Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - EXELIXIS, INC. | exel20170630exhibit321.htm |

| EX-31.2 - EXHIBIT 31.2 - EXELIXIS, INC. | exel20170630exhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - EXELIXIS, INC. | exel20170630exhibit311.htm |

| EX-12.1 - EXHIBIT 12.1 - EXELIXIS, INC. | exel20170630exhibit121.htm |

| EX-10.5 - EXHIBIT 10.5 - EXELIXIS, INC. | exel20170630exhibit105.htm |

| EX-10.4 - EXHIBIT 10.4 - EXELIXIS, INC. | exel20170630exhibit104.htm |

| 10-Q - 10-Q - EXELIXIS, INC. | exel2017063010-q.htm |

WATERFRONT AT HARBOR BAY

ALAMEDA, CA

LEASE AGREEMENT

between

ASCENTRIS 105, LLC,

as Landlord, and

EXELIXIS, INC.,

as Tenant

ALAMEDA, CA

LEASE AGREEMENT

between

ASCENTRIS 105, LLC,

as Landlord, and

EXELIXIS, INC.,

as Tenant

Table of Contents

Page

1. | BASIC LEASE DEFINITIONS, EXHIBITS AND ADDITIONAL DEFINITIONS. 1 |

1.1 | Basic Lease Definitions 1 |

1.2 | Exhibits and Riders 7 |

1.3 | Additional Definitions 7 |

2. | GRANT OF LEASE. 13 |

2.1 | Demise 13 |

2.2 | Acceptance of Premises 13 |

2.3 | Quiet Enjoyment 13 |

2.4 | Landlord and Tenant Covenants 14 |

2.5 | Landlord’s Reserved Rights 14 |

2.6 | Rentable Area Adjustments 14 |

3. | RENT. 15 |

3.1 | Base Rent 15 |

3.2 | Additional Rent 15 |

3.3 | Other Taxes 17 |

3.4 | Terms of Payment 17 |

3.5 | Interest on Late Payments, Late Charge 17 |

3.6 | Right to Accept Payments 17 |

4. | USE AND OCCUPANCY 18 |

4.1 | Use 18 |

4.2 | Compliance 18 |

4.3 | Occupancy 18 |

4.4 | Hazardous Material 18 |

4.5 | Civil Code Section 1938 Disclosure 22 |

5. | SERVICES AND UTILITIES; REPAIR AND MAINTENANCE OBLIGATIONS. 22 |

5.1 | Landlord’s Standard Services (and Repair and Maintenance Responsibilities) for Multi User Buildings 22 |

5.2 | Additional Services in Multi User Buildings. 23 |

5.3 | Landlord’s Standard Services (and Repair, Maintenance and Replacement Responsibilities) For Single User Buildings 24 |

5.4 | Tenant’s Services (and Repair, Maintenance and Replacement Responsibilities) For Single User Buildings 25 |

5.5 | HVAC For Single User Buildings 26 |

5.6 | Elevators For Single User Buildings 26 |

5.7 | Contactors and Contracts for Tenant’s Maintenance Obligations. 26 |

1

Table of Contents

Page

5.8 | Request for Major Replacement; Reimbursement of Major Replacement Expenditures 27 |

5.9 | Interruption of Services 27 |

5.10 | Security 28 |

5.11 | Amenities 28 |

6. | TENANT’S REPAIR AND MAINTENANCE OBLIGATIONS. 28 |

6.1 | Repairs Within the Premises 28 |

6.2 | Failure to Maintain Premises 29 |

6.3 | Notice of Damage 29 |

7. | ALTERATIONS. 29 |

7.1 | Alterations by Tenant 29 |

7.2 | Alterations by Landlord 30 |

8. | LIENS 31 |

9. | INSURANCE. 31 |

9.1 | Landlord’s Insurance 31 |

9.2 | Tenant’s Insurance 32 |

9.3 | Waiver of Subrogation 34 |

10. | DAMAGE OR DESTRUCTION. 35 |

10.1 | Termination Options 35 |

10.2 | Repair Obligations 35 |

10.3 | Rent Abatement 36 |

11. | WAIVERS AND INDEMNITIES 36 |

11.1 | Tenant’s Waivers 36 |

11.2 | Landlord’s Indemnity 36 |

11.3 | Tenant’s Indemnity 36 |

12. | CONDEMNATION. 37 |

12.1 | Full Taking 37 |

12.2 | Partial Taking. 37 |

12.3 | Awards 38 |

13. | ASSIGNMENT AND SUBLETTING. 38 |

13.1 | Limitation 38 |

13.2 | Notice of Proposed Transfer; Landlord’s Options 38 |

13.3 | Consent Not to be Unreasonably Withheld 39 |

13.4 | Form of Transfer 39 |

13.5 | Payments to Landlord 40 |

13.6 | Change of Ownership 40 |

13.7 | Effect of Transfers 40 |

13.8 | Applicability to Subsequent Transfers 40 |

13.9 | Letter of Credit 41 |

2

Table of Contents

Page

14. | PERSONAL PROPERTY. 41 |

14.1 | Installation and Removal 41 |

14.2 | Responsibility 41 |

15. | END OF TERM. 41 |

15.1 | Surrender 41 |

15.2 | Holding Over 42 |

16. | ESTOPPEL CERTIFICATES 42 |

17. | TRANSFERS OF LANDLORD’S INTEREST. 43 |

17.1 | Sale, Conveyance and Assignment 43 |

17.2 | Effect of Sale, Conveyance or Assignment 43 |

17.3 | Subordination and Nondisturbance 43 |

17.4 | Attornment 44 |

18. | RULES AND REGULATIONS 44 |

19. | PARKING 44 |

20. | DEFAULT AND REMEDIES. 45 |

20.1 | Tenant’s Default 45 |

20.2 | Landlord’s Remedies 46 |

20.3 | Intentionally Omitted. 50 |

20.4 | Landlord’s Default and Tenant’s Remedies. 50 |

20.5 | Non-waiver of Default 51 |

21. | SIGNAGE. 51 |

21.1 | Signage Provided by Landlord 51 |

21.2 | Monument Signage 51 |

21.3 | Exterior Building Signage 51 |

21.4 | General 52 |

22. | SECURITY DEPOSIT. 52 |

22.1 | Amount 52 |

22.2 | Use and Restoration 52 |

22.3 | Transfers 53 |

22.4 | Refund 53 |

23. | BROKERS 53 |

24. | LIMITATIONS ON LANDLORD’S LIABILITY 53 |

25. | NOTICES 54 |

26. | TELECOMMUNICATIONS. 54 |

26.1 | Certain Definitions 54 |

26.2 | Installation and Use of Telecommunications Technologies 54 |

26.3 | Limitation of Responsibility 54 |

3

Table of Contents

Page

26.4 | Necessary Service Interruptions 55 |

26.5 | Interference 55 |

26.6 | Removal of Telecom Equipment, Wiring and Other Facilities 55 |

26.7 | No Third Party Beneficiary 56 |

27. | MISCELLANEOUS. 56 |

27.1 | Binding Effect 56 |

27.2 | Complete Agreement; Modification 56 |

27.3 | Delivery for Examination 56 |

27.4 | No Air Rights 56 |

27.5 | Enforcement Expenses 56 |

27.6 | Intentionally Omitted. 56 |

27.7 | Project Name 56 |

27.8 | Press Release; Recording; Confidentiality 56 |

27.9 | Captions 57 |

27.10 | Invoices 57 |

27.11 | Severability 57 |

27.12 | Jury Trial 57 |

27.13 | Only Landlord/Tenant Relationship 57 |

27.14 | Covenants Independent 57 |

27.15 | Force Majeure 57 |

27.16 | Governing Law 58 |

27.17 | Financial Reports 58 |

27.18 | Joint and Several Liability 58 |

27.19 | Signing Authority 58 |

27.20 | Dates and Time 58 |

27.21 | Counterparts; Electronic Execution 59 |

28. | LETTER OF CREDIT. 59 |

28.1 | Generally 59 |

28.2 | Use and Restoration 59 |

28.3 | Transfers by Tenant 60 |

28.4 | Transfers and Assignments by Landlord 60 |

28.5 | Replacement 60 |

28.6 | Landlord’s Ability to Draw 61 |

28.7 | Return 61 |

29. | TERMINATION OPTION. 61 |

29.1 | Grant of Option 61 |

29.2 | Conditions for Exercise 61 |

29.3 | Early Termination 62 |

29.4 | Limitations on Tenant’s Rights 62 |

30. | RIGHT OF FIRST OFFER. 62 |

30.1 | Terms of Right 62 |

4

Table of Contents

Page

30.2 | Limitations on Tenant’s Rights 63 |

31. | RENEWAL OPTIONS. 63 |

31.1 | Grant of Rights 63 |

31.2 | Exercise 63 |

31.3 | Determination of Market Rental Rate 64 |

31.4 | Market Rental Rate Defined 65 |

31.5 | After Exercise 65 |

31.6 | Limitations on Tenant’s Rights 66 |

32. | LANDLORD’S HVAC WORK AND ALLOWANCE. 66 |

32.1 | Landlord’s HVAC Work 66 |

32.2 | 1801 HVAC Allowance 66 |

32.3 | Completion of Landlord’s HVAC Work 67 |

32.4 | Title 67 |

33. | TENANT’S HVAC WORK AND ALLOWANCE. 67 |

33.1 | Tenant’s HVAC Work 67 |

33.2 | 1851 HVAC Allowance 67 |

33.3 | Title and Liability 67 |

EXHIBIT A - PLAN DELINEATING THE PREMISES AND TENANT MAINTAINED OUTDOOR AREAS | A-1 |

EXHIBIT B - POSSESSION AND LEASEHOLD IMPROVEMENTS EXHIBIT | B-1 |

EXHIBIT C - OCCUPANCY ESTOPPEL CERTIFICATE | C-1 |

EXHIBIT D - RULES AND REGULATIONS | D-1 |

EXHIBIT E - INTENTIONALLY OMITTED | E-1 |

EXHIBIT F - FORM OF LETTER OF CREDIT | F-1 |

EXHIBIT G - HVAC EQUIPMENT LIST G-1

5

LEASE AGREEMENT

WATERFRONT AT HARBOR BAY

ALAMEDA, CALIFORNIA

WATERFRONT AT HARBOR BAY

ALAMEDA, CALIFORNIA

THIS LEASE AGREEMENT (“Lease”) is entered into as of the Lease Date, and by and between Landlord and Tenant, identified in Section 1.1 below.

1. BASIC LEASE DEFINITIONS, EXHIBITS AND ADDITIONAL DEFINITIONS.

Basic Lease Definitions. In this Lease, the following defined terms have the meanings indicated:

(a) “Lease Date” means that date set forth under Landlord’s signature at the end of this Lease.

(b) “Landlord” means Ascentris 105, LLC, a Colorado limited liability company.

(c) “Tenant” means Exelixis, Inc., a Delaware corporation.

