Attached files

| file | filename |

|---|---|

| EX-99.3 - EXHIBIT 99.3 KBW CONFERENCE PRESENTATION - Bank of Marin Bancorp | exhibit99-3kbwconference.htm |

| EX-99.1 - EXHIBIT 99.1 - Bank of Marin Bancorp | exhibit991pressrelease.htm |

| 8-K - 8-K - Bank of Marin Bancorp | form8kbankofnapa.htm |

Bank of Marin Bancorp

Acquisition of Bank of Napa

Investor Presentation | July 31, 2017

Forward Looking Statements

This presentation may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, but are not limited to, statements about the Company’s plans, objectives, expectations and intentions that

are not historical facts, and other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “should,”

“projects,” “seeks,” “estimates”, or the negative version of those words or other comparable words or phrases of a future or forward-looking

nature. These forward-looking statements are based on current beliefs and expectations of management and are inherently subject to

significant business, economic and competitive uncertainties and contingencies, many of which are beyond the Company’s control. In addition,

these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to

change. The following factors, among others, could cause actual results to differ materially from the anticipated results (express or implied) or

other expectations in the forward-looking statements, including those set forth in this presentation: 1) the risks associated with lending and

potential adverse changes of the credit quality of loans in the Company’s portfolio; 2) changes in trade, monetary and fiscal policies and laws,

including interest rate policies of the Board of Governors of the Federal Reserve System or the Federal Reserve Board, which could adversely

affect the Company’s net interest income and profitability; 3) legislative or regulatory changes, including increased banking and consumer

protection regulation that adversely affect the Company’s business; 4) ability to complete pending or prospective future acquisitions, limit certain

sources of revenue, or increase cost of operations; 5) costs or difficulties related to the completion and integration of acquisitions; 6) the

goodwill the Company has recorded in connection with acquisitions could become impaired, which may have an adverse impact on earnings

and capital; 7) reduced demand for banking products and services; 8) the reputation of banks and the financial services industry could

deteriorate, which could adversely affect the Company's ability to obtain (and maintain) customers; 9) competition among financial institutions in

the Company's markets may increase significantly; 10) the risks presented by continued public stock market volatility, which could adversely

affect the market price of the Company’s common stock and the ability to raise additional capital or grow the Company through acquisitions; 11)

the projected business and profitability of an expansion or the opening of a new branch could be lower than expected; 12) consolidation in the

financial services industry in the Company’s markets resulting in the creation of larger financial institutions who may have greater resources

could change the competitive landscape; 13) dependence on the CEO, the senior management team and the Presidents of Bank divisions; 14)

potential interruption or breach in security of the Company’s systems and technological changes which could expose us to new risks (e.g.,

cybersecurity), fraud or system failures; 15) natural disasters, including fires, floods, earthquakes, and other unexpected events; 16) the

Company’s success in managing risks involved in the foregoing; and 17) the effects of any reputational damage to the Company resulting from

any of the foregoing. Please take into account that forward-looking statements speak only as of the date of this presentation. Given the

described uncertainties and risks, the Company cannot guarantee its future performance or results of operations and you should not place

undue reliance on these forward-looking statements. The Company does not undertake any obligation to publicly correct, revise, or update any

forward-looking statement if it later becomes aware that actual results are likely to differ materially from those expressed in such forward-looking

statement, except as required under federal securities laws.

2

3

Transaction Highlights

• Significantly enhances Bank of Marin’s position in the attractive Napa market

• Pro forma #1 deposit market share among community banks

• Bank of Napa is a high quality business bank

• The only Napa based community bank

• Total assets of $246 million, gross loans of $139 million and total deposits of $218 million

• 64.0% loan / deposit ratio and 26.9% noninterest-bearing deposits

• Strong credit culture

• Complementary community-focused business banking models built around

strong core deposit bases

• Customer-facing employees committed to continue serving the Napa market

• Customers will benefit from broader product offerings and higher lending limits

