Attached files

| file | filename |

|---|---|

| EX-99.2 - TRUEBLUE EARNINGS RELEASE PRESENTATION - TrueBlue, Inc. | earningspresentationq220.htm |

| EX-99.1 - TRUEBLUE PRESS RELEASE - TrueBlue, Inc. | tbi2017q2pressreleaseexhib.htm |

| 8-K - TRUEBLUE FORM 8-K - TrueBlue, Inc. | tbi2017q2pressrelease.htm |

Forward-Looking Statements

July 2017

TrueBlue at a Glance

July 2017 3

124,000

Clients served annually

with strong diversity1

815,000

People connected to

work during 2016

One of the largest U.S.

industrial staffing providers

#1

Largest global

RPO provider2

2012-2016 Average Return

on Equity4

2012-2016 Adjusted

EBITDA CAGR3

$2.8B

2016 Revenue

20%

Growth

16%

Return

PeopleScout recognized as a

Leader and Star Performer by

Everest, Leader by NelsonHall and

consistently ranked as a Top

Provider by HRO Today

TrueBlue has been named to

Forbes’ list of America’s Most

Trustworthy Companies

Founding member of the

U.S. Chamber of Commerce

Veterans Employment

Advisory Council

Staff Management | SMX charter

member of the U.S. Immigration and

Customs Enforcement IMAGE

Program

1 No single customer accounts for more than 2% of total revenue on a TTM 1/1/17 basis, pro forma for reductions in use of contingent labor by Amazon announced in 2016.

2 Source: Everest Group overall service provider share distribution by annual number of hires (2016).

3 See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results.

4 Calculated as Adjusted Net Income divided by average shareholder’s equity over the prior four quarters.

Investment Highlights

Specialized Service Offerings to Meet Client Needs

July 2017

7% of Revenue / 20% of Adj. EBITDA2 34% of Revenue / 16% of Adj. EBITDA2 59% of Revenue / 64% of Adj. EBITDA2

1 Also includes management of service provider business, which provides customers with improved quality and spend management of their contingent labor vendors.

2 Revenue and Adjusted EBITDA mix calculations based on FY-2016; Adjusted EBITDA mix calculations exclude Corporate unallocated expenses.