(d) “Premises” means the following:

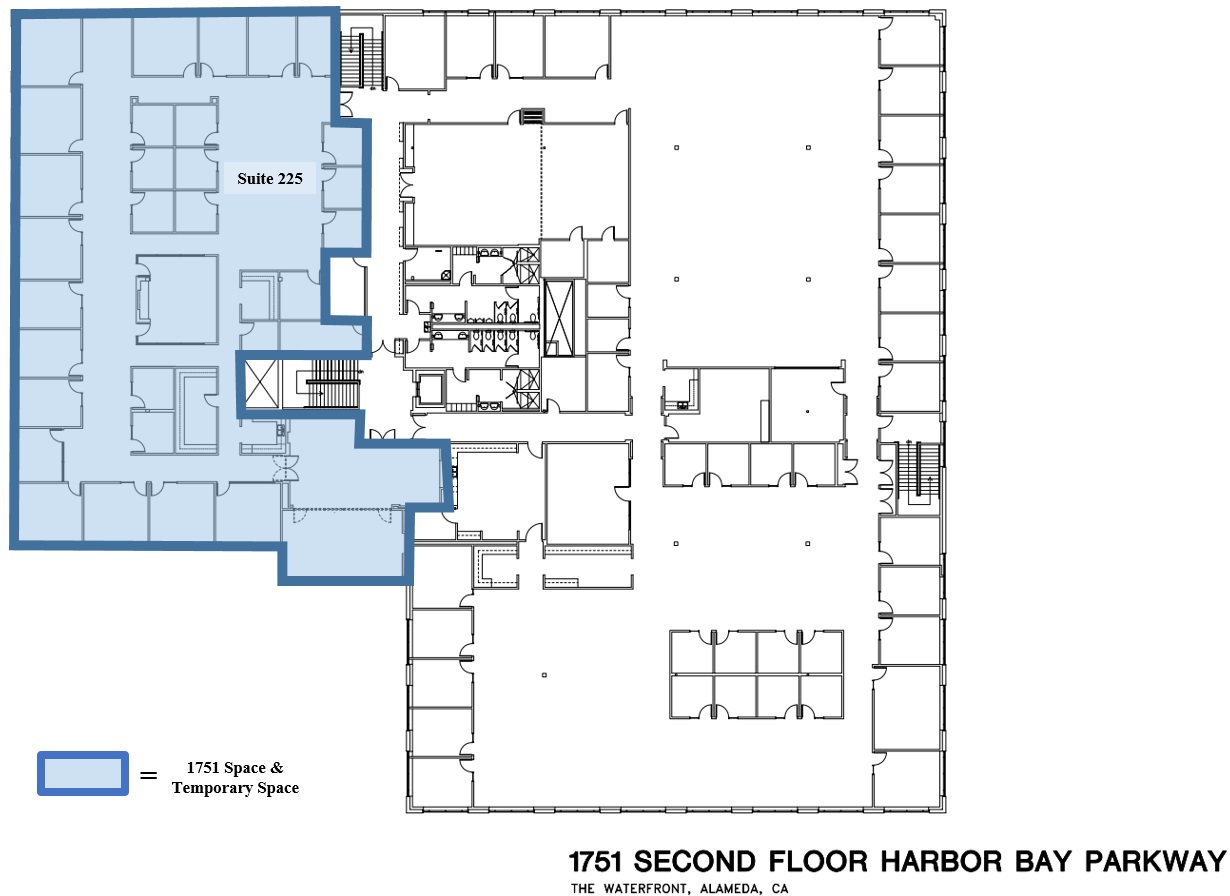

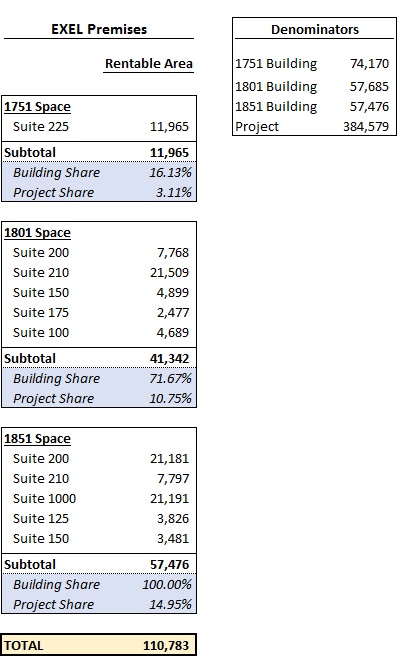

(i) Temporary Space; 1751 Space. Notwithstanding anything to the contrary in this Lease, Landlord shall deliver possession of Suite 225 located on the second floor of the 1751 Building and identified on Exhibit A (the “Temporary Space”) on the Lease Date. Tenant may use and occupy the Temporary Space, including conducting business therein, from the Lease Date until the Commencement Date (as defined in Paragraph 1(a) of Exhibit B) occurs (the “Temporary Space Period”), at no cost to Tenant, including payment of Rent, but on all of the other terms and conditions of this Lease. The parties acknowledge that upon the Commencement Date, the Temporary Space Period will end and the Temporary Space will become part of the Premises in accordance with the terms and conditions of this Lease and the Work Letter and shall, upon becoming part of the Premises, be referred to as the “1751 Space,” which contains approximately 11,965 square feet of Rentable Area, which shall not be subject to re-measurement except as set forth in Section 2.6 below;

