Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Discovery, Inc. | d432284dex992.htm |

| 8-K - 8-K - Discovery, Inc. | d432284d8k.htm |

Creating a Premier Real Life Entertainment Company July 31, 2017 Exhibit 99.1Filed by Discovery Communications, Inc.Pursuant to Rule 425 under the Securities Act of 1933, as amendedand deemed filed pursuant to Rule 14a-2under the Securities Exchange Act of 1934, as amendedSubject Company: Scripps Networks Interactive, Inc.Commission File No. 001-34177

Cautionary Statement Concerning Forward-Looking Projections This presentation contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations, forecasts and assumptions that involve risks and uncertainties and on information available to the Company as of the date hereof. Discovery’s actual results could differ materially from those stated or implied, due to risks and uncertainties associated with its business, which include the risk factors disclosed in its Annual Report on Form 10-K filed with the SEC on February 14, 2017. Scripps’ actual results could differ materially from those stated or implied, due to risks and uncertainties associated with its business, which include the risk factors disclosed in its Annual Report on Form 10-K filed with the SEC on February 24, 2017. Forward-looking statements include statements regarding Discovery’s and Scripps’ expectations, beliefs, intentions or strategies regarding the future, and can be identified by forward looking words such as “anticipate,” “believe,” “could,” “continue,” “estimate,” “expect,” “intend,” “may,” “should,” “will” and “would” or similar words. Forward-looking statements in this release include, without limitation, statements regarding investing in our programming and strategic growth initiatives. Discovery and Scripps’ expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in Discovery’s or Scripps’ expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

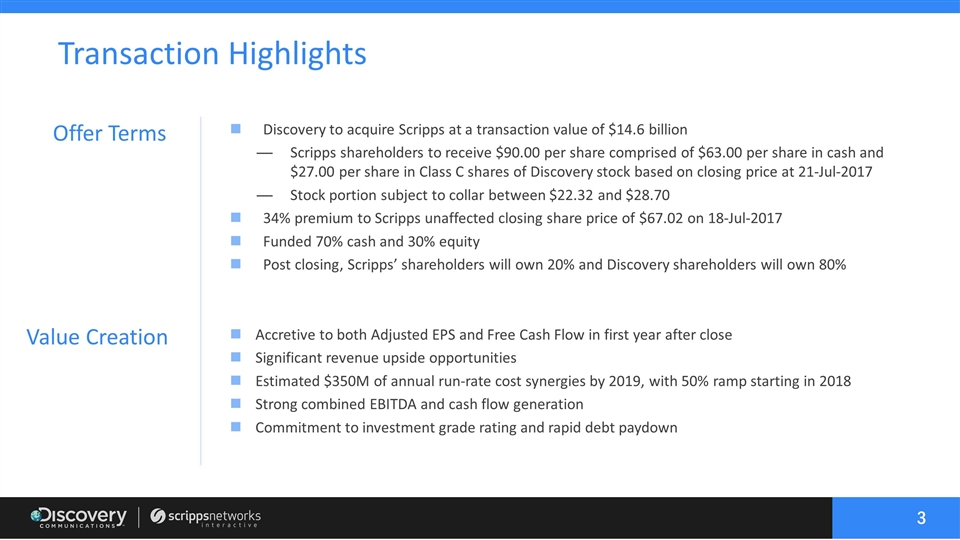

Transaction Highlights Discovery to acquire Scripps at a transaction value of $14.6 billion Scripps shareholders to receive $90.00 per share comprised of $63.00 per share in cash and $27.00 per share in Class C shares of Discovery stock based on closing price at 21-Jul-2017 Stock portion subject to collar between $22.32 and $28.70 34% premium to Scripps unaffected closing share price of $67.02 on 18-Jul-2017 Funded 70% cash and 30% equity Post closing, Scripps’ shareholders will own 20% and Discovery shareholders will own 80% Offer Terms Accretive to both Adjusted EPS and Free Cash Flow in first year after close Significant revenue upside opportunities Estimated $350M of annual run-rate cost synergies by 2019, with 50% ramp starting in 2018 Strong combined EBITDA and cash flow generation Commitment to investment grade rating and rapid debt paydown Value Creation