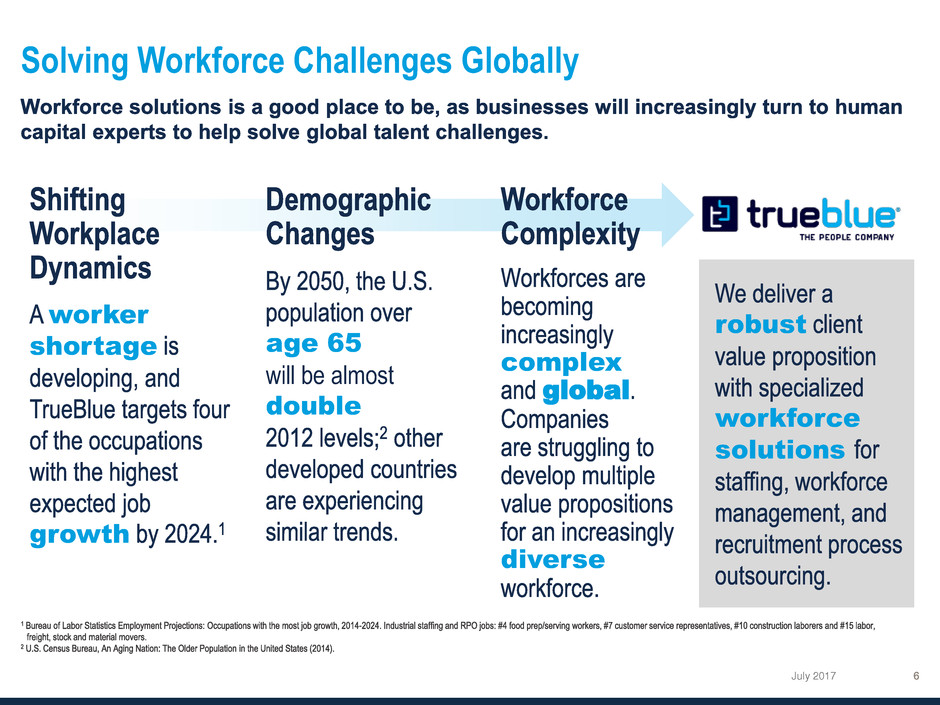

Solving Workforce Challenges Globally

July 2017

complex

global

diverse

age 65

will be almost

double

worker

shortage

growth

robust

workforce

solutions

Construction Manufacturing Transport & Wholesale Retail

In

d

u

s

tr

y

D

y

n

a

m

ic

s

Housing Starts Have Not Kept Pace U.S. Manufacturing Renaissance Wholesale Trade At New High E-commerce Growing % of Retail Sales

Source: U.S. Census Bureau Source: U.S. Board of Governors of the Federal Reserve System (FRB) Source: Bureau of Labor Statistics Source: U.S. Census Bureau

60

65

70

75

80

85

90

95

100

105

110

19

90

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

Industrial Production

Index

3.0

3.5

4.0

4.5

5.0

5.5

19

90

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

Transportation and Warehousing Employment

Millions

Strong Position in Attractive Vertical Markets

July 2017

-

500

1,000

1,500

2,000

2,500

150

170

190

210

230

250

270

290

310

330

350

19

70

19

75

19

80

19

85

19

90

19

95

20

00

20

05

20

10

20

15

US Population Housing Permits

Millions Thousands

4%

5%

6%

7%

8%

9%

10%

11%

12%

13%

19

93

19

96

19

99

20

02

20

05

20

08

20

11

20

14

20

17

E-commerce % of Retail Sales

7%

Growing Market

Capitalizing on Secular Forces in Industrial Staffing

July 2017

o

o

o

o

Positive

Demographic

Trends

Temp Penetration

Growth

Compelling

Technology

Rise of

E-commerce

On-Shoring

Comeback

1 Source: Staffing Industry Analysts.

2 Source: TrueBlue estimate based on 7% CAGR from 2016 to 2020.

3 Source: Bureau of Labor Statistics.

Strength of TrueBlue’s PeopleScout Business

July 2017

4%

7%

5%

20%

FY-15 FY-16

PeopleScout % of Total Company Results

Revenue Adjusted EBITDA

18%

9%

FY-16FY-15

Adjusted EBITDA Margin3

PeopleScout

TBI Total

(~15% of 2016 revenue came from placements beyond North America)

1 PeopleScout offers recruitment process outsourcing (RPO) as well as management of services providers.

2 Source: Nelson Hall.

3 We have two primary measures of segment performance: revenue from services and segment earnings before interest, taxes, depreciation and amortization (“Segment EBITDA”). There is no difference between

Segment EBITDA and Adjusted EBITDA for PeopleScout for FY 2015; see reconciliation for FY 2016 in the appendix.

3

Disciplined Cash Management and Strong Balance Sheet

July 2017

1 Calculated as net cash provided by operating activities, minus purchases for property and equipment. See the appendix to this presentation and “Financial Information” in the Investors section of our website at www.trueblue.com for a definition and full

reconciliation of non-GAAP financial measures to GAAP financial results

2 Calculated as Adjusted Net Income divided by average shareholders’ equity at the end of the prior four quarters.

$34

$73

$31

$54

$233

2012 2013 2014 2015 2016

No Debt

0.4x

1.7x 1.7x

0.9x

2012 2013 2014 2015 2016

13%

14%

17% 17% 17%

2012 2013 2014 2015 2016

millions

Strategic Priorities

July 2017

PeopleReady Transition

July 2017

Legacy branch based business transitioned to one brand/one system.

Expanding Scope of Services

• Within our legacy structure, only 12 of

our top 40 markets had access to all 3

service lines.

• PeopleReady will bring more

specialized services to more markets

while leveraging central resources to

streamline operations.

Increasing Operational Agility

• >50% of PeopleReady’s revenue is

generated from customers who

already work with multiple brands;

single point of contact makes it easier.

• One set of operating procedures and

systems provide a better customer

experience empowering staff to move

quickly and capture market share.

Larger Talent Pool

• Associates and customers benefit

from scale when information is visible

across all systems.