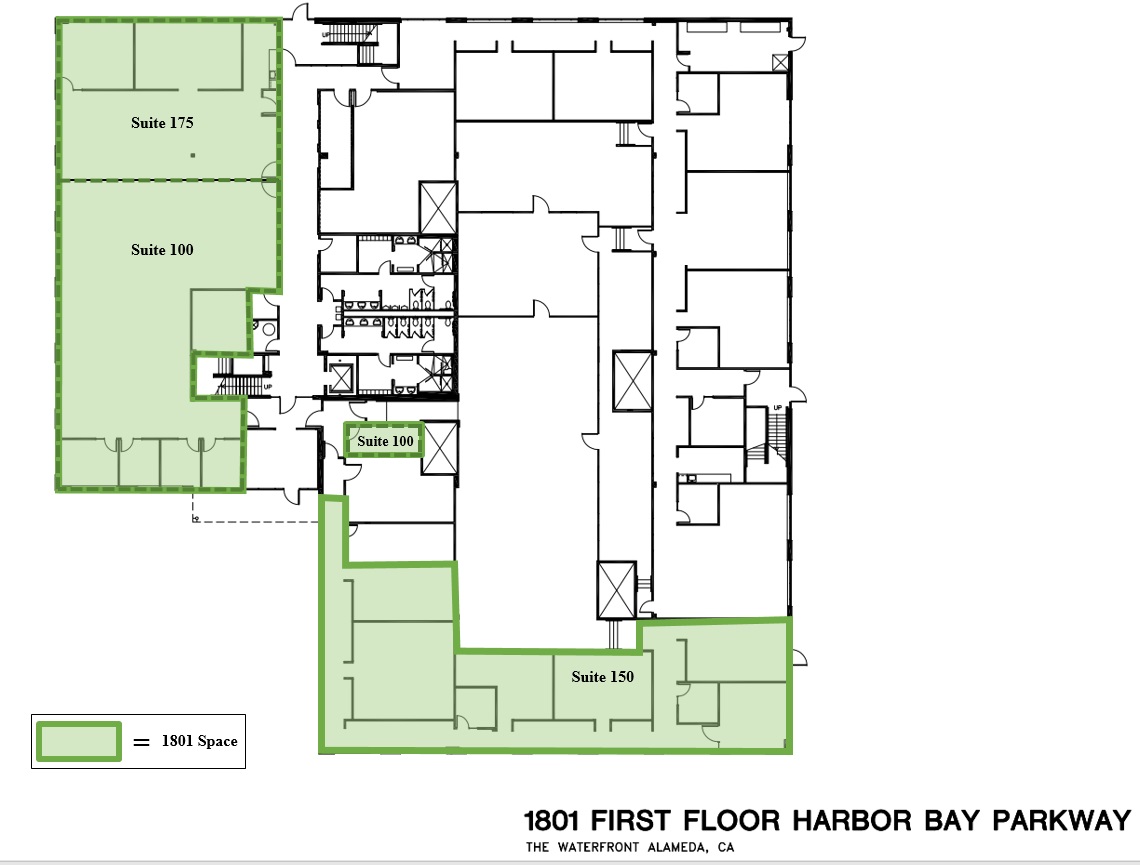

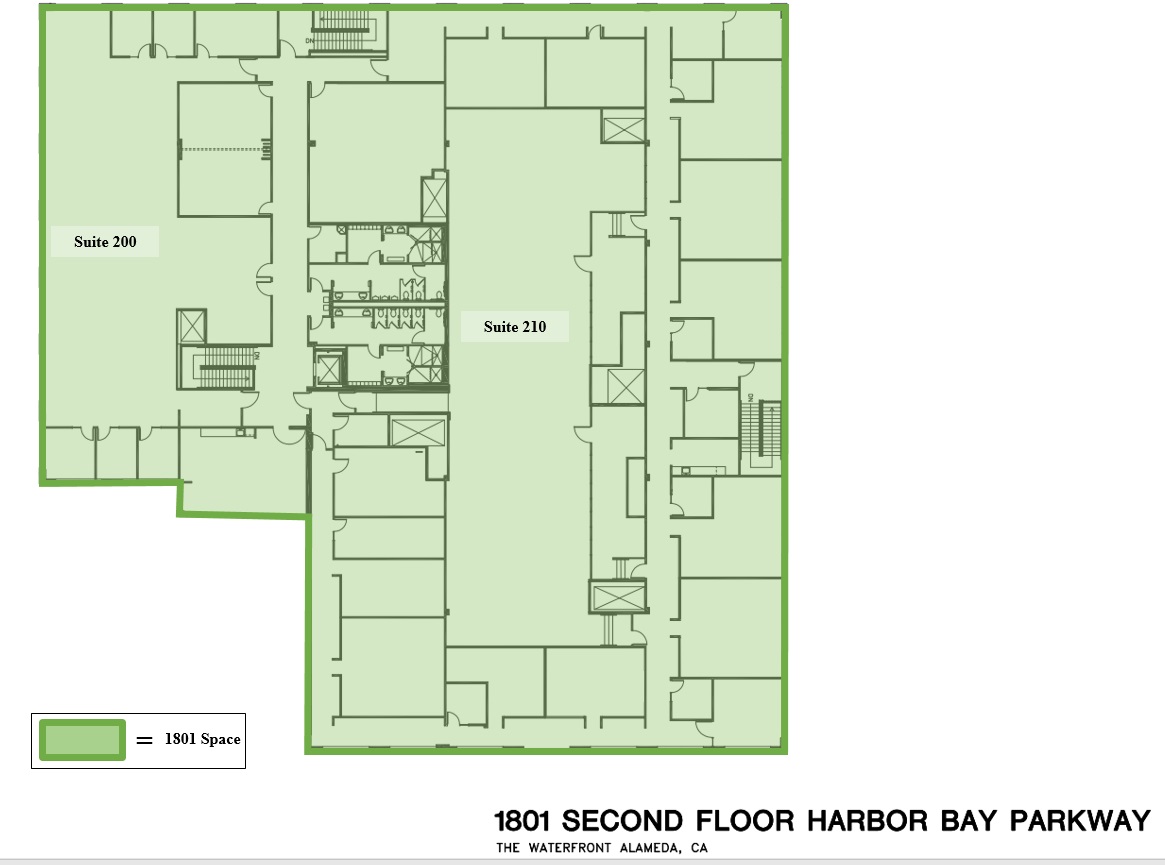

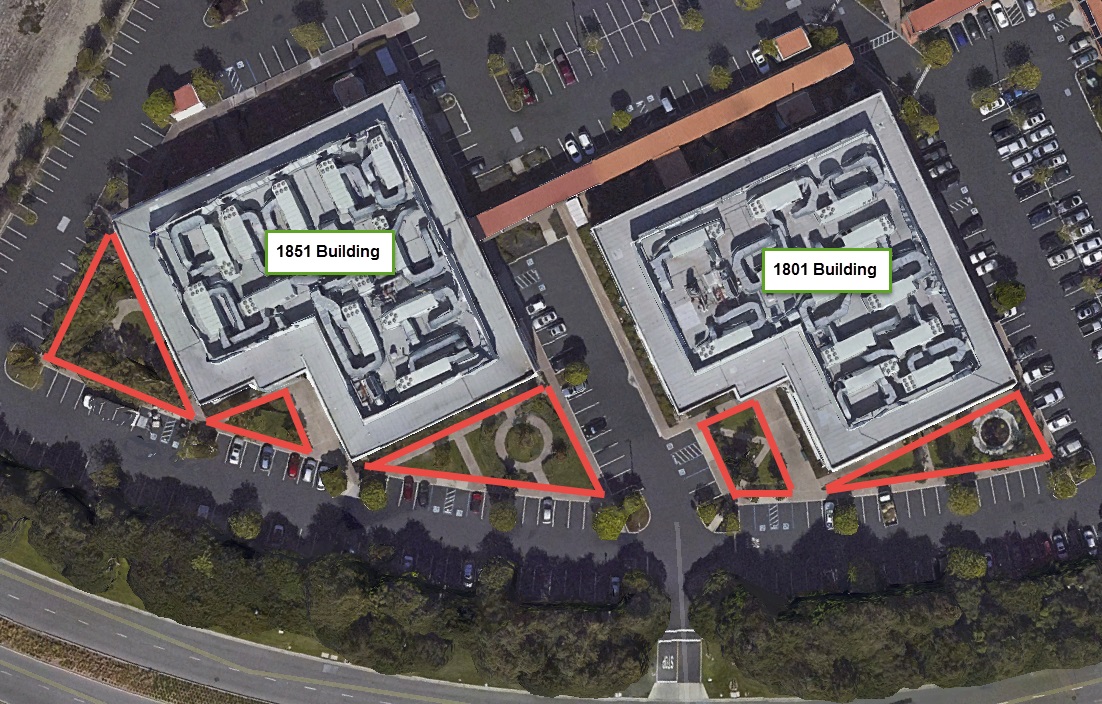

(ii) 1801 Space. Premises known as Suites 100, 150, 175, 200 and 210 located on the first and second floors of the 1801 Building and identified on Exhibit A (the “1801 Space”), which contains approximately 41,342 square feet of Rentable Area, which shall not be subject to re-measurement except as set forth in Section 2.6 below; and

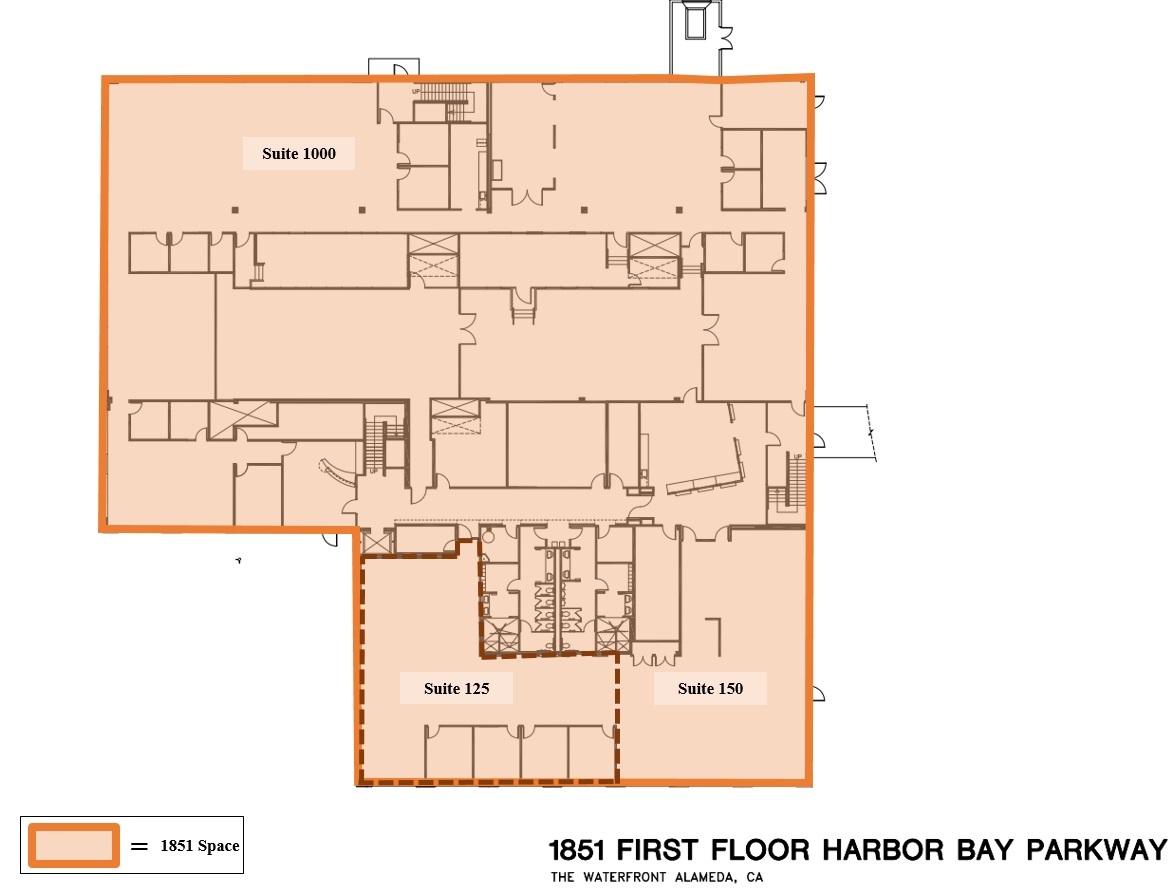

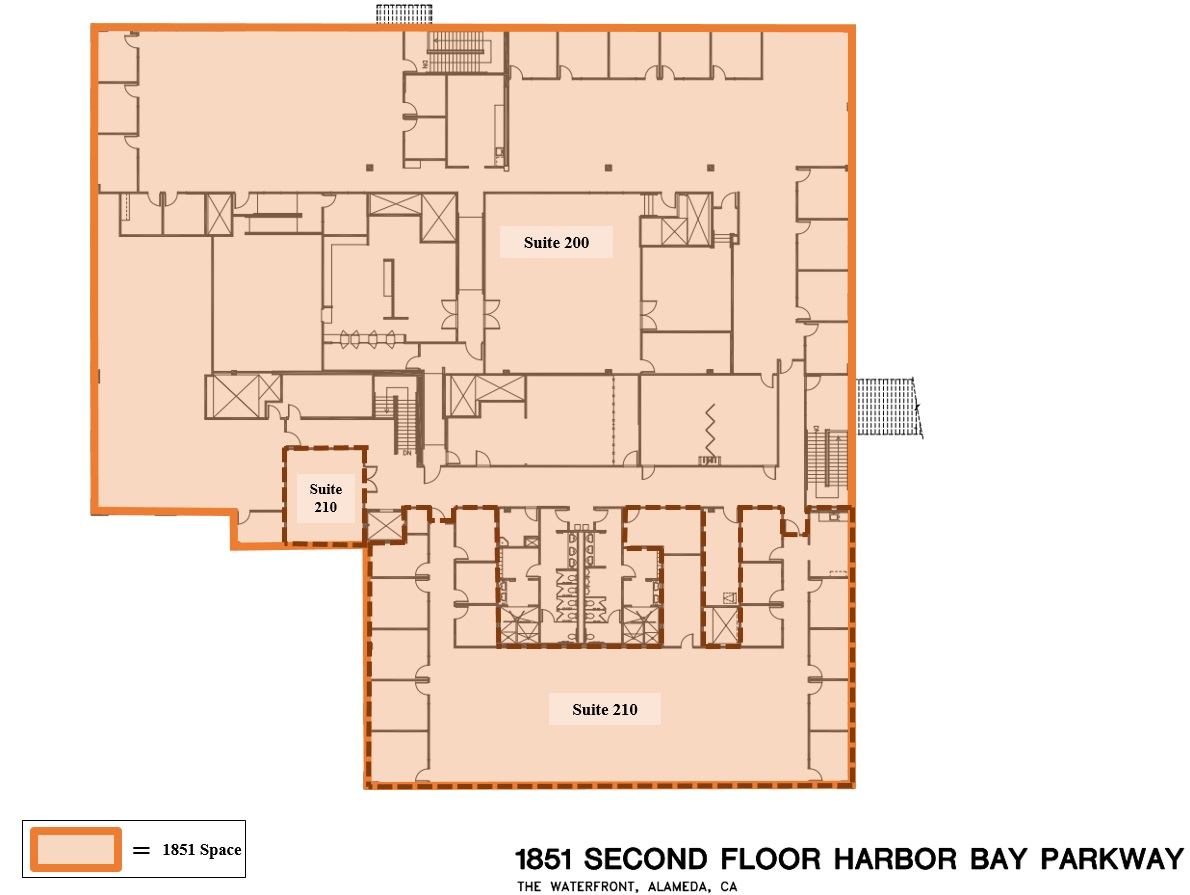

(iii) 1851 Space. Premises known as Suites 1000, 125, 150, 200 and 210 located on the first and second floors of the 1851 Building identified on Exhibit A (the “1851 Space”), which constitute the entire Building and contain approximately 57,476 square feet of the Rentable Area, which shall not be subject to re‑measurement except as set forth in Section 2.6 below.

The Premises contains a total of 110,783 square feet of Rentable Area, which shall not be subject to re-measurement except as set forth in Section 2.6 below. The Premises do not include any areas above the finished ceiling or below the finished floor covering installed in the Premises or any other areas not shown on Exhibit A as being part of the Premises.