Transaction Highlights (cont’d) Approvals & Closing Transaction is subject to approval by Discovery and Scripps’ shareholders, regulatory approvals, and other customary closing conditions. Transaction expected to close early FY2018 John C. Malone, Advance/Newhouse Programming Partnership and Scripps Family Shareholders representing an overwhelming majority of common voting shares of Scripps have entered into voting agreements to vote in favor of the transaction Approvals & Closing Governance Ken Lowe is expected to join Discovery’s Board of Directors following the close Discovery’s Board would expand to 12 members

Creates Premier Portfolio of Owned/Controlled IP in Real Life Entertainment 1 Compelling Strategic Rationale Opportunity to Deliver Global Strategic Synergies, including Estimated $350M Cost Savings 2 Significant Upside Potential to Extend Scripps Brands Internationally 3 Accelerates Digital/Mobile Innovation and Rollout 4 Robust Free Cash Flow to Lead to Balance Sheet Flexibility 5

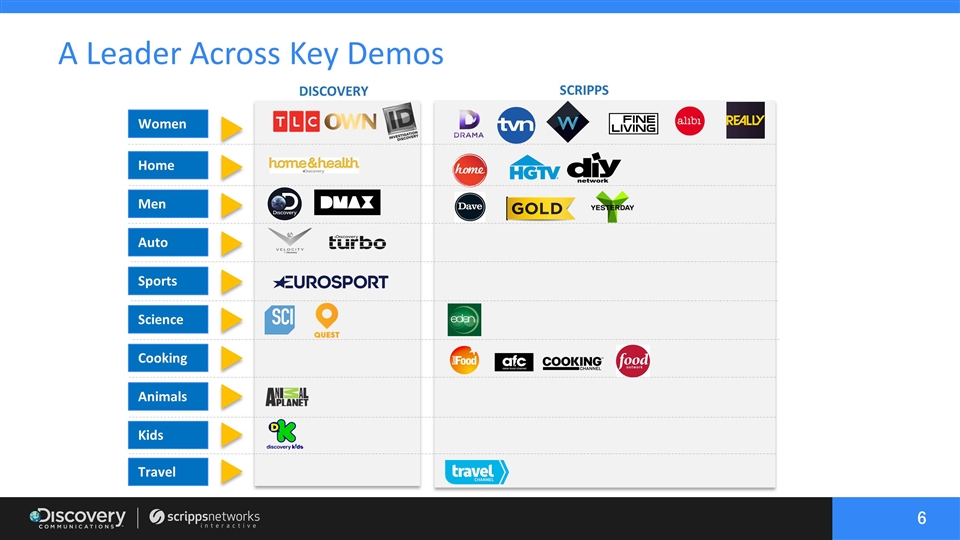

A Leader Across Key Demos Home Women Men Sports Science Cooking Animals Kids Auto SCRIPPS DISCOVERY Travel

Significant Portfolio of Owned/Controlled IP 8 Combined company to produce nearly 8,000 hours of original programming annually, with library of 300,000 hours of content

