Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Vanguard Natural Resources, Inc. | form8-kjunemor.htm |

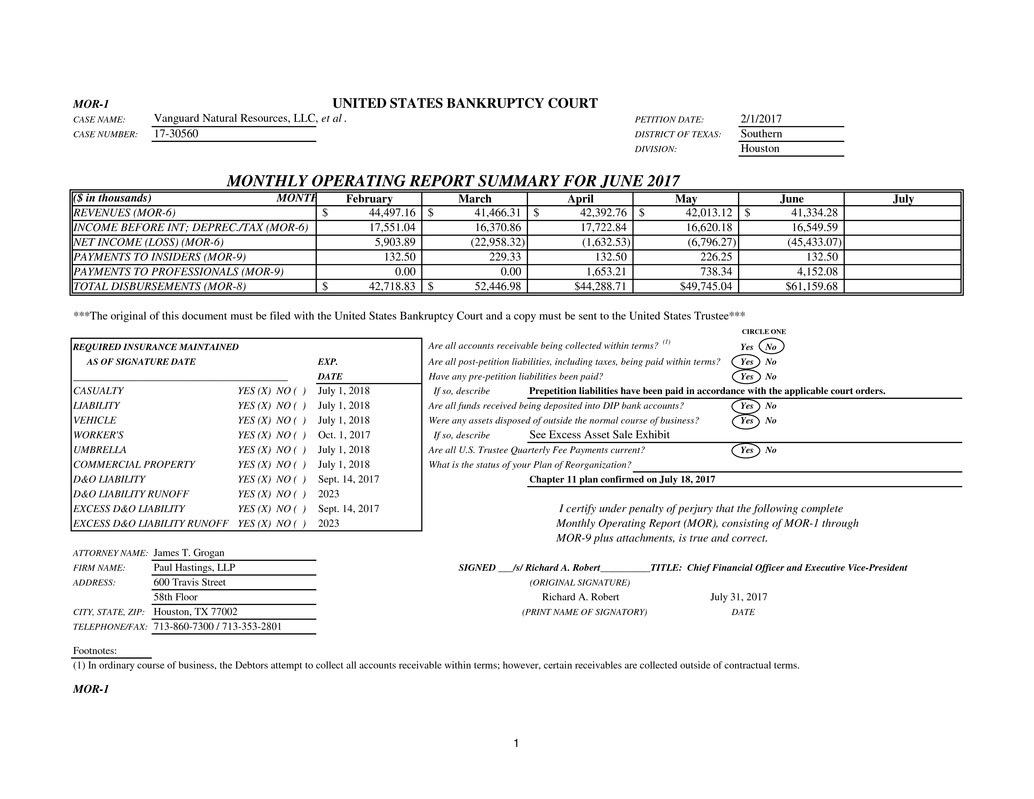

MOR-1 UNITED STATES BANKRUPTCY COURT

CASE NAME: Vanguard Natural Resources, LLC, et al . PETITION DATE: 2/1/2017

CASE NUMBER: 17-30560 DISTRICT OF TEXAS: Southern

DIVISION: Houston

MONTHLY OPERATING REPORT SUMMARY FOR JUNE 2017

($ in thousands) MONTH February March April May June July

REVENUES (MOR-6) 44,497.16$ 41,466.31$ 42,392.76$ 42,013.12$ 41,334.28$ 0.00

INCOME BEFORE INT; DEPREC./TAX (MOR-6) 17,551.04 16,370.86 17,722.84 16,620.18 16,549.59 0.00

NET INCOME (LOSS) (MOR-6) 5,903.89 (22,958.32) (1,632.53) (6,796.27) (45,433.07) 0.00

PAYMENTS TO INSIDERS (MOR-9) 132.50 229.33 132.50 226.25 132.50 0.00

PAYMENTS TO PROFESSIONALS (MOR-9) 0.00 0.00 1,653.21 738.34 4,152.08 0.00

TOTAL DISBURSEMENTS (MOR-8) 42,718.83$ 52,446.98$ $44,288.71 $49,745.04 $61,159.68 0.00

***The original of this document must be filed with the United States Bankruptcy Court and a copy must be sent to the United States Trustee***

CIRCLE ONE

REQUIRED INSURANCE MAINTAINED Are all accounts receivable being collected within terms?

(1)

Yes No

AS OF SIGNATURE DATE EXP. Are all post-petition liabilities, including taxes, being paid within terms? Yes No

_____________________________________ DATE Have any pre-petition liabilities been paid? Yes No

CASUALTY YES (X) NO ( ) July 1, 2018 If so, describe Prepetition liabilities have been paid in accordance with the applicable court orders.

LIABILITY YES (X) NO ( ) July 1, 2018 Are all funds received being deposited into DIP bank accounts? Yes No

VEHICLE YES (X) NO ( ) July 1, 2018 Were any assets disposed of outside the normal course of business? Yes No

WORKER'S YES (X) NO ( ) Oct. 1, 2017 If so, describe See Excess Asset Sale Exhibit

UMBRELLA YES (X) NO ( ) July 1, 2018 Are all U.S. Trustee Quarterly Fee Payments current? Yes No

COMMERCIAL PROPERTY YES (X) NO ( ) July 1, 2018 What is the status of your Plan of Reorganization?

D&O LIABILITY YES (X) NO ( ) Sept. 14, 2017 Chapter 11 plan confirmed on July 18, 2017

D&O LIABILITY RUNOFF YES (X) NO ( ) 2023

EXCESS D&O LIABILITY YES (X) NO ( ) Sept. 14, 2017 I certify under penalty of perjury that the following complete

EXCESS D&O LIABILITY RUNOFF YES (X) NO ( ) 2023 Monthly Operating Report (MOR), consisting of MOR-1 through

MOR-9 plus attachments, is true and correct.

ATTORNEY NAME: James T. Grogan

FIRM NAME: Paul Hastings, LLP SIGNED ___/s/ Richard A. Robert__________TITLE: Chief Financial Officer and Executive Vice-President

ADDRESS: 600 Travis Street (ORIGINAL SIGNATURE)

58th Floor Richard A. Robert

CITY, STATE, ZIP: Houston, TX 77002 (PRINT NAME OF SIGNATORY) DATE

TELEPHONE/FAX: 713-860-7300 / 713-353-2801

Footnotes:

(1) In ordinary course of business, the Debtors attempt to collect all accounts receivable within terms; however, certain receivables are collected outside of contractual terms.

MOR-1

July 31, 2017

1

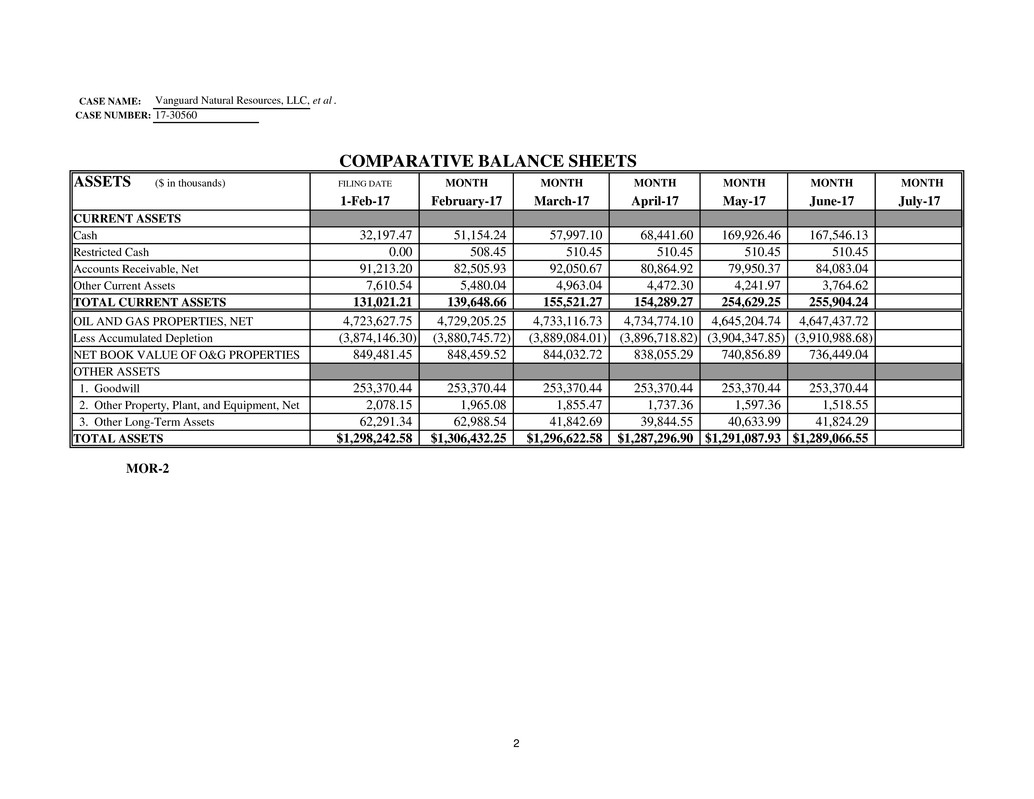

CASE NAME: Vanguard Natural Resources, LLC, et al .