(e) “Buildings” or “Building” means the office buildings in which the Premises is located. A “Multi User Building” means a Building occupied by Tenant and one or more other tenants or includes vacant space that could be marketed for lease to other tenants. A “Single User Building” means a Building occupied by Tenant and no other tenants and does not include vacant space that could be marketed for lease to other tenants. The Buildings are further described as follows:

(i) 1751 Harbor Bay Parkway, Alameda, California, in which the Temporary Space is located (the “1751 Building”), which Building contains 74,170 square feet of Rentable Area and is a Multi User Building;

(ii) 1801 Harbor Bay Parkway, Alameda, California, in which the 1801 Space is located (the “1801 Building”), which Building currently contains 57,685 square feet of Rentable Area and is a Multi User Building; and

(iii) 1851 Harbor Bay Parkway, Alameda, California, in which the 1851 Space is located (the “1851 Building”), which Building contains 57,476 square feet of Rentable Area and is a Single User Building.

(f) “Project” means the multiple building project, of which the Buildings are a part, known as of the Lease Date as 1750 North Loop Road and 1601, 1701, 1751, 1801 and 1851 Harbor Bay Parkway, Alameda, California, and related parking areas, walkways, landscaping areas and other common areas, less any portions that may be owned separately from the Buildings by a party other than Landlord from time to time. On the Lease Date, the Project contains 384,579 square feet of Rentable Area.

(g) “Use” means general office uses throughout the Premises, research and development uses throughout the Premises, vivarium in the 1801 Building and the 1851 Building only, manufacturing in the 1801 Building and the 1851 Building only, and ancillary uses related to the foregoing uses, subject to obtaining any required approvals.

(h) “Term” means the duration of this Lease, which will be approximately 120 months, beginning on the “Commencement Date” (as defined in Paragraph 1(a) of Exhibit B) and ending on the “Expiration Date” (as defined below), unless terminated earlier or extended further as provided in this Lease. The “Expiration Date” means (i) if the Commencement Date is the first day of a month, the date which is 120 months from the date preceding the Commencement Date; or (ii) if the Commencement Date is not the first day of a month, the date which is 120 months from the last day of the month in which the Commencement Date occurs.

(i) “Base Rent” means the Rent payable according to Section 3.1, which will be in an amount per month or portion thereof during the Term as follows:

2

Months | Monthly Rental Rate | Base Rent Payable Per Month | ||||

Months 1 – 12 | $1.65 | $182,791.95* | ||||

Months 13** – 24 | $1.70 | $188,275.71 | ||||

Months 25 – 36 | $1.75 | $193,923.98 | ||||

Months 37 – 48 | $1.80 | $199,741.70 | ||||

Months 49 – 60 | $1.86 | $205,733.95 | ||||

Months 61 – 72 | $1.91 | $211,905.97 | ||||

Months 73 – 84 | $1.97 | $218,263.15 | ||||

Months 85 – 96 | $2.03 | $224,811.04 | ||||

Months 97 – 108 | $2.09 | $231,555.37 | ||||

Months 109 – 120 | $2.15 | $238,502.03 | ||||

* 12 Month Rent Abatement Period. Base Rent for this period will be partially abated in the amount of $83,791.95 per month (the “Rent Abatement”) beginning on the Commencement Date and ending on the date that is 12 calendar months after the Commencement Date (the “Rent Abatement Period”). By way of example, if the Commencement Date occurs on October 10, 2017, then the Rent Abatement Period shall expire on October 9, 2018. However, if Landlord terminates this Lease as a result of a “Default” (as defined in Section 20.1) at any time during the Term, in addition to all other remedies available to Landlord, the unamortized portion of any Rent that is abated pursuant to this Section 1.1(i) will automatically become immediately due and payable. At any time on or before the Rent Abatement Period, upon notice to Tenant, Landlord shall have the right to purchase any Rent Abatement relating to the remaining Rent Abatement Period by paying to Tenant an amount equal to the “Rent Abatement Purchase Price” (as defined below). As used herein, “Rent Abatement Purchase Price” shall mean the aggregate amount of the Rent Abatement remaining during the Rent Abatement Period, as of the date of payment of the Rent Abatement Purchase Price by Landlord. Upon Landlord’s payment of the Rent Abatement Purchase Price to Tenant, Tenant shall be required to pay Rent in accordance with the provisions of Sections 1.1(i) and 3.1 and there shall be no further Rent Abatement.

**Proration for Partial Months. If the Commencement Date is not the first day of the month, then for purposes of this Section 1.1(i), “Month 13” of the Term will be the first full calendar month after the expiration of the Rent Abatement Period, together with the days in the prior calendar month after the expiration of the Rent Abatement Period (the “Partial Month”), and Rent for the Partial Month will be payable at the same rate as set forth in this Section 1.1(i) for Month 13, prorated based on the number of days in the Partial Month and the number of days in such prior calendar month. Except for the increase immediately following the Rent Abatement Period, all increases will occur on the first day of the applicable month.

(j) “Building Shares” or “Building Share” means, with respect to the calculation of Operating Expenses according to Section 1.3(j), the following:

(i) With respect to the 1751 Building, percentage obtained by dividing the Rentable Area of the 1751 Space by the total Rentable Area of the 1751 Building and multiplying the resulting quotient by 100 and rounding to the second decimal place (the “1751 Building Share”). As of the Commencement Date, upon which the Temporary Space becomes part of the Premises (and is thereafter referred to as the 1751 Space), the 1751 Building Share will be 16.13%, subject to adjustment pursuant to Section 2.6 below.

3

(ii) With respect to the 1801 Building, percentage obtained by dividing the Rentable Area of the 1801 Space which has been Delivered by Landlord by the total Rentable Area of the 1801 Building and multiplying the resulting quotient by 100 and rounding to the second decimal place (the “1801 Building Share”). As of the Lease Date, the 1801 Building Share will be 71.67%, subject to adjustment pursuant to Section 2.6 below.

(iii) With respect to the 1851 Building, percentage obtained by dividing the Rentable Area of the 1851 Space which has been Delivered by Landlord by the total Rentable Area of the 1851 Building and multiplying the resulting quotient by 100 and rounding to the second decimal place (the “1851 Building Share”). As of the Lease Date, the 1851 Building Share will be 100%, subject to adjustment pursuant to Section 2.6 below.

(k) “Project Shares” or “Project Share” means, with respect to the calculation of Operating Expenses according to Section 1.3(j), the following:

(i) With respect to the 1751 Building, percentage obtained by dividing the Rentable Area of the 1751 Space by the total rentable square footage of the Project and multiplying the resulting quotient by 100 and rounding to the second decimal place (the “1751 Project Share”). As of the Commencement Date, upon which the Temporary Space becomes part of the Premises (and is thereafter referred to as the 1751 Space), the 1751 Project Share will be 3.11%, subject to adjustment pursuant to Section 2.6 below.

(ii) With respect to the 1801 Building, percentage obtained by dividing the Rentable Area of the 1801 Space that has been Delivered by Landlord by the total rentable square footage of the Project and multiplying the resulting quotient by 100 and rounding to the second decimal place (the “1801 Project Share”). As of the Lease Date, the 1801 Project Share will be 10.75%, subject to adjustment pursuant to Section 2.6 below.

(iii) With respect to the 1851 Building, percentage obtained by dividing the Rentable Area of the 1851 Space which has been Delivered by Landlord by the total rentable square footage of the Project and multiplying the resulting quotient by 100 and rounding to the second decimal place (the “1851 Project Share”). As of the Lease Date, the 1851 Project Share will be 14.95%, subject to adjustment pursuant to Section 2.6 below.

The Rentable Area of the Project (and therefore, Project Shares) will be subject to adjustment based on the number of buildings in the Project that Landlord may own, from time to time.

(l) “Security Deposit” means $0.00. See, however, Sections 1.1(r) and 28 regarding the “Letter of Credit.”

(m) “Landlord’s Manager’s Address” means:

Jones Lang LaSalle Americas, Inc.

1601 Harbor Bay Parkway Suite 110

Alameda, CA 94502

Attention: Chris Wakefield – General Manager

4

(n) “Landlord’s General Address” means:

Ascentris 105, LLC

1401 17th Street, 12th Floor

Denver, Colorado 80202

Attention: Robert A. Toomey, Jr., Manager

(o) “Landlord’s Payment Address” means:

Ascentris 105, LLC

c/o Jones Lang LaSalle

P.O. Box 748365

Los Angeles, CA 90074-8365

(p) “Tenant’s Notice Address” means:

for notices given before the Commencement Date:

Exelixis, Inc.

210 East Grand Avenue

South San Francisco CA 94080

Attention: Executive Vice President, General Counsel and Secretary

and for notices given after the Commencement Date:

Exelixis, Inc.

1851 Harbor Bay Parkway

Alameda, California 94502

Attention: Executive Vice President, General Counsel and Secretary

In each case, with a copy to:

Cooley LLP

101 California Street, 5th Floor

San Francisco, California 94111-5800

Attn: Anna B. Pope

(q) “Tenant’s Invoice Address” means:

Exelixis, Inc.

1851 Harbor Bay Parkway

Alameda, California 94502

Attention: Accounts Payable APGroup@exelixis.com

(r) “Letter of Credit” means a single irrevocable, standby letter of credit as security for the performance of the obligations of Tenant hereunder in a form substantially similar to that attached as Exhibit F and consistent with the terms of Section 28 of this Lease in the initial amount of $500,000.00 (the “L/C Amount”). Within two (2) business days following mutual execution of this Lease (the “Deposit Date”), Tenant will deliver the Letter of Credit to Landlord, as additional consideration to induce Landlord to enter into this Lease. Provided that no default of the Lease by Tenant has occurred beyond any applicable cure period (unless transmittal of

5

notice of a default of the Lease by Tenant is barred by applicable Laws, in which case no such notice or cure period will be required with respect to such default), the L/C Amount shall periodically decrease in accordance with this Section 1.1(r), including the schedule set forth below, with each period during which the L/C Amount is at a certain level being a “L/C Amount Period” and the months set forth below being the months after the Commencement Date. Notwithstanding the foregoing, until the last L/C Amount Period, upon the occurrence of any monetary or insolvency Default during a L/C Amount Period (without limiting Landlord’s other remedies under this Lease), the next applicable reduction of the L/C Amount will automatically be extended one full L/C Amount Period, and all subsequent reductions will be postponed for a corresponding period of time. For instance, if Tenant first commits a monetary or insolvency Default, in Month 28 of the Term, the L/C Amount will not be decreased from $405,000.00 to $364,500.00 until Month 49 of the Term, and will not be decreased from $364,500.00 to $328,050.00 until Month 61 of the Term.

L/C Amount Period (Months after the Commencement Date) | L/C Amount* | ||

Deposit Date** through Month 12 | $500,000.00 | ||

Months 13 through 24 | $450,000.00 | ||

Months 25 through 36 | $405,000.00 | ||

Months 37 through 48 | $364,500.00 | ||

Months 49 through 60 | $328,050.00 | ||

Months 61 through 72 | $295,245.00 | ||

Months 73 through 84 | $265,720.50 | ||

Months 85 through 120 | $252,698.10 | ||

* These changes in the L/C Amount may be delayed as set forth above, and Tenant will be responsible for causing any such modifications of the applicable Letter of Credit to be made at Tenant’s sole cost.

** The first L/C Amount Period will begin on the date Tenant deposits the Letter of Credit with Landlord and end on Month 12 of the Term.