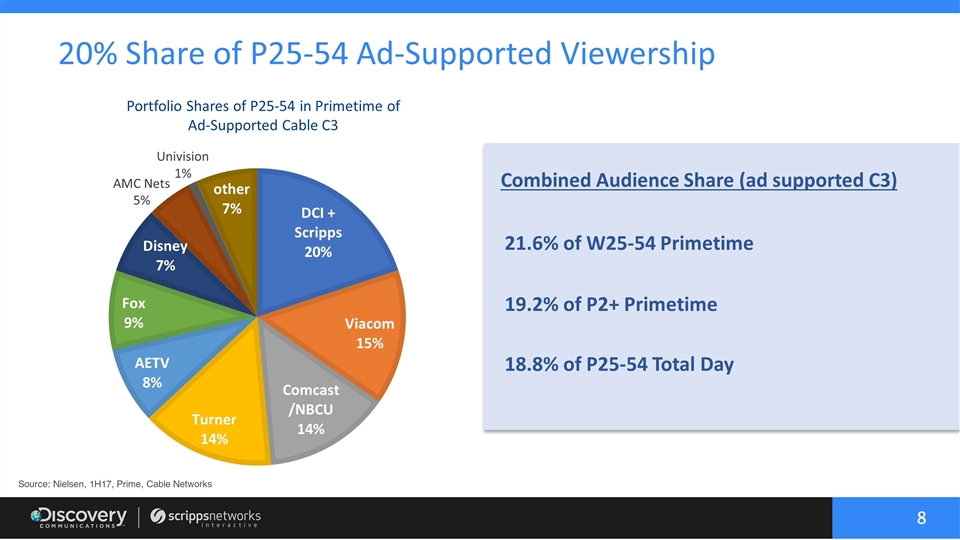

20% Share of P25-54 Ad-Supported Viewership Source: Nielsen, 1H17, Prime, Cable Networks Portfolio Shares of P25-54 in Primetime of Ad-Supported Cable C3 21.6% of W25-54 Primetime 19.2% of P2+ Primetime 18.8% of P25-54 Total Day Combined Audience Share (ad supported C3) AMC Nets5%

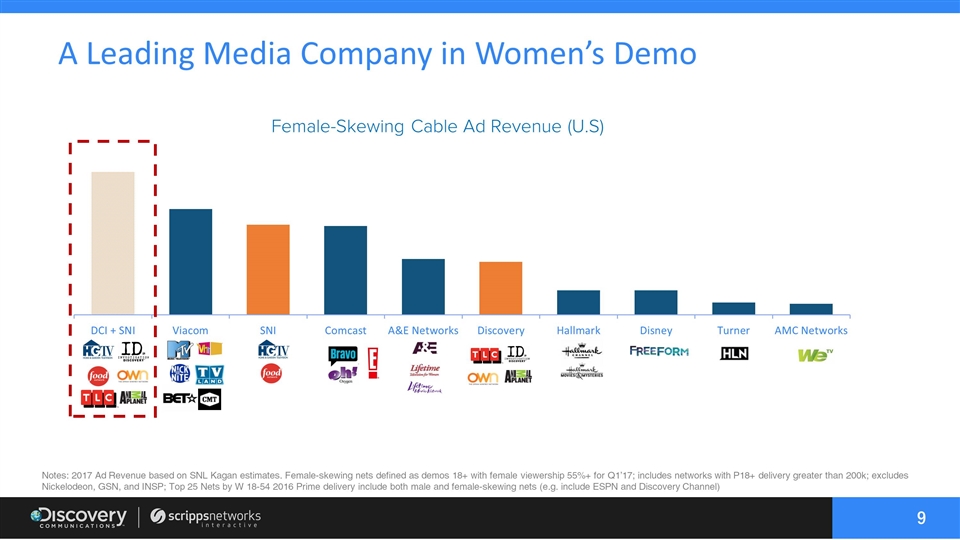

Notes: 2017 Ad Revenue based on SNL Kagan estimates. Female-skewing nets defined as demos 18+ with female viewership 55%+ for Q1’17; includes networks with P18+ delivery greater than 200k; excludes Nickelodeon, GSN, and INSP; Top 25 Nets by W 18-54 2016 Prime delivery include both male and female-skewing nets (e.g. include ESPN and Discovery Channel) Female-Skewing Cable Ad Revenue (U.S) A Leading Media Company in Women’s Demo

