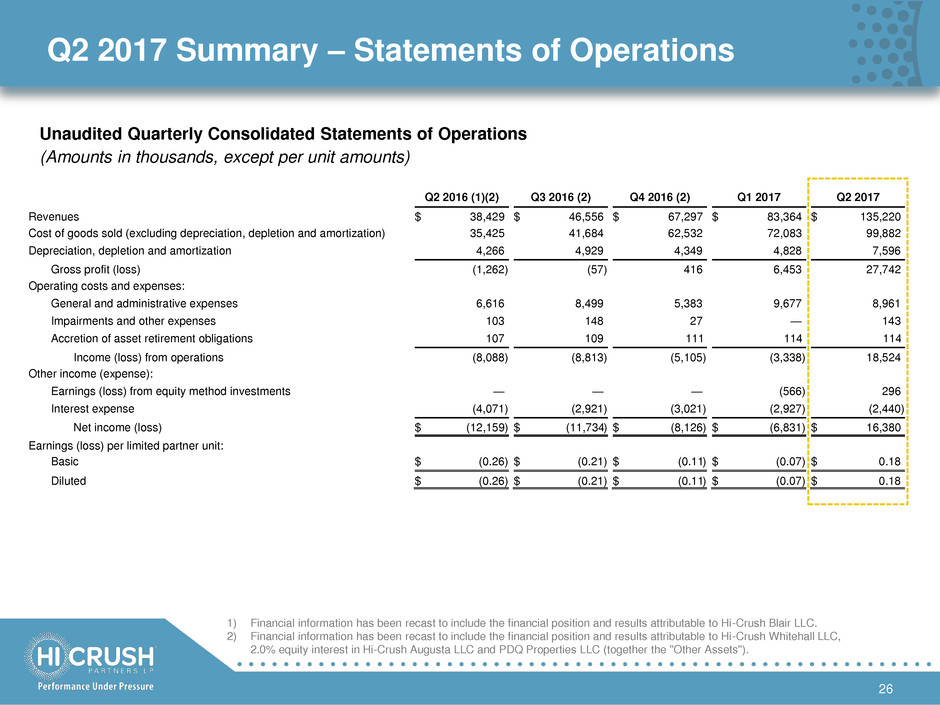

Unaudited Quarterly Consolidated Statements of Operations

(Amounts in thousands, except per unit amounts)

Q2 2016 (1)(2) Q3 2016 (2) Q4 2016 (2) Q1 2017 Q2 2017

Revenues $ 38,429 $ 46,556 $ 67,297 $ 83,364 $ 135,220

Cost of goods sold (excluding depreciation, depletion and amortization) 35,425 41,684 62,532 72,083 99,882

Depreciation, depletion and amortization 4,266 4,929 4,349 4,828 7,596

Gross profit (loss) (1,262 ) (57 ) 416 6,453 27,742

Operating costs and expenses:

General and administrative expenses 6,616 8,499 5,383 9,677 8,961

Impairments and other expenses 103 148 27 — 143

Accretion of asset retirement obligations 107 109 111 114 114

Income (loss) from operations (8,088 ) (8,813 ) (5,105 ) (3,338 ) 18,524

Other income (expense):

E rnings (loss) from equity method investments — — — (566 ) 296

Interest expense (4,071 ) (2,921 ) (3,021 ) (2,927 ) (2,440 )

Net income (loss) $ (12,159 ) $ (11,734 ) $ (8,126 ) $ (6,831 ) $ 16,380

Earnings (loss) per limited partner unit:

Basic $ (0.26 ) $ (0.21 ) $ (0.11 ) $ (0.07 ) $ 0.18

Diluted $ (0.26 ) $ (0.21 ) $ (0.11 ) $ (0.07 ) $ 0.18

27

Q2 2017 Summary – EBITDA, Adjusted EBITDA, DCF

Unaudited EBITDA, Adjusted EBITDA and Distributable Cash Flow

(Amounts in thousands)

1) Maintenance and replacement capital expenditures, including accrual for reserve replacement, were determined based on an estimated

reserve replacement cost of $1.35 per ton produced and delivered during the period. Such expenditures include those associated with

the replacement of equipment and sand reserves, to the extent that such expenditures are made to maintain our long-term operating

capacity. The amount presented does not represent an actual reserve account or requirement to spend the capital.

2) The Partnership's historical financial information has been recast to consolidate Hi-Crush Blair LLC, Hi-Crush Whitehall LLC and Other

Assets for the periods leading up to their contribution into the Partnership. For purposes of calculating distributable cash flow

attributable to Hi-Crush Partners LP, the Partnership excludes the incremental amount of recast distributable cash flow earned during

the periods prior to the contributions.

Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Reconciliation of distributable cash flow to net income (loss):

Net income (loss) $ (12,159 ) $ (11,734 ) $ (8,126 ) $ (6,831 ) $ 16,380

Depreciation and depletion expense 4,266 4,932 4,350 4,829 7,599

Amortization expense 421 420 421 420 421

Interest expense 4,071 2,921 3,021 2,927 2,440

EBITDA (3,401 ) (3,461 ) (334 ) 1,345 26,840

(Earnings) loss from equity method investments — — — 566 (296 )

Adjusted EBITDA (3,401 ) (3,461 ) (334 ) 1,911 26,544

Less: Cash interest paid (3,344 ) (2,548 ) (2,649 ) (2,554 ) (2,068 )

Less: Maintenance and replacement capital expenditures, including

accrual for reserve replacement (1) (1,164 ) (1,554 ) (1,717 ) (1,845 ) (2,945 )

Add: Accretion of asset retirement obligations 107 109 111 114 114

Add: Unit-based compensation 930 1,155 (395 ) 1,178 1,219

Distributable cash flow (6,872 ) (6,299 ) (4,984 ) (1,196 ) 22,864

Adjusted for: Distributable cash flow attributable to assets contributed by

the sponsor, prior to the period in which the contribution occurred (2) 627

(400 ) 579

1,247

—

Distributable cash flow attributable to Hi-Crush Partners LP (6,245 ) (6,699 ) (4,405 ) 51 22,864

Less: Distributable cash flow attributable to holders of incentive

distribution rights —

—

—

—

—

Distributable cash flow attributable to limited partner unitholders $ (6,245 ) $ (6,699 ) $ (4,405 ) $ 51 $ 22,864

APPENDIX

Investor Presentation | September, 2013 28

Efficient Railcar Management

29

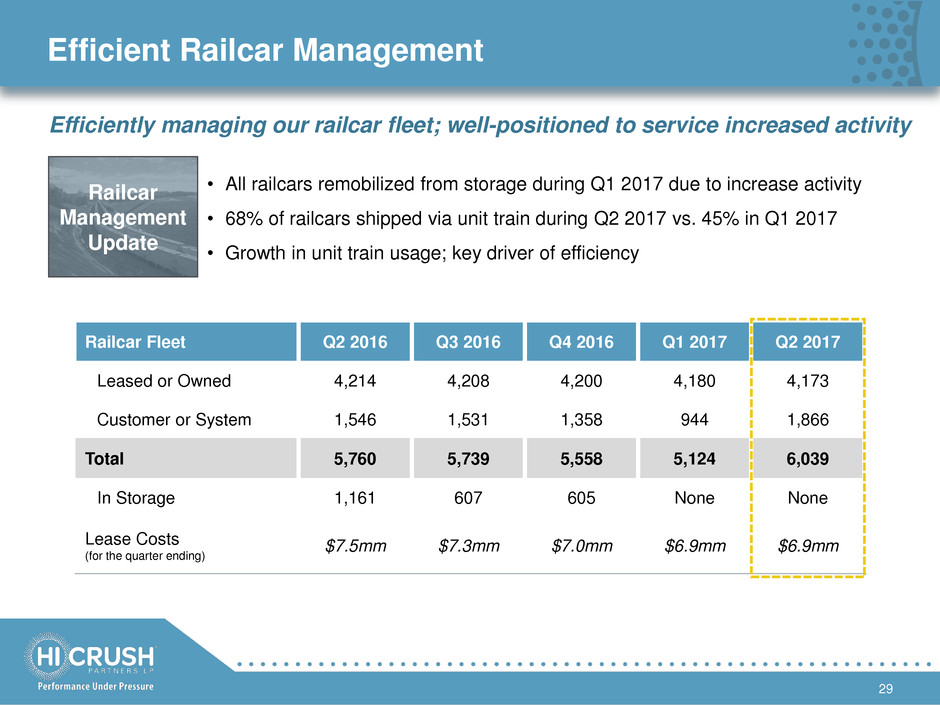

Railcar Fleet Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017

Leased or Owned 4,214 4,208 4,200 4,180 4,173

Customer or System 1,546 1,531 1,358 944 1,866

Total 5,760 5,739 5,558 5,124 6,039

In Storage 1,161 607 605 None None

Lease Costs

(for the quarter ending)

$7.5mm $7.3mm $7.0mm $6.9mm $6.9mm

• All railcars remobilized from storage during Q1 2017 due to increase activity

• 68% of railcars shipped via unit train during Q2 2017 vs. 45% in Q1 2017

• Growth in unit train usage; key driver of efficiency

Railcar

Management

Update

Efficiently managing our railcar fleet; well-positioned to service increased activity

