Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Armada Hoffler Properties, Inc. | q2-2017ex991earningsrelease.htm |

| 8-K - 8-K - Armada Hoffler Properties, Inc. | ahhq263020178-k.htm |

1

2Q 2017 | SUPPLEMENTAL FINANCIAL PACKAGE

2Table of Contents

3 Forward Looking Statements

4 Corporate Profile

5 Highlights

6 Outlook & Assumptions

7 Summary Information

8 Summary Balance Sheet

9 Summary Income Statement

10 FFO, Normalized FFO & Adjusted FFO

11 Outstanding Debt

12 Core Debt to Core EBITDA

13 Debt Information

14 Capitalization & Financial Ratios

15 Property Portfolio

17 Development Pipeline

18 Acquisitions & Dispositions

19 Construction Business Summary

20 Same Store NOI by Segment

21 Top 10 Tenants by Annualized Base Rent

22 Office Lease Summary

23 Office Lease Expirations

24 Retail Lease Summary

25 Retail Lease Expirations

26 Net Asset Value Component Data

27 Appendix – Definitions & Reconciliations

31 Same Store vs Non-Same Store Properties

32 Reconciliation to Property Portfolio NOI

34 Reconciliation to GAAP Net Income

3Forward Looking Statements

This Supplemental Financial Package should be read in conjunction with the unaudited condensed consolidated financial

statements appearing in our press release dated August 1, 2017, which has been furnished as Exhibit 99.1 to our Form 8-K

filed on August 1, 2017. The Company makes statements in this Supplemental financial package that are forward-looking

statements within the meaning of the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the

Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”)). In particular, statements pertaining to our capital resources, portfolio performance,

development pipeline and results of operations contain forward-looking statements. Likewise, all of our statements regarding

anticipated growth in our funds from operations, normalized funds from operations, adjusted funds from operations, and net

operating income are forward-looking statements. You can identify forward-looking statements by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “intends,” “plans,” “estimates” or “anticipates” or

the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or

trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of

strategy, plans or intentions.

Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future

events. Forward-looking statements depend on assumptions, estimates, data or methods, which may be incorrect or

imprecise, and actual results may vary materially from those anticipated, estimated or projected. The Company does not

guarantee that the transactions and events described will happen as described (or that they will happen at all). For further

discussion of risk factors and other events that could impact our future results, please refer to the section entitled “Risk

Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”), and

the documents subsequently filed by us from time to time with the SEC.

The Company does not provide a reconciliation for its guidance range of Normalized FFO per diluted share to net income per

diluted share, the most directly comparable forward-looking GAAP financial measure, because it is unable to provide a

meaningful or accurate estimate of reconciling items and the information is not available without unreasonable effort as a

result of the inherent difficulty of forecasting the timing and/or amounts of various items that would impact net income per

diluted share. For the same reasons, the Company is unable to address the probable significance of the unavailable

information and believes that providing a reconciliation for its guidance range of Normalized FFO per diluted share would imply

a degree of precision for its forward-looking net income per diluted share that could be misleading to investors.

4

Analyst Coverage

Corporate Profile

Armada Hoffler Properties, Inc. (NYSE:AHH) is a full service real estate company that develops, constructs, acquires and manages

institutional-grade office, retail and multifamily properties in the Mid-Atlantic and Southeastern United States. The Company also

provides general contracting and development services to third-party clients, in addition to developing and building properties to be

placed in its stabilized portfolio. Armada Hoffler Properties, Inc. was founded in 1979 and is headquartered in Virginia Beach, VA.

The Company has elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes.

Board of Directors Corporate Officers

Investor Relations

Daniel A. Hoffler

A. Russell Kirk

Louis S. Haddad

John W. Snow

George F. Allen

James A. Carroll

James C. Cherry

Eva S. Hardy

Executive Chairman of Board

Vice Chairman of the Board

Director

Lead Independent Director

Independent Director

Independent Director

Independent Director

Independent Director

Louis S. Haddad

Michael P. O’Hara

Eric L. Smith

Eric E. Apperson

Shelly R. Hampton

President and Chief Executive Officer

Chief Financial Officer and Treasurer

Chief Investment Officer and

Corporate Secretary

President of Construction

President of Asset Management

Michael P. O’Hara

(757) 366-6684

Chief Financial Officer and Treasurer

mohara@armadahoffler.com

D. A. Davidson & Co.

James O. Lykins

(503) 603-3041

jlykins@dadco.com

Raymond James & Associates

Bill Crow

(727) 567-2594

bill.crow@raymondjames.com

Robert W. Baird & Co.

David Rodgers

(216) 737-7341

drodgers@rwbaird.com

Stonegate Capital Partners

Laura Engel

(214) 987-4121

laura@stonegateinc.com

Janney, Montgomery,

& Scott LLC

Robert Stevenson

(646) 840-3217

robertstevenson@janney.com

FBR Capital Markets

Craig Kucera

(703) 862-5249

craigkucera@fbr.com

Stifel, Nicolaus

& Company, Inc.

John Guinee

(443) 224-1307

jwguinee@stifel.com

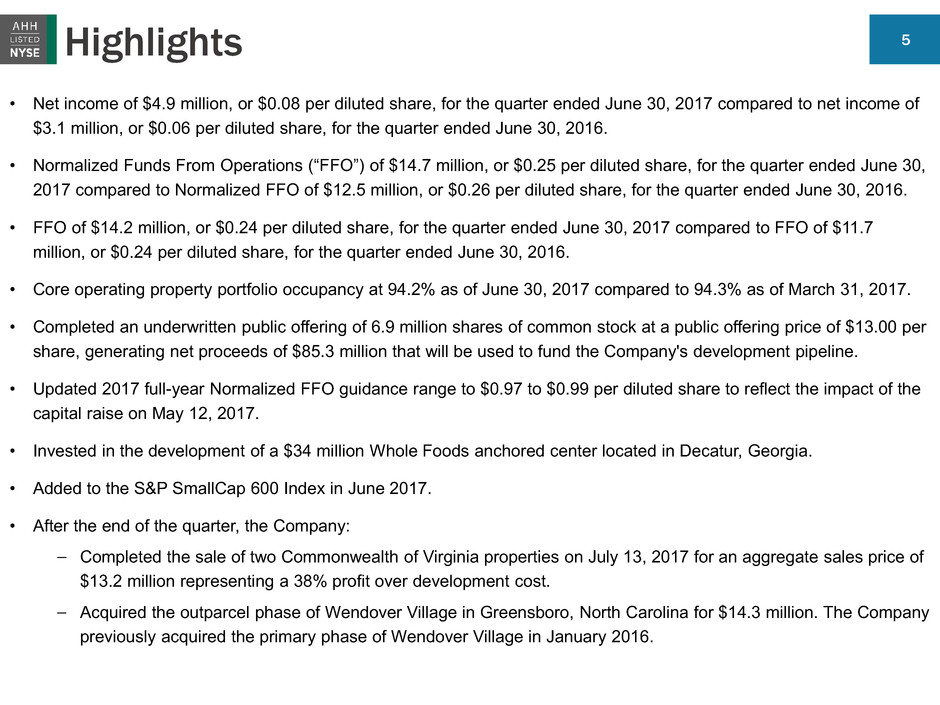

5Highlights

• Net income of $4.9 million, or $0.08 per diluted share, for the quarter ended June 30, 2017 compared to net income of

$3.1 million, or $0.06 per diluted share, for the quarter ended June 30, 2016.

• Normalized Funds From Operations (“FFO”) of $14.7 million, or $0.25 per diluted share, for the quarter ended June 30,

2017 compared to Normalized FFO of $12.5 million, or $0.26 per diluted share, for the quarter ended June 30, 2016.

• FFO of $14.2 million, or $0.24 per diluted share, for the quarter ended June 30, 2017 compared to FFO of $11.7

million, or $0.24 per diluted share, for the quarter ended June 30, 2016.

• Core operating property portfolio occupancy at 94.2% as of June 30, 2017 compared to 94.3% as of March 31, 2017.

• Completed an underwritten public offering of 6.9 million shares of common stock at a public offering price of $13.00 per

share, generating net proceeds of $85.3 million that will be used to fund the Company's development pipeline.

• Updated 2017 full-year Normalized FFO guidance range to $0.97 to $0.99 per diluted share to reflect the impact of the

capital raise on May 12, 2017.

• Invested in the development of a $34 million Whole Foods anchored center located in Decatur, Georgia.

• Added to the S&P SmallCap 600 Index in June 2017.

• After the end of the quarter, the Company:

— Completed the sale of two Commonwealth of Virginia properties on July 13, 2017 for an aggregate sales price of

$13.2 million representing a 38% profit over development cost.

— Acquired the outparcel phase of Wendover Village in Greensboro, North Carolina for $14.3 million. The Company

previously acquired the primary phase of Wendover Village in January 2016.