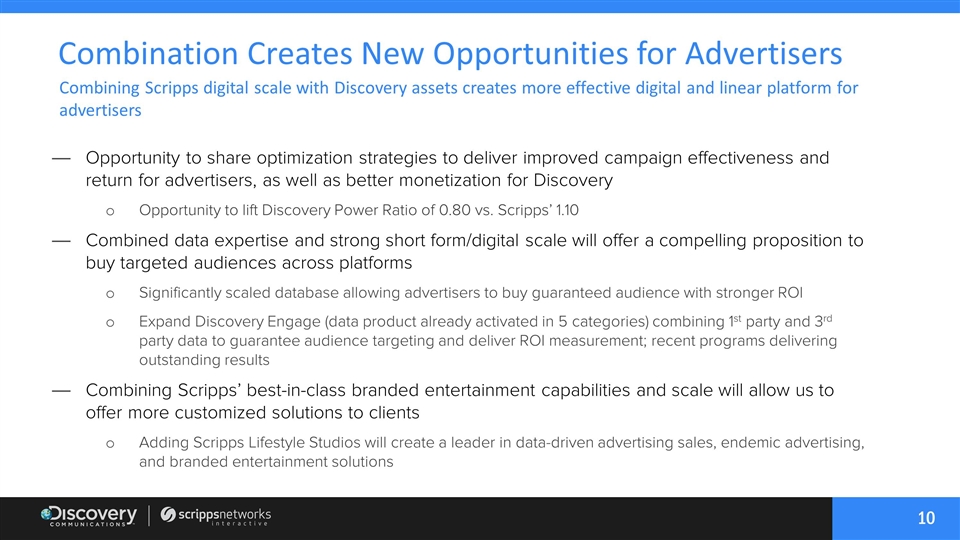

Combining Scripps digital scale with Discovery assets creates more effective digital and linear platform for advertisers Combination Creates New Opportunities for Advertisers

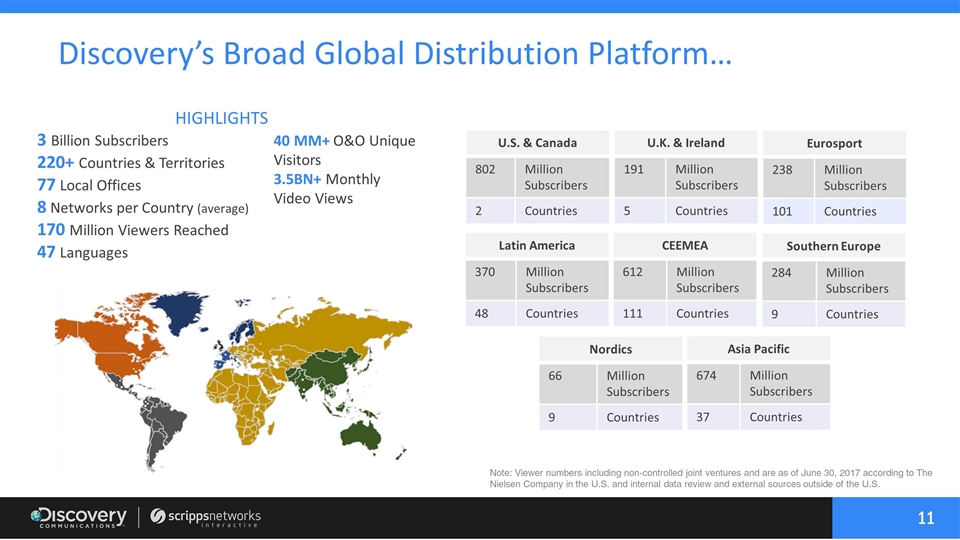

Discovery’s Broad Global Distribution Platform… 3 Billion Subscribers 220+ Countries & Territories 77 Local Offices 8 Networks per Country (average) 170 Million Viewers Reached 47 Languages U.S. & Canada 802 Million Subscribers 2 Countries U.K. & Ireland 191 Million Subscribers 5 Countries Eurosport 238 Million Subscribers 101 Countries Nordics 66 Million Subscribers 9 Countries Latin America 370 Million Subscribers 48 Countries CEEMEA 612 Million Subscribers 111 Countries Southern Europe 284 Million Subscribers 9 Countries Asia Pacific 674 Million Subscribers 37 Countries 40 MM+ O&O Unique Visitors 3.5BN+ Monthly Video Views HIGHLIGHTS Note: Viewer numbers including non-controlled joint ventures and are as of June 30, 2017 according to The Nielsen Company in the U.S. and internal data review and external sources outside of the U.S.