CASE NUMBER: 17-30560

COMPARATIVE BALANCE SHEETS

ASSETS ($ in thousands) FILING DATE MONTH MONTH MONTH MONTH MONTH MONTH

1-Feb-17 February-17 March-17 April-17 May-17 June-17 July-17

CURRENT ASSETS

Cash 32,197.47 51,154.24 57,997.10 68,441.60 169,926.46 167,546.13

Restricted Cash 0.00 508.45 510.45 510.45 510.45 510.45

Accounts Receivable, Net 91,213.20 82,505.93 92,050.67 80,864.92 79,950.37 84,083.04

Other Current Assets 7,610.54 5,480.04 4,963.04 4,472.30 4,241.97 3,764.62

TOTAL CURRENT ASSETS 131,021.21 139,648.66 155,521.27 154,289.27 254,629.25 255,904.24 0.00

OIL AND GAS PROPERTIES, NET 4,723,627.75 4,729,205.25 4,733,116.73 4,734,774.10 4,645,204.74 4,647,437.72

Less Accumulated Depletion (3,874,146.30) (3,880,745.72) (3,889,084.01) (3,896,718.82) (3,904,347.85) (3,910,988.68)

NET BOOK VALUE OF O&G PROPERTIES 849,481.45 848,459.52 844,032.72 838,055.29 740,856.89 736,449.04 0.00

OTHER ASSETS

1. Goodwill 253,370.44 253,370.44 253,370.44 253,370.44 253,370.44 253,370.44

2. Other Property, Plant, and Equipment, Net 2,078.15 1,965.08 1,855.47 1,737.36 1,597.36 1,518.55

3. Other Long-Term Assets 62,291.34 62,988.54 41,842.69 39,844.55 40,633.99 41,824.29

TOTAL ASSETS $1,298,242.58 $1,306,432.25 $1,296,622.58 $1,287,296.90 $1,291,087.93 $1,289,066.55 $0.00

MOR-2

2

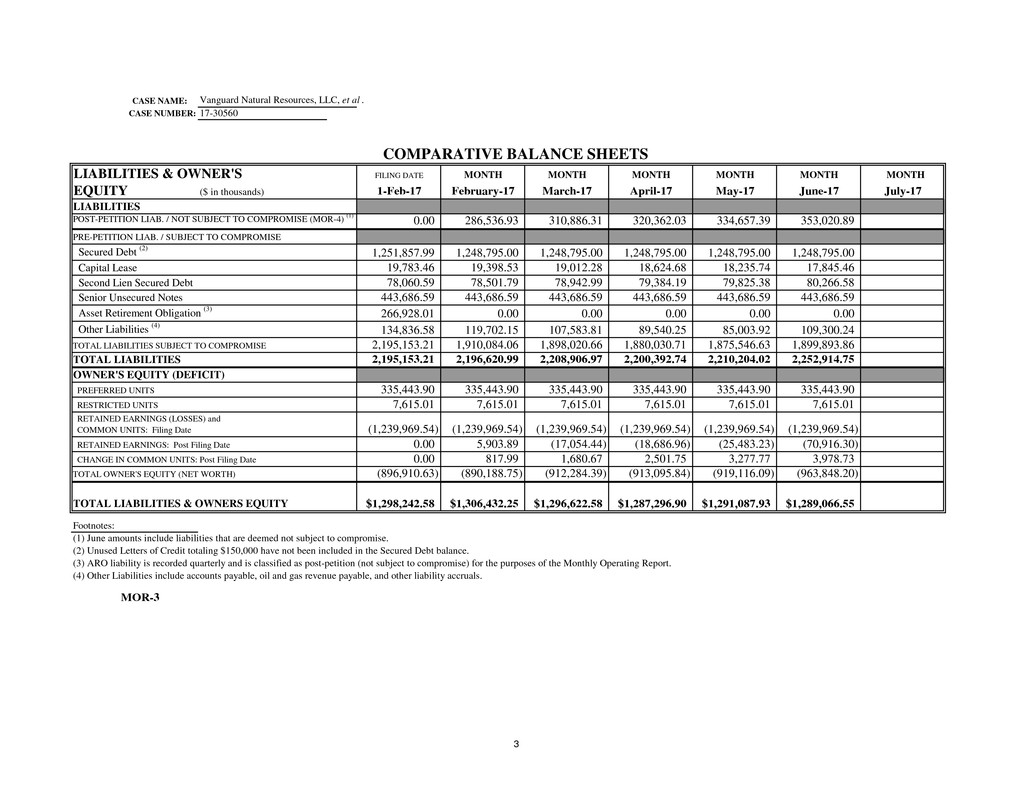

CASE NAME: Vanguard Natural Resources, LLC, et al .

CASE NUMBER: 17-30560

COMPARATIVE BALANCE SHEETS

LIABILITIES & OWNER'S FILING DATE MONTH MONTH MONTH MONTH MONTH MONTH

EQUITY ($ in thousands) 1-Feb-17 February-17 March-17 April-17 May-17 June-17 July-17

LIABILITIES

POST-PETITION LIAB. / NOT SUBJECT TO COMPROMISE (MOR-4) (1) 0.00 286,536.93 310,886.31 320,362.03 334,657.39 353,020.89

PRE-PETITION LIAB. / SUBJECT TO COMPROMISE

Secured Debt (2) 1,251,857.99 1,248,795.00 1,248,795.00 1,248,795.00 1,248,795.00 1,248,795.00

Capital Lease 19,783.46 19,398.53 19,012.28 18,624.68 18,235.74 17,845.46

Second Lien Secured Debt 78,060.59 78,501.79 78,942.99 79,384.19 79,825.38 80,266.58

Senior Unsecured Notes 443,686.59 443,686.59 443,686.59 443,686.59 443,686.59 443,686.59

Asset Retirement Obligation (3) 266,928.01 0.00 0.00 0.00 0.00 0.00

Other Liabilities (4) 134,836.58 119,702.15 107,583.81 89,540.25 85,003.92 109,300.24 0.00

TOTAL LIABILITIES SUBJECT TO COMPROMISE 2,195,153.21 1,910,084.06 1,898,020.66 1,880,030.71 1,875,546.63 1,899,893.86 0.00

TOTAL LIABILITIES 2,195,153.21 2,196,620.99 2,208,906.97 2,200,392.74 2,210,204.02 2,252,914.75 0.00

OWNER'S EQUITY (DEFICIT)

PREFERRED UNITS 335,443.90 335,443.90 335,443.90 335,443.90 335,443.90 335,443.90

RESTRICTED UNITS 7,615.01 7,615.01 7,615.01 7,615.01 7,615.01 7,615.01

(1,239,969.54) (1,239,969.54) (1,239,969.54) (1,239,969.54) (1,239,969.54) (1,239,969.54)

RETAINED EARNINGS: Post Filing Date 0.00 5,903.89 (17,054.44) (18,686.96) (25,483.23) (70,916.30)

CHANGE IN COMMON UNITS: Post Filing Date 0.00 817.99 1,680.67 2,501.75 3,277.77 3,978.73

TOTAL OWNER'S EQUITY (NET WORTH) (896,910.63) (890,188.75) (912,284.39) (913,095.84) (919,116.09) (963,848.20) 0.00

$1,298,242.58 $1,306,432.25 $1,296,622.58 $1,287,296.90 $1,291,087.93 $1,289,066.55 $0.00

Footnotes:

(1) June amounts include liabilities that are deemed not subject to compromise.