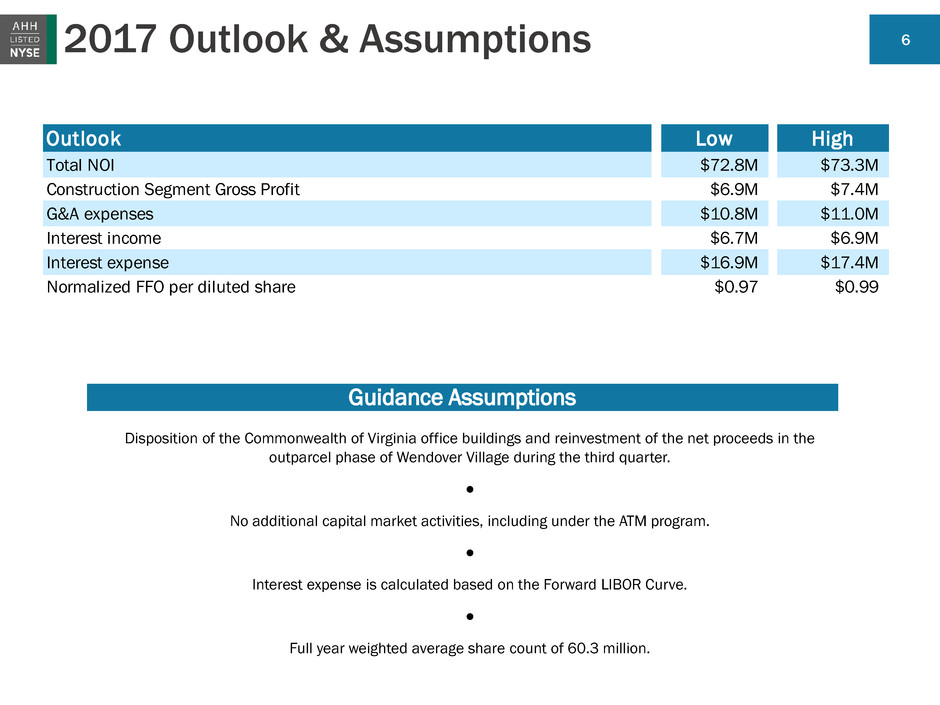

62017 Outlook & Assumptions

Guidance Assumptions

Disposition of the Commonwealth of Virginia office buildings and reinvestment of the net proceeds in the

outparcel phase of Wendover Village during the third quarter.

●

No additional capital market activities, including under the ATM program.

●

Interest expense is calculated based on the Forward LIBOR Curve.

●

Full year weighted average share count of 60.3 million.

Outlook Low High

Total NOI $72.8M $73.3M

Construction Segment Gross Profit $6.9M $7.4M

G&A expenses $10.8M $11.0M

Interest income $6.7M $6.9M

Interest expense $16.9M $17.4M

Normalized FFO per diluted share $0.97 $0.99

7Summary Information

$ in thousands, except per share data

(1) Excludes gains on dispositions of real estate and mark-to-market adjustments on interest rate derivatives

(2) Includes common shares and OP units

(3) Excludes unamortized GAAP adjustments

(4) Office and retail occupancy based on leased square feet as a % of respective total

(5) Multifamily occupancy based on occupied units as a % of respective total

(6) Total occupancy weighted by annualized base rent

Three months ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

OPERATIONAL METRICS

Net income $4,943 $8,753 $5,145 $7,946 $3,131

Net income per diluted share $0.08 $0.16 $0.09 $0.15 $0.06

Rental properties Net Operating Income (NOI) 17,989 18,655 18,304 17,115 16,798

General contracting and real estate services gross profit 2,656 2,323 1,436 1,278 1,175

Adjusted EBITDA (1) 19,272 19,376 18,097 16,720 16,077

Funds From Operations (FFO) 14,247 14,833 14,744 13,078 11,720

FFO per diluted share $0.24 $0.27 $0.27 $0.25 $0.24

Normalized FFO 14,724 14,590 13,669 13,156 12,530

Normalized FFO per diluted share $0.25 $0.26 $0.25 $0.26 $0.26

Annualized dividend yield 5.87% 5.47% 4.94% 5.37% 5.24%

CAPITALIZATION

Total common shares outstanding 44,932 37,813 37,491 34,256 32,825

Operating Partnership ("OP") units outstanding 17,846 17,859 17,793 17,793 17,597

Common shares and OP units outstanding 62,778 55,672 55,284 52,049 50,422

Market price per common share $12.95 $13.89 $14.57 $13.40 $13.74

Equity market capitalization(2) $812,975 $773,284 $805,488 $697,457 $692,798

Total debt(3) 470,314 527,504 527,082 519,209 512,702

Total market capitalization 1,283,289 1,300,788 1,332,570 1,216,666 1,205,500

Less: cash (21,726) (13,688) (25,193) (27,361) (23,142)

Total enterprise value $1,261,563 1,287,100 $1,307,377 $1,189,305 $1,182,358

BALANCE SHEET METRICS

Core Debt/enterprise value 30.9% 32.9% 31.7% 34.3% 35.4%

Fixed charge coverage ratio 3.5x 3.6x 3.3x 3.4x 3.3x

Core Debt/Annualized Core EBITDA 5.3x 6.0x 6.3x 6.4x 6.7x

CORE PORTFOLIO OCCUPANCY

Office (4) 89.9% 87.7% 86.8% 96.4% 94.6%

Retail (4) 96.8% 96.7% 95.8% 96.4% 96.0%

Multifamily(5) 91.6% 92.7% 94.3% 95.8% 94.3%

Weighted Average (6) 94.2% 94.3% 93.8% 96.2% 95.3%

8Summary Balance Sheet

$ in thousands

6/30/2017 12/31/2016

Assets (Unaudited)

Real estate investments:

Income producing property $900,782 $894,078

Held for development 680 680

Construction in progress 39,361 13,529

Accumulated depreciation (152,438) (139,553)

Net real estate investments 788,385 768,734

Cash and cash equivalents 18,587 21,942

Restricted cash 3,139 3,251

Accounts receivable, net 15,027 15,052

Notes receivable 73,382 59,546

Construction receivables, including retentions 45,820 39,433

Costs and estimated earnings in excess of bil l ings 53 110

Equity method investments 10,950 10,235

Other assets 58,995 64,165

Total Assets $1,014,338 $982,468

Liabilities and Equity

Indebtedness, net $465,291 $522,180

Accounts payable and accrued liabilities 9,311 10,804

Construction payables, including retentions 58,546 51,130

Bil l ings in excess of costs and estimated earnings 6,780 10,167

Other l iabilities 39,889 39,209

Total Liabilities 579,817 633,490

Redeemable noncontrolling interest 2,000 -

Total Equity 432,521 348,978

Total Liabilities and Equity $1,014,338 $982,468

As of

9Summary Income Statement

Amounts in thousands, except per share data

Three months ended Six Months Ended

6/30/2017 6/30/2016 6/30/2017 6/30/2016

Revenues (Unaudited)

Rental revenues $26,755 $24,251 $53,987 $47,534

General contracting and real estate services 56,671 33,200 120,190 70,003

Total Revenues 83,426 57,451 174,177 117,537

Expenses

Rental expenses 6,171 5,071 12,239 10,400

Real estate taxes 2,595 2,382 5,104 4,731

General contracting and real estate services 54,015 32,025 115,211 67,062

Depreciation and amortization 9,304 8,602 18,779 16,751

General and administrative 2,678 2,224 5,664 4,708

Acquisition, development & other pursuit costs 369 437 416 1,141

Impairment charges 27 - 31 35

Total Expenses 75,159 50,741 157,444 104,828

Operating Income 8,267 6,710 16,733 12,709

Interest income 1,658 722 3,056 904

Interest expense (4,494) (3,978) (9,029) (7,769)

Gain on real estate dispositions - 13 3,395 26,687

Change in fair value of interest rate derivatives (81) (373) 213 (2,762)

Other income 43 43 80 119

Income before taxes 5,393 3,137 14,448 29,888

Income tax provision (450) (6) (752) (224)

Net Income $4,943 $3,131 $13,696 $29,664

Per Diluted Share $0.08 $0.06 $0.24 $0.62

Weighted Average Shares-Diluted 59,936 48,849 57,718 47,534

10

(1) See definitions on pages 28-29

(2) Excludes development, redevelopment, and first generation space

FFO, Normalized FFO & Adjusted FFO(1)

$ in thousands, except per share data

Three months ended (Unaudited)

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Funds From Operations

Net income $4,943 $8,753 $5,145 $7,946 $3,131

Earnings per diluted share $0.08 $0.16 $0.09 $0.15 $0.06

Depreciation and amortization 9,304 9,475 9,692 8,885 8,602

Gains on dispositions of operating real estate - (3,395) (93) (3,753) (13)

FFO $14,247 $14,833 14,744 $13,078 $11,720

FFO per diluted share $0.24 $0.27 $0.27 $0.25 $0.24

Normalized FFO

Acquisition, development & other pursuit costs 369 47 77 345 437

Loss on extinguishment of debt - - - 82 -

Impairment charges 27 4 171 149 -

Change in fair value of interest rate derivatives 81 (294) (1,323) (498) 373

Normalized FFO $14,724 $14,590 $13,669 $13,156 $12,530

Normalized FFO per diluted share $0.25 $0.26 $0.25 $0.26 $0.26

Adjusted FFO

Non-cash stock compensation 421 411 218 212 215

Acquisition, development & other pursuit costs (369) (47) (77) (345) (437)

Tenant improvements, leasing commissions (2) (895) (943) (507) (233) (1,365)

Property related capital expenditures (840) (442) (434) (514) (603)

Non-cash interest expense 283 277 293 219 277

Net effect of straight-line rents (122) (245) (246) (158) (194)

Amor ization of leasing incentives & above (below) market rents (43) (47) (24) 116 (183)

AFFO $13,159 $13,554 $12,892 $12,453 $10,240

Weighted Average Common Shares Outstanding 42,091 37,622 36,465 33,792 31,736

Weighted Average Operating Partnership ("OP") Units Outstanding 17,845 17,853 17,793 17,720 17,113

Total Weighted Average Common Shares and OP Units Outstanding 59,936 55,475 54,258 51,512 48,849