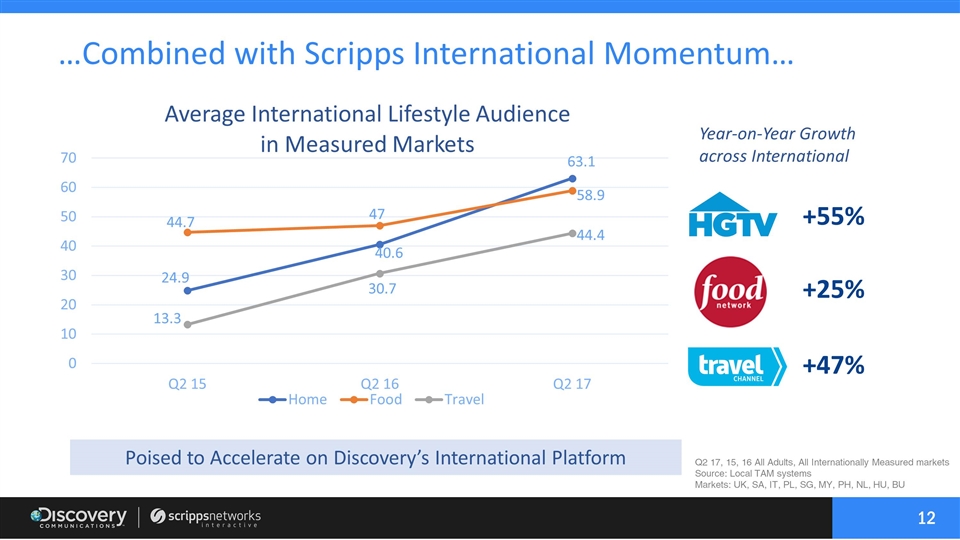

…Combined with Scripps International Momentum… +25% +55% +47% Q2 17, 15, 16 All Adults, All Internationally Measured markets Source: Local TAM systems Markets: UK, SA, IT, PL, SG, MY, PH, NL, HU, BU Year-on-Year Growth across International Poised to Accelerate on Discovery’s International Platform

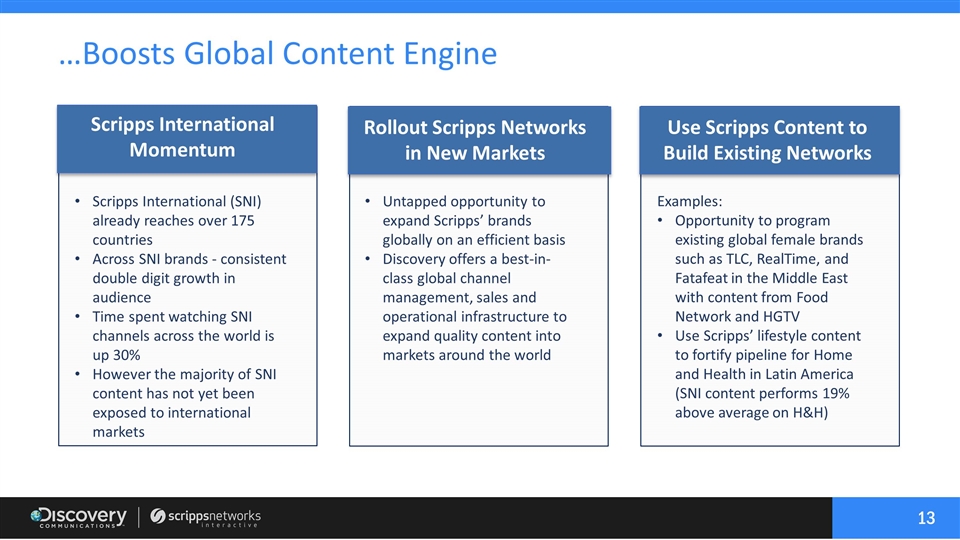

…Boosts Global Content Engine Scripps International Momentum Rollout Scripps Networks in New Markets Use Scripps Content to Build Existing Networks Scripps International (SNI) already reaches over 175 countries Across SNI brands - consistent double digit growth in audience Time spent watching SNI channels across the world is up 30% However the majority of SNI content has not yet been exposed to international markets Untapped opportunity to expand Scripps’ brands globally on an efficient basis Discovery offers a best-in-class global channel management, sales and operational infrastructure to expand quality content into markets around the world Examples: Opportunity to program existing global female brands such as TLC, RealTime, and Fatafeat in the Middle East with content from Food Network and HGTV Use Scripps’ lifestyle content to fortify pipeline for Home and Health in Latin America (SNI content performs 19% above average on H&H)