(2) Unused Letters of Credit totaling $150,000 have not been included in the Secured Debt balance.

(3) ARO liability is recorded quarterly and is classified as post-petition (not subject to compromise) for the purposes of the Monthly Operating Report.

(4) Other Liabilities include accounts payable, oil and gas revenue payable, and other liability accruals.

MOR-3

RETAINED EARNINGS (LOSSES) and

COMMON UNITS: Filing Date

TOTAL LIABILITIES & OWNERS EQUITY

3

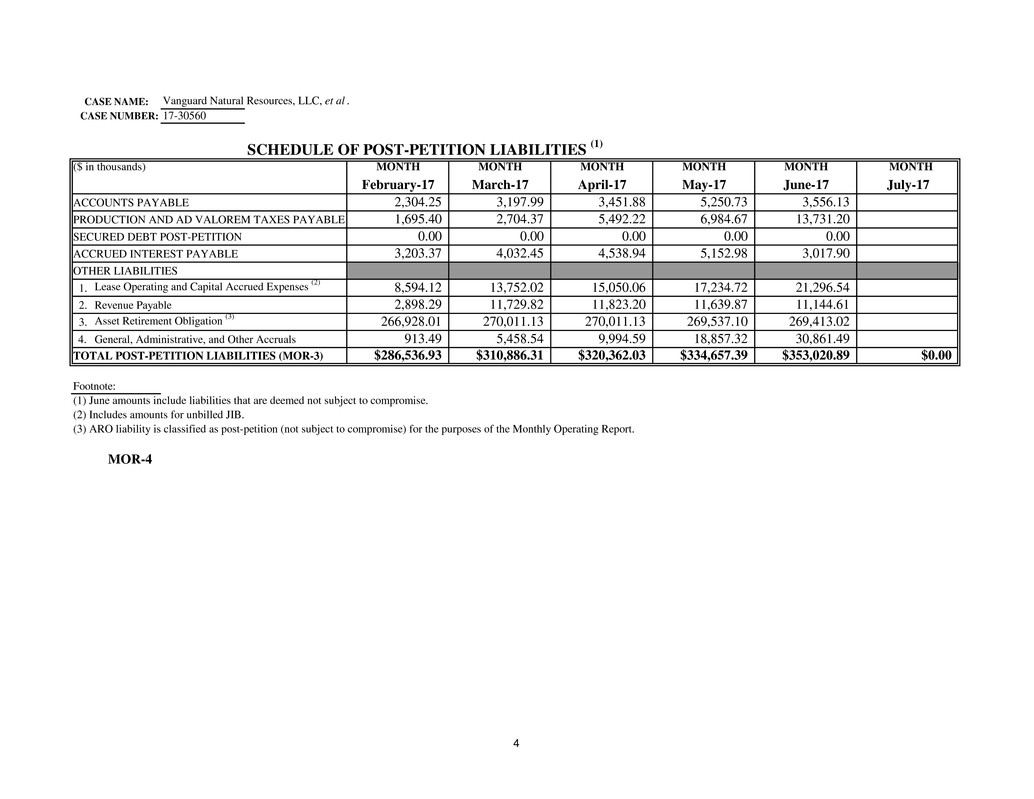

CASE NAME: Vanguard Natural Resources, LLC, et al .

CASE NUMBER: 17-30560

SCHEDULE OF POST-PETITION LIABILITIES (1)

($ in thousands) MONTH MONTH MONTH MONTH MONTH MONTH

February-17 March-17 April-17 May-17 June-17 July-17

ACCOUNTS PAYABLE 2,304.25 3,197.99 3,451.88 5,250.73 3,556.13

PRODUCTION AND AD VALOREM TAXES PAYABLE 1,695.40 2,704.37 5,492.22 6,984.67 13,731.20

SECURED DEBT POST-PETITION 0.00 0.00 0.00 0.00 0.00

ACCRUED INTEREST PAYABLE 3,203.37 4,032.45 4,538.94 5,152.98 3,017.90

OTHER LIABILITIES

1. Lease Operating and Capital Accrued Expenses

(2) 8,594.12 13,752.02 15,050.06 17,234.72 21,296.54

2. Revenue Payable 2,898.29 11,729.82 11,823.20 11,639.87 11,144.61

3. Asset Retirement Obligation

(3) 266,928.01 270,011.13 270,011.13 269,537.10 269,413.02

4. General, Administrative, and Other Accruals 913.49 5,458.54 9,994.59 18,857.32 30,861.49

TOTAL POST-PETITION LIABILITIES (MOR-3) $286,536.93 $310,886.31 $320,362.03 $334,657.39 $353,020.89 $0.00

Footnote:

(1) June amounts include liabilities that are deemed not subject to compromise.

(2) Includes amounts for unbilled JIB.

(3) ARO liability is classified as post-petition (not subject to compromise) for the purposes of the Monthly Operating Report.

MOR-4

4

CASE NAME: Vanguard Natural Resources, LLC, et al .

CASE NUMBER: 17-30560

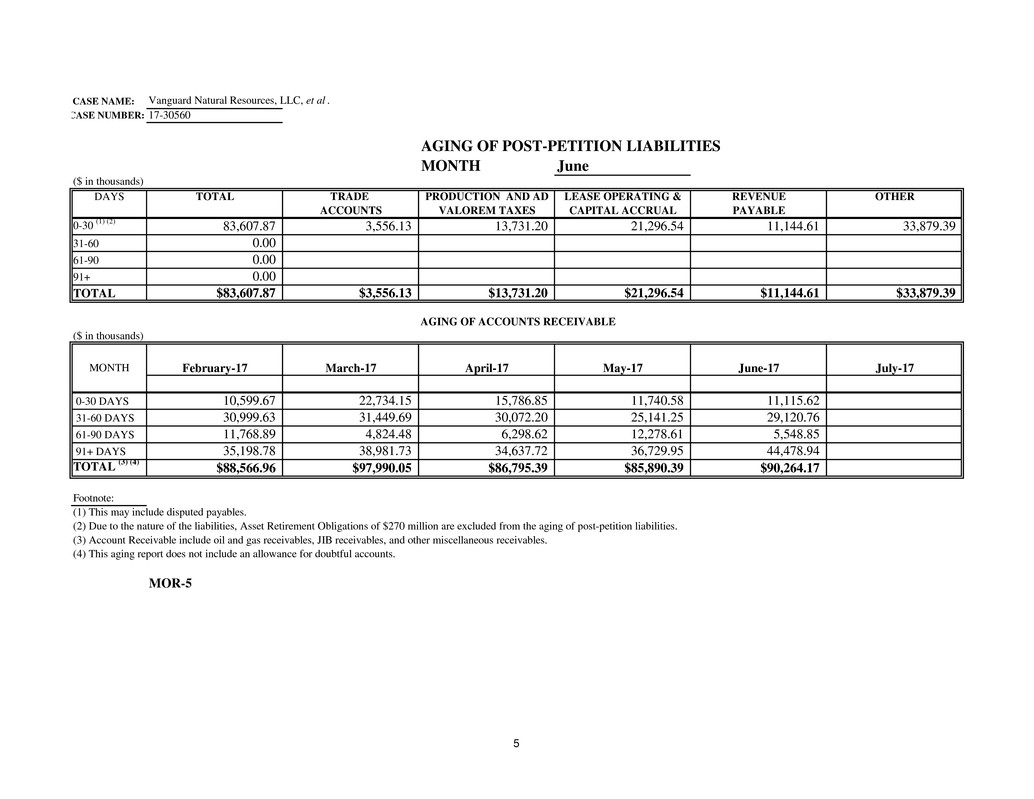

AGING OF POST-PETITION LIABILITIES

MONTH June

($ in thousands)

DAYS TOTAL TRADE PRODUCTION AND AD LEASE OPERATING & REVENUE OTHER

ACCOUNTS VALOREM TAXES CAPITAL ACCRUAL PAYABLE

0-30 (1) (2) 83,607.87 3,556.13 13,731.20 21,296.54 11,144.61 33,879.39

31-60 0.00

61-90 0.00

91+ 0.00

TOTAL $83,607.87 $3,556.13 $13,731.20 $21,296.54 $11,144.61 $33,879.39

AGING OF ACCOUNTS RECEIVABLE

($ in thousands)

MONTH February-17 March-17 April-17 May-17 June-17 July-17

0-30 DAYS 10,599.67 22,734.15 15,786.85 11,740.58 11,115.62

31-60 DAYS 30,999.63 31,449.69 30,072.20 25,141.25 29,120.76

61-90 DAYS 11,768.89 4,824.48 6,298.62 12,278.61 5,548.85

91+ DAYS 35,198.78 38,981.73 34,637.72 36,729.95 44,478.94

TOTAL (3) (4) $88,566.96 $97,990.05 $86,795.39 $85,890.39 $90,264.17 $0.00

Footnote:

(1) This may include disputed payables.