11

Debt Maturities & Principal Payments

Debt Stated Rate

Effective Rate as of

6/30/2017 Maturity Date 2017 2018 2019 2020 2021 Thereafter

Amount Outstanding

as of 6/30/2017

Secured Notes Payable - Core Debt

Commonwealth of Virginia - Chesapeake L+1.90% 3.12% 8/28/2017 $4,933 $4,933

Hanbury Village 6.67% 6.67% 10/11/2017 20,567 20,567

Sandbridge Commons L+1.85% 3.07% 1/17/2018 123 9,129 9,252

Columbus Village Note 1 L+2.00% 3.05% (1) 4/5/2018 89 6,080 6,169

Columbus Village Note 2 L+2.00% 3.22% 4/5/2018 26 2,218 2,244

North Point Center Note 1 6.45% 6.45% 2/5/2019 104 219 9,352 9,675

Southgate Square L+2.00% 3.22% 4/29/2021 276 539 561 584 19,075 21,035

249 Central Park Retail L+1.95% 3.17% 8/8/2021 119 229 243 258 16,117 16,966

South Retail L+1.95% 3.17% 8/8/2021 51 101 107 113 7,072 7,444

Fountain Plaza Retail L+1.95% 3.17% 8/8/2021 70 138 147 156 9,703 10,214

Encore Apartments 3.25% 3.25% 9/10/2021 124 504 24,338 24,966

4525 Main Street 3.25% 3.25% 9/10/2021 158 646 31,230 32,034

Socastee Commons 4.57% 4.57% 1/6/2023 47 100 105 109 115 4,343 4,819

North Point Center Note 2 7.25% 7.25% 9/15/2025 55 113 121 130 140 1,954 2,513

Smith's Landing 4.05% 4.05% 6/1/2035 383 791 824 858 890 16,394 20,140

Liberty Apartments 5.66% 5.66% 11/1/2043 166 344 364 385 415 18,171 19,845

The Cosmopolitan 3.75% 3.75% 7/1/2051 332 686 712 739 767 42,320 45,556

Total - Secured Core Debt $27,341 $20,687 $12,818 $4,482 $109,862 $83,182 $258,372

Secured Notes Payable - Development Pipeline

Lightfoot Marketplace L+1.90% 3.12% 11/14/2017 12,894 12,894

Johns Hopkins Village L+1.90% 3.12% 7/30/2018 46,048 46,048

Total - Development Pipeline 12,894 46,048 - - - - 58,942

Total Secured Notes Payable $40,235 $66,735 $12,818 $4,482 $109,862 $83,182 $317,314

Unsecured Core Debt

Senior unsecured line of credit L+1.40% - 2.00% 2.77% 2/20/2019 28,000 28,000

Senior unsecured term loan L+1.35% - 1.95% 2.72% 2/20/2020 75,000 75,000

Senior unsecured term loan L+1.35% - 1.95% 3.50% (1) 2/20/2020 50,000 50,000

Total - Unsecured Core Debt - - 28,000 125,000 - - 153,000

Total Notes Payable excluding GAAP Adjustments $40,235 $66,735 $40,818 $129,482 $109,862 $83,182 $470,314

Weighted Average Interest Rate 5.0% 3.2% 3.7% 3.1% 3.2% 4.4% 3.6%

Balloon Payments 38,326 62,956 37,333 125,000 106,274 5,567 375,456

Principal amortization 1,909 3,779 3,485 4,482 3,588 77,615 94,858

Total Consolidated Debt $40,235 $66,735 $40,818 $129,482 $109,862 $83,182 $470,314

Fixed-rate Debt(2) 21,743 8,333 11,760 53,371 57,895 83,182 236,284

Variable-rate Debt(3) 18,492 58,402 29,058 76,111 51,967 - 234,030

Total Consolidated Debt $40,235 $66,735 $40,818 $129,482 $109,862 83,182 $470,314

GAAP Adjustments (5,023)

Total Notes Payable $465,291

Outstanding Debt

$ in thousands

(1) Subject to an interest rate swap lock

(2) Includes debt subject to interest rate swap locks

(3) Excludes debt subject to interest rate swap locks

30 Day LIBOR as

of 6/30/2017

1.224%

12Core Debt to Core EBITDA(1)

$ in thousands

(1) See definitions on page 30

(2) Excludes GAAP Adjustments

Three months ended

6/30/2017 3/31/2017 12/31/2016 9/30/2016 6/30/2016

Net Income $4,943 8,753 5,145 7,946 3,131

Excluding:

Interest expense 4,494 4,535 4,573 4,124 3,978

Income tax 450 302 103 16 6

Depreciation and amortization 9,304 9,475 9,692 8,885 8,602

Gain on real estate dispositions - (3,395) (93) (3,753) (13)

Change in fair value of interest rate derivatives 81 (294) (1,323) (498) 373

Adjusted EBITDA $19,272 $19,376 $18,097 $16,720 $16,077

Other adjustments:

Loss on extinguishment of debt - - - 82 -

Non-cash stock compensation 418 411 218 212 215

Development Pipeline (1,244) (2,154) (1,917) (1,058) (719)

Total Other Adjustments (826) (1,743) (1,699) (764) (504)

Core EBITDA $18,446 $17,633 $16,398 $15,956 $15,573

Total Debt(2) $470,314 $527,504 $527,082 $519,209 $512,702

Adjustments to Debt:

(Less) Development Pipeline(2) (58,942) (90,021) (88,069) (84,321) (71,035)

(Less) Cash & restricted cash (21,726) (13,688) (25,193) (27,361) (23,142)

Core Debt $389,646 $423,795 $413,820 $407,527 $418,525

Core Debt/Annualized Core EBITDA 5.3x 6.0x 6.3x 6.4x 6.7x

13Debt Information

$ in thousands

(1) Excludes debt subject to interest rate swap locks

(2) Includes debt subject to interest rate swap locks

(3) Excludes GAAP adjustments

Fixed-rate&

Hedged Debt

100%

Debt Maturities & Principal Payments

$0

$20,000

$40,000

$60,000

$80,000

$100,000

$120,000

$140,000

2017 2018 2019 2020 2021 2022 and

thereafter

($

In

Th

ou

sa

nd

s)

Total Debt Composition

Weighted Average

Percent of Debt Interest Rate Maturity

Secured vs. Unsecured Debt

Unsecured Debt 32.5% 3.0% 2.5 Yrs

Secured Debt 67.5% 3.8% 9.6 Yrs

Variable vs. Fixed-rate Debt

Variable-rate Debt(1) 49.8% 3.0% 2.3 Yrs

Fixed-rate Debt(2)(3) 50.2% 4.2% 12.2 Yrs

Fixed-rate and Hedged Debt(2)(3) 100.0%

Total 3.6% 7.2 Yrs

Interest Rate Cap Agreements

Effective Date Maturity Date Strike Rate Notional Amount

October 26, 2015 October 15, 2017 1.25% $75,000

February 25, 2016 March 1, 2018 1.50% 75,000

June 17, 2016 June 17, 2018 1.00% 70,000

February 7, 2017 March 1, 2019 1.50% 50,000

June 23, 2017 July 1, 2019 1.50% 50,000

Total Interest Rate Caps 320,000

Fixed-rate Debt (2)(3) 236,284

Fixed-rate and Hedged Debt $556,284

% of Total (3) 100.0%

14Capitalization & Financial Ratios

$ in thousands

Capitalization as of June 30, 2017 Capital Structure as of June 30, 2017

Debt % of Total Carrying Value

Unsecured Credit Facility 6% $28,000

Unsecured Term Loans 27% 125,000

Mortgages Payable 67% 317,314

Total Debt $470,314

Equity % of Total Shares/Units Stock Price Market Value

Common Stock (NYSE: AHH) 72% 44,932 $12.95 $581,869

Common Units 28% 17,846 $12.95 231,106

Equity Market Capitalization 62,778 $812,975

Total Market Capitalization $1,283,289

Debt/Market Capitalization 36.6%

Dividend Data Liquidity as of June 30, 2017

Trailing 12

Months

Common Dividends and Distributions 38,067 Cash on Hand $21,726

AFFO 52,058 Availability under Credit Facility 117,900

AFFO Payout Ratio 73.1% $139,626

Debt

37%

Equity

63%

15Property Portfolio

As of 6/30/17

Net Rentable Square Feet (RSF)(1)

Property Anchor Tenant Location

Town

Center

Unencumbered

ABR Year Built

Core

Properties

Development

Properties Total

Core

Occupancy (2)

Development

Leased(2) ABR (3)

ABR per

Leased SF(3)

Retail Properties

249 Central Park Retail (4)

Cheesecake Factory, Brooks Brothers,

Gordon Biersch

Virginia Beach, VA ✓ - 2004 92,710 - 92,710 93.7% - $2,468,512 $28.42

Alexander Pointe Harris Teeter Salisbury, NC 100% 1997 57,710 - 57,710 97.6% - 649,530 11.53

Bermuda Crossroads (6) Food Lion, OfficeMax Chester, VA 100% 2001 122,566 - 122,566 93.7% - 1,691,826 14.73

Broad Creek Shopping Center(6)(10) Home Depot, Food Lion, PetSmart Norfolk, VA 100% 1997/2001 251,504 - 251,504 100.0% - 3,836,640 15.25

Broadmoor Plaza Kroger, Staples, Jo-Ann Fabrics South Bend, IN 100% 1980 115,059 - 115,059 92.2% - 1,251,946 11.81

Brooks Crossing Various Small Shops Newport News, VA 100% 2016 - 18,343 18,343 - 59.8% 151,380 13.80

Columbus Village Barnes & Noble Virginia Beach, VA ✓ - 1980/2013 66,594 - 66,594 88.5% - 1,145,259 19.42

Columbus Village II Regal Cinemas, BB&B Virginia Beach, VA ✓ 100% 1995/1996 92,061 - 92,061 100.0% - 1,580,113 17.16

Commerce Street Retail (5) Yard House Virginia Beach, VA ✓ 100% 2008 19,173 - 19,173 100.0% - 855,348 44.61

Courthouse 7-Eleven 7-Eleven Virginia Beach, VA 100% 2011 3,177 - 3,177 100.0% - 139,311 43.85

Dick's at Town Center Dick's Sporting Goods, USI Virginia Beach, VA ✓ 100% 2002 103,335 - 103,335 100.0% - 1,241,201 12.01

Dimmock Square Best Buy, Old Navy Colonial Heights, VA 100% 1998 106,166 - 106,166 97.2% - 1,742,666 16.89