30

PropStream Partners with PropX

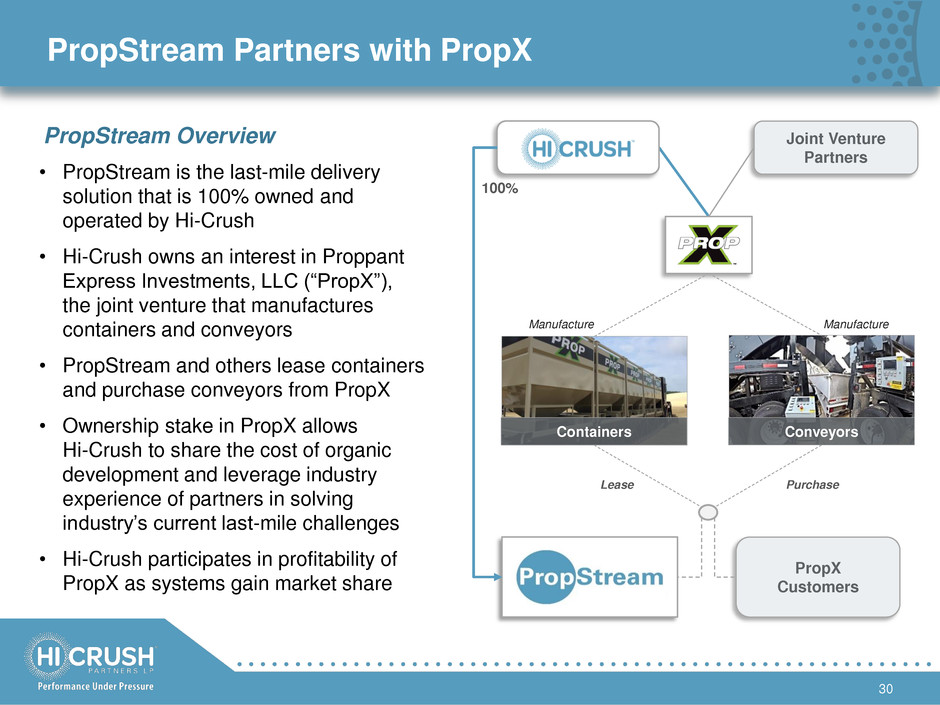

• PropStream is the last-mile delivery

solution that is 100% owned and

operated by Hi-Crush

• Hi-Crush owns an interest in Proppant

Express Investments, LLC (―PropX‖),

the joint venture that manufactures

containers and conveyors

• PropStream and others lease containers

and purchase conveyors from PropX

• Ownership stake in PropX allows

Hi-Crush to share the cost of organic

development and leverage industry

experience of partners in solving

industry’s current last-mile challenges

• Hi-Crush participates in profitability of

PropX as systems gain market share

Joint Venture

Partners

100%

Conveyors Containers

Manufacture Manufacture

Lease Purchase

PropX

Customers

PropStream Overview

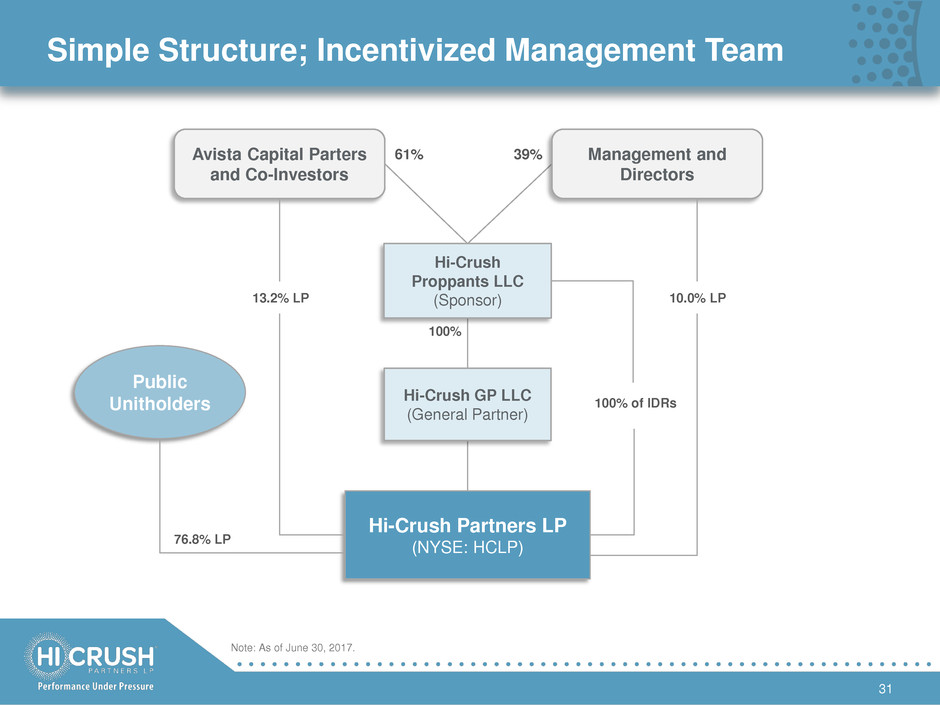

Simple Structure; Incentivized Management Team

31

39% 61%

100%

76.8% LP

100% of IDRs

Hi-Crush

Proppants LLC

(Sponsor)

Avista Capital Parters

and Co-Investors

Management and

Directors

Hi-Crush Partners LP

(NYSE: HCLP)

Public

Unitholders

Hi-Crush GP LLC

(General Partner)

13.2% LP 10.0% LP

Note: As of June 30, 2017.