(2) Due to the nature of the liabilities, Asset Retirement Obligations of $270 million are excluded from the aging of post-petition liabilities.

(3) Account Receivable include oil and gas receivables, JIB receivables, and other miscellaneous receivables.

(4) This aging report does not include an allowance for doubtful accounts.

MOR-5

5

CASE NAME: Vanguard Natural Resources, LLC, et al .

CASE NUMBER: 17-30560

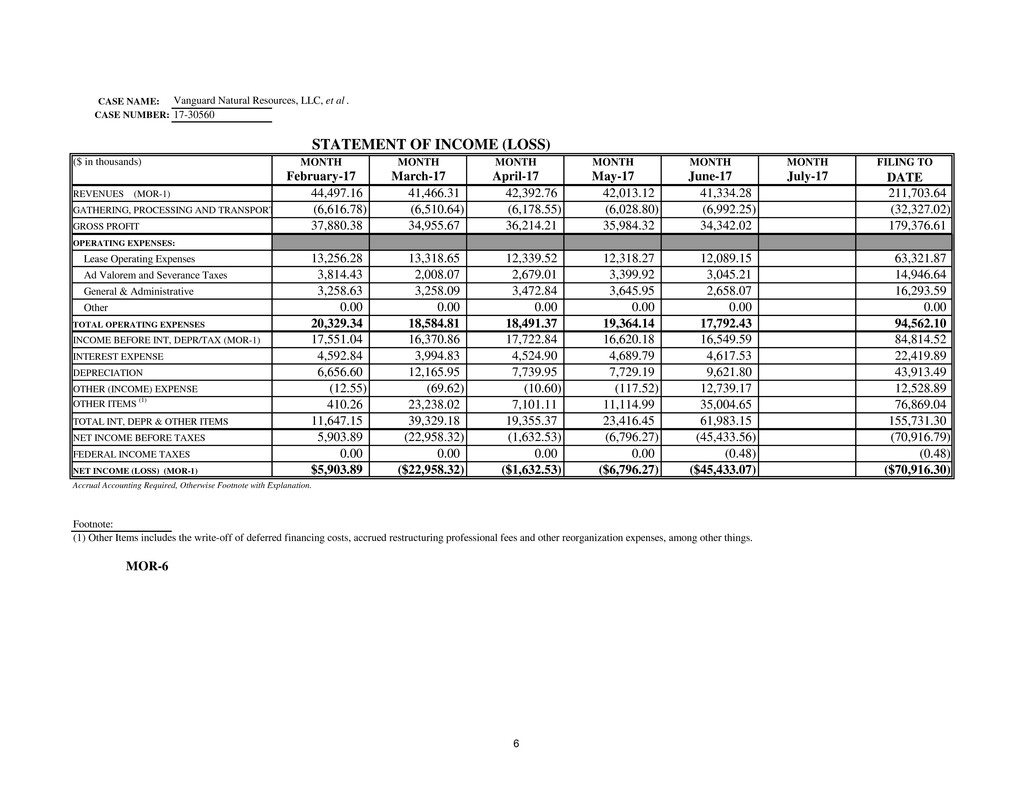

STATEMENT OF INCOME (LOSS)

($ in thousands) MONTH MONTH MONTH MONTH MONTH MONTH FILING TO

February-17 March-17 April-17 May-17 June-17 July-17 DATE

REVENUES (MOR-1) 44,497.16 41,466.31 42,392.76 42,013.12 41,334.28 211,703.64

GATHERING, PROCESSING AND TRANSPORT (6,616.78) (6,510.64) (6,178.55) (6,028.80) (6,992.25) (32,327.02)

GROSS PROFIT 37,880.38 34,955.67 36,214.21 35,984.32 34,342.02 0.00 179,376.61

OPERATING EXPENSES:

Lease Operating Expenses 13,256.28 13,318.65 12,339.52 12,318.27 12,089.15 63,321.87

Ad Valorem and Severance Taxes 3,814.43 2,008.07 2,679.01 3,399.92 3,045.21 14,946.64

General & Administrative 3,258.63 3,258.09 3,472.84 3,645.95 2,658.07 16,293.59

Other 0.00 0.00 0.00 0.00 0.00 0.00

TOTAL OPERATING EXPENSES 20,329.34 18,584.81 18,491.37 19,364.14 17,792.43 0.00 94,562.10

INCOME BEFORE INT, DEPR/TAX (MOR-1) 17,551.04 16,370.86 17,722.84 16,620.18 16,549.59 0.00 84,814.52

INTEREST EXPENSE 4,592.84 3,994.83 4,524.90 4,689.79 4,617.53 22,419.89

DEPRECIATION 6,656.60 12,165.95 7,739.95 7,729.19 9,621.80 43,913.49

OTHER (INCOME) EXPENSE (12.55) (69.62) (10.60) (117.52) 12,739.17 12,528.89

OTHER ITEMS (1) 410.26 23,238.02 7,101.11 11,114.99 35,004.65 76,869.04

TOTAL INT, DEPR & OTHER ITEMS 11,647.15 39,329.18 19,355.37 23,416.45 61,983.15 0.00 155,731.30

NET INCOME BEFORE TAXES 5,903.89 (22,958.32) (1,632.53) (6,796.27) (45,433.56) 0.00 (70,916.79)

FEDERAL INCOME TAXES 0.00 0.00 0.00 0.00 (0.48) (0.48)

NET INCOME (LOSS) (MOR-1) $5,903.89 ($22,958.32) ($1,632.53) ($6,796.27) ($45,433.07) $0.00 ($70,916.30)

Accrual Accounting Required, Otherwise Footnote with Explanation.

Footnote:

(1) Other Items includes the write-off of deferred financing costs, accrued restructuring professional fees and other reorganization expenses, among other things.

MOR-6

6

CASE NAME: Vanguard Natural Resources, LLC, et al .