Fountain Plaza Retail Ruth's Chris, Ann Taylor Virginia Beach, VA ✓ - 2004 35,961 - 35,961 100.0% - 1,025,369 28.51

Gainsborough Square Food Lion, Rite Aid Chesapeake, VA 100% 1999 88,862 - 88,862 92.5% - 1,241,449 15.11

Greentree Shopping Center Various Small Shops Chesapeake, VA 100% 2014 15,719 - 15,719 85.9% - 288,720 21.38

Hanbury Village(6) Harris Teeter, Walgreens, Starbucks Chesapeake, VA 32% 2006/2009 116,635 - 116,635 97.6% - 2,448,107 21.52

Harper Hill Commons (6) Harris Teeter Winston-Salem, NC 100% 2004 96,914 - 96,914 80.5% - 895,067 11.47

Harrisonburg Regal Regal Cinemas Harrisonburg, VA - 1999 49,000 - 49,000 100.0% - 683,550 13.95

Lightfoot Marketplace(6) Harris Teeter, CHKD Williamsburg, VA - 2016 - 107,643 107,643 - 72.6% 1,113,240 14.24

North Hampton Market PetSmart, Hobby Lobby Taylors, SC 100% 2004 114,935 - 114,935 99.0% - 1,435,243 12.62

North Point Center(6) Kroger, PetSmart, Home Depot, Costco Durham, NC 67% 1998/2009 496,246 - 496,246 100.0% - 3,688,215 7.43

Oakland Marketplace(6) Kroger Oakland, TN 100% 2004 64,600 - 64,600 97.8% - 453,378 7.17

Parkway Marketplace Rite Aid Virginia Beach, VA 100% 1998 37,804 - 37,804 100.0% - 753,814 19.94

Patterson Place BB&B, PetSmart, DSW, AC Moore Durham, NC 100% 2004 160,942 - 160,942 96.1% - 2,441,875 15.78

Perry Hall Marketplace Safeway Perry Hall, MD 100% 2001 74,256 - 74,256 100.0% - 1,247,059 16.79

Providence Plaza Cranfil l , Sumner & Hartzog, Chipotle Charlotte, NC 100% 2007/2008 103,118 - 103,118 97.5% - 2,623,698 26.11

Renaissance Square Harris Teeter Davidson, NC 100% 2008 80,467 - 80,467 92.2% - 1,288,047 17.36

Sandbridge Commons (6) Harris Teeter Virginia Beach, VA - 2015 69,417 - 69,417 100.0% - 911,425 13.13

Socastee Commons Bi-Lo Myrtle Beach, SC - 2000/2014 57,273 - 57,273 100.0% - 655,260 11.44

South Retail lululemon, free people, CPK Virginia Beach, VA ✓ - 2002 38,515 - 38,515 84.9% - 886,084 27.08

South Square(6) Ross, Petco, Office Depot Durham, NC 100% 1977/2005 109,590 - 109,590 100.0% - 1,897,056 17.31

Southgate Square Burlington, PetSmart, Michaels Colonial Heights, VA - 1991/2016 220,131 - 220,131 96.3% - 2,890,231 13.64

Southshore Shops Buffalo Wild Wings Midlothian, VA 100% 2006 40,333 - 40,333 97.5% - 781,321 19.86

Stone House Square(6) Weis Markets Hagerstown, MD 100% 2008 112,274 - 112,274 90.7% - 1,740,313 17.09

Studio 56 Retail McCormick & Schmick's Virginia Beach, VA ✓ 100% 2007 11,594 - 11,594 100.0% - 397,917 34.32

Tyre Neck Harris Teeter(6)(10) Harris Teeter Portsmouth, VA 100% 2011 48,859 - 48,859 100.0% - 533,052 10.91

Waynesboro Commons Kroger Waynesboro, VA 100% 1993 52,415 - 52,415 96.2% - 404,996 8.03

Wendover Village BB&B, T.J. Maxx, Petco Greensboro, NC 100% 2004 135,758 - 135,758 100.0% - 1,967,761 14.49

Total / Weighted Avg Retail Portfolio(11) 72% 3,461,673 125,986 3,587,659 96.8% 70.7% $51,445,979 $14.95

16

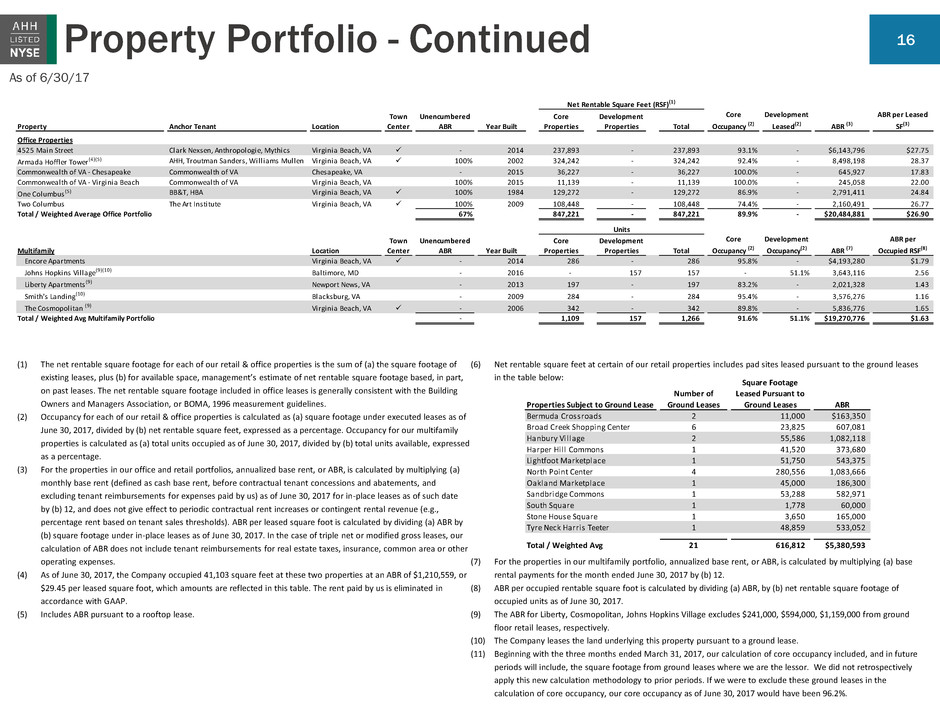

(1) The net rentable square footage for each of our retail & office properties is the sum of (a) the square footage of

existing leases, plus (b) for available space, management’s estimate of net rentable square footage based, in part,

on past leases. The net rentable square footage included in office leases is generally consistent with the Building

Owners and Managers Association, or BOMA, 1996 measurement guidelines.

(2) Occupancy for each of our retail & office properties is calculated as (a) square footage under executed leases as of

June 30, 2017, divided by (b) net rentable square feet, expressed as a percentage. Occupancy for our multifamily

properties is calculated as (a) total units occupied as of June 30, 2017, divided by (b) total units available, expressed

as a percentage.

(3) For the properties in our office and retail portfolios, annualized base rent, or ABR, is calculated by multiplying (a)

monthly base rent (defined as cash base rent, before contractual tenant concessions and abatements, and

excluding tenant reimbursements for expenses paid by us) as of June 30, 2017 for in-place leases as of such date

by (b) 12, and does not give effect to periodic contractual rent increases or contingent rental revenue (e.g.,

percentage rent based on tenant sales thresholds). ABR per leased square foot is calculated by dividing (a) ABR by

(b) square footage under in-place leases as of June 30, 2017. In the case of triple net or modified gross leases, our

calculation of ABR does not include tenant reimbursements for real estate taxes, insurance, common area or other

operating expenses.

(4) As of June 30, 2017, the Company occupied 41,103 square feet at these two properties at an ABR of $1,210,559, or

$29.45 per leased square foot, which amounts are reflected in this table. The rent paid by us is eliminated in

accordance with GAAP.

(5) Includes ABR pursuant to a rooftop lease.

(6) Net rentable square feet at certain of our retail properties includes pad sites leased pursuant to the ground leases

in the table below:

(7) For the properties in our multifamily portfolio, annualized base rent, or ABR, is calculated by multiplying (a) base

rental payments for the month ended June 30, 2017 by (b) 12.

(8) ABR per occupied rentable square foot is calculated by dividing (a) ABR, by (b) net rentable square footage of

occupied units as of June 30, 2017.

(9) The ABR for Liberty, Cosmopolitan, Johns Hopkins Village excludes $241,000, $594,000, $1,159,000 from ground

floor retail leases, respectively.

(10) The Company leases the land underlying this property pursuant to a ground lease.

(11) Beginning with the three months ended March 31, 2017, our calculation of core occupancy included, and in future

periods will include, the square footage from ground leases where we are the lessor. We did not retrospectively

apply this new calculation methodology to prior periods. If we were to exclude these ground leases in the

calculation of core occupancy, our core occupancy as of June 30, 2017 would have been 96.2%.