(s) “Brokers” means the following brokers who will be paid by Landlord: Kidder Matthews and Cushman Wakefield; and the following brokers who will be paid by Tenant: None.

Exhibits and Riders. The Exhibits and Riders listed below are attached to and incorporated in this Lease. In the event of any inconsistency between such Exhibits or Riders and the terms and provisions of this Lease, the terms and provisions of the Exhibits and Riders will control. The Exhibits to this Lease are:

Exhibit A | – | Plan Delineating the Premises and Tenant Maintained Outdoor Areas |

Exhibit B | – | Possession and Leasehold Improvements Exhibit |

Exhibit C | – | Occupancy Estoppel Certificate |

Exhibit D | – | Rules and Regulations |

Exhibit E | – | Intentionally Omitted |

Exhibit F | – | Form of Letter of Credit |

Exhibit G | – | HVAC Equipment List |

6

Additional Definitions. In addition to those terms defined in Section 1.1 and other sections of this Lease, the following defined terms when used in this Lease have the meanings indicated:

(a) “Additional Rent” means the Rent payable according to Section 3.2.

(b) “Affiliates” of a party means that party’s parent, subsidiary and affiliated corporations and its and their managers, members, partners, venturers, directors, officers, shareholders, agents, servants and employees.

(c) “Building Standard” means the scope and quality of leasehold improvements, Building systems or Building services, as the context may require, generally offered from time to time to all office tenants of the Buildings.

(d) “Business Hours” means the hours from 7:00 a.m. to 7:00 p.m. on Monday through Friday.

(e) “Common Areas” means certain interior and exterior common and public areas located on the Project and in the respective Buildings as may be designated by Landlord for the nonexclusive use in common by Tenant, Landlord and other tenants, and their employees, guests, customers, agents and invitees, including any fitness center in the Project made available to tenants; it being understood that the Common Areas will not include the Tenant Maintained Outdoor Areas. With respect to Single User Buildings, there will be no interior Common Areas within such Buildings; provided, however, Landlord will have access to the Single User Buildings in accordance with this Lease, including, without limitation, Sections 2.4 and 5.

(f) “Costs” means the aggregate of all ordinary and customary real property operating costs (other than those expressly excluded below) incurred or accrued during each calendar year according to standard real estate accounting principles for operating, managing, administering, equipping, securing and protecting (to the extent such services are provided by Landlord), insuring, heating, cooling, ventilating, lighting, repairing, replacing, renewing, cleaning, maintaining, decorating, inspecting, and providing water, sewer and other energy and utilities to, any portion of the Project, Buildings and Common Areas (any of which may be furnished by Landlord, an Affiliate of Landlord, or a third party, including an owners’ association or declarant under a Declaration); the total amounts paid by or due from Landlord in satisfaction of any charges or assessments made by any association or other party in connection with providing any services or benefits to the Premises, Buildings or the Project pursuant to any Declaration, but excluding the costs of electricity used in the Premises, which will be paid by Tenant pursuant to Section 5.2(f); management fees calculated according to the management agreement between Landlord and its managing agent, which management fees will be at a then‑current market rate) and shall never exceed 3% of gross revenues with respect to the portion of the Premises located in a Multi User Building and 2% of gross revenues with respect to the portion of the Premises located in a Single User Building (and the percentage will be adjusted accordingly if a Multi User Building is converted into a Single User Building and vice versa) and shall never exceed rates charged by third party commercial real estate property managers for comparable services at comparable business parks in the San Francisco Bay Area; reasonable fees and expenses incurred in connection with Landlord’s registration of the Buildings and/or Project with the Environmental Protection Agency’s Energy Star® Portfolio Manager system (the “Portfolio Manager System”) and with Landlord’s collection, tracking and disclosure of energy consumption information with respect to the Buildings and/or Project as may be reasonably

7

necessary to comply with California Public Resources Code Section 25402.10; fees and expenses (including reasonable attorneys’ fees) incurred in contesting, in good faith, the validity of any Laws that would cause an increase in Costs, provided that Landlord believes, in good faith, that the cost savings will be greater than the fees required to pursue such contest; depreciation and amortization on materials, tools, supplies and vendor type equipment purchased by Landlord to enable Landlord to supply services Landlord might otherwise contract for with a third party where such depreciation and amortization would otherwise have been included in the charge for such third party’s services, all as determined in accordance with generally accepted accounting principles, consistently applied, and when depreciation or amortization is permitted or required, the item shall be amortized over its reasonably anticipated useful life (“Permitted Depreciation and Amortization”); and, except as otherwise expressly set forth in this Lease, costs (whether capital or not) that (i) are incurred in order to conform to changes subsequent to the Lease Date in any Laws, or (ii) have been or are incurred with the reasonably expectation of a substantial reduction in Costs or the rate of increase in Costs (the costs described in clauses (i) and (ii) will be charged to Costs in annual installments over the useful life of the items for which such costs are incurred [in the case of items required by changes in Laws] or over the period Landlord reasonably estimates that it will take for the savings in Costs achieved by such items to equal their cost [in the case of items intended to reduce Costs or their rate of increase], and in either case together with interest, at the average Prime Rate in effect during each calendar year that such costs are charged to Costs, on the unamortized balance) (collectively, “Permitted Capital Expenditures”).

Costs will not include (1) principal, interest, points or fee on debt or amortization on any mortgage or mortgages or any other debt instrument encumbering the Building or Project; (2) ground lease payments; (3) leasing commissions; (4) costs of advertising space for lease in the Project; (5) costs for which Landlord is reimbursed by insurance proceeds or from tenants of the Project (other than such tenants’ regular contributions to Costs); (6) any amortization or depreciation, except for Permitted Depreciation and Amortization and Permitted Capital Expenditures, (7) and capital expenditures as determined in accordance with generally accepted accounting principles, except for Permitted Capital Expenditures; (8) legal fees and other costs incurred in connection with negotiating leases or collecting rents, (9) legal fees and other costs incurred in connection with disputes with present or prospective tenants, other occupants of the Building or Project, or other third parties; (10) costs directly and solely related to the maintenance and operation of the entity that constitutes Landlord, such as accounting fees incurred solely for the purpose of reporting Landlord’s financial condition; (11) any fines, costs, penalties or interest resulting from Landlord’s failure to comply with Laws, except as expressly provided above; (12) expenses in connection with services or other benefits which are exclusively offered to one tenant in the Project but not offered to Tenant or other tenants generally or for which Tenant is charged directly but which are not provided to another tenant or occupant of the Building or Project; (13) costs incurred by Landlord due to the violation by Landlord or any other tenant other than Tenant of the terms and conditions of any lease of space in the Building or Project; (14) any compensation paid to clerks, attendants, or other persons in commercial concessions operated by Landlord other than reasonable payments to food trucks to meet sales minimums; (15) (intentionally omitted); (16) all items and services for which Tenant or any other tenant of the Building or Project reimburses or is obligated to reimburse Landlord and which Landlord provides selectively to one or more tenants in the Project but not offered to Tenant or other tenants generally; (17) (intentionally omitted); (18) electric power costs for which any tenant directly contracts with the local public service company; (19) services provided and costs incurred in connection with any operation of any retail, restaurant or deli in the Building, if any; (20) (intentionally omitted);

8

(21) (intentionally omitted); (22) wages, salaries, fees and fringe benefits paid to administrative or executive personnel or officers or partners of Landlord or management agent or anyone else over the level of Project supervisor; (23) the cost of correcting defects in the original construction of the Buildings; (24) the cost of any repair made by Landlord because of the total or partial destruction of the Building or Project, or the condemnation of a portion of the Building or Project that is reimbursed by insurance or condemnation award; (25) the cost of overtime or other expense to Landlord due to Landlord’s defaults or incurred while performing work expressly provided in this lease to be borne at Landlord’s expense (but not including overtime related to emergencies or required weekend work); (26) allowances, concessions, permits, licensees, inspections, and other costs and expenses incurred in completing, fixturing, renovating, decorating or redecorating space for tenants (including Tenant), prospective tenants or other occupants or prospective occupants of the Building or Project, or vacant leasable space in the Building or Project, or constructing or finishing demising walls (but not including paint touch-up) and public corridors with respect to any such space whether such work or alteration is performed for the initial occupancy by such tenant or occupant or thereafter; (27) after hours or overtime HVAC costs or electricity costs if chargeable or charged separately to other Building tenants; (28) expenses incurred by Landlord with respect to a tenant’s space located in another project in connection with such tenant’s leasing of space in the Project; (29) any cost representing an amount paid for first-class services or materials to a related person, firm, or entity to the extent such amount exceeds the amount that would be paid for such first-class services or materials at the then-existing market rates to an unrelated person, firm, or entity; (30) costs incurred due to the late payment of taxes, utility bills or other amounts owing, so long as Landlord was obligated to make such payments and did not in good faith dispute the amount of such payments; (31) general corporate overhead and general administrative expenses and accounting, record-keeping and clerical support of Landlord or the management agent, except as otherwise included in Landlord’s management fees; (32) any increase in insurance premiums caused by Landlord’s or any tenant’s acts (other than Tenant’s acts) with respect to “Hazardous Material” (as defined in Section 4.4); (33) moving expense costs of tenants of the Building or Project; (34) costs incurred for any items to the extent Landlord recovers under a manufacturer’s, materialmen’s vendor’s or contractor’s warranty; (35) costs of acquisition (but not maintenance and repair) of sculpture, paintings, or other objects of art; (36) any rent or expenses for storage space or other facilities that solely benefits Landlord; (37) costs incurred to test, survey, clean up, contain, abate, remove or otherwise remedy Hazardous Material and/or indoor air quality problems from the Building or Project, subject, however, to Tenant’s obligations with respect to Hazardous Material as set forth in Section 4.4; (38) costs directly resulting from the gross negligence or intentional misconduct of Landlord, or its Affiliates; (39) costs or fees relating to the defense of Landlord’s title or interest in the real estate containing the Building or Project, or any part thereof; (40) costs or expenses incurred by Landlord in financing, refinancing, pledging, selling, granting or otherwise transferring or encumbering ownership rights in the Building or Project; (41) (intentionally omitted); (42) the cost of installing, operating and maintaining any specialty service operated by the Landlord, such as an athletic or recreational club in the Building, unless Tenant has access to the same; (43) any bad debt loss; (44) costs and expenses incurred in connection with any transfer of an interest in the Landlord, the Building or the Project; and (45) any other expenses that under standard real estate accounting principles consistently applied would not be considered normal maintenance, repair, management or operation expenses.

For each calendar year during the Term, the amount by which those Costs that vary with occupancy (such as cleaning costs and utilities) would have increased had the Project been 100% occupied

9

and operational and had all Project services been provided to all tenants will be reasonably determined and the amount of such increase will be included in Costs for such calendar year.