• Common information systems and

compelling new technology platforms

(i.e. mobile app) increases our ability

to attract a more diverse population of

workers.

Str

a

tegic R

a

ti

o

nal

e

Priorit

ie

s

JobStack Mobile App – A Competitive Differentiator

July 2017

CUSTOMER

ASSOCIATE

Mobile Technology Feature… Driving Value for TrueBlue…

24/7 order creation / viewing Round-the-clock revenue generation

Real-time order fill rates Improved customer and experience

ratings Lift quality

Worksite ratings Enhanced communication and safety

Control work week / set availability Tap into larger and more diverse talent pool

Reconciliation of U.S. GAAP Net Income (Loss) to Adjusted Net Income

July 2017

53 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

Jan 1, 2017

Dec 25,

2015

Dec 26,

2014

Dec 27,

2013

Dec 28,

2012

Net income (loss) $ (15,251 ) $ 71,247 $ 65,675 $ 44,924 $ 33,629

Acquisition/integration and other costs (1) 12,223 5,135 5,220 7,375 —

Amortization of intangible assets of acquired businesses (2) 27,069 19,903 12,046 4,939 3,095

Goodwill and intangible impairment charge (3) 103,544 — — — —

Tax effective of adjustments to net income (loss) (4) (39,994 ) (7,011 ) (4,834 ) (3,448 ) (867 )

Adjust income taxes to normalized effective rate (5) 606 (1,805 ) (6,747 ) (1,049 ) 5,687

Adjusted net income (6) $ 88,197 $ 87,469 $ 71,360 $ 52,741 $ 41,544

Adjusted net income, per diluted share (6) $ 2.10 $ 2.10 $ 1.73 $ 1.30 $ 1.04

Diluted weighted average shares outstanding 41,968 41,622 41,176 40,502 39,862

1. Acquisition/integration and other costs relate to the acquisition of the recruitment process outsourcing business of Aon Hewitt, which was completed on January 4, 2016, the acquisition of SIMOS, which

was completed on December 1, 2015, the acquisition of Seaton, which was completed on June 30, 2014, the acquisition of MDT, which was completed on February 4, 2013, the acquisition of The Work

Connection, which was completed October 1, 2013 and the acquisition of certain assets of Crowley Transportation Services, which was completed June 2013. In addition, other charges for the fiscal year

ended January 1, 2017, consist of costs of $2.6 million associated with our exit from the Amazon delivery business, $1.3 million adjustment to increase the earn-out associated with the acquisition of

SIMOS, and branch signage write branch signage write-offs of $1.6 million due to our re-branding to PeopleReady.

2. Amortization of intangible assets of acquired businesses as well as accretion expense related to the SIMOS acquisition earn-out.

3. The Goodwill and intangible asset impairment charge for the fiscal year ended January 1, 2017, included $99.3 million of impairment charges relating to our Staff Management | SMX, hrX, and

PlaneTechs reporting units, and write-off of the CLP and Spartan reporting unit trade names/trademarks of $4.3 million due to the re-branding to PeopleReady.

4. Total tax effect of each of the adjustments to U.S. GAAP Net income (loss) per diluted share using the ongoing rate of 28%.

5. Adjusts the effective income tax rate to the expected ongoing rate of 28%.

6. Adjusted net income and Adjusted net income per diluted share are non-GAAP financial measures, which exclude from Net income (loss) and Net income (loss) on a per diluted share basis, costs related

to acquisition/integration and other costs, goodwill and intangible asset impairment charge, amortization of intangibles of acquired businesses as well as accretion expense related to acquisition earn-out,

tax effect of each adjustment to U.S. GAAP Net income (loss), and adjusts income taxes to the expected ongoing effective tax rate. Adjusted net income and Adjusted net income per diluted share are key

measures used by management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into the underlying trends of the business. Adjusted net income

and Adjusted net income per diluted share should not be considered measures of financial performance in isolation or as an alternative to net income (loss) or net income (loss) per diluted share in the

Consolidated Statements of Operations in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Adjusted net income and net income per diluted share

previously excluded the third-party processing fees associated with generating Work Opportunity Tax Credits.