Significant Infrastructure of Creative Talent and Expertise Broader Content Bolsters Three Pronged Strategy Ad Supported Subscription Short-Form Combined team will have deep digital consumer marketing expertise creating a new scale player with enhanced ability to compete for audiences and ad dollars Significant content provider to key social media platforms: #1 provider of news to millennials on Facebook; one of the largest content providers to Snapchat Continue investment in digital-first content Broader content and deeper expertise facilitates ability to launch new products Accelerates innovation to meet evolving consumer demand Enhances opportunity with existing and potential bundles Potential to increase monetization opportunities and build on already growing digital revenue contributions Well-Positioned to Capture Growing Commercial Opportunity Accelerated Opportunity on all Screens and Services More compelling breadth and depth of content in TVE and OTT products Expands relevance in key demos Creates a leading digital player across short-form, mobile-first video with over 7 billion monthly views + = Shark Week was a top 3 Snapchat Show Premiere in terms of audience

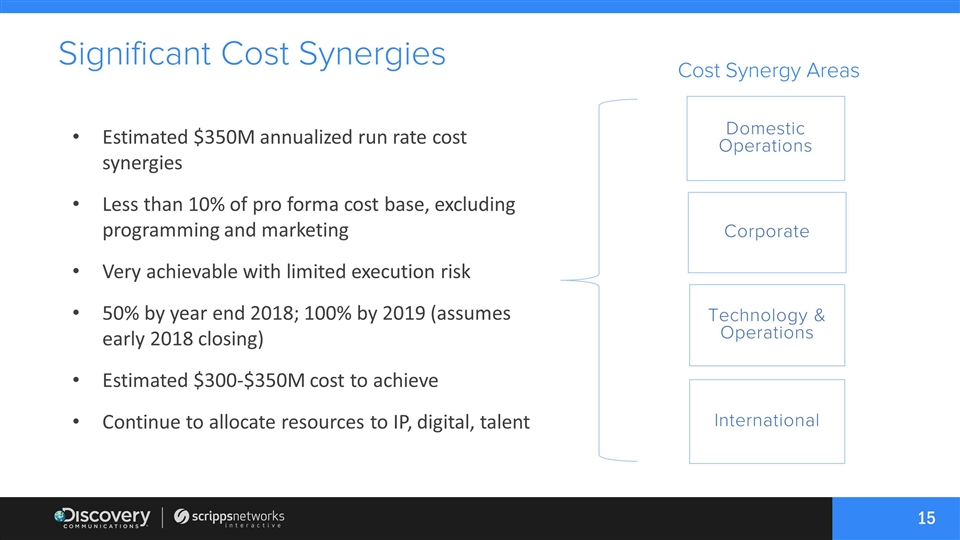

Estimated $350M annualized run rate cost synergies Less than 10% of pro forma cost base, excluding programming and marketing Very achievable with limited execution risk 50% by year end 2018; 100% by 2019 (assumes early 2018 closing) Estimated $300-$350M cost to achieve Continue to allocate resources to IP, digital, talent Domestic Operations Corporate Technology & Operations International Cost Synergy Areas Significant Cost Synergies

Financial Policy Outlook Discovery expects to maintain investment grade ratings throughout the transaction Scripps debt will be pari passu with existing/new Discovery debt Target returning to normalized leverage levels <3.5x gross debt to AOIBDA within the first two years after the transaction, using substantially all free cash flow to reduce pre-payable and/or short-term debt Once properly levered for the ratings category, capital will be used first to invest in any appropriate project that will deliver positive returns to shareholders Rigorous analysis and high hurdle rates will continue to be applied Residual capital will be returned to shareholders through discretionary share repurchases Minimum pro forma cash balance target of $250 million Remain highly disciplined in considering acquisition opportunities Focus on smaller acquisition targets and organic growth initiatives that can be supported with FCF Gross Debt / AOIBDA Target Capital Return Policy Acquisition Strategy