Financially

Attractive

• Immediately accretive to earnings per share

• Internal rate of return of greater than 15%

• Tangible book value dilution earnback of 4 years

• Regulatory capital ratios remain strong

Strategic

Rationale

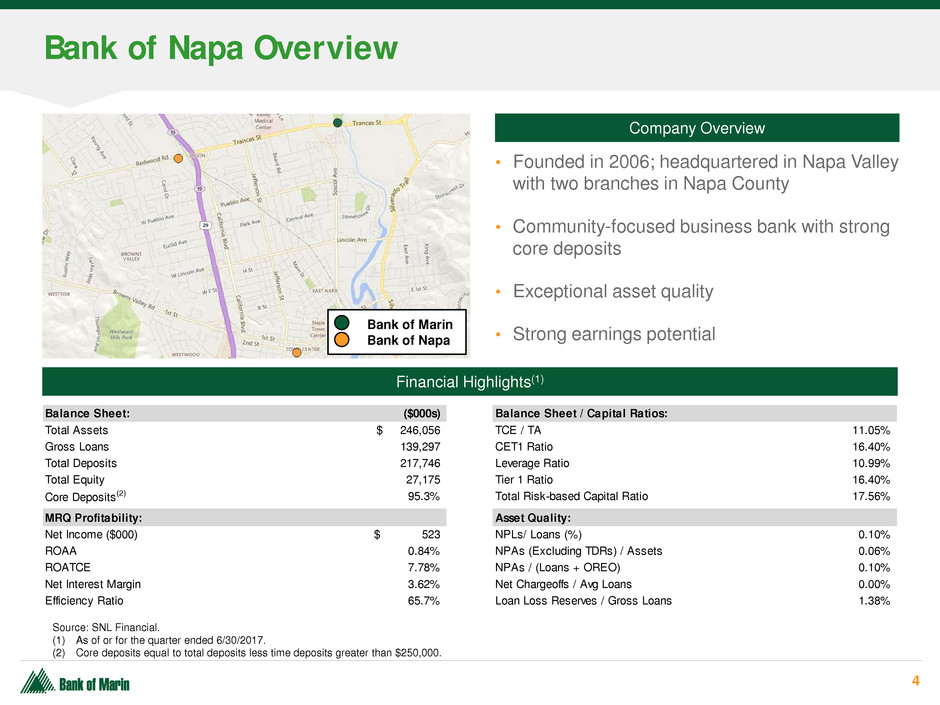

Balance Sheet: ($000s) Balance Sheet / Capital Ratios:

Total Assets 246,056$ TCE / TA 11.05%

Gross Loans 139,297 CET1 Ratio 16.40%

Total Deposits 217,746 Leverage Ratio 10.99%

Total Equity 27,175 Tier 1 Ratio 16.40%

Core Deposits(2) 95.3% Total Risk-based Capital Ratio 17.56%

MRQ Profitability: Asset Quality:

Net Income ($000) 523$ NPLs/ Loans (%) 0.10%

ROAA 0.84% NPAs (Excluding TDRs) / Assets 0.06%

ROATCE 7.78% NPAs / (Loans + OREO) 0.10%

Net Interest Margin 3.62% Net Chargeoffs / Avg Loans 0.00%

Efficiency Ratio 65.7% Loan Loss Reserves / Gross Loans 1.38%

4

• Founded in 2006; headquartered in Napa Valley

with two branches in Napa County

• Community-focused business bank with strong

core deposits

• Exceptional asset quality

• Strong earnings potential

Bank of Napa Overview

Source: SNL Financial.

(1) As of or for the quarter ended 6/30/2017.

(2) Core deposits equal to total deposits less time deposits greater than $250,000.

Company Overview

Financial Highlights(1)

• Bank of Marin

• Bank of Napa

5

• Strengthens presence in the attractive Napa County

market

• Napa county has a population of ~145,000

• 2017 – 2022 population growth is projected at 4.3% compared to 3.8%

nationally

• Napa County’s economy is strong and rapidly growing

• May 2017 unemployment rate of 3.1% is significantly less than

California’s 4.7% unemployment rate

• 2017 median household income of $77,751 is ~18% greater than

California’s median household income

• 2017 – 2022 projected household income growth of 12.3%

substantially outpaces California’s projected growth of 7.7%

• ~25% of Napa County’s workforce is involved in

leisure and hospitality or agriculture

• Opportunity to better serve Bank of Napa’s customers

through expanded service offerings and higher lending

limits

Napa County Market Highlights

Source: SNL Financial & Bureau of Labor Statistics.