(Unaudited, in thousands, except per share data)

Reconciliation of U.S. GAAP Net Income (Loss) to EBITDA and Adjusted EBITDA

July 2017

1. EBITDA and Adjusted EBITDA are non-GAAP financial measures. EBITDA excludes from Net income (loss) interest, taxes, depreciation and amortization. Adjusted EBITDA further excludes from

EBITDA costs related to acquisition/integration and other costs, goodwill and intangible asset impairment charge, and Work Opportunity Tax Credit third-party processing fees. EBITDA and Adjusted

EBITDA are key measures used by management to assess performance and, in our opinion, enhance comparability and provide investors with useful insight into the underlying trends of the business.

EBITDA and Adjusted EBITDA should not be considered measures of financial performance in isolation or as an alternative to Income from operations in the Consolidated Statements of Operations in

accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

2. Acquisition/integration and other costs relate to the acquisition of the recruitment process outsourcing business of Aon Hewitt, which was completed on January 4, 2016, the acquisition of SIMOS, which

was completed on December 1, 2015, the acquisition of Seaton, which was completed on June 30, 2014, the acquisition of MDT, which was completed on February 4, 2013, the acquisition of The Work

Connection, which was completed October 1, 2013 and the acquisition of certain assets of Crowley Transportation Services, which was completed June 2013. In addition, other charges for the fiscal year

ended January 1, 2017, consist of costs of $2.6 million associated with our exit from the Amazon delivery business, $1.3 million adjustment to increase the earn-out associated with the acquisition of

SIMOS, and branch signage write branch signage write-offs of $1.6 million due to our re-branding to PeopleReady.

3. The Goodwill and intangible asset impairment charge for the fiscal year ended January 1, 2017, included $99.3 million of impairment charges relating to our Staff Management | SMX, hrX, and

PlaneTechs reporting units, and write-off of the CLP and Spartan reporting unit trade names/trademarks of $4.3 million due to the re-branding to PeopleReady.

4. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher

than average unemployment rates and reduce our income taxes.

53 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

Jan. 1 2017 Dec. 25, 2015

Dec. 26,

2014 Dec 27, 2013 Dec 28, 2012

Net income (loss) $ (15,251 ) $ 71,247 $ 65,675 $ 44,924 $ 33,629

Income tax expense (benefit) (5,089 ) 25,200 16,169 16,013 20,976

Interest and other expense (income), net 3,345 1,395 (116 ) (1,354 ) (1,569 )

Depreciation and amortization 46,692 41,843 29,474 20,472 18,890

EBITDA (1) 29,697 139,685 111,202 80,055 71,926

Acquisition/integration and other costs (2) 12,223 5,135 5,220 7,375 —

Goodwill and intangible asset impairment charge (3) 103,544 — — — —

Work Opportunity Tax Credit processing fees (4) 1,858 2,352 3,020 1,276 —

Adjusted EBITDA (1) $ 147,322 $ 147,172 $ 119,442 $ 88,706 $ 71,926

(Unaudited, in thousands)