Costs shall be reduced by all cash discounts, trade discounts or quantity discounts received by Landlord or its Affiliates in the purchase of any goods, utilities or services in connection with the prudent operation of the Buildings and Project. In the calculation of any expenses hereunder, it is understood that the same exact expense shall not be charged more than once. Landlord shall use its best efforts in good faith to effect an equitable proration of bills for services rendered to a Building and to any other property owned by Landlord or its Affiliates. In the event there exists a conflict as to an expense which is specified to be included in Costs and is also specified to be excluded from Costs within the above list, the exclusions listed above shall prevail and the expenses shall be deemed excluded. Landlord shall not recover more than 100% of the Costs actually incurred by Landlord.

(g) “Declarations” means any declaration, reciprocal easement agreement or other similar instrument or agreement relating to access, use and/or maintenance of the Project and improvements thereon that now affect or in the future may affect the Project and is recorded in the real property records of Alameda County, California, as they may be recorded, amended and otherwise modified. This Lease and all of Tenant’s rights hereunder are and will be subject and subordinate to all Declarations. While such subordination will occur automatically, Tenant agrees to execute and deliver to Landlord or the applicable association or party contemplated by the applicable Declaration, within 10 days after request and without cost to Landlord, such commercially reasonable instrument(s) as may be reasonably required to evidence such subordination. Notwithstanding the foregoing, from and after the Lease Date, Landlord shall not voluntarily create or acquiesce to the creation of any new Declaration or a modification of any existing Declaration which would materially diminish the rights of Tenant under this Lease, materially increase Tenant’s costs under this Lease, materially reduce the available parking spaces for Tenant’s use at the Buildings or Project, or materially interfere with Tenant’s access to the Buildings or parking areas in the Project.

(h) “Delivers” (or “Deliver” or “Delivered”, as the context may require) means Landlord tenders possession of the applicable portion of the Premises in the condition required by Section 2.2 of this Lease and Exhibit B attached hereto.

(i) “Laws” means any and all present or future federal, state or local laws, statutes, ordinances, rules, regulations or orders of any and all governmental or quasi-governmental authorities having jurisdiction.

(j) “Operating Expenses” means the sum of (i) the 1751 Building Share multiplied by the Costs and Taxes incurred by Landlord in such calendar year in connection with the 1751 Building, (ii) the 1801 Building Share multiplied by the Costs and Taxes incurred by Landlord in such calendar year in connection with the 1801 Building, (iii) the 1851 Building Share multiplied by the Costs and Taxes incurred by Landlord in such calendar year in connection with the 1851 Building, (iv) the 1751 Project Share multiplied by all Costs and Taxes incurred by Landlord in such calendar year in connection with the Project, (v) the 1801 Project Share multiplied by all Costs and Taxes incurred by Landlord in such calendar year in connection with the Project, (vi) the 1851 Project Share multiplied by all Costs and Taxes incurred by Landlord in such calendar year in connection with the Project; the Project Shares shall include a share of all Costs and Taxes incurred by Landlord in connection with the Common Areas of the Project, but shall exclude Costs and Taxes incurred by Landlord with respect to any particular building

10

in the Project, as equitably and reasonably determined by Landlord in accordance with sound property management accounting principles.

(k) “Portfolio Manager System” has the meaning set forth in Section 1.3(f).

(l) “Prime Rate” means the rate of interest announced from time to time by Wells Fargo Bank, or any successor to it, as its prime rate. If Wells Fargo Bank or any successor to it ceases to announce a prime rate, Landlord will designate a reasonably comparable financial institution for purposes of determining the Prime Rate.

(m) “Rent” means the Base Rent, Additional Rent and all other amounts required to be paid by Tenant under this Lease.

(n) “Rentable Area” means the rentable area, measured in square feet, of any described space within the respective Buildings or Project, as applicable, as determined pursuant to a Standard Method for Measuring Floor Area in Office Buildings, ANSI/BOMA Z65.1-1996.

(o) “Taxes” means the amount incurred or accrued during each calendar year according to generally accepted accounting principles for: all ad valorem real and personal property taxes and assessments, special or otherwise, levied upon or with respect to the respective Buildings or Project, the personal property used in operating the respective Buildings or Project, and the rents and additional charges payable by tenants of the respective Buildings or Project, and imposed by any taxing authority having jurisdiction; all taxes, levies and charges which may be assessed, levied or imposed in replacement of, or in addition to, all or any part of ad valorem real or personal property taxes or assessments as revenue sources, and which in whole or in part are measured or calculated by or based upon the respective Buildings or Project, the leasehold estate of Landlord or the tenants of the respective Buildings or Project, or the rents and other charges payable by such tenants; capital and place-of-business taxes, and other similar taxes assessed relating to the Common Areas; and any reasonable expenses incurred by Landlord in attempting to reduce or avoid an increase in Taxes, including, without limitation, reasonable legal fees and costs. Notwithstanding the foregoing, if a reassessment of the respective Buildings or Project for ad valorem property tax purposes, including any reassessment pursuant to California Constitution Article 13A and Sections 60 through 67 of the California Revenue & Taxation Code, occurs, then Tenant will be obligated to pay the Building Shares and/or the Project Shares of any such additional Taxes resulting from any such reassessment with respect to the respective Buildings or Project. Notwithstanding the foregoing, Taxes shall not include any tax upon Landlord’s net income or profits and shall also not include: business professional, occupational and license taxes (BPOL), federal, state or local income taxes, franchise, gift, transfer, excise, capital stock, estate, succession, or inheritance taxes (collectively, “Excluded Taxes”). Landlord shall pay all real property taxes and assessments by the date due, and shall, upon Tenant’s written request, furnish Tenant with evidence of such payment. Taxes shall not include any interest, late fees or other changes incurred as a result of Landlord’s failure to pay Taxes as and when due. Landlord shall not include in taxes any interest or penalties incurred by Landlord by reason of Landlord’s failure to pay in a timely manner any real property taxes and assessments. Landlord shall not recover more than 100% of the Taxes actually incurred by Landlord.

(p) “Tenant Maintained Outdoor Areas” means certain exterior areas located outside of the 1801 Building and the 1851 Building as depicted in Exhibit A, as may be adjusted by Landlord from time to time, that will be maintained by Tenant for the use by Tenant and its employees, guests, customers, agents and invitees; provided, however, that the exterior areas

11

surrounding the 1801 Building will not be considered part of the Tenant Maintained Outdoor Areas until the time, if ever, the 1801 Building is converted into a Single User Building.

2. GRANT OF LEASE.

2.1 Demise. Subject to the terms, covenants, conditions and provisions of this Lease, Landlord leases to Tenant and Tenant leases from Landlord the Premises, together with the exclusive right to use the Tenant Maintained Outdoor Areas and the non-exclusive right to use the Common Areas, for the Term. Subject to the terms and conditions of this Lease and Landlord’s right to close the Buildings or Project in the event of an emergency, Tenant shall have access to the Premises 24 hours per day, seven days per week. Tenant’s exclusive right to use the Tenant Maintained Outdoor Areas will mean Tenant can erect and maintain fences and hedges to exclude others from the Tenant Maintained Outdoor Areas and may reasonably request that such persons leave the Tenant Maintained Outdoor Areas.

2.2 Acceptance of Premises. On the applicable “Start Dates” (as defined in Exhibit B), Landlord will deliver the Premises to Tenant in a clean condition, with the roof of each Building in good condition and repair, with all base building and Premises systems in good working order and condition, and, to the extent expressly required by the City of Alameda, with the path of travel to the applicable portion of the Premises and Common Areas in each Building in compliance with all regulatory/municipal requirements, including Americans with Disabilities Act of 1990, 42 U.S.C. §12101 et seq. Any capital expenditures required exclusively for such work to the base building systems, path of travel, or the Common Areas will be the responsibility of Landlord, at Landlord’s cost, and shall not be included as a Cost. Except as expressly set forth in this Lease, Tenant acknowledges that Landlord has not made any representation or warranty with respect to the condition of the Premises, the Buildings or the Project or with respect to the suitability or fitness for the conduct of the Use or for any other purpose. On the applicable Start Dates, Tenant agrees to accept the Premises in its “as is” physical condition without any agreements, representations, understandings or obligations on the part of Landlord to perform any alterations, repairs or improvements (or to provide any allowance for same), except as expressly set forth in this Lease.

2.3 Quiet Enjoyment. Landlord covenants that during the Term, Tenant will have quiet and peaceable possession of the Premises free from claims by, through and under Landlord, subject to the terms, covenants, conditions and provisions of this Lease, and Landlord will not disturb such possession except as expressly provided in this Lease.

2.4 Landlord and Tenant Covenants. Landlord covenants to observe and perform all of the terms, covenants and conditions applicable to Landlord in this Lease. Tenant covenants to pay the Rent when due, and to observe and perform all of the terms, covenants and conditions applicable to Tenant in this Lease.

2.5 Landlord’s Reserved Rights. With respect to Multi User Buildings, Landlord reserves, for Landlord’s exclusive use, any of the following (other than those installed for Tenant’s exclusive use) that may be located in such Multi User Buildings: janitor closets, stairways and stairwells; fan, mechanical, electrical, telephone and similar rooms; and elevator, pipe and other vertical shafts, flues and ducts. With respect to Single User Buildings, Landlord will have access to the roofs, all structural elements, the heating, ventilation and air conditioning (“HVAC”) systems and elevators located in such Single User Buildings for the purposes of inspection and performance of Landlord’s obligations under this Lease. In connection with the foregoing, and in addition to other rights in favor of Landlord set forth herein, Landlord, its agents and employees will have the right to enter the Premises from time to time at reasonable times and upon at least 24 hours’ written notice (which may be by email), unless a

12

shorter time frame is agreed to by Tenant on a case-by-case basis, and except in case of emergency, in which case, Landlord shall endeavor to provide notice to Tenant as soon as practicable, to examine the same, obtain ingress to and egress from the portions of the Premises to which Landlord has a right to access under this Lease, show them to prospective purchasers, lenders, investors, employees or consultants (and during the last 24 months of the Term or any time during the Term if Tenant is in Default, to prospective tenants), to supply janitorial services or any other services to be provided by Landlord to Tenant, to inspect or cause a consultant to inspect all portions of the Premises to ensure Tenant’s compliance with its maintenance and operational obligations under this Lease, to post notices of non-responsibility, to record any amendments to the Declarations and to create any related associations; without liability to Tenant for any loss or damage incurred as a result of such entry, provided that Landlord will take reasonable steps in connection with such entry to minimize any disruption to Tenant’s business or its use of the Premises. In any entrance into the Premises pursuant to the provisions of this Section 2.5, Landlord shall ensure compliance with Tenant’s reasonable security and operational procedures previously detailed by Tenant to Landlord, except to the extent Landlord or its agents determine that an emergency makes compliance with such procedures impracticable. Tenant may from time to time upon five days’ advance written notice to Landlord designate, as secured areas of the Premises, areas where unusually confidential information is kept; provided that such secured areas must be reasonably located so that such secured areas do not interfere with Landlord performing its obligations under this Lease. Except in the case of emergency (as determined by Landlord in good faith), Landlord shall not enter such secured areas unless accompanied by a representative of Tenant. Tenant agrees to make such representative available to Landlord during Business Hours upon reasonable advance written request by Landlord (which may be by email) at least 24 hours’ in advance. Landlord shall at all times be provided with a means of entry to the secured areas in the event of an emergency.