6

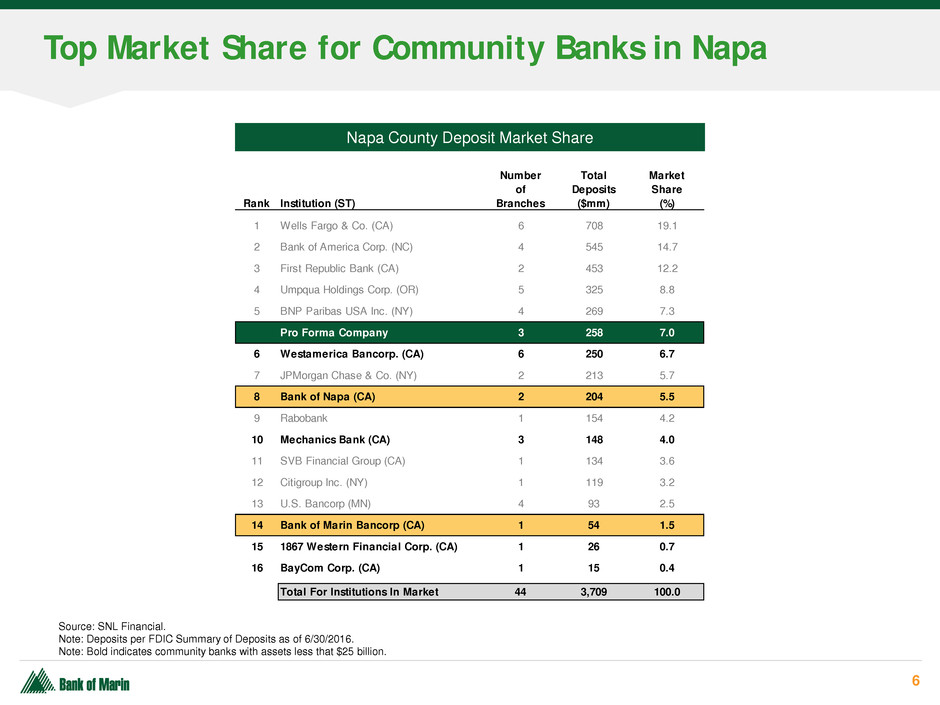

Top Market Share for Community Banks in Napa

Source: SNL Financial.

Note: Deposits per FDIC Summary of Deposits as of 6/30/2016.

Note: Bold indicates community banks with assets less that $25 billion.

Rank Institution (ST)

Number

of

Branches

Total

Deposits

($mm)

Market

Share

(%)