Property Portfolio - Continued

As of 6/30/17

Net Rentable Square Feet (RSF)(1)

Property Anchor Tenant Location

Town

Center

Unencumbered

ABR Year Built

Core

Properties

Development

Properties Total

Core

Occupancy (2)

Development

Leased(2) ABR (3)

ABR per Leased

SF(3)

Office Properties

4525 Main Street Clark Nexsen, Anthropologie, Mythics Virginia Beach, VA ✓ - 2014 237,893 - 237,893 93.1% - $6,143,796 $27.75

Armada Hoffler Tower(4)(5) AHH, Troutman Sanders, Will iams Mullen Virginia Beach, VA ✓ 100% 2002 324,242 - 324,242 92.4% - 8,498,198 28.37

Commonwealth of VA - Chesapeake Commonwealth of VA Chesapeake, VA - 2015 36,227 - 36,227 100.0% - 645,927 17.83

Commonwealth of VA - Virginia Beach Commonwealth of VA Virginia Beach, VA 100% 2015 11,139 - 11,139 100.0% - 245,058 22.00

One Columbus (5) BB&T, HBA Virginia Beach, VA ✓ 100% 1984 129,272 - 129,272 86.9% - 2,791,411 24.84

Two Columbus The Art Institute Virginia Beach, VA ✓ 100% 2009 108,448 - 108,448 74.4% - 2,160,491 26.77

Total / Weighted Average Office Portfolio 67% 847,221 - 847,221 89.9% - $20,484,881 $26.90

Units

Multifamily Location

Town

Center

Unencumbered

ABR Year Built

Core

Properties

Development

Properties Total

Core

Occupancy (2)

Development

Occupancy(2) ABR (7)

ABR per

Occupied RSF(8)

Enc re Apartments Virginia Beach, VA ✓ - 2014 286 - 286 95.8% - $4,193,280 $1.79

Johns Hopkins Village(9)(10) Baltimore, MD - 2016 - 157 157 - 51.1% 3,643,116 2.56

Liberty Apartments (9) Newport News, VA - 2013 197 - 197 83.2% - 2,021,328 1.43

Smith's Landing(10) Blacksburg, VA - 2009 284 - 284 95.4% - 3,576,276 1.16

The Cosmopolitan (9) Virginia Beach, VA ✓ - 2006 342 - 342 89.8% - 5,836,776 1.65

Total / Weighted Avg Multifamily Portfolio - 1,109 157 1,266 91.6% 51.1% $19,270,776 $1.63

Properties Subject to Ground Lease

Number of

Ground Leases

Square Footage

Leased Pursuant to

Ground Leases ABR

Bermuda Crossroads 2 11,000 $163,350

Broad Creek Shopping Center 6 23,825 607,081

Hanbury Village 2 55,586 1,082,118

Harper Hill Commons 1 41,520 373,680

Lightfoot Marketplace 1 51,750 543,375

North Point Center 4 280,556 1,083,666

Oakland M rke pl ce 1 45,000 186,300

Sandbridge Commons 1 53,288 582,971

South Square 1 1,778 60,000

Stone House Square 1 3,650 165,000

Tyre Neck Harris Teeter 1 48,859 533,052

Total / Weighted Avg 21 616,812 $5,380,593

17Development Pipeline

$ in thousands

Johns Hopkins Village Lightfoot Marketplace One City Center Point Street Apts.

(1) Represents estimates that may change as the development

process proceeds

(2) First full stabilized quarter

(3) AHH earns a preferred return on equity prior to any distributions

to JV Partners

(4) Signed letter of intent

Q2 2017 Year to Date

Capitalized Interest $246 $412

Capitalized Overhead $681 $1,142

Schedule(1)

Development, Not Delivered

Property

Type Estimated(1) % Leased

Construction

Start

Initial

Occupancy

Stabilized

Operation (2)

Estimated

Cost(1)

Cost to

Date

AHH

Ownership % Anchor Tenants & Other Notes

Meeting Street

Charleston, SC

Multifamily 114 units NA 3Q17 3Q19 3Q19 $53,000 $1,000 90% NA

King Street

Charleston, SC

Multifamily 74 units NA 3Q17 3Q19 3Q19 48,000 9,000 93% NA

Harding Place

Charlotte, NC

Multifamily 225 Units NA 3Q16 3Q18 1Q20 47,000 16,000 80%(3) NA

Town Center Phase VI

Virginia Beach, VA

Mixed-use 39,000 SF

130 Units

46% 4Q16 3Q18 3Q19 43,000 10,000 100% Anchor tenants not yet announced

Brooks Crossing

Newport News, VA

Office 100,000 sf 100% 1Q18 1Q19 1Q19 20,000 1,000 65%(3) Huntington Ingalls Industries (4)

Total Development, Not Delivered 211,000 37,000

Development, Delivered Not Stabilized

Brooks Crossing

Newport News, VA

Retail 18,000 sf 60% 3Q15 3Q16 2Q18 3,000 3,000 65%(3) Misc. small shops

Johns Hopkins Village

Baltimore, MD

Multifamily 157 units 51% 1Q15 3Q16 3Q17 69,000 68,000 80%(3) CVS

Lightfoot Marketplace

Will iamsburg, VA

Retail 109,000 sf 73% 3Q14 3Q16 2Q18 25,000 23,000 70%(3) Harris Teeter, CHKD

Total Development, Delivered Not Stabilized 97,000 94,000

Total $308,000 $131,000

Joint Ventures - Minority Partner Project Cost

Equity

Investment

One City Center - 37% JV

Durham, NC

Mixed-use 152,000 sf 36% 1Q16 2Q18 2Q19 $36,000 $11,000 100% Duke University

AHH Equity requirement $11.0M

Mezzanine Investments

Purchase

Option Price

Loan

Balance

Point Street Apartments

Baltimore, MD

Multifamily 289 units NA 1Q16 4Q17 1Q19 $92,000 $22,000 Option to purchase

88% upon completion

$23M Mezzanine financing by AHH,

earning 8% interest income

Annapolis Junction

Annapolis Junction, MD

Multifamily 416 units NA 2Q16 3Q17 2Q19 102,000 41,000 Option to purchase

88% upon completion

$43M Mezzanine financing by AHH,

earning 10% interest income

Total Mezzanine Investment $194,000 $63,000

18Acquisitions & Dispositions

$ in thousands

(1) Contractual purchase price

(2) Value of OP Units/Stock at issuance

(3) Anchor tenant vacated 9/30/16, which would represent a 2.5% Cash Cap Rate

ACQUISITIONS

Properties Location Square Feet Purchase Price (1)

Reinvested

1031 Proceeds

$ Value of

OP Units/Stock (2)

Cash Cap

Rate Purchase Date Anchor Tenants

Wendover Village Outparcel Greensboro, NC 35,895 $14,300 $7,900 - 7.7% 3Q17 Panera, Rooms to Go Kids

Renaissance Square Davidson, NC 80,468 $17,085 - - 7.1% 4Q16 Harris Teeter

Columbus Village II Virginia Beach, VA 92,061 $26,200 - $26,200 5.6% 4Q16 Regal, Bed Bath & Beyond

Southshore Shops Midlothian, VA 40,333 $9,160 - $2,475 7.8% 3Q16 Buffalo Wild Wings

Southgate Square Colonial Heights, VA 220,131 $38,585 - $17,485 7.3% 2Q16 PetSmart, Michael's, Burlington

Retail Portfolio (11 properties) Mid-Atlantic 1,082,681 $170,500 $87,000 - 7.2% 1Q16 Harris Teeter, Bed Bath & Beyond

Providence Plaza Charlotte, NC 103,118 $26,200 $14,000 - 7.3% 3Q15 Chipotle

Socastee Commons Myrtle Beach, SC 57,573 $8,600 $3,600 - 7.3% 3Q15 BiLo

Columbus Village Virginia Beach, VA 65,746 $21,025 - $14,025 6.4% 3Q15 Barnes & Noble

Perry Hall Marketplace &

Stone House Square

Maryland 182,949 $39,555 $15,200 $4,155 7.4% 2Q15 Safeway & Weis Markets

Dimmock Square Colonial Heights, VA 106,166 $19,662 - $9,662 7.3% 3Q14 Old Navy, Best Buy, Pier 1

Total/Weighted Average 2,067,121 $390,872 $127,700 74,002 7.1%

DISPOSITIONS

Properties Location

Square

Feet/Units Sale Price Cash Proceeds Gain on Sale

Cash Cap

Rate Disposition Date Anchor Tenants

Commonwealth of VA Buildings Virginia Beach & Chesapeake, VA 47,366 $13,150 $8,000 $4,194 6.8% 3Q17 Commonwealth of VA

Greentree Wawa Chesapeake, VA 5,088 $4,600 $4,400 $3,396 5.0% 1Q17 Wawa

Oyster Point Newport News, VA 100,139 $6,500 - $3,793 16.4% (3) 3Q16 GSA

Non-Core Retail Portfolio Various 174,758 $12,850 $12,600 ($27) 7.1% 2Q16 - 3Q16 Kroger, Family Dollar

Richmond Tower Richmond, VA 206,969 $78,000 $77,000 $26,674 7.9% 1Q16 Williams Mullen

Oceaneering Chesapeake, VA 154,000 $30,000 $10,000 $4,987 6.7% 4Q15 Oceaneering International

Whetstone Apartments Durham, NC 203 units $35,625 $17,600 $7,210 5.7% 2Q15 NA

Sentara Williamsburg Williamsburg, VA 49,200 $15,450 $15,200 $6,197 6.3% 1Q15 Sentara

Virginia Natural Gas Virginia Beach, VA 31,000 $8,900 $7,400 $2,211 6.3% 4Q14 Virginia Natural Gas