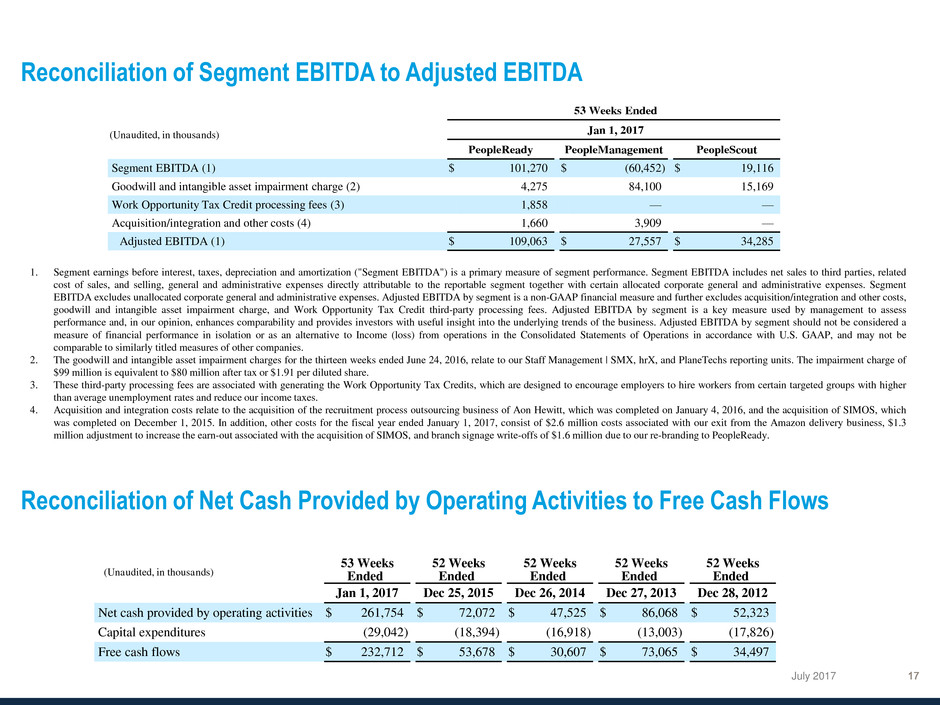

Reconciliation of Segment EBITDA to Adjusted EBITDA

July 2017

1. Segment earnings before interest, taxes, depreciation and amortization ("Segment EBITDA") is a primary measure of segment performance. Segment EBITDA includes net sales to third parties, related

cost of sales, and selling, general and administrative expenses directly attributable to the reportable segment together with certain allocated corporate general and administrative expenses. Segment

EBITDA excludes unallocated corporate general and administrative expenses. Adjusted EBITDA by segment is a non-GAAP financial measure and further excludes acquisition/integration and other costs,

goodwill and intangible asset impairment charge, and Work Opportunity Tax Credit third-party processing fees. Adjusted EBITDA by segment is a key measure used by management to assess

performance and, in our opinion, enhances comparability and provides investors with useful insight into the underlying trends of the business. Adjusted EBITDA by segment should not be considered a

measure of financial performance in isolation or as an alternative to Income (loss) from operations in the Consolidated Statements of Operations in accordance with U.S. GAAP, and may not be

comparable to similarly titled measures of other companies.

2. The goodwill and intangible asset impairment charges for the thirteen weeks ended June 24, 2016, relate to our Staff Management | SMX, hrX, and PlaneTechs reporting units. The impairment charge of

$99 million is equivalent to $80 million after tax or $1.91 per diluted share.

3. These third-party processing fees are associated with generating the Work Opportunity Tax Credits, which are designed to encourage employers to hire workers from certain targeted groups with higher

than average unemployment rates and reduce our income taxes.

4. Acquisition and integration costs relate to the acquisition of the recruitment process outsourcing business of Aon Hewitt, which was completed on January 4, 2016, and the acquisition of SIMOS, which

was completed on December 1, 2015. In addition, other costs for the fiscal year ended January 1, 2017, consist of $2.6 million costs associated with our exit from the Amazon delivery business, $1.3

million adjustment to increase the earn-out associated with the acquisition of SIMOS, and branch signage write-offs of $1.6 million due to our re-branding to PeopleReady.

(Unaudited, in thousands)

53 Weeks Ended

Jan 1, 2017

PeopleReady PeopleManagement PeopleScout

Segment EBITDA (1) $ 101,270 $ (60,452 ) $ 19,116

Goodwill and intangible asset impairment charge (2) 4,275 84,100 15,169

Work Opportunity Tax Credit processing fees (3) 1,858 — —

Acquisition/integration and other costs (4) 1,660 3,909 —

Adjusted EBITDA (1) $ 109,063 $ 27,557 $ 34,285

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flows

(Unaudited, in thousands)

53 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

52 Weeks

Ended

Jan 1, 2017 Dec 25, 2015 Dec 26, 2014 Dec 27, 2013 Dec 28, 2012

Net cash provided by operating activities $ 261,754 $ 72,072 $ 47,525 $ 86,068 $ 52,323

Capital expenditures (29,042 ) (18,394 ) (16,918 ) (13,003 ) (17,826 )

Free cash flows $ 232,712 $ 53,678 $ 30,607 $ 73,065 $ 34,497