CASE NUMBER: 17-30560

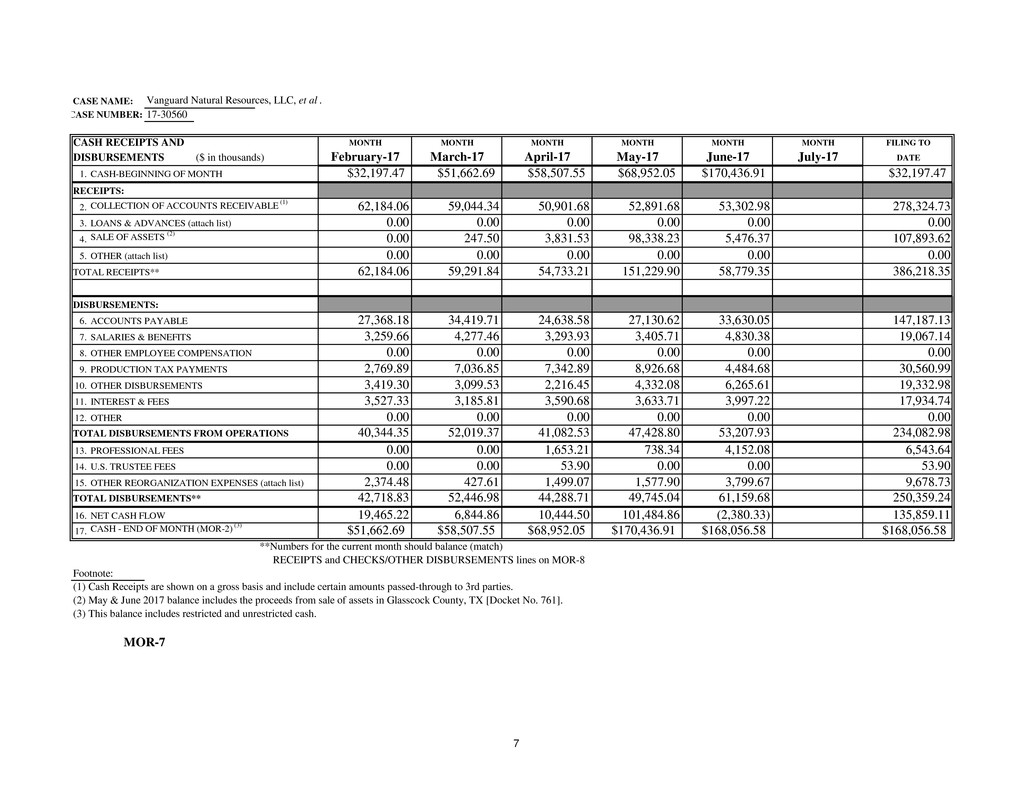

CASH RECEIPTS AND MONTH MONTH MONTH MONTH MONTH MONTH FILING TO

DISBURSEMENTS ($ in thousands) February-17 March-17 April-17 May-17 June-17 July-17 DATE

1. CASH-BEGINNING OF MONTH $32,197.47 $51,662.69 $58,507.55 $68,952.05 $170,436.91 $168,056.58 $32,197.47

RECEIPTS:

2. COLLECTION OF ACCOUNTS RECEIVABLE

(1) 62,184.06 59,044.34 50,901.68 52,891.68 53,302.98 278,324.73

3. LOANS & ADVANCES (attach list) 0.00 0.00 0.00 0.00 0.00 0.00

4. SALE OF ASSETS

(2) 0.00 247.50 3,831.53 98,338.23 5,476.37 107,893.62

5. OTHER (attach list) 0.00 0.00 0.00 0.00 0.00 0.00

TOTAL RECEIPTS** 62,184.06 59,291.84 54,733.21 151,229.90 58,779.35 0.00 386,218.35

DISBURSEMENTS:

6. ACCOUNTS PAYABLE 27,368.18 34,419.71 24,638.58 27,130.62 33,630.05 147,187.13

7. SALARIES & BENEFITS 3,259.66 4,277.46 3,293.93 3,405.71 4,830.38 19,067.14

8. OTHER EMPLOYEE COMPENSATION 0.00 0.00 0.00 0.00 0.00 0.00

9. PRODUCTION TAX PAYMENTS 2,769.89 7,036.85 7,342.89 8,926.68 4,484.68 30,560.99

10. OTHER DISBURSEMENTS 3,419.30 3,099.53 2,216.45 4,332.08 6,265.61 19,332.98

11. INTEREST & FEES 3,527.33 3,185.81 3,590.68 3,633.71 3,997.22 17,934.74

12. OTHER 0.00 0.00 0.00 0.00 0.00 0.00

TOTAL DISBURSEMENTS FROM OPERATIONS 40,344.35 52,019.37 41,082.53 47,428.80 53,207.93 0.00 234,082.98

13. PROFESSIONAL FEES 0.00 0.00 1,653.21 738.34 4,152.08 6,543.64

14. U.S. TRUSTEE FEES 0.00 0.00 53.90 0.00 0.00 53.90

15. OTHER REORGANIZATION EXPENSES (attach list) 2,374.48 427.61 1,499.07 1,577.90 3,799.67 9,678.73

TOTAL DISBURSEMENTS** 42,718.83 52,446.98 44,288.71 49,745.04 61,159.68 0.00 250,359.24

16. NET CASH FLOW 19,465.22 6,844.86 10,444.50 101,484.86 (2,380.33) 0.00 135,859.11

17. CASH - END OF MONTH (MOR-2)

(3)

$51,662.69 $58,507.55 $68,952.05 $170,436.91 $168,056.58 $168,056.58 $168,056.58

**Numbers for the current month should balance (match)

RECEIPTS and CHECKS/OTHER DISBURSEMENTS lines on MOR-8

Footnote:

(1) Cash Receipts are shown on a gross basis and include certain amounts passed-through to 3rd parties.

(2) May & June 2017 balance includes the proceeds from sale of assets in Glasscock County, TX [Docket No. 761].

(3) This balance includes restricted and unrestricted cash.

MOR-7

7

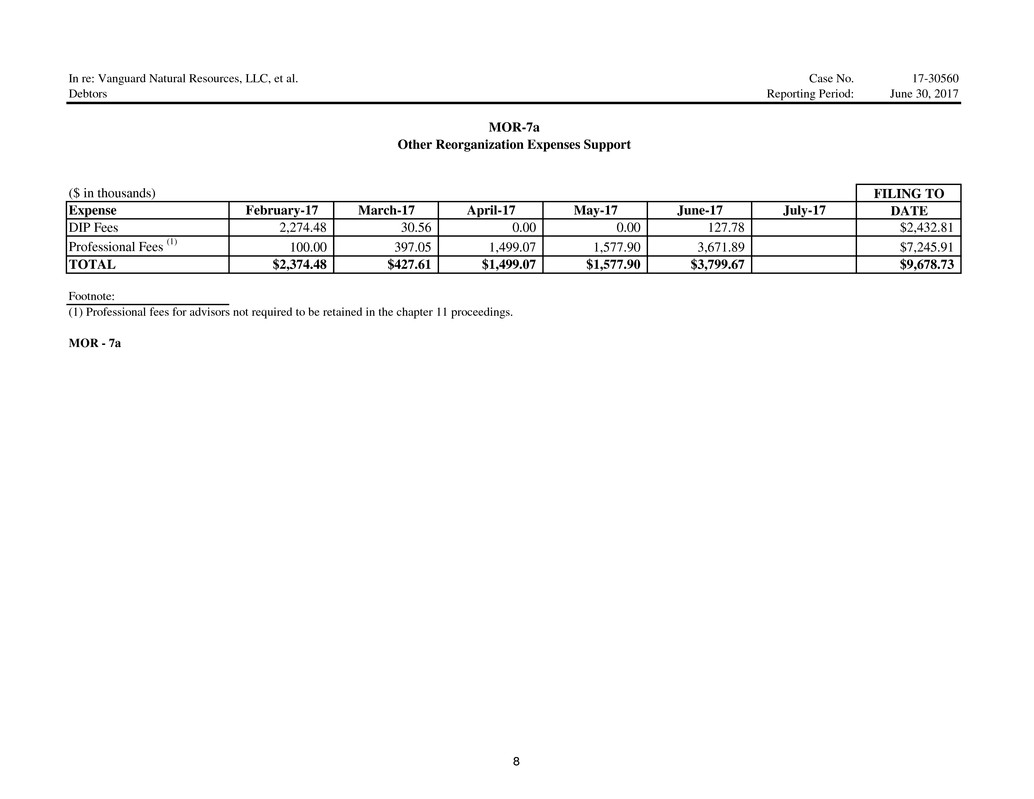

In re: Vanguard Natural Resources, LLC, et al. Case No. 17-30560

Debtors Reporting Period: June 30, 2017

Other Reorganization Expenses Support

($ in thousands) FILING TO

Expense February-17 March-17 April-17 May-17 June-17 July-17 DATE

DIP Fees 2,274.48 30.56 0.00 0.00 127.78 $2,432.81

Professional Fees (1) 100.00 397.05 1,499.07 1,577.90 3,671.89 $7,245.91

TOTAL $2,374.48 $427.61 $1,499.07 $1,577.90 $3,799.67 $9,678.73

Footnote:

(1) Professional fees for advisors not required to be retained in the chapter 11 proceedings.