Total/Weighted Average 768,520sf/

203 units

$205,075 $152,200 $58,635 7.2%

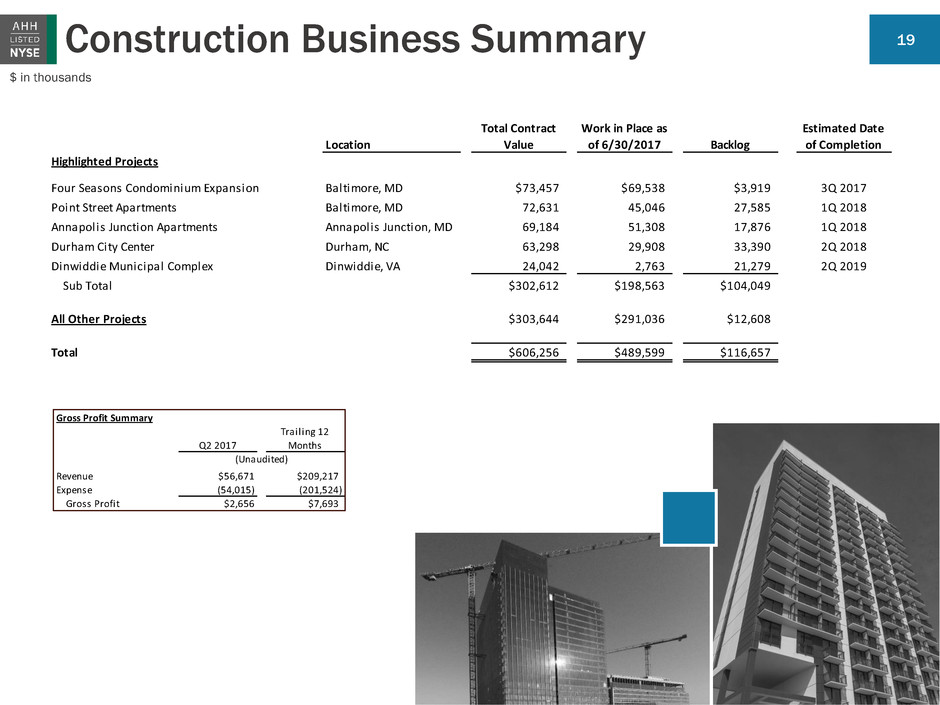

19Construction Business Summary

$ in thousands

Gross Profit Summary

Q2 2017

Trailing 12

Months

Revenue $56,671 $209,217

Expense (54,015) (201,524)

Gross Profit $2,656 $7,693

(Unaudited)

Location

Total Contract

Value

Work in Place as

of 6/30/2017 Backlog

Estimated Date

of Completion

Highlighted Projects

Four Seasons Condominium Expansion Baltimore, MD $73,457 $69,538 $3,919 3Q 2017

Point Street Apartments Baltimore, MD 72,631 45,046 27,585 1Q 2018

Annapolis Junction Apartments Annapolis Junction, MD 69,184 51,308 17,876 1Q 2018

Durham City Center Durham, NC 63,298 29,908 33,390 2Q 2018

Dinwiddie Municipal Complex Dinwiddie, VA 24,042 2,763 21,279 2Q 2019

Sub Total $302,612 $198,563 $104,049

All Other Projects $303,644 $291,036 $12,608

Total $606,256 $489,599 $116,657

20

(1) See page 31 for Same Store vs. Non – Same Store Properties

Same Store NOI by Segment

$ in thousands

(Reconciliation to GAAP located in appendix pg. 32)

Three months ended Six months ended

6/30/2017 6/30/2016 $ Change % Change 6/30/2017 6/30/2016 $ Change % Change

Office(1) (Unaudited) (Unaudited)

Revenue $3,657 $3,867 ($210) -5.4% $7,463 $7,788 ($325) -4.2%

Expenses 1,387 1,269 118 9.3% 2,723 2,659 64 2.4%

Net Operating Income 2,270 2,598 (328) -12.6% 4,740 5,129 (389) -7.6%

Retail(1)

Revenue 13,146 12,961 185 1.4% 18,861 18,534 327 1.8%

Expenses 3,554 3,325 229 6.9% 5,300 5,160 140 2.7%

Net Operating Income 9,592 9,636 (44) -0.5% 13,561 13,374 187 1.4%

Multifamily(1)

Revenue 4,641 4,752 (111) -2.3% 9,437 9,482 (45) -0.5%

Expenses 2,128 2,074 54 2.6% 4,239 4,136 103 2.5%

Net Operating Income 2,513 2,678 (165) -6.2% 5,198 5,346 (148) -2.8%

Same Store Net Operating Income (NOI) $14,375 $14,912 ($537) -3.6% $23,499 $23,849 ($350) -1.5%

Net effect of straight-line rents 140 (62) 202 355 5 350

Amortization of lease incentives and above (below) market rents (23) (4) (19) 230 250 (20)

Same store portfolio NOI, cash basis $14,492 $14,846 ($354) -2.4% $24,084 $24,104 ($20) -0.1%

NOI, Cash Basis:

Office $2,431 $2,568 ($137) -5.3% $5,104 $5,074 $31 0.6%

Retail 9,537 9,593 (56) -0.6% 13,761 13,660 100 0.7%

Multifamily 2,524 2,685 (161) -6.0% 5,218 5,370 (151) -2.8%

$14,492 $14,846 ($354) -2.4% $24,084 $24,104 ($20) -0.1%

NOI:

Office $2,270 $2,598 ($328) -12.6% $4,740 $5,129 ($389) -7.6%

Retail 9,592 9,636 (44) -0.5% 13,561 13,374 187 1.4%

Multifamily 2,513 2,678 (165) -6.2% 5,198 5,346 (148) -2.8%

$14,375 $14,912 ($537) -3.6% $23,499 $23,849 ($350) -1.5%

21Top 10 Tenants by Annualized Base Rent

$ in thousands

As of June 30, 2017

Office Portfolio

Tenant

Number

of Leases

Lease

Expiration

Annualized

Base Rent

% of Office Portfolio

Annualized Base Rent

% of Total Portfolio

Annualized Base Rent

Clark Nexsen 1 2029 $ 2,487 12.1% 2.7%

Mythics 1 2030 1,052 5.1% 1.2%

Hampton University 2 2023 - 2024 1,033 5.0% 1.1%

Commonwealth of Virginia 2 2029 - 2030 891 4.3% 1.0%

Pender & Coward 1 2030 860 4.2% 0.9%

Kimley-Horn 1 2027 859 4.2% 0.9%

Troutman Sanders 2 2025 838 4.1% 0.9%

The Art Institute 3 2019 835 4.1% 0.9%

City of Va Beach Development Authority 1 2024 701 3.4% 0.8%

Cherry Bekaert 1 2022 698 3.4% 0.8%

Top 10 Total $ 10,255 50.1% 11.2%

Retail Portfolio

Tenant

Number

of Leases

Lease

Expiration

Annualized

Base Rent

% of Retail Portfolio

Annualized Base Rent

% of Total Portfolio

Annualized Base Rent

Kroger/Harris Teeter 11 2018 - 2036 $ 5,830 11.3% 6.4%

Home Depot 2 2019 - 2023 2,190 4.3% 2.4%

Bed, Bath, & Beyond 4 2020 - 2024 1,677 3.3% 1.8%

Regal Cinemas 2 2019 - 2022 1,607 3.1% 1.8%

PetSmart 5 2020 - 2022 1,438 2.8% 1.6%

Food Lion 3 2019 - 2022 1,283 2.5% 1.4%

Dick's Sporting Goods 1 2020 840 1.6% 0.9%

Safeway 2 2021 821 1.6% 0.9%

Weis Markets 1 2028 802 1.6% 0.9%

Ross Dress for Less 2 2020 - 2022 762 1.5% 0.8%

Top 10 Total $ 17,249 33.5% 18.9%

22Office Lease Summary

(1) Excludes new leases from properties in development

Renewal Lease Summary GAAP Cash

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Leases

Expiring

Net rentable

SF Expiring

Contractual

Rent per SF

Prior Rent

per SF

Releasing

Spread

Contractual

Rent per SF

Prior Rent

per SF

Releasing

Spread

Weighted

Average Lease

Term (yrs) TI & LC

TI & LC

per SF

Q2 2017 2 13,420 - - $27.94 $27.22 2.7% $27.38 $28.42 -3.7% 7.21 $153,873 $11.47

Q1 2017 2 7,782 2 4,752 31.61 25.72 22.9% 32.30 29.25 10.4% 1.00 23,314 3.00

Q4 2016 1 22,950 1 777 30.66 26.58 15.3% 28.00 29.75 -5.9% 10.00 569,907 24.83

Q3 2016 - - - - - - 0.0% - - 0.0% - - -

New Lease Summary (1)

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Cash

Contractual

Rent per SF

Weighted

Average Lease

Term (yrs) TI & LC

TI & LC

per SF

Q2 2017 2 7,541 $24.39 4.36 259,901 $34.47

Q1 2017 3 13,491 23.92 4.53 390,548 28.95

Q4 2016 - - - - - -

Q3 2016 1 2,153 25.00 3.08 11,810 5.49

23Office Lease Expirations

(1) Includes new leases from properties in development

Year of Lease Expiration

Number of

Leases

Expiring

Square Footage

of Leases

Expiring (1)

% Portfolio

Net Rentable

Square Feet

Annualized

Base Rent

% of Portfolio

Annualized

Base Rent

Annualized Base

Rent per Leased

Square Foot

Available - 85,835 10.1% -$ - -$

2017 2 2,582 0.3% 57,107 0.3% 22.12

2018 16 80,010 9.4% 2,259,556 11.0% 28.24

2019 15 92,870 11.0% 2,341,688 11.4% 25.21

2020 5 20,864 2.5% 608,835 3.0% 29.18

2021 6 41,023 4.8% 1,151,787 5.6% 28.08

2022 9 72,783 8.6% 1,995,859 9.7% 27.42

2023 4 43,078 5.1% 1,083,861 5.3% 25.16

2024 3 60,751 7.2% 1,712,466 8.4% 28.19

2025 5 56,115 6.6% 1,597,628 7.8% 28.47

2026 3 15,140 1.8% 327,423 1.6% 21.63

2027 3 49,081 5.8% 1,395,538 6.8% 28.43

Thereafter 9 227,089 26.8% 5,953,132 29.1% 26.21

Total / Weighted Average 80 847,221 100.0% 20,484,881$ 100.0% $26.90

0.0%

5.0%

10.0%

15.0%

20.0%

25.0%

30.0%

35.0%

-

50,000

100,000

150,000

200,000

250,000

Leased Square Feet % ABR of Office Portfolio

24Retail Lease Summary

(1) Excludes new leases from properties in development

Renewal Lease Summary GAAP Cash

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Leases

Expiring

Net rentable SF

Expiring

Contractual

Rent per SF

Prior Rent

per SF

Releasing

Spread

Contractual

Rent per SF

Prior Rent

per SF

Releasing

Spread

Weighted

Average Lease

Term (yrs) TI & LC

TI & LC

per SF

Q2 2017 14 73,961 7 14,087 $19.46 $18.75 3.8% $19.60 $18.85 3.9% 3.78 $93,362 $1.26

Q1 2017 13 121,282 2 3,174 16.46 15.37 7.1% 16.42 15.51 5.9% 5.95 461,039 3.80

Q4 2016 8 57,227 8 23,035 16.81 17.07 -1.5% 16.25 17.13 -5.1% 6.50 443,344 7.75

Q3 2016 14 80,526 10 22,340 16.84 15.69 7.3% 16.36 15.80 3.5% 7.00 503,893 6.26

New Lease Summary(1)