1 Wells Fargo & Co. (CA) 6 708 19.1

2 Bank of America Corp. (NC) 4 545 14.7

3 First Republic Bank (CA) 2 453 12.2

4 Umpqua Holdings Corp. (OR) 5 325 8.8

5 BNP Paribas USA Inc. (NY) 4 269 7.3

Pro Forma Company 3 258 7.0

6 Westamerica Bancorp. (CA) 6 250 6.7

7 JPMorgan Chase & Co. (NY) 2 213 5.7

8 Bank of Napa (CA) 2 204 5.5

9 Rabobank 1 154 4.2

10 Mechanics Bank (CA) 3 148 4.0

11 SVB Financial Group (CA) 1 134 3.6

12 Citigroup Inc. (NY) 1 119 3.2

13 U.S. Bancorp (MN) 4 93 2.5

14 Bank of Marin Bancorp (CA) 1 54 1.5

15 1867 Western Financial Corp. (CA) 1 26 0.7

16 BayCom Corp. (CA) 1 15 0.4

Total For Institutions In Market 44 3,709 100.0

Napa County Deposit Market Share

7

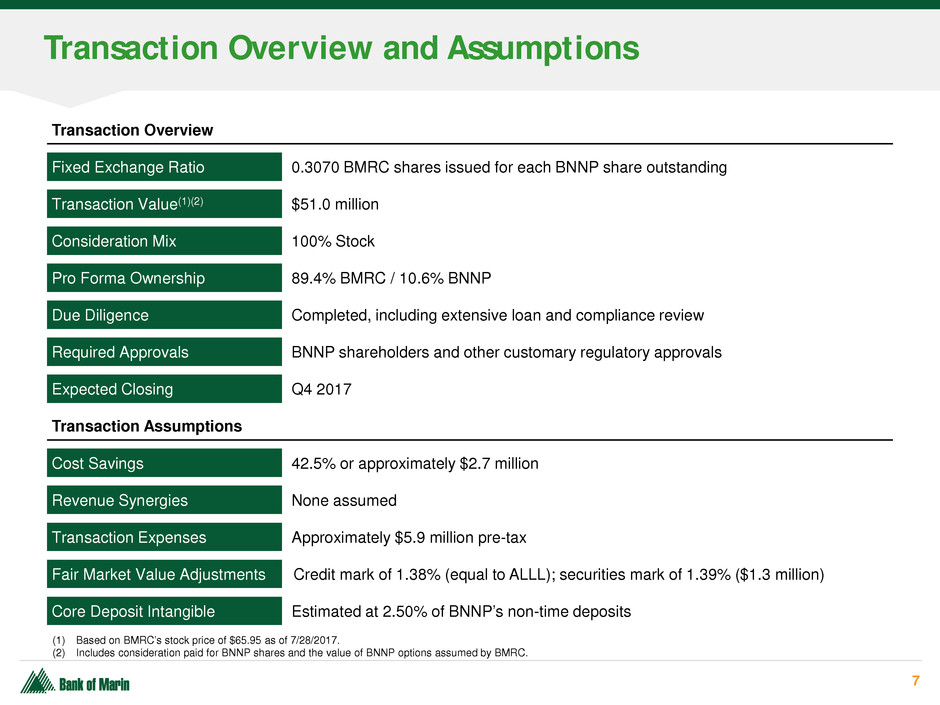

Transaction Overview and Assumptions

Transaction Value(1)(2) $51.0 million

Pro Forma Ownership

Due Diligence

Expected Closing

Required Approvals

89.4% BMRC / 10.6% BNNP

Completed, including extensive loan and compliance review

BNNP shareholders and other customary regulatory approvals

Q4 2017

Consideration Mix 100% Stock

Fixed Exchange Ratio 0.3070 BMRC shares issued for each BNNP share outstanding

(1) Based on BMRC’s stock price of $65.95 as of 7/28/2017.

(2) Includes consideration paid for BNNP shares and the value of BNNP options assumed by BMRC.

Transaction Overview

Transaction Assumptions

Revenue Synergies None assumed

Fair Market Value Adjustments

Core Deposit Intangible

Credit mark of 1.38% (equal to ALLL); securities mark of 1.39% ($1.3 million)

Estimated at 2.50% of BNNP’s non-time deposits

Transaction Expenses Approximately $5.9 million pre-tax

Cost Savings 42.5% or approximately $2.7 million

8

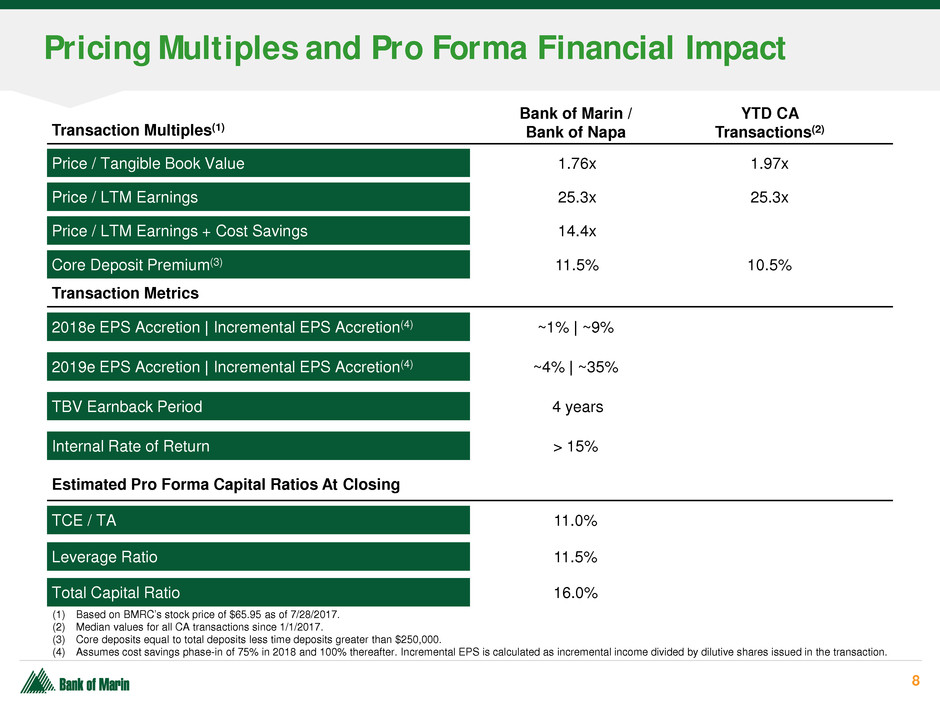

Pricing Multiples and Pro Forma Financial Impact

Transaction Multiples(1)