MOR - 7a

MOR-7a

8

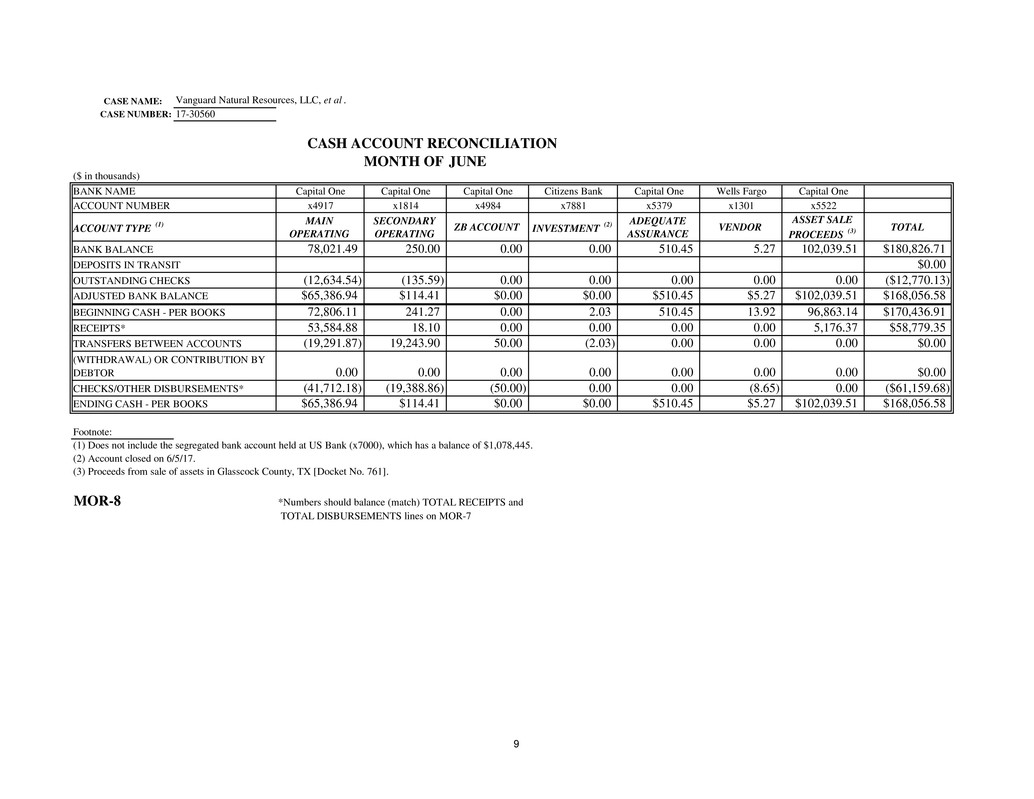

CASE NAME: Vanguard Natural Resources, LLC, et al .

CASE NUMBER: 17-30560

CASH ACCOUNT RECONCILIATION

MONTH OF JUNE

($ in thousands)

BANK NAME Capital One Capital One Capital One Citizens Bank Capital One Wells Fargo Capital One

ACCOUNT NUMBER x4917 x1814 x4984 x7881 x5379 x1301 x5522

ACCOUNT TYPE (1)

MAIN

OPERATING

SECONDARY

OPERATING

ZB ACCOUNT INVESTMENT (2)

ADEQUATE

ASSURANCE

VENDOR

ASSET SALE

PROCEEDS (3)

TOTAL

BANK BALANCE 78,021.49 250.00 0.00 0.00 510.45 5.27 102,039.51 $180,826.71

DEPOSITS IN TRANSIT $0.00

OUTSTANDING CHECKS (12,634.54) (135.59) 0.00 0.00 0.00 0.00 0.00 ($12,770.13)

ADJUSTED BANK BALANCE $65,386.94 $114.41 $0.00 $0.00 $510.45 $5.27 $102,039.51 $168,056.58

BEGINNING CASH - PER BOOKS 72,806.11 241.27 0.00 2.03 510.45 13.92 96,863.14 $170,436.91

RECEIPTS* 53,584.88 18.10 0.00 0.00 0.00 0.00 5,176.37 $58,779.35

TRANSFERS BETWEEN ACCOUNTS (19,291.87) 19,243.90 50.00 (2.03) 0.00 0.00 0.00 $0.00

0.00 0.00 0.00 0.00 0.00 0.00 0.00 $0.00

CHECKS/OTHER DISBURSEMENTS* (41,712.18) (19,388.86) (50.00) 0.00 0.00 (8.65) 0.00 ($61,159.68)

ENDING CASH - PER BOOKS $65,386.94 $114.41 $0.00 $0.00 $510.45 $5.27 $102,039.51 $168,056.58

Footnote:

(1) Does not include the segregated bank account held at US Bank (x7000), which has a balance of $1,078,445.

(2) Account closed on 6/5/17.

(3) Proceeds from sale of assets in Glasscock County, TX [Docket No. 761].

MOR-8 *Numbers should balance (match) TOTAL RECEIPTS and

TOTAL DISBURSEMENTS lines on MOR-7

(WITHDRAWAL) OR CONTRIBUTION BY

DEBTOR

9

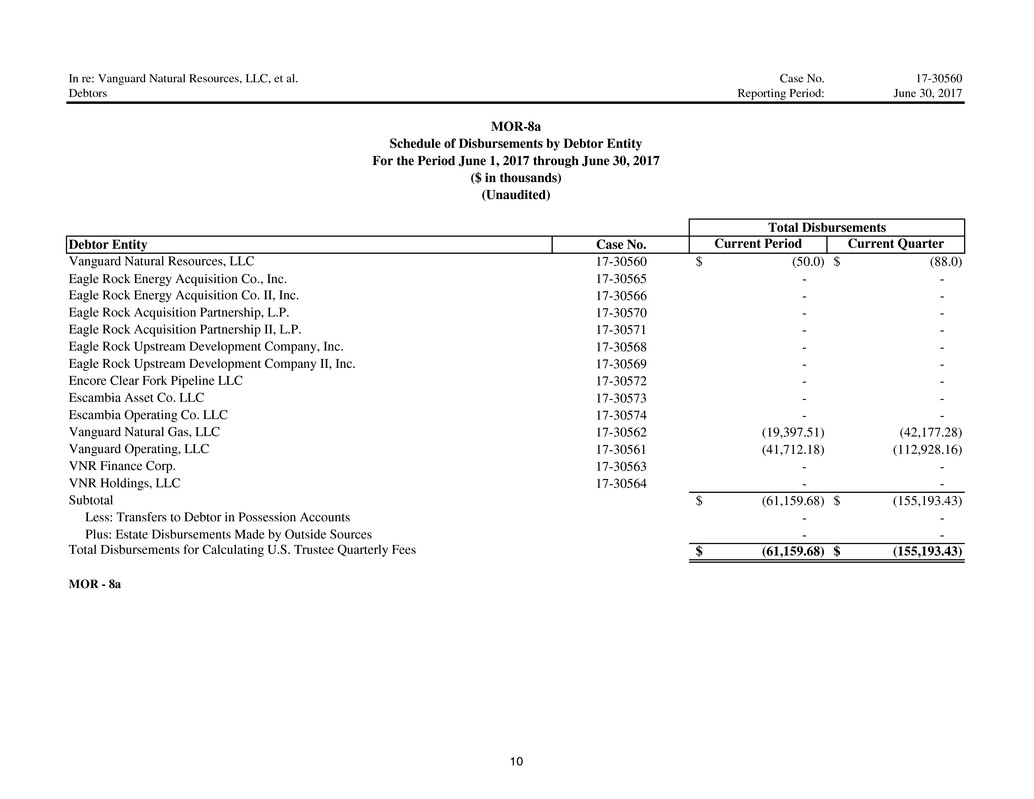

In re: Vanguard Natural Resources, LLC, et al. Case No. 17-30560

Debtors Reporting Period: June 30, 2017

Debtor Entity Case No. Current Period Current Quarter

Vanguard Natural Resources, LLC 17-30560 (50.0)$ (88.0)$

Eagle Rock Energy Acquisition Co., Inc. 17-30565 - -

Eagle Rock Energy Acquisition Co. II, Inc. 17-30566 - -

Eagle Rock Acquisition Partnership, L.P. 17-30570 - -

Eagle Rock Acquisition Partnership II, L.P. 17-30571 - -

Eagle Rock Upstream Development Company, Inc. 17-30568 - -

Eagle Rock Upstream Development Company II, Inc. 17-30569 - -

Encore Clear Fork Pipeline LLC 17-30572 - -

Escambia Asset Co. LLC 17-30573 - -

Escambia Operating Co. LLC 17-30574 - -

Vanguard Natural Gas, LLC 17-30562 (19,397.51) (42,177.28)