Quarter

Number of

Leases

Signed

Net rentable

SF Signed

Cash

Contractual

Rent per SF

Weighted

Average Lease

Term (yrs) TI & LC

TI & LC

per SF

Q2 2017 9 14,315 $20.66 7.65 $376,170 $26.28

Q1 2017 6 13,698 22.91 5.70 204,418 14.92

Q4 2016 6 21,078 13.25 8.39 365,657 17.35

Q3 2016 3 14,341 14.03 6.52 262,134 18.28

25Retail Lease Expirations

(1) Includes new leases from properties in development

Year of Lease Expiration

Number of

Leases

Expiring

Square Footage

of Leases

Expiring (1)

% Portfolio

Net Rentable

Square Feet

Annualized Base

Rent

% of Portfolio

Annualized

Base Rent

Annualized Base

Rent per Leased

Square Foot

Available - 147,293 4.1% -$ - -$

M-T-M 4 4,728 0.1% 68,990 0.1% 14.59

2017 20 50,090 1.4% 993,633 1.9% 19.84

2018 70 295,814 8.2% 4,662,204 9.1% 15.76

2019 81 577,019 16.1% 8,842,564 17.2% 15.32

2020 69 546,650 15.2% 7,586,515 14.7% 13.88

2021 50 258,260 7.2% 4,634,520 9.0% 17.95

2022 42 383,964 10.7% 6,001,745 11.7% 15.63

2023 18 256,235 7.1% 3,390,249 6.6% 13.23

2024 17 166,518 4.6% 2,631,996 5.1% 15.81

2025 16 222,955 6.2% 2,278,337 4.4% 10.22

2026 19 166,645 4.6% 2,877,886 5.6% 17.27

2027 14 105,286 2.9% 2,274,209 4.4% 21.60

Thereafter 16 406,202 11.3% 5,203,131 10.1% 12.81

Total / Weighted Average 436 3,587,659 100.0% 51,445,979$ 100.0% $14.95

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

-

100,000

200,000

300,000

400,000

500,000

600,000

700,000

Leased Square Feet % ABR of Retail Portfolio

26Net Asset Value Component Data

In thousands

(1) Includes leases for space occupied by Armada Hoffler which are eliminated for GAAP purposes

Stabilized Portfolio NOI (Cash) Taxable REIT Subsidiary (TRS)

Three months

ended Annualized Trailing 12 Months

6/30/2017 6/30/2017 General contracting and real estate services $7,693

Diversified Portfolio

Office $223 $892 Non-Property Assets

Retail 9,149 36,596 Non-Property Assets As of 6/30/2017

Multifamily 958 3,832 Cash and Cash Equivalents $18,587

Total Diversified Portfolio NOI $10,330 $41,320 Restricted Cash 3,139

Accounts Receivable 15,027

Virginia Beach Town Center Notes Receivable 73,382

Office(1) $2,978 $11,912 Construction receivables, including retentions 45,820

Retail (1) 2,080 8,320 Equity method investments (Durham City Center JV) 10,950

Multifamily 1,566 6,264 Other Assets 59,048

Total Virginia Beach Town Center NOI $6,624 $26,496 Land held for development 680

Total Non-Property Assets $226,633

Stabilized Portfolio NOI - Cash Basis $16,954 $67,816

Liabilities & Share Count

Development Pipeline As of 6/30/2017

Liabilities

6/30/2017 Mortgages and notes payable $465,291

Income producing property $92,000 Accounts payable and accrued liabilities 9,311

Construction in progress 36,000 Construction payables, including retentions 58,546

Other assets 3,000 Other Liabilities 46,669

Total cost to date $131,000 Total Liabilities $579,817

Three months ended

Share Count 6/30/2017

Weighted average common shares outstanding 42,091

Weighted average operating partnership ("OP") Units Outstanding 17,845

Total weighted average common shares and OP units outstanding 59,936

27

Appendix

Definitions & Reconciliations

28Definitions

Net Operating Income:

We calculate Net Operating Income (“NOI”) as property revenues (base rent, expense reimbursements and other

revenue) less property expenses (rental expenses and real estate taxes). Other REITs may use different

methodologies for calculating NOI, and accordingly, our NOI may not be comparable to such other REITs’ NOI. NOI is

not a measure of operating income or cash flows from operating activities as measured by GAAP and is not indicative

of cash available to fund cash needs. As a result, NOI should not be considered an alternative to cash flows as a

measure of liquidity. We consider NOI to be an appropriate supplemental measure to net income because it assists

both investors and management in understanding the core operations of our real estate business.

To calculate NOI on a cash basis, we adjust NOI to exclude the net effects of straight-line rent and the amortization of

lease incentives and above/below market rents.

Funds From Operations:

We calculate Funds From Operations (“FFO”) in accordance with the standards established by the National

Association of Real Estate Investment Trusts (“NAREIT”). NAREIT defines FFO as net income (loss) (calculated in

accordance with accounting principles generally accepted in the United States (“GAAP”)), excluding gains (or losses)

from sales of depreciable operating property, real estate related depreciation and amortization (excluding

amortization of deferred financing costs) and after adjustments for unconsolidated partnerships and joint ventures.

FFO is a supplemental non-GAAP financial measure. Management uses FFO as a supplemental performance measure

because it believes that FFO is beneficial to investors as a starting point in measuring our operational performance.

Specifically, in excluding real estate related depreciation and amortization and gains and losses from property

dispositions, which do not relate to or are not indicative of operating performance, FFO provides a performance

measure that, when compared period-over-period, captures trends in occupancy rates, rental rates and operating

costs. Other equity REITs may not calculate FFO in accordance with the NAREIT definition as we do, and, accordingly,

our FFO may not be comparable to such other REITs’ FFO.

29Definitions

Normalized Funds From Operations:

We calculate Normalized Funds From Operations (“Normalized FFO") as FFO calculated in accordance with the

standards established by NAREIT, adjusted for acquisition, development and other pursuit costs, gains or losses from

the early extinguishment of debt, impairment charges, mark-to-market adjustments on interest rate derivatives and

other non-comparable items.

Management believes that the computation of FFO in accordance to NAREIT’s definition includes certain items that

are not indicative of the results provided by the Company’s operating portfolio and affect the comparability of the

Company’s period-over-period performance. Our calculation of Normalized FFO differs from NAREIT's definition of

FFO. Other equity REITs may not calculate Normalized FFO in the same manner as us, and, accordingly, our

Normalized FFO may not be comparable to other REITs' Normalized FFO.

Adjusted Funds From Operations:

We calculate Adjusted Funds From Operations (“AFFO”) as Normalized FFO adjusted for the impact of non-cash stock

compensation, tenant improvement, leasing commission and leasing incentive costs associated with second

generation rental space, capital expenditures, non-cash interest expense, straight-line rents, the amortization of

leasing incentives and above (below) market rents and proceeds from government development grants.

Management believes that AFFO provides useful supplemental information to investors regarding our operating

performance as it provides a consistent comparison of our operating performance across time periods and allows

investors to more easily compare our operating results with other REITs. However, other REITs may use different

methodologies for calculating AFFO or similarly entitled FFO measures and, accordingly, our AFFO may not always be

comparable to AFFO or other similarly entitled FFO measures of other REITs.

30Definitions

Adjusted EBITDA:

We calculate Adjusted EBITDA as net income (loss) (calculated in accordance with GAAP), excluding interest expense,

income taxes, depreciation and amortization, gains (or losses) from sales of depreciable operating property and mark-

to-market adjustments on interest rate derivates. Management believes Adjusted EBITDA is useful to investors in

evaluating and facilitating comparisons of our operating performance between periods and between REITs by

removing the impact of our capital structure (primarily interest expense) and asset base (primarily depreciation and

amortization) from our operating results along with other non-comparable items.

Core EBITDA:

We calculate Core EBITDA as EBITDA, excluding certain items, including, but not limited to, debt extinguishment

losses, mark-to-market adjustments on interest rate derivatives, non-cash stock compensation and the impact of

development pipeline projects that are still in lease-up. We generally consider a property to be in lease-up until the

earlier of (i) the quarter after which the property reaches 80% occupancy or (ii) the thirteenth quarter after the

property receives its certificate of occupancy. Management believes that Core EBITDA provides useful supplemental

information to investors regarding our ongoing operating performance as it provides a consistent comparison of our

operating performance across time periods and allows investors to more easily compare our operating results with

other REITs. However, other REITs may use different methodologies for calculating Core EBITDA or similarly entitled

measures and, accordingly, our Core EBITDA may not always be comparable to Core EBITDA or other similarly entitled

measures of other REITs.

Core Debt:

We calculate Core Debt as our total debt, excluding loans associated with our development pipeline, cash & cash

equivalents, and restricted cash.

Same Store Portfolio:

We define same store properties as those that we owned and operated for the entirety of the comparative periods

presented. We generally consider a property to be in lease-up until the earlier of (i) the quarter after which the

property reaches 80% occupancy or (ii) the thirteenth quarter after the property receives its certificate of occupancy.

The following table shows the properties included in the same store and non-same store portfolio for the comparative

periods presented.