2.6 Rentable Area Adjustments. For purposes of all amounts, percentages and figures appearing or referred to in this Lease (including, without limitation, Building Shares and Project Shares), the Rentable Area of the Project, Buildings or Premises shall not be subject to remeasurement, except as follows: if the Premises, Building or Project shall be materially physically expanded or contracted, Landlord may cause its architect to measure and certify to Landlord and Tenant the Rentable Area of the Project, Buildings or Premises pursuant to standards set forth in Section 1.3(n) and, upon the request of Landlord, Landlord and Tenant will execute an amendment to this Lease to modify all amounts, percentages and figures appearing or referred to in this Lease (including, without limitation, Building Shares and Project Shares) as may be necessary to conform to such remeasurement.

3. RENT.

3.1 Base Rent. Commencing on the Commencement Date and then throughout the Term, Tenant agrees to pay Landlord Base Rent according to the following provisions. Base Rent during each month (or portion of a month) described in Section 1.1(i) will be payable in equal monthly installments for such month (or portion), in advance, on or before the first day of each and every month during the Term; provided, however, that the first full months’ Base Rent payment due (less applicable Rent Abatement) will be made upon execution of this Lease by Tenant. However, if the Term commences on a date other than the first day of a month or the Term ends on a date other than the last day of a month, Base Rent for such month will be appropriately adjusted on a prorated basis. Notwithstanding anything to the contrary contained in this Lease, in no event shall Tenant be obligated to pay Base Rent on a given portion of the Premises prior to the date Landlord has delivered such portion of the Premises. No Base Rent shall be payable on the Temporary Space until the Commencement Date occurs.

13

3.2 Additional Rent. Commencing on the Commencement Date and then throughout the Term, Tenant agrees to pay Landlord, as Additional Rent, in the manner provided below, Operating Expenses.

(a) Estimated Payments. Prior to the Commencement Date and as soon as practicable after the beginning of each calendar year thereafter, Landlord will notify Tenant in writing of Landlord’s estimate of the Operating Expenses for the ensuing calendar year. On or before the first day of each month during the Term, commencing on the applicable Commencement Date for each portion of the Premises, Tenant will pay to Landlord, in advance, 1/12th of such estimated amounts, provided that until such notice is given with respect to the ensuing calendar year, Tenant will continue to pay on the basis of the prior calendar year’s estimate until the month after the month in which such notice is given. However, if a Commencement Date falls on a date other than the first day of a month or the Term ends on other than the last day of a month, Operating Expenses for such month will be appropriately adjusted on a prorated basis. In the month Tenant first pays based on Landlord’s new estimate, Tenant will pay to Landlord 1/12th of the difference between the new estimate and the prior year’s estimate for each month which has elapsed since the beginning of the current calendar year.

(b) Annual Settlement. As soon as practicable after the close of each calendar year, but by no later than May 1 following the close of such calendar year, Landlord will deliver to Tenant its written statement setting forth in reasonable detail the Operating Expenses for such calendar year. If on the basis of such statement Tenant owes an amount that is less than the estimated payments previously made by Tenant for such calendar year, Landlord will either refund such excess amount to Tenant or credit such excess amount against the next payment(s), if any, due from Tenant to Landlord. If on the basis of such statement Tenant owes an amount that is more than the estimated payments previously made by Tenant for such calendar year, Tenant will pay the deficiency to Landlord within 30 days after the delivery of such statement. If this Lease commences on a day other than the first day of a calendar year or terminates on a day other than the last day of a calendar year, Operating Expenses applicable to the calendar year in which such commencement or termination occurs will be prorated on the basis of the number of days within such calendar year that are within the Term.

(c) Final Payment. Tenant’s obligation to pay the Additional Rent provided for in this Section 3.2 which is accrued but not paid for periods prior to the expiration or early termination of the Term will survive such expiration or early termination. Prior to or as soon as practicable after the expiration or early termination of the Term, Landlord may submit an invoice to Tenant stating Landlord’s estimate of the amount by which Operating Expenses through the date of such expiration or early termination will exceed Tenant’s estimated payments of Additional Rent for the calendar year in which such expiration or termination has occurred or will occur. Tenant will pay the amount of any such excess to Landlord within 30 days after the date of Landlord’s invoice. Notwithstanding the foregoing, in the event that Landlord shall fail to invoice Tenant for any Additional Rent pursuant to this Section 3.2 by May 1 following the close of the calendar year in which the expiration or earlier termination of the Term occurs, then Landlord shall be deemed to have waived its right to collect such Additional Rent. In the event that Tenant is entitled to a refund pursuant to this Section 3.2, Landlord shall pay such amount within 30 days after the end of the Term and Landlord’s obligation to refund any such amounts will survive termination or expiration of the Term.

14

(d) Tenant’s Right to Audit. Tenant will have the right to inspect and audit Landlord’s books and records with respect to Operating Expenses covered by such annual statement (an “Audit”), provided that Tenant provides Landlord 10 days’ prior notice of Tenant’s intention to conduct such Audit, which notice must be delivered to Landlord on or before the date that is 90 days after Tenant’s receipt of the applicable annual statement (including an annual statement received after the expiration or earlier termination of the Term). In the event Tenant does not give Landlord notice of its election to conduct an Audit within such 90-day period, the terms and amounts set forth in such annual statement will be conclusive and final, and Tenant shall have no further right to conduct an Audit with respect to such annual statement or the Operating Expenses related thereto. Tenant may only use a private accounting firm retained on an hourly or fixed-fee basis or Tenant’s internal accounting staff to conduct an Audit; in no event may Tenant use any auditor paid on a contingency fee or result-based basis. If the conclusion of the Audit (which conclusion must be reasonably supported by the documentation reviewed in connection with the Audit) reveals that the amount charged by Landlord for Operating Expenses was greater than actual Operating Expenses, Landlord will credit against Rent next coming due after the completion of the Audit (or if the Term has expired, Landlord will pay to Tenant within 30 days after the completion of the Audit) the amount due to Tenant based on such difference, and if such conclusion of the Audit is that the amount charged by Landlord for Operating Expenses was less than actual Operating Expenses, Tenant will pay to Landlord the amount due from Tenant based on such difference within 30 days after the completion of the Audit. If the conclusion of the Audit reveals that the amount charged by Landlord for Operating Expenses was greater than 105% of the actual Operating Expenses, Landlord will be responsible for its own costs and expenses related to the Audit and will reimburse Tenant for the actual and reasonable costs charged by the accounting firm retained by Tenant, if any, to conduct the Audit, excluding travel and lodging expenses within 30 days after Landlord’s receipt of Tenant’s request and evidence of such costs. A permitted assignee of Tenant’s interest in this Lease may conduct an Audit, but only with respect to annual statements delivered after the effective date of the applicable assignment of the Tenant’s interest in this Lease. No subtenant of the Premises will be permitted to conduct an Audit.

3.3 Other Taxes. Tenant will reimburse Landlord upon demand for any and all taxes payable by Landlord (other than Excluded Taxes and taxes included in the definition of Taxes) whether or not now customary or within the contemplation of Landlord and Tenant: (a) upon, measured by or reasonably attributable to the cost or value of Tenant’s equipment, furniture, fixtures and other personal property located in the Premises; (b) upon or measured by Rent; (c) upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises or any portion of the Premises; and (d) upon this transaction or any document to which Tenant is a party creating or transferring an interest or an estate in the Premises. If it is not lawful for Tenant to reimburse Landlord, the Base Rent payable to Landlord under this Lease will be revised to yield to Landlord the same net rental after the imposition of any such tax upon Landlord as would have been payable to Landlord prior to the imposition of any such tax.

3.4 Terms of Payment. All Base Rent, Additional Rent and other Rent will be paid to Landlord in lawful money of the United States of America, at Landlord’s Payment Address or to such other person or at such other place as Landlord may from time to time designate in writing, without notice or demand and without right of deduction, abatement or set-off, except as otherwise expressly provided in this Lease.

15

3.5 Interest on Late Payments, Late Charge. Tenant hereby acknowledges that the late payment by Tenant to Landlord of any amount payable under this Lease will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult to ascertain. All amounts payable under this Lease by Tenant to Landlord, if not paid within five days after such amounts are past due, will bear interest from the due date until paid at the lesser of the highest interest rate permitted by law or 4% in excess of the then-current Prime Rate. Landlord, at Landlord’s option, in addition to past due interest, may charge Tenant a late charge for all payments not paid within five days after such amounts are past due, equal to the lesser of 4% of the amount of said late payment or the maximum amount permitted by law. The parties hereby agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of late payment by Tenant. Acceptance of such late charge by Landlord will in no event constitute a waiver of Tenant’s default with respect to such overdue amount, nor prevent Landlord from exercising any of the other rights and remedies granted hereunder.

3.6 Right to Accept Payments. No receipt by Landlord of an amount less than Tenant’s full amount due will be deemed to be other than payment “on account”, nor will any endorsement or statement on any check or any accompanying letter effect or evidence an accord and satisfaction. Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance or pursue any right of Landlord. No payments by Tenant to Landlord: (a) after the expiration or other termination of the Term, or after termination of Tenant’s right to possession of the Premises, will reinstate, continue or extend the Term; or (b) will invalidate or make ineffective any notice (other than a demand for payment of money) given prior to such payment by Landlord to Tenant. After notice or commencement of a suit, or after final judgment granting Landlord possession of the Premises, Landlord may receive and collect any sums of Rent due under this Lease, and such receipt will not void any notice or in any manner affect any pending suit or any judgment obtained.

4. USE AND OCCUPANCY

4.1 Use. Tenant agrees to use and occupy the Premises only for the Use described in Section 1.1(g), or for such other purpose as Landlord expressly authorizes in writing.

4.2 Compliance. Tenant agrees to use the Premises and the Tenant Maintained Areas in compliance with all Laws applicable to Tenant’s use, occupancy or alteration of the Premises and the Tenant Maintained Areas or the condition of the Premises and the Tenant Maintained Areas resulting from such use, occupancy or alteration, at Tenant’s sole cost and expense.

4.3 Occupancy. Tenant will not do or permit anything which obstructs or unreasonably interferes with other tenants’ rights or with Landlord’s providing Building or Project services, or which injures or annoys other tenants, as determined by Landlord in good faith. Tenant will not cause, maintain or permit any nuisance in or about the Premises and will keep the Premises free of debris, and anything (other than the “Permitted Hazardous Materials” [as defined in Section 4.4(b) below]) of a dangerous, noxious, toxic or offensive nature or which could create a fire hazard or undue vibration, heat or noise. If any item of equipment, building material or other property (other than the Permitted Hazardous Materials) brought into the Project by Tenant or on Tenant’s request causes a dangerous, noxious, toxic or offensive effect (including an environmental effect) and in Landlord’s reasonable opinion such effect will not be permanent but will only be temporary and is able to be eliminated, then Tenant will not be required to remove such item, provided that Tenant promptly and diligently causes such effect to be eliminated, pays for all costs of elimination and indemnifies Landlord against all liabilities arising from such effect. Tenant will not make or permit any use of the Premises which would be reasonably expected to cause the cancellation of any insurance coverage, increase the cost of insurance or require additional

16

insurance coverage. If by reason of Tenant’s failure to comply with the provisions of this Section 4.3, (a) any insurance coverage becomes unavailable, then Landlord will have the option to terminate this Lease; or (b) any insurance premiums increase, then Landlord may, upon written notice to Tenant, require Tenant to promptly pay to Landlord as Rent the amount of the increase in insurance premiums.