Vanguard Operating, LLC 17-30561 (41,712.18) (112,928.16)

VNR Finance Corp. 17-30563 - -

VNR Holdings, LLC 17-30564 - -

Subtotal (61,159.68)$ (155,193.43)$

Less: Transfers to Debtor in Possession Accounts - -

Plus: Estate Disbursements Made by Outside Sources - -

Total Disbursements for Calculating U.S. Trustee Quarterly Fees (61,159.68)$ (155,193.43)$

MOR - 8a

Total Disbursements

MOR-8a

Schedule of Disbursements by Debtor Entity

For the Period June 1, 2017 through June 30, 2017

($ in thousands)

(Unaudited)

10

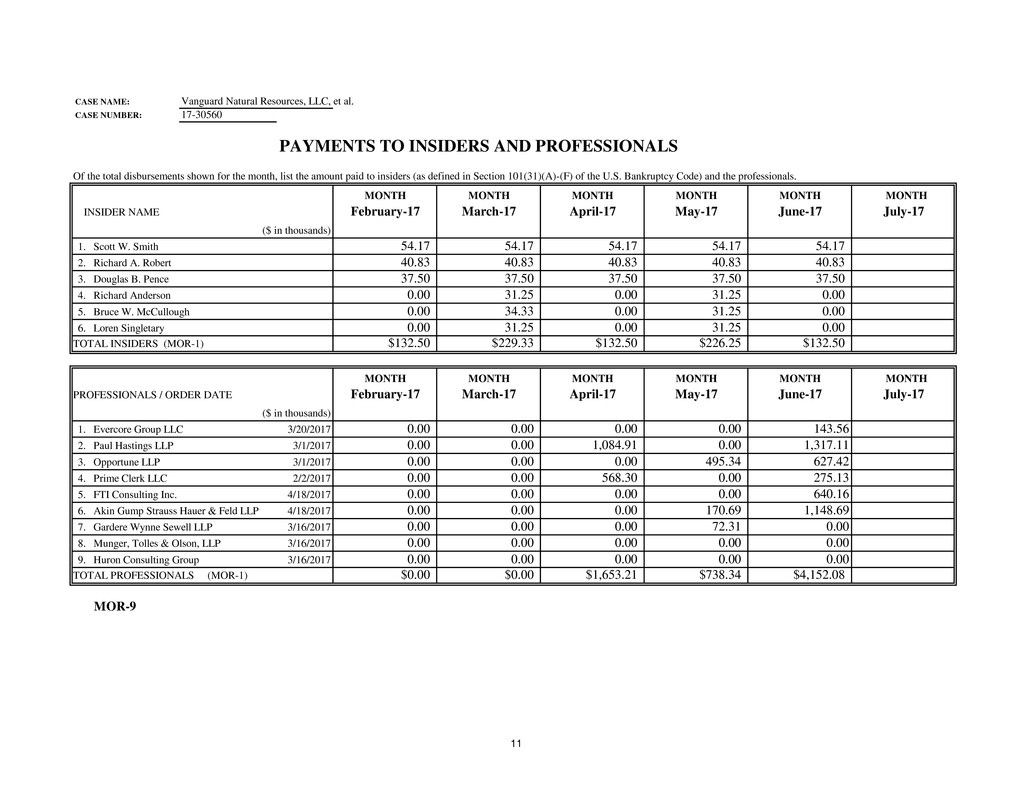

CASE NAME: Vanguard Natural Resources, LLC, et al.

CASE NUMBER: 17-30560

PAYMENTS TO INSIDERS AND PROFESSIONALS

Of the total disbursements shown for the month, list the amount paid to insiders (as defined in Section 101(31)(A)-(F) of the U.S. Bankruptcy Code) and the professionals.

MONTH MONTH MONTH MONTH MONTH MONTH

INSIDER NAME February-17 March-17 April-17 May-17 June-17 July-17

($ in thousands)

1. Scott W. Smith 54.17 54.17 54.17 54.17 54.17

2. Richard A. Robert 40.83 40.83 40.83 40.83 40.83

3. Douglas B. Pence 37.50 37.50 37.50 37.50 37.50

4. Richard Anderson 0.00 31.25 0.00 31.25 0.00

5. Bruce W. McCullough 0.00 34.33 0.00 31.25 0.00

6. Loren Singletary 0.00 31.25 0.00 31.25 0.00

TOTAL INSIDERS (MOR-1) $132.50 $229.33 $132.50 $226.25 $132.50 $0.00

MONTH MONTH MONTH MONTH MONTH MONTH

PROFESSIONALS / ORDER DATE February-17 March-17 April-17 May-17 June-17 July-17

($ in thousands)

1. Evercore Group LLC 3/20/2017 0.00 0.00 0.00 0.00 143.56

2. Paul Hastings LLP 3/1/2017 0.00 0.00 1,084.91 0.00 1,317.11

3. Opportune LLP 3/1/2017 0.00 0.00 0.00 495.34 627.42

4. Prime Clerk LLC 2/2/2017 0.00 0.00 568.30 0.00 275.13

5. FTI Consulting Inc. 4/18/2017 0.00 0.00 0.00 0.00 640.16

6. Akin Gump Strauss Hauer & Feld LLP 4/18/2017 0.00 0.00 0.00 170.69 1,148.69

7. Gardere Wynne Sewell LLP 3/16/2017 0.00 0.00 0.00 72.31 0.00

8. Munger, Tolles & Olson, LLP 3/16/2017 0.00 0.00 0.00 0.00 0.00

9. Huron Consulting Group 3/16/2017 0.00 0.00 0.00 0.00 0.00

TOTAL PROFESSIONALS (MOR-1) $0.00 $0.00 $1,653.21 $738.34 $4,152.08 $0.00

MOR-9

11

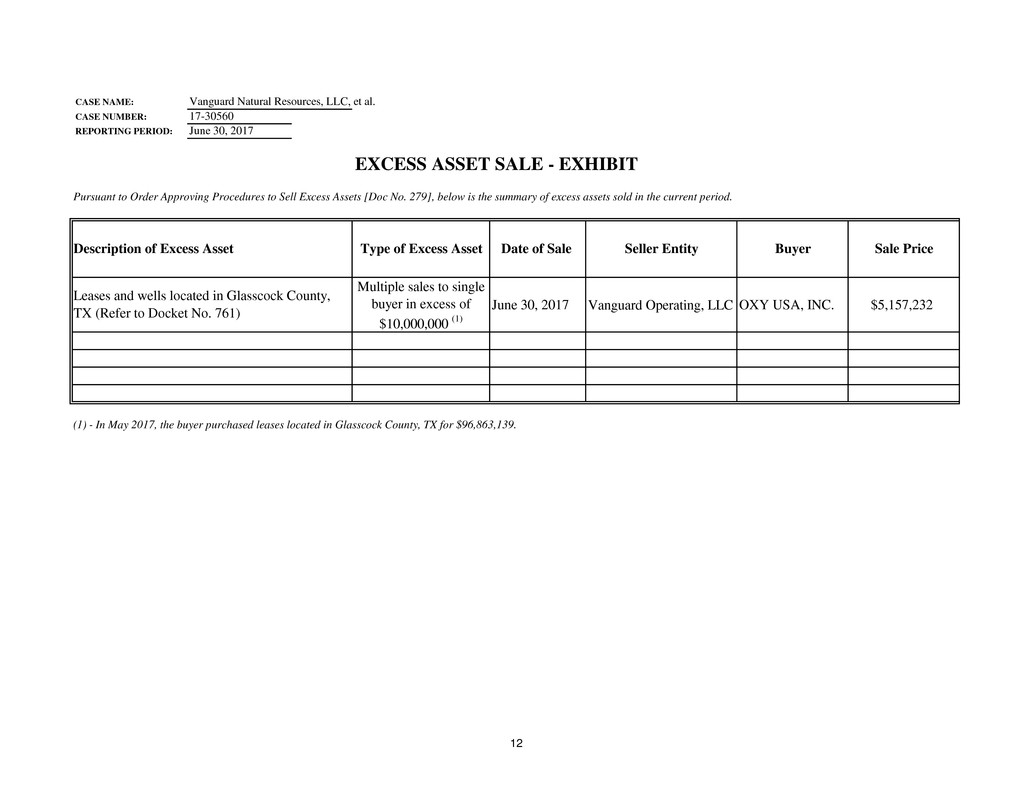

CASE NAME: Vanguard Natural Resources, LLC, et al.