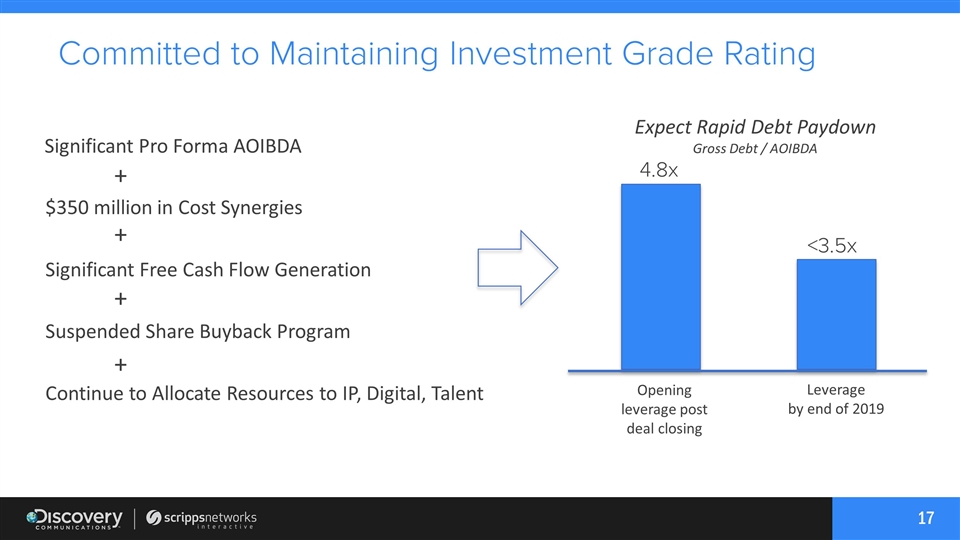

Significant Pro Forma AOIBDA Continue to Allocate Resources to IP, Digital, Talent $350 million in Cost Synergies Significant Free Cash Flow Generation Suspended Share Buyback Program + + + + 4.8x <3.5x Opening leverage post deal closing Leverage by end of 2019 Expect Rapid Debt Paydown Gross Debt / AOIBDA Committed to Maintaining Investment Grade Rating

Creates Premier Portfolio of Owned/Controlled IP in Real Life Entertainment 1 Compelling Strategic Rationale Opportunity to Deliver Global Strategic Synergies, including Estimated $350M Cost Savings 2 Significant Upside Potential to Extend Scripps Brands Internationally 3 Accelerates Digital/Mobile Innovation and Rollout 4 Robust Free Cash Flow to Lead to Balance Sheet Flexibility 5

Additional Information Where to Find Additional Information This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. This communication may be deemed to be solicitation material in respect of the proposed merger between Discovery Communications and Scripps Networks Interactive. In connection with the proposed merger, Discovery Communications intends to file a registration statement on Form S-4, containing a proxy statement/prospectus with the SEC. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE PROXY STATEMENT/PROSPECTUS WHEN IT BECOMES AVAILABLE, BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the proxy statement/prospectus (when available) and other documents filed by Discovery Communications and Scripps Networks Interactive with the SEC at http://www.sec.gov. Free copies of the proxy statement/prospectus, once available, and each company’s other filings with the SEC may also be obtained from the respective companies. Free copies of documents filed with the SEC by Discovery Communications will be made available free of charge on Discovery Communications’ investor relations website at corporate.discovery.com/investors. Free copies of documents filed with the SEC by Scripps Networks Interactive will be made available free of charge on Scripps Networks Interactive’s investor relations website at www.ir.scrippsnetworksinteractive.com. Participants in the Solicitation Discovery Communications and its directors and executive officers, and Scripps Networks Interactive and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from the holders of Discovery Communications and Scripps Networks Interactive common stock in respect of the proposed merger. Information about the directors and executive officers of Discovery Communications is set forth in its Annual Report on Form 1-K, which was filed with the SEC on February 14, 2017 and in its Annual Proxy Statement, which was filed with the SEC on April 5, 2017. Information about the directors and executive officers of Scripps Networks Interactive is set forth in its Annual Report on Form 1-K, which was filed with the SEC on February 24, 2017 and in its Annual Proxy Statement, which was filed with the SEC on March 29, 2017. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the proposed merger when it becomes available.

Creating a Premier Real Life Entertainment Company July 31, 2017