31Same Store vs. Non-Same Store

Same

Store

Non-Same

Store

Same

Store

Non-Same

Store

Same

Store

Non-Same

Store

Same

Store

Non-Same

Store

Retail Properties Retail Properties (Continued)

249 Central Park Retail X X Sandbridge Commons X X

Alexander Pointe X X Socastee Commons X X

Bermuda Crossroads X X South Retail X X

Broad Creek Shopping Center X X South Square X X

Brooks Crossing (Retail) X X Southgate Square X X

Broadmoor Plaza X X Southshore Shops X X

Columbus Village X X Stone House Square X X

Columbus Village II X X Studio 56 Retail X X

Commerce Street Retail X X Tyre Neck Harris Teeter X X

Courthouse 7-Eleven X X Waynesboro Commons X X

Dick’s at Town Center X X Wendover Village X X

Dimmock Square X X Office Properties

Greentree Shopping Center X X 4525 Main Street X X

Fountain Plaza Retail X X Armada Hoffler Tower X X

Gainsborough Square X X Commonwealth of VA - Chesapeake X X

Hanbury Village X X Commonwealth of VA - Virginia Beach X X

Harper Hill Commons X X One Columbus X X

Harrisonburg Regal X X Two Columbus X X

Lightfoot Marketplace X X Multifamily Properties

North Hampton Market X X Encore Apartments X X

North Point Center X X Liberty Apartments X X

Oakland Marketplace X X Smith’s Landing X X

Parkway Marketplace X X The Cosmopolitan X X

Patterson Place X X Johns Hopkins Village X X

Perry Hall Marketplace X X

Providence Plaza X X

Renaissance Square X X

Six Months Ended

6/30/2017 to 2016

Three Months Ended

6/30/2017 to 2016

Three Months Ended

6/30/2017 to 2016

Six Months Ended

6/30/2017 to 2016

32Reconciliation to Property Portfolio NOI

$ in thousands

(1) See page 31 for the Same Store vs. Non-Same Store properties

Three months ended 6/30 Six months ended 6/30

2017 2016 2017 2016

Office Same Store(1)

Rental revenues $3,657 $3,867 $7,463 $7,788

Property expenses 1,387 1,269 2,723 2,659

NOI 2,270 2,598 4,740 5,129

Non-Same Store NOI 673 877 1,333 1,872

Segment NOI $2,943 $3,475 $6,073 $7,001

Retail Same Store(1)

Rental revenues $13,146 $12,961 $18,861 $18,534

Property expenses $3,554 3,325 5,300 5,160

NOI $9,592 9,636 13,561 13,374

Non-Same Store NOI $1,987 927 9,680 6,601

Segment NOI $11,579 $10,563 $23,241 $19,975

Multifamily Same Store(1)

Rental revenues $4,641 $4,752 $9,437 $9,482

Property expenses $2,128 2,074 4,239 4,136

NOI $2,513 2,678 5,198 5,346

Non-Same Store NOI $954 82 2,132 81

Segment NOI $3,467 2,760 $7,330 $5,427

Total Property Portfolio NOI $17,989 $16,798 $36,644 $32,403

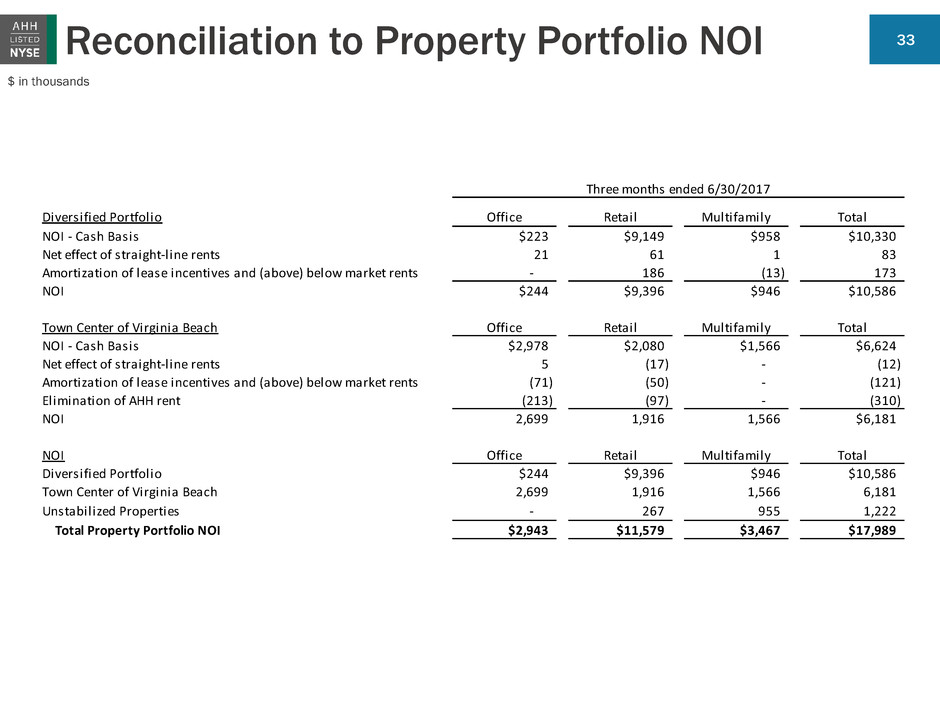

33Reconciliation to Property Portfolio NOI

$ in thousands

Three months ended 6/30/2017

Diversified Portfolio Office Retail Multifamily Total

NOI - Cash Basis $223 $9,149 $958 $10,330

Net effect of straight-line rents 21 61 1 83

Amortization of lease incentives and (above) below market rents - 186 (13) 173

NOI $244 $9,396 $946 $10,586

Town Center of Virginia Beach Office Retail Multifamily Total

NOI - Cash Basis $2,978 $2,080 $1,566 $6,624

Net effect of straight-line rents 5 (17) - (12)

Amortization of lease incentives and (above) below market rents (71) (50) - (121)

Elimination f AHH rent (213) (97) - (310)

NOI 2,699 1,916 1,566 $6,181

NOI Office Retail Multifamily Total

Diversified Portfolio $244 $9,396 $946 $10,586

Town Center of Virginia Beach 2,699 1,916 1,566 6,181

Unstabilized Properties - 267 955 1,222

Total Property Portfolio NOI $2,943 $11,579 $3,467 $17,989

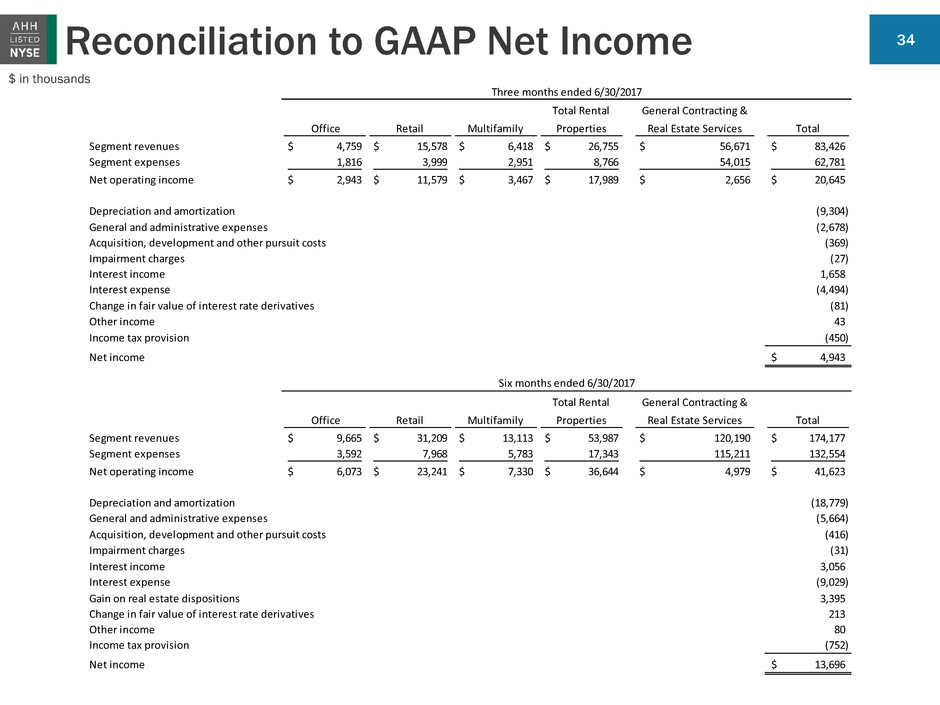

34Reconciliation to GAAP Net Income

$ in thousands

Office Retail Multifamily

Total Rental

Properties

General Contracting &

Real Estate Services Total

Segment revenues 4,759$ 15,578$ 6,418$ 26,755$ 56,671$ 83,426$

Segment expenses 1,816 3,999 2,951 8,766 54,015 62,781

Net operating income 2,943$ 11,579$ 3,467$ 17,989$ 2,656$ 20,645$

Depreciation and amortization (9,304)

General and administrative expenses (2,678)

Acquisition, development and other pursuit costs (369)

Impairment charges (27)

Interest income 1,658

Interest expense (4,494)

Change in fair value of interest rate derivatives (81)

Other income 43

Income tax provision (450)

Net income 4,943$

Office Retail Multifamily

Total Rental

Properties

General Contracting &

Real Estate Services Total

Segment revenues 9,665$ 31,209$ 13,113$ 53,987$ 120,190$ 174,177$

Segment expenses 3,592 7,968 5,783 17,343 115,211 132,554

Net operating income 6,073$ 23,241$ 7,330$ 36,644$ 4,979$ 41,623$

Depreciation and amortization (18,779)

General and administrative expenses (5,664)

Acquisition, development and other pursuit costs (416)

Impairment charges (31)

Interest income 3,056

Interest expense (9,029)

Gain on real estate dispositions 3,395

Change in fair value of interest rate derivatives 213

Other income 80

Income tax provision (752)

Net income 13,696$

Three months ended 6/30/2017

Six months ended 6/30/2017