CASE NUMBER: 17-30560

REPORTING PERIOD: June 30, 2017

EXCESS ASSET SALE - EXHIBIT

Pursuant to Order Approving Procedures to Sell Excess Assets [Doc No. 279], below is the summary of excess assets sold in the current period.

Description of Excess Asset Type of Excess Asset Date of Sale Seller Entity Buyer Sale Price

Multiple sales to single

buyer in excess of

$10,000,000 (1)

June 30, 2017 Vanguard Operating, LLC OXY USA, INC. $5,157,232

(1) - In May 2017, the buyer purchased leases located in Glasscock County, TX for $96,863,139.

Leases and wells located in Glasscock County,

TX (Refer to Docket No. 761)

12

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF TEXAS

CASE NAME: Vanguard Natural Resources, LLC, et al. PETITION DATE: 2/1/2017

CASE NUMBER: 17-30560

MONTHLY OPERATING REPORT NOTES FOR JUNE 30, 2017

Basis of Presentation

HOUSTON DIVISION

The accompanying consolidated financial statements of the Debtors have been prepared solely for the purpose of complying with the monthly

reporting requirements of the U.S. Bankruptcy Court for the Southern District of Texas (the “Monthly Operating Report”). The Monthly

Operating Report is limited in scope, covers a limited time period and the schedules contained herein were not audited or reviewed by

independent accountants nor are they intended to reconcile to any financial statements otherwise prepared or distributed by the Debtors or any

of the Debtors’ affiliates. The unaudited financial statements have been derived from the books and records of the Debtors. Because the

Debtors’ accounting systems, policies, and practices were developed with a view to producing consolidated financial reporting on a quarterly

basis, rather than by legal entity on a monthly basis, it is possible that not all assets or liabilities have been recorded at the correct legal entity of

either the Debtors or the non-Debtor affiliates. The Debtors reserve all rights to supplement or amend any schedules contained in this Monthly

Operating Report.

The information presented here is unaudited, subject to further review and material adjustments, and has not been subject to all procedures that

would typically be applied to financial information presented in accordance with generally accepted accounting principles in the United States

of America (“U.S. GAAP”), including, but not limited to, accruals, impairment adjustments, fair value assessments, tax provision, and other

recurring adjustments considered necessary by management to fairly state the financial position and results of operations for the interim

period(s) presented. Upon the application of such procedures, the Debtors believe that the financial information could be subject to changes,

and these changes could be material. The information furnished in this Monthly Operating Report includes normal recurring adjustments, but

does not include all of the adjustments that would typically be made for interim financial statements in accordance with U.S. GAAP.

As part of their restructuring efforts, the Debtors are reviewing their assets and liabilities on an ongoing basis, including without limitation with

respect to intercompany claims and obligations, and nothing contained in this Monthly Operating Report shall constitute a waiver of any of the

Debtors’ rights with respect to such assets, liabilities, claims and obligations that may exist.

The Debtors caution readers not to place undue reliance upon the information contained in this Monthly Operating Report. The results herein

are not necessarily indicative of results which may be expected from any other period or for the full year and may not necessarily reflect the

combined results and financial position of the Debtors in the future.

13

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF TEXAS

CASE NAME: Vanguard Natural Resources, LLC, et al. PETITION DATE: 2/1/2017

CASE NUMBER: 17-30560

MONTHLY OPERATING REPORT NOTES FOR JUNE 30, 2017

HOUSTON DIVISION

Treatment of Intercompany Transactions

Treatment of Certain Liabilities and GAAP Disclosures

The Debtors have not made any determination that tax refunds or attributes are assets or liabilities of a particular Debtor and the Debtors

reserve all of their rights on this issue.

Pursuant to the Interim Order (I) Authorizing Continued Use of Existing Bank Accounts, Business Forms, and Cash Management System, (II)

Addressing Requirements of Section 345 of the Bankruptcy Code, and (III) Authorizing Continuation of Intercompany Transfers [Docket No.

57], the Debtors have kept detailed information on all post-Petition Date transfers of cash among the Debtors for the period covered by the

Monthly Operating Report, as described in further detail in this Report.

As a result of the chapter 11 filings, the payment of prepetition indebtedness is subject to compromise or other treatment under a plan of

reorganization. The determination of how liabilities will ultimately be settled or treated cannot be made until the Bankruptcy Court approves a

chapter 11 plan of reorganization. Accordingly, the ultimate amount of such liabilities is not determinable at this time. ASC 852 requires

prepetition liabilities that are subject to compromise to be reported at the amounts expected to be allowed as claims, even if they may be settled

for lesser amounts. The amounts currently classified as liabilities subject to compromise are preliminary and may be subject to future

adjustments depending on Court actions, further developments with respect to disputed claims, determinations of the secured status of certain

claims, the values of any collateral securing such claims, rejection of executory contracts, continued reconciliation or other events.

The Monthly Operating Report does not contain all disclosures that would be required for presentation in accordance with US GAAP and there

can be no assurance that, from the perspective of an investor or potential investor, the Monthly Operating Report contains information that

would be typical of financial statements filed with the Securities and Exchange Commission. For instance, for the period commencing on the

Petition Date and thereafter, the company stopped accrued interest on both series of the Senior Notes until further review of these obligations is

completed.

The Debtors’ consolidated financial statements in this report have been prepared on a going concern basis, which contemplates continuity of

operations, realization of assets and liquidation of liabilities in the ordinary course of business. Certain prepetition liabilities have been

reclassified as liabilities subject to compromise. Liabilities subject to compromise currently include, among other things, funded debt

obligations and amounts due to third parties for goods and services received prior to the Petition Date. The Debtors continue to analyze and

reconcile these amounts, and, therefore, the amounts reflected herein are current estimates and subject to material change as additional analysis

and decisions are completed.

14

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF TEXAS

CASE NAME: Vanguard Natural Resources, LLC, et al. PETITION DATE: 2/1/2017

CASE NUMBER: 17-30560

MONTHLY OPERATING REPORT NOTES FOR JUNE 30, 2017

HOUSTON DIVISION

Treatment of Reorganization Costs

Treatment of Non-Debtor Entities

Reservation of Rights

Reservation of Rights: Given the complexity of the Debtors’ business, inadvertent errors, omissions or over inclusion of contracts or leases may

have occurred. Accordingly, the Debtors hereby reserve all of their rights to dispute the validity, status, enforceability, or executory nature of

any claim amount, representation or other statement in this Monthly Operating Report and reserve the right to amend or supplement this

Monthly Operating Report, if necessary, but shall be under no obligation to do so.

ASC 852 requires expenses and income directly associated with the chapter 11 filings to be reported separately in the income statement as

reorganization items. Reorganization items includes write off of discount, premium, debt issuance costs, and derivatives associated with long-

term debt, expenses related to legal advisory and representation services, other professional consulting and advisory services, estimates of

claims allowed related to legal matters and rejected executory contracts and changes in liabilities subject to compromise recognized as there are

changes in amounts expected to be allowed as claims.

Vanguard Natural Resources, LLC owns beneficial interest in Potato Hills Gas Gathering System (“Potato Hills”). The financial statements

stated within this Monthly Operating Report exclude the impact of Potato Hills as it is not a debtor entity in these Chapter 11 cases. In addition,

the financial statements and the supplemental information contained herein represent the financial information for the Debtors only. Non-Debtor

affiliates are not included in the financial statements and supplemental information contained in this Monthly Operating Report.

15