4.4 Hazardous Material.

(a) The term “Hazardous Material” as used in this Lease means any product, substance, chemical, material, or waste whose presence, nature, quantity and/or intensity of existence, use, manufacture, disposal, transportation, spill, release, or effect, either by itself or in combination with other materials expected to be owned or about the Premises is either: (i) potentially injurious to the public health, safety, or welfare, the environment, or the Premises, (ii) regulated or monitored by any governmental authority, or (iii) a basis for liability of Landlord to any governmental agency or third party under applicable statute or common law theory. Hazardous Material will include, but not be limited to, hydrocarbons, petroleum, gasoline, crude oil, or any products, by-products or fractions thereof, asbestos, chlorofluorocarbons, polychlorinated biphenyls (PCBs) and formaldehyde. Tenant will not bring, place, hold, treat, or dispose of any Hazardous Material on, under, or about the Premises, the Buildings, or the Project except in compliance with “Applicable Environmental Laws” (as defined below). The term “Hazardous Materials” does not include office supplies (such as cleaning materials and toner ink) used in the ordinary course of business in compliance with Applicable Environmental Laws. Except as permitted pursuant to Section 4.4(b) below, Tenant will not cause or allow any Hazardous Material to be incorporated into any improvements or alterations which it makes or causes to be made to the Premises.

(b) Tenant may utilize certain Hazardous Materials in the designated laboratory and manufacturing areas of the Premises in connection with Tenant’s research and development operations that (i) are necessary or useful to Tenant’s business, (ii) will be used, kept, and stored in a safe manner consistent with then-current best practices and in compliance with all Applicable Environmental Laws, and (iii) for which Tenant obtains, at Tenant’s sole cost and expense, any environmental permits, plans or approvals required for its operations under this Lease and for the Premises, including, but not limited to Hazardous Materials Business Plans, Storm Water Pollution Prevention Plans, Spill Response Plans, Air Pollution Control Permits, and Waste Discharge Requirements (Hazardous Materials meeting the criteria in this sentence are “Permitted Hazardous Materials”). Upon Landlord’s request, Tenant shall promptly provide to Landlord copies of any Safety Data Sheets (as required by the Occupational Safety and Health Act) relating to such Permitted Hazardous Materials. Tenant will be solely liable for any damages due to or arising from the Permitted Hazardous Materials. Tenant will indemnify, defend and hold harmless Landlord, its managers, members, partners, officers, directors, subsidiaries, affiliates, employees and agents and Property Manager from and against any and all liability, loss, claims, demands, damages or expenses (including reasonable attorneys’ fees) due to or arising from the Permitted Hazardous Materials.

(c) Tenant will promptly comply with the requirements of Section 25359.7(b) of the California Health and Safety Code and/or any successor or similar statute. Accordingly, if Tenant knows, or has reasonable cause to believe, that Hazardous Material, or a condition involving or resulting from same, has come to be located in, on, under, or about the Premises, in violation of Applicable Environmental Laws, Tenant will promptly give written notice of such fact to Landlord. Tenant will also promptly give Landlord a copy of any written statement, report, notice, registration, application, permit, business plan, license, claim, action, or proceeding given

17

to, or received from, any governmental authority or private party, or persons entering or occupying the Premises, concerning the presence, spill, release, discharge off, or exposure to, any Hazardous Material, or contamination in, on, under, or about the Premises in violation of Applicable Environmental Laws. Should Tenant fail to so notify Landlord, Landlord will have all rights and remedies provided for such a failure by such Section 25359.7(b) in addition to all other rights and remedies which Landlord may have under this Lease or otherwise. Additionally, Tenant will immediately notify Landlord in writing of (i) any enforcement, clean-up, removal, or other governmental action instituted, completed, or threatened with regard to Hazardous Material involving the Premises, the Buildings, or the Project, (ii) any claim made or threatened by any person against Tenant, Landlord, the Premises, the Buildings, or the Project related to damage, contribution, cost recovery, compensation, loss, or injury resulting from or claimed to result from any Hazardous Material, (iii) any reports made to any environmental agency arising out of or in connection with any Hazardous Material at or removed from the Premises, the Buildings, or the Project, including any complaints, notices, warnings, or assertions of any violation in connection therewith, and (iv) any spill, release, discharge, or disposal of Hazardous Material that occurs with respect to the Premises or Tenant’s operations, including, without limitation, those that would constitute a violation of California Health and Safety Code Section 25249.5 or any other Applicable Environmental Law.

(d) Tenant will promptly and diligently abate any Hazardous Material brought, placed, or leaked onto, or under, the Premises during the Term by Tenant or any of Tenant’s employees, agents, representatives, licensees, guests, contractors or invitees, in violation of Applicable Environmental Laws. Additionally, to the extent Tenant brings, places, holds, treats, disposes of, or utilizes any chlorofluorocarbons on or about the Premises, Tenant will remove all such chlorofluorocarbons prior to, or upon, termination of the Lease, regardless of whether such chlorofluorocarbons are then defined, recognized, known or supposed to be Hazardous Material. Tenant, however, will not take any remedial action related to Hazardous Material located in or about the Premises, the Buildings or the Project in violation of Applicable Environmental Laws and will not enter into a settlement, consent decree, or compromise in response to any claim related to Hazardous Material, without first notifying Landlord in writing of Tenant’s proposed action and affording Landlord a reasonable opportunity to appear, intervene, or otherwise participate in any discussion or proceeding for the purposes of protecting Landlord’s interest in the Premises, the Buildings and the Project.

(e) In addition to any other indemnity contained in this Lease, Tenant hereby will protect, defend, indemnify, and hold Landlord, its partners, managers, members, officers, directors, subsidiaries, affiliates, lenders, employees and agents, and Landlord’s property manager (“Property Manager”) and ground lessor, if any (individually a “Landlord Party” and collectively “Landlord Parties”), and the Premises, harmless, unless due to the gross negligence or willful misconduct of any Landlord Party, from and against any and all losses, liabilities, general, special, consequential and/or incidental damages, injuries, costs, expenses, claims of any and every kind whatsoever (including, without limitation, court costs, reasonable attorneys’ fees, damages to any person, the Premises, the Buildings, the Project, or any other property or loss of rents) which at any time or from time to time may be paid, incurred, or suffered by or asserted against Landlord with respect to, or as a result of: (i) breach by Tenant of any of the covenants set forth in this Section 4.4, and/or (ii) to the extent caused or allowed by Tenant, or any agent, employee, contractor, invitee, or licensee of Tenant, the presence on, under, or the escape, seepage, leakage, spillage, discharge, emission, release from, onto, or into the Premises, the Buildings, the Project, any land, the atmosphere, or any watercourse, body of water, or ground

18

water, of any Hazardous Material (including, without limitation, any losses, liabilities, damages, injuries, costs, expenses, or claims asserted or arising under the Comprehensive Environmental Response, Compensation and Liability Act of 1980 (42 U.S.C. §§ 9601 et seq.), any so-called “Superfund” or “Superlien” law, the Resource Conservation and Recovery Act of 1980 (42 U.S.C. §§ 6901 et seq.), the Federal Water Pollution Control Act (33 U.S.C. §§ 1251 et seq.), the Safe Drinking Water Act (42 U.S.C. §§ 300f et seq.), the Toxic Substances Control Act (15 U.S.C. §§ 2601 et seq.), the Clean Air Act (42 U.S.C. §§ 7401 et seq.), California Health & Safety Code §§ 25100 et seq. and §§ 39000 et seq., the California Safe Drinking Water & Toxic Enforcement Act of 1986 (California Health & Safety Code §§ 25249.5 et seq.), the Porter-Cologne Water Quality Control Act (California Water Code §§ 13000 et seq.), any and all amendments and recodifications of the foregoing statutes, or any other federal, state, local, or other statute, law, ordinance, code, rule, regulation, permit, order, or decree regulating, relating to or imposing liability or standards of conduct concerning Hazardous Material; all of the foregoing will collectively be referred to as “Applicable Environmental Laws”). The undertaking and indemnification set forth in this Section 4.4 will survive the termination of this Lease and will continue to be the personal liability and obligation of Tenant.

(f) Landlord represents and warrants to Tenant that to the actual knowledge of Jake Rome, who is the individual in Landlord’s organization in the best position to have knowledge of such matters, as of the Lease Date, Landlord has not received any written notice from any governmental entity of any violations of Applicable Environmental Laws affecting or applicable to the Premises or Buildings that have not been cured as of the Lease Date.

(g) Tenant will obtain insurance or other evidence of financial capability satisfactory to Landlord (in its reasonable discretion) to assure compliance with the indemnity and other obligations of Tenant related to Hazardous Material set forth in this Lease or otherwise now or in the future required by Laws.

(h) Subject to the limitations set forth in Section 2.5, Landlord and Landlord’s lender(s) will have the right to enter the Premises for the purpose of inspecting the condition of the Premises and for verifying compliance by Tenant with this Lease and with all Applicable Environmental Laws, and to employ experts and/or consultants in connection therewith and/or to advise Landlord with respect to Tenant’s activities including but not limited to the installation, operation, use, monitoring, maintenance, or removal of any Hazardous Material from the Premises. The costs and expenses of such inspection will be paid by the party requesting same, unless a Default of this Lease, violation of Applicable Environmental Law, or a contamination, caused or contributed to by Tenant is found to exist or be imminent, or unless the inspection is required or ordered by governmental authority as the result of any such existing or imminent violation or contamination. In any such case, Tenant will upon request reimburse Landlord or Landlord’s lender(s), as the case may be, for the costs and expenses of such inspections.

4.5 Civil Code Section 1938 Disclosure. California law requires the following disclosure:

“A Certified Access Specialist (“CASp”) can inspect the subject premises and determine whether the subject premises comply with all of the applicable construction-related accessibility standards under state law. Although state law does not require a CASp inspection of the subject premises, the commercial property owner or lessor may not prohibit the lessee or tenant from obtaining a CASp inspection of the subject premises for the occupancy or potential occupancy of the lessee or tenant, if

19

requested by the lessee or tenant. The parties shall mutually agree on the arrangements for the time and manner of the CASp inspection, the payment of the fee for the CASp inspection, and the cost of making any repairs necessary to correct violations of construction-related accessibility standards within the premises.”

Tenant will only be permitted to have a CASp conduct an inspection as required by applicable Laws, and Landlord will only be required to contribute to the cost of repairs (as contemplated by this Section 4.5) to the extent required by applicable Laws.

5. SERVICES AND UTILITIES; REPAIR AND MAINTENANCE OBLIGATIONS.