Price / Tangible Book Value 1.76x

Price / LTM Earnings 25.3x

Core Deposit Premium(3) 11.5%

Transaction Metrics

2018e EPS Accretion | Incremental EPS Accretion(4) ~1% | ~9%

2019e EPS Accretion | Incremental EPS Accretion(4) ~4% | ~35%

TBV Earnback Period 4 years

Internal Rate of Return

Estimated Pro Forma Capital Ratios At Closing

> 15%

TCE / TA 11.0%

Leverage Ratio 11.5%

Total Capital Ratio 16.0%

(1) Based on BMRC’s stock price of $65.95 as of 7/28/2017.

(2) Median values for all CA transactions since 1/1/2017.

(3) Core deposits equal to total deposits less time deposits greater than $250,000.

(4) Assumes cost savings phase-in of 75% in 2018 and 100% thereafter. Incremental EPS is calculated as incremental income divided by dilutive shares issued in the transaction.

Bank of Marin /

Bank of Napa

YTD CA

Transactions(2)

1.97x

25.3x

10.5%

Price / LTM Earnings + Cost Savings 14.4x

Appendix

10

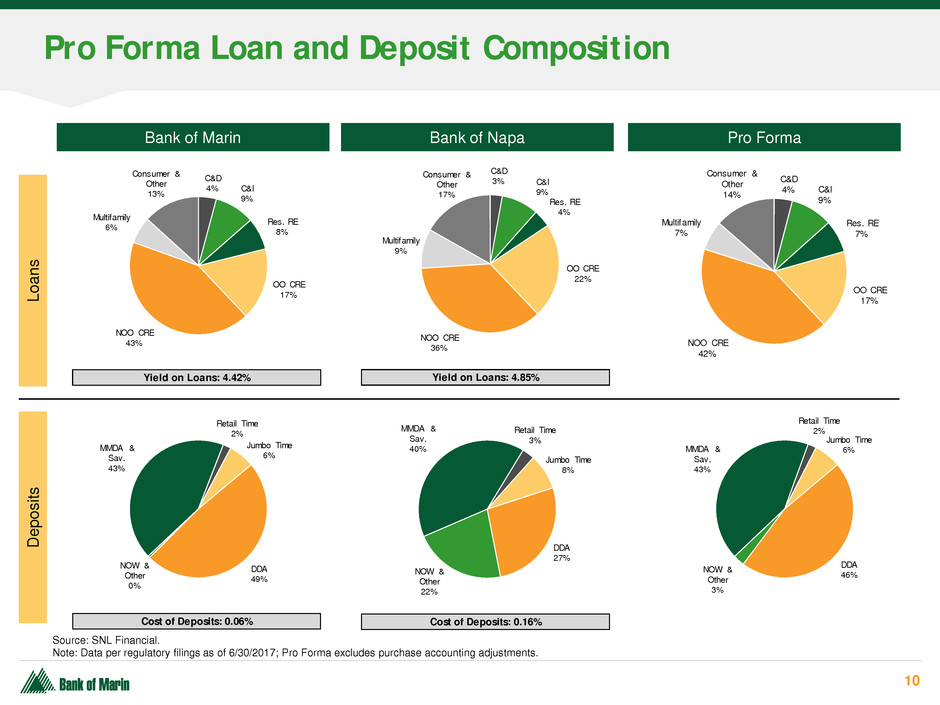

Pro Forma Loan and Deposit Composition

Source: SNL Financial.

Note: Data per regulatory filings as of 6/30/2017; Pro Forma excludes purchase accounting adjustments.

Lo

an

s

D

ep

os

its

Bank of Marin

Yield on Loans: 4.42%

C&D

4% C&I

9%

Res. RE

8%

OO CRE

17%

NOO CRE

43%

Multifamily

6%

Consumer &

Other

13%

Bank of Napa

Yield on Loans: 4.85%

C&D

3% C&I

9%

Res. RE

4%

OO CRE

22%

NOO CRE

36%

Multifamily

9%

Consumer &

Other

17%

Cost of Deposits: 0.16%

DDA

27%

NOW &

Other

22%

MMDA &

Sav.

40%

Retail Time

3%

Jumbo Time

8%

Pro Forma

C&D

4% C&I

9%

Res. RE

7%

OO CRE

17%

NOO CRE

42%

Multifamily

7%

Consumer &

Other

14%

Cost of Deposits: 0.06%

DDA

49%

NOW &

Other

0%

MMDA &

Sav.

43%

Retail Time

2%

Jumbo Time

6%

DDA

46%NOW & Other

3%

MMDA &

Sav.

43%

Retail Time

2%

Jumbo Time

6%

11

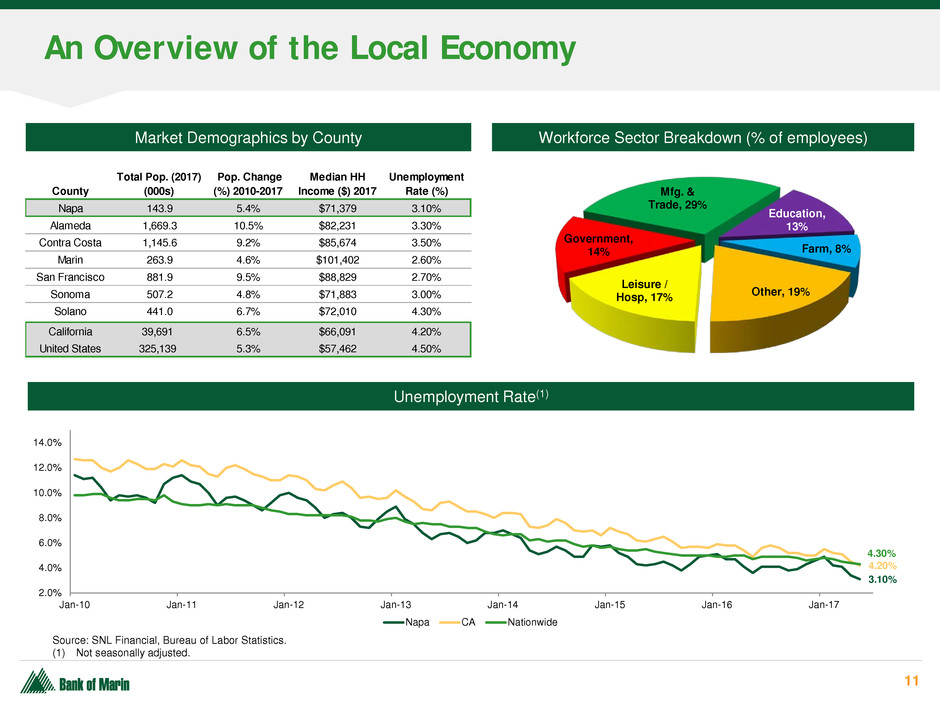

An Overview of the Local Economy

Market Demographics by County Workforce Sector Breakdown (% of employees)

Unemployment Rate(1)

Other

Services

Educational &

Health Services

Trade,

Transportation,

& Utilities

Government

Manufacturing

County

Total Pop. (2017)

(000s)

Pop. Change

(%) 2010-2017

Median HH

Income ($) 2017

Unemployment

Rate (%)

Napa 143.9 5.4% $71,379 3.10%

Alameda 1,669.3 10.5% $82,231 3.30%

Contra Costa 1,145.6 9.2% $85,674 3.50%

Marin 263.9 4.6% $101,402 2.60%

San Francisco 881.9 9.5% $88,829 2.70%

Sonoma 507.2 4.8% $71,883 3.00%

Solano 441.0 6.7% $72,010 4.30%

California 39,691 6.5% $66,091 4.20%

United States 325,139 5.3% $57,462 4.50%

3.10%

4.20%

4.30%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Jan-10 Jan-11 Jan-12 Jan-13 Jan-14 Jan-15 Jan-16 Jan-17

Napa CA Nationwide

Leisure /

Hosp, 17%

Government,

14%

Mfg. &

Trade, 29%

Education,

13%

Farm, 8%

Other, 19%

Source: SNL Financial, Bureau of Labor Statistics.

(1) Not seasonally adjusted.